Assessing the Influence of Financial Inclusion on Environmental Degradation in the ASEAN Region through the Panel PMG-ARDL Approach

Abstract

:1. Introduction

2. Literature Review

3. Materials and Methods

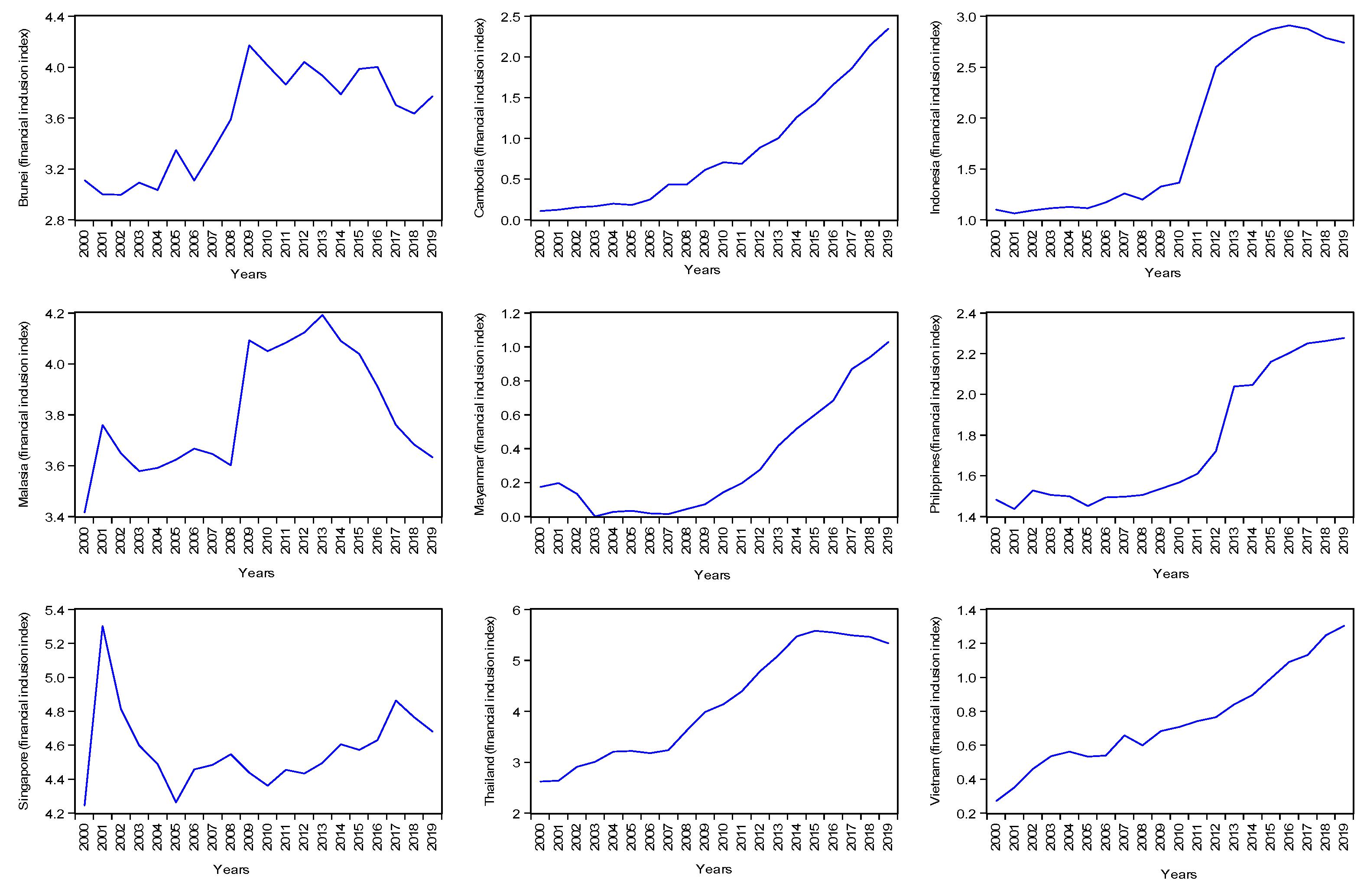

4. Results and Discussions

5. Conclusions and Policy Implications

6. Limitations and Prospects of the Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Khan, D.; Ullah, A. Testing the relationship between globalization and carbon dioxide emissions in Pakistan: Does environmental Kuznets curve exist? Environ. Sci. Pollut. Res. 2019, 26, 15194–15208. [Google Scholar] [CrossRef] [PubMed]

- Mahmood, N.; Wang, Z.; Yasmin, N.; Manzoor, W. How to bend down the environmental Kuznets curve: The significance of biomass energy. Environ. Sci. Pollut. Res. 2019, 26, 21598–21608. [Google Scholar] [CrossRef] [PubMed]

- Mehmood, U. Contribution of renewable energy towards environmental quality: The role of education to achieve sustainable development goals in G11 countries. Renew. Energy 2021, 178, 600–607. [Google Scholar] [CrossRef]

- Ullah, A.; Khan, D.; Khan, I.; Zheng, S. Does agricultural ecosystem cause environmental pollution in Pakistan? Promise and menace. Environ. Sci. Pollut. Res. 2018, 25, 13938–13955. [Google Scholar] [CrossRef] [PubMed]

- Wawrzyniak, D.; Doryń, W. Does the quality of institutions modify the economic growth-carbon dioxide emissions nexus? Evidence from a group of emerging and developing countries. Econ. Res. Ekon. Istraživanja 2020, 33, 124–144. [Google Scholar] [CrossRef] [Green Version]

- Sarkodie, A.S.; Adams, S.; Leirvik, T. Foreign direct investment and renewable energy in climate change mitigation: Does governance matter? J. Clean. Prod. 2020, 263, 121262. [Google Scholar] [CrossRef]

- Mujtaba, G.; Shahzad, S.J.H. Air pollutants, economic growth and public health: Implications for sustainable development in OECD countries. Environ. Sci. Pollut. Res. 2021, 28, 12686–12698. [Google Scholar] [CrossRef]

- Wang, L.; Chang, H.L.; Rizvi, S.K.A.; Sari, A. Are eco-innovation and export diversification mutually exclusive to control carbon emissions in G-7 countries? J. Environ. Manag. 2020, 270, 110829. [Google Scholar] [CrossRef]

- British Petroleum Statistical Review of World Energy. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energyeconomics/statistical-review/bp-stats-review-2020-full-report.pdf (accessed on 3 May 2022).

- Yu, B.; Fang, D. Decoupling economic growth from energy-related PM2.5 emissions in China: A GDIM-based indicator decomposition. Ecol. Indic. 2021, 127, 107795. [Google Scholar] [CrossRef]

- Ji, X.; Zhang, Y.; Mirza, N.; Umar, M.; Rizvi, S.K.A. The impact of carbon neutrality on the investment performance: Evidence from the equity mutual funds in BRICS. J. Environ. Manag. 2021, 297, 113228. [Google Scholar] [CrossRef]

- Bennett, M.; James, P. The Green Bottom Line: Environmental Accounting for Management: Current Practice and Future Trends; Routledge: Oxfordshire, UK, 2017. [Google Scholar]

- Ali, B.; Ullah, A.; Khan, D. Does the prevailing Indian agricultural ecosystem cause carbon dioxide emission? A consent towards risk reduction. Environ. Sci. Pollut. Res. 2021, 28, 4691–4703. [Google Scholar] [CrossRef] [PubMed]

- Bibi, Z.; Khan, D.; Haq, I.U. Technical and environmental efficiency of agriculture sector in South Asia: A stochastic frontier analysis approach. Environ. Dev. Sustain. 2021, 23, 9260–9279. [Google Scholar] [CrossRef]

- Khan, D.; Ullah, A. Comparative analysis of the technical and environmental efficiency of the agricultural sector: The case of Southeast Asia countries. Custos Agronegocio Line 2020, 16, 2–28. [Google Scholar]

- Esso, L.J.; Keho, Y. Energy consumption, economic growth and carbon emissions: Cointegration and causality evidence from selected African countries. Energy 2016, 114, 492–497. [Google Scholar] [CrossRef]

- Soytas, U.; Sari, R. Energy consumption, economic growth, and carbon emissions: Challenges faced by an EU candidate member. Ecol. Econ. 2009, 68, 1667–1675. [Google Scholar] [CrossRef]

- Das, K.; Lin, D. Asean States Have Fared Well. Now, to Continue Doing so. McKinsey & Company Home, McKinsey Global Institute. Available online: https://www.mckinsey.com/mgi/overview/in-the-news/asean-states-have-fared-well-now-tocontinue (accessed on 23 June 2021).

- Dahiya, S.; Kumar, M. Linkage between Financial Inclusion and Economic Growth: An Empirical Study of the Emerging Indian Economy. Vision J. Bus. Perspect. 2020, 24, 184–193. [Google Scholar] [CrossRef]

- Le, T.-H.; Chuc, A.T.; Taghizadeh-Hesary, F. Financial inclusion and its impact on financial efficiency and sustainability: Empirical evidence from Asia. Borsa Istanb. Rev. 2019, 19, 310–322. [Google Scholar] [CrossRef]

- Sági, J.; Vasa, L.; Lentner, C. Innovative solutions in the development of households’ financial awareness: A Hungarian example. Econ. Sociol. 2020, 13, 27–45. [Google Scholar] [CrossRef]

- World Bank. Global Financial Development Report 2017/2018, Bankers without Borders; The World Bank: Washington, DC, USA, 2017. [Google Scholar]

- Zaidi, S.A.H.; Hussain, M.; Zaman, Q.U. Dynamic linkages between financial inclusion and carbon emissions: Evidence from selected OECD countries. Resour. Environ. Sustain. 2021, 4, 100022. [Google Scholar] [CrossRef]

- Le, T.-H.; Le, H.-C.; Taghizadeh-Hesary, F. Does financial inclusion impact CO2 emissions? Evidence from Asia. Finance Res. Lett. 2020, 34, 101451. [Google Scholar] [CrossRef]

- Baulch, B.; Do, T.D.; Le, T.-H. Constraints to the uptake of solar home systems in Ho Chi Minh City and some proposals for improvement. Renew. Energy 2018, 118, 245–256. [Google Scholar] [CrossRef] [Green Version]

- Raghutla, C.; Chittedi, K.R. Financial development, energy consumption, technology, urbanization, economic output and carbon emissions nexus in BRICS countries: An empirical analysis. Manag. Environ. Qual. Int. J. 2020, 32, 290–307. [Google Scholar] [CrossRef]

- Arun, T.; Kamath, R. Financial inclusion: Policies and practices. IIMB Manag. Rev. 2015, 27, 267–287. [Google Scholar] [CrossRef] [Green Version]

- Kanobe, F.; Alexander, P.M.; Bwalya, K.J. Policies, Regulations and Procedures and their Effects on Mobile Money Systems in Uganda. Electron. J. Inf. Syst. Dev. Ctries. 2017, 83, 1–15. [Google Scholar] [CrossRef] [Green Version]

- Galvao, A.F.; Montes-Rojas, G.; Sosa-Escudero, W.; Wang, L. Tests for skewness and kurtosis in the one-way error component model. J. Multivar. Anal. 2013, 122, 35–52. [Google Scholar] [CrossRef]

- Gök, A. The role of financial development on carbon emissions: A meta regression analysis. Environ. Sci. Pollut. Res. 2020, 27, 11618–11636. [Google Scholar] [CrossRef]

- Al-Mulali, U.; Ozturk, I.; Lean, H.H. The influence of economic growth, urbanization, trade openness, financial development, and renewable energy on pollution in Europe. Nat. Hazards 2015, 79, 621–644. [Google Scholar] [CrossRef]

- Jiang, C.; Ma, X. The Impact of Financial Development on Carbon Emissions: A Global Perspective. Sustainability 2019, 11, 5241. [Google Scholar] [CrossRef] [Green Version]

- Maji, I.K.; Habibullah, M.S.; Yusof-Saari, M. Emissions from Agricultural Sector and Financial Development in Nigeria: An Empirical Study. Int. J. Econ. Manag. 2016, 10, 173–187. [Google Scholar]

- Paramati, S.R.; Mo, D.; Huang, R. The role of financial deepening and green technology on carbon emissions: Evidence from major OECD economies. Finance Res. Lett. 2021, 41, 101794. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew. Sustain. Energy Rev. 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Adebayo, T.S.; Akinsola, G.D.; Odugbesan, J.A.; Olanrewaju, V.O. Determinants of Environmental Degradation in Thailand: Empirical Evidence from ARDL and Wavelet Coherence Approaches. Pollution 2021, 7, 181–196. [Google Scholar]

- Adebayo, T.S.; Kirikkaleli, D. Impact of renewable energy consumption, globalization, and technological innovation on environmental degradation in Japan: Application of wavelet tools. Environ. Dev. Sustain. 2021, 23, 16057–16082. [Google Scholar] [CrossRef]

- Mughal, N.; Kashif, M.; Arif, A.; Guerrero, J.W.G.; Nabua, W.C.; Niedbała, G. Dynamic effects of fiscal and monetary policy instruments on environmental pollution in ASEAN. Environ. Sci. Pollut. Res. 2021, 28, 65116–65126. [Google Scholar] [CrossRef] [PubMed]

- Nathaniel, S.P. Environmental degradation in ASEAN: Assessing the criticality of natural resources abundance, economic growth and human capital. Environ. Sci. Pollut. Res. 2021, 28, 21766–21778. [Google Scholar] [CrossRef]

- Renzhi, N.; Baek, Y.J. Can financial inclusion be an effective mitigation measure? evidence from panel data analysis of the environmental Kuznets curve. Financ. Res. Lett. 2020, 37, 101725. [Google Scholar] [CrossRef]

- Xing, T.; Jiang, Q.; Ma, X. To Facilitate or Curb? The Role of Financial Development in China’s Carbon Emissions Reduction Process: A Novel Approach. Int. J. Environ. Res. Public Health 2017, 14, 1222. [Google Scholar] [CrossRef]

- Zhang, Y.-J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Shahbaz, M.; Shahzad, S.J.H.; Ahmad, N.; Alam, S. Financial development and environmental quality: The way forward. Energy Policy 2016, 98, 353–364. [Google Scholar] [CrossRef] [Green Version]

- Boutabba, M.A. The impact of financial development, income, energy and trade on carbon emissions: Evidence from the Indian economy. Econ. Model. 2014, 40, 33–41. [Google Scholar] [CrossRef] [Green Version]

- Fang, D.; Yu, B. Driving mechanism and decoupling effect of PM2. 5 emissions: Empirical evidence from China’s industrial sector. Energy Policy 2021, 149, 112017. [Google Scholar] [CrossRef]

- Acheampong, A.O. Modelling for insight: Does financial development improve environmental quality? Energy Econ. 2019, 83, 156–179. [Google Scholar] [CrossRef]

- Salahuddin, M.; Alam, K.; Ozturk, I.; Sohag, K. The effects of electricity consumption, economic growth, financial development and foreign direct investment on CO2 emissions in Kuwait. Renew. Sustain. Energy Rev. 2018, 81, 2002–2010. [Google Scholar] [CrossRef] [Green Version]

- Charfeddine, L.; Khediri, K.B. Financial development and environmental quality in UAE: Cointegration with structural breaks. Renew. Sustain. Energy Rev. 2016, 55, 1322–1335. [Google Scholar] [CrossRef]

- Saidi, K.; Mbarek, M.B. The impact of income, trade, urbanization, and financial development on CO2 emissions in 19 emerging economies. Environ. Sci. Pollut. Res. 2017, 24, 12748–12757. [Google Scholar] [CrossRef]

- Cetin, M.; Ecevit, E.; Yucel, A.G. The impact of economic growth, energy consumption, trade openness, and financial development on carbon emissions: Empirical evidence from Turkey. Environ. Sci. Pollut. Res. 2018, 25, 36589–36603. [Google Scholar] [CrossRef]

- Ali, H.S.; Law, S.H.; Lin, W.L.; Yusop, Z.; Chin, L.; Bare, U.A.A. Financial development and carbon dioxide emissions in Nigeria: Evidence from the ARDL bounds approach. GeoJournal 2019, 84, 641–655. [Google Scholar] [CrossRef]

- Liu, N.; Hong, C.; Sohail, M.T. Does financial inclusion and education limit CO2 emissions in China? A new perspective. Environ. Sci. Pollut. Res. 2022, 29, 18452–18459. [Google Scholar] [CrossRef]

- Haseeb, A.; Xia, E.; Danish; Baloch, M.A.; Abbas, K. Financial development, globalization, and CO2 emission in the presence of EKC: Evidence from BRICS countries. Environ. Sci. Pollut. Res. 2018, 25, 31283–31296. [Google Scholar] [CrossRef]

- Khan, M.; Ozturk, I. Examining the direct and indirect effects of financial development on CO2 emissions for 88 developing countries. J. Environ. Manag. 2021, 293, 112812. [Google Scholar] [CrossRef]

- Zhang, D.; Zhang, Z.; Managi, S. A bibliometric analysis on green finance: Current status, development, and future directions. Finance Res. Lett. 2019, 29, 425–430. [Google Scholar] [CrossRef]

- Marjanović, V.; Milovančević, M.; Mladenović, I. Prediction of GDP growth rate based on carbon dioxide (CO2) emissions. J. CO2 Util. 2016, 16, 212–217. [Google Scholar] [CrossRef]

- Shabani, Z.D.; Shahnazi, R. Energy consumption, carbon dioxide emissions, information and communications technology, and gross domestic product in Iranian economic sectors: A panel causality analysis. Energy 2019, 169, 1064–1078. [Google Scholar] [CrossRef]

- Salari, M.; Javid, R.J.; Noghanibehambari, H. The nexus between CO2 emissions, energy consumption, and economic growth in the U.S. Econ. Anal. Policy 2021, 69, 182–194. [Google Scholar] [CrossRef]

- Sadorsky, P. The effect of urbanization on CO2 emissions in emerging economies. Energy Econ. 2014, 41, 147–153. [Google Scholar] [CrossRef]

- Shao, X.; Zhong, Y.; Li, Y.; Altuntaş, M. Does environmental and renewable energy R&D help to achieve carbon neutrality target? A case of the US economy. J. Environ. Manag. 2021, 296, 113229. [Google Scholar]

- Zahra, S.; Khan, D.; Nouman, M. Fiscal policy and environment: A long-run multivariate empirical analysis of ecological footprint in Pakistan. Environ. Sci. Pollut. Res. 2022, 29, 2523–2538. [Google Scholar] [CrossRef]

- Liu, X.; Bae, J. Urbanization and industrialization impact of CO2 emissions in China. J. Clean. Prod. 2018, 172, 178–186. [Google Scholar] [CrossRef]

- Khan, D.; Ahmed, N.; Mehmed, B.; Haq, I.U. Assessing the Impact of Policy Measures in Reducing the COVID-19 Pandemic: A Case Study of South Asia. Sustainability 2021, 13, 11315. [Google Scholar] [CrossRef]

- Khan, D.; Nouman, M.; Popp, J.; Khan, M.; Rehman, F.U.; Oláh, J. Link between Technically Derived Energy Efficiency and Ecological Footprint: Empirical Evidence from the ASEAN Region. Energies 2021, 14, 3923. [Google Scholar] [CrossRef]

- Westerlund, J.; Edgerton, D.L. A panel bootstrap cointegration test. Econ. Lett. 2007, 97, 185–190. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. J. Appl. Econ. 2007, 22, 265–312. [Google Scholar] [CrossRef] [Green Version]

- Jalil, A.; Tariq, R.; Bibi, N. Fiscal deficit and inflation: New evidences from Pakistan using a bounds testing approach. Econ. Model. 2014, 37, 120–126. [Google Scholar] [CrossRef]

- Mehmood, U.; Tariq, S. Globalization and CO2 emissions nexus: Evidence from the EKC hypothesis in South Asian countries. Environ. Sci. Pollut. Res. 2020, 27, 37044–37056. [Google Scholar] [CrossRef]

- Baltagi, B.H.; Baltagi, B.H. Econometric Analysis of Panel Data; Springer: Berlin/Heidelberg, Germany, 2008; Volume 4. [Google Scholar]

- Kinoshita, Y.; Campos, N.F. Foreign Direct Investment and Structural Reforms: Evidence from Eastern Europe and Latin America; IMF: Washington, DC, USA, 2008. [Google Scholar]

- Arellano, M. Panel Data Econometrics; Oxford University Press: Oxford, UK, 2003. [Google Scholar]

- Loayza, V.N.; Ranciere, R. Financial development, financial fragility, and growth. J. Money Credit. Bank. 2006, 38, 1051–1076. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M.H.; Shin, Y.; Smith, J.R. Bond testing approach to the analysis of long run relationship. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, J.R. Bounds testing approaches to the analysis of level relationships. J. Appl. Econom. 2001, 16, 289–326. [Google Scholar] [CrossRef]

- Pesaran, M.; Smith, R. Estimating long-run relationships from dynamic heterogeneous panels. J. Econ. 1995, 68, 79–113. [Google Scholar] [CrossRef]

- Hussain, S.; Ahmad, T.; Shahzad, S.J.H. Financial Inclusion and CO2 Emissions in Asia: Implications for Environmental Sustainability; Research Square: Durham, NC, USA, 2021. [Google Scholar] [CrossRef]

- Breitung, J.; Das, S. Panel unit root tests under cross-sectional dependence. Stat. Neerlandica 2005, 59, 414–433. [Google Scholar] [CrossRef]

- Hausman, J.A. Specification tests in econometrics. Econom. J. Econom. Soc. 1978, 46, 1251–1271. [Google Scholar] [CrossRef] [Green Version]

- Ramsey, J.B. Tests for Specification Errors in Classical Linear Least-Squares Regression Analysis. J. R. Stat. Soc. Ser. B 1969, 31, 350–371. [Google Scholar] [CrossRef]

- Charfeddine, L.; Kahia, M. Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: A panel vector autoregressive (PVAR) analysis. Renew. Energy 2019, 139, 198–213. [Google Scholar] [CrossRef]

- Apergis, N.; Payne, J.E.; Menyah, K.; Wolde-Rufael, Y. On the causal dynamics between emissions, nuclear energy, renewable energy, and economic growth. Ecol. Econ. 2010, 69, 2255–2260. [Google Scholar] [CrossRef]

- Hu, K.; Raghutla, C.; Chittedi, K.R.; Zhang, R.; Koondhar, M.A. The effect of energy resources on economic growth and carbon emissions: A way forward to carbon neutrality in an emerging economy. J. Environ. Manag. 2021, 298, 113448. [Google Scholar] [CrossRef] [PubMed]

- Sun, H.; Samuel, C.A.; Amissah, J.C.K.; Taghizadeh-Hesary, F.; Mensah, I.A. Non-linear nexus between CO2 emissions and economic growth: A comparison of OECD and B&R countries. Energy 2020, 212, 118637. [Google Scholar]

- Abbasi, M.A.; Parveen, S.; Khan, S.; Kamal, M.A. Urbanization and energy consumption effects on carbon dioxide emissions: Evidence from Asian-8 countries using panel data analysis. Environ. Sci. Pollut. Res. 2020, 27, 18029–18043. [Google Scholar] [CrossRef]

- Adedoyin, F.F.; Zakari, A. Energy consumption, economic expansion, and CO2 emission in the UK: The role of economic policy uncertainty. Sci. Total Environ. 2020, 738, 140014. [Google Scholar] [CrossRef]

- Parker, S.; Bhatti, M.I. Dynamics and drivers of per capita CO2 emissions in Asia. Energy Econ. 2020, 89, 104798. [Google Scholar] [CrossRef]

- Fazal, R.; Rehman, S.A.U.; Rehman, A.U.; Bhatti, M.I.; Hussain, A. Energy-environment-economy causal nexus in Pakistan: A graph theoretic approach. Energy 2021, 214, 118934. [Google Scholar] [CrossRef]

- Le, T.-H.; Quah, E. Income level and the emissions, energy, and growth nexus: Evidence from Asia and the Pacific. Int. Econ. 2018, 156, 193–205. [Google Scholar] [CrossRef]

- Saboori, B.; Rasoulinezhad, E.; Sung, J. The nexus of oil consumption, CO2 emissions and economic growth in China, Japan and South Korea. Environ. Sci. Pollut. Res. 2017, 24, 7436–7455. [Google Scholar] [CrossRef] [PubMed]

- Zhang, X.; Zhang, H.; Yuan, J. Economic growth, energy consumption, and carbon emission nexus: Fresh evidence from developing countries. Environ. Sci. Pollut. Res. 2019, 26, 26367–26380. [Google Scholar] [CrossRef] [PubMed]

| Abbreviations | Variables | Unit | Data Source |

|---|---|---|---|

| CO2 | Carbon emissions | Metric tons per capita | World Bank (2021) |

| FI | This index is comprised of the following components: Automated teller machine (ATM)

| Index per 100,000 adults per 100,000 adults GDP (%) Volume to GDP (%) | World Bank (2021) World Bank (2021) World Bank (2021) World Bank (2021) |

| GDP | Gross Domestic Product | (Million measured at constant 2015 US$) | World Bank (2021) |

| EU | Energy use | (kg of oil equivalent per capita) | World Bank (2021) |

| URB | Urbanization | In thousands | United Nations (2021) |

| Countries | Variables | Mean | Median | Std. Dev. |

|---|---|---|---|---|

| Brunei | CO2 | 16.14 | 16.64 | 2.272 |

| FI | 3.57 | 3.66 | 0.407 | |

| EU | 8067.52 | 8511.59 | 1155.81 | |

| GDP | 12,763.94 | 12,838.67 | 565.59 | |

| URB | 290.05 | 288.05 | 31.99 | |

| Cambodia | CO2 | 0.36 | 0.33 | 0.19 |

| FI | 0.83 | 0.64 | 0.71 | |

| EU | 136.71 | 131.22 | 27.44 | |

| GDP | 13,345.4 | 12,391.3 | 5427.6 | |

| URB | 2958.65 | 2856.84 | 522.54 | |

| Indonesia | CO2 | 1.73 | 1.68 | 0.25 |

| FI | 1.84 | 1.34 | 0.79 | |

| EU | 106.15 | 104.7 | 14.12 | |

| GDP | 670,318 | 638,563.5 | 208,498.2 | |

| URB | 119,393 | 119,325 | 19,527.2 | |

| Malaysia | CO2 | 6.8 | 7.04 | 0.79 |

| FI | 3.8 | 3.72 | 0.23 | |

| EU | 131.84 | 133.3 | 6.14 | |

| GDP | 239,190.8 | 226,277.7 | 68,136.07 | |

| URB | 19,648.2 | 19,639.1 | 3315.5 | |

| Myanmar | CO2 | 0.28 | 0.22 | 0.15 |

| FI | 0.31 | 0.18 | 0.33 | |

| EU | 128.77 | 95.98 | 53.81 | |

| GDP | 41,426.89 | 40,598.24 | 19,772.39 | |

| URB | 14,488.5 | 14,389.4 | 1293.45 | |

| Philippines | CO2 | 0.98 | 0.9 | 0.17 |

| FI | 1.75 | 1.55 | 0.32 | |

| EU | 81.29 | 73.17 | 14.91 | |

| GDP | 240,040.9 | 220,810.8 | 78,340.55 | |

| URB | 42,834.5 | 42,134.2 | 4584.4 | |

| Singapore | CO2 | 8.69 | 8.39 | 0.77 |

| FI | 4.57 | 4.52 | 0.23 | |

| EU | 71.73 | 63.5 | 17.31 | |

| GDP | 238,928.3 | 231,408.5 | 72,621.77 | |

| URB | 4959.6 | 5020 | 620.98 | |

| Thailand | CO2 | 3.4 | 3.45 | 0.38 |

| FI | 4.14 | 4.05 | 1.1 | |

| EU | 171.21 | 121.05 | 223.96 | |

| GDP | 339,837.2 | 335,966.6 | 73,101.38 | |

| URB | 28,212 | 28,964 | 4908.09 | |

| Vietnam | CO2 | 1.56 | 1.57 | 0.65 |

| FI | 0.74 | 0.69 | 0.28 | |

| EU | 123.62 | 123.49 | 3.99 | |

| GDP | 148,062.4 | 140,618.1 | 52,959.23 | |

| URB | 26,956 | 26,486 | 5036.67 |

| Variable | ATMs | Bank Branches | Bank Deposits | Life Insurance Premium |

|---|---|---|---|---|

| Correlation Matrix | ||||

| AT | 1 | |||

| BB | 0.69 | 1 | ||

| BD | 0.68 | 0.46 | 1 | |

| LIP | 0.55 | 0.19 | 0.76 | 1 |

| Component Analysis | ||||

| Component | Eigenvalue | % Variance | Cumulative proportion % | First principal Component |

| 1 | 2.68 | 0.67 | 0.67 | (0.55) AT |

| 2 | 0.90 | 0.22 | 0.89 | (0.43) BB |

| 3 | 0.24 | 0.06 | 0.95 | (0.55) BD |

| 4 | 0.18 | 0.05 | 1 | (0.47) LIP |

| Series | Breitung and Das Test | CIPS Test | CADF Test | |||

|---|---|---|---|---|---|---|

| Level | First Diff | Level | First Diff | Level | First Diff | |

| Intercept | ||||||

| CO2 | −2.42 | −3.23 ** | −1.09 | −2.75 ** | −1.76 | −2.07 ** |

| FI | −1.86 | 3.33 ** | −2.06 | 3.11 ** | −1.70 | −2.83 ** |

| EU | −2.08 | −2.79 ** | −1.71 | −2.92 ** | −2.21 | −2.95 ** |

| GDP | −2.08 | −2.79 ** | −2.14 | −3.10 ** | −2.41 | −3.21 ** |

| URB | −2.26 | −2.97 ** | −2.27 | −3.71 ** | −2.91 | −4.17 ** |

| Intercept and trend | ||||||

| CO2 | −1.18 | −4.15 ** | −2.13 | 3.48 ** | −0.93 | −2.45 ** |

| FI | −1.94 | 2.84 ** | −2.92 | 4.03 ** | −2.23 | 3.37 ** |

| EU | −2.23 | −3.37 ** | −2.37 | 3.68 ** | −1.86 | −3.29 ** |

| GDP | −1.03 | −2.93 ** | −1.86 | −3.85 ** | −2.05 | −3.41 ** |

| URB | −1.49 | −3.52 ** | −1.10 | −2.69 ** | −2.36 | −3.94 ** |

| Statistics | Values | Z-Values | Prob. |

|---|---|---|---|

| Gt | −3.21 * | −5.97 | <0.01 |

| Ga | −15.51 * | −8.49 | <0.01 |

| Pt | −9.21 * | −5.12 | <0.01 |

| Pa | −12.34 * | −10.01 | <0.01 |

| Diagnostic Tests | Test Statistics | p-Values |

|---|---|---|

| Hausman test | 1.41 | 0.12 |

| Normality test | 0.89 | 0.71 |

| Ramsey RESET test | 1.52 | 0.63 |

| Variables | Parameters | t-Values | Std. Error | Prob. |

|---|---|---|---|---|

| LFI | 0.42 | 6.12 * | 0.07 | <0.01 |

| LEU | 0.67 | 7.75 * | 0.08 | <0.01 |

| LGDP | 1.08 | 9.01 * | 0.11 | <0.01 |

| LURB | 1.36 | 5.69 * | 0.24 | <0.01 |

| ∆LFI | 0.01 | 0.15 ** | 0.07 | <0.05 |

| ∆LEU | 0.28 | 1.04 | 0.26 | 0.29 |

| ∆LGDP | 0.75 | 1.60 ** | 0.47 | <0.05 |

| ∆LURB | 5.008 | 1.81 ** | 0.75 | <0.05 |

| Constant | −2.26 | −2.73 ** | 0.82 | <0.05 |

| ECT | −0.33 | −2.85 * | 0.11 | <0.01 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahmad, S.; Khan, D.; Magda, R. Assessing the Influence of Financial Inclusion on Environmental Degradation in the ASEAN Region through the Panel PMG-ARDL Approach. Sustainability 2022, 14, 7058. https://doi.org/10.3390/su14127058

Ahmad S, Khan D, Magda R. Assessing the Influence of Financial Inclusion on Environmental Degradation in the ASEAN Region through the Panel PMG-ARDL Approach. Sustainability. 2022; 14(12):7058. https://doi.org/10.3390/su14127058

Chicago/Turabian StyleAhmad, Seemab, Dilawar Khan, and Róbert Magda. 2022. "Assessing the Influence of Financial Inclusion on Environmental Degradation in the ASEAN Region through the Panel PMG-ARDL Approach" Sustainability 14, no. 12: 7058. https://doi.org/10.3390/su14127058

APA StyleAhmad, S., Khan, D., & Magda, R. (2022). Assessing the Influence of Financial Inclusion on Environmental Degradation in the ASEAN Region through the Panel PMG-ARDL Approach. Sustainability, 14(12), 7058. https://doi.org/10.3390/su14127058