1. Introduction

Kyrgyzstan is a landlocked mountainous nation in Central Asia’s eastern region. With a population of 6.1 million people, it is a tiny and open economy with a limited resource base. Following the disintegration of the former Soviet Union, the Kyrgyz economy, similar to other so-called transition economies, experienced tremendous suffering and profound economic upheavals. During the last 30 years, economic liberalization, political turbulence, the loss of fiscal transfers, and the disruption of trade flows have resulted in a significant economic decline and demographic impoverishment. Kyrgyzstan’s industrial base has been nearly completely eroded as a result of the long-term and profound recession [

1].

While the effects of the transition, including the subsequent recession and Soviet-era nostalgia, are still felt today, the Kyrgyz economy has slowly recovered. As a result of consistent expansion, the country has advanced from poor to lower-middle-income status, and over the past 20 years, its development has been one of the most equitable not only in Central Asia but also among all the lower-middle-income countries. Despite its strong performance, however, Kyrgyzstan remains one of the poorest nations in Central Asia and has made only meager progress toward developing a robust middle class with a stable source of income and improving living standards. The country is stuck in a situation where the majority of its citizens rely on low-paying and frequently informal occupations, with massive economic emigration taking place. The Kyrgyz economy is also extremely sensitive to external shocks due to its substantial reliance on three large but highly variable sources of income: natural resource exploitation, remittances, and foreign aid and loans [

2].

To boost its future economic prospects, Kyrgyzstan must optimize its geographical location. The country is at the crossroads of the People’s Republic of China, the Russian Federation, and Europe. This opens up huge trade and investment prospects, but only if the country can support and harness three existing regional economic connectivity initiatives: (i) the Eurasian Economic Union (EAEU) proposal; (ii) China’s Belt and Road plan; and (iii) an initiative based on the European Union’s (EU) operations in the area.

Kyrgyzstan must revitalize its industrial sector in order to achieve long-term economic growth and improved public welfare [

3]. The country has a large potential for renewable energy sources (RES), which are a key to sustainable development. RES could become an option for the decarbonization of the country’s energy generation, currently mainly fossil fuel–based. RES could also cover current and future energy needs, which will grow in line with the increasing energy needs of industries and private households. In terms of solar energy or photovoltaic (PV) technology potential, the country has more than 250 sunny days per year; the available level of solar radiation could thus cover a significant share of the total energy needs of private households. Kyrgyzstan also has significant potential for wind, biomass, and hydro energy. According to the data of the State Committee for Industry, Energy, and Subsoil Use, hydro energy offers the highest potential energy source in Kyrgyzstan at 5–8 billion kWh per year, compared with solar (490 million kWh) and wind (44.6 million kWh). Despite this, the current share of RES generation in total energy generation is minor. For instance, one small hydro power plant contributes only 1% of the current electricity mix [

4].

This paper tackles the following research questions:

- -

What are the opinions of the various stakeholder groups of the possible risks and advantages connected with the three economic connectivity processes in which Kyrgyzstan participates?

- -

How do various sustainable development factors, including environmental, social, and economic components, impact the development of scenarios for the country?

The novelty of this study lies in its use of a participatory methodology and scenario planning to evaluate the impacts of the three integration processes on the national economy of Kyrgyzstan, thereby ensuring that future development reflects the views, visions, and priorities of stakeholders. The data collection for this paper is also unique, given the extensive volume that was collected and reviewed. With three different integration processes occurring simultaneously, the integration of compromise-oriented policy solutions is important for Kyrgyzstan and, indeed, all countries aiming to create synergies between various strategic goals. The holistic compromise-oriented participatory methodology used here is applicable to strategic planning situations involving a multiplicity of targets, goals, and views.

2. Background: Economic Connectivity Processes

Economic connectivity processes are extremely important for Kyrgyzstan, given its geographical location at the cross-roads of various initiatives. Growing globalization increases the interconnectedness of countries through complex global supply and value chains. Interdependence likewise increases through transnational transport corridors, information and knowledge exchange, investments, and migration flows. The future of a small and open developing economy like Kyrgyzstan is highly contingent on the economic dynamics of its larger partners, both locally and globally (see

Figure 1 Map).

The term “economic connectivity” refers to various forms of economic relationships between states or groups of states in the areas of, for example, trade, business activities, finances, technology, and migration [

5]. Economic connectivity, a common feature of modern society, is characterized by various political and economic interactions and can be understood in at least two major forms. The first, including transport, communication, and energy infrastructure, is “hard” economic connectivity, while regulatory, institutional, and legal instruments or knowledge, culture, and understanding shape “soft” economic connectivity.

Economic connectivity in Central Asia is driven mainly by foreign investment. While water and energy represent important opportunities for connectivity, they are also sources of conflict and competition in the region. Uzbekistan in 2016, for example, following political changes, deployed several economic connectivity initiatives, such as the reopening of common borders, restorations of bus and flight connections, establishment of free economic zones, and harmonization of customs regulations. These initiatives helped overcome regional fragmentation and positively influenced the level of connectivity among Central Asian countries [

6].

We chose Kyrgyzstan as our case study for several reasons: first, because of the various impacts of three economic connectivity processes in which the country is involved, namely with (i) the Eurasian Economic Union (EAEU), (ii) the Belt and Road Initiative (BRI), and (iii) the European Union; second, because of the country’s current plans for reindustrialization which can create drivers for further industrial development; and third, because of the openness of the governance system of Kyrgyzstan to implementing new instruments to stimulate good and participatory governance, the favorable investment climate, and the implementation of regulations for environmental and social protection.

2.1. Eurasian Economic Union Economic Connectivity and Integration Process

In 2010 Belarus, Kazakhstan, and Russia established the Customs Union, which later became the Single Economic Space and eventually the Eurasian Economic Union (EAEU). In 2015 Kyrgyzstan became a member of the EAEU. At the core of the EAEU is its customs tariff policy, under which no customs tariffs are imposed on commerce inside the EAEU and customs taxes are consistently applied to trade with non-EAEU countries.

Within the EAEU, Kyrgyzstan’s main trading partners are Kazakhstan and Russia. Trade turnover increased by 20% in 2017 compared to 2016. Kyrgyzstan primarily exports fresh and dried vegetables to its partner nations, as well as milk and dairy products and agricultural raw materials. Clothing, comprising textiles and textile products, footwear, and clothing accessories, accounts for a large part of exports.

Following Kyrgyzstan’s accession to the EAEU, exports to Kazakhstan and Russia grew, but total exports declined; this may be explained by the fall in the re-export of Chinese goods due to their non-compliance with the newly enacted EAEU local content rules. Kyrgyz exports to the EAEU are now more diverse than their exports to other countries, and trade volumes between Kyrgyzstan and EAEU nations are expanding faster than trade volumes with the non-EAEU [

7].

Existing research [

8] demonstrates that the EAEU’s economic connectedness and integration have the following favorable effects: (i) harmonization of Kyrgyz law in important export industries to EAEU norms, (ii) streamlining of administrative processes, and (iii) elimination of double taxation and of indirect taxes on items imported inside the same legal organization.

According to the Supreme Eurasian Council [

9], the benefits of Eurasian economic connectivity and integration include: (i) import substitution, (ii) increased exports to third-party countries, (iii) increased exports to EAEU markets, (iv) multiplier effects, and (v) increased demand for intermediate products.

The process of establishing greater economic ties with the EAEU is now under way. It includes the creation of a single energy market, a common market for excisable goods, oil and oil products, gas, transportation services, and a common financial market. These “economic-connectedness” activities are predicted to provide further advantages to Kyrgyzstan, such as price stabilization and other synergistic economic consequences [

10]. Increased collaboration and integration with third-party nations, such as China, Iran, and Vietnam, with which free trade agreements have been signed, as well as Israel, Serbia, and Singapore, where free trade agreements are being negotiated, may provide further prospects.

Several development and financial institutions, such as the Russian–Kyrgyz Development Fund, the Eurasian Development Bank, and the Eurasian Fund for Stabilization and Development, facilitate economic connection inside the EAEU. There are also a number of bilateral activities with EAEU members to assist trade and logistical infrastructure development. Russia, for example, contributed funds to equip border crossings and certification laboratories [

11].

2.2. Economic Connectivity Process with the European Union

The Partnership and Interaction Agreement, in place since 1999, governs Kyrgyzstan–EU cooperation. The Agreement establishes three areas of collaboration: political discourse, economic relations, and sectoral cooperation.

In 2016, Kyrgyzstan was granted enhanced status under the EU’s Generalized System of Preferences (GSP+), which is part of the EU’s (GSP) for developing countries. Under GSP+, Kyrgyzstan can boost and diversify its exports to EU markets based on reduced customs taxes and zero customs tariffs for numerous items. GSP+ also mandates that Kyrgyz commodities meet technical criteria for safety, quality, and labeling. The EU is Kyrgyzstan’s largest contributor, with the majority of aid going to integrated rural development, education, and rule of law support. During 2014–2020, the Development Cooperation Instrument anticipated allocating 184 million euros (EUR ) for sustainable development initiatives [

3].

In 2018–2019, the European Union issued three key strategic documents on connectivity in the Central Asian region: Connecting Europe and Asia: Building Blocks for the EU (European External Action Service); European Way to Connectivity; and EU’s new Central Asia strategy (European Parliament). These documents include four key elements: definition of connectivity, sustainable development, good governance practices (including common rules and standards), and smarter investment. In them, the term “connectivity” covers such sectors as logistics and transportation, energy systems, digital economy, and social development (education, research, innovation, culture, and tourism). “Sustainable development” relates to the protection of environment and creation of fair benefits for local communities where infrastructure projects are being planned. “Good governance” includes the implementation of internationally recognized practices and technical standards. The European Commission is also proposing an increase in the EU’s external action budget in the region and the channeling of investment through the European Fund for Strategic Investments.

2.3. Belt and Road Initiative

The Belt and Road Initiative (BRI), led by China, aims to expand economic ties with nations along the route of the New Silk Road. It also aims to provide positive inputs for joint Chinese–Kyrgyz development projects in the transportation and infrastructure sectors, such as the formation of a transport corridor involving China, Kyrgyzstan, and Uzbekistan, the goal of which would be to create a new rail corridor to deliver goods to EU countries. Several transportation interconnection projects are being developed as part of this strategy, including a Chinese railway corridor connecting Urumchi, China, with Tashkent, the capital of Uzbekistan, and southern Kyrgyzstan. Under BRI it is intended to increase access to new markets, establish terms of trade, and foster the economic growth of the country’s rural regions (Xinjiang Uyghur Autonomous Region, Tibet Autonomous Region, Qinghai, Gansu, and Inner Mongolia). The program’s aim is to construct a new network of trains, roads, pipelines, and other infrastructure to connect China to Central Asia, West Asia, South Asia, Europe, and Africa, among other destinations. There is still doubt, however, about the EU’s reservations about the Silk Road Economic Belt (SREB) [

12]. The Export–Import Bank of China and the China State Bank are behind SREB, as are the Silk Road Investment Fund for infrastructure projects and the Maritime Silk Road for Chinese goods sales.

The impacts of integration processes on the economy of Kyrgyzstan have been studied by various scientists. Most, however, covered either impacts on a single sector, such as transportation [

12], labor and migration [

13], or trade and economy [

14], or the impacts of one particular integration process, such as the impacts of the Eurasian Economic Union on Central Asia [

15] and the accession of Kyrgyzstan to the Eurasian Economic Union [

16]. The studies also apply a variety of methods for analysis and data collection, such as discourse analysis regarding Eurasian integration in Central Asia [

17], VAR analysis [

18], or focus on a particular region such as Issyk-Kul [

19]. A holistic assessment of the various integration processes, based on a complex methodology involving stakeholders’ perceptions, is, however, lacking.

3. Methodology

This paper’s conceptual framework is based on participatory scenario planning—an increasingly popular tool for evaluating available alternatives while also involving stakeholders’ opinions and feedback. Considering that a scenario is a coherent and plausible description of the potential future trajectory of a system [

20], such as the national economy of Kyrgyzstan, scenario planning processes are often oriented toward influencing decisions [

21], which means they can potentially have a wide range of implications for a diverse set of stakeholders. Engagement of stakeholders is thus essential, and participatory scenario planning is a process in which stakeholders consider alternative futures and provide their input at all stages of the work.

The methodology of scenario planning was developed in the work of Krys et al. [

22] and applied in foresight studies with a focus on the Central Asian region [

23]. The inputs to scenarios such as the PESTEL approach were used in various areas: for example, marketing [

24]. In this paper, however, the participatory orientation of the scenario inputs and combinations of various methods puts this methodology to unique use.

The empirical data collection for this research included both quantitative and qualitative methods of analysis and different data collection steps which we describe below. The stakeholders were selected based on the comprehensive stakeholders matrix, which was developed after the study of the background literature, knowledge of Kyrgyz experts, and experience of work in Kyrgyzstan.

First, we collected and reviewed the background literature, including statistical databases, existing reports, and publications. This first step helped us develop the data collection protocol which included interviews, surveys, and questions for focus group discussion. There was a review of the existing literature and strategic planning documents by international organizations, including the Global Competitiveness Report 2017–2018 by the World Economic Forum [

13], Diagnostic report [

2] of the United Nations Industrial Development Organization (UNIDO), and others. We also reviewed the academic literature authored by Kyrgyz and international scientists. Materials from the annual and quarterly reports of the National Statistical Committee of the Kyrgyz Republic were used, as were documents adopted by the Jogorku Kenesh (the Kyrgyz Government) and messages of the President of the Kyrgyz Republic. We also reviewed materials from any strategic documents adopted, including national development programs, forums held on industrial development, and documents developed by international organizations, such as the United Nations Development Programme (UNDP), United Nations Environment Programme (UNEP), World Trade Organization (WTO), Helvetas, the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), and the World Bank. Some materials were obtained from the Kyrgyz information center “Toktom”.

Second, various existing strategic efforts (212 strategies, action plans, etc.) in Kyrgyzstan were analyzed.

Third, we conducted in-depth expert interviews with various stakeholders. In total, 50 interviews were conducted with experts from international and national organizations, government agencies, and business entities. Experts shared their perspectives on the situation in the industrial sector of the Kyrgyz Republic, emphasizing the main bottlenecks and problems existing in the key branches. During in-depth interviews, the following issues were covered: development of the regions, growth points, and the role of local governments in the development processes; foreign direct investments (FDI) and investment climate; effectiveness of the existing regulatory framework related to the different industrial sectors; and export potential of the country’s industry and opportunities in different integration processes.

There were also expert interviews and multiple-choice questionnaires. IIASA scientists designed and distributed a questionnaire on the role of regional economic connectivity and integration processes in the industrial development of Kyrgyzstan. Altogether, 28 national experts responded to the survey. The questionnaire included the following questions (see

Supplementary Material for complete text).

(1) Please evaluate the current development level of the economic and industrial integration between Kyrgyzstan and international partners from all over the world. With which countries is there a realistic perspective of significantly enhancing cooperation in the next 5 years?

(2) What ways of attracting international capital from China, EAEU, EU, and other countries to Kyrgyzstan could be the most realistic and effective for accelerating national economic growth from 2018 to 2023?

(3) What financial instruments could enable the economic development of Kyrgyzstan, increase its production competitiveness on global markets, and improve its investment attractiveness, including with respect to its EAEU membership, from 2018 to 2023?

(4) What non-financial instruments could enable the economic development of Kyrgyzstan, increase its production competitiveness on global markets, and improve its investment attractiveness, including with respect to its EAEU membership, from 2018 to 2023?

(5) Evaluate a possible role for China’s New Silk Road project for the socioeconomic and industrial development of Kyrgyzstan:

(5-1) What impact could the development of China’s New Silk Road project have on the socioeconomic and industrial development of Kyrgyzstan?

(5-2) What advantages could China’s New Silk Road project bring to Kyrgyzstan?

(6) Evaluate the role of Kyrgyzstan in the WTO:

(6-1) How helpful is Kyrgyzstan’s membership in the WTO for the development of national enterprises?

(6-2) What factors are currently preventing Kyrgyzstan from taking greater advantage of its WTO membership to accelerate socioeconomic and industrial development?

(7) What actions to deepen the political and economic interaction between the EU and Kyrgyzstan will, in your opinion, be the most effective in terms of enhancing the socioeconomic and industrial development of the country?

(8) How do mutual sanctions between Russia and the EU affect foreign investment in Kyrgyzstan?

Fourth, we implemented a comprehensive set of four surveys with national and international experts. The first survey was on the role of regional integration processes in the industrial development of Kyrgyzstan to which 28 experts provided their input. The second was on the investment climate in Kyrgyzstan to which 26 experts provided input. The third survey focused on development factors and the degree of their impact on the development of Kyrgyzstan following the PESTEL conceptual framework (P—political, E—economic, S—societal, T—technological, E—environmental, and L—legal factors). Here, 25 national and 7 international experts provided their responses. The fourth survey was on the actions and measures that are important for the industrial development of Kyrgyzstan at the national, regional, and sectoral level, to which five experts responded.

Using the PESTEL analysis technique [

24], IIASA specialists identified 75 PESTEL (political, economic, societal, technological, environmental, and legal) development elements based on expert surveys, normative documents, and selected research. Experts were then asked to rank these elements in terms of their relevance for Kyrgyzstan’s industrial growth and also predict the likelihood of their manifestation up to 2023 and 2040.

Fifth, we conducted four focus group discussions in various regions of Kyrgyzstan: Osh region (Osh city), 22 experts; Issyk Kul region (Karakul city), 15 experts; Chui region (Bishkek), 16 experts; and Jalal-Abad region (Jalal-Abad city), 20 experts. Altogether, 73 national experts provided feedback on these factors at the regional level during focus group discussions. Each focus group had between 15 and 30 participants representing small and medium enterprises, big companies, and business associations operating in Kyrgyzstan. Focus-group discussions were conducted in local languages comfortable to the participants (Kyrgyz and Russian). All were facilitated by moderators. Moderators (one or two per group) introduced topics for discussion and helped the group to participate in lively and natural deliberations. During focus group discussions, participants shared their main concerns and expectations related to industrial development and discussed measures aimed at solving existing problems in certain industrial sectors. At the end of the focus group discussion, all participants filled in questionnaires developed at IIASA. Completed questionnaires were sent back to IIASA for further processing and analysis.

Sixth, scenario development. The empirical data provided inputs for participatory scenario development. The work on scenarios included several steps, all participatory, and involved contributions from the key stakeholders involved to decision-making processes on industrial development in Kyrgyzstan. The group consisted of 14 individuals from policy circles, including representatives of the Agency for Management of Budget Credits (Ministry of Finance), the Ministry of Economy, and the Parliament; from academia, including representatives of the National Institute of Strategic Research; from development partners, including the Guarantee Fund of the Kyrgyz Republic and the UNDP; and from other interested organizations, such as the Chamber of Trade and Industry and others.

Scenario planning included foresight, a technique of studying predicted and alternate futures to guide a plan. Scenario planning, as a key approach in future studies, has long been utilized by government planners, business executives, and military analysts as a useful tool for making decisions in the face of ambiguity [

25]. Its goal is to conduct a systematic examination of feasible futures, with particular attention to polar instances with unclear elements. Each scenario is a story that paints a picture of a possible future that is internally consistent. Foresight combines the (partial) knowledge of a number of specialists to create as complete a set of possibilities as feasible. We used scenario planning because it depicts a range of potential future developments, based on the present situation, in the mid and long term. It also allows stakeholders to make changes to existing strategies and build new policies to mitigate a variety of shocks.

4. Results

The survey which was conducted by IIASA researchers with stakeholders—inside and outside Kyrgyzstan—who are involved in the country’s industrial activities showed that most survey participants believe Kyrgyzstan will continue and even improve its economic relations with all current trade partners. Russia, Kazakhstan, China, Uzbekistan, Turkey, and the EU will remain its major trading partners. This means that all three economic connectivity and integration processes involving the major trade partners will continue to play a significant role in the country.

Stakeholders believe China to currently have the highest level of economic and industrial connectivity with Kyrgyzstan, followed by Russia, Kazakhstan, Turkey, and Uzbekistan. The majority of survey participants also believed that this situation might change in the next five years as Russia increases its connectivity and integration, overtaking China, which would be in fourth place after Russia and Uzbekistan (

Figure 2). Countries such as Armenia, Cyprus, Norway, and Vietnam, as well as Turkmenistan, which belongs to the Central Asian region, have the lowest level of connectivity, and this will remain at a low level throughout the next five years [

26,

27].

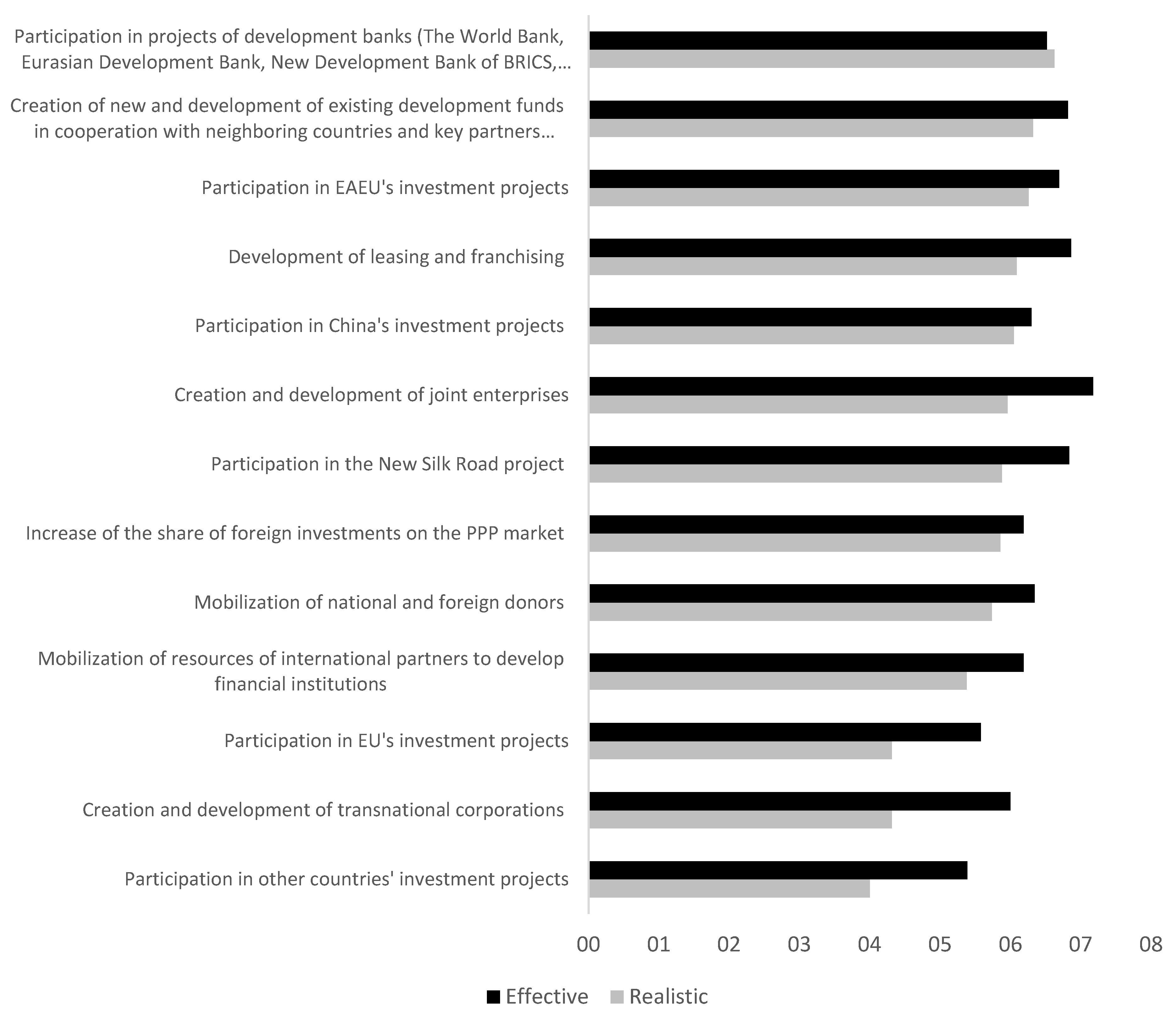

Stakeholders think that the participation of Kyrgyzstan in various activities within the connectivity processes will be limited mainly to national and international donor assistance projects, such as World Bank projects, which are for the most part publicly funded. Regarding private capital and investment projects, they perceive participation in EAEU investment projects as being much more realistic, followed by Chinese projects, with EU projects in third place.

While the stakeholders believe that the creation and development of joint enterprises would be the most effective way of accelerating national economic growth, this is not a very realistic prospect at the moment. If we look at participation in various investment projects vis à vis the three integration initiatives, the EAEU and BRI investment projects will be a more effective way of accelerating national economic growth than those of the EU (

Figure 3).

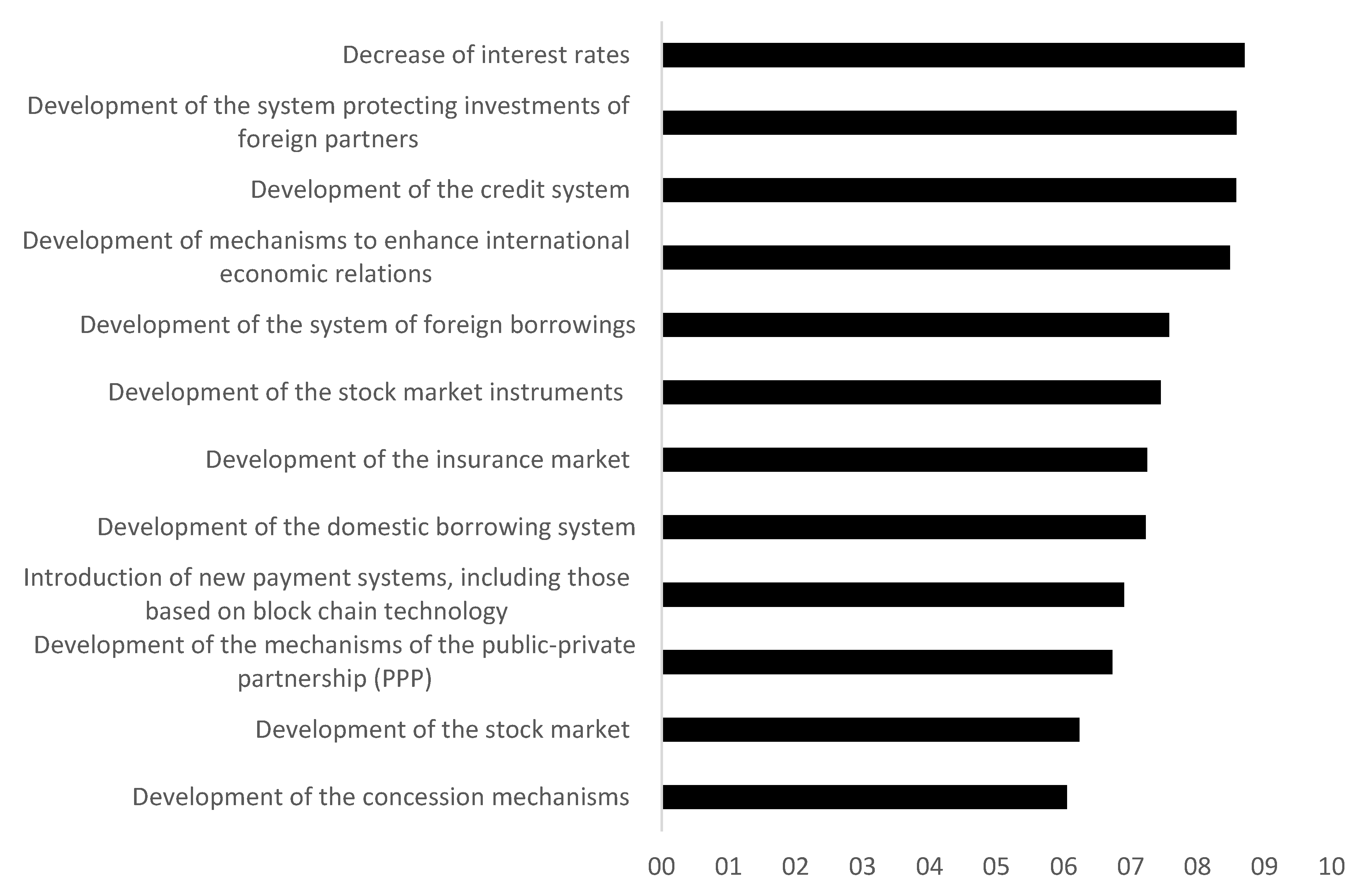

4.1. Perceived Benefits of EAEU Economic Connectivity and Integration Process

The connectivity process within the EAEU will have benefits for the development of both financial and non-financial instruments. For instance, it will allow a decrease in interest rates and will lead to the development of a regulatory system for protecting the investments of foreign partners (

Figure 4).

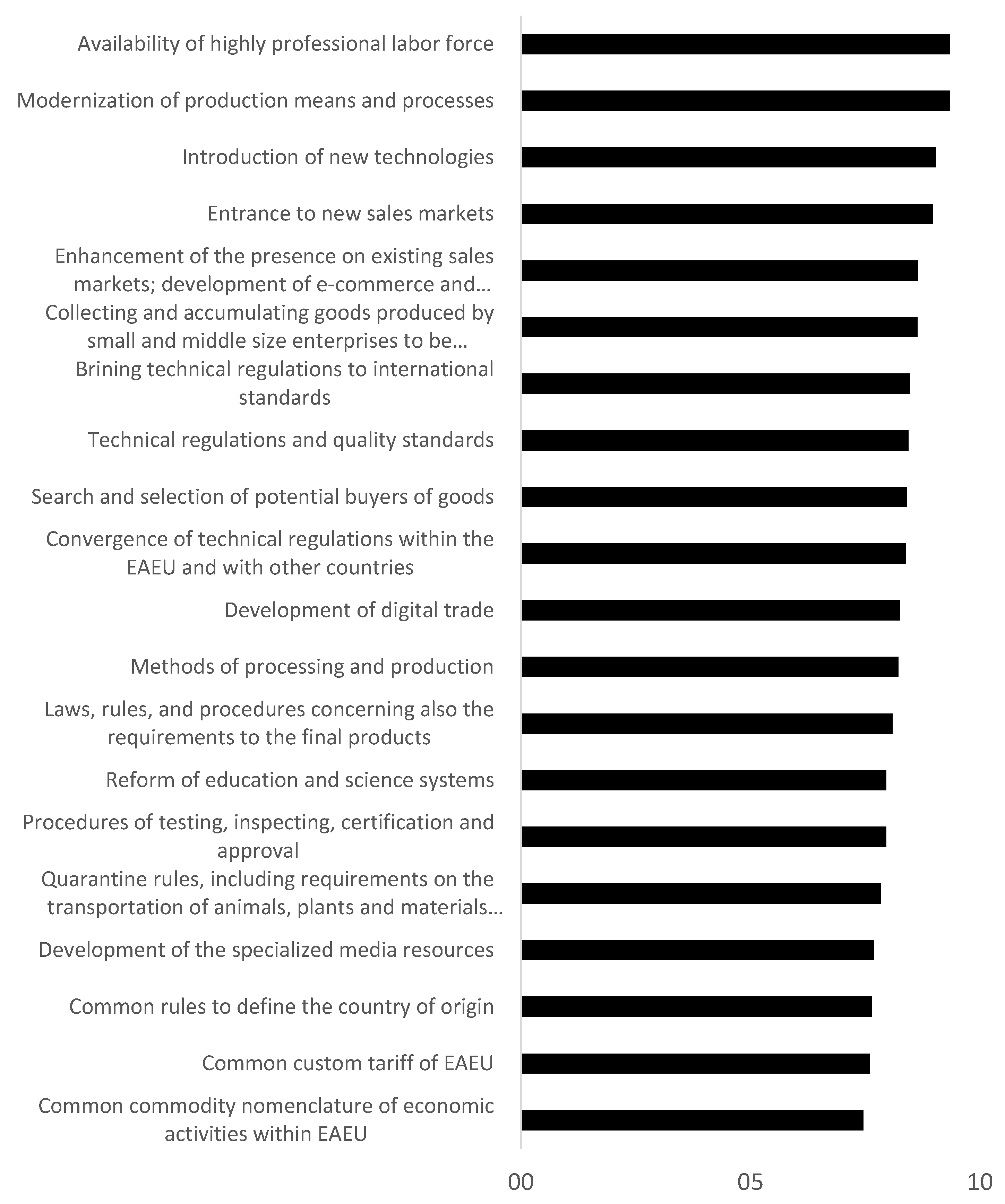

Besides financial benefits, stakeholders have significant expectations regarding the EAEU connectivity process, including tangible benefits such as the availability of a highly professional labor force, modernization of production means and processes, introduction of new technologies, and entry to new sales markets (

Figure 5).

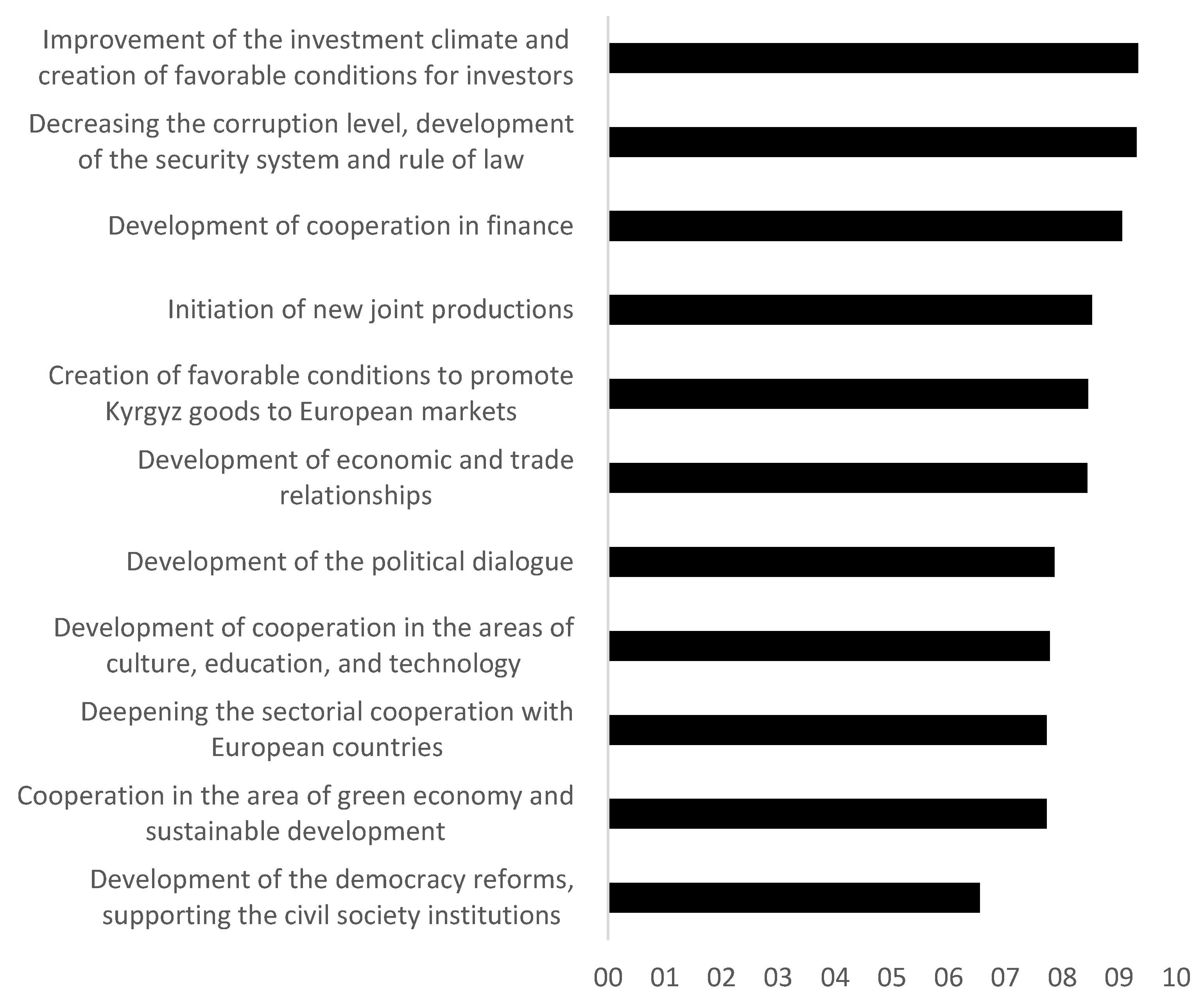

4.2. Perceived Benefits of EU Economic Connectivity Process

According to Kyrgyz experts’ perceptions, the major benefits of the EU economic connectivity process include the improvement of investment climate and good governance (

Figure 6).

4.3. Perceived Benefits of BRI Economic Connectivity Process

Stakeholders expect largely positive impacts from BRI economic connectivity. On the question “What impacts may BRI have on the socioeconomic and industrial development of Kyrgyzstan?”, 81% of all respondents answered that they expect positive impacts. Some stakeholders expect negative (4%) and very negative (4%) impacts, and some are indifferent or expect no impact (11%). Nobody expected very positive impacts, and the percentage of answers here was 0%.

According to the experts surveyed, the major benefits of BRI economic connectivity will lie in the creation and development of transport infrastructure in general—of roads and railways as well as improved transport corridors that will lead to further integration with neighboring countries. Technology transfer under the BRI economic connectivity process is the least-perceived benefit (

Figure 7).

During the regional workshops, concerns were expressed about the environmental impacts of the BRI economic connectivity process, namely the possible deployment of coal power generation capacities, including the beginning of exploration at existing reserves. China promotes coal extraction as the cheapest power generation option to cover its growing energy demands. Coal will not only impact the environment but will also encourage carbon-intense and air-polluting activity in Kyrgyzstan.

The results pertaining to the benefits of the three economic connectivity processes are supported by findings from six scenarios [

28,

29]. The two scenarios with largest positive impacts on the development of Kyrgyzstan are those depicting the benefits of all three integration processes: Modern yurt and Khagan’s fortress. These scenarios are based on the complementary advantages and synergies of the three connectivity processes. They are different in terms of trade policy and governmental regulation of the economy. Modern yurt has a significant decrease in liberalization, and Khagan’s fortress has advanced autocracy.

The Modern yurt scenario has the following findings regarding connectivity processes.

Economic connections drive an array of ventures among nations that co-exist within such groupings. A member of the EAEU, Kyrgyzstan also has other agreements with varying levels of commitment that ensure win–win cooperation. Because of improved trade cooperation between the EAEU and a number of its key trading partners, including tariff reductions and the gradual convergence of the EAEU standards with the standards of its major trading partners, EAEU membership has triggered an export growth, first to its member countries and then to non-EAEU countries.

Kyrgyzstan has become a “Eurasian gate” for China, which has risen to the top of the world economic hierarchy and other Asian nations (such as India and Pakistan) and whose economic power is now significant. Infrastructure for transportation and logistics plays a critical role, and this has been built with the help of partners such as China, Russia, and the EU. New supply networks are forming as a result, and total overland commerce in Eurasia has risen significantly, particularly between the EU and key Asian nations. As a result, regional connectivity is improving, and Kyrgyzstan may take advantage of its transit location and become a significant gateway for commercial flows between Europe and Asia. Massive investment by development partners has poured into Kyrgyzstan, bringing with it the transfer of technologies and contemporary international processes; the country’s capital Bishkek is mostly foreign-owned, and global firms have established branches there. The technical divide between Kyrgyzstan and industrialized nations has narrowed dramatically. Foreign investments are aimed, among other things, towards the development of innovative and environmentally friendly technology, such as renewable energy sources (i.e., hydro power systems (HPSs) and solar and wind power). Energy from Kyrgyzstan is exported to neighboring countries and South Asia. The quality of domestically produced products and services assures their competitiveness on regional and worldwide markets; Kyrgyz industry has integrated into international supply and value chains, aided by the development of trade and transportation infrastructure.

The Khagan’s fortress scenario depicts the following concerning economic connectivity processes.

Kyrgyzstan takes a pragmatic approach to regional cooperation, entering into agreements that it considers relevant to achieving its strategic goals. This includes the Commonwealth of Independent States (CIS), the Shanghai Cooperation Organization (SCO), and China’s Belt and Road Initiative (BRI). Membership in the EAEU is vital; the EAEU has grown to include additional Central Asian nations (Tajikistan, Uzbekistan) and other Asian countries (e.g., Vietnam). The EAEU has also increased its level of integration, effectively becoming a “Eurasian Union” modeled after the EU, with a shared currency known as “Eurasion”. The Kyrgyz economy has achieved a reasonable level of self-sufficiency; goods not produced domestically are primarily imported from the EAEU and Central Asian countries.

Another scenario—the Assembly shop scenario—which is still favorable but has fewer advantages for Kyrgyzstan’s growth, involves only one connecting procedure, mainly under the BRI initiative: Kyrgyzstan has evolved into a raw materials appendage of wealthier countries. Several industries, including gold mining, vehicle manufacturing, and food processing, have attracted international investment (mostly Chinese). The manufacturing base has been upgraded, and the quality of goods and services produced domestically is excellent. The Kyrgyz economy has been unable to profit from multiplier effects, as investors brought their own labor, technology, and inputs. The economy is still heavily controlled. The gap between rich and poor is widening, and average national welfare remains low. Domestic demand is minimal, and the country’s reliance on foreign financial assistance remains critical. Kyrgyzstan has been unable to benefit from participation in the EAEU, as Kyrgyz goods continue to be discriminated against due to non-tariff (administrative) restrictions. Foreign investors, mostly from China and other Asian nations, have proved attractive to the governing class. With the help of foreign donors, several agreements have been reached to reactivate idle industrial units, including manufacturing sites for machinery and equipment, and also to establish new ones.

Scenarios based on competition between the three connection mechanisms or that fail to generate synergies among these processes have severe consequences for Kyrgyzstan’s growth. The following is an example of the Sand building scenario: global superpowers strive for control over the Central Asian area because it connects Asia and Europe overland, plays a role in global security, and has valuable natural resources that are becoming limited as the world population grows. Foreign donors pour money into the nation, yet the country is unable to benefit from it. The economy is still heavily controlled. Although the production base has been upgraded, the quality of domestically produced goods and services remains inadequate due to a lack of both experienced management and a comprehensive national development strategy. Foreign aid benefits oligarchs and high-ranking officials personally; inequality is enormous, while the majority of the people live in poverty. Domestic demand is minimal, and the country’s reliance on foreign financial assistance remains critical. China is interested in strengthening Kyrgyzstan’s transportation infrastructure as part of its Belt and Road Initiative (BRI) and is willing to invest in it. Transport corridors, on the other hand, do not become development corridors. Despite their common markets, the EAEU nations pursue protectionism and support their producers; Kazakhstan continues to erect non-tariff obstacles to Kyrgyz agricultural exports. These factors hinder Kyrgyzstan’s ability to benefit from EAEU participation. Border disputes with Central Asian neighbors (for example, over shared water supplies) do not exist.

4.4. Perceived Barriers to Implementation of Sustainable Development Projects

Our in-depth qualitative interviews with experts revealed the following barriers to implementation of RES. We have classified them into the following categories: policy and regulations barriers and financing and economic barriers.

Policy and regulations: currently strategic programs for introduction of new generation capacities are missing. The unified approach to identifying areas for deployment of renewable energy projects or clean technologies and the lack of financing for research needed within such an approach are also a barrier. The complicated and complex administrative procedures are a significant barrier to further deployment of RES. For instance, the procedure for acquisition of land for deployment of RES projects is complex, involving several administrative units and several administrative steps. Sometimes for small hydro power projects, for example, the procedures can take up to 3–4 years.

Table 1 shows existing regulations and the period of time required to receive all the necessary approvals and permissions. There are corruption risks at every step of these procedures. The absence of a payment guarantee mechanism for delivery of electricity to transmission systems operations is a barrier to the further deployment of RES. From the institutional point of view, the creation of an administrative entity to deal with the deployment of RES projects and identify investment opportunities was recommended.

Financing and economic barriers: the current tariff policy foresees very low energy tariffs which are not favorable for the deployment of RES and require support schemes to be introduced either for energy generation or for energy demand. Other barriers include existing risks for financing of RES projects, such as operational risks or investment risks without guarantees and also currency risks. Other barriers include a lack of interest on the part of transmission systems operators in purchasing electricity generated by RES because there is still no financing mechanism to compensate for the additional expenses incurred by transmission systems operators.

5. Discussion

Our results show that stakeholders in Kyrgyzstan perceive the benefits and impacts of the three economic connectivity processes as complementary rather than competitive (

Table 2). They also show which of the connectivity processes will help overcome barriers to RES deployment based on the perceptions of Kyrgyz stakeholders. The key findings on the benefits of three connectivity processes, identified from the scenario work and experts’ elicitations, are described in

Table 2.

As shown in

Table 1, expectations for the EAEU economic connectivity process are mainly connected with the further development of conditions for private investment and with technology and knowledge transfer, including education, building a qualified labor force, and introduction of new technologies. Expectations for the BRI economic connectivity process are mainly connected with the development of transportation infrastructure, including roads and railways. Expectations for EU economic connectivity are mainly connected with improvement of good governance practices, including transparency and the rule of law.

Such results show that the three economic connectivity processes are not competitive but rather complementary and that all three are needed for further development of the country. For instance, Kofner et al. [

30] report that the EU and Chinese approaches to connectivity are complementary rather than competitive and that Europe does not have the same financial resources to invest in infrastructure as China does. At the same time, Europe has considerable expertise in the establishment of strong investment, labor, and environmental standards. The contribution of the EU could be in assisting development and implementation of regulatory practices and standards.

The focus of state policy on innovation and green growth should be the creation of attractive investment conditions. Improvements in the regulatory framework should include guarantees for private investment and regulation of state–private sector relationships. The institutional framework for deployment of new technologies for green growth and innovation should be also improved. For instance, there is, as yet, no state authority responsible for attracting investment in new projects and dealing with administrative procedures. Introducing such an authority has been successful in several countries. The lack of appropriate financing mechanisms also negatively influences the willingness of electricity distribution companies to purchase electricity generated from renewable energy sources.

These results also show that both soft and of hard economic integration could be achieved with the help of various economic connectivity processes. For instance, the EU and EAEU could contribute to the soft factors, such as development and harmonization of regulations and standards. BRI and EAEU could contribute to the development of hard factors, such as infrastructure and technology transfer. Moreover, implementation of economic connectivity initiatives would require good governance practices as well as implementation of environmental and social protection standards. As economic connectivity projects cannot exist in a vacuum and would require physical infrastructure for their implementation, a combination of both hard and soft connectivity factors is crucially important.

Energy, trade, and digitalization were identified as the areas with the highest potential for economic connectivity. To consider the impacts of three different economic connectivity processes in the Central Asian region on energy, trade, and digitalization, further research is needed. Because of the three processes’ complementary and non-competitive character, further research could usefully elicit how governance mechanisms and frameworks across various Central Asian countries might facilitate economic integration and also benefit from the synergistic impacts of three processes.

These results also provide directions for the development of further strategic technologies, such as hydrogen, which should be similarly studied.

This study discusses the benefits of Kyrgyzstan’s integration with the existing international unions [

30], while prospects of a hypothetical union between the Central Asian countries themselves are also studied [

31,

32]. However, perspectives of such an association are considered uncertain by some experts, being overridden by international unions such as the EAEU [

33]. The COVID-19 pandemic has also contributed to the slowdown of integration processes in the region [

33].

The outcomes of this study combined with the future development scenarios of Kyrgyzstan, for example [

29] or [

34], can be used for deliberative future visioning of the integration processes most beneficial for the Kyrgyz economy and society [

35]. More generally, incorporating voices of diverse stakeholders in a participatory manner, as presented in this study, can foster creating more inclusive governance infrastructures [

36].

These results also provide directions for the development of further strategic technologies, such as hydrogen or blockchain [

32], which should be also studied in a similar mode. The results also allow for further developing methodology, also outlined in previous research [

37].