Boom and Bust in China’s Pig Sector during 2018–2021: Recent Recovery from the ASF Shocks and Longer-Term Sustainability Considerations

Abstract

:1. Introduction

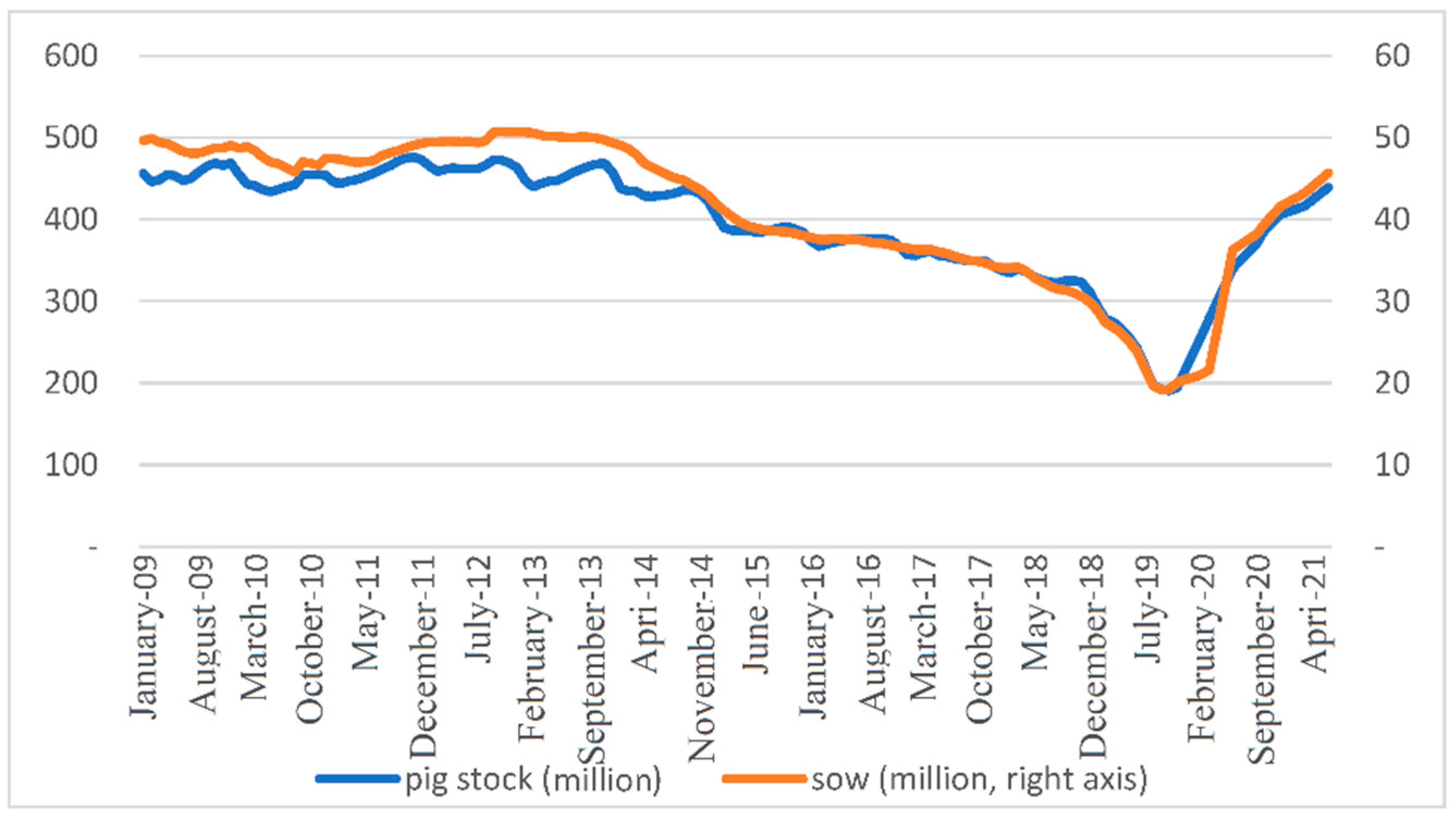

2. China’s Pig Production and Pork Market during 2000–2021

3. Methods

3.1. Qualitative Analysis

3.2. Quantitative Analysis

4. What Drives the Rapid Recovery of Pig Production in China? A Qualitative Analysis

4.1. ASF Containment

4.2. Government Initiatives

4.3. Investment and Structural Changes in China’s Pig Sector

4.4. Aftermath of the Rapid Recovery

5. Supply-Side Measures and Future Scenarios: A Quantitative Assessment

5.1. Possible Supply-Side Measures in China’s Feed Grain/Oilseeds and Pig Sectors

5.2. Modeling Future Supply Scenarios

5.3. Simulation Results

6. Conclusions and Discussions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Time | Issued By | Regulations | Specific Clauses on Livestock Production |

|---|---|---|---|

| 1 January 2014 | State Council [32] | Regulations on Prevention and Control of Pollution by Scaled Livestock and Poultry Breeding Industry | China’s first regulatory document specifically aimed at the prevention and control of pollution for livestock and poultry breeding. Clarified the division criteria of prohibited areas, applicable objects (livestock and poultry farms, breeding communities), incentives and punishments. |

| 1 January 2015 | State Council [33] | Environmental Protection Law | Clarified the site selection, construction and management of livestock and poultry farms, breeding communities, and designated slaughtering enterprises should comply with relevant laws and regulations. |

| April 2015 | State Council [34] | Water Pollution Prevention and Control Action Plan | Scientifically delineates the prohibited areas for livestock and poultry breeding. Before the end of 2017, closed or relocated livestock and poultry farms (communities) and specialized breeding households in the prohibited areas according to law, and the Beijing-Tianjin-Hebei, Yangtze River Delta, Pearl River Delta and other areas will be completed one year ahead of schedule. |

| August 2015 | Ministry of Agriculture and Rural Affairs (MARA) [47] | Notice on Cooperating with the Delimitation of Prohibited Areas for Livestock and Poultry Breeding | Requires that the animal husbandry and veterinary administrative departments at all levels actively cooperate with the environmental protection department to do a good job in the delimitation of prohibited areas, and report the delimitation of prohibited areas in time. |

| November 2015 | MARA [48] | Guiding Opinions on Promoting the Adjustment and Optimization of the Distribution of Pig Breeding in the Southern Water Network Area | Main producing counties should formulate a pig breeding plan. Local government closes or relocates large-scale pig farms according to law, and guides the transfer of pig breeding to non-overloaded areas. |

| May 2016 | State Council [49] | Soil Ten Articles | Clearly and reasonably determine the layout and scale of livestock breeding, and strengthen the prevention and control of livestock breeding pollution. |

| November 2016 | Ministry of Ecology and Environment (MEE) and MARA [35] | Technical Guidelines for Delimitation of Prohibited Areas for Livestock and Poultry Breeding | Basis for delineating prohibited areas throughout the country in the later period. Local environmental protection, agriculture and animal husbandry departments should follow the unified deployment of the local government, actively cooperate with relevant departments, and assist in the closure or relocation of existing farms that really need to be closed or relocated in the prohibited breeding area. |

| December 2016 | State Council [50] | The 13th Five-year Ecological and Environmental Protection Planning | Before the end of 2017, all regions are required to close or relocate livestock and poultry farms (communities) and professional breeding households in prohibited areas according to law. |

| 1 January 2018 | State Council [51] | Environmental Protection Tax Law | An environmental tax will be levied on farmers with a herd of more than 500 pigs. |

| May 2018 | MARA and MEE [52] | Implementation Plan for the Assessment of Resource Utilization of Livestock and Poultry Breeding Waste in 2017 | The environmental governance of livestock and poultry breeding was included in the performance assessment of local governments, which further increased the intensity of environmental supervision. |

| Corporate Producer | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|

| Muyuan | 3.11 | 7.24 | 11.01 | 10.25 | 18.12 |

| Zhengbang | 2.27 | 3.42 | 5.54 | 5.78 | 9.56 |

| Wen’s | 6.60 | 19.04 | 22.29 | 18.52 | 9.55 |

| New Hope Liuhe | 1.17 | 2.40 | 2.55 | 3.55 | 8.29 |

| Tianbang | 0.58 | 1.01 | 2.17 | 2.45 | 3.08 |

| COFCO | 1.71 | 2.23 | 2.55 | 1.99 | 2.10 |

| Aonong | 0.11 | 0.22 | 0.42 | 0.40 | 1.35 |

| Trs Group | 0.14 | 0.54 | 0.68 | 0.84 | 1.02 |

| Haid Group | 0.32 | 0.46 | 0.70 | 0.74 | 0.98 |

| Total | 16.01 | 36.56 | 47.91 | 44.52 | 54.04 |

References

- Schultz, T.W. Agriculture in an Unstable Economy; McGraw-Hill Book Company: New York, NY, USA, 1945. [Google Scholar] [CrossRef]

- Waugh, F.V. Does the Consumer Benefit from Price Instability? Q. J. Econ. 1944, 58, 602–614. [Google Scholar] [CrossRef]

- Oi, W.Y. The Desirability of Price Instability under Perfect Competition. Econometrica 1961, 29, 58–64. [Google Scholar] [CrossRef]

- Massell, B.F. Price Stabilization and Welfare. Q. J. Econ. 1969, 83, 404–417. [Google Scholar] [CrossRef]

- Johnson, D.G. World agriculture, commodity policy, and price variability. Am. J. Agric. Econ. 1975, 57, 823–828. [Google Scholar] [CrossRef] [Green Version]

- Deaton, A.; Laroque, G. On the behaviour of commodity prices. Rev. Econ. Stud. 1992, 59, 1–23. [Google Scholar] [CrossRef] [Green Version]

- Martin, W.; Anderson, K. Export Restrictions and Price Insulation during Commodity Price Booms. Am. J. Agric. Econ. 2012, 94, 422–427. Available online: https://www.jstor.org/stable/41331269 (accessed on 16 January 2022). [CrossRef]

- Wright, B.D. The economics of grain price volatility. Appl. Econ. Perspect. Policy 2011, 33, 32–58. [Google Scholar] [CrossRef]

- You, S.; Liu, T.; Zhang, M.; Zhao, X.; Dong, Y.; Wu, B.; Wang, Y.; Li, J.; Wei, X.; Shi, B. African swine fever outbreaks in China led to gross domestic product and economic losses. Nat. Food 2021, 2, 802–808. [Google Scholar] [CrossRef]

- Mason-D’Croz, D.; Bogard, J.R.; Herrero, M.; Robinson, S.; Sulser, T.B.; Wiebe, K.; Willenbockel, D.; Godfray, H.C.J. Modelling the global economic consequences of a major African swine fever outbreak in China. Nat. Food 2020, 1, 221–228. [Google Scholar] [CrossRef] [Green Version]

- Ma, M.; Wang, H.H.; Hua, Y.; Qin, F.; Yang, J. African swine fever in China: Impacts, responses, and policy implications. Food Policy 2021, 102, 102065. [Google Scholar] [CrossRef]

- Zhang, X.; Chu, F.; Yu, X.; Zhou, Y.; Tian, X.; Geng, X.; Yang, J. Changing Structure and Sustainable Development for China’s Hog Sector. Sustainability 2017, 9, 69. [Google Scholar] [CrossRef] [Green Version]

- Dong, W.; Wang, X.; Yang, J. Future perspective of China’s feed demand and supply during its fast transition period of food consumption. J. Integr. Agric. 2015, 14, 1092–1100. [Google Scholar] [CrossRef]

- Tang, L.; Chen, X.; Zhang, H.; Zhou, J.; Lou, J. Impact of African Swine Fever on China’s pig industry and countermeasures. Chin. J. Anim. Sci. 2021, 57, 219–223. (In Chinese) [Google Scholar] [CrossRef]

- Yao, H.; Zang, C.; Zuo, X.; Xian, Y.; Lu, Y.; Huang, Y.; Li, X. Tradeoff analysis of the pork supply and food security under the influence of African swine fever and the COVID-19 outbreak in China. Geogr. Sustain. 2022, 3, 32–43. [Google Scholar] [CrossRef]

- Bai, Z.; Jin, X.; Oenema, O.; Lee, M.R.; Zhao, J.; Ma, L. Impacts of African swine fever on water quality in China. Environ. Res. Lett. 2021, 16, 054032. [Google Scholar] [CrossRef]

- Yu, W.; Cao, L. China’s meat and grain imports during 2000–2012 and beyond: A comparative perspective. J. Integr. Agric. 2015, 14, 1101–1114. [Google Scholar] [CrossRef]

- Xu, T.; Sun, F.; Zhou, Y. Technical efficiency and its determinants in China’s hog production. J. Integr. Agric. 2015, 14, 1057–1068. [Google Scholar] [CrossRef]

- USDA. The Production, Supply and Distribution (PSD) Data Set. 2022. Available online: https://apps.fas.usda.gov/psdonline/app/index.html#/app/home (accessed on 16 January 2022).

- Li, H.; Zhao, M.; Lu, Q. Does the Livestock and Poultry Restricted Zone Policy Reduced China’s Pig Production Capacity? Issues Agric. Econ. 2021, 8, 12–27. (In Chinese) [Google Scholar] [CrossRef]

- Ministry of Agriculture and Rural Affairs of PRC. Press Conference on the Situation of Pig Production. 2020. Available online: http://www.gov.cn/shuju/2020-01/08/content_5467618.htm (accessed on 16 January 2022).

- State Council. Opinions on Promoting the High-Quality Development of Animal Husbandry. 2020. Available online: http://www.gov.cn/zhengce/content/2020-09/27/content_5547612.htm (accessed on 16 January 2022).

- Ministry of Agriculture and Rural Affairs of PRC. Opinions on Promoting the Sustainable and Healthy Development of the Pig Industry. 2021. Available online: http://www.moa.gov.cn/govpublic/xmsyj/202108/t20210806_6373631.htm (accessed on 16 January 2022).

- Hertel, T.W. Global Trade Analysis: Modeling and Applications; Cambridge University Press: Cambridge, UK, 1997; Available online: https://www.gtap.agecon.purdue.edu/resources/download/7685.pdf (accessed on 16 January 2022).

- Clora, F.; Yu, W.; Baudry, G.; Costa, L. Impacts of supply-side climate change mitigation practices and trade policy regimes under dietary transition: The case of European agriculture. Environ. Res. Lett. 2021, 16, 124048. [Google Scholar] [CrossRef]

- Ministry of Agriculture and Rural Affairs of PRC. 1.193 million Pigs Culled Due to ASF. 2019. Available online: https://baijiahao.baidu.com/s?id=1650891336838358669&wfr=spider&for=pc (accessed on 16 January 2022).

- Ministry of Agriculture and Rural Affairs of PRC. Press Conference on the Operation of Major Agricultural Products Markets. 2018. Available online: http://www.moa.gov.cn/hd/zbft_news/2018zyncpscjdqscrd/wzzb/ (accessed on 16 January 2022).

- Ministry of Agriculture and Rural Affairs of PRC. Notice on the Prevention and Control of ASF and Strengthening the Supervision of Pig Movement. 2018. Available online: http://www.moa.gov.cn/gk/tzgg_1/tfw/201808/t20180810_6155550.htm (accessed on 16 January 2022).

- Ministry of Agriculture and Rural Affairs of PRC. Notice on Effectively Strengthening the Supervision of Transporting Pig and Related Products. 2018. Available online: http://www.xmsyj.moa.gov.cn/zcjd/201809/t20180925_6158459.htm (accessed on 16 January 2022).

- Ministry of Finance of PRC, Ministry of Agriculture and Rural Affairs of PRC. Notice on Implementing the Subsidy for the Compulsory Culling of Pigs Infected with African Swine Fever. 2018. Available online: http://www.wugang.gov.cn/jc_wgs/126/145/content_3672.html (accessed on 16 January 2022).

- Kimura, S.; Yu, W.; Han, M. Multidimensional Evolution of Rural Development Policy in the People’s Republic of China; ADB: Mandaluyong, Philippines, 2021. [Google Scholar]

- State Council. Regulations on Prevention and Control of Pollution by Scaled Livestock and Poultry Breeding Industry. 2014. Available online: http://www.gov.cn/zwgk/2013-11/26/content_2534836.htm (accessed on 16 January 2022).

- State Council. Environmental Protection Law. 2015. Available online: http://www.gov.cn/zhengce/2014-04/25/content_2666434.htm (accessed on 16 January 2022).

- State Council. Water Pollution Prevention and Control Action Plan. 2015. Available online: http://www.gov.cn/zhengce/content/2015-04/16/content_9613.htm (accessed on 16 January 2022).

- Ministry of Ecology and Environment, Ministry of Agriculture and Rural Affairs of PRC. Technical Guidelines for Delimitation of Prohibited Areas for Livestock and Poultry Breeding. 2016. Available online: https://www.mee.gov.cn/gkml/hbb/bgt/201611/t20161114_367418.htm (accessed on 16 January 2022).

- Chen, M.; Xiao, H. The Impact of Livestock and Poultry Environmental Protection Policies on the Production Scale of Pig farms. Chin. J. Anim. Sci. 2021, 57, 275–278. (In Chinese) [Google Scholar] [CrossRef]

- Zhong, M.; Lin, C.; Duan, N. The Impact of Environmental Policy Changes on the Pig Industry. Swine Ind. Sci. 2015, 32, 90–91. (In Chinese) [Google Scholar] [CrossRef]

- Ministry of Ecology and Environment, Ministry of Agriculture and Rural Affairs of PRC. Notice on Further Doing a Good Job in the EIA Management of Current Large-Scale Pig Breeding. 2019. Available online: https://www.mee.gov.cn/xxgk2018/xxgk/xxgk06/202004/t20200413_774140.html (accessed on 16 January 2022).

- Ministry of Agriculture and Rural Affairs of PRC. Establishing Counter-Cyclical Control Mechanisms for Pig Production Capacity to Promote the Sustainable and Healthy Development of the Pig Industry. 2021. Available online: http://www.moa.gov.cn/ztzl/szcpxx/zyzc/202108/t20210806_6373688.htm (accessed on 16 January 2022).

- Reuters. Flush with Cash, Chinese Hog Producer Builds World’s Largest Pig Farm. 2020. Available online: https://www.reuters.com/article/us-china-swinefever-muyuanfoods-change-s-idUSKBN28H0MU (accessed on 16 January 2022).

- Tai, L. The Worst Pig Cycle in History, the Money Earned in the First Two Years has been Lost This Year. 2021. Available online: https://news.stcn.com/sd/202110/t20211015_3761921.html (accessed on 19 January 2022).

- Qiao, J. The Turning Point of the Current Pig Cycle Has Not Yet Come. 2021. Available online: http://www.news.cn/fortune/2021-12/07/c_1128137773.htm (accessed on 19 January 2022).

- Liu, Z.; Ying, H.; Chen, M.; Bai, J.; Xue, Y.; Yin, Y.; Batchelor, W.D.; Yang, Y.; Bai, Z.; Du, M.; et al. Optimization of China’s maize and soy production can ensure feed sufficiency at lower nitrogen and carbon footprints. Nat. Food 2021, 2, 426–433. [Google Scholar] [CrossRef]

- Aguiar, A.; Chepeliev, M.; Corong, E.L.; McDougall, R.; Van Der Mensbrugghe, D. The GTAP data base: Version 10. J. Glob. Econ. Anal. 2019, 4, 1–27. [Google Scholar] [CrossRef] [Green Version]

- Zhou, Y.; Zhang, X.; Tian, X.; Geng, X.; Zhang, P.; Yan, B. Technical and environmental efficiency of hog production in China–A stochastic frontier production function analysis. J. Integr. Agric. 2015, 14, 1069–1080. [Google Scholar] [CrossRef]

- Yu, W. How China’s Farm Policy Reforms Could Affect Trade and Markets: A Focus on Grains and Cotton; International Centre for Trade and Sustainable Development (ICTSD): Geneva, Switzerland, 2017; ISSN 1817-356X. [Google Scholar]

- Ministry of Agriculture and Rural Affairs of PRC. Notice on Cooperating with the Delimitation of Prohibited Areas for Livestock and Poultry Breeding. 2015. Available online: http://www.moa.gov.cn/govpublic/XMYS/201508/t20150812_4786158.htm (accessed on 16 January 2022).

- Ministry of Agriculture and Rural Affairs of PRC. Guiding Opinions on Promoting the Adjustment and Optimization of the Distribution of Pig Breeding in the Southern Water Network Area. 2015. Available online: http://www.moa.gov.cn/nybgb/2015/shierqi/201712/t20171219_6104128.htm (accessed on 16 January 2022).

- State Council. Soil Ten Articles. 2016. Available online: http://www.gov.cn/zhengce/content/2016-05/31/content_5078377.htm (accessed on 16 January 2022).

- State Council. The 13th Five-year Ecological & Environmental Protection Planning. 2016. Available online: http://www.gov.cn/zhengce/content/2016-12/05/content_5143290.htm (accessed on 16 January 2022).

- State Council. Environmental Protection Tax Law. 2018. Available online: http://www.chinatax.gov.cn/n810341/n810755/c3002759/content.html (accessed on 16 January 2022).

- Ministry of Agriculture and Rural Affairs of PRC, Ministry of Ecology and Environment. Implementation Plan for the Assessment of Resource Utilization of Livestock and Poultry Breeding Waste in 2017. 2018. Available online: http://www.moa.gov.cn/gk/tzgg_1/tfw/201805/t20180522_6142748.htm (accessed on 16 January 2022).

| Source | Document | Related Contents | |

|---|---|---|---|

| 10 August 2018 | MARA | Notice on the prevention and control of ASF and strengthening the supervision of pig movement | Strengthen the risk management and control of the movement of pigs, strengthen the quarantine work on the origin and slaughter of pigs, strengthen the supervision and management of the slaughtering process of pigs, and strengthen the supervision and inspection of the circulation process. |

| 31 August 2018 | MARA | Notice on effectively strengthening the supervision of transporting pig and related products | Vehicles that transport all livestock and poultry, such as pigs, no longer enjoy the “green channel” policy for fresh agricultural products |

| 13 September 2018 | MOF and MARA | Notice on doing a good job in the Subsidy for the Compulsory Culling of ASF | Offering financial compensations to pig farmers in connections with involuntary culling. Initially, farmers received a compensation of CNY800 per culled pig, similar to the compensation scheme adopted during the foot and mouth disease outbreaks. |

| FO | AY | AY_FR | AY_FR_FO | AY_FR_FO_TE | |

|---|---|---|---|---|---|

| Technical efficiency in feed use by the poultry and pig sector | 12.5 | 0 | 0 | 12.5 | 12.5 |

| Land productivity in soy production | 0 | 47.4 | 47.4 | 47.4 | 47.4 |

| Land productivity in maize production | 0 | 49.1 | 49.1 | 49.1 | 49.1 |

| Fertilizer use per unit of soy produced | 0 | 0 | 0 | 16.2 | 16.2 |

| Fertilizer use per unit of maize produced | 0 | 0 | 0 | 15.7 | 15.7 |

| Aggregate technical efficiency in poultry and pig sector | 0 | 0 | 0 | 0 | 33.3 |

| FO | AY | AY_FR | AY_FR_FO | AY_FR_FO_TE | ||

|---|---|---|---|---|---|---|

| Domestic outputs | oilseeds (soybean) | −0.48 | 14.48 | 15.91 | 15.23 | 14.35 |

| coarse grains (maize) | −1.09 | 2.63 | 2.88 | 1.68 | 0.39 | |

| pork and poultry | 1.38 | 0.47 | 0.52 | 1.86 | 26.50 | |

| Domestic market prices | oilseeds (soybean) | −0.46 | −16.68 | −18.05 | −18.23 | −18.23 |

| coarse grains (maize) | −1.10 | −19.57 | −21.25 | −21.51 | −21.52 | |

| pork and poultry | −2.13 | −0.51 | −0.55 | −2.59 | −22.74 | |

| Total imports | oilseeds (soybean) | −0.41 | −9.34 | −10.15 | −10.39 | −10.24 |

| coarse grains (maize) | −1.78 | −15.23 | −16.53 | −17.43 | −18.05 | |

| pork and poultry | −6.84 | −1.33 | −1.41 | −7.90 | −53.39 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Han, M.; Yu, W.; Clora, F. Boom and Bust in China’s Pig Sector during 2018–2021: Recent Recovery from the ASF Shocks and Longer-Term Sustainability Considerations. Sustainability 2022, 14, 6784. https://doi.org/10.3390/su14116784

Han M, Yu W, Clora F. Boom and Bust in China’s Pig Sector during 2018–2021: Recent Recovery from the ASF Shocks and Longer-Term Sustainability Considerations. Sustainability. 2022; 14(11):6784. https://doi.org/10.3390/su14116784

Chicago/Turabian StyleHan, Mingxi, Wusheng Yu, and Francesco Clora. 2022. "Boom and Bust in China’s Pig Sector during 2018–2021: Recent Recovery from the ASF Shocks and Longer-Term Sustainability Considerations" Sustainability 14, no. 11: 6784. https://doi.org/10.3390/su14116784

APA StyleHan, M., Yu, W., & Clora, F. (2022). Boom and Bust in China’s Pig Sector during 2018–2021: Recent Recovery from the ASF Shocks and Longer-Term Sustainability Considerations. Sustainability, 14(11), 6784. https://doi.org/10.3390/su14116784