Moderating Effects of Leadership and Innovation Activities on the Technological Innovation, Market Orientation and Corporate Performance Model

Abstract

:1. Introduction

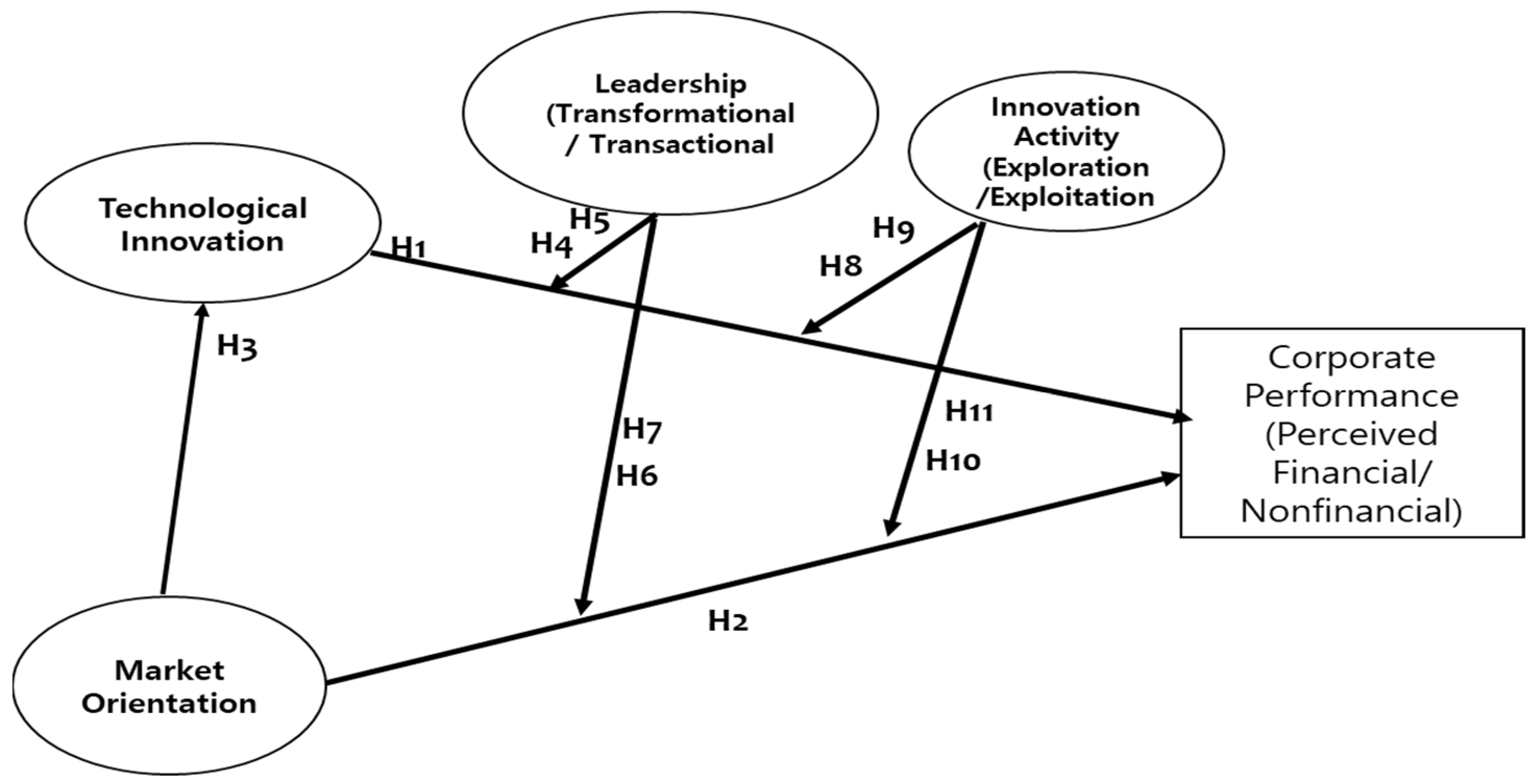

2. Theory and Hypotheses

2.1. Technological Innovation and Corporate Performance

2.2. Market Orientation and Corporate Performance

2.3. Technological Innovation and Market Orientation

2.4. Definition and Role of Leadership

2.5. Exploration and Exploitation as Innovation Activities

3. Methods

3.1. Data Survey and Measuremet Method

3.2. Common Method Bias Solution

4. Results

4.1. Verification of Validity and Reliability of Measurement Model

4.2. Hypothesis Verification

4.2.1. Mediating Effects of Technological Innovation

4.2.2. The Moderating Effect of Leadership

4.2.3. The Moderating Effect of Innovation Activities

5. Discussion

Author Contributions

Funding

Conflicts of Interest

References

- Conner, K.R.; Prahalad, C.K. A Resource-Based Theory of the Firm: Knowledge Versus Opportunism. Organ. Sci. 1996, 7, 477–501. [Google Scholar] [CrossRef]

- Spender, J.C.; Grant, R.M. Knowledge and the Firm: Overview. Strateg. Manag. J. 1996, 17, 5–9. [Google Scholar] [CrossRef]

- Banbury, C.M.; Mitchell, W. The Effect of Introducing Important Incremental Innovations on Market Share and Business Survival. Strateg. Manag. J. 1995, 16, 161–182. [Google Scholar] [CrossRef]

- Soni, P.K.; Lilien, G.L.; Wilson, D.T. Industrial Innovation and Firm Performance: A Re-conceptualization and Exploratory Structural Equation Analysis. Int. J. Res. Mark. 1993, 10, 365–380. [Google Scholar] [CrossRef]

- Schumpeter, J.A. The Theory of Economic Development: An inquiry into Profits Capital, Credit, Interests, and the Business Cycle; Transaction Publishers: New Brunswick, NJ, USA, 1934; pp. 3–30. [Google Scholar]

- Cooper, R.G. New Products: The Factors that Drive Success. Int. Mark. Rev. 1994, 11, 60–76. [Google Scholar] [CrossRef]

- Montoya-Weiss, M.M.; Calantone, R. Determinants of New Product Performance: A Review and Meta-Analysis. J. Prod. Innov. Manag. 1994, 11, 397–417. [Google Scholar] [CrossRef]

- Lawrence, P.R.; Lorsch, J.W. Differentiation and integration in complex organizations. Adm. Sci. 1967, 12, 1–47. [Google Scholar] [CrossRef]

- Gatignon, H.; Xuereb, J.-M. Strategic Orientation of the Firm and New Product Performance. J. Mark. Res. 1997, 34, 77–90. [Google Scholar] [CrossRef]

- March, J.G. Exploration and Exploitation in Organizational Learning. Organ. Sci. 1991, 2, 71–87. [Google Scholar] [CrossRef]

- Levinthal, D.A.; March, J.G. The Myopia of Learning. Strateg. Manag. J. 1993, 14, 95–112. [Google Scholar] [CrossRef]

- Raisch, S.; Birkinshaw, J. Organizational Ambidexterity: Antecedents, Outcomes, and Moderators. J. Manag. 2008, 34, 375–409. [Google Scholar] [CrossRef] [Green Version]

- Sidhu, J.S.; Commandeur, H.R.; Volberda, H.W. The Multifaceted Nature of Exploration and Exploitation: Value of Supply, Demand, and Spatial Search for Innovation. Organ. Sci. 2007, 18, 20–38. [Google Scholar] [CrossRef]

- Kanter, R.M. From spare change to real change. Harv. Bus. Rev. 1999, 77, 122–132. [Google Scholar] [PubMed]

- Jung, J.-H.; Kim, Y.J. Study on Corporate Foresight and Firm Performance in Korean SMEs with Mediating Effect of Innovativeness. Product. Rev. 2020, 34, 3–36. [Google Scholar] [CrossRef]

- Drucker, P.F. Peter F. Drucker on Innovation; HarperCollins: New York, NY, USA, 2006. [Google Scholar]

- Knight, K. A Descriptive Model of the Intra-Firm Innovation Process. J. Bus. 1967, 40, 478–496. [Google Scholar] [CrossRef]

- OECD. Oslo Manual. In The Measurement of Scientific and Technological Activities Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data, 3rd ed.; OECD Publishing: Paris, France, 2005. [Google Scholar]

- Lawless, M.W.; Fisher, R.J. Sources of Durable Competitive Advantage in New Products. J. Prod. Innov. Manag. 1990, 7, 35–44. [Google Scholar] [CrossRef]

- Michalski, G.; Rutkowska-Podołowska, M.; Sulich, A. Remodeling of FLIEM: The Cash Management in Polish Small and Medium Firms with Full Operating Cycle in Various Business Environments. In Efficiency in Business and Economics; Springer Proceedings in Business and Economics (SPBE), Dudycz, T., Osbert-Pociecha, G., Brycz, B., Eds.; Springer: Berlin/Heidelberg, Germany, 2018; pp. 119–132. [Google Scholar]

- Rogers, M. The Definition and Measurement of Innovation; Melbourne Institute of Applied Economic and Social Research: Parkville, Australia, 1998. [Google Scholar]

- Dess, G.G.; Robbins, R.B., Jr. Measuring organizational performance in the absence of objective measure: The case of the privately-held firm and conglomerate business unit. Strateg. Manag. J. 1984, 5, 265–273. [Google Scholar] [CrossRef]

- Bem, A.; Michalski, G.A. Hospital Profitability vs. Selected Healthcare System Indicators. In Proceedings of the Central European Conference in Finance and Economics (CEFE2015), Košice, Slovakia, 30 September–1 October 2015; pp. 52–61. [Google Scholar]

- Steers, M.R. Problems in the Measurement of Organizational Effectiveness. Adm. Sci. Q. 1975, 20, 546–568. [Google Scholar] [CrossRef]

- Banker, R.D.; Potter, G.; Srinivasan, D. An Empirical Investigation of an Incentive Plan that Includes Nonfinan-cial Performance Measures. Acc. Rev. 2000, 75, 65–92. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. The Balanced Scored Card-Measured that Drive Performance. Harv. Bus. Rev. 2005, 83, 172. [Google Scholar]

- McNair, C.J.; Lynch, R.L.; Cross, K.F. Do financial and nonfinancial performance measures have to agree? Manag. Acc. 1990, 72, 28. [Google Scholar]

- Duchesneau, D.A.; Gartner, W.B. A Profile of New Venture Success and Failure in an Emerging Industry. J. Bus. Ventur. 1990, 5, 297–312. [Google Scholar] [CrossRef]

- Schoenecker, T.; Swanson, L. Indicators Determining FTC. Assessing a Firm’s Technological Capability. IEEE Potentials 2002, 21, 12–17. [Google Scholar] [CrossRef]

- Kurtulmuş, B.E.; Warner, B. Entrepreneurial Orientation and Perceived Financial Performance. Does Environment Always Moderate EO Performance Relation. Procedia Soc. Behav. Sci. 2015, 207, 739–748. [Google Scholar] [CrossRef] [Green Version]

- Neely, A.; Gregory, M.; Platts, K. Performance Measurement System Design a Literature Review and Research Agenda. Int. J. Oper. Prod. Manag. 1995, 15, 80–116. [Google Scholar] [CrossRef]

- Neely, A.; Mills, J.; Platts, K.; Richards, H.; Gregory, M.; Bourne, M.; Kennerly, M. Performance Measurement System Design: Developing and Testing a Process-Based Approach. Int. J. Oper. Prod. Manag. 2000, 20, 1119–1145. [Google Scholar] [CrossRef]

- Neely, A. The Evolution of Performance Measurement research: Developments in the Last Decade and a Research Agenda for the Next. Int. J. Oper. Prod. Manag. 2005, 25, 1264–1277. [Google Scholar] [CrossRef]

- Lumpkin, G.T.; Dess, G.G. Clarifying the Entrepreneurial Orientation Construct and linking it to Performance. Acad. Manag. Rev. 1996, 21, 135–172. [Google Scholar] [CrossRef]

- Kohli, A.K.; Jaworski, B.J. Market orientation: The construct, research propositions, and managerial implications. J. Mark. 1990, 54, 1–18. [Google Scholar] [CrossRef] [Green Version]

- Kohli, A.K.; Jaworski, B.J.; Kumar, A. Markor: A measure of market orientation. J. Mark. Res. 1993, 20, 466–477. [Google Scholar]

- Narver, J.C.; Slater, S.F. The effect of a market orientation on business profitability. J. Mark. 1990, 54, 20–35. [Google Scholar] [CrossRef]

- Narver, J.C.; Slater, S.F. Does competitive environment moderate the market orientation-performance relationship? J. Mark. 1994, 58, 46–55. [Google Scholar]

- Levitt, T. Marketing Myopia. Harv. Bus. Rev. 1960, 38, 24–47. [Google Scholar]

- Day, G.S.; Wensley, R. Assessing Advantage: A Framework for Diagnosing Competitive Superiority. J. Mark. 1988, 52, 1–20. [Google Scholar] [CrossRef]

- Aaker, D.A. Strategic Market Management, 6th ed.; John Wiley and Sons Inc.: New York, NY, USA, 1988. [Google Scholar]

- Porter, M. Competitive Strategy; The Free Press: New York, NY, USA, 1980. [Google Scholar]

- Webster, F.E. Rediscovering Marketing Concept. Bus. Horiz. 1988, 31, 29–39. [Google Scholar] [CrossRef]

- Kirca, A.H.; Jayachandran, S.; Bearden, W.O. Market orientation: A meta analytic review and assessment of its antecedents and impact on performance. J. Mark. 2005, 69, 24–41. [Google Scholar] [CrossRef] [Green Version]

- Zhou, K.Z.; Gao, G.Y.; Yang, Z.; Zhou, N. Developing strategic orientation in China: Antecedents and consequences of market and innovation orientations. J. Bus. Res. 2005, 58, 1049–1058. [Google Scholar] [CrossRef]

- Hult, T.; Ketchen, D. Does Market Orientation Matter? A Test of the Relationship between Positional Advantage and Performance. Strateg. Manag. J. 2001, 22, 899–906. [Google Scholar] [CrossRef]

- Pelham, A.M.; Wilson, D.T. A longitudinal study of the impact of market structure, firm structure, strategy, and market orientation culture on dimensions of small-firm performance. J. Acad. Mark. Sci. 1996, 24, 27–43. [Google Scholar] [CrossRef]

- Appiah-Adu, K. Market Orientation and Performance: Empirical Tests in a Transition Economy. J. Strateg. Mark. 1997, 6, 25–45. [Google Scholar] [CrossRef]

- Bhuian, S.N. Exploring market orientation in banks: An empirical examination in Saudi Arabia. J. Serv. Mark. 1997, 11, 317–328. [Google Scholar] [CrossRef]

- Subramanian, R.; Gopalakrishna, P. The Market Orientation Performance Relationship in the Context of a Developing Economy. J. Bus. Res. 2001, 53, 1–13. [Google Scholar] [CrossRef]

- Han, J.K.; Kim, N.W.; Srivastava, R.K. Market Orientation and Organizational Performance: Is Innovation a Missing Link? J. Mark. 1998, 62, 30–45. [Google Scholar] [CrossRef]

- Lee, H.-B. The Moderating Effect of the Complementary Assets on the Relationships among the Market Orientation, Innovation Activities and Performance. Korea Assoc. Bus. Educ. Korea Bus. Educ. Rev. 2012, 76, 181–208. [Google Scholar]

- Kim, K.-M.; Park, J.-S. The Effect of Entrepreneurship and Market-orientation on the Performance of Medium and Small-sized Enterprise. J. Korea Contents Assoc. 2016, 16, 326–337. [Google Scholar] [CrossRef] [Green Version]

- Lukas, B.A.; Ferrell, O.C. The Effect of Market Orientation on Product Innovation. J. Acad. Mark. Sci. 2015, 39, 134–167. [Google Scholar] [CrossRef]

- Jung, C.H.; Jun, D.H.; Kim, H.J. The Relationships of Market Orientation and New Product Innovation Productivity to New Product Performance—Moderating Effect of Market Uncertainty. Product. Rev. 2006, 20, 61–88. [Google Scholar]

- Yang, Y.-I. A Study on financial institution’s quality of service and customer satisfaction. J. Ind. Econ. Bus. 2008, 21, 315–344. [Google Scholar]

- Langerak, F.; Hultink, E.J.; Robben, H.S.J. The Impact of Market Orientation, Product Advantage, and Launch Proficiency on New Product Performance and Organizational Performance. J. Prod. Innov. Manag. 2004, 21, 79–94. [Google Scholar] [CrossRef]

- Greenley, G.E. Market orientation and company performance: Empirical evidence from UK companies. Br. J. Manag. 1995, 6, 1–13. [Google Scholar] [CrossRef]

- Jaworski, B.J.; Kohli, A.K. Market Orientation: Antecedents and Consequences. J. Mark. 1993, 57, 53–71. [Google Scholar] [CrossRef]

- Walker, O.C., Jr.; Ruekert, R.W. Marketing’s role in the implementation of business strategies: A critical review and conceptual framework. J. Mark. 1987, 51, 15–33. [Google Scholar] [CrossRef]

- Cooper, R.G. Winning with new products: Doing it right. Ivey Bus. J. 2000, 64, 54–60. [Google Scholar]

- Baker, W.E.; Sinkula, J.M. The Complementary Effects of Market Orientation and Entrepreneurial Orientation on Profitability in Small Business. J. Small Bus. Manag. 2009, 47, 443–464. [Google Scholar] [CrossRef]

- Im, S.; Workman, J.P., Jr. Market Orientation, Creativity and New Product Performance in High Technology Firms. J. Mark. 2004, 68, 114–132. [Google Scholar] [CrossRef] [Green Version]

- Deshpande, R.; Farley, J.U.; Webster, F.E. Corporate Culture, Customer Orientation, and Innovativeness in Japanese Firms: A Quadrad Analysis. J. Mark. 1993, 57, 23–37. [Google Scholar] [CrossRef] [Green Version]

- Hurley, R.; Hult., G.; Knight, G. Innovativeness: Its Antecedents and Impact on Business Performance. Ind. Mark. Manag. 2004, 33, 429–438. [Google Scholar]

- Bass, B.M.; Avolio, B.J. Transformational Leadership Development: Manual for the Multifactor Leadership Questionnaire; Consulting Psychologists Press: Palo Alto, CA, USA, 1990. [Google Scholar]

- Yammarino, F.J.; Bass, B.M. Transformational leadership and multiple levels of analysis. Hum. Relat. 1990, 43, 975–995. [Google Scholar] [CrossRef]

- Lussier, R.N.; Achua, C.F. Leadership: Theory, Application, & Skill Development; Cengage Learning: Southbank, Australia, 2016. [Google Scholar]

- Burns, J.M. Leadership; Harper & Row: New York, NY, USA, 1978. [Google Scholar]

- Downton, J.V. Rebel Leadership: Commitment and Charisma in the Revolutionary Process; Free Press: New York, NY, USA, 1973. [Google Scholar]

- Northouse, P.G. Leadership: Theory and Practice; Sage Publications, Inc.: New York, NY, USA, 2013. [Google Scholar]

- Bass, B.M. The Ethics of Transformational Leadership. In Ethics, the Heart of Leadership; Ciulla, J.B., Ed.; Praeger: Westport, CT, USA, 1998; pp. 169–192. [Google Scholar]

- Bass, B.M. Leadership and Performance Beyond Expectation; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Gardner, W.L.; Avolio, B.A. The Charismatic Relationship: A Dramaturgical Perspective. Acad. Manag. Rev. 1998, 23, 32–58. [Google Scholar] [CrossRef]

- Oldham, G.R.; Cummings, A. Employee Creativity: Personal and Contextual Factors at Work. Acad. Manag. J. 1996, 39, 607–634. [Google Scholar]

- Amabile, T.M. How to Kill Creativity. Harv. Bus. Rev. 1998, 76, 77–87. [Google Scholar]

- Dougherty, D.; Hardy, C. Sustained Product Innovation in Large, Mature Organizations: Overcoming Innovation-Organization Problem. Acad. Manag. J. 1996, 39, 1120–1153. [Google Scholar]

- Bass, B.M.; Avolio, B.J. MLQ Multifactor Leadership Questionnaire Technical Report; Sage: Thousand Oaks, CA, USA, 2000. [Google Scholar]

- Graen, G.; Cashman, J.F. A role making Model of Leadership in Formal Organization: A Developmental Approach. In Leadership Frontiers; Hunt, J.G., Larson, L.L., Eds.; Southern Illinois University Press: Carbondale, IL, USA, 1975. [Google Scholar]

- Lowe, K.B.; Kroeck, K.G.; Sivasubramaniam, N. Effectiveness Correlates of Transformational and Transactional Leadership: A Meta-Analytic Review of the MLQ Literature. Leadersh. Q. 1996, 7, 385–425. [Google Scholar] [CrossRef] [Green Version]

- Avolio, B.J.; Bass, B.M.; Jung, D.I. Re-examining the components of transformational and transactional leadership using the Multifactor Leadership. J. Occup. Organ. Psychol. 1999, 72, 441–462. [Google Scholar] [CrossRef]

- Tichy, N.M.; Devanna, M.A. The Transformational Leader; Wiley: New York, NY, USA, 1986. [Google Scholar]

- Bass, B.M. From transactional to transformational leadership: Learning to share the vision. Organ. Dyn. 1990, 18, 19–32. [Google Scholar] [CrossRef] [Green Version]

- Pawar, B.S.; Eastman, K.K. The nature and implications of contextual influences on transformational leadership: A conceptual examination. Acad. Manag. Rev. 1997, 22, 80–109. [Google Scholar] [CrossRef]

- Daft, R.L. The Executive and the Elephant: A Leader’s Guide for Building Inner Excellence; John Wiley & Sons: New York, NY, USA, 2010. [Google Scholar]

- Cherrington, D.J. Organizational Behavior: The Management of Individual and Organizational Performance; Allyn & Bacon: Boston, MA, USA, 1994. [Google Scholar]

- Yukl, G. Leadership in Organization, 5th ed.; Prentice-Hall, Inc.: Hoboken, NJ, USA, 2002. [Google Scholar]

- Gumusluoglu, L.; Ilsev, A. Transformational Leadership, Creativity, and Organizational Innovation. J. Bus. Res. 2009, 62, 461–473. [Google Scholar] [CrossRef]

- Farr, J.L.; Ford, C.M. Individual Innovation. In Innovation and Creativity at Work: Psychological and Organizational Strategies; West, M.A., Farr, J.L., Eds.; Wiley: Chichester, UK, 1990. [Google Scholar]

- Kanter, R.M. The Change Masters; Simon and Schuster: New York, NY, USA, 1983. [Google Scholar]

- Farid, F.; El-Sharkawy, A.R.; Austin, L.K. Managing for Creativity and Innovation in A/E/C Organizations. J. Manag. Eng. 1993, 9, 399–409. [Google Scholar] [CrossRef]

- Braun, S.; Peus, C.; Weisweiler, S.; Frey, D. Transformational leadership, job satisfaction, and team performance: A multilevel mediation model of trust. Leadersh. Q. 2013, 24, 270–283. [Google Scholar] [CrossRef]

- Choudhary, A.I.; Akhtar, S.A.; Zaheer, A. Impact of transformational and servant leadership on organizational performance: A comparative analysis. J. Bus. Ethics 2013, 116, 433–440. [Google Scholar] [CrossRef]

- Avolio, B.J.; Waldman, D.A.; Einstein, W.O. Transformational leadership in a management game simulation: Impacting the bottom line. Gr. Organ. Stud. 1988, 13, 59–80. [Google Scholar] [CrossRef]

- Hater, J.J.; Bass, B.M. Superiors’ evaluations and subordinates’ perceptions of transformational and transactional leadership. J. Appl. Psychol. 1988, 73, 695. [Google Scholar] [CrossRef]

- Waldman, D.A.; Bass, B.M.; Einstein, W.O. Leadership and outcomes of performance appraisal processes. J. Occup. Psychol. 1987, 60, 177–186. [Google Scholar] [CrossRef]

- You, Y.-Y.; Roh, J.-W. The Analysis for the determinant Factors on the Outcome of Technology Innovation Among Small and Medium Manufacturers. J. Soc. Bus. Stud. 2010, 15, 61–87. [Google Scholar]

- Shin, Y.-S.; Ha, K.-S. A Study on the Effects of the Technology Management Capability on the Success of Technology Commercialization. J. Digit. Converg. 2012, 10, 97–110. [Google Scholar]

- Lee, J.-M.; Noh, M.S.; Chung, S.Y. Study on the Effects of SME’s Technology Planning Competency on the Success of Commercialization. J. Technol. Innov. 2013, 21, 253–278. [Google Scholar]

- Masi, R.J.; Cooke, R.A. Effects of transformational leadership on subordinate motivation, empowering norms, and organizational productivity. Int. J. Organ. Anal. 2000, 8, 16–47. [Google Scholar] [CrossRef]

- Lord, R.G.; Brown, D.J.; Freiberg, S.J. Understanding the dynamics of leadership: The role of follower self-concepts in the leader/follower relationship. Organ. Behav. Hum. Decis. Process. 1999, 78, 167–203. [Google Scholar] [CrossRef]

- Harris, L.C.; Ogbonna, E. Competitive Advantage in the UK Food Retailing Sector: Past, Present and Future. J. Retail. Consum. Serv. 2001, 8, 157–173. [Google Scholar] [CrossRef]

- Menguc, B.; Auh, S.; Shih, E. Transformational Leadership and Market Orientation: Implications for the Implementation of Competitive Strategies and Business Unit Performance. J. Bus. Res. 2007, 60, 314–321. [Google Scholar] [CrossRef]

- Cooper, R.G.; Kleinschmidt, E.J. Winning business in product development: The critical success factors. Res. Technol. Manag. 2007, 50, 52–66. [Google Scholar] [CrossRef]

- He, Z.L.; Wong, P.K. Exploration vs. Exploitation: An Empirical Test of the Ambidexterity Hypothesis. Organ. Sci. 2004, 15, 481–494. [Google Scholar] [CrossRef]

- Gupta, A.K.; Smith, K.G.; Shalley, C.E. The Interplay between Exploration and Exploitation. Acad. Manag. J. 2006, 49, 693–706. [Google Scholar] [CrossRef]

- Chung, D.-S. A Study on Taxonomy of Exploration and Exploitation Inno-Biz Small-Medium Corporation. Korean J. Bus. Adm. 2011, 24, 3723–3741. [Google Scholar]

- Shin, W.J.; Kim, Y.J. A Study on the Effect of Technical Innovation and Market Orientation on the Corporate Performance and Moderating Effect of Leadership. Korean J. Bus. Adm. 2021, 34, 1661–1699. [Google Scholar]

- Park, Y.P. Research on the R&D Capability, Manufacturing Capability, Market Orientation and Entrepreneurial Orientation on Technology Innovation. Ph.D. Thesis, Hanyang University, Seoul, Korea, 2015. [Google Scholar]

- Lee, I.-W. An Empirical Study on the Technological-orientation & Market-orientation of Startup Enterprises and Their Effect on Managerial Performance–Focused on The Technology Business Incubation (TBI) Enterprises. Ph.D. Thesis, KyungHee University, Seoul, Korea, 2009. [Google Scholar]

- Zahra, S.A.; Bonger, W.C. Technology strategy and software new ventures’ performance—A study of corporate-sponsored and independent biotechnology ventures. J. Bus. Ventur. 2000, 15, 135–173. [Google Scholar] [CrossRef]

- Bass, B.M.; Avolio, B.J. Multifactor Leadership Questionnaire; Mind Garden: Redwood City, CA, USA, 1995. [Google Scholar]

- Park, J.S. Creativity, Innovation and Leadership: Impact on Business Performance in Firms. Ph.D. Thesis, Korea University, Seoul, Korea, 2010. [Google Scholar]

- Lee, S.K. The Effects of Organizational Climate of the R&D Teams on Ambidexterity in Technological Innovation. Master’s Thesis, Sungkyunkwan University, Seoul, Korea, 2014. [Google Scholar]

- Lubatkin, M.H.; Simsek, Z.; Ling, Y.; Veiga, J.F. Ambidexterity and Performance in Small-to Medium–Sized Firms: The Pivotal Role of Top Management Team Behavioral Integration. J. Manag. 2006, 32, 646–672. [Google Scholar] [CrossRef] [Green Version]

- Jansen, J.J.P.; Van den Bosch, F.A.J.; Volberda, H.W. Exploratory innovation, exploitative innovation, and ambidexterity: The impact of environmental and organizational antecedents. Schmalenbach Bus. Rev. 2005, 57, 351–363. [Google Scholar] [CrossRef] [Green Version]

- Lee, C.H. The Effect of Dynamic Capabilities on Ambidexterity in Technological Innovation: The Moderating and Mediating Role of Top Management Team Behavioral Integration, Connectedness and Absorption Capacity. Ph.D. Thesis, SoGang University, Seoul, Korea, 2015. [Google Scholar]

- Henri, J.F. Management control systems and strategy: A resource-based perspective, Accounting. Organ. Soc. 2006, 31, 529–558. [Google Scholar] [CrossRef]

- Widener, S.K. An empirical analysis of the levers of control framework, Accounting. Organ. Soc. 2007, 32, 757–788. [Google Scholar] [CrossRef]

- Park, W.-W.; Kim, M.S.; Jeong, S.M.; Huh, K.M. Causes and Remedies of Common Method Bias. Korean J. Manag. 2007, 15, 89–133. [Google Scholar]

- Podsakoff, P.M.; Organ, D.M. Self-reports in organizational research: Problems and prospects. J. Manag. 1986, 12, 69–82. [Google Scholar] [CrossRef]

- Kline, T.J.B.; Sulsky, L.M.; Rever-Moriyama, S.D. Common method variance and specification errors: A practical approach to detection. J. Psychol. 2000, 134, 401–421. [Google Scholar] [CrossRef] [PubMed]

- Spector, P.E. Using self-report questionnaires in OB Research: A comment on the use of a controversial method. J. Organ. Behav. 1994, 15, 385–392. [Google Scholar] [CrossRef]

- Cole, D.A.; Howard, G.S.; Maxwell, S.E. The effect of mono versus multiple operationalization in construct validation efforts. J. Consult. Clin. Psychol. 1981, 49, 395–405. [Google Scholar] [CrossRef]

- Cole, D.A.; Lazarick, D.M.; Howard, G.S. Construct validity and the relation between depression and social skill. J. Couns. Psychol. 1987, 34, 315–321. [Google Scholar] [CrossRef]

- Gabbard, C.E.; Howard, G.S.; Dunfee, E.J. Reliability, sensitivity to measuring change, and construct validity of therapist adaptability. J. Couns. Psychol. 1986, 33, 377–386. [Google Scholar] [CrossRef]

- Howard, G.S.; Conway, C.G.; Maxwell, S.E. Construct validity of measures of college teaching effectiveness. J. Educ. Psychol. 1985, 77, 187–196. [Google Scholar] [CrossRef]

- Howard, G.S.; Maxwell, S.E.; Wiener, R.L.; Boynton, K.S.; Rooney, W.M. Is a behavioral measure the best estimate of behavioral parameters? Perhaps not. Appl. Psychol. Meas. 1980, 4, 293–311. [Google Scholar] [CrossRef] [Green Version]

- Peterson, R.A. Constructing Effective Questionnaires; Sage: Thousand Oaks, CA, USA, 2000. [Google Scholar]

- Howell, J.M.; Avolio, B.J. Transformational Leadership, Transactional Leadership, Locus of Control, and Support for Innovation: Key Predictors of Consolidated-business-unit Performance. J. Appl. Psychol. 1993, 78, 891–902. [Google Scholar] [CrossRef]

- Humphreys, J.H. Transformational and Transactional Leader Behavior. J. Manag. Res. 2001, 1, 149–159. [Google Scholar]

- Schulze, P.; Heinemann, F. Balancing exploitation and exploration. Acad. Manag. Proc. 2008, 2008, 1–6. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The Moderate-mediator variable distinction in social psychological research: Conceptual, strategic, and statistical consideration. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef] [PubMed]

- Yim, Y.-J.; Lee, C.-W. The Analysis of the Research Trends about the Transformational Leadership in Organizations. J. Korean Assoc. Organ. Stud. 2008, 5, 199–228. [Google Scholar]

| Respondent Profile | Numbers | Percentage | |

|---|---|---|---|

| Gender | Male | 247 | 59.7 |

| Female | 167 | 40.3 | |

| Age | 20~29 years old | 55 | 13.3 |

| 30~39 years old | 156 | 37.7 | |

| 40~49 years old | 134 | 32.4 | |

| >50 years old | 69 | 16.7 | |

| Levels of Management | CEO, Executives | 15 | 3.6 |

| Manager | 130 | 31.4 | |

| Assistant Manager | 144 | 34.8 | |

| Team Member | 125 | 30.2 | |

| Business | Personnel Management | 34 | 8.2 |

| Strategic Planning | 60 | 14.5 | |

| Marketing and Sales | 73 | 17.6 | |

| Research & Development | 74 | 17.9 | |

| Financial Accounting | 55 | 13.3 | |

| Production | 64 | 15.5 | |

| Others | 54 | 13.0 | |

| Industry | Manufacturing | 102 | 24.6 |

| Telecommunications | 116 | 28.0 | |

| Finance | 52 | 12.6 | |

| Distribution | 25 | 6.0 | |

| Construction | 33 | 8.0 | |

| Service | 66 | 15.9 | |

| Others | 20 | 4.8 | |

| Enterprise-scale | Start-up | 15 | 3.6 |

| Small- and Medium-Sized | 181 | 43.7 | |

| Mid-Sized | 95 | 22.9 | |

| Large | 123 | 29.7 | |

| Sum | 414 | 100.0 | |

| Latent Variable | Observed Variable | Factor Loading | Cronbach’s Alpha |

|---|---|---|---|

| Customer Orientation | Customer Orientation 1 | 0.774 | 0.874 |

| Customer Orientation 2 | 0.767 | ||

| Customer Orientation 3 | 0.668 | ||

| Customer Orientation 4 | 0.824 | ||

| Customer Orientation 5 | 0.718 | ||

| Competitor Orientation | Competitor Orientation 3 | 0.856 | 0.802 |

| Competitor Orientation 4 | 0.638 | ||

| Interfunctional Coordination | Interfunctional Coordination 1 | 0.725 | 0.866 |

| Interfunctional Coordination 2 | 0.775 | ||

| Interfunctional Coordination 3 | 0.684 | ||

| Interfunctional Coordination 4 | 0.740 |

| Latent Variable | Observed Variable | Factor Loading | Cronbach’s Alpha |

|---|---|---|---|

| Product Innovation | Production Innovaiton 1 | 0.819 | 0.863 |

| Production Innovaiton 2 | 0.822 | ||

| Production Innovaiton 3 | 0.719 | ||

| Production Innovaiton 4 | 0.636 | ||

| Process Innovation | Process Innovation 1 | 0.726 | 0.883 |

| Process Innovation 2 | 0.562 | ||

| Process Innovation 3 | 0.832 | ||

| Process Innovation 4 | 0.779 | ||

| Process Innovation 5 | 0.697 |

| Latent Variable | Observed Variable | Factor Loading | Cronbach’s Alpha |

|---|---|---|---|

| Charisma | Charisma 1 | 0.801 | 0.863 |

| Charisma 2 | 0.757 | ||

| Charisma 3 | 0.713 | ||

| Consideration Inspiration | Consideration 1 | 0.635 | 0.815 |

| Consideration 2 | 0.338 | ||

| Consideration 3 | 0.870 | ||

| Intellectual Stimulation | Intellectual Stimulation 1 | 0.765 | 0.869 |

| Intellectual Stimulation 2 | 0.721 | ||

| Intellectual Stimulation 3 | 0.752 | ||

| Contingent Reward | Contingent Reward 1 | 0.879 | 0.905 |

| Contingent Reward 2 | 0.862 | ||

| Contingent Reward 3 | 0.830 | ||

| Contingent Reward 4 | 0.842 | ||

| Management by Exception | Management by Exception 1 | 0.727 | 0.767 |

| Management by Exception 2 | 0.879 | ||

| Management by Exception 3 | 0.588 | ||

| Management by Exception 4 | 0.600 |

| Latent Variable | Observed Variable | Factor Loading | Cronbach’s Alpha |

|---|---|---|---|

| Exploration | Exploration 1 | 0.763 | 0.839 |

| Exploration 2 | 0.759 | ||

| Exploration 3 | 0.796 | ||

| Exploration 4 | 0.796 | ||

| Exploitation | Exploitation 1 | 0.691 | 0.840 |

| Exploitation 2 | 0.785 | ||

| Exploitation 3 | 0.825 | ||

| Exploitation 4 | 0.793 |

| Market Orientation | Technical Innovation | Transformational Leadership | Transactional Leadership | Exploratory Activity | Exploitation Activity | Perceived Financial Performace | |

|---|---|---|---|---|---|---|---|

| Market Orientation | 1 | ||||||

| Technical Innovation | 0.745 ** | 1 | |||||

| Transformational Leadership | 0.741 ** | 0.706 ** | 1 | ||||

| Transactional Leadership | 0.674 ** | 0.666 ** | 0.826 ** | 1 | |||

| Exploration | 0.734 ** | 0.792 ** | 0.759 ** | 0.715 ** | 1 | ||

| Exploitation | 0.567 ** | 0.618 ** | 0.642 ** | 0.698 ** | 0.615 ** | 1 | |

| Perceived Financial Performace | 0.566 ** | 0.694 ** | 0.636 ** | 0.640 ** | 0.695 ** | 0.584 ** | 1 |

| Non-Financial Performance | 0.685 ** | 0.751 ** | 0.776 ** | 0.759 ** | 0.776 ** | 0.651 ** | 0.835 ** |

| Step | Variable | Unstandardized Coefficient | Standardized Coefficient | t | Significant Probability | Collinearity Statistics | R2 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| B | Standard Error | ß | Tolerance | VIF | ||||||

| 1 | Perceived Financial Performance | (Constant) | 0.418 | 0.200 | 2.088 | 0.037 | 0.32 | |||

| Market Orientation | 0.761 | 0.055 | 0.566 | 13.924 | 0.000 | 1.000 | 1.000 | |||

| 2 | Technological Innovation | (Constant) | 0.230 | 0.237 | 0.972 | 0.332 | 0.536 | |||

| Market Orientation | 0.894 | 0.064 | 0.732 | 13.984 | 0.000 | 1.000 | 1.000 | |||

| 3 | Perceived Financial Performance | (Constant) | 0.474 | 0.141 | 3.366 | 0.001 | 0.482 | |||

| Technological Innovation | 0.794 | 0.041 | 0.694 | 19.582 | 0.000 | 1.000 | 1.000 | |||

| 4 | Perceived Financial Performance | (Constant) | 0.260 | 0.175 | 1.487 | 0.138 | 0.487 | |||

| Market Orientation | 0.147 | 0.071 | 0.109 | 2.061 | 0.040 | 0.445 | 2.246 | |||

| Technological Innovation | 0.701 | 0.061 | 0.613 | 11.583 | 0.000 | 0.445 | 2.246 | |||

| Step | Variable | Unstandardized Coefficient | Standardized Coefficient | t | Significant Probability | Collinearity Statistics | R2 | |||

|---|---|---|---|---|---|---|---|---|---|---|

| B | Standard Error | ß | Tolerance | VIF | ||||||

| 1 | Non-Financial Performance | (Constant) | 0.113 | 0.167 | 0.675 | 0.500 | 0.469 | |||

| Market Orientation | 0.871 | 0.046 | 0.685 | 19.061 | 0.000 | 1.000 | 1.000 | |||

| 2 | Technological Innovation | (Constant) | 0.230 | 0.237 | 0.972 | 0.332 | 0.536 | |||

| Market Orientation | 0.894 | 0.064 | 0.732 | 13.984 | 0.000 | 1.000 | 1.000 | |||

| 3 | Non-Financial Performance | (Constant) | 0.503 | 0.122 | 4.118 | 0.000 | 0.564 | |||

| Technological Innovation | 0.812 | 0.035 | 0.751 | 23.088 | 0.000 | 1.000 | 1.000 | |||

| 4 | Non-Financial Performance | (Constant) | −0.019 | 0.146 | −0.133 | 0.894 | 0.599 | |||

| Market Orientation | 0.358 | 0.060 | 0.281 | 6.007 | 0.000 | 0.445 | 2.246 | |||

| Technological Innovation | 0.586 | 0.051 | 0.542 | 11.574 | 0.000 | 0.445 | 2.246 | |||

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1372.562 | 1 | 1372.562 | 987.13 | 0.000 |

| Error | 65.416 | 47.047 | 1.390 a | |||

| Transformational leadership_group | Hypothesis | 2.813 | 1 | 2.813 | 4.405 | 0.044 |

| Error | 19.944 | 31.224 | 0.639 b | |||

| Technological innovation | Hypothesis | 76.596 | 35 | 2.188 | 2.983 | 0.005 |

| Error | 15.535 | 21.178 | 0.734 c | |||

| Transformational leadership_group * Technological innovation | Hypothesis | 14.618 | 19 | 0.769 | 1.923 | 0.012 |

| Error | 143.252 | 358 | 0.400 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1520.648 | 1 | 1520.648 | 1442.061 | 0.000 |

| Error | 48.361 | 45.861 | 1.054 a | |||

| Transformational leadership_group | Hypothesis | 12.596 | 1 | 12.596 | 21.073 | 0.000 |

| Error | 15.857 | 26.527 | 0.598 b | |||

| Technological innovation | Hypothesis | 58.835 | 35 | 1.681 | 2.298 | 0.025 |

| Error | 14.913 | 20.384 | 0.732 c | |||

| Transformational leadership_group * Technological innovation | Hypothesis | 14.860 | 19 | 0.782 | 2.997 | 0.000 |

| Error | 93.428 | 358 | 0.261 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1411.549 | 1 | 1411.549 | 1028.167 | 0.000 |

| Error | 64.543 | 47.013 | 1.373 a | |||

| Transactional leadership_group | Hypothesis | 6.030 | 1 | 6.030 | 11.055 | 0.002 |

| Error | 20.828 | 38.187 | 0.545 b | |||

| Technological innovation | Hypothesis | 76.259 | 35 | 2.179 | 3.661 | 0.000 |

| Error | 15.642 | 26.283 | 0.595 c | |||

| Transactional leadership_group * Technological innovation | Hypothesis | 13.336 | 21 | 0.635 | 1.629 | 0.041 |

| Error | 138.763 | 356 | 0.390 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1555.053 | 1 | 1555.053 | 1363.979 | 0.000 |

| Error | 51.000 | 44.734 | 1.140 a | |||

| Transactional leadership_group | Hypothesis | 13.017 | 1 | 13.017 | 31.146 | 0.000 |

| Error | 14.782 | 35.368 | 0.418 b | |||

| Technological innovation | Hypothesis | 64.947 | 35 | 1.856 | 3.974 | 0.000 |

| Error | 11.891 | 25.468 | 0.467 c | |||

| Transactional leadership_group * Technological innovation | Hypothesis | 10.629 | 21 | 0.506 | 1.912 | 0.010 |

| Error | 94.260 | 356 | 0.265 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1440.556 | 1 | 1440.556 | 1520.094 | 0.000 |

| Error | 66.377 | 70.042 | 0.948 a | |||

| Transformational leadership_group | Hypothesis | 14.760 | 1 | 14.760 | 23.717 | 0.000 |

| Error | 27.919 | 44.860 | 0.622 b | |||

| Market Orientaton | Hypothesis | 54.361 | 42 | 1.294 | 1.913 | 0.038 |

| Error | 18.572 | 27.448 | 0.677 c | |||

| Transformational leadership_group * Market Orientation | Hypothesis | 16.696 | 24 | 0.696 | 1.433 | 0.088 |

| Error | 167.969 | 346 | 0.485 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1572.796 | 1 | 1572.796 | 1778.503 | 0.000 |

| Error | 52.890 | 59.807 | 0.884 a | |||

| Transformational leadership_group | Hypothesis | 21.272 | 1 | 21.272 | 44.294 | 0.000 |

| Error | 19.302 | 40.193 | 0.480 b | |||

| Market Orientaton | Hypothesis | 55.052 | 42 | 1.311 | 2.404 | 0.009 |

| Error | 14.576 | 26.733 | 0.545 c | |||

| Transformational leadership_group * Market Orientation | Hypothesis | 13.635 | 24 | 0.568 | 1.797 | 0.013 |

| Error | 109.392 | 346 | 0.316 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1518.982 | 1 | 1518.982 | 1610.649 | 0.000 |

| Error | 64.456 | 68.346 | 0.943 a | |||

| Transactional leadership_group | Hypothesis | 17.836 | 1 | 17.836 | 36.595 | 0.000 |

| Error | 28.004 | 57.457 | 0.487 b | |||

| Market Orientation | Hypothesis | 54.204 | 42 | 1.291 | 2.638 | 0.002 |

| Error | 17.717 | 36.222 | 0.489 c | |||

| Transactional leadership_group * Market Orientation | Hypothesis | 13.242 | 27 | 0.490 | 1.020 | 0.441 |

| Error | 164.998 | 343 | 0.481 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1589.871 | 1 | 1589.871 | 1632.817 | 0.000 |

| Error | 55.738 | 57.243 | 0.974 a | |||

| Transactional leadership_group | Hypothesis | 15.136 | 1 | 15.136 | 37.394 | 0.000 |

| Error | 19.394 | 47.912 | 0.405 b | |||

| Market Orientation | Hypothesis | 61.322 | 42 | 1.460 | 3.401 | 0.000 |

| Error | 14.379 | 33.491 | 0.429 c | |||

| Transactional leadership_group * Market Orientation | Hypothesis | 12.094 | 27 | 0.448 | 1.422 | 0.083 |

| Error | 108.054 | 343 | 0.315 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1310.781 | 1 | 1310.781 | 1059.944 | 0.000 |

| Error | 61.126 | 49.429 | 1.237 a | |||

| Exploration_group | Hypothesis | 2.854 | 1 | 2.854 | 5.196 | 0.029 |

| Error | 18.325 | 33.364 | 0.549 b | |||

| Technological innovation | Hypothesis | 69.050 | 35 | 1.973 | 3.180 | 0.004 |

| Error | 12.066 | 19.449 | 0.620 c | |||

| Exploration_group * Technological innovation | Hypothesis | 10.960 | 17 | 0.645 | 1.602 | 0.061 |

| Error | 144.924 | 360 | 0.403 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1453.689 | 1 | 1453.689 | 1375.153 | 0.000 |

| Error | 49.133 | 46.479 | 1.057 a | |||

| Exploration_group | Hypothesis | 7.297 | 1 | 7.297 | 16.212 | 0.000 |

| Error | 13.358 | 29.678 | 0.450 b | |||

| Technological innovation | Hypothesis | 60.903 | 35 | 1.740 | 3.266 | 0.004 |

| Error | 10.091 | 18.943 | 0.533 c | |||

| Exploration_group * Technological innovation | Hypothesis | 9.536 | 17 | 0.561 | 2.005 | 0.010 |

| Error | 100.704 | 360 | 0.280 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1248.607 | 1 | 1248.607 | 778.906 | 0.000 |

| Error | 72.363 | 45.141 | 1.603 a | |||

| Exploitation_group | Hypothesis | 6.754 | 1 | 6.754 | 16.550 | 0.000 |

| Error | 29.811 | 73.047 | 0.408 b | |||

| Technological innovation | Hypothesis | 94.052 | 35 | 2.687 | 6.562 | 0.000 |

| Error | 14.425 | 35.227 | 0.409 c | |||

| Exploitation_group * Technological innovation | Hypothesis | 11.073 | 27 | 0.410 | 1.012 | 0.451 |

| Error | 141.808 | 350 | 0.405 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1393.565 | 1 | 1393.565 | 901.744 | 0.000 |

| Error | 65.597 | 42.447 | 1.545 a | |||

| Exploitation_group | Hypothesis | 7.457 | 1 | 7.457 | 18.812 | 0.000 |

| Error | 20.999 | 52.971 | 0.396 b | |||

| Technological innovation | Hypothesis | 93.539 | 35 | 2.673 | 5.952 | 0.000 |

| Error | 14.318 | 31.889 | 0.449 c | |||

| Exploitation_group * Technological innovation | Hypothesis | 12.767 | 27 | 0.473 | 1.664 | 0.022 |

| Error | 99.489 | 350 | 0.284 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1484.226 | 1 | 1484.226 | 1729.406 | 0.000 |

| Error | 64.858 | 75.572 | 0.858 a | |||

| Exploration_group | Hypothesis | 19.926 | 1 | 19.926 | 38.700 | 0.000 |

| Error | 29.142 | 56.601 | 0.515 b | |||

| Market Orientation | Hypothesis | 49.507 | 42 | 1.179 | 2.219 | 0.014 |

| Error | 15.193 | 28.599 | 0.531 c | |||

| Exploration_group * Market Orientation | Hypothesis | 12.876 | 24 | 0.537 | 1.118 | 0.321 |

| Error | 166.014 | 346 | 0.480 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1577.389 | 1 | 1577.389 | 1954.743 | 0.000 |

| Error | 51.418 | 63.719 | 0.807 a | |||

| Exploration_group | Hypothesis | 19.413 | 1 | 19.413 | 37.528 | 0.000 |

| Error | 20.852 | 40.310 | 0.517 b | |||

| Market Orientation | Hypothesis | 50.877 | 42 | 1.211 | 1.977 | 0.033 |

| Error | 16.207 | 26.455 | 0.613 c | |||

| Exploration_group * Market Orientation | Hypothesis | 15.443 | 24 | 0.643 | 2.057 | 0.003 |

| Error | 108.250 | 346 | 0.313 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1541.930 | 1 | 1541.930 | 1134.644 | 0.000 |

| Error | 82.267 | 60.537 | 1.359 a | |||

| Exploitation_group | Hypothesis | 7.346 | 1 | 7.346 | 12.088 | 0.001 |

| Error | 32.739 | 53.874 | 0.608 b | |||

| Market Orientation | Hypothesis | 89.682 | 42 | 2.135 | 3.221 | 0.000 |

| Error | 21.592 | 32.571 | 0.663 c | |||

| Exploitation_group * Market Orientation | Hypothesis | 19.166 | 28 | 0.684 | 1.446 | 0.071 |

| Error | 161.944 | 342 | 0.474 d |

| Source | Third Type Sum of Squares | Degree of Freedom | Mean Square | F | Significant Probability | |

|---|---|---|---|---|---|---|

| Intercept | Hypothesis | 1662.486 | 1 | 1662.486 | 1233.597 | 0.000 |

| Error | 73.361 | 54.435 | 1.348 a | |||

| Exploitation_group | Hypothesis | 7.673 | 1 | 7.673 | 19.149 | 0.000 |

| Error | 23.393 | 58.382 | 0.401 b | |||

| Market Orientation | Hypothesis | 93.906 | 42 | 2.236 | 5.277 | 0.000 |

| Error | 14.106 | 33.293 | 0.424 c | |||

| Exploitation_group * Market Orientation | Hypothesis | 12.115 | 28 | 0.433 | 1.255 | 0.179 |

| Error | 117.936 | 342 | 0.345 d |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hwangbo, Y.; Shin, W.-J.; Kim, Y. Moderating Effects of Leadership and Innovation Activities on the Technological Innovation, Market Orientation and Corporate Performance Model. Sustainability 2022, 14, 6470. https://doi.org/10.3390/su14116470

Hwangbo Y, Shin W-J, Kim Y. Moderating Effects of Leadership and Innovation Activities on the Technological Innovation, Market Orientation and Corporate Performance Model. Sustainability. 2022; 14(11):6470. https://doi.org/10.3390/su14116470

Chicago/Turabian StyleHwangbo, Yun, Wang-Jae Shin, and Youngjun Kim. 2022. "Moderating Effects of Leadership and Innovation Activities on the Technological Innovation, Market Orientation and Corporate Performance Model" Sustainability 14, no. 11: 6470. https://doi.org/10.3390/su14116470

APA StyleHwangbo, Y., Shin, W.-J., & Kim, Y. (2022). Moderating Effects of Leadership and Innovation Activities on the Technological Innovation, Market Orientation and Corporate Performance Model. Sustainability, 14(11), 6470. https://doi.org/10.3390/su14116470