Abstract

Developing banking services based on technology is an inevitable and objective trend in the era of international economic integration. This study aims to determine the factors impacting the adoption and use of online banking services in Vietnam. The proposed research model is based on the adjustment of Unified Theory of Acceptance and Use of Technology (UTAUT2). We employed the structural equation modeling (SEM) and artificial neural network model (ANN) to comprehensively evaluate the linear and non-linear effects of factors on the adoption and use of online banking services in Vietnam. With survey data of 433 customers from three key economic areas in Vietnam, the result shows that the factors of expected efficiency, cost, expected effort, brand image, perceived risk, and social influence impact behavioral intention to use online banking services. At the same time, the behavioral intention to use online banking services also increases the decision to choose online banking services. Based on the results, we propose some implications for Vietnamese commercial banks to increase the acceptance of online banking.

1. Introduction

From the early 1990s to the present, digital technology has continuously developed, reflecting the enormous revolution of new technologies and their application to corporations, firms, customers, as well as governments. In particular, the Internet is the most rapidly developing form of media in history, with the number of users increasing significantly year by year. The Internet has changed the business method in many fields. In the banking sectors, the Internet has created big changes in this business sector [1]. The banking sector is one of the sectors most affected by technology [2,3] due to its ability to process and provide service information to all users [4]. In addition, increasing competition in the banking sector forces suppliers to develop and use alternative distribution channels [5]. Therefore, the application of information technology and the Internet to create new products is a revolution in the approach of banks to provide convenient, reliable, and fast services to customers [4]. One of the products created from the application of information technology and the Internet is online banking, a banking service that allows users to be “at home” and use the service at any time through an internet connection [6]. In online banking services, the restrictions of time and geography have been removed, and customers can access their bank accounts and make transactions at almost anytime and anywhere via computers and an internet gateway [7]. In addition, when using online banking services, customers can reduce the risk of money loss, counterfeit money, and wasted time. Online transactions reduce the lack of transparency compared to cash transactions [8,9].

However, studies confirm that many individual customers are reluctant to adopt and use online banking services because of many reasons such as society, culture, and economy [10,11,12]. This is because of two reasons: First, the perception of financial service customers is still limited, sometimes creating “security holes”, especially individual customers. People are still not aware of the confidentiality of personal information such as full name, identity card number, passport, address, date of birth, and account number. It greatly increases the risk of safety loss to customers themselves as well as commercial banks. Second, individual customers often have fewer online banking transactions than corporation customers, especially customers in small cities and rural and mountainous areas. Therefore, it is important to understand the factors affecting the choice of online banking services.

There are many studies aimed at determining the factors impacting the intention and decision to choose online banking. However, these studies mainly use the theory of reasoned action (TRA) [13,14], theory of planned behavior (TPB), and technology acceptance model (TAM) [15]. For example, the study of Naruetharadhol et al. [16] developed a model based on TAM to examine the factors affecting the intention to use mobile payments with 688 mobile payment service users in Thailand. Ananda et al. [17] extended TAM to examine the factors influencing the intention to use digital banking with 200 individual customers of seven local banks and two Islamic banks across Oman. Mortimer et al. [18] developed a model based on TAM to empirically examine the motivations affecting the intention to use mobile banking of 348 consumers in Thailand and Australia. These studies have shown the factors affecting the consumer’s acceptance of using banking services. However, according to Venkatesh et al. [19], the studies based on the above theories are not really comprehensive. On the basis of synthesizing the above theories in the most comprehensive way, Venkatesh et al. [20] proposed the Unified Theory of Acceptance and Use of Technology (UTAUT). Due to its high generalizability, UTAUT is used by many researchers to assess the adoption and use of technology [11,12,21,22]. However, UTAUT has still not covered all the factors affecting the adoption and use of technology [19]. Therefore, in this study, we use UTAUT2, an extension of UTAUT, to assess the factors affecting the adoption and use of online banking services to overcome the limitations of previous studies.

In addition, the previous studies used structural equation modeling (SEM) to estimate the parameters and draw conclusions about the research hypothesis. However, SEM only evaluates the linear relationship between variables in the model and cannot evaluate the non-linear relationship. To solve this issue, we use the artificial neural network model (ANN) to evaluate the non-linear relationship between the variables in the model. To the best of our knowledge, there are no studies related to this topic using both SEM and ANN models to evaluate the factors affecting the adoption and use of online banking services by customers.

2. Literature Review and Development of Hypotheses

The Unified Theory of Acceptance and Use of Technology (UTAUT) was used by Venkatesh et al. [20] to explain the behavioral intention and usage choice of users towards technology. UTAUT is built on the basis of the development of previous models: TRA, TPB, TAM, and IDT.

By investigating, testing, and comparing the advantages and limitations of previous models, Venkatesh built the UTAUT model focusing on researching four key factors: performance expectancy, effort expectancy, social influence, and facilitating condition. These four factors are believed to directly influence the usage intentions and behaviors towards technology of individual customers.

UTAUT2 is an extension of the UTAUT model after adding new factors [19]. According to Yaseen and Qirem [21], UTAUT2 needs to be adjusted when conducting research in order to provide relevant information to the surveyed subjects. The first adjustment is related to the facilitating condition factor in the UTAUT2 model. In particular, Venkatesh et al. [19] argue that the facilitating condition factor is the condition that promotes or prevents the behavioral intention to choose. However, the promoting conditions are related to the effort expectancy and performance expectancy factors mentioned in the model. On the other hand, the anxiety of security risks has a negative impact on the acceptance of online banking services. People who have high anxiety will avoid technology due to fears of password theft or errors while using the services [22]. Therefore, in this study, we propose the perceived risk factor to replace the facilitating condition factor in the UTAUT2 model. Next, the factor that needs to be adjusted is the hedonic motivation factor in the UTAUT2 model. According to Venkatesh et al. [19], the hedonic motivation factor is related to customers’ perceived happiness when using the services. However, many researchers have shown that hedonic motivation is closely related to banking brand. The brand image represents the level of service users and is an important factor in the overall evaluation of a bank’s services [23,24,25,26].

2.1. Effort Expectancy

Effort expectancy is the expected ease of use of a new service [19]. In the field of banking technology, the effort expectancy in using a service is a factor associated with usage ease [15], complexity [27], simplicity, and how easy it is to understand [28]. Venkatesh et al. [19] argue that an easy-to-use online banking service will encourage individual customers to have a positive attitude about this technology and tend to use it. According to a study by Gupta and Arora [29] on the factors affecting the acceptance and use of the mobile payment system in India, the effort expectancy has a positive impact on the intention to use this service. In another study on the factors affecting the intention to use Internet banking of Jordanian customers, Alalwan et al. [30] also found a positive effect of effort expectancy on intention to use Internet banking. Similarly, in a study of factors that help explain customer willingness to adopt mobile banking of Iranian private banks, Farzin et al. [31] also found evidence that when a customer believes that a new technology is easy to use, the chances of adopting a mobile banking service are significantly increased. Therefore, we propose the following hypothesis:

Hypothesis 1 (H1).

Effort expectancy has a positive impact on the behavioral intention to choose online banking services of individual customers at commercial banks.

2.2. Performance Expectancy

According to Davis [32], performance expectancy is the degree to which an individual believes that using the system will help them achieve their work goals. Performance expectancy from a service stems from the usefulness that the service brings [32]. Performance expectancy has an important influence on customers’ acceptance of online banking service choices [19]. Because online banking services allow users to control their accounts from anywhere at a convenient time and at a lower cost, this brings many advantages to users in terms of price and convenience [33]. In recent studies on the factors affecting the intention to use financial services such as mobile payment services or online banking, performance expectancy is considered to have a positive impact on customer intention to use it [21,29,30,31,34]. Therefore, we propose the following hypothesis:

Hypothesis 2 (H2).

Performance expectancy has a positive impact on the behavioral intention to choose online banking services of individual customers at commercial banks.

2.3. Brand Image

The brand image of a bank is very important in the service business field, and the image can be built mainly on the service quality, including many factors such as culture, ideology, slogan, and public relations [35]. In studies in different countries, it has been confirmed that the supplier image factor is one of the important factors affecting the usage intention and acceptance of customers’ online banking services. Specifically, Rambocas et al. [25] investigated the link between brand equity and customer service intention in four retail banks in Trinidad and Tobago. Rambocas et al. [25] found that brand equity had a positive influence on the intention to use banking services. Another study, conducted by Linh et al. [26] in Vietnamese commercial banks, found that brand equity had an effect on customers’ intention to use banking services. Therefore, we propose the following hypothesis:

Hypothesis 3 (H3).

Brand image has a positive impact on the behavioral intention to choose online banking services of individual customers at commercial banks.

2.4. Perceived Risk

Perceived risk has an important impact on the behavioral intention to choose online banking services in the context of electronic commerce. Aspects of risk when using services are always a possibility mainly due to the user’s negligence and vigilance, which will directly affect customers’ behavioral intention and satisfaction. Suganthi [36] argue that security concerns have an important impact on the acceptance of using new technology. If online banking services have a high risk, customers will develop anxiety, and this results in psychological anxiety or emotional reactions when performing a specific behavior. Risk and privacy are the potential factors affecting the application of online banking. Online banking services are facilitated by bank’s reputation regarding size, perception, and reliability [33]. Banks have the means to create awareness of good security, reducing risk, and not violating personal privacy, which will improve a customer’s perception of online banking services, thereby encouraging a customer to accept use of the services. Several empirical studies have also demonstrated that perceived risk is a negative factor on customers’ intention to use online banking services [34,37,38,39]. Therefore, we propose the following hypothesis:

Hypothesis 4 (H4).

Perceived risk has a negative impact on the behavioral intention to choose online banking services of individual customers at commercial banks.

2.5. Cost Value

According to Venkatesh et al. [19], the cost value is customers’ comparative perception of the cost that they have to pay to use a new service with the benefits that the service brings. The types of costs that the users often pay when using online banking services in Vietnam are account maintenance fees, annual fees, account management fees, transfer fees, and statement printing fees. According to Liao and Cheung [40], price and cost show that there is a constraint on the actual use of online banking services. Through online banking services, customers can take advantage of the reduced transaction time, then the low prices together with price incentives will encourage customers to use online banking services [41]. Polatoglu and Ekin [33] also confirm that online banking users are significantly satisfied with the cost savings when using this service. Similarly, Migliore et al. [34] also found evidence of a positive effect of cost savings on the behavioral intention to use mobile payment services. Therefore, we propose the following hypothesis:

Hypothesis 5 (H5).

The lower cost value has a positive impact on the behavioral intention to choose online banking services of individual customers at commercial banks.

2.6. Social Influence

Social influence is defined as the degree to which an individual is influenced by other important people to believe in using a particular technological application [20]. Collectivist customers often see themselves as members of a community, emphasizing the opinions of others or group standards, being submissive, maintaining relationships, and being more attentive to the needs and wants of others [13,15]. Datta [42] argued that for consumers who lack expertise, referrals from their friends will become a significant factor in determining behavioral intention [14,42]. The experimental studies of Tarhini et al. [43] and Gupta and Arora [29] have all shown that social influence is one of the factors that positively affects customers’ intention to use online banking. Additionally, recent studies by Farzin et al. [31] and Migliore et al. [34] have demonstrated that when influential individuals endorse new technologies, customers are more willing to accept them. Therefore, we propose the following hypothesis:

Hypothesis 6 (H6).

Social influence has a positive impact on the behavioral intention to choose online banking services of individual customers at commercial banks.

2.7. Decision to Choose

Decision to choose is the attitude towards the acceptance of using online banking services in the future. Intentions turned into behavior will occur if the individual has a positive assessment of performing the behavior. The stronger intention towards a given behavior, the stronger an individual’s decision to accept that behavior [15,34,44,45]. The theory of behavioral intention suggests that the behavioral intention of an individual is influenced by controlling his or her behavioral and perceived ability. This is based on the premise that an individual can take part in performing a behavior when they believe that they have enough resources and self-perceived ability to perform that behavior effectively. Taylor and Todd [42] suggest that the effectively self-perceived ability has an impact on the intention to use online banking services.

Hypothesis 7 (H7).

Behavioral intention has a positive impact on the decision to choose online banking services of individual customers at commercial banks.

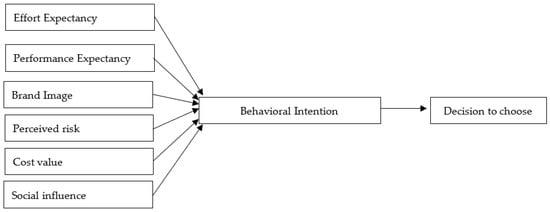

The research model, including six predictors of the behavioral intention and decision to use online banking services, is presented in Figure 1.

Figure 1.

Proposed Research Model.

3. Research Methodology

3.1. Sample and Data Collection

We built a survey questionnaire based on the research model to collect data. Specifically, we used the scale of effort expectancy from Pikkrainen et al. [44] with four observed variables. The scale of performance expectancy is also taken from Pikkrainen et al. [44] with four observed variables. The brand image scale is taken from Nguyen and LeBlanc [24] with four observed variables. The scale of perceived risk is taken from Chan and Lu [45] with four observed variables. The cost value scale is taken from Poon [39] with four observed variables. The social influence scale is taken from Venkatesh et al. [20] with four observed variables. The scale of behavioral intention to use online banking services is taken from Al-Somali et al. [46] with four observed variables. The scale for the decision to use online banking services is taken from Gupta and Arora [29] with three observed variables. The items in each scale are presented in Table 1.

Table 1.

The scale items.

The observed variables are measured through a 5-point Likert scale (score 1 represents strong disagreement, while score 5 represents strong agreement with the statement). Next, we conducted a preliminary study including two steps. Step 1: we used a focus group consisting of researchers in the banking and finance sector at universities and managers at commercial banks. The focus group was asked about the appropriateness of the scales in the research model and the clarity of the statements in the questionnaire. Step 2: the questionnaire was piloted on a small sample with the participation of 50 customers who have been using online banking services. The participants indicated the clarity of the questionnaire that they were given. Finally, the questionnaire, after being adjusted through the above 2 steps, was used to collect data for the official study.

The official research was conducted with a sample of 443 customers that had used online banking services of commercial banks in the three largest cities and provinces in Vietnam, namely Ho Chi Minh City, Ha Noi, and Da Nang. These localities were chosen because they can represent three regions of Vietnam, including the North, Central, and South. In each province, we interviewed 180 customers that had used online banking services of commercial banks. The questionnaires were distributed to customers through our relationships at commercial banks. Due to the survey being in many locations, we selected the customers according to the conventional method. To select data, we sent out 480 questionnaires and got back 462 questionnaires. Then, we eliminated 19 questionnaires that had a lack of response information. The sample size to conduct the research is 443 questionnaires with full necessary response information. The demographic structure of the samples is shown in Table 2.

Table 2.

Demographic Structure of Participants.

3.2. Data Analysis

The data analysis process was carried out in 3 steps:

Step 1: we evaluated the reliability of the scales corresponding to 8 factors in the model, which are effort expectancy, performance expectancy, brand image, perceived risk, cost value, social influence, intention to use online banking services, and decision to use online banking services. The reliability assessment was conducted through Cronbach’s Alpha coefficient. In addition, convergent validity, discriminant validity, and composite reliability were also tested by using confirmatory factor analysis (CFA).

Step 2: we estimated SEM by the maximum likelihood estimation to test the stated hypotheses.

Step 3: factors affecting the intention to use online banking service which were tested in the SEM model were redefined by the ANN model. As emphasized earlier, the use of ANN is to test the effects of these factors in non-linear conditions. In addition, the results of ANN are also more accurate and robust than SEM [47].

ANNs are computational tools that simulate neural networks in the human brain and are capable of non-linear mapping relationships between input and output variables. The analytical efficiency of ANNs has yielded remarkable results in many different fields, and artificial neural networks are increasingly being used in statistical scientific research [48]. ANNs have many different forms when applied to research practice. In this study, we use multilayer perceptron (MLP), a common form of ANN in economic research. MLP is divided into several layers, including an input layer, one or more hidden layers, and an output layer. Choosing the number of the MLP hidden layers depends on the complexity of the problem to be solved. In economic research, universal approximation theory suggests that an MLP network having a single hidden layer with a sufficiently large number of neurons can interpret any input-output structure [49]. Therefore, in this study, we use an MLP network with one input layer, one hidden layer, and one output layer. The input layer will have a number of neurons equal to the number of factors affecting the intention to use online banking services that have been tested from the SEM model. The output layer will have one neuron as a dependent factor. The number of neurons in the hidden layer will be determined according to the formula proposed by Fang and Ma [50] as follows:

where k is the number of neurons in the hidden layer and n is the number of neurons in the input layer.

Besides determining the number of neurons in the hidden layer, in this study, we use the Sigmoid function as the activation function for neurons in both the hidden and output layers. Data analysis was performed using SPSS 25 and AMOS 20 software.

4. Empirical Results and Discussion

4.1. The Results of Reliability, Convergent Validity, Discriminant Validity, and Composite Reliability Tests

Table 3 shows the results of the reliability analysis of the scales corresponding to 8 factors in the model: effort expectancy, performance expectancy, brand image, perceived risk, cost value, social influence, behavioral intention to use online banking services, and decision to choose to use online banking services.

Table 3.

Reliability Analysis.

Columns 3, 4, and 6 in Table 3 show the mean, variance, and Cronbach’s Alpha coefficient of the scale when removing each item, respectively. Column 5 in Table 3 shows the corrected item-total correlation, which represents the correlation of each item with the rest of the items on the scale. Table 3 shows that all scales are reliable because Cronbach’s Alpha coefficients are all more than 0.7 [51]. Specifically, Cronbach’s Alpha coefficients range from 0.797 to 0.885. In addition, the corrected item-total correlation coefficients are all greater than 0.3, showing that the items are reliable.

Next, we perform an Exploratory Factor Analysis by Principal Axis Factoring method with Promax rotation to identify latent factors. The results are presented in Table 4.

Table 4.

Pattern Matrix.

Table 4 shows that KMO has a value of 0.878, which is greater than 0 and less than 1, showing that exploratory factor analysis is consistent with the data [52]. In addition, Bartlett’s test has a significance level of 0.000 showing that items are correlated with latent factors [52]. The results of Exploratory Factor Analysis extracted seven latent factors consistent with the research model originally proposed. The exploratory factor analysis results also show that the total variance explained is 58.362%, lower than the 70% threshold. However, according to Hair et al. [53], in social sciences, a field of research where data information is often inaccurate, a total variance explained of 60% (or even less) is satisfactory. In addition, Fornell and Larcker [54] also suggested that a total variance explained greater than 50% is satisfactory.

The exploratory factor analysis identified latent factors and measured observed variables for each latent factor. The exploratory factor analysis results are the premise for the next confirmatory factor analysis. Table 5 below presents the standard loadings of the confirmatory factor analysis.

Table 5.

The standard loadings of the CFA.

Table 5 shows that most of the standard loadings are greater than 0.7, with the exception of four standard loadings that are less than 0.7 (but still greater than 0.5). This result implies that the scales have convergence.

To access the goodness of fit of the proposed model, we continue to consider the model’s goodness of fit indicators. They are relative fix index (FRI), adjusted goodness-of-fit index (AGFI), goodness-of-fit index (GFI), normed fit index (NFI), comparative goodness of fit (CFI), Tucker–Lewis Index (TLI), incremental fit index (IFI), and root mean square error of approximation (RMSEA). The values of these indicators are shown in Table 6.

Table 6.

The Model’s Goodness of Fit Criteria.

The Chi-square/df value of 1.932 is lower than the threshold of 3, recommended by Carmines and McIver [55]. The values of RFI, AGFI, GFI, and NFI are 0.886, 0.890, 0.912, and 0.902, respectively. For the CFI, TLI, and IFI, the obtained values are all greater than 0.90. The RMSEA is also in the desired range between 0.05 and 0.08 [52]. Thus, the proposed model is consistent with the data.

Table 7 presents the result of the intercorrelation matrix, the values of average variance extracted (AVE), and the composite reliability (CR) of each scale corresponding to each factor in the model. The result shows that AVEs are all greater than 0.5. Therefore, all of the factors in the model converge [54]. In addition, the correlation coefficients between factors have an absolute value less than 0.85. Therefore, the factors in the model all discriminate [56]. Finally, the CRs of the factors are all higher than 0.6 [57].

Table 7.

Intercorrelation matrix, AVE, and CR.

4.2. The Result of SEM

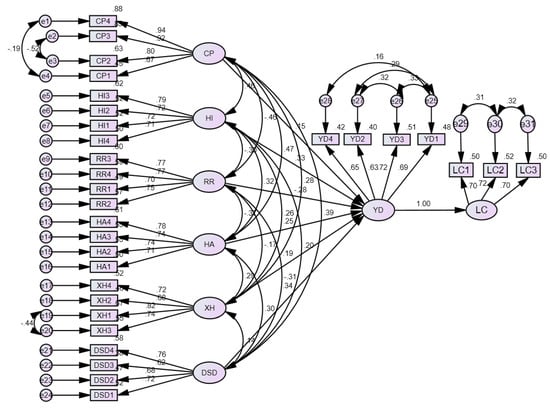

To test the research hypothesis, we estimate the SEM. The result of the estimations is presented in Figure 2.

Figure 2.

The Structural Equation Model. Effort expectancy (DSD), performance expectancy (HI), perceived risk (RR), brand image (HA), cost value (CP), social influence (XH), behavioral intention (YD), decision to choose (LC).

Table 8 shows that the Chi-square/df value of 2.124 is lower than the threshold of 3, recommended by Carmines and McIver [55]. The values of RFI, AGFI, GFI, and NFI are 0.870, 0.865, 0.890, and 0.887, respectively. For the CFI, TLI, and IFI, the obtained values are all greater than 0.90. The RMSEA is also in the desired range between 0.05 and 0.08 [52]. Thus, the SEM is consistent with the data.

Table 8.

The SEM Model’s Goodness of Fit Criteria.

The result of testing the research hypothesis is presented in Table 9. Table 9 shows that the coefficient of the cost value factor is 0.146 and is significant at the level of 1%. Therefore, the cost value has a positive impact on the behavioral intention to use online banking services, and hypothesis 5 (H5) is supported. This result is also consistent with Migliore et al. [34], Polatoglu and Ekin [33], Liao and Cheung [40]. The impact of cost value on behavioral intention to use online banking services in Vietnam is similar to the results obtained from Singapore, Turkey, China, and Italy. In fact, online banking can help customers save transaction time. At the same time, low transaction costs will encourage customers to use online banking services.

Table 9.

Hypothesis Testing.

Next, the regression coefficient of the performance expectancy is 0.331 and significant at the level of 1%. Thus, the performance expectancy has a positive impact on the behavioral intention to use online banking services, and hypothesis 2 (H2) is supported. This result is also consistent with Polatoglu and Ekin [33], Gupta and Arora [31], Alalwan et al. [32], Yaseen and Qirem [23], Migliore et al. [34], and Farzin et al. [31]. The impact of performance expectancy on behavioral intention to use online banking services in Vietnam is similar to the results obtained from Turkey, India, Jordan, China, and Italy. In fact, online banking in Vietnam is growing in popularity, providing customers with benefits such as instant, fast, and personalized services. Therefore, customers can accept online banking because they believe it is a useful and convenient tool to carry out banking transactions.

The regression coefficient of the perceived risk is −0.282 and significant at the level of 1%. Thus, the perceived risk has a negative impact on the behavioral intention to use online banking services, and hypothesis 4 (H4) is supported. This result is also consistent with Suganthi [36], Polatoglu and Ekin [33], Gupta and Arora [31], Alalwan et al. [32], Yaseen and Qirem [23], and Migliore et al. [34]. The impact of perceived risk on behavioral intention to use online banking services in Vietnam is similar to the results obtained from Malaysia, Turkey, India, and Jordan. In Vietnam, perceived risk is an important aspect when customers form an intention to use or refuse online banking services. The reality of Vietnam’s banking activities in recent years shows that perceived risks stem from customers’ concerns about the lack of security when using online banking services.

The regression coefficient of the brand image is 0.252 and significant at the level of 1%. Thus, the brand image has a positive impact on the behavioral intention to use online banking services, and hypothesis 3 (H3) is supported. This result is also consistent with Hernandez and Mazzon [58], Poon [39], Rambocas et al. [27], and Linh et al. [28]. With a developing market, like in Vietnam, possible hazards in banking activity are unavoidable. Therefore, banks with big brands typically provide clients comfort of mind while utilizing the service. In addition, the bank’s brand is also a factor that reflects the level of clients while utilizing it.

In addition, the regression coefficient of the social influence is 0.186 and significant at the level of 1%. Thus, the social influence has a positive impact on the behavioral intention to use online banking services, and hypothesis 6 (H6) is supported. This result is also consistent with Tarhini et al. [21], Gupta and Arora [31], Farzin et al. [31], Migliore et al. [34]. The impact of social influence on behavioral intention to use online banking services in Vietnam is similar to the results obtained from Lebanon, India, China, and Italy. This result shows that, in Vietnam as well as in other countries, when new technologies, such as online banking, are endorsed by influential individuals, customers are more likely to accept them.

The regression coefficient of the effort expectancy is 0.335 and significant at the level of 1%. Thus, the effort expectancy has a positive impact on the behavioral intention to use online banking services, and hypothesis 1 (H1) is supported. This result is also consistent with Gupta and Arora [31], Alalwan et al. [32], and Farzin et al. [31]. The impact of effort expectancy on behavioral intention to use online banking services in Vietnam is similar to the results obtained from India, Jordan, and Iran. This result implies that customers are often looking for technologies to simplify their operations with as little effort as possible. When customers believe that online banking is easy to use, the chances of accepting this service increase significantly.

Finally, the regression coefficient of the behavioral intention to use online banking services is 0.9997 and significant at the level of 1%. Thus, the behavioral intention to use online banking services has a positive impact on the decision to choose online banking services, and hypothesis 7 (H7) is supported. This result is also consistent with Davis [15], Taylor and Todd [42], and Kijsanayotin et al. [59]. Like previous studies, in this study, behavioral intention is proven to be a factor leading to customers’ decision to use services. In fact, when customers intend to use the service in the Vietnamese market, they will almost certainly perform their service use behavior.

In addition, the standardized regression weights show that effort expectancy has the strongest impact on the behavioral intention to use online banking services. Meanwhile, the cost value factor has the weakest impact on behavioral intention to use online banking services. The other factors in order of affecting the behavioral intention to use online banking services from strong to weak are performance expectancy, perceived risk, brand image, and social influence, respectively.

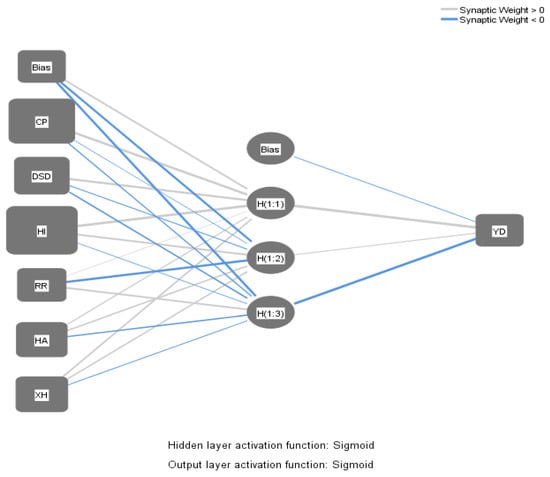

4.3. The Result of MLP Model

The estimation result of SEM shows that the factors affecting the behavioral intention to use online banking services are cost value, performance expectancy, perceived risk, brand image, social influence, effort expectancy. Therefore, these six factors will be brought to the input layer of the MLP model. The output layer is the behavioral intention to use online banking services factor. To the hidden layer, in the case of six input factors, the number of neurons in the hidden layer is . Thus, the number of neurons in the hidden layer is 3. The Sigmoid function is used as the activation function of the neurons in the hidden and the output layers. In this study, we use 90% of the sample data to train the model, and the remaining 10% is used to test the accuracy of the model. An MLP model is shown in Figure 3.

Figure 3.

MLP model. Effort expectancy (DSD), performance expectancy (HI), perceived risk (RR), brand image (HA), cost value (CP), social influence (XH), behavioral intention (YD).

Table 10 shows that the average sum of square errors of 10 models is relatively small (4.100 for the training data and 0.468 for the testing data), which means the prediction level of the model is fairly accurate.

Table 10.

Sum of Square Errors of 10 Models.

The importance of each influencing factor shows how the intention to use online banking services will change when the influencing factor changes. To see the importance of each influencing factor, we evaluate through the normalized importance of each factor. Specifically, the normalized importance of a factor is the ratio of the factor’s importance to the highest importance. The results of the importance of each factor are presented in Table 11.

Table 11.

Normalized Variable Importance.

Table 11 shows that the effect of performance expectancy on behavioral intention to use online banking services has the highest importance (100%). At the same time, the impact of social influence on behavioral intention to use online banking services has the lowest importance (33.3%). The remaining factors of importance in order are cost value (79.5%), effort expectancy (56.6%), brand image (56.4%), and perceived risk (36.1%). Thus, when controlling for the non-linear relationship through the MLP model, the impact of the factors on the behavioral intention to use online banking services has changed compared to the results obtained from the SEM.

5. Conclusions and Implication

5.1. Conclusions

The result shows that performance expectancy, cost value, effort expectancy, brand image, and social influence all positively impact the behavioral intention to use online banking services. Thus, increasing the factors of performance expectancy, cost value, effort expectancy, brand image, and social influence can increase the customer’s intention to use online banking services, while the perceived risk has a negative impact on the behavioral intention to use online banking services. This means that when customers feel that online banking services are risky, their behavioral intention to use online banking services will decrease.

At the same time, the behavioral intention to use online banking services also has a positive impact on the decision to choose to use online banking services. This result indicates that when customers form an intention to use, they will quickly make a decision to choose online banking services. The findings in this study are supported by Polatoglu and Ekin [33], Suganthi [36], Hernandez and Mazzon [58], Poon [39], Davis [15], Kijsanayotin et al. [59], Tarhini et al. [21], Gupta and Arora [31], Alalwan et al. [32], Yaseen and Qirem [23], Rambocas et al. [27], Linh et al. [28], Migliore et al. [34], and Farzin et al. [31]. Moreover, these results also shed light on the validity of the UTAUT2 model when conducting research on the adoption and use of technology in the Vietnamese market.

Next, the significant contribution of this study is the resolution of the non-linear relationship between the factors in the proposed model by using the MLP model. We have discovered that there are different impact levels of factors on intention to use online banking services between the MLP and SEM models. Specifically, the SEM model shows that the order of factors affecting the behavioral intention to use online banking services from strong to weak is effort expectancy, performance expectancy, perceived risk, brand image, social influence, and cost value, respectively. Meanwhile, the MLP model shows that the order of factors affecting the intention to use online banking services from strong to weak is performance expectancy, cost value, effort expectancy, brand image, perceived risk, and social influence, respectively. From the economic perspective, the results obtained from the MLP model show a better fit than the SEM model.

5.2. Implications to Practice

Therefore, in order to increase the customer’s adoption and use of online banking services, banks should aim to increase the positive influencing factors and limit the negative influencing factors. For example, in order to increase the performance expectancy factor, banks need to have a strategy to develop service quality and increase service convenience. The key point here is to change the cash payment habits of customers so that they realize that the online banking service is very convenient, saving money and time. Therefore, the leading policy of banks is to promote, introduce and guide for customers in this service as well as the utility and usefulness of the service. In order to increase the cost value, commercial banks need to develop appropriate policies on payment service fees to encourage customers to make payments on electronic channels. Commercial banks need to strengthen links with each other to reduce interbank transaction fees and create reasonable fees. In order to increase the expected effort, commercial banks need to design a website interface that meets the optimal standards of service quality, simplify operations and service steps, and has detailed instructions, ensuring convenience, and user-friendliness. In order to increase the brand image, commercial banks need to strengthen to promote the brand image of the bank and its products. In order to minimize the perceived risk of customers, banks need to build an overall security architecture, a fraud analysis system, and an early warning system of suspicious transactions, incidents, and possible risks. In order to increase social influence, banks need to increase appropriate marketing policies according to customers and geographical areas.

5.3. Limitations and Future Research Directions

Although the research objectives have been achieved, this study still has some limitations and opens up future research directions. First, the current sample is only within three areas, Ho Chi Minh, Da Nang, and Ha Noi. Therefore, in order to be able to more accurately assess the impact of these factors on the intention and decision to use online banking services, it is necessary to further expand the sample size and the scope of research in other areas. Second, the research object focuses on individual customers who are using online banking services, not with customers who have not used online banking services and corporate customers. Therefore, future studies need to expand the research object to obtain more general results. Third, in addition to the factors affecting the behavioral intention to use online banking mentioned in the model, the behavioral intention to use is also affected by other factors. Therefore, future studies need to add new factors to search for other results.

Author Contributions

Introduction, A.H.T.P.; literature review and development of hypotheses, A.H.T.P. and D.X.P.; research methodology, A.H.L.; empirical results and discussion, E.I.T. and A.H.L.; conclusion and implication, A.H.T.P. and A.H.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data for this study can be found on our GitHub page: https://github.com/anhle32/THE-APPLICATION-OF-SEM-NEURAL-NETWORK-METHOD.git (accessed on 21 March 2022).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Jayawardhena, C.; Foley, P. Changes in the Banking Sector—The Case of Internet Banking Inthe UK. Internet Res. 2000, 10, 19–31. [Google Scholar] [CrossRef]

- Prendergast, G.P.; Marr, N.E. The Future of Self-Service Technologies in Retail Banking. Serv. Ind. J. 1994, 14, 94–114. [Google Scholar] [CrossRef]

- Mols, N.P. The Internet and Services Marketing—The Case of Danishretail Banking. Internet Res. 2000, 10, 7–18. [Google Scholar] [CrossRef]

- Tan, M.; Teo, T.S.H. Factors Influencing the Adoption of Internet Banking. J. Assoc. Inf. Syst. 2000, 1. [Google Scholar] [CrossRef] [Green Version]

- Daniel, E. Provision of Electronic Banking in the UK and the Republic of Ireland. Int. J. Bank Mark. 1999, 17, 72–83. [Google Scholar] [CrossRef]

- Taleghani, M. Identification of Electronic Banking Acceptance Components in Branches of Keshavarzi Bank of Guilan Province (Northern of Iran). In Proceedings of the International Academic Conferences, Prague, Czech Republic, 1–4 September 2014; International Institute of Social and Economic Sciences: Prague, Czech Republic, 2014. [Google Scholar]

- Sathye, M. Adoption of Internet Banking by Australian Consumers: An Empirical Investigation. Int. J. Bank Mark. 1999, 17, 324–334. [Google Scholar] [CrossRef]

- Schiffman, L.G.; Kanuk, L.L. Consumer Behavior; Prentice-Hall: Upper Saddle River, NJ, USA, 2000; ISBN 978-0-13-084129-2. [Google Scholar]

- Benamati, J.; Serva, M.A. Trust and Distrust in Online Banking: Their Role in Developing Countries. Inf. Technol. Dev. 2007, 13, 161–175. [Google Scholar] [CrossRef]

- Al-Qeisi, K.; Dennis, C.; Alamanos, E.; Jayawardhena, C. Website Design Quality and Usage Behavior: Unified Theory of Acceptance and Use of Technology. J. Bus. Res. 2014, 67, 2282–2290. [Google Scholar] [CrossRef] [Green Version]

- AbuShanab, E.; Pearson, J.M. Internet Banking in Jordan: The Unified Theory of Acceptance and Use of Technology (UTAUT) Perspective. J. Syst. Inf. Technol. 2007, 9, 78–97. [Google Scholar] [CrossRef]

- Dajani, D.; Yaseen, S.G. The Applicability of Technology Acceptance Models in the Arab Business Setting. J. Bus. Retail. Manag. Res. 2016, 10. Available online: https://jbrmr.com/cdn/article_file/i-24_c-228.pdf (accessed on 21 March 2022).

- Ajzen, I. The Theory of Planned Behavior. Organ. Behav. Hum. Decis. Processes 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Fishbein, M.; Ajzen, I. Belief, Attitude, Intention and Behaviour: An Introduction to Theory and Research; Elsevier Science Publishing Co., Inc.: New York, NY, USA, 1975; Volume 27. [Google Scholar]

- Davis, F.D. Perceived Usefulness, Perceived Ease of Use, and User Acceptance of Information Technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef] [Green Version]

- Naruetharadhol, P.; Ketkaew, C.; Hongkanchanapong, N.; Thaniswannasri, P.; Uengkusolmongkol, T.; Prasomthong, S.; Gebsombut, N. Factors Affecting Sustainable Intention to Use Mobile Banking Services. SAGE Open 2021, 11, 21582440211029924. [Google Scholar] [CrossRef]

- Ananda, S.; Devesh, S.; Al Lawati, A.M. What Factors Drive the Adoption of Digital Banking? An Empirical Study from the Perspective of Omani Retail Banking. J. Financ. Serv. Mark. 2020, 25, 14–24. [Google Scholar] [CrossRef]

- Mortimer, G.; Neale, L.; Hasan, S.F.E.; Dunphy, B. Investigating the Factors Influencing the Adoption of M-Banking: A Cross Cultural Study. Int. J. Bank Mark. 2015, 33, 545–570. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Thong, J.Y.L.; Xu, X. Consumer Acceptance and Use of Information Technology: Extending the Unified Theory of Acceptance and Use of Technology. MIS Q. 2012, 36, 157–178. [Google Scholar] [CrossRef] [Green Version]

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User Acceptance of Information Technology: Toward a Unified View. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef] [Green Version]

- Yaseen, S.G.; El Qirem, I.A. Intention to Use E-Banking Services in the Jordanian Commercial Banks. Int. J. Bank Mark. 2018, 36, 557–571. [Google Scholar] [CrossRef]

- Compeau, D.R.; Higgins, C.A. Computer Self-Efficacy: Development of a Measure and Initial Test. MIS Q. 1995, 19, 189–211. [Google Scholar] [CrossRef] [Green Version]

- Wallin Andreassen, T.; Lindestad, B. Customer Loyalty and Complex Services: The Impact of Corporate Image on Quality, Customer Satisfaction and Loyalty for Customers with Varying Degrees of Service Expertise. Int. J. Serv. Ind. Manag. 1998, 9, 7–23. [Google Scholar] [CrossRef] [Green Version]

- Nguyen, N.; LeBlanc, G. The Mediating Role of Corporate Image on Customers’ Retention Decisions: An Investigation in Financial Services. Int. J. Bank Mark. 1998, 16, 52–65. [Google Scholar] [CrossRef]

- Rambocas, M.; Kirpalani, V.M.; Simms, E. Brand Equity and Customer Behavioral Intentions: A Mediated Moderated Model. Int. J. Bank Mark. 2018, 36, 19–40. [Google Scholar] [CrossRef]

- Linh, D.H.; Yen, H.H.; Nhung, N.T.H.; Tam, L.T. Brand Image on Intention of Banking Services Using: The Case of Vietnam Banks. Int. J. Sustain. Manag. Inf. Technol. 2018, 3, 63. [Google Scholar] [CrossRef] [Green Version]

- Thompson, C.J.; Locander, W.B.; Pollio, H.R. Putting Consumer Experience Back into Consumer Research: The Philosophy and Method of Existential-Phenomenology. J. Consum. Res. 1989, 16, 133–146. [Google Scholar] [CrossRef]

- Moore, G.C.; Benbasat, I. Development of an Instrument to Measure the Perceptions of Adopting an Information Technology Innovation. Inf. Syst. Res. 1991, 2, 192–222. [Google Scholar] [CrossRef] [Green Version]

- Gupta, K.; Arora, N. Investigating Consumer Intention to Accept Mobile Payment Systems through Unified Theory of Acceptance Model: An Indian Perspective. South Asian J. Bus. Stud. 2020, 9, 88–114. [Google Scholar] [CrossRef]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P.; Algharabat, R. Examining Factors Influencing Jordanian Customers’ Intentions and Adoption of Internet Banking: Extending UTAUT2 with Risk. J. Retail. Consum. Serv. 2018, 40, 125–138. [Google Scholar] [CrossRef] [Green Version]

- Farzin, M.; Sadeghi, M.; Yahyayi Kharkeshi, F.; Ruholahpur, H.; Fattahi, M. Extending UTAUT2 in M-Banking Adoption and Actual Use Behavior: Does WOM Communication Matter? Asian J. Econ. Bank. 2021, 5, 136–157. [Google Scholar] [CrossRef]

- Davis, F.D. User Acceptance of Information Technology: System Characteristics, User Perceptions and Behavioral Impacts. Int. J. Man-Mach. Stud. 1993, 38, 475–487. [Google Scholar] [CrossRef] [Green Version]

- Nui Polatoglu, V.; Ekin, S. An Empirical Investigation of the Turkish Consumers’ Acceptance of Internet Banking Services. Int. J. Bank Mark. 2001, 19, 156–165. [Google Scholar] [CrossRef]

- Migliore, G.; Wagner, R.; Cechella, F.S.; Liébana-Cabanillas, F. Antecedents to the Adoption of Mobile Payment in China and Italy: An Integration of UTAUT2 and Innovation Resistance Theory. Inf. Syst. Front. 2022. [Google Scholar] [CrossRef] [PubMed]

- Seth, N.; Deshmukh, S.G.; Vrat, P. Service Quality Models: A Review. Int. J. Qual. Reliab. Manag. 2005, 22, 913–949. [Google Scholar] [CrossRef] [Green Version]

- Suganthi, B. Internet Banking Patronage: AN Empirical Investigation of Malaysia. J. Internet Bank. Commer. 2001. Available online: http://citeseerx.ist.psu.edu/viewdoc/summary?doi=10.1.1.1069.2059 (accessed on 21 March 2022).

- Baabdullah, A.; Nasseef, O.; Alalwan, A. Consumer Adoption of Mobile Government in the Kingdom of Saudi Arabia: The Role of Usefulness, Ease of Use, Perceived Risk and Innovativeness. In Social Media: The Good, the Bad, and the Ugly; Dwivedi, Y.K., Mäntymäki, M., Ravishankar, M.N., Janssen, M., Clement, M., Slade, E.L., Rana, N.P., Al-Sharhan, S., Simintiras, A.C., Eds.; Springer International Publishing: Cham, Switzerland, 2016; pp. 267–279. [Google Scholar]

- Laukkanen, T.; Sinkkonen, S.; Laukkanen, P. Communication Strategies to Overcome Functional and Psychological Resistance to Internet Banking. Int. J. Inf. Manag. 2009, 29, 111–118. [Google Scholar] [CrossRef]

- Poon, W. Users’ Adoption of E-banking Services: The Malaysian Perspective. J. Bus. Ind. Mark. 2008, 23, 59–69. [Google Scholar] [CrossRef]

- Liao, Z.; Cheung, M.T. Internet-Based e-Banking and Consumer Attitudes: An Empirical Study. Inf. Manag. 2002, 39, 283–295. [Google Scholar] [CrossRef]

- Kerem, K. Adoption of Electronic Banking: Underlying Consumer Behaviour and Critical Success Factors. Available online: https://www.semanticscholar.org/paper/Adoption-of-electronic-banking-%3A-underlying-and-Kerem/419a9497919289acea27baeb0c9e9909b340f278 (accessed on 21 March 2022).

- Taylor, S.; Todd, P.A. Understanding Information Technology Usage: A Test of Competing Models. Inf. Syst. Res. 1995, 6, 144–176. [Google Scholar] [CrossRef]

- Tarhini, A.; El-Masri, M.; Ali, M.; Serrano, A. Extending the UTAUT Model to Understand the Customers’ Acceptance and Use of Internet Banking in Lebanon: A Structural Equation Modeling Approach. Inf. Technol. People 2016, 29, 830–849. [Google Scholar] [CrossRef] [Green Version]

- Pikkarainen, T.; Pikkarainen, K.; Karjaluoto, H.; Pahnila, S. Consumer Acceptance of Online Banking: An Extension of the Technology Acceptance Model. Internet Res. 2004, 14, 224–235. [Google Scholar] [CrossRef] [Green Version]

- Chan, S.; Lu, M. Understanding Internet Banking Adoption and Use Behavior: A Hong Kong Perspective. J. Glob. Inf. Manag. (JGIM) 2004, 12, 21–43. [Google Scholar] [CrossRef] [Green Version]

- Al-Somali, S.A.; Gholami, R.; Clegg, B. An Investigation into the Acceptance of Online Banking in Saudi Arabia. Technovation 2009, 29, 130–141. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Marinković, V.; Kalinić, Z. A SEM-Neural Network Approach for Predicting Antecedents of m-Commerce Acceptance. Int. J. Inf. Manag. 2017, 37, 14–24. [Google Scholar] [CrossRef]

- Movagharnejad, K.; Mehdizadeh, B.; Banihashemi, M.; Kordkheili, M.S. Forecasting the Differences between Various Commercial Oil Prices in the Persian Gulf Region by Neural Network. Energy 2011, 36, 3979–3984. [Google Scholar] [CrossRef]

- Tambe, S.S.; Kulkarni, B.D.; Deshpande, P.B. Elements of Artificial Neural Networks with Selected Applications in Chemical Engineering, & Chemical & Biological Sciences; Simulation & Advanced Controls Inc: Louisville, KY, USA, 1996; ISBN 978-0-9651639-0-3. [Google Scholar]

- Fang, B.; Ma, S. Application of BP Neural Network in Stock Market Prediction. In Proceedings of the 6th International Symposium on Neural Networks: Advances in Neural Networks—Part III, Wuhan, China, 26–29 May 2009; Springer: Berlin/Heidelberg, Germany, 2009; pp. 1082–1088. [Google Scholar]

- Nunnally, J.C. Psychometric Theory, 2nd ed.; McGraw-Hill Companies: New York, NY, USA, 1978. [Google Scholar]

- Hair, J.F.J.; Black, W.; Babin, B.; Anderson, R.; Tatham, R.L. Mutivariate Data Analysis; Pearson Prentice Hall: Upper Saddle River, NJ, USA, 2006; Volume 31. [Google Scholar]

- Hair, J.; Black, W.; Babin, B.; Anderson, R. Multivariate Data Analysis, 7th ed.; Prentice-Hall, Inc.: Upper Saddle River, NJ, USA, 2010. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating Structural Equation Models with Unobservable Variables and Measurement Error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Carmines, E.; McIver, J. An Introduction to the Analysis of Models with Unobserved Variables. Political Methodol. 1983, 9, 51–102. [Google Scholar] [CrossRef]

- Henseler, J.; Ringle, C.M.; Sarstedt, M. A New Criterion for Assessing Discriminant Validity in Variance-Based Structural Equation Modeling. J. Acad. Mark. Sci. 2015, 43, 115–135. [Google Scholar] [CrossRef] [Green Version]

- Bagozzi, R.P.; Yi, Y. On the Evaluation of Structural Equation Models. JAMS 1988, 16, 74–94. [Google Scholar] [CrossRef]

- Mauro, C.; Hernandez, J.; Afonso Mazzon, J. Adoption of Internet Banking: Proposition and Implementation of an Integrated Methodology Approach. Int. J. Bank Mark. 2007, 25, 72–88. [Google Scholar] [CrossRef]

- Kijsanayotin, B.; Pannarunothai, S.; Speedie, S.M. Factors Influencing Health Information Technology Adoption in Thailand’s Community Health Centers: Applying the UTAUT Model. Int. J. Med. Inform. 2009, 78, 404–416. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).