A Study on the Efficiency Analysis of Global Terminal Operators Based on the Operation Characteristics

Abstract

:1. Introduction

2. Literature Review

2.1. Status of GTOs

2.2. Classification of GTO by Characteristics

2.3. Container Terminal Efficiency Related Works

3. Materials and Methods

3.1. Methodology

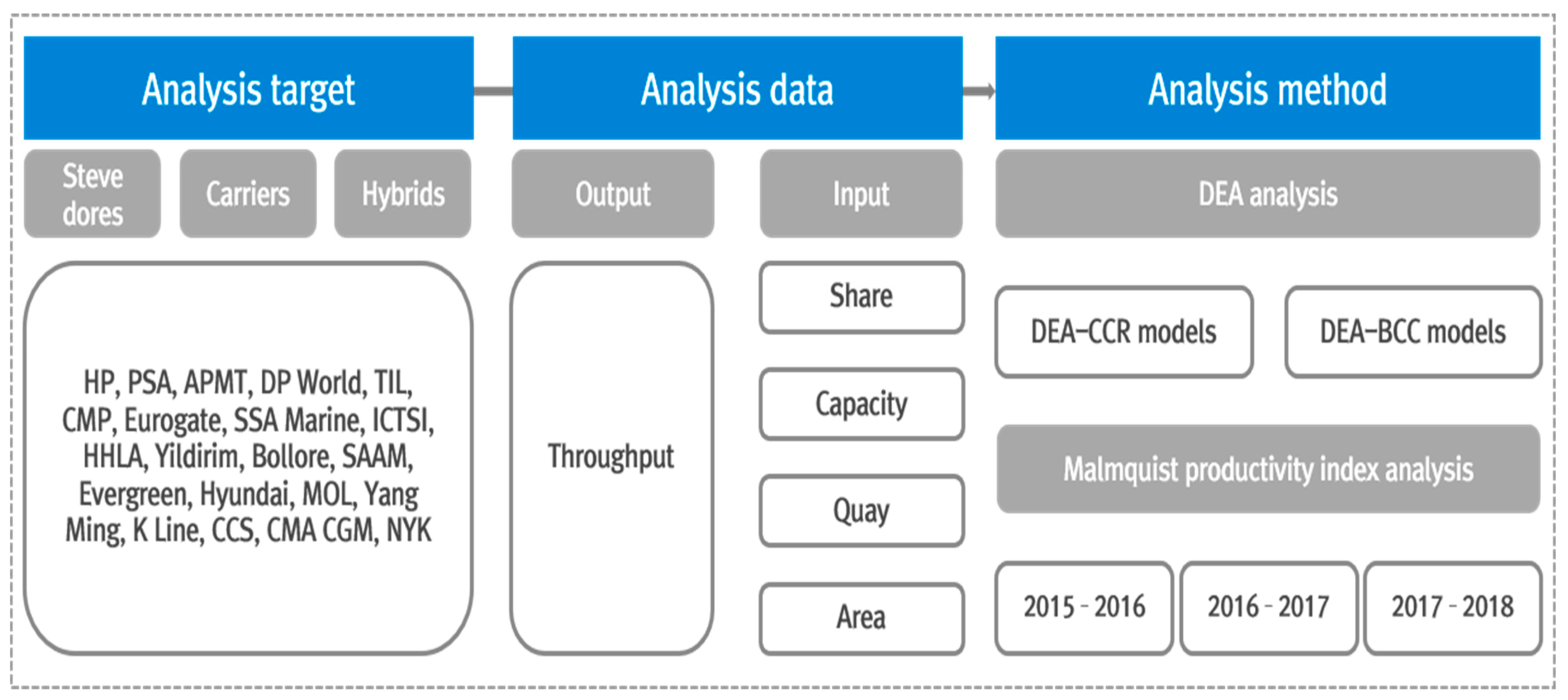

3.2. Analysis Target

3.3. Analysis Data

3.4. Analysis Method

4. Results

4.1. GTO Basic Data by Operating Characteristics

4.2. Operator Efficiency Based on Characteristics

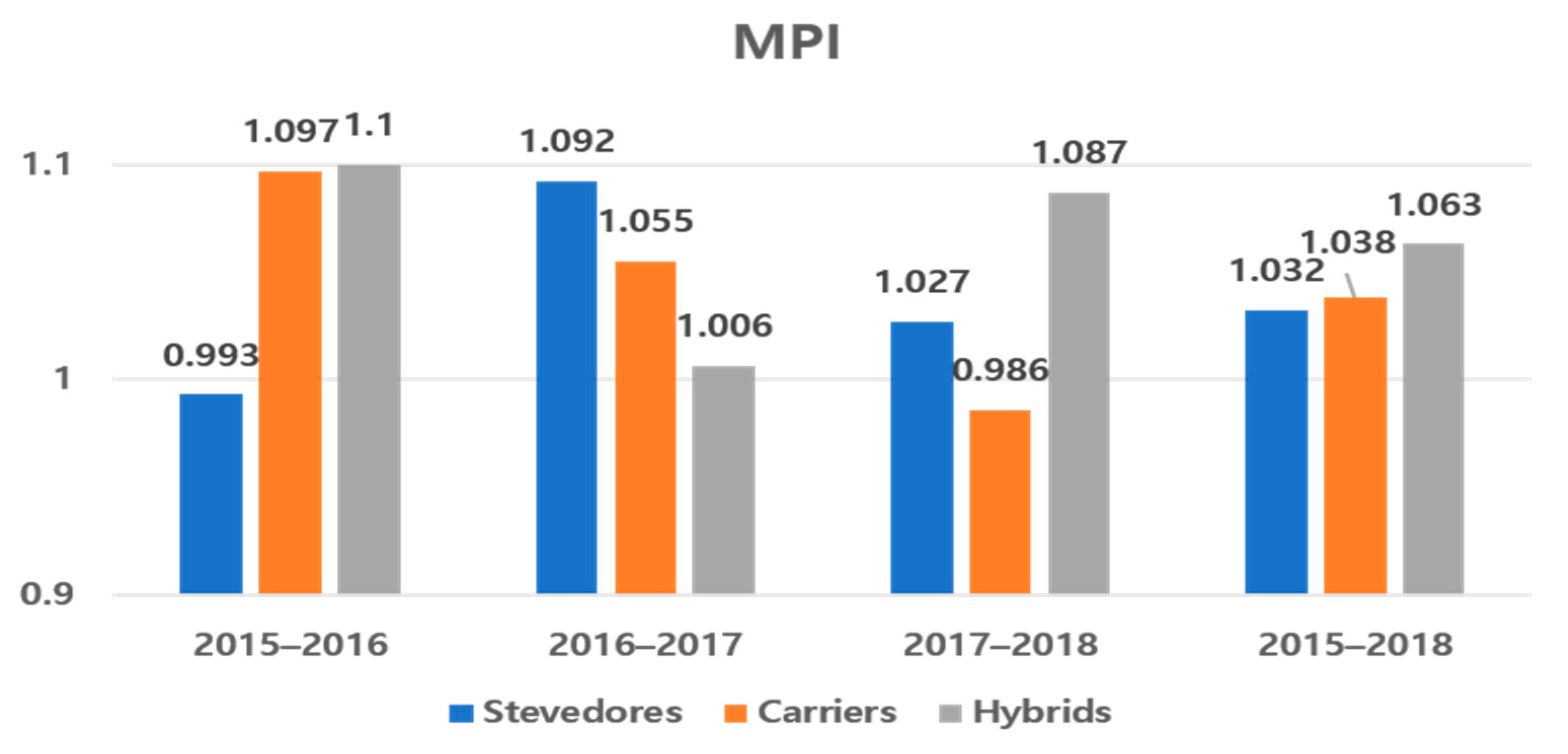

4.3. Malmquist Productivity Index Analysis

4.4. Analysis Results

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Operator | 2015 | 2016 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| T’put M teu | Share % | Quay m | Area m2 | Capa M teu | T’put M teu | Share % | Quay m | Area m2 | Capa M teu | |

| CCS | 93.7 | 13.0 | 54,715 | 31,435 | 104.3 | 96.6 | 12.2 | 59,780 | 33,036 | 106.8 |

| HP | 67.1 | 11.8 | 59,099 | 28,362 | 90.5 | 65.7 | 11.3 | 59,799 | 29,697 | 88.1 |

| PSA | 56.6 | 9.3 | 66,981 | 35,989 | 77.6 | 59.4 | 9.6 | 65,391 | 34,429 | 84.7 |

| APMT | 64.8 | 10.1 | 60,966 | 37,809 | 79.9 | 64.7 | 10.2 | 60,385 | 38,358 | 82.6 |

| DP World | 40.3 | 8.8 | 36,501 | 22,348 | 50.7 | 40.5 | 8.9 | 37,423 | 22,808 | 55.5 |

| TIL | 35.7 | 5.3 | 38,178 | 20,613 | 50.1 | 37.2 | 5.4 | 39,104 | 20,325 | 54.0 |

| CMP | 26.2 | 4.0 | 26,980 | 8062 | 34.9 | 27.8 | 4.1 | 29,160 | 8472 | 37.0 |

| CMA CGM | 9.6 | 1.6 | 12,133 | 5419 | 13.6 | 17.6 | 2.4 | 22,378 | 8560 | 25.0 |

| Eurogate | 14.6 | 2.0 | 19,414 | 9317 | 23.6 | 14.6 | 2.0 | 19,414 | 9317 | 23.8 |

| SSA Marine | 10.6 | 1.5 | 14,488 | 5765 | 18.4 | 10.6 | 1.5 | 14,488 | 5765 | 17.8 |

| NYK | 6.4 | 1.1 | 8886 | 2916 | 10.6 | 9.1 | 1.4 | 11,073 | 4449 | 13.7 |

| Evergreen | 5.7 | 0.6 | 7172 | 4044 | 9.8 | 5.4 | 1.3 | 7172 | 4044 | 10.2 |

| ICTSI | 7.8 | 1.0 | 16,037 | 8890 | 13.5 | 8.7 | 1.2 | 16,387 | 8985 | 14.0 |

| Hyundai | 3.4 | 0.7 | 2431 | 2261 | 4.8 | 3.6 | 0.4 | 2431 | 2261 | 4.2 |

| HHLA | 6.7 | 0.6 | 7250 | 3695 | 9.9 | 6.8 | 1.0 | 7250 | 3695 | 9.1 |

| MOL | 4.6 | 0.6 | 8124 | 4063 | 7.0 | 5.9 | 0.8 | 8124 | 4063 | 8.6 |

| Yildirim | 3.4 | 0.6 | 4487 | 745 | 5.0 | 3.7 | 0.8 | 4787 | 875 | 5.3 |

| Bollore | 3.7 | 0.6 | 9152 | 2416 | 6.2 | 3.7 | 0.6 | 9752 | 2486 | 7.7 |

| Yang Ming | 1.5 | 0.6 | 1500 | 748 | 2.8 | 1.7 | 0.6 | 1500 | 748 | 2.8 |

| K Line | 1.5 | 0.4 | 2962 | 1126 | 2.1 | 1.5 | 0.5 | 2962 | 1126 | 2.1 |

| SAAM | 2.7 | 0.4 | 7894 | 1642 | 4.0 | 2.7 | 0.4 | 7894 | 1642 | 4.2 |

| Operator | 2017 | 2018 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| T’put M teu | Share % | Quay m | Area m2 | Capa M teu | T’put M teu | Share % | Quay m | Area m2 | Capa M teu | |

| CCS | 91.7 | 12.2 | 56,809 | 32,810 | 101.0 | 95.4 | 13.5 | 53,051 | 29,828 | 110.2 |

| HP | 68.9 | 11.0 | 60,575 | 29,744 | 93.8 | 79.4 | 10.5 | 64,665 | 31,281 | 107.3 |

| PSA | 67.0 | 9.9 | 63,141 | 32,457 | 92.4 | 80.1 | 10.2 | 64,246 | 33,651 | 112.1 |

| APMT | 67,2 | 10,2 | 61,686 | 38,836 | 84.6 | 73.9 | 10.0 | 62,515 | 39,599 | 88.6 |

| DP World | 47.6 | 9.2 | 39,933 | 24,028 | 59.8 | 46.7 | 8.9 | 41,071 | 23,628 | 58.9 |

| TIL | 44.7 | 5.9 | 50,739 | 23,015 | 59.5 | 48.5 | 6.1 | 53,282 | 24,840 | 64.5 |

| CMP | 31.4 | 4.2 | 30,824 | 9308 | 38.5 | 32.6 | 4.4 | 30,824 | 9309 | 38.5 |

| CMA CGM | 20.8 | 3.3 | 23,002 | 8802 | 27.4 | 22.9 | 3.3 | 23,617 | 8982 | 27.9 |

| Eurogate | 14.4 | 1.9 | 20,214 | 9657 | 24.3 | 14.1 | 1.7 | 20,214 | 9657 | 22.6 |

| SSA Marine | 11.1 | 2.0 | 15,044 | 6095 | 18.8 | 12.2 | 1.6 | 16,069 | 6695 | 19.3 |

| NYK | 10.5 | 1.5 | 11,523 | 4769 | 15.0 | 11.3 | 1.4 | 11,523 | 4769 | 13.3 |

| Evergreen | 6.3 | 1.4 | 7172 | 4044 | 10.2 | 6.5 | 1.3 | 7172 | 4044 | 10.8 |

| ICTSI | 13.8 | 1.0 | 17,099 | 8699 | 15.4 | 9.7 | 1.2 | 17,589 | 8900 | 17.1 |

| Hyundai | 5.2 | 0.8 | 5355 | 4156 | 6.8 | 6.2 | 1.0 | 4745 | 3788 | 7.6 |

| HHLA | 7.3 | 1.0 | 7250 | 3695 | 9.5 | 7.4 | 1.0 | 8346 | 4075 | 10.3 |

| MOL | 7.1 | 0.9 | 8124 | 4063 | 9.6 | 7.3 | 0.9 | 8874 | 4513 | 10.0 |

| Yildirim | 3.8 | 0.8 | 4787 | 875 | 5.7 | 4.1 | 0.8 | 4787 | 875 | 5.7 |

| Bollore | 4.1 | 0.6 | 9752 | 2486 | 7.8 | 4.7 | 0.7 | 10,102 | 2666 | 8.3 |

| Yang Ming | 1.7 | 0.6 | 1500 | 748 | 2.8 | 1.7 | 0.6 | 1500 | 748 | 2.8 |

| K Line | 1.8 | 0.5 | 2962 | 1126 | 2.1 | 1.9 | 0.4 | 2962 | 1126 | 2.5 |

| SAAM | 3.2 | 0.4 | 8694 | 1762 | 5.0 | 3.4 | 0.4 | 7191 | 1489 | 5.4 |

References

- Arvis, J.F.; Ojala, L.; Wiederer, C.; Shepherd, B.; Raj, A.; Dairabayeva, K.; Kiiski, T. Connecting to Compete 2018: Trade Logistics in the Global Economy; World Bank: Washington, DC, USA, 2018. [Google Scholar]

- González-Cancelas, N.; Molina Serrano, B.; Soler-Flores, F.; Camarero-Orive, A. Using the SWOT methodology to know the scope of the digitalization of the Spanish ports. Logistics 2020, 4, 20. [Google Scholar] [CrossRef]

- Wang, C.; Nguyen, N.; Fu, H.; Hsu, H.; Dang, T. Efficiency assessment of seaport terminal operators using DEA Malmquist and epsilon-based measure models. Axioms 2021, 10, 48. [Google Scholar] [CrossRef]

- Cullinane, K.; Khanna, M. Economies of scale in large container ships: Optimal size and geographical implications. J. Transp. Geogr. 2000, 8, 181–195. [Google Scholar] [CrossRef]

- Pham, T.; Yeo, G. Evaluation of transshipment Container Terminals’ Service Quality in Vietnam: From the Shipping Companies’ Perspective. Sustainability 2019, 11, 1503. [Google Scholar] [CrossRef] [Green Version]

- Global Container Terminal Operators Annual Review and Forecast 2016–2019. Available online: https://www.drewry.co.uk/maritime-research-products/maritime-research-products (accessed on 28 July 2021).

- Grubisic, N.; Krljan, T.; Maglić, L.; Vilke, S. The microsimulation model for assessing the impact of inbound traffic flows for container terminals located near city centers. Sustainability 2020, 12, 9478. [Google Scholar] [CrossRef]

- Sim, K.S.; Kim, Y.H.; Kim, B.K. A Study on the Establishment of Global Terminal Operator(GTO) in Korea. Available online: https://www.kmi.re.kr/web/board/view.do?rbsIdx=287&idx=37082 (accessed on 26 April 2021).

- Kim, S. Sustainable Port Competitiveness in International Port Operations. J. Korea Port Econ. Assoc. 2015, 31, 61–74. [Google Scholar]

- Kang, D.; Kim, S. Conceptual Model Development of Sustainability Pratices: The Case of Port Operations for Collaboration and Governance. Sustainability 2017, 9, 2333. [Google Scholar] [CrossRef] [Green Version]

- Kim, S.; Chiang, B.G. Sustainability Practices to achieve Sustainability in International Port Operations. Korea Pt. Econ. Assoc. 2014, 30, 15–37. [Google Scholar]

- Yeo, H.J. Participation of private investors in container terminal operation: Influence of global terminal operators. Asian J. Shipp. Logist. 2015, 31, 363–383. [Google Scholar] [CrossRef] [Green Version]

- Low, J.M.W.; Lam, S.W.; Tang, L.C. Assessment of hub status among Asian ports from a network perspective. Transp. Res. A 2009, 43, 593–606. [Google Scholar] [CrossRef]

- ITF Transport Outlook 2019. Available online: https://www.oecd-ilibrary.org/transport/itf-transport-outlook-2019_transp_outlook-en-2019-en (accessed on 25 April 2021).

- Review of Maritime Transport 2020. Available online: https://unctad.org/webflyer/review-maritime-transport-2020 (accessed on 25 April 2021).

- Notteboom, T.; Rodrigue, J.P. Global Networks in the Container Terminal Operating Industry Part 2: The Future Direction of Terminal Networks. Available online: https://www.porttechnology.org/technical-papers/global_networks_in_the_container_terminal_operating_industry/ (accessed on 26 April 2021).

- Kim, Y.S.; Zheng, X.B.; Shin, Y.R. Efficiency and productivity changes of domestic container terminal operators by GTO characteristics. Asian J. Shipp. Logist. 2017, 33, 555–575. [Google Scholar]

- Tongzon, J.L. Determinants of port performance and efficiency. Transp. Res. A 1995, 29, 245–252. [Google Scholar] [CrossRef]

- Antonio, E.; Beatriz, T.F.; Lourdes, T. Sources of Efficiency Gains in Port Reform: A DEA Decomposition of a Malmquist TFP Index for Mexico. Util. Policy 2004, 12, 221–230. [Google Scholar]

- Cullinane, K.P.B.; Wang, T. The efficiency of European container ports: A cross-sectional data envelopment analysis. Int. J. Logist. Res. Appl. 2006, 9, 19–31. [Google Scholar] [CrossRef]

- Mennis, E.; Platis, A.; Lagoudis, I.; Nikitakos, N. Improving port container terminal efficiency with the use of markov theory. Marit. Econ. Logist. 2008, 10, 243–257. [Google Scholar] [CrossRef]

- Ahmed, S.A.-E.; Ahamad, T.K.; Adli, M. DEA Malmquist index measurement in Middle East and East African containers terminals. Int. J. Shipp. Transp. Logist. 2009, 1, 249–259. [Google Scholar]

- Cheon, S.H.; David, E.D.; Song, D.W. Evaluating impacts of institutional reforms on port efficiency changes: Ownership, corporate structure, and total factor productivity changes of world container ports. Transp. Res. Part E Logist. Transp. Rev. 2010, 46, 546–561. [Google Scholar] [CrossRef]

- Qianwen, L. Efficiency Analysis of Container Ports and Terminals. Ph.D. Thesis, University College London, London, UK, 2010. [Google Scholar]

- Wilmsmeier, G.; Tovar, B.; Sanchez, R.J. The evolution of container terminal productivity and efficiency under changing economic environments. Res. Transp. Bus. Manag. 2013, 8, 50–66. [Google Scholar] [CrossRef]

- Bichou, K. An empirical study of the impacts of operating and market conditions on container-port efficiency and benchmarking. Res. Transp. Econ. 2013, 42, 28–37. [Google Scholar] [CrossRef]

- Yuen, A.C.; Zhang, A.; Cheung, W. Foreign participation and competition: A way to improve the container port efficiency in China? Transp. Res. A 2013, 49, 220–231. [Google Scholar] [CrossRef]

- Chang, V.; Tovar, B. Efficiency and productivity changes for Peruvian and Chilean ports terminals: A parametric distance functions approach. Transp. Policy 2014, 31, 83–94. [Google Scholar] [CrossRef]

- Samuel, M.N. Factors influencing container terminals efficiency: A case study of Mombasa entry port. Eur. J. Logist. Purch. Supply Chain. Manag. 2014, 2, 39–78. [Google Scholar]

- Lin, Y.; Yan, L.; Wang, Y. Performance evaluation and investment analysis for container port sustainable development in China: An inverse DEA approach. Sustainability 2019, 11, 4617. [Google Scholar] [CrossRef] [Green Version]

- Park, R.K. A Brief Efficiency Measurement Way for the Korean Container Terminals Using Stochastic Frontier Analysis. J. Korea Port Econ. Assoc. 2010, 26, 63–87. [Google Scholar]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef] [Green Version]

- Rolf, F.; Shawna, G.; Mary, N.; Zhongyang, Z. Productivity growth, technical progress, and efficiency change in industrialized countries. Am. Econ. Rev. 1994, 84, 66–83. [Google Scholar]

| Stevedores | Carriers | Hybrids | |

|---|---|---|---|

| Main activity | Terminal operation | Liner shipping | Liner shipping (Separate terminal operation) |

| Financial aim | Generate profit | Reduce cost | Generate profit |

| Efficiency aim | Improved terminal efficiency by implementing common practices | Improved shipping network efficiency over terminals | Improved terminal efficiency by implementing common practices |

| Network aim | Spread of investment risk | Support for shipping activities and strategy | Support for shipping activities and additional business opportunities |

| Author | Method | Target | Output Variable | Input Variable |

|---|---|---|---|---|

| Kim et al. [17] | DEA, Malmquist index | 23 container operators worldwide | Throughput | Berth length, CY area, G/C and T/C index |

| Antonio et al. [19] | DEA, Malmquist index | 11 Mexican main ports | Throughput | Number of workers, berth length |

| Cullinane and Wang [20] | DEA | 69 container terminals in Europe | Throughput | Terminal length, terminal area, equipment |

| Ahmed et al. [22] | DEA, Malmquist index | 22 container terminals in the Middle East and East Africa | Ship calls, throughput | Berth length, quay crane, handling equipment, terminal area |

| Cheon et al. [23] | DEA, Malmquist index | 98 ports worldwide | Throughput | Berth length, terminal area, container quayside capacity, mobile cranes |

| Wilmsmeier et al. [25] | DEA, Malmquist index | 20 container terminals in Latin America, the Caribbean, and Spain | Throughput | Terminal area, ship-to-shore crane capacity equivalent, number of workers |

| Bichou [26] | DEA | 60 container terminals worldwide | Throughput | Terminal area, max draft, overall length, quay crane index, yard-stacking index, trucks & vehicles, gates |

| Yuen et al. [27] | Regression analysis, DEA | 21 major container terminals in and around China | Throughput | Number of berths, total length, port land area, quay crane, and yard gantries |

| Lin et al. [30] | IDEA | 16 main ports in China | Throughput | Berth length, equipment asset, Number of employees |

| Operator | Abbreviation | |

|---|---|---|

| Stevedores | Hutchison Ports | HP |

| PSA International | PSA | |

| APM Terminals | APMT | |

| DP World | DP World | |

| Terminal Investment Limited | TIL | |

| China Merchants Ports | CMP | |

| Eurogate | Eurogate | |

| SSA Marine | SSA Marine | |

| ICTSI | ICTSI | |

| HHLA | HHLA | |

| Yildirim | Yildirim | |

| Bollore | Bollore | |

| SAAM | SAAM | |

| Carriers | Evergreen | Evergreen |

| Hyundai | Hyundai | |

| MOL | MOL | |

| Yang Ming | Yang Ming | |

| K Line | K Line | |

| Hybrids | China Cosco Shipping | CCS |

| CMA CGM | CMA CGM | |

| NYK | NYK |

| Output | Input | |||||

|---|---|---|---|---|---|---|

| T’put (M teu) | Share (%) | Quay (m) | Area (m2) | Capa (M teu) | ||

| 2015 | Sum | 466.6 | 72.1 | 465,350 | 237,665 | 619.5 |

| Avg | 22.219 | 3.4333 | 22,159 | 11,317 | 29.5 | |

| Max | 93.7 | 11.8 | 66,981 | 37,809 | 104.3 | |

| Min | 1.5 | 0.4 | 1500 | 745 | 2.1 | |

| Mid | 7.8 | 1.4 | 12,133 | 5419 | 13.5 | |

| St Dev | 5.8896 | 0.8491 | 4710 | 2724 | 7.1107 | |

| 2016 | Sum | 487.5 | 76.6 | 486,654 | 245,141 | 657.2 |

| Avg | 23.2143 | 3.6476 | 23,174 | 11,673 | 31.2952 | |

| Max | 96.6 | 12.2 | 65,391 | 38,358 | 106.8 | |

| Min | 1.5 | 0.4 | 1500 | 748 | 2.1 | |

| Mid | 9.1 | 1.4 | 14,488 | 5765 | 14 | |

| St Dev | 5.936 | 0.8986 | 4735 | 2730 | 7.2785 | |

| 2017 | Sum | 529.6 | 79.3 | 506,185 | 251,175 | 690 |

| Avg | 25.219 | 3.7762 | 24,104 | 11,961 | 32.8571 | |

| Max | 91.7 | 12.2 | 63,141 | 38,836 | 101 | |

| Min | 1.7 | 0.4 | 1500 | 748 | 2.1 | |

| Mid | 11.1 | 1.5 | 15,044 | 6095 | 15.4 | |

| St Dev | 6.0428 | 0.8964 | 4780 | 2714 | 7.4389 | |

| 2018 | Sum | 570 | 79.9 | 514,345 | 254,463 | 743.7 |

| Avg | 27.1429 | 3.8048 | 24,492 | 12,117 | 35.4143 | |

| Max | 95.4 | 13.5 | 64,665 | 39,599 | 112.1 | |

| Min | 1.7 | 0.4 | 1,500 | 748 | 2.5 | |

| Mid | 11.3 | 1.4 | 16,069 | 6695 | 17.1 | |

| St Dev | 30.616 | 4.2093 | 22,345 | 12,545 | 38.4083 | |

| Characteristic | Year | T’put (M teu) | Share (%) | Quay (m) | Area (m2) | Capa (M teu) |

|---|---|---|---|---|---|---|

| Stevedores | 2015 | 340.2 | 56.5 | 367,427 | 185,653 | 464.3 |

| 2016 | 346.1 | 57.0 | 371,234 | 186,854 | 502.5 | |

| 2017 | 384.4 | 57.8 | 389,738 | 190,657 | 515.2 | |

| 2018 | 416.9 | 57.5 | 400,901 | 196,665 | 558.8 | |

| CAGR (%) | 7 | 1 | 3 | 2 | 6 | |

| Carriers | 2015 | 16.7 | 3.7 | 22,189 | 12,242 | 26.5 |

| 2016 | 18.1 | 3.6 | 22,189 | 12,242 | 27.9 | |

| 2017 | 22.1 | 4.2 | 25,113 | 14,137 | 31.5 | |

| 2018 | 23.6 | 4.2 | 25,253 | 14,219 | 33.7 | |

| CAGR (%) | 12 | 4 | 4 | 5 | 8 | |

| Hybrids | 2015 | 109.7 | 15.7 | 75,734 | 39,770 | 128.7 |

| 2016 | 123.3 | 16.0 | 93,231 | 46,045 | 145.5 | |

| 2017 | 123.0 | 17.0 | 91,334 | 46,381 | 143.3 | |

| 2018 | 129.5 | 18.2 | 88,191 | 43,579 | 152.3 | |

| CAGR (%) | 6 | 5 | 5 | 3 | 6 |

| Characteristic | Operator | 2015 | 2016 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| CCR | BCC | SE | RTS | CCR | BCC | SE | RTS | ||

| Stevedores | HP | 0.825 | 0.826 | 0.999 | IRS | 0.824 | 0.825 | 1 | CRS |

| PSA | 0.843 | 0.844 | 1 | CRS | 0.777 | 0.780 | 0.996 | DRS | |

| APMT | 0.903 | 0.904 | 0.999 | IRS | 0.866 | 0.867 | 0.999 | IRS | |

| DP WORLD | 0.885 | 0.889 | 0.996 | IRS | 0.807 | 0.808 | 0.998 | IRS | |

| TIL | 0.930 | 0.931 | 0.999 | CRS | 0.829 | 0.865 | 0.959 | DRS | |

| CMP | 0.980 | 1 | 0.980 | DRS | 1 | 1 | 1 | CRS | |

| Eurogate | 1 | 1 | 1 | CRS | 0.845 | 0.901 | 0.939 | DRS | |

| SSA Marine | 0.973 | 0.983 | 0.989 | IRS | 0.848 | 0.864 | 0.981 | DRS | |

| ICTSI | 0.971 | 0.987 | 0.985 | IRS | 0.806 | 0.878 | 0.917 | DRS | |

| HHLA | 0.924 | 1 | 0.924 | IRS | 0.836 | 0.847 | 0.987 | IRS | |

| Yildirim | 1 | 1 | 1 | CRS | 1 | 1 | 1 | CRS | |

| Bollore | 0.849 | 0.887 | 0.957 | IRS | 0.730 | 0.770 | 0.948 | IRS | |

| SAAM | 0.930 | 1 | 0.930 | IRS | 0.801 | 1 | 0.801 | IRS | |

| AVG | 0.924 | 0.942 | 0.981 | 0.844 | 0.877 | 0.965 | |||

| Carriers | Evergreen | 0.647 | 0.675 | 0.959 | IRS | 0.585 | 0.598 | 0.979 | IRS |

| Hyundai | 0.817 | 1 | 0.817 | IRS | 1 | 1 | 1 | CRS | |

| MOL | 0.906 | 0.966 | 0.938 | IRS | 0.839 | 0.874 | 0.960 | DRS | |

| Yang Ming | 0.651 | 1 | 0.651 | IRS | 0.759 | 1 | 0.759 | IRS | |

| K Line | 0.795 | 1 | 0.795 | IRS | 0.790 | 1 | 0.790 | IRS | |

| AVG | 0.763 | 0.928 | 0.832 | 0.795 | 0.894 | 0.898 | |||

| Hybrids | CCS | 1 | 1 | 1 | CRS | 1 | 1 | 1 | CRS |

| CMA CGM | 0.831 | 0.846 | 0.981 | IRS | 0.891 | 0.909 | 0.980 | DRS | |

| NYK | 0.806 | 0.854 | 0.944 | IRS | 0.803 | 0.831 | 0.967 | IRS | |

| AVG | 0.879 | 0.900 | 0.975 | 0.898 | 0.913 | 0.982 | |||

| Characteristic | Operator | 2017 | 2018 | ||||||

|---|---|---|---|---|---|---|---|---|---|

| CCR | BCC | SE | RTS | CCR | BCC | SE | RTS | ||

| Stevedores | HP | 0.825 | 0.831 | 0.993 | DRS | 0.983 | 0.991 | 0.993 | DRS |

| PSA | 0.838 | 0.888 | 0.943 | DRS | 1 | 1 | 1 | CRS | |

| APMT | 0.875 | 0.875 | 1 | CRS | 0.974 | 1 | 0.974 | DRS | |

| DP WORLD | 0.877 | 0.877 | 0.999 | IRS | 0.916 | 0.918 | 0.998 | IRS | |

| TIL | 0.869 | 0.949 | 0.916 | DRS | 0.981 | 1 | 0.981 | DRS | |

| CMP | 1 | 1 | 1 | CRS | 1 | 1 | 1 | CRS | |

| Eurogate | 0.781 | 0.782 | 0.998 | DRS | 1 | 1 | 1 | CRS | |

| SSA Marine | 0.827 | 0.857 | 0.965 | IRS | 0.933 | 0.938 | 0.995 | DRS | |

| ICTSI | 1 | 1 | 1 | CRS | 0.964 | 0.971 | 0.992 | DRS | |

| HHLA | 0.865 | 1 | 0.865 | IRS | 0.916 | 0.966 | 0.948 | IRS | |

| Yildirim | 1 | 1 | 1 | CRS | 1 | 1 | 1 | CRS | |

| Bollore | 0.758 | 0.835 | 0.907 | IRS | 0.807 | 0.812 | 0.994 | DRS | |

| SAAM | 0.867 | 1 | 0.867 | IRS | 1 | 1 | 1 | CRS | |

| AVG | 0.876 | 0.918 | 0.954 | 0.958 | 0.966 | 0.992 | |||

| Carriers | Evergreen | 0.680 | 0.708 | 0.960 | IRS | 0.697 | 0.737 | 0.945 | IRS |

| Hyundai | 0.843 | 1 | 0.843 | IRS | 0.942 | 1 | 0.942 | IRS | |

| MOL | 0.861 | 0.997 | 0.863 | IRS | 0.993 | 1 | 0.993 | IRS | |

| Yang Ming | 0.781 | 1 | 0.781 | IRS | 0.703 | 1 | 0.703 | IRS | |

| K Line | 0.944 | 1 | 0.944 | IRS | 0.878 | 1 | 0.878 | IRS | |

| AVG | 0.822 | 0.941 | 0.878 | 0.843 | 0.947 | 0.892 | |||

| Hybrids | CCS | 1 | 1 | 1 | CRS | 1 | 1 | 1 | CRS |

| CMACGM | 0.840 | 0.863 | 0.973 | IRS | 0.952 | 0.955 | 0.997 | IRS | |

| NYK | 0.859 | 0.927 | 0.926 | IRS | 1 | 1 | 1 | CRS | |

| AVG | 0.894 | 0.916 | 0.975 | 0.982 | 0.989 | 0.993 | |||

| Characteristic | Year | Effch (TECI) | Techch (TCI) | Pech (PECI) | Sech (SECI) | Tfpch (MPI) |

|---|---|---|---|---|---|---|

| Stevedores | 2015–2016 | 0.914 | 1.092 | 0.931 | 0.982 | 0.993 |

| 2016–2017 | 1.040 | 1.048 | 1.046 | 0.996 | 1.092 | |

| 2017–2018 | 1.102 | 0.933 | 1.065 | 1.037 | 1.027 | |

| 2015–2018 | 1.013 | 1.019 | 1.010 | 1.003 | 1.032 | |

| Carriers | 2015–2016 | 1.042 | 1.054 | 0.958 | 1.085 | 1.097 |

| 2016–2017 | 1.051 | 1.002 | 1.065 | 0.989 | 1.055 | |

| 2017–2018 | 1.025 | 0.967 | 1.009 | 1.016 | 0.986 | |

| 2015–2018 | 1.033 | 1.005 | 1.008 | 1.025 | 1.038 | |

| Hybrids | 2015–2016 | 1.023 | 1.075 | 1.016 | 1.008 | 1.100 |

| 2016–2017 | 1.004 | 1.002 | 1.022 | 0.984 | 1.006 | |

| 2017–2018 | 1.099 | 0.991 | 1.061 | 1.035 | 1.087 | |

| 2015–2018 | 1.040 | 1.021 | 1.032 | 1.008 | 1.063 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jeh, J.; Nam, J.; Sim, M.; Kim, Y.; Shin, Y. A Study on the Efficiency Analysis of Global Terminal Operators Based on the Operation Characteristics. Sustainability 2022, 14, 536. https://doi.org/10.3390/su14010536

Jeh J, Nam J, Sim M, Kim Y, Shin Y. A Study on the Efficiency Analysis of Global Terminal Operators Based on the Operation Characteristics. Sustainability. 2022; 14(1):536. https://doi.org/10.3390/su14010536

Chicago/Turabian StyleJeh, Jungwaun, Jungwoo Nam, Minseop Sim, Yulseong Kim, and Youngran Shin. 2022. "A Study on the Efficiency Analysis of Global Terminal Operators Based on the Operation Characteristics" Sustainability 14, no. 1: 536. https://doi.org/10.3390/su14010536

APA StyleJeh, J., Nam, J., Sim, M., Kim, Y., & Shin, Y. (2022). A Study on the Efficiency Analysis of Global Terminal Operators Based on the Operation Characteristics. Sustainability, 14(1), 536. https://doi.org/10.3390/su14010536