Exploring the Potential of Internet News for Supply Risk Assessment of Metals

Abstract

:1. Introduction

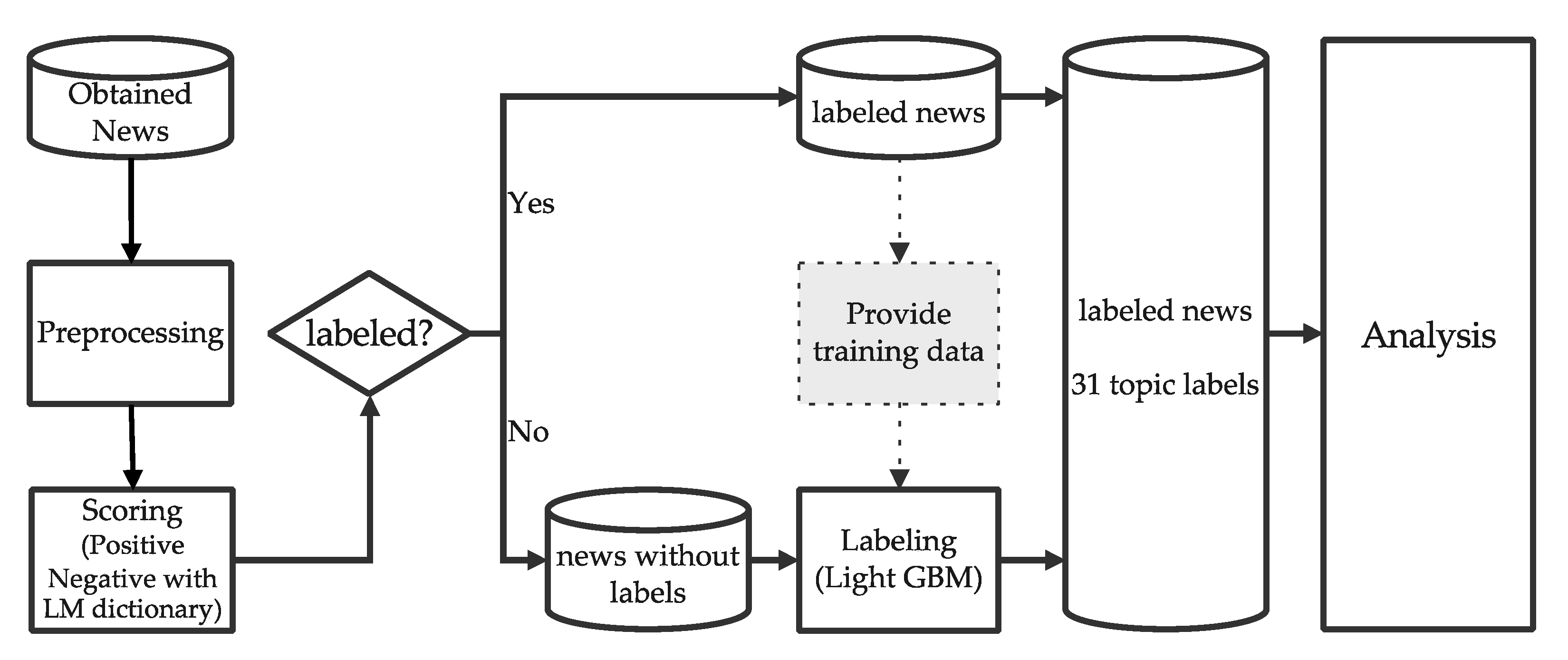

2. Materials and Methods

2.1. Data Acquisition

2.2. Methods

2.2.1. Preprocessing

- ∙

- Changing capital letters to lower case letters;

- ∙

- Deleting numbers;

- ∙

- Deleting stopwords;

- ∙

- Deleting unnecessary characters (!”#$%&()*+,-./:;<=>?@[\\]^_‘{|}~);

- ∙

- Extracting nouns, verbs, and adjectives;

- ∙

- Lemmatizing words if needed.

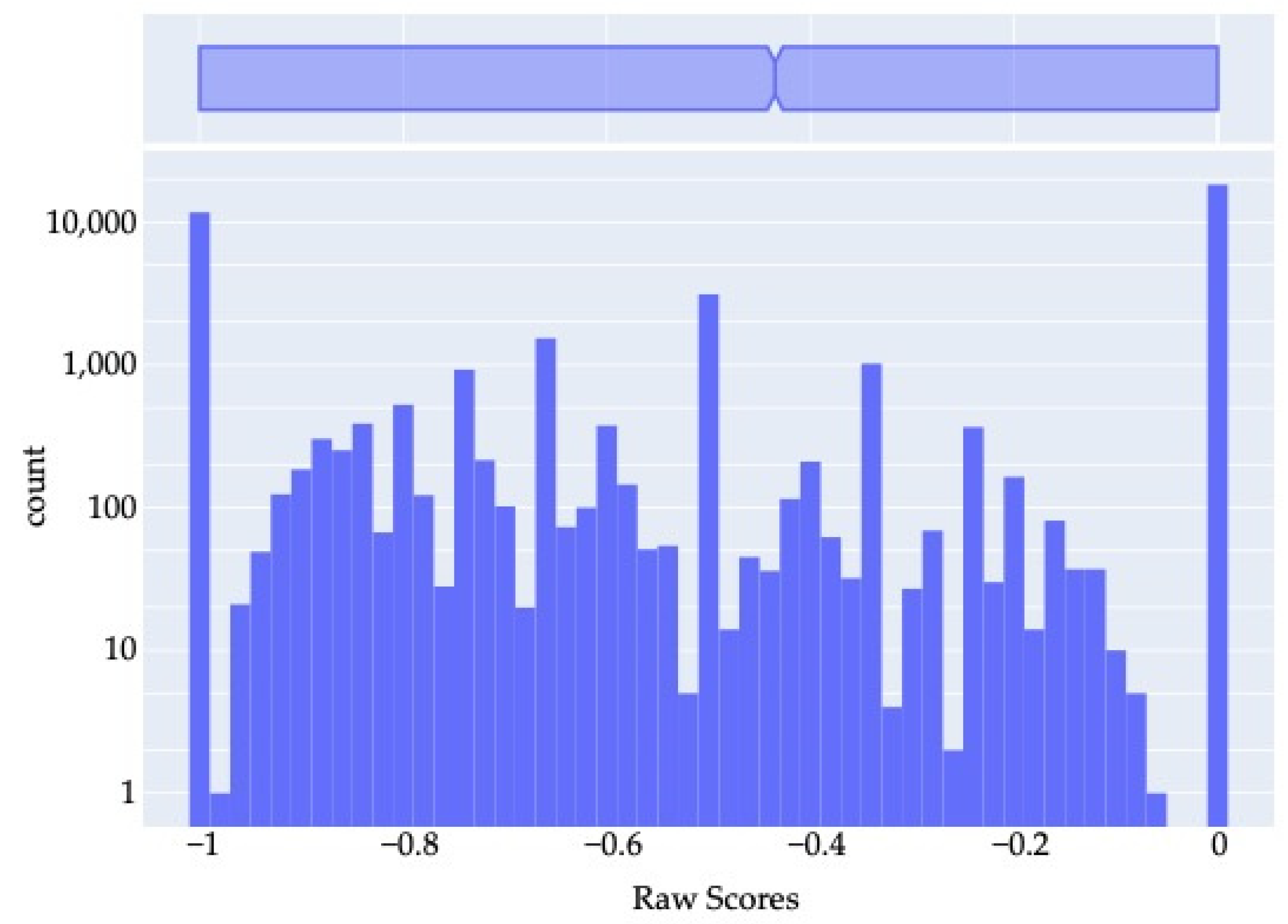

2.2.2. Positive–Negative Analysis

2.2.3. Labeling Topics

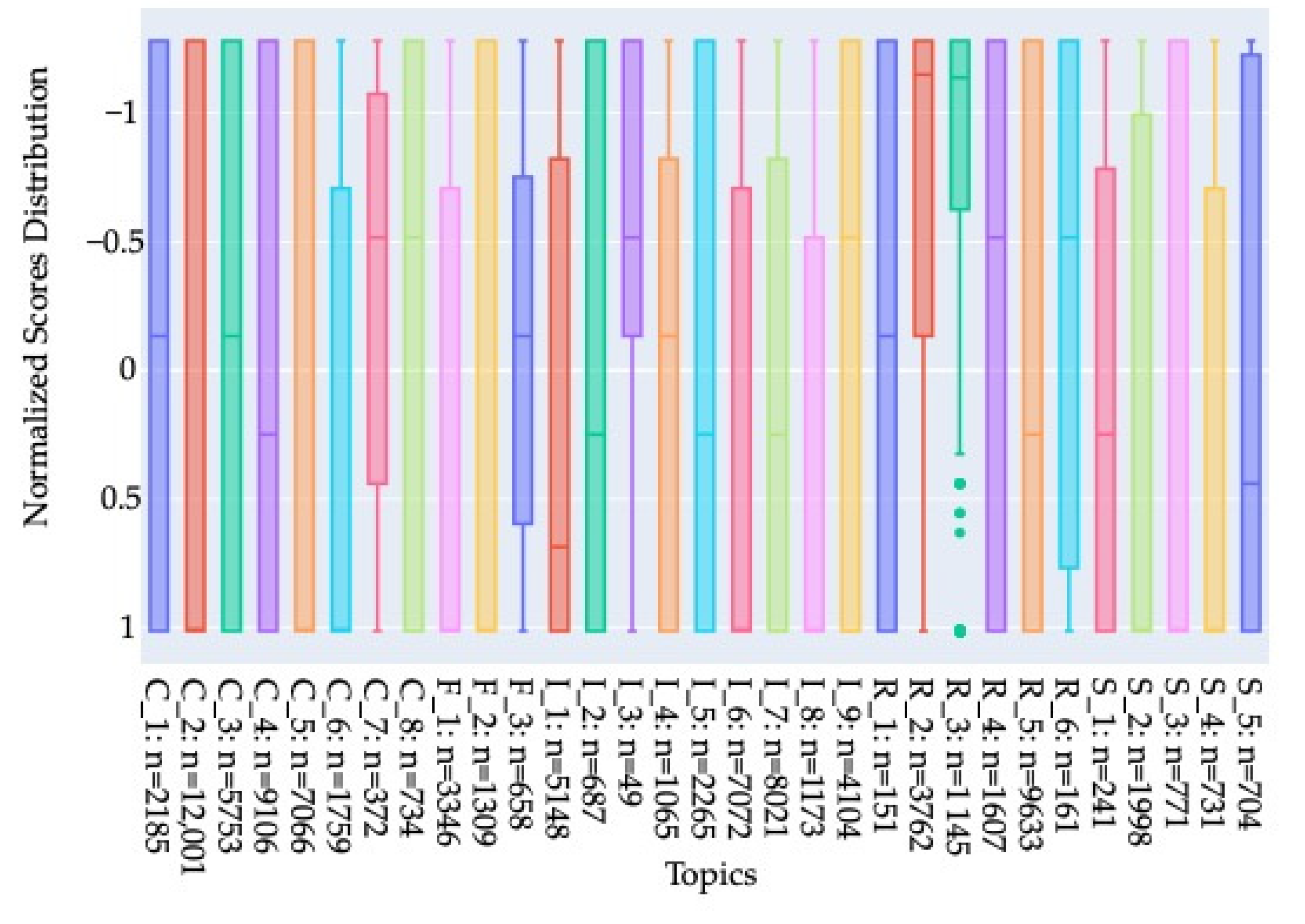

3. Results

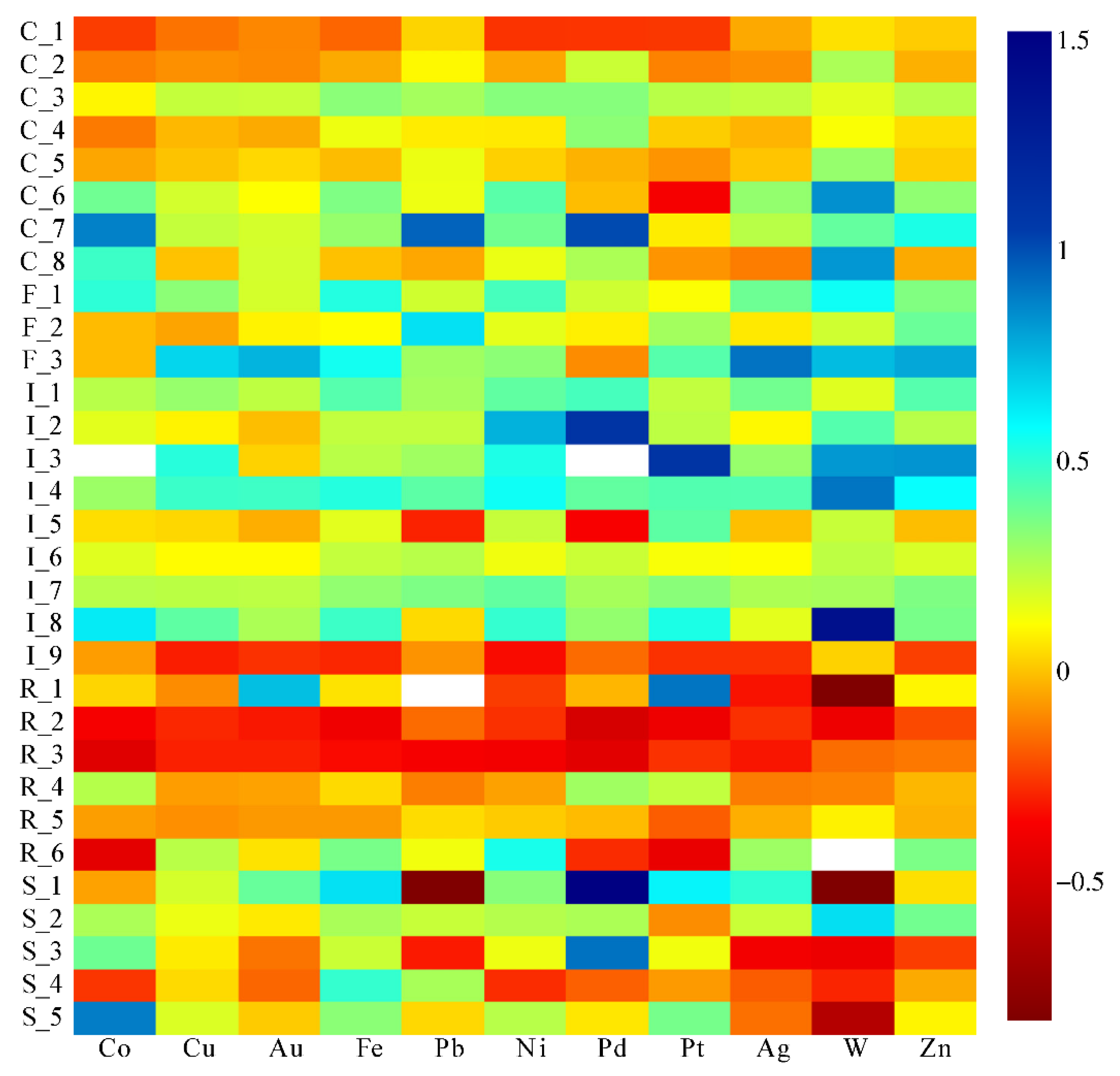

3.1. Scores for Each Article

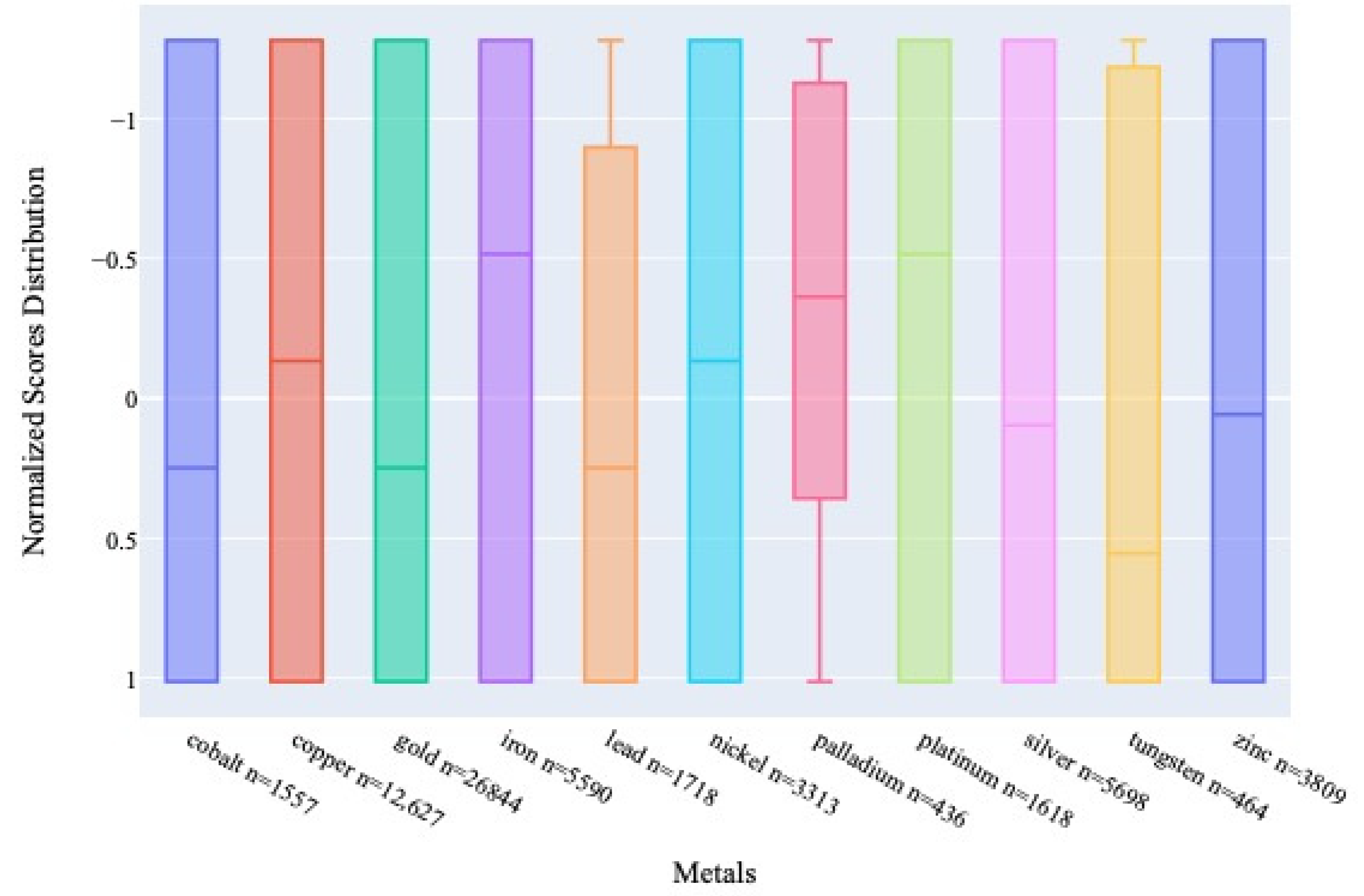

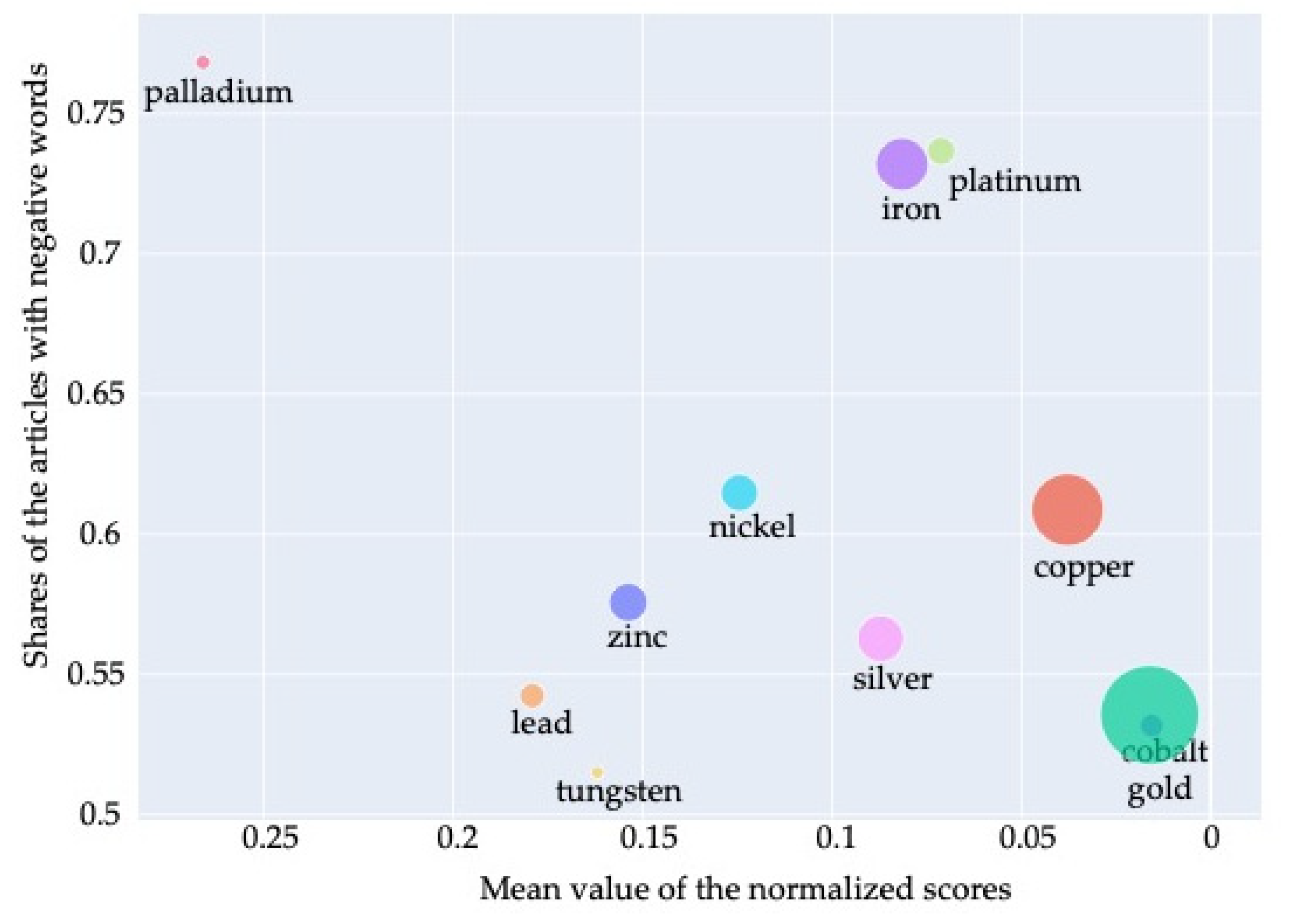

3.2. Shares and Scores of Negative Articles

4. Discussion

4.1. Comparison among Metals

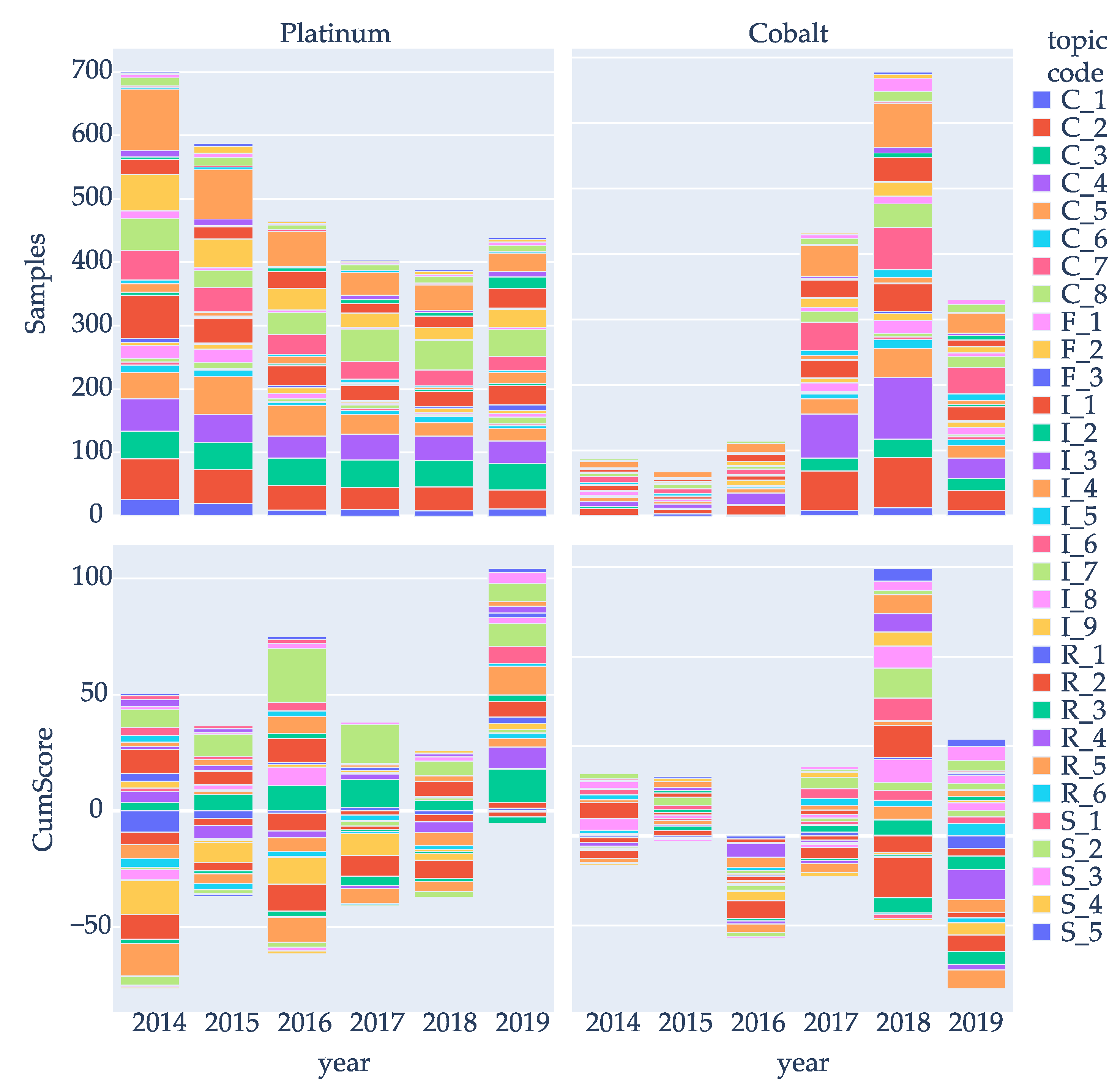

4.2. Historical Changes in Single Metal

4.3. Pros and Cons of Using Internet News Articles

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- National Research Council. Minerals, Critical Minerals, and the U.S. Economy; National Academies Press: Washington, DC, USA, 2008; Available online: https://nap.edu/catalog/12034/minerals-critical-minerals-and-the-us-economy (accessed on 28 December 2021).

- Graedel, T.E.; Barr, R.; Chandler, C.; Chase, T.; Choi, J.; Christoffersen, L.; Friedlander, E.; Henly, C.; Jun, C.; Nassar, N.T.; et al. Methodology of Metal Criticality Determination. Environ. Sci. Technol. 2012, 46, 1063–1070. [Google Scholar] [CrossRef]

- Grandell, L.; Lehtilä, A.; Kivinen, M.; Koljonen, T.; Kihlman, S.; Lauri, L.S. Role of critical metals in the future markets of clean energy technologies. Renew. Energy 2016, 95, 53–62. [Google Scholar] [CrossRef]

- European Commission. Study on the Eu’s List of Critical Raw Materials (2020), Critical Raw Materials Factsheets. Brussels. 2020. Available online: https://doi.org/10.2873/11619 (accessed on 28 December 2021).

- Schrijvers, D.; Hool, A.; Blengini, G.A.; Chen, W.-Q.; Dewulf, J.; Eggert, R.; van Ellen, L.; Gauss, R.; Goddin, J.; Habib, K.; et al. A review of methods and data to determine raw material criticality. Resour. Conserv. Recycl. 2020, 155, 104617. [Google Scholar] [CrossRef]

- Helbig, C.; Bruckler, M.; Thorenz, A.; Tuma, A. An Overview of Indicator Choice and Normalization in Raw Material Supply Risk Assessments. Resources 2021, 10, 79. [Google Scholar] [CrossRef]

- Narayan, P.K. Can stale oil price news predict stock returns? Energy Econ. 2019, 83, 430–444. [Google Scholar] [CrossRef]

- Shah, S.; Lütjen, M.; Freitag, M. Text Mining for Supply Chain Risk Management in the Apparel Industry. Appl. Sci. 2021, 11, 2323. [Google Scholar] [CrossRef]

- S&P Global Market Intelligence (Currently Renamed to S&P Capital IQ Pro). Available online: https://www.spglobal.com/en/ (accessed on 28 December 2021).

- Natural Language Toolkit. Available online: https://www.nltk.org (accessed on 28 December 2021).

- Loughran, T.; McDonald, B. When Is a Liability Not a Liability? Textual Analysis, Dictionaries, and 10-Ks. J. Financ. 2011, 66, 35–65. [Google Scholar] [CrossRef]

- LightGBM. Available online: https://lightgbm.readthedocs.io/ (accessed on 28 December 2021).

- World Bank Worldwide Governance Indicators (WGI). Available online: https://info.worldbank.org/governance/wgi/ (accessed on 2 June 2020).

- Fraser Institute. Annual Survey of Mining Companies. 2020. Available online: https://www.fraserinstitute.org/studies/annual-survey-of-mining-companies-2020 (accessed on 28 December 2021).

- Dewulf, J.; Blengini, G.A.; Pennington, D.; Nuss, P.; Nassar, N.T. Criticality on the international scene: Quo vadis? Resour. Policy 2016, 50, 169–176. [Google Scholar] [CrossRef] [Green Version]

- Farooq, M.U.; Hussain, A.; Masood, T.; Habib, M.S. Supply Chain Operations Management in Pandemics: A State-of-the-Art Review Inspired by COVID-19. Sustainability 2021, 13, 2504. [Google Scholar] [CrossRef]

- Hussain, A.; Farooq, M.U.; Habib, M.S.; Masood, T.; Pruncu, C.I. COVID-19 Challenges: Can Industry 4.0 Technologies Help with Business Continuity? Sustainability 2021, 13, 11971. [Google Scholar] [CrossRef]

| Metal | Period 1 | Number of News Articles 2 |

|---|---|---|

| Copper | 17 April 2013~26 May 2020 | 12,928 |

| Cobalt | 15 January 2014~26 May 2020 | 1664 |

| Gold | 31 January 2013~26 May 2020 | 26,334 |

| Nickel | 7 October 2013~26 May 2020 | 3757 |

| Platinum | 7 October 2013~26 May 2020 | 1859 |

| Palladium | 17 January 2014~26 May 2020 | 563 |

| Zinc | 20 August 2013~26 May 2020 | 4044 |

| Iron | 26 June 2013~26 May 2020 | 5647 |

| Lead | 18 December 2013~26 May 2020 | 1747 |

| Tungsten | 3 February 2014~26 May 2020 | 515 |

| Silver | 1 May 2013~26 May 2020 | 5493 |

| Topic Code | Topic Name | Typical Contents | Number of News 1 |

|---|---|---|---|

| Individual Corporates News | |||

| C_1 | Bankruptcy & Distressed | Corporates’ bankruptcy or distress | 679 |

| C_2 | Capital Markets | Corporates’ investment activities and related topics | 12,240 |

| C_3 | Earnings & Guidance | Corporates’ guidance and earnings | 6082 |

| C_4 | In the Boardroom | Corporates’ board decisions | 5658 |

| C_5 | Personnel | Corporates’ personnel | 7042 |

| C_6 | ESG_Environmental | Corporates’ ESG activities on environmental issues | 802 |

| C_7 | ESG_Governance | Corporates’ ESG activities on governance-related issues | 109 |

| C_8 | ESG_Social | Corporates’ ESG activities on social issues | 195 |

| General Financial News | |||

| F_1 | Commodities | Commodity market and supply chain | 1208 |

| F_2 | Private Equity | Private equity-related issues | 884 |

| F_3 | Ratings & Research | Corporates’ ratings and related issues | 1578 |

| Industry News | |||

| I_1 | Industry News | General mining and metallurgical industry issues | 5646 |

| I_2 | Midstream | Transportation, logistics in broader sense | 539 |

| I_3 | Mining_Coal Transportation | Coal transportation | 173 |

| I_4 | Mining_Demand | Minerals’ demand | 583 |

| I_5 | Mining_Exports & Imports | Minerals’ international trade | 583 |

| I_6 | Mining_Production | Mines’ production | 5336 |

| I_7 | Mining_Smelting & Refining | Smelters/refineries-related issues | 502 |

| I_8 | Technology | Technology-related issues | 90 |

| I_9 | Mining_Mine Safety | Mine safety | 671 |

| Regulation, Policy and Law | |||

| R_1 | Rates & Tariffs | Rates/tariff-related issues | 81 |

| R_2 | Regulation, Policy & Law_ Civil & Criminal Actions | Civil and criminal actions | 1730 |

| R_3 | Regulation, Policy & Law_ Courts | Lawsuits | 1103 |

| R_4 | Regulation, Policy & Law_ Legislative Activity | Legislative activity | 506 |

| R_5 | Regulation, Policy & Law_ Regulatory Activity | Regulatory activity | 3092 |

| R_6 | Regulation, Policy & Law_ Trade Policy | Trade policy | 139 |

| Surrounding Issues | |||

| S_1 | Electric Generation | Electric generation-related topics | 557 |

| S_2 | Environment | General environmental issues | 736 |

| S_3 | Power Grid | Power grid-related issues | 141 |

| S_4 | Renewables | All issues related to renewable energies | 185 |

| S_5 | Upstream | Upstream issues, including fossil fuel supply | 124 |

| ID 1 | Share of Negative News | Number of News | ID | Share of Negative News | Number of News 1 | ID | Share of Negative News | Number of News 1 |

|---|---|---|---|---|---|---|---|---|

| C_1 | 60.6% | 2185 | I_1 | 50.4% | 5148 | R_1 | 66.9% | 151 |

| C_2 | 47.3% | 12,001 | I_2 | 56.3% | 687 | R_2 | 80.4% | 3762 |

| C_3 | 67.8% | 5753 | I_3 | 91.8% | 49 | R_3 | 91.6% | 1145 |

| C_4 | 52.0% | 9106 | I_4 | 64.6% | 1065 | R_4 | 65.8% | 1607 |

| C_5 | 49.6% | 7066 | I_5 | 53.0% | 2265 | R_5 | 51.8% | 9633 |

| C_6 | 45.4% | 1759 | I_6 | 42.2% | 7072 | R_6 | 75.2% | 161 |

| C_7 | 76.6% | 372 | I_7 | 53.1% | 8021 | S_1 | 53.9% | 241 |

| C_8 | 73.0% | 734 | I_8 | 45.1% | 1173 | S_2 | 48.2% | 1998 |

| F_1 | 48.6% | 3346 | I_9 | 62.6% | 4104 | S_3 | 45.1% | 771 |

| F_2 | 47.9% | 1309 | S_4 | 39.5% | 731 | |||

| F_3 | 77.8% | 658 | S_5 | 51.4% | 704 |

| Metal | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | |

|---|---|---|---|---|---|---|---|

| Cobalt | Mean | 0.108 | 0.505 | −0.377 | −0.002 | 0.138 | −0.075 |

| Total Unique Articles | 71 | 59 | 91 | 337 | 532 | 266 | |

| Share of Negative News | 57.7% | 50.8% | 59.3% | 39.8% | 46.1% | 60.5% | |

| Platinum | Mean | −0.038 | −0.007 | 0.043 | 0.017 | −0.006 | 0.274 |

| Total Unique Articles | 300 | 249 | 207 | 183 | 181 | 192 | |

| Share of Negative News | 72.0% | 69.9% | 72.0% | 64.5% | 56.4% | 79.7% |

| T: Technical, physical, and geological factors | R: Regulatory and social factors | ||

|---|---|---|---|

| 1 | Decrease in quality of feedstock | 11 | Land use regulation |

| 2 | Insufficient supply of auxiliaries | 12 | Social acceptance |

| 3 | Lack of elasticity of the production capacity | 13 | Human and environmental disasters |

| E: Economic, strategic, and market supply risk factors | 14 | Regulation on ethical sourcing | |

| 4 | Concentration of supplier countries | 15 | Lack of waste-as-resource policy |

| 5 | Concentration of supplying companies | P: Political stability and governance factors | |

| 6 | Economic land use competition | 16 | Country stability and governance |

| 7 | By-production dynamics | 17 | Corporate stability and governance |

| 8 | Unstable market/prices/demand | ||

| 9 | Resource nationalism strategies of supplying countries | ||

| 10 | Embargo/trade barriers | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Murakami, S.; Muraoka, S. Exploring the Potential of Internet News for Supply Risk Assessment of Metals. Sustainability 2022, 14, 409. https://doi.org/10.3390/su14010409

Murakami S, Muraoka S. Exploring the Potential of Internet News for Supply Risk Assessment of Metals. Sustainability. 2022; 14(1):409. https://doi.org/10.3390/su14010409

Chicago/Turabian StyleMurakami, Shinsuke, and Shunya Muraoka. 2022. "Exploring the Potential of Internet News for Supply Risk Assessment of Metals" Sustainability 14, no. 1: 409. https://doi.org/10.3390/su14010409