Risk Management in Corporate Governance Framework

Abstract

1. Introduction

2. Background and Theoretical Framework

2.1. Managerial Ownership, Risk Management, and Financial Performance

2.2. Institutional Ownership, Risk Management, and Financial Performance

2.3. Government Ownership, Risk Management, and Financial Performance

2.4. Foreign Ownership, Risk Management, and Financial Performance

2.5. Block-Holder Ownership, Risk Management, and Financial Performance

2.6. Board Size, Risk Management, and Financial Performance

2.7. Board Independence, Risk Management and Financial Performance

2.8. Audit Committee Independence, Risk Management and Financial Performance

2.9. CEO Remuneration, Risk Management, and Financial Performance

2.10. CEO Duality, Risk Management, and Financial Performance

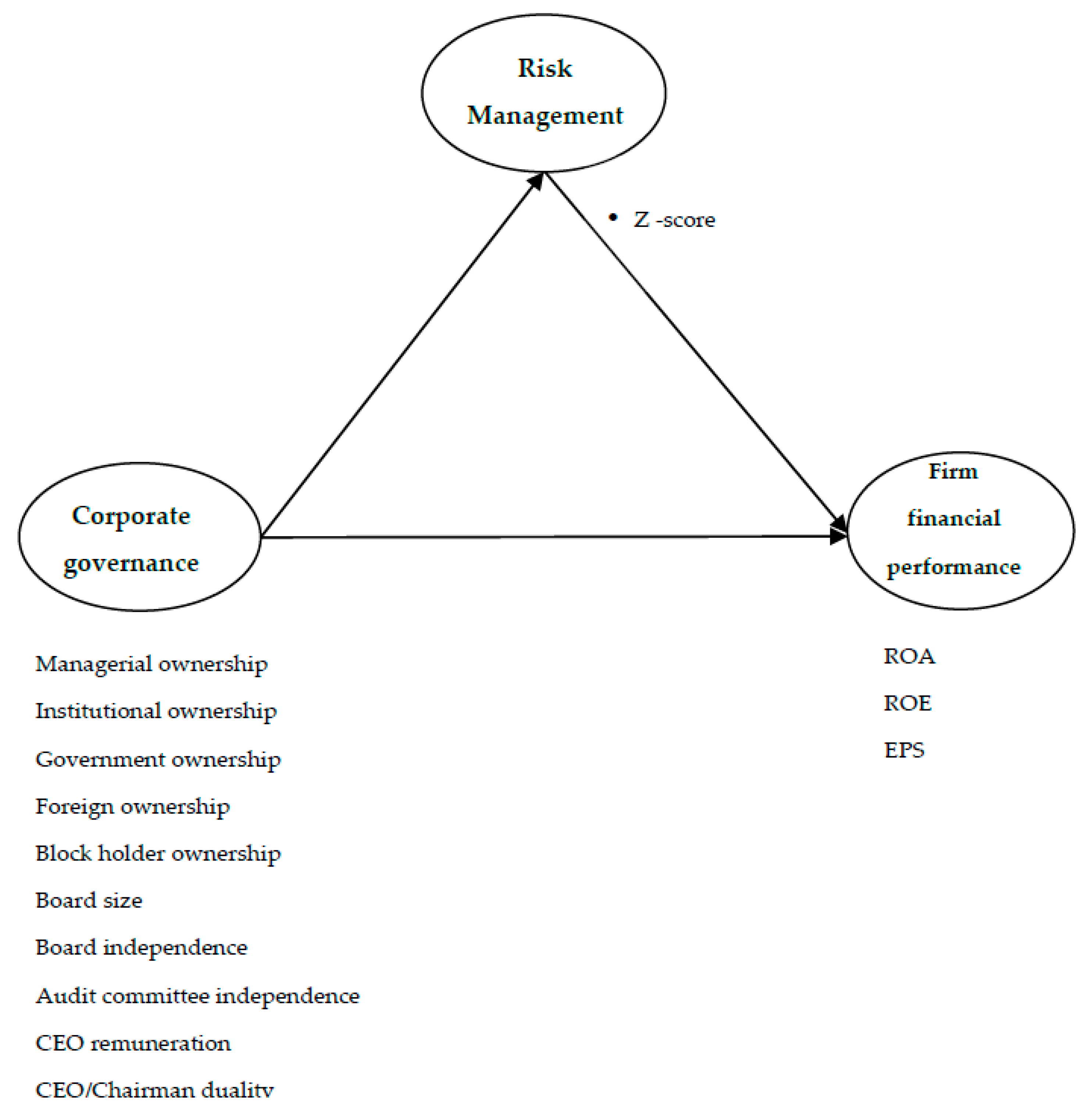

3. Data and Methodology

4. Results and Discussion

5. Conclusions and Policy Implication

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Jenkinson, T.; Mayer, C. The assessment: Corporate governance and corporate control. Oxf. Rev. Econ. Policy 1992, 8, 1–10. [Google Scholar] [CrossRef]

- Jenson, M.C.; Meckling, W.H. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Tarraf, H.; Majeske, K. Impact of risk taking on bank financial performance during 2008 financial crisis. J. Financ. Account. 2013, 13, 1–18. [Google Scholar]

- Governance, C. The Financial Crisis: Key Findings and Main Messages; Organization for Economic Cooperation and Development (OECD): Paris, France, 2009; Volume 19, pp. 19–32. [Google Scholar]

- Bebchuk, L.; Cohen, A.; Ferrell, A. What matters in corporate governance? Rev. Financ. Stud. 2009, 22, 783–827. [Google Scholar] [CrossRef]

- Claessens, S.; Yurtoglu, B.B. Corporate governance in emerging markets: A survey. Emerg. Mark. Rev. 2013, 15, 1–33. [Google Scholar] [CrossRef]

- Gericke, R. Corporate Governance and Risk Management in Financial Institutions: An International Comparison between Brazil and Germany; Springer: Berlin/Heidelberg, Germany, 2018. [Google Scholar]

- McNulty, T.; Florackis, C.; Ormrod, P. Corporate Governance and Risk: A Study of Board Structure and Process; ACCA Research Report; ACCA: London, UK, 2012; Volume 129. [Google Scholar]

- World Bank. The World Bank in Pakistan. Available online: https://www.worldbank.org/en/country/pakistan/overview (accessed on 12 June 2019).

- Ahsan, T.; Qureshi, M.A. The impact of financial liberalization on capital structure adjustment in Pakistan: A doubly censored modelling. Appl. Econ. 2017, 49, 4148–4160. [Google Scholar] [CrossRef]

- Keuper, F.; Neumann, F. Corporate Governance, Risk Management und Compliance—Innovative Konzepte und Strategien; Springer Fachmedien: Wiesbaden, Germany, 2010. [Google Scholar] [CrossRef]

- Rossi, C. A Risk Professional’s Survival Guide: Applied Best Practices in Risk Management; Wiley: Hoboken, NJ, USA, 2014. [Google Scholar]

- Bhagat, S.; Bolton, B.; Lu, J. Size, leverage, and risk-taking of financial institutions. J. Bank. Financ. 2015, 59, 520–537. [Google Scholar] [CrossRef]

- Saunders, A.; Cornett, M. Financial Institutions Management: A Risk Management Approach; McGraw Hill: New York, NY, USA, 2018. [Google Scholar]

- Li, X.; Sun, S.T.; Yannelis, C. Managerial ownership and firm performance: Evidence from the 2003 Tax Cut. SSRN Electron. J. 2018. [Google Scholar] [CrossRef][Green Version]

- Singh, H.; Harianto, F. Management-board relationships, takeover risk, and the adoption of golden parachutes. Acad. Manag. J. 1989, 32, 7–24. [Google Scholar] [CrossRef]

- Jelinek, K.; Stuerke, P.S. The nonlinear relation between agency costs and managerial equity ownership. Int. J. Manag. Financ. 2009, 5, 156–178. [Google Scholar] [CrossRef]

- Han, K.C.; Suk, D.Y. The effect of ownership structure on firm performance: Additional evidence. Rev. Financ. Econ. 1998, 7, 143–155. [Google Scholar] [CrossRef]

- Lin, Y.; Fu, X. Does institutional ownership influence firm performance? Evidence from China. Int. Rev. Econ. Financ. 2017, 49, 17–57. [Google Scholar] [CrossRef]

- Graves, S.B.; Waddock, S.A. Institutional ownership and control: Implications for long-term corporate strategy. Acad. Manag. Perspect. 1990, 4, 75–83. [Google Scholar] [CrossRef]

- Najid, N.A.; Rahman, R.A. Government ownership and performance of Malaysian government-linked companies. Int. Res. J. Financ. Econ. 2011, 61, 1450–2887. [Google Scholar]

- Berger, A.N.; Clarke, G.R.; Cull, R.; Klapper, L.; Udell, G.F. Corporate governance and bank performance: A joint analysis of the static, selection, and dynamic effects of domestic, foreign, and state ownership. J. Bank. Financ. 2005, 29, 2179–2221. [Google Scholar] [CrossRef]

- Barry, T.A.; Lepetit, L.; Tarazi, A. Ownership structure and risk in publicly held and privately owned banks. J. Bank. Financ. 2011, 35, 1327–1340. [Google Scholar] [CrossRef]

- Dong, Y.; Girardone, C.; Kuo, J.M. Governance, efficiency and risk taking in Chinese banking. Br. Account. Rev. 2017, 49, 211–229. [Google Scholar] [CrossRef]

- Ghazali, N.A.M. Ownership structure, corporate governance and corporate performance in Malaysia. Int. J. Commer. Manag. 2010, 20, 109–119. [Google Scholar] [CrossRef]

- Nguyen, T.; Pham, T.; Dao, T.; Tran, T. The impact of foreign ownership and management on firm performance in Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 409–418. [Google Scholar] [CrossRef]

- Filatotchev, I.; Isachenkova, N.; Mickiewicz, T. Corporate governance, managers’ independence, exporting, and performance of firms in transition economies. Emerg. Mark. Financ. Trade 2007, 43, 62–77. [Google Scholar] [CrossRef]

- Bonin, J.P.; Hasan, I.; Wachtel, P. Bank performance, efficiency and ownership in transition countries. J. Bank. Financ. 2005, 29, 31–53. [Google Scholar] [CrossRef]

- Mian, A. Distance constraints: The limits of foreign lending in poor economies. J. Financ. 2006, 61, 1465–1505. [Google Scholar] [CrossRef]

- Javid, A.Y.; Iqbal, R. Ownership concentration, corporate governance and firm performance: Evidence from Pakistan. Pak. Dev. Rev. 2008, 643–659. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Bank governance, regulation and risk taking. J. Financ. Econ. 2009, 93, 259–275. [Google Scholar] [CrossRef]

- Rahman, A.; Azureen, N.; Rejab, A.F. The Effect of Risk Taking on Ownership Structure and Bank Performance: A Malaysia Case. Int. Rev. Bus. Res. Pap. 2013, 9, 68–82. [Google Scholar]

- Haniffa, R.; Hudaib, M. Corporate governance structure and performance of Malaysian listed companies. J. Bus. Financ. Account. 2006, 33, 1034–1062. [Google Scholar] [CrossRef]

- Lipton, M.; Lorsch, J.W. A modest proposal for improved corporate governance. Bus. Lawyer 1992, 48, 59–77. [Google Scholar]

- Dato, M.H.; Mersland, R.; Mori, N. Board committees and performance in microfinance institutions. Int. J. Emerg. Mark. 2018. [Google Scholar] [CrossRef]

- Mayur, M.; Saravanan, P. Performance implications of board size, composition and activity: Empirical evidence from the Indian banking sector. Corp. Gov. 2017, 17, 466–489. [Google Scholar] [CrossRef]

- Pathan, S. Strong boards, CEO power and bank risk-taking. J. Bank. Financ. 2009, 33, 1340–1350. [Google Scholar] [CrossRef]

- Liang, C.J.; Lin, Y.L.; Huang, T.T. Does endogenously determined ownership matter on performance? Dynamic evidence from the emerging Taiwan market. Emerg. Mark. Financ. Trade 2011, 47, 120–133. [Google Scholar] [CrossRef]

- Aras, G. The effect of corporate governance practices on financial structure in emerging markets: Evidence from BRICK countries and lessons for Turkey. Emerg. Mark. Financ. Trade 2015, 51, 5–24. [Google Scholar] [CrossRef]

- IMF-Global Financial Stability Report. Global Financial Stability Report. Risk Taking, Liquidity, and Shadow Banking. Curbing Excess while Promoting Growth; IMF-Global Financial Stability Report: Washington, DC, USA, 2014. [Google Scholar]

- Collier, P.; Gregory, A. Audit committee activity and agency costs. J. Account. Public Policy 1999, 18, 311–332. [Google Scholar] [CrossRef]

- Dar, L.; Naseem, M.A.; Niazi, G.S.K.; Rehman, R.U. Corporate Governance and Firm Performance: A Case Study of Pakistan Oil and Gas Companies listed In Karachi Stock Exchange. Glob. J. Manag. Bus. Res. 2011, 11, 1–11. [Google Scholar]

- Mehran, H. Executive compensation structure, ownership, and firm performance. J. Financ. Econ. 1995, 38, 163–184. [Google Scholar] [CrossRef]

- Sheikh, N.A.; Karim, S. Effects of internal governance indicators on performance of commercial banks in Pakistan. Pak. J. Soc. Sci. 2015, 35, 77–90. [Google Scholar]

- Tonello, M. The role of the board in turbulent times: Overseeing risk management and executive compensation. SSRN Electron. J. 2008. [Google Scholar] [CrossRef]

- Erkens, D.H.; Hung, M.; Matos, P. Corporate governance in the 2007–2008 financial crisis: Evidence from financial institutions worldwide. J. Corp. Financ. 2012, 18, 389–411. [Google Scholar] [CrossRef]

- Basuroy, S.; Gleason, K.C.; Kannan, Y.H. CEO compensation, customer satisfaction, and firm value. Rev. Account. Financ. 2014, 13, 326–352. [Google Scholar] [CrossRef]

- Yermack, D. Higher market valuation of companies with a small board of directors. J. Financ. Econ. 1996, 40, 185–211. [Google Scholar] [CrossRef]

- Baliga, B.R.; Moyer, R.C.; Rao, R.S. CEO duality and firm performance: What’s the fuss? Strateg. Manag. J. 1996, 17, 41–53. [Google Scholar] [CrossRef]

- Hsu, W.H.L.; Wang, G.Y.; Hsu, Y.P. Testing mediator and moderator effects of independent director on firm performance. Int. J. Math. Models Methods Appl. Sci. 2012, 5, 698–705. [Google Scholar]

- Boyd, B.K. CEO duality and firm performance: A contingency model. Strateg. Manag. J. 1995, 16, 301–312. [Google Scholar] [CrossRef]

- Hannan, T.H.; Hanweck, G.A. Bank insolvency risk and the market for large certificates of deposit. J. Money Credit Bank. 1988, 20, 203–211. [Google Scholar] [CrossRef]

- Angkinand, A.; Wihlborg, C. Deposit insurance coverage, ownership, and banks’ risk-taking in emerging markets. J. Int. Money Financ. 2010, 29, 252–274. [Google Scholar] [CrossRef]

- Preacher, K.J.; Hayes, A.F. SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behav. Res. Methods Instrum. Comput. 2004, 36, 717–731. [Google Scholar] [CrossRef]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E.; Tatham, R.L. Multivariate Data Analysis; Prentice Hall: Upper Saddle River, NJ, USA, 1998; Volume 5, pp. 207–219. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Kenny, D.A. Multitrait Multimethod Matrix: Definitions and Introduction. 2012. Available online: http://davidakenny.net/cm/mtmm.htm (accessed on 28 April 2020).

- Kenny, D.A. Multiple Latent Variable Models: Confirmatory Factor Analysis. 2016. Available online: http://davidakenny.net/cm/mfactor.htm (accessed on 12 July 2019).

- Drummond, R.J.; Jones, K.D. Assessment Procedures for Counselors and Helping Professionals; Pearson/Merrill Prentice Hall: Upper Saddle River, NJ, USA, 2006. [Google Scholar]

- Watson, J.C.; Flamez, B. Counseling Assessment and Evaluation: Fundamentals of Applied Practice; SAGE: Newbury Park, CA, USA, 2015. [Google Scholar]

- Shleifer, A.; Vishny, R.W. A survey of corporate governance. J. Financ. 1997, 52, 737–783. [Google Scholar] [CrossRef]

- Eling, M.; Marek, S.D. Corporate governance and risk taking: Evidence from the UK and German insurance markets. J. Risk Insur. 2014, 81, 653–682. [Google Scholar] [CrossRef]

- Hutchinson, M.; Seamer, M.; Chapple, L.E. Institutional investors, risk/performance and corporate governance. Int. J. Account. 2015, 50, 31–52. [Google Scholar] [CrossRef]

- Haleblian, J.; Finkelstein, S. Top management team size, CEO dominance, and firm performance: The moderating roles of environmental turbulence and discretion. Acad. Manag. J. 1993, 36, 844–863. [Google Scholar] [CrossRef]

- Ross, S.A. The determination of financial structure: The incentive-signalling approach. Bell J. Econ. 1977, 23–40. [Google Scholar] [CrossRef]

- Core, J.E.; Guay, W.; Larcker, D.F. The power of the pen and executive compensation. J. Financ. Econ. 2008, 88, 1–25. [Google Scholar] [CrossRef]

- McConnell, J.J.; Servaes, H. Additional evidence on equity ownership and corporate value. J. Financ. Econ. 1990, 27, 595–612. [Google Scholar] [CrossRef]

- Haris, M.; Yao, H.; Tariq, G.; Javaid, H.; Ain, Q. Corporate Governance, Political Connections, and Bank Performance. Int. J. Financ. Stud. 2019, 7, 62. [Google Scholar] [CrossRef]

- Junaid, M.; Xue, Y.; Syed, M.; Ziaullah, M.; Numair, R. Corporate governance mechanism and performance of insurers in Pakistan. Green Financ. 2020, 2, 243–262. [Google Scholar] [CrossRef]

- Sheikh, S.; Syed, A.; Shah, S. Corporate reinsurance utilisation and capital structure: Evidence from Pakistan insurance industry. Geneva Pap. Risk Insur. Issues Pract. 2018, 43, 300–334. [Google Scholar] [CrossRef]

| Symbol | Measurement | |

|---|---|---|

| Independent variables | ||

| Managerial Ownership | MO | Shares owned by directors/total outstanding shares |

| Institutional Ownership | IO | Shares held by financial institutions/total outstanding shares |

| Government Ownership | GO | Shares held by government/total outstanding shares |

| Foreign Ownership | FO | Shares held by foreign investors/total outstanding shares |

| Block-holder Concentration | BH | Shares owned by block-holders (shareholders having 5% or more shareholding)/total outstanding shares |

| Board Size | BS | Dummy variable that assumes three values (“0” represents small size having 4 to 6 directors; “1” represents medium size having 7–9 directors; and “2” represents large size having 10–13 directors on board) 0, 1 & 2. |

| Board Independence | BI | Dummy variable calculated by dividing the number of non-executive directors to the total number of directors. It assumes three values (A value between 0–0.32 is considered as less independent board and is represented by “0”; a value between 0.33–0.62 is labelled as medium independent board and is represented by “1”; and a value between 0.63–1 is considered as highly independent board and is represented by “2”) 0, 1 & 2. |

| Audit Committee Independence | ACI | Dummy variable calculated by dividing the number of non-executive directors in audit committee by the total size of audit committee. It assumes three values (A value between 0–0.4 is considered as less independent audit committee and is represented by “0"; a value between 0.5–0.7 is considered as medium independent audit committee and is represented by “1”; and a value between 0.8–1 is considered as highly independent audit committee and is represented by “2”) 0, 1 & 2. |

| CEO Remuneration | REM | CEO remuneration/total return earned by the firm. |

| CEO/Chairman Duality | DUO | Dummy variable that assumes two values (“0” represents the case when CEO and chairperson of the board are two different people; and “1” represents the case when same individual acts as CEO as well as chairperson of the board) 0 and 1. |

| Risk Management | RISK | Z-score measures distance from insolvency and is calculated as the sum of return on assets (ROA) and capital asset ratio divided by standard deviation of ROA. Natural logarithm of z-score is taken since the values of z-score are highly skewed. |

| Dependent variables | ||

| Return on Asset | ROA | Profit before taxation/total assets |

| Return on Equity | ROE | Profit before taxation/total shareholder’s equity |

| Earnings per Share | EPS | (Net income–preferred dividends)/number of outstanding common shares |

| Variables | Minimum | Maximum | Mean | Std. Deviation |

|---|---|---|---|---|

| Managerial Ownership | 0.000 | 1.000 | 0.106 | 0.192 |

| Institutional Ownership | 0.000 | 1.000 | 0.364 | 0.343 |

| Government Ownership | 0.000 | 1.000 | 0.078 | 0.186 |

| Foreign Ownership | 0.000 | 0.840 | 0.054 | 0.144 |

| Block-holder Ownership | 0.000 | 1.000 | 0.447 | 0.312 |

| Board Size | 0.000 | 2.000 | 0.965 | 0.534 |

| Board Independence | 0.000 | 2.000 | 1.275 | 0.791 |

| Audit Committee Independence | 0.000 | 2.000 | 1.530 | 0.747 |

| CEO Remuneration | −38.140 | 5.950 | −0.52 | 1.655 |

| CEO/Chairman Duality | 0.000 | 1.000 | 0.078 | 0.269 |

| Return on Assets (ROA) | −800 | 0.720 | 0.031 | 0.119 |

| Return on Equity (ROE) | −890 | 0.880 | 0.137 | 0.214 |

| Earnings per Share (EPS) | −12.430 | 26.170 | 3.669 | 5.545 |

| Risk (Z-score) | −2.320 | 5.200 | 1.606 | 1.043 |

| Capital Asset Ratio (CAR) | −0.33 | 0.996 | 0.320 | 0.277 |

| Std. Deviation ROA | 0.003 | 0.309 | 0.080 | 0.078 |

| PATH | Direct Effect without Mediator (Estimate) | Direct Effect without Mediator (p-Value) | Direct Effect with Mediator (Estimate) | Direct Effect with Mediator (p-Value) | Indirect Effect (Estimate) | Indirect Effect (p-Value) |

|---|---|---|---|---|---|---|

| MO→RISK→ROA | 0.022 | 0.588 | 0.002 | 0.968 | −010 | 0.111 |

| IO→RISK→ROA | −0.13 | 0.810 | 0.026 | 0.604 | −200 | 0.106 |

| GO→RISK→ROA | −0.21 | 0.619 | −097 *** | 0.002 | 0.062 | 0.429 |

| FO→RISK→ROA | 0.035 *** | 0.000 | 0.020 *** | 0.001 | 0.341 *** | 0.001 |

| BH→RISK→ROA | 0.014 | 0.787 | 0.091 | 0.096 | 0.346 | 0.110 |

| REM→RISK→ROA | −184 *** | 0.000 | −222 *** | 0.002 | 0.007 | 0.610 |

| BS→RISK→ROA | 0.163 *** | 0.000 | 0.086 ** | 0.019 | 0.142 *** | 0.001 |

| BI→RISK→ROA | 0.025 | 0.576 | 0.009 | 0.839 | 0.034 | 0.105 |

| ACI→RISK→ROA | 0.017 ** | 0.037 | 0.011 | 0.786 | 0.037 | 0.260 |

| DUO→RISK→ROA | −0.48 | 0.215 | 0.094 | 0.734 | −113 | 0.102 |

| MO→RISK→ROE | 0.015 | 0.711 | 0.042 | 0.221 | −0.07 | 0.111 |

| IO→RISK→ROE | −125 ** | 0.014 | 0.110 ** | 0.017 | −154 | 0.106 |

| GO→RISK→ROE | 0.112 | 0.713 | 0.022 | 0.395 | 0.047 | 0.429 |

| FO→RISK→ROE | 0.146 *** | 0.000 | 0.101 *** | 0.001 | 0.262 *** | 0.001 |

| BH→RISK→ROE | 0.098 ** | 0.044 | 0.143 *** | 0.005 | 0.266 | 0.110 |

| REM→RISK→ROE | −0.47 | 0.314 | −0.73 | 0.155 | 0.006 | 0.610 |

| BS→RISK→ROE | 0.193 *** | 0.000 | 0.135 *** | 0.001 | 0.109 *** | 0.001 |

| BI→RISK→ROE | 0.089 | 0.430 | 0.083 * | 0.079 | 0.026 | 0.105 |

| ACI→RISK→ROE | 0.043 | 0.316 | 0.065 | 0.133 | 0.028 | 0.260 |

| DUO→RISK→ROE | −0.56 ** | 0.013 | −0.14 | 0.701 | −0.87 | 0.102 |

| MO→RISK→EPS | 0.078 ** | 0.041 | 0.127 * | 0.055 | −0.05 | 0.111 |

| IO→RISK→EPS | −184 *** | 0.000 | 0.216 *** | 0.001 | −101 | 0.106 |

| GO→RISK→EPS | 0.148 | 0.135 | 0.000 | 0.300 | 0.031 | 0.429 |

| FO→RISK→EPS | 0.150 *** | 0.000 | 0.112 *** | 0.001 | 0.172 *** | 0.001 |

| BH→RISK→EPS | 0.018 | 0.722 | 0.031 | 0.664 | 0.174 | 0.110 |

| REM→RISK→EPS | −022 | 0.637 | −0.28 | 0.588 | 0.004 | 0.610 |

| BS→RISK→EPS | 0.129 *** | 0.003 | 0.091 ** | 0.042 | 0.072 *** | 0.001 |

| BI→RISK→EPS | 0.001 | 0.975 | 0.013 | 0.753 | 0.017 | 0.105 |

| ACI→RISK→EPS | 0.035 | 0.422 | 0.050 | 0.204 | 0.018 | 0.260 |

| DUO→RISK→EPS | −0.49 | 0.198 | 0.001 | 0.972 | −0.57 | 0.102 |

| PATH | Direct Effect without Mediator (Estimate) | Direct Effect without Mediator (p-Value) | Direct Effect with Mediator (Estimate) | Direct Effect with Mediator (p-Value) | Indirect Effect (Estimate) | Indirect Effect (p-Value) |

|---|---|---|---|---|---|---|

| MO→RISK→ROA | 0.009 | 0.889 | −0.77 | 0.137 | 0.084 *** | 0.001 |

| IO→RISK→ROA | −278 *** | 0.004 | −0.71 | 0.343 | −213 | 0.111 |

| GO→RISK→ROA | −0.72 | 0.474 | 0.009 | 0.859 | −091 | 0.111 |

| FO→RISK→ROA | −103 | 0.149 | −102 ** | 0.044 | −0.00 | 0.994 |

| BH→RISK→ROA | 0.210 ** | 0.028 | 0.106 | 0.123 | 0.108 ** | 0.020 |

| REM→RISK→ROA | −150 | 0.111 | −322 *** | 0.001 | 0.171 | 0.110 |

| BS→RISK→ROA | −079 | 0.309 | −106 ** | 0.037 | −0.25 * | 0.050 |

| BI→RISK→ROA | 0.251 *** | 0.002 | 0.067 | 0.462 | 0.186 *** | 0.001 |

| ACI→RISK→ROA | −0.55 | 0.481 | −176** | 0.016 | 0.122 *** | 0.002 |

| DUO→RISK→ROA | 0.053 | 0.509 | 0.040 | 0.428 | 0.017 | 0.630 |

| MO→RISK→ROE | 0.094 ** | 0.013 | 0.014 | 0.783 | 0.079 *** | 0.001 |

| IO→RISK→ROE | −279 *** | 0.002 | −0.87 | 0.304 | −198 | 0.111 |

| GO→RISK→ROE | 0.102 | 0.285 | 0.177 ** | 0.015 | −085 | 0.111 |

| FO→RISK→ROE | −186 | 0.600 | −185 *** | 0.001 | −0.00 | 0.994 |

| BH→RISK→ROE | 0.134 ** | 0.013 | 0.038 | 0.622 | 0.101** | 0.020 |

| REM→RISK→ROE | −235 *** | 0.009 | −396 *** | 0.001 | 0.160 | 0.110 |

| BS→RISK→ROE | −254 *** | 0.000 | −229 *** | 0.002 | −0.23 | 0.500 |

| BI→RISK→ROE | 0.104 | 0.185 | −0.69 | 0.373 | 0.174 *** | 0.001 |

| ACI→RISK→ROE | 0.027 | 0.715 | −0.86 ** | 0.029 | 0.114 *** | 0.002 |

| DUO→RISK→ROE | −0.37 | 0.628 | −0.49 | 0.295 | 0.016 | 0.630 |

| MO→RISK→EPS | 0.000 | 0.998 | −0.51 | 0.484 | 0.047 *** | 0.001 |

| IO→RISK→EPS | −527 *** | 0.000 | −421 | 0.322 | −119 | 0.111 |

| GO→RISK→EPS | −0.29 | 0.732 | 0.000 *** | 0.000 | −0.51 | 0.111 |

| FO→RISK→EPS | −284 | 0.139 | −282 *** | 0.001 | −0.00 | 0.994 |

| BH→RISK→EPS | 0.224 *** | 0.006 | 0.174 | 0.280 | 0.060 ** | 0.020 |

| REM→RISK→EPS | −073 | 0.362 | −170 *** | 0.003 | 0.096 | 0.110 |

| BS→RISK→EPS | −228 * | 0.089 | −245 *** | 0.001 | −0.14 | 0.500 |

| BI→RISK→EPS | −154 | 0.280 | −254 | 0.173 | 0.104 *** | 0.001 |

| ACI→RISK→EPS | 0.199 *** | 0.002 | 0.134 ** | 0.027 | 0.068 *** | 0.002 |

| DUO→RISK→EPS | 0.173 | 0.110 | 0.171 ** | 0.043 | 0.009 | 0.630 |

| PATH | Direct Effect without Mediator (Estimate) | Direct Effect without Mediator (p-Value) | Direct Effect with Mediator (Estimate) | Direct Effect with Mediator (p-Value) | Indirect Effect (Estimate) | Indirect Effect (p-Value) |

|---|---|---|---|---|---|---|

| MO→RISK→ROA | −0.24 | 0.742 | −0.60 | 0.367 | 0.013 | 0.742 |

| IO→RISK→ROA | −0.47 ** | 0.027 | 0.110 | 0.560 | −0.86 | 0.400 |

| GO→RISK→ROA | 0.201 | 0.610 | 0.096 * | 0.052 | −0.22 | 0.369 |

| FO→RISK→ROA | 0.044 | 0.454 | −0.17 | 0.601 | 0.056 *** | 0.005 |

| BH→RISK→ROA | 0.195 ** | 0.022 | −341 | 0.100 | 0.175 | 0.614 |

| REM→RISK→ROA | −122 | 0.104 | −0.83 | 0.321 | −0.36 | 0.307 |

| BS→RISK→ROA | 0.067 | 0.340 | −193 | 0.200 | 0.261 | 0.110 |

| BI→RISK→ROA | 0.117 | 0.136 | 0.275 *** | 0.001 | −169 | 0.133 |

| ACI→RISK→ROA | 0.015 | 0.862 | −0.78 | 0.218 | 0.109 | 0.342 |

| DUO→RISK→ROA | −119 | 0.177 | −0.44 | 0.456 | 0.009 | 0.628 |

| MO→RISK →ROE | −0.12 | 0.869 | −045 | 0.386 | 0.006 | 0.747 |

| IO→RISK→ROE | 0.079 | 0.375 | 0.089 | 0.257 | −0.37 | 0.150 |

| GO→RISK→ROE | 0.283 | 0.102 | 0.141* | 0.078 | −0.09 | 0.379 |

| FO→RISK→ROE | 0.129 ** | 0.023 | 0.099 *** | 0.005 | 0.024 ** | 0.017 |

| BH→RISK→ROE | 0.313 *** | 0.000 | −354 | 0.100 | 0.075 | 0.120 |

| REM→RISK→ROE | 0.009 | 0.898 | 0.029 | 0.631 | −0.15 | 0.317 |

| BS→RISK→ROE | −0.66 | 0.299 | −178 | 0.900 | 0.112 | 0.210 |

| BI→RISK→ROE | 0.184 ** | 0.016 | 0.245 *** | 0.001 | −072 | 0.210 |

| ACI→RISK→ROE | 0.066 | 0.420 | 0.039 | 0.591 | 0.047 | 0.140 |

| DUO→RISK→ROE | −212 | 0.130 | −115 | 0.154 | 0.004 | 0.637 |

| MO→RISK→EPS | −0.39 | 0.583 | −0.84 | 0.130 | 0.002 | 0.775 |

| IO→RISK→EPS | 0.105 | 0.243 * | 0.077 | 0.352 | −014 | 0.288 |

| GO→RISK→EPS | 0.231 | 0.900 | 0.000 *** | 0.000 | −004 | 0.599 |

| FO→RISK→EPS | 0.040 | 0.482 | 0.022 | 0.518 | 0.009 | 0.288 |

| BH→RISK→EPS | 0.263*** | 0.002 | 0.236 ** | 0.017 | 0.029 | 0.285 |

| REM→RISK→EPS | 0.028 | 0.698 | 0.041 | 0.612 | −0.06 | 0.528 |

| BS→RISK→EPS | −0.59 | 0.356 | −102 | 0.175 | 0.043 | 0.285 |

| BI→RISK→EPS | 0.288 *** | 0.000 | 0.295 *** | 0.001 | −0.28 | 0.285 |

| ACI→RISK→EPS | 0.157 * | 0.057 | 0.145 * | 0.050 | 0.018 | 0.287 |

| DUO→RISK→EPS | −125 | 0.147 | 0.030 | 0.677 | 0.002 | 0.733 |

| PATH | Direct Effect without Mediator (Estimate) | Direct Effect without Mediator (p-Value) | Direct Effect with Mediator (Estimate) | Direct Effect with Mediator (p-Value) | Indirect Effect (Estimate) | Indirect Effect (p-Value) |

|---|---|---|---|---|---|---|

| MO→RISK→ROA | 0.136 ** | 0.014 | 0.079 | 0.395 | 0.057 ** | 0.024 |

| IO→RISK→ROA | −007 *** | 0.009 | −105 | 0.498 | 0.112 | 0.130 |

| GO→RISK→ROA | −042 *** | 0.007 | 0.056 | 0.340 | −104 | 0.240 |

| FO→RISK→ROA | 0.055 * | 0.023 | −172 | 0.910 | 0.117 | 0.159 |

| BH→RISK→ROA | 0.080 *** | 0.005 | −131 | 0.447 | 0.213 *** | 0.001 |

| REM→RISK→ROA | −173 ** | 0.044 | −083 | 0.444 | −090 | 0.241 |

| BS→RISK→ROA | −063 | 0.370 | −061 | 0.379 | −003 | 0.878 |

| BI→RISK→ROA | −067 | 0.425 | 0.088 | 0.376 | 0.022 | 0.350 |

| ACI→RISK→ROA | 0.022 | 0.830 | −019 | 0.802 | 0.041* | 0.081 |

| DUO→RISK→ROA | 0.035 | 0.665 | 0.054 | 0.566 | −019 | 0.442 |

| MO→RISK→ROE | 0.219 | 0.128 | 0.194 ** | 0.041 | 0.024 | 0.107 |

| IO→RISK→ROE | 0.091 | 0.449 | 0.043 | 0.781 | 0.048 * | 0.093 |

| GO→RISK→ROE | 0.027 | 0.690 | 0.066 | 0.155 | −044 | 0.104 |

| FO→RISK→ROE | −008 | 0.926 | −058 | 0.437 | 0.050 * | 0.084 |

| BH→RISK→ROE | −262 | 0.570 | −351 | 0.304 | 0.091 * | 0.085 |

| REM→RISK→ROE | −072 | 0.400 | −034 | 0.769 | −039 | 0.805 |

| BS→RISK→ROE | −067 | 0.343 | −066 | 0.346 | −001 | 0.851 |

| BI→RISK→ROE | 0.032 | 0.703 | 0.023 | 0.823 | 0.009 | 0.386 |

| ACI→RISK→ROE | −050 | 0.565 | 0.039 | 0.482 | 0.018 | 0.508 |

| DUO→RISK→ROE | 0.026 | 0.748 | −115 | 0.667 | −008 | 0.160 |

| MO→RISK→EPS | 0.140 | 0.113 | −084 | 0.184 | 0.016 | 0.269 |

| IO→RISK→EPS | 0.140 | 0.240 | −108 | 0.374 | 0.032 | 0.255 |

| GO→RISK→EPS | −020 | 0.771 | 0.000 *** | 0.000 | −030 | 0.269 |

| FO→RISK→EPS | 0.005 | 0.952 | −029 | 0.665 | 0.033 | 0.249 |

| BH→RISK→EPS | −074 | 0.577 | −131 | 0.315 | 0.061 | 0.249 |

| REM→RISK→EPS | 0.185 *** | 0.028 | −161 | 0.506 | −026 | 0.248 |

| BS→RISK→EPS | 0.016 | 0.813 | 0.017 | 0.775 | −001 | 0.861 |

| BI→RISK→EPS | −204 | 0.130 | −209 | 0.404 | 0.006 | 0.512 |

| ACI→RISK→EPS | 0.025 | 0.771 | 0.013 | 0.915 | 0.012 | 0.306 |

| DUO→RISK→EPS | −138 * | 0.086 | −134 | 0.181 | −005 | 0.596 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rehman, H.; Ramzan, M.; Haq, M.Z.U.; Hwang, J.; Kim, K.-B. Risk Management in Corporate Governance Framework. Sustainability 2021, 13, 5015. https://doi.org/10.3390/su13095015

Rehman H, Ramzan M, Haq MZU, Hwang J, Kim K-B. Risk Management in Corporate Governance Framework. Sustainability. 2021; 13(9):5015. https://doi.org/10.3390/su13095015

Chicago/Turabian StyleRehman, Hania, Muhammad Ramzan, Muhammad Zia Ul Haq, Jinsoo Hwang, and Kyoung-Bae Kim. 2021. "Risk Management in Corporate Governance Framework" Sustainability 13, no. 9: 5015. https://doi.org/10.3390/su13095015

APA StyleRehman, H., Ramzan, M., Haq, M. Z. U., Hwang, J., & Kim, K.-B. (2021). Risk Management in Corporate Governance Framework. Sustainability, 13(9), 5015. https://doi.org/10.3390/su13095015