Competency-Industry Relatedness (C-IR) Framework for Sustained Business Growth in Startups during and Beyond Pandemic: Myths and Lessons from Publicly Funded Innovative Startups

Abstract

1. Introduction

2. Theoretical Background

2.1. Startups Success Rate during the Pandemic

2.2. Startups during a Pandemic

3. Research Methodology

3.1. Case Study with Five Startups

3.2. Validation of Case Study Findings through Survey

3.3. Case Study of 36 EU-Funded Startups

- (a)

- Official website information is detailed, with useful insight: information on official websites was considered more accurate than that available on LinkedIn. The dataset was populated with the information from the official website only.

- (b)

- Official website information is too limited to bring any useful insight: LinkedIn information was considered more accurate than the official website information. The dataset was populated with the information from the LinkedIn profile only.

4. Dataset

- (a)

- Startup establishment year.

- (b)

- Startup founder’s background.

- (c)

- Primary industry served before COVID-19.

- (d)

- Team size and competencies.

- (e)

- Product line and nature of COVID-19 related products launched.

5. Seven Commonly Held Beliefs Amongst Startups

6. Real Facts

- ○

- Content Flow GmBH (established in 2015) did not diversify into new markets, but rather found applicability for its live streaming platform as a solution for COVID-19 challenges.

- ○

- Avy B.V. (established in 2016) proposed the applicability of its unmanned aerial vehicle (UAV) “drone” to provide urgent medical deliveries using drones.

- ○

- COVID-19 Telemedicine ApS (founded in 2020) launched a “remote patient monitoring system”, which seemed to have high applicability during the COVID-19 pandemic (and will have high applicability in future epidemics). The objective was to screen and monitor patients through online tools. This startup was born during the COVID-19 pandemic period by providing an effective solution.

- ○

- NanoScent Ltd. (Established in 2017) diversified into a new product, which can detect COVID-19 in just 30 s. Their diversification was possible as they utilize scent technology as their strategic asset.

- ○

- moveUP.care (established in 2015) serves the medical industry. The founder hash experience in engineering and management.

- ○

- Virogates AS (established in 2001) serves the medical industry. The founder has a rich background in management.

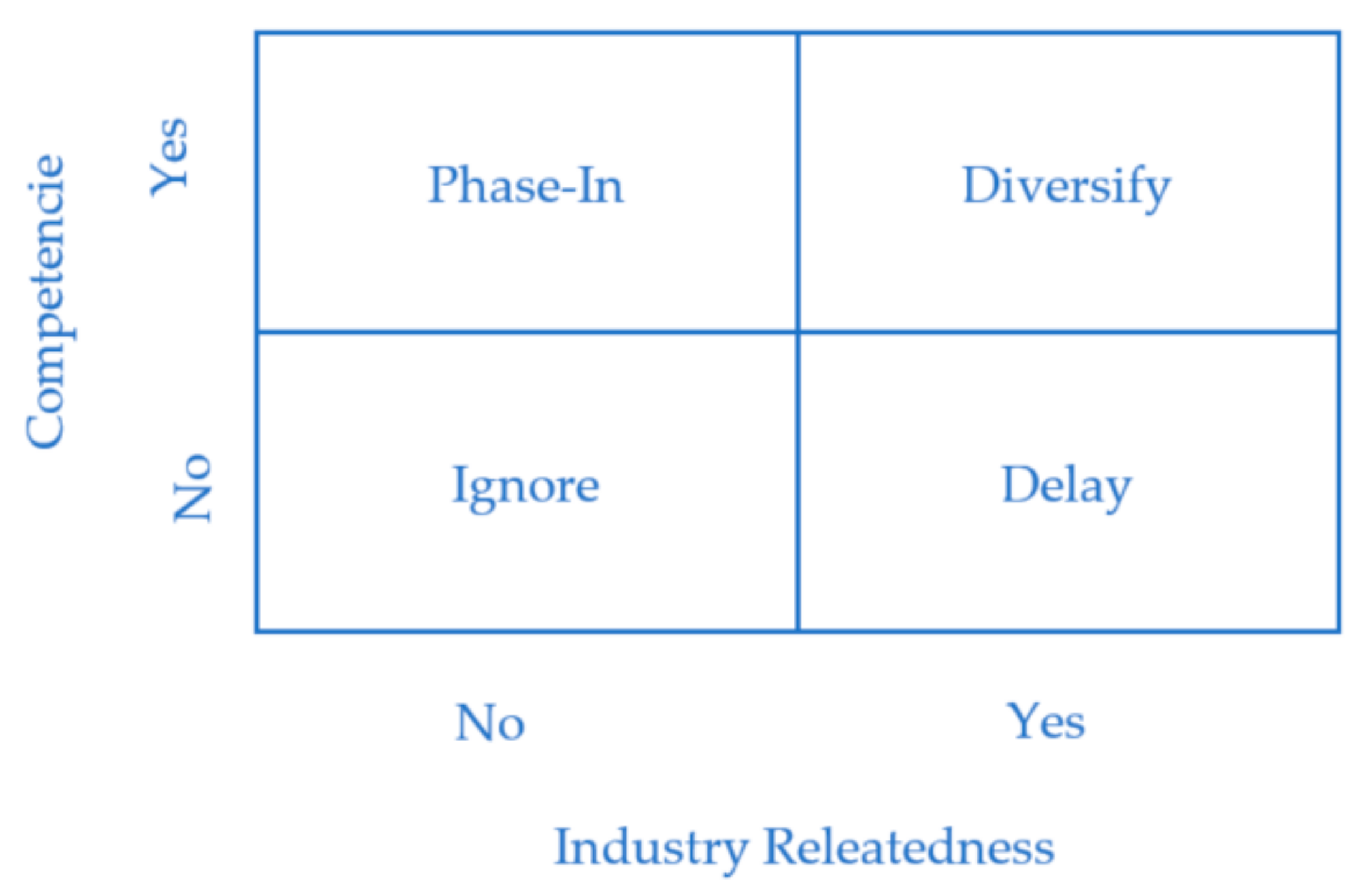

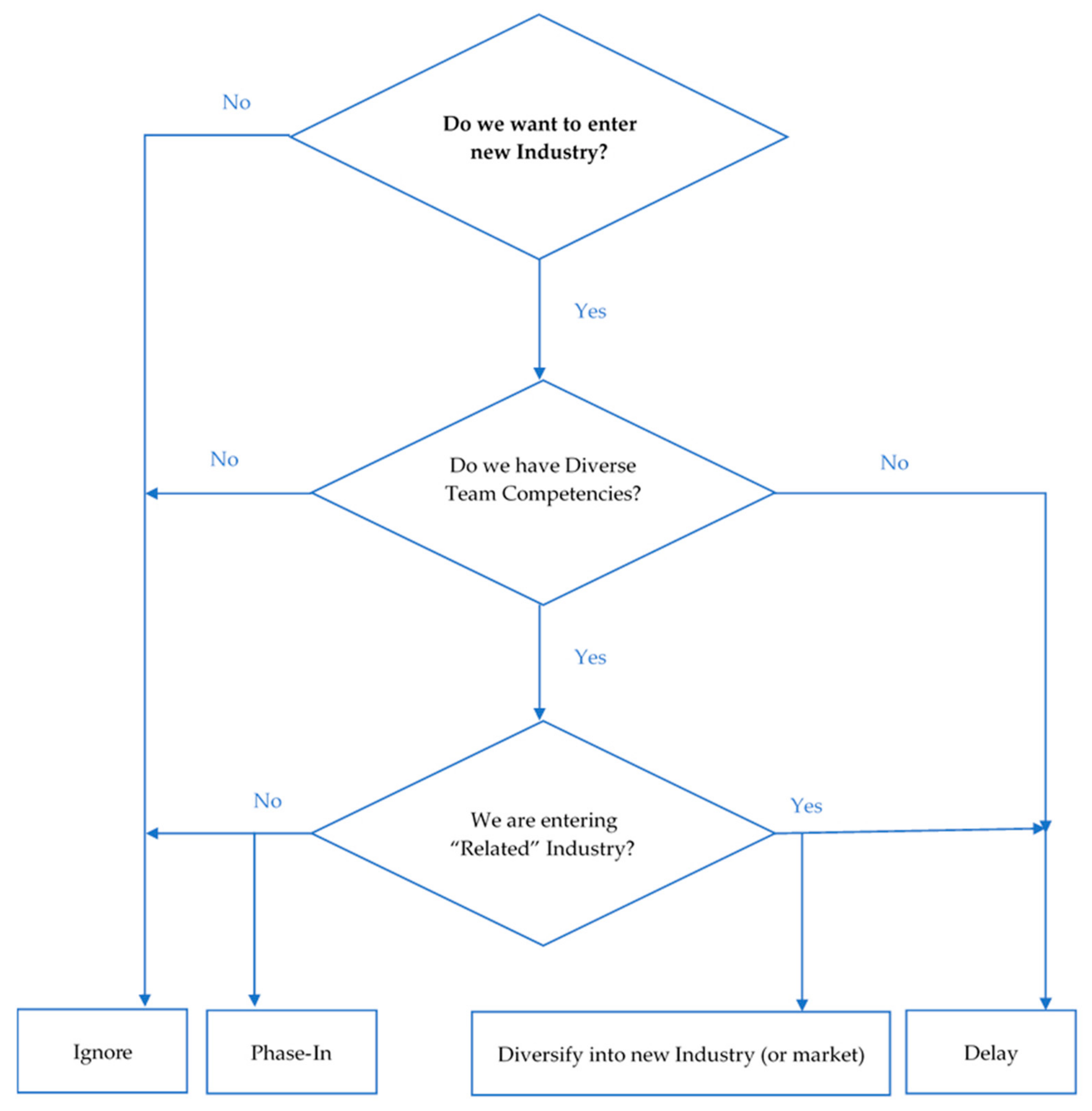

7. Implications for Managers

- ○

- Diverse team competencies: this element signifies that the startup should have diverse expertise at management, technical, and application domain levels (of the proposed product).

- ○

- Industry relatedness: this element signifies whether the startup is targeting the new industry that is closely related to its primary (existing) industry served by it, in terms of available technology and/or similar products in the product lines. Industry relatedness is composed of two elements:

- ○

- Applicability of “owned” technology: this element signifies whether the startup has ownership of the technology, which has applicability in the new industry that is under consideration by the startup.

- ○

- Applicability of existing products: this element signifies whether the startup already have products in its product lines that has applicability, directly or indirectly (through adaption), as a solution to the problem pertaining to the new industry under consideration.

- Ignore: this option suggests ignoring diversification. However, if a company chooses diversification, low competencies, and low relatedness between industries will incur high risks and a need for a large amount of financing.

- Delay: this option suggests delaying the diversification-related decisions for the time being. However, if a company chooses to take diversification, low competencies, and high relatedness between industries, it can incur medium risks and a need for a large amount of financing. For instance, a company may lack competency, but may have a patented technology that could find application in a new industry. Costs will be high because they may need to hire a new team, but procession of intellectual property, or a new product (that could be adapted to new markets) absorb the diversification risks. Low competencies signify that the company is not offering a product in the growth or mature stage of the product’s life cycle.

- Phase-in: this option suggests taking diversification in small increments. This decision, because of high competencies, but low relatedness between industries, would incur medium risks and the need for a medium amount of financing.

- Diversify: this option suggests diversification decisions because the company has both competencies and “relatedness” between industries. This option is the least risky and requires less financing.

8. Limitations of the Work

9. Conclusions and Future Work

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Section I (Informed Consent) |

|---|

| The objective of this survey is to validate the findings about the commonly held beliefs amongst the startups during a pandemic that impacts their business decisions. The participation is voluntary; however, your perspectives will be very helpful to make real contributions for boosting startup success rates. The data provided by you will only be used as aggregated responses of the survey and individual details will never be disclosed. |

| Section II (Participant Data) |

| Please provide your brief details, which will help us to analyze differences in perspectives among the cohort. |

What is your age?

|

| Section III |

| Myth 1: large team size helps the startups grow in the market. Remember strongly agree = 5, agree = 4, neither agree nor disagree = 3, disagree = 2, strongly disagree = 1. |

Have you conducted business expansion (scaling) decision based on your team size?

|

| Section IV |

| Myth 2: it is a good idea to diversify into markets with increased demand during a pandemic. Remember strongly agree = 5, agree = 4, neither agree nor disagree = 3, disagree = 2, strongly disagree = 1. |

Do you get motivated to launch a new product in an industry that shows increasing demand trends?

|

| Section V |

| Myth 3: pivoting is in the startup DNA and this will be a catalyst for turning COVID-19 into an opportunity. Remember strongly agree = 5, agree = 4, neither agree nor disagree = 3, disagree = 2, strongly disagree = 1. |

Do you feel pivots are a safe option to tackle fluctuating demand during the COVID-19 pandemic?

|

| Section VI |

| Myth 4: funding is too scarce during a pandemic. It is impossible to attract good funding. Remember strongly agree = 5, agree = 4, neither agree nor disagree = 3, disagree = 2, strongly disagree = 1. |

Do you reduce your efforts to attract new funding because of the pandemic?

|

| Section VII |

| Myth 5: alignment of the startup founder background with the new industry expertise requirements (industry where startup identified business opportunities) fosters strategic decision success in highly uncertain circumstances, especially a pandemic. Remember strongly agree = 5, agree = 4, neither agree nor disagree = 3, disagree = 2, strongly disagree = 1. |

Do you prefer to launch products in the industry that matches your domain expertise?

|

| Section VIII |

| Myth 6: availability of a large team of diverse skills is the only prerequisite to survive or grow in the markets during a pandemic. Remember strongly agree = 5, agree = 4, neither agree nor disagree = 3, disagree = 2, strongly disagree = 1. |

Do you feel that your business will survive turbulent market fluctuations if you have a big team with diverse expertise?

|

| Section IX |

| Myth 7: the growing startups usually have a single product in the market, and diversification (offering more products in product lines) is the reason for failure. Remember strongly agree = 5, agree = 4, neither agree nor disagree = 3, disagree = 2, strongly disagree = 1. |

Do you feel that startups should concentrate solely on a single product?

|

Appendix B

| Startup Information | Dataset Column Title | Usefulness |

|---|---|---|

| Establishment year | Year of Establishment | To understand if the startup is a new entry during COVID-19 or if it existed before. If it existed before, then how much experience did it have in the market? |

| Founder background | Founder Background (Except Entrepreneurship) | The founder has strong entrepreneurship experience. It helps to analyze the influence of the founder‘s background on the innovativeness of the startup. Innovativeness is evident from the startup’s ability to gain EU funding, i.e., their solutions are perceived innovative enough to tackle the COVID-19 pandemic. |

| Primary industry served | Primary Industry (Before COVID-19) | To evaluate if a startup diversified into a different industry during COVID-19, relative to the one served by its product line before the pandemic. |

| Team size and competencies |

| To analyze if the team competencies were strategic assets for these startups. In other words, the procession of the management, engineering, and application domain competencies helped startups find business opportunities during a pandemic. |

| Product line and nature of COVID-19 related products launched |

| This helps to analyze if startups launched a new product during COVID-19 or the launching is to be done in the future. In particular, if the startup diversified by launching a new product (compared to its original product line), adapted an existing product, launched a completely new product (new market entry of startup), or pivoted the business model. This is meaningful to analyze whether the startups have technology or existing solutions that have potential to form the basis for the pandemic solutions or just an excellent idea. |

| Development/manufacturing location | Software Development/Product Manufacturing Location (In-House of Third Parties) | To analyze if a startup preferred to have software development (for software products) or manufacturing (for hardware devices) in-house or through third parties. This helps to make an analysis if the procession of development/manufacturing experience helped the startups find COVID-19-related solutions feasible to be implemented. |

Appendix C

| Dataset Column Title | Data Types | Meaning |

|---|---|---|

| Year of Establishment | Number | Year the startup was founded. |

| Founder Background Except Entrepreneurship) | Text | Academic background of the founder (except entrepreneurship) |

| Primary Industry (Before COVID-19) | Text | The primary industry served by startup product lines (before COVID-19). |

| Team Size | Number | Size of the team (except advisor boards, etc.) |

| Corporate Management | Boolean | Team responsible for making corporate strategies. |

| Engineering/Technology (Software Engineers) | Boolean | Team responsible for engineering the software. The rationale is that software is the main component of innovative systems these days. |

| Application Domain Engineers | Boolean | Team responsible for engineering the product (even if it is a non-software product). |

| Business/Functional Management | Boolean | Team responsible for making business and functional strategies. |

| Product or Service | Text | The startup deals with delivery of the product or service in the market. |

| Existing Product Adapted | Boolean | If the startup adapted existing products to provide solutions to COVID-19-related problems. |

| Diversification (New Product) | Boolean | If the startup launched a new product (apart from the existing products of its product lines) as a solution to the COVID-19 related problems. |

| New Product Launch | Boolean | The startup is a new entrant to the market during the pandemic, with a solution to COVID-19 related problems. |

| Pivot Made (During COVID-19) | Boolean | The startup modified its business model (especially value proposition) to tackle COVID-19 opportunities rather than one formulated to execute another business idea. |

| Products/services | Text | Existing products in the product lines or details of the services offered in the market. |

| Software Development/Product Manufacturing location In-house of third parties) | Text | If the software development of product manufacturing happens in-house or through third parties. This is a “make or buy” or “in-house or outsource” decision. |

References

- Start-Up Procedures. Available online: https://ec.europa.eu/growth/smes/sme-strategy/start-up-procedures_en (accessed on 12 March 2021).

- Coronavirus: EU Grants €314 Million to Innovative Companies to Combat the Virus and Support Recovery. 2020. Available online: https://ec.europa.eu/commission/presscorner/detail/en/ip_20_1007 (accessed on 12 February 2021).

- Blank, S. What’s A Startup? First Principles. 2010. Available online: https://steveblank.com/2010/01/25/whats-a-startup-first-principles/ (accessed on 12 March 2021).

- Available online: https://hoop.co.uk/ (accessed on 31 December 2020).

- Guillen, M.F. How Businesses Have Successfully Pivoted during the Pandemic. Harvard Business Review. 2020. Available online: https://hbr.org/2020/07/how-businesses-have-successfully-pivoted-during-the-pandemic (accessed on 18 February 2021).

- Kuckertz, A.; Brändle, L.; Gaudig, A.; Hinderer, S.; Reyes, C.A.M.; Prochotta, A.; Steinbrink, K.; Berger, E.S. Startups in times of crisis—A rapid response to the COVID-19 pandemic. J. Bus. Ventur. Insights 2020, 13, e00169. [Google Scholar] [CrossRef]

- Namatovu, R.; Larsen, M.M. Responding to COVID-19: Insights from African firms. Afr. J. Manag. 2021, 7, 104–120. [Google Scholar] [CrossRef]

- Maritz, A.; Perenyi, A.; De Waal, G.; Buck, C. Entrepreneurship as the unsung hero during the current COVID-19 economic crisis: Australian perspectives. Sustainability 2020, 12, 4612. [Google Scholar] [CrossRef]

- Why Startups Fail. Lessons from 150 Founders. Available online: https://www.wilburlabs.com/blueprints/why-startups-fail (accessed on 14 March 2021).

- State of the Global Startup Economy. Available online: https://startupgenome.com/article/state-of-the-global-startup-economy (accessed on 14 March 2021).

- Bhooshan, N.; Kumar, A. How did Agri-start-ups fare during the COVID-19 pandemic? Econ. Political Wkly. 2020, 55, 13–17. [Google Scholar]

- Brown, R.; Rocha, A. Entrepreneurial uncertainty during the Covid-19 crisis: Mapping the temporal dynamics of entrepreneurial finance. J. Bus. Ventur. Insights 2020, 14, e00174. [Google Scholar] [CrossRef]

- Kuckertz, A. Standing up against crisis-induced entrepreneurial uncertainty: Fewer teams, more habitual entrepreneurs. Int. Small Bus. J. 2021. [Google Scholar] [CrossRef]

- Salamzadeh, A.; Dana, L.P. The coronavirus (COVID-19) pandemic: Challenges among Iranian startups. J. Small Bus. Entrep. 2020, 1–24. [Google Scholar] [CrossRef]

- List of Companies Selected for EIC Funding. 2020. Available online: https://ec.europa.eu/info/funding-tenders/opportunities/docs/cap/h2020/eic-smeinst-2018-2020/1895120-eic_list_for_public_20200320accelerator_en.pdf (accessed on 12 February 2021).

- Runeson, P.; Höst, M. Guidelines for conducting and reporting case study research in software engineering. Empir. Softw. Eng. 2009, 14, 131–164. [Google Scholar] [CrossRef]

- Gupta, V.; Fernandez-Crehuet, J.; Gupta, C.; Hanne, T. Freelancing models for fostering innovation and problem solving in software startups: An empirical comparative study. Sustainability 2020, 12, 10106. [Google Scholar] [CrossRef]

- Gupta, V.; Fernandez-Crehuet, J.; Hanne, T. Fostering continuous value proposition innovation through freelancer involvement in software startups: Insights from multiple case studies. Sustainability 2020, 12, 8922. [Google Scholar] [CrossRef]

- Gupta, V.; Fernandez-Crehuet, J.M.; Hanne, T.; Telesko, R. Fostering product innovations in software startups through freelancer supported requirement engineering. Results Eng. 2020, 8, 100175. [Google Scholar] [CrossRef]

- Gupta, V.; Fernandez-Crehuet, J.; Gupta, C. Startups Against Covid; Harvard Dataverse. 2021. Available online: https://doi.org/10.7910/DVN/L88OOB (accessed on 20 March 2021).

- Gupta, V.; Fernandez-Crehuet, J.M. Book Review on “Networks, SMEs, and the university: The process of collaboration and open innovation. Int. Small Bus. J. Res. Entrep. 2021, 1–3. [Google Scholar] [CrossRef]

| Reference | Threats/Findings | Response to Pandemic (Marketing View) |

|---|---|---|

| [3] | Liquidity, long-term survival, declining demand, funding, limited support from innovation ecosystems. | New products or services solving new customer problems. |

| [11] | Liquidity, funding, and declined product demand. | Product tailoring, technology modification, and long-term growth potential investments. |

| [12] | Limited financing for fostering entrepreneurial activities. | - |

| [13] | Habitual entrepreneurs dominate entrepreneurial team establishments. | - |

| [14] | Human resource management, market related, finance related, support from innovation ecosystem, crisis management skills, challenges in meeting current obligations towards customers, and the need to adapt business models | - |

| S. No. | Startup Name | Country | Market Growth | Number of Employees (Team Size) | Management People Interviewed | Industry Served | Change in Business (During COVID-19) |

|---|---|---|---|---|---|---|---|

| 1. | A | Italy | About to turn into company | 8 | 4 | Social sector | No. |

| 2. | B | India | 7 | 3 | Financial | No. | |

| 3. | C | France | 12 | 4 | Education | No. | |

| 4. | D | India | Initial Growth | 09 | 2 | Education | No. |

| 5. | E | Switzerland | 10 | 3 | Medical | No. |

| Parameter | Number | Percentage (%) |

|---|---|---|

| Age | ||

| 21–25 | 20 | 19.61 |

| 26–30 | 40 | 39.22 |

| 31–35 | 30 | 29.41 |

| 35+ | 12 | 11.76 |

| Continent | ||

| Europe | 30 | 29.41 |

| Asia | 25 | 24.51 |

| America | 20 | 19.61 |

| Africa | 17 | 16.67 |

| Australia | 10 | 9.80 |

| Gender | ||

| Male | 60 | 58.82 |

| Female | 42 | 41.18 |

| Prefer not to say | Nil | 0.00 |

| Domain | ||

| Engineering | 21 | 20.59 |

| Medical | 20 | 19.61 |

| Business Management | 19 | 18.63 |

| Interdisciplinary | 40 | 39.22 |

| Other | 02 | 1.96 |

| Variable Measured | Statement/Question | Strongly Agree (%) | Agree (%) | Neither Agree nor Disagree (%) | Disagree (%) | Strongly Disagree (%) | Mean | Overall Mean |

|---|---|---|---|---|---|---|---|---|

| Myth 1: large team size helps startups grow in the market. | Have you conducted business expansion (scaling) decision based on your team size? | 52.2 | 26.5 | 6.2 | 3.5 | 1.8 | 3.95 | 3.92 |

| To make internationalization decisions, or diversification decisions, do you consider your team size as one of the internal competencies? | 51.3 | 25.7 | 5.3 | 6.2 | 1.8 | 3.89 | ||

| Myth 2: it is a good idea to diversify into markets with increased demand during a pandemic. | Do you get motivated to launch a new product in an industry that shows increasing demand trends? | 69.0 | 20.4 | 0.0 | 0.0 | 0.9 | 4.27 | 4.18 |

| Is customer demand being the main basis when it comes to making strategic decisions? | 63.7 | 18.6 | 2.7 | 2.7 | 2.7 | 4.09 | ||

| Myth 3: pivoting is in the startup DNA and this will be a catalyst for turning COVID-19 into an opportunity. | Do you feel pivots are a safe option to tackle fluctuating demand during the COVID-19 pandemic? | 57.5 | 23.0 | 2.7 | 3.5 | 3.5 | 3.98 | 3.94 |

| Do you feel comfortable to make frequent pivots to improve business conditions during the COVID-19 pandemic? | 53.1 | 23.9 | 5.3 | 4.4 | 3.5 | 3.89 | ||

| Myth 4: funding is scarce during a pandemic. It is impossible to attract good funding. | Do you reduce your efforts to attract new funding because of the pandemic? | 55.8 | 31.0 | 3.5 | 0.0 | 0.0 | 4.13 | 4.12 |

| Are your business decisions affected because you feel that funding is hard to receive during a pandemic? | 55.8 | 30.1 | 2.7 | 0.9 | 0.9 | 4.10 | ||

| Myth 5: alignment of the startup founder’s background with the new industry expertise requirements (industry where the startup identified business opportunities), fosters strategic decision success in highly uncertain circumstances, especially during a pandemic. | Do you prefer to launch products in the industry that matches your domain expertise? | 61.9 | 19.5 | 2.7 | 0.0 | 6.2 | 4.02 | 4.09 |

| Do you avoid diversifying into “unrelated” industries (different from your background)? | 61.1 | 24.8 | 3.5 | 0.9 | 0.0 | 4.17 | ||

| Myth 6: availability of a large team of diverse skills is the only prerequisite to survive or grow in the market during a pandemic. | Do you feel that your business will survive turbulent market fluctuations if you have a big team with diverse expertise? | 45.1 | 34.5 | 7.1 | 1.8 | 1.8 | 3.90 | 3.95 |

| Do you think that team size and diverse skills are the main criteria for strategic business decisions? | 52.2 | 29.2 | 5.3 | 1.8 | 1.8 | 3.99 | ||

| Myth 7: the growing startups usually have a single product in the market and diversification (offering more products in the product line) is the reason for failure. | Do you feel that startups should concentrate solely on a single product? | 52.2 | 26.5 | 6.2 | 3.5 | 1.8 | 3.95 | 3.92 |

| Do you feel that, as a startup, you avoid launching another product, when you are already scaling up? | 51.3 | 25.7 | 5.3 | 6.2 | 1.8 | 3.89 |

| Myths | Success Factors | When to Diversify |

|---|---|---|

| Myth 1: large team size helps startups grow in the market. | Human resources | Your team has the right skill sets that are required to diversify in new markets. |

| Myth 2: it is a good idea to diversify into markets with increased demand during a pandemic. | Intellectual resources | Only if the industry is “related” to your existing industry where you operate, so that you can reuse your skill sets, experiences, and knowledge, and take advantage of your technologies. |

| Myth 3: pivoting is in a startup’s DNA and this will be a catalyst for turning COVID-19 into an opportunity. | Human, intellectual, and financial resources | Pivot only if the industry is related and the team has the right skills. |

| Myth 4: funding is scarce during a pandemic. It is impossible to attract good funding. | Financial resources | Not a criterium for diversification if the industry is related and the team has the right skills. |

| Myth 5: alignment of the startup founder’s background with the new industry expertise requirements (the industry where the startup identified business opportunities) fosters strategic decision success in highly uncertain circumstances, especially during a pandemic. | Human resources | Focus on your team’s existing competencies that best match those required by the industry where you are diversifying. |

| Myth 6: availability of a large team of diverse skills is the only prerequisite to survive (or grow) in the market during a pandemic. | Human resources | Do not judge diversity of skills based on quantity. Diversify if you have diverse skills possessed by even a small size team. |

| Myth 7: growing startups usually have a single product on the market and diversification (offering more products in product lines) is the reason for failure. | Human, intellectual, and financial resources | Diversify into related industries. |

| Option | If Diversification Decision Is Made | Diversification Decision in Pandemic | |

|---|---|---|---|

| Cost | Risk | ||

| Ignore | Too high | Too high | Ignore it completely. |

| Delay | High | Medium | Delay for time being. |

| Phase-In | Medium | Medium | Incremental entry. |

| Diversify | Less | Less | Rapid decision. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gupta, V.; Rubalcaba, L. Competency-Industry Relatedness (C-IR) Framework for Sustained Business Growth in Startups during and Beyond Pandemic: Myths and Lessons from Publicly Funded Innovative Startups. Sustainability 2021, 13, 4632. https://doi.org/10.3390/su13094632

Gupta V, Rubalcaba L. Competency-Industry Relatedness (C-IR) Framework for Sustained Business Growth in Startups during and Beyond Pandemic: Myths and Lessons from Publicly Funded Innovative Startups. Sustainability. 2021; 13(9):4632. https://doi.org/10.3390/su13094632

Chicago/Turabian StyleGupta, Varun, and Luis Rubalcaba. 2021. "Competency-Industry Relatedness (C-IR) Framework for Sustained Business Growth in Startups during and Beyond Pandemic: Myths and Lessons from Publicly Funded Innovative Startups" Sustainability 13, no. 9: 4632. https://doi.org/10.3390/su13094632

APA StyleGupta, V., & Rubalcaba, L. (2021). Competency-Industry Relatedness (C-IR) Framework for Sustained Business Growth in Startups during and Beyond Pandemic: Myths and Lessons from Publicly Funded Innovative Startups. Sustainability, 13(9), 4632. https://doi.org/10.3390/su13094632