Harnessing Wind Energy Potential in ASEAN: Modelling and Policy Implications

Abstract

1. Introduction

2. Harnessing Potential Wind Energy

2.1. Prospects

2.2. Drag Factors

2.3. Positive Signs of Harnessing Wind Energy

3. Principles of Wind Energy

3.1. Wind Energy as Kinetic Energy

3.2. Kinetic Energy in a Wind Turbine: Calculation

- Swept area (A) is π x r2 = π × 302

- Wind speed (v) is 9 metres per second (9 m/s)

- Volume of the cylinder (V) is v × A = 9 × π × 302 = 25,447 cubic metres per second

- Density of air (the mass per cubic metre) is 1.29 kg per cubic metre

- Mass of air arriving per second (m) is 1.29 × 25,447 = 32,827 kg per second

- The kinetic energy of a mass m moving with speed v is ½ mv2 = ½ × 32,827 × 92 = 1,329,494 joules per second = 1.33 megawatts (MW).

3.3. Economic Considerations of Wind Energy

- = the cost per unit of electricity generated;

- = the capital cost of the wind farm;

- = the capital recovery factor or the annual capital charge rate (expressed as a fraction);

- = the wind farm annual energy output;

- = the cost of operating and maintaining the wind farm annual output.

- x = the required annual rate of return net of inflation;

- n = the number of years over which the investment in the wind farm is to be recovered.

- h = the number of hours in a year (8760);

- Pr = the rated power of each wind turbine in kilowatts;

- F = the net annual capacity factor of the turbines at the site;

- T = the number of turbines.

- M = the operation and maintenance costs;

- K = the factor representing the annual operating costs of a wind farm as a fraction of the total capital cost.

3.4. Unit or Levelised Costs of Wind Energy

4. Methodology, Assumptions, and Data

4.1. Methodology

4.2. Assumptions

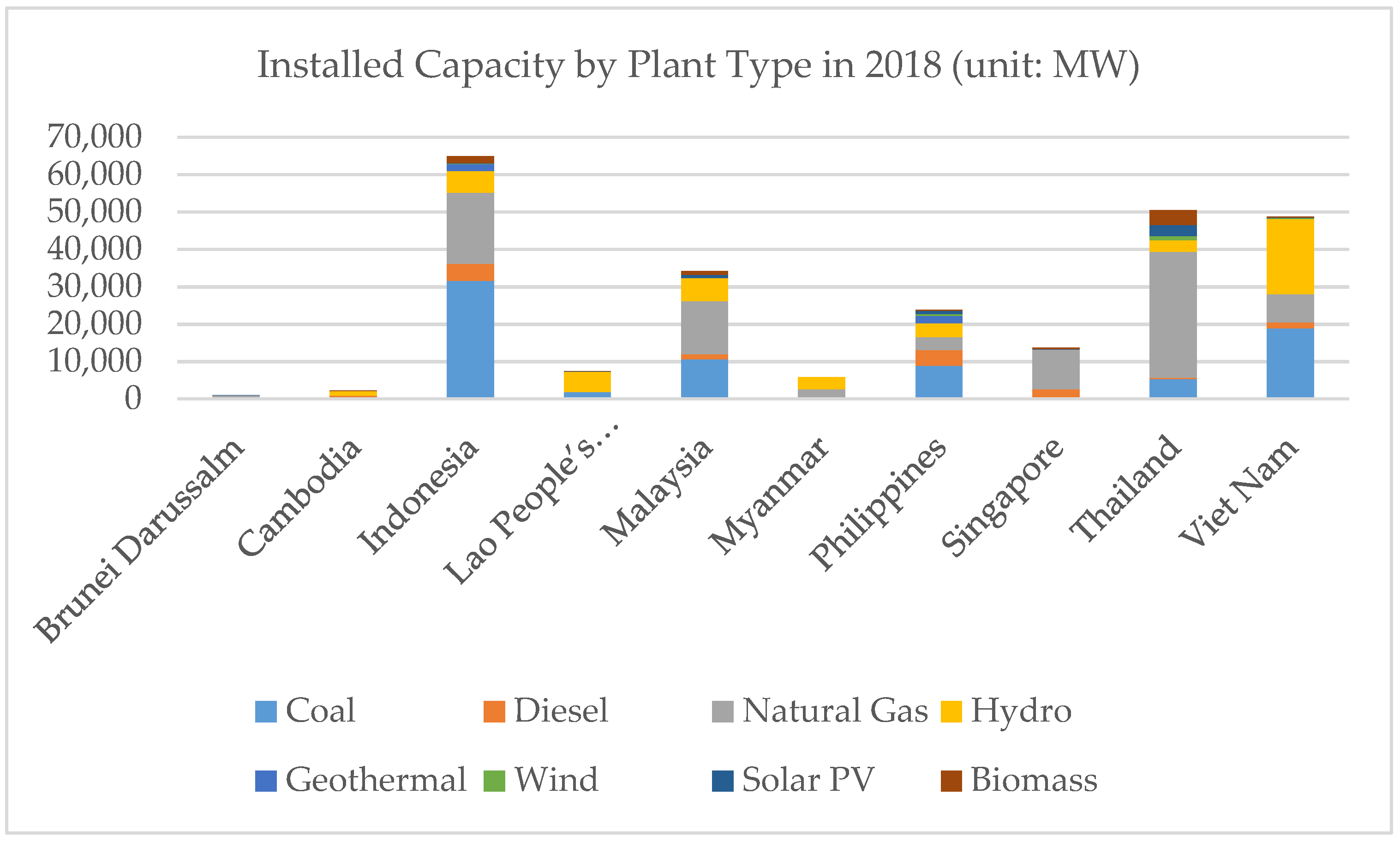

4.3. Data

4.4. Scenarios

5. Results, Discussions, and Policy Implications

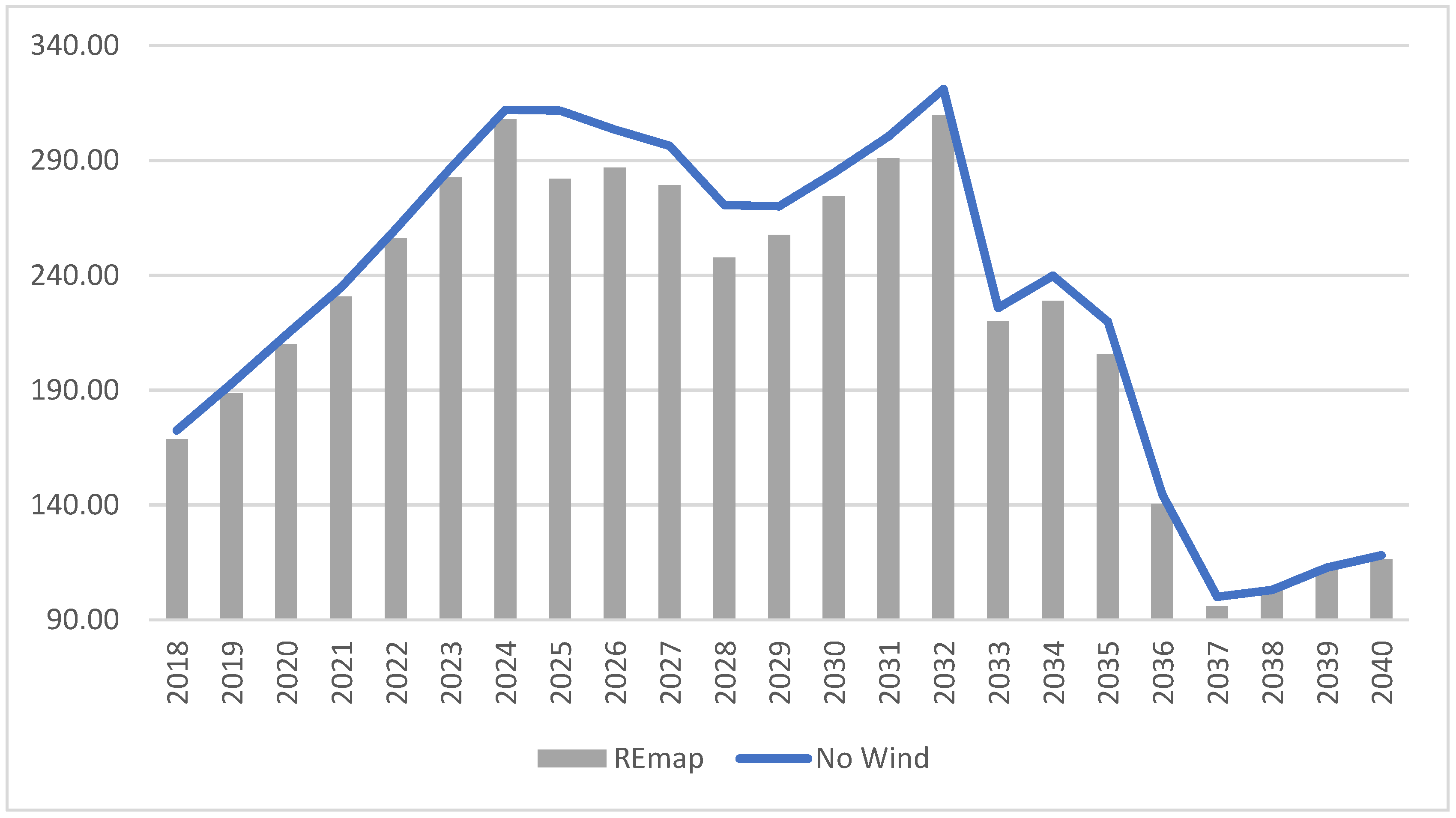

5.1. No Wind Energy

5.1.1. Cost of Electricity Generation in ASEAN Countries

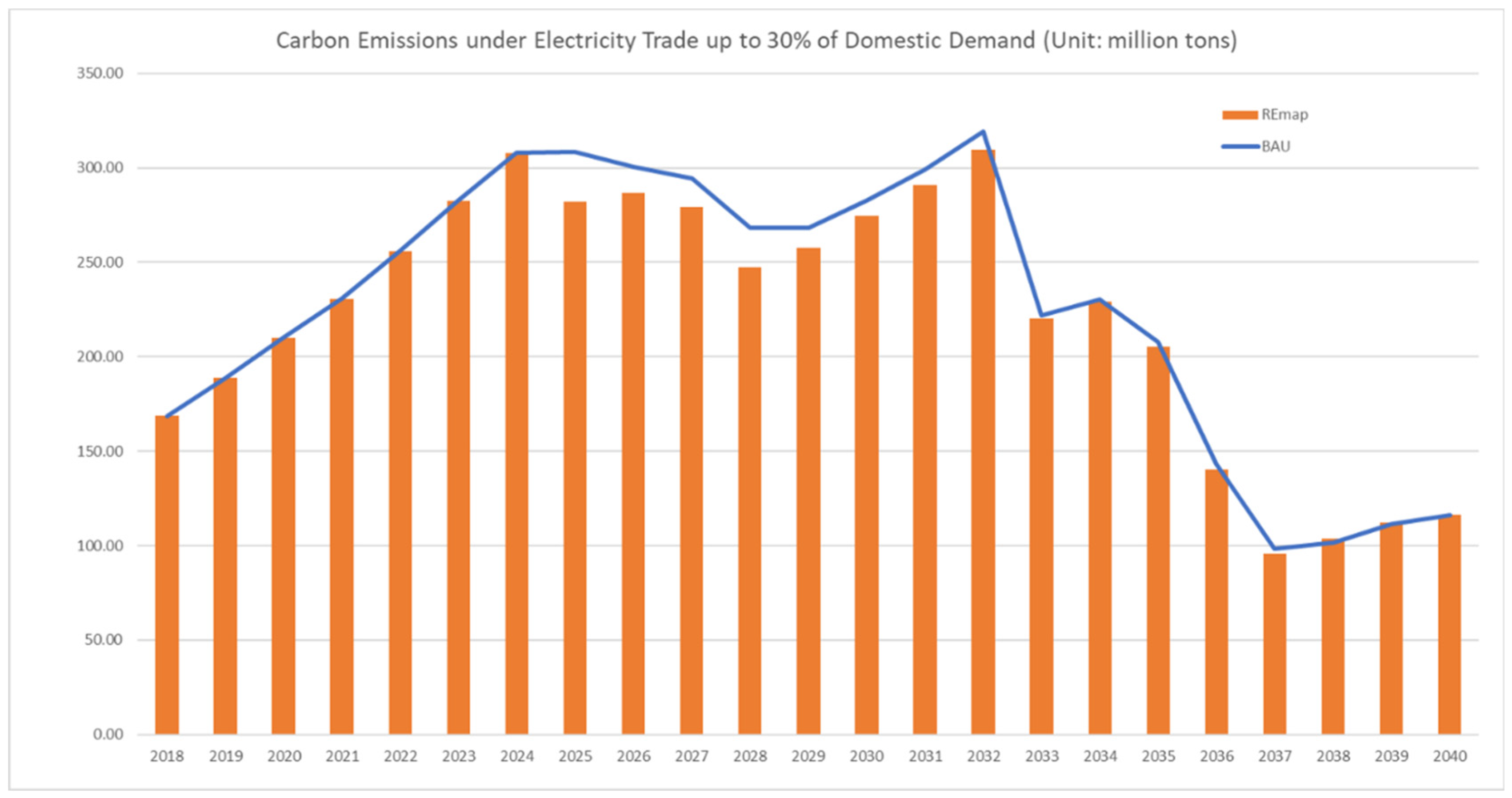

5.1.2. Carbon Emissions

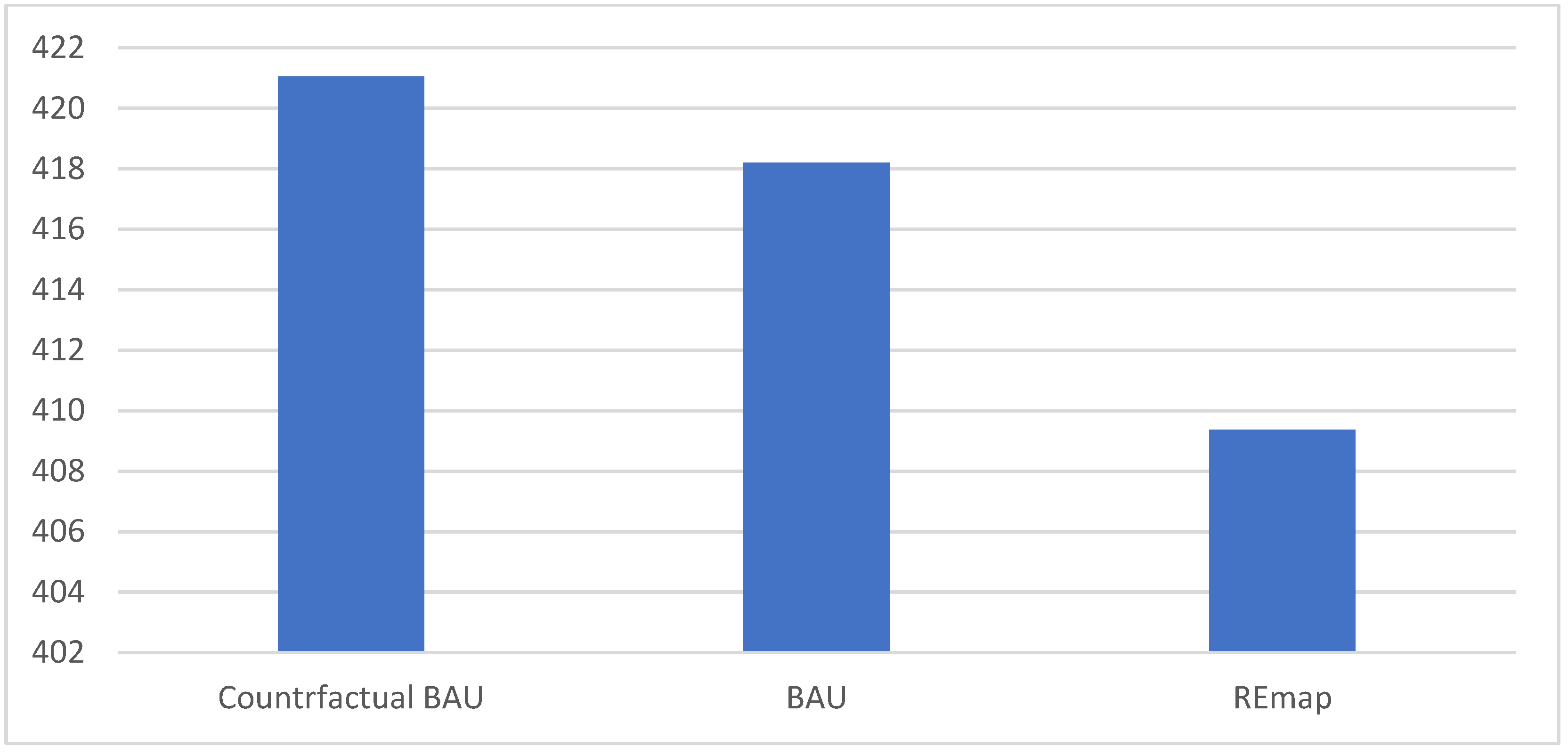

5.2. Actual Business-as-Usual Scenario and REmap Scenario

6. Conclusions and Policy Implications

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix A.1. Model Description

Appendix A.2. CAPEX

Appendix A.3. OPEX

Appendix A.4. Carbon Emissions

Appendix A.5. Cross-Border Transmission Cost

Appendix A.6. Objective Function

Appendix A.7. Constraint Conditions

References

- BP. BP Statistical Review of World Energy 2020; BP: London, UK, 2020. [Google Scholar]

- United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP). Statistical Perspectives: Energy and Development in the ASEAN Region; UNESCAP: Bangkok, Thailand, 2019. [Google Scholar]

- Blazquez, J.; Galeotti, M.; Martin-Moreno, J.M. An Empirical Study on the Drivers of Financial Leverage of Spanish Wind Farms. In OIES Papers, No. EL-40; Oxford Institute for Energy Studies: Oxford, UK, 2020. [Google Scholar]

- Ngo, T.N. Power System and Recent Trends in Wind Energy Development in Vietnam. Singapore International Energy Week: Singapore. Available online: https://static.agora-energiewende.de/fileadmin/user_upload/VIET_presentation_SIEW_2020_final.pdf (accessed on 29 October 2020).

- Minh, H.; Teske, S.; Pescia, D.; Pujantoto, M. Options for Wind Power in Vietnam by 2030. 2020. Available online: https://hal-enpc.archives-ouvertes.fr/hal-02329698v2/document (accessed on 29 October 2020).

- Chang, Y.; Li, Y. Power Generation and Cross-Border Grid Planning for the Integrated ASEAN Electricity Market: A Dynamic Linear Programming Model. Energy Strategy Rev. 2013, 2, 153–160. [Google Scholar] [CrossRef]

- International Renewable Energy Agency (IRENA); ASEAN Centre for Energy (ACE). Renewable Energy Outlook for ASEAN; IRENA: Abu Dhabi, United Arab Emirates, 2019. [Google Scholar]

- Marris, E. Snapshot: Global Wind Power. Nature 2008, 454, 264. [Google Scholar] [CrossRef]

- Lu, X.; McElroy, M.B.; Kiviluoma, J. Global Potential for Wind-Generated Electricity. Proc. Natl. Acad. Sci. USA 2009, 106, 10933–10938. [Google Scholar] [CrossRef] [PubMed]

- Keith, D.W.; DeCarolis, J.F.; Denkenberger, D.C.; Lenshow, D.H.; Malyshev, S.L.; Pacala, S.; Rasch, P.J. The Influence of Large-Scale Wind Power on Global Climate. Proc. Natl. Acad. Sci. USA 2004, 101, 16115–16120. [Google Scholar] [CrossRef] [PubMed]

- Bakos, G.C. Feasibility Study of a Hybrid Wind/Hydro Power-System for Low-Cost Electricity Production. Appl. Energy 2002, 72, 599–608. [Google Scholar] [CrossRef]

- Fairless, D. Energy-Go-Round: How Did a Little Spanish Province Become One of the World’s Wind-Energy Giants? Nature 2007, 447, 1046–1048. [Google Scholar] [CrossRef] [PubMed]

- Vance, E. High Hopes. Nature 2009, 460, 564–566. [Google Scholar] [CrossRef][Green Version]

- Kempton, W.; Pimenta, F.M.; Veron, D.E.; Colle, B.A. Electric Power from Offshore Wind via Synoptic-Scale Interconnection. Proc. Natl. Acad. Sci. USA 2010, 107, 7240–7245. [Google Scholar] [CrossRef] [PubMed]

- Keay, M. Wind Power in the UK: Has the Sustainable Development Commission Got It Right. In Oxford Energy Comment May 2005; Oxford Institute for Energy Studies: Oxford, UK, 2005. [Google Scholar]

- Marris, E.; Fairless, D. ‘Wind Farms’ Deadly Reputation Hard to Shift. Nature 2007, 447, 126. [Google Scholar] [CrossRef] [PubMed]

- Seelye, K.Q. After 16 Years, Hopes for Cape Cod Wind Farm Float Away. New York Times, 19 December 2017. [Google Scholar]

- Schiermeier, Q. Credit Crunch Threatens US Wind-Energy Projects. Nature 2008, 455, 572–573. [Google Scholar]

- Miller, L.M.; Kleidon, A. Wind Speed Reductions by Large-Scale Wind Turbine Deployments Lower Turbine Efficiencies and Set Low Generation Limits. Proc. Natl. Acad. Sci. USA 2016, 113, 13570–13575. [Google Scholar] [CrossRef] [PubMed]

- Hughes, G. The Performance of Wind Farms in the United Kingdom and Denmark; Renewable Energy Foundation: London, UK, 2012. [Google Scholar]

- Dutton, A.G.; Halliday, J.A.; Blanch, M.J. The Feasibility of Building-Mounted/Integrated Wind Turbines (BUWTs): Achieving Their Potential for Carbon Emission Reductions; Final Report; Carbon Trust: London, UK, 2005. [Google Scholar]

- Clark, P. Shipping Giants Trial Use of Wind-Power to Cut Tankers’ Fuel Bills. Financial Times, 14 March 2017. [Google Scholar]

- Boyle, G. Renewable Energy: Power for a Sustainable Future; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Dahl, C.A. International Energy Markets: Understanding Pricing, Policies, and Profits; PennWell: Tulsa, OK, USA, 2015. [Google Scholar]

- International Renewable Energy Agency (IRENA). Renewable Power Generation Costs in 2019; IRENA: Abu Dhabi, United Arab Emirates, 2020. [Google Scholar]

- ASEAN Centre for Energy (ACE). 2020. Available online: https://aseanenergy.org/ (accessed on 20 November 2020).

- Turvey, R.; Anderson, D. Electricity Economics: Essays and Case Studies; The Johns Hopkins University Press: Baltimore, MD, USA, 1977. [Google Scholar]

- Chang, Y.; Tay, T. Efficiency and Deregulation of the Electricity Market in Singapore. Energy Policy 2006, 34, 2498–2508. [Google Scholar] [CrossRef]

| Oil | Natural Gas | Coal | Nuclear | Hydro | Renewables | Others | Total | |

|---|---|---|---|---|---|---|---|---|

| Electricity | 825.3 | 6297.9 | 9824.1 | 2796.0 | 4222.2 | 2805.5 | 233.6 | 27,004.7 |

| Share (%) | 3.06 | 23.32 | 36.38 | 10.35 | 15.64 | 10.39 | 0.86 | 100.0 |

| Wind | Solar | Others | Total | |

|---|---|---|---|---|

| Electricity | 1429.6 | 724.1 | 651.8 | 2805.5 |

| Share (%) | 50.96 | 25.81 | 23.23 | 100.0 |

| Type | Cost (2010 $ per Megawatt-Hour) |

|---|---|

| Gas (all types) * | 66.1–127.9 |

| Hydro | 88.9 |

| Wind | 96.0 |

| Coal (all types) * | 97.7–138.8 |

| Geothermal | 98.2 |

| Advanced Nuclear | 111.4 |

| Biomass | 115.4 |

| Solar Photovoltaic | 152.7 |

| Solar Thermal | 242.0 |

| Biomass | Geothermal | Hydro | Solar Photovoltaic | Concentrated Solar Power | Offshore Wind | Onshore Wind | |

|---|---|---|---|---|---|---|---|

| 2010 | 0.076 | 0.049 | 0.037 | 0.378 | 0.346 | 0.161 | 0.086 |

| 2019 | 0.066 | 0.073 | 0.047 | 0.068 | 0.182 | 0.115 | 0.053 |

| Country | Wind Capacity (Megawatts) | Remarks |

|---|---|---|

| Brunei Darussalam | 0 | |

| Cambodia | 200 | |

| Indonesia | 2900 | |

| Lao People’s Democratic Republic | 0 | |

| Malaysia | 100 | |

| Myanmar | 500 | |

| Philippines | 1100 | |

| Singapore | 270 | Offshore wind |

| Thailand | 1800 | |

| Viet Nam | 5700 |

| Scenarios | Cost | Difference |

|---|---|---|

| Counterfactual BAU | 421.05 | - |

| BAU | 418.20 | 0.7% |

| REmap | 409.36 | 2.8% |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chang, Y.; Phoumin, H. Harnessing Wind Energy Potential in ASEAN: Modelling and Policy Implications. Sustainability 2021, 13, 4279. https://doi.org/10.3390/su13084279

Chang Y, Phoumin H. Harnessing Wind Energy Potential in ASEAN: Modelling and Policy Implications. Sustainability. 2021; 13(8):4279. https://doi.org/10.3390/su13084279

Chicago/Turabian StyleChang, Youngho, and Han Phoumin. 2021. "Harnessing Wind Energy Potential in ASEAN: Modelling and Policy Implications" Sustainability 13, no. 8: 4279. https://doi.org/10.3390/su13084279

APA StyleChang, Y., & Phoumin, H. (2021). Harnessing Wind Energy Potential in ASEAN: Modelling and Policy Implications. Sustainability, 13(8), 4279. https://doi.org/10.3390/su13084279