Factors Affecting Outbound Open Innovation Performance in Bio-Pharmaceutical Industry-Focus on Out-Licensing Deals

Abstract

1. Introduction

2. Research Background

2.1. Characteristics of Bio-Pharmaceuticalindustry in Terms of Open Innovation

2.2. Outbound Open Innovation with Knowledge Based View

2.2.1. Licensing as Outbound Open Innovation Strategies

2.2.2. Resource-Based View (RBV)

2.2.3. Dynamic Capabilities

2.2.4. Knowledge Based View (KBV)

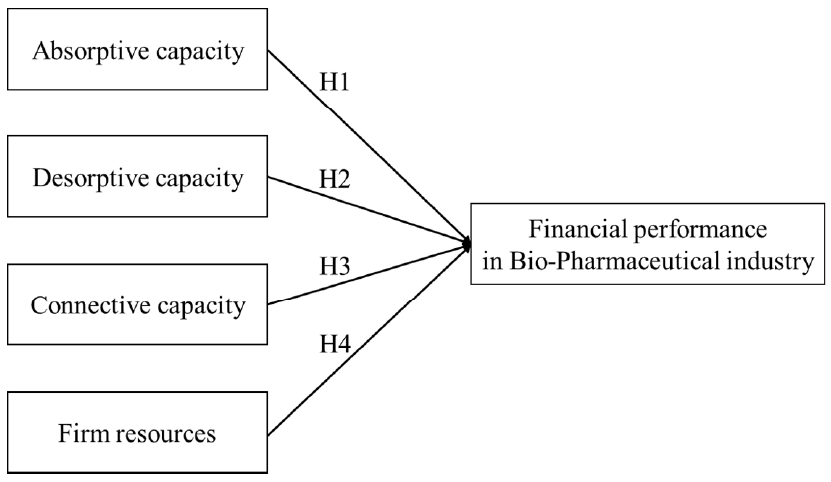

2.3. Research Framework and Hypothesis

2.3.1. Firm Capacity

2.3.2. Absorptive Capacity

2.3.3. Desorptive Capacity

2.3.4. Connective Capacity

2.3.5. Firm Resource

3. Methodology

3.1. Data

3.2. Econometric Method

3.3. Variables

3.3.1. Dependent Variable

3.3.2. Independent Variables

- (1)

- The Number of Forward Patent Citation (CITN)

- (2)

- The Number of Patents (PAT)

- (3)

- The Number of Out-Licensing (OUT) and In-Licensing (IN)

- (4)

- Number of Same IPC Code (IPC)

- (5)

- R&D Collaboration (COLA)

- (6)

- R&D Intensity (RND)

- (7)

- Firm Size (SIZE)

4. Estimation Results

5. Discussion and Implications

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Schuhmacher, A.; Germann, P.-G.; Trill, H.; Gassmann, O. Models for open innovation in the pharmaceutical industry. Drug Discov. Today 2013, 18, 1133–1137. [Google Scholar] [CrossRef] [PubMed]

- Bianchi, M.; Cavaliere, A.; Chiaroni, D.; Frattini, F.; Chiesa, V. Organisational modes for Open Innovation in the bio-pharmaceutical industry: An exploratory analysis. Technovation 2011, 31, 22–33. [Google Scholar] [CrossRef]

- Dahlander, L.; Gann, D.M. How open is innovation? Res. Policy 2010, 39, 699–709. [Google Scholar] [CrossRef]

- Madhok, A.; Osegowitsch, T. The International Biotechnology Industry: A Dynamic Capabilities Perspective. J. Int. Bus. Stud. 2000, 31, 325–335. [Google Scholar] [CrossRef]

- Owen-Smith, J.; Riccaboni, M.; Pammolli, F.; Powell, W.W. A Comparison of U.S. and European University-Industry Relations in the Life Sciences. Manag. Sci. 2002, 48, 24–43. [Google Scholar] [CrossRef]

- Powell, W.W.; Koput, K.W.; Bowie, J.I.; Smith-Doerr, L. The spatial clustering of science and capital: Accounting for biotech firm-venture capital rela-tionships. Reg. Stud. 2002, 36, 291–305. [Google Scholar] [CrossRef]

- Booth, B.; Zemmel, R. Opinion: Prospects for productivity. Nat. Rev. Drug Discov. 2004, 3, 451. [Google Scholar] [CrossRef]

- Paul, S.M.; Mytelka, D.S.; Dunwiddie, C.T.; Persinger, C.C.; Munos, B.H.; Lindborg, S.R.; Schacht, A.L. How to improve R&D productivity: The pharmaceutical industry’s grand challenge. Nat. Rev. Drug Discov. 2010, 9, 203–214. [Google Scholar]

- Appleyard, M.M.; Chesbrough, H.W. The Dynamics of Open Strategy: From Adoption to Reversion. Long Range Plan. 2017, 50, 310–321. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Implementation Steps for Successful Out-Licensing. Res. Manag. 2011, 54, 47–53. [Google Scholar] [CrossRef]

- Chesbrough, H. Open Business Models: How to Thrive in the New Innovation Landscape; Harvard Business Press: Boston, MA, USA, 2006. [Google Scholar]

- Rivera, K.G.; Kline, D. Discovering New Value in Intellectual Property; Harvard Business Review: Brighton, MA, USA, 2000; p. 55. [Google Scholar]

- Lichtenthaler, U. Open Innovation in Practice: An Analysis of Strategic Approaches to Technology Transactions. IEEE Trans. Eng. Manag. 2008, 55, 148–157. [Google Scholar] [CrossRef]

- Lichtenthaler, U. Open innovation: Past research, current debates, and future directions. Acad. Manag. Perspect. 2011, 25, 75–93. [Google Scholar]

- Hofman, J.; Niklasson, A. Success Factors in Product Licensing in the Pharmaceuticals Industry: Identification and Evaluation of Factors Influencing Likelihood and Financial Value of a Licensing Deal. Master’s Thesis, Chalmers University of Technology, Gothenburg, Sweden, 2016. [Google Scholar]

- Hunter, J.; Stephens, S. Is open innovation the way forward for big pharma? Nat. Rev. Drug Discov. 2010, 9, 87–88. [Google Scholar] [CrossRef]

- Chesbrough, H. Pharmaceutical Innovation Hits the Wall: How Open Innovation Can Help; Forbes: Jersey City, NJ, USA, 2011. [Google Scholar]

- Anand, B.N.; Khanna, T. The Structure of Licensing Contracts. J. Ind. Econ. 2003, 48, 103–135. [Google Scholar] [CrossRef]

- Amit, R.; Schoemaker, P.J.H. Strategic assets and organizational rent. Strateg. Manag. J. 1993, 14, 33–46. [Google Scholar] [CrossRef]

- Fosfuri, A. The licensing dilemma: Understanding the determinants of the rate of technology licensing. Strateg. Manag. J. 2006, 27, 1141–1158. [Google Scholar] [CrossRef]

- Shin, K.; Lee, D.; Shin, K.; Kim, E. Measuring the Efficiency of U.S. Pharmaceutical Companies Based on Open Innovation Types. J. Open Innov. Technol. Mark. Complex. 2018, 4, 34. [Google Scholar] [CrossRef]

- Enkel, E.; Gassmann, O.; Chesbrough, H. Open R&D and open innovation: Exploring the phenomenon. R D Manag. 2009, 39, 311–316. [Google Scholar]

- Gassmann, O.; Enkel, E. Towards a Theory of Open Innovation: Three Core Process Archetypes. In Proceedings of the R&D Management Conference (RADMA), Lisbon, Portugal, 7–9 July 2004. [Google Scholar]

- Shin, K.; Kim, E.; Jeong, E. Structural Relationship and Influence between Open Innovation Capacities and Performances. Sustainability 2018, 10, 2787. [Google Scholar] [CrossRef]

- Lee, Y.J.; Shin, K.; Kim, E. The Influence of a Firm’s Capability and Dyadic Relationship of the Knowledge Base on Ambidex-trous Innovation in Biopharmaceutical M&As. Sustainability 2019, 11, 4920. [Google Scholar]

- Carroll, G.P.; Srivastava, S.; Volini, A.S.; Piñeiro-Núñez, M.M.; Vetman, T. Measuring the effectiveness and impact of an open innovation platform. Drug Discov. Today 2017, 22, 776–785. [Google Scholar] [CrossRef] [PubMed]

- Kim, H.; Kim, E. How an Open Innovation Strategy for Commercialization Affects the Firm Performance of Korean Healthcare IT SMEs. Sustainability 2018, 10, 2476. [Google Scholar] [CrossRef]

- Gautam, A.; Pan, X. The changing model of big pharma: Impact of key trends. Drug Discov. Today 2016, 21, 379–384. [Google Scholar] [CrossRef] [PubMed]

- Florida, R. The Rise of the Creative Class; Basic Books: New York, NY, USA, 2002. [Google Scholar]

- Teece, D.J. Capturing Value from Knowledge Assets: The New Economy, Markets for Know-How, and Intangible Assets. Calif. Manag. Rev. 1998, 40, 55–79. [Google Scholar] [CrossRef]

- Gassmann, O. Opening up the innovation process: Towards an agenda. R D Manag. 2006, 36, 223–228. [Google Scholar] [CrossRef]

- Gassmann, O.; Reepmeyer, G. Organizing Pharmaceutical Innovation: From Science-based Knowledge Creators to Drug-oriented Knowledge Brokers. Creat. Innov. Manag. 2005, 14, 233–245. [Google Scholar] [CrossRef]

- Chesbrough, H. The Logic of Open Innovation: Managing Intellectual Property. Calif. Manag. Rev. 2003, 45, 33–58. [Google Scholar] [CrossRef]

- Lee, S.; Park, G.; Yoon, B.; Park, J. Open innovation in SMEs—An intermediated network model. Res. Policy 2010, 39, 290–300. [Google Scholar] [CrossRef]

- Hung, K.-P.; Chou, C. The impact of open innovation on firm performance: The moderating effects of in-ternal R&D and environmental turbulence. Technovation 2013, 33, 368–380. [Google Scholar]

- Lichtenthaler, U.; Ernst, H.; Hoegl, M. Not-Sold-Here: How Attitudes Influence External Knowledge Exploitation. Organ. Sci. 2010, 21, 1054–1071. [Google Scholar] [CrossRef]

- Davis, L. Intellectual property rights, strategy and policy. Econ. Innov. New Technol. 2004, 13, 399–415. [Google Scholar] [CrossRef]

- Rivette, K.G.; Kline, D. Rembrandts in the Attic: Unlocking the Hidden Value of Patents; Harvard Business Press: Boston, MA, USA, 2000. [Google Scholar]

- Gambardella, A.; Giuri, P.; Luzzi, A. The market for patents in Europe. Res. Policy 2007, 36, 1163–1183. [Google Scholar] [CrossRef]

- Kim, Y.; Vonortas, N.S.; Kim, Y.; Vonortas, N.S. Determinants of technology licensing: The case of licensors. Manag. Decis. Econ. 2006, 27, 235–249. [Google Scholar] [CrossRef]

- Cai, Y. The Evolution of Distribution of Technology Transfer in China: Evidence from Patent Licensing. Am. J. Ind. Bus. Manag. 2018, 8, 1239–1252. [Google Scholar] [CrossRef]

- Tsai, K.-H.; Wang, J.-C. External technology sourcing and innovation performance in LMT sectors: An analysis based on the Taiwanese Technological Innovation Survey. Res. Policy 2009, 38, 518–526. [Google Scholar] [CrossRef]

- Nishimura, J.; Okada, Y. R&D portfolios and pharmaceutical licensing. Res. Policy 2014, 43, 1250–1263. [Google Scholar]

- Lee, J.H.; Sung, T.-E.; Kim, E.; Shin, K. Evaluating Determinant Priority of License Fee in Biotech Industry. J. Open Innov. Technol. Mark. Complex. 2018, 4, 30. [Google Scholar] [CrossRef]

- Lee, J.H.; Kim, E.; Sung, T.-E.; Shin, K. Factors Affecting Pricing in Patent Licensing Contracts in the Biopharmaceutical Industry. Sustainability 2018, 10, 3143. [Google Scholar] [CrossRef]

- Van de Vrande, V.; de Jong, J.P.; Vanhaverbeke, W.; De Rochemont, M. Open innovation in SMEs: Trends, motives and management challenges. Technovation 2009, 29, 423–437. [Google Scholar] [CrossRef]

- Ziegler, N.; Ruether, F.; Bader, M.A.; Gassmann, O. Creating value through external intellectual property commercialization: A desorptive capacity view. J. Technol. Transf. 2013, 38, 930–949. [Google Scholar] [CrossRef]

- Ruckman, K.; McCarthy, I. Why do some patents get licensed while others do not? Ind. Corp. Chang. 2016, 26, 667–688. [Google Scholar] [CrossRef]

- Arnold, K.; Coia, A.; Saywell, S.; Smith, T.; Minick, S.; Loffler, A. Value drivers in licensing deals. Nat. Biotechnol. 2002, 20, 1085–1089. [Google Scholar] [CrossRef] [PubMed]

- Arora, A.; Gambardella, A. Ideas for rent: An overview of markets for technology. Ind. Corp. Chang. 2010, 19, 775–803. [Google Scholar] [CrossRef]

- Di Minin, A.; Frattini, F.; Piccaluga, A. Fiat: Open innovation in a downturn (1993–2003). Calif. Manag. Rev. 2010, 52, 132–159. [Google Scholar] [CrossRef]

- Kim, Y. Choosing between international technology licensing partners: An empirical analysis of U.S. biotechnology firms. J. Eng. Technol. Manag. 2009, 26, 57–72. [Google Scholar] [CrossRef]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Ray, G.; Barney, J.B.; Muhanna, W.A. Capabilities, business processes, and competitive advantage: Choosing the dependent variable in empirical tests of the resource-based view. Strateg. Manag. J. 2003, 25, 23–37. [Google Scholar] [CrossRef]

- Eisenhardt, K.M.; Martin, J.A. Dynamic capabilities: What are they? Strateg. Manag. J. 2000, 21, 1105–1121. [Google Scholar] [CrossRef]

- Powell, T.C. Competitive advantage: Logical and philosophical considerations. Strateg. Manag. J. 2001, 22, 875–888. [Google Scholar] [CrossRef]

- Priem, R.L.; Butler, J.E. Is the Resource-Based “View” a Useful Perspective for Strategic Management Research? Acad. Manag. Rev. 2001, 26, 22. [Google Scholar]

- Hitt, M.A.; Bierman, L.; Shimizu, K.; Kochhar, R. Direct and moderating effects of human capital on strategy and performance in professional service firms: A resource-based perspective. Acad. Manag. J. 2001, 44, 13–28. [Google Scholar]

- Nelson, R.R. Why do firms differ, and how does it matter? Strateg. Manag. J. 1991, 12, 61–74. [Google Scholar] [CrossRef]

- Penrose, E.T. The Theory of the Growth of the Firm; Oxford University Press: New York, NY, USA, 1959. [Google Scholar]

- Barney, J.B. Strategic Factor Markets: Expectations, Luck, and Business Strategy. Manag. Sci. 1986, 32, 1231–1241. [Google Scholar] [CrossRef]

- Teece, D.; Pisano, G.; Shuen, A. Dynamic Capabilities and Strategic Management. Strateg. Manag. J. 1997, 18, 509–533. [Google Scholar] [CrossRef]

- Mahoney, J.T.; Pandian, J.R. The resource-based view within the conversation of strategic management. Strateg. Manag. J. 1992, 13, 363–380. [Google Scholar] [CrossRef]

- Dierickx, I.; Cool, K. Asset Stock Accumulation and Sustainability of Competitive Advantage. Manag. Sci. 1989, 35, 1504–1511. [Google Scholar] [CrossRef]

- Ambrosini, V.; Bowman, C. What are dynamic capabilities and are they a useful construct in strategic man-agement? Int. J. Manag. Rev. 2009, 11, 29–49. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Dynamics from open innovation to evolutionary change. J. Open Innov. Technol. Mark. Complex. 2016, 2, 1–22. [Google Scholar] [CrossRef]

- Helfat, C.E.; Finkelstein, S.; Mitchell, W.; Peteraf, M.; Singh, H.; Teece, D.; Winter, S.G. Dynamic Capabilities: Understanding Strategic Change in Organizations; John Wiley & Sons: Hoboken, NJ, USA, 2009. [Google Scholar]

- Wang, C.L.; Ahmed, P.K. Dynamic capabilities: A review and research agenda. Int. J. Manag. Rev. 2007, 9, 31–51. [Google Scholar] [CrossRef]

- Roos, J.; Edvinsson, L.; Dragonetti, N.C. Intellectual Capital: Navigating the New Business Landscape; Springer: Berlin/Heidelberg, Germany, 1997. [Google Scholar]

- Stewart, T.; Ruckdeschel, C. Intellectual capital: The new wealth of organizations. Perform. Improv. 1998, 37, 56–59. [Google Scholar] [CrossRef]

- Wernerfelt, B. A resource-based view of the firm. Strateg. Manag. J. 1984, 5, 171–180. [Google Scholar] [CrossRef]

- Argote, L.; McEvily, B.; Reagans, R. Managing Knowledge in Organizations: An Integrative Framework and Review of Emerging Themes. Manag. Sci. 2003, 49, 571–582. [Google Scholar] [CrossRef]

- Zahra, S.A.; Sapienza, H.J.; Davidsson, P. Entrepreneurship and Dynamic Capabilities: A Review, Model and Research Agenda*. J. Manag. Stud. 2006, 43, 917–955. [Google Scholar] [CrossRef]

- Grant, R.M. Toward a knowledge-based theory of the firm. Strateg. Manag. J. 1996, 17, 109–122. [Google Scholar] [CrossRef]

- Hoskisson, R.E.; Wan, W.P.; Yiu, D.; Hitt, M.A. Theory and research in strategic management: Swings of a pendulum. J. Manag. 1999, 25, 417–456. [Google Scholar] [CrossRef]

- Helfat, C.E.; Peteraf, M.A. The dynamic resource-based view: Capability lifecycles. Strateg. Manag. J. 2003, 24, 997–1010. [Google Scholar] [CrossRef]

- Teece, D.J. Explicating dynamic capabilities: The nature and microfoundations of (sustainable) enterprise performance. Strateg. Manag. J. 2007, 28, 1319–1350. [Google Scholar] [CrossRef]

- Spender, J.-C. Making knowledge the basis of a dynamic theory of the firm. Strateg. Manag. J. 1996, 17, 45–62. [Google Scholar] [CrossRef]

- Lichtenthaler, U.; Lichtenthaler, E. A Capability-Based Framework for Open Innovation: Complementing Absorptive Capacity. J. Manag. Stud. 2009, 46, 1315–1338. [Google Scholar] [CrossRef]

- Cohen, W.M.; Levinthal, D.A. Absorptive Capacity: A New Perspective on Learning and Innovation. Adm. Sci. Q. 1990, 35, 128. [Google Scholar] [CrossRef]

- Lane, P.J.; Koka, B.R.; Pathak, S. The reification of absorptive capacity: A critical review and rejuvenation of the construct. Acad. Manag. Rev. 2006, 31, 833–863. [Google Scholar] [CrossRef]

- Zahra, S.A.; George, G. Absorptive capacity: A review, reconceptualization, and extension. Acad. Manag. Rev. 2002, 27, 185–203. [Google Scholar] [CrossRef]

- Jansen, J.J.P.; van den Bosch, F.A.J.; Volberda, H.W. Managing potential and realized absorptive capacity: How do organizational antecedents matter? Acad. Manag. J. 2005, 48, 999–1015. [Google Scholar] [CrossRef]

- Laursen, K.; Leone, M.I.; Torrisi, S. Technological exploration through licensing: New insights from the licensee’s point of view. Ind. Corp. Chang. 2010, 19, 871–897. [Google Scholar] [CrossRef]

- McAdam, R.; McAdam, M.; Brown, V. Proof of concept processes in UK university technology transfer: An absorptive capacity perspective. R D Manag. 2009, 39, 192–210. [Google Scholar] [CrossRef]

- Riccaboni, M.; Moliterni, R. Managing technological transitions through R&D alliances. R D Manag. 2009, 39, 124–135. [Google Scholar]

- Eom, B.-Y.; Lee, K. Determinants of industry–academy linkages and, their impact on firm performance: The case of Korea as a latecomer in knowledge industrialization. Res. Policy 2010, 39, 625–639. [Google Scholar] [CrossRef]

- Lichtenthaler, U. The Drivers of Technology Licensing: An Industry Comparison. Calif. Manag. Rev. 2007, 49, 67–89. [Google Scholar] [CrossRef]

- Granstrand, O. The Economics and Management of Intellectual Property. In Books; Edward Elgar Publishing: Cheltenham, UK, 1999. [Google Scholar]

- Monk, A.H.B. The emerging market for intellectual property: Drivers, restrainers, and implications. J. Econ. Geogr. 2009, 9, 469–491. [Google Scholar] [CrossRef]

- Lichtenthaler, U.; Lichtenthaler, E. Technology Transfer across Organizational Boundaries: Absorptive Capacity and Desorptive Capacity. Calif. Manag. Rev. 2010, 53, 154–170. [Google Scholar] [CrossRef]

- Kale, P.; Singh, H. Building firm capabilities through learning: The role of the alliance learning process in alliance capability and firm-level alliance success. Strateg. Manag. J. 2007, 28, 981–1000. [Google Scholar] [CrossRef]

- Lorenzoni, G.; Lipparini, A. The leveraging of interfirm relationships as a distinctive organizational capability: A longitudinal study. Strateg. Manag. J. 1999, 20, 317–338. [Google Scholar] [CrossRef]

- Gulati, R. Network location and learning: The influence of network resources and firm capabilities on alliance for-mation. Strateg. Manag. J. 1999, 20, 397–420. [Google Scholar] [CrossRef]

- Luhmann, N. Social Systems; Stanford University Press: Redwood City, CA, USA, 1995. [Google Scholar]

- Garud, R.; Nayyar, P.R. Transformative capacity: Continual structuring by intertemporal technology transfer. Strateg. Manag. J. 1994, 15, 365–385. [Google Scholar] [CrossRef]

- Grant, R.M.; Baden-Fuller, C. A Knowledge Accessing Theory of Strategic Alliances. J. Manag. Stud. 2004, 41, 61–84. [Google Scholar] [CrossRef]

- Powell, W.W.; Koput, K.W.; Smith-Doerr, L. Interorganizational collaboration and the locus of in-novation: Networks of learning in biotechnology. Adm. Sci. Q. 1996, 41, 116–145. [Google Scholar] [CrossRef]

- Rothaermel, F.T.; Deeds, D.L. Exploration and exploitation alliances in biotechnology: A system of new product development. Strateg. Manag. J. 2004, 25, 201–221. [Google Scholar] [CrossRef]

- Liu, S.J.; Shyu, J. Strategic planning for technology development with patent analysis. Int. J. Technol. Manag. 1997, 13, 661. [Google Scholar] [CrossRef]

- Barney, J.B.; Arikan, A.M. The resource-based view: Origins and implications. In Handbook of Strategic Management; Wiley: Hoboken, NJ, USA, 2001; p. 124188. [Google Scholar]

- Kim, S.; Kim, H.; Kim, E. How knowledge flow affects Korean ICT manufacturing firm perfor-mance: A focus on open innovation strategy. Technol. Anal. Strateg. Manag. 2016, 28, 1167–1181. [Google Scholar] [CrossRef]

- Wernerfelt, B. The resource-based view of the firm: Ten years after. Strateg. Manag. J. 1995, 16, 171–174. [Google Scholar] [CrossRef]

- Makadok, R. Toward a synthesis of the resource-based and dynamic-capability views of rent creation. Strateg. Manag. J. 2001, 22, 387–401. [Google Scholar] [CrossRef]

- Lin, B.-W.; Chen, C.-J.; Wu, H.-L. Patent portfolio diversity, technology strategy, and firm value. IEEE Trans. Eng. Manag. 2006, 53, 17–26. [Google Scholar]

- Agrawal, A.; Henderson, R. Putting Patents in Context: Exploring Knowledge Transfer from MIT. Manag. Sci. 2002, 48, 44–60. [Google Scholar] [CrossRef]

- Yun, J.J.; Jeong, E.; Lee, C.; Park, J.; Zhao, X. Effect of Distance on Open Innovation: Differences among Institutions According to Patent Citation and Reference. Sustainability 2017, 9, 1478. [Google Scholar] [CrossRef]

- Dosi, G. Technological paradigms and technological trajectories: A suggested interpretation of the determinants and directions of technical change. Res. Policy 1982, 11, 147–162. [Google Scholar] [CrossRef]

- Sanditov, B. Patent Citations, the Value of Innovations and Path-Dependency; Università Commerciale Luigi Bocconi: Milan, Italy, 2005. [Google Scholar]

- Hall, B.; Jaffe, A.; Trajtenberg, M. Market Value and Patent Citations: A First Look. Natl. Bur. Econ. Res. 2000. [Google Scholar] [CrossRef]

- Harhoff, D.; Narin, F.; Scherer, F.M.; Vopel, K. Citation Frequency and the Value of Patented Innovation; Discussion Paper No. 97-26; Wissenschaftszentrum Berlin für Sozialforschung (WZB): Berlin, Germany, 1997. [Google Scholar]

- Reitzig, M. The private values of ‘thickets’ and ‘fences’: Towards an updated picture of the use of patents across industries. Econ. Innov. New Technol. 2004, 13, 457–476. [Google Scholar] [CrossRef]

- Gittelman, M.; Kogut, B. Does good science lead to valuable knowledge? Biotechnology firms and the evolutionary logic of citation patterns. Manag. Sci. 2003, 49, 366–382. [Google Scholar] [CrossRef]

- Narin, F.; Noma, E.; Perry, R. Patents as indicators of corporate technological strength. Res. Policy 1987, 16, 143–155. [Google Scholar] [CrossRef]

- Trajtenberg, M. A Penny for Your Quotes: Patent Citations and the Value of Innovations. RAND J. Econ. 1990, 21, 172. [Google Scholar] [CrossRef]

- Harhoff, D.; Scherer, F.M.; Vopel, K. Citations, family size, opposition and the value of patent rights. Res. Policy 2003, 32, 1343–1363. [Google Scholar] [CrossRef]

- Comanor, W.S.; Scherer, F.M. Patent Statistics as a Measure of Technical Change. J. Political Econ. 1969, 77, 392–398. [Google Scholar] [CrossRef]

- Grindley, P.C.; Teece, D.J. Managing Intellectual Capital: Licensing and Cross-Licensing in Semiconductors and Electronics. Calif. Manag. Rev. 1997, 39, 8–41. [Google Scholar] [CrossRef]

- Cohen, W.M.; Goto, A.; Nagata, A.; Nelson, R.R.; Walsh, J.P. R&D spillovers, patents and the incentives to innovate in Japan and the United States. Res. Policy 2002, 31, 1349–1367. [Google Scholar]

- Hagedoorn, J. Inter-firm R&D partnerships: An overview of major trends and patterns since 1960. Res. Policy 2002, 31, 477–492. [Google Scholar]

- Arora, A. Licensing Tacit Knowledge: Intellectual Property Rights and The Market for Know-How. Econ. Innov. New Technol. 1995, 4, 41–60. [Google Scholar] [CrossRef]

- Johnson, D.K. “Learning-by-Licensing”: R&D and Technology Licensing in Brazilian Invention. Econ. Innov. New Technol. 2002, 11, 163–177. [Google Scholar]

- Davenport, T.H.; De Long, D.W.; Beers, M.C. Successful knowledge management projects. Sloan Manag. Rev. 1998, 39, 43–57. [Google Scholar]

- Zhang, S.; Yang, D.; Qiu, S.; Bao, X.; Li, J. Open innovation and firm performance: Evidence from the Chinese mechanical manufacturing industry. J. Eng. Technol. Manag. 2018, 48, 76–86. [Google Scholar] [CrossRef]

- Rogers, M. Networks, Firm Size and Innovation. Small Bus. Econ. 2004, 22, 141–153. [Google Scholar] [CrossRef]

- Zahra, S.A. Entrepreneurial Risk Taking in Family Firms. Fam. Bus. Rev. 2005, 18, 23–40. [Google Scholar] [CrossRef]

- Decarolis, D.M.; Deeds, D.L. The impact of stocks and flows of organizational knowledge on firm performance: An empirical investigation of the biotechnology industry. Strateg. Manag. J. 1999, 20, 953–968. [Google Scholar] [CrossRef]

| Knowledge Exploration | Knowledge Retention | Knowledge Exploitation | |

|---|---|---|---|

| External (Interfirm) | Absorptive capacity | Connective capacity | Desorptive capacity |

| Variables | Explanation | Source | References | |

|---|---|---|---|---|

| Dependent variable | Financial Performance (FP) | Average sales over three years after licensing | Compustat | [126] |

| Independent Variable (Knowledge Capacities) | Desorptive capacity | Number of forward citation patents | GPASS | [24] |

| Number of Out-licensing | Medtrack | [2] | ||

| Absorptive capacity | Number of patent applications | GPASS | [24] | |

| Number of In-licensing | Medtrack | [2] | ||

| Connective capacity | Number of same IPC code | GPASS | [121] | |

| Number of R&D Collaboration | Medtrack | [2] | ||

| Control variables | R&D intensity | R&D Intensity | Compustat | [127] |

| Firm size | Number of Employees | Compustat | [24] | |

| Mean | Std.Dev | VIF | CITN | OUT | PAT | IN | IPC | COLA | RND | SIZE | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CITN | 2.48600 | 0.99009 | 1.82277 | 1.000 | |||||||

| OUT | 5.70998 | 3.59222 | 1.68487 | 0.50507 | 1.000 | ||||||

| PAT | 0.30034 | 0.72335 | 1.24103 | −0.0518 | 0.02905 | 1.000 | |||||

| IN | 2.41067 | 2.53914 | 1.03440 | 0.03716 | 0.03502 | −0.05644 | 1.000 | ||||

| IPC | 0.01998 | 0.14772 | 1.24168 | −0.0022 | 0.00836 | 0.42450 | 0.01391 | 1.000 | |||

| COLA | 1.70998 | 2.61780 | 1.33455 | 0.38976 | 0.37361 | −0.05222 | 0.13902 | −0.03722 | 1.000 | ||

| RND | 4.84061 | 0.28990 | 1.14128 | −0.2668 | −0.1826 | −0.08521 | −0.03782 | −0.10952 | −0.17654 | 1.000 | |

| SIZE | 63.91102 | 41.30372 | 1.86925 | 0.57277 | 0.54282 | 0.00439 | −0.06320 | −0.04018 | 0.14024 | −0.27889 | 1.000 |

| Variables | Explanation | Performance Variables: Financial Performance (FP) | |

|---|---|---|---|

| Knowledge capacity variables | Absorptive capacity | Number of patent applications (PAT) | −0.02209 (−0.41) |

| Number of In-licensing (IN) | −0.02522 * (−1.78) | ||

| Desorptive capacity | Number of forward citation patents (CITN) | 0.10909 ** (2.27) | |

| Number of Out-licensing (OUT) | 0.05904 *** (4.63) | ||

| Connective capacity | Number of same IPC code (IPC) | 0.22263 (0.84) | |

| Number of R&D collaboration (COLA) | −0.00307 (−0.20) | ||

| Control variables | R&D intensity | R&D Intensity (RND) | −1.13318 *** (−8.71) |

| Firm size | Number of Employees (SIZE) | 0.01654 *** (14.15) | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, E.; Lee, I.; Kim, H.; Shin, K. Factors Affecting Outbound Open Innovation Performance in Bio-Pharmaceutical Industry-Focus on Out-Licensing Deals. Sustainability 2021, 13, 4122. https://doi.org/10.3390/su13084122

Kim E, Lee I, Kim H, Shin K. Factors Affecting Outbound Open Innovation Performance in Bio-Pharmaceutical Industry-Focus on Out-Licensing Deals. Sustainability. 2021; 13(8):4122. https://doi.org/10.3390/su13084122

Chicago/Turabian StyleKim, Eungdo, InGyu Lee, Hongbum Kim, and Kwangsoo Shin. 2021. "Factors Affecting Outbound Open Innovation Performance in Bio-Pharmaceutical Industry-Focus on Out-Licensing Deals" Sustainability 13, no. 8: 4122. https://doi.org/10.3390/su13084122

APA StyleKim, E., Lee, I., Kim, H., & Shin, K. (2021). Factors Affecting Outbound Open Innovation Performance in Bio-Pharmaceutical Industry-Focus on Out-Licensing Deals. Sustainability, 13(8), 4122. https://doi.org/10.3390/su13084122