Russian Tourism Enterprises’ Marketing Innovations to Meet the COVID-19 Challenges

Abstract

1. Introduction

2. Literature Review

2.1. Challenges Businesses Are Facing during the COVID-19 Pandemic

2.2. Tourism Firms’ Challenges in Pandemic and Postpandemic Environment

2.3. Shift in Consumer Behavior: What Is Important for Tourism?

3. Materials and Methods

4. Results

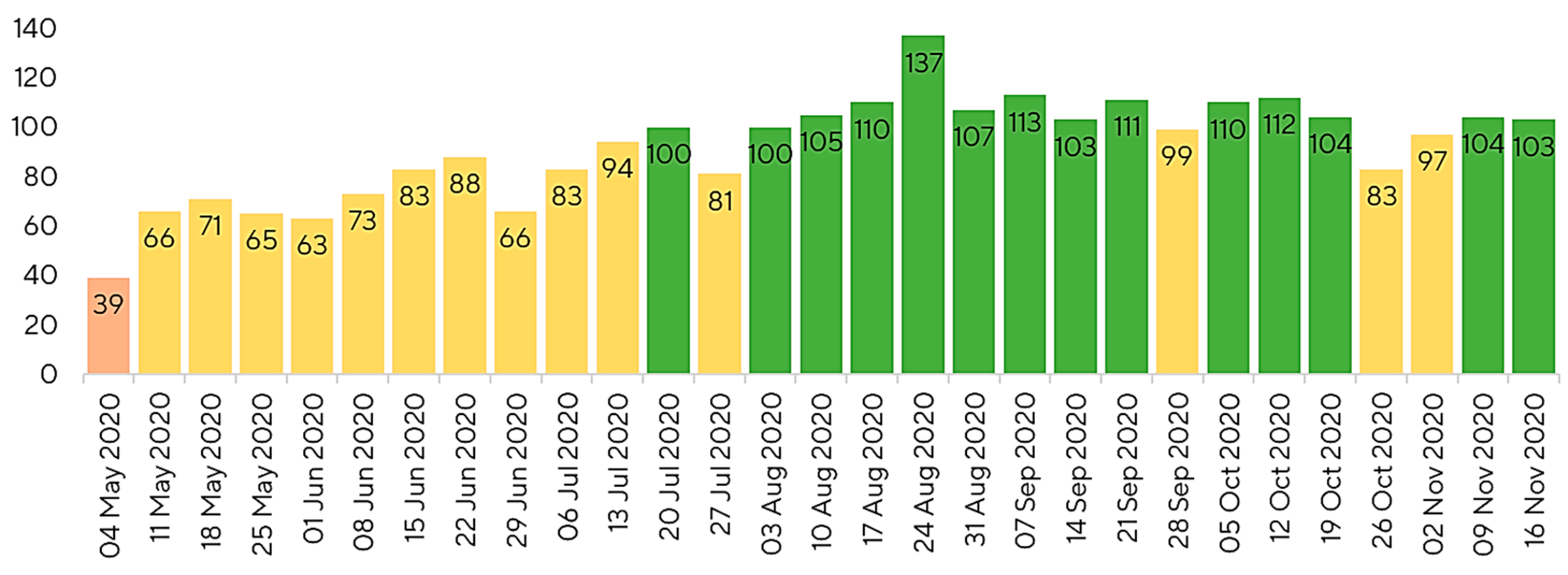

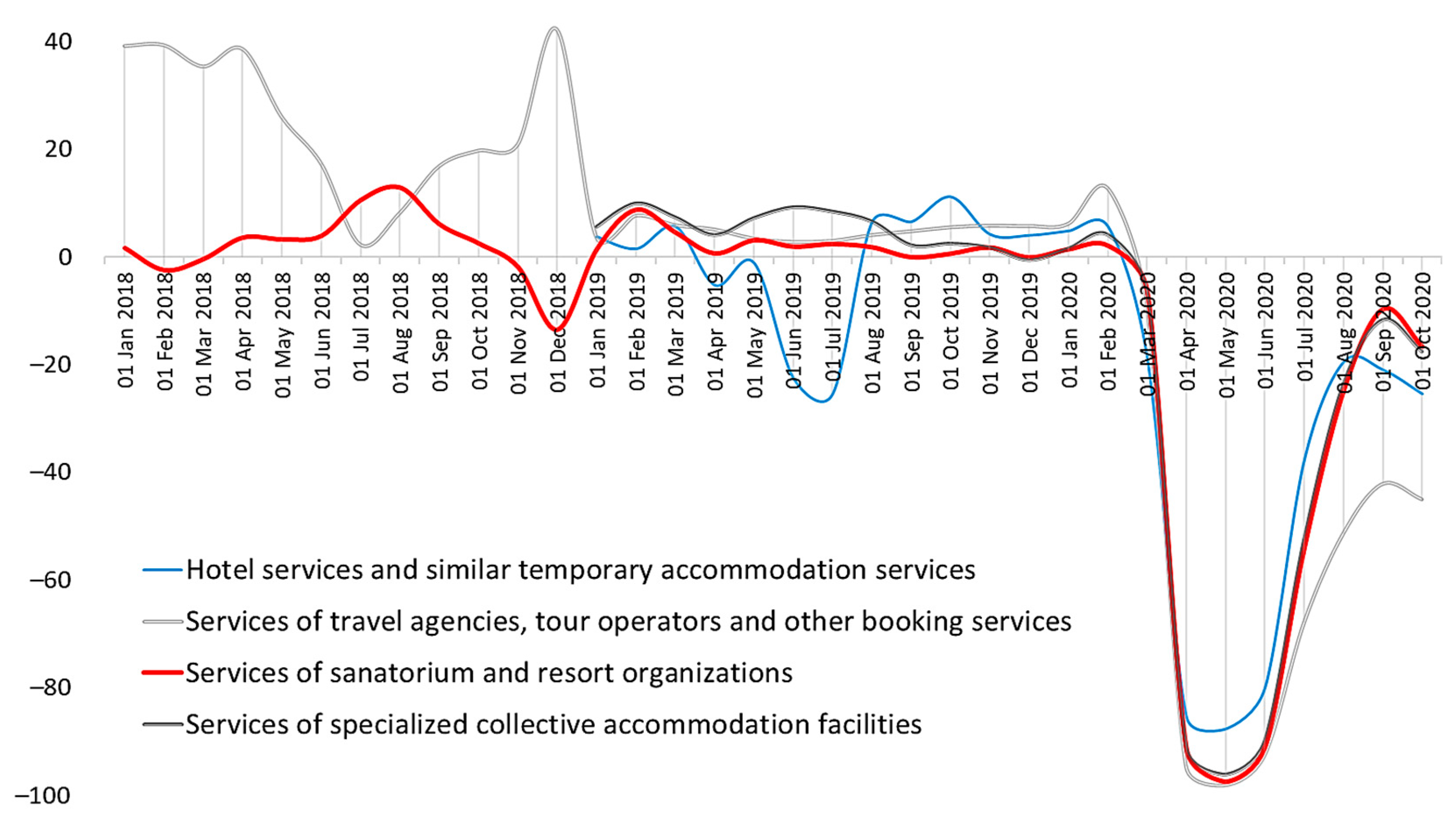

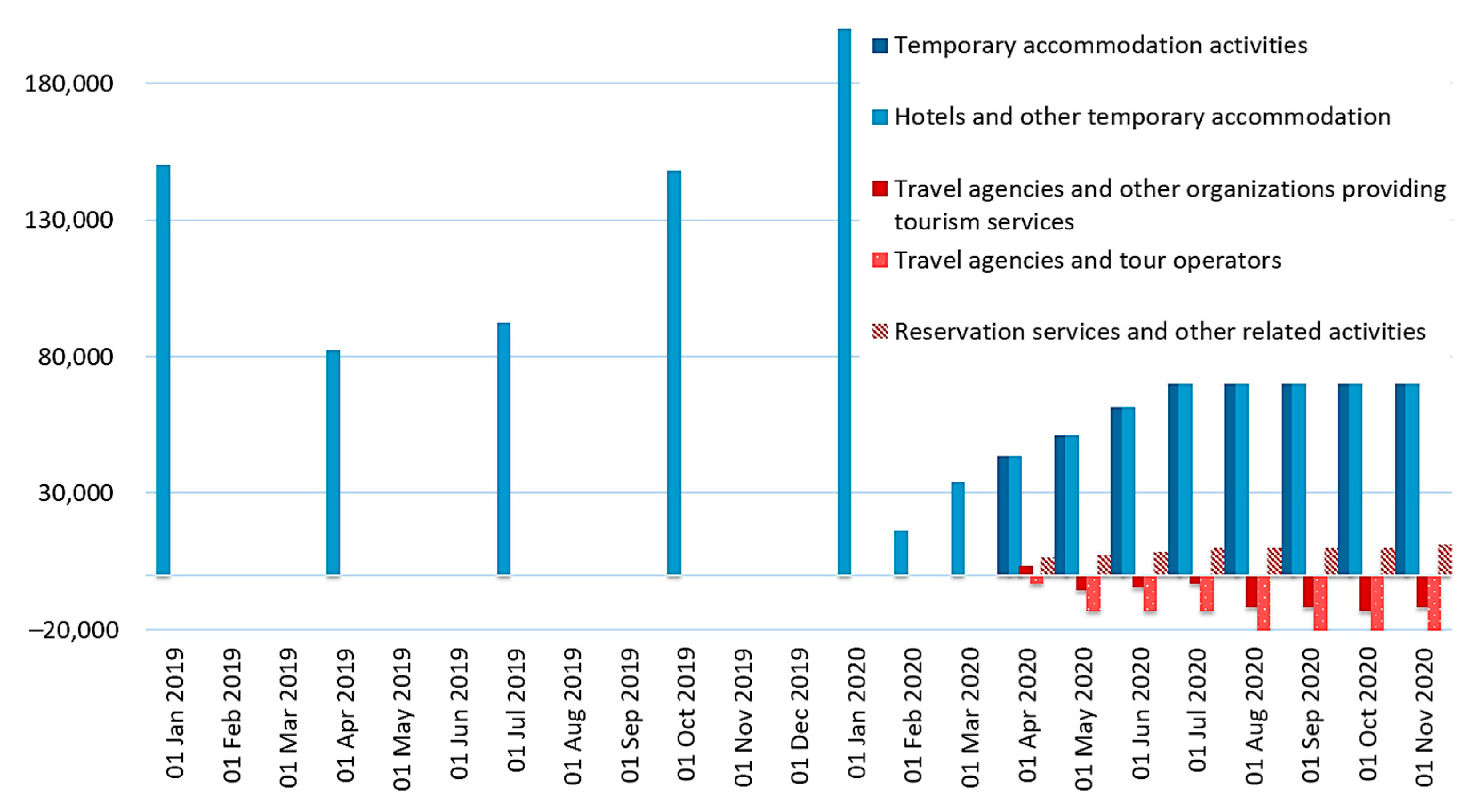

4.1. The Impact of the Pandemic on the Russian Tourism Market

4.2. Tourism SMEs in the Nizhny Novgorod Region: Statistics and Survey Results

5. Discussion

6. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Hall, C.M.; Scott, D.; Gössling, S. Pandemics, transformations and tourism: Be careful what you wish for. Tour. Geogr. 2020, 22, 577–598. [Google Scholar] [CrossRef]

- Bénassy-Quéré, A.; Marimon, R.; Pisani-Ferry, J.; Reichlin, L.; Schoenmaker, D.; Weder di Mauro, B. COVID-19: Europe Needs a Catastrophe Relief Plan. VOX CEPR Policy Portal. 11 March 2020. Available online: https://voxeu.org/article/covid-19-europe-needs-catastrophe-relief-plan (accessed on 18 March 2021).

- Lenzen, M.; Li, M.; Malik, A.; Pomponi, F.; Sun, Y.-Y.; Wiedmann, T.; Faturay, F.; Fry, J.; Gallego, B.; Geschke, A.; et al. Global socio-economic losses and environmental gains from the Coronavirus pandemic. PLoS ONE 2020, 15, e0235654. [Google Scholar] [CrossRef]

- Gavurova, B.; Suhanyi, L.; Rigelský, M. Tourist spending and productivity of economy in OECD countries—Research on perspectives of sustainable tourism. Entrep. Sustain. Issues 2020, 8, 983–1000. [Google Scholar] [CrossRef]

- Gössling, S.; Scott, D.; Hall, C.M. Pandemics, tourism and global change: A rapid assessment of COVID-19. J. Sustain. Tour. 2020, 29, 1–20. [Google Scholar] [CrossRef]

- Tsionas, M.G. COVID-19 and gradual adjustment in the tourism, hospitality, and related industries. Tour. Econ. 2020, 15. [Google Scholar] [CrossRef]

- Haywood, K.M. A post COVID-19 future—Tourism re-imagined and re-enabled. Tour. Geogr. 2020, 22, 599–609. [Google Scholar] [CrossRef]

- Higgins-Desbiolles, F. Socialising tourism for social and ecological justice after COVID-19. Tour. Geogr. 2020, 22, 610–623. [Google Scholar] [CrossRef]

- Amankwah-Amoah, J.; Khan, Z.; Wood, G. COVID-19 and business failures: The paradoxes of experience, scale, and scope for theory and practice. Eur. Manag. J. 2020. [Google Scholar] [CrossRef]

- Besenyő, J.; Kármán, M. Effects of COVID-19 pandemy on African health, political and economic strategy. Insights Reg. Dev. 2020, 2, 630–644. [Google Scholar] [CrossRef]

- Donthu, N.; Gustafsson, A. Effects of COVID-19 on business and research. J. Bus. Res. 2020, 117, 284–289. [Google Scholar] [CrossRef]

- Fetzer, T.; Witte, M.; Hensel, L.; Jachimowicz, J.M.; Haushofer, J.; Ivchenko, A.; Caria, S.A.; Reutskaja, E.; Roth, C.; Fiorin, S.; et al. Global Behaviours and Perceptions at the Onset of the COVID-19 Pandemic. Natl. Bur. Econ. Res. 2020. [Google Scholar] [CrossRef]

- Jordà, Ò.; Singh, S.R.; Taylor, A.M. Longer-Run Economic Consequences of Pandemics; Federal Reserve Bank of San Francisco Working Paper No. 26934; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar] [CrossRef]

- Craven, M.; Liu, L.; Mysore, M.; Wilson, M. COVID-19: Implications for Business. Available online: https://www.mckinsey.com/business-functions/risk/our-insights/covid-19-implications-for-business# (accessed on 9 December 2020).

- Pantano, E.; Pizzi, G.; Scarpi, D.; Dennis, C. Competing during a pandemic? Retailers’ ups and downs during the COVID-19 outbreak. J. Bus. Res. 2020, 116, 209–213. [Google Scholar] [CrossRef]

- Krishnamurthy, S. The future of business education: A commentary in the shadow of the Covid-19 pandemic. J. Bus. Res. 2020, 117, 1–5. [Google Scholar] [CrossRef]

- Tucker, H. Coronavirus Bankruptcy Tracker: These Major Companies are Failing Amid the Shutdown. Forbes. 2020. Available online: https://www.forbes.com/sites/hanktucker/2020/05/03/coronavirus-bankruptcy-tracker-these-major-companies-are-failing-amid-theshutdown/#5649f95d3425 (accessed on 16 December 2020).

- Crick, J.M.; Crick, D. Coopetition and COVID-19: Collaborative business-to-business marketing strategies in a pandemic crisis. Ind. Mark. Manag. 2020, 88, 206–213. [Google Scholar] [CrossRef]

- He, H.; Harris, L. The impact of Covid-19 pandemic on corporate social responsibility and marketing philosophy. J. Bus. Res. 2020, 116, 176–182. [Google Scholar] [CrossRef]

- Bartik, A.W.; Bertrand, M.; Cullen, Z.; Glaeser, E.L.; Luca, M.; Stanton, C. The impact of COVID-19 on small business outcomes and expectations. Proc. Natl. Acad. Sci. USA 2020, 117, 17656–17666. [Google Scholar] [CrossRef] [PubMed]

- Fairlie, R. The Impact of Covid-19 on Small Business Owners: Evidence of Early-Stage Losses from the April 2020 Current Population Survey; National Bureau of Economic Research: Cambridge, MA, USA, 2020. [Google Scholar]

- Ferrando, A. Firms’ Expectations on Access to Finance at the Early Stages of the Covid-19 Pandemic; ECB Working Paper No. 20202446, July 2020; European Central Bank: Frankfurt, Germany, 2020; Available online: https://ssrn.com/abstract=3656265 (accessed on 23 March 2021).

- Juergensen, J.; Guimón, J.; Narula, R. European SMEs amidst the COVID-19 crisis: Assessing impact and policy responses. J. Ind. Bus. Econ. 2020, 47, 499–510. [Google Scholar] [CrossRef]

- Shafi, M.; Liu, J.; Ren, W. Impact of COVID-19 pandemic on micro, small, and medium-sized Enterprises operating in Pakistan. Res. Glob. 2020, 2, 100018. [Google Scholar] [CrossRef]

- Syriopoulos, K. The impact of Covid-19 on entrepreneurship and SMES. J. Int. Acad. Case Stud. 2020, 26, 1–2. Available online: https://search.proquest.com/docview/2419452454?accountid=35424 (accessed on 23 January 2021).

- Lu, Y.; Wu, J.; Peng, J.; Lu, L. The perceived impact of the Covid-19 epidemic: Evidence from a sample of 4807 SMEs in Sichuan Province, China. Environ. Hazards 2020, 19, 323–340. [Google Scholar] [CrossRef]

- Eggers, F. Masters of disasters? Challenges and opportunities for SMEs in times of crisis. J. Bus. Res. 2020, 116, 199–208. [Google Scholar] [CrossRef]

- Alonso, A.D.; Kok, S.K.; Bressan, A.; O’Shea, M.; Sakellarios, N.; Koresis, A.; Solis, M.A.B.; Santoni, L.J. COVID-19, aftermath, impacts, and hospitality firms: An international perspective. Int. J. Hosp. Manag. 2020, 91, 102654. [Google Scholar] [CrossRef]

- Kuckertz, A.; Brändle, L.; Gaudig, A.; Hinderer, S.; Reyes, C.A.M.; Prochotta, A.; Steinbrink, K.M.; Berger, E.S. Startups in times of crisis—A rapid response to the COVID-19 pandemic. J. Bus. Ventur. Insights 2020, 13, e00169. [Google Scholar] [CrossRef]

- Thorgren, S.; Williams, T.A. Staying alive during an unfolding crisis: How SMEs ward off impending disaster. J. Bus. Ventur. Insights 2020, 14, e00187. [Google Scholar] [CrossRef]

- Jnr, B.A.; Petersen, S.A. Examining the digitalisation of virtual enterprises amidst the COVID-19 pandemic: A systematic and meta-analysis. Enterp. Inf. Syst. 2020, 1–34. [Google Scholar] [CrossRef]

- Efremova, M.V.; Sheresheva, M.Y.; Valitova, L.A. Post-Pandemic challenges and prospects for SMEs in the Russian tourism sector. In Proceedings of the 33rd EBES Conference, Madrid, Spain, 7–9 October 2020. [Google Scholar]

- Priyono, A.; Moin, A.; Putri, V.N.A.O. Identifying Digital Transformation Paths in the Business Model of SMEs during the COVID-19 Pandemic. J. Open Innov. Technol. Mark. Complex. 2020, 6, 104. [Google Scholar] [CrossRef]

- Benn, S.; Edwards, M.; Williams, T. Organizational Change for Corporate Sustainability; Routledge & CRC Press: Oxfordshire, UK, 2018. [Google Scholar]

- Ritter, T.; Pedersen, C.L. Analyzing the impact of the coronavirus crisis on business models. Ind. Mark. Manag. 2020, 88, 214–224. [Google Scholar] [CrossRef]

- Belso-Martínez, J.A.; Mas-Tur, A.; Sánchez, M.; López-Sánchez, M.J. The COVID-19 response system and collective social service provision. Strategic network dimensions and proximity considerations. Serv. Bus. 2020, 14, 387–411. [Google Scholar] [CrossRef]

- Baum, T.; Hai, N.T.T. Hospitality, tourism, human rights and the impact of COVID-19. Int. J. Contemp. Hosp. Manag. 2020, 32, 2397–2407. [Google Scholar] [CrossRef]

- Sheresheva, M.Y. Coronavirus and tourism. Popul. Econ. 2020, 4, 72–76. [Google Scholar] [CrossRef]

- Brouder, P. Reset redux: Possible evolutionary pathways towards the transformation of tourism in a COVID-19 world. Tour. Geogr. 2020, 22, 484–490. [Google Scholar] [CrossRef]

- Niewiadomski, P. COVID-19: From temporary de-globalisation to a re-discovery of tourism? Tour. Geogr. 2020, 22, 651–656. [Google Scholar] [CrossRef]

- Romagosa, F. The COVID-19 crisis: Opportunities for sustainable and proximity tourism. Tour. Geogr. 2020, 22, 690–694. [Google Scholar] [CrossRef]

- Assaf, A.; Scuderi, R. COVID-19 and the recovery of the tourism industry. Tour. Econ. 2020, 26, 731–733. [Google Scholar] [CrossRef]

- Zeng, Z.; Chen, P.-J.; Lew, A.A. From high-touch to high-tech: COVID-19 drives robotics adoption. Tour. Geogr. 2020, 22, 724–734. [Google Scholar] [CrossRef]

- Żemła, M. Tourism destination: The networking approach. Morav. Geogr. Rep. 2016, 24, 2–14. [Google Scholar] [CrossRef]

- Perkins, R.; Khoo-Lattimore, C.; Arcodia, C. Understanding the contribution of stakeholder collaboration towards regional destination branding: A systematic narrative literature review. J. Hosp. Tour. Manag. 2020, 43, 250–258. [Google Scholar] [CrossRef]

- Dhewanto, W.; Nazmuzzaman, E.; Fauzan, T.R. Cross-countries’ policies comparison of supporting small and medium-sized enterprises during Covid-19 pandemic. In Proceedings of the ECIE 2020 16th European Conference on Innovation and Entrepreneurship Academic Conferences Limited, Lisbon, Portugal, 17–18 September 2020; p. 218. [Google Scholar]

- Javed, A. Impact of COVID-19 on Pakistan’s services sector. J. Inov. Èkon. 2020, 5, 107–116. [Google Scholar] [CrossRef]

- Merkel, L.; Feißt, R.; Müller, P. Spanish Government Measures for SME Exporters in Times of COVID-19 Crisis; IfTI Working Paper December 2020; Hochschule Offenburg: Offenburg, Germany, 2020; Available online: https://opus.hs-offenburg.de/frontdoor/deliver/index/docId/4135/file/Essay_Spain_final.pdf (accessed on 9 February 2021).

- World Tourism Organization. Supporting Jobs and Economies through Travel & Tourism-A Call for Action to Mitigate the Socio-Economic Impact of COVID-19 and Accelerate Recovery; The World Tourism Organization (UNWTO): Madrid, Spain, 2020. [Google Scholar] [CrossRef]

- Kock, F.; Nørfelt, A.; Josiassen, A.; Assaf, A.G.; Tsionas, M.G. Understanding the COVID-19 tourist psyche: The evolutionary tourism paradigm. Ann. Tour. Res. 2020, 85, 103053. [Google Scholar] [CrossRef] [PubMed]

- Laato, S.; Islam, A.N.; Farooq, A.; Dhir, A. Unusual purchasing behavior during the early stages of the COVID-19 pandemic: The stimulus-organism-response approach. J. Retail. Consum. Serv. 2020, 57, 102224. [Google Scholar] [CrossRef]

- Sheth, J. Impact of Covid-19 on consumer behavior: Will the old habits return or die? J. Bus. Res. 2020, 117, 280–283. [Google Scholar] [CrossRef]

- Gursoy, D.; Chi, C.G. Effects of COVID-19 pandemic on hospitality industry: Review of the current situations and a research agenda. J. Hosp. Mark. Manag. 2020, 29, 527–529. [Google Scholar] [CrossRef]

- Kourgiantakis, M.; Apostolakis, A.; Dimou, I. COVID-19 and holiday intentions: The case of Crete, Greece. Anatolia 2021, 32, 148–151. [Google Scholar] [CrossRef]

- Han, H.; Al-Ansi, A.; Chua, B.-L.; Tariq, B.; Radic, A.; Park, S.-H. The Post-Coronavirus World in the International Tourism Industry: Application of the Theory of Planned Behavior to Safer Destination Choices in the Case of US Outbound Tourism. Int. J. Environ. Res. Public Health 2020, 17, 6485. [Google Scholar] [CrossRef]

- Zenker, S.; Kock, F. The coronavirus pandemic—A critical discussion of a tourism research agenda. Tour. Manag. 2020, 81, 104164. [Google Scholar] [CrossRef]

- Hao, F.; Xiao, Q.; Chon, K. COVID-19 and China’s Hotel Industry: Impacts, a Disaster Management Framework, and Post-Pandemic Agenda. Int. J. Hosp. Manag. 2020, 90, 102636. [Google Scholar] [CrossRef]

- Radovič-Markovič, M.; Živanovič, B. Fostering green entrepreneurship and women’s empowerment through education and banks’ investments in tourism: Evidence from Serbia. Sustainability 2019, 11, 6826. [Google Scholar] [CrossRef]

- Mirskikh, I.; Mingaleva, Z.; Kuranov, V.; Matseeva, S. Digitization of Medicine in Russia: Mainstream Development and Potential. Lect. Notes Netw. Syst. 2021, 136, 337–345. [Google Scholar] [CrossRef]

- Wen, J.; Wang, W.; Kozak, M.; Liu, X.; Hou, H. Many brains are better than one: The importance of interdisciplinary studies on COVID-19 in and beyond tourism. Tour. Recreat. Res. 2020, 1–4. [Google Scholar] [CrossRef]

- Polemis, M.; Stengos, T. Threshold Effects during the COVID-19 Pandemic: Evidence from International Tourist Destinations. Munich Personal RePEc Archive; MPRA Paper No. 102845; University of Piraeus, Guelph University: Guelph, ON, Canada, 2020; Available online: https://mpra.ub.uni-muenchen.de/102845/1/MPRA_paper_102845.pdf (accessed on 19 January 2021).

- Chang, C.-L.; McAleer, M.; Ramos, V. A Charter for Sustainable Tourism after COVID-19. Sustainability 2020, 12, 3671. [Google Scholar] [CrossRef]

- Mingaleva, Z. On digital development of Russian urban transport infrastructure. Adv. Intell. Syst. Comput. 2019, 850, 29–35. [Google Scholar] [CrossRef]

- Reyes-Menendez, A.; Correia, M.; Matos, N.; Adap, C. Understanding Online Consumer Behavior and eWOM Strategies for Sustainable Business Management in the Tourism Industry. Sustainability 2020, 12, 8972. [Google Scholar] [CrossRef]

- Saura, J.R.; Reyes-Menendez, A.; Palos-Sanchez, P.R. The digital tourism business: A systematic review of essential digital marketing strategies and trends. In Digital Marketing Strategies for Tourism, Hospitality, and Airline Industries; IGI Global: Hershey, PA, USA, 2020; pp. 1–22. [Google Scholar]

- Alves, G.M.; Sousa, B.M.; Machado, A. The role of digital marketing and online relationship quality in social tourism: A tourism for all case study. In Digital Marketing Strategies for Tourism, Hospitality, and Airline Industries; IGI Global: Hershey, PA, USA, 2020; pp. 49–90. [Google Scholar]

- Legard, R.; Keegan, J.; Ward, K. In-depth Interviews. Qualitative Research Practice: A guide for Social Science Students and Researchers; SAGE Publications: London, UK, 2003; Volume 6, pp. 138–169. [Google Scholar]

- Sheresheva, M.; Valitova, L.; Tsenzharik, M.; Oborin, M. Industrial Life-Cycle and the Development of the Russian Tourism Industry. J. Risk Financ. Manag. 2020, 13, 113. [Google Scholar] [CrossRef]

- Andrades, L.; Dimanche, F. Destination competitiveness and tourism development in Russia: Issues and challenges. Tour. Manag. 2017, 62, 360–376. [Google Scholar] [CrossRef]

- Andrades, L.; Dimanche, F. Destination competitiveness in Russia: Tourism professionals’ skills and competences. Int. J. Contemp. Hosp. Manag. 2019, 31, 910–930. [Google Scholar] [CrossRef]

- Chkalova, O.; Efremova, M.; Lezhnin, V.; Polukhina, A.; Sheresheva, M. Innovative mechanism for local tourism system management: A case study. Entrep. Sustain. Issues 2019, 6, 2052–2067. [Google Scholar] [CrossRef]

- Polukhina, A.N.; Sheresheva, M.Y.; Rukomoinikova, V.P.; Napol’skikh, D.L. The rationale for comparative effec-tiveness of tourist potential realization (case study of the Volga Region). Econ. Soc. Chang. Facts Trends Forecast 2016, 5, 122–140. [Google Scholar] [CrossRef]

- Polukhina, A.; Sheresheva, M.; Efremova, M.; Suranova, O.; Agalakova, O.; Antonov-Ovseenko, A. The Concept of Sustainable Rural Tourism Development in the Face of COVID-19 Crisis: Evidence from Russia. J. Risk Financ. Manag. 2021, 14, 38. [Google Scholar] [CrossRef]

| Question | Answers | Number and Percentage of Respondents | |

|---|---|---|---|

| 1 | The scale of business decline | Insignificant | 3 (5%) |

| Significant | 38 (60%) | ||

| Critical | 22 (35%) | ||

| 2 | The drop in sales | <20% | - |

| 21–40% | - | ||

| 41–60% | 16 (25%) | ||

| 61–80% | 37 (59%) | ||

| >80% | 10 (16%) | ||

| 3 | How many days would your company be able to live on funds in accounts in the absence of money inflows (if there are constant costs)? | <30 | 25 (40%) |

| 30–60 | 28 (44%) | ||

| 90–120 | 10 (16%) | ||

| 4 | What anticrisis measures will you implement at your enterprise? (Multiple answer options possible) | Changing business strategy/Vision | 28 (44%) |

| Replacement of key specialists | 2 (3%) | ||

| Business Process Reengineering | 9 (14%) | ||

| Staff reduction | 33 (52%) | ||

| Innovating | 9 (14%) | ||

| Lower wages | 16 (25%) | ||

| Reconstruction of the logistics base | 7 (11%) | ||

| I will keep the staff, but I will take a salary loan for employees | 16 (25%) | ||

| Increased use of digital technologies | 16 (25%) | ||

| Market withdrawal/Shutdown | 3 (5%) | ||

| Short-term shift to other services | 10 (16%) | ||

| Other | 7 (11%) | ||

| Reduced costs | 22 (35%) | ||

| Combining positions | 9 (14%) | ||

| Increasing customer orientation | 3 (5%) | ||

| 5 | Do you need financial resources to grow your business? | No, not required | 3 (5%) |

| Required, but we will cope on our own | 25 (40%) | ||

| Required, will have to take out a loan | 33 (52%) | ||

| Another | 2 (3%) | ||

| 6 | Have you used any state support measures? | No, not used | 3 (5%) |

| Received a direct subsidy | 41 (65%) | ||

| Received a rental benefit | 9 (14%) | ||

| Received a tax benefit | 22 (35%) | ||

| Received an interest-free loan | 19 (30%) | ||

| Another | 3 (5%) | ||

| 7 | Has state support solved any current problems? | Yes | 13 (21%) |

| Partly, but state support was rather insufficient/ineffective | 45 (72%) | ||

| No, state support for us was not useful in anything | 5 (8%) | ||

| 8 | Did your company interrupt its busines activity in a pandemic? | Yes | 47 (75%) |

| No | 16 (25%) | ||

| 9 | Has the staff of your labor collective survived? | Yes | 25 (40%) |

| No, we had to reduce staff | 9 (14%) | ||

| No, some employees quit themselves | 25 (40%) | ||

| No, there was a reduction in staff, and the employees themselves were leaving | 4 (6%) | ||

| 10 | Did you have to cut employee wages? | Yes | 27 (43%) |

| No | 13 (21%) | ||

| Staff were formally reassigned to a reduced schedule | 21 (33%) | ||

| Employees were placed on unpaid leave | 2 (3%) | ||

| Another | - | ||

| 11 | Have you experienced unfair behavior on the part of your suppliers? | Yes | 41 (65%) |

| No | 22 (35%) | ||

| 12 | Have you encountered legal problems (claims and complaints) due to the inability to fulfill obligations to customers? | Yes | 28 (44%) |

| No | 35 (56%) | ||

| Another | - | ||

| 13 | Have you managed to solve these problems without compromising your business/negotiating with your customers? | Yes | 47 (75%) |

| No | 7 (11%) | ||

| Another | 9 (14%) | ||

| 14 | Have you repurposed from offline to online service? | No, the specifics of our business does not allow | 30 (48%) |

| No, time constraints (and/or technical resources) prevented rapid repurposing | 2 (3%) | ||

| Yes, partially | 21 (33%) | ||

| Yes, we are fully ready for online format | 10 (16%) | ||

| 15 | Have you been able to repurpose your business to provide other services, or service new destinations? | Yes | 3 (5%) |

| No | 44 (70%) | ||

| Partially | 16 (25%) | ||

| 16 | Due to the pandemic, we felt disappointed in our work | Yes, absolutely agree Yes rather than No No rather than Yes No, absolutely disagree | 6 (10%) 3 (5%) 21 (33%) 33 (52%) |

| 17 | We sacrifice short-term results and shareholder value for the long-term survival of our business | Yes, absolutely agree Yes rather than No No rather than Yes No, absolutely disagree | 28 (44%) 16 (25%) 10 (16%) 9 (14%) |

| 18 | In a pandemic, our team has become more cohesive | Yes, absolutely agree Yes rather than No No rather than Yes No, absolutely disagree | 25 (40%) 21 (33%) 16 (25%) 1 (2%) |

| 19 | The pandemic has accelerated the digitalization of our business | Yes, absolutely agree Yes rather than No No rather than Yes No, absolutely disagree | 47 (75%) 13 (21%) 3 (5%) - |

| 20 | Did you provide social assistance in a pandemic? | Yes (specify which)

| 57(90%) |

| No | 6 (10%) | ||

| 21 | What factors hinder the further development of your business? | Lack of finance | 35 (56%) |

| Lack of knowledge | - | ||

| Weak state support | 28 (44%) | ||

| Lack of qualified staff | 13 (21%) | ||

| Uncertainty related to COVID-19 | 57 (90%) | ||

| Other | 10 (16%) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sheresheva, M.; Efremova, M.; Valitova, L.; Polukhina, A.; Laptev, G. Russian Tourism Enterprises’ Marketing Innovations to Meet the COVID-19 Challenges. Sustainability 2021, 13, 3756. https://doi.org/10.3390/su13073756

Sheresheva M, Efremova M, Valitova L, Polukhina A, Laptev G. Russian Tourism Enterprises’ Marketing Innovations to Meet the COVID-19 Challenges. Sustainability. 2021; 13(7):3756. https://doi.org/10.3390/su13073756

Chicago/Turabian StyleSheresheva, Marina, Marina Efremova, Lilia Valitova, Anna Polukhina, and Georgy Laptev. 2021. "Russian Tourism Enterprises’ Marketing Innovations to Meet the COVID-19 Challenges" Sustainability 13, no. 7: 3756. https://doi.org/10.3390/su13073756

APA StyleSheresheva, M., Efremova, M., Valitova, L., Polukhina, A., & Laptev, G. (2021). Russian Tourism Enterprises’ Marketing Innovations to Meet the COVID-19 Challenges. Sustainability, 13(7), 3756. https://doi.org/10.3390/su13073756