The Nature of Global Green Finance Standards—Evolution, Differences, and Three Models

Abstract

1. Introduction

2. Literature Review

3. Hypotheses

3.1. Levels of Institutional Change

3.2. Focus of Institutional Change

3.3. Proliferation of Institutional Change

3.4. Models of Institutional Change

4. Materials and Methods

- Governments and regulators (e.g., green bond and green credit standards in China)

- Intermediary groups and associations (e.g., non-governmental organizations, such as ICMA, CICERO, Climate Bonds Initiative and multilateral organizations, such as UN organizations dealing with green finance)

- Supranational and development institutions including multilateral and bilateral development financial institutions (e.g., IFC, Asian Development Bank (ADB), Asian Infrastructure and Investment Bank (AIIB))

- (1).

- Market economies—where we chose the European Union (EU): Much of the development of the EU’s green finance system was driven by market stakeholders (particularly banks, and to some extent securities markets and shareholders): the German development bank KfW claims, for example, to have “supported green finance” through its environmental program for SME’s already in 1984 [56]. Besides the market-driven development, the EU and its nations, had been developing green finance standards on the government level to regulate green finance with the first related green finance standard published in 1998, and 113 more since then [23]. The EU’s environmental strategy is based on, e.g., the Gothenburg Summit in 2001, where it called for a “new approach to policy making that ensures the EU’s economic, social and environmental policies mutually reinforce each other” with a special mention of climate change. In 2007, The European Council “insisted on the need to give priority to implementation measures” that included the “protection of biodiversity and ecosystem services” and “calls upon business, NGOs and citizens to become more involved in working for sustainable development” [57]. Yet, few comprehensive government-led green finance standards had so far been issued, which brought even advanced EU economies, like Germany, to the conclusion that the regulatory approach for green finance has trailed [58]. To accelerate its regulatory approach, the EU introduced the Sustainable Finance Action Plan in 2018 [59] and published the EU Taxonomy on Sustainable Activities” (the de-facto EU green and sustainable finance standard) in 2019 [60] (which, in March 2021, was still waiting for the final approval). Similarly, the European Central Bank had only seriously considered climate and environmental risks in its “Guide on climate-related and environmental risks for banks” published in November 2020 [61]. Despite little government regulation, the EU has become one of the largest markets for green finance, for example with more than USD 125 billion in green bonds issued in 2020 [62].

- (2).

- Government-led economies, where we chose China: As a country with strong government influence in the economy and with weaker scores with regard to free market mechanisms (e.g., [55]), China’s green finance development has seen multiple government-level green finance interventions [63], particularly by Cinese Banking and Insurance Regulatory Commission (CBIRC)—the Chinese banking regulator (e.g., Green Credit Guidelines in 2012, Green Credit Statistics System in 2013 and Green Credit Key Performance Indicators in 2014) for the banking sector, and by the People’s Bank of China (e.g., Guidelines for Establishing the Green Financial System in 2016, the Green Bond Catalogue in 2016) [63] to regulate the green bond market. By 2019, 12% of the recorded sustainable finance standards issued by governments recorded on the World Bank’s Green Finance Platform were issued by China—making China the most active green finance regulatory standard issuer in the world. Meanwhile, market-driven initiatives had been few (an exception, was the introduction of the Green Investment Principles for the Belt and Road Initiative in 2018 [64]). China’s green finance system is embedded in and supporting national strategies that focus on the “three key battles” of poverty alleviation, air pollution and financial stability [65], and supports the “battle for blue skies” [66]. Its green finance system therefore has a strong focus on fighting air pollution (which led to the inclusion of “clean coal” in the Chinese Green Bond Catalogue and Green Industry Catalogue, which has little air pollution, but high greenhouse gas emissions). To accelerate climate finance, relevant ministries issued a separate climate finance guidance [67] in November 2020. As a consequence of much government support [68], China has become one of the largest markets for green finance [69] with USD 800 billion in green bonds issued over the past years [70], and about USD 1.85 trillion of outstanding green credits [71].

- (3).

- Emerging economies with neither particularly strong market nor government-led governance: with less developed domestic financial market and with a higher dependence on foreign aid in many of the emerging economies, an important driver for green finance standards evolution and application has been developing finance institutions (DFIs), such as multilateral development banks (e.g., the IFC, World Bank, Asian Development Bank, European Bank for Reconstruction and Development (EBRD)) or bilateral development banks or financial programs (e.g., the French Development Bank AFD, the British Department for International Development (DFID) or the German Development Bank KfW). The development and application of green finance standards in weak governance countries became necessary, as DFIs were expected by their investor countries (mostly developed countries) to contribute to sustainable development and sustainable investments. To overcome a lack of market-driven and government-driven green finance standards in less developed countries, DFIs developed their own green finance standards, such as IFC’s Environmental and Social Review Procedure (ESRP) from 1998. This procedure was updated in 2006 with IFC’s Sustainability Framework. IFC’s Performance Standard Framework was published in 2012 and has since been widely adopted and adapted by other DFIs (e.g., ADB, KfW, European Investment Bank (EIB)) investing in emerging economies. With a particular financial sector development mandate, IFC, supported green finance standards integration in many of the emerging market financial institutions they invested (e.g., through adopting the Equator Principles) and supported emerging market regulators to develop and apply green finance standards through the Sustainable Banking Network (SBN) it helped establish in 2012 [72].

5. Results

5.1. Hypothesis 1: The Level of Green Finance Standard Evolution Depends on the Country’s Institutional Setting

5.2. Hypothesis 2: The Focus of Green Finance Standards Is Evolving

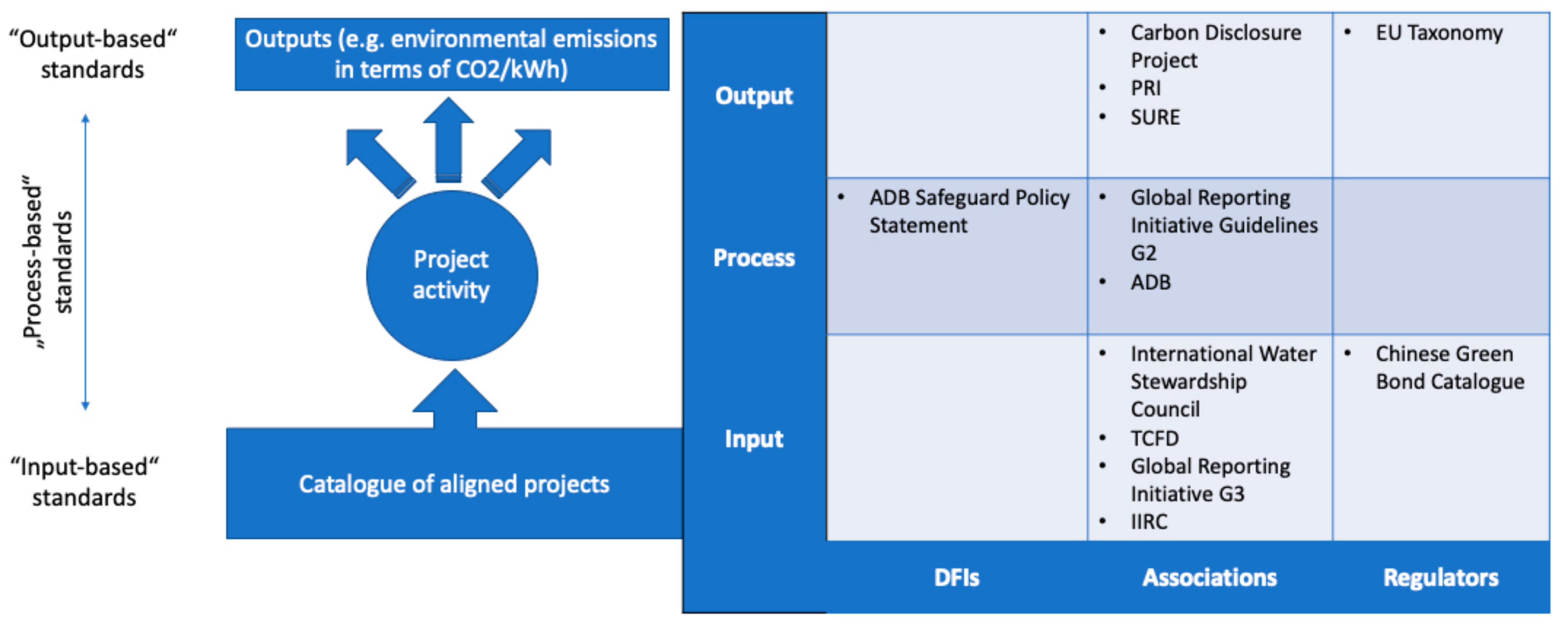

5.2.1. Hypothesis 2a: Focus Area Depending on Actor

5.2.2. Hypothesis 2b: Focus Area Depending on Jurisdiction

5.2.3. Hypothesis 2c: Focus Area Depending on Time

5.3. Hypothesis 3: Green Financial Standards Accelerate with Broader Recognition

“Making finance flows consistent with a pathway towards low greenhouse gas emissions and climate resilient development”[84]

5.4. Hypothesis 4: Different Models of Green Finance Standards Will Be Developed Depending on the Problem Objectivation and Local Capacity

5.4.1. Hypothesis 4a: Actor–Model Relationship

5.4.2. Hypothesis 4b: Region–Model Relationship

5.4.3. Hypothesis 4c: Time–Model Relationship

6. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Andreeva, O.V.; Vovchenko, N.G.; Ivanova, O.B.; Kostoglodova, E.D. Green Finance: Trends and Financial Regulation Prospects. In Contemporary Issues in Business and Financial Management in Eastern Europe; Contemporary Studies in Economic and Financial Analysis; Grima, S., Thalassinos, E., Eds.; Emerald Publishing: Bingley, UK, 2018; Volume 100, pp. 9–17. ISBN 978-1-78756-449-7. [Google Scholar]

- Zhang, D.; Zhang, Z.; Managi, S. A Bibliometric Analysis on Green Finance: Current Status, Development, and Future Directions. Financ. Res. Lett. 2019, 29, 425–430. [Google Scholar] [CrossRef]

- Nyström, M.; Jouffray, J.-B.; Norström, A.V.; Crona, B.; Jørgensen, P.S.; Carpenter, S.R.; Bodin, Ö.; Galaz, V.; Folke, C. Anatomy and Resilience of the Global Production Ecosystem. Nature 2019, 575, 98–108. [Google Scholar] [CrossRef]

- Chiapello, È. Stalemate for the Financialization of Climate Policy. Econ. Sociol. Eur. Electron. Newsl. 2020, 22, 20–29. [Google Scholar]

- Gilbert, D.U.; Rasche, A.; Waddock, S. Accountability in a Global Economy: The Emergence of International Accountability Standards. Bus. Ethics Q. 2011, 21, 23–44. [Google Scholar] [CrossRef]

- Heaps, T.; Guyatt, D. A Review of International Financial Standards as They Relate to Sustainable Development; UN Environment Inquiry; United Nations Environment Programme (UNEP): Nairobi, Kenya, 2017. [Google Scholar]

- Rajeev, P. How China Became a Global Leader in Green Finance. Available online: http://www.eco-business.com/news/how-china-became-a-global-leader-in-green-finance/ (accessed on 13 May 2020).

- Reinecke, J.; Manning, S.; von Hagen, O. The Emergence of a Standards Market: Multiplicity of Sustainability Standards in the Global Coffee Industry. Organ. Stud. 2012, 33, 791–814. [Google Scholar] [CrossRef]

- Wang, Y. Understanding China’s Green Finance Triumph. Available online: http://www.chinadaily.com.cn/global/2019-08/22/content_37504406.htm (accessed on 13 May 2020).

- European Investment Bank (EIB). Green Finance Committee of China Society for Finance and Banking. In The Need for A Common Language in Green Finance; European Investment Bank (EIB): Beijing, China, 2017. [Google Scholar]

- Bebchuk, L.A.; Roe, M.J. A Theory of Path Dependence in Corporate Governance and Ownership; The Center for Law and Economic Studies, Columbia Law School: New York, NY, USA, 1999. [Google Scholar]

- Weber, O.; Adeniyi, I. Voluntary Sustainability Codes of Conduct in the Financial Sector 2015; CIGI: Waterloo, ON, Canada, 2015. [Google Scholar]

- Wright, C.; Rwabizambuga, A. Institutional Pressures, Corporate Reputation, and Voluntary Codes of Conduct: An Examination of the Equator Principles. Bus. Soc. Rev. 2006, 111, 89–117. [Google Scholar] [CrossRef]

- Blankenbach, J. Voluntary Sustainability Standards and the Role of the Government; Die—Deutsches Institut für Entwicklungspolitik: Berlin, Germany, 2016. [Google Scholar]

- Migliorelli, M. What Do We Mean by Sustainable Finance? Assessing Existing Frameworks and Policy Risks. Sustainability 2021, 13, 975. [Google Scholar] [CrossRef]

- Kasper, W.; Streit, M.E. Institutional Economics—Social Order and Public Policy; Edward Elgar Publishing Limited: Cheltenham, UK; Northampton, MA, USA, 1998. [Google Scholar]

- Lawrence, T.B.; Suddaby, R.; Leca, B. Institutional Work: Actors and Agency in Institutional Studies of Organizations; Cambridge University Press: Cambridge, UK; New York, NY, USA, 2009; ISBN 978-0-521-51855-0. [Google Scholar]

- Slager, R.; Gond, J.-P.; Moon, J. Standardization as Institutional Work: The Regulatory Power of a Responsible Investment Standard. Organ. Stud. 2012. [Google Scholar] [CrossRef]

- Timmermans, S.; Epstein, S. A World of Standards but Not a Standard World: Toward a Sociology of Standards and Standardization. Annu. Rev. Sociol. 2010, 36, 69–89. [Google Scholar] [CrossRef]

- Underhill, G.R.D. States, Markets and Governance for Emerging Market Economies: Private Interests, the Public Good and the Legitimacy of the Development Process. Int. Aff. 2003, 79, 755–781. [Google Scholar] [CrossRef][Green Version]

- Kaufmann, D.; Kraay, A.; Zoido-Lobatón, P. Aggregating Governance Indicators; Policy Research Working Paper; The World Bank: Washington, DC, USA, 1999. [Google Scholar]

- Harlan, T. Green Development or Greenwashing? A Political Ecology Perspective on China’s Green Belt and Road. Null 2021, 62, 202–226. [Google Scholar] [CrossRef]

- Green Finance Platform Browse Policies and Regulations. Available online: https://www.greenfinanceplatform.org/financial-measures/browse (accessed on 28 February 2020).

- Amran, A.; Haniffa, R. Evidence in Development of Sustainability Reporting: A Case of a Developing Country. Bus. Strategy Environ. 2011, 20, 141–156. [Google Scholar] [CrossRef]

- Sachs, J.D.; Woo, W.T.; Yoshino, N.; Taghizadeh-Hesary, F. Why Is Green Finance Important? SSRN J. 2019. [Google Scholar] [CrossRef]

- Robertson, F.A.; Samy, M. Factors Affecting the Diffusion of Integrated Reporting—A UK FTSE 100 Perspective. Sustain. Account. Manag. Policy J. 2015, 6, 190–223. [Google Scholar] [CrossRef]

- North, D.C. The New Institutional Economics. J. Inst. Theor. Econ. 1986, 142, 230–237. [Google Scholar]

- Coase, R.H. The Institutional Structure of Production. In Handbook of New Institutional Economics; Menard, C., Shirley, M.M., Eds.; Springer: Dordrecht, The Netherlands, 2005; pp. 31–39. [Google Scholar]

- Guillén, M.F.; O’Sullivan, M.A. The Changing International Corporate Governance Landscape. In Wharton-INSEAD on Globalization; Gatignon, H., Kimberly, J., Eds.; Cambridge University Press: New York, NY, USA, 2004; pp. 23–48. [Google Scholar]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R.W. Legal Determinants of External Finance. J. Financ. 1997, 52, 1131–1150. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R.W. Law and Finance. J. Political Econ. 1998, 106, 1113–1155. [Google Scholar] [CrossRef]

- Soppe, A. Sustainable Corporate Finance. J. Bus. Ethics 2004, 53, 213–224. [Google Scholar] [CrossRef]

- Coco, G.; Ferri, G. From Shareholders to Stakeholders Finance: A More Sustainable Lending Model. Int. J. Sustain. Econ. 2010, 2, 352. [Google Scholar] [CrossRef]

- Solomon, B.D. New Directions in Emissions Trading: The Potential Contribution of New Institutional Economics. Ecol. Econ. 1999, 30, 371–387. [Google Scholar] [CrossRef]

- Branch, B. Institutional Economics and Behavioral Finance. J. Behav. Exp. Financ. 2014, 1, 13–16. [Google Scholar] [CrossRef]

- Guild, J. The Political and Institutional Constraints on Green Finance in Indonesia. J. Sustain. Financ. Invest. 2020, 10, 157–170. [Google Scholar] [CrossRef]

- Moszyński, M.; Więckowska, M. Evolution of Ecological Financial Market from the Perspective of Institutional Economics. Copernic. J. Financ. Account. 2014, 3, 1212. [Google Scholar] [CrossRef]

- Martiensen, J. Institutionenökonomik; Vahlen: München, Germany, 2000. [Google Scholar]

- Richter, R.; Furubotn, E.G. Neue Institutionenökonomik: Eine Einführung Und Kritische Würdigung, 2nd ed.; J.C.B. Mohr (Paul Siebeck): Tübingen, Germany, 1999. [Google Scholar]

- Zucker, L.G. Institutional Theories of Organization. Annu. Rev. Sociol. 1987, 13, 443–464. [Google Scholar] [CrossRef]

- Potters, J.; Sloof, R. Interest Groups: A Survey of Empirical Models That Try to Assess Their Influence. Eur. J. Political Econ. 1996, 12, 403–442. [Google Scholar] [CrossRef]

- Battaglini, M.; Harstad, B. Participation and Duration of Environmental Agreements. J. Political Econ. 2016, 124, 160–204. [Google Scholar] [CrossRef]

- Chaudhury, A. Role of Intermediaries in Shaping Climate Finance in Developing Countries—Lessons from the Green Climate Fund. Sustainability 2020, 12, 5507. [Google Scholar] [CrossRef]

- Giamporcaro, S.; Gond, J.-P.; O’Sullivan, N. Orchestrating Governmental Corporate Social Responsibility Interventions through Financial Markets: The Case of French Socially Responsible Investment. Bus. Ethics Q. 2020, 30, 288–334. [Google Scholar] [CrossRef]

- Scott, R.W. The Adolescence of Institutional Theory. Adm. Sci. Q. 1987, 32, 493–511. [Google Scholar] [CrossRef]

- Selznick, P. Leadership in Administration; Harper & Row: New York, NY, USA, 1956. [Google Scholar]

- Meyer, J.W.; Rowan, B. Institutionalized Organizations—Formal-Structure as Myth and Ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- Oliver, C. The Antecedents of Deinstitutionalisation. Organ. Stud. 1992, 13, 563–589. [Google Scholar] [CrossRef]

- Nedopil, C.; Wang, Y.; Xie, W.; DeBoer, D.; Liu, S.; Chen, X.; Li, Y.; Zhu, Y.; Lan, Y.; Li, P.; et al. Green Development Guidance for BRI Projects Baseline Study Report; International Belt and Road Initiative Green Development Coalition (BRIGC): Beijing, China, 2020. [Google Scholar]

- Oliver, C. Strategic Responses to Institutional Change and Economic Performance. Acad. Manag. J. 1991, 16, 145–179. [Google Scholar]

- DiMaggio, P.J.; Powell, W.W. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Timmermans, S.; Berg, M. The Gold Standard: The Challenge of Evidence-Based Medicine; Temple University Press: Philadelphia, PA, USA, 2003; ISBN 978-1-59213-187-7. [Google Scholar]

- Demirguc-Kunt, A.; Levine, R. Bank-Based and Market-Based Financial Systems—Cross-Country Comparisons; The World Bank: Washington, DC, USA, 1999. [Google Scholar]

- Tadesse, S. Financial Architecture and Economic Performance: International Evidence. J. Financ. Intermediat. 2002, 11, 429–454. [Google Scholar] [CrossRef]

- Heritage Foundation. 2019 Index of Economic Freedom; Heritage Foundation: Washington, DC, USA, 2019. [Google Scholar]

- KfW Development Finance Environmental and Climate Protection Has Always Been a Priority at KfW. Available online: https://www.kfw.de/KfW-Group/About-KfW/Identität/Geschichte-der-KfW/Themenfelder/Umwelt/ (accessed on 26 March 2020).

- European Commission. Sustainable Development—Environment. Available online: https://ec.europa.eu/environment/eussd/ (accessed on 20 March 2021).

- Sustainable Finance Committee of the German Federal Government. Interim Report—The Significance of Sustainable Finance to the Great Transformation; Sustainable Finance Committee of the German Federal Government: Berlin, Germany, 2020.

- European Commission. Financing Sustainable Growth—European Commission Action Plan; European Commission: Brussels, Belgium, 2018. [Google Scholar]

- EU Technical Expert Group on Sustainable Finance. Taxonomy Technical Report; European Union: Brussels, Belgium, 2019. [Google Scholar]

- European Central Bank (ECB). ECB Publishes Final Guide on Climate-Related and Environmental Risks for Banks; European Central Bank—Banking Supervision: Frankfurt, Germany, 2020. [Google Scholar]

- Climate Bonds Initiative (CBI). Record $269.5 bn Green Issuance for 2020: Late Surge Sees Pandemic Year Pip 2019 Total by $3 bn. Available online: https://www.climatebonds.net/2021/01/record-2695bn-green-issuance-2020-late-surge-sees-pandemic-year-pip-2019-total-3bn (accessed on 21 March 2021).

- Wang, Y.; Zadek, S. Establishing China’s Green Financial System: Progress Report 2017; Inquiry: Design of a Sustainable Financial System; UNEP Finance Initiative: Beijing, China, 2018. [Google Scholar]

- Green Finance Leadership Program Green Investment Principles (GIP) for the Belt and Road 2018. Available online: https://www.commerzbank.de/en/nachhaltigkeit/nachhaltigkeitsstandards/mitgliedschaften_und_initiativen/green_investment_principles/gip.html (accessed on 4 January 2021).

- Li, K. Report on the Work of the Government; State Council of the People’s Republic of China: Beijing, China, 2020. [Google Scholar]

- Government of the People’s Republic of China Action Plan for Blue Skys 2018—国务院关于印发打赢蓝天保卫战三年行动计划的通知(国发〔2018〕22号)_政府信息公开专栏. Available online: http://www.gov.cn/zhengce/content/2018-07/03/content_5303158.htm (accessed on 29 February 2020).

- Ministry of Ecology and Environment of the People’s Republic of China (MEE); National Development and Reform Commission (NDRC); People’s Bank of China (PBOC); China Banking and Insurance Regulatory Commission (CBIRC); China Securities Regulatory Commission (CSRC). 关于促进应对气候变化投融资的指导意见-Guiding Opinions on Promoting Investment and Financing to Address Climate Change; Ministry of Ecology and Environment of the People’s Republic of China: Beijing, China, 2020.

- Shen, H.; Ng, A.W.; Zhang, J.; Wang, L. Sustainability Accounting, Management and Policy in China: Recent Developments and Future Avenues. Sustain. Account. Manag. Policy J. 2020. [Google Scholar] [CrossRef]

- Shurey, D. How China Is Looking to Create the Next Green Wave. Available online: https://about.bnef.com/blog/china-looking-create-next-green-wave/ (accessed on 29 February 2020).

- Wang, C.N.; De Boer, D. China Must Boost Green Finance to Achieve Carbon Neutrality by 2060. China Dialogue, 17 November 2020. [Google Scholar]

- Hong, L.; Wei, H. Trust Companies Tap Green Finance Amid China’s Carbon Neutrality Push—Caixin Global. Caixin, 19 March 2021. [Google Scholar]

- International Finance Corporation (IFC). Sustainable Banking Network—Members. Available online: https://www.ifc.org/wps/wcm/connect/Topics_Ext_Content/IFC_External_Corporate_Site/Sustainability-At-IFC/Company-Resources/Sustainable-Finance/SBN_Members (accessed on 14 May 2020).

- Aureli, S.; Medei, R.; Supino, E.; Travaglini, C. Sustainability Disclosure after a Crisis: A Text Mining Approach. Int. J. Soc. Ecol. Sustain. Dev. 2016, 7, 35–49. [Google Scholar] [CrossRef]

- Silge, J.; Robinson, D. Tidytext: Text Mining and Analysis Using Tidy Data Principles in R. J. Open Source Softw. 2016, 1, 37. [Google Scholar] [CrossRef]

- Feinerer, I.; Hornik, K.; Meyer, D. Text Mining Infrastructure in R. J. Stat. Softw. 2008, 25. [Google Scholar] [CrossRef]

- CBN. China Banking News China Host to 4588 Banking Sector Financial Institutions, over 230,000 Physical Bank Branches. China Banking News, 1 March 2019. [Google Scholar]

- Statista Number of MFIs in Europe by Type. 2020. Available online: https://www.statista.com/statistics/1111010/european-union-number-monetary-financial-institutions-by-type/ (accessed on 5 June 2020).

- Reed, E. Top 10 Biggest Banks in the World. Available online: https://www.thestreet.com/personal-finance/biggest-banks-in-the-world (accessed on 14 May 2020).

- Convention on Biological Diversity Convention Text. Available online: https://www.cbd.int/convention/articles/?a=cbd-02 (accessed on 28 June 2020).

- Lammerant, J.; Grigg, A.; Dimitrijevic, J.; Leach, K.; Brooks, S.; Burns, A.; Berger, J.; Houdet, J.; Oorschot, M. Assessment of Biodiversity Measurement Approaches for Businesses and Financial Institutions; European Commission: Brussels, Belgium, 2019. [Google Scholar]

- IPCC. Summary for Policymakers. In Global Warming of 1.5 °C. An IPCC Special Report on the Impacts of Global Warming of 1.5 °C above Pre-Industrial Levels and Related Global Greenhous-Gas Emission Pathways, in the Context of Strengthening the Global Response to the Threat of Climate Change, Sustainable Development and Efforts to Eradicate Poverty; IPCC: Geneva, Switzerland, 2018; in press. [Google Scholar]

- World Health Organization (WHO). WHO|Ambient Air Pollution: Pollutants. Available online: http://www.who.int/airpollution/ambient/pollutants/en/ (accessed on 28 June 2020).

- Climate Bonds Initiative. Comparing China’s Green Bond Endorsed Project Catalogue and the Green Industry Guiding Catalogue with the EU Sustainable Finance Taxonomy; Climate Bonds Initiative (CBI): London, UK, 2019. [Google Scholar]

- United Nations. Paris Agreement; UN: New York, NY, USA, 2015. [Google Scholar]

| Name of Issuer | Financial Initiative | Year |

|---|---|---|

| International Finance Corporation (IFC) | Environmental and Social Review Procedure (ESRP) (predecessor of IFC Sustainability Framework in 2006) | 1998 |

| Global Reporting Initiative (GRI) | Global Reporting Initiative Guidelines G1 | 2000 |

| GRI | Global Reporting Initiative Guidelines G2 | 2002 |

| Carbon Disclosure Project (CDP) | Carbon Disclosure Project (CDP) | 2002 |

| Asian Development Bank (ADB) | Environment Policy | 2002 |

| Equator Principles | Equator Principles EP I | 2003 |

| Extractive Industries Transparency Initiative (EITI) | Extractive Industries Transparency Initiative Standard | 2003 |

| GRI | Global Reporting Initiative Guidelines G3 | 2006 |

| Equator Principles | Equator Principles EP III | 2006 |

| United Nations (UN) | United Nations Global Compact Principles | 2006 |

| IFC | IFC Performance Standards Social and Environmental Sustainability | 2006 |

| UN | Principles of Responsible Investing (PRI) | 2006 |

| ADB | ADB Safeguard Policy Statement | 2009 |

| Climate Bonds Initiative (CBI) | Climate Bonds Initiatives—Climate Bonds Standard and Certification Scheme | 2009 |

| International Integrated Reporting Council (IIRC) | International Integrated Reporting Council (IIRC) | 2010 |

| OECD | OECD Guidelines for Multinational Enterprises | 2011 |

| International Development Finance Club (IDFC) | International Development Finance Club (IDFC) | 2011 |

| Asia Investor Group on Climate Change (AIGCC) | Asia Investor Group on Climate Change | 2011 |

| Sustainability accounting Standards Board (SASB) | Sustainability Accounting Standards Board Industry Standards | 2011 |

| IFC | IFC Performance Standards Social and Environmental Sustainability | 2012 |

| IFC | IFC Performance Standard 1—Environmental and Social Risks | 2012 |

| IFC | IFC Performance Standard 6—Biodiversity Conservation | 2012 |

| SASB | SASB Commercial Banks | 2012 |

| United Nations Environmental Programme (UNEP) | UNEP Principles for Sustainable Insurance (PSI) | 2012 |

| China Banking Regulatory Commission (CBRC) | CBRC—Green Credit Guidelines | 2012 |

| IFC | IFC—Sustainable Banking Network | 2012 |

| Global Investor Coalition | Global Investor Coalition on Climate Change | 2012 |

| GRI | Global Reporting Initiative Guidelines G4 | 2013 |

| Equator Principles | Equator Principles EP III | 2013 |

| EITI | Extractive Industries Transparency Initiative Standard | 2013 |

| ADB | ADB Safeguard Policy Statement | 2013 |

| ADB | Environment Operation Direction | 2013 |

| Green Climate Fund (GCF) | GCF Investment Framework | 2013 |

| UNEP | Partnership for Action in Green Economy (PAGE) | 2013 |

| International Capital Markets Association (ICMA) | ICMA—The Green Bond Principles | 2014 |

| CBRC | CBRC—Key Indicators of Green Credit Performance | 2014 |

| Alliance for Water Stewardship (AWS) | International Water Stewardship Standard | 2014 |

| China Social Enterprise and Investment Forum (CSEIF) | China Social Enterprise and Investment Forum | 2014 |

| Global Investor Coalition | The Low Carbon Registry | 2014 |

| Multilateral Development Banks (MDB) | MDB—IDFC Common Principles for Climate Mitigation Finance Tracking | 2015 |

| CiCERO | CICERO Shades of Green | 2015 |

| Global Infrastructure Basel (GIB) | The Standard for Sustainable and Resilient Infrastructure | 2015 |

| French Ministry for the Ecology | French Ministry for the Ecological and Solidary Transition—Greenfin Label | 2015 |

| Task Force for Climate-related Financial Disclosure (TCFD) | Financial Stability Board—Task-Force on Climate-Related Financial Disclosures | 2015 |

| Global Steering Group (GSG/GSGII) | Global Steering Group for Impact Investment | 2015 |

| GRI | Global Reporting Initiative Standards | 2016 |

| United Nationss Principles of Responsible Investments (UNPRI) | UNPRI—Private Equity Action on Climate Change | 2016 |

| People’s Bank of China (PBOC) PBOC | Chinese Green Bond Catalogue | 2016 |

| TCFD | Financial Stability Board—Task-Force on Climate-Related Financial Disclosures | 2017 |

| ICMA | ICMA—Sustainability Bond Guidelines (SBG) | 2017 |

| ICMA | ICMA—The Social Bond Principles | 2017 |

| ASEAN Capital Markets Forum (ACFM) | ASEAN Green Bond Standards | 2017 |

| Network for Greening the Financial System (NGFS) | Central Banks and Supervisors Network for Greening the Financial System (NGFS) | 2017 |

| Green Investment Group | Green Investment Principles | 2017 |

| World Bank | World Bank Environmental and Social Framework | 2017 |

| SASB | SASB Investment Banking and Brokerage | 2018 |

| SASB | SASB Commercial Bank Standard | 2018 |

| ICMA | ICMA—The Green Bond Principles | 2018 |

| CICERO | CICERO Shades of Green | 2018 |

| GIB | SURE—The Standard for Sustainable and Resilient Infrastructure | 2018 |

| GSG/GSGII | Global Steering Group for Impact Investment | 2018 |

| World Benchmarking Alliance (WBA) | World Benchmarking Alliance (WBA) | 2018 |

| ICMA | ICMA—Sustainability Bond Guidelines (SBG) | 2018 |

| World Bank | World Bank—Environmental and Social Safeguards Framework ESS 1—Environmental and Social Risk | 2018 |

| World Bank | World Bank—Environmental and Social Safeguards Framework—ESS 6 Biodiversity | 2018 |

| ASFI/WWF | Asia Sustainable Finance Initiative | 2018 |

| Loan Market Association (LMA) | LMA—Green Loan Principles | 2018 |

| Science-Based Target Initiative (SBTI() | Science-Based Targets Initiative for Financial Institutions (SBTI FI) | 2018 |

| Carbon Disclosure Project (CDP) | Carbon Disclosure Project (CDP) | 2019 |

| EITI | Extractive Industries Transparency Initiative Standard | 2019 |

| IFC | IFC Performance Standard 6—Biodiversity Conservation | 2019 |

| UN | Principles of Responsible Investing (PRI) | 2019 |

| CBI | Climate Bonds Initiatives—Climate Bonds Standard and Certification Scheme | 2019 |

| AWS | International Water Stewardship Standard | 2019 |

| French Ministry for the Ecology | French Ministry for the Ecological and Solidary Transition—Greenfin Label | 2019 |

| UNDP | SDG Impact Practice Standards for Private Equity Funds | 2019 |

| Global Impact Investment Network (GIIN) | IRIS+ | 2019 |

| LMA | LMA—Sustainability Linked Loan Principles | 2019 |

| UNPRI | Inevitable Policy Response (IPR) | 2019 |

| ICMA | ICMA Harmonized Framework for Impact Reporting | 2019 |

| European Union (EU) | EU—Sustainable Finance Taxonomy | 2019 |

| 2∞investing initiative | Paris Agreement Capital Transition Assessment (PACTA) | 2019 |

| GIP | Green Investment Principles for the BRI | 2019 |

| Equator Principles | Equator Principles EP IV | 2020 |

| Biodiversity | Climate | Pollution |

|---|---|---|

| species | adaptation | air pollution |

| ecosystems | mitigation | PM2.5 |

| biosphere | temperature | particulate matter |

| bio-finance | greenhouse gas | air quality |

| extinction | GHG emissions | pollutant |

| habitat | extreme weather | lung cancer |

| conservation | drought | exhaust |

| deforestation | floods | soot |

| wetlands | storms | sulfur oxide |

| oceans | global warming | nitrogen oxide |

| Process | Input | Output |

|---|---|---|

| EIA | catalogue | CO2e/kwh |

| environmental impact assessment | list | emissions |

| safeguards | threshold | |

| project evaluation | CO2 | |

| reporting | outcome | |

| appraisal | screening criteria | |

| approval | criteria | |

| procedure | ||

| screening process |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nedopil, C.; Dordi, T.; Weber, O. The Nature of Global Green Finance Standards—Evolution, Differences, and Three Models. Sustainability 2021, 13, 3723. https://doi.org/10.3390/su13073723

Nedopil C, Dordi T, Weber O. The Nature of Global Green Finance Standards—Evolution, Differences, and Three Models. Sustainability. 2021; 13(7):3723. https://doi.org/10.3390/su13073723

Chicago/Turabian StyleNedopil, Christoph, Truzaar Dordi, and Olaf Weber. 2021. "The Nature of Global Green Finance Standards—Evolution, Differences, and Three Models" Sustainability 13, no. 7: 3723. https://doi.org/10.3390/su13073723

APA StyleNedopil, C., Dordi, T., & Weber, O. (2021). The Nature of Global Green Finance Standards—Evolution, Differences, and Three Models. Sustainability, 13(7), 3723. https://doi.org/10.3390/su13073723