The Drivers of Green Investment: A Bibliometric and Systematic Review

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

3.1. Selection of Methods

3.2. Data Collection and Preparation

4. Results

4.1. Bibliometric Results

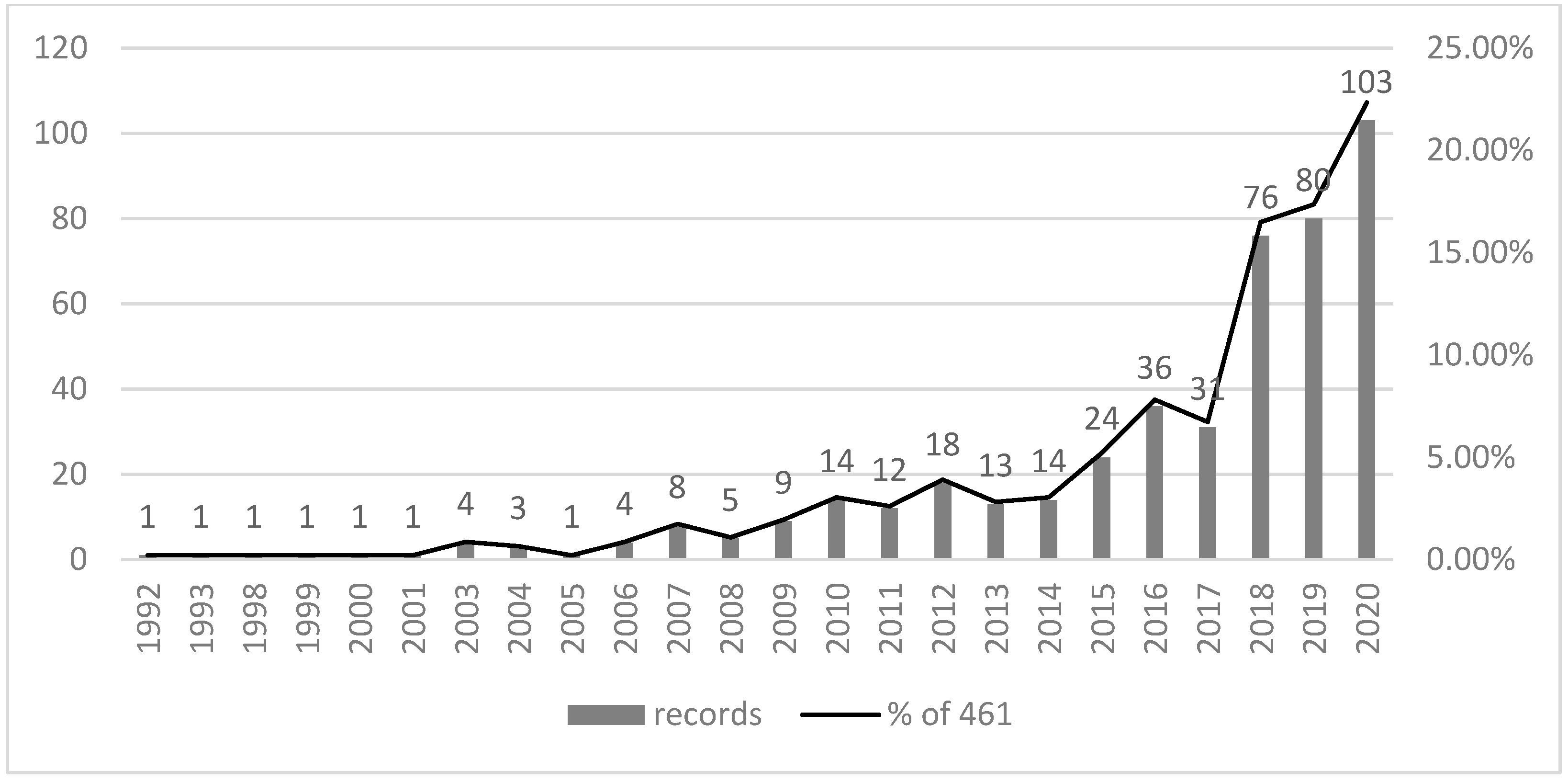

4.1.1. The Evolution in Time of Research

4.1.2. Journals

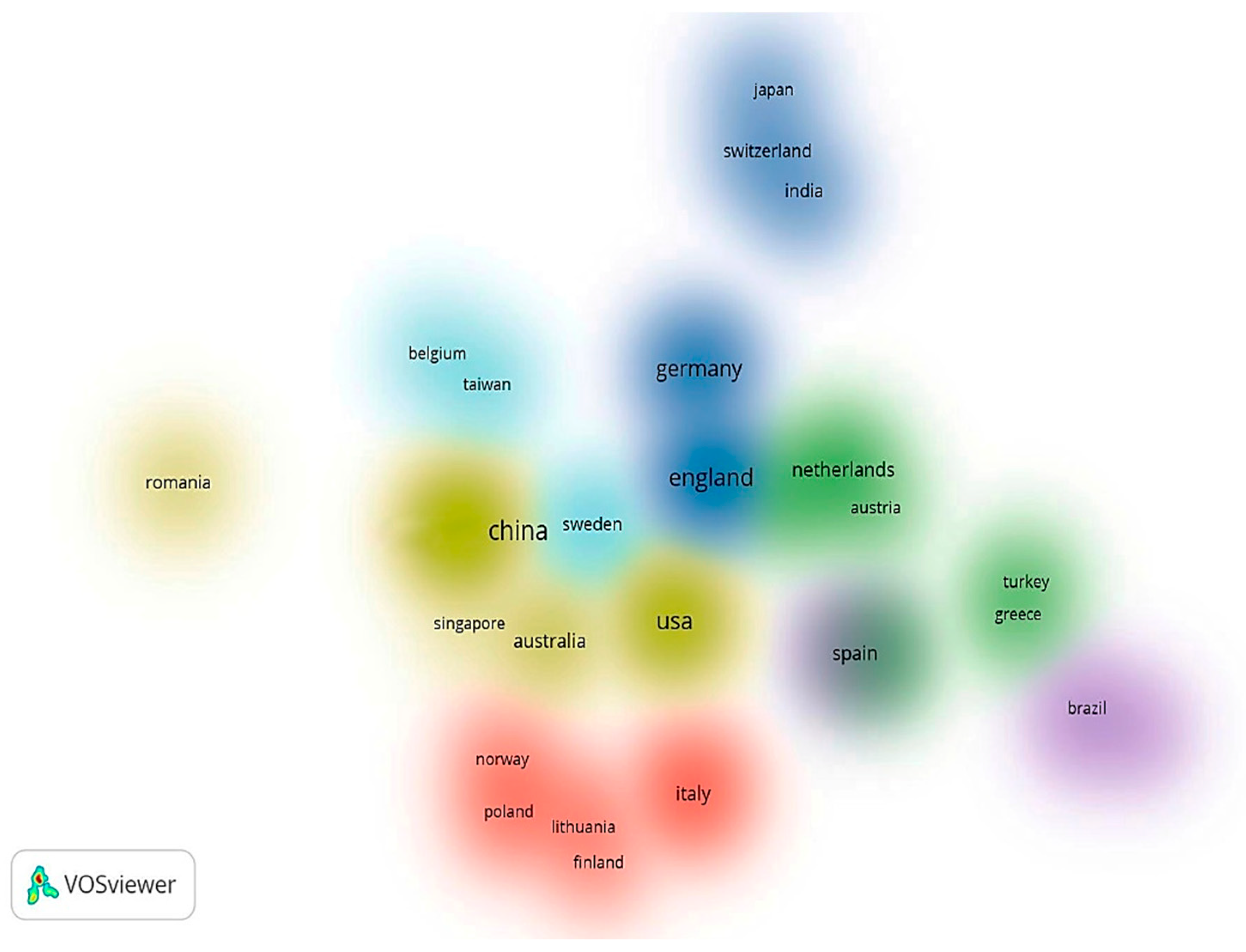

4.1.3. Countries and Citations

4.1.4. Authors and Citations

4.1.5. Keyword Co-Occurrence Analysis

4.2. Systematic Review

4.2.1. Methodological Approach

4.2.2. External and Internal Drivers and Motivation for Green Investment

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Acknowledgments

Conflicts of Interest

References

- Han, S.-R.; Li, P.; Xiang, J.-J.; Luo, X.-H.; Chen, C.-Y. Does the institutional environment influence corporate social responsibility? Consideration of green investment of enterprises—Evidence from China. Environ. Sci. Pollut. Res. 2020, 1–18. [Google Scholar] [CrossRef]

- Allen, C.; Clouth, S. A guidebook to the Green Economy Issue 1: Green Economy, Green Growth, and Low-Carbon Development–history, definitions and a guide to recent publications Division for Sustainable Development. UNDESA, August 2012. [Google Scholar]

- Inderst, G.; Kaminker, C.; Stewart, F. Defining and Measuring Green Investments: Implications for Institutional nvestors’ Asset Allocations. In OECD Working Papers on Finance, Insurance and Private Pensions; OECD Publishing: Paris, France, 2012; p. 24. [Google Scholar]

- Ambec, S.; Lanoie, P. When and why does it pay to be green? Acad. Manag. Perspect. 2008, 23, 45–62. [Google Scholar]

- Falcone, P.M. Green investment strategies and bank-firm relationship: A firm-level analysis. Econ. Bull. 2018, 38, 2225–2239. Available online: https://www.researchgate.net/publication/329359983 (accessed on 23 December 2020).

- Zhang, X.; Wu, Z.; Feng, Y.; Xu, P. “Turning green into gold”: A framework for energy performance contracting (EPC) in China’s real estate industry. J. Clean. Prod. 2015, 109, 166–173. [Google Scholar] [CrossRef]

- Xing, G.; Xia, B.; Guo, J. Sustainable Cooperation in the Green Supply Chain under Financial Constraints. Sustainability 2019, 11, 5977. [Google Scholar] [CrossRef]

- Pekovic, S.; Grolleau, G.; Mzoughi, N. Environmental investments: Too much of a good thing? Int. J. Prod. Econ. 2018, 197, 297–302. [Google Scholar] [CrossRef]

- Taghizadeh-Hesary, F.; Yoshino, N. Sustainable Solutions for Green Financing and Investment in Renewable Energy Projects. Energies 2020, 13, 788. [Google Scholar] [CrossRef]

- Mokhov, V.G.; Chebotareva, G.S.; Khomenko, P.M. Modelling of “Green” Investments Risks. Series “Mathematical Modelling, Programming and Computer Software”. Bull. South Ural State Univ. 2018, 11, 154–159. [Google Scholar]

- Wang, Y.Z.; Lo, F.Y.; Weng, S.M. Family businesses successors knowledge and willingness on sustainable innovation: The moderating role of leader’s approval. J. Innov. Knowl. 2019, 4, 188–195. [Google Scholar] [CrossRef]

- Rauter, R.; Globocnik, D.; Perl-Vorbach, E.; Baumgartner, R.J. Open innovation and its effects on economic and sustainability innovation performance. J. Innov. Knowl. 2019, 4, 226–233. [Google Scholar] [CrossRef]

- Utz, S.W. Tri-criterion modeling for constructing more-sustainable mutual funds. Eur. J. Oper. Res. 2015, 246, 331–338. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Rivera-Lirio, J.M.; Munoz-Torres, M.J.; Fernandez-Izquierdo, M.A. Integrating multiple ESG investors’ preferences into sustainable investment: A fuzzy multicriteria methodological approach. J. Clean. Prod. 2017, 162, 1334–1345. [Google Scholar] [CrossRef]

- Zhang, X.; Yousaf, H.A.U. Green supply chain coordination considering government intervention, green investment, and customer green preferences in the petroleum industry. J. Clean. Prod. 2020, 246, 118984. [Google Scholar] [CrossRef]

- Costa, J. Carrots or Sticks: Which Policies Matter the Most in Sustainable Resource Management? Resources 2021, 10, 12. [Google Scholar] [CrossRef]

- Wang, K.; Zhang, M.-H.; Tsai, S.-B.; Wu, L.-D.; Xue, K.-K.; Fan, H.-J.; Zhou, J.; Chen, Q. Does a Board Chairman’s Political Connection Affect Green Investment?-From a Sustainable Perspective. Sustainability 2018, 10, 582. [Google Scholar] [CrossRef]

- Du, H.S.; Zhan, B.; Xu, J.; Yang, X. The influencing mechanism of multi-factors on green investments: A hybrid analysis. J. Clean. Prod. 2019, 239, 1–12. [Google Scholar] [CrossRef]

- Eyraud, L.; Clements, B.; Wane, A. Green investment: Trends and determinants. Energy Policy 2013, 60, 852–865. [Google Scholar] [CrossRef]

- Shi, B.; Yang, H.; Wang, J.; Zhao, J. City green economy evaluation: Empirical evidence from15 sub-provincial cities in China. Sustainability 2016, 8, 551. [Google Scholar] [CrossRef]

- Han, Y. Impact of environmental regulation policy on environmental regulation level: A quasi-natural experiment based on carbon emission trading pilot. Environ. Sci. Pollut. Res. 2020, 27, 23602–23615. [Google Scholar] [CrossRef]

- Yen, Y.-X. Buyer–supplier collaboration in green practices: The driving effects from stakeholders. Bus. Strategy Environ. 2018, 27, 1666–1678. [Google Scholar] [CrossRef]

- Ganda, F.; Milondzo, K.S. The Impact of Carbon Emissions on Corporate Financial Performance: Evidence from the South African Firms. Sustainability 2018, 10, 2398. [Google Scholar] [CrossRef]

- Ghosh, A.; Sarmah, S.P.; Kanauzia, R.K. The effect of investment in green technology in a two echelon supply chain under strict carbon-cap policy. Benchmarking Int. J. 2020, 27, 1875–1891. [Google Scholar] [CrossRef]

- Mikołajek-Gocejna, M. The Relationship Between Corporate Social Responsibility And Corporate Financial Performance–Evidence From Empirical Studies. Comp. Econ. Res. 2016, 19, 67–84. [Google Scholar] [CrossRef]

- Karásek, J.; Pavlica, J. Green investment scheme: Experience and results in the Czech Republic. Energy Policy 2016, 90, 121–130. [Google Scholar] [CrossRef]

- Atif, M.; Alam, M.S.; Hossain, M. Firm sustainable investment: Are female directors greener? Bus. Strategy Environ. 2019, 29, 1–21. [Google Scholar]

- Ilg, P. How to foster green product innovation in an inert sector. J. Innov. Knowl. 2019, 4, 129–138. [Google Scholar] [CrossRef]

- Martin, P.R.; Moser, D.V. Managers’ green investment disclosures and investors’ reaction. J. Account. Econ. 2016, 61, 239–254. [Google Scholar] [CrossRef]

- Pimonenko, T.; Bilan, Y.; Horak, J.; Starchenko, L.; Gajda, W. Green Brand of Companies and Greenwashing under Sustainable Development Goals. Sustainability 2020, 12, 1679. [Google Scholar] [CrossRef]

- Hoppmann, J.; Sakhel, A.; Richert, M. With a little help from a stranger: The impact of external change agents on corporate sustainability investments. Bus. Strategy Environ. 2018, 27, 1052–1066. [Google Scholar] [CrossRef]

- Paul, A.K.; Bhattacharyya, D.K.; Anand, S. Green Initiatives for Business Sustainability and Value Creation (Advances in Business Strategy and Competitive Advantage (ABSCA)), 1st ed.; IGI Global: Hershey, PA, USA, 2017. [Google Scholar]

- Liao, X.; Shi, X. Public appeal, environmental regulation and green investment: Evidence from China. Energy Policy. 2018, 119, 554–562. [Google Scholar] [CrossRef]

- Strugatch, W. Turning values into valuation. Can corporate social responsibility survive hard times and emerge intact? J. Manag. Dev. 2011, 30, 44–48. [Google Scholar] [CrossRef]

- Puopolo, G.W.; Teti, E.; Milani, V. Does the market reward for going green? J. Manag. Dev. 2015, 34, 729–742. [Google Scholar] [CrossRef]

- Gonzalez-Loureiro, M.; Dabić, M.; Furrer, O. A content and comparative analysis of strategic management research in the Baltic area: A research agenda for qualitative studies. Baltic J. Manag. 2015, 10, 243–266. [Google Scholar] [CrossRef]

- Dabić, M.; Maley, J.; Dana, L.P.; Novak, I.; Pellegrini, M.M.; Caputo, A. Pathways of SME internationalization: A bibliometric and systematic review. Small Bus. Econ. 2020, 55, 705–725. [Google Scholar] [CrossRef]

- Duriau, V.J.; Reger, R.K.; Pfarrer, M.D. A content analysis of the content analysis literature in organization studies: Research themes, data sources, and methodological refinements. Organ. Res. Methods 2007, 10, 5–34. [Google Scholar] [CrossRef]

- Khoo, C.S.G.; Jin-Cheon, N.; Jaidka, K. Analysis of the macro-level discourse structure of literature reviews. Online Inf. Rev. Bradf. 2011, 35, 255–271. [Google Scholar] [CrossRef]

- Seuring, S.; Gold, S. Conducting content-analysis based literature reviews in supply chain management. Supply Chain Manag. 2012, 17, 544–555. [Google Scholar] [CrossRef]

- Servantie, V.; Cabrol, M.; Guieu, G.; Boissin, J.P. Is international entrepreneurship a field? A bibliometric analysis of the literature (1989–2015). J. Int. Entrep. 2016, 14, 168–212. [Google Scholar] [CrossRef]

- Zheng, Y. The Past, Present and Future of Research on Chinese Entrepreneurship Education: A Bibliometric Analysis Based on CSSCI Journal Articles. Educ. Sci. Theory Pract. 2018, 18, 1255–1276. [Google Scholar]

- Dan, M.C.; Goia, S.I. Entrepreneurship and regional development. A bibliometric analysis. Proc. Int. Conf. Bus. Excell. 2018, 12, 276–287. [Google Scholar] [CrossRef]

- Berbegal-Mirabent, J.; Alegre, I.; Ribeiro-Soriano, D. Entrepreneurship in the Middle East and North Africa: A Bibliometric Analysis. In Entrepreneurship Education and Research in the Middle East and North Africa (MENA); Nezameddin, F., Mohammad, R.Z., Eds.; Springer: Cham, Switzerland, 2018; pp. 273–290. [Google Scholar]

- Dionisio, M. The evolution of social entrepreneurship research: A bibliometric analysis. Soc. Enterp. J. 2019, 15, 22–45. [Google Scholar] [CrossRef]

- Lampe, J.; Kraft, P.S.; Bausch, A. Mapping the Field of Research on Entrepreneurial Organizations (1937–2016): A Bibliometric Analysis and Research Agenda. Entrep. Theory Pract. 2019, 44, 1–33. [Google Scholar] [CrossRef]

- Gora, A.A. The Link Between Decision making Process and Performance: A Bibliometric Analysis. Manag. Econ. Rev. 2019, 4, 177–191. [Google Scholar] [CrossRef]

- Chițimiea, A.; Ciocoiu, C.N.; Stoica, B.Ș.; Prioteasa, A.L. Bibliometric Assessment of Research on Risk Attitude of Entrepreneurs. Management 2020, 15, 3–27. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br. Acad. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Jones, M.L. Application of systematic review methods to qualitative research: Practical issues. J. Adv. Nurs. 2004, 48, 271–278. [Google Scholar] [CrossRef] [PubMed]

- Becker, M.C. Organizational routines: A review of the literature. Ind. Corp. Chang. 2004, 13, 643–678. [Google Scholar] [CrossRef]

- Crossan, M.M.; Apaydin, M. A Multi-Dimensional Framework of Organizational Innovation: A Systematic Review of the Literature. J. Manag. Stud. 2009, 47, 1154–1191. [Google Scholar] [CrossRef]

- Hallinger, P. A conceptual framework for systematic reviews of research in educational leadership and management. J. Educ. Adm. 2013, 51, 126–149. [Google Scholar] [CrossRef]

- Voorberg, W.H.; Bekkers, V.J.J.M.; Tummers, L.G. A Systematic Review of Co-Creation and Co-Production: Embarking on the social innovation journey. Public Manag. Rev. 2015, 17, 1333–1357. [Google Scholar] [CrossRef]

- Bourcet, C. Empirical determinants of renewable energy deployment:A systematic literature review. Energy Econ. 2019, 85, 104563. [Google Scholar] [CrossRef]

- Bossle, M.B.; Dutra de Barcellos, M.; Vieira, L.M.; Sauvée, L. The drivers for adoption of eco-innovation. J. Clean. Prod. 2016, 113, 861–872. [Google Scholar] [CrossRef]

- Rey-Martí, A.; Ribeiro-Soriano, D.; Palacios-Marqués, D. A bibliometric analysis of social entrepreneurship. J. Bus. Res. 2016, 69, 1651–1655. [Google Scholar] [CrossRef]

- Song, J.; Zhang, H.; Dong, W. A Review of Emerging Trends in Global ppp Research: Analysis and Visualization. Scientometr 2016, 107, 1111–1147. [Google Scholar] [CrossRef]

- Zhao, X.; Zuo, J.; Wu, G.; Huang, C. A bibliometric review of green building research 2000–2016. Archit. Sci. Rev. 2019, 62, 74–88. [Google Scholar] [CrossRef]

- Archambault, É.; Campbell, D.; Gingras, Y.; Larivière, V. Comparing Bibliometric Statistics Obtained from the Web of Science and Scopus. J. Assoc. Inf. Sci. Technol. 2009, 60, 1320–1326. [Google Scholar] [CrossRef]

- Cobo, M.J.; López-Herrera, A.G.; Herrera-Viedma, E.; Herrera, F. Science Mapping Software Tools: Review, Analysis, and Cooperative Study among Tools. J. Am. Soc. Inf. Sci. Technol. 2011, 62, 1382–1402. [Google Scholar] [CrossRef]

- Cubas-Díaz, M.; Martínez Sedano, M.Á. Measures for Sustainable Investment Decisions and Business Strategy–A Triple Bottom Line Approach. Bus. Strategy Environ. 2017, 27, 16–38. [Google Scholar] [CrossRef]

- Bowman, M.; Minas, S. Resilience through interlinkage: The green climate fund and climate finance governance. Clim. Policy 2019, 19, 342–353. [Google Scholar] [CrossRef]

- Schmid, J.; Olaru, M.; Verjel, A.M. The Effect of Sustainable Investments to the Economic Objectives of the Company in Relation to the Total Quality Management. Amfiteatru Econ. 2017, 19, 939–950. Available online: http://hdl.handle.net/10419/196402 (accessed on 23 December 2020).

- de Lange, D.E. A social capital paradox: Entrepreneurial dynamism in a small world clean technology cluster. J. Clean. Prod. 2016, 139, 576–585. [Google Scholar] [CrossRef]

- Jazairy, A. Aligning the purchase of green logistics practices between shippers and logistics service providers. Transp. Res. Part D Transp. Environ. 2020, 82, 102305. [Google Scholar] [CrossRef]

- Kraus, S.; Burtscher, J.; Vallaster, C.; Angerer, M. Sustainable Entrepreneurship Orientation: A Reflection on Status-Quo Research on Factors Facilitating Responsible Managerial Practices. Sustainability 2018, 10, 444. [Google Scholar] [CrossRef]

- Sueyoshi, T.; Yuan, Y. Comparison among U.S. industrial sectors by DEA environmental assessment: Equipped with analytical capability to handle zero or negative in production factors. Energy Econ. 2015, 52, 69–86. [Google Scholar] [CrossRef]

- Yadav, P.L.; Han, S.H.; Rho, J.J. Impact of Environmental Performance on Firm Value for Sustainable Investment: Evidence from Large US Firms. Bus. Strategy Environ. 2016, 25, 402–420. [Google Scholar] [CrossRef]

- Teti, E.; Dell’Acqua, A.; Etro, L.L.; Andreoletti, L.B. Corporate social performance and portfolio management. J. Manag. Dev. 2015, 34, 1144–1160. [Google Scholar] [CrossRef]

- Elheddad, M.; Djellouli, N.; Tiwari, A.K.; Hammoudeh, S. The relationship between energy consumption and fiscal decentralization and the importance of urbanization: Evidence from Chinese provinces. J. Environ. Manag. 2020, 264, 110474. [Google Scholar] [CrossRef] [PubMed]

- Qi, L.; Wang, L.; Li, W. Do mutual fund networks affect corporate social responsibility? Evidence from China. Corp. Soc. Responsib. Environ. Manag. 2019, 27, 1040–1050. [Google Scholar] [CrossRef]

- Gandullia, L.; Pisera, S. Do Income Taxes Affect Corporate Social Responsibility? Evidence from European-Listed Companies. Corp. Soc. Responsib. Environ. Manag. 2020, 27, 1–11. [Google Scholar] [CrossRef]

- Fiskerstrand, S.R.; Fjeldavli, S.; Leirvik, T.; Antoniuk, Y.; Nenadić, O. Sustainable investments in the Norwegian Stock Market. J. Sustain. Financ. Investig. 2019, 10, 294–310. [Google Scholar] [CrossRef]

- Cheng, Y.; Kuang, Y.; Shi, X.; Dong, C. Sustainable investment in a supply chain in the big data era: An information updating approach. Sustainability 2018, 10, 403. [Google Scholar] [CrossRef]

- Apostolakis, G.; Kraanen, F.; van Dijk, G. Pension beneficiaries’ and fund managers’ perceptions of responsible investment: A focus group study. Corp. Gov. Int. J. Bus. Soc. 2016, 16, 1–20. [Google Scholar] [CrossRef]

- McInerney, C.; Bunn, D.W. Expansion of the investor base for the energy transition. Energy Policy 2019, 129, 1240–1244. [Google Scholar] [CrossRef]

- Karlsson, N.P.E. Business models and business cases for financial sustainability: Insights on corporate sustainability in the Swedish farm-based biogas industry. Sustain. Prod. Consum. 2019, 18, 115–129. [Google Scholar] [CrossRef]

- Zheng, D.; Ng, A. Let’s agree to disagree! On payoffs and green tastes in green energy investments. Energy Econ. 2018, 69, 155–169. [Google Scholar]

- Dreyer, M.; Chefneux, L.; Goldberg, A.; Von Heimburg, J.; Patrignani, N.; Schofield, M.; Shilling, C. Responsible Innovation: A Complementary View from Industry with Proposals for Bridging Different Perspectives. Sustainability 2017, 9, 1719. [Google Scholar] [CrossRef]

- Aboulamer, A. Adopting a circular business model improves market equity value. Thunderbird Int. Bus. Rev. 2018, 60, 765–769. [Google Scholar]

- Li, G.; Shi, X.; Yang, Y.; Lee, P.K.C. Green Co-Creation Strategies among Supply Chain Partners: A Value Co-Creation Perspective. Sustainability 2020, 12, 4305. [Google Scholar] [CrossRef]

- Stoever, J.; Weche, J.P. Environmental Regulation and Sustainable Competitiveness: Evaluating the Role of Firm-Level Green Investments in the Context of the Porter Hypothesis. Environ. Resour. Econ. 2017, 70, 429–455. [Google Scholar] [CrossRef]

- Apostolakis, G.; Van Dijk, G.; Blomme, R.J.; Kraanen, F.; Papadopoulos, A.P. Predicting pension beneficiaries’ behaviour when offered a socially responsible and impact investment portfolio. J. Sustain. Financ. Investig. 2018, 8, 213–241. [Google Scholar] [CrossRef]

- Mielke, J. Signals for 2 °C: The influence of policies, market factors and civil society actions on investment decisions for green infrastructure. J. Sustain. Financ. Investig. 2019, 9, 87–115. [Google Scholar] [CrossRef]

- Kim, K.; Lee, S.-M. Does Sustainability Affect Corporate Performance and Economic Development? Evidence from the Asia-Pacific region and North America. Sustainability 2018, 10, 909. [Google Scholar] [CrossRef]

- Deng, X.; Cheng, X.; Gu, J.; Xu, Z. An innovative indicator system and group decision framework for assessing sustainable development enterprises. Group Decis Negot. 2019. [Google Scholar] [CrossRef]

- Palma-Ruiz, J.M.; Castillo-Apraiz, J.; Gómez-Martínez, R. Socially Responsible Investing as a Competitive Strategy for Trading Companies in Times of Upheaval Amid COVID-19: Evidence from Spain. Int. J. Financ. Stud. 2020, 8, 41. [Google Scholar] [CrossRef]

- Lozano, R.; Reid, A. Socially responsible or reprehensible? Investors, electricity utility companies, and transformative change in Europe. Energy Res. Social Sci. 2018, 37, 37–43. [Google Scholar] [CrossRef]

- Awan, U.; Khattak, A.; Rabbani, S.; Dhir, A. Buyer-Driven Knowledge Transfer Activities to Enhance Organizational Sustainability of Suppliers. Sustainability 2020, 12, 2933. [Google Scholar] [CrossRef]

- Ferri, G.; Pini, M. Environmental vs. Social Responsibility in the Firm. Evidence from Italy. Sustainability 2019, 11, 4277. [Google Scholar] [CrossRef]

- Duran-Santomil, P.; Otero-González, L.; Correia-Domingues, R.H.; Reboredo, J.C. Does Sustainability Score Impact Mutual Fund Performance? Sustainability 2019, 11, 2972. [Google Scholar] [CrossRef]

- Shi, X.; Li, G.; Dong, C.; Yang, Y. Value Co-Creation Behavior in Green Supply Chains: An Empirical Study. Energies 2020, 13, 3902. [Google Scholar] [CrossRef]

- Ajour El Zein, S.; Consolacion-Segura, C.; Huertas-Garcia, R. The Role of Sustainability in Brand Equity Value in the Financial Sector. Sustainability 2020, 12, 254. [Google Scholar] [CrossRef]

- Kim, J.B.; Li, B.; Liu, Z. Does social performance influence breadth of ownership? J. Bus. Financ. Account. 2018, 45, 1164–1194. [Google Scholar] [CrossRef]

- Shi, X.; Zhang, X.; Dong, C.; Wen, S. Economic Performance and Emission Reduction of Supply Chains in Different Power Structures: Perspective of Sustainable Investment. Energies 2018, 11, 983. [Google Scholar] [CrossRef]

- Segura, S.; Ferruz, L.; Gargallo, P.; Salvador, M. Environmental versus economic performance in the EU ETS from the point of view of policy makers: A statistical analysis based on copulas. J. Clean. Prod. 2018, 176, 1111–1132. [Google Scholar] [CrossRef]

- Hsiao, H.-F.; Zhong, T.; Dincer, H. Analysing Managers’ Financial Motivation for Sustainable Investment Strategies. Sustainability 2019, 11, 3849. [Google Scholar] [CrossRef]

- Nassani, A.A.; Aldakhil, A.M.; Abro, M.M.Q.; Zaman, K. Environmental Kuznets curve among BRICS countries: Spot lightening finance, transport, energy and growth factors. J. Clean. Prod. 2017, 154, 474–487. [Google Scholar] [CrossRef]

- Negra, C.; Remans, R.; Attwood, S.; Jones, S.; Werneck, F.; Smith, A. Sustainable agri-food investments require multi-sector co-development of decision tools. Ecol. Indic. 2020, 110, 105851. [Google Scholar] [CrossRef]

- Litvinenko, V.S.; Tsvetkov, P.S.; Molodtsov, K.V. The social and market mechanism of sustainable development of public companies in the mineral resource sector. Eurasian Mining. 2020, 1, 36–41. [Google Scholar] [CrossRef]

| Name of the Journal | First Year of Publication | Year of First Issue in WoS | Impact Factor 2019 | Articles | % of 461 |

|---|---|---|---|---|---|

| Sustainability | 2009 | 2016 | 2.576 | 43 | 9.33% |

| Journal of Cleaner Production | 1993 | 2003 | 7.246 | 26 | 5.64% |

| Energy Policy | 1973 | 2004 | 5.042 | 11 | 2.39% |

| Ecological Economics | 1989 | 2007 | 4.482 | 10 | 2.17% |

| Energies | 2008 | 2009 | 2.702 | 10 | 2.17% |

| Journal of Business Ethics | 1982 | 2003 | 4.141 | 9 | 1.95% |

| Journal of Sustainable Finance & Investment | 2011 | 2018 | 0 | 9 | 1.95% |

| Business Strategy and the Environment | 1992 | 2016 | 5.483 | 6 | 1.30% |

| Energy Economics | 1979 | 2014 | 5.203 | 6 | 1.30% |

| Organization & Environment | 1987 | 2009 | 3.333 | 6 | 1.30% |

| Country | Articles | Citations | Link Strength | Country | Articles | Citations | Link Strength |

|---|---|---|---|---|---|---|---|

| England | 62 | 1081 | 84 | Ukraine | 7 | 20 | 14 |

| China | 87 | 593 | 71 | Czech Republic | 6 | 21 | 12 |

| Germany | 45 | 355 | 60 | Poland | 10 | 43 | 11 |

| USA | 68 | 1290 | 58 | Taiwan | 8 | 26 | 11 |

| Spain | 27 | 221 | 37 | South Africa | 6 | 45 | 9 |

| Canada | 18 | 942 | 31 | Turkey | 6 | 47 | 9 |

| Netherlands | 23 | 336 | 31 | Greece | 8 | 120 | 8 |

| Australia | 22 | 264 | 29 | Norway | 7 | 149 | 8 |

| Austria | 7 | 283 | 29 | India | 15 | 291 | 4 |

| France | 24 | 377 | 22 | Belgium | 7 | 134 | 3 |

| Sweden | 12 | 212 | 18 | Finland | 6 | 36 | 3 |

| Italy | 27 | 245 | 17 | Japan | 6 | 16 | 2 |

| Switzerland | 17 | 524 | 17 | Portugal | 6 | 41 | 2 |

| Singapore | 5 | 220 | 15 | Russia | 6 | 5 | 2 |

| Brazil | 10 | 43 | 14 | South Korea | 10 | 94 | 2 |

| Lithuania | 6 | 67 | 14 | Romania | 11 | 299 | 1 |

| Name of the Author | Country of Origin | Affiliation | Articles | Citations | Journals in Which the Author Published (Number of Articles/Journal) |

|---|---|---|---|---|---|

| Dong Ciwei | China | Zhongnan University of Economics & Law | 4 | 44 | Energies (2); Sustainability (2) |

| Wang Ying | China | Hubei Univ of Education | 4 | 33 | Discrete Dynamics in Nature and Society (1); Journal of Sustainable Finance & Investment (1); Mathematical Problems in Engineering (1); Journal of Cleaner Production (1) |

| Shi Xiutian | China | Nanjing University of Science & Technology | 3 | 44 | Energies (1); Sustainability (2) |

| Mielke Jahel | Germany | University of Potsdam | 3 | 18 | Journal of Sustainable Finance & Investment (1); Ecological Economics (1); Sustainability (1) |

| Taghizadeh-Hesary Farhad | Japan | Tokai University | 3 | 17 | Energies (1); Finance Research Letters (1); Plos One (1) |

| Klein Christian * | Germany | Universitat Kassel | 3 | 9 | Journal of Asset Management (1); Journal of Sustainable Finance & Investment (1); Sustainability (1) |

| Zwergel Bernhard * | Germany | Universitat Kassel | 3 | 9 | Journal of Asset Management (1); Journal of Sustainable Finance & Investment (1); Sustainability (1) |

| Liu Xingxing | China | Chinese Academy of Sciences | 3 | 6 | Discrete Dynamics in Nature and Society (1); Journal of Cleaner Production (1); Mathematical Problems in Engineering (1) |

| Zhang Yang | China | Central South University | 2 | 34 | Journal of Cleaner Production (1); Sustainability (1) |

| Bilan Yuriy | Czech Republic | University of Social Sciences | 2 | 21 | Energies (1); Sustainability (1) |

| Authors | Citation | Method | Source | Impact Factor of the Journal (2019) | First Year of Publishing |

|---|---|---|---|---|---|

| Survey | |||||

| Falcone (2018) [5] | 12 | Survey | Economics Bulletin | 0 | 2001 |

| Cubas-Díaz and Martínez Sedano (2017) [62] | 10 | Survey | Business Strategy and the Environment | 5.483 | 1992 |

| Schmid, Olaru and Verjel (2017) [64] | 6 | Survey | Amfiteatru Economic | 1.625 | 1999 |

| de Lange (2016) [65] | 7 | Survey | Journal of Cleaner Production | 7.246 | 1993 |

| Jazairy (2020) [66] | 1 | Survey | Transportation Research Part D: Transport and Environment | 4.577 | 1996 |

| Taghizadeh-Hesary and Yoshino (2020) [9] | 6 | Survey | Energies | 2.702 | 2008 |

| Kraus et al. (2018) [67] | 24 | Survey | Sustainability | 2.576 | 2009 |

| Sueyoshi and Yuan (2015) [68] | 21 | Survey | Energy Economics | 5.203 | 1979 |

| Yadav, Han and Rho (2015) [69] | 44 | Survey | Business Strategy and the Environment | 5.483 | 1992 |

| Hoppmann, Sakhel and Richert (2018) [31] | 5 | Survey | Business Strategy and the Environment | 5.483 | 1992 |

| Teti et al. (2015) [70] | 2 | Survey | Journal of Management Development | 1.690 | 1982 |

| Puopolo, Teti and Milani (2015) [35] | 4 | Survey | Journal of Management Development | 1.690 | 1982 |

| Elheddad et al. (2020) [71] | 4 | Survey | Journal of Environmental Management | 5.647 | 1970 |

| Qi, Wang and Li (2019) [72] | 0 | Survey | Corporate Social Responsibility and Environmental Management | 4.542 | 2003 |

| Gandullia and Pisera (2020) [73] | 0 | Survey | Corporate Social Responsibility and Environmental Management | 4.542 | 2003 |

| Fiskerstrand et al. (2020) [74] | 0 | Survey | Journal of Sustainable Finance & Investment | 0.760 | 2011 |

| Case study | |||||

| Cheng et al. (2018) [75] | 13 | Case study | Sustainability | 2.576 | 2009 |

| Apostolakis, Kraanen and van Dijk (2016) [76] | 4 | Case study | Corporate Governance: The International Journal of Business in Society | 0 | 2001 |

| Zhang et al. (2015) [6] | 38 | Case study | Journal of Cleaner Production | 7.246 | 1993 |

| McInerney and Bunn (2019) [77] | 5 | Case study | Energy Policy | 5.042 | 1973 |

| Karlsson (2019) [78] | 2 | Case study | Sustainable Production and Consumption | 3.66 | 2015 |

| Zheng and Ng (2018) [79] | 5 | Case study | Energy Economics | 5.203 | 1979 |

| Dreyer et al. (2017) [80] | 14 | Case study | Sustainability | 2.576 | 2009 |

| Aboulamer (2018) [81] | 10 | Case study | Thunderbird International Business Review | 0.649 | 2005 |

| Li et al. (2020) [82] | 1 | Case study | Sustainability | 2.576 | 2009 |

| Mixed methods | |||||

| Yen (2018) [22] | 6 | Questionnaire and public data | Business Strategy and the Environment | 5.483 | 1992 |

| Stoever and Weche (2017) [83] | 9 | Case study and survey | Environmental and Resource Economics | 2.286 | 1991 |

| Pekovic, Grolleau and Mzoughi (2018) [8] | 13 | Survey and public data | International Journal of Production Economics | 5.134 | 1991 |

| Wang et al. (2018) [17] | 0 | Econometric study and public data | Sustainability | 2.576 | 2009 |

| Apostolakis et al. (2018) [84] | 3 | Survey and econometric study | Journal of Sustainable Finance & Investment | 0 | 2011 |

| Mielke (2019) [85] | 4 | Questionnaire and interviews | Journal of Sustainable Finance & Investment | 0 | 2011 |

| Pimonenko et al. (2020) [30] | 4 | Public data, Equation modeling (PLS-PM), content analysis, and Fishbourne methods | Sustainability | 2.576 | 2009 |

| Kim and Lee (2018) [86] | 1 | Econometric study and public data | Sustainability | 2.576 | 2009 |

| Deng et al. (2019) [87] | 0 | Q-rung orthopair fuzzy set with themultiplicativemulti-objective optimization by ratio analysis method | Group Decision and Negotiation | 1.612 | 1992 |

| Palma-Ruiz, Castillo-Apraiz, and Gomez-Martinez (2020) [88] | 1 | Survey and public data | International Journal of Financial Studies | 0 | 2019 |

| Atif, Alam and Hossain (2020) [26,27] | 0 | Econometric study and public data | Business Strategy and the Environment | 5.483 | 1992 |

| Lozano and Reid (2018) [89] | 1 | Interviews—Grounded Theory (GT) | Energy Research & Social Science | 4.771 | 2014 |

| Han et al. (2020) [1] | 0 | Questionnaire and statistical analysis | Environmental Science and Pollution Research | 3.000 | 1994 |

| Awan et al. (2020) [90] | 0 | Questionnaire and equation modeling (PLS-SEM) | Sustainability | 2.576 | 2009 |

| Ferri and Pini (2019) [91] | 0 | Survey and econometric study | Sustainability | 2.576 | 2009 |

| Duran-Santomil et al. (2019) [92] | 5 | Survey and econometric study | Sustainability | 2.576 | 2009 |

| Shi et al. (2020) [93] | 0 | Questionnaire and statistical analysis | Energies | 2.702 | 2008 |

| Ganda and Milondzo (2018) [23] | 3 | Survey and econometric study | Sustainability | 2.576 | 2009 |

| Ajour El Zein, Consolacion-Segura, and Huertas-Garcia (2020) [94] | 0 | Econometric study and public data | Sustainability | 2.576 | 2009 |

| Du et al. (2019) [18] | 1 | Econometric study and public data | Journal of Cleaner Production | 7.246 | 1993 |

| Panel data—secondary data | |||||

| Kim, Li, and Liu (2018) [95] | 6 | Econometric study | Journal of Business Finance & Accounting | 1.473 | 1974 |

| Mokhov et al. (2018) [10] | 2 | Econometric study | Bulletin of the South Ural State University | 0 | 2008 |

| Shi et al. (2018) [96] | 7 | Econometric case study | Energies | 2.702 | 2008 |

| Liao and Shi (Roc) (2018) [33] | 58 | Empirical analysis | Energy Policy | 5.042 | 1973 |

| Segura et al. (2018) [97] | 12 | Econometric study | Journal of Cleaner Production | 7.246 | 1993 |

| Han (2020) [21] | 2 | Empirical analysis | Environmental Science and Pollution Research | 3.056 | 1994 |

| Mikołajek-Gocejna (2016) [25] | 5 | Empirical analysis | Comparative Economic Research. Central and Eastern Europe | 0 | 2009 |

| Escrig-Olmedo et al.(2017) [14] | 20 | Fuzzy MCDM, specifically fuzzy TOPSIS (Technique for Order Preference by Similarity to Ideal Situation) | Journal of Cleaner Production | 7.246 | 1993 |

| Hsiao, Zhong and Dincer (2019) [98] | 0 | Empirical analysis | Sustainability | 2.576 | 2009 |

| Xing, Xia and Guo (2019) [7] | 3 | Empirical analysis | Sustainability | 2.576 | 2009 |

| Nassani et al. (2017) [99] | 51 | Empirical study | Journal of Cleaner Production | 7.246 | 1993 |

| Patents | |||||

| Negra et al. (2020) [100] | 1 | Sectoral framework analysis | Ecological Indicators | 4.229 | 2001 |

| Other methods | |||||

| Litvinenko, Tsvetkov and Molodtsov (2020) [101] | 0 | Fuzzy set theory, entropy weights, and analytical network process analytical network process | Eurasian Mining | 0 | 2005 |

| Ghosh, Sarmah and Kanauzia (2020) [24] | 1 | Mathematical models | International Journal of Process Management and Benchmarking | 0.308 | 2005 |

| Drivers | Definition | Source |

|---|---|---|

| External factors | ||

| Consumers’ and stakeholders’ behavior | Customers are more acknowledgeable and more concerned with the environmental impact of the products that they are buying. Despite the green investment pressure, coming from the stakeholders (consumers, investors, shareholders, NGO’s) companies are still hesitant to invest in green technologies because of the higher costs and risks involved. | Pimonenko et al. (2020) [29,30]; Palma-Ruiz, Castillo-Apraiz, and Gomez-Martinez, (2020) [88]; Cheng et al. (2018) [75]; Aboulamer, (2018) [81]; |

| Jazairy (2020) [66]; Shi et al. (2020) [93]; Xing, Xia, and Guo (2019) [7]; Yen (2018) [22]; Zhang et al. (2015) [6] | ||

| Climate change | Green investments are invariably combined with climate change mitigation or adaptation. Environmentally-friendly technologies significantly reduce pollution ( CO2 emissions and fuel consumption), the abatement cost being under environmental regulations. The negative impact on the environment has influenced companies to implement innovative green ideas in order to reduce pollution. | Han (2020) [21]; Mielke (2019) [85]; Du et al. (2019) [18]; Deng et al. (2019) [87]; Segura et al. (2018) [97]; Lozano and Reid (2018) [90]; Hoppmann, Sakhel, and Richert (2018) [31]; Nassani et al. (2017) [99]; Yadav, Han, and Rho (2015) [69] Elheddad et al. (2020) [71]; Liao and Shi (Roc) (2018) [33] |

| Legislation & regulations | Environmental regulation policies play a significant role in promoting the environmental regulation level. Much research has been done to investigate the influence of regulatory pressure on green innovations and investments, but it is important to know how such pressure motivates organizations to improve their green investment performance. | Han (2020) [21]; Li et al. (2020) [82]; McInerney and Bunn (2019) [77] |

| The legislative impact has a direct effect on the companies’ activity, sometimes generating increases in operating or financial expenses (taxes and duties). | Han et al. (2020) [1]; Gandullia and Pisera (2020) [73]; Kim and Lee (2018) [86]; Lozano and Reid (2018) [89]; Stoever and Weche (2017) [83]; Sueyoshi and Yuan (2015) [68] | |

| Target market | The target market reacts favorably to green investments. This means that the companies follow the megatrends and can do what they always do: maximize earnings. | Palma-Ruiz, Castillo-Apraiz, and Gomez-Martinez (2020) [88]; Schmid, Olaru and Verjel (2017) [64] |

| Adapting to the continuous market changes represents the key factor in implementing green investments. There is always the risk that the developed service/product does not satisfy the market demands or that the price is not competitive. Consequently, the companies might experience losses. | Han et al. (2020) [1]; Deng et al. (2019) [87] | |

| Public financing and incentives | Public financial investments (PFIs) can use both traditional and innovative approaches to link green projects with finance by enhancing their access to capital, facilitating risk reduction and sharing, improving the capacity of market actors, and shaping broader market practices and conditions. | Taghizadeh-Hesary and Yoshino (2020) [9]; Han (2020) [21]; Du et al. (2019) [18]; Falcone (2018) [5] |

| The duration of the firm-bank relationship is associated with a higher probability of a firm’s green investment strategies. Conversely, the presence of a multiple credit relationship could concretely hinder a firm’s investments towards environmental innovations. With regard to the firm-financial characteristics, credit-constrained and indebted firms encounter more difficulties. | ||

| Internal factors | ||

| Investors’ preferences | Environmental damage is the main concern for investors, which firms need to address in the process of improving environmental performance. Nowadays, it seems that investors must choose between “traditional” investments (strictly financially oriented) or sustainable investments. | Pimonenko et al. (2020) [30]; Palma-Ruiz, Castillo-Apraiz, and Gomez-Martinez (2020) [88]; Lozano and Reid (2018) [89]; Escrig-Olmedo et al. (2017) [14]; Apostolakis, Kraanen and van Dijk (2016) [76]; Yadav, Han, and Rho (2015) [69] |

| There are specific risks on financing a green investment and, consequently, the need for investors to have a minimum investment security based on indicators is growing. At present, indicator-based tools for incorporating sustainability values are being developed without adequate engagement by scientists. | Fiskerstrand et al. (2020) [74]; Taghizadeh-Hesary and Yoshino (2020) [9]; Negra et al. (2020) [100]; Ferri and Pini (2019) [91]; Mielke (2019) [85]; Kim, Li, and Liu (2018) [95]; Mokhov et al. (2018) [10]; Zheng and Ng (2018) [79]; Dreyer et al. (2017) [80]; Mikołajek-Gocejna (2016) [25]; de Lange (2016) [65] | |

| Organizational culture | Entrepreneurs tend to derive their will to act more sustainably from their personal values or traits. To increase an organization’s chances of becoming more sustainable, sustainability efforts must be integrated internally, and vertically, within a firm and between departments, plans, and divisions. | Kraus et al. (2018) [67] |

| The financial motivation of managers is one of the best indicators of the market value of firms and sustainable investment projects. Internal contextual variables (manager’s attitude, supply chain relationship, digitization capability) have little effect on promoting value co-creation in the green supply chain. | Shi et al. (2020) [93]; Atif, Alam, and Hossain (2020) [26,27]; Hsiao, Zhong and Dincer (2019) [98]; Wang et al. (2018) [17]; Lozano and Reid (2018) [89]; Apostolakis, Kraanen and van Dijk (2016) [76]; | |

| Financial performance | There is a strong relationship between financial returns and sustainability, explained by the level of performance for all the metrics analyzed (Carhart’s alpha, Sharpe, net return, reduced cost). | Ghosh, Sarmah, and Kanauzia (2020) [24]; Li et al. (2020) [82] Duran-Santomil et al. (2019) [92]; Kim and Lee (2018) [86]; Ganda and Milondzo (2018) [23]; Teti et al. (2015) [70]; Yadav, Han, and Rho (2015) [69] |

| With responsible management and strategy, the firms can use tools to optimize their performance, improving sustainability while not necessarily sacrificing financial outcomes and making the company more profitable and more likely to survive in the long run. | Pekovic, Grolleau, and Mzoughi (2018) [8]; Cubas-Díaz and Martínez Sedano (2017) [62] | |

| Reputational considerations | As a solution to develop environmentally-friendly technologies and increase their level of CSR (corporate social responsibility), the mutual funds could put pressure on the firm when peer firms in the investment network pay more attention to CSR practices. | Litvinenko, Tsvetkov, and Molodtsov (2020) [101]; Qi, Wang and Li (2019) [72] |

| The more sustainable a company is, the higher its brand equity value is. Companies that invest more resources and capabilities to both manage the environmental impact of their activity and to respect environmental rules in force, create considerably higher financial value in the medium- and long-term. | Ajour El Zein, Consolacion-Segura, and Huertas-Garcia (2020) [94]; Han et al. (2020) [1]; Awan et al. (2020) [90]; Yadav, Han and Rho (2015) [69]; Teti et al. (2015) [70] | |

| Efficiency gains | Sustainability has been an important issue for several decades because companies want to secure competitive advantages for their future such as cost savings, consumer demand, risk mitigation, tax incentives, and using resources efficiently in saturated or competitive markets. | Han et al. (2020) [1]; Karlsson (2019) [78]; Kim and Lee (2018) [86] |

| The cooperation mode of value co-creation can guide the partners to invest in green technology and distribute benefits. | Li et al. (2020) [82] | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chițimiea, A.; Minciu, M.; Manta, A.-M.; Ciocoiu, C.N.; Veith, C. The Drivers of Green Investment: A Bibliometric and Systematic Review. Sustainability 2021, 13, 3507. https://doi.org/10.3390/su13063507

Chițimiea A, Minciu M, Manta A-M, Ciocoiu CN, Veith C. The Drivers of Green Investment: A Bibliometric and Systematic Review. Sustainability. 2021; 13(6):3507. https://doi.org/10.3390/su13063507

Chicago/Turabian StyleChițimiea, Andreea, Mihaela Minciu, Andreea-Mariana Manta, Carmen Nadia Ciocoiu, and Cristina Veith. 2021. "The Drivers of Green Investment: A Bibliometric and Systematic Review" Sustainability 13, no. 6: 3507. https://doi.org/10.3390/su13063507

APA StyleChițimiea, A., Minciu, M., Manta, A.-M., Ciocoiu, C. N., & Veith, C. (2021). The Drivers of Green Investment: A Bibliometric and Systematic Review. Sustainability, 13(6), 3507. https://doi.org/10.3390/su13063507