Abstract

The substantial focus on achieving corporate sustainability has necessitated the implementation of green human resource management (GHRM) practices. The purpose of this paper is to reveal the industries’ perspective of the impact of GHRM practices (i.e., green recruitment and selection, green pay and rewards, and green employee involvement and green training) on corporate sustainability practices. Data were collected from 200 human resource professionals in major industrial sectors of a developing country. Partial least squares structural equation modelling was used to test the study hypotheses and multigroup analysis (MGA) between industrial sectors. The findings show a positive impact of three GHRM practices, i.e., green recruitment and selection, green pay and rewards, and green employee involvement on corporate sustainability. However, green training has no significant association with corporate sustainability, which is interesting. Furthermore, the multigroup analysis (MGA) revealed partial and significant differences among different sectors. The results provide more contextualized social, environmental, and economic implications to academics and practitioners interested in green initiatives. To date, limited research has been conducted to investigate whether GHRM practices can be an effective strategy in increasing corporate sustainability in a developing country context. Particularly, the industry’s perspective on the subject matter was rather absent in the existing literature. The present study fills this gap and contributes to the existing literature by providing the industry’s perspective on GHRM and corporate sustainability.

1. Introduction

The notion of businesses being driven by profit-oriented activities is rapidly changing. Today, businesses and the corporate world have realized that people make the center of all activities [1]. This has changed the corporate world and gave birth to corporate sustainability that creates long-term value for consumers and employees, among others, by developing a “green” strategy [2]. This strategy focuses on the natural environment by considering every dimension of business operations and their social, cultural, economic, and environmental impacts [3]. Corporate sustainability is a transformation of more traditional phrases that define ethical and equitable corporate practices. Though traditional expressions such as corporate social responsibility (CSR) and corporate citizenship are still common, these have already started to be replaced by corporate sustainability which is a broader and comprehensive term. Past research linked corporate sustainability to increased revenue, reduced wastes, materials, water, energy, and overall expenses. These studies also associated corporate sustainability with increased employees’ productivity, reduced hiring and attrition expenses, and reduced strategic as well as operational risks [4,5,6]. Therefore, both practitioners and academics need to have a clear understanding of the factors affecting corporate sustainability.

Largely, firms’ operations and corporate sustainability or efforts for adopting it are greatly influenced by humans [7]. Green-oriented management practices are executed entirely by humans expressing a positive attitude towards the environment and having a sense of responsibility for their actions that may have any environmental implications. Green human resource management practices (GHRM) consist of key practices such as green recruitment and selection, green training, pay and rewards, and employees’ involvement. Needless to say, the role of GHRM is very significant when it comes to the development of environment-friendly norms and practices within organizations [8]. The authors argue GHRM practices play a vital role in providing the necessary ingredients for achieving corporate sustainability [9]. As such, recent literature emphasizes the significance and the potential of GHRM in achieving corporate sustainability [8].

The objective of this paper is to explore the industry’s perspective on the impact of GHRM practices (i.e., green recruitment and selection, green pay and reward, and green employee involvement) on corporate sustainability practices. As there is a lack of research on the causal relationship between GHRM practices and corporate sustainability, this study is timely in filling a clear research gap. Particularly, the industry’s perspective on this important subject is absent in the existing literature. The present study fills this gap and contributes to the existing literature by providing the industry’s perspective on GHRM and corporate sustainability. Practically, the findings of the present study will provide practitioners to ascertain the significance of GHRM practices in achieving corporate sustainability.

Nevertheless, there is little evidence in the academic literature to confirm the relationship between GHRM practices and corporate sustainability, particularly in this emerging field of research [8,10]. Additionally, the literature also reports some recent calls to investigate the aforementioned relationship in emerging and developing countries to merge the importance of GHRM practices and corporate sustainability [8,11]. However, research further reported that the investigation of the above relationship is rare in different industries [8]. Hence, to fill this gap the current study uses the crux of the stakeholder theory in different industries such as industrial/manufacturing, information technology (IT), banking, and education. The aforesaid are the main sectors that contribute tremendously to the gross domestic product (GDP) of the sample country. Similarly, in the above sectors, the country focuses on the overall sustainability and human development as a whole.

After achieving the above research objective, the study brings several contributions to theory, method, and practices. Firstly, the study has theoretical significance to underpin the crux of stakeholder theory in the relationship between GHRM and corporate sustainability practices to satisfy the demands of multiple stakeholders. Secondly, the study contributes to the limited literature of the subject relationship particularly in developing economies context. Thirdly, the study has a methodological contribution by validating the newly developed scale of GHRM by the authors [4] in a developing country context. Finally, the study offers practical implications for the different industries of the country as the Security Exchange Commission (SEC) issued a code of corporate governance 2019 mentioning the implementation of green and sustainable workplace practices in these industries.

A brief review of the literature on GHRM and corporate sustainability is presented in the next section, which is followed by the development of research hypotheses. Next, we describe the methods employed in the present study. We then describe both the analysis and results, followed by a detailed explanation of the findings, including their implications for research and practice. The last section highlights the limitations of this research and provides several recommendations for future studies.

2. Literature Review

2.1. Theoretical Framework and Hypotheses Development

The stakeholder theory posits that the managers’ core responsibility is not only to take care of the shareholders only, but they are also responsible to be impactful for general “stakeholders” [12]. The stakeholder of an organization is someone who has any direct or indirect stake in its business. In other words, anyone who affects or is affected by the operations of an organization is its stakeholder. The stakeholder thus can be either close to the business environment and has more direct stakes, e.g., employees and shareholders, or remote and having indirect stakes, e.g., communities and people/entities outside the business. Hence, the theory is selected in the study to comprehensively explain its all prepositions. Previous studies on the concept also adopted the crux of the stakeholder theory [13,14]. To achieve corporate sustainability, a company needs to look internally and externally to understand its environmental and social impacts [15]. This needs the engagement of stakeholders to know and realize impacts and concerns. A business can focus on corporate sustainability internally by training its employees and devise strategies or policies that ensure sustainability. As a company looks externally, stakeholders include customers, suppliers, community, and non-government organizations, etc. In this case, the organization is expected to deal with the diverse expectations of a long-range of stakeholders. In other words, stakeholders’ involvement and engagement (both internal to organization and external to the organization) is critical for corporate sustainability. By applying the concept of sustainability and GHRM, the organization meets the demands of multiple stakeholders. Similarly, the crux of the stakeholder theory also applies in the different industries such as industrial/manufacturing, banking, and education and information technology (IT) [16,17,18]. Moreover, these stakeholders’ demands may vary in these different industries; however, the importance would still be vital [19]. Corporate Sustainability and GHRM are two interrelated subjects, as both strive to serve the interest of internal and external stakeholders, thereby focusing on the impact of the social, environmental, and economic performance of the organization.

2.2. Corporate Sustainability

In 1980, the Worlds Commission on Environment and Development (WCED) came up with the terminology of “sustainable development” and it linked sustainability to environmental integrity and social justice [20]. This report devised the definition of sustainable development as “sustainable development is the development that meets the needs of the present without compromising the ability of future generations to meet their own needs” [20]. The definition also links sustainability with the corporate world and economic prosperity. The definition was acknowledged by international leaders who attended the Earth Summit in 1992 held in Rio de Janeiro [21]. Along with the environmental and economic challenges, organizations are demanded to improve human and social welfare and simultaneously to decrease the organizations’ ecological effects, while also safeguarding the efficacious and efficient attainment of organizational goals [22,23]. Building on the literature around management and strategy formulation, numerous definitions of sustainability have evolved in the context of organizations. These definitions diverge on three different levels: (1) the degree to which corporate sustainability could be classified either largely as an ecological concern [24] or (2) as an organization’s social responsibility [7], or perhaps (3) expand and contribute to the theory to integrate organizational interest around the natural and the social environment with corporate economic activities [25].

The terminology of “corporate sustainability” is also used by various scholars to define the integration of organizational concerns of social, environmental, and/or economic nature embedded in the culture of the organizations, their decision-making process, the strategy formulation, and implementation as well as operations [25]. External factors, such as environmental regulations, government standards, and laws, or demands/expectations from pressure groups, e.g., customers and community, etc., are considered the primary driving forces behind the adoption process. While the factors within the organization are mostly considered as a ‘‘black-box’’ [26], this attitude leaves a huge vacuum that is not taken into consideration. For Example, many recent research studies have pointed out the “pressures from within the organization” for the adoption of practices that promote and ensure sustainability [27]. Furthermore, these studies also identify factors internal to organizations, for example, support of the top management, management of the human resources, training(s) on pro-environment issues, empowerment of employees, teamwork and reward systems, etc., as important facets for attaining corporate sustainability [28]. Yet, some researchers believe that more wide-ranging changes in employees’ values and relevant norms are essential ingredients for accomplishing corporate sustainability in its true sense [7]. Together, these two stances propose that corporate sustainability is a multi-layered concept, and the organization may consider its operationalization which would require change and adaptation from the organizations on several levels.

For an organization to be sustainable, GHRM certainly matters for various reasons; however, primarily it matters because stakeholders expect organizations to use resources wisely and responsibly. In other words, organizations are expected to protect the environment, minimize the usage, or more specifically the wastage of air, water, energy, minerals, and other materials in manufacturing the goods we consume. Moreover, organizations are expected to recycle and use these goods again to the possible extent instead to rely on nature to restore or renew these for us. Organizations are expected to preserve nature’s beauty and tranquility and mitigate any or all toxicity that could potentially harm people in the workplace as well as communities [29]. Following the sustainable development principles, the social, economic as well as environmental objectives are mutually dependent and reinforcing [30]. Hence, the companies’ developmental strategies should take into account a balance among the economic, environmental, and social dimensions of their economic tasks or undertakings. This implies that the agreed economic solutions be considerate of social responsibility, environmental friendliness, and economic value [31].

2.3. GHRM and Corporate Sustainability

GHRM is a derived term evolved from green management philosophy, policies, and practices followed by firms for environmental management (EM) [27]. It is defined as the portion of human resource management which is focused on efforts to transform organizational employees into green employees with a vision to attain organizational sustainability goals (for example, increasing business opportunities, employees’ motivation, the public image of the brand and/or business and compliance with environment-friendly policies and laws and reducing labor turnover and utility costs, and creating competitive advantage) and also make a significant contribution to the environment [32]. GHRM is also defined as a system that uses HRM policies to promote the use of resources within business organizations to promote environmental sustainability [33,34]. Reading through the theory related to the definition of GHRM and the movement behind it, three key principles guide the philosophy of GHRM, such as the principles of environmentalism, sustainability, and social justice.

GHRM promotes the sustainable use of all types of resources, which supports the cause of environmental sustainability in general, and enhances employees’ awareness and commitments towards the challenges of environmental management in particular [5,35]. Additionally, the development of GHRM includes improving the social (balance between work and life) and economic (i.e., sustainable profits) related matters. GHRM supports the classic understanding of the concept of the “triple bottom line”; that is to say, GHRM involves practices alongside the three key dimensions of sustainability, i.e., environment, social, and economic balance [32,36,37] to bring benefits to the organization in the long run [30,38]. To expand the understanding of the subject matter, developing GHRM measures is a work that is in progress. For example, some of the presented measures lay down ecologically relevant HRM policies and practices that are differentiated as the functional (job description and analysis, recruitment, selection, training, performance appraisal, and reward system) and competitive dimensions (team, culture, and organizational learning) of GHRM [36].

GHRM has been measured with four constructs, i.e., employee life cycle, rewards, education and training, and employee empowerment [37]. Later, it was measured using four other practices including green recruitment, green training, green pay and compensation, and green employees’ involvement [39]. Recently, GHRM is also measured with the five-factor model including environmental training, investment in people, creation of work-life balance and family-friendly employment, improved employee health and safety, and employee participation in decision-making processes [40]. Building on the data collected from China, Malaysia, and Pakistan, three fairly new and broad GHRM measures are proposed [2,4,29]. However, all these efforts were mainly focused on environmental concerns from the perspective of the organization. Nonetheless, little work has been carried out in this regard so far to conceptualize GHRM as a possible roadmap for achieving corporate sustainability. Similarly, few previous studies that investigated the impact of GHRM on corporate sustainability have documented a positive relationship in the context of Palestinian healthcare organizations [41] and Malaysian manufacturing firms [8]. Likewise, past research hints at the key role of GHRM in achieving corporate sustainability in the context of developing countries [18,42,43].

To help us understand in what way organizations can convert HRM practices into “green” initiatives that are more likely going to support corporate sustainability, the different dimensions or practices of GHRM are discussed below.

2.3.1. Green Involvement (GI)

Green involvement refers to the involvement of organizational employees in green-activities. This involvement of employees in green activities stimulates and inspires them to support the prevention of pollution and excessive waste [41,42]. A review of numerous studies establishes a point in favor of green involvement (GI) of employees, according to which GI is a crucial factor in improving the performance of organizations (For example, reducing waste, pollution, and making full use of resources in a workplace) [36,44,45]. As part of adopting green practices, organizations have to encourage and inspire their workforce to become involved by initiating green and eco-friendly ideas. This could be achieved by empowering workers [33,36]. For this drive, the human resource department can work on highlighting the importance and requirement of creating a participative work environment for strategic level managers: an environment where employees feel confident and keep no fear in disagreeing with top managements’ decisions or negotiating with them. In other words, an environment where employees can propose or offer diverse ideas to deal with important organizational issues [40]. However, the importance of empowering employees and their participation originates from the fact that employees like to be autonomous when making decisions regarding environmental problems and other issues associated with sustainability that may emerge in the implementation of corporate sustainability and its various initiatives [46,47]. To achieve this, employees must be involved in the formulation of environmental strategies, which should then enable them to develop and expand on the required knowledge for green products and services. The insight developed from the literature regarding employees’ involvement could be concluded as enabling employees to give suggestions and to be involved in the problem-solving responsibilities which are the main pillars for ensuring and encouraging their participation in green initiatives. Based on this, the following hypothesis has been formulated:

H1:

Green Involvement is perceived to have a positive impact on corporate sustainability practices.

2.3.2. Green Pay and Reward (GPR)

The strategic approach of rewards management (RM) suggests green pay and reward (GPR) is “a system of financial and non-financial rewards” that is aimed to achieve the goal of attracting, retaining, and finally motivating employees who are best suited for contributing towards green goals of the organization [36]. Accomplishing the objectives of greening the organization can be improved by rewarding employees for their commitment to exhibit and promote green behaviors as well as sustainable practices [36]. In this context, corporate sustainability could benefit from reward and compensation systems if it concentrates on limiting or eliminating undesirable behaviors and encourage green behavior [5]. To reach this goal, reward systems should be designed to reflect the commitment of strategic-level managers towards greening [46,47]. This strategic level commitment will inspire workers too using becoming more environmentally responsible and more involved in green initiatives [36,48,49]. A study links the success of rewards programs aimed at motivating employees to exhibiting and promoting green behaviors by joining rewards with greening [44]. This leads to the formulation of the following hypothesis:

H2:

GPR is perceived to have a positive impact on corporate sustainability practices.

2.3.3. Green Recruitment and Selection (GRS)

GRS is the process of attracting candidates who are committed or have a high potential to contribute to environmental issues linked with the organization [4]. GHRM practices consider green recruitment and selection an important component that helps identify green employees who exhibit green inclinations and helps develop a green culture [42]. Based on the studies carried out previously, e.g., [4,42], briefly, there could be three aspects of GRS, i.e., “green awareness of candidates, green employer branding, and green criteria to attract candidates”. Green awareness of candidates is the first and most important aspect of GRS [4,42]. Firstly, it is the green awareness of employees (candidates) that enables an organization to achieve its environmental goals and goals linked to cost effectiveness, etc. Therefore, to ensure that candidates are positive towards organizational strategic green goals, the firms should run a series of tests that enable them to choose the best. Secondly, the green employer branding generally refers to the development of a green reputation of the company through better environmental management that is formed via GHRM practices [42]. Thirdly, there have to be green criteria for an employee to be selected and evaluated [45]. GRS make sure that new employees must not only understand the established green culture of the organization but also share its environmental values [50] through continuous enhancement of environmental knowledge of recruits and ingraining of values and beliefs [42,45]. Some studies suggest that recruitment communications should contain environmental criteria [32]. However, the author recommends several preventive and institutive actions that organizations can embrace to enrich GHRM through GRS processes [48]. Firstly, job descriptions should consist of features that emphasize the role of environmental reporting. Secondly, an induction program for recruits must ensure the availability of information around environmental sustainability policies of the organization, values, and green goals.

Finally, interviews have to be designed in a way to assess the potential agreeableness and fitness of the candidates with the greening programs of organizations. The emphasis laid on the GRS process indicates that during the interview process candidates must be asked more environment-related questions. Additionally, the authors described that organizations can expand their determinations to safeguard the environment using combining environmental tasks and responsibilities of every employees’ job description [49,51]. It can also be carried out by designing new jobs or positions to focus exclusively on corporate sustainability aspects of the organizations [49]. Based on this, the following hypothesis has been articulated.

H3:

GRS is perceived to have a positive impact on corporate sustainability practices.

2.3.4. Green Training (GT)

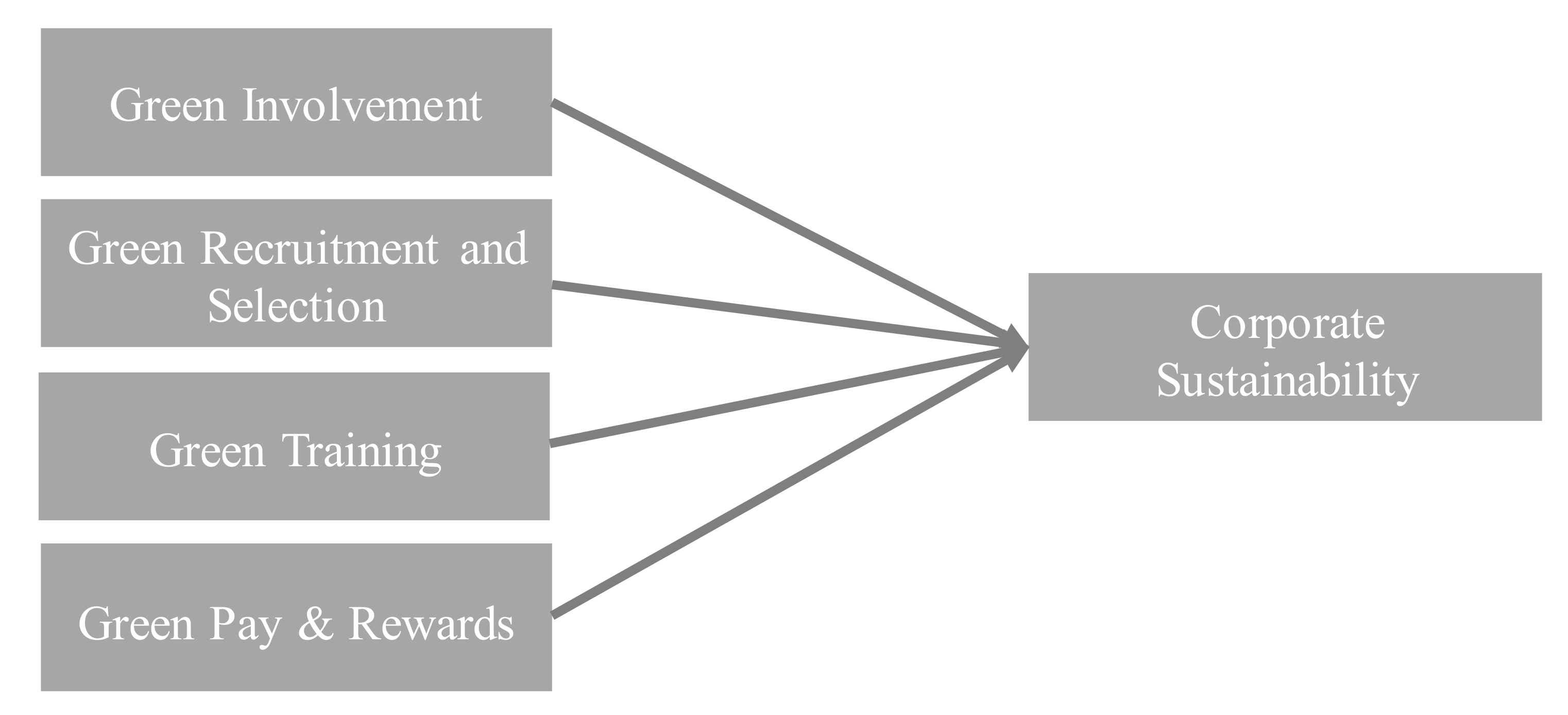

Green training is a combination of coordinated activities that encourage and inspire employees to acquire skills around the protection of the environment and give consideration to environmental issues that play a key role in achieving environmental objectives [49,52]. Training helps improve employees’ awareness, knowledge, and skills relevant to environmental activities [52]. Researchers suggest that the provision of green training must be ensured along with educational programs to all employees of the firm, and these training(s) and educational programs must not be restricted to the organizational departments of the environment [49]. The authors advocate and recommend various green training and development practices, such as employees’ training for ensuring green analysis of workspace, energy efficiency, waste and recycling management, as well as the development of personal capacities on green concepts and strategies [6,49,50,52]. Therefore, it is important in organizational training and development plans to include programs, seminars, and sessions that may enable workforces to develop and acquire knowledge in green skills [53]. Additionally, the authors describe that firms should make those opportunities available which allows employees’ engagement in environmental problem-solving missions [54]. To accomplish these goals, job rotation philosophies must be used as a crucial component of training and career development strategies [53]. Considering the green aspects embedded in the training process, the following hypothesis has been framed. Figure 1 represents the hypotheses development of the study.

Figure 1.

Conceptual Framework.

H4:

GT is perceived to have a positive impact on corporate sustainability practices.

The above hypotheses are explained in Figure 1 as follows.

3. Research Design

3.1. Instrument

GHRM Practices: The GHRM practices were measured using a 15-item scale from Tang et al. (2018). The scale covers green involvement (GI), green recruitment and selection (GRS), green pay and reward (GPR), and green training (GT). The minimum and maximum reliability of the GHRM scale was recorded from 0.83 to 0.87. For the corporate sustainability construct, we adapted a scale from Tom (2015). The items include questions covering knowledge of sustainability of the respondents, followed by the focus of integrated dimensions such as social, economic, and ecological dimensions. The sample item includes “we know enough about corporate sustainability”. The reliability score of the corporate sustainability construct was 0.862 [55].

3.2. Sample Size and Data Collection

G*Power software was employed to calculate the minimum sample size with a significant level of 0.05 and the power of 0.95. A priori power analysis using a medium effect size suggested a sample size of 138. Thus, the present sample size (N = 200) for this research was deemed appropriate. However, due to the potential of missing values, non-response rate, and outliers, we distributed 250 questionnaires (Appendix A) among the HR professional working in different industrial sectors of Pakistan such as manufacturing, banking, education, and information technology (IT). These industries are the main contributors to the economy. Before the data collection, the respondents were informed regarding the ethical considerations, the study objectives and ensured the confidentiality of the information. After the due consent for the questionnaires filing, the questionnaires were distributed using a self-administered approach. The self-administered data collection approach carries the advantage of a high response rate of up to 90% [56]. Hence, of the distributed questionnaires, respondents returned the filled questionnaire with a response rate of 80% and hence was acceptable [56]. However, seven incomplete questionnaires were excluded. A total of 200 samples were submitted for final data analysis. Data were collected between September 2019 and January 2020.

3.3. Demographic Profile of Respondents

The respondents were from various professional levels, experiences, educational backgrounds, and diverse sectors.

Since the purpose of the study was to understand the impact of GHRM on corporate sustainability, the respondents must be individuals who are currently holding a position in the company’s HR department or equivalent to represent his/her organization. An invitation letter including a questionnaire along with a consent form that clearly stated the purpose of the study, and its possible logical conclusion was provided to the participants as exhibited in Table 1. The Table reports the details of the participants of the survey. Among 200 participants, 78.57% represented males, while 21.43% accounted for females. The ratio of males is higher than females as females of the sample country are less job-oriented as well as less participative in the survey [57,58]. Regarding age, it is found that we have a mix of ages. The majority of the participants (55%) were holding a Master’s degree, followed by Bachelor’s degree holders (37%). The average experience and the total were collected from almost every managerial level. Twenty-seven percent of participants belonged to the industrial sector, the remaining (73%) having an association with banking (23%), education (24%), and information technology sectors (24%).

Table 1.

Demographics of respondents (N = 200).

4. Data Analysis and Results

Partial Least Squares Structural Equation Modelling (PLS-SEM) using SmartPLS 3.0 was used for data analysis [59]. PLS-SEM is considered a good choice for HRM models when the goal of the study is to explore key predictors of the outcome variables. Measurement model (internal consistency reliability, convergent validity, and discriminant validity), structural model (R-square (R2), path coefficient, f2, and Q2), and multigroup analysis (significantly differs between groups) were performed [60,61].

Table 2 summarizes the results of convergent validity and internal consistency reliability. All indicators and constructs are found to have met the reflective measurement criteria. Specifically, the outer loadings (λ) are all above 0.651, demonstrating that indicator reliability is achieved [59]. Moreover, the average variance extracted (AVE) values are all more than 0.50, denoting that convergent validity is also achieved [59]. Furthermore, composite reliability (CR) values are 0.822 or higher, which are clearly above the required minimum level of 0.70 and thus have secure internal consistency [59]. In other words, the test results show the measurement criteria of the model are being achieved.

Table 2.

Measurement model.

Discriminant validity is the degree to which a construct is unique from its counterparts [62]. The criterion was used to determine the discriminant validity proposed by the authors [63]. The values in the diagonal must be larger than all other values in the corresponding rows and columns [62]. As shown in Table 3, all the diagonal values are higher than others, thereby confirming the discriminant validity.

Table 3.

Fornell–Larcker criterion.

The assessment of the structural model includes R2, effect size (f2), multicollinearity (VIF), model fit, coefficients, p-values, and t-values [62]. Table 3 and Table 4 summarize the results of the structural model. Before moving into this step, we first test the collinearity of the structural model. Collinearity is measured using the Variance Inflation Factor (VIF).

Table 4.

Structural model results.

Table 4 reports that all VIF values are below the threshold of 5, suggesting that there is no such issue of collinearity among the constructs [62]. The adjusted R2 measures the predictive power of the model, and this shows the amount of variance in the endogenous variable that can be explained by the exogenous variables. The adjusted R2 (0.578) indicates that all GHRM practices combined to contribute more than 57% to corporate sustainability.

Table 4 also reports the effect size using f2 of the model. The values range from 0.005 to 0.089, which fall in the small category of effect size. The Q2 value indicates the predictive relevance values generated of variables. All the values of Q2 are >0, which means that the model has predictive relevance. The values of the goodness of fit that were generated through the standardized root mean squared residual (SRMR) are equal to 0.073 < 0.080; the normed fit index (NFI) 0.736 is close to 1; and the rms Theta are close to <0.20, which means that our model fits the empirical data.

The statistical values furnished in Table 5 indicate a positive significant relationship (β = 0.308, t-value = 3.945, p < 0.01) between green involvement and corporate sustainability which supports our first hypothesis (H1) of the study. The findings are in line with the previous authors who found that green involvement is a crucial factor in improving sustainability performance such as reducing waste, pollution, and making full use of resources in a workplace [42,64].

Table 5.

Hypotheses testing.

Similarly, the numerical values provided a positive significant relationship (β = 0.296, t-value = 4.295, p < 0.01) between green pay and reward and corporate sustainability which supports our second hypothesis (H2). Our results are according to the postulations of previous studies that stated that green performance rewards both financial and non-financial motivate the employees to participate and improve the corporate sustainability of the organization [6,65].

Likewise, there is a positive significant relationship (β = 0.199, t-value = 2.874, p < 0.01) between green recruitment and selection and corporate sustainability which clearly supports our hypothesis (H3) of the study. These results support previous studies that recorded that green recruitment and selection is an important component that helps identify green employees who exhibit green inclinations and helps develop corporate sustainability culture within the organization [45,49]. Lastly, the relationship between green training and corporate sustainability is not supported as the p-value is >0.05.

By employing PLS structural model technique, the study performed multigroup analysis. “PLS multigroup analysis is used to determine if the PLS model significantly differs between groups” [60]. The author further explained multigroup analysis by using independent samples t-tests to compare paths between groups [66,67,68]. The multigroup analysis is “parametric” because significance testing requires the assumption of multivariate normal distributions, unlike traditional PLS. As the study consists of different groups of industries, it is important to evaluate the difference between these groups.

Table 6 reported the multigroup analysis for four sectors, namely, industrial, banking, information technology (IT), and education sectors. The study assumes the industrial sector as the dirtiest industry, and hence selected it as a base industry. According to the statistics of parametric and Welch–Satterthwaite tests, there is a significant difference between green recruitment and selection and corporate sustainability of industrial and banking sectors (showing in bold figures). The results explain that the banking sector performs better in green recruitment and selection and corporate sustainability practices than the industrial sector. However, there is no significant difference between the two industries for the rest of the variables or their association. On the contrary, the green involvement and corporate sustainability path are significant between the industrial and IT sectors. Surprisingly, the industrial sector performs better than the IT sector in the aforementioned practices. Lastly, the study found significant differences in the association of green recruitment and selection with corporate sustainability in the industrial and education sectors. Thus, it is concluded that the education sector performs better than the industrial sector for the association of green recruitment and selection with corporate sustainability. However, there is no significant difference between the two industries for the rest of the variables or their association.

Table 6.

Multigroup analysis (MGA) between industries.

5. Discussion and Conclusions

This study aimed to investigate the industry’s perspective on the impact of GHRM practices (i.e., green recruitment and selection, green training, green pay and rewards, and green employee involvement) on corporate sustainability practices. It was interesting to see how the industry perceives GHRM practices as important factors for corporate sustainability. The findings indicate that human resource is an important stakeholder if managed well, which assists organizations in attaining corporate sustainability. Green awareness of the employee (candidate) enables an organization to achieve its sustainability and organizational strategic green goals. In the same way, green employer branding generally develops the green reputation of the company through better environmental management that is formed via GHRM practices [42], specifically during the recruitment and selection process. The results further documented that green involvement and recruitment and selection vary among the industries particularly among industrial, banking, and education sectors. For instance, the association of green recruitment and selection with corporate sustainability in the banking sector is better than in the industrial sector. Likewise, green involvement has a significant relationship with corporate sustainability in both the industrial and IT sectors, where the performance of the former is better than the latter. Besides, the education sector has better statistics than the industrial sector for the impact of green recruitment and selection on corporate sustainability.

Unexpectedly, unlike past findings, the results of the present study show that the respondents of the study do not perceive green training as the predictor of corporate sustainability. One of the reasons for such findings is that in fast-paced business activities employees are being pushed to focus more and more on core activities of daily operations, thus other activities such as “training” are probably going to be assumed less important. The findings also show a strong and significant nexus of green involvement with corporate sustainability. This finding is consistent with the prior literature reporting that green involvement is a vital element in improving sustainability performance, such as reducing waste, pollution, and making full and efficient use of resources at the workplace [42,64]. Likewise, the results of the present study also confirm the significant positive relationship between green pay and reward and corporate sustainability. This result endorses the claims of previous literature that both financial and non-financial rewards motivate employees to participate and improve the corporate sustainability of the organization [6,65].

The finding of this study offers several implications for theory and practice. First, the study contributes to the limited literature of GHRM practices and corporate sustainability by increasing the understanding of their nexus. Second, there is a lack of literature on GHRM practices and corporate sustainability, particularly in developing and emerging economies. Hence, the study partially validated a newly developed GHRM scale by the authors [4] in the developing country context. Third, the study underpins the crux of stakeholder theory for the subject relationship and hence has practical implications for the CEOs and HR managers to implement GHRM and integrate corporate sustainability within the organization for the satisfaction of multiple stakeholders in developing countries. From a practical perspective, the study sheds light on how an organization implements GHRM initiatives by involving its employees in green practices. Organizations should recruit and select their employees through the green process, train them in, and design their pay and reward system sustainably. The findings of the study help organizations by addressing the broad agenda of sustainable productions by adopting GHRM and corporate sustainability practices particularly in industrial and IT sectors. Similarly, the findings bring practical implications for the banking sector as the regulator issued a policy towards the implementation of green banking practices. Likewise, the findings also helpful to inform the education sector, particularly the universities, on the adoption of the broad agenda of education for sustainable development (ESD).

This study has a few limitations that may be addressed in future studies. Firstly, as in the current study the perceptions of the industrial respondents are captured, in future studies the model should be replicated on a general sample such as business graduates, academics, and other practitioners related to the fields. Similarly, the new scale developed by the author [2] should also be tested in the sample country context. Secondly, in the future, the studies should be directed towards qualitative aspects of the GHRM practices, and their role in the implementation of corporate sustainability. Thirdly, the available theory used for this study also paves a path for considering organizational culture and strategic orientation variables for any future studies. This would be carried out by utilizing the moderating and mediating models in the relationship between GHRM and corporate sustainability. Last but not least, the studies in future directions should consider the multigroup analysis and longitudinal nature, particularly secondary data analysis.

Author Contributions

Conceptualization, T.J.; data curation, M.Z.; formal analysis, M.Z.; funding acquisition, M.N.M., P.N.M.; resources, J.M.M. and H.U.R. All authors have read and agreed to the published version of the manuscript.

Funding

This work was partially supported by the Polytechnic Institute of Lisbon through the Projects for Research, Development, Innovation and Artistic Creation (IDI&CA), within the framework of the project ANEEC—Assessment of the level of business efficiency to increase competitiveness, IPL/2020/ANEEC_ISCAL.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Questionnaire of the Study

Corporate Sustainability

- We know enough about corporate sustainability.

- Organizations, where operations are based on sustainable growth, social responsibility, and environmental protection, are sustainable organizations.

- Sustainable organizations would consider sustainability as one of the essential components of the corporate culture.

- Sustainable organizations exploit environmental challenges and legislation to their advantage by developing new greener products.

- Ecological regulations add more restrictions on firms.

- Due to ecological constraints, it is okay to think of relocating production to other countries, where ecological requirements are lower.

- Sustainability has to be taken as an important route for the long-term development of the enterprise.

Green Recruitment and Selection

- We attract green job candidates who use green criteria to select organizations.

- We use green employer branding to attract green employees.

- Our firm recruits employees who have green awareness.

Green Involvement

- Green organizations have a responsibility to provide a clear developmental vision for the guidance of the employees’ actions in environmental management.

- The green firm shall have a mutual learning climate among employees for green behavior and awareness.

- In green organizations, there should be several formal or informal communication channels to spread green culture within the organization.

- Green organizations are those that involve employees in quality improvement and problem-solving on green issues.

- Green organizations involve their employees by offering practices to participate in environment management (such as newsletters, suggestion schemes, problem-solving groups, low-carbon champions, and green action teams, etc.).

- Those organizations that emphasize a culture of environmental protection are green.

Green Pay and Reward

- The green organization will make available green benefits to its employees such as combine transportation and travel to support green efforts.

- Provision of financial or tax incentives to employees is an essential part of the ‘Pay and Reward’ system in a green organization (e.g., bicycle loans, use of less polluting cars)

- Recognition-based rewards in environment management for staff (e.g., public recognition, awards, paid vacations, time off, gift certificates) are given due importance in the green organization.

Green Training

- Organizations with GHRM must develop training programs in environmental management to increase environmental awareness, skills, and expertise of employees.

- Organizations with GHRM should consider integrating training to create the emotional involvement of employees in environment management.

- Organizations with GHRM will have a defined green knowledge management system (link environmental education and knowledge to behaviors to develop preventative solutions).

References

- Goffee, R.; Jones, G. Creating the Best Workplace on Earth. Harv. Bus. Rev. 2013, 91, 98–106. [Google Scholar]

- Shah, M. Green human resource management: Development of a valid measurement scale. Bus. Strat. Environ. 2019, 28, 771–785. [Google Scholar] [CrossRef]

- Yong, J.Y.; Yusliza, M.-Y.; Ramayah, T.; Fawehinmi, O. Nexus between green intellectual capital and green human resource management. J. Clean. Prod. 2019, 215, 364–374. [Google Scholar] [CrossRef]

- Tang, G.; Chen, Y.; Jiang, Y.; Paillé, P.; Jia, J. Green human resource management practices: Scale development and validity. Asia Pac. J. Hum. Resour. 2017, 56, 31–55. [Google Scholar] [CrossRef]

- Masri, H.A.; Jaaron, A.A. Assessing green human resources management practices in Palestinian manufacturing context: An empirical study. J. Clean. Prod. 2017, 143, 474–489. [Google Scholar] [CrossRef]

- Ren, S.; Tang, G.; Jackson, S.E. Green human resource management research in emergence: A review and future directions. Asia Pac. J. Manag. 2017, 35, 769–803. [Google Scholar] [CrossRef]

- Schaltegger, S.; Burritt, R.L. Business Cases and Corporate Engagement with Sustainability: Differentiating Ethical Motivations. J. Bus. Ethic 2018, 147, 241–259. [Google Scholar] [CrossRef]

- Yong, J.Y.; Yusliza, M.-Y.; Ramayah, T.; Jabbour, C.J.C.; Sehnem, S.; Mani, V. Pathways towards sustainability in manufacturing organizations: Empirical evidence on the role of green human resource management. Bus. Strat. Environ. 2020, 29, 212–228. [Google Scholar] [CrossRef]

- Ramasamy, A.; Inore, I.; Sauna, R. A Study on Implications of Implementing Green HRM in the Corporate Bodies with Special Reference to Developing Nations. Int. J. Bus. Manag. 2017, 12, 117. [Google Scholar] [CrossRef]

- Bin Saeed, B.; Afsar, B.; Hafeez, S.; Khan, I.; Tahir, M.; Afridi, M.A. Promoting employee’s proenvironmental behavior through green human resource management practices. Corp. Soc. Responsib. Environ. Manag. 2019, 26, 424–438. [Google Scholar] [CrossRef]

- Kim, Y.J.; Kim, W.G.; Choi, H.-M.; Phetvaroon, K. The effect of green human resource management on hotel employees’ eco-friendly behavior and environmental performance. Int. J. Hosp. Manag. 2019, 76, 83–93. [Google Scholar] [CrossRef]

- Moneva, J.M.; Pajares, J.H. Corporate social responsibility performance and sustainability reporting in SMEs: An analysis of owner-managers’ perceptions. Int. J. Sustain. Econ. 2018, 10, 405. [Google Scholar] [CrossRef]

- Järlström, M.; Saru, E.; Vanhala, S. Sustainable Human Resource Management with Salience of Stakeholders: A Top Management Perspective. J. Bus. Ethic 2018, 152, 703–724. [Google Scholar] [CrossRef]

- Guerci, M.; Longoni, A.; Luzzini, D. Translating stakeholder pressures into environmental performance—The mediating role of green HRM practices. Int. J. Hum. Resour. Manag. 2015, 27, 262–289. [Google Scholar] [CrossRef]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence, and Implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Zahid, M.; Rahman, H.U.; Khan, M.; Ali, W.; Shad, F. Addressing endogeneity by proposing novel instrumental variables in the nexus of sustainability reporting and firm financial performance: A step-by-step procedure for non-experts. Bus. Strat. Environ. 2020, 29, 3086–3103. [Google Scholar] [CrossRef]

- Zahid, M.; Rahman, H.U.; Ali, W.; Habib, M.N.; Shad, F. Integration, implementation and reporting outlooks of sustainability in higher education institutions (HEIs): Index and case base validation. Int. J. Sustain. High. Educ. 2020, 22, 120–137. [Google Scholar] [CrossRef]

- Rawashdeh, A.M. The impact of green human resource management on organizational environmental performance in Jordanian health service organizations. Manag. Sci. Lett. 2018, 10, 1049–1058. [Google Scholar] [CrossRef]

- Dissanayake, D.; Tilt, C.; Xydias-Lobo, M. Sustainability reporting by publicly listed companies in Sri Lanka. J. Clean. Prod. 2016, 129, 169–182. [Google Scholar] [CrossRef]

- WCED (World Commission on Environment and Development). Our Common Future; Oxford University Press: Oxford, UK, 1987; Volume 17, pp. 1–91. [Google Scholar]

- Dyllick, T.; Hockerts, K. Beyond the business case for corporate sustainability. Bus. Strategy Environ. 2002, 11, 130–141. [Google Scholar] [CrossRef]

- Pedregosa, F.; Varoquaux, G.; Gramfort, A.; Michel, V.; Thirion, B.; Grisel, O.; Vanderplas, J. Scikit-learn: Machine Learning in Python. J. Mach. Learn. Res. 2012, 12, 2825–2830. [Google Scholar]

- De Stefano, F.; Bagdadli, S.; Camuffo, A. The HR role in corporate social responsibility and sustainability: A boundary-shifting literature review. Hum. Resour. Manag. 2018, 57, 549–566. [Google Scholar] [CrossRef]

- Dooley, K.; Kartha, S. Land-based negative emissions: Risks for climate mitigation and impacts on sustainable development. Int. Environ. Agreements: Politi- Law Econ. 2018, 18, 79–98. [Google Scholar] [CrossRef]

- Van Marrewijk, M. Multiple Levels of Corporate Sustainability. J. Bus. Ethics 2003, 44, 107–119. [Google Scholar] [CrossRef]

- Blok, V.; Wesselink, R.; Studynka, O.; Kemp, R. Encouraging sustainability in the workplace: A survey on the pro-environmental behaviour of university employees. J. Clean. Prod. 2015, 106, 55–67. [Google Scholar] [CrossRef]

- Patel, S. Green HRM—A Key for Sustainable Development. Int. J. Res. Manag. 2018, 8, 29–30. [Google Scholar]

- Gholami, H.; Rezaei, G.; Saman, M.Z.M.; Sharif, S.; Zakuan, N. State-of-the-art Green HRM System: Sustainability in the sports center in Malaysia using a multi-methods approach and opportunities for future research. J. Clean. Prod. 2016, 124, 142–163. [Google Scholar] [CrossRef]

- Arulrajah, A.A.; Opatha, H.H.D.N.P.; Nawaratne, N.N.J. Employee green performance of job: A systematic attempt towards measurement. Sri Lankan J. Hum. Resour. Manag. 2016, 6, 37. [Google Scholar] [CrossRef]

- Tooranloo, H.S.; Azadi, M.H.; Sayyahpoor, A. Analyzing factors affecting implementation success of sustainable human resource management (SHRM) using a hybrid approach of FAHP and Type-2 fuzzy DEMATEL. J. Clean. Prod. 2017, 162, 1252–1265. [Google Scholar] [CrossRef]

- Zaid, A.A.; Jaaron, A.A.; Bon, A.T. The impact of green human resource management and green supply chain management practices on sustainable performance: An empirical study. J. Clean. Prod. 2018, 204, 965–979. [Google Scholar] [CrossRef]

- Arulrajah, A.A.; Opatha, H.H.D.N.P. Analytical and Theoretical Perspectives on Green Human Resource Management: A Simplified Underpinning. Int. Bus. Res. 2016, 9, 153. [Google Scholar] [CrossRef]

- Ahmad, S. Green Human Resource Management: Policies and practices. Cogent Bus. Manag. 2015, 2, 1030817. [Google Scholar] [CrossRef]

- Nicolăescu, E.; Alpopi, C.; Zaharia, C. Measuring Corporate Sustainability Performance. Sustainability 2015, 7, 851. [Google Scholar] [CrossRef]

- Gupta, H. Assessing organizations performance on the basis of GHRM practices using BWM and Fuzzy TOPSIS. J. Environ. Manag. 2018, 226, 201–216. [Google Scholar] [CrossRef]

- Alhaddi, H. Triple Bottom Line and Sustainability: A Literature Review. Bus. Manag. Stud. 2015, 1, 6. [Google Scholar] [CrossRef]

- Ehnert, I.; Parsa, S.; Roper, I.; Wagner, M.; Muller-Camen, M. Reporting on sustainability and HRM: A comparative study of sustainability reporting practices by the world’s largest companies. Int. J. Hum. Resour. Manag. 2016, 27, 88–108. [Google Scholar] [CrossRef]

- Bhutto, S.A.; Phil, M. Effects of Green Human Resources Management on Firm Performance: An Empirical Study on Pakistani Firms. Eur. J. Bus. Manag. 2016, 8, 2222–2839. [Google Scholar]

- Jabbour, C.J.C.; de Sousa Jabbour, A.B.L. Green human resource management and green supply chain management: Linking two emerging agendas. J. Clean. Prod. 2016, 112, 1824–1833. [Google Scholar] [CrossRef]

- Zibarras, L.D.; Coan, P. HRM practices used to promote pro-environmental behavior: A UK survey. Int. J. Hum. Resour. Manag. 2015, 26, 2121–2142. [Google Scholar] [CrossRef]

- Guerci, M.; Carollo, L. A paradox view on green human resource management: Insights from the Italian context. Int. J. Hum. Resour. Manag. 2015, 27, 212–238. [Google Scholar] [CrossRef]

- O’Donohue, W.; Torugsa, N. (Ann) The moderating effect of ‘Green’ HRM on the association between proactive environmental management and financial performance in small firms. Int. J. Hum. Resour. Manag. 2015, 27, 239–261. [Google Scholar] [CrossRef]

- Mousa, S.K.; Othman, M. The impact of green human resource management practices on sustainable performance in healthcare organisations: A conceptual framework. J. Clean. Prod. 2020, 243, 118595. [Google Scholar] [CrossRef]

- Delmas, M.A.; Burbano, V.C. The Drivers of Greenwashing. Calif. Manag. Rev. 2011, 54, 64–87. [Google Scholar] [CrossRef]

- Colwell, S.R.; Joshi, A.W. Corporate Ecological Responsiveness: Antecedent Effects of Institutional Pressure and Top Management Commitment and Their Impact on Organizational Performance. Bus. Strat. Environ. 2011, 22, 73–91. [Google Scholar] [CrossRef]

- Tahir, M.; Safwan, N.; Usman, A.; Adnan, A. Green HRM as predictor of firms’ environmental performance and role of employees’ environmental organizational citizenship behavior as a mediator. J. Res. Rev. Soc. Sci. 2020, 3, 699–715. [Google Scholar]

- Meyer, K.E.; Estrin, S.; Bhaumik, S.K.; Peng, M.W. Institutions, resources, and entry strategies in emerging economies. Strateg. Manag. J. 2008, 30, 1–43. [Google Scholar]

- Renwick, D.W.S.; Redman, T.; Maguire, S. Green Human Resource Management: A Review and Research Agenda. Int. J. Manag. Rev. 2013, 15, 1–14. [Google Scholar] [CrossRef]

- Calia, R.C.; Guerrini, F.M.; De Castro, M. The impact of Six Sigma in the performance of a Pollution Prevention program. J. Clean. Prod. 2009, 17, 1303–1310. [Google Scholar] [CrossRef]

- Daily, B.F.; Huang, S.C. Achieving sustainability through attention to human resource factors in environmental management. Int. J. Oper. Prod. Manag. 2001, 21, 1539–1552. [Google Scholar] [CrossRef]

- Kim, A.; Kim, Y.; Han, K.; Jackson, S.E.; Ployhart, R.E. Multilevel Influences on Voluntary Workplace Green Behavior: Individual Differences, Leader Behavior, and Coworker Advocacy. J. Manag. 2014, 43, 1335–1358. [Google Scholar] [CrossRef]

- Aykan, E. Gaining a Competitive Advantage through Green Human Resource Management. In Corporate Governance and Strategic Decision Making; IntechOpen: London, UK, 2017. [Google Scholar] [CrossRef]

- Opatha, H.H.D.N.P.; Arulrajah, A.A. Green Human Resource Management: Simplified General Reflections. Int. Bus. Res. 2014, 7, 101. [Google Scholar] [CrossRef]

- Arulrajah, A.A.; Opatha, H.H.D.N.P.; Nawaratne, N.N.J. Green human resource management practices: A review. Sri Lankan J. Hum. Resour. Manag. 2016, 5, 108. [Google Scholar] [CrossRef]

- Paillé, P.; Chen, Y.; Boiral, O.; Jin, J. The Impact of Human Resource Management on Environmental Performance: An Employee-Level Study. J. Bus. Ethics 2014, 121, 451–466. [Google Scholar] [CrossRef]

- Subramanian, N.; Abdulrahman, M.D.; Wu, L.; Nath, P. Green competence framework: Evidence from China. Int. J. Hum. Resour. Manag. 2016, 27, 151–172. [Google Scholar] [CrossRef]

- Sharma, R.; Gupta, N. Green HRM: An Innovative Approach to Environmental Sustainability. Proceedings of Twelfth AIMS International Conference on Management, Kozhikode, India, 2–5 January 2015; pp. 1–15. [Google Scholar]

- Tomšič, N.; Bojnec, Š.; Simčič, B. Corporate sustainability and economic performance in small and medium sized enterprises. J. Clean. Prod. 2015, 108, 603–612. [Google Scholar] [CrossRef]

- Saunders, M.N.K.; Lewis, P.; Thornhill, A. Research Methods for Business Students, 8th ed.; Pearson: London, UK, 2019. [Google Scholar]

- Baloch, Q.B.; Zahid, M. Naveed Impact of Information Technology on E-Banking: Evidence from Pakistan’s Banking Industry. Abasyn J. Soc. Sci. 2012, 4, 241–263. [Google Scholar]

- Zahid, M.; Jehangir, M.; Shahzad, N. Towards Digital Economy. Int. J. E-Entrep. Innov. 2012, 3, 34–46. [Google Scholar] [CrossRef]

- Hair, J.F.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M.; Thiele, K.O. Mirror, mirror on the wall: A comparative evaluation of composite-based structural equation modeling methods. J. Acad. Mark. Sci. 2017, 45, 616–632. [Google Scholar] [CrossRef]

- Garson, G.D. Partial Least Squares: Regression & Structural Equation Models; Statistical Associates Publishing: Asheboro, NC, USA, 2016. [Google Scholar]

- Sarstedt, M.; Ringle, C.M.; Hair, J.F. Partial Least Squares Structural Equation Modeling; Springer International Publishing: Cham, Switzerland, 2017; pp. 1–40. [Google Scholar]

- Joe, F.H., Jr.; Sarstedt, M.; Hopkins, L.; Kuppelwieser, V.G. Partial least squares structural equation modeling (PLS-SEM). Eur. Bus. Rev. 2014, 26, 106–121. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Luu, T.T. Employees’ green recovery performance: The roles of green HR practices and serving culture. J. Sustain. Tour. 2018, 26, 1308–1324. [Google Scholar] [CrossRef]

- Keil, M.; Tan, B.C.Y.; Wei, K.-K.; Saarinen, T.; Tuunainen, V.; Wassenaar, A. A cross-cultural study on escalation of commit-ment behavior in software projects. MIS Q. 2000, 24, 299–325. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).