Alignment of Islamic Banking Sustainability Indicators with Sustainable Development Goals: Policy Recommendations for Addressing the COVID-19 Pandemic

Abstract

1. Introduction

2. Literature Review

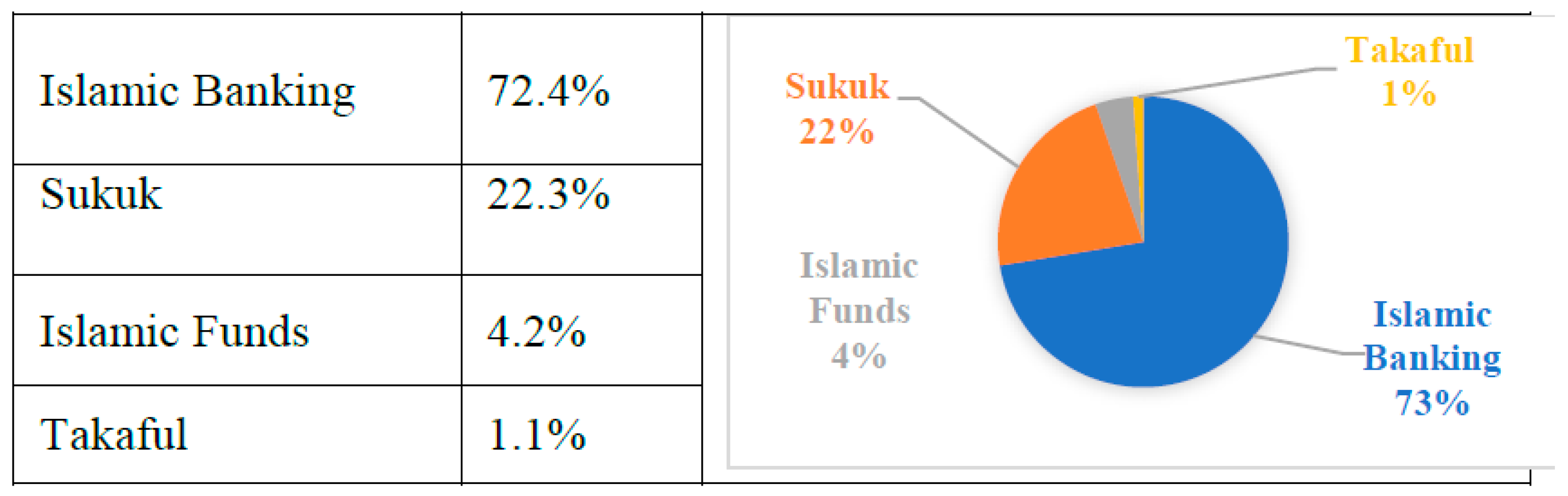

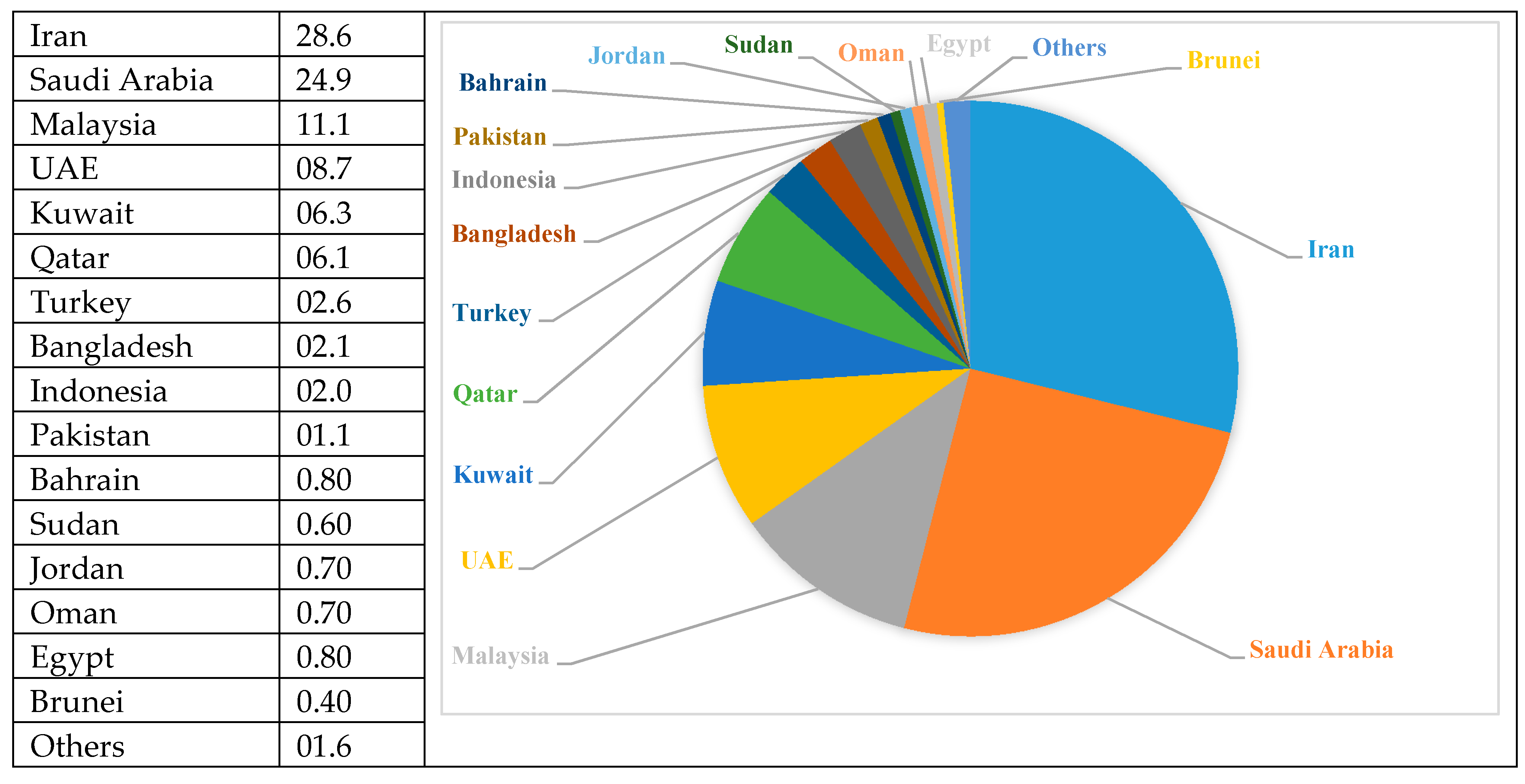

2.1. The Concept of Islamic Banking and its Global Profile

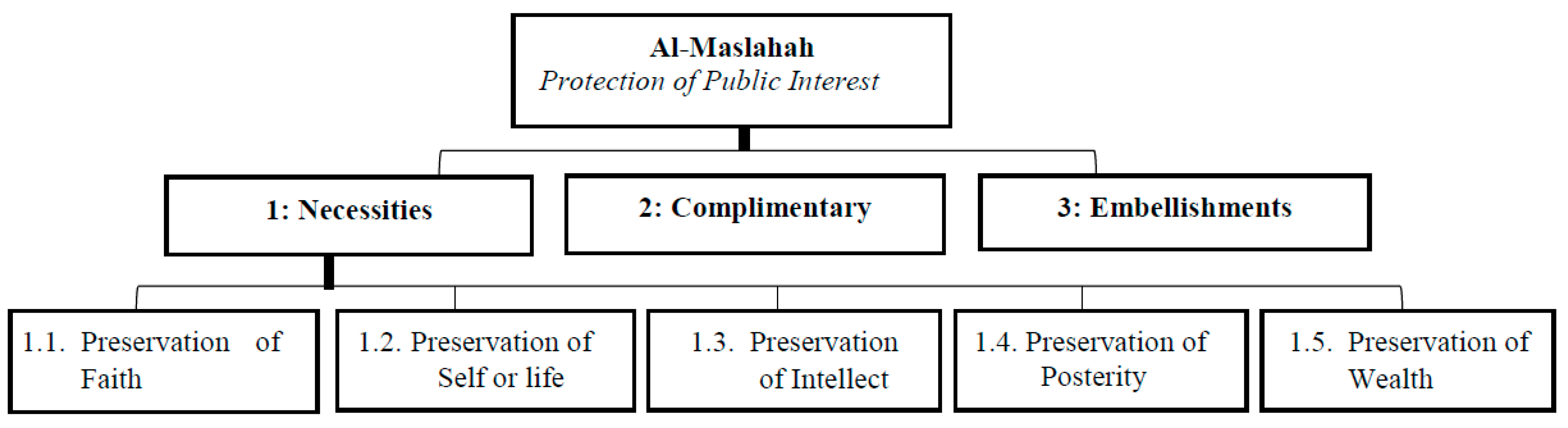

2.2. What Are the Objectives of Shariah (Maqasid al-Shariah)?

2.3. The United Nations Sustainable Development Goals (UN SDGs)

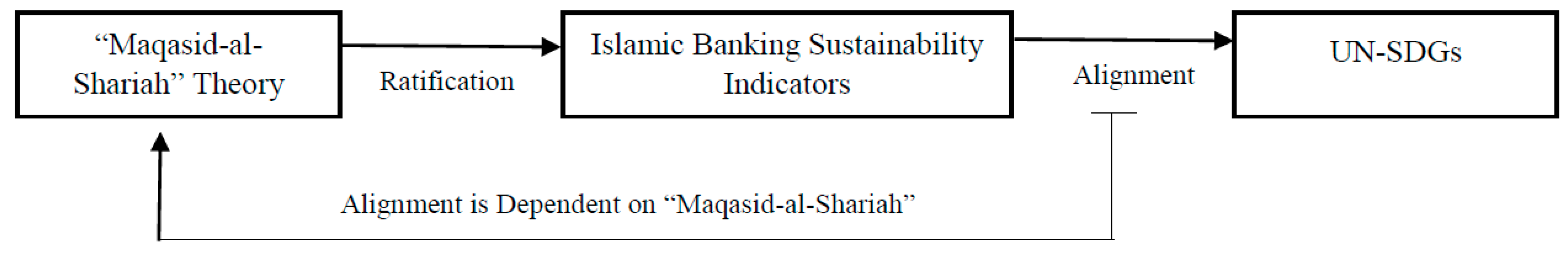

2.4. Theoretical Foundation

3. Methodology

3.1. Grounded Theory

3.2. Open Coding and Axial Coding Methods

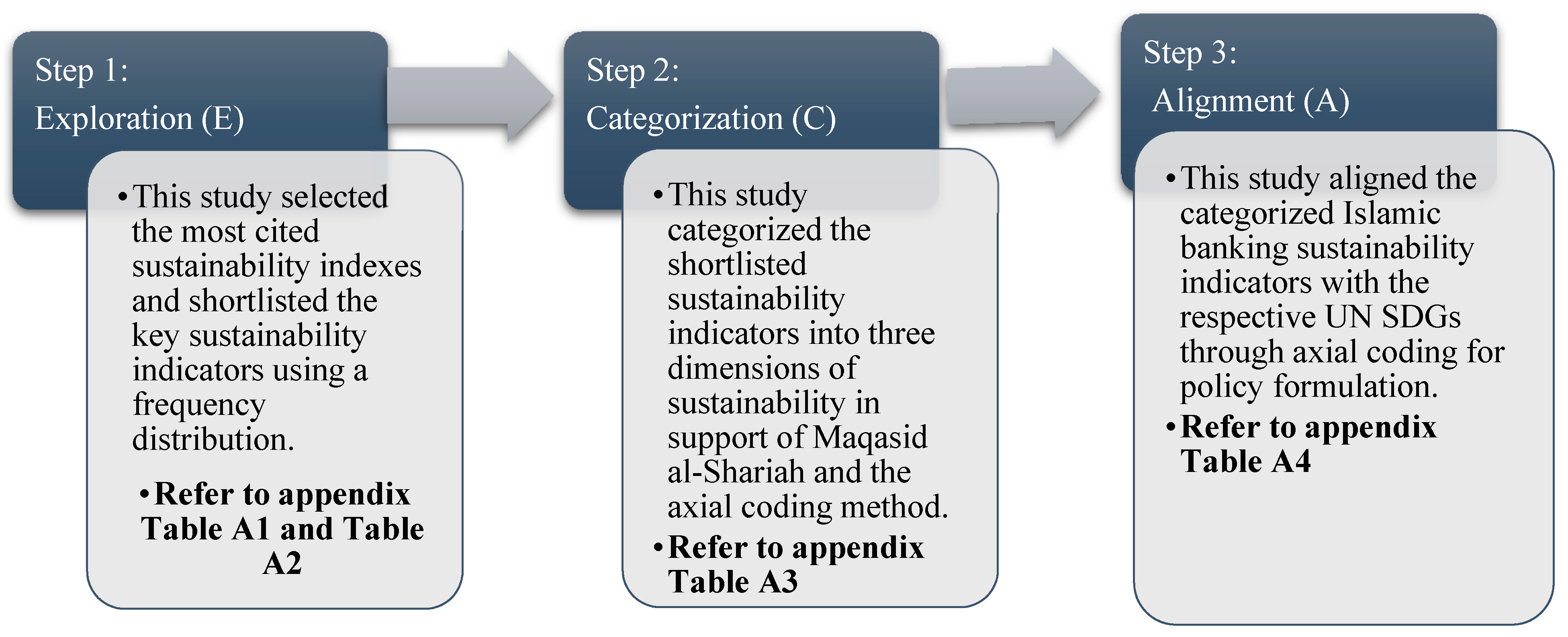

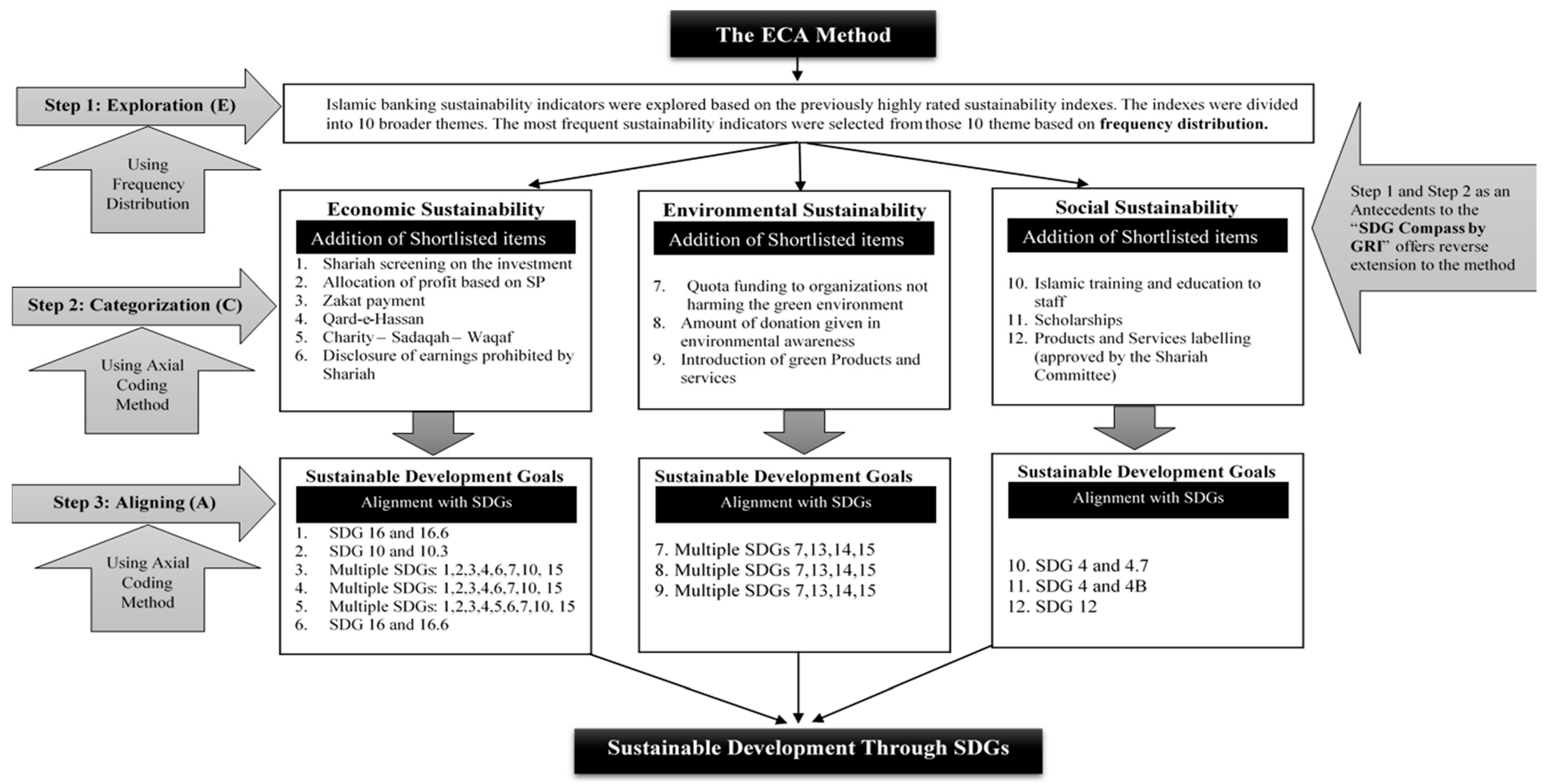

3.3. The New ECA Method

3.3.1. Step 1: Exploration (E)

3.3.2. Step 2: Categorization (C)

3.3.3. Step 3: Alignment (A)

3.4. Methodological Flow Chart

3.5. Economic Sustainability Indicators

3.5.1. Shariah Screening of Investments

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

3.5.2. Allocation of Profit Based on Shariah Principles

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

3.5.3. Zakat Payment

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response

3.5.4. Qard-e-Hassan (Benevolent Loans)

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

3.5.5. Donating to Charity through Sadaqah and Waqf

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

3.5.6. Disclosure of Earnings Prohibited by Shariah

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

3.6. Environmental Sustainability Indicators

3.6.1. Funding for Organizations Upholding a Green Environment

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

3.6.2. Amount of Donations to Environmental Awareness

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

3.6.3. Introduction of Green Products and Services

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

3.7. Social Sustainability Indicators

3.7.1. Islamic Training and Education for Staff

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

3.7.2. Offering Scholarships

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alfa and Beta

3.7.3. Approval of New Products and Services by the Shariah Committee

- ▪

- Categorization of Sustainability Indicator into Respective Sustainability Dimension (Alpha)

- ▪

- Alignment of Sustainability Indicator with the UN SDGs (Beta)

- ▪

- The COVID-19 Response: Based on Alpha and Beta

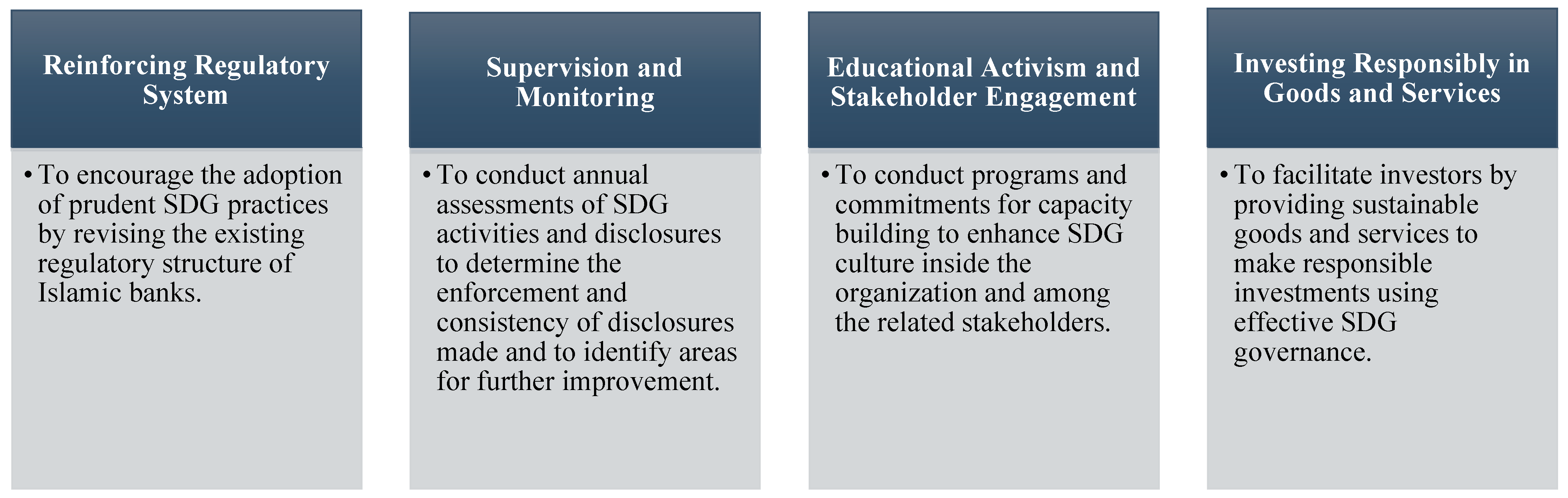

4. Conclusions

4.1. Theoretical Implications

4.2. Social/Practical Implications

4.3. Policy Recommendations

4.4. Avenues for Future Research and Recommendations

Author Contributions

Funding

Conflicts of Interest

Appendix A

Appendix A.1. Shortlisting Key Islamic Banking Sustainability Indicators (EXPLORATION)

Appendix A.2. Categorizing the Shortlisted Sustainability Indicators (CATEGORIZATION)

Appendix A.3. Alignment of the Categorized Sustainability Indicators with the UN SDGs (ALIGNMENT)

| Broader Themes from Sustainability Indexes | Platonova, et al. [22] | Amran, et al. [56] | Aribi and Arun [57] | Mallin, et al. [12] | Aribi and Gao [58] | Farook, et al. [17] | Rahman, et al. [59] | Hassan and Harahap [15] | Othman and Thani [60] | Haniffa and Hudaib [61] | Maali, et al. [62] | Dusuki [63] | Frequency Distribution | Percentage | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Employees | 1. Employment 2. Commitment to employees 3. Employees 4. Employees 5. Employees 6. Employees 7. Employees 8. Employees 9A. Workers’ health and safety 9B. Workers’ education and training 9C. Fair treatment of workers and applicants 9D. Fostering Islamic values among staff 10. Employees 11. Commitment towards employees | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 12 | 100 |

| 2. Community and Society | 1. Commitment to community 2. Community development and social goals 3. Community 4. Society 5. Community 6. Other aspects of community involvement 7A. Financing companies not violating human rights 7B. Financing SMEs, providing affordable service to deprived areas 7C. Supporting charities and community projects 7D. Solving social problems 8. Community involvement 9. Commitment to society | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 10 | 83 |

| 3. Governance/Shariah Compliance | 1. Governance 2. Shariah compliance 3. Corporate governance and Shariah-compliant corporate governance 4. Corporate governance 5. BOD and top management 6. Shariah Supervisory Board SSB 7. Sharia opinion—unlawful (haram) transaction 8. Islamic value and SSB 9. Shariah Supervisory Board 10A. Unusual supervisory restrictions 10B. Unlawful (haram) transactions 10C. Sharia Supervisory Council | 0 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 10 | 83 |

| 4. Zakat/Charity/Qard-e-Hasan | 1. Zakat, charity and benevolent funds 2. Zakat, charity, donations, and Qard-e-Hassan 3. Charity and zakat 4. Zakat, charity, and benevolent loans 5. Zakat, Qard-e-Hassan, Charitable and social activities 6. Paying zakat, charity, and granting Qard-e-Hassan 7. Zakat, charity, and benevolent funds 8. Zakat obligation, Qard fund | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 0 | 0 | 1 | 1 | 1 | 10 | 83 |

| 5. Product and Services | 1. Products and services 2. Products 3. Products and services 4. Products, services, and fair dealing with supply chain 5. Products and services 6. Products 7. Products and services | 1 | 1 | 0 | 1 | 1 | 0 | 1 | 1 | 1 | 1 | 0 | 0 | 8 | 67 |

| 6. Environment | 1. Environment 2. Environment 3. Environment 4. Environment 5. Environment 6A. Energy and water conservation 6B. Waste recycling policies 6C. Financing companies not harming the environment 7. Environment | 0 | 1 | 1 | 1 | 0 | 0 | 1 | 1 | 1 | 0 | 1 | 1 | 8 | 67 |

| 7. Mission and Vision | 1. Mission and vision statement 2. Strategy—corporate vision 3. Vision and mission statement 4. Vision and mission statement | 1 | 1 | 0 | 1 | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 5 | 42 |

| 8. Customer and Clients | 1. Ethical behavior, stakeholders’ engagement, and customer relations 2. Listening to public view and concern, fostering Islamic values among customers 3. Customers 4. Late repayments and insolvent clients | 0 | 0 | 0 | 1 | 0 | 1 | 1 | 0 | 0 | 1 | 4 | 33 | ||

| 9. Debtors | 1. Commitment to debtors 2. Debtors 3. Debtors 4. Commitment to debtors | 1 | 0 | 1 | 1 | 0 | 1 | 0 | 0 | 0 | 1 | 0 | 0 | 5 | 42 |

| 10. Other | 1. Finance and Investment 2. Contribution | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 1 | 8 | |||

| Broader Themes | Platonova, et al. [22] | Amran, et al. [56] | Aribi and Arun [57] | Mallin, et al. [12] | Aribi and Gao [58] | Farook, et al. [17] | Rahman, et al. [59] | Hassan and Harahap [15] | Othman and Thani [60] | Haniffa and Hudaib [61] | Maali, et al. [62] | Shortlisted Sustainability Indicators |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1. Employees | Training: Shariah awareness | Training: Shariah awareness | The policy on education and training in relation to the Islamic financial institution | Employee training and development in line with Islamic principles | 0 | 0 | Training: Shariah awareness | 1A. Religious freedom for Muslims to perform prayers. 1B. The proper place of worship for employees. | Training: Shariah awareness | The policy on education and training of employees in line with Islamic principles | Shariah education for the employee | 1. Islamic training and education for the staff (8 indexes). |

| 2. Community and Society | Conferences on Islamic economics and other educational areas | Zakat. Qard-e-Hassan and Sadaqah -for strategic social development. | 0 | Zakat | 0 | 0 | 0 | Scholarships. Sadaqah/Waqf/Qard-e-Hassan. | Conferences on Islamic economics | 0 | Supporting charities and community projects | 2. Sadaqah, charity, Qard-e-Hassan (4 indexes). 3. Offering scholarships, conducting Islamic conferences (3 indexes). |

| 3. Governance/Shariah Compliance | 0 | 1A. Nature of unlawful transactions. 1B. Allocation of profits based on Shariah principles. 1C. Shariah screening of investments. 1D. Zakat. calculation and payment | 1A. Nature of unlawful transactions. 1B. Compliance with Shariah in all products and services. | Commitment to ethical conduct | 1A. Report of SSB. 1B. Nature of unlawful transactions or services. | 1A. Unlawful haram transactions. 1B. Shariah supervisory council. 1C. Unusual supervisory restrictions. | 1A. Nature of unlawful transactions. 1B. Allocation of profits based on Shariah principles. 1C. Shariah screening of investments. 1D. Zakat calculation and payment | Declaration of forbidden activities | SSB Report | Nature of unlawful transactions | Fostering Islamic values among staff | 4. Disclosure of earnings prohibited by Shariah (7 indexes). 5. Shariah screening of investments (3 indexes). 6. Allocation of profits based on Shariah principles (3 indexes). |

| 4. Zakat/Charity/Qard-e-Hassan | Zakat, charity, and benevolent funds (Qard-e-Hassan) | Zakat, charity, and benevolent funds (Qard-e-Hassan) | Zakat, charity, and benevolent funds (Qard-e-Hassan) | Charity and zakat | Zakat, charity, and benevolent funds (Qard-e-Hassan) | Zakat, and (Qard-e-Hassan) | 0 | 0 | Zakat, charity, and benevolent funds (Qard-e-Hassan) | Zakat, charity, and benevolent funds (Qard-e-Hassan) | Zakat, charity, and benevolent funds (Qard-e-Hassan) | 7. Zakat payment (9 indexes). 8. Charity/Sadaqah (8 indexes). 9. Qard-e-Hassan (benevolent funds) (8 indexes). |

| 5. Products and Services | 1A. No involvement in non-permissible activities. 1B. Approval ex-ante by SSB for new product. | 1A. Introduction of SSB-approved new product. 1B. Basis of Shariah concept on new products. | 0 | New product and services in maintenance with religious credentials | 0 | Products and services in line with Shariah principles | 1A. Introduction of SSB-approved new product. 1B. Basis of Shariah concept on new products. | Halal status of the product | 1A. Approval ex-ante by SSB for the new product. 1B. Basis of Shariah concept on new products | 0 | 0 | 10. Approval of new products and services by the Shariah Committee (7 Indexes). |

| 6. Environment | 0 | 1. Introduction of green product. 2. Amount of donations to environmental awareness. | Lending policy | 0 | 0 | 0 | 1. Introduction of green product. 2. Amount of donations to environmental awareness. 3. Investment in sustainable development projects. | Environmental education | 0 | 1A. The amount and nature of any donations or activities undertaken to protect the environment. 1B. The projects financed by the bank that may lead to harming the environment. | Financing companies not harming the environment | 11. Funding for organizations upholding a green environment (4 indexes). 12. Amount of donations to environmental awareness (3 indexes). 13. Introduction of green products and services (3 indexes). |

| Items | 1: Phenomena | 2: Causal Condition | 3: Intervening Strategies | 4: Consequences | Category |

| Q1: How are the item and category related to each other? | Q2: How do the item and category influence each other? | Q3: What are the actions and strategies required to relate item and category? | Q4: What are the consequences of relating item and category? | ||

| 1. Shariah screening of investments | The item and category are related to each other through their economic kind of nature. The investments are made through the funds available to the Islamic banks in the form of different economic capitals. The investment of Islamic banks is recorded in the annual reports of the Islamic banks, which depicts the economic position of banks. Hence, based on the economic nature this item and category are closely related to each other. | The item and category greatly affect each other based on inductive information. This is because it will increase the trust of stakeholders in Islamic banks to be more in line with Islamic values by executing and reporting on this item. The increased trust of stakeholders would eventually lead the Islamic bank to raise more funds. This would gradually improve its economic viability. Thus the object and category favourably affect each other based on the positive causal situation. | The strategy adopted by this study to relate the item to economic sustainability is to establish its theoretical relation. Following the Maqasid al-Shariah principle, this study ponders that the investment screening of Shariah falls under the “essential” category and “preservation of faith and wealth” subcategory. Based on inductive knowledge and Islamic teachings, preservation of wealth according to Islamic teachings will improve economic sustainability. Hence, as a strategy and action, Islamic banks are required to intensify the level of Shariah screening of investments for better economic sustainability. | Based on inductive knowledge, relating item and category with each other will improve the economic sustainability profile of the Islamic banks. This will offer Islamic banks greater economic surveillance and better management of Islamic funds in compliance with Shariah principles. | Economic Sustainability Dimension |

| 2. Allocation of profits based on Shariah principles | This item and category relate to each other based on their economic (monetary) nature. Profits are paid from the earnings of banks, recorded in the income statement. The income statement shows the economic condition of the banks. Hence, this item and category follow the same philosophy and are related to each other in monetary terms. | As per Islamic law, Islamic banks are expected to allocate profit to all depositors with complete fairness, and also to protect their capital in the process. The dedication of such actions would increase the customer’s interest in the Islamic bank, which will increase deposits. It would thus boost the economic viability of Islamic banks. Thus the item and category favorably affect each other based on the causal situation. | This is based on the strategy of establishing a theoretical link between the item and category. The principles of Maqasid al-Shariah alludes to the allocation of profits based on Shariah principles falling under the “essential” category and “preservation of wealth” subcategory. Based on inductive knowledge, better wealth preservation will improve economic sustainability accordingly. Hence, the action and strategies required by Islamic banks are to further ensure the allocation of effective Shariah principles to safeguard economic sustainability. | As a consequence of relating this item with the category, it will safeguard the economic sustainability of Islamic banks. As a causal condition, following Shariah principles in profit sharing will positively address the stakeholders, which may increase the cash inflow as a positive goodwill of the banks. As a consequence, economic sustainability will be improved. | |

| 3. Qard-e-Hassan | This item is related to the economic sustainability dimension because of its monetary nature. This is because Qard-e-Hassan is paid as an interest-free loan from the economic profit of banks. The bank with the most economic funding (profits) can distribute more Qard-e-Hassan and vice versa. Therefore, this item and category are related to each other in terms of the same segment of recording, i.e., financial statements. | The Qard-e-Hassan financing facility is more applicable in poor or underdeveloped countries where it can serve to remove hardship from society and life. Providing Qard-e-Hassan to poor customers will increase the goodwill of the Islamic banks not only in their customers’ minds but also in public at large. As a result, Islamic banks will attract more deposits from other stakeholders, which may strengthen their economic sustainability positively. Hence, based on the causal condition the item and category positively influence each other. | According to the principles of Maqasid al-Shariah, this study categorized Qard-e-Hassan as a complementary item to the subcategories of preservation of self or life and preservation of posterity. This is based on inductive knowledge when the self, life, and posterity of people are preserved. The economic burden on them is reduced. Hence, to improve the economic sustainability of Islamic banks’ stakeholders and the banks themselves, these principles can serve as a strategic base. | Linking Qard-e-Hassan with economic sustainability will improve economic sustainability. One would argue that paying interest-free loans should decrease economic sustainability in the short run. However, holistic inductive knowledge would argue that it will improve economic sustainability in the long run. This is because of the goodwill philosophy. | |

| 4. Charity—Sadaqah—Waqf | The items of charity and economic sustainability are closely related to each other based on their monetary nature. Charity is paid from the different banking sources and funds, which comes under the economic head of the annual reports. Therefore, this item and category both share the same financial head under the annual report of the Islamic banks and are strongly related to each other. | In the context of Islamic banks, paying charity through Sadaqah and Waqf is a part of their operations. Islamic banks are required to channel the income derived from unclear or tainted activities to charitable bodies, including Waqf institutions. Circulating wealth to the people through charity, Sadaqah and Waqf have upgraded the image of Islamic banks and subsequently, improved their economic sustainability. Hence, based on the causal condition the item and category positively influence each other. | According to the principles of Maqasid al-Shariah, this study posits that the instrument of donating to charity through the Islamic instruments of Sadaqah and Waqf falls under the “embellishment” category. Paying charity through Sadaqah and Waqf is a part of their operations. Islamic banks are required to channel the income derived from unclear or tainted activities to charitable bodies, including Waqf institutions. Circulating wealth to the people through charity, Sadaqah, and Waqf has upgraded the image of Islamic banks and subsequently improved economic sustainability. Hence, as an efficient strategy and action, Islamic banks must channel charity to the least addressed SDGs to promote sustainable development, which as a consequent will improve their economic sustainability based on the goodwill and compliance philosophy. | The linkage of charity with the economic sustainability dimension will improve economic sustainability. In line with the philosophy of Qard-e-Hassan, in the short term charity payment decreases the profit of Islamic banks, which can be perceived as a negative impact on economic sustainability. However, in the long run, based on the goodwill philosophy, the instrument of charity payment will improve the economic sustainability of Islamic banks as a consequence of receiving more funds through their positive goodwill. | |

| 5. Disclosure of earnings prohibited by Shariah | Based on Islamic philosophy the earning of income by prohibited sources is not allowed. Therefore, if any bank is willingly dealing in it and is not recording it, it can affect the economic condition of an Islamic bank negatively and vice versa. Hence, the progression of the economic performance of Islamic banks lies in avoiding haram profit. If it is committed mistakenly, the bank must immediately send it to charity. Hence, this item is strongly related to the economic sustainability dimension based on the Shariah philosophy. | To prevent the recurrence of such a transaction, Islamic banks must design control systems and forward any other gain to the funds of charities. This will strengthen the client’s confidence in Islamic banks. More deposits will be produced with improved confidence, and more deposits will boost the economic viability of Islamic banks. Therefore the item and category positively affect each other based on the positive causal situation. | As a strategy, to develop the theoretical link between the item and category, based on the principles of Maqasid al-Shariah, this study posits that the disclosures of earnings prohibited by Shariah are complementary to the preservation of faith, self, and wealth. This is because in Islam all financial transactions must be transparent, accurate, and fully recorded. All income received from non-Shariah sources must be fully audited and managed, otherwise they would affect the economic sustainability of the Islamic bank. Hence, as a strategy and action, Islamic banks must properly channel these earnings to charity funds to preserve their economic sustainability. | The consequences of relating this item with economic sustainability may be seen in the shape of strong economic sustainability. This is because the recording of unlawful and haram income and simultaneously dispatching it to a charity fund will increase the Shariah rating process of Islamic banks, which as a consequent will keep the existing economic stakeholders satisfied, and will attract more customers, which will increase the economic sustainability of Islamic banks. | |

| 6. Zakat payment | Using inductive knowledge, zakat is related to the economic category based on the fact that zakat is paid from the income earned and is reported on the economic part of the annual report, i.e., on the income statement. Hence, both are related to each other based on their financial nature. | Based on inductive knowledge, zakat item zakat and the economic category strongly influence each other, i.e., zakat payment increases the goodwill of Islamic banks. As an effect of high goodwill, the banks generate more funds, which eventually influence their economic sustainability positively. | The strategy adopted by this study to relate the item with the category is by developing a theoretical link. According to Maqasid al-Shariah, zakat falls under the subcategory of the preservation of wealth. As a strategic requirement, the principles assure a link in the presence of Shariah principles. Now as an action, the bank must channel its zakat payment to SDGs that are relatively unaddressed. As a result of such actions and compliance, the economic sustainability of Islamic banks will get better. | The consequences of relating zakat with the economic category are assumed to be positive. Based on the goodwill philosophy (causal condition), it improves the economic sustainability of Islamic banks. Strong economic sustainability ultimately improves the financial performance of Islamic banks in a positive way. Hence, consequently, the relative results are positive. | |

| 7. Quota funding to organizations not harming a green environment | Islam considers humans the stewards of the earth. Based on this, every business that operates under Islamic principles must preserve the ecosystem. Therefore, based on the Shariah philosophy of stewardship, this funding is related to environmental sustainability. | The causal condition between this funding and environmental sustainability is significant. The low funding for organizations that are involved in renewable energy projects will lead to a lower level of green projects, which as a result will reduce environmental sustainability and vice versa. Hence, the causal condition between this item and category depends on the level of funds. If there are more funds, environmental sustainability will be better and vice versa. | Based on the theory of Maqasid al-Shariah, the above instrument is linked to the main category of “essential” and subcategory of preservation of posterity and preservation of life. Hence, it is assumed that there is a theoretical link between the item and category in the context of Shariah. The action required by Islamic banks is to prioritize funding for better environmental preservation. | The consequence of relating this funding with environmental sustainability will protect the environment. This is because that funding as a consequence will accelerate green projects, which will positively protect the environment. | Environmental Sustainability Dimension |

| 8. Amount of donations given to environmental awareness | This item also relates to the environmental sustainability dimension based on the Islamic philosophy of humans as stewards of the earth. This philosophy triggers the banks to distribute donations to environmental awareness. Hence, this item and category are related to each other based on the Islamic concept of stewardship. | The causal condition between the funding given for environmental awareness and the environmental sustainability dimension depends on the level of funds. If the amount of funds is high, the causal condition would be high. If the amount is less the causal condition would be negative. | According to the principles of Maqasid al-Shariah, this item is categorized as the preservation of self/life and the preservation of posterity under the main category of “essential” because there exists a theoretical link and consensus between this item and the principles of Shariah for improving environmental sustainability. Therefore, as a strategy and action, Islamic banks are required to increase the amount of such donations. | The consequence of relating these donations to environmental sustainability will protect the environment and will improve environmental sustainability ratings if the funding amount is high and vice versa. | |

| 9. Introduction of green products and services | The item and the category of environmental sustainability relate to each other based on the nature of service and product initiation. This is because the purpose of launching the product or service is to keep the environment in nature. Hence, based on the purpose, this item and category relate to each other. | The causal condition between this item and category is significant in terms of impact. The offered product and service would create a positive impact on the environment based on its purpose of serving the environment. Hence the causal condition is perceived as positive. | According to the theory of Maqasid al-Shariah, this item is categorized as the preservation of self/life and the preservation of posterity under the main category of “essential” because there exists a theoretical link and consensus between this item and the principles of Shariah for improving environmental sustainability. Therefore, as a strategy and action, Islamic banks are required to increase the production and services of green products. | The consequence of relating this item to environmental sustainability will bring positive environmental ratings. This is because those products and services as a consequence will accelerate green projects, which will protect the environment. | |

| 10. Islamic training and education for staff | This item is related to the social sustainability dimension based on the nature of the work. That is, Islamic training and education for staff would ensure decent work practices ensured by Shariah. As Islam prohibits discrimination based on gender, race, or ethnicity, the concept is referred to as Husn-e-akhlaq/obligingness. | The causal condition between this item and category depends upon the standard of training and education. If the standard of Islamic education is in-depth and pure, it will boost the character of banking staff positively towards their co-workers, which as a cause will affect social sustainability positively. | Islamic training and education are categorized as a complimentary item to the preservation of intellect under the category of “essential.” Based on the consensus and theoretical link between these items, Islamic banks as a strategy are required to set up a banking institution dedicated to supporting social justice and social up-gradation through banking staff. | The linking of Islamic training and education for staff with social sustainability as a consequence will bring positive outcomes in the social dimension of sustainability. | Social Sustainability Dimension |

| 11. Scholarships | This is related to the social sustainability dimension because providing scholarships to multiple stakeholders will raise the quality of education in society and will uplift social standards as well. | The causal condition of this item with that of social sustainability is also perceived as positive. This is because providing scholarships will uplift the standard of education of different stakeholders, and those stakeholders using their knowledge and education may work for the betterment of society based on the social contract theory. | According to the theory of Maqasid al-Shariah, this item of scholarships is categorized as a complimentary item to the preservation of intellect under the main category of “essential” because there exists a theoretical link between this item and Shariah principles. So, as a way forward, Islamic banks must increase the amount of funding for scholarships to reduce child labor and forced labor. Eventually, it will improve the social sustainability of Islamic banks. | There are fears that due to the current turmoil of COVID-19, students from mostly underdeveloped or developing countries may completely lose out on their education. This can result in more child-labor cases. Therefore, this is the most appropriate time for Islamic banks to start offering more scholarships to peoples from mostly underdeveloped countries to avoid child-labor cases. Hence, the consequences of offering scholarships on social sustainability would be very positive. | |

| 12. Product and service labeling (approved by the Shariah Committee) | This is related to social sustainability because Islam prohibits dealing in haram products and services. Muslims must preserve faith while doing business. Hence, based on the principles of Islamic faith, this item and category are related to each other. | The causal condition between this item and social sustainability is also perceived positively. This is because unethical labeling that can affect any people from any religion may cause high distress among the stakeholders of Islamic banks. Therefore, the causal condition between this item and category is significant. | According to the theory of Maqasid al-Shariah, the product and service approval from the Shariah Committee is categorized as essential under the subcategory of preservation of faith because there exists a theoretical link between this item and Shariah principles. So, as a way forward, as a strategy and action, Islamic banks are required to deepen the process of Shariah evaluation to safeguard its social sustainability. | Nowadays most banking services and products are provided online or using electronic machines that are directly associated with people and society. For instance, the content in the advertisements of Islamic banks must be ethically and socially acceptable for all stakeholders from all religions. Ignoring ethical elements in the delivery of products and services to society may directly affect the social sustainability of Islamic banks. Hence, the Shariah Committee must ensure the elements of society before approving any product or service. This is because the intended objectives of the principle of Shariah are to achieve socioeconomic justice for individuals and society and to enhance welfare in society. Hence, the consequence of this linkage is positive. |

| Items | 1: Phenomena | 2: Causal Condition | 3: Intervening Strategies | 4: Consequences | Alignment with the UN SDGs |

| Q1: How are the item and category related to each other? | Q2: How do the item and category influence each other? | Q3: What are the actions and strategies required to relate item and category? | Q4: What are the consequences of relating item and category? | ||

| 1. Shariah screening of investments | The item and UN SDG are related to each other based on the principles of transparency. Shariah screening of investments offers great transparency and accountability based on Islamic laws in developing effective institutions. Shariah objectives aim to promote social welfare (Al-Maslahah), therefore, the instrument of Shariah screening of investments will ensure the prevention of investments in inappropriate haram business (forbidden by Islamic laws) such as gambling, which generally violates the business objectives of free and fair exchange, which halts the process of building strong and transparent institutions. | The causal condition between the sustainability indicators and UN SDG 6 and sub-goal 16.6 is considered positive. This is because Shariah objectives aim at achieving socio-economic development. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDG will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDG 16 (sub-goal 16.6) |

| 2. Allocation of profits based on Shariah principles | The item and UN SDG are related to each other in terms of principles and laws, as UN SDG 10.3 alludes to reducing inequality of outcomes by eradicating discriminatory principles and laws. On the other hand, Shariah principles (based on the principles of socio-economic justice) reduce inequalities of outcomes by fairly distributing profit to all stakeholders. | The causal condition between the item and SDG is considered positive. This is because the allocation of profits based on Shariah principles will enhance compliance of Islamic banks with SDG goal 10 and its sub-goal 10.3. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDG will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDG 10 (sub-goal 10.3) |

| 3. Qard-e-Hassan | The item and UN SDGs are related to each other in terms of their philanthropic nature and addressing the needs of poor stakeholders. This study relates the instrument with multiple SDGs because these goals are interconnected. Improvement in one goal, for instance no poverty, as a subset, will bring an improvement in the other goals as well, such as alleviating poverty enhancing the purchasing power of stakeholders, which allows them to afford food, health services, water, and energy. | The causal condition between the item and multiple SDGs is perceived as positive. This is because the item will address the needs of various deprived stakeholders related to SDGs 1, 2, 3, 4, 6, 7, 10, and 15, which as a result will reduce the challenges faced by those deprived stakeholders. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDGs will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDGs 1, 2, 3, 4, 6, 7, 10, 15 |

| 4. Charity—Sadaqah—Waqf | The item and UN SDGs are related to each other in terms of their philanthropic nature and addressing the needs of poor stakeholders. Charity (Sadaqah and Waqf) are used for poverty alleviation and socioeconomic development. In line with that, this study related the instrument with UN SDGs 1, 2, 3, and 4. This is because these goals are directly related to poverty alleviation and socioeconomic development. | The causal condition between the item and UN SDGs is perceived as positive. This is because channeling charity towards the goals will address the needs of the deprived stakeholders. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDGs will increase, which will promote sustainable development and will mitigate the stress fromCOVID-19 on the triple bottom line. | SDGs 1, 2, 3, 4 |

| 5. Disclosure of earnings prohibited by Shariah | The item and UN SDG are related to each other based on the principles of transparency. UN SDG 16.5 alludes to building transparent, accountable, and effective institutions at all levels. The earnings are channeled by Islamic banks to charity funds because they violates the principles of Islamic business. Dispatching the earned amount from the profit of Islamic banks ensures greater transparency, accountability, and business effectiveness as well. Consonant with that, this study relates the instrument to UN SDG 16 and 16.5. | The causal condition between the item and UN SDG is also significantly positive. This is because disclosures of earnings prohibited by Shariah will ensure business transparency, which helps build a strong institution. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDG will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDG 16 (Sub-goal: 16.6) |

| 6. Zakat payment | The item and UN SDGs are related to each other in terms of their philanthropic nature and addressing the needs of poor stakeholders. Zakat is paid with the aim of supporting disadvantaged people in society (Malik, 2016). In the same vein, this study relates the instrument of zakat to the UN SDGs because these goals are directly related to the needs of disadvantaged people. | The causal condition between the item and UN SDGs is also perceived as positive. This is because channeling zakat towards the goals will address the needs of the deprived stakeholders. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDGs will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDGs 1,2,3,4,6,7,10,15 |

| 7. Funding organizations not harming a green environment | This instrument and the UN SDGs are related to each other based on the principles of protecting the environment. | This instrument and the UN SDGs positively affect each other. Increase in this instrument will bring positive outcomes to the SDGs. Hence, the causal condition is perceived as positive. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDGs will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDGs 7,13,14,15 |

| 8. Amount of donations given for environmental awareness | This instrument and the UN SDGs are related to each other based on the principles of protecting the environment. | This instrument and the UN SDGs positively affect each other. Increase in this instrument will bring positive outcomes to the SDGs. Hence, the causal condition is perceived as positive. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDGs will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDGs 7,13,14,15 |

| 9. Introduction of green products and services | This instrument and the UN SDGs are related to each other based on the principles of protecting the environment. | This instrument and the UN SDGs positively affect each other. Increase in this instrument will bring positive outcomes to the SDGs. Hence, the causal condition is perceived as positive. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDGs will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDGs 7,13,14,15 |

| 10. Islamic training and education for staff | This instrument and UN SDG are related to each other in terms of the category of education. | The causal condition between the instrument and the UN SDG is perceived as positive. The training will serve UN SDG 4 and 4.7 positively. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDG will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDG 4 (Sub-goal: 4.7) |

| 11. Scholarships | This instrument and UN SDG are related to each other in terms of the category of education | The causal condition between the instrument and the UN SDG is perceived as positive. The training will serve UN SDG 4 and 4.7 positively. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDG will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDG 4 (Sub-goal: 4B) |

| 12. Product and service labeling (approved by the Shariah Committee) | This instrument and category are related to each other in terms of product and service responsibility aimed at society. As such Shariah approval will promote responsible production and consumption. | The causal condition between the item and UN SDG is positive. Shariah approval will promote responsible consumption and production. Hence, it will support UN SDG 12 positively. | As a strategic requirement, this study proposes a modern governance role, i.e., SDG governance (refer to Figure 7). The modern governance role ensures the alignment process between sustainability indicators and the UN SDGs in four detailed stages. | As a consequence of relating the item and category, the compliance of Islamic banks with the SDG will increase, which will promote sustainable development and will mitigate the stress from COVID-19 on the triple bottom line. | SDG 12 |

References

- Goodell, J.W. COVID-19 and finance: Agendas for future research. Financ. Res. Lett. 2020, 35, 101512. [Google Scholar] [CrossRef]

- Ashraf, B.N. Economic impact of government interventions during the COVID-19 pandemic: International evidence from financial markets. J. Behav. Exp. Financ. 2020, 27, 100371. [Google Scholar] [CrossRef]

- Nicola, M.; Alsafi, Z.; Sohrabi, C.; Kerwan, A.; Al-Jabir, A.; Iosifidis, C.; Agha, M.; Agha, R. The socio-economic implications of the coronavirus pandemic (COVID-19): A review. Int. J. Surg. 2020, 78, 185. [Google Scholar] [CrossRef]

- Syed, M.H.; Khan, S.; Rabbani, M.R.; Thalassinos, Y.E. An Artificial Intelligence and NLP Based Islamic FinTech Model Combining Zakat and Qardh-Al-Hasan for Countering the Adverse Impact of COVID 19 on SMEs and Individuals. Int. J. Econ. Bus. Adm. 2020, 8, 351–364. [Google Scholar]

- Zhang, D.; Hu, M.; Ji, Q. Financial markets under the global pandemic of COVID-19. Financ. Res. Lett. 2020, 36, 101528. [Google Scholar] [CrossRef]

- Shaharuddin, A. Do Islamic Banks Act ‘Islamic’During COVID-19 Pandemic? J. Muamalat Islamic Financ. Res. 2020, 17, 3–12. [Google Scholar]

- Azhari, A.R.; Salsabilla, A.; Wahyudi, R. Performance analysis of Islamic bank social funds in the Covid-19: Evidance from Indonesia. In Islam in World Perspectives Symposium; Universitas Ahmad Dahlan: Yogyakarta, Indonesia, 2020; pp. 1–7. [Google Scholar]

- Aliyu, S.; Hassan, M.K.; Yusof, R.M.; Naiimi, N. Islamic Banking Sustainability: A Review of Literature and Directions for Future Research. Emerg. Mark. Financ. Trade 2017, 53, 440–470. [Google Scholar] [CrossRef]

- Meutia, I.; Febrianti, D. Islamic Social Reporting in Islamic Banking: Stakeholders Theory Perspective. In SHS Web of Conferences; EDP Sciences: Kuching Sarawak, Malaysia, 2017; Volume 34. [Google Scholar] [CrossRef]

- Nobanee, H.; Ellili, N. Corporate sustainability disclosure in annual reports: Evidence from UAE banks: Islamic versus conventional. Renew. Sustain. Energy Rev. 2016, 55, 1336–1341. [Google Scholar] [CrossRef]

- Belal, A.R.; Abdelsalam, O.; Nizamee, S.S. Ethical reporting in islami bank Bangladesh limited (1983–2010). J. Bus. Ethics 2015, 129, 769–784. [Google Scholar] [CrossRef]

- Mallin, C.; Farag, H.; Ow-Yong, K. Corporate social responsibility and financial performance in Islamic banks. J. Econ. Behav. Organ. 2014, 103, S21–S38. [Google Scholar] [CrossRef]

- Yusoff, H.; Darus, F. Mitigation of climate change and prevention of pollution activities: Environmental disclosure practice in Islamic financial institutions. Procedia-Soc. Behav. Sci. 2014, 145, 195–203. [Google Scholar] [CrossRef]

- Haji, A.A.; Ghazali, N.A.M. The quality and determinants of voluntary disclosures in annual reports of Shari’ah compliant companies in Malaysia. Humanomics 2013, 29, 24–42. [Google Scholar] [CrossRef]

- Farook, S.; Hassan, M.K.; Lanis, R. Determinants of corporate social responsibility disclosure: The case of Islamic banks. J. Islamic Account. Bus. Res. 2011, 2, 114–141. [Google Scholar] [CrossRef]

- Jusoh, W.; Ibrahim, U.; Napiah, M.D.M. Corporate social responsibility of Islamic banks: A literature review and direction for future research. J. Appl. Environ. Biol. Sci. 2014, 4, 57–61. [Google Scholar]

- Hassan, A.; Harahap, S.S. Exploring corporate social responsibility disclosure: The case of Islamic banks. Int. J. Islamic Middle East. Financ. Manag. 2010, 3, 203–227. [Google Scholar] [CrossRef]

- Zafar, M.B.; Sulaiman, A.A. Corporate social responsibility and Islamic banks: A systematic literature review. Manag. Rev. Q. 2019, 69, 159–206. [Google Scholar] [CrossRef]

- Jan, A.; Marimuthu, M.; Mohd, M.P.b.; Isa, M. The nexus of sustainability practices and financial performance: From the perspective of Islamic banking. J. Clean. Prod. 2019, 228, 703–717. [Google Scholar] [CrossRef]

- Jan, A.; Marimuthu, M.; Hassan, R. Sustainable Business Practices and Firm’s Financial Performance in Islamic Banking: Under the Moderating Role of Islamic Corporate Governance. Sustainability 2019, 11, 6606. [Google Scholar] [CrossRef]

- Jan, A.; Marimuthu, M.; Pisol, M.; Isa, M.; Albinsson, P. Sustainability practices and banks financial performance: A conceptual review from the islamic banking industry in Malaysia. Int. J. Bus. Manag. 2018, 13, 61. [Google Scholar] [CrossRef]

- Platonova, E.; Asutay, M.; Dixon, R.; Mohammad, S. The impact of corporate social responsibility disclosure on financial performance: Evidence from the GCC Islamic banking sector. J. Bus. Ethics 2018, 151, 451–471. [Google Scholar] [CrossRef]

- Hassan, R.; Nor, F.M. Value-Based Intermediation: An Analysis from The Perspective of Shariah And Its Objectives. Int. J. Fiqh Usul Al-Fiqh Stud. (IJFUS) 2019, 3, 81–89. [Google Scholar]

- Jamaruddin, W.N.; Markom, R. The Application of Fintech in The Operation of Islamic Banking Focussing on Islamic Documentation: Post-COVID-19. Insla E-Proc. 2020, 3, 31–43. [Google Scholar]

- Shahabi, V.; Azar, A.; Razi, F.F.; Shams, M.F.F. Simulation of the effect of COVID-19 outbreak on the development of branchless banking in Iran: Case study of Resalat Qard–al-Hasan Bank. Rev. Behav. Financ. 2020. [Google Scholar] [CrossRef]

- Abdul-Rahman, A.; Nor, S.M. Challenges of profit-and-loss sharing financing in Malaysian Islamic banking. Geogr. Malays. J. Soc. Space 2017, 12, 39–46. [Google Scholar]

- Saeed, M.; Izzeldin, M.; Hassan, M.K.; Pappas, V. The Inter-temporal relationship between Risk, Capital and Efficiency: The case of Islamic and conventional banks. Pac. Basin Financ. J. 2020, 62, 101328. [Google Scholar] [CrossRef]

- Yusof, S.A.; Amin, R.M.; Haneef, M.A.; Muhammad, A.; Oziev, G. The Integrated Development Index (I-Dex): A New Comprehensive Approach to Measuring Human Development; Bloomsbury Qatar Foundation Doha Bloomsbury Qatar Foundation: Ar Rayyan, Qatar, 2015. [Google Scholar]

- Szennay, Á.; Szigeti, C.; Kovács, N.; Szabó, D.R. Through the Blurry Looking Glass—SDGs in the GRI Reports. Resources 2019, 8, 101. [Google Scholar] [CrossRef]

- Sachs, J.D.; Schmidt-Traub, G.; Mazzucato, M.; Messner, D.; Nakicenovic, N.; Rockström, J. Six transformations to achieve the sustainable development goals. Nat. Sustain. 2019, 2, 805–814. [Google Scholar] [CrossRef]

- Tóth, G. Circular Economy and its Comparison with 14 Other Business Sustainability Movements. Resources 2019, 8, 159. [Google Scholar] [CrossRef]

- Corbin, J.M.; Strauss, A. Grounded theory research: Procedures, canons, and evaluative criteria. Qual. Sociol. 1990, 13, 3–21. [Google Scholar] [CrossRef]

- Heshmati, E.; Saeednia, H.; Badizadeh, A. Designing a customer-experience-management model for the banking-services sector. J. Islamic Mark. 2019, 10, 790–810. [Google Scholar] [CrossRef]

- Vollstedt, M.; Rezat, S. An introduction to grounded theory with a special focus on axial coding and the coding paradigm. Compend. Early Career Res. Math. Educ. 2019, 13, 81–100. [Google Scholar]

- Strauss, A.; Corbin, J.M. Grounded Theory in Practice Sage; SAGE Publishing: San Jose, CA, USA, 1997. [Google Scholar]

- Charmaz, K.; Belgrave, L.L. Grounded theory. In The Blackwell Encyclopedia of Sociology; Blackwell Publishing: New York, NY, USA, 2007. [Google Scholar]

- Matteucci, X.; Gnoth, J. Elaborating on grounded theory in tourism research. Ann. Tour. Res. 2017, 65, 49–59. [Google Scholar] [CrossRef]

- Corbin, J.; Strauss, A. Basics of Qualitative Research: Techniques and Procedures for Developing Grounded Theory; Sage Publications; SAGE Publishing: San Jose, CA, USA, 2014. [Google Scholar]

- Grainger-Brown, J.; Malekpour, S. Implementing the sustainable development goals: A review of strategic tools and frameworks available to organisations. Sustainability 2019, 11, 1381. [Google Scholar] [CrossRef]

- Raworth, K. A Safe and Just Space for Humanity: Can We Live within the Doughnut? Oxfam: Nairobi, Kenya, 2012. [Google Scholar]

- Samiullah, M. Prohibition of Riba (Interest) & Insurance in the Light of Islam. Islamic Stud. 1982, 21, 53–76. [Google Scholar]

- Ashraf, D.; Rizwan, M.S.; Ahmad, G. Islamic Equity Investments and the COVID-19 Pandemic. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Hasan, Z. The Impact Of Covid-19 On Islamic Banking In Indonesia During The Pandemic Era. J. Entrep. Bus. 2020, 8, 19–32. [Google Scholar] [CrossRef]

- Yusfiarto, R.; Setiawan, A.; Nugraha, S.S. Literacy and Intention to Pay Zakat. Int. J. Zakat 2020, 5, 15–27. [Google Scholar] [CrossRef]

- Malik, B.A. Philanthropy in practice: Role of Zakat in the realization of justice and economic growth. Int. J. Zakat 2016, 1, 64–77. [Google Scholar] [CrossRef]

- Zafar, M.A.; Khan, K.; Roberts, K.W.; Zafar, A.M. Local agricultural financing and Islamic banks: Is Qard-al-Hassan a possible solution? J. Islamic Account. Bus. Res. 2015, 6, 122–147. [Google Scholar]

- Sadeq, A.M. Waqf, perpetual charity and poverty alleviation. Int. J. Soc. Econ. 2002, 29, 135–151. [Google Scholar] [CrossRef]

- Saiti, B.; Abdullah, A. Prohibited elements in Islamic financial transactions: A comprehensive review. Al-Shajarah J. Int. Inst. Islamic Thought Civiliz. (ISTAC) 2016, 21. Available online: https://journals.iium.edu.my/shajarah/index.php/shaj/article/view/416 (accessed on 19 February 2021).

- Puneri, A.; Chora, M.; Ilhamiddin, N.; Benraheem, H. The Disclosure of Sharia Non-Compliance Income: Comparative Study between Full-fledged and Subsidiaries Malaysian Islamic Banks. JESI (J. Ekon. Syariah Indones.) 2020, 9, 104–117. [Google Scholar] [CrossRef]

- Hassan, R. Shariah Non-Compliance Risk and Its Effects on Islamic Financial Institutions. Al-Shajarah J. Int. Inst. Islamic Thought Civiliz. (ISTAC). 2016, 21. Available online: https://journals.iium.edu.my/shajarah/index.php/shaj/article/view/411 (accessed on 19 February 2021).

- Omar, H.N.; Hassan, R. Shariah Non-Compliance Treatment in Malaysian Islamic Banks. Int. J. Manag. Appl. Res. 2019, 6, 218–231. [Google Scholar] [CrossRef]

- Jusoff, K.; Samah, S.A.A.; Akmar, S. Environmental Sustainability: What Islam Propagates. World Appl. Sci. J. 2011, 12, 46–53. [Google Scholar]

- Matali, Z.H. Sustainability in Islam. Faith Values Educ. Sustain. Dev. 2012, 35–43. [Google Scholar]

- Khalil, H.; Ecke, F.; Evander, M.; Magnusson, M.; Hörnfeldt, B. Declining ecosystem health and the dilution effect. Sci. Rep. 2016, 6, 31314. [Google Scholar] [CrossRef]

- Julia, T.; Kassim, S. Exploring green banking performance of Islamic banks vs conventional banks in Bangladesh based on Maqasid Shariah framework. J. Islamic Mark. 2019, 11, 729–744. [Google Scholar] [CrossRef]

- Amran, A.; Fauzi, H.; Purwanto, Y.; Darus, F.; Yusoff, H.; Zain, M.M.; Naim, D.M.A.; Nejati, M. Social responsibility disclosure in Islamic banks: A comparative study of Indonesia and Malaysia. J. Financ. Report. Account. 2017, 15, 99–115. [Google Scholar] [CrossRef]

- Aribi, Z.A.; Arun, T. Corporate social responsibility and Islamic financial institutions (IFIs): Management perceptions from IFIs in Bahrain. J. Bus. Ethics 2015, 129, 785–794. [Google Scholar] [CrossRef]

- Aribi, Z.A.; Gao, S.S. Narrative disclosure of corporate social responsibility in Islamic financial institutions. Manag. Audit. J. 2011, 27, 199–222. [Google Scholar] [CrossRef]

- Rahman, A.A.; Hashim, M.; Bakar, F.A. Corporate social reporting: A preliminary study of Bank Islam Malaysia Berhad (BIMB). Issues Soc. Environ. Account. 2010, 4, 18–39. [Google Scholar] [CrossRef]

- Othman, R.; Thani, A.M. Islamic social reporting of listed companies in Malaysia. Int. Bus. Econ. Res. J. (IBER) 2010, 9. [Google Scholar] [CrossRef]

- Haniffa, R.; Hudaib, M. Exploring the ethical identity of Islamic banks via communication in annual reports. J. Bus. Ethics 2007, 76, 97–116. [Google Scholar] [CrossRef]

- Maali, B.; Casson, P.; Napier, C. Social reporting by Islamic banks. Abacus 2006, 42, 266–289. [Google Scholar] [CrossRef]

- Dusuki, A.W. Corporate Social Responsibility of Islamic Banks in Malaysia: A Synthesis of Islamic and Stakeholders’ Perspectives; © Asyraf Wajdi Dusuki; Loughborough University: Loughborough, UK, 2005. [Google Scholar]

| Goal: 01 | No Poverty | Goal: 10 | Reduce Inequalities |

| Goal: 02 | Zero Hunger | Goal:11 | Sustainable Cities and Communities |

| Goal: 03 | Good Health | Goal: 12 | Responsible Consumption |

| Goal: 04 | Quality Education | Goal: 13 | Climate Action |

| Goal: 05 | Gender Equality | Goal: 14 | Life Below Water |

| Goal: 06 | Clean Water and Sanitation | Goal: 15 | Life on Land |

| Goal: 07 | Renewable Energy | Goal:16 | Peace and Justice |

| Goal: 08 | Good Jobs and Economic Growth | Goal: 17 | Partnership for the Goals |

| Goal: 09 | Innovation and Infrastructure |

| Relevance | Economic Sustainability | Environmental Sustainability | Social Sustainability |

|---|---|---|---|

| Pure Dominance |

|

|

|

| Interconnected Goals |

|

|

|

| Economic Sustainability Indicators (Profit) | ||

| Sustainability Indicators | Linkage with Maqasid al-Shariah | Alignment with the Sustainable Development Goals (SDGs) |

| 1. Shariah screening of investments | Necessities—preservation of faith | SDG 16 and sub-goal 16.6 |

| 2. Allocation of profit based on Shariah principles | Necessities—preservation of faith and wealth | SDG 10 and sub-goal 10.3 |

| 3. Zakat payment | Necessities—preservation of faith and wealth | SDGs 1, 2, 3, 4, 6, 7, 10, 15 |

| 4. Qard-e-Hassan | Complementary—preservation of self or life and posterity | SDGs 1, 2, 3, 4, 6, 7, 10, 15 |

| 5. Charity—Sadaqah—Waqaf | Embellishment | SDGs 1, 2, 3, 4 |

| 6. Disclosure of earnings prohibited by Shariah | Complementary—preservation of faith, self, and wealth | SDG 16 and sub-goal 16.6 |

| Environmental Sustainability Indicators (Planet) | ||

| Sustainability Indicators | Linkage with Maqasid al-Shariah | Alignment with the Sustainable Development Goals |

| 7. Funding for organizations upholding green environment | Necessities—preservation of posterity and preservation of life | SDGs 7, 13, 14, 15 |

| 8. Amount of donations to environmental awareness | Necessities—preservation of posterity and preservation of life | SDGs 7, 13, 14, 15 |

| 9. Introduction of green products and service | Necessities—preservation of posterity and preservation of life | SDGs 7, 13, 14, 15 |

| Social Sustainability Indicators (People) | ||

| Sustainability Indicators | Linkage with Maqasid al-Shariah | Alignment with the Sustainable Development Goals |

| 10. Islamic training and education for the staff | Complementary—preservation of intellect | SDG 4 and sub-goal 4.7 |

| 11. Offering scholarships | Complementary—preservation of intellect | SDG 4 and sub-goal 4B |

| 12. Approval of new products and services by the Shariah committee | Necessities—preservation of faith | SDG 12 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jan, A.; Mata, M.N.; Albinsson, P.A.; Martins, J.M.; Hassan, R.B.; Mata, P.N. Alignment of Islamic Banking Sustainability Indicators with Sustainable Development Goals: Policy Recommendations for Addressing the COVID-19 Pandemic. Sustainability 2021, 13, 2607. https://doi.org/10.3390/su13052607

Jan A, Mata MN, Albinsson PA, Martins JM, Hassan RB, Mata PN. Alignment of Islamic Banking Sustainability Indicators with Sustainable Development Goals: Policy Recommendations for Addressing the COVID-19 Pandemic. Sustainability. 2021; 13(5):2607. https://doi.org/10.3390/su13052607

Chicago/Turabian StyleJan, Amin, Mário Nuno Mata, Pia A. Albinsson, José Moleiro Martins, Rusni Bt Hassan, and Pedro Neves Mata. 2021. "Alignment of Islamic Banking Sustainability Indicators with Sustainable Development Goals: Policy Recommendations for Addressing the COVID-19 Pandemic" Sustainability 13, no. 5: 2607. https://doi.org/10.3390/su13052607

APA StyleJan, A., Mata, M. N., Albinsson, P. A., Martins, J. M., Hassan, R. B., & Mata, P. N. (2021). Alignment of Islamic Banking Sustainability Indicators with Sustainable Development Goals: Policy Recommendations for Addressing the COVID-19 Pandemic. Sustainability, 13(5), 2607. https://doi.org/10.3390/su13052607