An Analysis of the Demand-Side, Platform-Based Collaborative Economy: Creation of a Clear Classification Taxonomy

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

- The separation of the pipeline business model from platform-based business models.

- The definition of the demand-side, platform-based CoE.

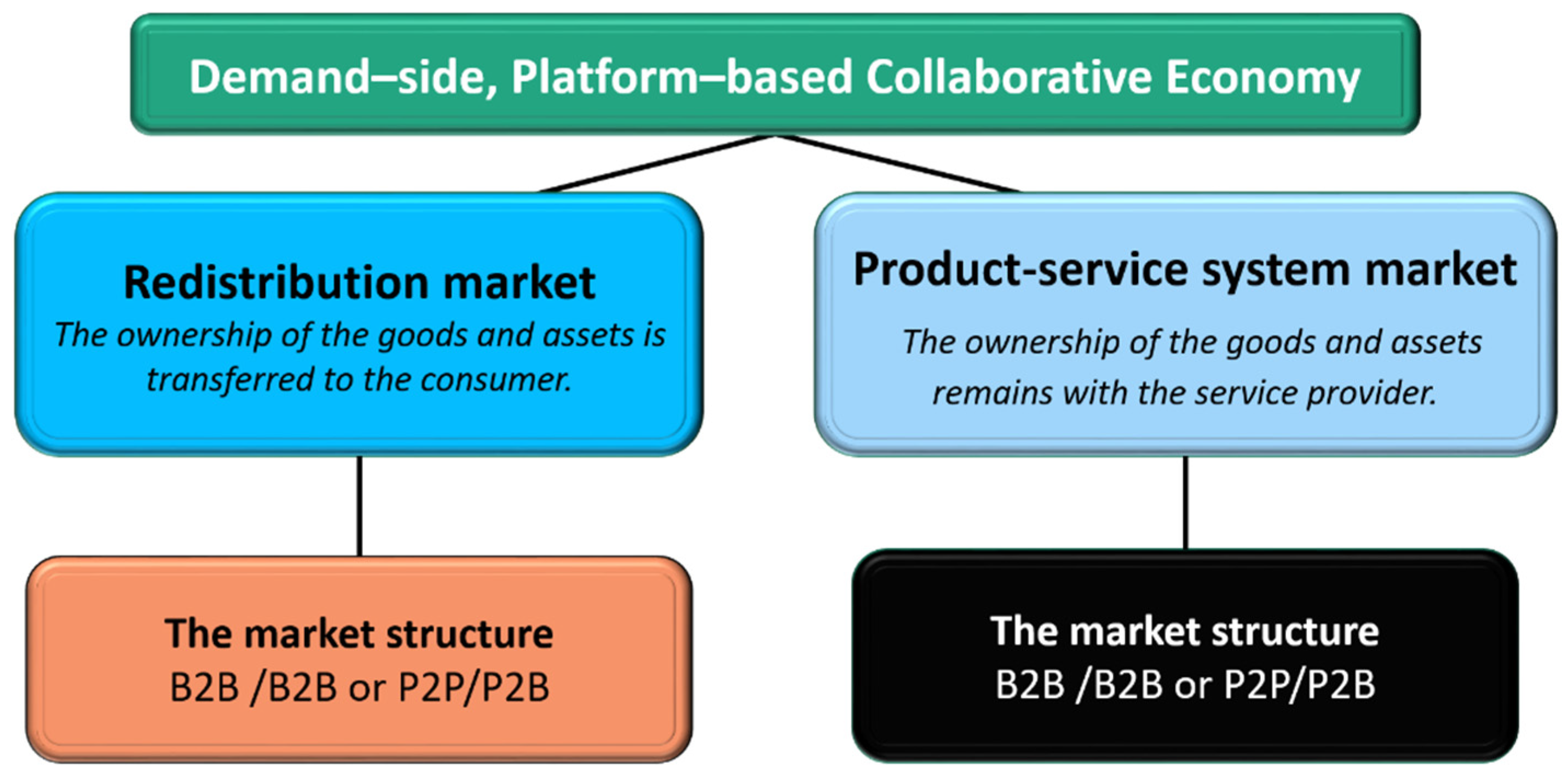

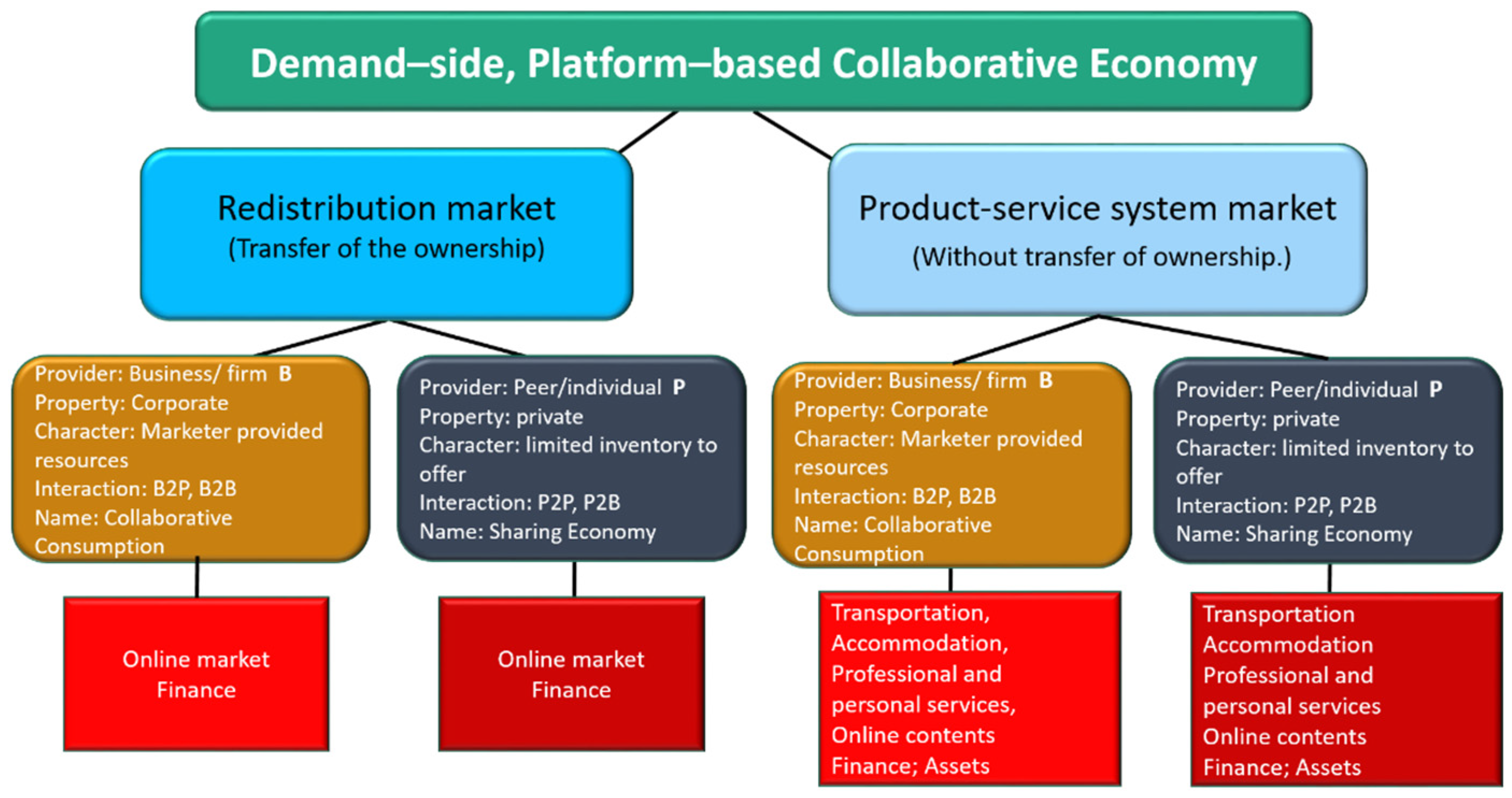

- The categorization of the demand-side, platform-based CoE

- Supplier is a legal business entity where transactions are characterized as Business to Peer (B2P) or Business to Business (B2B).

- Supplier is a private individual or peer where transactions are characterized as Peer to Peer (P2P) or Peer to Business (P2B).

4. Results

4.1. The Separation of the Pipeline Business Model from Platform-Based Business Models

4.2. The Definition of the Demand-Side, Platform-Based Business Model

The Definition of the CoE

- (i)

- service providers who share means, resources, time and/or skills—these can be private individuals offering services on an occasional basis (‘peers’) or service providers acting in their professional capacity (‘professional services providers’);

- (ii)

- users of these; and

- (iii)

- intermediaries that connect—via an online platform—providers with users and that facilitate transactions between them (‘collaborative platforms’).

- The activity is implemented through a website, an application or an online platform.

- It enables P2P transactions.

- It provides temporary access to goods and services without a change of ownership. This characteristic excludes the sale of second–hand goods and online market trading from the umbrella of the SE.

- Unused means, services, skills or resources are put to use.

The CoE is a demand-side, platform-based economic activity generated by consumers, built on trust and operated by information technology organizations in digital markets. The consumers’ needs are met on an online Internet platform by providing immediate access to new or underutilized goods, services or money, with or without the transfer of ownership. Information is provided by multiple third parties on digital marketplace product or service, whereas the marketplace operator enables direct interaction between the participant groups.

4.3. The Main Categories of the CoE

4.3.1. The Classification of Demand-Side Platforms

- The product-service systems market is use–oriented, where the ownership of a product or goods remains with the service provider, who sells only the product’s function through modified selling channels; examples include equipment finance (leasing), sharing, or pooling [74]. Consumers enjoy the benefits of the product without owning it. Car sharing, co-working offices and P2P equipment–rental are the best–known services of the product-service systems market.

- In the redistribution market, people exchange goods they do not want to use any longer. Due to many platform-based applications, this can happen not only locally but also globally. Of course, other products can be exchanged too, and selling is possible at prices that are often lower than traditionally provided by businesses operating outside of the SE.

- In the collaborative lifestyles market, the goods, which are shared, are usually not tangible and include time, money, know-how, skills, venues or space.

- Ownership, i.e., whether the access is only temporary; e.g., short–term rental, quick right of us, or the transaction is accompanied by the transfer of ownership, e.g., by selling, vending;

- The nature of the service provider; i.e., whether the provider of the means or the resources is a private individual or a legal entity.

4.3.2. Principles Distinguishing Attributes between the Redistribution Market and Product-Service Systems Market

- Redistribution market

- Product-service systems market

5. Discussion and Practical Examples of Categories and Groups

5.1. The Segmentation of Redistribution Markets

5.1.1. CC in the Redistribution Market (B2B, B2P)

5.1.2. SE in the Redistribution Market (P2B, P2P)

5.2. The Segmentation of Product-Service Systems Market

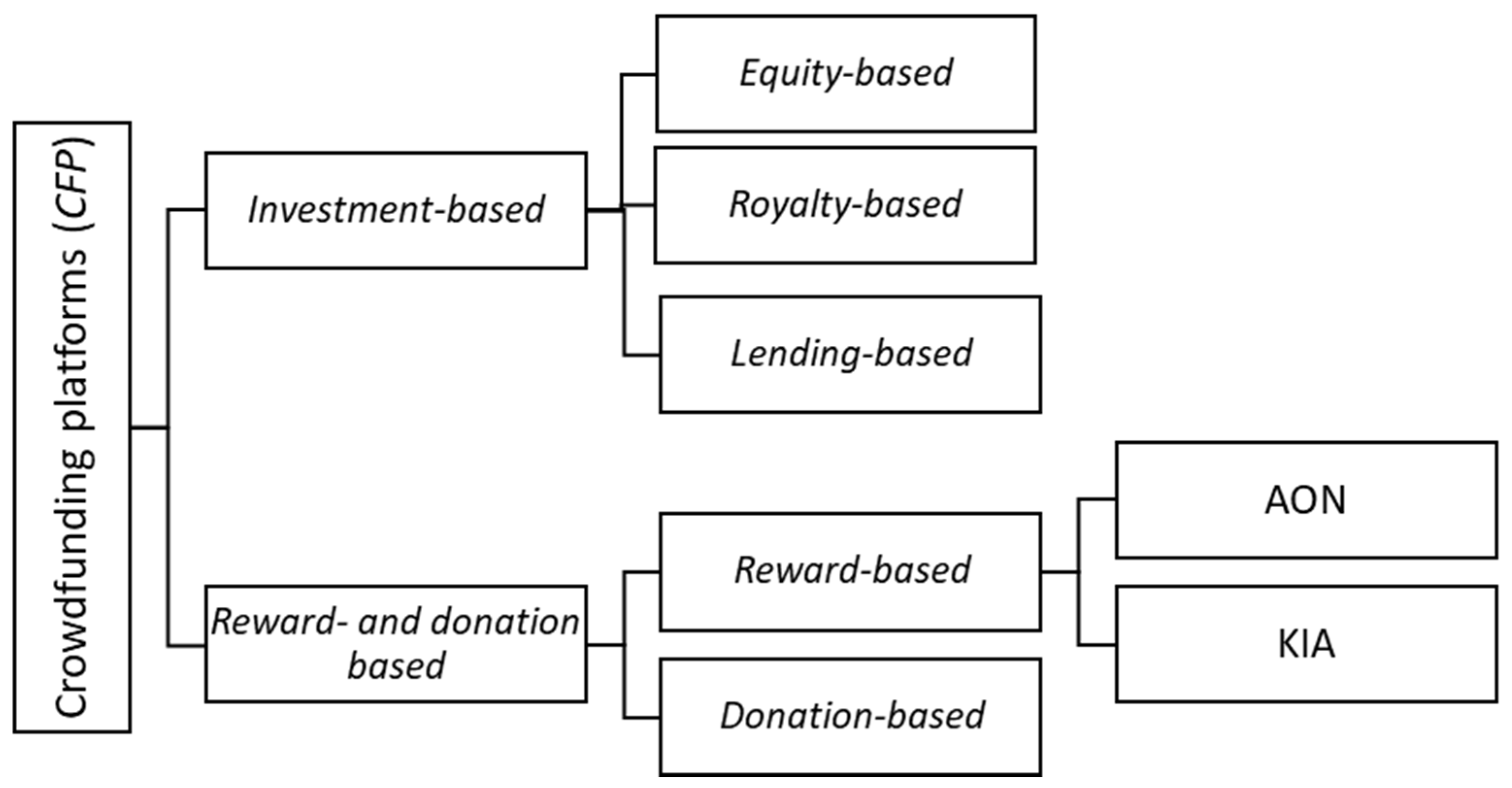

5.2.1. CC in the Product-Service System (B2B, B2P)

- Equity-based finance, where the entrepreneur offers ownership in exchange for financing. We have already introduced this financing model in connection with redistribution markets.

- Royalty–based finance, where the project promoter offers investors a share of future royalties generated from the fund; e.g., Quirky.

- Lending–based finance, where the community members provide a loan to a person or a company, like CircleUp, MagNetBank, Prosper, Zopa, Grupeer, FundingCircle, Lending Club.

- In exchange for a reward- and donation-based finance, investors do not expect financial gain because they get services or products, and/or they subsidize the creation of these. The reward- and donation-based CFP has the following subgroups:

- All-Or-Nothing (AON) finance model, where the entrepreneur predetermines the desired amount of money they will receive once it is collected, so the project implementation starts when the limit sum is reached; e.g., Kickstarter, Crowdfunder, Crowdsupply, WeAreHere, Multifintare.ro, Potsieu.ro, Startarium.

- Keep-It-All (KIA) finance model, where the sum can be used to implement the project, even if it has not reached the predetermined amount, e.g., IndieGogo, GoFundMe, Sponsume.

- Donation-based finance, where social, community-related, creative or personal projects are subsidized, in the form of occasional or regular donations, for which donors expect nothing in return [78], e.g., Causes, AdjukOssze.hu, Patreon.

5.2.2. SE in the Product-Service Systems (P2B, P2P)

6. Limitations

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| No. | Related Articles and Studies | Platform Business Model | Core Activities | Market Structure | Mode of Exchange | New Business Model |

| 1–2 | Kenney—Zysmann [1,81] | √ | - | - | - | - |

| 3 | Schor [2] | √ | √ | √ | √ | - |

| 4 | Sijabat [3] | √ | √ | - | - | - |

| 5 | Tabcum [4] | √ | - | √ | - | - |

| 6 | Owyang [5] | √ | √ | √ | - | - |

| 7 | Wirtz et al. [6] | √ | √ | √ | √ | √ |

| 8 | Gansky [12] | √ | √ | - | - | - |

| 9 | Hamari et al. [10] | √ | - | - | √ | - |

| 10 | Schor—Fitzmaurice [11] | √ | √ | - | - | - |

| 11 | Valant (EC) [8] | √ | √ | √ | √ | - |

| 12 | Ranjbari et al. [7] | √ | - | √ | √ | - |

| 13 | Kumar et al. [17] | √ | - | - | √ | - |

| 14 | PwC [24] | √ | √ | √ | - | - |

| 15 | Martin [16] | √ | - | - | √ | - |

| 16 | Sundararajan [28] | √ | √ | √ | √ | - |

| 17 | Friedman [29] | √ | √ | - | - | - |

| 18 | Gyulavári [30] | √ | √ | - | - | - |

| 19 | Eckhardt—Bardhi [31] | √ | - | √ | - | - |

| 20 | Cockayne [32] | √ | √ | - | - | - |

| 21 | Selloni [33] | √ | - | - | √ | - |

| 22 | Acquier et al. [13] | √ | √ | √ | √ | √ |

| 23 | Dudás—Boros [36] | √ | √ | √ | - | - |

| 24 | Botsman—Rogers [37] | √ | √ | √ | √ | √ |

| 25 | Van Alstyne et al. [44] | √ | √ | - | - | - |

| 26 | Hagiu—Wright [45] | √ | - | - | - | - |

| 27 | Sutherland—Jarrahi [46] | √ | - | - | √ | - |

| 28 | Bakó—Horváth [47] | √ | - | - | - | - |

| 29 | Johnson [50] | √ | - | - | - | - |

| 30 | Heinrichs [26] | √ | √ | - | √ | - |

| 31 | Stephany [52] | √ | √ | - | - | - |

| 32 | Codagnone et al. [53] | √ | √ | √ | √ | - |

| 33 | Szegedi [54] | √ | - | √ | √ | - |

| 34 | Haase—Pick [55] | √ | √ | - | √ | - |

| 35 | McDonald [56] | - | √ | - | √ | - |

| 36 | Rauch—Schleicher [57] | √ | √ | - | √ | - |

| 37 | Richardson [58] | √ | √ | - | √ | - |

| 38 | Winterhalter et al. [59] | - | - | - | √ | - |

| 39 | Edbring et al. [60] | √ | - | - | √ | - |

| 40 | Belk [61] | √ | - | - | √ | - |

| 41 | Bardhi—Eckhardt [63] | √ | - | - | √ | - |

| 42 | Matzler et al. [64] | √ | - | - | √ | - |

| 43 | Frenken— Schor [65] | √ | √ | √ | √ | √ |

| 44 | Gerwe—Silva [66] | √ | √ | √ | √ | - |

| 45 | Frenken [67] | √ | √ | √ | √ | √ |

| 46 | Plewnia— Guenther [68] | √ | √ | √ | - | - |

| 47 | Laurentini et al. [69] | √ | √ | √ | - | - |

| 48 | Choi et al. [70] | √ | - | - | √ | - |

| 49 | Olson—Kemp [71] | √ | √ | √ | - | - |

| 50 | Belleflamme et al. [77] | √ | √ | √ | - | - |

| 51 | Kuti—Madarász [78] | √ | √ | √ | - | - |

| 52 | Pelzer—Burgard [82] | √ | √ | - | - | - |

| 53 | Cohen—Munoz [83] | √ | √ | √ | - | - |

| 54 | Rifkin [84] | √ | √ | - | - | - |

| 55 | Munoz—Cohen [85] | √ | - | √ | - | - |

| 56 | Möhlmann [86] | √ | - | - | √ | - |

| 57 | Lamberton—Rose [87] | √ | √ | √ | - | - |

| 58 | Cohen—Kietzmann [88] | √ | √ | √ | - | - |

| 59 | Benoit et al. [89] | √ | √ | √ | - | - |

References

- Kenney, M.; Zysman, J. The rise of the platform economy. Issues Sci. Technol. 2016, 32, 9. [Google Scholar]

- Schor, J. Debating the Sharing Economy. J. Self Gov. Manag. Econ. 2016, 4, 7. [Google Scholar] [CrossRef]

- Sijabat, R. Sharing economy: A study on the factors influencing users’ motivation to use ride sharing platforms. Derema (Dev. Res. Manag.) J. Manaj. 2019, 14, 23. [Google Scholar] [CrossRef]

- Tabcum, S., Jr. The Sharing Economy Is Still Growing, and Businesses Should Take Note. Forbes. Available online: https://www.forbes.com/sites/forbeslacouncil/2019/03/04/the-sharing-economy-is-still-growing-and-businesses-should-take-note/?sh=67b700e24c33 (accessed on 11 November 2020).

- Owyang, J.; Tran, C.; Silva, C. The collaborative economy. Altimeter US 2013, 2013, 1–51. [Google Scholar]

- Wirtz, J.; So Kevin Kam, F.; Mody Makarand, A.; Liu Stephanie, Q.; Chun HaeEun, H. Platforms in the peer-to-peer sharing economy. J. Serv. Manag. 2019, 30, 33. [Google Scholar] [CrossRef]

- Ranjbari, M.; Morales-Alonso, G.; Carrasco-Gallego, R. Conceptualizing the sharing economy through presenting a comprehensive framework. Sustainability 2018, 10, 2336. [Google Scholar] [CrossRef]

- Valant, J. A European agenda for the collaborative economy. Eur. Parliam. Res. Serv. Publ. Bruss. Belg. 2016, 510, 2–12. [Google Scholar]

- Botsman, R.; Rogers, R. What’s Mine is Yours: The Rise of Collaborative Consumption; HarperCollins Publishers: London, UK, 2010. [Google Scholar]

- Hamari, J.; Sjöklint, M.; Ukkonen, A. The sharing economy: Why people participate in collaborative consumption. J. Assoc. Inf. Sci. Technol. 2016, 67, 13. [Google Scholar] [CrossRef]

- Schor, J.B.; Fitzmaurice, C.J. Collaborating and connecting: The emergence of the sharing economy. In Handbook of Research on Sustainable Consumption; Edward Elgar Publishing: Massachusetts, MA, USA, 2015; pp. 410–425. [Google Scholar]

- Gansky, L. The Mesh: Why the Future of Business Is Sharing; Portfolio Penguin: New York, NY, USA, 2010. [Google Scholar]

- Acquier, A.; Daudigeos, T.; Pinkse, J. Promises and paradoxes of the sharing economy: An organizing framework. Technol. Forecast. Soc. Chang. 2017, 125, 1–10. [Google Scholar] [CrossRef]

- Molnár, C. Sharing Economy: Lyuk Kell, Nem Fúrógép. Magyar Nemzet. 2017. Available online: https://molnarcsaba.wordpress.com/2017/03/31/sharing-economy-lyuk-kell-nem-furogep/ (accessed on 11 November 2020).

- Chandler, A. What Should the ‘Sharing Economy’ Really Be Called? Atlantic. 2016. Available online: https://www.theatlantic.com/business/archive/2016/05/sharing-economy-airbnb-uber-yada/484505/ (accessed on 11 September 2020).

- Martin, C.J. The sharing economy: A pathway to sustainability or a nightmarish form of neoliberal capitalism? Ecol. Econ. 2016, 121, 149–159. [Google Scholar] [CrossRef]

- Kumar, V.; Lahiri, A.; Dogan, O.B. A strategic framework for a profitable business model in the sharing economy. Ind. Mark. Manag. 2017, 69, 14. [Google Scholar] [CrossRef]

- Schumpeter, J. Capitalism, Socialism and Democracy, 3rd ed.; Harper & Row: New York, NY, USA, 1942. [Google Scholar]

- Chatain, O. Value creation, competition, and performance in buyer-supplier relationships. Strateg. Manag. J. 2011, 32, 76–102. [Google Scholar] [CrossRef]

- Fonseca, L.M.; Domingues, J.P.; Pereira, M.T.; Martins, F.F.; Zimon, D. Assessment of Circular Economy within Portuguese Organizations. Sustainability 2018, 10, 2521. [Google Scholar] [CrossRef]

- Geissdoerfer, M.; Savaget, P.; Bocken, N.M.P.; Hultink, E.J. The Circular Economy—A new sustainability paradigm? J. Clean. Prod. 2017, 143, 757–768. [Google Scholar] [CrossRef]

- Wallenstein, J.; Shelat, U. Hopping aboard the sharing economy. Boston Consult. Group 2017, 22, 6. [Google Scholar]

- Derek, M. The Sharing Economy and How it Is Changing Industries. Available online: https://www.thebalancesmb.com/the-sharing-economy-and-how-it-changes-industries-4172234 (accessed on 21 September 2020).

- PwC. Sharing or Paring? Growth of the Sharing Economy; PriceWaterhouseCoopers Magyarország Kft: Budapest, Hungary, 2015. [Google Scholar]

- Benkler, Y. Sharing nicely: On shareable goods and the emergence of sharing as a modality of economic production. Yale Lj 2004, 114, 273. [Google Scholar] [CrossRef]

- Heinrichs, H. Sharing economy: A potential new pathway to sustainability. Gaia Ecol. Perspect. Sci. Soc. 2013, 22, 228–231. [Google Scholar] [CrossRef]

- Schor, J. Getting sharing right. Contexts 2015, 14, 2. [Google Scholar] [CrossRef]

- Sundararajan, A. The Sharing Economy: The End of Employment and the Rise of Crowd-Based Capitalism; MIT Press: Cambridge, MA, USA, 2016. [Google Scholar]

- Friedman, G. Workers without employers: Shadow corporations and the rise of the gig economy. Rev. Keynes. Econ. 2014, 2, 171–188. [Google Scholar] [CrossRef]

- Gyulavari, T. Hakni Gazdaság a Láthatáron: Az Internetes Munka Fogalma és Sajátosságai. Iustum Aequum Salut. 2019, 15, 25. [Google Scholar]

- Eckhardt, G.M.; Bardhi, F. The sharing economy isn’t about sharing at all. Harv. Bus. Rev. 2015, 28, 881–898. [Google Scholar]

- Cockayne, D.G. Sharing and neoliberal discourse: The economic function of sharing in the digital on-demand economy. Geoforum 2016, 77, 73–82. [Google Scholar] [CrossRef]

- Selloni, D. New forms of economies: Sharing economy, collaborative consumption, peer-to-peer economy. In CoDesign for Public-Interest Services; Springer: Berlin/Heidelberg, Germany, 2017; pp. 15–26. [Google Scholar] [CrossRef]

- Eisenstein, C. Sacred Economics: Money, Gift, and Society in the Age of Transition; Readhowyouwant: Richmond, BC, Canada, 2011. [Google Scholar]

- Ness, D. Sustainable urban infrastructure in China: Towards a Factor 10 improvement in resource productivity through integrated infrastructure systems. Int. J. Sustain. Dev. World Ecol. 2008, 15, 288–301. [Google Scholar] [CrossRef]

- Dudás, G.; Boros, L. A közösségi gazdaság (sharing economy) definiálásának dilemmái= Dilemmas of defining the sharing economy. Tér És Társadalom 2019, 33, 107–130. [Google Scholar] [CrossRef]

- Botsman, R.; Rogers, R. Beyond zipcar: Collaborative consumption. Harv. Bus. Rev. 2010, 88, 30. [Google Scholar]

- Paul, J.; Parthasarathy, S.; Gupta, P. Exporting challenges of SMEs: A review and future research agenda. J. World Bus. 2017, 52, 327–342. [Google Scholar] [CrossRef]

- Nábrádi, A. Vállalkozási Ismeretek; DE: Debrecen, Hungary, 2015. [Google Scholar]

- Porter, M. Competitive Strategy: Techniques for Analyzing Industries and Competitors; Free Press: New York, NY, USA, 1980. [Google Scholar]

- Chikán, A. Vállalatok és Funkciók Integrációja: Folyamatjellegű Irányítás-Alprojekt Zárótanulmánya; Budapesti Közgazdaságtudományi Egyetem, Vállalatgazdaságtan Tanszék: Budapest, Hungary, 1997; Volume Z8, p. 68. [Google Scholar]

- Barney, J. Firm Resources and Sustained Competitive Advantage. J. Manag. 1991, 17, 21. [Google Scholar] [CrossRef]

- Porter, M. How Competitive Forces Shape Strategy. Harv. Bus. Rev. 1979, 57, 137–145. [Google Scholar]

- Van Alstyne, M.W.; Parker, G.G.; Choudary, S.P. Pipelines, platforms, and the new rules of strategy. Harv. Bus. Rev. 2016, 94, 54–62. [Google Scholar]

- Hagiu, A.; Wright, J. Multi-sided platforms. Int. J. Ind. Organ. 2015, 43, 162–174. [Google Scholar] [CrossRef]

- Sutherland, W.; Jarrahi, M.H. The sharing economy and digital platforms: A review and research agenda. Int. J. Inf. Manag. 2018, 43, 328–341. [Google Scholar] [CrossRef]

- Bakó, B.; Horváth, D. Termékdifferenciálás kétoldalú piacokon. Közgazdasági Szle. 2020, 67, 1–13. [Google Scholar]

- Carnevale-Maffè, C.; Ruffoni, G. Two Sided Markets: Models and Business Cases; Working Paper; SDA Bocconi School of Management: Milan, Italy, 2009. [Google Scholar]

- Hermans, J. Platform Business Model Explained… in under 100 Words. Deloitte. 2015. Available online: https://www2.deloitte.com/ch/en/pages/innovation/articles/platform-business-model-explained.html (accessed on 30 April 2019).

- Johnson, N. What Are Network Effects? Applico. 2018. Available online: https://www.applicoinc.com/blog/network-effects/ (accessed on 11 October 2020).

- Martin, C.J.; Upham, P.; Budd, L. Commercial orientation in grassroots social innovation: Insights from the sharing economy. Ecol. Econ. 2015, 118, 240–251. [Google Scholar] [CrossRef]

- Stephany, A. The Business of Sharing: Making It in the New Sharing Economy; Springer: Berlin/Heidelberg, Germany, 2015. [Google Scholar]

- Codagnone, C.; Biagi, F.; Abadie, F. The passions and the interests: Unpacking the’sharing economy. Inst. Prospect. Technol. Stud. Jrc Sci. Policy Rep. 2016. [Google Scholar] [CrossRef]

- Szegedi, L. Digitális Platformok Mint A Sharing Economy Munkáltatói? Ars Boni. 2019. Available online: https://arsboni.hu/digitalis-platformok-mint-a-sharing-economy-munkaltatoi/ (accessed on 11 September 2020).

- Haase, M.; Pick, D. Value creation in sharing networks: Towards a typology of sharing networks. In Interaktive Wertschöpfung durch Dienstleistungen; Springer: Berlin/Heidelberg, Germany, 2015; pp. 439–468. [Google Scholar]

- McDonald, L. Share Now. Altern. J. 2014, 40, 23–27. [Google Scholar] [CrossRef]

- Rauch, D.E.; Schleicher, D. Like Uber, but for Local Government Policy. Ohio State Law J. 2015, 76, 901–963. [Google Scholar]

- Richardson, L. Performing the sharing economy. Geoforum 2015, 67, 121–129. [Google Scholar] [CrossRef]

- Winterhalter, S.; Wecht, C.H.; Krieg, L. Keeping reins on the sharing economy: Strategies and business models for incumbents. Mark. Rev. St. Gallen 2015, 32, 32–39. [Google Scholar] [CrossRef]

- Edbring, E.G.; Lehner, M.; Mont, O. Exploring consumer attitudes to alternative models of consumption: Motivations and barriers. J. Clean. Prod. 2016, 123, 5–15. [Google Scholar] [CrossRef]

- Belk, R. You are what you can access: Sharing and collaborative consumption online. J. Bus. Res. 2014, 67, 1595–1600. [Google Scholar] [CrossRef]

- Belk, R. Sharing versus pseudo-sharing in Web 2.0. Anthropologist 2014, 18, 7–23. [Google Scholar] [CrossRef]

- Bardhi, F.; Eckhardt, G.M. Access-Based Consumption: The Case of Car Sharing. J. Consum. Res. 2012, 39, 881–898. [Google Scholar] [CrossRef]

- Matzler, K.; Veider, V.; Kathan, W. Adapting to the sharing economy. Mit Sloan Manag. Rev. 2015, 56, 71. [Google Scholar]

- Frenken, K.; Schor, J. Putting the sharing economy into perspective. In A Research Agenda for Sustainable Consumption Governance; Edward Elgar Publishing: Cheltenham, UK, 2019. [Google Scholar]

- Gerwe, O.; Silva, R. Clarifying the sharing economy: Conceptualization, typology, antecedents, and effects. Acad. Manag. Perspect. 2020, 34, 65–96. [Google Scholar] [CrossRef]

- Frenken, K. Political economies and environmental futures for the sharing economy. Philos. Trans. R. Soc. A Math. Phys. Eng. Sci. 2017, 375, 20160367. [Google Scholar] [CrossRef]

- Plewnia, F.; Guenther, E. Mapping the sharing economy for sustainability research. Manag. Decis. 2018. [Google Scholar] [CrossRef]

- Laurenti, R.; Singh, J.; Cotrim, J.M.; Toni, M.; Sinha, R. Characterizing the sharing economy state of the research: A systematic map. Sustainability 2019, 11, 5729. [Google Scholar] [CrossRef]

- Choi, H.; Cho, M.J.; Lee, K.; Hong, S.G.; Woo, C.R. The business model for the sharing economy between SMEs. Architecture 1998, 6, 625–634. [Google Scholar]

- Olsen, M.; Kemp, S. Sharing Economy-An in-Depth Look at its Evolution and Trajectory across Industries; PiperJaffray: Minneapolis, MN, USA, 2015. [Google Scholar]

- Kovács, T.Z.; David, F.; Kovács, K.; Popovics, P.; Nábrádi, A. Collaborative economy and its awareness in Visegrad Group countries and within the European Union. Issues Inf. Syst. 2020, 21, 153–166. [Google Scholar]

- Nábrádi, A.; Kovács, T.Z. Types of platform based Collaborative economy and its potential areas in agribusiness. West. Balk. J. Agric. Econ. Rural Dev. 2020, 2, 9–19. [Google Scholar] [CrossRef]

- Neely, A. Exploring the financial consequences of the servitization of manufacturing. Oper. Manag. Res. 2008, 1, 103–118. [Google Scholar] [CrossRef]

- Kovács, T.Z.; Nábrádi, A. Types of sharing economies and collaborative consumptions. In Proceedings of the International Conference on the Economic of Decoupling (ICED), Zagreb, Croatia, 30 November–1 December 2020; pp. 530–546. [Google Scholar]

- Nábrádi, A.; Kovács, T.Z. Sharing Economy And Its Popularity In Hungary And Romania. Oradea J. Bus. Econ. 2020, 5, 60–71. [Google Scholar] [CrossRef]

- Belleflamme, P.; Omrani, N.; Peitz, M. The economics of crowdfunding platforms. Inf. Econ. Policy 2015, 33, 11–28. [Google Scholar] [CrossRef]

- Kuti, M.; Madarász, G. A közösségi finanszírozás. Pénzügyi Szle. 2014, 59, 374. [Google Scholar]

- Coase, R.H. The nature of the firm. In Essential Readings in Economics; Springer: Berlin/Heidelberg, Germany, 1995; pp. 37–54. [Google Scholar]

- North, D.C. Structure and Change in Economic History; Norton: New York, NY, USA, 1981. [Google Scholar]

- Kenney, M.; Zysman, J. Choosing a future in the platform economy: The implications and consequences of digital platforms. In Proceedings of the Kauffman Foundation New Entrepreneurial Growth Conference, Amelia Island, FL, USA, 18–19 June 2015. [Google Scholar]

- Pelzer, C.; Burgard, N. Cases. In Co-Economy: Wertschöpfung im Digitalen Zeitalter; Springer: Berlin/Heidelberg, Germany, 2014; pp. 23–65. [Google Scholar]

- Cohen, B.; Muñoz, P. Sharing cities and sustainable consumption and production: Towards an integrated framework. J. Clean. Prod. 2016, 134, 87–97. [Google Scholar] [CrossRef]

- Rifkin, J. The Zero Marginal Cost Society: The Internet of Things, the Collaborative Commons, and the Eclipse of Capitalism; St. Martin’s Press: New York, NY, USA, 2014. [Google Scholar]

- Muñoz, P.; Cohen, B. Mapping out the sharing economy: A configurational approach to sharing business modeling. Technol. Forecast. Soc. Chang. 2017, 125, 21–37. [Google Scholar] [CrossRef]

- Möhlmann, M. Collaborative consumption: Determinants of satisfaction and the likelihood of using a sharing economy option again. J. Consum. Behav. 2015, 14, 193–207. [Google Scholar] [CrossRef]

- Lamberton, C.P.; Rose, R.L. When is ours better than mine? A framework for understanding and altering participation in commercial sharing systems. J. Mark. 2012, 76, 109–125. [Google Scholar] [CrossRef]

- Cohen, B.; Kietzmann, J. Ride on! Mobility business models for the sharing economy. Organ. Environ. 2014, 27, 279–296. [Google Scholar] [CrossRef]

- Benoit, S.; Baker, T.L.; Bolton, R.N.; Gruber, T.; Kandampully, J. A triadic framework for collaborative consumption (CC): Motives, activities and resources & capabilities of actors. J. Bus. Res. 2017, 79, 219–227. [Google Scholar]

| Term | Literature |

|---|---|

| sharing economy | Benkler [25] Heinrichs [26] |

| collaborative consumption | Botsman—Rogers [9] Hamari et al. [10] Schor—Fitzmaurice [11] |

| peer-to-peer based sharing | Schor [27] |

| crowd-based capitalism | Sundararajan [28] |

| gig-economy | Friedman [29] Gyulavári [30] |

| connected consumption | Schor—Fitzmaurice [11] |

| access economy | Eckhardt—Bardhi [31] |

| on-demand economy | Cockayne [32] Selloni [33] |

| gift-economy | Eisenstein [34] |

| circular economy | Ness [35] |

| Research Objective |

|---|

Developing a new and improved method of grouping and classification of CoE in four criteria:

|

| Initial Inclusion Criteria |

| The scientific databases Google Scholar, Web of Science, SpringerLink and European Commission (EC) were searched for relevant scientific publications. |

| Setting the Inclusion Criteria |

|

| Applying the Exclusion Criteria |

After the reading of titles and abstracts, articles were removed that were NOT focused on the following criteria:

|

| Content Analysis |

| In-depth analysis and classification of selected papers according to the four criteria of research objectives.Compared findings of selected papers on criteria of research objectives. |

| Discussion and Conclusion |

| Selected Articles and Studies | Transfer of the Ownership (Sale and Purchase) | Without the Transfer of the Ownership (Short Term Access) |

|---|---|---|

| Schor [2] | - | √ |

| Wirtz et al. [6] | √ | √ |

| Botsman—Rogers [9,37] | √ | √ |

| Hamari et al. [10] | √ | √ |

| Schor—Fitzmaurice [11] | - | √ |

| Valant (EC) [8] | - | √ |

| Ranjbari et al. [7] | - | √ |

| Kumar et al. [17] | - | √ |

| PwC [24] | - | √ |

| Martin [16] | √ | √ |

| Sundararajan [28] | - | √ |

| Selloni [33] | - | √ |

| Acquier et al. [13] | √ | √ |

| Sutherland—Jarrahi [46] | - | √ |

| Heinrichs [26] | - | √ |

| Martin et al. [51] | √ | √ |

| Stephany [52] | - | √ |

| Codagnone et al. [53] | √ | √ |

| Szegedi [54] | - | √ |

| Haase—Pick [55] | - | √ |

| McDonald [56] | - | √ |

| Rauch—Schleicher [57] | - | √ |

| Richardson [58] | - | √ |

| Winterhalter et al. [59] | √ | √ |

| Edbring et al. [60] | √ | √ |

| Belk [61,62] | - | √ |

| Bardhi—Eckhardt [63] | - | √ |

| Matzler et al. [64] | √ | √ |

| Frenken—Schor [65] | √ | √ |

| Gerwe—Silva [66] | - | √ |

| Frenken [67] | √ | √ |

| Redistribution Market | Product-Service Systems Market |

|---|---|

| Product-oriented | Service-oriented |

| Ownership of the goods is transferred to the customer | Ownership of the goods remains with the service provider |

| Products are heterogeneous within the company | Products are relatively homogeneous within the service provider company |

| Face-to-face interaction is not required | Face-to-face interaction with consumers is essential |

| The quality of the service is secondary | The quality of the service is essential |

| Core marketing activities can be executed through suppliers | Core marketing activities cannot be executed through suppliers |

| The supplier has low risks associated with their involvement or assets due to the transfer of ownership | Service providers take high risks; they risk their goods due to the personal nature of the transaction |

| Name | Mode of Exchange: Redistribution Market | |

|---|---|---|

| Market structure | Collaborative consumption, CC in the redistribution market | Sharing economy, SE in the redistribution market |

| Provider’s person: Who is responsible for providing the goods or the service? | Legal entity (business)—a company with a balance sheet detailing its means and assets. The transactions of product-service are executed in B2P and B2B constructions. | Private individual (peer)—who has private property only. The transactions of product–service are executed in P2P and P2B constructions. |

| Type of performed activity | 1. Online Market 2. Finance | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kovács, T.Z.; David, F.; Nagy, A.; Szűcs, I.; Nábrádi, A. An Analysis of the Demand-Side, Platform-Based Collaborative Economy: Creation of a Clear Classification Taxonomy. Sustainability 2021, 13, 2817. https://doi.org/10.3390/su13052817

Kovács TZ, David F, Nagy A, Szűcs I, Nábrádi A. An Analysis of the Demand-Side, Platform-Based Collaborative Economy: Creation of a Clear Classification Taxonomy. Sustainability. 2021; 13(5):2817. https://doi.org/10.3390/su13052817

Chicago/Turabian StyleKovács, Tünde Zita, Forest David, Adrián Nagy, István Szűcs, and András Nábrádi. 2021. "An Analysis of the Demand-Side, Platform-Based Collaborative Economy: Creation of a Clear Classification Taxonomy" Sustainability 13, no. 5: 2817. https://doi.org/10.3390/su13052817

APA StyleKovács, T. Z., David, F., Nagy, A., Szűcs, I., & Nábrádi, A. (2021). An Analysis of the Demand-Side, Platform-Based Collaborative Economy: Creation of a Clear Classification Taxonomy. Sustainability, 13(5), 2817. https://doi.org/10.3390/su13052817