A Structured Literature Review about the Role of Management Accountants in Sustainability Accounting and Reporting

Abstract

1. Introduction

2. Research Method

- Write a literature review protocol;

- Define the questions that the literature review is setting out to answer;

- Determine the type of studies to include and carry out a comprehensive literature search;

- Measure article impact;

- Define an analytical framework;

- Establish literature review reliability;

- Test literature review validity;

- Code data using the developed framework;

- Develop insights and critique through dataset analysis;

- Develop future research paths and questions.

3. The Structured Literature Review

3.1. The Literature Review Protocol

3.2. The Research Questions

- RQ.1

- How is research for inquiring into the role of management accountants in sustainability accounting and reporting developing?

- RQ.2

- What is the focus and critique of the research on the role of management accountants in sustainability accounting and reporting?

- RQ.3

- What future avenues of research on the role of management accountants in sustainability accounting and reporting can be identified?

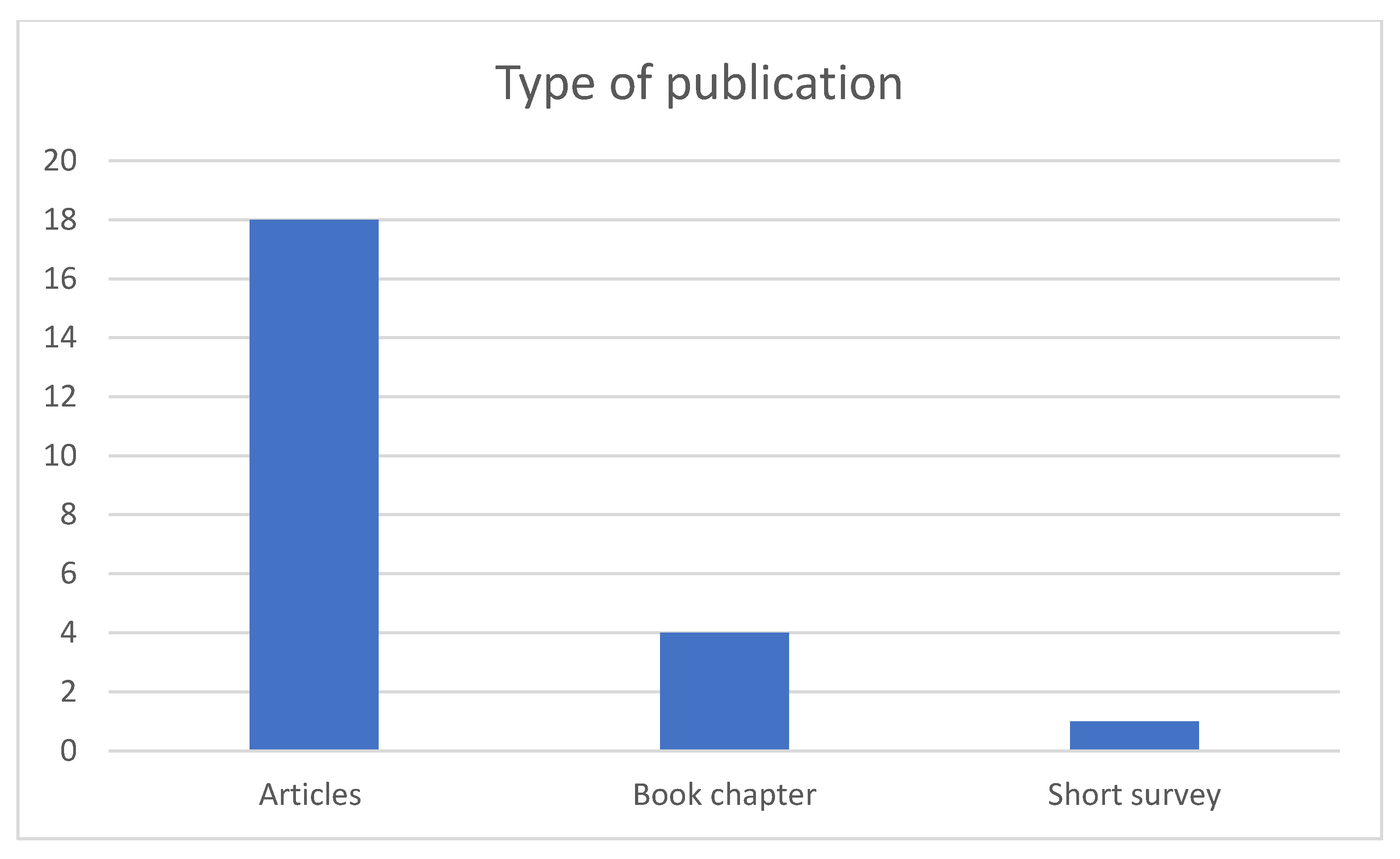

3.3. Type of Studies and Literature Search

3.4. Publication Impact

3.5. The Analytical Framework

3.6. The Coding of the Publications and Its Reliability

3.7. The Literature Review Validity

4. Findings

4.1. Author Type

4.2. Location

4.3. Jurisdiction

4.4. Organizational Focus

4.5. Research Method

4.6. Sustainability Definition

4.7. Sustainability Accounting and Reporting Focus

4.8. Management Accountants’ Current Involvement in Sustainability Accounting and Reporting

4.9. Management Accountants’ Future/potential Involvement in Sustainability Accounting and Reporting

4.10. Management Accountants’ Role in Sustainability Accounting and Reporting

5. Discussion, Future Research Directions, and Conclusions

5.1. Management Accountants’ Involvement in Sustainability Accounting and Reporting

5.2. The Role of Management Accountants in Sustainability Accounting and Reporting

5.3. Management Accountants and the Harmonization of Sustainability Information

5.4. Management Accountants, Sustainability and Accounting Education

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Publications Reviewed in Chronological Order

- Lodhia S.K. The accounting implications of the sustainable development bill. Soc. Environ. Account. J. 2001, 21, 8–11.

- Lewis, T. Debate: Public sector sustainability reporting – Implications for Accountants. Public Money Manag. 2008, 28, 329–331.

- Jones M.J. Accounting for the environment: Towards a theoretical perspective for environmental accounting and reporting. Account. Forum 2010, 34, 123–138.

- Tilt, C.A. Corporate Responsibility, Accounting and Accountants. In Professionals’ Perspectives of Corporate Social Responsibility; Idowu S.O., Filho W.L. Eds.; Springer, 2010, pp. 11–32.

- Fernández Chulián, M. Constructing new accountants: the role of sustainability education. Rev. Cont. 2011, 14, 241–265.

- Idowu, S.O. Accounting for decision makers in a sustainable environment. In Theory and practice of corporate social responsibility; Idowu S.O., Louche C. Eds.; Springer, 2011, pp. 208–228.

- Fraser, M. “Fleshing out” an engagement with a social accounting technology. Account. Audit. Account. J. 2012, 25, 508–534.

- Burritt, R.L.; Tingey-Holyoak, J. Forging cleaner production: the importance of academic-practitioner links for successful sustainability embedded carbon accounting. J. Clean. Prod. 2012, 36, 39–47.

- Ballou, B.; Casey, R.J.; Grenier, J.H.; Heitger, D.L. Exploring the Strategic Integration of Sustainability Initiatives: Opportunities for Accounting Research. Account. Horizons. 2012, 26, 265–288.

- Schaltegger, S.; Zvezdov, D. In Control of Sustainability Information: Untangling the Role of Accountants. In Accounting and control for sustainability, Studies in Managerial and Financial Accounting; Songini, L.; Pistoni, A.; Herzig, C. Eds.; Emerald, 2013, pp. 265–296.

- Botes, V.; Low, M.; Chapman, J. Is accounting education sufficiently sustainable? Sustain. Account. Manag. Policy J. 2014, 5(1), 95–124.

- Çalışkan, A.Ö. How accounting and accountants may contribute in sustainability? Soc. Responsib. J. 2014, 10(2), 246–267.

- Mistry, V.; Sharma, U.; Low, M. Management accountants’ perception of their role in accounting for sustainable development. An exploratory study. Pac. Account. Rev. 2014, 26, 112–133.

- Schaltegger, S.; Zvezdov, D. Gatekeepers of sustainability information: exploring the roles of accountants. J. Account. Organ. Change 2015, 11, 333–361.

- Seay, S. Sustainability is Applied Ethics. J. Legal Ethic. Regulatory Iss. 2015, 18, 63–70.

- Williams, B.R. The local government accountants’ perspective on sustainability. Sustain. Account. Manag. Policy J. 2015, 6, 267–287.

- Schaltegger, S. Sustainability as a fundamental challenge for management accountants. In The role of management accountants, Local Variations and Global Influences; Goretzki L., Strauss E. Eds.; Routledge, 2017, pp. 274–291.

- Boulianne, E.; Keddie, L.S.; Postaire, M. (Non) coverage of sustainability within the French professional accounting education program. Sustain. Account. Manag. Policy J. 2018, 9, 313–335.

- Egan, M.; Tweedie, D. A “green” accountant is difficult to find. Can accountants contribute to sustainability management initiatives? Account. Audit. Account. J. 2018, 31, 1749–1773.

- Hoang, T. The Role of the Integrated Reporting in Raising Awareness of Environmental, Social and Corporate Governance (ESG) Performance. Stakeholders Gov. Responsib. 2018, 14, 47–69.

- Tingey-Holyoak, J.; Pisaniello, J.D. Water accounting knowledge pathways. Pac. Account. Rev. 2019, 31, 258–274.

- Margerison, J.; Fan, M.; Birkin, F. The prospects for environmental accounting and accountability in China. Account. Forum 2019, 43, 327–347.

- Oyewo, B.M. Outcomes of interaction between organizational characteristics and management accounting practice on corporate sustainability: the global management accounting principles (GMAP) approach. J. Sustain. Fin. Invest. 2020. doi:10.1080/20430795.2020.1738141.

References

- Crutzen, N.; Herzig, C. A review of the empirical research in management control, strategy and sustainability. Perform. Meas. Manag. Control. Glob. Issues 2013, 26, 165–195. [Google Scholar] [CrossRef]

- De Villiers, C.J.; Rouse, P.; Kerr, J. A new conceptual model of influences driving sustainability based on case evidence of the integration of corporate sustainability management control and reporting. J. Clean. Prod. 2016, 136, 78–85. [Google Scholar] [CrossRef]

- Henri, J.-F.; Journeault, M. Eco-control: The influence of management control systems on environmental and economic performance. Account. Organ. Soc. 2010, 35, 63–80. [Google Scholar] [CrossRef]

- Lueg, R.; Radlach, R. Managing sustainable development with management control systems: A literature review. Eur. Manag. J. 2016, 34, 158–171. [Google Scholar] [CrossRef]

- Schaltegger, S. Sustainability as driver of corporate success. Control. Z. 2010, 22, 238–243. [Google Scholar] [CrossRef]

- Schaltegger, S.; Sturm, A. Eco-Efficiency through Eco-Control; VDF: Zurich, Switzerland, 1995.

- Burritt, R.L.; Schaltegger, S. Sustainability accounting and reporting: Fad or trend? Account. Audit. Account. J. 2010, 23, 829–846. [Google Scholar] [CrossRef]

- Chiucchi, M.S. Intellectual capital accounting in action: Enhancing learning through interventionist research. J. Intellect. Cap. 2013, 14, 48–68. [Google Scholar] [CrossRef]

- Emsley, D. Restructuring the management accounting function: A note on the effect of role involvement on innovativeness. Manag. Account. Res. 2005, 16, 157–177. [Google Scholar] [CrossRef]

- Ma, Y.; Tayles, M. On the emergence of strategic management accounting: An institutional perspective. Account. Bus. Res. 2009, 39, 473–495. [Google Scholar] [CrossRef]

- Goretzki, L.; Strauss, E.; Weber, J. An institutional perspective on the changes in management accountants’ professional role. Manag. Account. Res. 2013, 24, 41–63. [Google Scholar] [CrossRef]

- Hyvönen, T.; Järvinen, J.; Pellinen, J. Dynamics of creating a new role for business controllers. Nord. J. Bus. 2015, 64, 21–39. [Google Scholar]

- Vaivio, J. Mobilizing local knowledge with ‘Provocative’ non-financial measures. Eur. Account. Rev. 2004, 13, 39–71. [Google Scholar] [CrossRef]

- Chiucchi, M.S. Measuring and reporting intellectual capital. Lessons learnt from some interventionist research projects. J. Intellect. Cap. 2013, 14, 395–413. [Google Scholar] [CrossRef]

- Giuliani, M.; Marasca, S. Construction and valuation of intellectual capital: A case study. J. Intellect. Cap. 2011, 12, 377–391. [Google Scholar] [CrossRef]

- Giuliani, M.; Chiucchi, M.S. Guess who’s coming to dinner: The case of IC reporting in Italy. J. Manag. Gov. 2018, 23, 403–433. [Google Scholar] [CrossRef]

- Mio, C.; Marco, F.; Pauluzzo, R. Internal application of IR principles: Generali’s Internal Integrated Reporting. J. Clean. Prod. 2016, 139, 204–218. [Google Scholar] [CrossRef]

- CIMA. Sustainability and the role of the management accountant. Res. Exec. Summ. Ser. 2011, 7, 1–14. [Google Scholar]

- Massaro, M.; Dumay, J.; Guthrie, J. On the shoulders of giants: Undertaking a structured literature review in accounting. Account. Audit. Acc. J. 2016, 29, 767–801. [Google Scholar] [CrossRef]

- Denyer, D.; Tranfield, D. Using qualitative research synthesis to build an actionable knowledge base. Manag. Decis. 2006, 44, 213–227. [Google Scholar] [CrossRef]

- Petticrew, M.; Roberts, H. Systematic Reviews in the Social Sciences: A Practical Guide; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a Methodology for Developing Evidence-Informed Management Knowledge by Means of Systematic Review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Alvesson, M.; Deetz, S. Doing Critical Management Research; Sage: London, UK, 2000. [Google Scholar]

- Secundo, G.; Ndou, V.; Del Vecchio, P.; De Pascale, G. Knowledge management in entrepreneurial universities: A structured literature review and avenue for future research agenda. Manag. Decis. 2019, 57, 3226–3257. [Google Scholar] [CrossRef]

- Massaro, M.; Dumay, J.; Garlatti, A. Public sector knowledge management: A structured literature review. J. Knowl. Manag. 2015, 19, 530–558. [Google Scholar] [CrossRef]

- Traxler, A.A.; Schrack, D.; Greiling, D. Sustainability reporting and management control—A systematic exploratory literature review. J. Clean. Prod. 2020, 276, 122725. [Google Scholar] [CrossRef]

- Ahrens, T.; Chapman, C.S. Occupational identity of MAs in Britain and Germany. Eur. Account. Rev. 2020, 9, 477–498. [Google Scholar] [CrossRef]

- Harzing, A.-W. A preliminary test of Google Scholar as a source for citation data: A longitudinal study of Nobel prize winners. Science 2013, 94, 1057–1075. [Google Scholar] [CrossRef]

- Harzing, A.-W. A longitudinal study of Google Scholar coverage between 2012 and 2013. Science 2014, 98, 565–575. [Google Scholar] [CrossRef]

- Dumay, J.; Bernardi, C.; Guthrie, J.; DeMartini, P. Integrated reporting: A structured literature review. Acc. Forum 2016, 40, 166–185. [Google Scholar] [CrossRef]

- Cuozzo, B.; Dumay, J.; Palmaccio, M.; Lombardi, R. Intellectual capital disclosure: A structured literature review. J. Intellect. Cap. 2017, 18, 9–28. [Google Scholar] [CrossRef]

- Jones, M.J. Accounting for the environment: Towards a theoretical perspective for environmental accounting and reporting. Account. Forum 2010, 34, 123–138. [Google Scholar] [CrossRef]

- Ballou, B.; Casey, R.J.; Grenier, J.H.; Heitger, D.L. Exploring the Strategic Integration of Sustainability Initiatives: Opportunities for Accounting Research. Account. Horiz. 2012, 26, 265–288. [Google Scholar] [CrossRef]

- Tilt, C.A. Corporate Responsibility, Accounting and Accountants. In Professionals’ Perspectives of Corporate Social Responsibility; Idowu, S.O., Filho, W.L., Eds.; Springer: Berlin/Heidelberg, Germany, 2010; pp. 11–32. [Google Scholar]

- Fraser, M. “Fleshing out” an engagement with a social accounting technology. Account. Audit. Account. J. 2012, 25, 508–534. [Google Scholar] [CrossRef]

- Çalişkan, A.Ö. How accounting and accountants may contribute in sustainability? Soc. Responsib. J. 2014, 10, 246–267. [Google Scholar] [CrossRef]

- Guthrie, J.; Ricceri, F.; Dumay, J. Reflections and projections: A decade of Intellectual Capital Accounting Research. Br. Account. Rev. 2012, 44, 68–82. [Google Scholar] [CrossRef]

- Elkington, J. Cannibals with Forks: The Triple Bottom Line of 21st Century Business; Capstone: Oxford, UK, 1997. [Google Scholar]

- Elkington, J. Partnerships from cannibals with forks: The triple bottom line of 21st-century business. Environ. Qual. Manag. 1998, 8, 37–51. [Google Scholar] [CrossRef]

- Järvinen, J. Shifting NPM agendas and MAs’ occupational identities. Account. Audit. Account. J. 2009, 22, 1187–1210. [Google Scholar] [CrossRef]

- Friedman, A.L.; Lyne, S.R. The beancounter stereotype: Towards a general model of stereotype generation. Crit. Perspect. Account. 2001, 12, 423–451. [Google Scholar] [CrossRef]

- Järvenpää, M. Making Business Partners: A Case Study on how Management Accounting Culture was Changed. Eur. Account. Rev. 2007, 16, 99–142. [Google Scholar] [CrossRef]

- Krippendorff, K. Content Analysis: An Introduction to Its Methodology; Sage Publications: Los Angeles, CA, USA, 2018. [Google Scholar]

- R Core Team. R: A Language and Environment for Statistical Computing; R Foundation for Statistical Computing: Vienna, Austria, 2018; Available online: https://www.R-project.org (accessed on 20 December 2020).

- Gamer, M.; Lemon, J.; Fellows, I.; Singh, P. Coefficients of Interrater Reliability and Agreement for Quantitative, Ordinal and Nominal Data. 2012. Available online: https://cran.r-project.org/web/packages/irr/index.html (accessed on 20 December 2020).

- Lewis, T. Debate: Public Sector Sustainability Reporting-Implications for Accountants. Public Money Manag. 2008, 28, 329–331. [Google Scholar] [CrossRef]

- Botes, V.; Low, M.; Chapman, J. Is accounting education sufficiently sustainable? Sustain. Account. Manag. Policy J. 2014, 5, 95–124. [Google Scholar] [CrossRef]

- Mistry, V.; Sharma, U.; Low, M. Management accountants’ perception of their role in accounting for sustainable development. Pac. Account. Rev. 2014, 26, 112–133. [Google Scholar] [CrossRef]

- Williams, B. The local government accountants’ perspective on sustainability. Sustain. Account. Manag. Policy J. 2015, 6, 267–287. [Google Scholar] [CrossRef]

- Boulianne, E.; Keddie, L.S.; Postaire, M. (Non) coverage of sustainability within the French professional accounting education program. Sustain. Account. Manag. Policy J. 2018, 9, 313–335. [Google Scholar] [CrossRef]

- Schaltegger, S.; Zvezdov, D. Gatekeepers of sustainability information: Exploring the roles of accountants. J. Account. Organ. Chang. 2015, 11, 333–361. [Google Scholar] [CrossRef]

- Burritt, R.L.; Tingey-Holyoak, J. Forging cleaner production: The importance of academic-practitioner links for successful sustainability embedded carbon accounting. J. Clean. Prod. 2012, 36, 39–47. [Google Scholar] [CrossRef]

- Tingey-Holyoak, J.; Pisaniello, J.D. Water accounting knowledge pathways. Pac. Account. Rev. 2019, 31, 258–274. [Google Scholar] [CrossRef]

- Guthrie, J.; Petty, R. Intellectual capital: Australian annual reporting practices. J. Intellect. Cap. 2000, 1, 241–251. [Google Scholar] [CrossRef]

- Adams, S.; Simnett, R. Integrated Reporting: An Opportunity for Australia’s Not-for-Profit Sector. Aust. Account. Rev. 2011, 21, 292–301. [Google Scholar] [CrossRef]

- Dumay, J.; Hossain, M.D.A. Sustainability Risk Disclosure Practices of Listed Companies in Australia. Aust. Account. Rev. 2019, 29, 343–359. [Google Scholar] [CrossRef]

- Higgins, C.; Stubbs, W.; Tweedie, D.; McCallum, G. Journey or toolbox? Integrated reporting and processes of organisational change. Account. Audit. Account. J. 2019, 32, 1662–1689. [Google Scholar] [CrossRef]

- Stubbs, W.; Higgins, C. Integrated Reporting and internal mechanisms of change. Account. Audit. Account. J. 2014, 27, 1068–1089. [Google Scholar] [CrossRef]

- Hoang, T. The Role of the Integrated Reporting in Raising Awareness of Environmental, Social and Corporate Governance (ESG) Performance. Dev. Corp. Gov. Responsib. 2018, 14, 47–69. [Google Scholar] [CrossRef]

- Idowu, S.O. Accounting for decision makers in a sustainable environment. In Theory and Practice of Corporate Social Responsibility; Idowu, S.O., Louche, C., Eds.; Springer-Verlag: Berlin/Heidelberg, Germany, 2011; pp. 208–228. [Google Scholar]

- Seay, S. Sustainability is Applied Ethics. J. Legal Ethic. Regul. Iss. 2015, 18, 63–70. [Google Scholar]

- Lodhia, S.K. The accounting implications of the sustainable development bill. Soc. Environ. Account. J. 2001, 21, 8–11. [Google Scholar] [CrossRef]

- Fernández Chulián, M. Constructing new accountants: The role of sustainability education. Rev. Cont. 2011, 14, 241–265. [Google Scholar] [CrossRef]

- Egan, M.; Tweedie, D. A “green” accountant is difficult to find. Can accountants contribute to sustainability management initiatives? Account. Audit. Account. J. 2018, 31, 1749–1773. [Google Scholar] [CrossRef]

- Schaltegger, S.; Zvezdov, D. In Control of Sustainability Information: Untangling the Role of Accountants. In Accounting and Control for Sustainability, Studies in Managerial and Financial Accounting; Songini, L., Pistoni, A., Herzig, C., Eds.; Emerald: Bingley, UK, 2013; pp. 265–296. [Google Scholar]

- Oyewo, B.M. Outcomes of interaction between organizational characteristics and management accounting practice on corporate sustainability: The global management accounting principles (GMAP) approach. J. Sustain. Financ. Investig. 2020, 1–35. [Google Scholar] [CrossRef]

- Margerison, J.; Fan, M.; Birkin, F. The prospects for environmental accounting and accountability in China. Account. Forum 2019, 43, 327–347. [Google Scholar] [CrossRef]

- Brundtland, G. Our common future: The World Commission on Environment and Development; Oxford University Press: Oxford, UK, 1987. [Google Scholar]

- Schaltegger, S. Sustainability as a fundamental challenge for management accountants. In The Role of Management Accountants, Local Variations and Global Influences; Goretzki, L., Strauss, E., Eds.; Routledge: London, UK; New York, NY, USA, 2017; pp. 274–291. [Google Scholar]

- Caglio, A. Enterprise Resource Planning systems and accountants: Towards hybridization? Eur. Account. Rev. 2003, 12, 123–153. [Google Scholar] [CrossRef]

- Lantto, A.-M. Business Involvement in Accounting: A Case Study of International Financial Reporting Standards Adoption and the Work of Accountants. Eur. Account. Rev. 2014, 23, 335–356. [Google Scholar] [CrossRef]

- Burns, J.; Vaivio, J. Management accounting change. Manag. Account. Res. 2001, 12, 389–402. [Google Scholar] [CrossRef]

- Scapens, R.W.; Jazayeri, M. ERP systems and management accounting change: Opportunities or impacts? A research note. Eur. Account. Rev. 2003, 12, 201–233. [Google Scholar] [CrossRef]

- Lukka, K. Total accounting in action: Reflections on sten Jönsson’s Accounting for Improvement. Account. Organ. Soc. 1998, 23, 333–342. [Google Scholar] [CrossRef]

| Reference | Article | Journal/Book | Google Scholar Citations | |

|---|---|---|---|---|

| 1 | Jones [32] | Accounting for the environment: Towards a theoretical perspective for environmental accounting and reporting | Accounting Forum | 303 |

| 2 | Ballou, Casey, Grenier and Heitger [33] | Exploring the strategic integration of sustainability initiatives: Opportunities for accounting research | Accounting Horizons | 179 |

| 3 | Tilt [34] | Corporate responsibility, accounting and accountants | Professionals Perspectives of Corporate Social Responsibility | 116 |

| 4 | Fraser [35] | “Fleshing out” an engagement with a social accounting technology | Accounting, Auditing and Accountability Journal | 68 |

| 5 | Çalişkan [36] | How accounting and accountants may contribute in sustainability? | Social Responsibility Journal | 58 |

| Reference | Article | Journal/Book | Google Scholar CPY | |

|---|---|---|---|---|

| 1 | Jones [32] | Accounting for the environment: Towards a theoretical perspective for environmental accounting and reporting | Accounting Forum | 30.3 |

| 2 | Ballou, Casey, Grenier and Heitger [33] | Exploring the strategic integration of sustainability initiatives: Opportunities for accounting research | Accounting Horizons | 22.28 |

| 3 | Tilt [34] | Corporate responsibility, accounting and accountants | Professionals Perspectives of Corporate Social Responsibility | 10.55 |

| 4 | Çalişkan [36] | How accounting and accountants may contribute in sustainability? | Social Responsibility Journal | 9.67 |

| 5 | Fraser [35] | “Fleshing out” an engagement with a social accounting technology | Accounting, Auditing and Accountability Journal | 8.5 |

| K-alpha | K-alpha | ||||||

|---|---|---|---|---|---|---|---|

| A | Author Type | 1.000 | B | Location | 1.000 | ||

| A1 | Academic(s) | 22 | B1 | Africa | 1 | ||

| A2 | Practitioner(s) and consultant(s) | 1 | B2 | The Americas | 1 | ||

| A3 | Academic(s), practitioner(s) and consultant(s) | 0 | B3 | Asia | 1 | ||

| Total | 23 | B4 | Europe | 5 | |||

| B5 | Oceania | 8 | |||||

| B6 | Other | 7 | |||||

| Total | 23 | ||||||

| K-alpha | K-alpha | ||||||

| C | Jurisdiction | 1.000 | D | Organizational focus | 1.000 | ||

| C1 | Supra-national/International/Comparative-General | 7 | D1 | Publicly listed companies | 0 | ||

| C1.1 | Supra-national/International/Comparative-Industry | 0 | D2 | Private companies | 3 | ||

| C1.2 | Supra-national/International/Comparative-Organizational | 2 | D3 | Public sector | 5 | ||

| C2 | National-General | 2 | D4 | Not for profit | 0 | ||

| C2.1 | National-Industry | 5 | D5 | General/Other | 15 | ||

| C2.2 | National-Organizational | 4 | Total | 23 | |||

| C3 | One organization | 3 | |||||

| Total | 23 | ||||||

| K-alpha | K-alpha | ||||||

| E | Research method | 1.000 | F | Sustainability definition | 0.928 | ||

| E1 | Case/field study/interviews | 5 | F1 | Environmental-Social-Economic | 12 | ||

| E2 | Content analysis/historical analysis | 0 | F2 | Environmental-Social | 4 | ||

| E3 | Survey/Questionnaire/Other empirical | 5 | F3 | Environmental-Economic | 0 | ||

| E4 | Mixed methods | 4 | F4 | Social-Economic | 0 | ||

| E5 | Commentary/Normative/Policy | 8 | F5 | Environmental | 7 | ||

| E6 | Literature review | 1 | F6 | Social | 0 | ||

| Total | 23 | F7 | Economic | 0 | |||

| Total | 23 | ||||||

| K-alpha | K-alpha | ||||||

| G | Sustainability accounting and reporting focus | 0.861 | H | Management accountant’s current involvement in sustainability accounting and reporting | 0.940 | ||

| G1 | Internal: measurement and management | 5 | H1 | No involvement in sustainability accounting and reporting | 1 | ||

| G2 | External: disclosure | 5 | H2 | Low involvement in sustainability accounting and reporting | 9 | ||

| G3 | Internal and external: measurement, management, and disclosure | 13 | H3 | Involvement in sustainability accounting and reporting | 3 | ||

| Total | 23 | H4 | High involvement in sustainability accounting and reporting | 2 | |||

| H5 | Not specified | 8 | |||||

| Total | 23 | ||||||

| K-alpha | K-alpha | ||||||

| I | Management accountant’s future/potential involvement in sustainability accounting and reporting | 0.839 | L | Management accountant’s role in sustainability accounting and reporting | 1.000 | ||

| I1 | No involvement in sustainability accounting and reporting | 0 | L1 | Bean counter | 0 | ||

| I2 | Low involvement in sustainability accounting and reporting | 0 | L2 | Business partner | 2 | ||

| I3 | Involvement in sustainability accounting and reporting | 6 | L3 | Other | 21 | ||

| I4 | High involvement in sustainability accounting and reporting | 15 | Total | 23 | |||

| I5 | Not specified | 2 | |||||

| Total | 23 |

| Source Title | Number |

|---|---|

| Accounting Forum | 2 |

| Accounting Horizons | 1 |

| Accounting, Auditing and Accountability Journal | 2 |

| Journal of Accounting and Organizational Change | 1 |

| Journal of Cleaner Production | 1 |

| Journal of Legal, Ethical and Regulatory Issues | 1 |

| Journal of Sustainable Finance and Investment | 1 |

| Pacific Accounting Review | 2 |

| Revista de Contabilidad – Spanish Accounting Review | 1 |

| Social and Environmental Accountability Journal | 1 |

| Social Responsibility Journal | 1 |

| Studies in Managerial and Financial Accounting | 1 |

| Sustainability Accounting, Management and Policy Journal | 3 |

| Potential/Future Involvement | ||||

|---|---|---|---|---|

| Current Involvement | High involvement in sustainability accounting and reporting | Involvement in sustainability accounting and reporting | Not specified | Total |

| High involvement in sustainability accounting and reporting | 1 | - | 1 | 2 |

| Involvement in sustainability accounting and reporting | 2 | 1 | - | 3 |

| Low involvement in sustainability accounting and reporting | 7 | 1 | 1 | 9 |

| No involvement in sustainability accounting and reporting | 1 | - | - | 1 |

| Not specified | 4 | 4 | - | 8 |

| Total | 15 | 6 | 2 | 23 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ascani, I.; Ciccola, R.; Chiucchi, M.S. A Structured Literature Review about the Role of Management Accountants in Sustainability Accounting and Reporting. Sustainability 2021, 13, 2357. https://doi.org/10.3390/su13042357

Ascani I, Ciccola R, Chiucchi MS. A Structured Literature Review about the Role of Management Accountants in Sustainability Accounting and Reporting. Sustainability. 2021; 13(4):2357. https://doi.org/10.3390/su13042357

Chicago/Turabian StyleAscani, Ilenia, Roberta Ciccola, and Maria Serena Chiucchi. 2021. "A Structured Literature Review about the Role of Management Accountants in Sustainability Accounting and Reporting" Sustainability 13, no. 4: 2357. https://doi.org/10.3390/su13042357

APA StyleAscani, I., Ciccola, R., & Chiucchi, M. S. (2021). A Structured Literature Review about the Role of Management Accountants in Sustainability Accounting and Reporting. Sustainability, 13(4), 2357. https://doi.org/10.3390/su13042357