1. Introduction

As we all know, high-quality service can win the trust and brand recognition of new and existing customers for enterprises in the current fierce supply chain competition, which is a sticky and powerful way to maintain and attract consumers, and even the service revenues can become a new important engine for the long-term sustainable development of enterprises. In fact, many big manufacturers like GM and Ford have developed special websites to provide reliable online referral marketing services, such as GMBuyPower.com and FordDirect.com [

1]. From a practical point of view, service investment does benefit enterprises in terms of profit growth, market expansion and brand building. Take JD.com, large-scale e-commerce platform and online shopping sites in China, as an example. In the novel coronavirus epidemic period, JD.com made full use of the previous “O2O” omni-channel strategy under the supply chain system, launched “mobile vegetable basket” and “group” fresh purchasing mode and other services to timely meet the needs of community diversified and decentralized retail services during the COVID-19 (Corona Virus Disease 2019) epidemic period. Moreover, JD.com provides emergency drug delivery services for local pharmaceutical enterprises in Hubei Province, and has opened a free doctor consultation and psychological counseling service platform, which has more than 30,000 doctors to provide 24-h online consulting services. These quality services clearly enhance the consumer experience and brand trust. Speaking from facts and figures, the annual financial results released in March 2020 showed that the annual net service revenue increased by 44.1% to 66.2 billion yuan in 2019. In the fourth quarter alone, the number of active buyers increased by 8.3% to 27.6 million, which was 9.6 million more than its competitor Alibaba.com [

2,

3].

Although these personalized high-quality and high-cost services can enhance the stickiness and brand recognition of consumers, they may also lead to free riding behavior or negative spillover effect in the competition, which is likely to harm the reasonable interests and enthusiasm of service providers and threaten the long-term sustainability of their profits. In this paper, the service spillover effect refers to the fact that the enterprise or supply chain attracts more customers and acquires a larger market due to the provision of services, while the overall market is limited and the market for competitors shrinks.

Thus, several key academic issues are worth exploring: When considering the above service negative spillover, how can the supply chain that provides service and its rival conduct complex games and decisions in the competition? Does the original supply chain-to-chain competition mechanism change significantly when negative spillover effects are taken into account? How exactly does it work in competition? Furthermore, considering the negative spillover effect and competition, what decisions and responses should participants take in the competition to achieve the best performance?

In theory, retailer-led supply chain structure is generally divided into two types: decentralized and centralized [

4]. A decentralized supply chain means all members act independently, while in a centralized structure, members make decisions and actions as a whole [

5]. Take JD and Alibaba, two large online retailers in China. Alibaba’s sellers and suppliers on its platforms such as Taobao and Tmall make decisions independently of Alibaba, and Alibaba only provides platforms and related services. Obviously, this kind of structure where upstream suppliers and downstream retailers are independent from each other is the decentralized structure. In addition to the above decentralized structure, JD has another centralized structure; that is, JD realizes a fully autonomous decision-making model for pricing, procurement, sales, distribution, and other links through its own operation.

Therefore, this article attempts to discuss academic issues as follows: How to optimize and make decisions to achieve long-term sustainable development when considering negative spillover effect and service competition of retailer-dominated supply chain with different structures? What are the differences and connections between different competitive structures of supply chain? Which supply chain structure performs better? At the same time, which structure is the equilibrium of the Nash game? In addition, how do the key variables (such as competition intensity and negative spillover effect) in the model affect the optimization and decision? The discussion and solution of the above problems have unusual academic value and practical significance. We try to answer above questions by game model and optimization method.

Motivated by above facts and key questions, the framework of this paper is as follows: The literature review on inter supply chain competition, service competition, and spillover effect for supply chains are sorted in

Section 2.

Section 3 puts forward the basic academic problems and the competitive structure of supply chain and defines and explains the relevant parameters. In

Section 4, we construct four double-layer compound nested Stackelberg models according to the practical operation and management problems and optimize the equilibrium solution. The equilibrium solutions under four game models are comprehensively compared and analyzed in

Section 5. Specifically, this part studies the influence of negative spillover effects on each equilibrium, and at the same time analyzes the impact of competition intensity on the equilibrium. In

Section 6, the numerical experiments focus on the influence of negative spillover effect on the optimal service level and the optimal profit of supply chain under four structures, especially considering the negative spillover effect and chain-to-chain competition in the analysis of service level decision. Finally,

Section 7 gives the research conclusions and implications of this article.

2. Literature Review

The relevant research is closely related to inter supply chain competition, service competition and spillover effect for supply chains. The detailed literature related to the above streams of research is discussed in the following subsections.

2.1. Inter Supply Chain Competition

In recent years, on the basis of the study of inter supply chain competition, the scope and perspective have been extended to inter-chain competition. McGuire and Staelin (1983), Rice and Hoppe (2001), and Lakhal et al. (2007) have discussed this issue earlier, believing that in the context of economic globalization and integration, the competitive advantage of enterprises is not only affected by their own market position, but also largely depends on the competitive advantage of their supply chains, and a general network model structure is constructed to optimize the supply chain [

6,

7,

8]. This research has also been subsequently extended to other factors and themes that may affect supply chain optimization and decision-making, including channel structure [

9,

10,

11,

12,

13,

14], degree of competition [

13,

14,

15], information sharing [

16,

17], and delivery lead time [

18]. Li et al. (2013) examine how the power and product substitutability affect the channel selection, and they find that integration is the dominant strategy when the competition is weak, but decentralized structure may perform better when competition intensifies to a certain extent [

9]. Similarly, when product substitutability is weak, Veldman et al. (2014) find that centralized supply chain performs better in a pure structure (that is, both supply chains are integrated or decentralized), but when product is more substitutable, the performance of decentralization is higher. In mixed or asymmetric structure (i.e., one supply chain is centralized and the other is decentralized), the integration is the dominant strategy [

10]. In addition, under two competing manufacturer-led supply chain model, Xia et al. (2019) investigate the service investment and structure decisions [

13]. Furthermore, Wu et al. (2019) examine how the competition and negative spillover affect the equilibrium in two competing manufacturer-led supply chains [

14].

Furthermore, some scholars pay attention to sustainability issues or sustainable operation management issues in supply chain competition research. The impact of buyer power on optimal wholesale price and retail price with downstream competition is investigated by Zhao (2019) [

19]. The conclusions show that the competition and buyer power is replaceable. When competition is fierce, the influence of buyer power on retail prices is relatively weak. Liu et al. (2019) construct four game models to investigate alliance decision and optimization of supply chain, and the results show that competition intensity is critical for alliance decisions, namely channel structure strategies [

20]. Yang et al. (2020) study the competitiveness and structure strategy of supply chains. The results show that integrated structure is the unique Nash equilibrium when the competitiveness is low, but when competitiveness is relatively high, both centralization–centralization and decentralization–decentralization are equilibriums [

5]. Pi and Wang (2020) and Nielsen et al. (2020) also study the operational decisions under different competing supply chain network [

21,

22]. Unlike the above-mentioned research, we consider the situation where retailer is the dominant enterprise in the supply chain and there are negative spillover effects in the competition.

2.2. Service Competition

Recently, with the development of supply chain competition and supply chain service research, some scholars believe that the traditional price competition mode in supply chain management will be gradually replaced by service competition [

1,

23,

24,

25,

26].

Therefore, some scholars take both price and service competition into consideration. For instance, Boyaci and Gallego (2010) take two competing supply chains composed of a wholesaler and a retailer as object to study customer service competition and set up coordination and non-coordination under the assumption that the retail prices of the two channels are equal. Three scenarios of coordination, discoordination, and partial coordination are set up, and the comparative analysis shows that coordination is the dominant strategy, but the strategic behavior often evolves into the prisoner’s dilemma, so as to benefit the customers [

27]. Furthermore, Xiao and Yang (2017) examine the price and service competition model of supply chain under demand uncertainty. They find that the optimal retail price and service level decrease with increasing risk sensitivity. In other words, in most cases, the optimal wholesale price decreases with increasing risk sensitivity, but when the product substitutability is sufficiently small, it will increase first and then decrease [

28]. Jena and Meena (2019) also study price and service competition by a mathematical model for three scenarios and find that the optimal profit of supply chain in competition is higher than without competition [

29].

The above studies assume that the service is provided by the upstream manufacturers or suppliers, but others assume that the service is provided by the retailers [

23,

30,

31]. This paper also assumes that retailers provide services. Furthermore, most of the above research on the topics of service decision-making, service competition, and service strategy are based on dual-channel supply chains, and the supply chain power structure is relatively single. Therefore, some scholars have also carried out further research on this limitation, considering a variety of different supply chain power structures. For instance, Nagurney et al. (2015) discuss price and quality competition in the network model composed of multiple service providers and multiple manufacturers and established two dynamic and static competition models [

32]. Xia and Chen (2015) study the service competition and market segmentation in the supply chain composed of multiple telephone call centers [

33]. Moreover, Xia et al. (2019) also examine how the price and service competition affect the optimization and the channel structure decision in a competing supply chain context [

13]. The expansion of power structure and framework provides important inspiration and ideas for this article.

2.3. Spillover Effect

However, in the supply chain network competition, it is inevitable to involve the problem of spillover effect. Therefore, some scholars begin to pay close attention to the service spillover effect in the supply chain competition, especially when the spillover effect is negative. For instance, Dan et al. (2012) and Hu and Li (2012) introduce negative service spillover effects when studying the impact of retailer services and customer loyalty on pricing decisions based on a dual-channel supply chain [

34,

35]. Further, Wu et al. (2019) consider the negative service spillover effect in the network and examine the optimal decisions of supply chain and service level based on two manufacturer-led supply chains with unequal power. The results show that the negative spillover effect has negative incentives on both supply chains, but the inter-chain competition has negative incentives on the leader supply chain providing service and a free-rider effect on the followers [

14]. This paper is a further extension of this article.

In general, there are some limitations in the existing literatures related to inter supply chain competition, service competition and spillover effect for supply chains:

(1) Most of the literatures on supply chain competition are based on the assumption of equal power and market position among game participants, ignoring the unequal bargaining power. However, in the practice of production and operation management, many companies or product brands usually have a sequential order of entry into the market, and there are strong or weak bargaining power. Furthermore, with the development of enterprises and changes in the market, the power in the competition may also change. Therefore, the research on the supply chain competition with unequal bargaining power or position has very important practical significance and application value, which has not been studied in most of the existing literatures.

(2) Most of the literatures are modeled through a single or dual channel supply chain when studying the effect of supply chain service spillover effect on supply chain decisions. Few literatures have extended this research to the competition between two or more independent supply chains, which has crucial academic value and practical significance.

Overall, the main contributions and innovations of this study are as follows:

(1) We take into account the unequal bargaining power in supply chain competition that is common in practice. Four competitive structures of centralization–centralization, decentralization–centralization, centralization–decentralization, and decentralization–decentralization are considered, and optimal decisions of supply chain are obtained through the in-depth analysis and comprehensive comparison of the game optimization models.

(2) The negative spillover effect of service is studied based on supply chain network, which is regarding two competing supply chains as the research object and carrier. Research on the effects of competition and spillovers together and observes the impact of the changes on supply chain decisions, especially optimal profit and optimal service level.

(3) For the model and method, a new double-layer compound nested Stackelberg model is constructed in this paper, and the game equilibriums are derived. This model is mainly based on the actual situation and needs of this research, which has important reference significance and value for the future supply chain competition framework expansion and optimization analysis.

3. Problem Description and Analysis

In order to simplify and better construct the game competition model, we propose some basic assumptions that are consistent with the actual operation management.

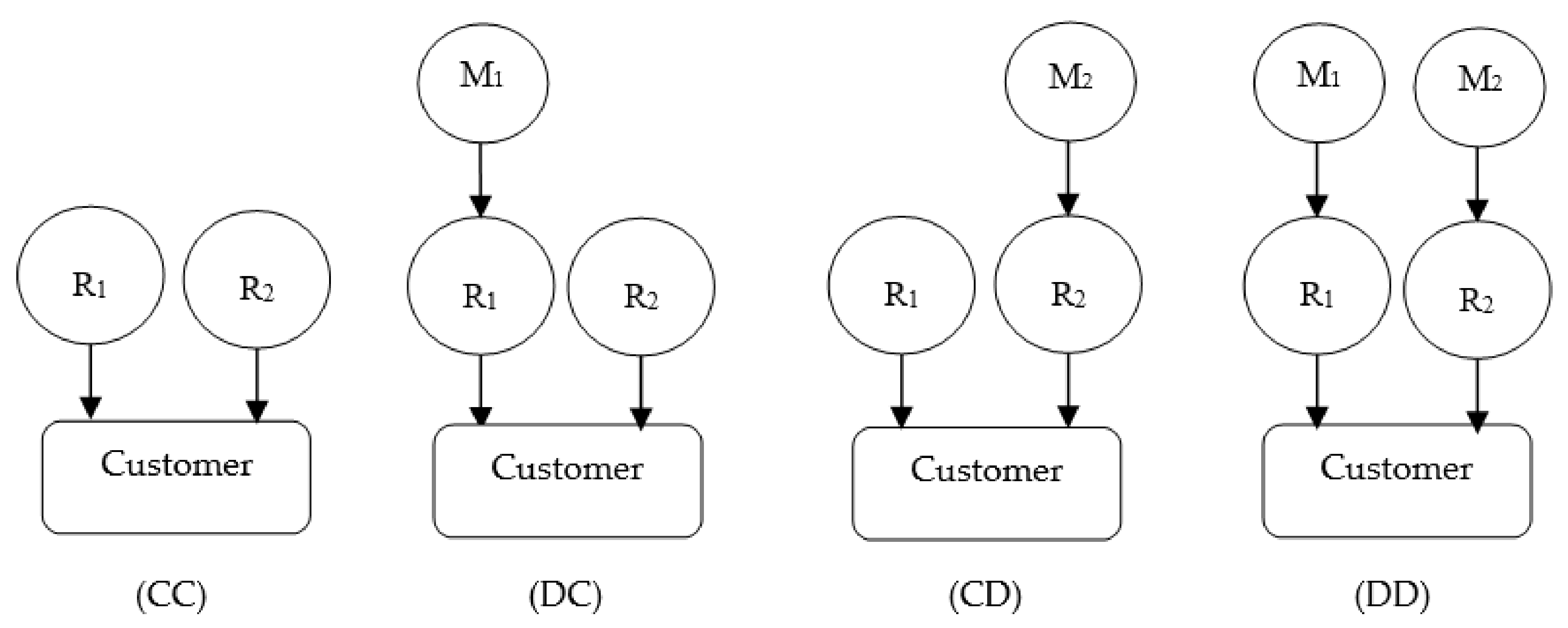

First, it is assumed that there are two unequal retailer-leading supply chains in the competitive market, which is represented by i (i = 1, 2). Obviously, this competition is a typical Stackelberg game model. Without loss of generality, we assume that supply chain 1 is the leader and supply chain 2 is the follower in the model. Further, the service is only provided by retailer 1, and retailer 2 does not provide the service only as the reference group. Meanwhile, this paper assumes that the products of the two supply chains are completely replaceable, and competition is reflected in product price. The supply chain structures and symbols are shown in

Table 1.

Figure 1 shows the four basic supply chain competition structures in this article.

The main variables involved in the model and their definitions are as follows (

Table 2):

To be clear, it is assumed that the demand function of supply chain 1 is and that of supply chain 2 is where represents the potential basic demand of the supply chain, and represents the substitutability between products in the two supply chains. In other words, when other parameters are fixed, the price change of the supply chain has an impact on market demand in another competing supply chain. The value reflects the competitive intensity of the supply chain. is the level of service provided by retailers to consumers. Of course, the service needs to pay a certain cost, and the cost function is expressed by .

It needs to be explained that there are three considerations and rationality for adopting this design of the quadratic cost function:

First of all, this function is in line with the actual operation management, that is, when retailer improves the service level and quality, the service cost will rise sharply. Secondly, compared with the linear form, this quadratic cost function can better obtain the equilibrium and simplifies the complexity of the model solution. Of course, this kind of design also has a certain literature basis and reference source, like Tsay and Agrawal (2000), Yan and Pei (2009), Xia et al. (2019), and Wu et al. (2019) adopt this form [

13,

14,

23,

31].

Moreover, is the negative spillover effect of the service, that is, the supply chain 1 provides the service will lead to the loss of product market on the supply chain 2 that does not provide services. The greater the value of , the stronger the negative spillover effects of the service, and the more serious the loss of customers in supply chain 2 will be.

Next, the optimization and decision-making of pricing, service, and structure under the horizontal Stackelberg competition between supply chains are carried out in the following sections.

4. Analytical Results

This section analyzes the double-layer compound nested Stackelberg models and optimization under CC, DC, CD, and DD structures by means of backward recursion, and the equilibrium solutions are derived. It is assumed that supply chain 1 is the leader and supply chain 2 plays the role of follower in the Stackelberg game. Meanwhile, the bargaining power of two downstream retailers are stronger than that of upstream manufacturers in their supply chains, that is retailers act as the first mover due to their dominant position and preemptive advantage in the game.

4.1. Pure Centralized Structures (CC)

First of all, we discuss the game of two centralized structures that are dominated by two retailers. This subsection is a benchmark for the pure decentralized and hybrid competitive structure of the supply chain to make better service and pricing decisions.

In pure centralized structure, both chains are integrated, i.e., the retailer and the manufacturer in each chain act as a whole to achieve the optimal overall performance. In order to simplify the research, only one leading enterprise or retailer is used to represent the supply chain under this structure.

The following is the basic action orders of the game participants:

(1) The dominant retailer 1 gives optimal retail price and the level of service to maximize the profit of the supply chain 1.

(2) The dominant retailer 2 decides the optimal response to maximize the overall profit of the supply chain 2.

Further, we can obtain the following profit function of supply chains:

The equilibrium solution of the game can be derived by the method of backward recursion. The unique pure strategy equilibrium and optimal profits of supply chains or retailers for the CC structure are characterized as following theorem.

Theorem 1. (CC Equilibrium) When both supply chains are centralized, the unique pure strategy equilibrium is given by:whereand the optimal profits of supply chains are as follows: 4.2. Mixed Structures (DC)

This scenario analyzes the game that the leader, supply chain 1, is decentralized while the follower, supply chain 2, is centralized. Therefore, it is assumed that supply chain 1 is composed of manufacturer 1 and retailer 1, and supply chain has only one member enterprise represented by retailer 2.

The following is the basic action orders of the game players:

(1) As the dominant member of the leading supply chain, the downstream retailer 1 announces the optimal retail price and the optimal level of service s to upstream manufacturer 1 to maximize its own profit.

(2) Manufacturer 1 decides the wholesale price to maximize its own profit.

(3) The follower supply chain 2 gives the optimal retail price .

The profit of manufacturer 1 is:

and the profit of retailer 1 is:

the profit of retailer 2 is:

Furthermore, the unique pure strategy sub-game perfect equilibrium and the corresponding optimal profits of game players are obtained as follow.

Theorem 2. (DC Equilibrium) In hybrid structure, the unique pure strategy is:where The optimal profits of game participants are:

and the optimal profits of the supply chains are:

4.3. Mixed Structures (CD)

In this subsection, supply chain 1 is integrated and supply chain 2, composed of retailer 2 and manufacturer 2, is decentralized. The following is the basic action orders of the game players:

(1) As the leader in the Stackelberg game, supply chain 1 gives the optimal retail price and the level of service s in order to maximize its own profit.

(2) As the core member of supply chain 2, retailer 2 gives the optimal retail price to maximize its own performance.

(3) Weaker Manufacturer 2 makes optimal response, announcing the optimal wholesale price .

The profit of supply chain 1 is:

the profit of retailer 2 is:

and the profit of manufacturer 2 is:

Furthermore, the game is solved backwards, and the following theorem can be obtained.

Theorem 3. (CD Equilibrium) In hybrid structure, the unique pure strategy is:where The optimal profits of players are as follow:

and the optimal profits of the supply chains are:

4.4. Decentralized Structures (DD)

For convenience, we assume that the supply chain i is composed of the retailer i as the leader, and the exclusive manufacturer i as the follower.

The following is the specific action orders of the game players:

(1) As the dominant member in the leader supply chain 1, retailer 1 gives the retail price and the optimal level of service s to maximize its own profits.

(2) Manufacturer 1 responds optimally in order to maximize its own profit, announcing the optimal wholesale price .

(3) As the dominant member of supply chain 2, retailer 2 decides the retail price .

(4) Manufacturer 2 announces the optimal wholesale price .

We can get the profits of two manufacturers as follows:

and the profits of retailers are:

The game equilibrium and the players’ optimal profit are shown in the following theorem.

Theorem 4. (DD Equilibrium) When both chains are decentralized, the unique pure strategy is:where The optimal profits of the four members are:

and the optimal profits of the supply chains are:

5. Comparison and Analyses

The impact and interaction of service negative spillover and chain-to-chain competition on the equilibriums under the four models are comprehensively compared and analyzed in the section. For convenience, superscript “CC”, “DC”, “CD”, and “DD” are used to denote the corresponding structures and “T” is used to represent the total profit of supply chain.

5.1. Sensitivity Analyses of Negative Service Spillover k

The derivative of the equilibrium solution with respect to spillover coefficient

k is obtained as shown in

Table 3.

In general, the negative spillover coefficient k has significantly different effects on the equilibrium solution of the game under different supply chain competition models.

When the negative spillover coefficient of service increases, the optimal profit of retailer 1 and service level in the four supply chain competition models gradually decrease, and the optimal retail price and overall optimal profit of supply chain 1 also decrease. Meanwhile, when the structure of supply chain 1 is decentralization (i.e., DC and DD structure), the optimal profit of manufacturer 1 is negatively correlated with the negative spillover coefficient of service, but the optimal wholesale price is not affected by the negative spillover coefficient.

In short, the increase of the negative spillover coefficient has a negative effect on the retailer 1 or supply chain 1 that provides the service, resulting in the loss of its own performance and the reduction in service level. So, we get the following corollary.

Corollary 1. Under the competition of retailer-led supply chains, the negative spillover effect of service has a negative incentive effect on the retailers and their supply chain that provide service, which erodes the performance and reduces the willingness to provide service.

The corollary indicates that the negative spillover effect of service is a negative factor for the leader supply chain that provides service, but the impact on the decision of supply chain 2 that does not provide service cannot be determined temporarily. It also depends on the inter-chain competition, the coefficient of service cost, and other parameters.

The above corollary differs from the common intuition. Generally speaking, the negative spillover effect in competitive network can stimulate enterprises to improve their service level and quality so as to improve their market demand. For example, in the face of hot pot restaurants of the same customer group, “Haidilao” (a large hotpot chain store in China) can attract more potential customers from competitors in the same industry due to its refined, high-quality, and high-level service characteristics. Obviously, this negative spillover effect will encourage Haidilao to continuously improve its service level and has a positive incentive effect [

36]. However, we find that when the two competing supply chains are in a leader-follower game, the negative spillover effect has a negative incentive effect on the service provider, which will dampen the enthusiasm for improving and enriching services.

5.2. Sensitivity Analyses of Competition Degree

In order to explore the impact of the inter-chain competition on the equilibrium of the four games, and to make the analysis more general and avoid the interference of the negative spillover effect on equilibrium, this section considers two groups of control experiments with low spillover () and high spillover () in the analysis.

This part pays close attention to the sensitivity analysis of key

,

,

,

and

. First assume

,

,

,

, and then assume

,

,

,

,

in turn. The result is shown in

Table 4.

In order to make a more comprehensive comparison and in-depth analysis, it is necessary to observe and discuss from both horizontal and vertical aspects. The analysis results and findings of

Table 4 are as follows.

Through horizontal comparison, it is found that in all structures, with the increase of competition intensity , the optimal service level provided by retailer l gradually decreases, the optimal retail price and overall profit of supply chain 1 gradually decrease, and the overall profit of supply chain 2 increases. However, the retail price of supply chain 2 appears to increase first and then decrease.

Vertically, the optimal retail prices of the two supply chains always show a relationship of , but the price gap gradually narrows as the competition between supply chains increases. This result indicates that fierce competition between supply chains is not conducive to improving service levels for service providers, but it has a free-rider effect on the supply chain that does not provide services to benefit it.

At the same time, when competition is weak, the overall optimal profit of the two supply chains has a relationship of , but the gap gradually decreases as the intensity of competition increases, especially in the DC structure, may even occur when the intensity of competition is sufficiently large.

Then, we can get following corollary.

Corollary 2. When considering the negative spillover effect of service, the intensification of competition has a negative incentive effect on the retailer and its supply chain providing services, which erodes their performance level, but will generate a certain free-rider effect, which benefit the supply chains that do not provide services.

This corollary further shows the complex role of competition and negative spillover effects in supply chain optimization and decision-making processes.

Vertically compare the DC and CC structure, DD, and CD structure, that is, keep the structure of supply chain 2 unchanged, and compare the change of the supply chain 1 from integrated to decentralized. It is also found in

Table 4 that

,

,

,

. This finding indicates that the transition of leader supply chain structure from centralization to decentralization has a “double marginalization effect”. But for supply chain 2, it is found that

,

, which shows that the structural transformation of the leader supply chain will have positive externalities to the follower supply chain and benefit it.

At the same time, vertically compare the CD and CC structure, DD, and DC structure, that is, remain the structure of supply chain 1 unchanged, and compare the change of the supply chain 2 from integrated to decentralized. We can find that , , , . This result also indicates the emergence of “double marginalization effect”. However, for supply chain 1, , exists, indicating that the structure conversion of follower supply chain will also have positive externalities to the leader chain. In summary, we can get the following corollary.

Corollary 3. In Stackelberg competition between two retailer-led supply chains, when the structure of one supply chain remains unchanged and the other supply chain changes from centralized to decentralized, “double marginalization effect” will occur, but it will also generate positive externalities and benefit its rival.

This corollary is a “double marginalization” paradox that is clearly different from the common sense of competition among internal members in a single supply chain. The traditional double marginalization theory believes that, compared with full cooperation and overall action under centralized decision-making, the overall profit of the decentralized supply chain is lower than that under centralized structure due to the selfish behavior of members in the game. However, when the perspective of competition shifts from enterprise within a single supply chain to chain to chain, this paper proves that the structural transformation from concentration to decentralization can generate obvious altruism, network externality, to benefit the competitive supply chain.

In addition,

Table 4 also shows that: For all supply chain structures, the optimal service level

, retail price

and overall profit

of the experimental group with higher negative spillover effect are all smaller than those with lower spillover effect. This finding further supports the conclusion in Corollary 1 that negative spillover effect of service has a negative incentive effect on service providers.

6. Numerical Experiments

In this section, the numerical experiment mainly focuses on the influence of negative spillover effect on the optimal profit and service level. In the analysis of the optimal service level, the influence of inter-chain competition on the decision of the service level is also considered to make the results more general and universal.

6.1. The Influence of Negative Spillover Effect on Optimal Profit of Supply Chain

The optimal profits and trends of the two supply chains under the models of CC, DC, CD and DD are compared respectively in this subsection.

Without loss of generality, we assume that

,

,

,

and

. The spillover coefficient

changes from 0 to 1, and we need to observe how the changes affect the overall profits.

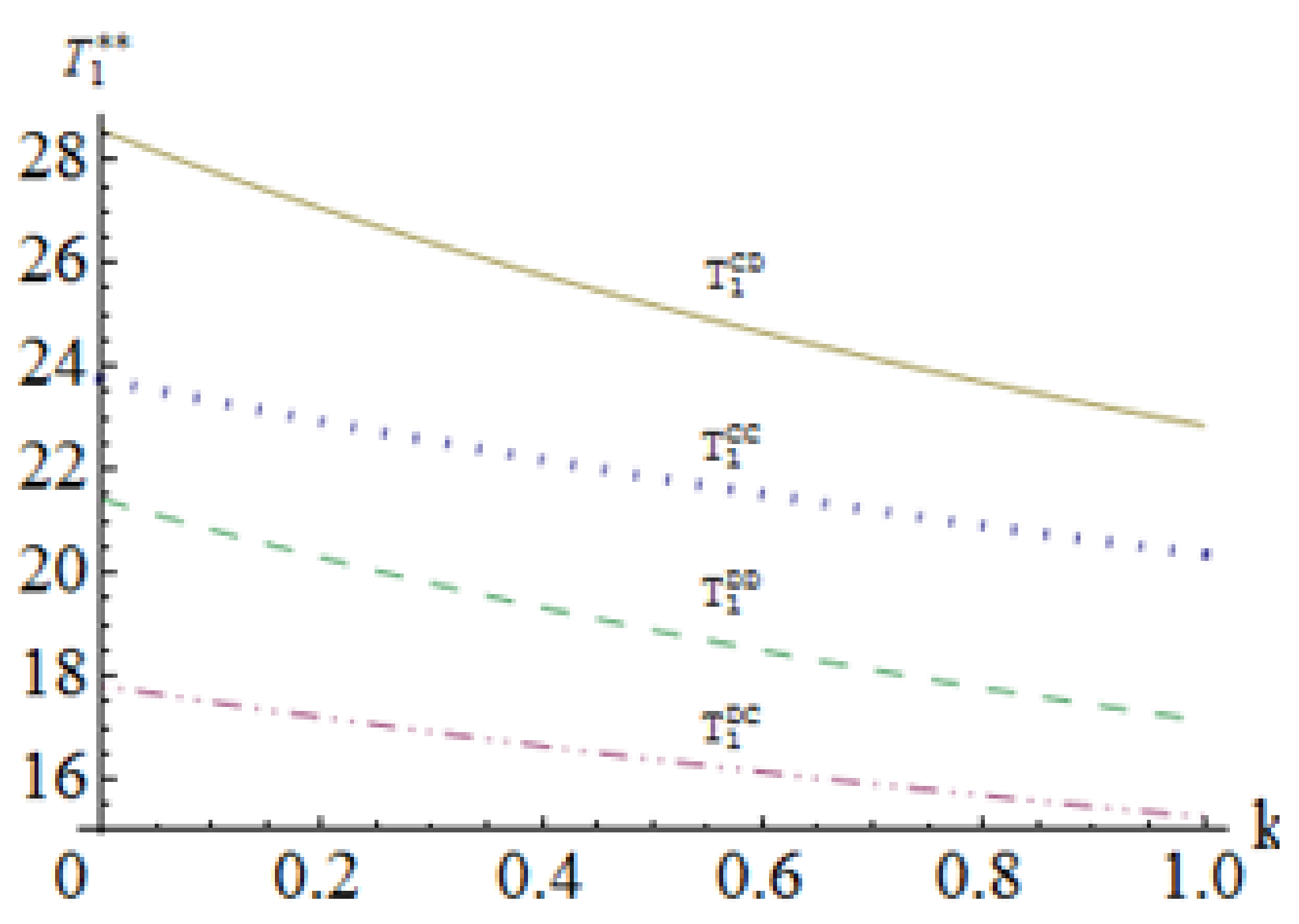

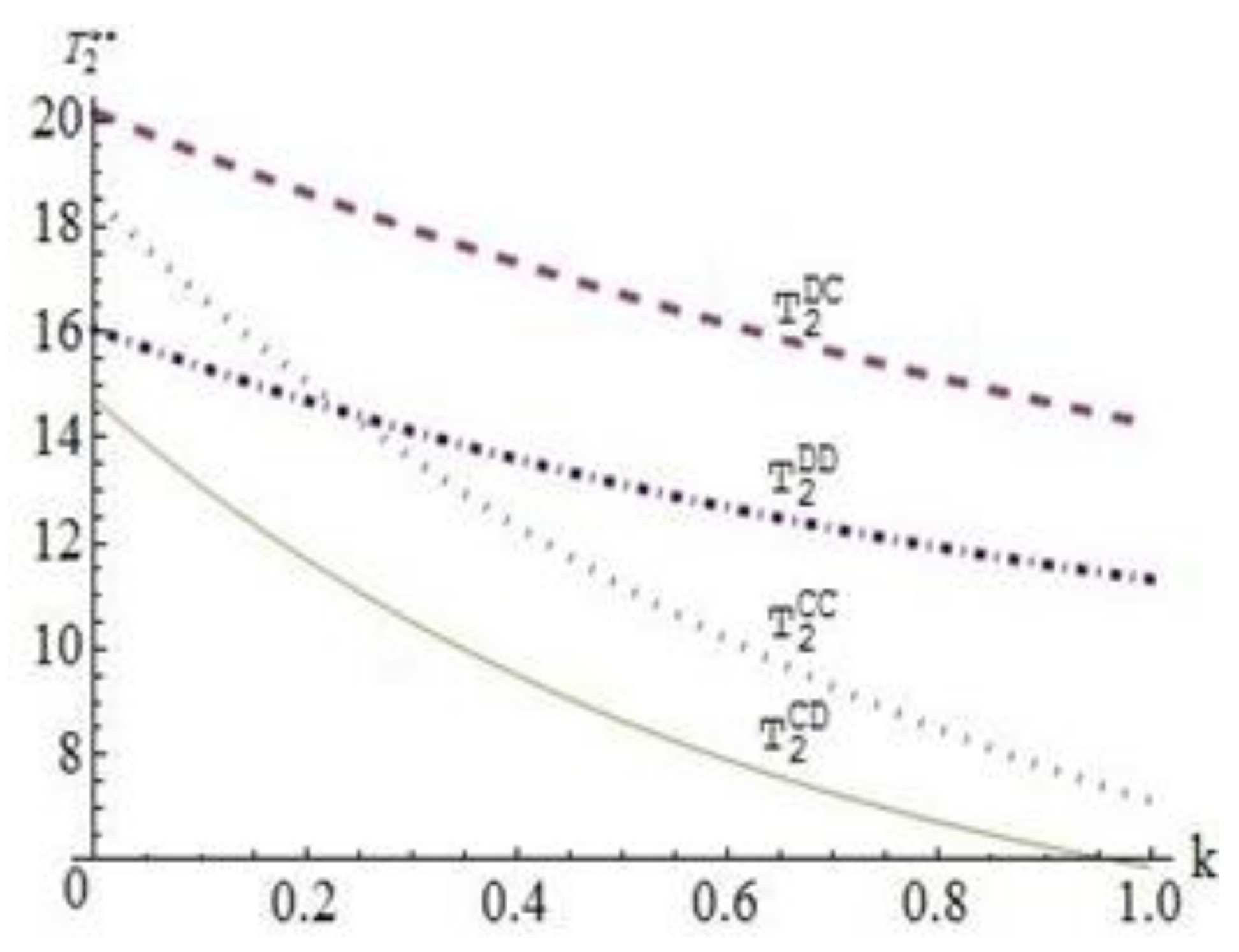

Figure 2 and

Figure 3 below are the experimental results.

Three insights can be briefly observed as follow.

(1) Firstly, the negative spillover effect has different influences on the optimal profits of supply chains under four different competitive structures. In

Figure 2, with the increase of

k, the optimal profit of the leading supply chain 1 providing services under the four competitive structures shows a downward trend on the whole. This result also confirms the conclusions of

Table 4 and Corollary 1, that the increase of negative spillover coefficient of service has a negative incentive effect on the service provider, namely, supply chain 1. Meanwhile, in

Figure 3, the optimal profit of follower supply chain 2 under four competitive structures also decreases with the increase of negative spillover effect of service. The results indicate that when the negative spillover effect increases, the overall profit of the follower supply chain 2 that does not provide the service declines due to the negative spillover effect. The root cause is that the increase of the negative spillover effect intensifies the market demand loss of supply chain 2, thus eroding its performance.

(2) Secondly, by analyzing

Figure 2, we find that

and

, which shows that when the structure of supply chain 2 remains constant, the structure conversion of supply chain 1 from integrated to decentralized makes its own supply chain’s overall profit decline, resulting in double marginalization effects. Meanwhile, finding

and

in

Figure 3 shows that when the structure of supply chain 1 remains constant, the structure conversion of supply chain 2 also generates a double marginalization effect. These results are also consistent with the findings in

Table 4. This finding indicates that when the structure of a competitor’s supply chain is constant, a centralized structure is the optimal decision for that supply chain. These results further indicate that the centralized structure is the dominant strategy when the structure of the competing supply chain is unchanged.

(3) Finally, we can find that

,

in

Figure 2 and

,

in

Figure 3. It shows that when the structure of a supply chain keeps constant, the structure conversion of the competitive supply chain from centralization to decentralization will produce positive externalities and promote the performance improvement of the competing supply chain.

This result in line with the findings of

Table 4 and Corollary 3, showing that in the inter-chain competition, the structure conversion from integrated to decentralized has an obvious “altruism”, which can benefit the competing supply chain.

6.2. The Influence of Negative Spillover Effect on Optimal Service Level

In order to better explore and analyze the role of negative service spillover effect on the decision of the optimal service level of the supply chain, we need plot the graph of service levels changing with spillovers. The experimental results are shown in

Figure 4.

Overall, we can find that the optimal service level under the four structures decreases with the increase of the negative spillover coefficient k. However, there are some differences in the specific changes in service levels under each structure. Specifically, there are three main findings.

Firstly, the optimal service level under the structure of CD and CC is much higher than that under the structure of DD and DC, that is, the leading supply chain 1 under the centralized structure is more willing to provide high level of service. Meanwhile, combined with the findings in

Figure 2, the leader supply chain 1 can also obtain higher profits under the centralized structure.

Secondly, although the optimal service level under the four structures gradually decreases with the increase of spillover coefficient k, the service level under the CD and CC structures decreases more and declines faster than that of the DD and DC structures. That is, when the leader supply chain is centralized, the optimal service level decreases greatly with the increase of the spillover coefficient.

In addition, if the structure of leader supply chain remains constant, for the follower supply chain, when negative spillover is weak, the leader supply chain will provide a higher level of service on the condition that the structure of follower supply chain is decentralization (i.e., , ); when service spillover effect is strong, the leader supply chain will provide high-level service on the condition that the follower chain is centralized (i.e., , ).

6.3. The Influence of Competiton and Negative Spillover Effect on Optimal Service Level

In order to make the analysis more comprehensive, the influences of the degree of inter-chain competition and the negative spillover effect on the optimal service level under four competitive structures are described, respectively, in the decision analysis of the optimal service level. Similarly, suppose

,

,

,

, and let the degree of competition

change from 0 to 1, and the spillover coefficient

k also change from 0 to 1, and observe how these two variables affect the optimal service level. We can obtain the experimental results shown in the following figures (

Figure 5,

Figure 6,

Figure 7, and

Figure 8).

By analyzing the above four graphs, we can obtain the following two main findings.

(1) First, on the whole, the optimal service level of supply chain in the four structures decreases with the increase of negative spillover effect and inter-chain competition. The results also further support the findings in

Table 4, reflecting that both the competition between supply chains and the negative spillover effect will exert a certain negative incentive effect on the leading supply chain or retailer providing services; in other words, the fierce inter-chain competition and the strong negative spillover effect will seriously dampen their enthusiasm for improving and enriching services.

(2) Second, with the increase of inter-chain competition, the optimal service level does not decline steadily, but shows a trend of rapid decline. Especially when the degree of competition is small, a small increase in competition can lead to a sharp decline in service level. Therefore, in order to stimulate the enthusiasm and willingness of service providers to improve the service level, efforts should be made to reduce the negative spillover effect in the competition network in the operation practice, to avoid the free-rider effect of the unserved supply chain and the members, and to avoid the fierce competition between supply chains.

7. Conclusions and Management Implications

Considering the negative spillover effect and inter-chain competition, the optimal service decision and Stackelberg competition of retailer-led supply chain are studied by constructing CC, DC, CD, and DD competition models.

The game equilibrium under four structures can be derived through optimization, and the following conclusions are obtained through comparative analysis:

(1) The negative spillover effect of service has a negative incentive effect on the leading supply chain providing service. In other words, with the increase of the negative spillover effect, the optimal service level and profit of the leader supply chain or its retailers will decline, and the optimal retail price and overall optimal profit of the supply chain will also decline. This conclusion verifies the finding by Wu et al. (2019) that negative spillover effect reduces the level of service [

14]. However, there are some differences as well. The results of this paper show that the optimal wholesale price of the supply chain providing services decreases with the increase of the negative spillover coefficient, and we further find that the retail price and supply chain profit are negatively correlated with the spillover effect. However, Wu et al. (2019) hold that the optimal wholesale price rises when service negative spillover coefficient increases [

14]. The reason for the difference may be the different structure of supply chain and the setting of service provider.

(2) The inter-chain competition has a negative incentive effect on the retailer and its supply chain that provide service, but for the supply chain that does not provide service, it can generate a certain free-riding effect to benefit it, and the more intense the competition, the more obvious the free-riding effect.

(3) The leader supply chain 1 under the centralized structure is more willing to provide high level of service and also obtains higher profits. Meanwhile, if the structure of leader supply chain remains constant, for the follower supply chain, when negative spillover is weak, the leader supply chain will provide higher level of service on the condition that the structure of follower supply chain is decentralization; when service spillover effect is strong, the leader supply chain will provide high-level service on the condition that the follower chain is centralized.

(4) Under the framework of the supply chain network and inter-chain competition, there is significant altruism in the change of supply chain structure from centralization to decentralization. That is, when one supply chain structure keeps constant and the other chain changes from an integrated to a decentralized structure, there will be a double marginalization effect and a positive externality, which will promote the performance of the competitive supply chain to improve significantly. This conclusion also further supports the findings under the equal power supply chain competition (Wu et al. 2018) [

12] and the manufacturer-led supply chain competition with unequal power (Wu et al. 2019) [

14].

Therefore, we can obtain the following two vital managerial implications and suggestions based on the above conclusions in this paper:

(1) In order to incentivize service providers to continuously improve service level and service quality, special attention should be paid to reducing or even eliminating the negative spillover effect in actual operation management, especially in fierce competition, so as to reduce its negative impact on the intention of service provider. For example, enterprises should reduce excessively investment and development in homogeneous services and products. In contrast, they should deeply explore their own advantages and characteristics from the perspective of customers, and combine consumer scenarios, consumer characteristics, and innovative experiences to provide more high-quality, personalized services that differ from competitors but meet consumer needs, thereby enhancing consumer experience value, which in turn enhances the supply chain’s competitive advantage and overall performance level. In this way, the sustainability of enterprises’ profit and development in the competition can be improved, and the formation of healthy competition can also be promoted.

(2) In actual supply chain management, proper competition can promote continuous innovation and benign cycle development of enterprises, but excessive competition is not desirable, which may bring many negative issues that are not conducive to sustainable development. Therefore, we should avoid excessive supply chain competition to reduce its negative incentive effect. For instance, companies can achieve the transformation from competition to partnership through horizontal integration measures such as contracts, cross-shareholdings, or mergers. They can also explore and absorb the advantages of channels, brands, and marketing of their respective supply chains. At the same time, enterprises should design a cooperation and sharing mechanisms to share service costs and the additional benefits brought by services, thereby improving the overall performance of the supply chain, and achieving a win-win goal.

There are also some other research directions. This paper only considers a single supply chain or leading enterprise to provide services. In the future, multiple enterprises can provide services at the same time. At the same time, other types of power structures, such as power equivalence between supply chains, power equivalence, and inequality among members of supply chains, can also be considered to verify the conclusions of this paper under specific competition scenarios.