From Neoclassical Economics to Common Good Economics

Abstract

:1. Introduction

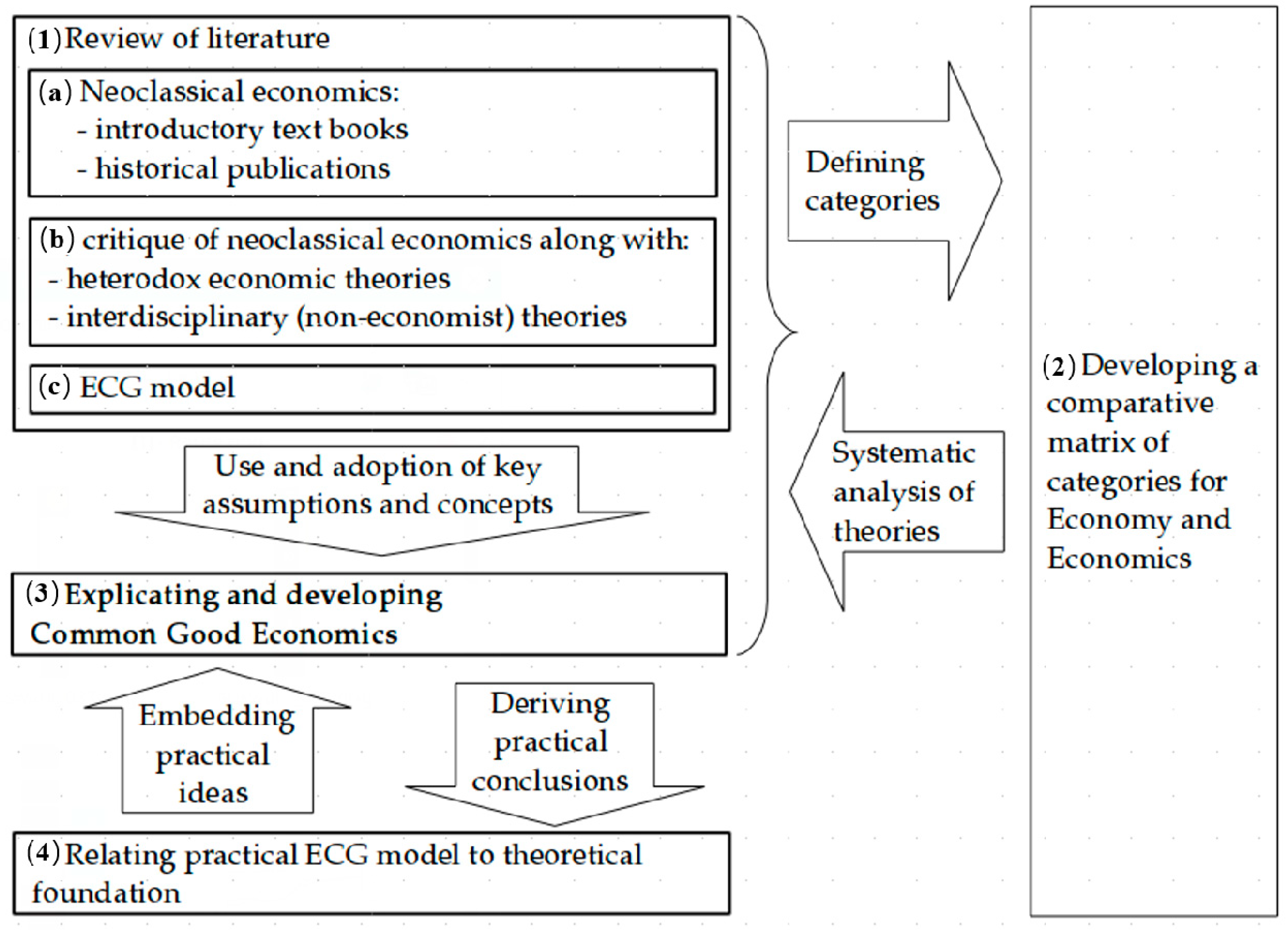

2. Materials and Methods

- (a)

- We used the most widely used introductory textbooks on economics to grasp the “paradigm” they are disseminating: Samuelson/Nordhaus, Mankiw/Taylor, Varian, Pindyck/Rubinfeld, and Van Suntum. For the sake of a historical understanding we also examined some of Walras’, Menger’s, and Jevon’s work, who are considered to be the founders of neoclassical economic theory.

- (b)

- We examined the literature which represents alternative, heterodox economic perspectives, and thereby a critique of neoclassical economics, with a focus on textbooks. The literature covers a wide range of theories and critiques. Amongst these are both entire economic paradigms, such as ecological economics [11], doughnut economics [12], or sustainable economics [13], as well as rather particular theoretical contributions, such as from Keen, Stiglitz, Ötsch, Göpel, and Komlos.We also read some “non-economists” who have contributed interdisciplinary insights, part of which are evidence-based, instead of assumption-based, e.g., Claus Dierksmeier and Michael Pirson (philosophy), Alfie Kohn (social psychology), Tim Kasser (psychology), Johan Rockström et al. (earth system science), Hans-Peter Dürr (physics), and Joachim Bauer (neurobiology).

- (c)

3. Results

3.1. Philosophy of Science

3.1.1. Scientific Genre

3.1.2. Epistemology

3.1.3. Methods

3.1.4. Inter- and Trans-Disciplinarity

3.2. Definition and Goals of the Economy and Economics

3.3. Basic Elements of the Economy

3.3.1. Concept of Needs

3.3.2. Conception of Man

3.3.3. Resources and Capital

3.3.4. Types of Goods and Property

3.3.5. Places of the Economy

3.4. Welfare and Market Economy

3.4.1. Concept and Measurement of Welfare/Common Good

- (a)

- only markets are considered as places of need satisfaction and resource management;

- (b)

- all market activities are evaluated ex-post as efficient need satisfaction;

- (c)

- only current value flows are relevant for welfare.

3.4.2. Markets and Welfare

3.4.3. External Effects

3.4.4. Complete Information

3.4.5. Power Asymmetries and Inequality

3.4.6. Role of Democratic Institutions

- (d)

- creator, designer, and limiter of markets and economic freedoms;

- (e)

- lawmaker and regulator: it determines the rules of the game;

- (f)

- provider or guarantor of public goods and services;

- (g)

- guarantor of social and public security.

3.4.7. Market Economy and Planetary Ecological Boundaries

4. Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- WBGU. Civilisational Progress within Planetary Guard Rails, A Contribution to the SDG Debate; Policy Paper 8; WBGU: Bowling Green, OH, USA, 2014. [Google Scholar]

- WFP. Risk of Hunger Pandemic as Coronavirus Set to Almost Double Acute Hunger by End of 2020. Available online: https://www.wfp.org/stories/risk-hunger-pandemic-coronavirus-set-almost-double-acute-hunger-end-2020 (accessed on 31 December 2020).

- Halbmeier, C.; Grabka, M.M. Vermögensungleichheit in Deutschland bleibt trotz deutlich steigender Nettovermögen anhaltend hoch. DIW Wochenbericht 2019, 40, 739. [Google Scholar]

- Felber, C. Gemeinwohl-Ökonomie; Piper: Munich, Germany, 2018; p. 95. [Google Scholar]

- Wilkinson, R.G. Sick Societies. Social Equilibrium and Health; The New Press: New York, NY, USA, 2005; p. 300. [Google Scholar]

- Kasser, T. The High. Price of Materialism; MIT Press: Cambridge, MA, USA, 2002. [Google Scholar]

- Lawson, T. What is this ’school’ called neoclassical economics? Camb. J. Econ. 2013, 37, 947–983. [Google Scholar] [CrossRef]

- Arnsberger, C.; Varoufakis, Y. What is Neoclassical Economics? The three axioms responsible for its theoretical oeuvre, practical irrelevance and, thus, discursive power. Panoeconomicus 2006, 1, 5–18. [Google Scholar] [CrossRef]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 24. [Google Scholar]

- Schneidewind, U.; Pfriem, R.; Barth, J.; Beschorner, T.; Binswanger, M.; Diefenbacher, H.; Eisenack, K.; Elsen, S.; Goldschmidt, N.; Graupe, S.; et al. Transformative Wirtschaftswissenschaft im Kontext nachhaltiger Entwicklung. Ökologisches Wirtschaften 2016, 31, 30–34. [Google Scholar] [CrossRef]

- Costanza, R.; Cumberland, J.H.; Daly, H.; Goodland, R.; Norgaard, R.B.; Kubiszewski, I.; Franco, C. An Introduction to Ecological Economics, 2nd ed.; CRC Press: Boca Raton, FL, USA; New York, NY, USA; London, UK, 2015. [Google Scholar]

- Raworth, K. Doughnut Economics. Seven Ways to Think Like a 21st-Century-Economist; Random House Business Books: London, UK, 2017. [Google Scholar]

- Rogall, H. Grundlagen einer Nachhaltigen Wirtschaftslehre, 2nd ed.; Metropolis: Marburg, Germany, 2015. [Google Scholar]

- Felber, C. Change Everything. Creating an Economy for the Common Good; Zed Books: London, UK, 2015; pp. 210–212. [Google Scholar]

- Economy for the Common Good. Available online: https://www.ecogood.org/ (accessed on 30 December 2020).

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 5th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2012; p. VIII. [Google Scholar]

- Walras, L. Elements of Pure Economics: Or, The Theory of Social Wealth; American Economic Association and Royal Economic Society: London, UK, 1954; p. 71. [Google Scholar]

- Allais, M. An Outline of my Main Contributions to Economic Science; Nobel Lecture: Stockholm, Sweden, 1988; p. 243. [Google Scholar]

- Friedman, M. The Methodology of Positive Economics. In Essays in Positive Economics; University of Chicago Press: Chicago, IL, USA, 1966; p. 4. [Google Scholar]

- Straubhaar, T. End the imperialism of economists. Financial Times Deutschland, 5 March 2012. [Google Scholar]

- Samuelson, P.A.; Nordhaus, W.D. Economics, 19th ed.; McGraw-Hill/Irwin: New York, NY, USA, 2010; p. xviii. [Google Scholar]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 3. [Google Scholar]

- Keen, S. Debunking Economics: The Naked Emperor Dethroned? Zed Books: London, UK; New York, NY, USA, 2011; p. 73. [Google Scholar]

- Schumpeter, J.A. History of Economic Analysis; University Press: New York, NY, USA, 1954; p. 41. [Google Scholar]

- Komlos, P. Ökonomisches Denken Nach dem Crash. Einführung in eine Realitätsbasierte Volkswirtschaftslehre; Houghton Mifflin Company: Boston, MA, USA; New York, NY, USA, 2015; p. 55. [Google Scholar]

- Davis, J.B. Keynes’s View of Economics as a Moral Science. In Keynes and Philosophy: Essays on the Origins of Keynes’s Thought; Baeteman, B.W., Davis, J.B., Eds.; Edward Elgar Publishing: Cheltenham, UK, 1991; p. 89. [Google Scholar]

- Kirchgässner, G. In: C. von Rechenberg: VWL in der Krise. What is the lesson? ZDF Info, 15 November 2011; p. 1. [Google Scholar]

- Stiglitz, J. Where Modern Macroeconomics Went Wrong; NBER Working Paper 23795; NBER: Cambridge, MA, USA, 2017; p. 21. [Google Scholar]

- Rockström, J.; Steffen, W.; Noone, K.; Persson, A.; Chapin, F.S., III; Lanbin, E.; Lenton, T.M.; Scheffer, M.; Folke, C.; Schellnhuber, H.J.; et al. Planetary Boundaries: Exploring the Safe Operating Space for Humanity. Nature 2009, 461, 472–475. [Google Scholar] [CrossRef] [PubMed]

- Felber, C. This is Not Economy. Aufruf zur Revolution der Wirtschaftswissenschaft; Deuticke: Vienna, Austria, 2019; pp. 42–44. [Google Scholar]

- Post-Autistic Economics Network. Available online: http://www.paecon.net/HistoryPAE.htm (accessed on 30 December 2020).

- Fourcade, M.; Ollion, E.; Algan, Y. The Superiority of Economics. J. Econ. Perspect. 2015, 29, 95. [Google Scholar] [CrossRef] [Green Version]

- Komlos, P. Ökonomisches Denken nach dem Crash. Einführung in eine realitätsbasierte Volkswirtschaftslehre; Houghton Mifflin Company: Boston, MA, USA; New York, NY, USA, 2015. [Google Scholar]

- Oswald, A.; Stern, N. Why are economists letting the world down on climate change? voxeu.org, 17 September 2019; p. 1. [Google Scholar]

- Felber, C. This is Not Economy. Aufruf zur Revolution der Wirtschaftswissenschaft; Deuticke: Vienna, Austria, 2019; pp. 255–268. [Google Scholar]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 2. [Google Scholar]

- Dierksmeier, D. Reframing Economic Ethics. The Philosophical Foundations of Humanistic Management; Palgrave Macmillan: Cham, Switzerland, 2016; p. 35. [Google Scholar]

- Stiglitz, J.; Sen, A.; Fitoussi, J.-P. Report by the Commission on the Measurement of Economic Performance and Social Progress; Commission on the Measurement of Economic Performance and Social Progress: Paris, France, 2009. [Google Scholar]

- Felber, C. This is Not Economy. Aufruf zur Revolution der Wirtschaftswissenschaft; Deuticke: Vienna, Austria, 2019; p. 258. [Google Scholar]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 127. [Google Scholar]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; pp. 231–233. [Google Scholar]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 137. [Google Scholar]

- Varian, H.R. Grundzüge der Mikroökonomik, 9th ed.; De Gruyter: Berlin, Germany; Boston, MA, USA, 2016; p. 36. [Google Scholar]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 130. [Google Scholar]

- Samuelson, P.A.; Nordhaus, W.D. Volkswirtschaftslehre. Das internationale Standardwerk der Makro- und Mikroökonomie, 3rd updated ed.; mi-Fachverlag: Landsberg am Lech, Germany, 2007; p. 21. [Google Scholar]

- Neef, M.M. Human Scale Development. Conception, Application and Further Reflections; The Appex Press: New York, NY, USA; London, UK, 1991; pp. 29–37. [Google Scholar]

- Gough, I. Climate Change and Sustainable Welfare: The Centrality of Human Needs. Camb. J. Econ. 2015, 39, 1191–1214. [Google Scholar] [CrossRef] [Green Version]

- Rauschmeyer, F.; Omann, I. Need as a Central Element of Sustainable Development. In Routledge Handbook of Ecol. Econ.; Spash, C.L., Ed.; Routledge: New York, NY, USA, 2017; pp. 246–255. [Google Scholar]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 128. [Google Scholar]

- Sen, A.K. Rational Fools: A Critique of the Behavioral Foundations of Economic Theory. Philos. Public Aff. 1977, 6, 336. [Google Scholar]

- Weber, M. Wirtschaft und Gesellschaft; Zweitausendeins: Frankfurt, Germany, 2005; p. 27. [Google Scholar]

- Faber, M.; Petersen, T.; Schiller, J. Homo Oeconomicus and Homo Politicus in Ecological Economics. Ecol. Econ. 2002, 40, 323–333. [Google Scholar] [CrossRef]

- Flieger, U. Homo communitas. Die fundamental-theoretische Evolution in der GWÖ. Zeitschrift für Wirtschafts- und Unternehmensethik 2019, 20, 427–442. [Google Scholar] [CrossRef]

- Bastien, C.; Cardoso, J.L. From homo economicus to homo corporativus: A neglected critique of neoclassical economics. J. Soc. Econ. 2007, 36, 118–127. [Google Scholar] [CrossRef]

- Siebenhüner, B. Homo Sustinens. Auf dem Weg zu einem Menschenbild der Nachhaltigkeit; Metropolis-Verlag: Marburg, Germany, 2001. [Google Scholar]

- Felber, C. This is Not Economy. Aufruf zur Revolution der Wirtschaftswissenschaft; Deuticke: Vienna, Austria, 2019; p. 115f. [Google Scholar]

- Raworth, K. Doughnut Economics. Seven Ways to Think Like a 21st-Century-Economist; Random House Business Books: London, UK, 2017; p. 100. [Google Scholar]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 176. [Google Scholar]

- Costanza, R.; Daly, L.; Fioramonti, L.; Giovannini, E.; Kubiszewski, I.; Mortensen, L.F.; Pickett, K.E.; Agnarsdottir, K.V.; De Vogli, R.; Wilkinson, R. Modelling and measuring sustainable wellbeing in connection with the UN Sustainable Development Goals. Ecol. Econ. 2016, 130, 350–355. [Google Scholar] [CrossRef]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 304. [Google Scholar]

- Helfrich, S.; Bollier, D. Frei, Fair und Lebendig. Die Macht der Commons; Transcript: Bielefeld, Germany, 2019. [Google Scholar]

- Goodwin, N.; Harris, J.; Nelson, J.A.; Roach, B.; Torras, M. Principles of Economics in Context; Routledge: London, UK; New York, NY, USA, 2014; p. 43. [Google Scholar]

- Dierksmeier, C.; Pirson, M. Oikonomia Versus Chrematistike, Learning from Aristotle About the Future Orientation of Business Management. J. Bus. Ethics 2009, 88, 417–430. [Google Scholar] [CrossRef]

- Ha Vinh, T. Der Glücksstandard: Wie wir Bhutans Bruttonationalglück praktisch umsetzen können; O. W. Barth Verlag: Munich, Germany, 2019. [Google Scholar]

- Mankiw, N.G. Grundzüge der Volkswirtschaftslehre, 3rd ed.; Schäffer-Poeschel: Stuttgart, Germany, 2004; p. 169. [Google Scholar]

- Fritsch, M. Marktversagen und Wirtschaftspolitik. Mikroökonomische Grundlagen staatliches Handelns; Vahlen: Munich, Germany, 2014; p. 82. [Google Scholar]

- Stern, N. The Economics of Climate Change. The Stern Review; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Trucost. Natural Capital at Risk. The top 100 Externalities of Business; Trucost: London, UK, 2013. [Google Scholar]

- Meynhardt, T.; Jasinenko, A.; Grubert, T. For a critique of the legitimacy of the Common Good Balance sheet. Die Gemeinwohl-Bilanz auf dem Prüfstand der Bevölkerung. Empirische Überprüfung der demokratischen Legitimation der Gemeinwohl-Bilanz. ZFWU 2019, 20, 406–426. [Google Scholar] [CrossRef]

- Friedman, F. Kapitalismus und Freiheit, 3rd ed.; Piper: Munich, Germany, 2006; p. 36. [Google Scholar]

- Felber, C. Neue Werte für die Wirtschaft. Eine Alternative zu Kommunismus und Kapitalismus; Deuticke: Vienna, Austria, 2008; p. 22. [Google Scholar]

- Fogel, R.W. Some Notes on the Scientific Methods of Simon Kuznets; Working Paper, No. 2461; National Bureau of Economic Research: Cambridge, MA, USA, 1987; pp. 26–27. [Google Scholar]

- Van Suntum, U. Die unsichtbare Hand. Ökonomisches Denken gestern und heute, 5th ed.; Springer Gabler: Wiesbaden, Germany, 2013; p. 256. [Google Scholar]

- Mankiw, N.G.; Taylor, M.P. Grundzüge der Volkswirtschaftslehre, 7th ed.; Schäffer-Poeschel: Stuttgart, Germany, 2018; p. 8. [Google Scholar]

- Graupe, S. Beeinflussung und Manipulation in der ökonomischen Bildung. Hintergründe und Beispiele; FGW-Studie Neues Ökonomisches Denken 05: Düsseldorf, Germany, 2017; pp. 54–55. [Google Scholar]

- Mazzucato, M. The Entrepreneurial State: Debunking Public vs. Private Sector Myths; Penguin: London, UK, 2018. [Google Scholar]

- Colander, D.; Holt, R.; Rosser, B. The Changing Face of Mainstream Economics. Rev. Politic. Econ. 2004, 16, 485–500. [Google Scholar] [CrossRef] [Green Version]

- Lowenberg, A.D. Neoclassical Economics as a Theory of Politics and Institutions. Cato J. 1990, 9, 619–639. [Google Scholar]

- Kahnemann, D. Thinking Fast and Slow; Penguin Books: London, UK, 2012. [Google Scholar]

- Sukhdev, P.; Wittmer, H.; Schröter-Schlaack, C.; Neßhöver, C.; Bishop, J.; Brink, P.T.; Gundimeda, H.; Kumar, P.; Simmons, B. The Economics of Ecosystems & Biodiversity. Mainstreaming the Economics of Nature. A Synthesis of the Approach, Conclusions and Recommendations of TEEB. Available online: http://teebweb.org/wp-content/uploads/Study%20and%20Reports/Reports/Synthesis%20report/TEEB%20Synthesis%20Report%202010.pdf (accessed on 29 January 2021).

- Peukert, H. Mikroökonomische Lehrbücher: Wissenschaft oder Ideologie? Metropolis: Marburg, Germany, 2018. [Google Scholar]

- Peukert, H. Makroökonomische Lehrbücher: Wissenschaft oder Ideologie? Metropolis: Marburg, Germany, 2018. [Google Scholar]

- Dürmeier, T.; Von Egan-Krieger, T.; Peukert, H. Die Scheuklappen der Wirtschaftswissenschaft. Postautistische Ökonomik für Eine Plurale Wirtschaftslehre; Metropolis: Marburg, Germany, 2006. [Google Scholar]

- Van Treek, T.; Urban, J. Wirtschaft neu Denken. Blinde Flecken der Lehrbuchökonomie; iRights.Media: Berlin, Germany, 2016. [Google Scholar]

- Daly, H.E.; Cobb, J.B. For the Common Good. Redirecting the Economy toward Community, the Environment, and a Sustainable Future, 2nd revised ed.; Beacon Press: Boston, MA, USA, 1994. [Google Scholar]

- Keen, S. Debunking Economics: The Naked Emperor Dethroned? Zed Books: London, UK; New York, NY, USA, 2011. [Google Scholar]

- Rogall, H. Grundlagen einer Nachhaltigen Volkswirtschaftslehre. Volkswirtschafts für Studierende des 21. Jahrhunderts, 2nd revised ed.; Metropolis: Marburg, Germany, 2015. [Google Scholar]

- Pfriem, R.; Schneidewind, U.; Barth, J.; Graupe, S.; Korbun, T. (Eds.) Transformative Wirtschaftswissenschaft im Kontext Nachhaltiger Entwicklung; Metropolis: Marburg, Germany, 2017. [Google Scholar]

- Ötsch, W.O. Mythos Markt. Mythos Neoklassik. Das Elend des Marktfundamentalismus; Metropolis: Marburg, Germany, 2018. [Google Scholar]

- Zamagni, S. Economia del Bene Commune; Città Nuova: Rome, Italy, 2007. [Google Scholar]

- Tirole, J. Economics for the Common Good; Princeton University Press: Princeton, NJ, USA, 2017. [Google Scholar]

- Brockhoff, D.; Engelhardt, G.; Yabroudi, H.; Karg, L.; Aschenbrenner, A.; Felber, C. Publizitätspflicht zur Nachhaltigkeit. Entwicklung eines Anforderungskatalogs für einen Universellen Standard (PuNa-Studie); IASS: Potsdam, Germany, 2020. [Google Scholar]

| Neoclassical Economics (Theoretical Foundation) | Critical Analysis (of Neoclassical Economics) | Common Good Economics (Theoretical Foundation) | Economy for the Common Good (Practical Model) |

|---|---|---|---|

| 1 Philosophy of Science | |||

| 1.1 Scientific Genre | |||

| 1.2 Epistemology | |||

| 1.3 Methods | |||

| 1.4 Interdisciplinarity | |||

| 2 Definition and Goal of Economy and Economics | |||

| 2.1 Definition and goal of the economy | |||

| 2.2 Definition and goal of economics | |||

| 3 Basic Elements of Economy | |||

| 3.1 Concept of Needs | |||

| 3.2 Conception of Man | |||

| 3.3 Resources | |||

| 3.4 Types of goods and property | |||

| 3.5 Places of the Economy | |||

| 4 Common Good and Market Economy | |||

| 4.1 Concept and Measurement | |||

| 4.2 Market Economy | |||

| 4.3 Complete Information | |||

| 4.4 External Effects | |||

| 4.5 Power and Inequality | |||

| 4.6 Democratic Institutions | |||

| 4.7 Planetary Boundaries | |||

| Neoclassical Economics Theoretical Foundation | Critical Analysis of Neoclassical Economics | Common Good Economics Theoretical foundation | ECG Practical Model | |

|---|---|---|---|---|

| 1 Philosophy of Science | ||||

| 1.1 Scientific Genre | “like“ a natural science, “truths“, “principles“, “laws“ | Cultural norms and free decisions ignored; use of misguiding metaphors | Social science: markets are cultural constructions → “market design“, game rules | Design and reformability of economic processes |

| 1.2 Epistemology | Pretension of objectivity | Lack of reflexivity, ignorance of pre-analytical vision, selective perception | Self-reflection, critical realism, pragmatism | basic issues of the common good democratically discussed |

| Positivist ideal of a value-free science | Implicit and thus non-transparent values and normativity | Reflection and transparency about values | Alignment of economic activities with basic values | |

| 1.3 Methods | Mathematical methods | Inappropriate for a social science, qualitative methods neglected | Plural methods (quantitative and qualitative) | Organic, participatory, discourse-oriented processes |

| Linear causalities, e.g., methodological individualism | Complex systems underestimated | Holistic analysis of complex systems with system theory | Definition of limits, negative feedback mechanisms | |

| 1.4 Inter-disciplinarity | Isolated discipline | Findings of other disciplines ignored | Inter- and trans-disciplinary approach, “universal science“ | Economy is not only something for economists |

| 2 Definition and Goal of Economy and Economics | ||||

| 2.1 Definition and goal of economy | Economy as production and trade activities related to markets | Reduced definition of economy, inconsistent with definition of economics | Economy as all conscious activities to satisfy (basic) human needs | Need satisfaction and the common good as fundamental reference to evaluate and coordinate economic activities |

| 2.2 Definition and goal of economics | Economics as the science of “efficient management of scarce resources” | No explicit reference point, need satisfaction and welfare only implicit goals behind decisions | Economics as a science of the efficient need satisfaction and the promotion of the common good | |

| 3 Basic Elements of Economy | ||||

| 3.1 Concept of Needs | Equalization of preferences and needs | Equalization can lead to target-missing inefficiency, reinforced by advertising | Basic needs are defined; preferences are culturally variable | Products serve needs, induced by the Common Good Balance Sheet |

| Unlimited needs | Falsified by happiness research; | Limited/saturable needs; unlimited strategies | Efficient welfare level; restrictions to advertising | |

| 3.2 Conceptionof Man | Homo economicus: purpose-rational = egoistic = capitalistic | Value-rational, affective and traditional behavior is ignored | multidimensionality of humans includes empathy, care, and responsibility | Value-based education promotes:

|

| Between axiom and hypothesis | Tautological axiom or implicitly normative hypothesis | Implicit normativity of concept of man is made explicit | Reflection of diverse concepts of man in economic education | |

| 3.3 Resources | Focus on labor, capital and land; high substitutability of resources | Functional hierarchies and tipping points are ignored | Includes natural, social, human, and built capital; complementary and limited resources | Framework and thresholds for balanced resource mix |

| 3.4 Types of goods and property | Focus on private goods, public goods a minor issue | Public and common goods, commons are underestimated | Variable and diverse forms of goods, with limits and conditions | Coexistence of private, public, and collective types of property; protection rights of nature |

| 3.5 Places of the economy | Markets as the only relevant place of need satisfaction | Other places like public goods, commons or households are downplayed | All places of need satisfaction are considered on an equal footing | All economic activities are included in the measurement of the common good |

| 4 Welfare and Market Economy | ||||

| 4.1 Concept and measurement | Deductive definition by economists | Selective definition without well-grounded legitimization | Procedural definition through democratic decision | Democratic conventions to identify components |

| Monetary measurement with GDP; endless growth as goal | Non-monetary aspects are ignored→ e.g., ecological boundaries are overlooked | Multidimensional consideration; trade-offs resolved through threshold values | Common good product as a multidimensional compass | |

| 4.2 Market economy | Market failure is exception, efficient equilibria are the norm | Market failure occurs regularly, but no method to capture it systematically | Market failure is derived from/captured by common good product and prevented by market design | Complete information and cost internalization; small power asymmetries |

| 4.3 Complete information | Focus on price–performance-ratio of final product | Non-market information remains unconsidered | Complete information of all ethical side-effects of production | Common good balance sheet provides full transparency |

| 4.4 External Effects | External effects as exceptions | Unsystematic, incomplete identification | Systematic derivation and identification of external effects | Complete internalization with common good balance Sheet and incentives |

| 4.5 Power and inequality | Complete competition = rule; excessive power = exception | Power asymmetries and positive feedback mechanisms underestimated | Market design, with negative feedback mechanisms, prevents power concentration | Progressive taxes, size limits for companies, fusion control |

| 4.6 Democratic institutions | Free market as ideal; state action = inefficient as a rule | “Free market“ is undefined myth; institutional prerequisites ignored | State institutions are legal infrastructure and thus inseparable elements of markets | Growing set of regulatory bodies including strong global governance |

| 4.7 Planetary boundaries | Not part of theory; partly regarded as non-economic issues | Dissociation turns “autistic” economics into a danger for humanity | Part of the definition of economy and thus inherent limits of economic activities | Ecological human rights: personal, equal environmental accounts |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dolderer, J.; Felber, C.; Teitscheid, P. From Neoclassical Economics to Common Good Economics. Sustainability 2021, 13, 2093. https://doi.org/10.3390/su13042093

Dolderer J, Felber C, Teitscheid P. From Neoclassical Economics to Common Good Economics. Sustainability. 2021; 13(4):2093. https://doi.org/10.3390/su13042093

Chicago/Turabian StyleDolderer, Johannes, Christian Felber, and Petra Teitscheid. 2021. "From Neoclassical Economics to Common Good Economics" Sustainability 13, no. 4: 2093. https://doi.org/10.3390/su13042093