Trade Openness and CO2 Emissions: The Heterogeneous and Mediating Effects for the Belt and Road Countries

Abstract

1. Introduction

2. Literature Review

2.1. Literature on the Association between Trade Openness and CO2 Emissions

2.2. Literature on Other Factors Influencing CO2 Emissions

2.3. Literature Gap

3. Methodology and Data

3.1. Hypotheses

3.2. Econometric Model

3.3. Data Description

4. Empirical Analyses

4.1. Empirical Results

4.2. The Test of Endogeneity

4.3. Robustness Check

5. Further Discussion on the Mediating Effect Between Trade Openness and CO2 Emissions

6. Conclusions and Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Dong, K.Y.; Dong, X.C.; Ren, X.H. Can expanding natural gas infrastructure mitigate CO2 emissions? Analysis of heterogeneous and mediation effects for China. Energy Econ. 2020, 90, 104830. [Google Scholar] [CrossRef]

- Ma, M.D.; Ma, X.; Cai, W.G.; Cai, W. Carbon-dioxide mitigation in the residential building sector: A household scale-based assessment. Energy Conv. Manag. 2019, 198, 111915. [Google Scholar] [CrossRef]

- Zoundi, Z. CO2 emissions, renewable energy and the Environmental Kuznets Curve, a panel cointegration approach. Renew. Sustain. Energy Rev. 2016, 72, 1067–1075. [Google Scholar] [CrossRef]

- Zhao, J.; Jiang, Q.Z.; Dong, X.C.; Dong, K.Y. Would environmental regulation improve the greenhouse gas benefits of natural gas use? A Chinese case study. Energy Econ. 2020, 87, 104712. [Google Scholar] [CrossRef]

- Gabriela, M.V.; Bernand, P.M.; Becerril-Torres, O.U. Inversión en infraestructura del transporte: Base para la implementación de la iniciativa de la franja y la ruta. México y la Cuenca del Pacífico 2020, 9, 21–39. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Kumar, R.R.; Zakaria, M.; Hurr, M. Carbon emission, energy consumption, trade openness and financial development in Pakistan: A revisit. Renew. Sustain. Energy Rev. 2017, 70, 185–192. [Google Scholar] [CrossRef]

- Oktavilia, S.; Firmansyah, F. The relationships of environmental degradation and trade openness in Indonesia. Int. J. Econ. Financ. Issues 2016, 6, 125–129. Available online: https://www.researchgate.net/publication/309264417_The_Relationships_of_Environmental_Degradation_and_Trade_Openness_in_Indonesia (accessed on 14 January 2021).

- Al-Mulali, U.; Sheau-Ting, L. Econometric analysis of trade, exports, imports, energy consumption and CO2 emission in six regions. Renew. Sustain. Energy Rev. 2014, 33, 484–498. [Google Scholar] [CrossRef]

- Mohsen, M.; Rezaei, A.A.; Panait, I. A panel estimation of the relationship between trade liberalization, economic growth and CO2 emissions in BRICS countries. Hyperion Econ. J. 2014, 1, 3–27. Available online: https://www.ingentaconnect.com/content/doaj/23437995/2013/00000001/00000004/art00001 (accessed on 14 January 2021).

- Cui, J.; Lapan, H.; Moschini, G.C. Productivity, export, and environmental performance: Air pollutants in the United States. Am. J. Agr. Econ. 2015, 98, 66. [Google Scholar] [CrossRef]

- Forslid, R.; Okubo, T.; Ulltveit-Moe, K.H. Why are firms that export cleaner? International trade, abatement and environmental emissions. Res. Pap. Econ. 2015, 1–49. Available online: http://www2.ne.su.se/paper/wp15_02.pdf (accessed on 14 January 2021). [CrossRef]

- Pazienza, P. The environmental impact of the FDI inflow in the transport sector of OECD countries and policy implications. Int. Adv. Econ. Res. 2015, 1, 105–116. [Google Scholar] [CrossRef]

- Rafindadi, A.A. Does the need for economic growth influence energy consumption and CO2 emissions in Nigeria? Evidence from the innovation accounting test. Renew. Sustain. Energy Rev. 2016, 62, 1209–1225. [Google Scholar] [CrossRef]

- Appiahkonadu, P. The effect of trade liberalization on the environment: A case study of Ghana. Univ. Ghana 2013, 1–107. Available online: http://hdl.handle.net/123456789/5402 (accessed on 14 January 2021).

- Baek, J.; Kim, H.S. Trade liberalization, economic growth, energy consumption and the environment: Time series evidence from G-20 Economies. East Asian Econ. Rev. 2011, 1, 3–32. [Google Scholar] [CrossRef]

- Ferraz, C.; Young, C.E. Trade liberalization and industrial pollution in Brazil. Proc. Am. Soc. Inf. Sci. Technol. 1999, 40, 71–77. [Google Scholar] [CrossRef]

- Sefeedpari, P.; Ghahderijani, M.; Pishgar-Komleh, S.H. Assessment the effect of wheat farm sizes on energy consumption and CO2 emission. J. Renew. Sustain. Energy 2013, 5, 604–608. [Google Scholar] [CrossRef]

- Sajjad, S.H.; Blond, N.; Clappier, A.; Raza, A.; Shirazi, S.A.; Shakrullah, K. The preliminary study of urbanization, fossil fuels consumptions and CO2 emission in Karachi. Afr. J. Biotechnol. 2010, 13, 1941–1948. [Google Scholar] [CrossRef]

- Sohail, A.; Baiocchi, G.; Creutzig, F. CO2 emissions from direct energy use of urban households in India. Environ. Sci. Technol. 2015, 49, 11312–11320. [Google Scholar] [CrossRef]

- Owusu, E.L. The relationship between energy consumption, CO2 emission, population growth and economic growth: An empirical multivariate causal linkage from Ethiopia. Econ. Policy. Energy. Environ. 2018, 1, 225–239. Available online: https://ideas.repec.org/a/fan/efeefe/vhtml10.3280-efe2018-001010.html (accessed on 14 January 2021).

- Begum, R.A.; Sohag, K.; Abdullah, S.M.S.; Jaafar, M. CO2 emissions, energy consumption, economic and population growth in Malaysia. Renew. Sustain. Energy Rev. 2015, 41, 594–601. [Google Scholar] [CrossRef]

- Tian, J.; Yang, H.; Xiang, P.; Liu, D.; Li, L. Drivers of agricultural carbon emissions in Hunan Province, China. Environ. Earth Sci. 2016, 75, 121.1–121.17. [Google Scholar] [CrossRef]

- Xu, B.; Lin, B. Investigating drivers of CO2 emission in China’s heavy industry: A quantile regression analysis. Energy 2020, 206, 118159. [Google Scholar] [CrossRef]

- Yang, Z.; Liu, Y.S.; Wu, W.X.; Li, Y.R. Effects of rural-urban development transformation on energy consumption and CO2 emissions: A regional analysis in China. Renew. Sustain. Energy Rev. 2015, 52, 863–875. [Google Scholar] [CrossRef]

- Wang, Z.; Yin, F.; Zhang, Y.; Xian, Z. An empirical research on the influencing factors of regional CO2 emissions: Evidence from Beijing city, China. Appl. Energy 2012, 100, 277–284. [Google Scholar] [CrossRef]

- Lisa, R.; Madhav, P. Scenarios for future urbanization: Carbon dioxide emissions from passenger travel in three Indian cities. Transp. Res. Rec. 2018, 2193, 124–131. [Google Scholar] [CrossRef]

- Khan, A.; Chenggang, Y.; Hussain, J.; Bano, S.; Nawaz, A. Natural resources, tourism development, and energy-growth-CO2 emission nexus: A simultaneity modeling analysis of BRI countries. Resour. Policy 2020, 68, 101751. [Google Scholar] [CrossRef]

- Auci, S.; Trovato, G. The environmental Kuznets curve within European countries and sectors: Greenhouse emission, production function and technology. Econ. Politica 2018, 35, 895–915. [Google Scholar] [CrossRef]

- Yi, S.; Jian-Bai, H.; Chao, F. Decomposition of energy-related CO2 emissions in China’s iron and steel industry: A comprehensive decomposition framework. Resour. Policy 2018, 59, 103–116. [Google Scholar] [CrossRef]

- Xu, G.; Schwarz, P.; Yang, H. Adjusting energy consumption structure to achieve China’s CO2 emissions peak. Renew. Sustain. Energy Rev. 2020, 122, 109737. [Google Scholar] [CrossRef]

- Tajudeen, I.A.; Wossink, A.; Banerjee, P. How significant is energy efficiency to mitigate CO2 emissions? Evidence from OECD countries. Energy Econ. 2018, 72, 200–221. [Google Scholar] [CrossRef]

- Li, T.; Balezentis, T.; Makuteniene, D.; Streimikience, D.; Irena, K. Energy-related CO2 emission in European Union agriculture: Driving forces and possibilities for reduction. Appl. Energy 2016, 180, 682–694. [Google Scholar] [CrossRef]

- Li, H.; Mu, H.; Ming, Z.; Gui, S. Analysis of regional difference on impact factors of China’s energy-related CO2 emissions. Energy 2012, 39, 319–326. [Google Scholar] [CrossRef]

- Chen, J.; Wang, P.; Cui, L.; Huang, S.; Song, M. Decomposition and decoupling analysis of CO2 emissions in OECD. Appl. Energy 2018, 231, 937–950. [Google Scholar] [CrossRef]

- Zhang, M.; Mu, H.; Ning, Y.; Song, Y. Decomposition of energy-related CO2 emission over 1991–2006 in China. Ecol. Econ. 2009, 68, 2122–2128. [Google Scholar] [CrossRef]

- Branstetter, L. Is foreign direct investment a channel of knowledge spillovers? Evidence from Japan’s FDI in the United States. J. Int. Econ. 2006, 68, 325–344. [Google Scholar] [CrossRef]

- Herzer, D. Outward FDI and economic growth. J. Econ. Stud. 2010, 35, 476–494. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.S. Trade, growth, and the environment. J. Econ. Lit. 2004, 42, 7–71. [Google Scholar] [CrossRef]

- Fisher-Vanden, K.; Jefferson, G.H.; Jingkui, M.; Ma, J.; Xu, J. Technology development and energy productivity in China. Energy Econ. 2006, 28, 690–705. [Google Scholar] [CrossRef]

- Huebler, M.; Keller, A. Energy savings via FDI? Empirical evidence from developing countries. Environ. Dev. Econ. 2010, 15, 59–80. [Google Scholar] [CrossRef]

- Copeland, B.R.; Taylor, M.S. The trade-induced degradation hypothesis. Resour. Energy Econ. 1997, 19, 321–344. Available online: https://www.ixueshu.com/document/e07dee1f468034da318947a18e7f9386.html (accessed on 14 January 2021). [CrossRef]

- Wing, I.S.; Richard, S.E. The implications of the historical decline in US energy intensity for long-run CO2 emission projections. Energy Policy 2007, 35, 5267–5286. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Nguyen, D.K.; Sousa, R.M. Energy prices and CO2 emission allowance prices: A quantile regression approach. Energy Policy 2014, 70, 201–206. [Google Scholar] [CrossRef]

- Guan, D.; Hubacek, K.; Weber, C.L.; Peters, G.P.; Reiner, D.M. The drivers of Chinese CO2 emissions from 1980–2030. Glob. Environ. Chang. 2008, 18, 626–634. [Google Scholar] [CrossRef]

- Yang, Y.; Cai, W.; Wang, C. Industrial CO2 intensity, indigenous innovation and R & D spillovers in China’s provinces. Appl. Energy 2014, 131, 117–127. [Google Scholar] [CrossRef]

- Wintoki, M.B.; Linck, J.S.; Netter, J.M. Endogeneity and the dynamics of internal corporate governance. J. Financ. Econ. 2012, 105, 581–606. [Google Scholar] [CrossRef]

- Bellemare, M.F.; Masaki, T.; Pepinsky, T.B. Lagged explanatory variables and the estimation of causal effect. J. Politics 2017, 79, 949–963. [Google Scholar] [CrossRef]

- Sobel, M.E. Asymptotic Confidence Intervals for Indirect Effects in Structural Equation Models; Leinhardt, S., Ed.; Sociological Methodology; American Sociological Association: Washington, DC, USA, 1982; pp. 290–312. [Google Scholar]

- Preacher, K.J.; Hayes, A.F. Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. Methods 2008, 40, 879–891. [Google Scholar] [CrossRef]

| Types | Code | Meaning | Measurement |

|---|---|---|---|

| Independent variable | trapen | Trade openness | The total sum of import and export for goods (% of GDP) |

| Dependent variable | co2em | CO2 emissions | Per capita CO2 emissions |

| fasat | Financial development level | Domestic private sector credit (% of GDP) | |

| eguse | Fossil fuel energy consumption | (%) | |

| spurb | Urbanization level | Urban population (%) | |

| dinv | Net foreign direct investment inflows | (% of GDP) | |

| Control variables | negdi | Total fixed capital formation | (% of GDP) |

| enpop | Density of population | Population (per kilometer of land area) | |

| necon | Household final consumption expenditure | (Annual growth rate) | |

| sppop | The number of R&D researchers | ||

| nycoal | Coal rents | (% of GDP) |

| Country | Country | Country | Country |

|---|---|---|---|

| Afghanistan | Estonia | Malaysia | Saudi Arabia |

| Albania | Georgia | Maldives | Serbia |

| Armenia | Greece | Mali | Singapore |

| Azerbaijan | Hungary | Mongolia | Slovakia |

| Bahrain | India | Montenegro | Slovenia |

| Bangladesh | Indonesia | Morocco | Sri Lanka |

| Belarus | Iran | Myanmar | The Syrian Arab Republic |

| Bhutan | Iraq | Negara Brunei Darussalam | Tajikistan |

| Bosnia and Herzegovina | Israel | Nepal | Thailand |

| Bulgaria | Jordan | North Macedonia | Turkey |

| Cambodia | Kazakhstan | Oman | Turkmenistan |

| China | Kuwait | Pakistan | Ukraine |

| Croatia | Kyrgyz | Philippines | United Arab Emirates |

| Cyprus | Lao | Poland | Uzbekistan |

| Czech Republic | Latvia | Qatar | Vietnam |

| Egypt | Lithuania | Romania | Yemen |

| Variables | Obs | Mean | Std. Dev. | Min | Max | Unit |

|---|---|---|---|---|---|---|

| trapen | 1216 | 91.3369 | 55.1202 | 0.1674 | 437.3267 | % |

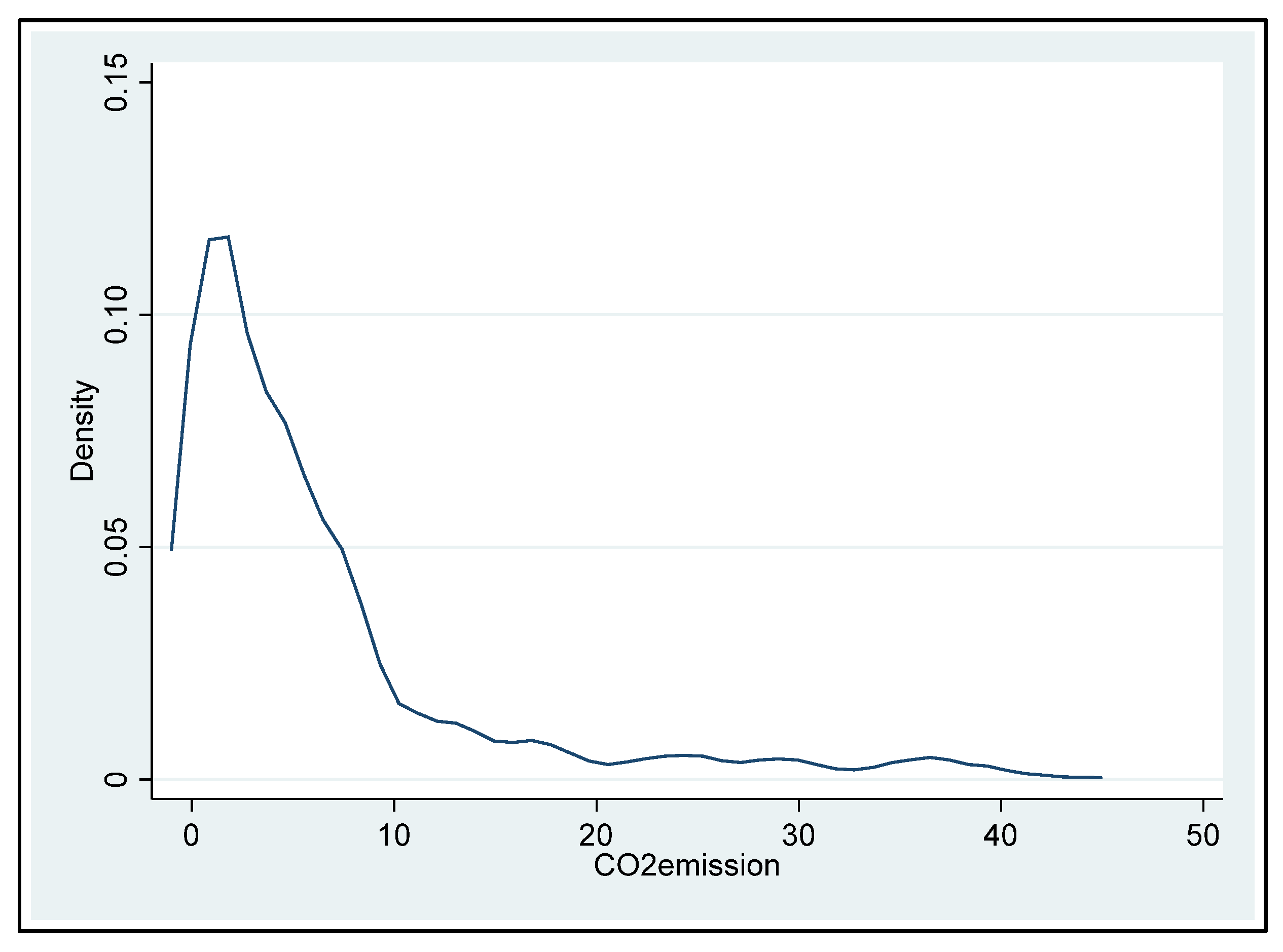

| co2em | 1216 | 6.4852 | 8.3338 | 0.0371 | 43.9083 | Metric tons Per capita |

| fasat | 1216 | 41.3341 | 39.3178 | 0.1862 | 255.3103 | % |

| eguse | 1216 | 0.5024 | 0.4120 | 0.0000 | 100 | % |

| spurb | 1216 | 0.5656 | 0.2080 | 0.1395 | 100 | % |

| dinv | 1216 | 5.5515 | 15.9683 | −40.4143 | 280.1318 | % |

| negdi | 1216 | 22.8356 | 9.4226 | 5.3606 | 69.6728 | % |

| enpop | 1216 | 251.4360 | 878.2109 | 1.5574 | 7952.9980 | People |

| necon | 1216 | 5.8502 | 4.2826 | 3.7364 | 72.8556 | % |

| sppop | 1216 | 631.3633 | 1107.7210 | 12.1546 | 7006.6300 | Per million people |

| nycoal | 1216 | 2.963 | 1.2356 | 0.0000 | 25.3274 | % |

| Variables | LLC Test | HT Test | Breitung Test | IPS Test | Fisher Test |

|---|---|---|---|---|---|

| trapen | −0.9814 | −3.9428 *** | 2.7015 | −4.2101 *** | 327.1814 *** |

| D.trapen | −78.8388 *** | −20.4134 *** | −5.3375 *** | −15.8255 *** | 489.4965 *** |

| co2em | −1.5205 ** | −0.6811 | −0.1646 | −3.4100 *** | 557.8632 *** |

| D.co2em | −15.4362 *** | −18.6695 *** | −15.4613 *** | −16.4455 *** | 987.1120 *** |

| sppop | 2.5394 | −8.6838 *** | 21.1815 | 13.4773 | 298.3623 *** |

| D.sppop | −19.4739 *** | −34.8949 *** | 18.7267 | 3.7596 | 254.6861 *** |

| spurb | −6.7269 *** | 9.8447 | 18.4546 | 10.7576 | 380.5033 *** |

| D.spurb | −27.2065 *** | 11.1360 | 1.1457 | −3.4913 *** | 288.1503 *** |

| negdi | −5.0643 *** | 1.8225 | 3.4967 | −1.7457 ** | 352.3466 *** |

| D.negdi | −16.5912 *** | −16.0497 *** | −10.1359 *** | −13.5483 *** | 459.6010 *** |

| eguse | −6.7008 *** | −18.1889 *** | −8.5717 *** | −10.6971 *** | 313.7531 ** |

| D.eguse | −24.1172 *** | −35.2930 *** | −21.8667 *** | −20.1537 *** | 597.5104 *** |

| necon | −14.1506 *** | −26.3955 *** | −12.3223 *** | −14.0119 *** | 414.0875 *** |

| D.necon | −53.3830 *** | −40.8711 *** | −18.5433 *** | −20.3546 *** | 617.9352 *** |

| nycoal | −5.4424 *** | −2.4780 *** | −6.7129 *** | −8.1634 *** | 282.4633 *** |

| D.nycoal | −10.6393 *** | −25.9495 *** | −16.8364 *** | −19.8844 *** | 541.2529 *** |

| enpop | 45.3962 | 103.5968 | 29.0601 | 19.1853 | 351.5903 *** |

| D.enpop | 127.1427 | −32.9342 *** | 28.4541 | 16.4986 | 90.0907 |

| fsast | −3.1991 *** | 4.4457 | 6.1520 | 1.4908 | 350.2999 *** |

| D.fsast | −20.8155 *** | −18.9724 *** | −9.6367 *** | −13.5020 *** | 421.5271 *** |

| dinv | −13.7742 *** | −10.7110 *** | −9.0316 *** | −11.0296 *** | 353.1475 *** |

| D.dinv | −29.7284 *** | −38.0679 *** | −14.1801 *** | −20.5195 *** | 477.6492 *** |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Variables | co2em | co2em | co2em | co2em | co2em |

| Quantiles | 10th | 25th | 50th | 75th | 90th |

| trapen | 0.0422 | 0.0395 * | 0.0338 *** | 0.0306 *** | 0.0282 ** |

| (0.0271) | (0.0207) | (0.0085) | (0.0074) | (0.0112) | |

| sppop | 0.0015 *** | 0.0002 | 0.0001 | 0.0001 | 0.0001 |

| (0.0006) | (0.0004) | (0.0002) | (0.0002) | (0.0002) | |

| spurb | 0.0569 | 0.0549 | 0.0505 | 0.0481 | 0.0463 |

| (0.1116) | (0.0855) | (0.0352) | (0.0304) | (0.0461) | |

| negdi | 0.0031 | 0.0033 | 0.0037 | 0.0039 | 0.0041 |

| (0.0616) | (0.0472) | (0.0194) | (0.0168) | (0.0255) | |

| eguse | 0.0000 | 0.0031 | 0.0097 ** | 0.0134 *** | 0.0162 *** |

| (0.0120) | (0.0092) | (0.0038) | (0.0033) | (0.0050) | |

| necon | −0.0010 | 0.0023 | 0.0095 | 0.0135 | 0.0166 |

| (0.0687) | (0.0527) | (0.0217) | (0.0187) | (0.0284) | |

| nycoal | 0.1623 | 0.0921 | −0.0618 | −0.1467 | −0.2111 |

| (0.3656) | (0.2802) | (0.1163) | (0.0996) | (0.1515) | |

| enpop | 0.0182 *** | 0.0130 *** | 0.0002 | −0.0004 | −0.0009 |

| (0.0056) | (0.0043) | (0.0018) | (0.0015) | (0.0023) | |

| fsast | 0.0152 | 0.1336 *** | 0.0094 * | 0.0071 | 0.0055 |

| (0.0170) | (0.0130) | (0.0054) | (0.0046) | (0.0070) | |

| dinv | 0.0008 | 0.0015 | 0.0032 | 0.0041 | 0.0048 |

| (0.0110) | (0.0084) | (0.0035) | (0.0030) | (0.0045) | |

| Observations | 1216 | 1216 | 1216 | 1216 | 1216 |

| (6) | (7) | (8) | (9) | (10) | (11) | |

|---|---|---|---|---|---|---|

| Variables | co2em | co2em | co2em | co2em | co2em | co2em |

| Quantiles | --- | 10th | 25th | 50th | 75th | 90th |

| L.co2em | 0.9873 *** | |||||

| (0.0072) | ||||||

| trapen | 0.0018 *** | 0.0469 *** | 0.0439 *** | 0.0373 *** | 0.0338 *** | 0.0314 *** |

| (0.0006) | (0.0140) | (0.0107) | (0.0062) | (0.0074) | (0.0094) | |

| sppop | 0.0001*** | 0.0001 | 0.0001 | 0.0001 | 0.0000 | 0.0000 |

| (0.0000) | (0.0003) | (0.0002) | (0.0001) | (0.0001) | (0.0002) | |

| spurb | −0.0254 *** | 0.0470 | 0.0458 | 0.0432 * | 0.0419 | 0.0409 |

| (0.0046) | (0.0533) | (0.0406) | (0.0234) | (0.0282) | (0.0357) | |

| negdi | 0.0036 ** | −0.0012 | −0.0003 | 0.0018 | 0.0028 | 0.0035 |

| (0.0017) | (0.0287) | (0.0218) | (0.0126) | (0.0152) | (0.0192) | |

| eguse | 0.0014 ** | 0.0011 | 0.0038 | 0.0095 *** | 0.0126 *** | 0.0146 *** |

| (0.0007) | (0.0054) | (0.0041) | (0.0024) | (0.0029) | (0.0036) | |

| necon | −0.0012 | −0.0047 | −0.0010 | 0.0072 | 0.0115 | 0.0144 |

| (0.0049) | (0.0308) | (0.0234) | (0.0135) | (0.0163) | (0.0206) | |

| nycoal | −0.0001 *** | 0.1523 | 0.0800 | −0.0767 | −0.1596 | −0.2147 * |

| (0.0000) | (0.1880) | (0.1433) | (0.0840) | (0.0994) | (0.1264) | |

| enpop | 0.0026 ** | 0.01398 *** | 0.0097 *** | 0.0001 | −0.0004 | −0.0007 |

| (0.0012) | (0.0024) | (0.0018) | (0.0010) | (0.0012) | (0.0016) | |

| fsast | −0.0025 ** | 0.0156 ** | 0.0134 ** | 0.0085 ** | 0.0060 | 0.0043 |

| (0.0012) | (0.0078) | (0.0059) | (0.0034) | (0.0041) | (0.0052) | |

| dinv | 0.6792 *** | −0.0001 | 0.0009 | 0.0032 | 0.0045 | 0.0053 |

| (0.1488) | (0.0053) | (0.0040) | (0.0023) | (0.0028) | (0.0036) | |

| Constant | 0.9873 *** | |||||

| (0.0072) | ||||||

| Observations | 1152 | 1152 | 1152 | 1152 | 1152 | 1152 |

| Wald’s statistic | 748,582.6300 | |||||

| Number of countries | 64 |

| (12) | (13) | (14) | (15) | (16) | (17) | |

|---|---|---|---|---|---|---|

| Variables | co2em | co2em | co2em | co2em | co2em | co2em |

| Quantiles | --- | 10th | 25th | 50th | 75th | 90th |

| trapen2 | 0.0351 *** | 0.0415 *** | 0.0355 *** | 0.0276 *** | 0.0205 ** | 0.0164 |

| (0.0032) | (0.0105) | (0.0073) | (0.0059) | (0.0084) | (0.0108) | |

| sppop | 0.0001 | 0.0000 | 0.0000 | 0.0000 | 0.0001 | 0.0001 |

| (0.0001) | (0.0003) | (0.0002) | (0.0002) | (0.0002) | (0.0003) | |

| spurb | 0.0515 ** | 0.0144 | 0.0068 | −0.0031 | −0.0120 | −0.0172 |

| (0.0252) | (0.0670) | (0.0463) | (0.0371) | (0.0538) | (0.0691) | |

| negdi | 0.0036 | 0.0560 | 0.0589 * | 0.0626 ** | 0.0660 * | 0.0680 |

| (0.0093) | (0.0487) | (0.0336) | (0.0270) | (0.0391) | (0.0502) | |

| eguse | −0.0082 *** | −0.0121 * | −0.0145 *** | −0.0177 *** | −0.0205 *** | −0.0221 *** |

| (0.0018) | (0.0069) | (0.0048) | (0.0038) | (0.0056) | (0.0071) | |

| necon | 0.0079 | −0.0064 | −0.0041 | −0.0010 | 0.0018 | 0.0034 |

| (0.0136) | (0.0414) | (0.0286) | (0.0229) | (0.0333) | (0.0427) | |

| nycoal | −0.0262 | −0.2026 | −0.2336 * | −0.2742 *** | −0.3103 ** | −0.3317 * |

| (0.0636) | (0.1905) | (0.1316) | (0.1055) | (0.1529) | (0.1964) | |

| enpop | 0.0004 * | 0.0021 | 0.0014 | 0.0004 | −0.0005 | −0.0010 |

| (0.0002) | (0.0033) | (0.0023) | (0.0018) | (0.0027) | (0.0034) | |

| fsast | 0.0103 *** | −0.0059 | −0.0034 | 0.0000 | 0.0030 | 0.0048 |

| (0.0029) | (0.0094) | (0.0065) | (0.0052) | (0.0076) | (0.0097) | |

| dinv | 0.0028 | 0.0028 | 0.0031 | 0.0035 | 0.0039 | 0.0041 |

| (0.0045) | (0.0064) | (0.0044) | (0.0035) | (0.0051) | (0.0066) | |

| Constant | 0.0351 *** | |||||

| (0.0032) | ||||||

| Observations | 1216 | 972 | 972 | 972 | 972 | 972 |

| F-statistics | 43.37 | |||||

| R-square | 0.4270 | |||||

| Number of countries | 64 |

| (13) | (14) | (15) | (16) | (17) | |

|---|---|---|---|---|---|

| Variables | co2em | co2em | co2em | co2em | co2em |

| Quantiles | 10th | 25th | 50th | 75th | 90th |

| trapen | 0.0506 *** | 0.0494 *** | 0.0471 *** | 0.0457 *** | 0.0446 *** |

| (0.0143) | (0.0108) | (0.0075) | (0.0096) | (0.0126) | |

| sppop | 0.0001 | 0.0000 | 0.0000 | 0.0000 | 0.0000 |

| (0.0002) | (0.0002) | (0.0001) | (0.0002) | (0.0002) | |

| spurb | 0.0451 | 0.0487 | 0.0556 * | 0.0600 | 0.0633 |

| (0.0550) | (0.0413) | (0.0288) | (0.0371) | (0.0484) | |

| negdi | 0.0026 | 0.0064 | 0.0137 | 0.0185 | 0.0220 |

| (0.0407) | (0.0307) | (0.0213) | (0.0275) | (0.0359) | |

| eguse | −0.0005 | −0.0033 | −0.0085 ** | −0.0119 *** | −0.0144 *** |

| (0.0062) | (0.0047) | (0.0033) | (0.0042) | (0.0055) | |

| necon | −0.0326 | −0.0241 | −0.0082 | 0.0022 | 0.0098 |

| (0.0557) | (0.0419) | (0.0292) | (0.0375) | (0.0490) | |

| nycoal | 0.2890 | 0.2622 | 0.2115 | 0.1785 | 0.1542 |

| (0.2457) | (0.1849) | (0.1286) | (0.1657) | (0.2164) | |

| enpop | 0.0018 | 0.0013 | 0.0003 | −0.0003 | −0.0008 |

| (0.0019) | (0.0014) | (0.0010) | (0.0013) | (0.0017) | |

| fsast | 0.0229 ** | 0.0192 *** | 0.0122 ** | 0.0076 | 0.0042 |

| (0.0090) | (0.0068) | (0.0048) | (0.0061) | (0.0079) | |

| dinv | 0.0306 | 0.0271 * | 0.0203 * | 0.0159 | 0.0127 |

| (0.0206) | (0.0155) | (0.0108) | (0.0139) | (0.0181) | |

| Observations | 741 | 741 | 741 | 741 | 741 |

| (18) | (19) | (20) | (21) | (22) | |

|---|---|---|---|---|---|

| Variables | co2em | co2em | co2em | co2em | co2em |

| Quantiles | 10th | 25th | 50th | 75th | 90th |

| trapen | 0.0089 | 0.0082 ** | 0.0069 *** | 0.0060 ** | 0.0053 |

| (0.0056) | (0.0042) | (0.0024) | (0.0030) | (0.0041) | |

| sppop | 0.0005 | 0.0004 | 0.0003 | 0.0002 | 0.0001 |

| (0.0004) | (0.0003) | (0.0002) | (0.0002) | (0.0003) | |

| spurb | 0.0485 | 0.0560 | 0.0693 ** | 0.0788 ** | 0.0854 * |

| (0.0642) | (0.0475) | (0.0279) | (0.0341) | (0.0464) | |

| negdi | −0.0180 | −0.0178 | −0.0175 * | −0.0173 | −0.0172 |

| (0.0211) | (0.0156) | (0.0091) | (0.0112) | (0.0152) | |

| eguse | −0.0048 | −0.0066 | −0.0099 *** | −0.0123 *** | −0.0139 *** |

| (0.0056) | (0.0042) | (0.0025) | (0.0030) | (0.0041) | |

| necon | −0.0058 | −0.0005 | 0.0090 | 0.0157 | 0.0205 |

| (0.0298) | (0.0221) | (0.0130) | (0.0158) | (0.0215) | |

| nycoal | 0.2270 | 0.1237 | −0.0608 | −0.1917 | −0.2839 |

| (0.2557) | (0.1904) | (0.1158) | (0.1362) | (0.1850) | |

| enpop | −0.0001 | −0.0000 | 0.0001 | 0.0002 | 0.0003 |

| (0.0013) | (0.0009) | (0.0006) | (0.0007) | (0.0009) | |

| fsast | 0.0097 | 0.0081 * | 0.0052 * | 0.0031 | 0.0017 |

| (0.0062) | (0.0046) | (0.0027) | (0.0033) | (0.0045) | |

| dinv | 0.0000 | 0.0012 | 0.0033 | 0.0048 | 0.0059 |

| (0.0070) | (0.0052) | (0.0030) | (0.0037) | (0.0050) | |

| Observations | 475 | 475 | 475 | 475 | 475 |

| Channel | Mediating Variable | Coefficient | Bootstrap Standard Error | z-Statistic | p-Value | 95% CI |

|---|---|---|---|---|---|---|

| The substitution channel | renewable energy consumption | −0.0087 | 0.0013 | −6.7200 | 0.0000 | [−0.0112, −0.0061] |

| The economic channel | GDP | 0.0786 | 0.0058 | 13.5100 | 0.0000 | [0.0672,0.0899] |

| The technology channel | energy intensity | −0.0129 | 0.0022 | −5.6600 | 0.0000 | [−0.0173, −0.0084] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, F.; Jiang, G.; Kitila, G.M. Trade Openness and CO2 Emissions: The Heterogeneous and Mediating Effects for the Belt and Road Countries. Sustainability 2021, 13, 1958. https://doi.org/10.3390/su13041958

Chen F, Jiang G, Kitila GM. Trade Openness and CO2 Emissions: The Heterogeneous and Mediating Effects for the Belt and Road Countries. Sustainability. 2021; 13(4):1958. https://doi.org/10.3390/su13041958

Chicago/Turabian StyleChen, Fuzhong, Guohai Jiang, and Getachew Magnar Kitila. 2021. "Trade Openness and CO2 Emissions: The Heterogeneous and Mediating Effects for the Belt and Road Countries" Sustainability 13, no. 4: 1958. https://doi.org/10.3390/su13041958

APA StyleChen, F., Jiang, G., & Kitila, G. M. (2021). Trade Openness and CO2 Emissions: The Heterogeneous and Mediating Effects for the Belt and Road Countries. Sustainability, 13(4), 1958. https://doi.org/10.3390/su13041958