Business Friendliness: A Double-Edged Sword

Abstract

1. Introduction

2. Background

3. Literature Review and Theory

3.1. Business Friendliness

3.2. Peer-to-Peer Lending

3.3. Hypotheses

4. Methods

4.1. Data

4.2. Measures

4.3. Estimation Models

5. Results

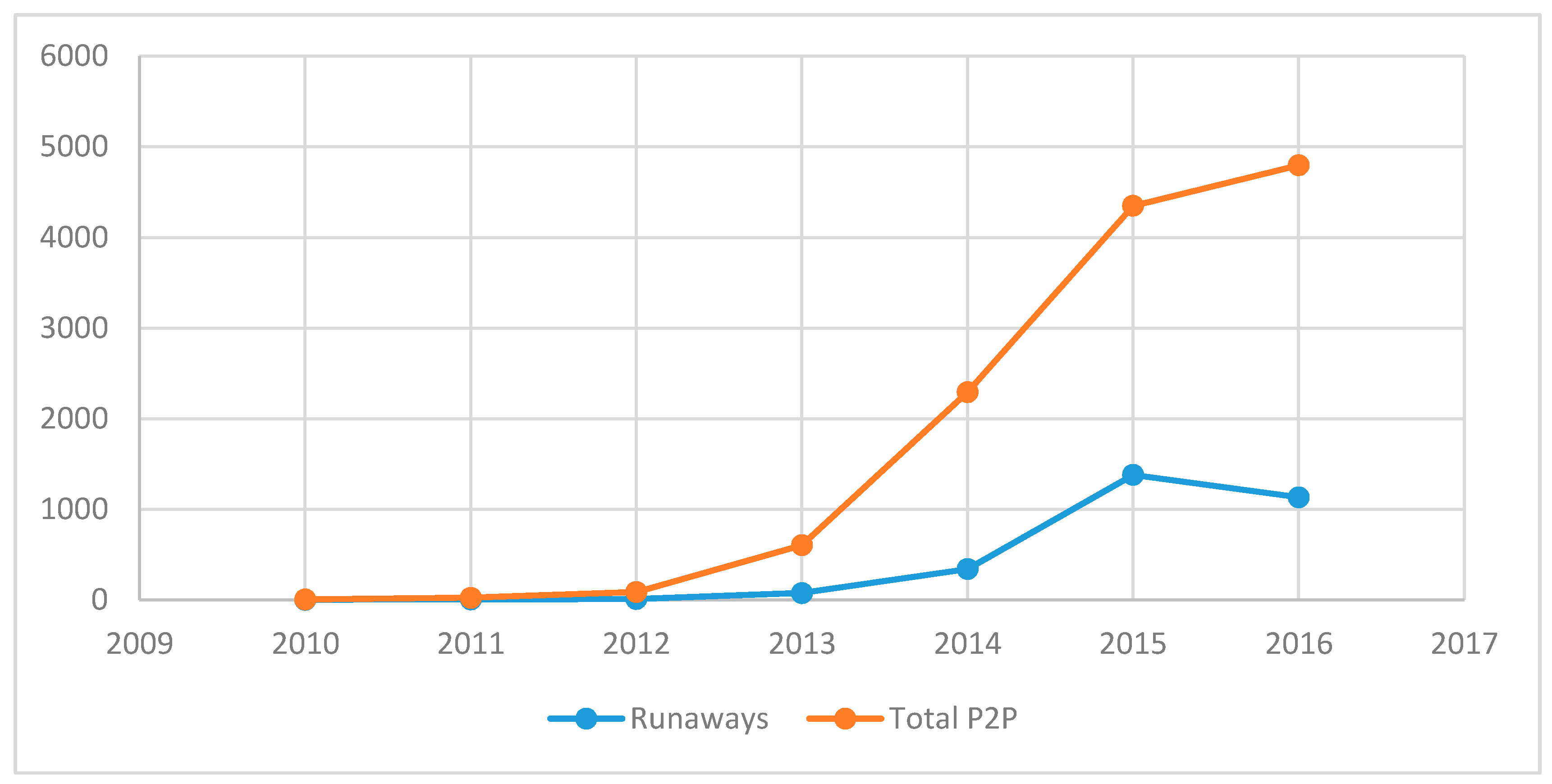

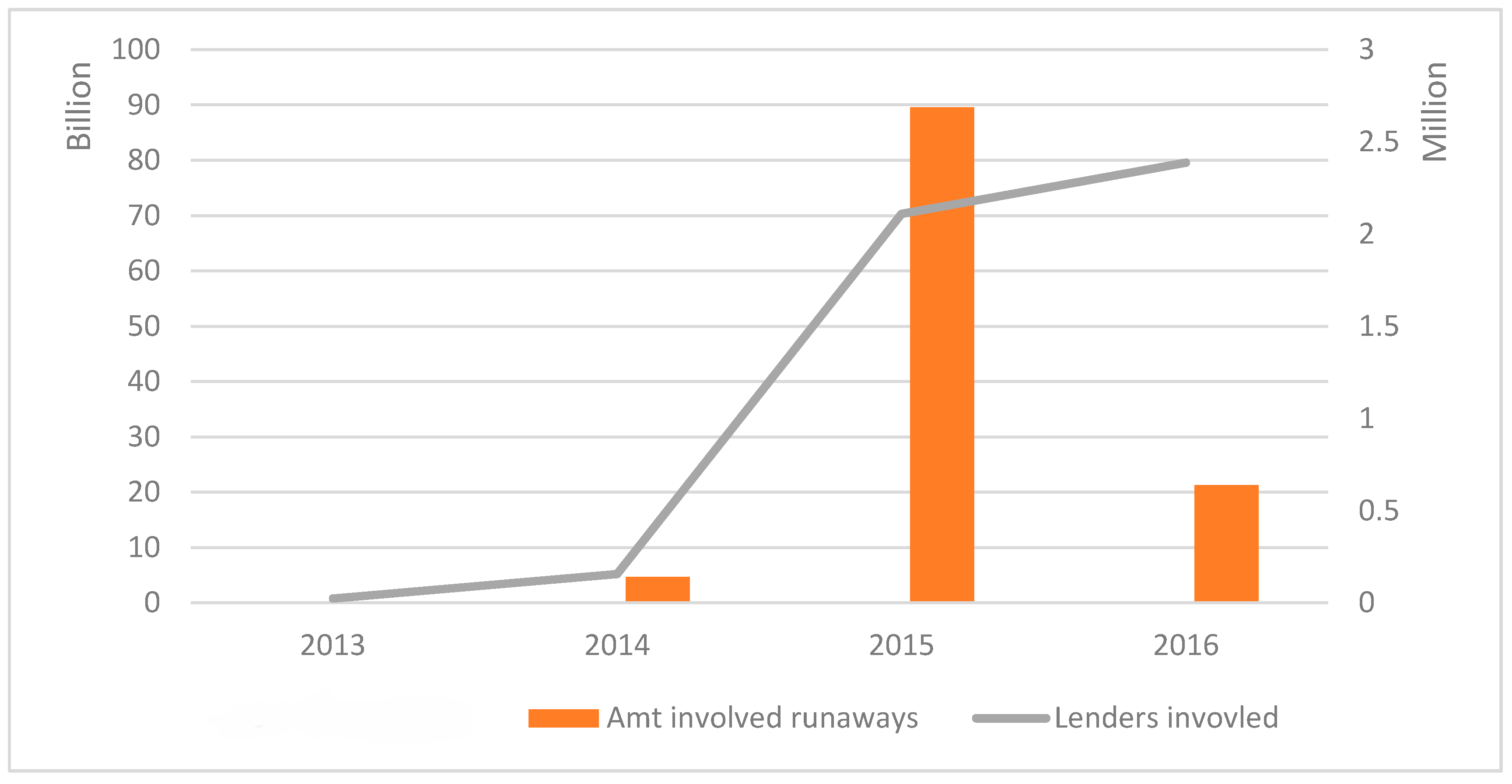

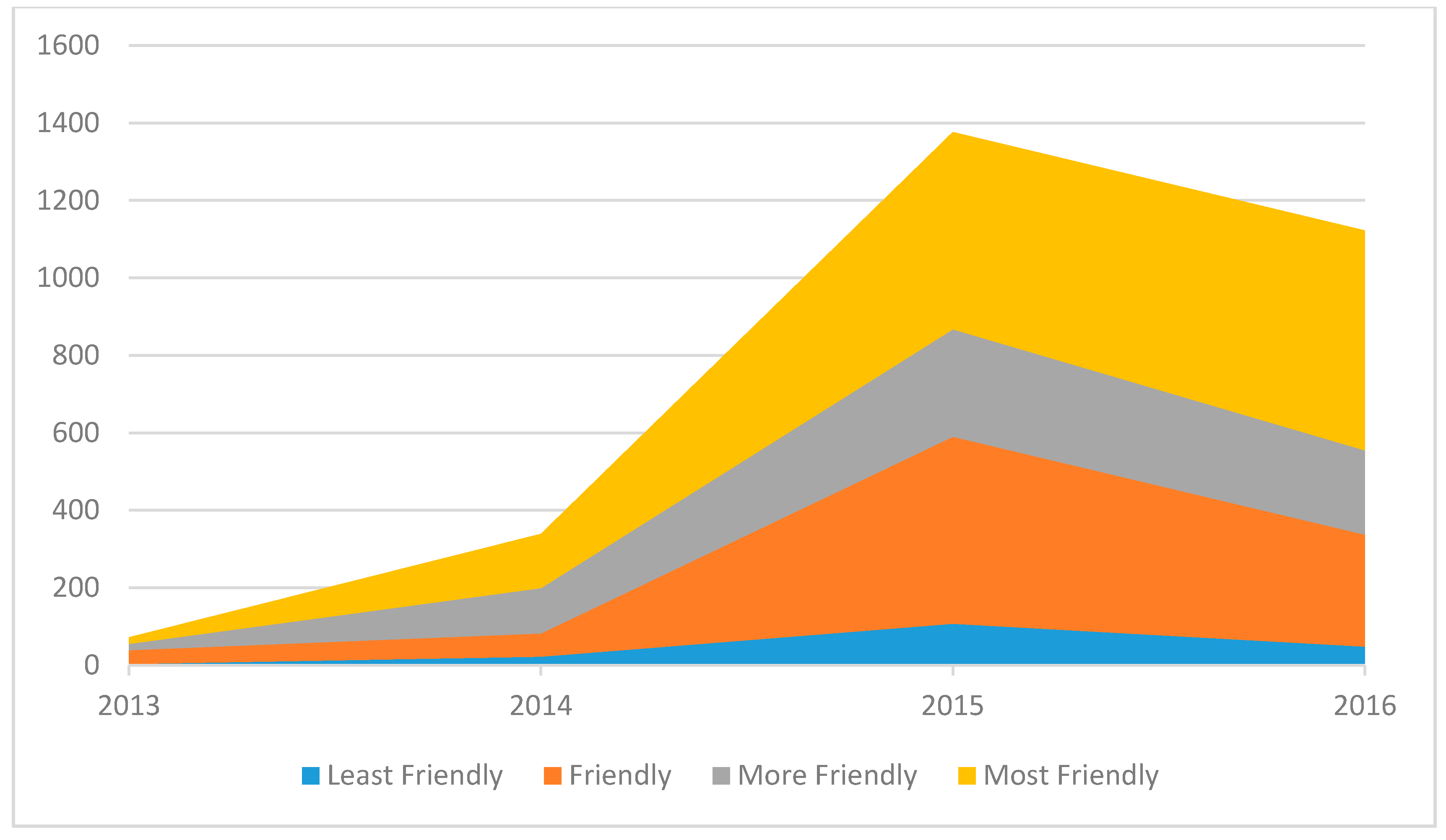

5.1. Summary Statistics

5.2. Regression Results

5.3. Robustness Tests

6. Discussions and Conclusions

6.1. Business Friendliness and P2P Runaways

6.2. Attenuation Effect of the Private Sector (Informal Institutions)

6.3. The Role of Law Enforcement (Formal Institutions)

6.4. Complementary Effects of Formal and Informal Institutions

6.5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Deng, X.; Huang, Z.; Cheng, X. FinTech and sustainable development: Evidence from china based on p2p data. Sustainability 2019, 11, 6434. [Google Scholar] [CrossRef]

- Cull, R.; Xu, L.C. Institutions, ownership, and finance: The determinants of profit reinvestment among Chinese firms. J. Financ. Econ. 2005, 77, 117–146. [Google Scholar] [CrossRef]

- Escribano, A.; Guasch, J.L. Assessing the impact of the investment climate on productivity using firm-level data: Methodology and the cases of Guatemala, Honduras, and Nicaragua. World Bank Policy Res. Work. Pap. 2005. [Google Scholar] [CrossRef]

- Beck, T.; Demirgüç-Kunt, A.; Maksimovic, V. Financial and legal constraints to growth: Does firm size matter? J. Financ. 2005, 60, 137–177. [Google Scholar] [CrossRef]

- Djankov, S.; Glaeser, E.; La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. The new comparative economics. J. Comp. Econ. 2003, 31, 595–619. [Google Scholar] [CrossRef]

- Rudner, D.W. Caste and Capitalism in Colonial India: The Nattukottai Chettiars; University of California Press: Berkeley, CA, USA, 1994. [Google Scholar]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R.W. Legal determinants of external finance. J. Financ. 1997, 52, 1131–1150. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R.W. Law and finance. J. Polit. Econ. 1998, 106, 1113–1155. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R.W. Investor protection and corporate governance. J. Financ. Econ. 2000, 58, 3–28. [Google Scholar] [CrossRef]

- Cull, R.; Xu, L.C. Who gets credit? The behavior of bureaucrats and state banks in allocating credit to Chinese state-owned enterprises. J. Dev. Econ. 2003, 71, 533–559. [Google Scholar] [CrossRef]

- Allen, F.; Qian, J.; Qian, M. Law, finance, and economic growth in China. J. Financ. Econ. 2005, 77, 57–116. [Google Scholar] [CrossRef]

- OECD. China in a Changing Global Environment. 2015. Available online: https://www.oecd.org/china/china-in-a-changing-global-environment_EN.pdf (accessed on 28 January 2021).

- Montinola, G.; Qian, Y.; Weingast, B.R. Federalism, Chinese style: The political basis for economic success in China. World Polit. 1995, 48, 50–81. [Google Scholar] [CrossRef]

- Campello, M.; Ribas, R.P.; Wang, A.Y. Is the stock market just a side show? Evidence from a structural reform. Rev. Corp. Financ. Stud. 2014, 3, 1–38. [Google Scholar] [CrossRef]

- Francis, B.B.; Hasan, I.; Sun, X. Political connections and the process of going public: Evidence from China. J. Int. Money Financ. 2009, 28, 696–719. [Google Scholar] [CrossRef]

- Sun, Q.; Tong, W.; Yu, Q. Determinants of foreign direct investment across China. J. Int. Money Financ. 2002, 21, 79–113. [Google Scholar] [CrossRef]

- Firth, M.; Lin, C.; Wong, S.M. Leverage and investment under a state-owned bank lending environment: Evidence from China. J. Corp. Financ. 2008, 14, 642–653. [Google Scholar] [CrossRef]

- Ma, M.; Sun, X.; Waisman, M.; Zhu, Y. State ownership and market liberalization: Evidence from China’s domestic M&A market. J. Int. Money Financ. 2016, 69, 205–223. [Google Scholar]

- Klapper, L.; Laeven, L.; Rajan, R. Business environment and firm entry: Evidence from international data. World Bank Policy Res. Work. Pap. 2004. [Google Scholar] [CrossRef]

- Xia, H.; Tan, Q.; Bai, J. Business environment, enterprise rent-seeking and market innovation: Evidence from the China enterprise survey. Econ. Res. J. 2019, 4, 84–98. [Google Scholar]

- Mongay, J.; Filipescu, D.A. Are corruption and ease of doing business correlated? An analysis of 172 nations. In International Business; Harris, S., Kuivalainen, O., Stoyanova, V., Eds.; Palgrave Macmillan: London, UK, 2012; pp. 13–26. [Google Scholar]

- Bastos, F.; Nasir, J. Productivity and the investment climate: What matters most? World Bank Policy Res. Work. Pap. 2004. [Google Scholar] [CrossRef]

- Dollar, D.; Hallward-Driemeier, M.; Mengistae, T. Investment climate and firm performance in developing economies. Econ. Dev. Cult. Chang. 2005, 54, 1–31. [Google Scholar] [CrossRef]

- Dollar, D.; Hallward-Driemeier, M.; Mengistae, T. Investment climate and international integration. World Dev. 2006, 34, 1498–1516. [Google Scholar] [CrossRef]

- Plaut, T.R.; Pluta, J.E. Business climate, taxes and expenditures, and state industrial growth in the United States. South. Econ. J. 1983, 50, 99–119. [Google Scholar] [CrossRef]

- Aterido, R.; Hallward-Driemeier, M.; Pages-Serra, C. Investment Climate and Employment Growth: The Impact of Access to Finance, Corruption and Regulations across Firms. IZA Discuss. Pap. 2007. Available online: https://ssrn.com/abstract=1032567 (accessed on 28 January 2021). [CrossRef][Green Version]

- Bah, E.H.; Fang, L. Impact of the business environment on output and productivity in Africa. J. Dev. Econ. 2015, 114, 159–171. [Google Scholar] [CrossRef]

- Forbes. China’s best cities for business. Forbes China 2016, 11–12. Available online: https://www.forbes.com/sites/forbeschina/2018/12/13/beijing-tops-shanghai-as-chinas-best-city-for-business-in-new-ranking/?sh=3266c8264884 (accessed on 28 January 2021).

- Demirgüç-Kunt, A.; Love, I.; Maksimovic, V. Business environment and the incorporation decision. J. Bank. Financ. 2006, 30, 2967–2993. [Google Scholar] [CrossRef]

- Corcoran, A.; Gillanders, R. Foreign direct investment and the ease of doing business. Rev. World Econ. 2015, 151, 103–126. [Google Scholar] [CrossRef]

- Zhang, K.H. What attracts foreign multinational corporations to China? Contemp. Econ. Policy 2001, 19, 336–346. [Google Scholar] [CrossRef]

- Shi, W.S.; Sun, S.L.; Yan, D.; Zhu, Z. Institutional fragility and outward foreign direct investment from China. J. Int. Bus. Stud. 2017, 48, 452–476. [Google Scholar] [CrossRef]

- Ramasamy, B.; Yeung, M.; Laforet, S. China’s outward foreign direct investment: Location choice and firm ownership. J. World Bus. 2012, 47, 17–25. [Google Scholar] [CrossRef]

- Shi, C.; Liang, H. Provincial differences of business environment and imports expansion: An empirical study based on 30 provincial cross-section data. J. Shanxi Financ. Econ. Univ. 2013, 5, 12–23. [Google Scholar]

- Yunus, M. The Nobel peace prize 2006-Nobel lecture. Law Bus. Rev. 2007, 13, 267. [Google Scholar]

- Bouman, F. ROSCA: On the Origin of the Species. Sav. Dev. 1995, 19, 117–148. [Google Scholar]

- Verstein, A. The misregulation of person-to-person lending. UCDL Rev. 2011, 45, 445. [Google Scholar] [CrossRef]

- Kupp, M.; Anderson, J. Zopa: Web 2.0 Meets Retail Banking. Bus. Strateg. Rev. 2007, 18, 11–17. [Google Scholar] [CrossRef]

- Wei, S. Internet lending in China: Status quo, potential risks and regulatory options. Comput. Law Secur. Rev. 2015, 31, 793–809. [Google Scholar] [CrossRef]

- Frerichs, A.; Schuhmann, M. Peer to peer banking–state of the art. Inst. Wirtsch. Georg-August-Univ. Götting. 2008, 2, 1–80. [Google Scholar]

- Zhang, H. Regulation of information disclosure and the patterns of P2P lending in China. China Econ. Q. 2016, 16, 371–392. [Google Scholar]

- Liu, D.; Brass, D.; Lu, Y.; Chen, D. Friendships in online peer-to-peer lending: Pipes, prisms, and relational herding. MIS Q. 2015, 39, 729–742. [Google Scholar] [CrossRef]

- Chen, D.; Lai, F.; Lin, Z. A trust model for online peer-to-peer lending: A lender’s perspective. Inf. Technol. Manag. 2014, 15, 239–254. [Google Scholar] [CrossRef]

- Lin, X.; Li, X.; Zheng, Z. Evaluating borrower’s default risk in peer-to-peer lending: Evidence from a lending platform in China. Appl. Econ. 2017, 49, 3538–3545. [Google Scholar] [CrossRef]

- Xu, Y.; Luo, C.; Chen, D.; Zheng, H. What influences the market outcome of online P2P lending marketplace? A cross-country analysis. J. Glob. Inf. Manag. 2015, 23, 23–40. [Google Scholar] [CrossRef]

- Mi, J.J.; Zhu, H. Can funding platforms’ self-initiated financial innovation improve credit availability? Evidence from China’s P2P market. Appl. Econ. Lett. 2017, 24, 396–398. [Google Scholar] [CrossRef]

- Tao, Q.; Dong, Y.; Lin, Z. Who can get money? Evidence from the Chinese peer-to-peer lending platform. Inf. Syst. Front. 2017, 19, 425–441. [Google Scholar] [CrossRef]

- Li, Y.; Guo, Y.; Zhang, W. An analysis of factors influencing the success rate of P2P micro loan market in China. J. Financ. Res. 2013, 7, 126–138. [Google Scholar]

- Liao, L.; Ji, L.; Zhang, W. Education and credit: Evidence from P2P lending platform. J. Financ. Res. 2015, 3, 146–159. [Google Scholar]

- Liu, H.; Mao, J. A study of P2P lending risk events: The perspective of the real option theory. J. Financ. Res. 2018, 11, 119–132. [Google Scholar]

- Yu, L.; Kang, C.; Wang, L. Study on internet financial supervision game: A case study of the P2P net loan mode. Nankai Econ. Stud. 2015, 5, 126–139. [Google Scholar]

- Guo, Y.; Zhou, W.; Luo, C.; Liu, C.; Xiong, H. Instance-based credit risk assessment for investment decisions in P2P lending. Eur. J. Oper. Res. 2016, 249, 417–426. [Google Scholar] [CrossRef]

- Malekipirbazari, M.; Aksakalli, V. Risk assessment in social lending via random forests. Expert Syst. Appl. 2015, 42, 4621–4631. [Google Scholar] [CrossRef]

- Serrano-Cinca, C.; Gutiérrez-Nieto, B.; López-Palacios, L. Determinants of default in P2P lending. PLoS ONE 2015, 10, e0139427. [Google Scholar] [CrossRef] [PubMed]

- Emekter, R.; Tu, Y.; Jirasakuldech, B.; Lu, M. Evaluating credit risk and loan performance in online Peer-to-Peer (P2P) lending. Appl. Econ. 2015, 47, 54–70. [Google Scholar] [CrossRef]

- Duarte, J.; Siegel, S.; Young, L. Trust and credit: The role of appearance in peer-to-peer lending. Rev. Financ. Stud. 2012, 25, 2455–2484. [Google Scholar] [CrossRef]

- Herzenstein, M.; Sonenshein, S.; Dholakia, U.M. Tell me a good story and I may lend you money: The role of narratives in peer-to-peer lending decisions. J. Market. Res. 2011, 48, 138–149. [Google Scholar] [CrossRef]

- Lin, M.; Prabhala, N.R.; Viswanathan, S. Judging borrowers by the company they keep: Friendship networks and information asymmetry in online peer-to-peer lending. Manag. Sci. 2013, 59, 17–35. [Google Scholar] [CrossRef]

- Freedman, S.; Jin, G.Z. The information value of online social networks: Lessons from peer-to-peer lending. Int. J. Ind. Organ. 2017, 51, 185–222. [Google Scholar] [CrossRef]

- Chen, X.; Zhou, L.; Wan, D. Group social capital and lending outcomes in the financial credit market: An empirical study of online peer-to-peer lending. Electron. Commer. Res. Appl. 2016, 15, 1–13. [Google Scholar] [CrossRef]

- Berger, S.C.; Gleisner, F. Emergence of Financial Intermediaries in Electronic Markets: The Case of Online P2P Lending. BuR Bus. Res. J. 2009. Available online: https://ssrn.com/abstract=1568679 (accessed on 28 January 2021). [CrossRef]

- Dorfleitner, G.; Priberny, C.; Schuster, S.; Stoiber, J.; Weber, M.; de Castro, I.; Kammler, J. Description-text related soft information in peer-to-peer lending–Evidence from two leading European platforms. J. Bank. Financ. 2016, 64, 169–187. [Google Scholar] [CrossRef]

- Caldieraro, F.; Zhang, J.Z.; Cunha, M.; Shulman, J.D. Strategic information transmission in peer-to-peer lending markets. J. Market. 2018, 82, 42–63. [Google Scholar] [CrossRef]

- Larrimore, L.; Jiang, L.; Larrimore, J.; Markowitz, D.; Gorski, S. Peer to peer lending: The relationship between language features, trustworthiness, and persuasion success. J. Appl. Commun. Res. 2011, 39, 19–37. [Google Scholar] [CrossRef]

- Hoskisson, R.E.; Eden, L.; Lau, C.M.; Wright, M. Strategy in emerging economies. Acad. Manag. J. 2000, 43, 249–267. [Google Scholar]

- Meyer, K.E.; Estrin, S.; Bhaumik, S.K.; Peng, M.W. Institutions, resources, and entry strategies in emerging economies. Strateg. Manag. J. 2009, 30, 61–80. [Google Scholar] [CrossRef]

- Peng, M.W.; Wang, D.Y.; Jiang, Y. An institution-based view of international business strategy: A focus on emerging economies. J. Int. Bus. Stud. 2008, 39, 920–936. [Google Scholar] [CrossRef]

- Inoue, C.F.; Lazzarini, S.G.; Musacchio, A. Leviathan as a minority shareholder: Firm-level implications of state equity purchases. Acad. Manag. J. 2013, 56, 1775–1801. [Google Scholar] [CrossRef]

- North, D.C. Institutions, Institutional Change, and Econ. Performance; Harvard University Press: Cambridge, MA, USA, 1990. [Google Scholar]

- Scott, W.R. Institutions and Organizations; Sage: Thousand Oaks, CA, USA, 1995. [Google Scholar]

- DiMaggio, P.J.; Powell, W.W. The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Meyer, J.W.; Rowan, B. Institutionalized organizations: Formal structure as myth and ceremony. Am. J. Sociol. 1977, 83, 340–363. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A. The economic consequences of legal origins. J. Econ. Lit. 2008, 46, 285–332. [Google Scholar] [CrossRef]

- Sun, Z.; Zhang, Z. Government’s Behavior Norms, Policy Supply Level and the Development of Private-owned Enterprises. J. Financ. Econ. 2007, 33, 84–96. [Google Scholar]

- Beck, T.; Demirguc-Kunt, A.S.L.I.; Laeven, L.; Levine, R. Finance, firm size, and growth. J. Money Credit Bank. 2008, 40, 1379–1405. [Google Scholar] [CrossRef]

- Goh, T.-T.; Xin, Z.; Jin, D. Habit formation in social media consumption: A case of political engagement. Behav. Inf. Technol. 2019, 38, 273–288. [Google Scholar] [CrossRef]

- Li, L.; Zhu, F.; Sun, H.; Hu, Y.; Yang, Y.; Jin, D. Multi-source information fusion and deep-learning-based characteristics measurement for exploring the effects of peer engagement on stock price synchronicity. Inf. Fusion 2021, 69, 1–21. [Google Scholar] [CrossRef]

- Lewis, M.K. New dogs, old tricks. Why do Ponzi schemes succeed? Account. Forum 2012, 36, 294–309. [Google Scholar] [CrossRef]

- Hopner, M. What Connects Industrial Relations and Corporate Governance? Explaining Institutional Complementarity. Socio-Econ. Rev. 2005, 3, 331–358. [Google Scholar] [CrossRef]

| Label | Describe | Count |

|---|---|---|

| Stop Business | The platform has stopped business for more than three months, no news or announcements to the public about the continuance of the platform. | 942 |

| Website Shutdown | Unable to open the website, no news or announcements to the public about the continuance of the platform. | 520 |

| Change Business | The platform stops all the P2P business and transforms into other businesses. | 3 |

| Restructuring | The platform is merged and restructured by other companies | 2 |

| Withdraw Difficulty | Investors are difficult to withdraw. Or the platform default payment, and there is no announcement of future payment and withdraw. | 359 |

| Loss of Contact | The actual controller, other managers, and staffs of the platform could not be reached. | 328 |

| Bankrupt | The platform went bankrupt and lost contact. | 46 |

| Fraud | The platform is suspected of economic crimes. It has not been investigated. | 208 |

| Police Recorded | The platform is suspected of economic crimes. It has been investigated by police. The platform’s funds are frozen or suspended. | 14 |

| Vicious Runaway | The platform has been proven to be deliberately fraudulent and runaway. | 488 |

| Others | Other suspected runaways | 31 |

| Variables | Descriptions |

|---|---|

| Runaway year | The runaway year of the P2P-lending platforms |

| Founding year | The founding year of the P2P-lending platforms |

| Province | The province where the P2P platforms were registered in |

| Total amount involved | Sum of the total-amount outstanding balance of every P2P platform in the province and crisis in this year |

| Total P2P | The number of active P2Ps by 2016 |

| Size | The funding size of the runaway P2Ps |

| P2P Incorporation Province | Active P2P in 2016 | Total Runaways between 2011 and 2016 | Amounts Involved in Runaways (in Millions Chinese Yuan) | Total Lenders |

|---|---|---|---|---|

| Anhui | 468 | 138 | ¥2837 | 167,650 |

| Beijing | 1365 | 242 | ¥70,774 | 1,322,166 |

| Chongqing | 252 | 51 | ¥709 | 103,575 |

| Fujian | 287 | 70 | ¥603 | 105,148 |

| Gansu | 28 | 8 | ¥113 | 10,923 |

| Guangdong | 2239 | 481 | ¥14,960 | 671,591 |

| Guangxi | 146 | 42 | ¥197 | 52,333 |

| Guizhou | 97 | 23 | ¥251 | 42,272 |

| Hainan | 32 | 11 | ¥11 | 10,065 |

| Hebei | 283 | 85 | ¥174 | 111,977 |

| Heilongjiang | 38 | 12 | ¥146 | 15,525 |

| Henan | 223 | 62 | ¥841 | 188,898 |

| Hong Kong | 9 | 3 | ¥2 | 1345 |

| Hubei | 430 | 106 | ¥2052 | 149,960 |

| Hunan | 259 | 68 | ¥1092 | 72,607 |

| Inner Mongolia | 73 | 13 | ¥21 | 2435 |

| Jiangsu | 663 | 168 | ¥5483 | 197,395 |

| Jiangxi | 110 | 27 | ¥199 | 46,251 |

| Jilin | 77 | 20 | ¥45 | 39,725 |

| Liaoning | 34 | 9 | ¥38 | 9211 |

| Ningxia | 39 | 9 | ¥16 | 16,755 |

| Qinghai | 2 | 1 | ¥5 | 5670 |

| Shaanxi | 153 | 48 | ¥177 | 62,060 |

| Shandong | 1538 | 492 | ¥3567 | 381,937 |

| Shanghai | 1285 | 291 | ¥2694 | 343,112 |

| Shanxi | 68 | 17 | ¥12 | 12,520 |

| Sichuan | 357 | 78 | ¥955 | 95,043 |

| Tianjin | 125 | 26 | ¥48 | 28,146 |

| Xinjiang | 26 | 6 | ¥207 | 10,615 |

| Xizang | 1 | 0 | 0 | 0 |

| Yunnan | 85 | 35 | ¥506 | 37,788 |

| Zhejiang | 1364 | 299 | ¥7071 | 363,791 |

| Grand Total | 12,155 | 2941 | ¥115,805 | 4,678,489 |

| Variables | Mean | S.D. | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1. LnRunaways | 2.12 | 1.57 | 1 | |||||||

| 2. Business Friendlinessfounding year | 0.64 | 0.12 | 0.360 ** | 1 | ||||||

| 3. Private Sector GDPfounding year | 0.51 | 0.11 | 0.070 | −0.067 | 1 | |||||

| 4. LnGDPfounding year | 17.70 | 0.95 | 0.400 ** | 0.865 ** | −0.325 ** | 1 | ||||

| 5. GDP Growthfounding year | 0.12 | 0.05 | 0.076 | 0.112 | −0.161 | 0.158 | 1 | |||

| 6. GDP Growthrunaway year | 0.08 | 0.05 | −0.140 | 0.181 * | −0.118 | 0.041 | 0.333 ** | 1 | ||

| 7. LntotalP2Pcrisis year | 26.26 | 48.20 | 0.922 ** | 0.521 ** | 0.033 | 0.548 ** | 0.014 | −0.075 | 1 | |

| 8. LnSizecrisis year | 17.33 | 17.27 | 0.851 *** | 0.342 *** | −0.005 | 0.425 *** | 0.286 *** | 0.425 *** | 0.815 *** | 1 |

| Number of Runaways | |

|---|---|

| Business Friendlinessfounding year | 1.731 * (0.069) |

| High Private Sector GDPfounding year | −0.067 (0.423) |

| LnGDPfounding year | −0.395 *** (0.001) |

| GDP growthfounding year | 0.305 (0.804) |

| GDP growthrunaway year | −0.522 (0.519) |

| LntotalP2Pcrisis year | 0.849 *** (0.000) |

| LnSizecrisis year | 0.098 *** (0.010) |

| constant | 2.701 (0.132) |

| Year effects | Yes |

| N | 95 |

| Adj. R2 | 0.926 |

| Prob. > F | 0.000 |

| Number of Runaways | |

|---|---|

| Business Friendlinessfounding year | 2.572 ** (0.019) |

| High Private Sector GDPfounding year | 1.458 * (0.062) |

| Business Friendlinessfounding year * High Private Sector GDPfounding year | −2.320 ** (0.048) |

| LnGDPfounding year | −0.466 *** (0.000) |

| GDP growthfounding year | 0.806 (0.524) |

| GDP growthrunaway year | −0.697 (0.395) |

| LntotalP2Pcrisis year | 0.817 *** (0.000) |

| LnSizecrisis year | 0.101 (0.009) |

| constant | 3.319 * (0.072) |

| Year effects | Yes |

| N | 95 |

| Adj. R2 | 0.928 |

| Prob. > F | 0.000 |

| Number of Runaways | |

|---|---|

| Law Enforcementfounding year | −10.644 ** (0.028) |

| Business Friendlinessfounding year | 1.208 (0.198) |

| High Private Sector GDPfounding year | −0.033 (0.687) |

| LnGDPfounding year | −0.362 *** (0.003) |

| GDP growthfounding year | 0.493 (0.688) |

| GDP growthrunaway year | −0.845 (0.310) |

| LntotalP2Pcrisis year | 0.909 *** (0.000) |

| LnSizecrisis year | 0.095 ** (0.013) |

| constant | 3.070 * (0.090) |

| Year effects | Yes |

| N | 95 |

| Adj. R2 | 0.929 |

| Prob. > F | 0.000 |

| High Law Enforcement (≥0.05) | Low Law Enforcement (<0.05) | |

|---|---|---|

| Business Friendlinessfounding year | 4.657 *** (0.004) | −0.035 (0.985) |

| High Private Sector GDPfounding year | 3.198 *** (0.003) | −0.503 (0.680) |

| Business Friendlinessfounding year * High Private Sector GDPfounding year | −5.124 *** (0.001) | 0.832 (0.652) |

| LnGDPfounding year | −0.747 *** (0.001) | −0.237 * (0.077) |

| GDP growthfounding year | 2.075 (0.197) | −2.321 (0.120) |

| GDP growthrunaway year | −1.197 (0.192) | −6.315 * (0.098) |

| LntotalP2Pcrisis year | 0.820 *** (0.000) | 1.121 *** (0.000) |

| LnSizecrisis year | 0.081 (0.127) | 0.082 (0.104) |

| constant | 7.086 ** (0.019) | 3.600 * (0.062) |

| Year effects | Yes | Yes |

| N | 59 | 36 |

| Adj. R2 | 0.943 | 0.956 |

| Prob. > F | 0.000 | 0.000 |

| (1) | (2) | |

|---|---|---|

| Robustness1 | 1.576 * | |

| (0.097) | ||

| Marketization | 0.212 *** | |

| (0.005) | ||

| High Private Sector GDPfounding year | 0.289 ** | 0.193 * |

| (0.025) | (0.096) | |

| LnGDPfounding year | −0.018 | 0.091 |

| (0.889) | (0.271) | |

| GDP growthfounding year | −2.671 * | −1.560 |

| (0.083) | (0.278) | |

| GDP growthrunaway year | 1.403 | −0.069 |

| (0.238) | (0.954) | |

| LntotalP2Pcrisis year | 0.010 *** | 0.008 *** |

| (0.000) | (0.000) | |

| LnSizecrisis year | 0.249 *** (0.000) | 0.256 *** (0.000) |

| Constant | −4.463 ** | −9.940 *** |

| (0.019) | (1.715) | |

| Year effects | Yes | Yes |

| N | 95 | 103 |

| Adj. R2 | 0.851 | 0.808 |

| Prob. > F | 0.000 | 0.000 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, M.; Phan, P.H.; Sun, X. Business Friendliness: A Double-Edged Sword. Sustainability 2021, 13, 1819. https://doi.org/10.3390/su13041819

Li M, Phan PH, Sun X. Business Friendliness: A Double-Edged Sword. Sustainability. 2021; 13(4):1819. https://doi.org/10.3390/su13041819

Chicago/Turabian StyleLi, Mengyin, Phillip H. Phan, and Xian Sun. 2021. "Business Friendliness: A Double-Edged Sword" Sustainability 13, no. 4: 1819. https://doi.org/10.3390/su13041819

APA StyleLi, M., Phan, P. H., & Sun, X. (2021). Business Friendliness: A Double-Edged Sword. Sustainability, 13(4), 1819. https://doi.org/10.3390/su13041819