A Sustainable Online-to-Offline (O2O) Retailing Strategy for a Supply Chain Management under Controllable Lead Time and Variable Demand

Abstract

1. Introduction

2. Related Literature Review

2.1. Supply Chain Management

2.2. Sustainable Supply Chain Management

2.3. O2O Retailing

2.4. Price Dependent Demand

2.5. Backorder

2.6. Variable Lead Time

3. Problem Definition, Notation, and Assumptions

3.1. Problem Definition

3.2. Notation

| Index | |

| p | minimum duration lead time component |

| q | normal duration lead time component |

| Decision | variables |

| volume of each shipment (unit) | |

| r | reorder point (unit) |

| lead time (weeks) | |

| product’s online selling-price ($/unit) | |

| product’s offline selling-price ($/unit) | |

| probability of going to the out-of-control state | |

| ordering cost for retailer ($/unit) | |

| x | number of product shipment per lot, (a positive integer) |

| Parameters | |

| lot size (units) | |

| demand rate of retailer, (units) | |

| production rate of manufacturer, (units/time) | |

| initial ordering cost ($/order) | |

| cycle time, (time) | |

| inventory holding cost for retailer ($/unit/unit time) | |

| initial probability to transfer “out-of-control” state | |

| inventory holding cost for manufacturer ($/unit/unit time) | |

| manufacturer’s unit production cost per unit ($/unit) | |

| technology development cost for O2O channeling ($/unit) | |

| retailer’s unit purchase cost per unit ($/unit purchased) | |

| I | fixed investment to develop the technology ($/cycle) |

| unit shortage cost per unit ($/unit shortage) | |

| web page designing cost for O2O installation ($/unit) | |

| setup cost ($/unit) | |

| internet host purchasing cost for O2O installation ($/unit) | |

| standard normal probability density function | |

| web page visualization cost for O2O installation ($/unit) | |

| annual fractional cost for the capital investment for online sell ($/investment) | |

| annual fractional cost for the capital investment for offline sell ($/investment) | |

| price elasticity parameter for online sell | |

| price elasticity parameter for offline sell | |

| defective rate, which follows certain distribution | |

| standard normal cumulative distribution function | |

| labor charge for O2O installation ($/unit) | |

| consumer’s total number during lead time | |

| backorder rate | |

| total amount purchased by time | |

| total crashing cost is related to the lead time ($/week) | |

| component p of lead time with as minimum duration(days) | |

| component p of lead time with as normal duration(days) | |

| fixed carbon emission cost of consumer ($/shipment) | |

| variable carbon emission cost of consumer ($/unit) | |

| fixed carbon emission cost of manufacturer ($/shipment) | |

| variable carbon emission cost of manufacturer ($/unit) | |

| fixed transportation cost ($/shipment) | |

| variable transportation cost ($/unit) |

3.3. Assumptions

- 1.

- This paper deals with a single-retailer, single-manufacturer sustainable O2O retail channeling supply chain for a single product type.

- 2.

- The retailer sold the items online and offline, whereas the manufacturer only sold in the offline mode to the retailer. Thus, the demand for both online and offline modes depends on selling price, thus the demand of the supply chain is given by , which makes the model more sustainable.

- 3.

- Two investments are introduced to reduce ordering costs and upgrade the production process’s reliability.

- 4.

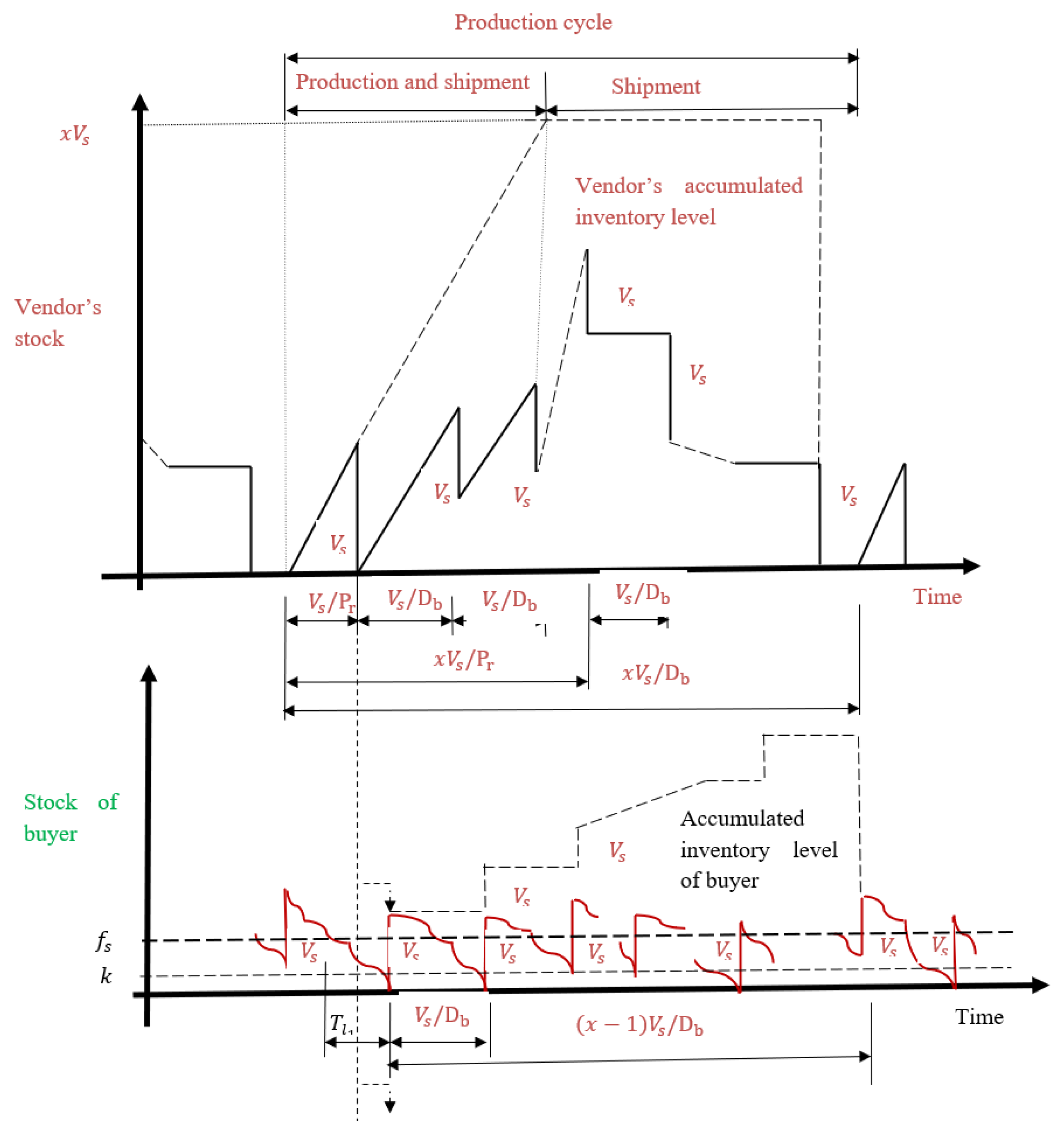

- Reduction of lead time is another component for service improvement. There are different crashing costs to reduce the lead time for different, mutually independent components are contemplated in this model. Let be the normal duration of the th component and be the minimum duration where the crashing costs per unit time satisfy Suppose is the length of the lead time for which components crash to their minimum duration, and let . Then and the crashing cost can be written as for .

- 5.

- A single-setup multi-delivery (SSMD) policy is adopted for transportation in this model. The manufacturer produced the products in a single lot and transported them in the multi-delivery process. The main reason for adopting the SSMD policy is that this policy makes the supply chain model more sustainable in the O2O environment. As multiple deliveries were used, the number of deliveries and the transportation cost also increased. Thus, there is a trade-off between the retailer’s holding cost and the increased transportation cost. For this transportation, variable and fixed transportation costs and carbon emission costs were considered to make the model more sustainable.

- 6.

- The safety stock and the sum of the expected demand during the lead time measured the reorder point, i.e., .

- 7.

- Fully backordered shortages are permitted at the normally distributed backorder rate, and distribution-free approaches are considered to formulate two models.

4. Mathematical Model

4.1. Retailer’s Profit

4.1.1. Holding Cost (HC)

4.1.2. Ordering Cost (OC)

4.1.3. Investment for Improve the Service by Reducing Ordering Cost

4.1.4. Backorder Cost (BC)

4.1.5. Technology Development Cost (TDC)

4.1.6. Lead Time Crashing Cost (LTCC)

4.2. Manufacturer’s Profit

4.2.1. Setup Cost for Supply Chain Model

4.2.2. O2O Installation Cost

4.2.3. Carbon Emission Cost for O2O Supply Chain Model

4.2.4. Transportation Cost for O2O Supply Chain Model

4.2.5. Investment to Improve Process Quality

4.2.6. Holding Cost of the Manufacturer

4.3. Normal Distributed Model

4.4. Distribution-Free Approach

5. Numerical Experiment

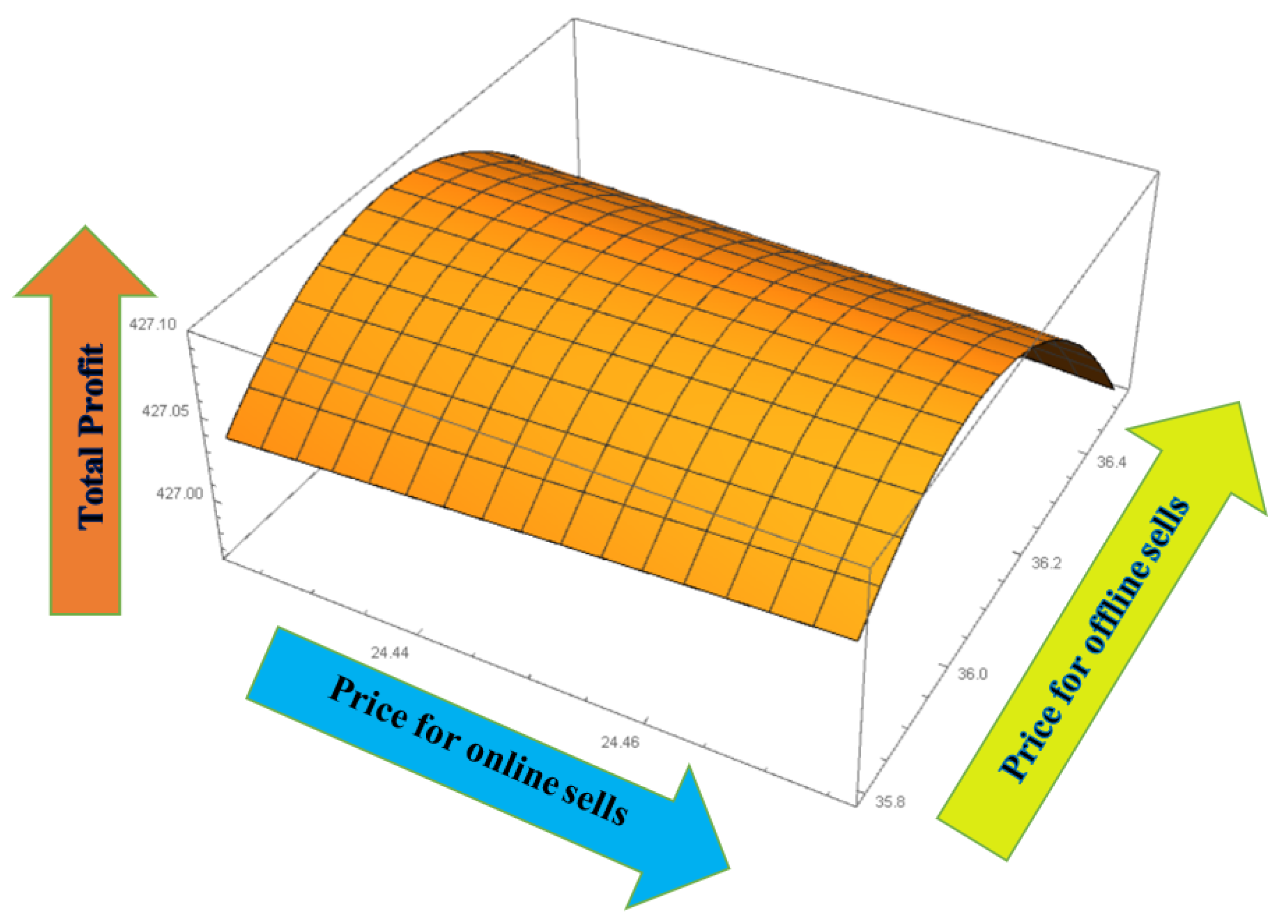

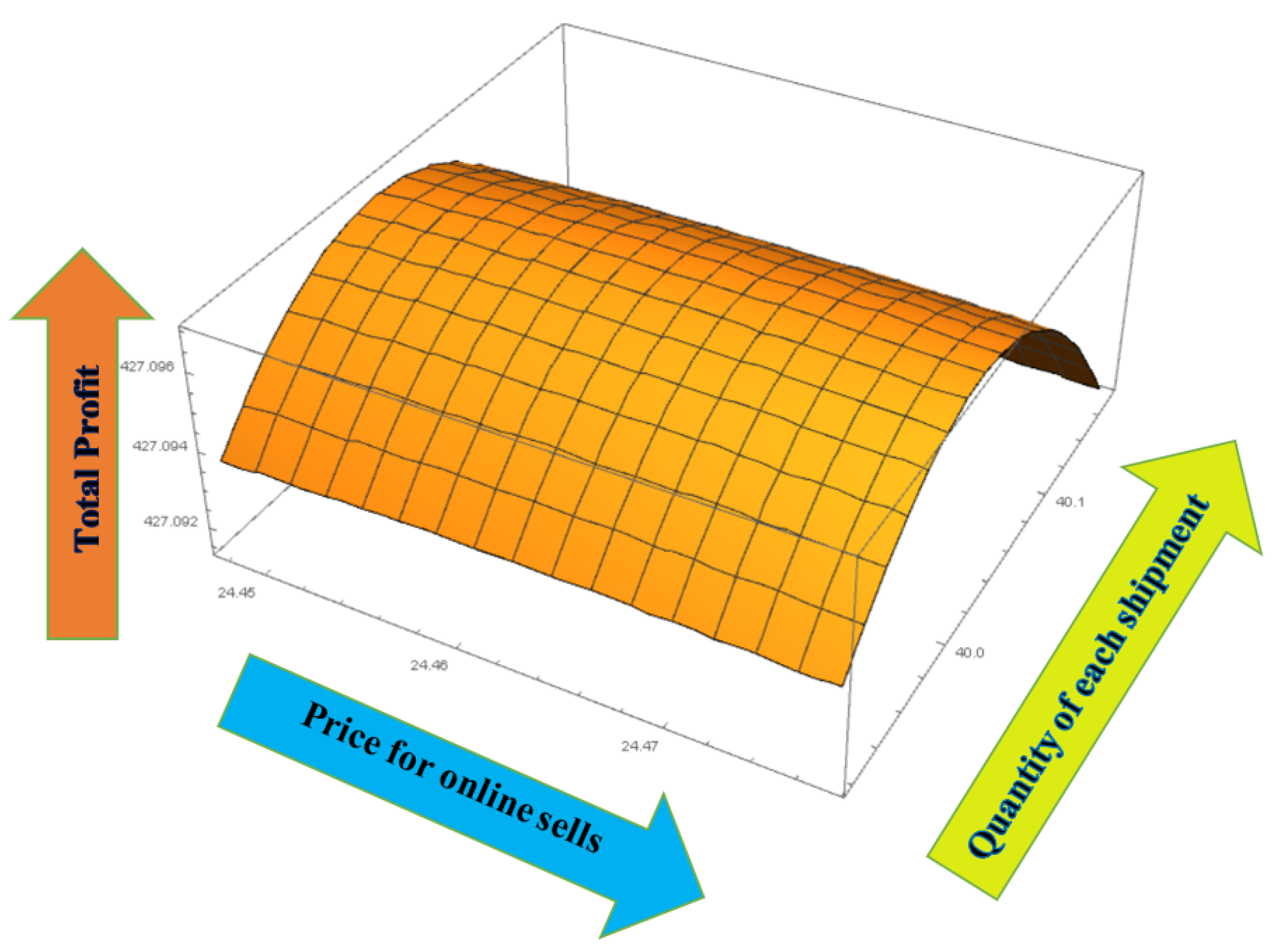

5.1. Example for Normal Distribution

5.2. Example for Distribution-Free Approach

5.3. Discussion

6. Sensitivity Analysis

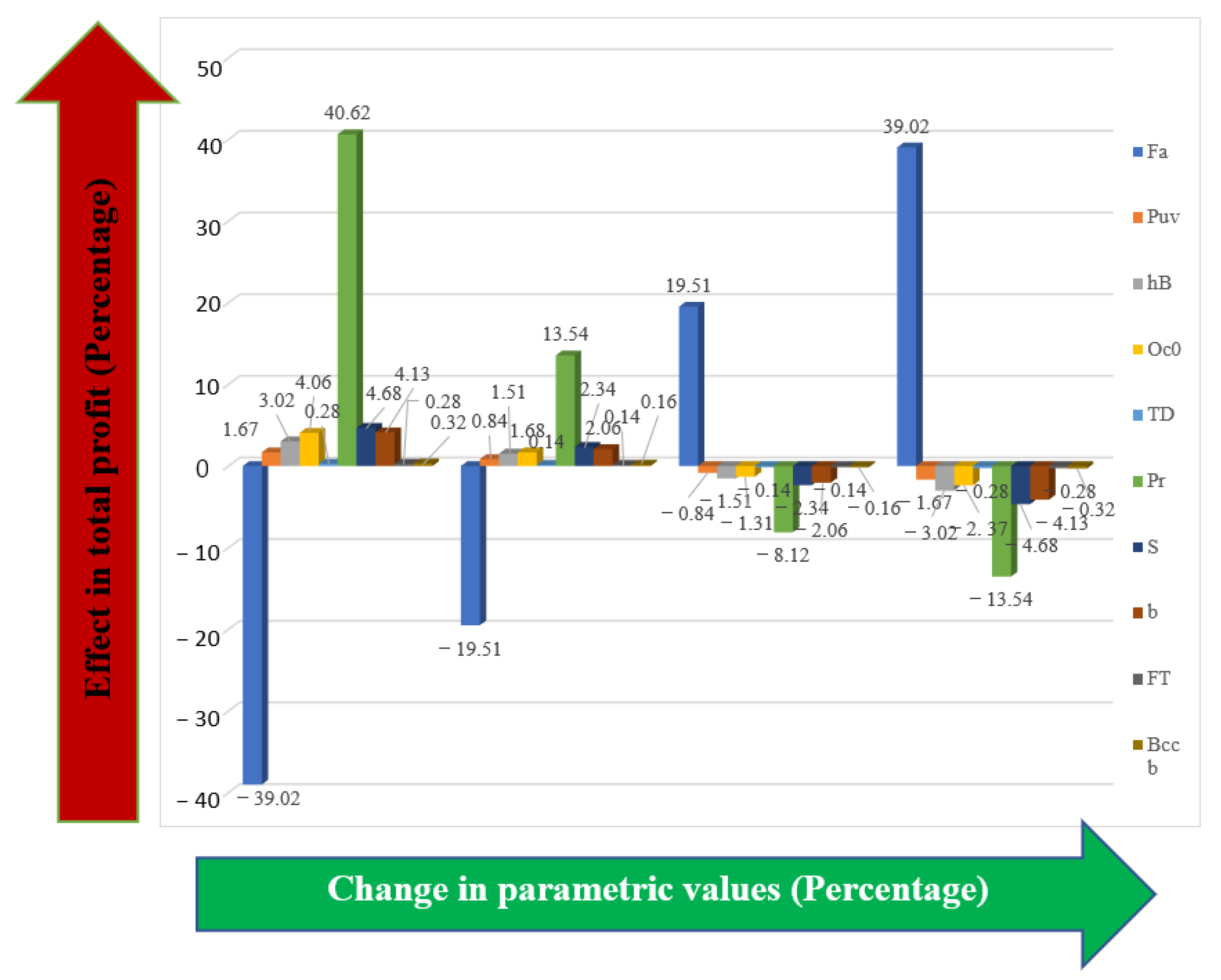

- (i)

- The price elasticity parameter for online sales is highly sensitive. A small change in the online sale elasticity parameter significantly impacts the total system profit and is proportional to system profit.

- (ii)

- Production rate had a significant impact on any sustainable supply chain. In this sustainable O2O supply chain model, production rate plays a vital role. Production rate and system profit are inversely proportional, i.e., reducing production increases the system’s profit.

- (iii)

- Holding cost for the retailer, the retailer’s initial ordering cost, and the manufacturer’s defective rate are quite sensitive. All those components are inversely proportional to the system profit. Thus, the reduction of those costs always beneficial for any industry.

- (iv)

- The scaling parameter, related to process quality, is slightly sensitive. Reduction in this parameter is beneficial for the industry.

- (v)

- Production cost for the manufacturer is slightly sensitive as usual. Reduction in production always costs beneficial for any production industry.

- (vi)

- Technology development cost and all other cost parameters related to supply chain are very little sense. Change from to in those costs, the total system profit changes below .

7. Managerial Insights

- (i)

- It is a sustainable supply chain management in the presence of a smart O2O environment, where the total joint profit of the supply chain is optimized along with the optimized values of selling prices for both online and offline sales, safety factor, shipment size, shipment numbers, ordering cost for retailer, lead period, and probability to transfer the production process from the “in-control” to the “out-of-control” state.

- (ii)

- It is a sustainable supply chain due to the presence of the concept of online and offline sales. The retailer can purchase the product from the manufacturer online or offline. Due to the O2O strategy, holding costs for the manufacturer reduced, making the supply chain sustainable.

- (iii)

- To control carbon emissions and keep the environment clean, variable and fixed carbon emission costs were employed along with fixed and variable transportation costs, making the supply chain more sustainable.

- (iv)

- The supply chain system’s ordering cost can be reduced by some continuous investment, which improves the total supply chain management service, making this model more sustainable. Some investment also improved the process quality. It also has a significant impact on the total joint expected profit of the O2O supply.

- (v)

- Lead time and shortages always create a terrible image of any company, affecting its customers’ service. This current model lead period and safety factor were also optimized along with different decision variables that provided better service and made the model more sustainable.

8. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Seok, H.; Nof, S.Y.; Filip, F.G. Sustainability decision support system based on collaborative control theory. Annu. Rev. Control 2012, 36, 85–100. [Google Scholar] [CrossRef]

- Chowdhury, M.M.H.; Agarwal, R.; Quaddus, M.A. Dynamic capabilities for meeting stakeholders’ sustainability requirements in supply chain. J. Clean. Prod. 2019, 215, 34–35. [Google Scholar] [CrossRef]

- Chowdhury, M.M.H.; Quaddus, M.A. Supply chain sustainability practices and governance for mitigating sustainability risk and improving market performance: A dynamic capability perspective. J. Clean. Prod. 2021, 278, 123521. [Google Scholar] [CrossRef]

- Sett, B.K.; Dey, B.K.; Sarkar, B. The effect of O2O retail service quality in supply chain management. Mathematics 2020, 8, 1743. [Google Scholar] [CrossRef]

- Pei, Z.; Wooldridge, B.R.; Swimberghe, K.R. Manufacturer rebate and channel coordination in O2O retailing. J. Retail. Consum. Serv. 2021, 58, 102268. [Google Scholar] [CrossRef]

- Wee, H.M.; Wang, W.T.; Cárdenas-Barrán, L.E. An alternative analysis and solution procedure for the EPQ model with rework process at a single-stage manufacturing system with planned backorders. Comput. Ind. Eng. 2013, 64, 748–755. [Google Scholar] [CrossRef]

- Sarkar, B.; Cárdenas-Barrán, L.E.; Sarkar, M.; Singgih, M.L. An economic production quantity model with random defective rate, rework process and backorders for a single stage production system. J. Manuf. Syst. 2014, 33, 423–435. [Google Scholar] [CrossRef]

- Sarkar, B.; Moon, I. Improved quality, setup cost reduction, and variable backorder costs in an imperfect production process. Int. J. Prod. Econ. 2013, 155, 204–213. [Google Scholar] [CrossRef]

- Dey, B.K.; Sarkar, B.; Sarkar, M.; Pareek, S. An integrated inventory model involving discrete setup cost reduction, variable safety factor, selling price dependent demand, and investment. Rairo-Oper. Res. 2019, 53, 39–57. [Google Scholar] [CrossRef]

- Gallego, G.; Moon, I. The Distribution free Newsboy problem: Review and extensions. J. Oper. Res. Soc. 1993, 44, 825–834. [Google Scholar] [CrossRef]

- Sroufe, R.; Gopalakrishna-Remani, V. Management, social sustainability, reputation, and financial performance relationships: An empirical examination of U.S. firms. Organ. Environ. 2019, 32, 331–362. [Google Scholar] [CrossRef]

- Xiao, S.; Dong, M. Hidden semi-Markov model-based reputation management system for online to offline (O2O) e-commerce markets. Decis. Support Syst. 2014, 77, 87–99. [Google Scholar] [CrossRef]

- Zimon, D.; Tyan, J.; Sroufe, R. Implementing sustainable supply chain management: Reactive, cooperative, and dynamic models. Sustainability 2019, 11, 7227. [Google Scholar] [CrossRef]

- Pal, B.; Sana, S.S.; Chaudhuri, K.S. A multi-echelon supply chain model for reworkable items in multiple-markets with supply disruption. Econ. Model. 2012, 29, 1891–1898. [Google Scholar] [CrossRef]

- Rad, A.R.; Khoshalhan, F.; Glock, C.H. Optimizing inventory and sales decisions in a two-stage supply chain with imperfect production and backorders. Comput. Ind. Eng. 2014, 74, 219–227. [Google Scholar] [CrossRef]

- Giri, B.C.; Mondal, C.; Maiti, T. Analysing a closed-loop supply chain with selling price, warranty period and green sensitive consumer demand under revenue sharing contract. J. Clean. Prod. 2018, 190, 822–837. [Google Scholar] [CrossRef]

- Ali, S.M.; Rahmaan, M.H.; Tumpa, T.J.; Rifat, A.A.M.; Paul, S.K. Examining price and service competition among retailers in a supply chain under potential demand disruption. J. Retail. Consum. Serv. 2018, 40, 40–47. [Google Scholar] [CrossRef]

- Malekian, Y.; Rasti-Barzoki, M. A game theoretic approach to coordinate price promotion and advertising policies with reference price effects in a two-echelon supply chain. J. Retail. Consum. Serv. 2019, 51, 114–128. [Google Scholar] [CrossRef]

- Liu, Y.; Liu, Z.; Ren, W.; Forrest, J.Y.L. A coordination mechanism through relational contract in a two-echelon supply chain. J. Retail. Consum. Serv. 2020, 56, 102156. [Google Scholar] [CrossRef]

- Sardar, S.K.; Sarkar, B. How does advanced technology solve unreliability under supply chain management using game policy? Mathematics 2020, 8, 1191. [Google Scholar] [CrossRef]

- Zhang, G.; Dai, G.; Sun, H.; Zhang, G.; Yang, Z. Equilibrium in supply chain network with competition and service level between channels considering consumers’ channel preferences. J. Retail. Consum. Serv. 2020, 57, 102199. [Google Scholar] [CrossRef]

- Sarkar, B.; Sarkar, M.; Ganguly, B.; Cárdenas-Barrán, L.E. Combined effects of carbon emission and production quality improvement for fixed lifetime products in a sustainable supply chain management. Int. J. Prod. Econ. 2021, 231, 107867. [Google Scholar] [CrossRef]

- Tayyab, M.; Jemai, J.; Lim, H.; Sarkar, B. A sustainable development framework for a cleaner multi-item multi-stage textile production system with a process improvement initiative. J. Clean. Prod. 2020, 246, 119055. [Google Scholar] [CrossRef]

- Chowdhury, M.M.H.; Quaddus, M.A. A multi-phased QFD based optimization approach to sustainable service design. Int. J. Prod. Econ. 2016, 171, 165–178. [Google Scholar] [CrossRef]

- Hossain, M.M.; Chowdury, M.H.; Evans, R.; Lema, A.C. The relationship between corporate social responsibility and corporate financial performance: Evidence from a developing country. Corp. Ownersh. Control 2015, 12, 474–487. [Google Scholar] [CrossRef]

- Chowdhury, M.M.H.; Paul, S.K.; Sianaki, O.A.; Quaddus, M.A. Dynamic sustainability requirements of stakeholders and the supply portfolio. J. Clean. Prod. 2020, 255, 120148. [Google Scholar] [CrossRef]

- Ahmed, W.; Sarkar, B. Impact of carbon emissions in a sustainable supply chain management for a second generation biofuel. J. Clean. Prod. 2018, 186, 807–820. [Google Scholar] [CrossRef]

- Shaharudin, M.S.; Fernando, Y.; Jabbour, C.J.C.; Sroufe, R.; Jasmi, M.F.A. Past, present, and future low carbon supply chain management: A content review using social network analysis. J. Clean. Prod. 2019, 218, 629–643. [Google Scholar] [CrossRef]

- Mishra, U.; Wu, J.Z.; Sarkar, B. Optimum sustainable inventory management with backorder and deterioration under controllable carbon emissions. J. Clean. Prod. 2021, 279, 123699. [Google Scholar] [CrossRef]

- Appolloni, A.; Sun, H.; Jia, F.; Li, X. Green Procurement in the private sector: A state of the art review between 1996 and 2013. J. Clean. Prod. 2014, 85, 122–133. [Google Scholar] [CrossRef]

- Zimon, D.; Tyan, J.; Sroufe, R. Drivers of sustainable supply chain management: Practices to alignment with un sustainable development goals. Int. J. Qual. Res. 2020, 14, 219–236. [Google Scholar] [CrossRef]

- Schulz, K.P.; Mnisri, K.; Shrivastava, P.; Sroufe, R. Facilitating, envisioning and implementing sustainable development with creative approaches. J. Clean. Prod. 2020, 278, 123762. [Google Scholar] [CrossRef]

- Sana, S.S. Price competition between green and non green products under corporate social responsible firm. J. Retail. Consum. Serv. 2020, 55, 102118. [Google Scholar] [CrossRef]

- Dey, B.K.; Pareek, S.; Sarkar, B. A two—Echelon supply chain management with setup time and cost reduction, quality improvement and variable production rate. Mathematics 2019, 7, 328. [Google Scholar] [CrossRef]

- Sarkar, B.; Guchhait, R.; Sarkar, M.; Pareek, S.; Kim, N. Impact of safety factors and setup time reduction in a two-echelon supply chain management. Robot. Comput. Integr. Manuf. 2019, 55, 250–258. [Google Scholar] [CrossRef]

- Visser, J.; Nemoto, T.; Browne, M. Home delivery and the impacts on urban freight transport: A review. Procedia Soc. Behav. Sci. 2014, 125, 15–27. [Google Scholar] [CrossRef]

- He, Z.; Cheng, T.E.C.; Dong, J.; Wang, S. Evolutionary location and pricing strategies for service merchants in competitive O2O markets. Euro. J. Oper. Res 2016, 254, 595–609. [Google Scholar] [CrossRef]

- Yan, R.; Cao, Z. Product returns, asymmetric information, and firm performance. Int. J. Prod. Econ. 2017, 185, 211–222. [Google Scholar] [CrossRef]

- Yan, R.; Pei, Z.; Ghose, S. Reward points, profit sharing, and valuable coordination mechanism in the O2O era. Int. J. Prod. Econ. 2018, 215, 34–47. [Google Scholar] [CrossRef]

- Ray, A.; Dhir, A.; Bala, P.K.; Kaur, P. Why do people use food delivery apps (FDA)? A uses and gratification theory perspective. J. Retail. Consum. Serv. 2019, 51, 221–230. [Google Scholar] [CrossRef]

- Yuchen, P.; Desheng, W.; Luo, C.; Alexandre, D. User activity measurement in rating-based online-to-offline (O2O) service recommendation. Inf. Sci. 2019, 479, 180–196. [Google Scholar]

- Son, J.; Kang, J.H.; Jung, S. The effects of out-of-stock, return, and cancellation amounts on the order amounts of an online retailer. J. Retail. Consum. Serv. 2019, 51, 421–427. [Google Scholar] [CrossRef]

- Yang, W.; Si, Y.; Zhang, J.; Liu, S.; Appolloni, A. Coordination mechanism of dual-channel supply chains considering retailer innovation inputs. Sustainability 2021, 13, 813. [Google Scholar] [CrossRef]

- Wei, Z.; Dou, W.; Jiang, Q.; Gu, C. Influence of incentive frames on offline-to-online interaction of outdoor advertising. J. Retail. Consum. Serv. 2021, 58, 102282. [Google Scholar] [CrossRef]

- Feng, L.; Chan, L.Y.; Cárdenas-Barrón, L.E. Pricing and lot-sizing polices for perishable goods when the demand depends on selling price, displayed stocks, and expiration date. Int. J. Prod. Econ. 2017, 185, 11–20. [Google Scholar] [CrossRef]

- Pal, B.; Sana, S.S.; Chudhuri, K.S. Two-echelon manufacturer–retailer supply chain strategies with price, quality, and promotional effort sensitive demand. Int. Trans. Oper. Res. 2015, 22, 1071–1095. [Google Scholar] [CrossRef]

- Thangam, A.; Uthayakumar, R. Two-echelon trade credit financing for perishable items in a supply chain when demand depends on both selling price and credit period. Comput. Ind. Eng. 2009, 57, 773–786. [Google Scholar] [CrossRef]

- Sana, S.S.; Chaudhuri, K.S. A deterministic EOQ model with delays in payments and price-discount offers. Eur. J. Oper. Res. 2008, 184, 509–533. [Google Scholar] [CrossRef]

- Sana, S.S. Optimal selling price and lotsize with time varying deterioration and partial backlogging. Appl. Math. Comput. 2010, 217, 185–194. [Google Scholar] [CrossRef]

- Sana, S.S. An EOQ model for salesmen’s initiatives, stock and price sensitive demand of similar products—A dynamical system. Appl. Math. Comput. 2010, 218, 3277–3288. [Google Scholar] [CrossRef]

- Ku, C.Y.; Chang, Y.W. Optimal production and selling policies with fixed-price contracts and contingent-price offers. Int. J. Prod. Econ. 2012, 137, 94–101. [Google Scholar] [CrossRef]

- Sarkar, B.; Saren, S.; Wee, H.M. An inventory model with variable demand, component cost and selling price for deteriorating items. Econ. Model. 2013, 30, 306–310. [Google Scholar] [CrossRef]

- Abad, P. Determining optimal price and order size for a price setting newsvendor under cycle service level. Int. J. Prod. Econ. 2014, 158, 106–113. [Google Scholar] [CrossRef]

- Alfares, H.K.; Ghaithan, A.M. Inventory and pricing model with price-dependent demand, time-varying holding cost, and quantity discounts. Comput. Ind. Eng. 2016, 94, 170–177. [Google Scholar] [CrossRef]

- Wu, J.; Chang, C.T.; Teng, J.T.; Lai, K.K. Optimal order quantity and selling price over a product life cycle with deterioration rate linked to expiration date. Int. J. Prod. Econ. 2017, 193, 343–351. [Google Scholar] [CrossRef]

- Li, R.; Teng, J.T. Pricing and lot-sizing decisions for perishable goods when demand depends on selling price, reference price, product freshness, and displayed stocks. Eur. J. Oper. Res. 2018, 270, 1099–1108. [Google Scholar] [CrossRef]

- Khan, A.A.M.; Shaikh, A.A.; Konstantaras, I.; Bhunia, A.K.; Cárdenas-Barrón, L.E. Inventory models for perishable items with advanced payment, linearly time-dependent holding cost and demand dependent on advertisement and selling price. Int. J. Prod. Econ. 2020, 230, 107804. [Google Scholar] [CrossRef]

- He, P.; He, Y.; Xu, H.; Zhou, L. Online selling mode choice and pricing in an O2O tourism supply chain considering corporate social responsibility. Electron. Commer. Res. Appl. 2019, 38, 100894. [Google Scholar] [CrossRef]

- Liu, X.; Wang, W.; Peng, R. An integrated production, inventory and preventive maintenance model for a multi-product production system. Reliab. Eng. Syst. Saf. 2015, 137, 76–86. [Google Scholar] [CrossRef]

- Bhuniya, S.; Sarkar, B.; Pareek, S. Multi-product production system with the reduced failure rate and the optimum energy consumption under variable demand. Mathematics 2019, 7, 465. [Google Scholar] [CrossRef]

- Kim, M.S.; Kim, J.S.; Sarkar, B.; Sarkar, M.; Iqbal, M.W. An improved way to calculate imperfect items during long-run production in an integrated inventory model with backorders. J. Manuf. Syst. 2018, 47, 153–167. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Sarkar, B.; Hasani, M. Delayed payment policy in multi-product single-machine economic production quantity model with repair failure and parrtial backordering. J. Ind. Manag. Optim. 2020, 16, 1273–1296. [Google Scholar]

- Guchhait, R.; Dey, B.K.; Bhuniya, S.; Ganguly, B.; Mandal, B.; Bachar, R.; Sarkar, B.; Wee, H.; Chaudhuri, K.S. Investment for process quality improvement and setup cost reduction in an imperfect production process with warranty policy and shortages. Rairo-Oper. Res. 2020, 54, 251–266. [Google Scholar] [CrossRef]

- Taleizadeh, A.A.; Tafakkori, K.; Thaichon, P. Resilience toward supply disruptions: A stochastic inventory control model with partial backordering under the base stock policy. J. Retail. Consum. Serv. 2021, 58, 102291. [Google Scholar] [CrossRef]

- Snyder, R.D.; Koehler, A.B.; Hyndman, R.J.; Ord, J.K. Exponential smoothing models: Means and variances for lead-time demand. Eur. J. Oper. Res. 2004, 158, 444–455. [Google Scholar] [CrossRef]

- Hsiao, Y.C. A note on integrated single vendor single buyer model with stochastic demand and variable lead time. Int. J. Prod. Econ. 2008, 114, 294–297. [Google Scholar] [CrossRef]

- Moon, I.; Shin, E.; Sarkar, B. Min–max distribution free continuous-review model with a service level constraint and variable lead time. Appl. Math. Comput. 2014, 229, 310–315. [Google Scholar] [CrossRef]

- Sarkar, B.; Mandal, B.; Sarkar, S. Quality improvement and backorder price discount under controllable lead time in an inventory model. J. Manuf. Syst. 2015, 35, 26–36. [Google Scholar] [CrossRef]

- Wang, S.; Disney, S.M. Mitigating variance amplification under stochastic lead-time: The proportional control approach. Eur. J. Oper. Res. 2016, 256, 1–12. [Google Scholar] [CrossRef]

- Dominguez, R.; Cannella, S.; Ponte, B.; Framinan, J. On the dynamics of closed-loop supply chains under remanufacturing lead time variability. Omega 2020, 97, 102106. [Google Scholar] [CrossRef]

- Hota, S.K.; Sarkar, B.; Ghosh, S.K. Effects of unequal lot size and variable transportation in unreliable supply chain management. Mathematics 2020, 8, 357. [Google Scholar] [CrossRef]

- Haeussler, S.; Stampfer, C.; Missbauer, H. Comparison of two optimization based order release models with fixed and variable lead times. Int. J. Prod. Econ. 2020, 227, 107682. [Google Scholar] [CrossRef]

- Malik, A.I.; Sarkar, B. Coordination supply chain management under flexible manufacturing, stochastic leadtime demand, and mixture of inventory. Mathematics 2020, 8, 911. [Google Scholar] [CrossRef]

- Dey, B.K.; Pareek, S.; Tayyab, M.; Sarkar, B. Autonomation policy to control work-in-process inventory in a smart production system. Int. J. Prod. Res. 2020, 1–23. [Google Scholar] [CrossRef]

| Author(s) | O2O Retailing | SCM | Lead Time | Backorder | Demand Rate |

|---|---|---|---|---|---|

| Dey et al. [9] | NA | Integrated | Poisson | Planned | Price dependent |

| Gallego and Moon [10] | NA | Newsboy | DFA | NA | Constant |

| Sarkar and Moon [8] | NA | Normal | Variable | Partial | Constant |

| Seok et al. [1] | NA | Sustainable | NA | NA | Constant |

| Sett et al. [4] | Yes | Normal | Normal | Planned | Price dependent |

| Sroufe et al. [11] | NA | Sustainable | NA | NA | Constant |

| Xiao and Dong [12] | Yes | Normal | NA | NA | Constant |

| Zimon et al. [13] | NA | Sustainable | NA | NA | Constant |

| This study | Yes | Sustainable | DFA & Normal | Planned | Online & offline price dependent |

| Uniform | Triangular | Double | |

|---|---|---|---|

| Distribution | Distribution | Triangular | |

| 3 | 3 | 3 | |

| (units) | |||

| ($) | |||

| ($) | |||

| (weeks) | 4 | 4 | 4 |

| ($) | |||

| ($) |

| Uniform | Triangular | Double | |

|---|---|---|---|

| Distribution | Distribution | Triangular | |

| 3 | 3 | 3 | |

| (units) | |||

| ($) | |||

| ($) | |||

| (weeks) | 4 | 3 | 4 |

| ($) | |||

| ($) | 305.61 |

| Sana and Chaudhuri’s [48] | Sana [33] | This Study |

|---|---|---|

| $91.54 | $168.05 | $427.10 |

| Parameters | Changes | TP | Parameters | Changes | TP |

|---|---|---|---|---|---|

| (in%) | (in%) | (in%) | (in%) | ||

| −50 | |||||

| S | b | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sarkar, B.; Dey, B.K.; Sarkar, M.; AlArjani, A. A Sustainable Online-to-Offline (O2O) Retailing Strategy for a Supply Chain Management under Controllable Lead Time and Variable Demand. Sustainability 2021, 13, 1756. https://doi.org/10.3390/su13041756

Sarkar B, Dey BK, Sarkar M, AlArjani A. A Sustainable Online-to-Offline (O2O) Retailing Strategy for a Supply Chain Management under Controllable Lead Time and Variable Demand. Sustainability. 2021; 13(4):1756. https://doi.org/10.3390/su13041756

Chicago/Turabian StyleSarkar, Biswajit, Bikash Koli Dey, Mitali Sarkar, and Ali AlArjani. 2021. "A Sustainable Online-to-Offline (O2O) Retailing Strategy for a Supply Chain Management under Controllable Lead Time and Variable Demand" Sustainability 13, no. 4: 1756. https://doi.org/10.3390/su13041756

APA StyleSarkar, B., Dey, B. K., Sarkar, M., & AlArjani, A. (2021). A Sustainable Online-to-Offline (O2O) Retailing Strategy for a Supply Chain Management under Controllable Lead Time and Variable Demand. Sustainability, 13(4), 1756. https://doi.org/10.3390/su13041756