Economic Sustainability and Multiple Risk Management Strategies: Examining Interlinked Decisions of Small American Farms

Abstract

1. Introduction

2. Material and Method

2.1. Conceptual Model

2.2. Econometric Specification

2.3. Sampling Procedure and Data Collection

3. Result and Discussion

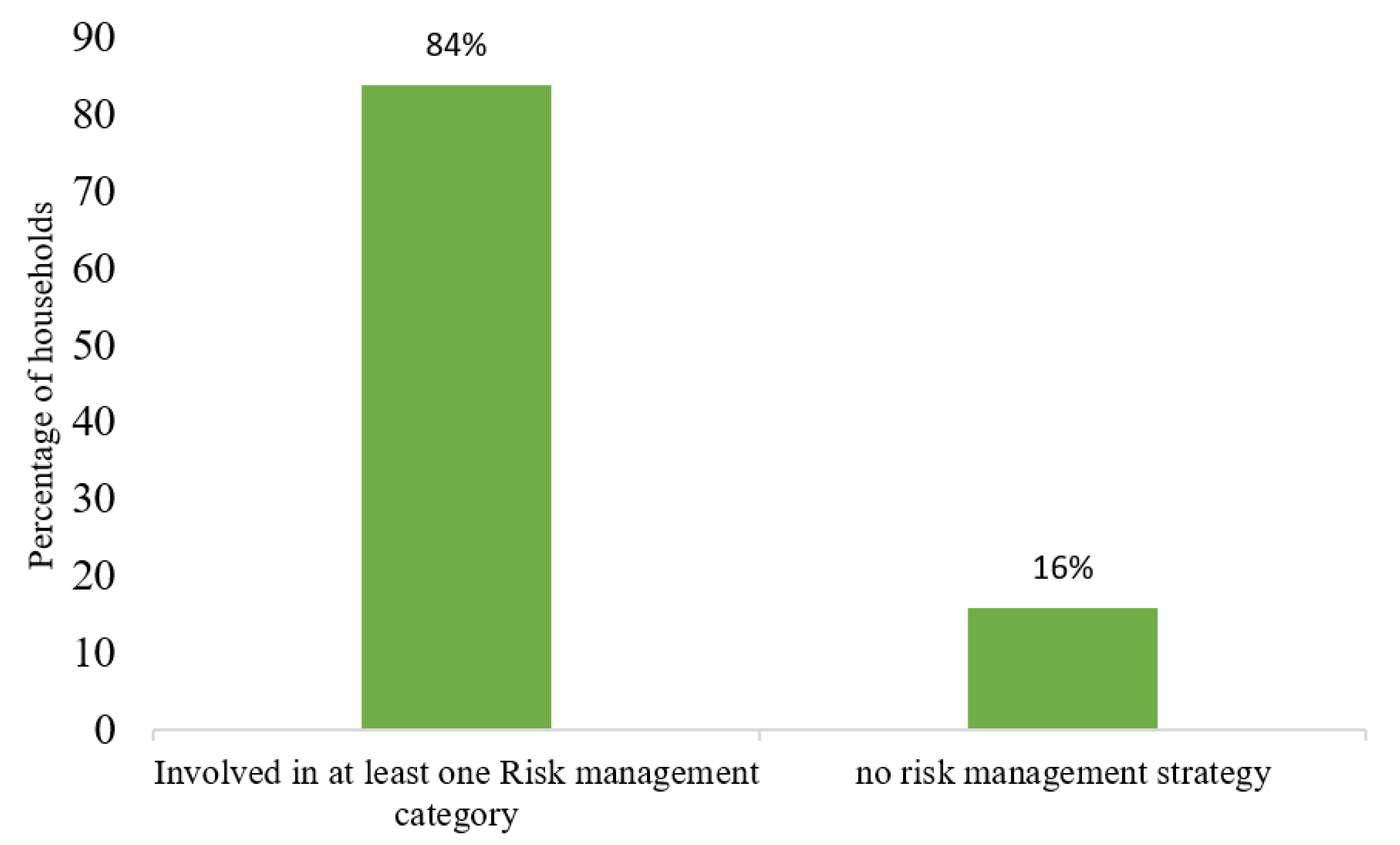

3.1. Descriptive and Summary Statistics

3.2. Results from Multivariate Regression

3.3. Interlinkage between Risk Management Decisions

3.4. Factors Influencing Risk Management Decisions

4. Summary and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Janowicz-Lomott, M.; Łyskawa, K. The new instruments of risk management in agriculture in the European Union. Procedia Econ. Financ. 2014, 9, 321–330. [Google Scholar] [CrossRef]

- Aimin, H. Uncertainty, Risk Aversion, and Risk Management in Agriculture. Agric. Agric. Sci. Procedia 2010, 1, 152–156. [Google Scholar] [CrossRef]

- Meraner, M.; Finger, R. Risk perceptions, preferences, and management strategies: Evidence from a case study using German livestock farmers. J. Risk Res. 2019, 22, 110–135. [Google Scholar] [CrossRef]

- USDA. Economic Research Service. Most Farms Are Small, But Most Production is on Large Farms. United States Department of Agriculture. 2019. Available online: https://www.ers.usda.gov/data-products/chart-gallery/gallery/chart-detail/?chartId=58288 (accessed on 4 February 2021).

- Gebremedhin, T.G.; Christy, R.D. Structural changes in U.S. agriculture: Implications for small farms. J. Agric. Appl. Econ. 1996, 28, 57–66. [Google Scholar] [CrossRef][Green Version]

- USDA. America’s Diverse Family Farms. National Agricultural Statistics Service and Economics Research Services, United States Department of Agriculture. 2017. Available online: https://www.ers.usda.gov/webdocs/publications/86198/eib-185.pdf?v=463.4 (accessed on 4 February 2021).

- Woodard, J.D. Theme Overview: Current Issues in Risk Management and U.S. Agricultural Policy. Choices 2013, 28, 1–2. [Google Scholar]

- Koesling, M.; Ebbesvik, M.; Lien, G.; Flaten, O.; Valle, P.S.; Arntzen, H. Risk and risk management in organic and conventional cash crop farming in Norway. Food Econ. Acta Agric. Scand. Sect. C 2004, 1, 195–206. [Google Scholar] [CrossRef]

- Garrido, A.; Zilberman, D. Revisiting the demand of agricultural Insurance: The case of Spain. Agric. Financ. Rev. 2007, 68, 43–66. [Google Scholar] [CrossRef]

- Finger, R.; Lehmann, N. The influence of direct payments on farmers’ hail insurance decisions. Agric. Econ. 2012, 43, 343–354. [Google Scholar] [CrossRef]

- Székely, C.; Pálinkás, P. Agricultural Risk Management in the European Union and the USA. Stud. Agric. Econ. 2009, 109, 55–72. [Google Scholar] [CrossRef]

- Kahan, D. Managing Risk in Farming (Farm Management Extension Guide); Food and Agriculture Organization of the United Nations: Rome, Italy, 2008; Volume 153, pp. 38–75. [Google Scholar]

- Huirne, R.; Meuwissen, M.; Asseldonk, M.V. Importance of Whole-farm Risk Management in Agriculture. In Handbook of Operations Research in Natural Resources; Springer: Boston, MA, USA, 2007; pp. 3–15. [Google Scholar] [CrossRef]

- Khanal, A.R.; Mishra, A.K. Agritourism and off-farm work: Survival strategies for small farms. Agric. Econ. 2014, 45, 65–76. [Google Scholar] [CrossRef]

- Marin, D. Study on the economic impact of tourism and of agrotourism on local communities. Res. J. Agric. Sci. 2015, 47, 160–163. [Google Scholar] [CrossRef]

- Ammirato, S.; Felicetti, A. The Agritourism as a means of sustainable development for rural communities: A research from the field. Int. J. Interdiscip. Environ. Stud. 2014, 8, 17–29. [Google Scholar] [CrossRef]

- Roman, M.; Roman, M.; Prus, P. Innovations in Agritourism: Evidence from a region in Poland. Sustainability 2020, 12, 4858. [Google Scholar] [CrossRef]

- Mishra, A.K.; El-Osta, H.S.; Sandretto, C.L. Factors Affecting Farm Enterprise Diversification. Agric. Financ. Rev. 2004, 64, 151–166. [Google Scholar] [CrossRef]

- Wan, J.; Li, R.; Wang, W.; Liu, Z.; Chen, B. Income diversification: A strategy for rural region risk management. Sustainability 2016, 8, 1064. [Google Scholar] [CrossRef]

- Vogel, S.J. Multi-enterprising farm households: The importance of their alternative business ventures in the rural economy. USDA-ERS Econ. Inf. Bull. 2012. [Google Scholar] [CrossRef]

- Aguglia, L.; Henke, K.; Poppe, K.J.; Roest, A.; Salvioni, C. Diversification and Multifunctionality in Italy and the Netherlands: A Comparative Analysis; Wye City Group: Wageningen, The Netherland, 2009; Volume 8. [Google Scholar]

- Khanal, A.; Mishra, A. Interlinked diversification strategies: Evidence from U.S. farm business households. In Proceedings of the Annual Meetings of Southern Agricultural Economics Association, Atlanta, Georgia, 31 January–3 February 2015. [Google Scholar]

- Cole, S.; Giné, X.; Vickery, J. How does risk management influence production decisions? Evidence from a field experiment. Rev. Financ. Stud. 2017, 30, 1935–1970. [Google Scholar] [CrossRef]

- Velandia, M.; Rejesus, R.M.; Thomas, O.K.; Sherrick, B.J. Factors Affecting Farmers’ Utilization of Agricultural Risk Management Tools: The Case of Crop Insurance, Forward Contracting, and Spreading Sales. J. Agric. Appl. Econ. 2009, 41, 107–123. [Google Scholar] [CrossRef]

- Martin, S. Risk management strategies in New Zealand agriculture, horticulture. Rev. Market. Agric. Econ. 1996, 64, 31–44. [Google Scholar] [CrossRef]

- Bartolini, F.; Andreoli, M.; Brunori, G. Explaining determinants of the on-farm diversification: Empirical evidence from the Tuscany region. Bio-Based Appl. Econ. J. 2014, 3, 137–157. [Google Scholar] [CrossRef]

- Joo, H.; Khanal, A.R.; Mishra, A.K. Farmers’ participation in Agritourism: Does it affect the bottom line? Agric. Resour. Econ. Rev. 2013, 42, 471–490. [Google Scholar] [CrossRef]

- Kumar, D.S.; Barah, B.C.; Ranganathan, C.R.; Venkatram, R.; Gurunathan, S.; Thirumoorthy, S. An analysis of farmers’ perception and awareness towards crop insurance as a tool for risk management in Tamil Nadu. Agric. Econ. Res. Rev. 2011, 24, 37–46. [Google Scholar] [CrossRef]

- Boyd, M.; Pai, J.; Qiao, Z.; Ke, W. Crop insurance principles and risk implications for China. Hum. Ecol. Risk Assess. 2011, 17, 554–565. [Google Scholar] [CrossRef]

- Coble, K.H.; Heifner, R.G.; Zuniga, M. Implications of crop yield and revenue insurance for producer hedging. J. Agric. Resour. Econ. 2000, 25, 432–452. [Google Scholar]

- Ke, B.; Wang, H.H. An assessment of risk management strategies for grain growers in the Pacific Northwest. Agric. Financ. Rev. 2002, 62, 117–133. [Google Scholar] [CrossRef]

- Sherrick, B.J.; Barry, P.J.; Ellinger, P.N.; Schnitkey, G.D. Factors influencing farmers’ crop insurance decisions. Am. J. Agric. Econ. 2004, 86, 103–114. [Google Scholar] [CrossRef]

- Blank, S.C. Returns to limited crop diversification. West. J. Agric. Econ. 1990, 15, 204–212. [Google Scholar]

- Lucas, M.P.; Pabuayon, I.M. Risk perceptions, attitudes, and influential factors of rainfed lowland rice farmers in Ilocos Norte, Philippines. Asian J. Agric. Dev. 2011, 8, 61–77. [Google Scholar]

- Wang, L.; Watanabe, T. Factors affecting farmers’ risk perceptions regarding biomass supply: A case study of the national bioenergy industry in northeast China. J. Clean. Prod. 2016, 139, 517–526. [Google Scholar] [CrossRef]

- Iqbal, M.A.; Ping, Q.; Abid, M.; Kazmi, S.M.M.; Rizwan, M. Assessing risk perceptions and attitudes among cotton farmers: A case of Punjab province, Pakistan. Int. J. Disaster Risk Reduct. 2016, 16, 68–74. [Google Scholar] [CrossRef]

- Sulewski, P.; Kłoczko-Gajewska, A. Farmers’ risk perception, risk aversion, and strategies to cope with production risk: An empirical study from Poland. Stud. Agric. Econ. 2014, 116, 140–147. [Google Scholar] [CrossRef]

- Train, K.E. Discrete Choice Methods with Simulation; Cambridge University Press: Cambridge, UK, 2009. [Google Scholar]

- Dow, J.K.; Endersby, J.W. Multinomial probit and multinomial logit: A comparison of choice models for voting research. Elect. Stud. 2004, 23, 107–122. [Google Scholar] [CrossRef]

- Chib, S.; Greenberg, E. Analysis of multivariate probit models. Biometrika 1998, 85, 347–361. [Google Scholar] [CrossRef]

- Mishra, A.K.; Khanal, A.R. Is participation in agri-environmental programs affected by liquidity and solvency? Land Use Policy 2013, 35, 163–170. [Google Scholar] [CrossRef]

- Khanal, A.R.; Mishra, A.K.; Omobitan, O. Examining organic, Agritourism, and agri-environmental diversification decisions of American farms: Are these decisions interlinked? Rev. Agric. Food Environ. Stud. 2019, 100, 27–45. [Google Scholar] [CrossRef]

- Mastronardi, L.; Giaccio, V.; Giannelli, A.; Scardera, A. Is agritourism eco-friendly? A comparison between agritourisms and other farms in Italy using farm accountancy data network dataset. Springerplus 2015, 4, 1–2. [Google Scholar] [CrossRef]

- Potter, C.; Lobley, M. The farm family life cycle, succession paths, and environmental change in Britain’s countryside. J. Agric. Econ. 1996, 47, 172–190. [Google Scholar] [CrossRef]

- Knight, J.; Weir, S.; Woldehanna, T. The role of education in facilitating risk-taking and innovation in agriculture. J. Dev. Stud. 2003, 39, 1–22. [Google Scholar] [CrossRef]

- McNamara, K.T.; Weiss, C. Farm household income and on-and off-farm diversification. J. Agric. Appl. Econ. 2005, 37, 37–48. [Google Scholar] [CrossRef]

- McElwee, G.; Bosworth, G. Exploring the strategic skills of farmers across a typology of farm diversification approaches. J. Farm. Manag. 2010, 13, 819–838. [Google Scholar]

- Hoppe, R.A.; MacDonald, J.M.; Korb, P. Small Farms in the United States: Persistence under Pressure; Economic Information Bulletin No. 63; United States Department of Agriculture; Economic Research Service: Washington, DC, USA, 2010.

| Risk Management Strategies | Percentage of Total Farms |

|---|---|

| Diversification | 65% |

| Alternative Farm enterprises (AFE) | 61% |

| off-farm work | 35% |

| Insurance | 32% |

| Variables Definitions | Mean | Std. Dev. |

|---|---|---|

| Age (age of the principal farm operator) | 53.29 | 10.38 |

| Education (years of schooling of principal farm operator) | 14.06 | 2.79 |

| Log of income (log of the total household income) | 5.56 | 9.08 |

| Income (total household income) | 55,930.25 | 47,098.40 |

| Log of acres (log of the total acres of the farm) | 2.52 | 2.76 |

| Acres (total farm acreage in acres) | 71.58 | 129.78 |

| Smartphone (=1 if the principal operator uses a smartphone with internet access) | 0.84 | 0.37 |

| Continuation plan (=1 if the principal operator expects to farm for the next 5 or 10 years) | 0.85 | 0.36 |

| Family involvement (=1 if family members other than principle operator also involve on-farm activities) | 0.67 | 0.47 |

| Share of Agriculture (percentage of agriculture on total household income) | 26.93 | 32.87 |

| Government payment (=1 if farm household received any type of government plan) | 0.18 | 0.39 |

| Number of Observations | 100 |

| Independent Variables | Crop/Livestock Diversification | Adoption of Alternative Farm Enterprises (AFE) | Off-Farm Work | Crop/Livestock Insurance | ||||

|---|---|---|---|---|---|---|---|---|

| Coefficient | Marginal Effect | Coefficient | Marginal Effect | Coefficient | Marginal Effect | Coefficient | Marginal Effect | |

| Age | −0.0399 ** | −0.0114 | −0.0359 ** | −0.0137 | −0.0111 | −0.0032 | −0.0131 | −0.0022 |

| (0.0174) | (0.0051) | (0.0165) | (0.0044) | (0.0169) | (0.0051) | (0.0163) | (0.0048) | |

| education | 0.1131 ** | 0.0332 | −0.0056 | −0.0032 | 0.0303 | 0.0119 | −0.087 * | −0.0171 |

| (0.0498) | (0.0152) | (0.0524) | (0.017) | (0.0548) | (0.0169) | (0.0509) | (0.0151) | |

| Log of income | −0.0005 | 0.0003 | 0.0329 * | 0.006 | 0.0018 | 0.0007 | −0.0172 | −0.0009 |

| (0.0166) | (0.0056) | (0.0172) | (0.0051) | (0.0188) | (0.0057) | (0.0174) | (0.0052) | |

| Log of acres | 0.1804 ** | 0.0494 | −0.0949 | −0.0241 | 0.00009 | 0.0005 | 0.2224 * | 0.0542 |

| (0.0772) | (0.0221) | (0.0661) | (0.0185) | (0.0647) | (0.0196) | (0.0842) | (0.0238) | |

| smartphone | −0.4603 | −0.1167 | 0.8505 * | 0.2524 | 0.6439 | 0.2035 | −0.04 | −0.0346 |

| (0.4444) | (0.137) | (0.3905) | (0.1153) | (0.4645) | (0.1392) | (0.4363) | (0.1226) | |

| Continuation plan | −0.1295 | 0.0077 | −0.3022 | −0.0904 | 0.8592 * | 0.2834 | −0.1981 | −0.0258 |

| (0.4527) | (0.1428) | (0.4452) | (0.1267) | (0.5076) | (0.1475) | (0.458) | (0.1349) | |

| Family involvement | −0.0826 | −0.0325 | 0.2186 | 0.0457 | 0.017 | 0.0053 | −0.491 | −0.1762 |

| (0.3241) | (0.1428) | (0.3117) | (0.0936) | (0.3185) | (0.0984) | (0.3216) | (0.0884) | |

| Share of Agriculture | 0.0081 * | 0.0022 | 0.0069 | 0.0019 | −0.0194 ** | −0.0058 | 0.0023 | 0.0005 |

| (0.0046) | (0.0014) | (0.0047) | (0.0014) | (0.0059) | (0.0015) | (0.0045) | (0.0014) | |

| Government pay | −0.9925 ** | −0.2605 | −0.2951 | −0.11 | 0.7806 * | 0.2323 | 0.8053 ** | 0.2215 |

| (0.4389) | (0.127) | (0.3977) | (0.00014) | (0.4508) | (0.1309) | (0.3784) | (0.1111) | |

| Constant | 0.1362 (1.5171) | 1.6992 (1.482) | −1.2312 (1.6288) | 1.164 (1.5276) | ||||

| Joint decisionparameters | AFE and Diversification (rho 21) | 0.4765 ** (0.1377) | off-farm work and diversification (rho31) | 0.039 (0.180) | ||||

| Insurance and Diversification (rho41) | −0.3679 ** (0.1862) | off-farm work and AFE (rho32) | 0.061 (0.176) | |||||

| Insurance and AFE (rho42) | 0.3779 ** (0.1734) | Insurance and off-farm work (rho43) | −0.301 * (0.184) | |||||

| Likelihood ratio test of rho21 = rho31 = rho41 = rho32 = rho42 = rho43 = 0: chi2(6) = 19.2248, Prob > chi2 = 0.0038 | ||||||||

| Wald-Chi-square statistics of overall fit: 86.01 (Prob > chi2, 0.0000) | N = 100 | |||||||

| Log-likelihood:−203.05851 | ||||||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adhikari, S.; Khanal, A.R. Economic Sustainability and Multiple Risk Management Strategies: Examining Interlinked Decisions of Small American Farms. Sustainability 2021, 13, 1741. https://doi.org/10.3390/su13041741

Adhikari S, Khanal AR. Economic Sustainability and Multiple Risk Management Strategies: Examining Interlinked Decisions of Small American Farms. Sustainability. 2021; 13(4):1741. https://doi.org/10.3390/su13041741

Chicago/Turabian StyleAdhikari, Sudip, and Aditya R. Khanal. 2021. "Economic Sustainability and Multiple Risk Management Strategies: Examining Interlinked Decisions of Small American Farms" Sustainability 13, no. 4: 1741. https://doi.org/10.3390/su13041741

APA StyleAdhikari, S., & Khanal, A. R. (2021). Economic Sustainability and Multiple Risk Management Strategies: Examining Interlinked Decisions of Small American Farms. Sustainability, 13(4), 1741. https://doi.org/10.3390/su13041741