Research on Enterprises’ Intention to Adopt Green Technology Imposed by Environmental Regulations with Perspective of State Ownership

Abstract

1. Introduction

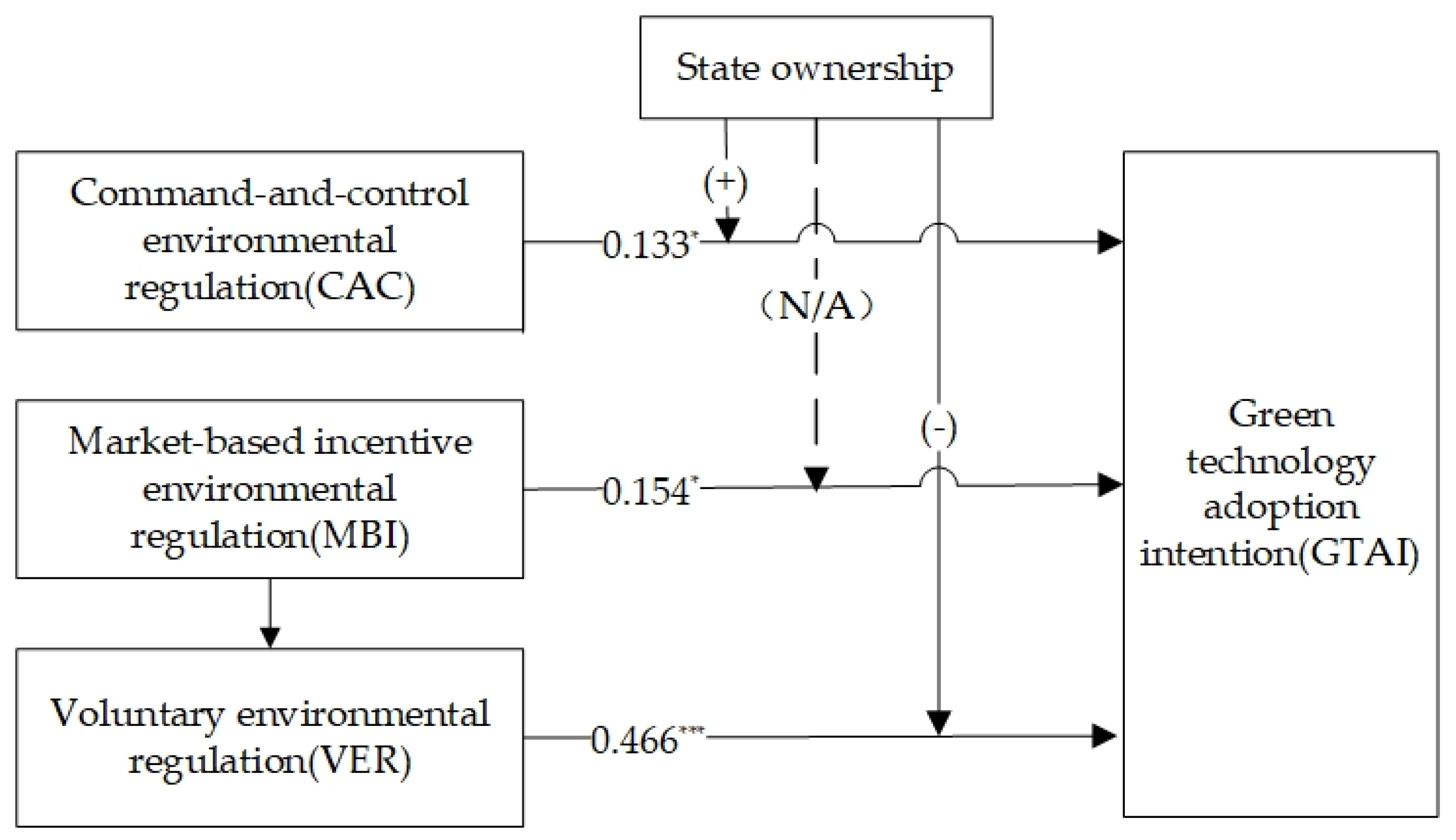

2. Theoretical Basis and Research Hypothesis

2.1. Environmental Regulations (ER) and Enterprises’ GTA

2.2. State Ownership, Environmental Regulation and Enterprises’ GTA

2.2.1. Command-and-Control Environmental Regulation (CAC) and Green Technology Adoption Intention (GTAI)

2.2.2. Market-Based Incentive Environmental Regulation (MBI) and Green Technology Adoption Intention (GTAI)

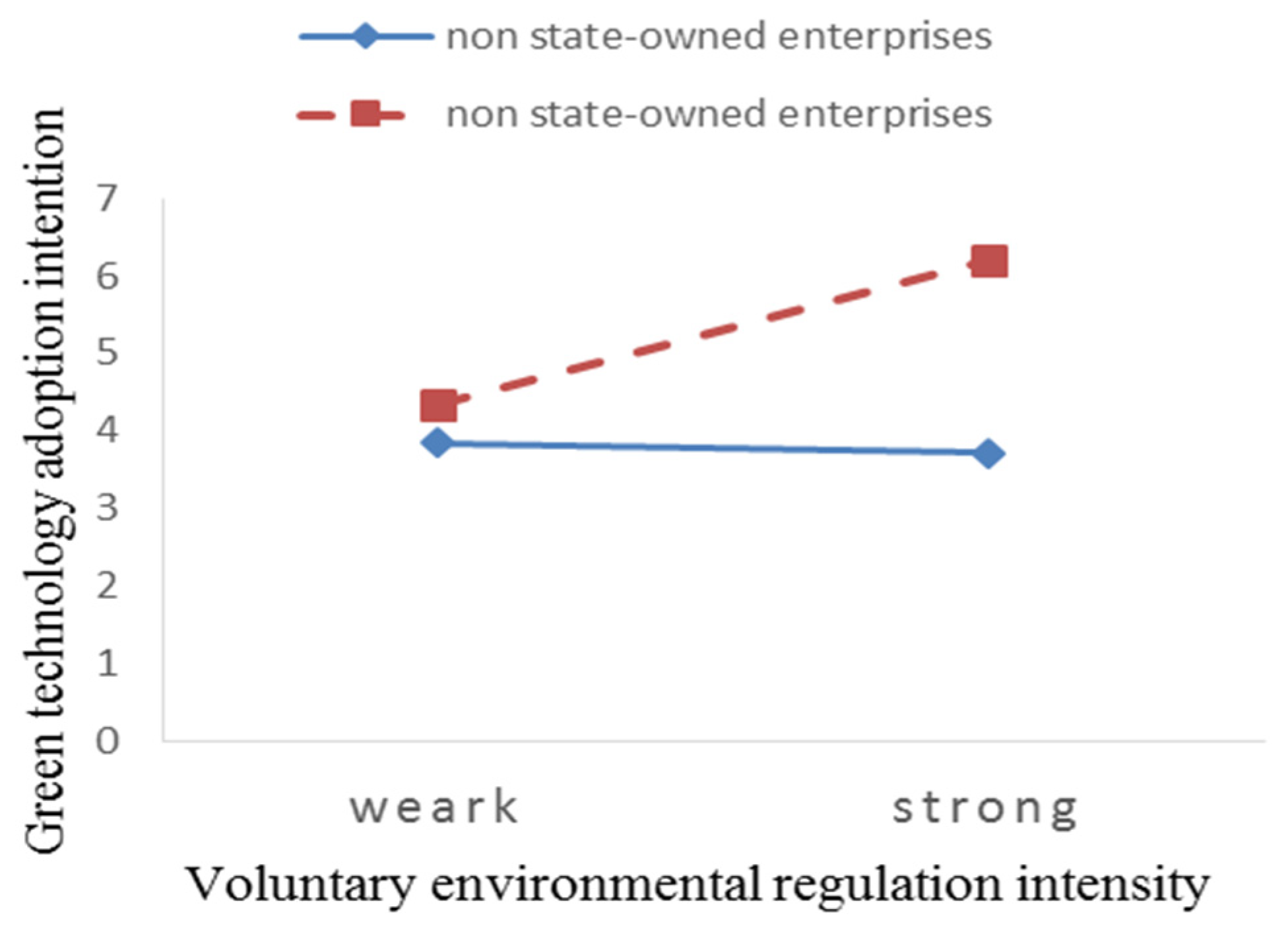

2.2.3. Voluntary Environmental Regulation (VER) and Green Technology Adoption intention (GTAI)

3. Methodology

3.1. Sample and Data Collection

3.2. Variable and Items

3.3. Measurement and Results Analysis

3.3.1. Validity and Reliability Analysis

3.3.2. Correlation among Variables

3.3.3. Results Analysis

4. Discussion

4.1. The Effect of Environmental Regulations

4.2. The Moderate Effect of State Ownership

4.3. Managerial Implication

5. Conclusions

5.1. Contribution

5.2. Limitations and Future Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Yao, X.; Huang, R.; Song, M. How to Reduce Carbon Emissions of Small and Medium Enterprises (SMEs) by Knowledge Sharing in China. Prod. Plan. Control. 2019, 30, 881–892. [Google Scholar] [CrossRef]

- Wu, J.; Xia, P.; Zhu, Q. Measuring Environmental Efficiency of Thermoelectric Power Plants: A Common Equilibrium Efficient Frontier DEA Approach with Fixed-Sum Undesirable Output. Ann. Oper. Res. 2019, 275, 731–749. [Google Scholar] [CrossRef]

- Song, M.; Wang, S.; Sun, J. Environmental Regulations, Staff Quality, Green Technology, R&D Efficiency, and Profit in Manufacturing. Technol. Forecast. Soc. Chang. 2018, 133, 1–14. [Google Scholar]

- Liu, H.; Wu, J.; Chu, J. Environmental Efficiency and Technological Progress of Transportation Industry-Based on Large Scale Data. Technol. Forecast. Soc. Chang. 2019, 144, 475–482. [Google Scholar] [CrossRef]

- Tornatzky, L.G.; Klein, K.J. Innovation Characteristics and Innovation Adoption-Implementation: A Meta-Analysis of Findings. IEEE Trans. Eng. Manag. 1982, 1, 28–45. [Google Scholar] [CrossRef]

- Jaffe, A.B.; Newell, R.G.; Stavins, R.N. Environmental Policy and Technological Change. Environ. Resour. Econ. 2002, 22, 41–70. [Google Scholar] [CrossRef]

- Darko, A.; Chan, A.P.C.; Yang, Y.; He, B.J.; Yang, J.; Shan, M.; Gou, Z. Influences of Barriers, Drivers, and Promotion Strategies on Green Building Technologies Adoption in Developing Countries: The Ghanaian Case. J. Clean. Prod. 2018, 200, 687–703. [Google Scholar] [CrossRef]

- Hottenrott, H.; Rexhäuser, S.; Veugelers, R. Organisational Change and the Productivity Effects of Green Technology Adoption. Resour. Energy Econ. 2016, 43, 172–194. [Google Scholar] [CrossRef]

- Xia, D.; Chen, B.; Zheng, Z. Relationships among Circumstance Pressure, Green Technology Selection and Firm Performance. J. Clean. Prod. 2015, 106, 487–496. [Google Scholar] [CrossRef]

- Weng, M.H.; Lin, C.Y. Determinants of Green Innovation Adoption for Small and Medium-Size Enterprises (SMES). Afr. J. Bus. Manag. 2011, 5, 9154–9163. [Google Scholar]

- Horbach, J. Determinants of Environmental Innovation—New Evidence from German Panel Data Sources. Res. Policy 2008, 37, 163–173. [Google Scholar] [CrossRef]

- Pujari, D. Eco-Innovation and New Product Development: Understanding the Influences on Market Performance. Technovation 2006, 26, 76–85. [Google Scholar] [CrossRef]

- Triguero, A.; Mondéjar, L.M.; Davia, M.A. Drivers of Different Types of Eco-Innovation in European SMEs. Ecol. Econ. 2013, 92, 25–33. [Google Scholar] [CrossRef]

- Estrin, S.; Perotin, V. Does Ownership Always Matter? Int. J. Ind. Organ. 1991, 9, 55–72. [Google Scholar] [CrossRef]

- Arvanitis, S.; Ley, M. Factors Determining the Adoption of Energy-Saving Technologies in Swiss Firms: An Analysis Based on Micro Data. Environ. Resour. Econ. 2013, 54, 389–417. [Google Scholar] [CrossRef]

- Bukchin, S.; Kerret, D. Once You Choose Hope: Early Adoption of Green Technology. Environ. Sci. Pollut. Res. 2020, 27, 3271–3280. [Google Scholar] [CrossRef]

- Stucki, T.; Woerter, M. Intrafirm Diffusion of Green Energy Technologies and the Choice of Policy Instruments. J. Clean. Prod. 2016, 131, 545–560. [Google Scholar] [CrossRef]

- Jefferson, G.; Albert, G.Z.; Guan, X.; Yu, X. Ownership, Performance, and Innovation in China’s Large-and Medium-Size Industrial Enterprise Sector. China Econ. Rev. 2003, 14, 89–113. [Google Scholar] [CrossRef]

- Xie, R.; Yuan, Y.; Huang, J. Different Types of Environmental Regulations and Heterogeneous Influence on “Green” Productivity: Evidence from China. Ecol. Econ. 2017, 132, 104–112. [Google Scholar] [CrossRef]

- Golombek, R.; Raknerud, A. Do Environmental Standards Harm Manufacturing Employment? Scand. J. Econ. 1997, 99, 29–44. [Google Scholar] [CrossRef]

- Bollinger, B. Green Technology Adoption: An Empirical Study of the Southern California Garment Cleaning Industry. Quant. Mark. Econ. 2015, 13, 319–358. [Google Scholar] [CrossRef]

- Porter, M.E. America’s Green Strategy. Sci. Am. 1991, 264, 193–246. [Google Scholar]

- Porter, M.E.; Van der Linde, C. Toward a New Conception of the Environment-Competitiveness Relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Requate, T.; Unold, W. Environmental Policy Incentives to Adopt Advanced Abatement Technology: Will the True Ranking Please Stand Up? Eur. Econ. Rev. 2003, 47, 125–146. [Google Scholar] [CrossRef]

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental Taxes and the Choice of Green Technology. Prod. Oper. Manag. 2013, 22, 1035–1055. [Google Scholar] [CrossRef]

- Hattori, K. Optimal Combination of Innovation and Environmental Policies under Technology Licensing. Econ. Model. 2017, 64, 601–609. [Google Scholar] [CrossRef]

- Villegas-Palacio, C.; Coria, J. On the Interaction between Imperfect Compliance and Technology Adoption: Taxes versus Tradable Emissions Permits. J. Regul. Econ. 2010, 38, 274–291. [Google Scholar] [CrossRef]

- Zhen, L.; Wu, Y.; Wang, S.; Laporte, G. Green Technology Adoption for Fleet Deployment in a Shipping Network. Transp. Res. Part B Methodol. 2020, 139, 388–410. [Google Scholar] [CrossRef]

- Klemetsen, M.E.; Bye, B.; Raknerud, A. Can Direct Regulations Spur Innovations in Environmental Technologies? A Study on Firm-Level Patenting. Scand. J. Econ. 2018, 120, 338–371. [Google Scholar] [CrossRef]

- Ramanathan, R.; Ramanathan, U.; Bentley, Y. The Debate on Flexibility of Environmental Regulations, Innovation Capabilities and Financial Performance–A Novel Use of DEA. Omega 2018, 75, 131–138. [Google Scholar] [CrossRef]

- Sapra, H.; Subramanian, A.; Subramanian, K.V. Corporate Governance and Innovation: Theory and Evidence. J. Financ. Quant. Anal. 2014, 49, 957–1003. [Google Scholar] [CrossRef]

- Saengsupavanich, C.; Gallardo, W.G.; Sajor, E.; Murray, W.M. Constraints Influencing Stakeholder Participation in Collective Environmental Management. Environ. Earth Sci. 2012, 66, 1817–1829. [Google Scholar] [CrossRef]

- Ambec, S.; Lanoie, P. Does It Pay to Be Green? A Systematic Overview. Acad. Manag. Perspect. 2008, 22, 45–62. [Google Scholar]

- Donaldson, T.; Preston, L.E. The Stakeholder Theory of the Corporation: Concepts, Evidence and Implications. Acad. Manag. Rev. 1995, 20, 65–91. [Google Scholar] [CrossRef]

- Berrone, P.; Fosfuri, A.; Gelabert, L.; Mejia, L.R.G. Necessity as the Mother of ’Green’ Inventions: Institutional Pressures and Environmental Innovations. Strateg. Manag. J. 2013, 34, 891–909. [Google Scholar] [CrossRef]

- La Porta, R.; Silanes, F.d.L.; Shleifer, A. Corporate Ownership around the World. J. Financ. 1999, 54, 471–517. [Google Scholar] [CrossRef]

- Cronqvist, H.; Nilsson, M. Agency Costs of Controlling Minority Shareholders. J. Financ. Quant. Anal. 2003, 38, 695–719. [Google Scholar] [CrossRef]

- Child, J.; Tse, D.K. China’s Transition and Its Implications for International Business. J. Int. Bus. Stud. 2001, 32, 5–21. [Google Scholar] [CrossRef]

- Jiang, L.A.; Waller, D.S.; Cai, S. Does Ownership Type Matter for Innovation? Evidence from China. J. Bus. Res. 2013, 66, 2473–2478. [Google Scholar] [CrossRef]

- Xu, X.N.; Wang, Y. Ownership Structure and Corporate Governance in Chinese Stock Companies. China Econ. Rev. 1999, 10, 75–98. [Google Scholar] [CrossRef]

- Tan, J. Impact of Ownership Type on Environment–Strategy Linkage and Performance: Evidence from a Transitional Economy. J. Manag. Stud. 2002, 39, 333–354. [Google Scholar] [CrossRef]

- Sharma, S.; Pablo, A.L.; Vredenburg, H. Corporate Environmental Responsiveness Strategies: The Importance of Issue Interpretation and Organizational Context. J. Appl. Behav. Sci. 1999, 35, 87–108. [Google Scholar] [CrossRef]

- Féres, J.; Reynaud, A. Assessing the Impact of Formal and Informal Regulations on Environmental and Economic Performance of Brazilian Manu-Facturing Firms. Environ. Resour. Econ. 2012, 52, 65–85. [Google Scholar] [CrossRef]

- Brents, B.G.; Hausbeck, K. State-Sanctioned Sex: Negotiating Formal and Informal Regulatory Practices in Nevada Brothels. Sociol. Perspect. 2001, 44, 307–332. [Google Scholar] [CrossRef]

- Wu, G.C. Environmental Innovation Approaches and Business Performance: Effects of Environmental Regulations and Resource Com-Mitment. Innovation 2017, 19, 407–427. [Google Scholar] [CrossRef]

- Blackman, A.; Lahiri, B.; Pizer, W.; Planter, M.R.; Pina, C.M. Voluntary Environmental Regulation in Developing Countries: Mexico’s Clean Industry Program. J. Environ. Econ. Manag. 2010, 60, 182–192. [Google Scholar] [CrossRef]

- Bu, M.; Qiao, Z.; Liu, B. Voluntary Environmental Regulation and Firm Innovation in China. Econ. Model. 2020, 89, 10–18. [Google Scholar] [CrossRef]

- Jennings, P.D.; Zandbergen, P.A. Ecologically Sustainable Organizations: An Institutional Approach. Acad. Manag. Rev. 1995, 20, 1015–1052. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. The Determinants of an Environmentally Responsive Firm: An Empirical Approach. J. Environ. Econ. Manag. 1996, 30, 381–395. [Google Scholar] [CrossRef]

- Sethi, S.P. A Conceptual Framework for Environmental Analysis of Social Issues and Evaluation of Business Response Patterns. Acad. Manag. Rev. 1979, 4, 63–74. [Google Scholar] [CrossRef]

- Suchman, M.C. Managing Legitimacy: Strategic and Institutional Approaches. Acad. Manag. Rev. 1995, 20, 571–610. [Google Scholar] [CrossRef]

- Siegel, P.B.; Johnson, T.G. Measuring the Economic Impacts of Reducing Environmentally Damaging Production Activities. Rev. Reg. Stud. 1993, 23, 237–254. [Google Scholar]

- Acemoglu, D.; Aghion, P.; Bursztyn, L.; Hemous, D. The Environment and Directed Technical Change. Am. Econ. Rev. 2012, 102, 131–166. [Google Scholar] [CrossRef] [PubMed]

- Braun, E.; Wield, D. Regulation as a Means for the Social Control of Technology. Technol. Anal. Strateg. Manag. 1994, 6, 259–272. [Google Scholar] [CrossRef]

- Rennings, K.; Zwick, T. Employment Impact of Cleaner Production on the Firm Level: Empirical Evidence from a Survey in Five European Countries. Int. J. Innov. Manag. 2002, 6, 319–342. [Google Scholar] [CrossRef]

- Brunnermeier, S.B.; Cohen, M.A. Determinants of Environmental Innovation in US Manufacturing Industries. J. Environ. Econ. Manag. 2003, 45, 278–293. [Google Scholar] [CrossRef]

- Lesic, V.; De Bruin, W.B.; Davis, M.C. Consumers’ Perceptions of Energy Use and Energy Savings: A Literature Review. Environ. Res. Lett. 2018, 13, 033004. [Google Scholar] [CrossRef]

- Mills, B.; Schleich, J. Residential Energy-Efficient Technology Adoption, Energy Conservation, Knowledge, and Attitudes: An Analysis of European Countries. Energy Policy 2012, 49, 616–628. [Google Scholar] [CrossRef]

- Delmas, M.A.; Toffel, M.W. Organizational Responses to Environmental Demands: Opening the Black Box. Strateg. Manag. J. 2008, 29, 1027–1055. [Google Scholar] [CrossRef]

- Sharma, S. Managerial Interpretations and Organizational Context as Predictors of Corporate Choice of Environmental Strategy. Acad. Manag. J. 2000, 43, 681–697. [Google Scholar]

- Constantatos, C.; Herrmann, M. Market Inertia and the Introduction of Green Products: Can Strategic Effects Justify the Porter Hypothesis? Environ. Resour. Econ. 2011, 50, 267. [Google Scholar] [CrossRef]

- Brännlund, R.; Chung, Y.; Färe, R.; Grosskopf, S. Emissions Trading and Profitability: The Swedish Pulp and Paper Industry. Environ. Resour. Econ. 1998, 12, 345–356. [Google Scholar] [CrossRef]

- Conrad, K.; Wastl, D. The Impact of Environmental Regulation on Productivity in German Industries. Empir. Econ. 1995, 20, 615–633. [Google Scholar] [CrossRef]

- Lanoie, P.; Patry, M.; Lajeunesse, R. Environmental Regulation and Productivity: Testing the Porter Hypothesis. J. Product. Anal. 2008, 30, 121–128. [Google Scholar] [CrossRef]

- Liu, Y.; Zhu, J.; Li, E.Y.; Meng, Z.; Song, Y. Environmental Regulation, Green Technological Innovation, and Eco-Efficiency: The Case of Yangtze River Economic Belt in China. Technol. Forecast. Soc. Chang. 2020, 155, 119993. [Google Scholar] [CrossRef]

- Lanjouw, J.O.; Mody, A. Innovation and the International Diffusion of Environmentally Responsive Technology. Res. Policy 1996, 25, 549–571. [Google Scholar] [CrossRef]

- Akerlof, G.A. The Market for “Lemons”: Quality Uncertainty and the Market Mechanism [M]//Uncertainty in Economics; Academic Press: Cambridge, MA, USA, 1978; pp. 235–251. [Google Scholar]

- Chen, Y.S.; Lai, S.B.; Wen, C.T. The Influence of Green Innovation Performance on Corporate Advantage in Taiwan. J. Bus. Ethics 2006, 67, 331–339. [Google Scholar] [CrossRef]

- Ajzen, I. The Theory of Planned Behavior. Organ. Behav. Hum. Decis. Process. 1991, 50, 179–211. [Google Scholar] [CrossRef]

- Zhang, B.; Yang, S.; Bi, J. Enterprises’ Willingness to Adopt/Develop Cleaner Production Technologies: An Empirical Study in Changshu, China. J. Clean. Prod. 2013, 40, 62–70. [Google Scholar] [CrossRef]

- Corral, C.M. Sustainable Production and Consumption Systems—Cooperation for Change: Assessing and Simulating the Willingness of the Firm to Adopt/Develop Cleaner Technologies. The Case of the In-Bond Industry in Northern Mexico. J. Clean. Prod. 2003, 11, 411–426. [Google Scholar] [CrossRef]

- Zhang, B.; Bi, J.; Yuan, Z.; Ge, Y. Why Do Firms Engage in Environmental Management? An Empirical Study in China. J. Clean. Prod. 2008, 16, 1036–1045. [Google Scholar] [CrossRef]

- Sun, Q.; Tong, W.H.S.; Tong, J. How Does Government Ownership Affect Firm Performance? Evidence from China’s Privatization Experience. J. Bus. Financ. Account. 2002, 29, 1–27. [Google Scholar] [CrossRef]

- Hu, J.; Wang, Z.; Lian, Y. Environmental Regulation, Foreign Direct Investment and Green Technological Progress—Evidence from Chinese Manufacturing Industries. Int. J. Environ. Res. Public Health 2018, 15, 221. [Google Scholar]

- Cambini, C.; Rondi, L. Incentive Regulation and Investment: Evidence from European Energy Utilities. J. Regul. Econ. 2010, 38, 1–26. [Google Scholar] [CrossRef]

- Popp, D. International Innovation and Diffusion of Air Pollution Control Technologies: The Effects of NOX and SO2 Regulation in the US, Japan, and Germany. J. Environ. Econ. Manag. 2006, 51, 46–71. [Google Scholar] [CrossRef]

- Scott, W.R. The Adolescence of Institutional Theory. Adm. Sci. Q. 1987, 32, 493–511. [Google Scholar] [CrossRef]

- Sánchez, R.G.; Bolívar, M.P.R.; Hernández, A.M.L. Corporate and Managerial Characteristics as Drivers of Social Responsibility Disclosure by State-Owned Enterprises. Rev. Manag. Sci. 2017, 11, 633–659. [Google Scholar] [CrossRef]

- Cai, X.; Zhu, B.; Zhang, H.; Li, L.; Xie, M. Can Direct Environmental Regulation Promote Green Technology Innovation in Heavily Polluting Industries? Evidence from Chinese Listed Companies. Sci. Total Environ. 2020, 746, 140810. [Google Scholar] [CrossRef]

- Brandt, L.; Li, H. Bank Discrimination in Transition Economies: Ideology, Information, or Incentives? J. Comp. Econ. 2003, 31, 387–413. [Google Scholar] [CrossRef]

- McGartland, A. A Comparison of Two Marketable Discharge Permits Systems. J. Environ. Econ. Manag. 1988, 15, 35–44. [Google Scholar] [CrossRef]

- Malueg, D.A. Emission Credit Trading and the Incentive to Adopt New Pollution Abatement Technology. J. Environ. Econ. Manag. 1989, 16, 52–57. [Google Scholar] [CrossRef]

- Zhou, Y.; Zhu, S.; He, C. How Do Environmental Regulations Affect Industrial Dynamics? Evidence from China’s Pollution-Intensive Industries. Habitat Int. 2017, 60, 10–18. [Google Scholar] [CrossRef]

- Bertarelli, S.; Lodi, C. Heterogeneous Firms, Exports and Pigouvian Pollution Tax: Does the Abatement Technology Matter? J. Clean. Prod. 2019, 228, 1099–1110. [Google Scholar] [CrossRef]

- Tang, W.; Liang, X. Income tax incentives, property rights and corporation’s social responsibility performance. Commer. Account. 2015, 4, 50–52. (In Chinese) [Google Scholar]

- Feldman, M.P.; Kelley, M.R. The Ex Ante Assessment of Knowledge Spillovers: Government R&D Policy, Economic Incentives and Private Firm Behavior. Res. Policy 2006, 35, 1509–1521. [Google Scholar]

- Kleer, R. Government R&D Subsidies as a Signal for Private Investors. Res. Policy 2010, 39, 1361–1374. [Google Scholar]

- Lin, C.; Lin, P.; Song, F.M.; Li, C. Managerial Incentives, CEO Characteristics and Corporate Innovation in China’s Private Sector. J. Comp. Econ. 2011, 39, 176–190. [Google Scholar] [CrossRef]

- Choi, S.B.; Lee, S.H.; Williams, C. Ownership and Firm Innovation in a Transition Economy: Evidence from China. Res. Policy 2011, 40, 441–452. [Google Scholar] [CrossRef]

- Darnall, N.; Henriques, I.; Sadorsky, P. Adopting Proactive Environmental Strategy: The Influence of Stakeholders and Firm Size. J. Manag. Stud. 2010, 47, 1072–1094. [Google Scholar] [CrossRef]

- Abrell, J.; Rausch, S. Combining Price and Quantity Controls under Partitioned Environmental Regulation. J. Public Econ. 2017, 145, 226–242. [Google Scholar] [CrossRef]

- Kang, Y.S.; Kim, B.Y. Ownership Structure and Firm Performance: Evidence from the Chinese Corporate Reform. China Econ. Rev. 2012, 23, 471–481. [Google Scholar] [CrossRef]

- Amacher, G.S.; Malik, A.S. Instrument Choice When Regulators and Firms Bargain. J. Environ. Econ. Manag. 1998, 35, 225–241. [Google Scholar] [CrossRef]

- Taylor, C.M.; Pollard, S.J.T.; Rocks, S.A.; Angus, A.J. Better by Design: Business Preferences for Environmental Regulatory Reform. Sci. Total Environ. 2015, 512, 287–295. [Google Scholar] [CrossRef] [PubMed]

- Bowen, F.; Tang, S.; Panagiotopoulos, P. A Classification of Information-Based Environmental Regulation: Voluntariness, Compliance and Beyond. Sci. Total Environ. 2020, 712, 135571. [Google Scholar] [CrossRef]

- Welch, E.W.; Mori, Y.; Aoyagi-Usui, M. Voluntary Adoption of ISO 14001 in Japan: Mechanisms, Stages and Effects. Bus. Strategy Environ. 2002, 11, 43–62. [Google Scholar] [CrossRef]

- Camisón, C. Effects of Coercive Regulation versus Voluntary and Cooperative Auto-Regulation on Environmental Adaptation and Perfor-Mance: Empirical Evidence in Spain. Eur. Manag. J. 2010, 28, 346–361. [Google Scholar] [CrossRef]

- Woerter, M.; Stucki, T.; Arvanitis, S.; Ramer, C.; Peneder, M. The Adoption of Green Energy Technologies: The Role of Policies in Austria, Germany, and Switzerland. Int. J. Green Energy 2017, 14, 1192–1208. [Google Scholar] [CrossRef]

- Jiang, Z.; Wang, Z.; Zeng, Y. Can Voluntary Environmental Regulation Promote Corporate Technological Innovation? Bus. Strategy Environ. 2020, 29, 390–406. [Google Scholar] [CrossRef]

- Christmann, P.; Taylor, G. Globalization and the Environment: Determinants of Firm Self-Regulation in China. J. Int. Bus. Stud. 2001, 32, 439–458. [Google Scholar] [CrossRef]

- DiMaggio, P.J.; Powell, W.W. The Iron Cage Revisited: Institutional Isomorphism and Collective Rationality in Organizational Fields. Am. Sociol. Rev. 1983, 48, 147–160. [Google Scholar] [CrossRef]

- Oliver, C. Strategic Responses to Institutional Processes. Acad. Manag. Rev. 1991, 16, 145–179. [Google Scholar] [CrossRef]

- Kemp, R.; Volpi, M. The Diffusion of Clean Technologies: A Review with Suggestions for Future Diffusion Analysis. J. Clean. Prod. 2008, 16, S14–S21. [Google Scholar] [CrossRef]

- Fallah, M.A.; Mojarrad, F. Corporate Governance Effects on Corporate Social Responsibility Disclosure: Empirical Evidence from Heavy-Pollution Industries in Iran. Soc. Responsib. J. 2019, 15, 208–225. [Google Scholar] [CrossRef]

- Rooij, V.B.; Fryxell, G.E.; Lo, C.W.H.; Wang, W. From Support to Pressure: The Dynamics of Social and Governmental Influences on Environmental Law Enforcement in Guangzhou, C. Ty, China. Regul. Gov. 2013, 7, 321–347. [Google Scholar] [CrossRef]

- Gunningham, N.; Grabosky, P.; Sinclair, D. Smart Regulation. Regul. Theory 1998, 8, 133–148. [Google Scholar]

- Quinn, A.C. Smart Regulation: Designing Environmental Policy: Neil Gunningham and Peter Grabosky, Clarendon Press, Oxford, 1998. J. Gov. Inf. 2002, 29, 335–337. [Google Scholar]

- Ma, F.P.; Cha, N. The Impact of Environmental Regulation on Technological Innovation Performance—The Moderating Role of Institutional Environment. R&D Manag. 2012, 24, 60–66. [Google Scholar]

- Meyer, A.D.; Goes, J.B. Organizational Assimilation of Innovations: A Multilevel Contextual Analysis. Acad. Manag. J. 1988, 31, 897–923. [Google Scholar]

- Tsui, A.S.; Ashford, S.J.; Clair, L.S.; Xin, K.R. Dealing with Discrepant Expectations: Response Strategies and Managerial Effectiveness. Acad. Manag. J. 1995, 38, 1515–1543. [Google Scholar]

- Kormos, C.; Gifford, R. The Validity of Self-Report Measures of Pro-Environmental Behavior: A Meta-Analytic Review. J. Environ. Psychol. 2014, 40, 359–371. [Google Scholar] [CrossRef]

- Gavana, G.; Gottardo, P.; Moisello, A.M. Do Customers Value CSR Disclosure? Evidence from Italian Family and Non-Family Firms. Sustainability 2018, 10, 1642. [Google Scholar] [CrossRef]

- Berrone, P.; Cruz, C.; Gomez-Mejia, L.R.; Kintana, M.L. Socioemotional Wealth and Corporate Responses to Institutional Pressures: Do Family-Controlled Firms Pollute Less? Adm. Sci. Q. 2010, 55, 82–113. [Google Scholar] [CrossRef]

| Feature | Range | N | Percentage |

|---|---|---|---|

| Industry (Ind.) | Agriculture, forestry, animal husbandry and fishery | 4 | 1.93% |

| Mining industry | 13 | 6.28% | |

| Manufacturing | 65 | 31.4% | |

| Electricity, heat, gas and water production and supply | 18 | 8.7% | |

| Civil engineering industry | 31 | 14.98% | |

| Transportation, warehousing and postal services | 15 | 7.25% | |

| Accommodation and catering industry | 5 | 2.42% | |

| Others | 56 | 27.05% | |

| Ownership (owns) | State-owned enterprise | 90 | 43.48% |

| Non-state-owned enterprise | 117 | 56.52% | |

| Number of employee (Size) | <300 | 64 | 30.92% |

| <2000 | 49 | 23.67% | |

| >2000 | 94 | 45.41% | |

| No. of years establishment (Firm Age) | ≤2 | 37 | 17.87% |

| 3–5 | 29 | 14.01% | |

| 6–10 | 31 | 14.98% | |

| >10 | 110 | 53.14% |

| Variable | Measurement Items |

|---|---|

| Command-and-control environmental regulations (CAC) | Enterprise’s production follows strict technical standards from policy; The products produced by the company meet the relevant environmental standards from regulatory department; Enterprise control the concentration and total amount of waste according to emission performance standards; Some production licenses of enterprise are determined by the regulatory department; Enterprise violating the relevant regulations of environmental regulations will be severely punished. |

| Market-based incentive environmental regulations (MBI) | Enterprise have to bear the corresponding taxes and fees when discharge pollutants; Enterprise must pay a certain pollution deposit; Enterprise can get financial subsidies for environmental pollution control; Enterprise can get tax benefits for environmental pollution control; Enterprise can get a certain deposit refund for recycling product waste. |

| Voluntary environmental regulations (VER) | Enterprise publishes the business environment information in time and accurately; Enterprise environmental management is ISO 14000 certified; We will actively solicit opinions from relevant units, experts and the public on the enterprise’s environmental impact assessment report; Companies are actively committed to achieving higher environmental performance than regulatory policies; Enterprise implements clean production and whole process control. |

| Green technology adoption intention (GTAI) | Knowledge-awareness stage The employees of my company can know the existence of green technology in related business areas; Corporate employees will actively consider the applicability of a certain green technology to the enterprise; Corporate employees will actively participate in conference discussions about green technology adoption; Evaluation-choice stage Enterprise is willing to formally put forward strategic plans for green technology adoption practices; Our company is willing to conduct technical and economic evaluations for the proposed green technology adoption ideas; Our company is willing to evaluate the compatibility of alternative green technologies with the strategic requirements; Adoption-implementation stage Company is willing to adopt green technologies and try them out; Company is willing to adopt green technologies and use them often; Company is willing to continue to adopt this green technology in the next similar production activities; Company is willing to adopt green technology and continue to expand, improve and innovate. |

| Variables | Item | Factor Loading | Means | Cronbach’sα |

|---|---|---|---|---|

| CAC | CAC1 | 0.882 | 3.974 | 0.906 |

| CAC2 | 0.895 | |||

| CAC3 | 0.904 | |||

| CAC4 | 0.902 | |||

| CAC5 | 0.901 | |||

| MBI | MBI1 | 0.866 | 4.131 | 0.859 |

| MBI2 | 0.901 | |||

| MBI3 | 0.904 | |||

| MBI4 | 0.927 | |||

| MBI5 | 0.908 | |||

| VER | VER 1 | 0.709 | 3.898 | 0.904 |

| VER 2 | 0.727 | |||

| VER 3 | 0.775 | |||

| VER 4 | 0.760 | |||

| VER 5 | 0.688 | |||

| GTAI | ||||

| Knowledge-awareness stage | GTAI1 | 0.814 | 3.834 | 0.912 |

| GTAI2 | 0.845 | |||

| GTAI3 | 0.815 | |||

| Evaluation-choice stage | GTAI4 | 0.708 | 3.973 | 0.900 |

| GTAI5 | 0.770 | |||

| GTAI6 | 0.652 | |||

| Adoption-implementation stage | GTAI7 | 0.737 | 3.954 | 0.921 |

| GTAI8 | 0.831 | |||

| GTAI9 | 0.865 | |||

| GTAI10 | 0.737 |

| No. Variable | Mean | SD | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

|---|---|---|---|---|---|---|---|---|---|---|

| 1 Ind. | 4.95 | 2.20 | 1 | |||||||

| 2 Owns | 0.43 | 0.50 | 0.15 * | 1 | ||||||

| 3 Size | 2.15 | 0.87 | −0.11 | −0.319 ** | 1 | |||||

| 4 Age | 3.04 | 1.18 | 0.057 | −0.087 | 0.376 ** | 1 | ||||

| 5 CAC | 3.97 | 0.82 | −0.003 | 0.253 ** | 0.023 | 0.048 | 1 | |||

| 6 MBI | 4.13 | 0.92 | −0.059 | −0.002 | 0.077 | 0.038 | 0.702 ** | 1 | ||

| 7 VER | 3.90 | 0.90 | −0.075 | −0.087 | 0.112 | 0.129 | 0.607 ** | 0.712 ** | 1 | |

| 8 GTAI | 3.92 | 0.78 | −0.076 | −0.018 | 0.082 | 0.099 | 0.588 ** | 0.659 ** | 0.733 ** | 1 |

| Step1 | Step 2 | Step 3 | Step 4 | |

|---|---|---|---|---|

| Control variables | ||||

| Ind. | −0.027 | −0.010 | −0.010 | −0.019 |

| Size | 0.036 | −0.004 | −0.006 | −0.018 |

| Age | 0.058 | 0.015 | 0.015 | −0.015 |

| Independent variables | ||||

| CAC | 0.134 * | 0.137 * | 0.133 * | |

| MBI | 0.172 ** | 0.171 ** | 0.154 * | |

| VER | 0.430 *** | 0.429 *** | 0.466 *** | |

| Regulated variables | ||||

| Owns | −0.012 | −0.013 | ||

| Interaction item | ||||

| CAC × Owns | 0.327 * | |||

| MBI × Owns | 0.069 | |||

| VER × Owns | −0.496 *** | |||

| R2 | 0.018 | 0.586 | 0.587 | 0.627 |

| 0.018 | 0.569 | 0.001 | 0.040 | |

| VIF | <2 | <3 | <3 | <4 |

| F | 1.225 | 47.274 *** | 40.325 *** | 32.940 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xia, D.; Chen, W.; Gao, Q.; Zhang, R.; Zhang, Y. Research on Enterprises’ Intention to Adopt Green Technology Imposed by Environmental Regulations with Perspective of State Ownership. Sustainability 2021, 13, 1368. https://doi.org/10.3390/su13031368

Xia D, Chen W, Gao Q, Zhang R, Zhang Y. Research on Enterprises’ Intention to Adopt Green Technology Imposed by Environmental Regulations with Perspective of State Ownership. Sustainability. 2021; 13(3):1368. https://doi.org/10.3390/su13031368

Chicago/Turabian StyleXia, De, Wenhua Chen, Qinglu Gao, Rui Zhang, and Yundong Zhang. 2021. "Research on Enterprises’ Intention to Adopt Green Technology Imposed by Environmental Regulations with Perspective of State Ownership" Sustainability 13, no. 3: 1368. https://doi.org/10.3390/su13031368

APA StyleXia, D., Chen, W., Gao, Q., Zhang, R., & Zhang, Y. (2021). Research on Enterprises’ Intention to Adopt Green Technology Imposed by Environmental Regulations with Perspective of State Ownership. Sustainability, 13(3), 1368. https://doi.org/10.3390/su13031368