Sustainable Banking, Market Power, and Efficiency: Effects on Banks’ Profitability and Risk

Abstract

:1. Introduction

2. Literature Review

2.1. Sustainable Banking and the United Nations Principles for Responsible Banking

2.2. Sustainable Banking, Market Power, Efficiency, and Profitability

2.3. Sustainable Banking and Risk

3. Empirical Analysis

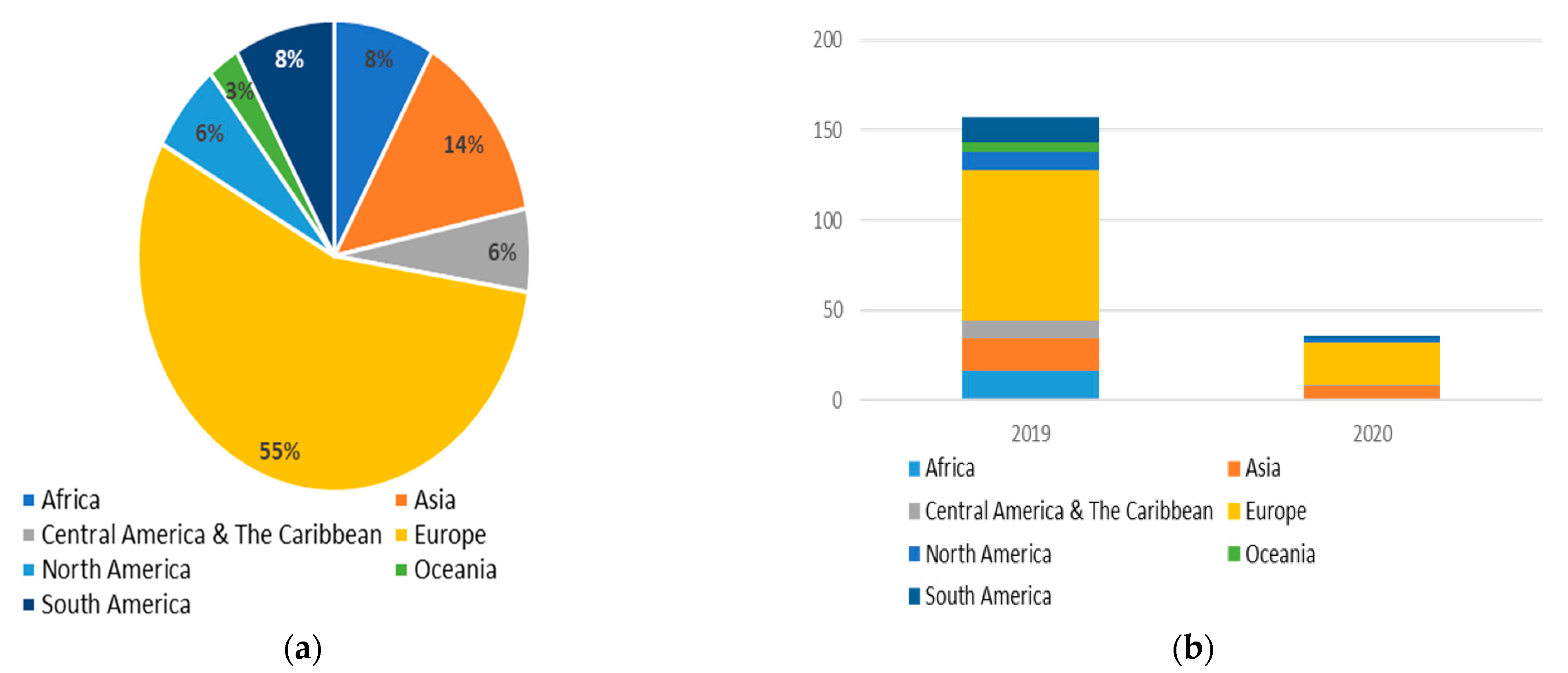

3.1. Selection of the Sample

3.2. Profitability Analysis

3.2.1. Econometric Model of the Profitability Analysis

3.2.2. Methodology

3.2.3. Results of the Profitability Analysis

3.3. Risk Analysis

3.3.1. Econometric Model of the Risk Analysis

3.3.2. Methodology

3.3.3. Results of the Risk Analysis

3.4. Discussion

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

- y1 = loans.

- y2 = securities.

- y3 = deposits.

- w1 = cost of lendable funds: interest expenses over liabilities (deposits, money market funding and other funding).

- w2 = cost of physical capital: defined as the ratio of non-interest expenses and the book value of physical capital.

- w3 = cost of labor: operating expenses to total employees.

- v1 = outstanding loans from commercial banks to GDP.

- v2 = per capita GDP.

- v3 = population density.

- v4 = Herfindahl concentration index to assets.

Appendix B

References

- Cornett, M.M.; Erhemjamts, O.; Tehranian, H. Greed or good deeds: An examination of the relation between corporate social responsibility and the financial performance of U.S. commercial banks around the financial crisis. J. Bank. Financ. 2016, 70, 137–159. [Google Scholar] [CrossRef]

- Agirre-Aramburu, I.; Gómez-Pescador, I. The effects of corporate social responsibility on customer loyalty: The mediating effect of reputation in cooperative banks versus commercial banks in the Basque Country. J. Bus. Ethics 2019, 154, 701–719. [Google Scholar] [CrossRef]

- Nosratabadi, S.; Pinter, G.; Mosavi, A.; Semperger, S. Sustainable banking; Evaluation of the European business models. Sustainability 2020, 12, 2314. [Google Scholar] [CrossRef] [Green Version]

- Berger, A.N. The profit-structure relationship in banking-tests of market-power and efficient-structure hypotheses. J. Money Credit Bank. 1995, 27, 404–431. [Google Scholar] [CrossRef]

- Platonova, E.; Asutay, M.; Dixon, R.; Mohammad, S. The impact of corporate social responsibility disclosure on financial performance: Evidence from the GCC Islamic banking sector. J. Bus. Ethics 2018, 151, 451–471. [Google Scholar] [CrossRef] [Green Version]

- Szegedi, K.; Khan, Y.; Lentner, C. Corporate social responsibility and financial performance: Evidence from Pakistani listed banks. Sustainability 2020, 12, 4080. [Google Scholar] [CrossRef]

- Sanfilippo-Azofra, S.; Cantero-Saiz, M.; Torre-Olmo, B.; López-Gutiérrez, C. Financial crises, concentration and efficiency: Effects on performance and risk of banks. Financ. Uver 2013, 63, 537–558. [Google Scholar]

- Matute-Vallejo, J.; Bravo, R.; Pina, J.M. The influence of corporate social responsibility and price fairness on customer behaviour: Evidence from the financial sector. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 317–331. [Google Scholar] [CrossRef]

- Nidumolu, R.; Prahalad, C.K.; Rangaswami, M.R. Why sustainable is now the key driver of innovation? Harv. Bus. Rev. 2009, 87, 56–64. [Google Scholar]

- Hambrick, D.C. Some tests of the effectiveness and functional attributes of miles and snow’s strategic types. Acad. Manag. J. 1983, 26, 5–26. [Google Scholar]

- Bassen, A.; Meyer, K.; Schlange, J. The Influence of Corporate Responsibility on the Cost of Capital. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=984406 (accessed on 25 November 2020).

- Clarkson, P.; Li, Y.; Richardson, G.; Vasvari, F. Does it pay to be green? Determinants and consequences of proactive environmental strategies. J. Account. Public Policy 2011, 30, 122–144. [Google Scholar] [CrossRef]

- Saïdane, D.; Abdallah, S.B. Sustainability and financial stability: Evidence from European banks. Econ. Bull. 2020, 40, 1769–1780. [Google Scholar]

- Bouis, R.; Rawdanowicz, L.; Renne, J.P.; Watanabe, S.; Christensen, A.K. The Effectiveness of Monetary Policy Since the Onset of the Financial Crisis; OECD Economics Department Working Paper No. 1081; OECD Publishing: Paris, France, 2013. [Google Scholar]

- Valencia, F. Aggregate Uncertainty and the Supply of Credit. J. Bank. Financ. 2017, 81, 150–165. [Google Scholar] [CrossRef] [Green Version]

- Scholtens, B.; Van’t Klooster, S. Sustainability and bank risk. Palgrave Commun. 2019, 5, 1–8. [Google Scholar] [CrossRef] [Green Version]

- Ruiz, B.; García, J.A.; Revilla, A.J. Antecedents and consequences of bank reputation: A comparison of the United Kingdom and Spain. Int. Mark. Rev. 2016, 33, 781–805. [Google Scholar] [CrossRef]

- Lopatta, K.; Buchholz, F.; Kaspereit, T. Asymmetric information and corporate social responsibility. Bus. Soc. 2016, 55, 458–488. [Google Scholar] [CrossRef]

- Endrikat, J.; Guenther, E.; Hoppe, H. Making sense of conflicting empirical findings: A meta-analytic review of the relationship between corporate environmental and financial performance. Eur. Manag. J. 2014, 32, 735–751. [Google Scholar] [CrossRef]

- Tregidga, H.; Milne, M.; Kearins, K. (Re) presenting sustainable organizations. Account. Organ. Soc. 2014, 39, 477–494. [Google Scholar] [CrossRef]

- Arellano, M.; Bond, S. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef] [Green Version]

- Allen, F.; Santomero, A.M. The theory of financial intermediation. J. Bank. Financ. 1997, 21, 1461–1485. [Google Scholar] [CrossRef]

- Allen, F.; Santomero, A.M. What do financial intermediaries do? J. Bank. Financ. 2001, 25, 271–294. [Google Scholar] [CrossRef] [Green Version]

- Polonskaya, J.; Babenko, M. Best Practice Guide on Sustainable Finance: A Practical Toolkit for Russian Financial Sector; Sustainable Finance Programme Report; WWF—World Wide Fund For Nature: Gland, Switzerland, 2012. [Google Scholar]

- Shah, A.A.; Wu, D.; Korotkov, V. Are sustainable banks efficient and productive? A data envelopment analysis and the Malmquist productivity index analysis. Sustainability 2019, 11, 2398. [Google Scholar] [CrossRef] [Green Version]

- Scholtens, B. Corporate social responsibility in the international banking industry. J. Bus. Ethics 2012, 86, 159–175. [Google Scholar] [CrossRef]

- Weber, O. Environmental credit risk management in banks and financial service institutions. Bus. Strateg. Environ. 2009, 21, 248–263. [Google Scholar] [CrossRef]

- Gangi, F.; Meles, A.; D’Angelo, E.; Daniele, L.M. Sustainable development and corporate governance in the financial system: Are environmentally friendly banks less risky? Corp. Soc. Responsib. Environ. Manag. 2019, 26, 529–547. [Google Scholar] [CrossRef]

- UNEP Finance Initiative (UNEP FI). Available online: www.unepfi.org (accessed on 18 January 2021).

- Keffas, G.; Olulu-Briggs, O.V. Corporate social responsibility: How does it affect the financial performance of banks? Empirical evidence from US, UK and Japan. J. Manag. Gov. 2011, 3, 8–26. [Google Scholar]

- Demsetz, H. Barriers to entry. Am. Econ. Rev. 1982, 72, 47–57. [Google Scholar]

- Shepherd, W.G. Economies of scale and monopoly profits. In Industrial Organization, Antitrust, and Public Policy; Craven, J.V., Ed.; Kluwer Nijhoff: Boston, MA, USA; Springer: Dordrecht, The Netherlands, 1983; pp. 165–204. [Google Scholar]

- Peltzman, S. The gains and losses from industrial concentration. J. Law Econ. 1977, 20, 229–263. [Google Scholar] [CrossRef]

- Corvoisier, S.; Gropp, R. Bank concentration and retail interest rates. J. Bank. Financ. 2002, 26, 2155–2189. [Google Scholar] [CrossRef] [Green Version]

- De Jonghe, O.; Vander Vennet, R. Competition versus efficiency: What drives franchise values in European banking? J. Bank. Financ. 2008, 32, 1820–1835. [Google Scholar] [CrossRef]

- Hsieh, M.F.; Lee, C.C. The Puzzle between banking competition and profitability can be solved: International evidence from bank-level data. J. Financ. Serv. Res. 2010, 38, 135–157. [Google Scholar] [CrossRef]

- Dietrich, A.; Wanzenried, G. Determinants of bank profitability before and during the crisis: Evidence from Switzerland. J. Int. Financ. Mark. Inst. 2011, 21, 307–327. [Google Scholar] [CrossRef]

- Tan, Y.; Floros, C.; Anchor, J. The profitability of Chinese banks: Impacts of risk, competition and efficiency. Rev. Account. Financ. 2017, 16, 86–105. [Google Scholar] [CrossRef]

- Gatzert, N. The impact of corporate reputation and reputation damaging events on financial performance: Empirical evidence from the literature. Eur. Manag. J. 2015, 33, 485–499. [Google Scholar] [CrossRef]

- Igbudu, N.; Garanti, Z.; Popoola, T. Enhancing bank loyalty through sustainable banking practices: The mediating effect of corporate image. Sustainability 2018, 10, 4050. [Google Scholar] [CrossRef] [Green Version]

- Daub, C.H.; Ergenzinger, R. Enabling sustainable management through a new multi-disciplinary concept of customer satisfaction. Eur. J. Mark. 2005, 39, 998–1012. [Google Scholar] [CrossRef]

- Ferreira, F.; Jalali, M.; Meiudute-Kavaliauskiene, I.; Viana, B. A metacognitive decision making based-framework for bank customer loyalty measurement and management. Technol. Econ. Dev. Econ. 2015, 21, 280–300. [Google Scholar] [CrossRef]

- Bussoli, C.; Conte, D.; Letorri, G.; Barone, M. Does it pay to be sustainable? Evidence from European banks. Int. J. Bus. Manag. 2019, 14, 128–146. [Google Scholar] [CrossRef] [Green Version]

- Yip, A.W.; Bocken, N.M. Sustainable business models archetypes for the banking industry. J. Clean. Prod. 2018, 174, 150–169. [Google Scholar] [CrossRef]

- Fay, P. Sustainability Gains Consumer Traction as Modo Anticipates Eco 2.0. Available online: Visionmonday.com (accessed on 25 November 2020).

- Mason, C.F. The economics of eco-labeling: Theory and empirical implications. Int. Rev. Environ. Resour. Econ. 2012, 6, 341–372. [Google Scholar] [CrossRef]

- Sun, H.; Rabbani, M.R.; Ahmad, N.; Sial, M.S.; Cheng, G.; Zia-Ud-Din, M.; Fu, Q. CSR, co-creation and green consumer loyalty: Are green banking initiatives important? A moderated mediation approach from an emerging economy. Sustainability 2020, 12, 10688. [Google Scholar] [CrossRef]

- Boitan, I.A. Determinants of sustainable banks’ profitability, evidence from EU countries. Financ. Stud. 2015, 19, 21–39. [Google Scholar]

- Global Alliance for Banking on Values (GABV). Strong, Straightforward and Sustainable Banking; GABV: Amsterdam, The Netherlands, 2012. [Google Scholar]

- Global Alliance for Banking on Values (GABV). Real Banking for the Real Economy: Comparing Sustainable Bank Performance with the Largest Banks in the World; GABV: Amsterdam, The Netherlands, 2013. [Google Scholar]

- Aupperle, K.E.; Carroll, A.B.; Hatfield, J.D. An empirical examination of the relationship between corporate social responsibility and profitability. Acad. Manag. J. 1985, 28, 446–463. [Google Scholar]

- Ullman, A.A. Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of US firms. Acad. Manag. Rev. 1985, 10, 540–557. [Google Scholar]

- Burgstahler, D.; Dichev, I. Earnings management to avoid earnings decreases and losses. J. Account. Econ. 1997, 24, 99–126. [Google Scholar] [CrossRef]

- El Ghoul, S.; Guedhami, O.; Kwok, C.; Mishra, D. Does corporate social responsibility affect the cost of capital? J. Bank. Financ. 2011, 35, 2388–2408. [Google Scholar] [CrossRef]

- Hachenberg, B.; Schiereck, D. Are green bonds priced differently from conventional bonds? J. Asset Manag. 2018, 19, 371–383. [Google Scholar] [CrossRef]

- Hart, S. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef] [Green Version]

- Sharma, S.; Vredenburg, H. Proactive corporate environmental strategy and the development of competitively valuable organizational capabilities. Strateg. Manag. J. 1998, 19, 729–753. [Google Scholar] [CrossRef]

- Christmann, P. Effects of “best practices” of environmental management on cost advantage: The role of complementary assets. Acad. Manag. J. 2000, 43, 663–680. [Google Scholar]

- Pampurini, F.; Quaranta, A.G. Sustainability and efficiency of the European banking market after the global crisis: The impact of some strategic choices. Sustainability 2018, 10, 2237. [Google Scholar] [CrossRef] [Green Version]

- Wu, M.; Shen, C. Corporate social responsibility in the banking industry: Motives and financial performance. J. Bank. Financ. 2011, 37, 3529–3547. [Google Scholar] [CrossRef]

- Harjoto, M.A.; Laksmana, I. The impact of corporate social responsibility on risk taking and firm value. J. Bus. Ethics 2016, 151, 353–373. [Google Scholar] [CrossRef]

- Monti, A.; Pattitoni, P.; Petracci, B.; Randl, O. Does Corporate Social Responsibility Impact Equity Risk? International Evidence. 31 January 2019. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3167883 (accessed on 25 November 2020).

- Rajput, N.; Oberoi, S. Does corporate social responsibility give long term sustainability and stability? An empirical validation. J. Indian Manag. Strategy 2015, 20, 36–40. [Google Scholar] [CrossRef]

- Goss, A.; Roberts, G.S. The impact of corporate social responsibility on the cost of bank loans. J. Bank. Financ. 2011, 35, 1794–1810. [Google Scholar] [CrossRef]

- Cui, Y.; Geobey, S.; Weber, O.; Lin, H. The impact of green lending on credit risk in China. Sustainability 2018, 10, 2008. [Google Scholar] [CrossRef] [Green Version]

- Homer-Dixon, T.; Walker, B.; Biggs, R.; Crépin, A.S.; Folke, C.; Lambin, E.F.; Peterson, G.D.; Rockström, J.; Scheffer, M.; Steffen, W.; et al. Synchronous failure: The emerging causal architecture of global crisis. Ecol. Soc. 2015, 20, 6. [Google Scholar] [CrossRef]

- European Central Bank (ECB). Guide on Climate-Related and Environmental Risks. Supervisory Expectations Relating to Risk Management and Disclosure; ECB: Frankfurt, Germany, 2020. [Google Scholar]

- Chollet, P.; Sandwidi, B.W. CSR engagement and financial risk: A virtuous cycle? International evidence. Glob. Financ. J. 2018, 38, 65–81. [Google Scholar] [CrossRef]

- Sanfilippo-Azofra, S.; Torre-Olmo, B.; Cantero-Saiz, M.; López-Gutiérrez, C. Financial development and the bank lending channel in developing countries. J. Macroecon. 2018, 55, 215–234. [Google Scholar] [CrossRef]

- Tregenna, F. The fat years: The structure and profitability of the US banking sector in the precrisis period. Camb. J. Econ. 2009, 33, 609–632. [Google Scholar] [CrossRef]

- De Nicoló, G.; Bartholomew, P.; Zaman, J.; Zephirin, M. Bank consolidation, internationalization, and conglomerization: Trends and implications for financial risk. Financ. Mark. Inst. Instrum. 2004, 13, 173–217. [Google Scholar] [CrossRef] [Green Version]

- Barth, J.R.; Caprio, G., Jr.; Levine, R. Bank regulation and supervision: What works best? J. Financ. Intermediat. 2004, 13, 205–248. [Google Scholar] [CrossRef] [Green Version]

- Beck, T.; Demirgüç-Kunt, A.; Levine, R. Bank concentration, competition and crises: First results. J. Bank. Financ. 2006, 30, 1581–1603. [Google Scholar] [CrossRef] [Green Version]

- Maudos, J.; Pastor, J.M.; Pérez, F.; Quesada, J. Cost and profit efficiency in European banks. J. Int. Financ. Mark. Inst. 2002, 12, 33–58. [Google Scholar] [CrossRef]

- Kohers, T.; Huang, M.; Kohers, N. Market perception of efficiency in bank holding company mergers: The roles of the DEA and SFA models in capturing merger potential. Rev. Financ. Econ. 2000, 9, 101–120. [Google Scholar] [CrossRef]

- Vander Vennet, R. Cost and profit efficiency of financial conglomerates and universal banks in Europe. J. Money Credit Bank. 2002, 34, 254–282. [Google Scholar] [CrossRef]

- Athanasoglou, P.; Brissimis, S.; Delis, M. Bank-specific, industry-specific and macroeconomic determinants of bank profitability. J. Int. Financ. Mark. Inst. 2008, 18, 121–136. [Google Scholar] [CrossRef] [Green Version]

- Bourke, P. Concentration and other determinants of bank profitability in Europe, North America and Australia. J. Bank. Financ. 1989, 13, 65–79. [Google Scholar] [CrossRef]

- Wheelock, D.C.; Wilson, P.W. Consolidation in US banking: Which banks engage in mergers? Rev. Financ. Econ. 2004, 13, 7–39. [Google Scholar] [CrossRef] [Green Version]

- Eichengreen, B.J.; Gibson, H.D. Greek Banking at the Dawn of the New Millennium; Centre for Economic Policy Research: London, UK, 2001. [Google Scholar]

- Goldberg, L.G.; Rai, A. The structure-performance relationship for European banking. J. Bank. Financ. 1996, 20, 745–771. [Google Scholar] [CrossRef]

- Behr, P.; Schmidt, R.H.; Xie, R. Market structure, capital regulation and bank risk taking. J. Financ. Serv. Res. 2010, 37, 131–158. [Google Scholar] [CrossRef]

- Smirlock, M. Evidence on the (non) relationship between concentration and profitability in banking. J. Money Credit Bank. 1985, 17, 69–83. [Google Scholar] [CrossRef]

- Pasiouras, F.; Kosmidou, K. Factors influencing the profitability of domestic and foreign commercial banks in the European Union. Res. Int. Bus. Financ. 2007, 21, 222–237. [Google Scholar] [CrossRef]

- Bikker, J.A.; Hu, H. Cyclical patterns in profits, provisioning and lending of banks and procyclicality of the new Basel capital requirements. BNL Q. Rev. 2002, 55, 143–175. [Google Scholar]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef] [Green Version]

- Arellano, M.; Bover, O. Another look at the instrumental variable estimation of error component models. J. Econom. 1995, 68, 29–51. [Google Scholar] [CrossRef] [Green Version]

- Nagarajan, N.R.; Teixeira, A.A.C.; Silva, S.T. Ageing population: Identifying the determinants of ageing in the least developed countries. Popul. Res. Policy Rev. 2020, 1–24. [Google Scholar] [CrossRef]

- Bowsher, C.G. On testing overidentifying restrictions in dynamic panel data models. Econ. Lett. 2002, 77, 211–220. [Google Scholar] [CrossRef] [Green Version]

- Roodman, D.M. How to do xtabond2: An introduction to difference and system GMM in stata. Stata J. 2009, 9, 86–136. [Google Scholar] [CrossRef] [Green Version]

- Mehrhoff, J. A Solution to the Problem of Too Many Instruments in Dynamic Panel Data GMM; Discussion Paper Series 1: Economic Studies (2009, 31); Deutsche Bundesbank: Frankfurt, Germany, 2009. [Google Scholar]

- Wintoki, M.B.; Linck, J.S.; Netter, J.M. Endogeneity and the dynamics of internal corporate governance. J. Financ. Econ. 2012, 105, 581–606. [Google Scholar] [CrossRef]

- Torre-Olmo, B.; Sanfilippo-Azofra, S.; Cantero-Saiz, M. Creditor rights and the bank lending channel of monetary policy. In Corporate Governance in Banking and Investor Protection. From Theory to Practice; CSR, Sustainability, Ethics & Governance; Díaz-Díaz, B., Idowu, S.O., Molyneux, P., Eds.; Springer International Publishing: Cham, Switzerland, 2018; Chapter 6. [Google Scholar]

- Keasey, K.; Martínez, B.; Pindado, J. Young family firms: Financing decisions and the willingness to dilute control. J. Corp. Financ. 2015, 24, 47–63. [Google Scholar] [CrossRef] [Green Version]

- Cantero-Sáiz, M.; Sanfilippo-Azofra, S.; Torre-Olmo, B.; López-Gutiérrez, C. Trade credit, sovereign risk and monetary policy in Europe. Int. Rev. Econ. Financ. 2017, 52, 39–54. [Google Scholar] [CrossRef] [Green Version]

- Staiger, D.; Stock, J.H. Instrumental variables regression with weak instruments. Econometrica 1997, 65, 557–586. [Google Scholar] [CrossRef]

- Laeven, L.; Levine, R. Bank governance, regulation and risk taking. J. Financ. Econ. 2009, 93, 259–275. [Google Scholar] [CrossRef] [Green Version]

- Goetz, M.R.; Laeven, L.; Levine, R. Does the geographical expansion of banks reduce risk? J. Financ. Econ. 2016, 120, 346–362. [Google Scholar] [CrossRef]

- Boyd, J.H.; de Nicoló, G.; Smith, B.D. Crises in competitive versus monopolistic banking systems. J. Money Credit Bank. 2004, 36, 487–506. [Google Scholar] [CrossRef]

- Méon, P.G.; Weill, L. Can mergers in Europe help banks hedge against macroeconomic risk? Appl. Financ. Econ. 2005, 15, 315–326. [Google Scholar] [CrossRef] [Green Version]

- Boyd, J.H.; de Nicoló, G. The theory of bank risk taking and competition revisited. J. Financ. 2005, 60, 1329–1343. [Google Scholar] [CrossRef]

- Mishkin, S. Financial consolidation: Dangers and opportunities. J. Bank. Financ. 1999, 23, 675–691. [Google Scholar] [CrossRef] [Green Version]

- Hughes, J.P.; Mester, L.J. Efficiency in banking: Theory, practice and evidence. In Oxford Handbook of Banking; Berger, A.N., Molyneux, P., Wilson, J.O.S., Eds.; Oxford University Press: Oxford, UK, 2012. [Google Scholar]

- Fiordelisi, F.; Marques-Ibanez, D.; Molyneux, P. Efficiency and risk in European banking. J. Bank. Financ. 2011, 35, 1315–1326. [Google Scholar] [CrossRef] [Green Version]

- Diamond, D.W.; Rajan, R.G. Liquidity risk, liquidity creation, and financial fragility: A theory of banking. J. Political Econ. 2001, 109, 287–327. [Google Scholar] [CrossRef]

- De Bruyckere, V.; Gerhardt, M.; Schephens, G.; Vander Vennet, R. Bank/sovereign risk spillovers in the European debt crisis. J. Bank. Financ. 2013, 37, 4793–4809. [Google Scholar] [CrossRef] [Green Version]

- Cetorelli, N.; Hirtle, B.; Morgan, D.; Peristiani, S.; Santos, J. Trends in financial market concentration and their implications for market stability. Econ. Policy Rev. 2007, 13, 33–51. [Google Scholar]

- Fries, S.; Taci, A. Cost efficiency of banks in transition: Evidence from 289 banks in 15 post-communist countries. J. Bank. Financ. 2005, 29, 55–81. [Google Scholar] [CrossRef]

- Van den End, J.W. A macroprudential approach to address liquidity risk with the loan-to-deposit ratio. Eur. J. Financ. 2016, 22, 237–253. [Google Scholar] [CrossRef]

- García-Benau, A.; Sierra-García, L.; Zorio, A. Financial crisis impact on sustainability reporting. Manag. Decis. 2013, 51, 1528–1542. [Google Scholar] [CrossRef]

- Altunbas, Y.; Molyneux, P. Economies of scale and scope in European banking. Appl. Financ. Econ. 1996, 6, 367–375. [Google Scholar] [CrossRef]

- Berger, A.N.; Mester, L.J. Explaining the dramatic changes in performance of US banks: Technological change, deregulation, and dynamic changes in competition. J. Financ. Intermediat. 2003, 12, 57–95. [Google Scholar] [CrossRef] [Green Version]

- Carbó-Valverde, S.; Humphrey, D.B.; López del Paso, R. Do cross-country differences in bank efficiency support a policy of “national champions”? J. Bank. Financ. 2007, 31, 2173–2188. [Google Scholar] [CrossRef]

- Altunbas, Y.; Gardener, E.P.M.; Molyneux, P.; Moore, B. Efficiency in European banking. Eur. Econ. Rev. 2001, 45, 1931–1955. [Google Scholar] [CrossRef]

| Region/Country | No. of Banks | Region/Country | No. of Banks |

|---|---|---|---|

| EUROPE | 107 | AFRICA | 16 |

| Norway | 18 | Nigeria | 5 |

| Spain | 11 | Egypt | 4 |

| United Kingdom | 9 | South Africa | 3 |

| France | 8 | Kenya | 1 |

| Germany | 8 | Mauritius | 1 |

| Switzerland | 6 | Morocco | 1 |

| Netherlands | 5 | Togo | 1 |

| Turkey | 5 | ASIA | 26 |

| Denmark | 4 | Japan | 7 |

| Finland | 4 | South Korea | 5 |

| Greece | 4 | China | 4 |

| Italy | 4 | Bahrain | 2 |

| Sweden | 4 | Malaysia | 2 |

| Iceland | 3 | Bangladesh | 1 |

| Belgium | 2 | India | 1 |

| Ireland | 2 | Mongolia | 1 |

| Luxembourg | 2 | Myanmar | 1 |

| Russia | 2 | Philippines | 1 |

| Bulgaria | 1 | Thailand | 1 |

| Estonia | 1 | NORTH AMERICA | 12 |

| Liechtenstein | 1 | Mexico | 5 |

| Portugal | 1 | Canada | 4 |

| Slovenia | 1 | United States | 3 |

| Ukraine | 1 | SOUTH AMERICA | 16 |

| CENTRAL AMERICA and THE CARIBBEAN | 11 | Ecuador | 8 |

| Panama | 4 | Brazil | 4 |

| Costa Rica | 2 | Argentina | 2 |

| El Salvador | 2 | Colombia | 1 |

| Dominican Republic | 1 | Paraguay | 1 |

| Nicaragua | 1 | OCEANIA | 5 |

| Trinidad and Tobago | 1 | Australia | 5 |

| Panel A: Number of Banks and Observations per Country | ||||||

| Country | No. of Banks | No. of Obs. | Country | No. of Banks | No. of Obs. | |

| Austria | 32 | 153 | Luxembourg | 7 | 33 | |

| Bangladesh | 11 | 53 | Malaysia | 8 | 39 | |

| Belgium | 8 | 39 | Netherlands | 9 | 44 | |

| Bolivia | 5 | 24 | Nigeria | 13 | 52 | |

| Brazil | 15 | 70 | Norway | 17 | 82 | |

| Bulgaria | 8 | 38 | Oman | 5 | 20 | |

| Canada | 7 | 34 | Pakistan | 21 | 103 | |

| China | 98 | 459 | Peru | 9 | 44 | |

| Colombia | 14 | 68 | Philippines | 6 | 29 | |

| Costa Rica | 9 | 44 | Poland | 8 | 39 | |

| Croatia | 10 | 45 | Portugal | 8 | 39 | |

| Czech Republic | 10 | 50 | Romania | 9 | 41 | |

| Denmark | 8 | 40 | Russia | 6 | 29 | |

| Egypt | 9 | 36 | Saudi Arabia | 12 | 59 | |

| France | 81 | 385 | Serbia | 6 | 29 | |

| Germany | 105 | 500 | Slovenia | 7 | 33 | |

| Greece | 6 | 30 | South Africa | 7 | 31 | |

| Hong Kong | 9 | 44 | Spain | 20 | 98 | |

| Hungary | 6 | 28 | Sweden | 8 | 37 | |

| Indonesia | 40 | 193 | Switzerland | 41 | 197 | |

| Ireland | 6 | 30 | Turkey | 8 | 38 | |

| Israel | 6 | 29 | United Kingdom | 34 | 167 | |

| Italy | 41 | 182 | United States | 402 | 1961 | |

| Latvia | 11 | 51 | Vietnam | 10 | 46 | |

| Number of total banks and Obs. | 1236 | 5915 | ||||

| Panel B: Temporary Disribution of the Sample | ||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | Total Obs. | |

| No. of Obs. | 1129 | 1236 | 1236 | 1236 | 1078 | 5915 |

| Variable | Description | Expected Relationship with Profitability (R) |

|---|---|---|

| SB | Dummy that takes the value of 1 if a bank has signed the UN Principles for Responsible Banking, and 0 otherwise | Positive |

| CONC | Herfindahl-Hirschman index (HHI) in terms of assets | Positive |

| MS | Market share in terms of assets | Positive |

| XEF | Cost X-efficiency | Positive |

| SEF | Scale efficiency with respect to the inputs | Positive |

| SB × CONC | Interaction between sustainable banks and market concentration | Non-significant |

| SB × MS | Interaction between sustainable banks and market share | Non-significant |

| SB × XEF | Interaction between sustainable banks and cost X-efficiency | Positive |

| SB × SEF | Interaction between sustainable banks and scale efficiency | Positive |

| EQUITY | Equity/Total assets | Positive |

| LOANS | Loans/Total assets | Positive/Negative |

| SIZE | Log (Total assets) | Positive/Negative |

| ΔGDP | GDP per capita growth | Positive |

| Variable | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| ROA | 0.0072 | 0.0086 | −0.1173 | 0.1491 |

| ROE | 0.0731 | 0.0786 | −0.9124 | 0.7087 |

| CONC | 0.0792 | 0.0524 | 0.0306 | 0.2914 |

| MS | 0.0261 | 0.0570 | 1.69 × 10−6 | 0.4602 |

| XEF | 0.8161 | 0.0579 | 0.3896 | 0.9470 |

| SEF | 0.7455 | 0.0998 | 0.0041 | 0.7813 |

| EQUITY | 0.0996 | 0.0458 | 0.0192 | 0.7450 |

| LOANS | 0.6340 | 0.1596 | 0.0195 | 0.9747 |

| SIZE | 8.9409 | 2.0031 | 3.1179 | 14.7620 |

| ΔGDP | 2.1572 | 1.9563 | −4.3515 | 23.9855 |

| CONC | MS | XEF | SEF | EQUITY | LOANS | SIZE | ΔGDP | |

|---|---|---|---|---|---|---|---|---|

| CONC | 1 | |||||||

| MS | 0.5002 | 1 | ||||||

| XEF | −0.0792 | −0.0906 | 1 | |||||

| SEF | −0.0137 | −0.2421 | −0.0101 | 1 | ||||

| EQUITY | 0.0153 | −0.0315 | 0.0301 | 0.1302 | 1 | |||

| LOANS | −0.1249 | −0.1222 | 0.1223 | 0.1928 | −0.0004 | 1 | ||

| SIZE | 0.2204 | 0.4497 | −0.0141 | −0.4382 | −0.2631 | −0.1559 | 1 | |

| ΔGDP | −0.0486 | −0.0053 | −0.0032 | −0.0051 | −0.0679 | −0.2236 | 0.0350 | 1 |

| R | F-Statistic | p-Value | R2 |

|---|---|---|---|

| Panel A. Dependent variable in levels, explanatory variables (instruments) in differences | |||

| SB | 254.4 | 0.0000 | 0.9832 |

| CONC | 10.9 | 0.0010 | 0.4071 |

| SB × CONC | 57 | 0.0000 | 0.9134 |

| MS | 43.6 | 0.0000 | 0.5870 |

| SB × MS | 58.5 | 0.0000 | 0.7957 |

| XEF | 28.5 | 0.0000 | 0.1375 |

| SB × XEF | 58.6 | 0.0000 | 0.9858 |

| SEF | 16.3 | 0.0000 | 0.5226 |

| SB × SEF | 6.5 | 0.0016 | 0.9371 |

| EQUITY | 94 | 0.0000 | 0.1873 |

| LOANS | 13.3 | 0.0000 | 0.1419 |

| SIZE | 1.9 | 0.1456 | 0.4103 |

| Panel B. Dependent variable in differences, explanatory variables (instruments) in levels | |||

| ΔSB | 22,222.9 | 0.0000 | 0.9344 |

| ΔCONC | 33.9 | 0.0000 | 0.4108 |

| Δ(SB × CONC) | 39.8 | 0.0000 | 0.5180 |

| ΔMS | 67.1 | 0.0000 | 0.4418 |

| Δ(SB × MS) | 6.9 | 0.0010 | 0.4927 |

| ΔXEF | 30.1 | 0.0000 | 0.1146 |

| Δ(SB × XEF) | 87.3 | 0.0000 | 0.2539 |

| ΔSEF | 59.5 | 0.0000 | 0.3644 |

| Δ(SB × SEF) | 75.7 | 0.0000 | 0.4049 |

| ΔEQUITY | 20 | 0.0000 | 0.0739 |

| ΔLOANS | 42 | 0.0000 | 0.0853 |

| ΔSIZE | 85 | 0.0000 | 0.2191 |

| ROA (a) | ROE (b) | |||||||

|---|---|---|---|---|---|---|---|---|

| Coefficient | Standard Error | T-Student | p-Value | Coefficient | Standard Error | T-Student | p-Value | |

| SB | 0.0007 | 0.0002 | 3.14 | 0.002 *** | 0.0086 | 0.0032 | 2.71 | 0.007 *** |

| CONC | 0.0357 | 0.0216 | 1.66 | 0.098 * | 0.5286 | 0.2004 | 2.64 | 0.008 *** |

| SB × CONC | −0.0407 | 0.0388 | −1.05 | 0.295 | −0.3207 | 0.3826 | −0.84 | 0.402 |

| MS | 0.0294 | 0.0172 | 1.71 | 0.087 * | 0.1422 | 0.1366 | 1.04 | 0.298 |

| SB × MS | −0.0062 | 0.0359 | −0.17 | 0.864 | 0.1472 | 0.2637 | 0.56 | 0.577 |

| XEF | 0.0178 | 0.0166 | 1.08 | 0.282 | 0.0336 | 0.1363 | 0.25 | 0.805 |

| SB × XEF | 0.0002 | 0.0072 | 0.02 | 0.982 | −0.0235 | 0.0725 | −0.32 | 0.746 |

| SEF | 0.0120 | 0.0069 | 1.74 | 0.081 * | 0.1679 | 0.0996 | 1.69 | 0.092 * |

| SB × SEF | 0.0036 | 0.0109 | 0.33 | 0.740 | −0.0015 | 0.1004 | −0.02 | 0.988 |

| EQUITY | 0.0427 | 0.0169 | 2.52 | 0.012 ** | 0.0060 | 0.1713 | 0.04 | 0.972 |

| LOANS | 0.0020 | 0.0044 | 0.46 | 0.646 | −0.0001 | 0.0548 | −0.00 | 0.999 |

| SIZE | −0.0001 | 0.0007 | −0.12 | 0.904 | 0.0066 | 0.0086 | 0.77 | 0.441 |

| ΔGDP | 0.0003 | 0.0002 | 2.09 | 0.036 ** | 0.0030 | 0.0016 | 1.89 | 0.058 * |

| LR Test. SB × CONC | −0.0050 | 0.0384 | −0.13 | 0.896 | 0.2078 | 0.4117 | 0.50 | 0.614 |

| LR Test. SB × MS | 0.0233 | 0.0266 | 0.88 | 0.381 | 0.2894 | 0.2338 | 1.24 | 0.216 |

| LR Test. SB × XEF | 0.0180 | 0.0087 | 0.86 | 0.390 | 0.0101 | 0.1614 | 0.06 | 0.950 |

| LR Test. SB × SEF | 0.0156 | 0.0209 | 1.80 | 0.071 * | 0.1664 | 0.0861 | 1.93 | 0.053 * |

| CONS | −0.0258 | 0.0181 | −1.42 | 0.154 | −0.1823 | 0.2059 | −0.89 | 0.376 |

| Year dummies | Yes | Yes | ||||||

| Country dummies | Yes | Yes | ||||||

| M2 | 0.654 | 0.599 | ||||||

| Hansen | 0.133 | 0.168 | ||||||

| Variable | Description | Expected Relationship with Risk (Z) |

|---|---|---|

| SB | Dummy that takes the value of 1 if a bank has signed the UN Principles for Responsible Banking, and 0 otherwise | Positive |

| CONC | Herfindahl-Hirschman index (HHI) in terms of assets | Positive/Negative |

| MS | Market share in terms of assets | Positive/Negative |

| XEF | Cost X-efficiency | Positive |

| SEF | Scale efficiency with respect to the inputs | Positive |

| SB × CONC | Interaction between sustainable banks and market concentration | Positive/Negative |

| SB × MS | Interaction between sustainable banks and market share | Positive/Negative |

| SB × XEF | Interaction between sustainable banks and cost X-efficiency | Positive |

| SB × SEF | Interaction between sustainable banks and scale efficiency | Positive |

| LOANS | Loans/Total assets | Positive/Negative |

| SIZE | Log (Total assets) | Positive/Negative |

| LOANDEP | Loans/Deposits | Negative |

| Variable | Mean | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|

| Z | 95.9222 | 196.7297 | 0.1661 | 3975.0530 |

| CONC | 0.0792 | 0.0524 | 0.0306 | 0.2914 |

| MS | 0.0261 | 0.0570 | 1.69 × 10−6 | 0.4602 |

| XEF | 0.8161 | 0.0579 | 0.3896 | 0.9470 |

| SEF | 0.7455 | 0.0998 | 0.0041 | 0.7813 |

| LOANS | 0.6340 | 0.1596 | 0.0195 | 0.9747 |

| SIZE | 8.9409 | 2.0031 | 3.1179 | 14.7620 |

| LOANDEP | 7.0419 | 398.6775 | 0.0202 | 30,647.1700 |

| CONC | MS | XEF | SEF | LOANS | SIZE | LOANDEP | |

|---|---|---|---|---|---|---|---|

| CONC | 1 | ||||||

| MS | 0.5002 | 1 | |||||

| XEF | −0.0792 | −0.0906 | 1 | ||||

| SEF | −0.0137 | −0.2421 | −0.0101 | 1 | |||

| LOANS | −0.1249 | −0.1222 | 0.1223 | 0.1928 | 1 | ||

| SIZE | 0.2204 | 0.4497 | −0.0141 | −0.4382 | −0.1559 | 1 | |

| LOANDEP | −0.0122 | −0.0046 | 0.0146 | 0.0024 | 0.0020 | 0.0151 | 1 |

| Z | F-Statistic | p-Value | R2 |

|---|---|---|---|

| Panel A. Dependent variable in levels, explanatory variables (instruments) in differences | |||

| SB | 255 | 0.0000 | 0.9832 |

| CONC | 40.4 | 0.0000 | 0.4481 |

| SB × CONC | 57 | 0.0000 | 0.9134 |

| MS | 42.6 | 0.0000 | 0.5859 |

| SB × MS | 58.4 | 0.0000 | 0.7958 |

| XEF | 30.6 | 0.0000 | 0.1327 |

| SB × XEF | 58.9 | 0.0000 | 0.9858 |

| SEF | 16.5 | 0.0000 | 0.5247 |

| SB × SEF | 6.5 | 0.0016 | 0.9371 |

| LOANDEP | 139.1 | 0.0000 | 0.2518 |

| LOANS | 13.5 | 0.0000 | 0.1401 |

| SIZE | 4.6 | 0.0099 | 0.3930 |

| Panel B. Dependent variable in differences, explanatory variables (instruments) in levels | |||

| ΔSB | 22,235.2 | 0.0000 | 0.9344 |

| ΔCONC | 92.5 | 0.0000 | 0.4163 |

| Δ(SB × CONC) | 39.8 | 0.0000 | 0.5181 |

| ΔMS | 43.5 | 0.0000 | 0.4725 |

| Δ(SB × MS) | 6.9 | 0.0010 | 0.4924 |

| ΔXEF | 28.6 | 0.0000 | 0.0937 |

| Δ(SB × XEF) | 87.4 | 0.0000 | 0.2539 |

| ΔSEF | 59.3 | 0.0000 | 0.3643 |

| Δ(SB × SEF) | 75.7 | 0.0000 | 0.4049 |

| ΔLOANDEP | 366.4 | 0.0000 | 0.2561 |

| ΔLOANS | 42 | 0.0000 | 0.0904 |

| ΔSIZE | 82.3 | 0.0000 | 0.2020 |

| Coefficient | Standard Error | T-Student | p-Value | |

|---|---|---|---|---|

| SB | 2.1820 | 2.9806 | 0.73 | 0.464 |

| CONC | −181.4364 | 159.8146 | −1.14 | 0.256 |

| SB × CONC | 241.6333 | 485.7008 | 0.50 | 0.619 |

| MS | −223.2634 | 180.3790 | −1.24 | 0.216 |

| SB × MS | −169.0902 | 340.5535 | −0.50 | 0.620 |

| XEF | 173.6664 | 145.4064 | 1.19 | 0.232 |

| SB × XEF | −178.9392 | 120.7129 | −1.48 | 0.138 |

| SEF | −87.7759 | 157.7984 | −0.56 | 0.578 |

| SB × SEF | 137.3545 | 156.4459 | 0.88 | 0.380 |

| LOANS | 87.1793 | 2.2423 | 1.69 | 0.091 * |

| SIZE | 15.7375 | 51.5945 | 1.93 | 0.054 * |

| LOANDEP | 0.1084 | 2.2423 | 0.05 | 0.961 |

| LR Test. SB × CONC | 60.1970 | 474.8923 | 0.13 | 0.899 |

| LR Test. SB × MS | −392.3537 | 298.9900 | −1.31 | 0.189 |

| LR Test. SB × XEF | −5.2728 | 139.2918 | −0.04 | 0.970 |

| LR Test. SB × SEF | 49.5783 | 95.7228 | 0.52 | 0.605 |

| CONS | −133.1983 | 156.7711 | −0.85 | 0.396 |

| Year dummies | Yes | |||

| Country dummies | Yes | |||

| M2 | 0.442 | |||

| Hansen | 0.102 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Torre Olmo, B.; Cantero Saiz, M.; Sanfilippo Azofra, S. Sustainable Banking, Market Power, and Efficiency: Effects on Banks’ Profitability and Risk. Sustainability 2021, 13, 1298. https://doi.org/10.3390/su13031298

Torre Olmo B, Cantero Saiz M, Sanfilippo Azofra S. Sustainable Banking, Market Power, and Efficiency: Effects on Banks’ Profitability and Risk. Sustainability. 2021; 13(3):1298. https://doi.org/10.3390/su13031298

Chicago/Turabian StyleTorre Olmo, Begoña, María Cantero Saiz, and Sergio Sanfilippo Azofra. 2021. "Sustainable Banking, Market Power, and Efficiency: Effects on Banks’ Profitability and Risk" Sustainability 13, no. 3: 1298. https://doi.org/10.3390/su13031298

APA StyleTorre Olmo, B., Cantero Saiz, M., & Sanfilippo Azofra, S. (2021). Sustainable Banking, Market Power, and Efficiency: Effects on Banks’ Profitability and Risk. Sustainability, 13(3), 1298. https://doi.org/10.3390/su13031298