Green Taxation Promotes the Intelligent Transformation of Chinese Manufacturing Enterprises: Tax Leverage Theory

Abstract

:1. Introduction

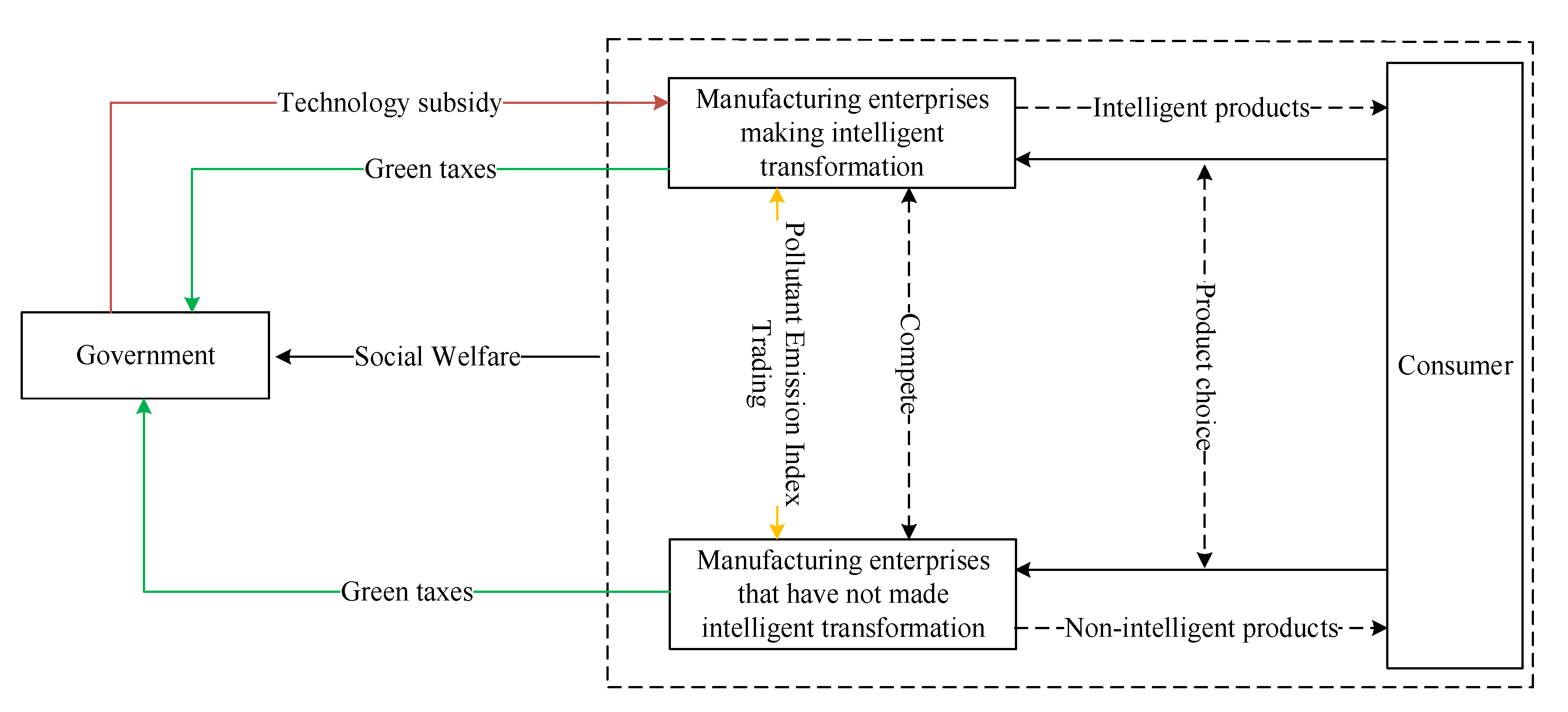

- We proposed the PEITM, by which the government establishes legal rights to pollutant emissions and gives such rights the property of a commodity that can be bought and sold to achieve the control of pollutant emissions. Thus, the pollution emissions charge has been changed from a single pollutant emissions charge to pollutant emissions charges that can coexist with excess pollutant emissions charges. Green taxes are consequently divided into TPE and TEPE.

- We designed the tax rate threshold according to principle of tax leverage, which leads to a threshold effect of the government’s green taxation, by which an effective measure for the government to promote the intelligent transformation of manufacturing enterprises can be proposed.

- The work provides a theoretical basis for the government to formulate reasonable tax policies for different types of polluting enterprises. Manufacturing enterprises with high energy consumption and high pollution will receive more obvious incentive effects for intelligent transformation.

2. Literature Review

2.1. Literature on Green Tax

2.2. Literature on Technology Subsidy

2.3. The Position of This Study

3. Path Selection for Transformation of Chinese Manufacturing Enterprises

3.1. TIS for Transformation of Enterprises

3.2. Market-Oriented PEITM for Transformation of Enterprises

3.3. Green Tax System for Sustainable Development in China

4. Model

4.1. Event Sequence

4.2. Consumer Utility

4.3. The utility of the Government and Manufacturing Enterprises

5. The Optimal Decision of the Three Subsidy Schemes

6. Optimal Government Green Taxes Scheme

6.1. The Green Taxes Scheme of Lightly Polluting Enterprises and Moderately Polluting Enterprises

6.2. The Research Object has Severely Polluting Enterprises

- (1)

- When , if , always holds, otherwise .

- (2)

- When , if , always holds, otherwise.where:

7. Policy Implications

8. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A

Appendix B

References

- Su, J.; Su, K.; Wang, S. Does the Digital Economy Promote Industrial Structural Upgrading?—A Test of Mediating Effects Based on Heterogeneous Technological Innovation. Sustainability 2021, 13, 10105. [Google Scholar] [CrossRef]

- Tim, S.; Michael, O.; Sascha, K.; Holger, K. Industry 4.0 as Enabler for a Sustainable Development: A Qualitative Assessment of its Ecological and Social Potential. Process. Saf. Environ. 2018, 118, S1879791293. [Google Scholar]

- Niu, P.; Zhu, J.; Sun, Y. Dynamic Modeling and Chaos Control of Informatization Development in Manufacturing Enterprises. Entropy 2021, 23, 681. [Google Scholar] [CrossRef]

- Jz, A.; Ys, B. Dynamic modeling and chaos control of sustainable integration of informatization and industrialization—ScienceDirect. Chaos Solitons Fract. 2020, 135, 109745. [Google Scholar]

- Li, F.; Andries, P.; Pellens, M.; Xu, J. The importance of large firms for generating economic value from subsidized technological innovation: A regional perspective. Technol. Forecast Soc. 2021, 171, 120973. [Google Scholar] [CrossRef]

- Lin, B.; Luan, R. Do government subsidies promote efficiency in technological innovation of China’s photovoltaic enterprises? J. Clean Prod. 2020, 254, 120108. [Google Scholar] [CrossRef]

- Xu, J.; Wang, X.; Liu, F. Government subsidies, R&D investment and innovation performance: Analysis from pharmaceutical sector in China. Technol. Anal. Strateg. Manag. 2020, 33, 535–553. [Google Scholar]

- Luo, G.; Liu, Y.; Zhang, L.; Xu, X.; Guo, Y. Do governmental subsidies improve the financial performance of China’s new energy power generation enterprises? Energy 2021, 227, 120432. [Google Scholar] [CrossRef]

- Ouyang, X.; Li, Q.; Du, K. How does environmental regulation promote technological innovations in the industrial sector? Evidence from Chinese provincial panel data. Energ. Policy 2020, 139, 111310. [Google Scholar] [CrossRef]

- Ma, H.; Li, L. Could environmental regulation promote the technological innovation of China’s emerging marine enterprises? Based on the moderating effect of government grants. Environ. Res. 2021, 202, 111682. [Google Scholar] [CrossRef]

- Hattori, M.; Tanaka, Y. Subsidy or tax policy for new technology adoption in duopoly with quadratic and linear cost functions. Mpra Pap. 2015, 35, 1423–1433. [Google Scholar]

- Krass, D.; Nedorezov, T.; Ovchinnikov, A. Environmental taxes and the choice of green technology. Oper. Res. 2015, 22, 1035–1055. [Google Scholar] [CrossRef]

- Liu, L.; Kang, C.; Yin, Z.; Liu, Z. The effects of fiscal and taxation policies on the innovation efficiency of manufacturing enterprises: A comparative study from the perspective of economic regions. Transform. Bus. Econ. 2019, 18, 206–228. [Google Scholar]

- Wu, H.; Hu, S. The impact of synergy effect between government subsidies and slack resources on green technology innovation. J. Clean Prod. 2020, 274, 122682. [Google Scholar] [CrossRef]

- Buravleva, Y.; Tang, D.; Bethel, B.J. Incentivizing Innovation: The Causal Role of Government Subsidies on Lithium-Ion Battery Research and Development. Sustainability 2021, 13, 8309. [Google Scholar] [CrossRef]

- Zhang, G.P.; Yu, J.; Xia, Y. The Payback of Effective Innovation Programs: Empirical Evidence from Firms that Have Won Innovation Awards. Prod. Oper. Manag. 2014, 23, 1401–1420. [Google Scholar] [CrossRef] [Green Version]

- He, P.; Ning, J.; Yu, Z.; Xiong, H.; Jin, H. Can Environmental Tax Policy Really Help to Reduce Pollutant Emissions? An Empirical Study of a Panel ARDL Model Based on OECD Countries and China. Sustainability 2019, 11, 4384. [Google Scholar] [CrossRef] [Green Version]

- Mardones, C.; Mena, C. Economic, environmental and distributive analysis of the taxes to global and local air pollutants in Chile. J. Clean Prod. 2020, 259, 120893. [Google Scholar] [CrossRef]

- Fullerton, D.; Karney, D.H. Multiple pollutants, co-benefits, and suboptimal environmental policies. J. Environ. Econ. Manag. 2017, 87, S516208804. [Google Scholar] [CrossRef]

- Bing, X.; Mitchell, B.; Yong, G.; Ren, W.; Mueller, K.; Ma, Z.; Oliveira, J.; Fujita, T.; Tobias, M. A review on China’s pollutant emissions reduction assessment. Ecol. Indic. 2014, 38, 272–278. [Google Scholar]

- Gao, G.; Zeng, X.; An, C.; Lei, Y. A Sustainable Industry-Environment Model for the Identification of Urban Environmental Risk to Confront Air Pollution in Beijing, China. Sustainability 2018, 10, 962. [Google Scholar] [CrossRef] [Green Version]

- Yu, F.; Wang, L.; Li, X. The effects of government subsidies on new energy vehicle enterprises: The moderating role of intelligent transformation. Energ. Policy 2020, 141, 111463. [Google Scholar] [CrossRef]

- Meng, B.; Kuang, H.; Niu, E.; Li, J.; Li, Z. Research on the Transformation Path of the Green Intelligent Port: Outlining the Perspective of the Evolutionary Game “Government–Port–Third-Party Organization”. Sustainability 2020, 12, 8072. [Google Scholar] [CrossRef]

- Chiroleu-Assouline, M.; Fodha, M. From regressive pollution taxes to progressive environmental tax reforms. Eur. Econ. Rev. 2014, 69, 126–142. [Google Scholar] [CrossRef] [Green Version]

- Matsukawa, I. The Welfare Effects of Environmental Taxation on a Green Market Where Consumers Emit a Pollutant. Environ. Resour. Econ. 2012, 52, 87–107. [Google Scholar] [CrossRef]

- Kuralbayeva, K. Environmental Taxation, Employment and Public Spending in Developing Countries. Environ. Resour. Econ. 2019, 72, 877–912. [Google Scholar] [CrossRef] [Green Version]

- Loomis, J.B.; Allen, B. Using Non Market Valuation to Inform the Choice Between Permits and Fees in Environmental Regulation. Environ. Resour Econ. 2008, 40, 329–337. [Google Scholar] [CrossRef]

- Li, H.L.; Zhu, X.H.; Chen, J.Y.; Jiang, F.T. Environmental regulations, environmental governance efficiency and the green transformation of China’s iron and steel enterprises. Ecol. Econ. 2019, 165, 106397. [Google Scholar] [CrossRef]

- Li, D.; Zhu, J. The Role of Environmental Regulation and Technological Innovation in the Employment of Manufacturing Enterprises: Evidence from China. Sustainability 2019, 11, 2982. [Google Scholar] [CrossRef] [Green Version]

- Hu, B.; Dong, H.; Jiang, P.; Zhu, J. Analysis of the Applicable Rate of Environmental Tax through Different Tax Rate Scenarios in China. Sustainability 2020, 12, 4233. [Google Scholar] [CrossRef]

- Wu, W.; Zhao, K.; Li, L. Can government subsidy strategies and strategy combinations effectively stimulate enterprise innovation? Theory and evidence. Econ. Polit. 2021, 1–12. [Google Scholar] [CrossRef]

- Jia, L.; Nam, E.; Chun, D. Impact of Chinese Government Subsidies on Enterprise Innovation: Based on a Three-Dimensional Perspective. Sustainability 2021, 13, 1288. [Google Scholar] [CrossRef]

- Klette, T.J.; Møen, J. R&D investment responses to R&D subsidies: A theoretical analysis and a microeconometric study. Dep. Bus. Manag. Sci. Nor. Sch. Econ. 2010, 9, 169–203. [Google Scholar]

- Yi, J.; Murphree, M.; Meng, S.; Li, S. The More the Merrier? Chinese Government R&D Subsidies, Dependence and Firm Innovation Performance. J. Prod. Innovat. Manag. 2021, 38, 289–310. [Google Scholar]

- Yang, X.; He, L.; Xia, Y.; Chen, Y. Effect of government subsidies on renewable energy investments: The threshold effect. Energ. Policy 2019, 132, 156–166. [Google Scholar] [CrossRef]

- Jiang, Y.; Wang, D.; Zeng, Q. Can founders’dual rolesfacilitate innovation? —From the perspective of founders’ R&D network characteristics. J. Bus. Econ. Manag. 2021, 22, 1288–1307. [Google Scholar]

- Wang, Y.; Yu, L. Can the current environmental tax rate promote green technology innovation?—Evidence from China’s resource-based industries. J. Clean Prod. 2020, 278, 123443. [Google Scholar] [CrossRef]

- Zhang, S.; Yu, Y.; Zhu, Q.; Qiu, C.M.; Tian, A. Green Innovation Mode under Carbon Tax and Innovation Subsidy: An Evolutionary Game Analysis for Portfolio Policies. Sustainability 2020, 12, 1385. [Google Scholar] [CrossRef] [Green Version]

- Deng, Y.; You, D.; Zhang, Y. Research on improvement strategies for low-carbon technology innovation based on a differential game: The perspective of tax competition. Sustain. Prod. Consum. 2021, 26, 1046–1061. [Google Scholar] [CrossRef]

- Guo, D.; Guo, Y.; Jiang, K. Government-subsidized R&D and firm innovation: Evidence from China. Res. Policy 2016, 45, 1129–1144. [Google Scholar]

- Wu, A.; Li, H. The impact of government subsidies on contract design of green technology R&D cooperation. Technol. Anal. Strat. Manag. 2021, 33, 1–17. [Google Scholar]

- Li, Y.; Li, G.; Shao, W.; Duan, K. Impact of government subsidies and environmental regulations on investment in technological innovation. Technol. Soc. 2019, 37, 1694–1701. [Google Scholar]

- Sungmin, P. Evaluating the efficiency and productivity change within government subsidy recipients of a national technology innovation research and development program. R D Manag. Res. Dev. Manag. 2015, 45, 549–568. [Google Scholar]

| Technology Subsidy | ||

| Degree of Intelligent Transformation | ||

| Product price | ||

| Market demand | ||

| Technology subsidy | ||

| Degree of intelligent transformation | ||

| Product price | ||

| Market demand | ||

| Technology subsidy | ||

| Degree of intelligent transformation | ||

| Product price | ||

| Market demand | ||

| Technology Subsidy | ||

| Degree of Intelligent Transformation | ||

| Product Price | ||

| Market Demand | ||

| Technology Subsidy | ||

| Degree of Intelligent Transformation | ||

| Product Price | ||

| Market Demand | ||

| Technology Subsidy | ||

| Degree of Intelligent Transformation | ||

| Product Price | ||

| Market Demand | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Yu, L.; Zhu, J.; Wang, Z. Green Taxation Promotes the Intelligent Transformation of Chinese Manufacturing Enterprises: Tax Leverage Theory. Sustainability 2021, 13, 13321. https://doi.org/10.3390/su132313321

Yu L, Zhu J, Wang Z. Green Taxation Promotes the Intelligent Transformation of Chinese Manufacturing Enterprises: Tax Leverage Theory. Sustainability. 2021; 13(23):13321. https://doi.org/10.3390/su132313321

Chicago/Turabian StyleYu, Longzhen, Jianhua Zhu, and Zhixian Wang. 2021. "Green Taxation Promotes the Intelligent Transformation of Chinese Manufacturing Enterprises: Tax Leverage Theory" Sustainability 13, no. 23: 13321. https://doi.org/10.3390/su132313321

APA StyleYu, L., Zhu, J., & Wang, Z. (2021). Green Taxation Promotes the Intelligent Transformation of Chinese Manufacturing Enterprises: Tax Leverage Theory. Sustainability, 13(23), 13321. https://doi.org/10.3390/su132313321