Does Business Group Matter for the Relationship between Green Innovation and Financial Performance? Evidence from Chinese Listed Companies

Abstract

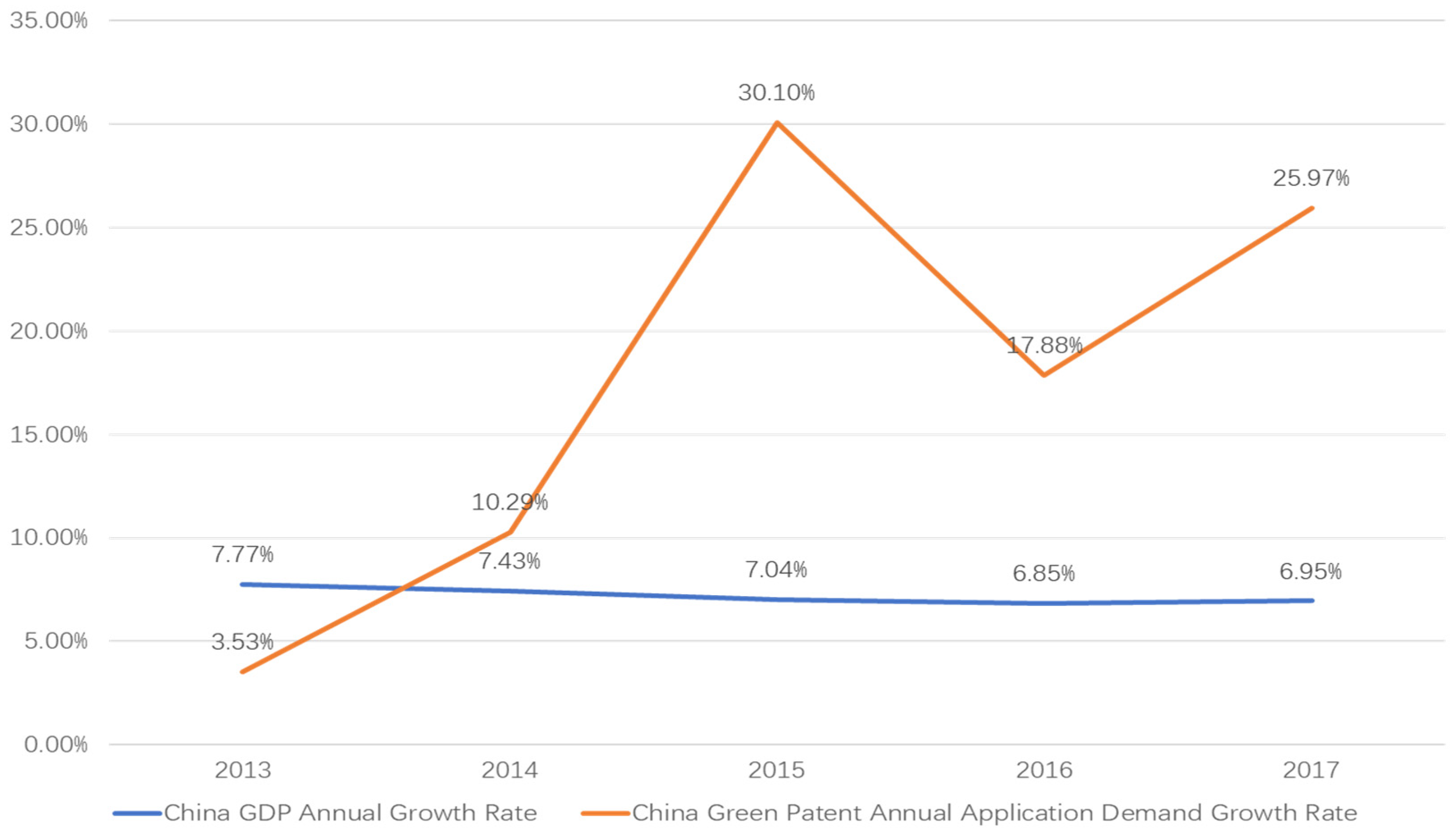

1. Introduction

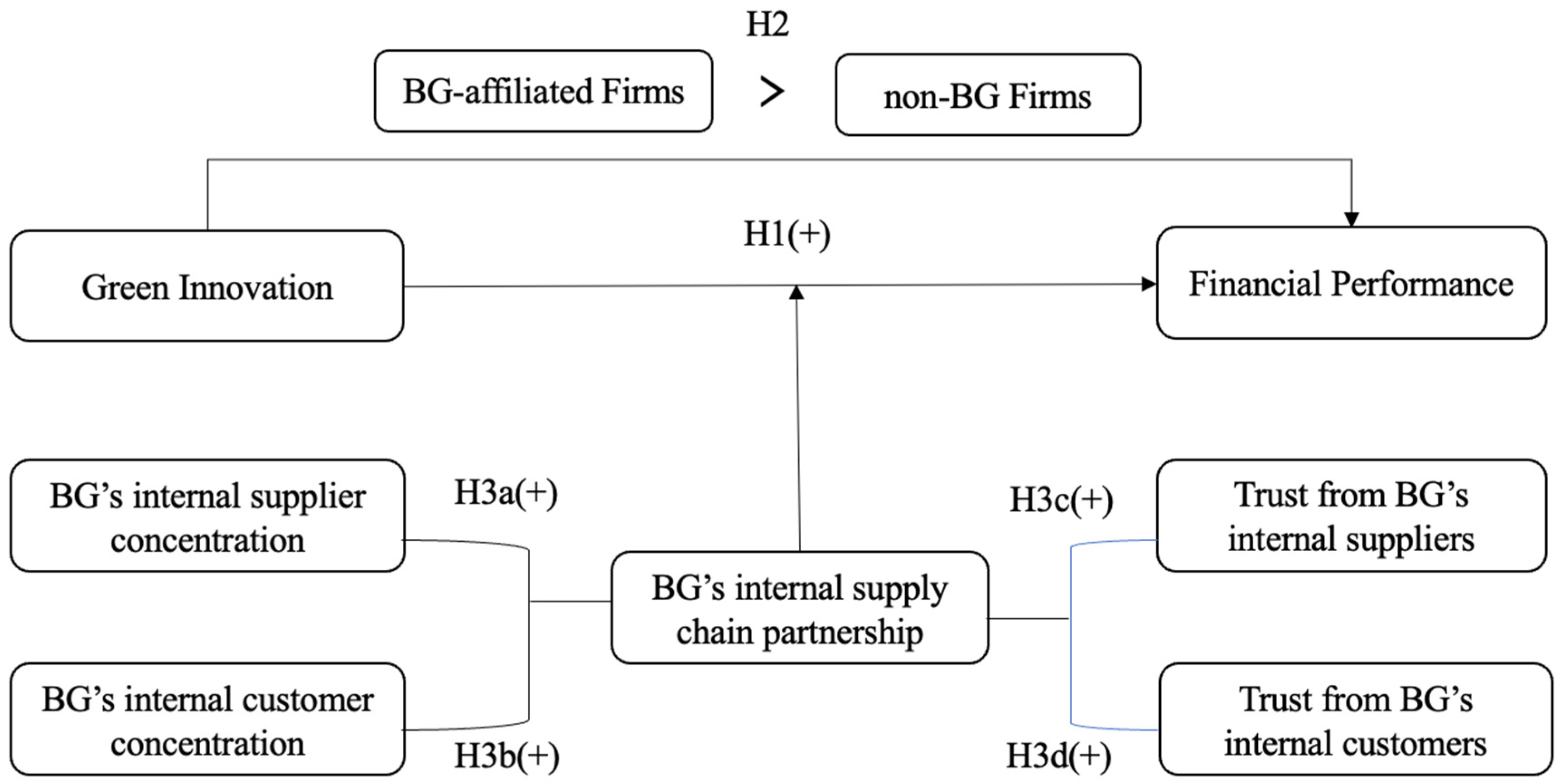

2. Theoretical Analysis and Hypotheses Development

2.1. Relationship between Green Innovation and Corporate Financial Performance

2.2. Impact of Green Innovation Carried out by BG-Affiliated Firms and Non-BG Firms on Financial Performance

2.3. The Moderating Role of BG’s Internal Supply Chain Partnership

3. Methodology

3.1. Sample and Data Collection

3.2. Variable Measurement

3.3. Modeling

4. Results

4.1. Regression Results

4.2. Robustness Test

5. Conclusions and Discussion

5.1. Research Implications

5.2. Practical Implications

5.3. Limitations and Future Research Directions

Author Contributions

Funding

Conflicts of Interest

References

- Hkc, A.; Rwyy, B.; Jing, D.A.; Ming, K. The moderating effect of environmental dynamism on green product innovation and performance. Int. J. Prod. Econ. 2016, 181, 384–391. [Google Scholar] [CrossRef]

- Porter, M.E.; Linde, C. Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 1995, 9, 97–118. [Google Scholar] [CrossRef]

- Olson, E.L. Perspective: The green innovation value chain: A tool for evaluating the diffusion prospects of green products. J. Prod. Innov. Manag. 2013, 30, 782–793. [Google Scholar] [CrossRef]

- Hart, S.L.; Dowell, G. Invited editorial: A natural-resource-based view of the firm: Fifteen years after. J. Manag. 2011, 37, 1464–1479. [Google Scholar] [CrossRef]

- Link, S.; Naveh, E. Standardization and discretion: Does the environmental standard iso 14001 lead to performance benefits? IEEE Trans. Eng. Manag. 2006, 53, 508–519. [Google Scholar] [CrossRef]

- Stucki, T. Which firms benefit from investments in green energy technologies?—The effect of energy costs. Res. Policy 2019, 48, 546–555. [Google Scholar] [CrossRef]

- He, F.; Miao, X.; Wong, C.W.Y.; Lee, S. Contemporary corporate eco-innovation research: A systematic review. J. Clean. Prod. 2018, 174, 502–526. [Google Scholar] [CrossRef]

- Ray, S.; Chaudhuri, B.R. Business Group Affiliation and Corporate Sustainability Strategies of Firms: An Investigation of Firms in India. J. Bus. Ethics 2018, 153, 955–976. [Google Scholar] [CrossRef]

- Khanna, T.; Yafeh, Y. Business groups in emerging markets: Paragons or parasites? J. Econ. Lit. 2007, 45, 331–372. [Google Scholar] [CrossRef]

- Guzzini, E.; Iacobucci, D. Business Group Affiliation and R&D. Ind. Innov. 2014, 21, 20–42. [Google Scholar] [CrossRef]

- Zimon, D.; Tyan, J.; Sroufe, R. Implementing sustainable supply chain management: Reactive, cooperative, and dynamic models. Sustainability 2019, 11, 7227. [Google Scholar] [CrossRef]

- Heim, S. Capability building and functions of SMEs in business groups: A case study of Toyota’s supply chain. Int. J. Automot. Technol. Manag. 2013, 13, 338–353. [Google Scholar] [CrossRef]

- Chan, R. Does the natural-resource-based view of the firm apply in an emerging economy? A survey of foreign invested enterprises in china. J. Manag. Stud. 2005, 42, 625–672. [Google Scholar] [CrossRef]

- Lee, K.H.; Min, B. Green R&D for eco-innovation and its impact on carbon emissions and firm performance. J. Clean. Prod. 2015, 108, 534–542. [Google Scholar] [CrossRef]

- Pataki, G. Ecological modernization as a paradigm of corporate sustainability. Sustain. Dev. 2009, 17, 82–91. [Google Scholar] [CrossRef]

- Zhu, Q.; Sarkis, J.; Lai, K.H. Green supply chain management innovation diffusion and its relationship to organizational improvement: An ecological modernization perspective. J. Eng. Technol. Manag. 2012, 29, 168–185. [Google Scholar] [CrossRef]

- Chen, Y.S. The driver of green innovation and green image—Green core competence. J. Bus. Ethics 2008, 81, 531–543. [Google Scholar] [CrossRef]

- Ma, Y.; Hou, G.; Xin, B. Green process innovation and innovation benefit: The mediating effect of firm image. Sustainability 2017, 9, 1778. [Google Scholar] [CrossRef]

- Belenzon, S.; Berkovitz, T. Innovation in business groups. Manag. Sci. 2010, 56, 519–535. [Google Scholar] [CrossRef]

- Lou, Z.K.; Chen, S.Y.; Jia, Y.Y.; Yu, X.Y. Business Group Affiliation and R&D Investment: Evidence from China. Emerg. Mark. Financ. Trade 2019, 57, 2307–2322. [Google Scholar] [CrossRef]

- Komera, S.; Lukose, P.J.; Sasidharan, S. Does business group affiliation encourage R&D activities? Evidence from india. Asia Pac. J. Manag. 2018, 35, 887–917. [Google Scholar] [CrossRef]

- Mahmood, I.P.; Zhu, H.J.; Zajac, E.J. Where can capabilities come from? Network ties and capability acquisition in business groups. Strateg. Manag. J. 2011, 32, 820–848. [Google Scholar] [CrossRef]

- Mark, G. 19. Business Groups and Social Organization. In The Handbook of Economic Sociology, 2nd ed.; Smelser, N.J., Swedberg, R., Eds.; Princeton University Press: Princeton, NJ, USA, 2010. [Google Scholar] [CrossRef][Green Version]

- Chang, S.J.; Hong, J. Economic performance of group-affiliated companies in korea: Intragroup resource sharing and internal business transactions. Acad. Manag. J. 2000, 43, 429–448. [Google Scholar] [CrossRef]

- Mahmood, I.P.; Mitchell, W. Two Faces: Effects of Business Groups on Innovation in Emerging Economies. Manag. Sci. 2004, 50, 1348–1365. [Google Scholar] [CrossRef]

- Mahmood, I.; Chung, C.N.; Mitchell, W. The Evolving Impact of Combinatorial Opportunities and Exhaustion on Innovation by Business Groups as Market Development Increases: The Case of Taiwan. Manag. Sci. 2013, 59, 1142–1161. [Google Scholar] [CrossRef]

- Ireland, R.D.; Webb, J.W. A multi-theoretic perspective on trust and power in strategic supply chains. J. Oper. Manag. 2007, 25, 482–497. [Google Scholar] [CrossRef]

- Wei, C.; Zhang, X. Supply Chain Partnership, Knowledge Trading and Cooperative Performance: An Empirical Study Based on Chinese Manufacturing Enterprises. Stud. Sci. Sci. 2011, 29, 1865–1874. [Google Scholar] [CrossRef]

- Beheshti, H.M.; Oghazi, P.; Mostaghel, R.; Hultman, M. Supply chain integration and firm performance: An empirical study of swedish manufacturing firms. Compet. Rev. 2014, 24, 120. [Google Scholar] [CrossRef]

- Ku, E.C.S.; Wu, W.C.; Chen, Y.J. The relationships among supply chain partnerships, customer orientation, and operational performance: The effect of flexibility. Inf. Syst. E-Bus. Manag. 2016, 14, 415–441. [Google Scholar] [CrossRef]

- Lanier, D., Jr.; Wempe, W.F.; Zacharia, Z.G. Concentrated supply chain membership and financial performance: Chain- and firm-level perspectives. Oper. Res. 2010, 28, 1–16. [Google Scholar] [CrossRef]

- Jung, C.-H. The effects of factors of partnership between suppliers and buyers toward on collaboration and supply chain performance. J. Korea Acad. Coop. Soc. 2012, 13, 2921–2929. [Google Scholar]

- He, J.; Mao, X.; Rui, O.M.; Zha, X. Business groups in China. J. Corp. Financ. 2013, 22, 166–192. [Google Scholar] [CrossRef]

- Zhang, Y.L.; Cantwell, J. Exploration and exploitation: The different impacts of two types of Japanese business group network on firm innovation and global learning. Asian Bus. Manag. 2011, 10, 151–181. [Google Scholar] [CrossRef]

- Roy, S.; Sivakumar, K.; Wilkinson, I.F. Innovation generation in supply chain relationships: A conceptual model and research propositions. J. Acad. Mark. Sci. 2004, 32, 61–79. [Google Scholar] [CrossRef]

- Hsieh, T.J.; Yeh, R.S.; Chen, Y.J. Business group characteristics and affiliated firm innovation: The case of Taiwan. Ind. Mark. Manag. 2010, 39, 560–570. [Google Scholar] [CrossRef]

- Martinez-sola, C.; Garcia-teruel, P.J.; Martinez-solano, P. Trade credit and SME profitability. Small Bus. Econ. 2014, 42, 561–577. [Google Scholar] [CrossRef]

- Aguilera-Caracuel, J.; Ortiz-de-Mandojana, N. Green Innovation and Financial Performance: An Institutional Approach. Organ. Environ. 2013, 26, 365–385. [Google Scholar] [CrossRef]

- Acs, Z.J.; Anselin, L.; Varga, A. Patents and innovation counts as measures of regional production of new knowledge. Res. Policy 2002, 31, 1069–1085. [Google Scholar] [CrossRef]

- Choi, Y.K.; Han, S.H.; Kwon, Y. CSR activities and internal capital markets: Evidence from Korean business groups. Pac. Basin Financ. J. 2019, 55, 283–298. [Google Scholar] [CrossRef]

- Xie, Z.; Wang, J.; Miao, L. Big data and emerging market firms’ innovation in an open economy: The diversification strategy perspective. Technol. Forecast. Soc. Chang. 2021, 173, 121091. [Google Scholar] [CrossRef]

- Kumar, S.; Sureka, R.; Lim, W.M.; Mangla, S.K.; Goyal, N. What do we know about business strategy and environmental research? Insights from Business Strategy and the Environment. Bus. Strategy Environ. 2021. [Google Scholar] [CrossRef]

- Tang, Z.; Tang, J. The impact of competitors: Firm power divergence on Chinese SMEs’ environmental and financial performance. J. Bus. Ethics 2016, 136, 147–165. [Google Scholar] [CrossRef]

- Lim, W.M. History, lessons, and ways forward from the COVID-19 pandemic. Int. J. Qual. Innov. 2021, 5, 101–108. [Google Scholar]

| Industry Name | Percentage % |

|---|---|

| Wine, beverage, and refined tea manufacturing | 0.99 |

| Textile industry | 0.99 |

| Woodworking and wood, bamboo, vine, grass | 0.99 |

| Paper and paper products | 1.98 |

| Petroleum processing, coking, and nuclear fuel processing industry | 0.99 |

| Chemical raw materials and chemical manufacturing | 5.94 |

| Medical manufacturing | 2.97 |

| Chemical fiber manufacturing | 1.98 |

| Rubber and plastic products | 2.97 |

| Non-metal mineral products industry | 2.97 |

| Non-ferrous metal smelting and calendering | 4.95 |

| Metalwork | 3.96 |

| General equipment manufacturing | 6.93 |

| Special equipment manufacturing | 13.86 |

| Automotive manufacturing | 8.91 |

| Railway, ship, aerospace, and other transport equipment manufacturing | 2.97 |

| Electrical machinery manufacturing | 15.84 |

| Computer, communications, and other electronic equipment manufacturing | 18.82 |

| Abandoned resource comprehensive utilization | 0.99 |

| Type | Variable Name | Variable Symbol | Definition and Measurement |

|---|---|---|---|

| Dependent Variable | Financial Performance | ROA | Net Profit/[(The Assets’ Total Closing Balance + The Assets’ Total Opening Balance)/2] |

| Independent Variable | Green Innovation | GPT | Quantity of Green Patents Applied |

| Moderating Variable | Business Group’s Internal Supplier Concentration | GSC | Purchase Amount in Related Transactions/Total Purchase Amount |

| Business Group’s Internal Customer Concentration | GCC | Sales Volume in Related Transactions/Total Sales Volume | |

| Trust Acquired from Supplier within the Business Group | GST | (Accounts Payable and Bills Payable in Related Transactions)/ Operating Cost | |

| Trust Given to Customer within the Business Group | GCT | (Accounts Payable and Bills Payable in Related Transactions)/ Operating Revenue | |

| Control Variable | Firm Size | Size | Ln (Total Assets) |

| Firm Age | Age | Ln (The number of years since establishment + 1) | |

| Capital Structure | Lev | Total Liabilities/Total Assets | |

| Assets Operation Ability | Tat | Main Operating Income/Total Assets | |

| Ownership Type | P | Ownership Nature: set equal to one if it is state-owned enterprise, and zero otherwise | |

| Equity Concentration | Top1 | Shareholding proportion of the firm’s largest shareholder | |

| R&D Investment | R&D | R&D investment/operating revenue | |

| Tobin’s Q | Q | Tobin’s Q |

| Overall Samples | Samples of BG-Affiliated Firms | Samples of Non-BG Firms | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | Mean | SD | Min | Max | Mean | SD | Min | Max | Mean | SD | Min | Max |

| ROA | 0.041 | 0.059 | −0.560 | 0.499 | 0.044 | 0.054 | −0.111 | 0.308 | 0.038 | 0.062 | −0.560 | 0.499 |

| GPT | 11.912 | 57.322 | 0.000 | 921.000 | 21.093 | 79.819 | 0.000 | 921.000 | 2.731 | 6.168 | 0.000 | 69.000 |

| Size | 22.430 | 1.250 | 19.885 | 27.307 | 23.067 | 1.266 | 20.537 | 27.307 | 21.792 | 0.844 | 19.885 | 24.216 |

| Age | 16.644 | 5.078 | 5.000 | 37.000 | 18.079 | 5.144 | 6.000 | 37.000 | 15.271 | 4.587 | 5.000 | 29.000 |

| Lev | 0.433 | 0.183 | 0.020 | 1.280 | 0.488 | 0.174 | 0.078 | 0.857 | 0.378 | 0.174 | 0.020 | 1.280 |

| Tat | 0.629 | 0.326 | 0.068 | 3.110 | 0.689 | 0.333 | 0.118 | 2.315 | 0.569 | 0.308 | 0.068 | 3.110 |

| State | 0.285 | 0.452 | 0.000 | 1.000 | 0.560 | 0.497 | 0.000 | 1.000 | 0.010 | 0.099 | 0.000 | 1.000 |

| Top1 | 0.306 | 0.140 | 0.042 | 0.788 | 0.354 | 0.144 | 0.072 | 0.788 | 0.259 | 0.117 | 0.042 | 0.729 |

| R&D | 0.047 | 0.035 | 0.001 | 0.5825 | 0.042 | 0.024 | 0.001 | 0.201 | 0.052 | 0.042 | 0.001 | 0.583 |

| Q | 2.287 | 1.360 | 0.840 | 13.240 | 2.005 | 1.193 | 0.840 | 11.256 | 2.568 | 1.457 | 0.929 | 13.240 |

| GSC | — | — | — | — | 0.034 | 0.078 | 0.000 | 0.649 | — | — | — | — |

| GCC | — | — | — | — | 0.034 | 0.086 | 0.000 | 0.855 | — | — | — | — |

| GST | — | — | — | — | 0.021 | 0.074 | 0.000 | 0.773 | — | — | — | — |

| GCT | — | — | — | — | 0.035 | 0.115 | 0.000 | 0.892 | — | — | — | — |

| Variable | ROA | GPT | Size | Age | Lev | Tat | State | Top1 | R&D | Q |

|---|---|---|---|---|---|---|---|---|---|---|

| ROA | 1.000 | |||||||||

| GPT | 0.042 | 1.000 | ||||||||

| Size | 0.059 | 0.340 | 1.000 | |||||||

| Age | −0.018 | 0.172 | 0.208 | 1.000 | ||||||

| Lev | −0.289 | 0.138 | 0.553 | 0.101 | 1.000 | |||||

| Tat | 0.170 | −0.015 | 0.176 | 0.074 | 0.180 | 1.000 | ||||

| State | −0.080 | 0.164 | 0.462 | 0.298 | 0.301 | 0.145 | 1.000 | |||

| Top1 | 0.183 | −0.099 | 0.193 | −0.065 | 0.065 | 0.154 | 0.311 | 1.000 | ||

| R&D | 0.088 | 0.026 | −0.185 | 0.061 | −0.269 | −0.284 | −0.166 | −0.116 | 1.000 | |

| Q | 0.254 | −0.083 | −0.394 | −0.067 | −0.396 | −0.037 | −0.220 | −0.115 | 0.227 | 1.000 |

| Variable | Overall Samplers | BG-Affiliated Firms | Non-BG Firms |

|---|---|---|---|

| Model 1 | Model 2a | Model 2b | |

| GPT | 0.114 ** (2.45) | 0.142 *** (3.37) | 0.094 * (1.69) |

| Size | 0.270 ** (2.30) | 0.148 (1.24) | 0.240 * (1.88) |

| Age | −0.389 *** (−3.44) | −0.189 * (−1.80) | −0.477 *** (−2.72) |

| Lev | −0.240 *** (−4.11) | −0.041 (−0.64) | −0.280 *** (−3.23) |

| Tat | 0.336 *** (5.50) | 0.390 *** (5.81) | 0.301 *** (3.33) |

| State | −0.363 ** (−2.38) | −0.027 (−0.15) | −0.113 ** (−2.23) |

| Top1 | 0.017 (0.20) | −0.135 (−1.61) | 0.127 (1.03) |

| R&D | −0.063 (−1.57) | −0.064 (−1.33) | −0.052 (−0.82) |

| Q | 0.189 *** (5.58) | 0.137 *** (3.81) | 0.227 *** (4.41) |

| Number | 1010 | 505 | 505 |

| R2 | 0.110 | 0.134 | 0.131 |

| Variable | Model 3a | Model 3b | Model 3c | Model 3d |

|---|---|---|---|---|

| GPT | 0.139 *** (3.32) | 0.098 ** (2.04) | 0.143 *** (3.43) | 0.115 *** (2.63) |

| Size | 0.204 * (1.71) | 0.149 (1.24) | 0.145 (1.22) | 0.162 (1.36) |

| Age | −0.205 * (−1.96) | −0.184 * (−1.75) | −0.155 (−1.47) | −0.195 * (−1.85) |

| Lev | −0.058 (−0.91) | −0.044 (−0.69) | −0.048 (−0.76) | −0.042 (-0.66) |

| Tat | 0.399 *** (5.98) | 0.393 *** (5.87) | 0.396 *** (5.94) | 0.386 *** (5.76) |

| State | −0.019 (−0.11) | −0.021 (−0.12) | −0.033 (−0.18) | −0.021 (−0.11) |

| Top1 | −0.094 (−1.10) | −0.144 * (−1.72) | −0.126 (−1.51) | −0.134 (−1.61) |

| R&D | −0.063 (−1.34) | −0.063 (−1.32) | −0.065 (−1.36) | −0.057 (−1.20) |

| Q | 0.140 *** (3.92) | 0.142 *** (3.93) | 0.142 *** (3.97) | 0.138 *** (3.84) |

| GSC | −0.033 (−0.88) | |||

| GSC × GPT | 0.198 ** (2.39) | |||

| GCC | −0.023 (−0.77) | |||

| GCC × GPT | 0.075 ** (1.97) | |||

| GST | −0.102 *** (−2.86) | |||

| GST × GPT | 0.027 ** (1.99) | |||

| GCT | 0.047 (1.07) | |||

| GCT × GPT | 0.151 ** (2.07) | |||

| Number | 505 | 505 | 505 | 505 |

| R2 | 0.154 | 0.146 | 0.153 | 0.144 |

| Variable | Model 4 | Model 5a | Model 5b |

|---|---|---|---|

| GPT | 0.114 ** (2.45) | 0.077 * (0.96) | 0.212 *** (4.20) |

| Size | 0.270 ** (2.30) | 0.231 ** (2.23) | 0.114 (0.80) |

| Age | −0.389 *** (−3.44) | −0.504 *** (−3.55) | −0.132 (−1.05) |

| Lev | −0.240 *** (−4.11) | −0.380 *** (−5.41) | −0.070 (−0.92) |

| Tat | 0.336 *** (5.50) | 0.071 (0.96) | 0.434 *** (5.40) |

| State | −0.363 ** (−2.38) | −0.124 *** (−3.02) | −0.009 (−0.04) |

| Top1 | 0.017 (0.20) | 0.220 ** (2.19) | −0.034 (−0.34) |

| R&D | −0.063 (−1.57) | −0.004 (−0.08) | −0.054 (−0.95) |

| Q | 0.189 *** (5.58) | 0.150 *** (3.60) | 0.127 *** (2.94) |

| Number | 1010 | 505 | 505 |

| R2 | 0.110 | 0.186 | 0.122 |

| Variable | Model 6a | Model 6b | Model 6c | Model 6d |

|---|---|---|---|---|

| GPT | 0.208 *** (4.22) | 0.077 * (1.72) | 0.206 *** (4.61) | 0.162 *** (3.12) |

| Size | 0.214 (1.52) | 0.126 ** (1.98) | 0.125 (0.99) | 0.139 (0.99) |

| Age | −0.156 (−1.26) | −0.116 ** (−2.05) | −0.103 (−0.91) | −0.131 (−1.06) |

| Lev | −0.114 (−1.51) | −0.208 *** (−4.04) | −0.047 (−0.70) | −0.065 (−0.87) |

| Tat | 0.443 *** (5.63) | 0.293 *** (5.85) | 0.443 *** (6.22) | 0.428 *** (5.41) |

| State | 0.006 (0.03) | −0.132 * (−1.95) | −0.023 (−0.12) | −0.002 (−0.01) |

| Top1 | 0.053 (0.53) | 0.062 (1.09) | −0.023 (−0.26) | −0.037 (−0.38) |

| R&D | −0.057 (−1.02) | 0.012 (0.27) | −0.062 (−1.21) | −0.048 (−0.85) |

| Q | 0.131 *** (3.12) | 0.195 *** (5.65) | 0.136 *** (3.55) | 0.127 *** (3.00) |

| GSC | −0.108 ** (−2.48) | |||

| GSC × GPT | 0.265 *** (2.70) | |||

| GCC | −0.023 (−0.66) | |||

| GCC × GPT | 0.173 *** (3.83) | |||

| GST | −0.108 *** (−2.85) | |||

| GST × GPT | 0.147 *** (10.23) | |||

| GCT | −0.011 (−0.20) | |||

| GCT × GPT | 0.306 *** (3.57) | |||

| Number | 505 | 505 | 505 | 505 |

| R2 | 0.166 | 0.159 | 0.314 | 0.153 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, Q.; Xu, L.; Xie, Z.; Jin, M. Does Business Group Matter for the Relationship between Green Innovation and Financial Performance? Evidence from Chinese Listed Companies. Sustainability 2021, 13, 13204. https://doi.org/10.3390/su132313204

Xu Q, Xu L, Xie Z, Jin M. Does Business Group Matter for the Relationship between Green Innovation and Financial Performance? Evidence from Chinese Listed Companies. Sustainability. 2021; 13(23):13204. https://doi.org/10.3390/su132313204

Chicago/Turabian StyleXu, Qiang, Lian Xu, Zaiyang Xie, and Mufan Jin. 2021. "Does Business Group Matter for the Relationship between Green Innovation and Financial Performance? Evidence from Chinese Listed Companies" Sustainability 13, no. 23: 13204. https://doi.org/10.3390/su132313204

APA StyleXu, Q., Xu, L., Xie, Z., & Jin, M. (2021). Does Business Group Matter for the Relationship between Green Innovation and Financial Performance? Evidence from Chinese Listed Companies. Sustainability, 13(23), 13204. https://doi.org/10.3390/su132313204