Operational Performance Evaluation of Korean Ship Parts Manufacturing Industry Using Dynamic Network SBM Model

Abstract

:1. Introduction

2. Literature Review

2.1. Data Envelopment Analysis

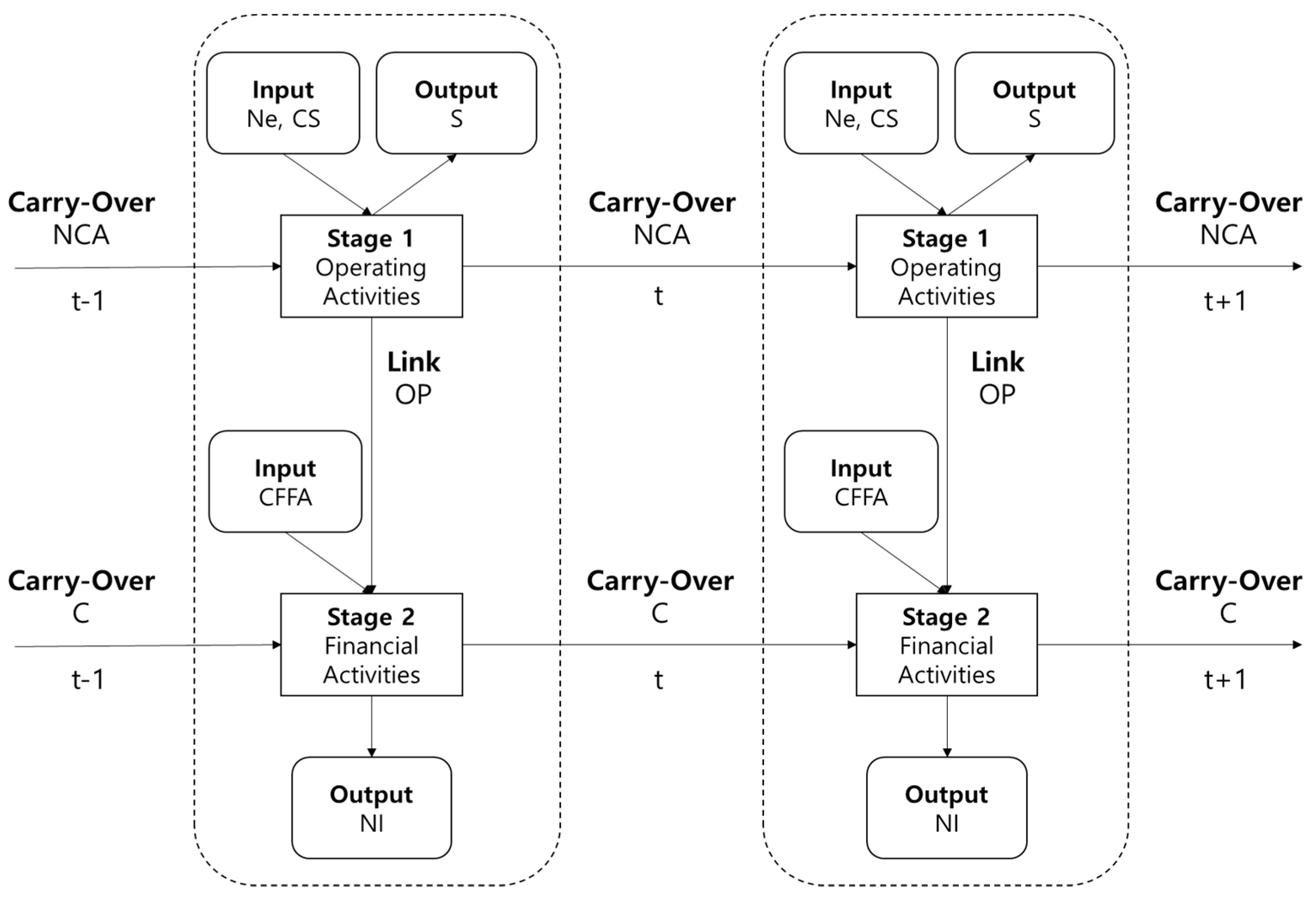

2.2. Dynamic Network SBM Model

- (a)

- The objective function of overall efficiency iswithwhere and are input and output matrices, and and are input/output slacks, respectively. Moreover, is the weight of Stage k in period t. If , it means variable returns to scale assumption. (, , . is slacks and non-negative, and is the number of “as input” link from Stage k. . is slacks and non-negative, and is the number of “as output” link from Stage k. is the weight to period t and is the weight to Stage k.: Number of DMUs.T: Number of periods.: Number of Stages.: Number of input.: Number of output.: In period t, Stage k, the i-th input variable of .: In period t, Stage k, the i-th output variable of .: In period t, the l-th link variable of from Stage k to Stage h.: The l-th carry-over variable of Stage k, from period t to period t + 1.

- (b)

- Period efficiency (efficiency during period t):

- (c)

- The efficiency of Stage k

- (d)

- During period t, the efficiency of Stage k can be expressed as:

2.3. Malmquist Productivity Index

- (a)

- Divisional catch-up index (DCU)

- (b)

- Divisional frontier-shift effect

- (c)

- Divisional Malmquist index

- (d)

- Overall Malmquist index

3. Research Methodology

3.1. Data and Variables

3.2. Descriptive Statistics

4. Analysis Results

4.1. Empirical Results of the Dynamic Network DEA

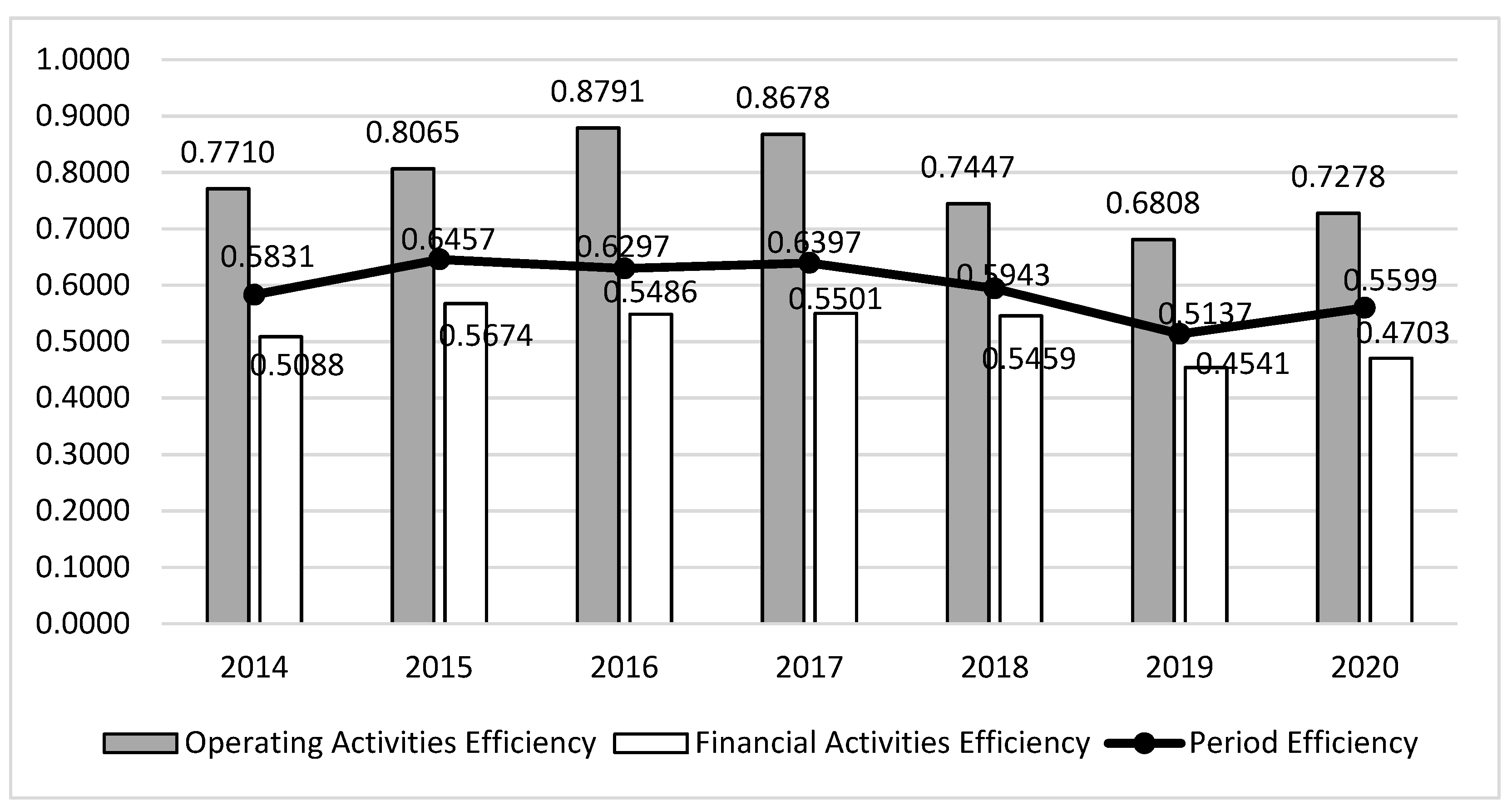

4.1.1. Operating Activity (Stage 1) Efficiency

4.1.2. Financial Activities Stage (Stage 2) Efficiency

4.1.3. Periodic and Overall Efficiency

4.2. Empirical Results of the Malmquist Productivity Index

5. Discussion

6. Conclusions

6.1. Summary of Results

6.2. Limitations and Future Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Tan, S.K. Race in the Shipbuilding Industry: Cases of South Korea, Japan and China. Int. J. East Asian Studies 2017, 6, 65–81. [Google Scholar] [CrossRef]

- Lee, T.T.; Han, J.K. Optimal Korea’s Government Organization of Shipping and Shipbuilding. Asian J. Ship. Logis. 2018, 34, 234–239. [Google Scholar] [CrossRef]

- Chung, D.; Shin, D. When do firms invest in R&D? Two types of performance feedback and organizational search in the Korean shipbuilding industry. Asian Bus. Manag. 2021, 20, 583–617. [Google Scholar]

- Business Korea. Big Drop in Number of Skilled Shipbuilding Workforce Feared to Erode the Industry Base. 2018. Available online: http://www.businesskorea.co.kr/news/articleView.html?idxno=20369 (accessed on 24 January 2018).

- Maeil Business News Korea. Korean Shipbuilders Gain Full Govt Blessing for Global Dominance, Stocks Rise. 2021. Available online: https://pulsenews.co.kr/view.php?sc=30800028&year=2021&no=875065 (accessed on 10 September 2021).

- The Korea Times. Raw Material Price Increases Could Burden Korea’s Economy. 2021. Available online: https://www.koreatimes.co.kr/www/nation/2021/09/488_314728.html?fl (accessed on 30 August 2021).

- Park, S.Y.; Lee, D.H. The Effects of CEO’s Compassionate Rationalism Leadership Strategies on Innovation Activities and Business Performance in SMEs. J. Soc. Korea Ind. Syst. Eng. 2019, 42, 70–79. [Google Scholar] [CrossRef]

- Vietnam News. Shipbuilding Industry Short of Skilled Workers. 2019. Available online: https://vietnamnews.vn/society/536283/shipbuilding-industry-short-of-skilled-workers.html (accessed on 3 October 2019).

- Newsdirectory3. I Can’t Work Overtime, So My Monthly Salary is Reduced by 100,000 won… Runs from Two-Job to Three-Job. 2021. Available online: https://www.newsdirectory3.com/i-cant-work-overtime-so-my-monthly-salary-is-reduced-by-100000-won-runs-from-two-job-to-three-job/ (accessed on 12 September 2021).

- Offshore Energy. South Korea Unveils Initiative to Promote Eco-Friendly Ship Technologies—Offshore Energy (Offshore-Energy.Biz); Navingo: Schiedam, The Netherlands, 2020. [Google Scholar]

- Netherlands Enterprise Agency. Development of Autonomous Ship technologies in Korea; Netherlands Enterprise Agency: AL Den Haag, The Netherlands, 2019. [Google Scholar]

- The Economist. As Crews Grow Old, Japanese Shipping Firms Try to Do without Them as Crews Grow Old, Japanese Shipping Firms Try to Do without Them; The Economist: London, UK, 2020. [Google Scholar]

- Globenewswire. Global Autonomous Ships Market (2020 to 2030)—Increasing Use of Automated Systems to Reduce Human Errors and Risks is Driving Growth. 2021. Available online: https://www.globenewswire.com/en/news-release/2021/01/21/2162032/28124/en/Global-Autonomous-Ships-Market-2020-to-2030-Increasing-Use-of-Automated-Systems-to-Reduce-Human-Errors-and-Risks-is-Driving-Growth.html (accessed on 21 January 2021).

- Wada, Y.; Hamada, K.; Hirata, N. Shipbuilding capacity optimization using shipbuilding demand forecasting model. J. Mar. Sci. Technol. 2021. [Google Scholar] [CrossRef]

- Martin, P. Size of the Global Shipbuilding Market in 2019 with a Forecast for 2020 through 2023; Statista: Hamburg, Germany, 2021. [Google Scholar]

- OECD. Global Value Chains and the Shipbuilding Industry; OECD Publishing: Paris, France, 2019. [Google Scholar]

- OECD. Shipbuilding Policy and Market Developments in Selected Economies; OECD Publishing: Paris, France, 2021. [Google Scholar]

- Korea Offshore & Shipbulding Association. 2020. Available online: http://www.koshipa.or.kr/ (accessed on 2 January 2020).

- Lyu, J.; Gunasekaran, A. Design for quality in the shipbuilding industry. Int. J. Qual. Rel. Manag. 1993, 10, 57–64. [Google Scholar] [CrossRef]

- Li, H.; Womer, K. Optimizing the supply chain configuration for make-to-order manufacturing. Eur. J. Oper. Res. 2012, 221, 118–128. [Google Scholar] [CrossRef]

- KISVALUE. 2021. Available online: https://www.kisvalue.com/web/index.jsp (accessed on 2 January 2021).

- The Korea Herald, Last Straw—Application of 52-Hour Workweek Adds to Difficulties Faced by Small Businesses. 2021. Available online: http://www.koreaherald.com/view.php?ud=20210608000960 (accessed on 9 June 2021).

- Korea JoongAng Daily. 52-Hour Workweek Continues to Create Headaches. 2019. Available online: https://koreajoongangdaily.joins.com/2019/07/07/economy/52hour-workweek-continues-to-create-headaches/3065212.html (accessed on 7 July 2019).

- Grosskopf, S. Efficiency and Productivity, the Measurement of Productive Efficiency: Techniques and Applications; Oxford University Press: New York, NY, USA, 1993. [Google Scholar]

- Lee, J.S. Directions for the sustainable development of Korean small and medium sized shipyards. Asian J. Ship. Logis. 2013, 29, 335–336. [Google Scholar] [CrossRef]

- Park, J.; Lee, D.; Zhu, J. An integrated approach for ship block manufacturing process performance evaluation: Case from a Korean shipbuilding company. Int. J. Prod. Econ. 2014, 156, 214–222. [Google Scholar] [CrossRef]

- Choi, Y.; Yu, Y.; Lee, H.S. A study on the sustainable performance of the steel industry in Korea based on SBM-DEA. Sustainability 2018, 10, 173. [Google Scholar] [CrossRef] [Green Version]

- Charnes, A.; Cooper, W.W.; Rhodes, E. Measuring the efficiency of decision-making units. Eur. J. Oper. Res. 1978, 2, 429–444. [Google Scholar] [CrossRef]

- Gandhi, A.; Shankar, R. Efficiency measurement of Indian retailers using data envelopment analysis. Int. J. Ret. Dist. Manag. 2014, 42, 500–520. [Google Scholar] [CrossRef]

- Goyal, J.; Kaur, H.; Aggarwal, A. Investigating the Technical and Scale Efficiencies of Indian Textile Industry: A Target Setting Based Analysis Through DEA. IUP J. Oper. Manag. 2017, 16, 16–38. [Google Scholar]

- Banker, R.D.; Charnes, A.; Cooper, W.W. Some models for estimating technical and scale inefficiencies in data envelopment analysis. Manag. Sci. 1984, 30, 1078–1092. [Google Scholar] [CrossRef] [Green Version]

- Tone, K. Variations on the theme of slacks-based measure of efficiency in DEA. Eur. J. Oper. Res. 2010, 200, 901–907. [Google Scholar] [CrossRef] [Green Version]

- Tone, K.; Tsutsui, M. Dynamic DEA with network structure: A slacks-based measure approach. Omega 2014, 42, 124–131. [Google Scholar] [CrossRef] [Green Version]

- Tone, K.; Tsutsui, M. Dynamic DEA: A slacks-based measure approach. Omega 2010, 38, 145–156. [Google Scholar] [CrossRef] [Green Version]

- Guo, X.; Lu, C.C.; Lee, J.H.; Chiu, Y.H. Applying the dynamic DEA model to evaluate the energy efficiency of OECD countries and China. Energy 2017, 134, 392–399. [Google Scholar] [CrossRef]

- Malmquist, S. Index numbers and indifference surfaces. Trab. Estadística 1953, 4, 209–242. [Google Scholar] [CrossRef]

- Akbarian, D. Overall profit Malmquist productivity index under data uncertainty. Fin. Innov. 2020, 6, 6. [Google Scholar] [CrossRef] [Green Version]

- Fare, R.; Färe, R.; Fèare, R.; Grosskopf, S.; Lovell, C.K. Production Frontiers; Cambridge University Press: New York, NY, USA, 1994. [Google Scholar]

- Karimi, B.; Davtalab-Olyaie, M.; Abdali, A.A. A suitable business model for bank branches: Combining business model and Malmquist Productivity Index (MPI). Bus. Econ. J. 2018, 9, 348. [Google Scholar] [CrossRef]

- Lee, C.; Cho, H.; Lee, D. The mechanism of innovation spill-over across sub-layers in the ICT industry. Asian J. Technol. Innov. 2021, 29, 159–179. [Google Scholar] [CrossRef]

- Ravid, S.A. On interactions of production and financial decisions. Fin. Manag. 1988, 17, 87–99. [Google Scholar] [CrossRef]

- Siminica, M.; Motoi, A.G.; Dumitru, A. Financial management as component of tactical management. Pol. J. Manag. Stud. 2017, 15, 206–217. [Google Scholar] [CrossRef]

- Roth, A.V.; Miller, J.G. Success factors in manufacturing. Bus. Hor. 1992, 35, 73–82. [Google Scholar] [CrossRef]

- Wayhan, V.B.; Werner, S. The impact of workforce reductions on financial performance: A longitudinal perspective. J. Manag. 2000, 26, 341–363. [Google Scholar] [CrossRef]

- Hofer, C.; Eroglu, C.; Hofer, A.R. The effect of lean production on financial performance: The mediating role of inventory leanness. Int. J. Prod. Econ. 2012, 138, 242–253. [Google Scholar] [CrossRef]

- Lundholm, R.; Serafeim, G.; Yu, G. FIN around the world: The contribution of financing activity to profitability. Harv. Bus. Sch. Work. Paper Ser. 2012, 13-011, 1–50. [Google Scholar] [CrossRef] [Green Version]

- Sinha, R.P. A dynamic DEA model for Indian life insurance companies. Glob. Bus. Rev. 2015, 16, 258–269. [Google Scholar] [CrossRef]

- Takouda, P.M.; Dia, M. Relative efficiency of hardware retail stores chains in Canada. Int. J. Oper. Res. 2016, 27, 275–290. [Google Scholar] [CrossRef]

- Omrani, H.; Soltanzadeh, E. Dynamic DEA models with network structure: An application for Iranian airlines. J. Air Trans. Manag. 2016, 57, 52–61. [Google Scholar] [CrossRef]

- Tone, K.; Kweh, Q.L.; Lu, W.M.; Ting, I.W. Modeling investments in the dynamic network performance of insurance companies. Omega 2019, 88, 237–247. [Google Scholar] [CrossRef]

- Wanke, P.; Azad, M.A.; Emrouznejad, A.; Antunes, J. A dynamic network DEA model for accounting and financial indicators: A case of efficiency in MENA banking. Int. Rev. Econ. Fin. 2019, 61, 52–68. [Google Scholar] [CrossRef] [Green Version]

- Goshime, Y.; Kitaw, D.; Jilcha, K. Lean manufacturing as a vehicle for improving productivity and customer satisfaction: A literature review on metals and engineering industries. Int. J. Lean Six Sigma 2019, 10, 691–714. [Google Scholar] [CrossRef]

- Wanke, P.; Tsionas, M.G.; Chen, Z.; Antunes, J.J. Dynamic network DEA and SFA models for accounting and financial indicators with an analysis of super-efficiency in stochastic frontiers: An efficiency comparison in OECD banking. Int. Rev. Econ. Fin. 2020, 69, 456–468. [Google Scholar] [CrossRef]

- Avkiran, N.K. An application reference for data envelopment analysis in branch banking: Helping the novice researcher. Int. J. Bank Mark. 1999, 17, 206–220. [Google Scholar] [CrossRef]

- Udhayakumar, A.; Charles, V.; Kumar, M. Stochastic simulation based genetic algorithm for chance constrained data envelopment analysis problems. Omega 2011, 39, 387–397. [Google Scholar] [CrossRef]

- Kuo, K.C.; Lu, W.M.; Dinh, T.N. Firm performance and ownership structure: Dynamic network data envelopment analysis approach. Manag. Decis. Econ. 2020, 41, 608–623. [Google Scholar] [CrossRef]

- Hoff, A. Second stage DEA Comparison of approaches for modelling the DEA score. Eur. J. Oper. Res. 2007, 181, 425–435. [Google Scholar] [CrossRef]

- Deng, F.; Xu, L.; Fang, Y.; Gong, Q.; Li, Z. PCA-DEA-tobit regression assessment with carbon emission constraints of China’s logistics industry. J. Clean. Prod. 2020, 271, 122548. [Google Scholar] [CrossRef]

- Li, N.; Liu, C.; Zha, D. Performance evaluation of Chinese photovoltaic companies with the input-oriented dynamic SBM model. Renew. Energy 2016, 89, 489–497. [Google Scholar] [CrossRef]

- The Korean Economic Daily. Korea’s Only Shipyard under Creditor Protection to Be Sold This Year. 2021. Available online: https://www.kedglobal.com/newsView/ked202107300013 (accessed on 30 July 2021).

- Kaplan, R.S.; Norton, D.P. The balanced scorecard: Measures that drive performance. Harv. Bus. Rev. 2005, 83, 172. [Google Scholar]

- Unctadstat. Ships Built by Country of Building. 2021. Available online: https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=89493 (accessed on 31 March 2021).

- Hoshi, T.; Kashyap, A.; Scharfstein, D. The role of banks in reducing the costs of financial distress in Japan. J. Fin. Econ. 1990, 27, 67–88. [Google Scholar] [CrossRef]

- Aggrey, N.; Eliab, L.; Joseph, S. Firm size and technical efficiency in East African manufacturing firms. Curr. Res. J. Econ. Theory 2010, 2, 69–75. [Google Scholar]

- Chun, D.; Chung, Y.; Bang, S. Impact of firm size and industry type on R&D efficiency throughout innovation and commercialisation stages: Evidence from Korean manufacturing firms. Technol. Anal. Strateg. Manag. 2015, 27, 895–909. [Google Scholar]

- Statista. Global Shipbuilding Capacity from 2013 to 2020, with a Forecast for 2021 through 2026, by Country. 2021. Available online: https://www.statista.com/statistics/1256561/global-shipbuilding-capacity-by-country/ (accessed on 11 August 2021).

- Lai, P.L.; Potter, A.; Beynon, M.; Beresford, A. Evaluating the efficiency performance of airports using an integrated AHP/DEA-AR technique. Transp. Policy 2015, 42, 75–85. [Google Scholar] [CrossRef]

| Researchers | Analysis Target | Input | Output | Link | Carry-Over |

|---|---|---|---|---|---|

| [29] | Indian retailers | 1. Cost of labor 2. Capital employed | 1. Profit 2. Sales | - | - |

| [47] | Indian life insurance companies | 1. Operating expenses and commissions | 1. Premium collected 2. Sum assured | - | 1. Investments |

| [48] | Retail store chains in Canada | 1. Capital 2. Number of stores 3. Number of employees 4. Total sales area | 1. Sales 2. Profits | - | - |

| [49] | Iranian airlines | 1. Number of employees | 1. Passenger-km performed 2. Passenger Ton/km performed | 1. Available seat/km 2. Available ton/km 3. Number of scheduled flights | 1. The number of fleet’s seat |

| [50] | Insurance company in Malaysia | 1. The operating expenses used in labor and business services | 1. Investment Income | 1. Incurred claims plus additions to reserves | 1. Fixed assets 2. Investment assets |

| [51] | MENA banking | 1. Net loans 2. Total earning assets 3. Non-earning Assets 4. Loan loss prov. 5. Costs | 1. Income | 1. Net interest Margin 2. Equity 3. Total assets | 1. Gross loans 2. Total assets 3. Income |

| Year | NE | CS | S&A | S | OP | NCA | CFFA | NI | C | |

|---|---|---|---|---|---|---|---|---|---|---|

| 2014 | AVE | 101.9 | 416.1 | 43.6 | 489.5 | 29.8 | 432.2 | 14.3 | 16.1 | 250.2 |

| STDEV | 90.7 | 703.8 | 33.1 | 777.4 | 53.5 | 633.6 | 73.2 | 32.2 | 338.2 | |

| 2015 | AVE | 101.4 | 420.8 | 44.7 | 498.8 | 33.3 | 437.1 | −6.8 | 14.0 | 268.8 |

| STDEV | 86.6 | 700.3 | 36.7 | 782.7 | 61.4 | 594.2 | 59.3 | 57.7 | 363.5 | |

| 2016 | AVE | 89.4 | 393.7 | 46.6 | 455.7 | 15.4 | 444.1 | 20.3 | 11.3 | 283.6 |

| STDEV | 76.3 | 651.9 | 43.3 | 711.0 | 54.0 | 590.2 | 82.8 | 61.1 | 403.1 | |

| 2017 | AVE | 79.8 | 284.4 | 39.1 | 323.6 | 0.1 | 437.2 | 0.2 | −14.2 | 270.0 |

| STDEV | 71.6 | 425.5 | 38.2 | 463.6 | 55.6 | 594.7 | 40.1 | 61.4 | 430.4 | |

| 2018 | AVE | 80.6 | 268.5 | 31.8 | 305.9 | 5.7 | 442.9 | −5.5 | −15.9 | 262.0 |

| STDEV | 70.9 | 347.5 | 23.1 | 380.2 | 34.5 | 597.8 | 58.3 | 60.3 | 456.2 | |

| 2019 | AVE | 80.3 | 339.1 | 34.7 | 385.2 | 11.4 | 441.4 | −9.0 | −2.5 | 285.1 |

| STDEV | 74.4 | 488.7 | 27.7 | 526.1 | 31.6 | 584.7 | 74.3 | 42.3 | 453.8 | |

| 2020 | AVE | 77.8 | 328.0 | 34.6 | 364.7 | 2.1 | 450.6 | −4.3 | −9.2 | 289.8 |

| STDEV | 69.0 | 464.2 | 29.3 | 496.8 | 53.4 | 590.6 | 39.3 | 57.6 | 481.7 | |

| NE | CS | S&A | S | OP | NCA | CFFA | NI | C | |

|---|---|---|---|---|---|---|---|---|---|

| NE | 1 | ||||||||

| CS | 0.733 ** | 1 | |||||||

| S&A | 0.734 ** | 0.642 ** | 1 | ||||||

| S | 0.751 ** | 0.998 ** | 0.658 ** | 1 | |||||

| OP | 0.510 ** | 0.615 ** | 0.221 ** | 0.656 ** | 1 | ||||

| NCA | 0.595 ** | 0.805 ** | 0.402 ** | 0.796 ** | 0.488 ** | 1 | |||

| CFFA | 0.144 * | 0.253 ** | 0.108 | 0.253 ** | 0.206 ** | 0.191 ** | 1 | ||

| NI | 0.300 ** | 0.216 ** | 0.107 | 0.260 ** | 0.679 ** | 0.140 * | 0.207 ** | 1 | |

| C | 0.722 ** | 0.576 ** | 0.492 ** | 0.593 ** | 0.489 ** | 0.711 ** | 0.071 | 0.454 ** | 1 |

| DMU No. | Overall Efficiency Rank | OA Efficiency Rank | Overall Efficiency | OA Efficiency | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||||

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 3 | 3 | 1 | 0.9999 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 4 | 4 | 1 | 0.9992 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 5 | 5 | 12 | 0.9866 | 0.8171 | 1 | 1 | 1 | 1 | 1 | 1 |

| 6 | 6 | 1 | 0.8978 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 7 | 7 | 15 | 0.8274 | 0.9996 | 1 | 0.9996 | 0.9999 | 0.9999 | 0.9980 | 0.3254 |

| 8 | 8 | 14 | 0.6923 | 1 | 1 | 1 | 1 | 0.7306 | 0.7084 | 1 |

| 9 | 9 | 17 | 0.6731 | 1 | 0.7500 | 0.7500 | 0.7500 | 0.7500 | 1 | 0.7500 |

| 10 | 10 | 18 | 0.6508 | 1 | 1 | 1 | 1 | 0.6274 | 0.5403 | 0.5610 |

| 11 | 11 | 20 | 0.6414 | 1 | 1 | 1 | 0.8477 | 0.7056 | 0.6751 | 0.4386 |

| 12 | 12 | 16 | 0.6329 | 1 | 1 | 1 | 1 | 1 | 0.3737 | 0.4609 |

| 13 | 13 | 1 | 0.5913 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 14 | 14 | 1 | 0.5836 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 15 | 15 | 29 | 0.5086 | 0.5720 | 0.7540 | 0.8282 | 1 | 0.5562 | 0.3986 | 0.4133 |

| 16 | 16 | 24 | 0.4741 | 0.4750 | 0.5724 | 0.6642 | 0.6370 | 1 | 1 | 0.6614 |

| 17 | 17 | 33 | 0.4566 | 0.3795 | 0.1427 | 0.7101 | 0.7700 | 0.7717 | 0.8000 | 0.6375 |

| 18 | 18 | 1 | 0.4441 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 19 | 19 | 27 | 0.4117 | 0.6173 | 0.7010 | 0.5364 | 0.8179 | 0.4758 | 0.6772 | 1 |

| 20 | 20 | 34 | 0.3731 | 0.5925 | 0.6711 | 0.5274 | 0.8928 | 0.9859 | 0.1865 | 0.2507 |

| 21 | 21 | 26 | 0.3597 | 0.4933 | 0.5648 | 0.8676 | 0.9546 | 0.9999 | 0.5329 | 0.5069 |

| 22 | 22 | 1 | 0.3380 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 23 | 23 | 22 | 0.3348 | 0.9584 | 1 | 1 | 0.7887 | 0.7104 | 0.2018 | 0.6804 |

| 24 | 24 | 19 | 0.3264 | 0.7700 | 1 | 1 | 1 | 0.8396 | 0.0693 | 1 |

| 25 | 25 | 32 | 0.3216 | 0.5080 | 0.9535 | 1 | 0.3497 | 0.3994 | 0.4431 | 0.5738 |

| 26 | 26 | 40 | 0.3076 | 0.3537 | 0.3945 | 0.5650 | 0.4209 | 0.3503 | 0.4751 | 0.5451 |

| 27 | 27 | 1 | 0.2955 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 28 | 28 | 13 | 0.2623 | 0.7232 | 0.8372 | 1 | 0.9987 | 0.9350 | 1 | 1 |

| 29 | 29 | 30 | 0.2472 | 0.7444 | 1 | 1 | 0.9997 | 0.1575 | 0.2542 | 0.2490 |

| 30 | 30 | 36 | 0.2347 | 0.8298 | 0.3550 | 0.5795 | 1 | 0.4090 | 0.3554 | 0.2092 |

| 31 | 31 | 21 | 0.2245 | 1 | 1 | 1 | 1 | 1 | 0.4876 | 0.1736 |

| 32 | 32 | 31 | 0.2112 | 0.3882 | 0.6400 | 0.8230 | 0.7175 | 0.6102 | 0.4474 | 0.7296 |

| 33 | 33 | 1 | 0.1769 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 34 | 34 | 35 | 0.1760 | 0.7144 | 0.7279 | 0.7317 | 0.6147 | 0.0650 | 0.1568 | 0.7757 |

| 35 | 35 | 37 | 0.1394 | 0.3528 | 0.0989 | 0.5810 | 0.5950 | 0.6026 | 0.5947 | 0.6323 |

| 36 | 36 | 25 | 0.1226 | 0.6680 | 0.6053 | 0.9694 | 0.8025 | 1 | 0.1646 | 0.7211 |

| 37 | 37 | 39 | 0.0745 | 0.4640 | 0.6405 | 0.5665 | 0.2124 | 0.0193 | 0.4515 | 0.9743 |

| 38 | 38 | 28 | 0.0652 | 0.3825 | 0.2964 | 0.7672 | 0.9301 | 0.3440 | 1 | 1 |

| 39 | 39 | 23 | 0.0611 | 0.5465 | 1 | 1 | 0.9997 | 0.2203 | 0.8337 | 0.6867 |

| 40 | 40 | 38 | 0.0248 | 0.4907 | 0.5560 | 0.6974 | 0.6110 | 0.5212 | 0.4063 | 0.1559 |

| AVE | 0.4537 | 0.7710 | 0.8065 | 0.8791 | 0.8678 | 0.7447 | 0.6808 | 0.7278 | ||

| MAX | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||

| MIN | 0.0248 | 0.3528 | 0.0989 | 0.5274 | 0.2124 | 0.0193 | 0.0693 | 0.1559 | ||

| STDEV | 0.2962 | 0.2456 | 0.2648 | 0.1709 | 0.2043 | 0.3058 | 0.3198 | 0.2890 | ||

| DMU No. | Overall Efficiency Rank | FA Efficiency Rank | Overall Efficiency | FA Efficiency | ||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | ||||

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 3 | 3 | 4 | 0.9999 | 1 | 1 | 0.9998 | 0.9987 | 1 | 1 | 1 |

| 4 | 4 | 5 | 0.9992 | 1 | 1 | 1 | 1 | 0.9908 | 0.9986 | 1 |

| 5 | 5 | 1 | 0.9866 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 6 | 6 | 6 | 0.8978 | 0.9524 | 1 | 0.7850 | 0.3889 | 1 | 1 | 1 |

| 7 | 7 | 7 | 0.8274 | 0.9998 | 0.9464 | 0.4939 | 0.9957 | 0.9996 | 0.9997 | 0.6697 |

| 8 | 8 | 22 | 0.6923 | 0.9999 | 1 | 0.6027 | 0.3011 | 0.1095 | 0.1931 | 0.0353 |

| 9 | 9 | 19 | 0.6731 | 0.5000 | 0.5000 | 0.5000 | 0.5000 | 0.5000 | 0.5000 | 0.5000 |

| 10 | 10 | 12 | 0.6508 | 0.2865 | 0.4727 | 0.9432 | 0.5001 | 1 | 0.5241 | 0.6472 |

| 11 | 11 | 17 | 0.6414 | 0.4430 | 1 | 0.3007 | 0.7712 | 0.0998 | 0.5529 | 0.5267 |

| 12 | 12 | 14 | 0.6329 | 1 | 0.7801 | 0.7234 | 0.5257 | 0.3875 | 0.1965 | 0.6021 |

| 13 | 13 | 8 | 0.5913 | 0.0598 | 1 | 1 | 1 | 0.9963 | 1 | 0.9998 |

| 14 | 14 | 27 | 0.5836 | 0.3014 | 0.3098 | 0.3230 | 0.3236 | 0.6291 | 0.4465 | 0.2774 |

| 15 | 15 | 20 | 0.5086 | 0.2331 | 0.3023 | 0.8933 | 0.8743 | 0.5701 | 0.2196 | 0.3290 |

| 16 | 16 | 16 | 0.4741 | 0.0719 | 0.5403 | 0.8366 | 0.5007 | 1 | 0.5285 | 0.5181 |

| 17 | 17 | 9 | 0.4566 | 0.1207 | 1 | 1 | 1 | 1 | 0.9995 | 0.5855 |

| 18 | 18 | 28 | 0.4441 | 1 | 0.2921 | 0.2099 | 0.2317 | 0.1640 | 0.3332 | 0.1763 |

| 19 | 19 | 30 | 0.4117 | 0.4639 | 0.1631 | 0.2206 | 0.3500 | 0.1795 | 0.0552 | 0.7611 |

| 20 | 20 | 10 | 0.3731 | 0.8579 | 0.9001 | 0.1156 | 0.9945 | 0.9789 | 0.6293 | 0.1772 |

| 21 | 21 | 26 | 0.3597 | 0.0861 | 0.1781 | 0.6377 | 0.2892 | 1 | 0.1384 | 0.3680 |

| 22 | 22 | 25 | 0.3380 | 0.2165 | 0.1443 | 0.0592 | 0.8745 | 0.8540 | 0.3905 | 0.3490 |

| 23 | 23 | 23 | 0.3348 | 0.4872 | 0.4866 | 1 | 0.3242 | 0.0688 | 0.2850 | 0.4518 |

| 24 | 24 | 18 | 0.3264 | 1 | 1 | 1 | 0.1176 | 0.1174 | 0.1911 | 0.0963 |

| 25 | 25 | 15 | 0.3216 | 0.2827 | 0.7956 | 1 | 0.8535 | 0.1019 | 0.0680 | 0.9302 |

| 26 | 26 | 32 | 0.3076 | 0.1699 | 0.1990 | 0.6948 | 0.0627 | 0.5045 | 0.1943 | 0.3059 |

| 27 | 27 | 38 | 0.2955 | 0.0993 | 0.2845 | 0.0922 | 0.1149 | 0.1951 | 0.1574 | 0.2353 |

| 28 | 28 | 11 | 0.2623 | 0.0828 | 0.4806 | 0.0315 | 1 | 1 | 1 | 1 |

| 29 | 29 | 33 | 0.2472 | 0.2833 | 0.4199 | 0.0782 | 0.3570 | 0.1273 | 0.2512 | 0.1412 |

| 30 | 30 | 40 | 0.2347 | 0.2147 | 0.0844 | 0.1844 | 0.1765 | 0.0776 | 0.0635 | 0.0292 |

| 31 | 31 | 13 | 0.2245 | 1 | 0.9636 | 0.1792 | 0.9686 | 0.9809 | 0.1078 | 0.0301 |

| 32 | 32 | 35 | 0.2112 | 0.2861 | 0.3028 | 0.3996 | 0.1130 | 0.1431 | 0.0801 | 0.0794 |

| 33 | 33 | 36 | 0.1769 | 0.1548 | 0.0938 | 0.0325 | 0.0705 | 0.1293 | 0.6147 | 0.2451 |

| 34 | 34 | 21 | 0.1760 | 0.6912 | 1 | 1 | 0.4602 | 0.0890 | 0.1073 | 0.0334 |

| 35 | 35 | 39 | 0.1394 | 0.0667 | 0.0950 | 0.1373 | 0.4392 | 0.2202 | 0.0087 | 0.1949 |

| 36 | 36 | 31 | 0.1226 | 0.9351 | 0.3537 | 0.6373 | 0.1504 | 0.0516 | 0.0214 | 0.0251 |

| 37 | 37 | 37 | 0.0745 | 0.0610 | 0.0857 | 0.1450 | 0.1014 | 0.3566 | 0.0125 | 0.5329 |

| 38 | 38 | 34 | 0.0652 | 0.0373 | 0.0982 | 0.0224 | 0.0130 | 0.0310 | 0.8155 | 0.5003 |

| 39 | 39 | 24 | 0.0611 | 0.2541 | 0.2962 | 0.4755 | 0.9999 | 0.5283 | 0.0038 | 0.4536 |

| 40 | 40 | 29 | 0.0248 | 0.6535 | 0.1288 | 0.1900 | 0.2613 | 0.6562 | 0.4749 | 0.0031 |

| AVE | 0.4537 | 0.5088 | 0.5674 | 0.5486 | 0.5501 | 0.5459 | 0.4541 | 0.4703 | ||

| MAX | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | ||

| MIN | 0.0248 | 0.0373 | 0.0844 | 0.0224 | 0.0130 | 0.0310 | 0.0038 | 0.0031 | ||

| STDEV | 0.2962 | 0.3823 | 0.3666 | 0.3752 | 0.3622 | 0.3981 | 0.3726 | 0.3473 | ||

| DMU No. | Overall Efficiency Rank | Overall Efficiency | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 |

|---|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| 3 | 3 | 0.9999 | 1 | 1 | 0.9999 | 0.9994 | 1 | 1 | 1 |

| 4 | 4 | 0.9992 | 1 | 1 | 1 | 1 | 0.9954 | 0.9993 | 1 |

| 5 | 5 | 0.9866 | 0.9072 | 1 | 1 | 1 | 1 | 1 | 1 |

| 6 | 6 | 0.8978 | 0.9756 | 1 | 0.8925 | 0.5861 | 1 | 1 | 1 |

| 7 | 7 | 0.8274 | 0.9997 | 0.9727 | 0.7383 | 0.9978 | 0.9998 | 0.9988 | 0.4544 |

| 8 | 8 | 0.6923 | 0.9999 | 1 | 0.8014 | 0.6505 | 0.4510 | 0.4755 | 0.5177 |

| 9 | 9 | 0.6731 | 0.8333 | 0.6250 | 0.6250 | 0.6250 | 0.6250 | 0.8333 | 0.6250 |

| 10 | 10 | 0.6508 | 0.4564 | 0.6450 | 0.9716 | 0.7500 | 0.8137 | 0.5322 | 0.6041 |

| 11 | 11 | 0.6414 | 0.6150 | 1 | 0.5913 | 0.8094 | 0.4087 | 0.6140 | 0.4827 |

| 12 | 12 | 0.6329 | 1 | 0.8765 | 0.8617 | 0.7629 | 0.6580 | 0.2796 | 0.5272 |

| 13 | 13 | 0.5913 | 0.1454 | 1 | 1 | 1 | 0.9981 | 1 | 0.9999 |

| 14 | 14 | 0.5836 | 0.6121 | 0.5889 | 0.4883 | 0.4979 | 0.7961 | 0.6639 | 0.5709 |

| 15 | 15 | 0.5086 | 0.4172 | 0.5323 | 0.8608 | 0.9356 | 0.5635 | 0.3083 | 0.3633 |

| 16 | 16 | 0.4741 | 0.1476 | 0.5548 | 0.7504 | 0.5689 | 1 | 0.7642 | 0.5898 |

| 17 | 17 | 0.4566 | 0.1649 | 0.3056 | 0.8551 | 0.8850 | 0.8858 | 0.8997 | 0.6115 |

| 18 | 18 | 0.4441 | 1 | 0.5515 | 0.3541 | 0.4046 | 0.2817 | 0.5191 | 0.5023 |

| 19 | 19 | 0.4117 | 0.5503 | 0.3438 | 0.3878 | 0.4914 | 0.3648 | 0.2030 | 0.8806 |

| 20 | 20 | 0.3731 | 0.6991 | 0.7720 | 0.1898 | 0.9435 | 0.9825 | 0.2562 | 0.2106 |

| 21 | 21 | 0.3597 | 0.1716 | 0.3086 | 0.7569 | 0.5348 | 1 | 0.2053 | 0.4193 |

| 22 | 22 | 0.3380 | 0.3659 | 0.3537 | 0.1118 | 0.9368 | 0.9270 | 0.5827 | 0.6549 |

| 23 | 23 | 0.3348 | 0.7240 | 0.7395 | 1 | 0.4418 | 0.1184 | 0.2262 | 0.5716 |

| 24 | 24 | 0.3264 | 0.8850 | 1 | 1 | 0.2119 | 0.4785 | 0.0779 | 0.5482 |

| 25 | 25 | 0.3216 | 0.3874 | 0.8663 | 1 | 0.4971 | 0.1881 | 0.1152 | 0.7520 |

| 26 | 26 | 0.3076 | 0.2216 | 0.2479 | 0.6299 | 0.2418 | 0.4274 | 0.3347 | 0.4255 |

| 27 | 27 | 0.2955 | 0.2446 | 0.4429 | 0.1706 | 0.2745 | 0.3524 | 0.4085 | 0.4424 |

| 28 | 28 | 0.2623 | 0.2388 | 0.6704 | 0.0611 | 0.9994 | 0.9675 | 1 | 1 |

| 29 | 29 | 0.2472 | 0.4748 | 0.7081 | 0.1457 | 0.6784 | 0.1489 | 0.2527 | 0.1904 |

| 30 | 30 | 0.2347 | 0.5409 | 0.2033 | 0.4036 | 0.5457 | 0.3112 | 0.2306 | 0.0916 |

| 31 | 31 | 0.2245 | 1 | 0.9815 | 0.3935 | 0.9843 | 0.9904 | 0.2185 | 0.0507 |

| 32 | 32 | 0.2112 | 0.3287 | 0.4610 | 0.5941 | 0.1890 | 0.2210 | 0.1304 | 0.1429 |

| 33 | 33 | 0.1769 | 0.2680 | 0.2368 | 0.0629 | 0.1449 | 0.3668 | 0.8074 | 0.4522 |

| 34 | 34 | 0.1760 | 0.7028 | 0.8640 | 0.8658 | 0.5374 | 0.0743 | 0.1419 | 0.0669 |

| 35 | 35 | 0.1394 | 0.1132 | 0.0985 | 0.3592 | 0.5028 | 0.3163 | 0.0453 | 0.4311 |

| 36 | 36 | 0.1226 | 0.8016 | 0.4830 | 0.8040 | 0.3153 | 0.0982 | 0.0363 | 0.1172 |

| 37 | 37 | 0.0745 | 0.2749 | 0.3702 | 0.3495 | 0.1834 | 0.0279 | 0.0349 | 0.7557 |

| 38 | 38 | 0.0652 | 0.0853 | 0.1412 | 0.0424 | 0.0260 | 0.0532 | 0.9077 | 0.7502 |

| 39 | 39 | 0.0611 | 0.4001 | 0.5807 | 0.7309 | 0.9998 | 0.2905 | 0.0101 | 0.5869 |

| 40 | 40 | 0.0248 | 0.5721 | 0.3014 | 0.3394 | 0.4361 | 0.5887 | 0.4335 | 0.0053 |

| AVE | 0.4537 | 0.5831 | 0.6457 | 0.6297 | 0.6397 | 0.5943 | 0.5137 | 0.5599 | |

| MAX | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| MIN | 0.0248 | 0.0853 | 0.0985 | 0.0424 | 0.0260 | 0.0279 | 0.0101 | 0.0053 | |

| STDEV | 0.2962 | 0.3230 | 0.2982 | 0.3259 | 0.3012 | 0.3524 | 0.3583 | 0.3031 | |

| Estimate | Std. Error | T-Value | Pr(>t) | |

|---|---|---|---|---|

| Intercept | 0.368 | 0.200 | 1.843 | 0.065 |

| Firm Size | −0.308 | 0.139 | −2.220 | 0.026 * |

| Firm Age | 0.012 | 0.006 | 2.102 | 0.036 * |

| Region | 0.052 | 0.105 | 0.493 | 0.622 |

| GDP | 0.000 | 0.000 | 0.757 | 0.449 |

| logSigma | −1.296 | 0.116 | −11.149 | 0.000 *** |

| DMU No. | OMI Rank | OMI | OA (Stage 1) | FA (Stage 2) | ||||

|---|---|---|---|---|---|---|---|---|

| DCU | DFS | DMI | DCU | DFS | DMI | |||

| 1 | 25 | 0.8621 | 1 | 1.0299 | 1.0299 | 1 | 0.7217 | 0.7217 |

| 2 | 3 | 1.2536 | 1 | 1.7592 | 1.7591 | 1 | 0.8933 | 0.8933 |

| 3 | 11 | 1.0819 | 1 | 1.2076 | 1.2076 | 1 | 0.9693 | 0.9692 |

| 4 | 31 | 0.7919 | 1 | 0.9200 | 0.9200 | 1 | 0.6816 | 0.6816 |

| 5 | 38 | 0.6786 | 1.0342 | 1 | 1.0342 | 1 | 0.4450 | 0.4453 |

| 6 | 28 | 0.8500 | 1 | 1.0216 | 1.0216 | 1.0082 | 0.7016 | 0.7073 |

| 7 | 23 | 0.8898 | 0.8294 | 0.9911 | 0.8220 | 0.9354 | 1.0298 | 0.9633 |

| 8 | 34 | 0.7182 | 1 | 0.9361 | 0.9361 | 0.5728 | 0.9618 | 0.5510 |

| 9 | 16 | 0.9763 | 0.9532 | 1 | 0.9532 | 1 | 1 | 1 |

| 10 | 13 | 1.0241 | 0.9082 | 0.9638 | 0.8753 | 1.1455 | 1.0462 | 1.1983 |

| 11 | 21 | 0.9089 | 0.8717 | 0.9522 | 0.8300 | 1.0293 | 0.9669 | 0.9952 |

| 12 | 30 | 0.7941 | 0.8789 | 0.9536 | 0.8381 | 0.9189 | 0.8188 | 0.7525 |

| 13 | 4 | 1.2400 | 1 | 0.9615 | 0.9616 | 1.5991 | 1 | 1.5989 |

| 14 | 29 | 0.8127 | 1 | 0.8790 | 0.8790 | 0.9863 | 0.7619 | 0.7514 |

| 15 | 24 | 0.8843 | 0.9473 | 0.9127 | 0.8645 | 1.0591 | 0.8541 | 0.9046 |

| 16 | 6 | 1.2168 | 1.0567 | 1.0039 | 1.0608 | 1.3898 | 1.0044 | 1.3958 |

| 17 | 1 | 1.5242 | 1.0903 | 1.0443 | 1.1385 | 1.3011 | 1.5684 | 2.0407 |

| 18 | 20 | 0.9272 | 1 | 1.3286 | 1.3286 | 0.7488 | 0.8642 | 0.6471 |

| 19 | 14 | 1.0195 | 1.0837 | 1.0375 | 1.1244 | 1.0860 | 0.8511 | 0.9244 |

| 20 | 33 | 0.7487 | 0.8665 | 1.0246 | 0.8877 | 0.7688 | 0.8214 | 0.6315 |

| 21 | 19 | 0.9293 | 1.0045 | 1.0015 | 1.0060 | 1.2739 | 0.6738 | 0.8584 |

| 22 | 18 | 0.9470 | 1 | 1.0789 | 1.0789 | 1.0828 | 0.7676 | 0.8312 |

| 23 | 17 | 0.9642 | 0.9445 | 1.0553 | 0.9968 | 0.9875 | 0.9444 | 0.9326 |

| 24 | 36 | 0.7011 | 1.0445 | 0.8549 | 0.8929 | 0.6770 | 0.8131 | 0.5505 |

| 25 | 12 | 1.0406 | 1.0205 | 0.9978 | 1.0183 | 1.2196 | 0.8719 | 1.0634 |

| 26 | 9 | 1.1049 | 1.0747 | 1.0023 | 1.0772 | 1.1030 | 1.0275 | 1.1333 |

| 27 | 10 | 1.0876 | 1 | 0.9068 | 0.9068 | 1.1546 | 1.1296 | 1.3044 |

| 28 | 5 | 1.2176 | 1.0555 | 1.0898 | 1.1503 | 1.5147 | 0.8509 | 1.2889 |

| 29 | 26 | 0.8584 | 0.8332 | 1.0346 | 0.8620 | 0.8904 | 0.9600 | 0.8548 |

| 30 | 35 | 0.7101 | 0.7948 | 0.9879 | 0.7852 | 0.7171 | 0.8956 | 0.6422 |

| 31 | 39 | 0.6255 | 0.7469 | 1.0752 | 0.8031 | 0.5577 | 0.8735 | 0.4872 |

| 32 | 27 | 0.8546 | 1.1109 | 0.9623 | 1.0691 | 0.8076 | 0.8458 | 0.6831 |

| 33 | 15 | 1.0176 | 1 | 0.9590 | 0.9591 | 1.0796 | 1 | 1.0797 |

| 34 | 32 | 0.7821 | 1.0138 | 1 | 1.0138 | 0.6035 | 1 | 0.6034 |

| 35 | 8 | 1.1548 | 1.1021 | 1.0215 | 1.1258 | 1.1957 | 0.9905 | 1.1845 |

| 36 | 37 | 0.6942 | 1.0128 | 0.9492 | 0.9614 | 0.5472 | 0.9159 | 0.5012 |

| 37 | 7 | 1.1964 | 1.1316 | 0.8814 | 0.9973 | 1.4351 | 1 | 1.4352 |

| 38 | 2 | 1.3231 | 1.1737 | 0.9677 | 1.1358 | 1.5414 | 1 | 1.5414 |

| 39 | 22 | 0.8942 | 1.0388 | 0.9233 | 0.9591 | 1.1014 | 0.7568 | 0.8336 |

| 40 | 40 | 0.5494 | 0.8260 | 1.0041 | 0.8295 | 0.4099 | 0.8861 | 0.3639 |

| AVE | 0.9464 | 0.9862 | 1.0170 | 1.0025 | 1.0112 | 0.9041 | 0.9236 | |

| MAX | 1.5242 | 1.1737 | 1.7592 | 1.7591 | 1.5991 | 1.5684 | 2.0407 | |

| MIN | 0.5494 | 0.7469 | 0.8549 | 0.7852 | 0.4099 | 0.4450 | 0.3639 | |

| STDEV | 0.2111 | 0.0953 | 0.1470 | 0.1726 | 0.2795 | 0.1694 | 0.3551 | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Park, S.; Kim, P. Operational Performance Evaluation of Korean Ship Parts Manufacturing Industry Using Dynamic Network SBM Model. Sustainability 2021, 13, 13127. https://doi.org/10.3390/su132313127

Park S, Kim P. Operational Performance Evaluation of Korean Ship Parts Manufacturing Industry Using Dynamic Network SBM Model. Sustainability. 2021; 13(23):13127. https://doi.org/10.3390/su132313127

Chicago/Turabian StylePark, Sungmin, and Pansoo Kim. 2021. "Operational Performance Evaluation of Korean Ship Parts Manufacturing Industry Using Dynamic Network SBM Model" Sustainability 13, no. 23: 13127. https://doi.org/10.3390/su132313127

APA StylePark, S., & Kim, P. (2021). Operational Performance Evaluation of Korean Ship Parts Manufacturing Industry Using Dynamic Network SBM Model. Sustainability, 13(23), 13127. https://doi.org/10.3390/su132313127