Do Green Finance and Environmental Regulation Play a Crucial Role in the Reduction of CO2 Emissions? An Empirical Analysis of 126 Chinese Cities

Abstract

:1. Introduction

1.1. Background

1.2. Contributions of the Article

- The study empirically estimated a reduction in environmental emissions using regional green finance and environmental regulation.

- The findings of the study provide a reference for the sustainable development of the regional economy.

- Moreover, the article focuses on green finance that is subdivided into debt instrument and equity instrument, rather than a general analysis of the total amount of green finance for the reduction in carbon emissions.

- From the perspective of combining official environmental regulation and market-oriented green finance, this study attempted to support the reduction of carbon emissions and promotion of sustainable regional economic development.

2. A Theoretical Mechanism for Reduction of Environmental Emissions

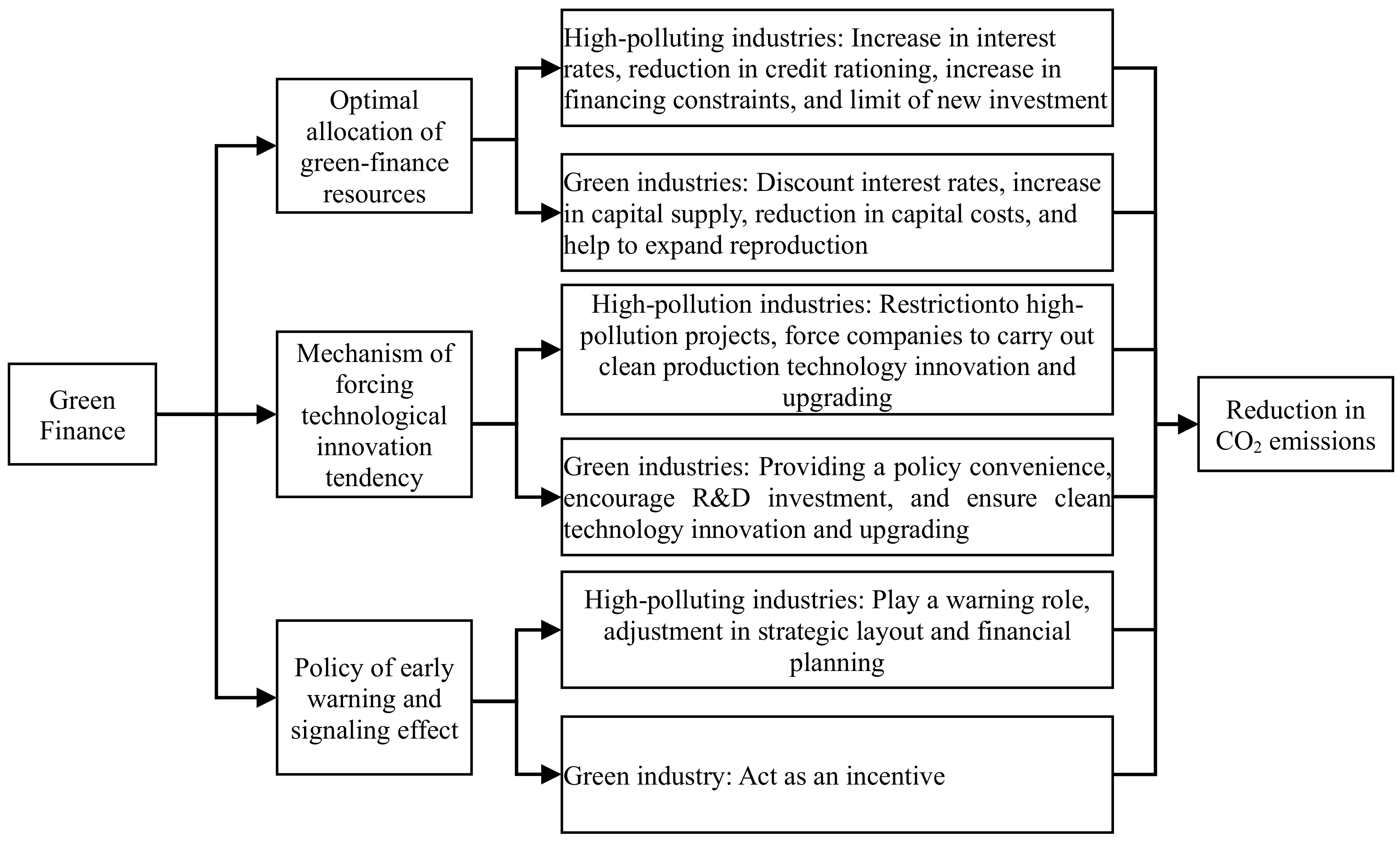

2.1. A Theoretical Mechanism for Reduction of CO2 Emissions with the Perspective of Green Finance

2.1.1. Optimal Allocation of Resources

2.1.2. The Mechanism of Forcing Technological Innovation Tendency

2.1.3. Early Warning and Signaling Effect

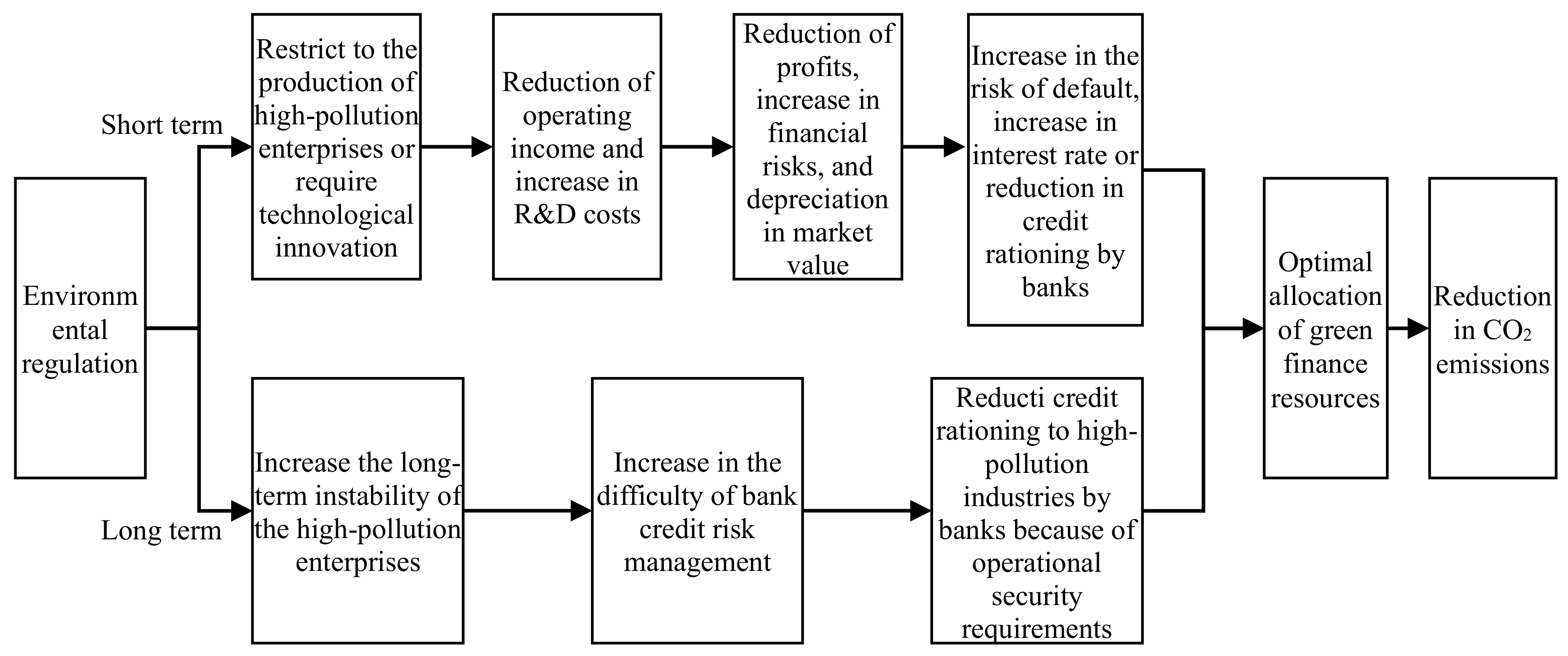

2.2. A Theoretical Mechanism for Reduction of CO2 Emissions with the Perspective of Environmental Regulations

2.2.1. Short-Term Mechanism of Action

2.2.2. Long-Term Mechanism of Action

3. Materials and Methods

3.1. Construction of the Model

3.2. Data Source and Selection of Variables

3.2.1. Source of Data

3.2.2. Selection of Variables

CO2 Relative Intensity (CRI)

Green-Finance Credit (GFC)

Green Venture Capital (GVC)

Green Finance Development Index (GFI)

Financial Industry Competition Index (FICI)

Research and Development (R&D)

Industrial Structure (IS)

Finance Scale (FS)

4. Results and Discussion

4.1. Summary of Basic Statistics

4.2. Empirical Analysis of CO2 Emissions Reduction Effects of Green Finance

4.2.1. Empirical Analysis of the CO2 Emissions Reduction Effect of Green Finance without Environmental Regulation

4.2.2. Robustness Test

4.3. Empirical Analysis of the CO2 Emission Reduction Effect of Green Finance under Environmental Regulation

4.3.1. Emission Reduction Due to Green Finance under Strong Environmental Regulation

4.3.2. Emission Reduction Due to Green Finance under Weak Environmental Regulation

4.3.3. Robustness Test

5. Conclusions, Policy Implications, and Future Research

5.1. Main Conclusions

5.2. Policy Implications

5.2.1. Development of Green Venture Capital and Innovation of Green Financial Tools

5.2.2. Environmental Regulation and Green Finance

5.2.3. Expansion in the Scale of Green Credit and Green Venture Capital

5.3. Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Teo, E.C. Singapore–China Economic Collaboration 2.0. Singap. Econ. Rev. 2021, 66, 207–217. [Google Scholar] [CrossRef]

- Koondhar, M.A.; Tan, Z.; Alam, G.M.; Khan, Z.A.; Wang, L.; Kong, R. Bioenergy consumption, carbon emissions, and agricultural bioeconomic growth: A systematic approach to carbon neutrality in China. J. Environ. Manag. 2021, 296, 113242. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Y.; Peng, B.; Elahi, E.; Wan, A. Does the extended producer responsibility system promote the green technological innovation of enterprises? An empirical study based on the difference-in-differences model. J. Clean. Prod. 2021, 319, 128631. [Google Scholar] [CrossRef]

- Zhao, X.; Peng, B.; Elahi, E.; Zheng, C.; Wan, A. Optimization of Chinese coal-fired power plants for cleaner production using Bayesian network. J. Clean. Prod. 2020, 273, 122837. [Google Scholar] [CrossRef]

- Zheng, C.; Peng, B.; Elahi, E.; Wan, A. Strategies of Haze Risk Reduction Using the Tripartite Game Model. Complexity 2020, 2020, 6474363. [Google Scholar] [CrossRef]

- Dong, F.; Zhang, Y.; Zhang, X.; Hu, M.; Gao, Y.; Zhu, J. Exploring ecological civilization performance and its determinants in emerging industrialized countries: A new evaluation system in the case of China. J. Clean. Prod. 2021, 315, 128051. [Google Scholar] [CrossRef]

- Peng, B.; Chen, S.; Elahi, E.; Wan, A. Can corporate environmental responsibility improve environmental performance? An inter-temporal analysis of Chinese chemical companies. Environ. Sci. Pollut. Res. 2021, 1–12. [Google Scholar] [CrossRef]

- Fan, F.; Wang, Y.; Liu, Q. China’s carbon emissions from electricity sector: Spatial characteristics and interregional transfer. Integr. Environ. Assess. Manag. 2021, 1–16. [Google Scholar] [CrossRef]

- Wang, H.; Chen, Z.; Wu, X.; Nie, X. Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis?—Empirical analysis based on the PSM-DID method. Energy Policy 2019, 129, 930–938. [Google Scholar] [CrossRef]

- Peng, B.; Wang, Y.; Elahi, E.; Wei, G. Behavioral game and simulation analysis of extended producer responsibility system’s implementation under environmental regulations. Environ. Sci. Pollut. Res. 2019, 26, 17644–17654. [Google Scholar] [CrossRef]

- Li, T.; Liao, G. The heterogeneous impact of financial development on green total factor productivity. Front. Energy Res. 2020, 8, 29. [Google Scholar] [CrossRef] [Green Version]

- Peng, B.; Zhang, X.; Elahi, E.; Wan, A. Evolution of spatial–temporal characteristics and financial development as an influencing factor of green ecology. Environ. Dev. Sustain. 2021, 1–21. [Google Scholar] [CrossRef]

- Xu, S.; Zhao, X.; Yao, S. Analysis on the effect of green credit on the upgrading of industrial structure. J. Shanghai Univ. Financ. Econ. 2018, 20, 59–72. [Google Scholar]

- Peng, B.; Zheng, C.; Wei, G.; Elahi, E. The cultivation mechanism of green technology innovation in manufacturing industry: From the perspective of ecological niche. J. Clean. Prod. 2020, 252, 119711. [Google Scholar] [CrossRef]

- Shen, D.; Xia, M.; Zhang, Q.; Elahi, E.; Zhou, Y.; Zhang, H. The impact of public appeals on the performance of environmental governance in China: A perspective of provincial panel data. J. Clean. Prod. 2019, 231, 290–296. [Google Scholar] [CrossRef]

- Sheng, X.; Peng, B.; Elahi, E.; Wei, G. Regional convergence of energy-environmental efficiency: From the perspective of environmental constraints. Environ. Sci. Pollut. Res. 2019, 26, 25467–25475. [Google Scholar] [CrossRef]

- Wu, B.; Peng, B.; Wei, W.; Ehsan, E. A comparative analysis on the international discourse power evaluation of global climate governance. Environ. Dev. Sustain. 2021, 1–22. [Google Scholar] [CrossRef]

- Chiu, A.S.; Yong, G. On the industrial ecology potential in Asian developing countries. J. Clean. Prod. 2004, 12, 1037–1045. [Google Scholar] [CrossRef]

- Peng, B.; Li, Y.; Elahi, E.; Wei, G. Dynamic evolution of ecological carrying capacity based on the ecological footprint theory: A case study of Jiangsu province. Ecol. Indic. 2019, 99, 19–26. [Google Scholar] [CrossRef]

- Peng, B.; Wang, Y.; Elahi, E.; Wei, G. Evaluation and prediction of the ecological footprint and ecological carrying capacity for yangtze river urban agglomeration based on the grey model. Int. J. Environ. Res. Public Health 2018, 15, 2543. [Google Scholar] [CrossRef] [Green Version]

- Zhong, Z.; Peng, B.; Elahi, E. Spatial and temporal pattern evolution and influencing factors of energy–environmental efficiency: A case study of Yangtze River urban agglomeration in China. Energy Environ. 2021, 32, 242–261. [Google Scholar] [CrossRef]

- Peng, B.; Tu, Y.; Elahi, E.; Wei, G. Extended Producer Responsibility and corporate performance: Effects of environmental regulation and environmental strategy. J. Environ. Manag. 2018, 218, 181–189. [Google Scholar] [CrossRef]

- Dogan, E.; Seker, F. The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renew. Sustain. Energy Rev. 2016, 60, 1074–1085. [Google Scholar] [CrossRef]

- Charfeddine, L.; Khediri, K.B. Financial development and environmental quality in UAE: Cointegration with structural breaks. Renew. Sustain. Energy Rev. 2016, 55, 1322–1335. [Google Scholar] [CrossRef]

- Li, X.; Xie, Y. Research on the Development Path of Chinese Commercial Banks Based on Green Finance. In Proceedings of the 5th International Conference on Financial Innovation and Economic Development (ICFIED 2020), Sanya, China, 10–12 January 2020; Atlantis Press China: Zhengzhou, China, 2020; pp. 205–211. [Google Scholar]

- Liu, X.; Wang, E.; Cai, D. Green credit policy, property rights and debt financing: Quasi-natural experimental evidence from China. Financ. Res. Lett. 2019, 29, 129–135. [Google Scholar] [CrossRef]

- Atasu, A.; Sarvary, M.; Van Wassenhove, L.N. Remanufacturing as a marketing strategy. Manag. Sci. 2008, 54, 1731–1746. [Google Scholar] [CrossRef] [Green Version]

- Ștefănică, M.; Sandu, C.B.; Butnaru, G.I.; Haller, A.-P. The Nexus between Tourism Activities and Environmental Degradation: Romanian Tourists’ Opinions. Sustainability 2021, 13, 9210. [Google Scholar] [CrossRef]

- Mazzucato, M.; Wray, L.R. Financing the Capital Development of the Economy: A Keynes-Schumpeter-Minsky Synthesis; LEM Working Paper Series; Scuola Superiore Sant’Anna, Laboratory of Economics and Management (LEM): Pisa, Italy, 2015. [Google Scholar]

- Xia, Y.; Liu, P.; Huang, G. Bank deregulation, environmental regulation and pollution reduction: Evidence from Chinese firms. Econ. Res. Ekon. Istraž. 2021, 34, 2162–2193. [Google Scholar] [CrossRef]

- Yu, C.; de Jong, M.; Cheng, B. Getting depleted resource-based cities back on their feet again—The example of Yichun in China. J. Clean. Prod. 2016, 134, 42–50. [Google Scholar] [CrossRef] [Green Version]

- Wang, R. Corporate Environmentalism in China; ERIM Ph.D. Series Research in Management; Erasmus University Rotterdam: Rotterdam, The Netherlands, 2017. [Google Scholar]

- Shahab, Y.; Ntim, C.G.; Chengang, Y.; Ullah, F.; Fosu, S. Environmental policy, environmental performance, and financial distress in China: Do top management team characteristics matter? Bus. Strategy Environ. 2018, 27, 1635–1652. [Google Scholar] [CrossRef]

- Sun, Z.; Wang, X.; Liang, C.; Cao, F.; Wang, L. The impact of heterogeneous environmental regulation on innovation of high-tech enterprises in China: Mediating and interaction effect. Environ. Sci. Pollut. Res. 2021, 28, 8323–8336. [Google Scholar] [CrossRef] [PubMed]

- Song, Y.; Yang, T.; Zhang, M. Research on the impact of environmental regulation on enterprise technology innovation—An empirical analysis based on Chinese provincial panel data. Environ. Sci. Pollut. Res. 2019, 26, 21835–21848. [Google Scholar] [CrossRef] [PubMed]

- Mo, X.; Changqi, T. The Effect of Environmental Regulation on Technological Innovation from the Optimization Perspective—Empirical Study Based on 29 Sub-Section of China’s Manufacturing Industry. J. Jiangxi Norm. Univ. 2016, 5, 525–530, (Natural Science Edition). [Google Scholar]

- Qing-Huang, H.; Ming, G. Quantity and quality effects of environmental regulation on economic growth—Test based on simultaneous equations. Economist 2016, 4, 53–62. [Google Scholar]

- Zhang, J.; Wang, J.; Yang, X.; Ren, S.; Ran, Q.; Hao, Y. Does local government competition aggravate haze pollution? A new perspective of factor market distortion. Socio-Econ. Plan. Sci. 2021, 76, 100959. [Google Scholar] [CrossRef]

- Gu, H.; Yan, W.; Elahi, E.; Cao, Y. Air pollution risks human mental health: An implication of two-stages least squares estimation of interaction effects. Environ. Sci. Pollut. Res. 2020, 27, 2036–2043. [Google Scholar] [CrossRef]

- Gu, H.; Cao, Y.; Elahi, E.; Jha, S.K. Human health damages related to air pollution in China. Environ. Sci. Pollut. Res. 2019, 26, 13115–13125. [Google Scholar] [CrossRef]

- Gu, H.; Bian, F.; Elahi, E. Effect of air pollution on female labor supply: An empirical analysis based on data of labor force dynamic survey of China. Soc. Work Public Health 2020, 35, 187–196. [Google Scholar] [CrossRef]

- Fu, J.; Lu, X. Enhancing Sustainable Development through Regulatory Means and Market-Oriented Incentives for Waste Management in the GBA. In Sustainable Energy and Green Finance for a Low-Carbon Economy; Springer: Berlin/Heidelberg, Germany, 2020; pp. 271–285. [Google Scholar]

- Yijun, Y.; Liu, L. Environmental Regulation and Economic Growth: A Research Based on Different Kinds of Economic Regulation. Econ. Rev. 2013, 1, 27–33. [Google Scholar]

- Violi, M.P. Is There Any Future for Green Finance in China? Ph.D. Thesis, Università Ca’Foscari Venezia, Veneto, Italy, 2020. [Google Scholar]

- Gong, R.; Wu, Y.-Q.; Chen, F.-W.; Yan, T.-H. Labor costs, market environment and green technological innovation: Evidence from high-pollution firms. Int. J. Environ. Res. Public Health 2020, 17, 522. [Google Scholar] [CrossRef] [Green Version]

- Armand, D.M.; Germain, N.T. Incentives Factors for the Performance of Microfinance Institutions in Cameroon. Sch. J. Econ. Bus. Manag. 2021, 2, 58–68. [Google Scholar] [CrossRef]

- Elahi, E.; Weijun, C.; Jha, S.K.; Zhang, H. Estimation of realistic renewable and non-renewable energy use targets for livestock production systems utilising an artificial neural network method: A step towards livestock sustainability. Energy 2019, 183, 191–204. [Google Scholar] [CrossRef]

- Polukhin, A.; Grudkina, T.; Grudkina, M. Factors increasing the effectiveness of state support in agriculture. In IOP Conference Series: Earth and Environmental Science; IOP Publishing: Beijing, China, 2019; p. 012113. [Google Scholar]

- Wang, Z.; Brownlee, A.E.; Wu, Q. Production and joint emission reduction decisions based on two-way cost-sharing contract under cap-and-trade regulation. Comput. Ind. Eng. 2020, 146, 106549. [Google Scholar] [CrossRef]

- Wu, S.; Han, H. Sectoral changing patterns of China’s green GDP considering climate change: An investigation based on the economic input-output life cycle assessment model. J. Clean. Prod. 2020, 251, 119764. [Google Scholar] [CrossRef]

- Hao, Y.; Ba, N.; Ren, S.; Wu, H. How does international technology spillover affect China’s carbon emissions? A new perspective through intellectual property protection. Sustain. Prod. Consum. 2021, 25, 577–590. [Google Scholar] [CrossRef]

- Wang, W.; Yang, F. The Belt and Road Initiative and China’s green foreign direct investment 1. In Green Finance, Sustainable Development and the Belt and Road Initiative; Routledge: London, UK, 2020; pp. 33–57. [Google Scholar]

- Dai, Y.; Li, N.; Gu, R.; Zhu, X. Can China’s carbon emissions trading rights mechanism transform its manufacturing industry? Based on the perspective of enterprise behavior. Sustainability 2018, 10, 2421. [Google Scholar] [CrossRef] [Green Version]

- Bruce, S. The 2015 Paris Climate Agreement: Design Options and Incentives to Increase Participation and Ambition. J. Soc. Sci. Electron. Publ. 2014, 1, 2525957. [Google Scholar] [CrossRef]

- Liu, Y.; Zhu, J.; Li, E.Y.; Meng, Z.; Song, Y. Environmental regulation, green technological innovation, and eco-efficiency: The case of Yangtze river economic belt in China. Technol. Forecast. Soc. Chang. 2020, 155, 119993. [Google Scholar] [CrossRef]

- Zhang, S.; Wu, Z.; Wang, Y.; Hao, Y. Fostering green development with green finance: An empirical study on the environmental effect of green credit policy in China. J. Environ. Manag. 2021, 296, 113159. [Google Scholar] [CrossRef]

- Karakoç, B. Foreign Capital, Real Sector Financing and Excessive Leverage in Turkey: What Went Wrong? EMAJ Emerg. Mark. J. 2020, 10, 30–39. [Google Scholar] [CrossRef]

- Jin, P.; Peng, C.; Song, M. Macroeconomic uncertainty, high-level innovation, and urban green development performance in China. China Econ. Rev. 2019, 55, 1–18. [Google Scholar] [CrossRef]

- Chao, X.; Kou, G.; Peng, Y.; Alsaadi, F.E. Behavior monitoring methods for trade-based money laundering integrating macro and micro prudential regulation: A case from China. Technol. Econ. Dev. Econ. 2019, 25, 1081–1096. [Google Scholar] [CrossRef]

- Langpap, C.; Shimshack, J.P. Private citizen suits and public enforcement: Substitutes or complements? J. Environ. Econ. Manag. 2010, 59, 235–249. [Google Scholar] [CrossRef]

- Zhang, D.; Mohsin, M.; Rasheed, A.K.; Chang, Y.; Taghizadeh-Hesary, F. Public spending and green economic growth in BRI region: Mediating role of green finance. Energy Policy 2021, 153, 112256. [Google Scholar] [CrossRef]

- Jefferson, G.H.; Tanaka, S.; Yin, W. Environmental Regulation and Industrial Performance: Evidence from Unexpected Externalities in China. SSRN Electron. J. 2013. [Google Scholar] [CrossRef]

- Du, Y.; Li, Z.; Du, J.; Li, N.; Yan, B. Public environmental appeal and innovation of heavy-polluting enterprises. J. Clean. Prod. 2019, 222, 1009–1022. [Google Scholar] [CrossRef]

- Huang, B.; Punzi, M.T.; Wu, Y. Do Banks Price Environmental Transition Risks? Evidence from a Quasi-Natural Experiment in China. J. Corp. Financ. 2021, 69, 101983. [Google Scholar] [CrossRef]

- Breitenfellner, A.; Pointner, W.; Schuberth, H. The potential contribution of central banks to green finance. Vierteljahrsh. Wirtsch. 2019, 88, 55–71. [Google Scholar] [CrossRef]

- Liu, J.; Xie, J. Environmental regulation, technological innovation, and export competitiveness: An empirical study based on China’s manufacturing industry. Int. J. Environ. Res. Public Health 2020, 17, 1427. [Google Scholar] [CrossRef] [Green Version]

- Tong, J.; Liu, W.; Xue, J. Environmental regulation, factor input structure and industrial transformation. Econ. Res. J. 2016, 7, 43–57. [Google Scholar]

- Lam, P.T.; Law, A.O. Crowdfunding for renewable and sustainable energy projects: An exploratory case study approach. Renew. Sustain. Energy Rev. 2016, 60, 11–20. [Google Scholar] [CrossRef] [Green Version]

- Fushuai, W.; Ruichao, X.; Wenxia, C. Research on the Impact of Financial Development on TFP—DEA-Malmquist Index and Hansen Threshold Model Based on Panel Data of Shandong Province, China. J. Financ. Res. 2020, 2, 71–79. [Google Scholar] [CrossRef]

- Ren, X.; Shao, Q.; Zhong, R. Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. J. Clean. Prod. 2020, 277, 122844. [Google Scholar] [CrossRef]

- Jiang, L.; Wang, H.; Tong, A.; Hu, Z.; Duan, H.; Zhang, X.; Wang, Y. The Measurement of Green Finance Development Index and Its Poverty Reduction Effect: Dynamic Panel Analysis Based on Improved Entropy Method. Discret. Dyn. Nat. Soc. 2020, 2020, 8851684. [Google Scholar] [CrossRef]

- Wang, H.; Wang, M. Effects of technological innovation on energy efficiency in China: Evidence from dynamic panel of 284 cities. Sci. Total Environ. 2020, 709, 136172. [Google Scholar] [CrossRef]

- Zhang, Y.; Xing, C.; Tripe, D. Redistribution of China’s Green Credit Policy among Environment-Friendly Manufacturing Firms of Various Sizes: Do Banks Value Small and Medium-Sized Enterprises? Int. J. Environ. Res. Public Health 2021, 18, 33. [Google Scholar] [CrossRef]

- Pingkuo, L.; Huan, P.; Zhiwei, W. Orderly-synergistic development of power generation industry: A China’s case study based on evolutionary game model. Energy 2020, 211, 118632. [Google Scholar] [CrossRef]

- He, L.; Zhang, L.; Zhong, Z.; Wang, D.; Wang, F. Green credit, renewable energy investment and green economy development: Empirical analysis based on 150 listed companies of China. J. Clean. Prod. 2019, 208, 363–372. [Google Scholar] [CrossRef]

- Chen, Q.; Ning, B.; Pan, Y.; Xiao, J. Green finance and outward foreign direct investment: Evidence from a quasi-natural experiment of green insurance in China. Asia Pac. J. Manag. 2021, 1–26. [Google Scholar] [CrossRef]

- Huang, L.; Zhao, X. Impact of financial development on trade-embodied carbon dioxide emissions: Evidence from 30 provinces in China. J. Clean. Prod. 2018, 198, 721–736. [Google Scholar] [CrossRef]

- Zhao, J.; Shahbaz, M.; Dong, X.; Dong, K. How does financial risk affect global CO2 emissions? The role of technological innovation. Technol. Forecast. Soc. Chang. 2021, 168, 120751. [Google Scholar] [CrossRef]

- Song, Y.; Zhang, J.; Song, Y.; Fan, X.; Zhu, Y.; Zhang, C. Can industry-university-research collaborative innovation efficiency reduce carbon emissions? Technol. Forecast. Soc. Chang. 2020, 157, 120094. [Google Scholar] [CrossRef]

- Xu, R.; Lin, B. Why are there large regional differences in CO2 emissions? Evidence from China’s manufacturing industry. J. Clean. Prod. 2017, 140, 1330–1343. [Google Scholar] [CrossRef]

- Elahi, E.; Khalid, Z.; Tauni, M.Z.; Zhang, H.; Lirong, X. Extreme weather events risk to crop-production and the adaptation of innovative management strategies to mitigate the risk: A retrospective survey of rural Punjab, Pakistan. Technovation 2021, 3, 102255. [Google Scholar] [CrossRef]

- Elahi, E.; Zhang, H.; Lirong, X.; Khalid, Z.; Xu, H. Understanding cognitive and socio-psychological factors determining farmers’ intentions to use improved grassland: Implications of land use policy for sustainable pasture production. Land Use Policy 2021, 102, 105250. [Google Scholar] [CrossRef]

- Elahi, E.; Weijun, C.; Zhang, H.; Abid, M. Use of artificial neural networks to rescue agrochemical-based health hazards: A resource optimisation method for cleaner crop production. J. Clean. Prod. 2019, 238, 117900. [Google Scholar] [CrossRef]

- Elahi, E.; Weijun, C.; Zhang, H.; Nazeer, M. Agricultural intensification and damages to human health in relation to agrochemicals: Application of artificial intelligence. Land Use Policy 2019, 83, 461–474. [Google Scholar] [CrossRef]

- Elahi, E.; Abid, M.; Zhang, H.; Weijun, C.; Hasson, S.U. Domestic water buffaloes: Access to surface water, disease prevalence and associated economic losses. Prev. Vet. Med. 2018, 154, 102–112. [Google Scholar] [CrossRef]

- Elahi, E.; Zhang, L.; Abid, M.; Javed, M.T.; Xinru, H. Direct and indirect effects of wastewater use and herd environment on the occurrence of animal diseases and animal health in Pakistan. Environ. Sci. Pollut. Res. 2017, 3, 1–14. [Google Scholar] [CrossRef]

- Xie, T.; Liu, J. How does green credit affect China’s green economy growth. China Popul. Resour. Environ. 2019, 29, 83–90. [Google Scholar]

- Elahi, E.; Khalid, Z.; Weijun, C.; Zhang, H. The public policy of agricultural land allotment to agrarians and its impact on crop productivity in Punjab province of Pakistan. Land Use Policy 2020, 90, 104324. [Google Scholar] [CrossRef]

- Lv, C.; Bian, B.; Lee, C.-C.; He, Z. Regional gap and the trend of green finance development in China. Energy Econ. 2021, 102, 105476. [Google Scholar] [CrossRef]

- Zhang, Y.-J. The impact of financial development on carbon emissions: An empirical analysis in China. Energy Policy 2011, 39, 2197–2203. [Google Scholar] [CrossRef]

- Lin, S.-J.; Beidari, M.; Lewis, C. Energy consumption trends and decoupling effects between carbon dioxide and gross domestic product in South Africa. Aerosol Air Qual. Res. 2015, 15, 2676–2687. [Google Scholar] [CrossRef] [Green Version]

- Qiu, S.; Wang, Z.; Liu, S. The policy outcomes of low-carbon city construction on urban green development: Evidence from a quasi-natural experiment conducted in China. Sustain. Cities Soc. 2021, 66, 102699. [Google Scholar] [CrossRef]

- Wu, H.; Xu, L.; Ren, S.; Hao, Y.; Yan, G. How do energy consumption and environmental regulation affect carbon emissions in China? New evidence from a dynamic threshold panel model. Resour. Policy 2020, 67, 101678. [Google Scholar] [CrossRef]

- Roodman, D. How to do xtabond2: An introduction to difference and system GMM in Stata. Stata J. 2009, 9, 86–136. [Google Scholar] [CrossRef] [Green Version]

- Zhou, X.; Tang, X.; Zhang, R. Impact of green finance on economic development and environmental quality: A study based on provincial panel data from China. Environ. Sci. Pollut. Res. 2020, 27, 19915–19932. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, Y. How to reduce household carbon emissions: A review of experience and policy design considerations. Energy Policy 2017, 102, 116–124. [Google Scholar] [CrossRef]

- Fu, Y.; Hu, J.; Cao, X. Different sources of FDI, environmental regulation and green total factor productivity. J. Int. Trade 2018, 2018, 134–148. [Google Scholar]

- Li, C.; Liu, X.; Bai, X.; Umar, M. Financial development and environmental regulations: The two pillars of green transformation in China. Int. J. Environ. Res. Public Health 2020, 17, 9242. [Google Scholar] [CrossRef]

- Dong, S.; Xu, L.; McIver, R. China’s financial sector sustainability and “green finance” disclosures. Sustain. Account. Manag. Policy J. 2020, 12, 353–384. [Google Scholar] [CrossRef]

- Pandey, R.; Sane, R. Financing Biodiversity: The Role of Financial Institutions; Working Papers from National Institute of Public Finance and Policy; National Institute of Public Finance and Policy: New Delhi, India, 2019. [Google Scholar]

- Ho, V.H. Beyond regulation: A comparative look at state-centric corporate social responsibility and the law in China. Vand. J. Transnat’l L. 2013, 46, 375. [Google Scholar]

- Lovins, L.H.; Cohen, B. Climate Capitalism: Capitalism in the Age of Climate Change; Hill and Wang: New York, NY, USA, 2011. [Google Scholar]

- Butnaru, G.I.; Haller, A.-P.; Clipa, R.I.; Ștefănică, M.; Ifrim, M. The Nexus Between Convergence of Conventional and Renewable Energy Consumption in the Present European Union States. Explorative Study on Parametric and Semi-Parametric Methods. Energies 2020, 13, 5272. [Google Scholar] [CrossRef]

- Elahi, E.; Abid, M.; Zhang, L.; Ul Haq, S.; Sahito, J.G.M. Agricultural advisory and financial services; farm level access, outreach and impact in a mixed cropping district of Punjab, Pakistan. Land Use Policy 2018, 71, 249–260. [Google Scholar] [CrossRef]

| Variables | Samples | Average | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| CRI | 1638 | 0.176 | 0.869 | 0.000 | 23.149 |

| GFC | 1638 | 10.009 | 15.954 | 0.093 | 264.394 |

| GVC | 1638 | 2.766 | 5.432 | 0.000 | 94.584 |

| GFI | 1638 | 5.079 | 3.471 | 0.300 | 32.995 |

| FICI | 1638 | 7.444 | 1.702 | 1.490 | 13.705 |

| R&D | 1638 | 11.730 | 19.747 | 0.003 | 260.117 |

| IS | 1638 | 1.112 | 3.811 | 0.011 | 105.993 |

| FS | 1638 | 632.646 | 667.896 | 14.800 | 6813.760 |

| Dependent Variable: lnCRI | Equation (1) | Equation (2) | Equation (3) |

|---|---|---|---|

| lnCRI(−1) | 0.029 (1.62) | 0.086 *** (3.78) | 0.181 *** (7.35) |

| lnGFC | −0.585 *** (−21.91) | −0.125 *** (−5.06) | |

| lnGVC | −0.263 *** (−8.69) | −0.119 *** (−7.56) | |

| lnGFI | −0.841 *** (−5.49) | −0.720 *** (−7.21) | |

| (lnGFC) (lnGVC) | −0.064 (−2.66) | ||

| (lnGFC) (lnGFI) | −0.232 *** (−4.97) | ||

| (lnGVC) (lnGFI) | −0.222 *** (−7.31) | ||

| lnFICI | 0.210 *** (8.19) | −0.686 *** (−3.27) | 0.277 *** (7.96) |

| lnR&D | −0.245 *** (−36.68) | −0.416 *** (−24.10) | −0.249 *** (−17.92) |

| lnIS | 1.613 *** (68.44) | 1.274 *** (52.67) | 1.353 *** (43.62) |

| lnFS | −0.034 (−1.48) | 0.223 * (1.67) | −0.321 *** (−13.00) |

| Constant Term | −8.561 *** (−47.47) | −6.249 *** (−32.68) | −6.287 *** (−25.71) |

| Dependent Variable: lnCRI | Equation (1) | Equation (2) | Equation (3) |

|---|---|---|---|

| lnCRI(−1) | 0.037 ** (2.40) | 0.001 (0.06) | 0.200 *** (7.21) |

| lnGFC | −0.512 *** (−20.01) | −0.462 *** (−19.41) | |

| lnGVC | −0.063 *** (−3.35) | −0.082 *** (−5.14) | |

| lnGFI | −0.444 *** (−7.62) | −0.419 *** (−5.20) | |

| (lnGFC) (lnGVC) | 0.035 (8.88) | ||

| (lnGFC) (lnGFI) | −0.487 *** (−4.57) | ||

| (lnGVC) (lnGFI) | −0.090 *** (−2.36) | ||

| lnFICI | 0.066 (1.11) | 0.256 *** (3.48) | 0.144 ** (2.43) |

| lnR&D | −0.245 *** (−19.97) | −0.320 *** (−43.08) | −0.196 *** (−6.84) |

| lnIS | 1.273 *** (33.10) | 1.322 *** (42.92) | 1.397 *** (30.92) |

| lnFS | −0.301 *** (−12.26) | −0.336 *** (−5.54) | −0.200 *** (−3.47) |

| Constant Term | −5.225 *** (−23.79) | −5.972 *** (−19.56) | −6.837 *** (−15.99) |

| Dependent Variable: lnCRI | Equation (1) | Equation (2) | Equation (3) |

|---|---|---|---|

| lnCRI(−1) | 0.004 (0.11) | 0.142 *** (2.95) | 0.091 ** (2.19) |

| lnGFC | −0.398 *** (−16.44) | −0.617 *** (−14.60) | |

| lnGVC | −0.135 *** (−6.67) | −0.177 *** (−5.89) | |

| lnGFI | 0.092 *** (1.00) | 0.335 *** (5.26) | |

| (lnGFC) (lnGVC) | 0.005 (1.11) | ||

| (lnGFC) (lnGFI) | 0.192 *** (5.66) | ||

| (lnGVC) (lnGFI) | 0.083 *** (9.66) | ||

| lnFICI | 0.030 (1.18) | 0.550 *** (5.33) | −0.242 *** (−2.73) |

| lnR&D | −0.253 *** (−25.82) | −0.237 *** (−13.67) | −0.379 *** (−23.69) |

| lnIS | 1.582 *** (51.89) | 1.403 *** (23.43) | 1.284 *** (23.76) |

| lnFS | −0.082 *** (−5.02) | −0.474 *** (−7.38) | −0.137 ** (−2.42) |

| Constant Term | −8.195 *** (−27.65) | −6.014 *** (−16.94) | −5.881 *** (−16.53) |

| Dependent Variable: lnCRI | Equation (1) | Equation (2) | Equation (3) |

|---|---|---|---|

| lnCRI(−1) | 0.091 *** (7.37) | 0.128 *** (9.09) | 0.085 *** (7.17) |

| lnGFC | −0.358 *** (−5.32) | −0.436 *** (−4.32) | |

| lnGVC | −0.207 *** (−3.89) | −0.175 *** (−2.30) | |

| lnGFI | −0.450 ** (−1.85) | −0.144 ** (−1.21) | |

| (lnGFC) (lnGVC) | 0.002 (0.13) | ||

| (lnGFC) (lnGFI) | −0.042 ** (−0.95) | ||

| (lnGVC) (lnGFI) | −0.008 ** (−0.11) | ||

| lnFICI | 0.744 *** (5.04) | 1.657 *** (7.61) | 0.405 ** (2.24) |

| lnR&D | −0.196 *** (−8.10) | −0.183 *** (−6.59) | −0.247 *** (−8.46) |

| lnIS | 1.590 *** (39.07) | 1.534 *** (37.15) | 1.536 *** (34.93) |

| lnFS | −0.164 *** (−4.88) | −0.670 *** (−5.43) | −0.263 ** (−2.48) |

| Constant Term | −8.871 *** (−37.33) | −7.894 *** (−14.26) | −7.777 *** (−20.66) |

| Dependent Variable: lnCRI | Strong Regulation | Weak Regulation | ||

|---|---|---|---|---|

| Equation (2) | Equation (3) | Equation (2) | Equation (3) | |

| lnCRI(−1) | −0.078 ** (−2.21) | 0.143 *** (3.74) | 0.090 (8.05) | 0.096 *** (8.07) |

| lnGFC | −0.378 *** (−14.44) | −0.875 *** (−4.83) | ||

| lnGVC | −0.174 *** (−3.00) | −0.382 *** (−6.49) | ||

| lnGFI | 0.444 *** (6.24) | 0.321 *** (4.17) | −0.327 ** (−2.54) | −0.106 ** (−0.42) |

| lnGFC·lnGFI | 0.418 *** (4.10) | −0.427 ** (−2.47) | ||

| lnGVC·lnGFI | 0.079 *** (0.72) | −0.032 ** (−0.87) | ||

| lnFICI | −0.574 *** (−5.80) | −0.178 * (−1.68) | 1.174 (6.07) | 0.97 *** (4.75) |

| lnR&D | −0.306 *** (−25.62) | −0.203 *** (−13.68) | −0.166 (−6.89) | −0.140 *** (−5.05) |

| lnIS | 1.653 *** (35.97) | 1.451 ** (30.52) | 1.628 (46.44) | 1.665 *** (42.44) |

| lnFS | 0.293 *** (4.29) | 0.059 (0.86) | −0.465 (−3.89) | −0.403 *** (−3.67) |

| Constant Term | −9.114 *** (−30.52) | −7.496 *** (−25.14) | −8.557 (−27.92) | −8.558 *** (−18.54) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, F.; Cai, W.; Elahi, E. Do Green Finance and Environmental Regulation Play a Crucial Role in the Reduction of CO2 Emissions? An Empirical Analysis of 126 Chinese Cities. Sustainability 2021, 13, 13014. https://doi.org/10.3390/su132313014

Wang F, Cai W, Elahi E. Do Green Finance and Environmental Regulation Play a Crucial Role in the Reduction of CO2 Emissions? An Empirical Analysis of 126 Chinese Cities. Sustainability. 2021; 13(23):13014. https://doi.org/10.3390/su132313014

Chicago/Turabian StyleWang, Fushuai, Wenxia Cai, and Ehsan Elahi. 2021. "Do Green Finance and Environmental Regulation Play a Crucial Role in the Reduction of CO2 Emissions? An Empirical Analysis of 126 Chinese Cities" Sustainability 13, no. 23: 13014. https://doi.org/10.3390/su132313014

APA StyleWang, F., Cai, W., & Elahi, E. (2021). Do Green Finance and Environmental Regulation Play a Crucial Role in the Reduction of CO2 Emissions? An Empirical Analysis of 126 Chinese Cities. Sustainability, 13(23), 13014. https://doi.org/10.3390/su132313014