Using Fuzzy AHP-PROMETHEE for Market Risk Assessment of New-Build River Cruises on the Yangtze River

Abstract

:1. Introduction

- What situation is the river cruise ship market on the Yangtze River?

- How to identify market risks of new-build river cruises from the perspective of consumer demand?

- How to formulate a rational evaluation criteria framework to represent possible impact of risk factors from different perspectives?

- How to choose and establish an appropriate risk assessment model to determine risk level?

2. Literature Review

2.1. Tourist Preference

2.2. Fuzzy MCDA Methods

2.2.1. MCDA Methods

2.2.2. Fuzzy Numbers

2.3. Research Gap

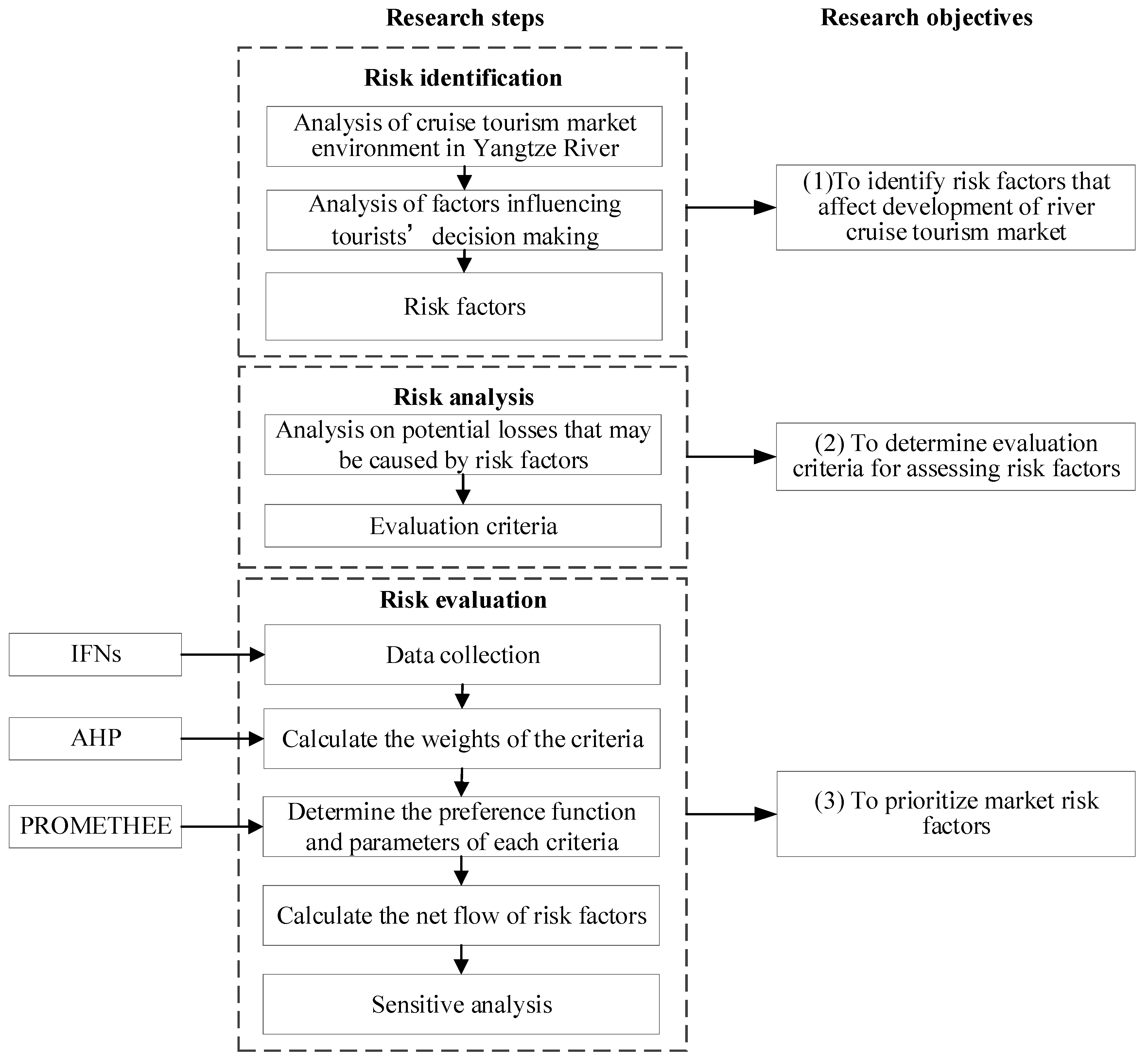

3. Methodology

3.1. Intuitionistic Fuzzy Numbers

- )

- )

- ,

3.2. Determining the Weights of Criteria Using AHP

3.3. PROMETHEE Method

- Type 1: Usual criterion

- Type 2: U-shape criterion

- Type 3: V-shape criterion

- Type 4: Level criterion

- Type 5: V-shape with indifference criterion

- Type 6: Gaussian criterion

4. Risk Evaluation Framework of River Cruise New-Build

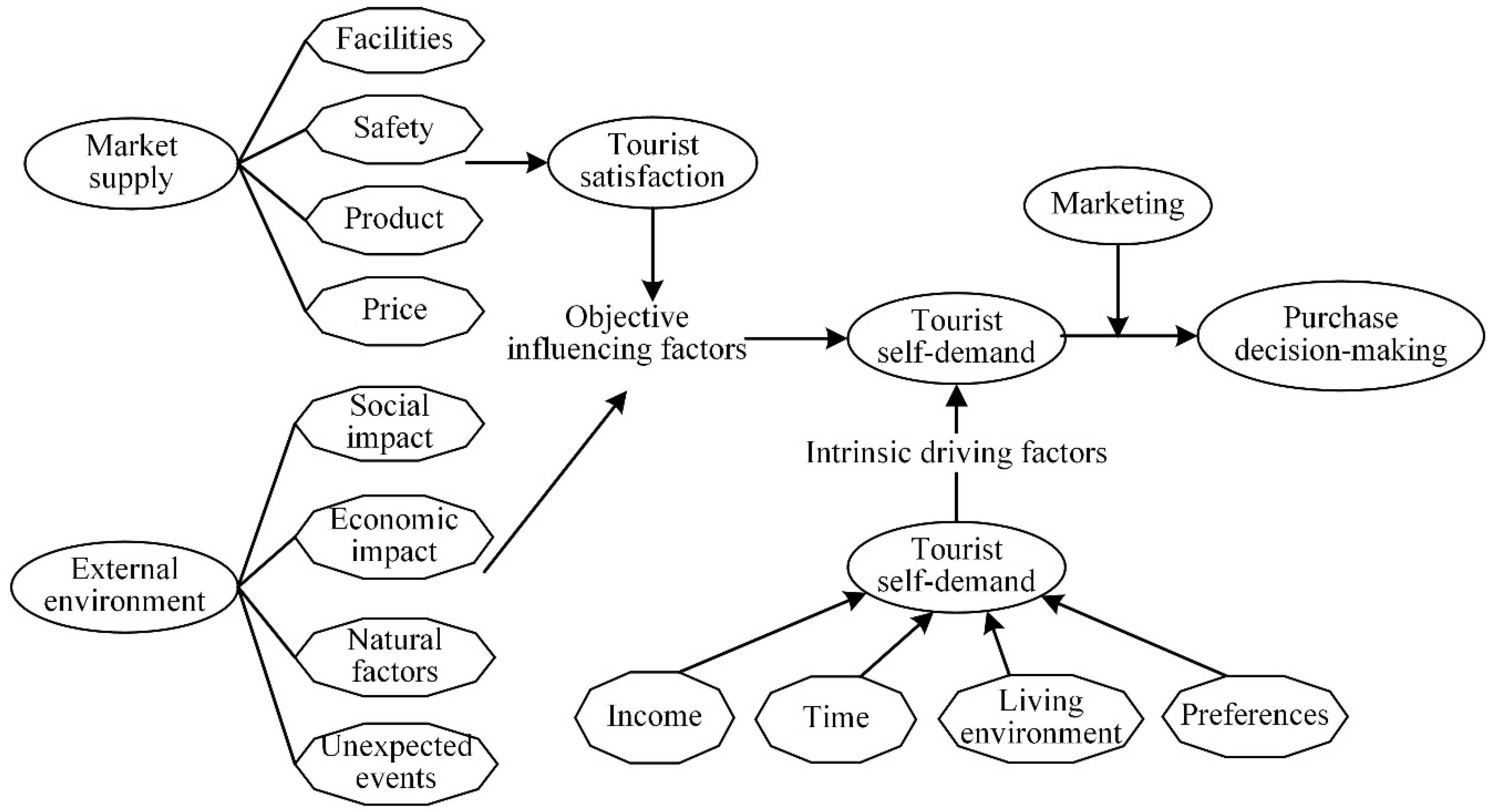

4.1. Risk Identification

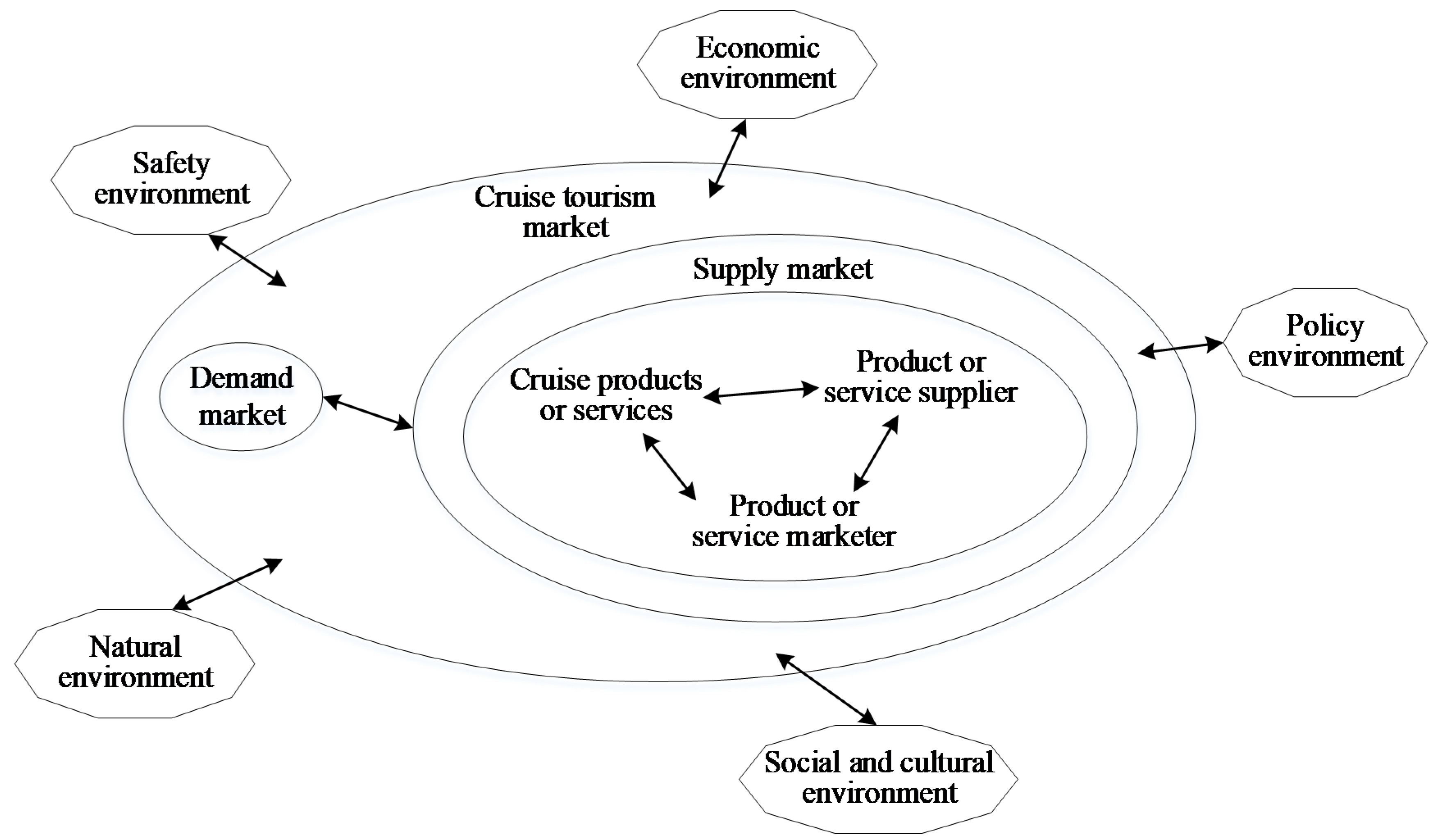

4.1.1. Analysis of Cruise Tourism Market

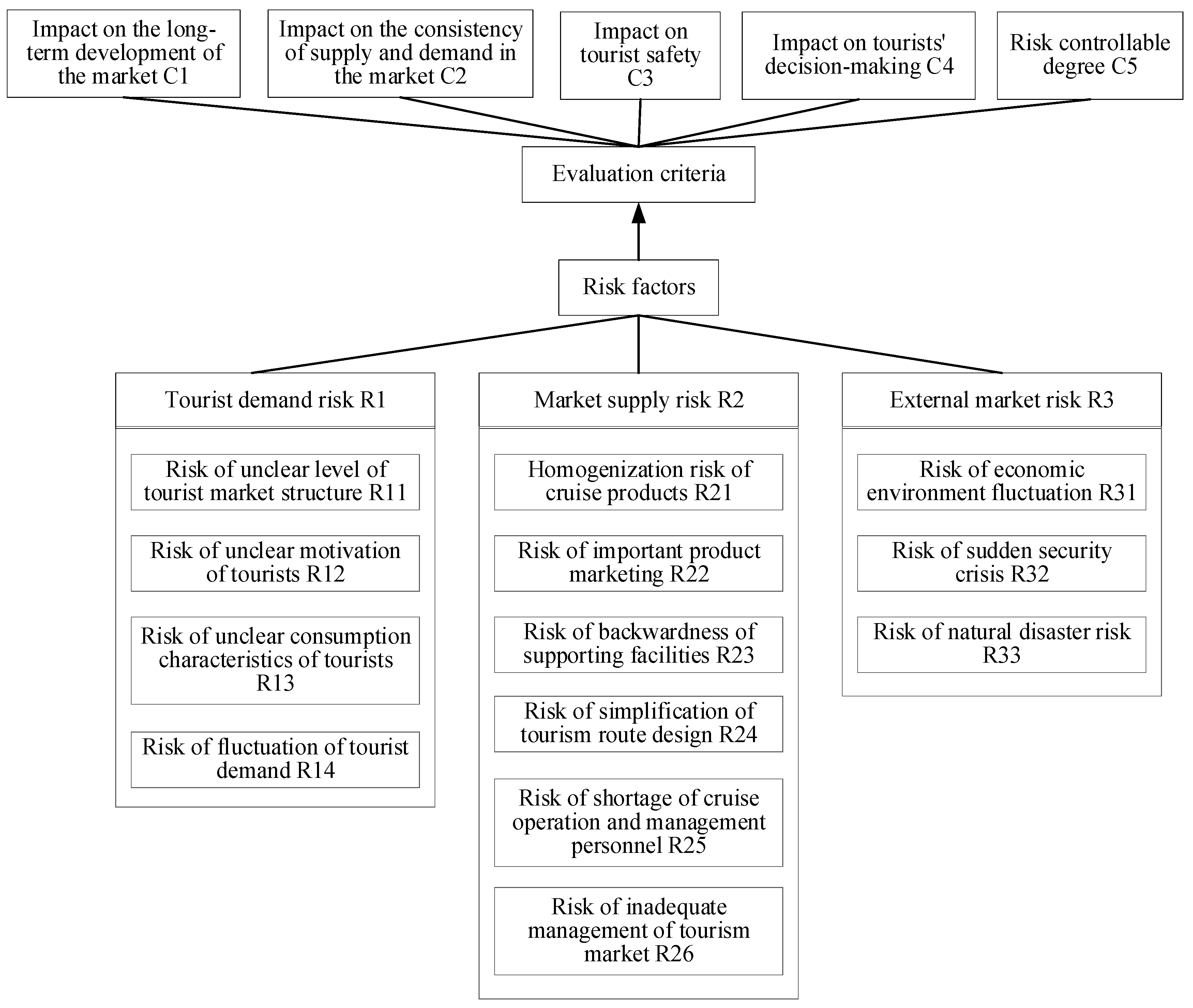

4.1.2. Market Risk Factors of New-Build River Cruises

4.2. Determination of Risk Assessment Criteria

4.3. Risk Prioritization Using Fuzzy PROMETHEE

4.4. Sensitive Analysis

5. Results and Discussion

5.1. Data Processing

5.2. Ranking of Risk Factors

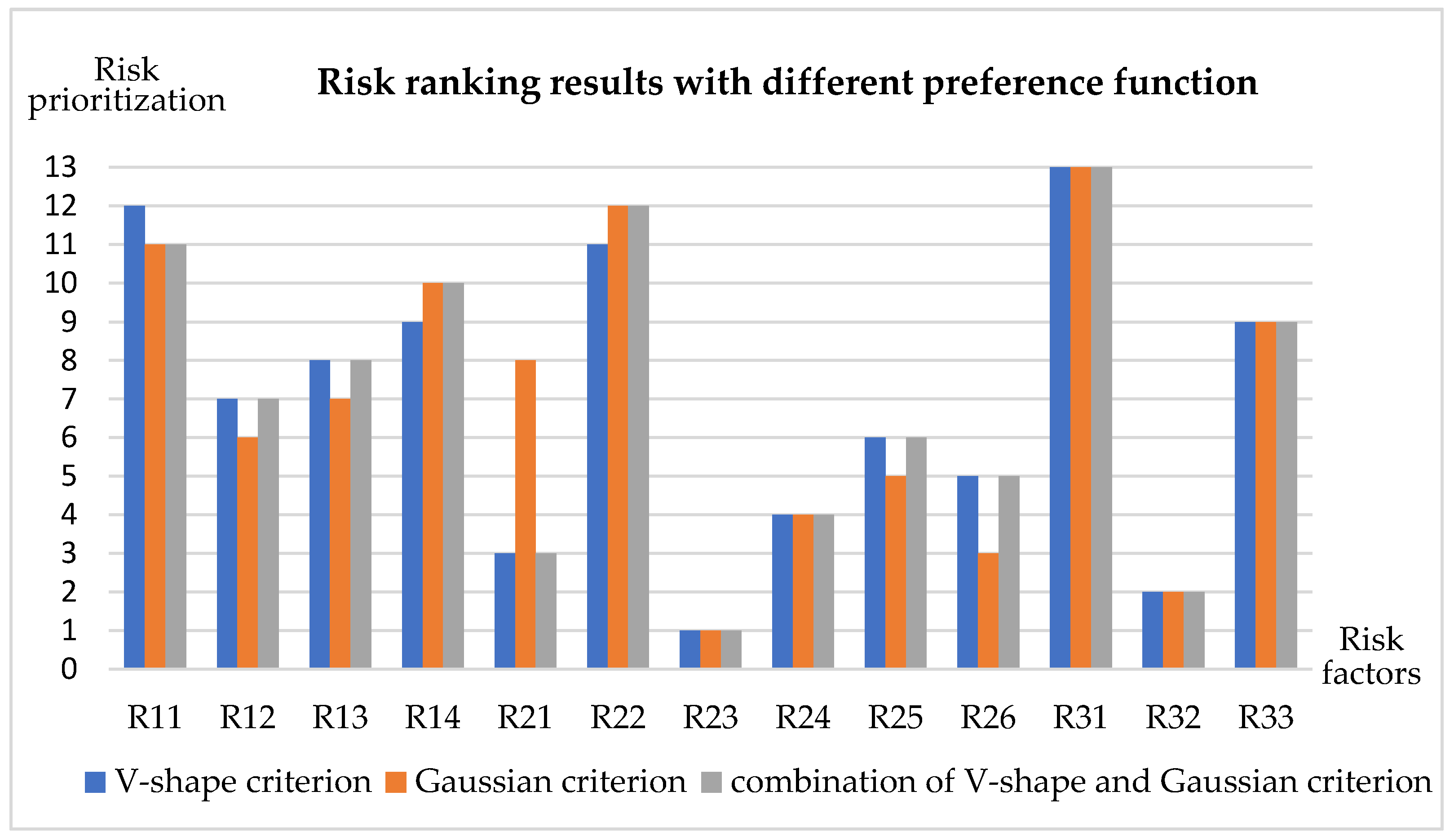

5.3. Model Validation

5.4. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| DM1 | C1 | C2 | C3 | C4 | C5 | DM2 | C1 | C2 | C3 | C4 | C5 | DM3 | C1 | C2 | C3 | C4 | C5 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| C1 | 1 | 3 | 1 | 3 | 3 | 1 | 3 | 3 | 3 | 3 | 1 | 1 | 1/3 | 7 | 3 | ||

| C2 | 1/3 | 1 | 1 | 3 | 1/3 | 1/3 | 1 | 1/3 | 3 | 3 | 1 | 1 | 1/3 | 3 | 1 | ||

| C3 | 1 | 1 | 1 | 5 | 1 | 1/3 | 3 | 1 | 3 | 3 | 3 | 3 | 1 | 1 | 5 | ||

| C4 | 1/3 | 1/3 | 1/5 | 1 | 1/5 | 1/3 | 1/3 | 1/3 | 1 | 5 | 1/7 | 1/3 | 1 | 1 | 1 | ||

| C5 | 1/3 | 3 | 1 | 5 | 1 | 1/3 | 1/3 | 1/3 | 1/5 | 1 | 1/3 | 1 | 1/5 | 1 | 1 |

| DM1 | C1 | C2 | C3 | C4 | C5 | DM2 | C1 | C2 | C3 | C4 | C5 | DM3 | C1 | C2 | C3 | C4 | C5 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| R11 | 4 | 3 | 2 | 4 | 3 | 2 | 4 | 1 | 3 | 2 | 3 | 5 | 2 | 4 | 2 | ||

| R12 | 4 | 4 | 1 | 4 | 3 | 4 | 5 | 2 | 5 | 4 | 4 | 5 | 3 | 5 | 2 | ||

| R13 | 3 | 4 | 1 | 3 | 2 | 4 | 5 | 1 | 4 | 4 | 4 | 4 | 3 | 5 | 3 | ||

| R14 | 4 | 4 | 1 | 4 | 3 | 4 | 4 | 1 | 3 | 3 | 5 | 5 | 2 | 5 | 2 | ||

| R21 | 5 | 4 | 3 | 4 | 4 | 5 | 4 | 2 | 5 | 4 | 5 | 4 | 2 | 5 | 4 | ||

| R22 | 4 | 3 | 2 | 3 | 3 | 4 | 2 | 1 | 3 | 2 | 5 | 3 | 1 | 3 | 4 | ||

| R23 | 4 | 3 | 4 | 4 | 4 | 4 | 5 | 5 | 4 | 4 | 5 | 4 | 4 | 4 | 5 | ||

| R24 | 3 | 3 | 2 | 4 | 3 | 5 | 5 | 3 | 4 | 4 | 5 | 4 | 1 | 5 | 4 | ||

| R25 | 4 | 4 | 2 | 4 | 4 | 5 | 3 | 3 | 3 | 4 | 3 | 4 | 3 | 2 | 2 | ||

| R26 | 4 | 4 | 4 | 4 | 4 | 3 | 3 | 5 | 3 | 3 | 4 | 4 | 4 | 3 | 3 | ||

| R31 | 3 | 3 | 2 | 3 | 5 | 4 | 1 | 1 | 1 | 4 | 3 | 3 | 1 | 4 | 2 | ||

| R32 | 4 | 5 | 5 | 5 | 5 | 5 | 3 | 4 | 5 | 5 | 4 | 3 | 5 | 5 | 4 | ||

| R33 | 3 | 3 | 4 | 4 | 4 | 2 | 2 | 5 | 4 | 4 | 3 | 1 | 4 | 4 | 5 |

| C1 | C2 | C3 | C4 | C5 | |

|---|---|---|---|---|---|

| R11 | (0.9125,0.0360) | (0.9813,0.0060) | (0.5590,0.3060) | (0.9688,0.0090) | (0.7550,0.1440) |

| R12 | (0.9844,0.0034) | (0.9944,0.0015) | (0.6850,0.2040) | (0.9944,0.0015) | (0.9125,0.0360) |

| R13 | (0.9688,0.0090) | (0.9906,0.0023) | (0.5950,0.2890) | (0.9813,0.0060) | (0.9125,0.0360) |

| R14 | (0.9906,0.0023) | (0.9906,0.0023) | (0.4330,0.4335) | (0.9813,0.0060) | (0.8250,0.0960) |

| R21 | (0.9966,0.0010) | (0.9844,0.0034) | (0.7550,0.1440) | (0.9944,0.0015) | (0.9844,0.0034) |

| R22 | (0.9906,0.0023) | (0.8250,0.0960) | (0.4330,0.4335) | (0.8750,0.0640) | (0.9125,0.0360) |

| R23 | (0.9906,0.0023) | (0.9813,0.0060) | (0.9906,0.0023) | (0.9844,0.0034) | (0.9906,0.0023) |

| R24 | (0.9888,0.0040) | (0.9813,0.0060) | (0.6850,0.2040) | (0.9906,0.0023) | (0.9688,0.0090) |

| R25 | (0.9813,0.0060) | (0.9688,0.0090) | (0.8250,0.0960) | (0.9125,0.0360) | (0.9563,0.0135) |

| R26 | (0.9688,0.0090) | (0.9688,0.0090) | (0.9906,0.0023) | (0.9375,0.0240) | (0.9375,0.0240) |

| R31 | (0.9375,0.0240) | (0.7750,0.1360) | (0.4330,0.4335) | (0.8875,0.0510) | (0.9738,0.0090) |

| R32 | (0.9906,0.0023) | (0.9625,0.0160) | (0.9944,0.0015) | (0.9966,0.0010) | (0.9944,0.0015) |

| R33 | (0.8250,0.0960) | (0.6850,0.2040) | (0.9906,0.0023) | (0.9844,0.0034) | (0.9906,0.0023) |

| C1 | C2 | C3 | C4 | C5 | |

|---|---|---|---|---|---|

| R11 | 2.3654 | 2.6496 | 1.1372 | 2.6050 | 1.7123 |

| R12 | 2.6655 | 2.6988 | 1.4742 | 2.6988 | 2.3654 |

| R13 | 2.6050 | 2.6863 | 1.2209 | 2.6496 | 2.3654 |

| R14 | 2.6863 | 2.6863 | 0.8818 | 2.6496 | 1.9809 |

| R21 | 2.7063 | 2.6655 | 1.7123 | 2.6988 | 2.6655 |

| R22 | 2.6863 | 1.9809 | 0.8818 | 2.1909 | 2.3654 |

| R23 | 2.6863 | 2.6496 | 2.6863 | 2.6655 | 2.6863 |

| R24 | 2.6763 | 2.6496 | 1.4742 | 2.6863 | 2.6050 |

| R25 | 2.6496 | 2.6050 | 1.9809 | 2.3654 | 2.5556 |

| R26 | 2.6050 | 2.6050 | 2.6863 | 2.4721 | 2.4721 |

| R31 | 2.4721 | 1.7806 | 0.8818 | 2.2542 | 2.6199 |

| R32 | 2.6863 | 2.5689 | 2.6988 | 2.7063 | 2.6988 |

| R33 | 1.9809 | 1.4742 | 2.6863 | 2.6655 | 2.6863 |

| Index | C1 | C2 | C3 | C4 | C5 |

|---|---|---|---|---|---|

| d (R12, R11) | 0.300 | 0.049 | 0.337 | 0.094 | 0.653 |

| d (R12, R13) | 0.061 | 0.012 | 0.253 | 0.049 | 0.000 |

| d (R12, R14) | −0.021 | 0.012 | 0.592 | 0.049 | 0.384 |

| d (R12, R21) | −0.041 | 0.033 | −0.238 | 0.000 | −0.300 |

| d (R12, R22) | −0.021 | 0.718 | 0.592 | 0.508 | 0.000 |

| d (R12, R23) | −0.021 | 0.049 | −1.212 | 0.033 | −0.321 |

| d (R12, R24) | −0.011 | 0.049 | 0.000 | 0.012 | −0.240 |

| d (R12, R25) | 0.016 | 0.094 | −0.507 | 0.333 | −0.190 |

| d (R12, R26) | 0.061 | 0.094 | −1.212 | 0.227 | −0.107 |

| d (R12, R31) | 0.193 | 0.918 | 0.592 | 0.445 | −0.254 |

| d (R12, R32) | −0.021 | 0.130 | −1.225 | −0.008 | −0.333 |

| d (R12, R33) | 0.685 | 1.225 | −1.212 | 0.033 | −0.321 |

| d (R11, R12) | −0.300 | −0.049 | −0.337 | −0.094 | −0.653 |

| d (R13, R12) | −0.061 | −0.012 | −0.253 | −0.049 | 0.000 |

| d (R14, R12) | 0.021 | −0.012 | −0.592 | −0.049 | −0.384 |

| d (R21, R12) | 0.041 | −0.033 | 0.238 | 0.000 | 0.300 |

| d (R22, R12) | 0.021 | −0.718 | −0.592 | −0.508 | 0.000 |

| d (R23, R12) | 0.021 | −0.049 | 1.212 | −0.033 | 0.321 |

| d (R24, R12) | 0.011 | −0.049 | 0.000 | −0.012 | 0.240 |

| d (R25, R12) | −0.016 | −0.094 | 0.507 | −0.333 | 0.190 |

| d (R26, R12) | −0.061 | −0.094 | 1.212 | −0.227 | 0.107 |

| d (R31, R12) | −0.193 | −0.918 | −0.592 | −0.445 | 0.254 |

| d (R32, R12) | 0.021 | −0.130 | 1.225 | 0.008 | 0.333 |

| d (R33, R12) | −0.685 | −1.225 | 1.212 | −0.033 | 0.321 |

| 0.000 | 0.816 | 0.584 | 0.502 | 0.795 | 0.462 | 0.773 | 0.767 | 0.751 | 0.737 | 0.274 | 0.787 | 0.444 |

| 0.000 | 0.394 | 0.000 | 0.027 | 0.462 | 0.027 | 0.449 | 0.436 | 0.390 | 0.345 | 0.133 | 0.452 | 0.422 |

| 0.289 | 0.448 | 0.422 | 0.107 | 0.573 | 0.107 | 0.535 | 0.516 | 0.449 | 0.345 | 0.133 | 0.549 | 0.428 |

| 0.000 | 0.021 | 0.013 | 0.013 | 0.466 | 0.133 | 0.428 | 0.422 | 0.422 | 0.422 | 0.133 | 0.442 | 0.428 |

| 0.538 | 0.538 | 0.538 | 0.249 | 0.697 | 0.000 | 0.300 | 0.289 | 0.289 | 0.289 | 0.000 | 0.309 | 0.300 |

| 0.000 | 0.043 | 0.023 | 0.023 | 0.049 | 0.000 | 0.671 | 0.671 | 0.612 | 0.595 | 0.156 | 0.671 | 0.512 |

| 0.000 | 0.036 | 0.023 | 0.036 | 0.361 | 0.013 | 0.345 | 0.000 | 0.000 | 0.000 | 0.000 | 0.036 | 0.000 |

| 0.115 | 0.171 | 0.142 | 0.190 | 0.262 | 0.048 | 0.525 | 0.492 | 0.289 | 0.289 | 0.008 | 0.359 | 0.332 |

| 0.076 | 0.221 | 0.116 | 0.223 | 0.357 | 0.107 | 0.319 | 0.281 | 0.103 | 0.327 | 0.034 | 0.503 | 0.448 |

| 0.538 | 0.792 | 0.713 | 0.531 | 0.870 | 0.409 | 0.855 | 0.822 | 0.721 | 0.701 | 0.079 | 0.327 | 0.184 |

| 0.051 | 0.083 | 0.075 | 0.075 | 0.088 | 0.000 | 0.051 | 0.051 | 0.023 | 0.023 | 0.000 | 0.862 | 0.414 |

| 0.488 | 0.500 | 0.488 | 0.488 | 0.500 | 0.488 | 0.488 | 0.488 | 0.488 | 0.488 | 0.488 | 0.524 | 0.000 |

| 0.816 | 0.000 | 0.000 | 0.289 | 0.000 | 0.538 | 0.000 | 0.000 | 0.115 | 0.076 | 0.538 | 0.051 | 0.488 |

| 0.584 | 0.000 | 0.394 | 0.448 | 0.021 | 0.538 | 0.043 | 0.036 | 0.171 | 0.221 | 0.792 | 0.083 | 0.500 |

| 0.502 | 0.027 | 0.107 | 0.422 | 0.013 | 0.538 | 0.023 | 0.023 | 0.142 | 0.116 | 0.713 | 0.075 | 0.488 |

| 0.795 | 0.462 | 0.573 | 0.466 | 0.013 | 0.249 | 0.023 | 0.036 | 0.190 | 0.223 | 0.531 | 0.075 | 0.488 |

| 0.462 | 0.027 | 0.107 | 0.133 | 0.000 | 0.697 | 0.049 | 0.361 | 0.262 | 0.357 | 0.870 | 0.088 | 0.500 |

| 0.773 | 0.449 | 0.535 | 0.428 | 0.300 | 0.671 | 0.000 | 0.013 | 0.048 | 0.107 | 0.409 | 0.000 | 0.488 |

| 0.780 | 0.142 | 0.523 | 0.435 | 0.000 | 0.666 | 0.007 | 0.345 | 0.525 | 0.319 | 0.855 | 0.051 | 0.488 |

| 0.751 | 0.390 | 0.449 | 0.422 | 0.289 | 0.612 | 0.000 | 0.289 | 0.180 | 0.270 | 0.806 | 0.051 | 0.495 |

| 0.737 | 0.345 | 0.345 | 0.422 | 0.289 | 0.595 | 0.000 | 0.289 | 0.327 | 0.103 | 0.721 | 0.023 | 0.488 |

| 0.274 | 0.133 | 0.133 | 0.133 | 0.000 | 0.156 | 0.000 | 0.008 | 0.034 | 0.079 | 0.701 | 0.023 | 0.488 |

| 0.787 | 0.452 | 0.549 | 0.442 | 0.309 | 0.671 | 0.036 | 0.359 | 0.503 | 0.327 | 0.862 | 0.000 | 0.488 |

| 0.444 | 0.422 | 0.428 | 0.428 | 0.300 | 0.512 | 0.000 | 0.332 | 0.448 | 0.184 | 0.414 | 0.000 | 0.524 |

| V-Shape Criterion with p Value of 0.15 (All Criteria) | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| R11 | R12 | R13 | R14 | R21 | R22 | R23 | R24 | R25 | R26 | R31 | R32 | R33 | |

| 0.184 | 0.379 | 0.295 | 0.244 | 0.515 | 0.173 | 0.519 | 0.470 | 0.409 | 0.405 | 0.136 | 0.527 | 0.340 | |

| 0.674 | 0.255 | 0.401 | 0.379 | 0.133 | 0.548 | 0.025 | 0.196 | 0.300 | 0.290 | 0.754 | 0.072 | 0.497 | |

| −0.490 | 0.124 | −0.105 | −0.135 | 0.382 | −0.375 | 0.494 | 0.274 | 0.108 | 0.115 | −0.618 | 0.455 | −0.157 | |

| V-shape criterion with p value of 0.25 (all criteria) | |||||||||||||

| 0.175 | 0.338 | 0.261 | 0.205 | 0.457 | 0.150 | 0.478 | 0.436 | 0.378 | 0.380 | 0.120 | 0.485 | 0.326 | |

| 0.642 | 0.238 | 0.345 | 0.372 | 0.128 | 0.537 | 0.015 | 0.174 | 0.246 | 0.199 | 0.684 | 0.043 | 0.493 | |

| −0.467 | 0.101 | −0.084 | −0.167 | 0.329 | −0.387 | 0.463 | 0.262 | 0.132 | 0.182 | −0.564 | 0.442 | −0.167 | |

| V-shape criterion with p value of 0.35 (all criteria) | |||||||||||||

| 0.149 | 0.304 | 0.236 | 0.177 | 0.404 | 0.130 | 0.447 | 0.405 | 0.348 | 0.359 | 0.102 | 0.454 | 0.313 | |

| 0.588 | 0.213 | 0.297 | 0.362 | 0.120 | 0.512 | 0.011 | 0.159 | 0.214 | 0.142 | 0.607 | 0.031 | 0.490 | |

| −0.439 | 0.091 | −0.062 | −0.185 | 0.284 | −0.381 | 0.436 | 0.246 | 0.134 | 0.218 | −0.505 | 0.423 | −0.177 | |

| V-shape criterion with p value of 0.45 (all criteria) | |||||||||||||

| 0.128 | 0.274 | 0.204 | 0.155 | 0.364 | 0.114 | 0.418 | 0.380 | 0.328 | 0.348 | 0.091 | 0.424 | 0.299 | |

| 0.516 | 0.192 | 0.263 | 0.347 | 0.115 | 0.485 | 0.008 | 0.150 | 0.187 | 0.110 | 0.554 | 0.024 | 0.483 | |

| −0.388 | 0.082 | −0.059 | −0.192 | 0.249 | −0.371 | 0.410 | 0.230 | 0.140 | 0.237 | −0.464 | 0.400 | −0.183 | |

| Gaussian criterion with S value of 0.2 (all criteria) | |||||||||||||

| 0.123 | 0.277 | 0.200 | 0.138 | 0.190 | 0.102 | 0.409 | 0.375 | 0.312 | 0.348 | 0.095 | 0.414 | 0.303 | |

| 0.478 | 0.186 | 0.215 | 0.324 | 0.271 | 0.464 | 0.001 | 0.096 | 0.167 | 0.065 | 0.518 | 0.012 | 0.471 | |

| −0.356 | 0.091 | −0.015 | −0.186 | −0.081 | −0.362 | 0.408 | 0.279 | 0.144 | 0.283 | −0.423 | 0.402 | −0.168 | |

| criteria C1, C3, C4 with Gaussian and criteria C2, C5 with V-shape (p = 0.25, S = 0.2) | |||||||||||||

| 0.130 | 0.276 | 0.208 | 0.158 | 0.366 | 0.110 | 0.430 | 0.392 | 0.332 | 0.350 | 0.109 | 0.428 | 0.317 | |

| 0.514 | 0.212 | 0.266 | 0.347 | 0.118 | 0.507 | 0.008 | 0.154 | 0.198 | 0.120 | 0.545 | 0.041 | 0.482 | |

| −0.384 | 0.064 | −0.058 | −0.190 | 0.249 | −0.396 | 0.421 | 0.238 | 0.134 | 0.231 | −0.436 | 0.387 | −0.166 | |

References

- Wang, H. Report on the Development of Cruise Industry in China (2019); Springer: Singapore, 2020. [Google Scholar] [CrossRef]

- Strömberg, P.; Steven, N.K. Characteristics, Contracts, and Actions: Evidence from Venture Capitalist Analyses. J. Financ. 2004, 59, 2177–2210. [Google Scholar]

- Tian, F.J.; Li, Z.Y. Study on Choosing of Enterprise’s Market Innovation Domain and Its Venture-eluding. Sci. Sci. Manag. S. T. 2007, 28, 68–72. (In Chinese) [Google Scholar]

- Sun, B.; Wang, F.; Xie, J.; Sun, X. Electricity Retailer Trading Portfolio Optimization Considering Risk Assessment in Chinese Electricity Market. Electr. Power Syst. Res. 2021, 190, 106833. [Google Scholar] [CrossRef]

- Zhu, B.M.; Zhang, H.; Wang, X.J. Analysis and Evaluation of Project Cost Risk Based on BP Algorithm. Syst. Eng. Procedia 2011, 1, 264–270. [Google Scholar] [CrossRef] [Green Version]

- HE, S.B.; Wang, F. Default Risk Level from Voluntary Carbon Market—A Simple but Effective Assessment Method. Int. Bus. Manag. 2015, 10, 124–128. [Google Scholar]

- Pritchard, M.P.; Howard, D.R. The Loyal Traveler: Examining a Typology of Service Patronage. J. Travel Res. 1997, 35, 2–10. [Google Scholar] [CrossRef]

- Lim, S.; Lee, B. Loyalty programs and dynamic consumer preference in online markets. Decis. Support Syst. 2015, 78, 104–112. [Google Scholar] [CrossRef]

- Cheng, K.T.G.; Kasiri, L.A.; Samsinar, M.S.; Sambasivan, M. Integration of standardization and customization: Impact on service quality, customer satisfaction, and loyalty. J. Retail. Consum. Serv. 2017, 35, 91–97. [Google Scholar] [CrossRef]

- Silvestre, A.L.; Santos, C.M.; Ramalho, C. Satisfaction and behavioural intentions of cruise passengers visiting the Azores. Tour. Econ. 2008, 14, 169–184. [Google Scholar] [CrossRef]

- Paolo, C.; Gabriel, B.J. Tourist’s Intention of Returning to a Visited Destination: Cruise Ship Passengers in Cartagena De Indias, Colombia. Tour. Mar. Environ. 2012, 8, 127–143. [Google Scholar] [CrossRef]

- Anderson, E.W.; Fornell, C.; Lehmann, D.R. Customer Satisfaction, Market Share, and Profitability: Findings from Sweden. J. Mark. 1994, 58, 53–66. [Google Scholar] [CrossRef]

- Chen, C.F.; Chen, F.S. Experience quality, perceived value, satisfaction and behavioral intentions for heritage tourists. Tour. Manag. 2010, 31, 29–35. [Google Scholar] [CrossRef]

- Teye, V.B.; Leclerc, D. Product and service delivery satisfaction among North America cruise passengers. Tour. Manag. 1998, 19, 153–160. [Google Scholar] [CrossRef]

- Han, H.; Hwang, J.; Lee, M.J. Antecedents of travellers’ repurchase behaviour for luxury cruise product. Curr. Issues Tour. 2018, 21, 821–841. [Google Scholar] [CrossRef]

- Castillo-Manzano, J.I.; López-Valpuesta, L. What does cruise passengers’ satisfaction depend on? Does size really matter? Int. J. Hosp. Manag. 2018, 75, 116–118. [Google Scholar] [CrossRef]

- Wu, H.C.; Cheng, C.C.; Ai, C.H. A study of experiential quality, experiential value, trust, corporate reputation, experiential satisfaction and behavioral intentions for cruise tourists: The case of Hong Kong. Tour. Manag. 2018, 66, 200–220. [Google Scholar] [CrossRef]

- Bayih, B.E.; Singh, A. Modeling domestic tourism: Motivations, satisfaction and tourist behavioral intentions. Heliyon 2020, 6. [Google Scholar] [CrossRef] [PubMed]

- Jones, R.V. Motivations to Cruise: An Itinerary and Cruise Experience Study. J. Hosp. Tour. Manag. 2011, 18, 30–40. [Google Scholar] [CrossRef]

- Hung, K.; Petrick, J.F. Why do you cruise? Exploring the motivations for taking cruise holidays, and the construction of a cruising motivation scale. Tour. Manag. 2011, 32, 386–393. [Google Scholar] [CrossRef]

- Petrick, J.F. The Roles of Quality, Value, and Satisfaction in Predicting Cruise Passengers’ Behavioral Intentions. J. Travel Res. 2004, 42, 397–407. [Google Scholar] [CrossRef]

- Petrick, J.F.; Li, X.R.; Park, S.Y. Cruise Passengers’ Decision-Making Processes. J. Travel Tour. Mark. 2007, 23, 1–14. [Google Scholar] [CrossRef]

- Mateus, R.; Ferreira, J.A.; Carreira, J. Multicriteria decision analysis (MCDA): Central Porto high-speed railway station. Eur. J. Oper. Res. 2008, 187, 1–18. [Google Scholar] [CrossRef]

- Amaral, T.M.; Costa, A.P.C. Improving decision-making and management of hospital resources: An application of the PROMETHEE II method in an Emergency Department. Oper. Res. Health Care 2014, 3, 1–6. [Google Scholar] [CrossRef]

- Wu, Y.; Tao, Y.; Zhang, B.; Wang, S.; Zhou, J. A decision framework of offshore wind power station site selection using a PROMETHEE method under intuitionistic fuzzy environment: A case in China. Ocean Coast. Manag. 2019, 184, 105016. [Google Scholar] [CrossRef]

- Mavi, R.K.; Goh, M.; Mavi, N.K. Supplier Selection with Shannon Entropy and Fuzzy TOPSIS in the Context of Supply Chain Risk Management. Procedia Soc. Behav. Sci. 2016, 235, 216–225. [Google Scholar] [CrossRef]

- Krishankumar, R.; Ravichandran, K.S.; Saeid, A.B. A new extension to PROMETHEE under intuitionistic fuzzy environment for solving supplier selection problem with linguistic preferences. Appl. Soft Comput. 2017, 60, 564–576. [Google Scholar]

- Mete, S.; Serin, F.; Oz, N.E.; Gul, M. A decision-support system based on Pythagorean fuzzy VIKOR for occupational risk assessment of a natural gas pipeline construction. J. Nat. Gas Sci. Eng. 2019, 71, 102979. [Google Scholar] [CrossRef]

- Pham, B.T.; Luu, C.; Dao, D.V.; Tran, P.; Nguyen, H.D.; Le, H.V.; Meding, J.V. Flood risk assessment using deep learning integrated with multi-criteria decision analysis. Knowl.-Based Syst. 2021, 219, 106899. [Google Scholar] [CrossRef]

- Luu, C.; Meding, J.V.; Mojtahedi, M. Analyzing Vietnam’s national disaster loss database for flood risk assessment using multiple linear regression-TOPSIS. Int. J. Disast. Risk. Reduct. 2019, 40, 101153. [Google Scholar] [CrossRef]

- Taylan, O.; Bafail, A.O.; Abdulaal, R.M.S.; Kabli, M.R. A Construction projects selection and risk assessment by fuzzy AHP and fuzzy TOPSIS methodologies. Appl. Soft Comput. 2014, 17, 105–116. [Google Scholar] [CrossRef]

- Chen, F.; Wang, J.J.; Deng, Y.J. Road safety risk evaluation by means of improved entropy TOPSIS–RSR. Saf. Sci. 2015, 79, 39–54. [Google Scholar] [CrossRef]

- Lamba, N.; Thareja, P. Developing the structural model based on analyzing the relationship between the barriers of green supply chain management using TOPSIS approach. Mater. Today Proc. 2021, 43, 1–8. [Google Scholar] [CrossRef]

- Mokrini, A.E.; Kafa, N.; Dafaoui, E.; Mhamedi, A.E.; Berrado, A. Evaluating outsourcing risks in the pharmaceutical supply chain: Case of a multi-criteria combined fuzzy AHP-PROMETHEE approach. IFAC-PapersOnLine 2016, 49, 114–119. [Google Scholar] [CrossRef]

- Sennaroglu, B.; Celebi, G.V. A military airport location selection by AHP integrated PROMETHEE and VIKOR methods. Transp. Res. Part D Transp. Environ. 2018, 59, 160–173. [Google Scholar] [CrossRef]

- Polat, G.; Damci, A.; Gurgun, A.P.; Demirli, I. Urban Renewal Project Selection Using the Integration of AHP and PROMETHEE Approaches. Procedia Eng. 2016, 164, 339–346. [Google Scholar] [CrossRef]

- Akram, M.; Alcantud, J.C.R. An m-Polar Fuzzy PROMETHEE Approach for AHP-Assisted Group Decision-Making. Math. Comput. Appl. 2020, 25, 26. [Google Scholar] [CrossRef]

- Chen, S.M. A new method for tool steel materials selection under fuzzy environment. Fuzzy Set. Syst. 1997, 92, 265–274. [Google Scholar] [CrossRef]

- Celik, E.; Gul, M.; Aydin, N.; Gumus, A.T.; Guneri, A.F. A comprehensive review of multi criteria decision making approaches based on interval type-2 fuzzy sets. Knowl.-Based Syst. 2015, 85, 329–341. [Google Scholar] [CrossRef]

- Atanassov, K.T. More on intuitionistic fuzzy sets. Fuzzy Set. Syst. 1989, 33, 37–45. [Google Scholar] [CrossRef]

- Chen, T.Y. A comparative analysis of score functions for multiple criteria decision making in intuitionistic fuzzy setting. Inform. Sci. 2011, 181, 3652–3676. [Google Scholar] [CrossRef]

- Chen, T.Y. Multiple criteria decision analysis using a likelihood-based outranking method based on interval-valued intuitionistic fuzzy sets. Inform. Sci. 2014, 286, 188–208. [Google Scholar] [CrossRef]

- Wood, D.A. Supplier selection for development of petroleum industry facilities, applying multi-criteria decision making techniques including fuzzy and intuitionistic fuzzy TOPSIS with flexible entropy weighting. J. Nat. Gas. Sci. Eng. 2016, 28, 594–612. [Google Scholar] [CrossRef]

- Cavallaro, F.; Zavadskas, E.K.; Streimikiene, D.; Mardani, A. Assessment of concentrated solar power (CSP) technologies based on a modified intuitionistic fuzzy topsis and trigonometric entropy weights. Technol. Forecast. Soc. 2019, 140, 258–270. [Google Scholar] [CrossRef]

- Wan, C.; Yan, X.; Zhang, D.; Qu, Z.; Yang, Z. An advanced fuzzy Bayesian-based FMEA approach for assessing maritime supply chain risks. Transp. Res. Part E Logist. Transp. Rev. 2019, 125, 222–240. [Google Scholar] [CrossRef]

- Gao, J.; Guo, F.; Ma, Z.; Huang, X. Multi-criteria decision-making framework for large-scale rooftop photovoltaic project site selection based on intuitionistic fuzzy sets. Appl. Softw. Comput. 2021, 102, 107098. [Google Scholar] [CrossRef]

- Brans, J.P.; Vincke, P.; Mareschal, B. How to select and how to rank projects: The Promethee method. Eur. J. Oper. Res. 1986, 24, 228–238. [Google Scholar] [CrossRef]

- Mohamadabadi, H.S.; Tichkowsky, G.; Kumar, A. Development of a multi-criteria assessment model for ranking of renewable and non-renewable transportation fuel vehicles. Energy 2009, 34, 112–125. [Google Scholar] [CrossRef]

- Albadvi, A.; Chaharsooghi, S.K.; Esfahanipour, A. Decision making in stock trading: An application of PROMETHEE. Eur. J. Oper. Res. 2007, 177, 673–683. [Google Scholar] [CrossRef]

- Xie, X. Supply Aging of Inland Cruise ships and its solution. China Ship Insp. 2017, 19, 45–48. (In Chinese) [Google Scholar]

| RI Value Table | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | |

| 0 | 0 | 0.58 | 0.90 | 1.12 | 1.24 | 1.32 | 1.41 | 1.45 | 1.49 | 1.51 | |

| Category | Risk Factor | Description |

|---|---|---|

| Tourist demand risk R1 | Risk of unclear level of tourist market structure R11 | Unclear hierarchical structure is not conducive to the study of tourist spending capacity and situation, and product design is difficult to accurately match customer needs. |

| Risk of unclear motivation of tourists R12 | Motivation is the internal driving force that drives tourists to carry out tourism activities, which will affect tourist consumption behavior and purchase decisions. Unknown motivation can’t accurately design and sell products. | |

| Risk of unclear consumption characteristics of tourists R13 | Unclear consumption characteristics can’t accurately locate tourist consumption preferences, which is not conducive to further optimize market positioning and meet customer needs. | |

| Risk of fluctuation of tourist demand R14 | The demand of tourists is vulnerable to the influence of the group, the surrounding environment and culture, so that the perception of cruise products is easy to change. | |

| Market supply risk R2 | Homogenization risk of cruise products R21 | Homogenization leads to no comparative advantage and no attraction to consumers, and there is vicious low-price competition, which can hinder the long-term development of market. |

| Risk of improper product marketing R22 | The commonly used charter and cabin-cutting sales mode adopts low-price competition to aggravate the market supply competition. | |

| Risk of backwardness of support facilities R23 | The lack of matching of port and terminal facilities with cruise ships affects tourism experience and long-term development, and there are security risks. | |

| Risk of simplification of tourism route design R24 | The singleness of the route design and the lack of connection with the coastal resources lead to the inability to highlight the characteristics of inland river tourism and face the pressure of sea cruise tourism. | |

| Risk of shortage of cruise operation and management personnel R25 | The lack of cruise operation and management personnel affects the overall service level of cruise ships, resulting in poor tourist experience. | |

| Risk of inadequate management of tourism market R26 | The lack of coordination of information among coastal management agencies and low administrative efficiency lead to non-standard management, man-made tourism safety accidents and not conducive to the integration of coastal resources, ultimately affecting tourist sense of experience and safety. | |

| External market risk R3 | Risk of economic environment fluctuation R31 | The price of cruise tourism, which belongs to high-end tourism products, is relatively high. Thus changes in the economic environment, such as economic crisis and exchange rate changes, having a great impact on the tourism market. |

| Risk of sudden security crisis R32 | The occurrence of infectious or mass diseases of unknown causes will seriously affect the physical and mental health of tourists, taking a long time for the market to recover. | |

| Risk of natural disaster risk R33 | Mountain torrents and storms directly affect the normal operation of cruise ships, posing a threat to the safety of tourists and having a short and serious impact on the market. |

| Evaluation Criteria | Description |

|---|---|

| Impact on the long-term development of the market C1 | Indicates the long-term and far-reaching impact on the development of the market when there is a certain risk. |

| Impact on the consistency of supply and demand in the market C2 | Indicates the extent to which the supply of products meets the needs of tourists when there is a certain risk. |

| Impact on tourist safety C3 | Indicates the severity of the impact on tourist safety and psychological repercussions when there is a certain risk. |

| Impact on tourist decision-making C4 | Indicates the degree of influence on tourist decision to choose a cruise when there is a certain risk. |

| Risk controllable degree C5 | Indicates the difficulty of taking control or mitigation measures to reduce a risk when it occurs. |

| Influence Level | Linguistic Variables | Intuitionistic Fuzzy Values | |

|---|---|---|---|

| 1 | Very slight | Easy to control (manage) | (0.10, 0.85) |

| 2 | Slight | Relatively easy to control (manage) | (0.30, 0.60) |

| 3 | Medium | Relatively difficult to control (manage) | (0.50, 0.40) |

| 4 | Severe | Difficult to control (manage) | (0.75, 0.15) |

| 5 | Dangerous | Force majeure | (0.85, 0.10) |

| Evaluation Criterion | Weights |

|---|---|

| Impact on the long-term development of the market C1 | 0.329 |

| Impact on tourist safety C3 | 0.289 |

| Impact on the consistency of supply and demand in the market C2 | 0.159 |

| Risk controllable degree C5 | 0.133 |

| Impact on tourist decision-making C4 | 0.090 |

| Index | C1 | C2 | C3 | C4 | C5 |

|---|---|---|---|---|---|

| R11 | 2.3654 | 2.6496 | 1.1372 | 2.6050 | 1.7123 |

| R12 | 2.6655 | 2.6988 | 1.4742 | 2.6988 | 2.3654 |

| R13 | 2.6050 | 2.6863 | 1.2209 | 2.6496 | 2.3654 |

| R14 | 2.6863 | 2.6863 | 0.8818 | 2.6496 | 1.9809 |

| R21 | 2.7063 | 2.6655 | 1.7123 | 2.6988 | 2.6655 |

| R22 | 2.6863 | 1.9809 | 0.8818 | 2.1909 | 2.3654 |

| R23 | 2.6863 | 2.6496 | 2.6863 | 2.6655 | 2.6863 |

| R24 | 2.6763 | 2.6496 | 1.4742 | 2.6863 | 2.6050 |

| R25 | 2.6496 | 2.6050 | 1.9809 | 2.3654 | 2.5556 |

| R26 | 2.6050 | 2.6050 | 2.6863 | 2.4721 | 2.4721 |

| R31 | 2.4721 | 1.7806 | 0.8818 | 2.2542 | 2.6199 |

| R32 | 2.6863 | 2.5689 | 2.6988 | 2.7063 | 2.6988 |

| R33 | 1.9809 | 1.4742 | 2.6863 | 2.6655 | 2.6863 |

| Index | C1 | C2 | C3 | C4 | C5 |

|---|---|---|---|---|---|

| d (R11, R12) | −0.300 | −0.049 | −0.337 | −0.094 | −0.653 |

| d (R11, R13) | −0.240 | −0.037 | −0.084 | −0.045 | −0.653 |

| d (R11, R14) | −0.321 | −0.037 | 0.255 | −0.045 | −0.269 |

| d (R11, R21) | −0.341 | −0.016 | −0.575 | −0.094 | −0.953 |

| d (R11, R22) | −0.321 | 0.669 | 0.255 | 0.414 | −0.653 |

| d (R11, R23) | −0.321 | 0.000 | −1.549 | −0.061 | −0.974 |

| d (R11, R24) | −0.311 | 0.000 | −0.337 | −0.081 | −0.893 |

| d (R11, R25) | −0.284 | 0.045 | −0.844 | 0.240 | −0.843 |

| d (R11, R26) | −0.240 | 0.045 | −1.549 | 0.133 | −0.760 |

| d (R11, R31) | −0.107 | 0.869 | 0.255 | 0.351 | −0.908 |

| d (R11, R32) | −0.321 | 0.081 | −1.562 | −0.101 | −0.987 |

| d (R11, R33) | 0.384 | 1.175 | −1.549 | −0.061 | −0.974 |

| Index | Ranking | |||

|---|---|---|---|---|

| R11 | 0.175 | 0.642 | −0.467 | 12 |

| R12 | 0.338 | 0.238 | 0.101 | 7 |

| R13 | 0.261 | 0.345 | −0.084 | 8 |

| R14 | 0.205 | 0.372 | −0.167 | 9 |

| R21 | 0.457 | 0.128 | 0.329 | 3 |

| R22 | 0.150 | 0.537 | −0.387 | 11 |

| R23 | 0.478 | 0.015 | 0.463 | 1 |

| R24 | 0.436 | 0.174 | 0.262 | 4 |

| R25 | 0.378 | 0.246 | 0.132 | 6 |

| R26 | 0.380 | 0.199 | 0.182 | 5 |

| R31 | 0.120 | 0.684 | −0.564 | 13 |

| R32 | 0.485 | 0.043 | 0.442 | 2 |

| R33 | 0.326 | 0.493 | −0.167 | 9 |

| Index | ||||

|---|---|---|---|---|

| R11 | 12 | 12 | 12 | 12 |

| R12 | 5 | 7 | 7 | 7 |

| R13 | 8 | 8 | 8 | 8 |

| R14 | 9 | 9 | 10 | 10 |

| R21 | 3 | 3 | 3 | 3 |

| R22 | 11 | 11 | 11 | 11 |

| R23 | 1 | 1 | 1 | 1 |

| R24 | 4 | 4 | 4 | 5 |

| R25 | 7 | 6 | 6 | 6 |

| R26 | 6 | 5 | 5 | 4 |

| R31 | 13 | 13 | 13 | 13 |

| R32 | 2 | 2 | 2 | 2 |

| R33 | 10 | 9 | 9 | 9 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhu, J.; Wang, H.; Xu, B. Using Fuzzy AHP-PROMETHEE for Market Risk Assessment of New-Build River Cruises on the Yangtze River. Sustainability 2021, 13, 12932. https://doi.org/10.3390/su132212932

Zhu J, Wang H, Xu B. Using Fuzzy AHP-PROMETHEE for Market Risk Assessment of New-Build River Cruises on the Yangtze River. Sustainability. 2021; 13(22):12932. https://doi.org/10.3390/su132212932

Chicago/Turabian StyleZhu, Jing, Haiyan Wang, and Biwen Xu. 2021. "Using Fuzzy AHP-PROMETHEE for Market Risk Assessment of New-Build River Cruises on the Yangtze River" Sustainability 13, no. 22: 12932. https://doi.org/10.3390/su132212932

APA StyleZhu, J., Wang, H., & Xu, B. (2021). Using Fuzzy AHP-PROMETHEE for Market Risk Assessment of New-Build River Cruises on the Yangtze River. Sustainability, 13(22), 12932. https://doi.org/10.3390/su132212932