Abstract

Emerging transportation infrastructure (e.g., HSR) is considered to be an important influencing factor of executive compensation. Moreover, information asymmetry is a contextual factor that cannot be ignored in the above relationship. Based on signal theory, this study used the group data from 2371 Chinese-listed companies between 1999 and 2018 as the research object. This study regarded the operation of HSR as an exogenous shock, using the time-varying difference-in-difference (DID) method to test whether discrepancies exist in the influence of HSR on executive compensation in different contexts. The results show that the operation of HSR positively affects the executive compensation of enterprises in cities along the line. In addition, compared with state-owned enterprises, the impact of a high-speed railway on executive compensation is particularly significant in private enterprises. Furthermore, compared with well-known enterprises, the impact of high-speed railways on executive compensation is particularly significant in enterprises with low visibility. This study reduced the endogeneity problem and made the results more reliable by treating HSR operation as an exogenous variable. The research conclusions are expected to provide a theoretical basis and management implications for companies in cities along high-speed railways to improve their salary system.

1. Introduction

In recent years, executive compensation has become one of the most controversial issues in corporate governance and has attracted extensive attention from scholars [1]. At present, China’s labor market has changed from an equal central planning system to a complex market system, and market characteristics will have an impact on labor compensation that cannot be ignored [2]. For example, due to the high mobility of senior executives, the market cluster effect of urban agglomeration significantly influences the standard and structure of executive salaries [3]. To absorb the benefits of network spillovers and large-scale markets in urban agglomerations, enterprises are often willing to pay a premium, which leads to a positive correlation between urban agglomerations and executive compensation [4]. Therefore, it is worth discussing the impact that transportation infrastructure will bring to executive compensation in the context of the urban agglomeration phenomenon.

As an emerging type of transportation infrastructure, high-speed railways are an important strategic initiative to connect marginal cities, promote information dissemination, drive the regional economy, and improve industrial agglomeration [5]. In terms of geographical connections, high-speed railways ameliorate transportation facilities and improve accessibility between cities, especially the long-distance connections of marginal cities [6]. Regarding information transmission, high-speed railways enhance communication closeness among economic entities, resulting in a knowledge spillover effect [7]. With respect to the economy, high-speed railways can bring more entrepreneurial opportunities for cities, as well as attracting abundant talent, and can indirectly stimulate economic growth. In the field of industrial agglomeration, high-speed railways transfer labor and production factors from small cities to large cities, thus enhancing the degree of specialization and the industrial agglomeration effect [8].

Most of the existing literature on the influencing mechanism of high-speed railways is focused on the perspectives of the economy, trade, and population mobility. Generally, scholars have two different views. On the one hand, scholars believe that the impact of high-speed railways on the urban economy is positive. HSR can promote the economic growth of cities along the line by increasing the mobility of the labor force, trade contacts, and the speed of information dissemination [9,10]. For example, Cascetta et al. [11] showed that HSR in Italy contributed to an extra growth of per capita GDP of +2.6% in 10 years. On the other hand, scholars have suggested that the impact of HSR on the urban economy is negative. High-speed railways not only increase the cost of resource transportation but also make a large number of resources flow into the core cities, which may cause the unbalanced development of the regional economy and form a “metropolitan effect” [12,13]. However, the current research is less involved with the impact of HSR on the executive compensation of listed companies in cities along the line. As an important incentive factor to improve the work enthusiasm of senior executives, compensation determines whether enterprises can attract and retain talent to achieve sustainable development [4]. Therefore, the relationship between high-speed railway operation and executive compensation is a significant research topic that affects the survival and development of enterprises.

In addition, ownership and management rights are separated in modern enterprises. Shareholders must entrust managers to operate to maximize the value of companies. Due to people’s self-interest, executives may sometimes damage the benefits of shareholders for their own profits, resulting in contradictions with shareholders. The contradiction of this principal–agent model is rooted in the information asymmetry between shareholders and managers. Information asymmetry reflects the size of the gap between the information held by both sides of the relationship. This phenomenon is particularly serious in lower-profile private firms and enterprises because these enterprises are usually not required to disclose vast quantities of important information [14]. A higher degree of information asymmetry indicates that there exists an obvious disparity in the amount of information held by both players in the relationship, which means that the enterprise’s information management system is not perfect. A lower degree of information asymmetry indicates that both sides of the relationship have the same amount of information, which means that the information transparency of the enterprise is higher. Thus, due to the different degrees of information asymmetry, it is worth examining whether the effect of high-speed railways on executive compensation shows diverse results among various types of enterprises.

Based on the above analysis, this study took the group data of 2371 listed Chinese companies between 1999 and 2018 as samples to explore how high-speed railway operation affects the executive compensation of listed enterprises in cities along the line. In order to verify the mechanism of information asymmetry between the operation of high-speed railways and executive compensation, this study chose two contingent factors: firm nature (private vs. state-owned) and firm popularity (well-known vs. low visibility). This paper makes the following two contributions. First, using a large-scale panel dataset, this study clarified the effect of high-speed railways on the executive compensation in cities along the line. Most of the existing literature on the effect of HSR is focused on the perspective of the economy, trade, and population mobility, and there are two different views. Some scholars argue that high-speed railways will promote the economic growth of cities along the line [9,10]. Other scholars suggest that high-speed railways lead to the unbalanced development of regional economies [12,13]. However, few studies have considered the impact of high-speed railways on the executive compensation of listed companies in cities along the line. This paper makes up for the lack of research on the influencing mechanism of high-speed railways by confirming the promoting effect of high-speed railways on executive compensation. Second, this study identified the contingent effect of information asymmetry on the impact of high-speed railways on executive compensation. As an objective existence, information asymmetry reflects various amounts of information held by the Board of Directors and managers, and its degree influences the effect of high-speed railways on executive compensation. This paper makes a theoretical contribution to the research of contingent factors between high-speed railways and executive compensation by comparing the different impacts of executive compensation affected by high-speed railway operation in various types of enterprises with different degrees of information asymmetry. The scientific novelty of this study mainly includes two sides. First, this study regarded the operation of HSR as an exogenous shock to study its relationship with executive compensation, which has mitigated the endogeneity problem. Second, this paper studied the HSR effect from the information asymmetry perspective, which is different from the existing studies.

2. Theory and Hypotheses

As an emerging railway infrastructure, high-speed railways have become an important means to affect talent flow and employment distribution, and its influencing mechanism has also been widely studied by many scholars [5,15,16]. The impact of high-speed railways on employment lead to changes in employees’ compensation, and executives are the group that are most obviously affected. The positive impact of high-speed railways on executive compensation can be analyzed from the following aspects. From a spatial perspective, high-speed railways shorten the geographical distance between cities, enhance the economic ties between regions, and improve the salary level of senior executives by changing the industrial scale and economic effect in space [17]. In terms of employment, the operation of high-speed railways increases the convenience of transportation, which expands the employment scope and provides diversified employment opportunities for senior executives so that they can choose jobs with higher salaries [18,19]. In terms of information and resources, the opening of high-speed railways provides a platform for knowledge sharing and resource flow and helps executives obtain more information about the business performance of enterprises and their own value. In this case, if the Board of Directors finds that executive pay is lower than normal, they will increase the salary standard to regulate the salary system [20,21]. However, some scholars have suggested that although high-speed railways drive the development of large cities along the line, they may also weaken the development of small cities in remote areas, resulting in unbalanced regional development and a “metropolitan effect”, which has a negative impact on the economic model and executive compensation of remote cities [22].

The problem of unreasonable executive compensation is often caused by information asymmetry between the Board of Directors and executives. The Board of Directors is the owner of the enterprise and therefore has the information advantage, while the executives are only employees of the enterprise and are thus at an informational disadvantage [23]. Generally, executives know little about business performance and their own value, while the Board of Directors and shareholders may release false information and formulate an unreasonable salary system, so that the salary of senior managers is not equal to the actual labor remuneration. In fact, due to the lack of real and effective information, the Board of Directors may exploit the surplus value of the labor force to save costs in the process of production and operation. Therefore, dishonesty and unfairness—caused by information asymmetry—often occur in enterprises [24].

To solve the problem of information asymmetry between the Board of Directors and senior executives, this study sought solutions according to the content of signal theory. This theory proposes that when one party is at an information disadvantage in the relationship, they can collect the information of other subjects in situations similar to their own through external channels and can make decisions through the evaluation of this information [25]. This study assumed that executives do not have accurate information about the business performance of enterprises and their own value. However, the operation of high-speed railways brings about a knowledge spillover effect and reduces the degree of information asymmetry in enterprises [26]. At this time, executives judge whether their salary is reasonable by referring to the salary of others, and the Board of Directors discloses more key information as the basis for formulating the salary system. If the remuneration of senior executives is low, the Board of Directors raises the remuneration standard to avoid the risk of brain drain. In contrast, if the remuneration of senior executives is high, the Board of Directors also reduces the remuneration standard to control costs.

In accordance with signal theory, this study mainly discusses the promotional effect of HSR on executive compensation because it alleviates the degree of information asymmetry. The operation of high-speed railways enhances accessibility and mobility between cities, helps to improve the social network density of enterprises, and thus increases the spatial interaction frequency among enterprises [27]. From the perspective of the Board of Directors and shareholders, the opening of high-speed rails has facilitated their communication with enterprises in cities along the line and has helped them obtain more information about the actual value of executives from other enterprises [7,9,28]. By analyzing and evaluating this information, the Board of Directors can realize that they have underestimated the economic benefits brought to the enterprise by senior executives, so they should pay higher salaries to them to avoid the risk of brain drain. From the perspective of executives, the accessibility of high-speed railways provides them with more employment options [19]. When they find that they are capable of higher paid positions, they will choose those positions, even if they need to transfer to other cities along the high-speed railway, because the opening of the high-speed railway can reduce the time and economic costs of reaching those cities. Based on the above analysis, this study came to the first hypothesis.

Hypothesis 1 (H1).

Stronger high-speed railway operation leads to increased executive compensation in firms in cities along the railway.

In private enterprises, the Board of Directors and shareholders are owners and enjoy the privilege of control. Senior executives are managers employed by the owners to realize the operating profit and possess only the rights of management. This kind of hierarchical relationship leads to the Board of Directors and shareholders trying to lower the executives’ salaries below the normal level to reduce operating costs [29]. In this case, on the one hand, high-speed railway operation provides more opportunities for the Board of Directors and shareholders to interact and communicate with other economic entities, which helps them improve the management system of enterprises according to the obtained information about the value of managers. This results in the Board of Directors and shareholders having a more reasonable and objective evaluation of the actual ability of executives so they can adjust executive compensation from a lower level to a higher level. On the other hand, high-speed railway operation brings greater risk of brain drain to enterprises due to the promotion of trade, personnel flow, and knowledge spillover between cities [7,30]. Therefore, when managers find better employment opportunities in cities along the railway, they tend to move to those cities. Consequently, the shareholders paying managers a salary equivalent to their labor can ensure that the company will not face the dilemma of job vacancy and will continue to operate normally.

In contrast, due to the supervision of the country and government, the information transparency of state-owned enterprises is relatively high, and the management systems are relatively normal [21]. In these companies, because the evaluation of executives’ actual abilities is usually objective, their salaries are basically at the normal level. Therefore, the executive compensation of state-owned enterprises is not significantly promoted by high-speed railway operation. Based on the above analysis, this study proposed our second hypothesis.

Hypothesis 2 (H2).

With high-speed railway operation, executive compensation in private firms grows more significantly than that in state firms.

For companies with low social visibility, media exposure and public attention are generally low [31]. These enterprises do not need to face too much pressure from public opinion and legitimacy perception, so their information transmission mechanisms are incomplete and lack standardization. In these enterprises, the Board of Directors does not know enough about managers; hence, it is difficult to establish a reasonable compensation evaluation system. High-speed railway operation improves the social awareness and attention of these enterprises. To obtain a more positive evaluation, enterprises choose to actively disclose more information [32], which provides executives more opportunities to gather information about enterprise value and their actual price value, thus obtaining higher labor remuneration. In this sense, HSR helps to increase the Board of Directors’ understanding of their executives, improve the business environment of enterprises, and standardize the compensation evaluation system. In addition, high-speed railway operation helps enterprises to establish a social network with high embeddedness and to gather more material, financial, and information resources. Through the efficient integration and rational utilization of these resources, enterprises can establish a more competitive product value system to improve business performance and the salary treatment of executives.

In contrast, in enterprises with high visibility, the Board of Directors and shareholders are usually under the self-restraint governance model [33], which takes the legitimacy, recognition, and support of the enterprises to a higher level, and also keeps the salary level of senior executives within a reasonable range. Therefore, the promotion of high-speed railway openings is not particularly significant for senior executives’ salaries in well-known enterprises. Based on the above analysis, this study proposed our third hypothesis.

Hypothesis 3 (H3).

With high-speed railway operation, executive compensation in unknown firms grows more significantly than that in high-profile firms.

3. Methods

3.1. Sample

Our sample included all Chinese firms listed on the Shenzhen stock exchange and Shanghai stock exchange between 1999 and 2018. This study chose 1999 as the initial study year because the amount of executive compensation disclosure has increased since that year. In addition, China’s high-speed rail operation mainly began in 2008. As noted in the Introduction section, the DID model is mainly adopted in this paper. Therefore, data from the 10 years around 2008 were selected. Two data sources were used: the China Stock Market and Accounting Research Database (CSMAR) and the Train Schedule Book. As one of the largest databases, CSMAR provides the primary source of financial data and basic information about Chinese listed firms. Information about high-speed railways, such as departure time, arrival time, departure station, and arrival station, was mainly taken from the Train Schedule Book. After merging these two data sources, removing observations without key variables, and deleting the extreme values, this study finally obtained data for 2371 firms with 27,333 firm-year-level observations distributed across 330 prefecture-level cities.

3.2. Measures

Dependent variable (Compensation). The main target of this study was to investigate the relationship between HSR operation and executive compensation. Therefore, the dependent variable was executive compensation. Due to the huge difference in salaries between different industries, this study chose to use the median salary of every industry as the standard and then used the true value of the firm minus the median salary of the same industry to reduce industry interference [34]. To adjust for skewness, the logarithm of firm compensation was adopted. Due to the lag effect of high-speed railways, the firm executive compensation advanced one period.

Independent variable (HSR). The opening of high-speed railways is a top-down policy and is gradually implemented in prefecture-level cities. According to prior research, the time-varying difference-difference (DID) method is a preferable way to test the relationship between HSR operation and executive compensation. Then, the sample was divided into two groups. If the city had opened a high-speed railway in the observation period, treat = 1; otherwise, treat = 0. In addition, if the city opened a high-speed railway in the observation year or before, time = 1; otherwise, time = 0. Then, this study defined the HSR = treat × time.

Moderator variables. Based on the theoretical analysis, this study chose two conditional variables to verify the mechanism of this study: firm nature (State) and firm popularity (Index). Whether the firm is a state-owned firm was used to test the firm nature, yes = 1 and no = 0. Firm popularity was measured by the Baidu search index times [35].

Control variables. According to the research design, this study tried to introduce some control variables to guarantee that the explanation between the theoretical and empirical study was matched and unique: For ROA (the ratio of net profit to total assets), Jääskeläinen et al. [36] pointed out that the profit of firms is significant to the firm’s compensation structure. For Lev (the ratio of total debts to total assets), Ortiz-Molina [37] examined how CEO compensation is related to firms’ capital structures and found that CEO pay–performance sensitivity decreases in straight-debt leverage but increases in firms with convertible debt. For diversity (diversification of firm business), more diversified firms tend to use objective rather than subjective performance criteria for corporate managers, and manager bonuses are greater in more diversified firms [38]. For duality (whether the CEO and chairman are concurrent), CEO duality may further exacerbate a CEOs’ motivation of self-interest to engage in mergers and acquisitions to increase their compensation [39]. Based on previous research [40], this study also controlled for age (the observation year minus the establishment year); Lee and Chen [41] pointed out that older firms have better systems, so firm age is negatively related to compensation. For size (the logarithm of total assets), the extant literature suggests that no matter whether firm size is measured as assets or as sales revenue, the evidence is clear, showing that bigger firms pay more [42].

3.3. Method

Because the opening of high-speed railways is a top-down policy, when facing the policy effect, the DID method is a preferable regression method that has been used by previous scholars [35]. In the main equation, this study mainly tested the relationship between HSR operation and executive compensation. The equation is as follows:

In Equation (1), represents executive compensation; represents the HSR operation; ,,,, and are control variables; and are moderator variables; and represent year- and city-fixed effects, respectively; is the error term; ,, and represent firm, city, and time, respectively; is the main coefficient on which this study focuses.

In addition, to verify the mechanism between HSR operation and executive compensation, two conditional variables were added into the model. The equation is as follows:

In Equation (2), represents all control variables in Equation (1); and represent the interaction terms of HSR with firm nature and firm popularity, respectively; and are the key coefficients on which this study needs to focus. The definitions of the other variables are the same as in Equation (1).

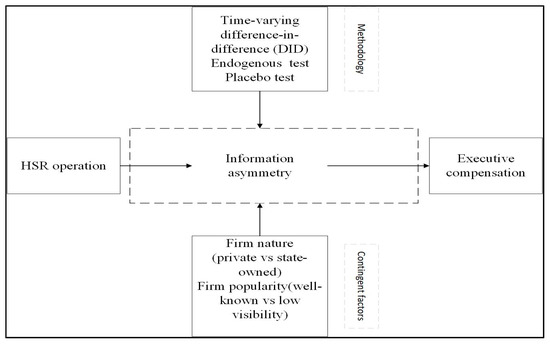

In order to clarify our research methodology and contents, the following flowchart in Figure 1 shows the points.

Figure 1.

The research analysis framework.

4. Results

4.1. Descriptive Analysis

Table 1 shows the descriptive analysis results of all variables and all samples. From the table, after dimensional processing, the results show that the mean value of compensation is 0.05, and the minimum and maximum values are −0.13 and 5.63, respectively, which proves that there are huge differences in the executive compensation of different firms. Some firms’ compensation is higher than the median value of the industry, while other firms’ compensation is lower. The mean value of HSR operation is 0.56. Regarding other variables, the results show that the mean, minimum, and maximum values are at reasonable levels, which proves that there are no extreme values or outliers.

Table 1.

Descriptive analysis.

Table 2 shows the results of the pairwise correlation test among variables. From the table, the results show that the correlation coefficients between executive compensation and other variables are lower than 0.5, which illustrates that there is no high correlation among them. In addition, to judge whether there is a multicollinearity problem among variables, the variance inflation factor (VIF) test was adopted in this study. The VIF results show that the maximum value of the VIF is 1.17, and the mean value of VIF is 1.08, which is lower than the threshold value of 10 [43,44]. Therefore, the choice of variables is suitable.

Table 2.

Pairwise correlation results.

4.2. Parallel Trend Test

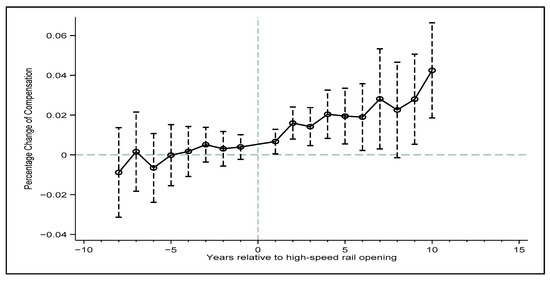

Because HSR operation is a top-down policy, DID is a preferable method to test the relationship when facing the policy effect. Before using the DID method, the sample must satisfy a prerequisite, the parallel trend. The meaning of a parallel trend is that before the policy, there is no relationship between the dependent and independent variables. Figure 2 shows the results of the parallel trend test.

Figure 2.

Parallel trend test.

Figure 2 shows two important results. First, there is no trend between HSR operation and executive compensation before HSR operation, with the coefficient of HSR fluctuating around zero. Second, the HSR operation has a positive relationship after HSR operation. Therefore, this study can conclude that the sample fits the parallel trend.

4.3. Regression Results

Table 3 shows the results of HSR operation on executive compensation. Model 1 includes all variables and all samples. The results illustrate that there is a significantly prominent effect between HSR operation and executive compensation (coefficient = 0.008, p < 0.1), which means that the operation of high-speed railways has increased executive compensation. From the control variables, there is a positive relationship between ROA and compensation (coefficient = 0.071, p < 0.01), which means that executive compensation is positively related with firm ROA. The relationship between Lev and compensation is negative (coefficient = −0.025, p < 0.05), which means that firm debt is negative with executive compensation. For the sake of brevity, not all control variables are described specifically.

Table 3.

The DID results of HSR operation on executive compensation.

To verify the mechanism between HSR operation and executive compensation, two conditional variables were chosen to test the relationship. Model 2 and Model 3 tested the differences between state- and non-state-owned firms, and the results show that in the case of non-state-owned firms, HSR operation has a more positive influence on executive compensation than in the case of state-owned firms.

Model 4 tests the moderating effect of firm popularity, and the results show that the coefficient of the interaction term between HSR operation and firm popularity is significantly negative (coefficient = −0.004, p < 0.1). That is, in the case of low firm popularity, HSR operation has a more significant effect on executive compensation than in the case of high firm popularity.

4.4. Endogenous Test

According to previous research, there are many factors that may influence firm executive compensation. Therefore, to relieve the bias that may be caused by missing variables and other factors, instrumental variables were adopted to solve endogeneity problems. In the transport infrastructure field, the instrumental variables were mainly from the following categories. First, geographic information, such as the city slope, was collected. Second, climate information, such as the possible occurrence of debris flows, was collected. Third, historical information about the train line, such as whether there was a train line in the past, was collected [45,46]. This study tried to use the year gap between the HSR operation time and the first train line time as the instrumental variable. The results are shown in Table 4, proving that the relationship between HSR operation and executive compensation is stable (coefficient = 0.145, p < 0.01).

Table 4.

Endogenous test.

4.5. Placebo Test

The placebo test is a kind of robustness test. Its main principle is to delay or advance the time that the policy effect occurs and then construct a false policy time. If the false policy time has the same effect on the observation phenomenon, the true policy effect is not reliable. This study proposed HSR operation for three, four, and five years, and the results are shown in Table 5. The results show that there is no relationship between false policy and executive compensation, which can prove again that the relationship between HSR operation and executive compensation is stable.

Table 5.

Placebo test.

5. Discussion

5.1. Main Findings and Comparison with Other Studies

Scholars have proven the “metropolitan effect” of HSRs as an emerging type of transportation infrastructure [13]. It is worth discussing whether high-speed railway operation has an effect on compensation, as the most attractive factor in a city. Therefore, this study regarded the operation of HSRs as an exogenous shock, using the time-varying DID method to verify the relationship between HSR operation and executive compensation based on information asymmetry theory. In addition, in order to test whether the mechanism is reasonable, this study chose two contingent factors to test the relationship between HSR and executive compensation. Finally, this study arrived at the following three conclusions.

First, HSR operation has a significantly positive influence on executive compensation. Second, the positive relationship between HSRs and executive compensation is stronger in private firms. Third, the positive relationship between HSR and executive compensation is stronger in low-visibility firms. Previous studies have studied the effect of HSR operation on environmental pollution [46] and corporate social responsibility [47] based on the social pressure perspective. Several studies, for example, that of Jin et al. [48], from the information asymmetry perspective, have studied the HSR effect on firms’ cross-region merger and acquisitions and obtained the conclusion that HSRs can reduce the degree of distance-induced information asymmetry between bidders and targets by reducing travel time and cost. The research results provide support for the viewpoint of the present study that the opening of high-speed railways reduces information asymmetry.

5.2. Explanations of Findings and Managerial Implications

First, as this study found herein, the relationship between HSR and executive compensation shows that HSR operation has a significant role in promoting executive compensation. This indicates that the opening of HSRs can increase information access channels for the Board of Directors and shareholders so that they can more accurately understand the actual ability of senior executives and pay them higher salaries to avoid job vacancies. In addition, high-speed railways can also provide more employment opportunities for executives and enable them to find jobs with higher compensation in other cities along the line, which is supported by Willigers [49]. Therefore, after the opening of HSR, the Board of Directors and shareholders of enterprises in cities along the railway should take some measures to standardize the salary system. On the one hand, the Board of Directors can make use of the accessibility of high-speed railways to strengthen the close relationships with other economic entities, broaden the business scope of enterprises, and learn from new innovation models to improve the business performance of enterprises and then improve the overall level of executive compensation [50]. On the other hand, with the help of convenient information dissemination channels, the Board of Directors can learn more information related to the actual ability of executives, so it can understand the contribution of executives correctly and improve the remuneration of executives within a certain range.

Second, this study concluded that compared with state-owned enterprises, the promoting effect of high-speed railways on executive compensation is more significant in private enterprises. This conclusion is consistent with the study of Dai and Cheng [51], who showed that state-owned firms suffer less information asymmetry than non-SOEs. This indicates that due to the different degrees of information asymmetry between state-owned and private enterprises, the impact of high-speed railways on executive compensation presents discrepant results. Specifically, in private enterprises, the problem of information asymmetry is more serious, so the opening of high-speed railways is conducive to improving the information transmission mechanisms of enterprises, which allows the Board of Directors to make a more objective evaluation of the actual working ability of executives. At the same time, to avoid the risk of brain drain, the Board of Directors will pay the top managers a higher salary. Therefore, after the opening of high-speed railways, the Board of Directors and shareholders in private enterprises should take the initiative to improve the management system and information transmission mechanism of enterprises, increase the communication frequency with executives, and learn more information that can reflect their actual value. These measures can provide a more reliable basis for improving executive compensation. At the same time, improving executive compensation is also an important strategy to reduce the risk of brain drain, which can ensure that the company will not face the dilemma of job vacancies and will operate normally.

Third, this study found that compared with well-known enterprises, the promotional effect of high-speed railways on executive compensation is more significant in low-profile enterprises. This implies that enterprises with low popularity also have serious information asymmetry problems. The opening of high-speed railways increases the attention of enterprises, which results in enterprises disclosing more information related to enterprise value for positive evaluation and using the obtained resources to improve the efficiency of resource allocation. These measures can contribute to the development of enterprises and improve executive compensation. Therefore, if low-profile enterprises are located in cities along high-speed railways, they should establish a self-restraint mechanism and improve the internal salary management system first. Then, by taking advantage of the accessibility and knowledge spillover effect of high-speed railways, they can build a social network with higher embeddedness to share information and collect resources, which can help enterprises obtain more social recognition and enhance their competitive advantages.

5.3. Strengths and Limitations

The strengths of this study mainly include two factors. First, this study regarded the operation of high-speed railways as an exogenous shock, which has reduced the endogeneity problem. Second, the research adopted a transportation infrastructure perspective to study the influence factor of executive compensation, which has supplemented the research on executive compensation. The limitations of this paper are mainly reflected in two aspects. First, this study only considered the direct impact of high-speed railway operation on executive compensation and did not explore in more depth whether there is a mediating mechanism that is present in the above relationship. For example, high-speed railways may influence executive compensation through their impact on firms’ management mode and governance system. Second, this study only used the data of listed Chinese companies to verify the relationship between high-speed railway operation and executive compensation, without using data from different countries for a cross-cultural comparison.

5.4. Recommendations and Future Research Directions

In short, the operation of HSR can reduce the information asymmetry among different regions, and this facilitates the flow of information and talent, especially in those private firms and low visibility firms with a lower information transparency environment. Therefore, for governments, in order to attract and retain talent, in addition to formulating various policies and regulations, each region can also strengthen regional infrastructure construction, ensure a more transparent regional development environment, and provide a good environment for attracting talent. For enterprises, in order to attract more talent, they should ensure the transparency of the internal information environment and strengthen the communication with the outside world in a way that reflects their own advantages.

Based on this study, future research can further examine the mediating variables of the core effect and open the dark box of the influencing mechanism of high-speed railways on executive compensation. In addition, due to different cultures and management concepts in other countries, high-speed railways may have a negative or U-shaped impact on executive compensation. Future research can consider cultural factors to compare the impact of high-speed railways on executive compensation in different countries, aiming at improving the universality of research conclusions.

Author Contributions

Conceptualization, Y.W.; methodology, Y.C.; software, Y.C.; validation, Y.C. and Y.W.; formal analysis, Y.C.; investigation, S.C.; resources, Y.C.; data curation, Y.C.; writing—original draft preparation, S.C.; writing—review and editing, Y.C.; visualization, Y.C.; supervision, Y.W.; project administration, Y.W.; funding acquisition, Y.W. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by National Natural Science Foundation of China, grant number 71974136.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Our sample included all Chinese firms listed on the Shenzhen and Shanghai stock exchanges. In addition, two data sources were used: The China Stock Market and Accounting Research Database (CSMAR) and the Train Schedule Book.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ben-Amar, W.; Zeghal, D. Board of directors’ independence and executive compensation disclosure transparency: Canadian evidence. J. Appl. Account. Res. 2011, 12, 43–60. [Google Scholar] [CrossRef]

- Appleton, S.; Song, L.; Xia, Q. Has China crossed the river? The evolution of wage structure in urban China during reform and retrenchment. J. Comp. Econ. 2005, 33, 644–663. [Google Scholar] [CrossRef]

- Kedia, S.; Rajgopal, S. Neighborhood matters: The impact of location on broad based stock option plans. J. Financ. Econ. 2009, 92, 109–127. [Google Scholar] [CrossRef]

- Francis, B.B.; Hasan, I.; John, K.; Waisman, M. Urban agglomeration and CEO compensation. J. Financ. Quant. Anal. 2016, 51, 1925–1953. [Google Scholar] [CrossRef] [Green Version]

- Duan, L.; Niu, D.; Sun, W.; Zheng, S. Transportation infrastructure and capital mobility: Evidence from China’s high-speed railways. Annu. Regional Sci. 2021, 1–32. [Google Scholar] [CrossRef]

- Garmendia, M.; Ribalaygua, C.; Ureña, J.M. High speed rail: Implication for cities. Cities 2012, 29, S26–S31. [Google Scholar] [CrossRef]

- Shaw, S.-L.; Fang, Z.; Lu, S.; Tao, R. Impacts of high speed rail on railroad network accessibility in China. J. Transp. Geogr. 2014, 40, 112–122. [Google Scholar] [CrossRef]

- Faber, B. Trade integration, market size, and industrialization: Evidence from China’s National Trunk Highway System. Rev. Econ. Stud. 2014, 81, 1046–1070. [Google Scholar] [CrossRef] [Green Version]

- Givoni, M. Development and impact of the modern high-speed train: A review. Transp. Rev. 2006, 26, 593–611. [Google Scholar] [CrossRef]

- Graham, D.J.; Melo, P.C. Assessment of wider economic impacts of high-speed rail for Great Britain. Transp. Res. Rec. 2011, 2261, 15–24. [Google Scholar] [CrossRef]

- Cascetta, E.; Cartenì, A.; Henke, I.; Pagliara, F. Economic growth, transport accessibility and regional equity impacts of high-speed railways in Italy: Ten years ex post evaluation and future perspectives. Transp. Res. Part. A Policy Pract. 2020, 139, 412–428. [Google Scholar] [CrossRef]

- Ahlfeldt, G.M.; Feddersen, A.; From Periphery to Core: Economic Adjustments to High Speed Rail. IEB Working Paper 2010/36. 2010. Available online: http://hdl.handle.net/2445/116855 (accessed on 2 May 2010).

- Albalate, D.; Bel, G. High-speed rail: Lessons for policy makers from experiences abroad. Public Adm. Rev. 2012, 72, 336–349. [Google Scholar] [CrossRef]

- Jansen, M. Resolving information asymmetry through contractual risk sharing: The case of private firm acquisitions. J. Account. Res. 2020, 58, 1203–1248. [Google Scholar] [CrossRef]

- Samila, S.; Sorenson, O. Venture capital, entrepreneurship, and economic growth. Rev. Econ. Stat. 2011, 93, 338–349. [Google Scholar] [CrossRef]

- Dong, X. High-speed railway and urban sectoral employment in China. Transp. Res. Part. A Policy Pract. 2018, 116, 603–621. [Google Scholar] [CrossRef]

- Ahlfeldt, G.M.; Feddersen, A. From periphery to core: Measuring agglomeration effects using high-speed rail. J. Econ. Geogr. 2018, 18, 355–390. [Google Scholar] [CrossRef]

- Ma, L.; Niu, D.; Sun, W. Transportation infrastructure and entrepreneurship: Evidence from high-speed railway in China. China Econ. Rev. 2021, 65, 101577. [Google Scholar] [CrossRef]

- Martincus, C.V.; Carballo, J.; Cusolito, A. Roads, exports and employment: Evidence from a developing country. J. Dev. Econ. 2017, 125, 21–39. [Google Scholar] [CrossRef]

- Dong, X.; Zheng, S.; Kahn, M.E. The role of transportation speed in facilitating high skilled teamwork across cities. J. Urban Econ. 2020, 115, 103212. [Google Scholar] [CrossRef]

- Sun, F.; Mansury, Y.S. Economic impact of high-speed rail on household income in China. Transp. Res. Rec. 2016, 2581, 71–78. [Google Scholar] [CrossRef]

- Hall, P. Magic carpets and seamless webs: Opportunities and constraints for high-speed trains in Europe. Built Environ. 2009, 35, 59–69. [Google Scholar] [CrossRef]

- Dakhlaoui, M.; Gana, M.R. Ownership structure and cost of equity capital: Tunisian evidence. Int. J. Bus. Gov. Ethics 2020, 14, 96–121. [Google Scholar] [CrossRef]

- Stuart, T.; Wang, Y. Who cooks the books in China, and does it pay? Evidence from private, high-technology firms. Strateg. Manag. J. 2016, 37, 2658–2676. [Google Scholar] [CrossRef]

- Connelly, B.L.; Certo, S.T.; Ireland, R.D.; Reutzel, C.R. Signaling theory: A review and assessment. J. Manag. 2011, 37, 39–67. [Google Scholar] [CrossRef]

- Chen, Z.; Haynes, K.E. Impact of high speed rail on housing values: An observation from the Beijing−Shanghai line. J. Transp. Geogr. 2015, 43, 91–100. [Google Scholar] [CrossRef]

- Moyano, A.; Martínez, H.S.; Coronado, J.M. From network to services: A comparative accessibility analysis of the Spanish high-speed rail system. Transp. Policy 2018, 63, 51–60. [Google Scholar] [CrossRef]

- Yu, H.; Jiao, J.; Houston, E.; Peng, Z.-R. Evaluating the relationship between rail transit and industrial agglomeration: An observation from the Dallas-fort worth region, TX. J. Transp. Geogr. 2018, 67, 33–52. [Google Scholar] [CrossRef]

- Faller, C.M.; zu Knyphausen-Aufseß, D. Does equity ownership matter for corporate social responsibility? A literature review of theories and recent empirical findings. J. Bus Ethics 2018, 150, 15–40. [Google Scholar] [CrossRef]

- Levinson, D.M. Accessibility impacts of high speed rail. J. Transp. Geogr. 2012, 22, 288–291. [Google Scholar] [CrossRef] [Green Version]

- Ranft, A.L.; Zinko, R.; Ferris, G.R.; Buckley, M.R. Marketing the image of management: The costs and benefits of CEO reputation. Organ. Dyn. 2006, 35, 279–290. [Google Scholar] [CrossRef]

- Hayward, M.L.; Rindova, V.P.; Pollock, T.G. Believing one’s own press: The causes and consequences of CEO celebrity. Strateg. Manag. J. 2004, 25, 637–653. [Google Scholar] [CrossRef] [Green Version]

- Luchs, C.; Stuebs, M.; Sun, L. Corporate reputation and earnings quality. J. Appl. Bus. Res. (JABR) 2009, 25. [Google Scholar] [CrossRef]

- Acharya, V.V.; Bharath, S.T.; Srinivasan, A. Does industry-wide distress affect defaulted firms? Evidence from creditor recoveries. J. Financ. Econ. 2007, 85, 787–821. [Google Scholar] [CrossRef]

- Wang, X. Foreign direct investment and innovation in China’s e-commerce sector. J. Asian Econ. 2012, 23, 288–301. [Google Scholar] [CrossRef]

- Jääskeläinen, M.; Maula, M.; Murray, G. Profit distribution and compensation structures in publicly and privately funded hybrid venture capital funds. Res. Policy 2007, 36, 913–929. [Google Scholar] [CrossRef] [Green Version]

- Ortiz-Molina, H. Executive compensation and capital structure: The effects of convertible debt and straight debt on CEO pay. J. Account. Econ. 2007, 43, 69–93. [Google Scholar] [CrossRef]

- Napier, N.K.; Smith, M. Product diversification, performance criteria and compensation at the corporate manager level. Strateg. Manag. J. 1987, 8, 195–201. [Google Scholar] [CrossRef]

- Dorata, N.T.; Petra, S.T. CEO duality and compensation in the market for corporate control. Manag. Financ. 2008, 34, 342–353. [Google Scholar] [CrossRef]

- Wright, P.; Kroll, M.; Elenkov, D. Acquisition returns, increase in firm size, and chief executive officer compensation: The moderating role of monitoring. Acad. Manag. J. 2002, 45, 599–608. [Google Scholar]

- Lee, S.P.; Chen, H.J. Corporate governance and firm value as determinants of CEO compensation in Taiwan: 2SLS for panel data model. Manag. Res. Rev. 2011, 34, 252–265. [Google Scholar] [CrossRef]

- Kostiuk, P.F. Firm size and executive compensation. J. Hum. Resour. 1990, 25, 90–105. [Google Scholar] [CrossRef]

- Chatterjee, S.; Price, B. Regression Analysis by Example; Wiley: New York, NY, USA, 1991. [Google Scholar]

- Chen, Y.; Wang, Y.D.; Hu, D.; Zhou, Z. Government R&D subsidies, information asymmetry, and the role of foreign investors: Evidence from a quasi-natural experiment on the shanghai-hong kong stock connect. Technol. Forecast. Soc. Chang. 2020, 158, 120162. [Google Scholar]

- Yang, X.; Lin, S.; Li, Y.; He, M. Can high-speed rail reduce environmental pollution? Evidence from China. J. Clean. Prod. 2019, 239, 118135. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, Y.; Hu, R. Sustainability by high–speed rail: The reduction mechanisms of transportation infrastructure on haze pollution. Sustainability 2020, 12, 2763. [Google Scholar] [CrossRef] [Green Version]

- Chen, Y.; Gu, X.; Gao, Y.; Lan, T. Sustainability with high-speed rails: The effects of transportation infrastructure development on firms’ CSR performance. J. Contemp. Account. Econ. 2021, 17, 100261. [Google Scholar] [CrossRef]

- Jin, Z.; Yang, Y.; Zhang, L. Geographic proximity and cross-region merger and acquisitions: Evidence from the opening of high-speed rail in China. Pac.-Basin Financ. J. 2021, 68, 101592. [Google Scholar] [CrossRef]

- Willigers, J. High-speed railway developments and corporate location decisions. In European Regional Science Association; ERSA: Louvain-la-Neuve, Belgium, 2003. [Google Scholar]

- Willigers, J.; Van Wee, B. High-speed rail and office location choices. A stated choice experiment for the Netherlands. J. Transp. Geogr. 2011, 19, 745–754. [Google Scholar] [CrossRef]

- Dai, X.; Cheng, L. Public selection and research and development effort of manufacturing enterprises in China: State owned enterprises versus non-state owned enterprises. Innovation 2015, 17, 182–195. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).