Mechanism Analysis of Applying Blockchain Technology to Forestry Carbon Sink Projects Based on the Differential Game Model

Abstract

:1. Introduction

2. Problem Description and Basic Assumptions

2.1. Problem Description

2.2. Assumptions and Model Parameters

3. The Model and the Solutions

3.1. Before Applying Blockchain Technology

3.2. After Applying Blockchain Technology

4. Discussions and Management Implications

4.1. Discussion

4.2. Management Implications

5. A Numerical Example

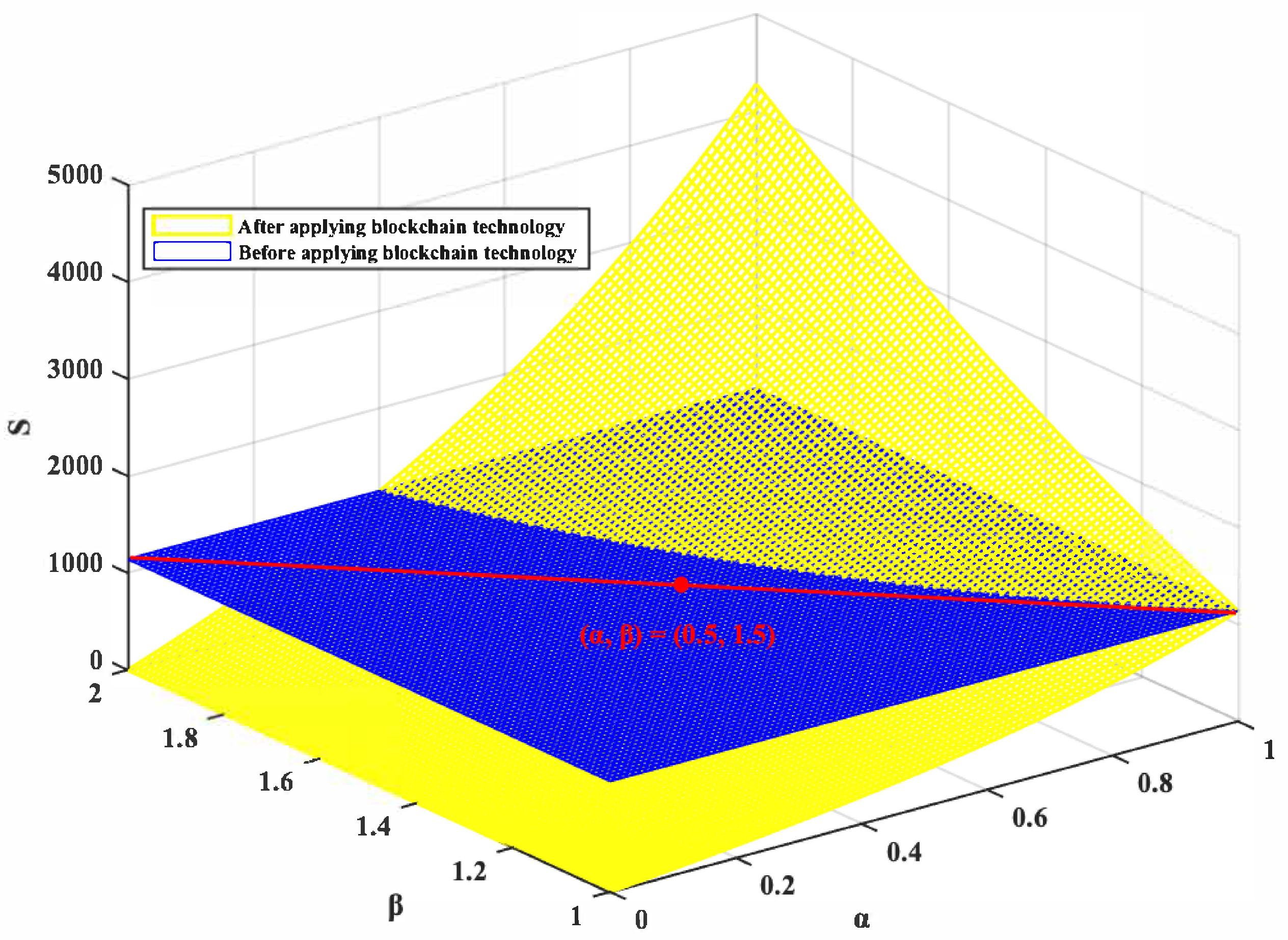

5.1. Changes in S before and after Applying the Blockchain Technology

5.2. The Relationship between S and ,

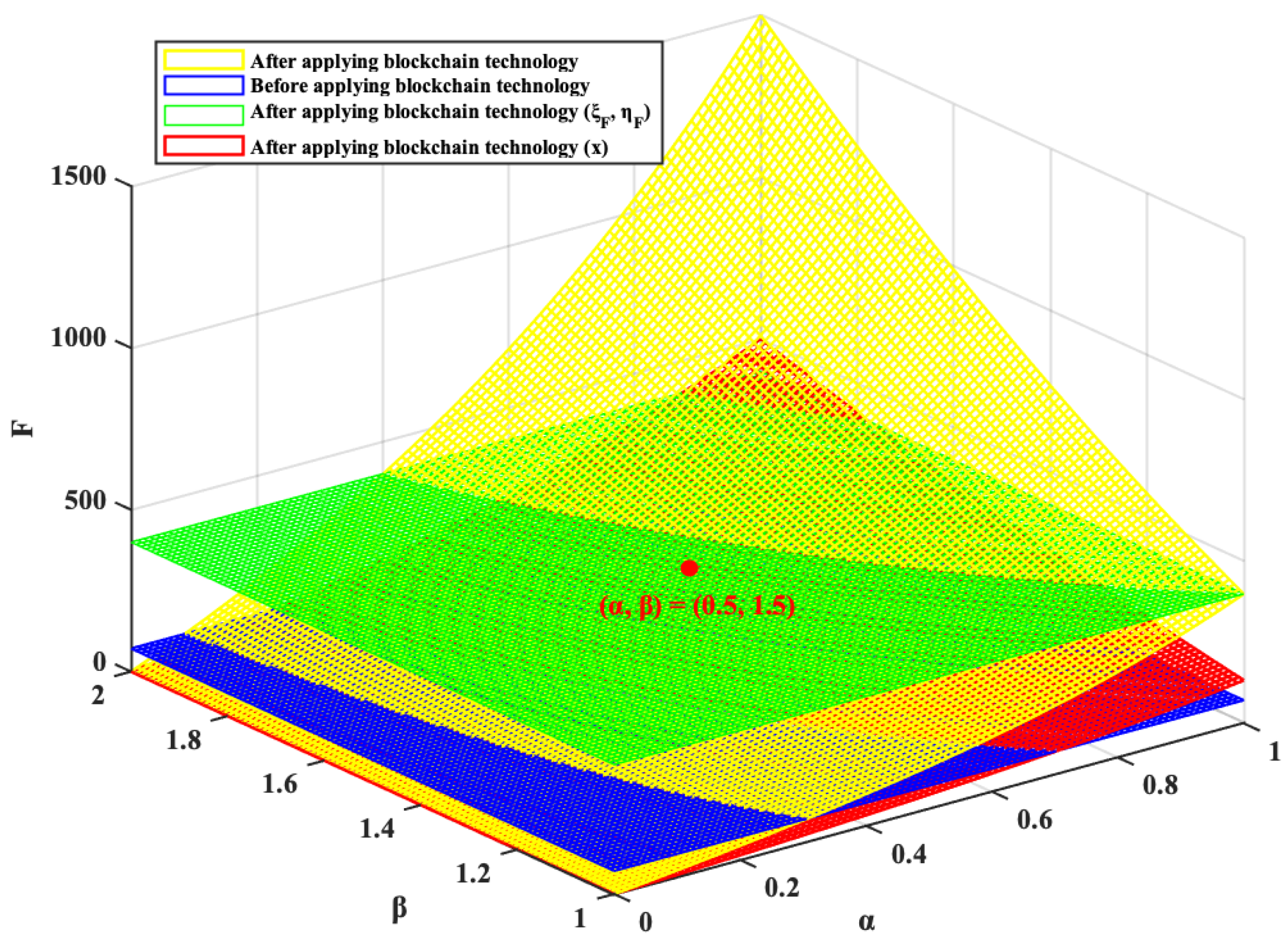

5.3. Changes in F before and after Applying the Blockchain Technology

5.4. The Optimal Trajectory for FCS and ECEs’ Emission Reductions before and after Applying Blockchain Technology

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Conflicts of Interest

References

- Zhang, Y.; Li, F.; Li, Y. A Study of the Forestry-Based Carbon Sink Market and the Development of Forestry-Based Carbon Sink Trading in Hainan under the Background of Carbon Neutrality. J. Hainan Norm. Univ. 2021, 39, 35–43. [Google Scholar]

- Song, Y.; Peng, H. Strategies of Forestry Carbon Sink under Forest Insurance and Subsidies. Sustainability 2019, 11, 4067. [Google Scholar] [CrossRef] [Green Version]

- Cornelis, V.K.G.; Maria, N.; Kimpton, B. Can carbon accounting promote economic development in forest-dependent, indigenous communities? For. Policy Econ. 2019, 100, 68–74. [Google Scholar]

- Ojha, H.; Maraseni, T.; Nightingale, A.; Bhattarai, B.; Khatri, D. Rescuing forests from the carbon trap. For. Policy Econ. 2019, 101, 15–18. [Google Scholar] [CrossRef]

- Keren, C.; Qiyuan, C.; Nan, Z.; Yinan, L.; Changyong, L.; Yuanfei, L. Forest carbon sink evaluation—An important contribution for carbon neutrality. IOP Conf. Ser. Earth Environ. Sci. 2021, 811, 012009. [Google Scholar]

- Jin, T.; Gao, Q.; Cao, X.; Wu, W. Research on risk measurement and impact of forestry carbon sink project. Issues For. Econ. 2021, 41, 304–310. [Google Scholar]

- Du, X.; Liang, K.; Li, D. Reward and penalty model of carbon emission reduction and carbon trading matching model for power industry based on blockchain technology. Autom. Electr. Power Syst. 2020, 44, 29–35. [Google Scholar]

- Chuang, T.J.; Yen, T.M. Public views on the value of forests in relation to forestation projects—A case study in central Taiwan. For. Policy Econ. 2017, 78, 173–179. [Google Scholar] [CrossRef]

- White, A.E.; Lutz, D.A.; Howarth, R.B.; Soto, J.R. Small-scale forestry and carbon offset markets: An empirical study of Vermont Current Use forest landowner willingness to accept carbon credit programs. PLoS ONE 2018, 13, e0201967. [Google Scholar] [CrossRef]

- Khanal, P.N.; Grebner, D.L.; Straka, T.J.; Adams, D.C. Obstacles to participation in carbon sequestration for nonindustrial private forest landowners in the southern United States: A diffusion of innovations perspective. For. Policy Econ. 2019, 100, 95–101. [Google Scholar] [CrossRef]

- Zou, Y.; Li, J.; Qi, Y.; Guan, J. Demand willingness and influencing factors of emission control enterprises for forest carbon sink in the context of carbon trade: Based on the theory of planned behavior. Sci. Silvae Sin. 2020, 56, 162–172. [Google Scholar]

- Zhang, Y.; Qi, H.; Xu, X.; Long, F. Research on the policy combination effect of the demand response of the forestry carbon sink market. Issues For. Econ. 2021, 41, 311–319. [Google Scholar]

- Lin, B.; Ge, J. Does institutional freedom matter for global forest carbon sinks in the face of economic development disparity? China Econ. Rev. 2021, 65, 101563. [Google Scholar] [CrossRef]

- Tsai, W. Forest resource management and its climate-change mitigation policies in Taiwan. Climate 2020, 9, 3. [Google Scholar] [CrossRef]

- Jiang, S.; Lu, Y.L.Q.; Hong, Y.; Guan, D.; Xiong, Y.; Wang, S. Policy assessments for the carbon emission flows and sustainability of Bitcoin blockchain operation in China. Econ. Pap. J. Appl. Econ. Policy 2021, 12, 1938–1947. [Google Scholar]

- Pop, C.; Cioara, T.; Antal, M.; Anghel, I.; Ioan Salomie, M.B. Blockchain based decentralized management of demand response programs in smart energy grids. Sensors 2018, 18, 162. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Khaqqi, K.N.; Sikorski, J.J.; Hadinoto, K.; Kraft, M. Incorporating seller/buyer reputation-based system in blockchain-enabled emission trading application. Appl. Energy 2018, 209, 8–19. [Google Scholar] [CrossRef]

- Hua, W.; Jiang, J.; Sun, H.; Wu, J. A blockchain based peer-to-peer trading framework integrating energy and carbon markets. Appl. Energy 2020, 279, 115539. [Google Scholar] [CrossRef]

- Wang, M. Blockchain technology and its role in enhancing supply chain integration capability and reducing carbon emission: A conceptual framework. Sustainability 2020, 12, 10550. [Google Scholar] [CrossRef]

- Hartmann, S.; Thomas, S. Applying blockchain to the Australian carbon market. Econ. Pap. 2020, 39, 133–151. [Google Scholar] [CrossRef]

- Liu, T. Research on the impact of blockchain technology on carbon trading price mechanism. Price Theory Pract. 2020, 54–57. [Google Scholar]

- Ji, B.; Chang, L.; Chen, Z.; Liu, Y.; Zhu, D.; Zhu, L. Blockchain technology based design and application of market mechanism for power carbon emission allowance trading. Autom. Electr. Power Syst. 2021, 45, 1–10. [Google Scholar]

- Rodrigo, M.N.N.; Perera, S.; Senaratne, S.; Jin, X. Potential application of blockchain technology for embodied carbon estimating in construction supply chains. Buildings 2020, 10, 140. [Google Scholar] [CrossRef]

- Woo, J.; Fatima, R.; Kibert, C.J.; Newman, R.E.; Tian, Y.; Srinivasan, R.S. Applying blockchain technology for building energy performance measurement, reporting, and verification (MRV) and the carbon credit market: A review of the literature. Build. Environ. 2021, 205, 108199. [Google Scholar] [CrossRef]

- Sadik-Zada, E.R. An Ode to ODA against all Odds? A Novel Game-Theoretical and Empirical Reappraisal of the Terrorism-Aid Nexus. Atl. Econ. J. 2021, 49, 221–240. [Google Scholar] [CrossRef]

- Sadik-Zada, E.R. Distributional Bargaining and the Speed of Structural Change in the Petroleum Exporting Labor Surplus Economies. Eur. J. Dev. Res. 2020, 32, 51–98. [Google Scholar] [CrossRef]

- Wang, D.; Wang, T. Dynamic Optimization of Cooperation on Carbon Emission Reduction and Promotion in Supply Chain Under Government Subsidy. J. Syst. Manag. 2021, 30, 14–27. [Google Scholar]

- Wang, M.; Liu, Y.; Shi, W.; Li, M.; Zhong, C. Research on technology remote synergic sharing strategy of low carbon under the ETS in China. Syst.-Eng.-Theory Pract. 2019, 39, 1419–1434. [Google Scholar]

- Hou, B. Discussion on the Risks of Forestry Asset Securitization from the Perspective of Block Chain. China For. Econ. 2021, 130–134. [Google Scholar] [CrossRef]

- Caulkins, J.P.; Feichtinger, G.; Grass, D.; Hartl, R.F.; Kort, P.M.; Seidl, A. Interaction of pricing, advertising and experience quality: A dynamic analysis. Eur. J. Oper. Res. 2017, 256, 877–885. [Google Scholar] [CrossRef]

- Gundersen, P.; Thybring, E.E.; Nord-Larsen, T.; Vesterdal, L.; Nadelhoffer, K.J.; Johannsen, V.K. Old-growth forest carbon sinks overestimated. Nature 2021, 591, 21–23. [Google Scholar] [CrossRef]

- Liu, Y.; Gao, X.; Fu, C.; Yu, G.; Liu., Z. Estimation of carbon sequestration potential of forest biomass in China based on National Forest Resources Inventory. Acta Ecol. Sin. 2019, 39, 4002–4010. [Google Scholar]

- Li, Q.; Zhu, J.; Feng, Y.; Xiao, W. Carbon storage and carbon sequestration potential of the forest in China. Clim. Chang. Res. 2018, 14, 287–294. [Google Scholar]

- Ren, J.; Xia, J. Prediction of Forest Carbon Sink Potential in Heilongjiang Province: The Carbon Density-Age Relationship-Based Approach. Res. Environ. Sci. 2017, 30, 552–558. [Google Scholar]

- Yang, F.; Jiang, Y.; Paudel, K.P. Farmers’ Willingness to Participate in Forest Management for Carbon Sequestration on the Sloping Land Conservation Program in China. Sci. Total Environ. 2021, 23, 244–261. [Google Scholar]

- Du, W.; Li, M. Assessing the impact of environmental regulation on pollution abatement and collaborative emissions reduction: Micro-evidence from Chinese industrial enterprises. Environ. Impact Assess. Rev. 2020, 82, 106382. [Google Scholar] [CrossRef]

- Ji, J.; Zhang, Z.; Yang, L. Carbon emission reduction decisions in the retail-/dual-channel supply chain with consumers’ preference. J. Clean. Prod. 2017, 141, 852–867. [Google Scholar] [CrossRef]

- Qiu, L.; Zeng, W.; Shashi, K.; Wang, S. The role of social capital in rural households’ perceptions toward the benefits of forest carbon sequestration projects: Evidence from a rural household survey in Sichuan and Yunnan provinces, China. Land 2021, 10, 91. [Google Scholar] [CrossRef]

- Gleim, M.R.; Stevens, J.L. Blockchain: A game changer for marketers? Mark. Lett. 2021, 32, 123–128. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sun, R.; He, D.; Yan, J.; Tao, L. Mechanism Analysis of Applying Blockchain Technology to Forestry Carbon Sink Projects Based on the Differential Game Model. Sustainability 2021, 13, 11697. https://doi.org/10.3390/su132111697

Sun R, He D, Yan J, Tao L. Mechanism Analysis of Applying Blockchain Technology to Forestry Carbon Sink Projects Based on the Differential Game Model. Sustainability. 2021; 13(21):11697. https://doi.org/10.3390/su132111697

Chicago/Turabian StyleSun, Rui, Dayi He, Jingjing Yan, and Li Tao. 2021. "Mechanism Analysis of Applying Blockchain Technology to Forestry Carbon Sink Projects Based on the Differential Game Model" Sustainability 13, no. 21: 11697. https://doi.org/10.3390/su132111697

APA StyleSun, R., He, D., Yan, J., & Tao, L. (2021). Mechanism Analysis of Applying Blockchain Technology to Forestry Carbon Sink Projects Based on the Differential Game Model. Sustainability, 13(21), 11697. https://doi.org/10.3390/su132111697