The Relationship between Artificial Intelligence and China’s Sustainable Economic Growth: Focused on the Mediating Effects of Industrial Structural Change

Abstract

:1. Introduction

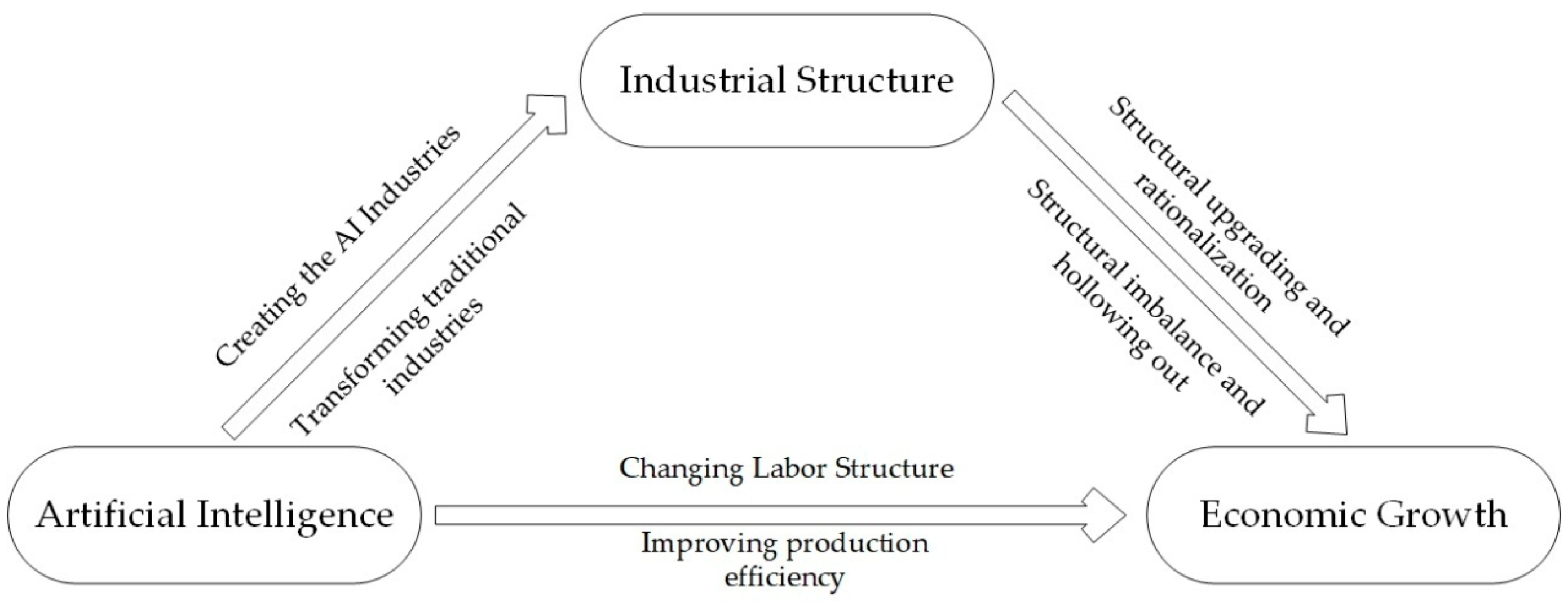

2. Study Hypothesis and Theoretical Framework

3. Model and Data

3.1. Model Setting

3.2. Variables and Data

- (1)

- Dependent variable: The dependent variable in this study is economic growth (GDPit). GDP is the classical indicator of regional economic development, so this paper used the GDP growth rate of each Chinese province to examine the dynamic growth of the regional economy [32]. Additionally, the GDP growth rate was calculated in constant prices with 2000 as the base period.

- (2)

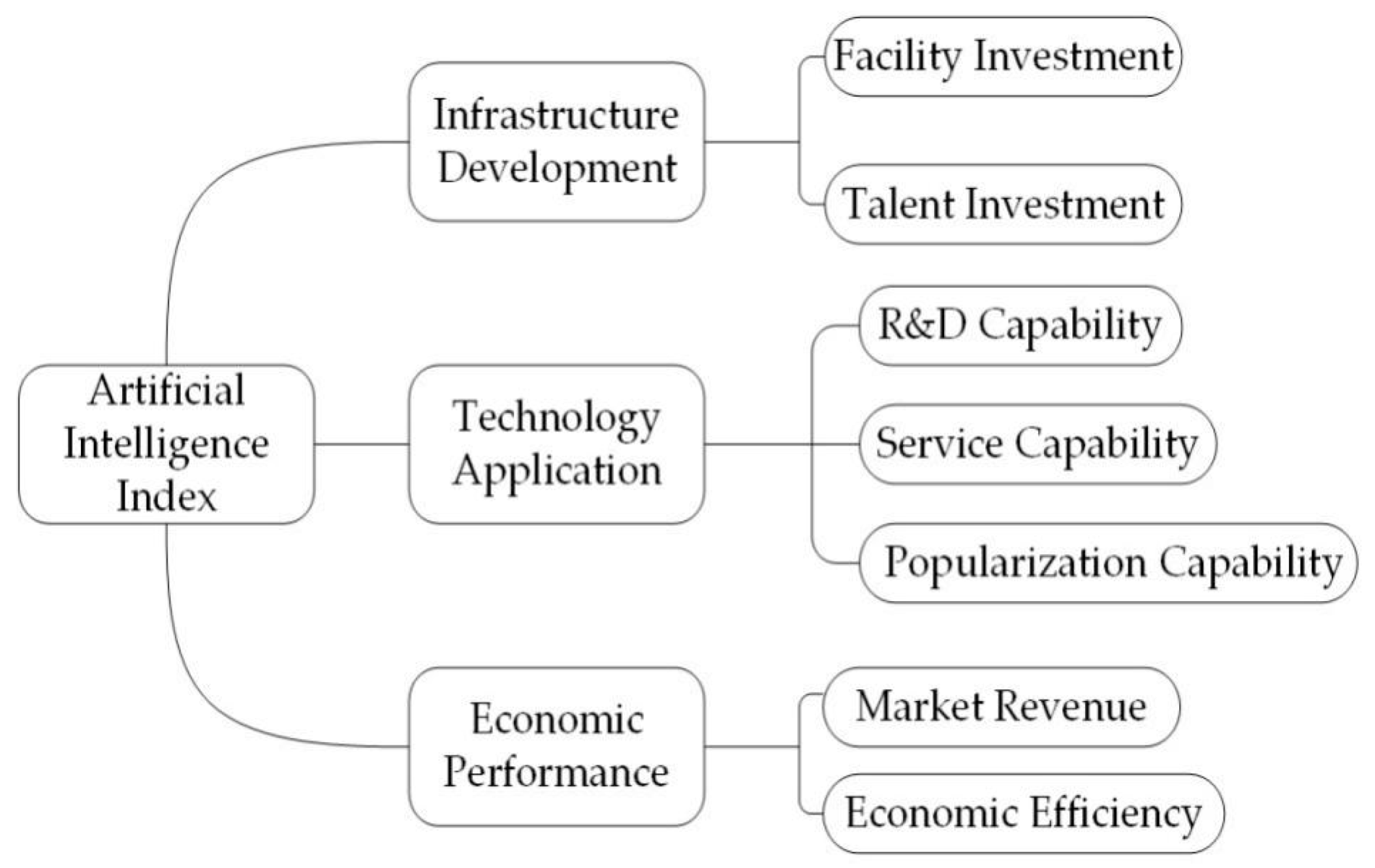

- Independent variable: Currently, many studies use a single index, such as the number of industrial robots, to measure the application level of AI [33,34], but there are fewer relevant data in China, and the choice of a single index does not allow a comprehensive assessment. In this paper, we referred to the research results of many Chinese scholars and constructed a regional artificial intelligence evaluation system from three aspects: infrastructure development, technology application, and market benefits (Figure 2) [35,36].

- (3)

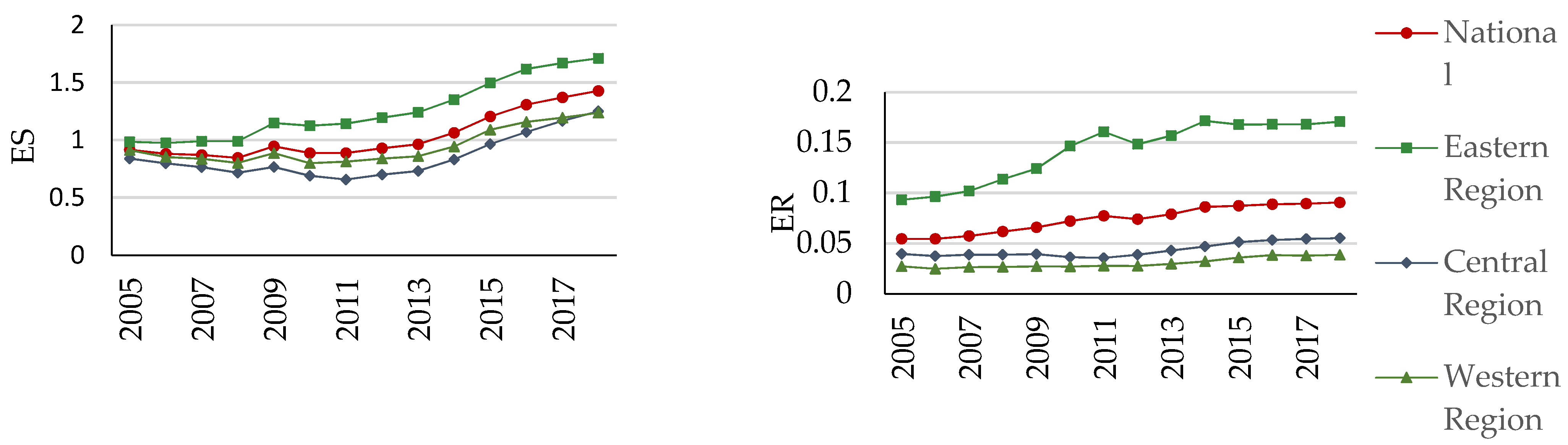

- Mediating variables: The industrial structure upgrading index (ESit) and industrial structure rationalization index (ERit) were used as mediating variables. In this paper, the ratio of the tertiary sector to secondary sector output was used to measure the level of structural upgrading, and the improved Theil index (TRit) was used to measure the rationality of the industrial structure (Equations (12) and (13), where Y denotes the output value, L denotes employment, i denotes industry, n denotes the number of industrial sectors, and ERit is the inverse of the Theil index). The lower the value of the Theil index, the higher the index of structure rationalization, indicating that the structure is closer to the equilibrium state and the structure is more rational [37].

- (4)

- Control variables: The main variables include ① the urbanization index (URBit): regions with a higher urbanization index usually have better economic development, so this paper used the proportion of the urban population to the total population in each province to measure the level of regional urbanization [38]; ② trade openness (FDIit): foreign investment can increase additional capital for regional input, and also expose industries to advanced technology and management experience, so FDI is beneficial to regional economic development, and the proportion of trade import and export to GDP of each province was used as a proxy variable for trade openness [39]; ③ government intervention (GOVit): the government can realize the effective allocation of resources within the market through macropolicies, but excessive fiscal intervention may also inhibit the independent innovation of industries, and the fiscal expenditure ratio was used to measure government intervention; ④ communication level (PTBit): the improvement of communication level can effectively reduce the cost of inter-regional information exchange, and this paper adopted the per-capital amount of telecommunications to measure it [40].

4. Estimation Results

4.1. Basic Regression and Discussion

4.2. Mediating Effects Regression

4.3. Regional and Temporal Regression

4.4. Robustness Test

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Primary Variables | Data Source |

|---|---|

| GDP growth rate | China Statistical Yearbook (CSY) |

| The investment amount of fixed assets in the telecommunication industry | China Electronic Information Industry Statistical Yearbook (CEINSY) |

| The number of software development personnel | CEINSY |

| The number of software enterprises | CEINSY |

| IT service revenue | CEINSY |

| Software product revenue | CEINSY |

| The profit and per capita income of the artificial intelligence industry | National Bureau of Statistics Database |

| The industrial output | CSY |

| The number of industrial employees | CSY |

| The proportion of the urban population to total population | CSY |

| The proportion of trade import and export to GDP | CSY |

| The fiscal expenditure ratio | CSY |

| The per-capital amount of telecommunications | CSY |

References

- Olsen, T.L.; Tomlin, B. Industry 4.0: Opportunities and challenges for operations management. M&SOM-Manuf. Serv. Op. 2020, 22, 113–122. [Google Scholar]

- Li, L. China′s manufacturing locus in 2025: With a comparison of “made-in-China 2025” and “industry 4.0”. Technol. Forecast. Soc. 2018, 135, 66–74. [Google Scholar] [CrossRef]

- Guan, J.; Shi, Y. China’s economic strategy: When theory meets practice. Aust. J. Int. Aff. 2020, 74, 348–354. [Google Scholar] [CrossRef] [Green Version]

- Restrepo, P.; Acemoglu, D. The wrong kind of AI? Artificial intelligence and the future of labour demand. Cam. J. Reg. Econ. Soc. 2020, 13, 25–35. [Google Scholar]

- Andreoni, A.; Tregenna, F. Escaping the middle-income technology trap: A comparative analysis of industrial policies in China, Brazil, and South Africa. Struct. Change Econ. D. 2020, 54, 324–340. [Google Scholar] [CrossRef]

- Rajapathirana, R.P.J.; Hui, Y. Relationship between innovation capability, innovation type, and firm performance. J. Innov. Knowl. 2018, 3, 44–55. [Google Scholar] [CrossRef]

- Teece, D.J. Profiting from innovation in the digital economy: Enabling technologies, standards, and licensing models in the wireless world. Res. Policy. 2018, 47, 1367–1387. [Google Scholar] [CrossRef]

- Lv, L.; Yin, Y.; Wang, Y.; Chen, C.-H. The Impact of R&D Input on Technological Innovation: Evidence from South Asian and Southeast Asian Countries. Discret. Dyn. Nat. Soc. 2020, 2020, 1–11. [Google Scholar] [CrossRef]

- Gazni, A.; Ghaseminik, Z. The increasing dominance of science in the economy: Which nations are successful? Scientometrics 2019, 120, 1411–1426. [Google Scholar] [CrossRef]

- Lewis, P.; Bell, K. Understanding the UK’s productivity problems. Empl. Relat. Int. J. 2019, 41, 296–312. [Google Scholar] [CrossRef]

- Kim, D.-H.; Kim, T.J.Y.; Wang, X.; Kim, M.; Quan, Y.-J.; Oh, J.W.; Min, S.-H.; Kim, H.; Bhandari, B.; Yang, I.; et al. Smart Machining Process Using Machine Learning: A Review and Perspective on Machining Industry. Int. J. Precis. Eng. Manuf.–Green Technol. 2018, 5, 555–568. [Google Scholar] [CrossRef]

- Kumar, V.; Rajan, B.; Venkatesan, R.; Lecinski, J. Understanding the role of artificial intelligence in personalized engagement marketing. Calif. Manag. Rev. 2019, 61, 135–155. [Google Scholar] [CrossRef]

- Wei, F.; Sheng, D.; Lili, W. Evolutionary model and simulation research of collaborative innovation network: A case study of artificial intelligence industry. Discret. Dyn. Nat. Society. 2018, 2018, 1–13. [Google Scholar] [CrossRef]

- Vinuesa, R.; Azizpour, H.; Leite, I.; Balaam, M.; Dignum, V.; Domisch, S.; Fellander, A.; Langhans, S.D.; Tegmark, M.; Nerini, F.F. The role of artificial intelligence in achieving the sustainable development goals. Nat. Commun. 2020, 11, 233. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Henstock, P.V. Artificial Intelligence for Pharma: Time for Internal Investment. Trends Pharmacol. Sci. 2019, 40, 543–546. [Google Scholar] [CrossRef] [PubMed]

- Autor, D.H.; Dorn, D. The Growth of Low-Skill Service Jobs and the Polarization of the US Labor Market. Am. Econ. Rev. 2013, 103, 1553–1597. [Google Scholar] [CrossRef] [Green Version]

- Liu, J.; Chang, H.; Forrest, J.Y.-L.; Yang, B. Influence of artificial intelligence on technological innovation: Evidence from the panel data of china's manufacturing sectors. Technol. Forecast. Soc. Chang. 2020, 158, 120–142. [Google Scholar] [CrossRef]

- Sertsios, G. Corporate finance, industrial organization, and organizational economics. J. Corp. Financ. 2020, 64, 101680. [Google Scholar] [CrossRef]

- Zhou, X.; Pan, Z.; Shahbaz, M.; Song, M. Directed technological progress driven by diversified industrial structural change. Struct. Chang. Econ. Dyn. 2020, 54, 112–129. [Google Scholar] [CrossRef]

- Tsai, D.H.A. The effects of dynamic industrial transition on sustainable development. Struct. Chang. Econ. Dyn. 2018, 44, 46–54. [Google Scholar] [CrossRef]

- Qian, X.F.; Liu, Z.; Pan, Y. China’s trade slowdown: Cyclical or structural? China World Econ. 2017, 25, 65–83. [Google Scholar] [CrossRef]

- Baumol, W.J. Macroeconomics of unbalanced growth: The anatomy of urban crisis. Am. Econ. Rev. 1967, 57, 415–426. [Google Scholar]

- Cheng, D.Z. Features, causes, and effects of service industry growth: Baumol-Fuchs hypothesis and an empirical study. Soc. Sci. China. 2004, 4, 18–32+204. [Google Scholar]

- Capasso, M.; Stam, E.; Cefis, E. Industrial Dynamics and Economic Geography. Reg. Stud. 2014, 49, 5–9. [Google Scholar] [CrossRef]

- He, B.; Bai, K.-J. Digital twin-based sustainable intelligent manufacturing: A review. Adv. Manuf. 2020, 9, 1–21. [Google Scholar] [CrossRef]

- Wang, L. From Intelligence Science to Intelligent Manufacturing. Engineering 2019, 5, 615–618. [Google Scholar] [CrossRef]

- Min, H. Artificial intelligence in supply chain management: Theory and applications. Int. J. Logist. Res. Appl. 2009, 13, 13–39. [Google Scholar] [CrossRef]

- Kundisch, D.O.; Mittal, N.; Nault, B.R. Research Commentary—Using Income Accounting as the Theoretical Basis for Measuring IT Productivity. Inf. Syst. Res. 2014, 25, 449–467. [Google Scholar] [CrossRef] [Green Version]

- Shrestha, Y.R.; Ben-Menahem, S.M.; von Krogh, G. Organizational Decision-Making Structures in the Age of Artificial Intelligence. Calif. Manag. Rev. 2019, 61, 66–83. [Google Scholar] [CrossRef]

- Jarrahi, M.H. Artificial intelligence and the future of work: Human-AI symbiosis in organizational decision making. Bus. Horiz. 2018, 61, 577–586. [Google Scholar] [CrossRef]

- Aghion, P.; Jones, B.F.; Jones, C.I. Artificial intelligence and economic growth. NBER Work. Papers 2018, 23928. [Google Scholar] [CrossRef]

- Amirat, A.; Zaidi, M. Estimating GDP Growth in Saudi Arabia Under the Government’s Vision 2030: A Knowledge-based Economy Approach. J. Knowl. Econ. 2019, 11, 1145–1170. [Google Scholar] [CrossRef]

- Lee, H.; Kraft, B.; Leigh, N.G. Robots, skill demand and manufacturing in US regional labour markets. Camb. J. Reg. Econ. Soc. 2020, 13, 77–97. [Google Scholar] [CrossRef]

- Clark, C.M.A.; Gevorkyan, A.V. Artificial Intelligence and Human Flourishing. Am. J. Econ. Sociol. 2020, 79, 1307–1344. [Google Scholar] [CrossRef]

- Liu, L.; Li, L.S.; Liu, J.; Cheng, Z.H. Intelligentization and the transformation of economic development mode: Theoretical mechanism and empirical evidence. Econ. Rev. 2020, 4, 3–19. [Google Scholar]

- Liu, L.; Yang, K.; Fujii, H.; Liu, J. Artificial intelligence and energy intensity in China’s industrial sector: Effect and transmission channel. Econ. Anal. Policy 2021, 70, 276–293. [Google Scholar] [CrossRef]

- Gan, C.H.; Zheng, R.G.; Yu, D.F. An empirical study on the effects of industrial structure on economic growth and fluctuations in China. Econ. Res. J. 2011, 46, 4–16+31. [Google Scholar]

- Yunsong, C.; Yi, Z. The Inequality Effect of Urbanization and Social Integration. Soc. Sci. China 2016, 37, 117–135. [Google Scholar] [CrossRef]

- Droste, N.; Hansjürgens, B.; Kuikman, P.; Otter, N.; Antikainen, R.; Leskinen, P.; Pitkänen, K.; Saikku, L.; Loiseau, E.; Thomsen, M. Steering innovations towards a green economy: Understanding government intervention. J. Clean. Prod. 2016, 135, 426–434. [Google Scholar] [CrossRef]

- Symeou, P.C. Economy size and performance: An efficiency analysis in the telecommunications sector. Telecommun. Policy 2011, 35, 426–440. [Google Scholar] [CrossRef]

- Kaplan, A.; Haenlein, M. Rulers of the world, unite! The challenges and opportunities of artificial intelligence. Bus. Horiz. 2020, 63, 37–50. [Google Scholar] [CrossRef]

- Wen, Z.L.; Chang, L.; Hau, K.T.; Liu, H.Y. Testing and application of the mediating effects. Acta Psychol. Sin. 2004, 36, 614–620. [Google Scholar]

- Liao, H.; Yang, L.; Ma, H.; Zheng, J. Technology import, secondary innovation, and industrial structure optimization: A potential innovation strategy for China. Pac. Econ. Rev. 2020, 25, 145–160. [Google Scholar] [CrossRef]

- Wagner, D.N. Economic patterns in a world with artificial intelligence. Evol. Inst. Econ. Rev. 2020, 17, 111–131. [Google Scholar] [CrossRef] [Green Version]

- Lei, X.; Wu, S. Improvement of Different Types of Environmental Regulations on Total Factor Productivity: A Threshold Effect Analysis. Discret. Dyn. Nat. Soc. 2019, 2019, 1–12. [Google Scholar] [CrossRef]

- Lu, R.; Ruan, M.; Reve, T. Cluster and co-located cluster effects: An empirical study of six Chinese city regions. Res. Policy 2016, 45, 1984–1995. [Google Scholar] [CrossRef]

- Jia, Z.; Gu, G. Is Local Government Intervention Effective in Promoting the Tfp of an Old Industrial Area?—a Spatial Econometric Analysis of Northeast China. Singap. Econ. Rev. 2020, 66, 933–951. [Google Scholar] [CrossRef]

- Lampe, H.W.; Hilgers, D. Trajectories of efficiency measurement: A bibliometric analysis of DEA and SFA. Eur. J. Oper. Res. 2015, 240, 1–21. [Google Scholar] [CrossRef]

- Xiao, W.E.N.; Pan, J.-D.; Liu, L.-Y. China’s Industrial Structure Upgrade in the “New Normal”: Empirical Test and Determinants. Singap. Econ. Rev. 2018, 63, 1037–1058. [Google Scholar] [CrossRef] [Green Version]

| Variable | Obs | Mean | Std.Dev. | Min | Max |

|---|---|---|---|---|---|

| GDP | 392 | 0.1070 | 0.0324 | −0.0250 | 0.2380 |

| INR | 392 | 0.2305 | 0.1892 | 0.0070 | 0.8293 |

| ER | 392 | 7.8976 | 9.0856 | 1.2140 | 62.0542 |

| ES | 392 | 1.0361 | 0.5788 | 0.4991 | 4.3548 |

| URB | 392 | 0.5386 | 0.1425 | 0.2687 | 0.8960 |

| FDI | 392 | 0.1556 | 0.2420 | 0.0002 | 1.2371 |

| GOV | 392 | 0.2066 | 0.0758 | 0.0792 | 0.4575 |

| PTB | 392 | 0.1995 | 0.1550 | 0.0455 | 1.1204 |

| Cross-Sectional Correlation Test | Unit Root Test | ||||

|---|---|---|---|---|---|

| Original Values | Original Values | Second-order differenced values | |||

| CD | LLC | IPS | LLC | IPS | |

| GDP | 58.64 *** | 0.30 | 4.41 | −39.62 *** | −27.41 *** |

| INR | 23.26 *** | −3.22 *** | −0.88 | −22.19 *** | −17.21 *** |

| ER | 37.67 *** | −0.56 | 3.30 | −21.50 *** | −16.71 *** |

| ES | 53.09 *** | 6.90 | 8.85 | −21.03 *** | −16.14 *** |

| URB | 63.74 *** | −0.90 | 6.15 | −23.36 *** | −17.45 *** |

| FDI | 13.78 *** | −3.41 *** | 1.28 | −23.24 *** | −17.92 *** |

| GOV | 62.81 *** | −5.78 *** | 0.26 | −21.64 *** | −17.54 *** |

| PTB | 70.24 *** | 20.94 | 10.31 | −12.01 *** | −8.08 *** |

| Variables | Method | Statistical Variables | Values |

|---|---|---|---|

| Artificial intelligence index | Westerlund | Variance ratio | 3.95 *** |

| Pedroni | Augmented Dickey–Fuller t | −6.86 *** | |

| Phillips–Perron t | −7.27 *** | ||

| Industrial structure upgrading | Westerlund | Variance ratio | 1.54 * |

| Pedroni | Augmented Dickey–Fuller t | −7.16 *** | |

| Phillips–Perron t | −7.19 *** | ||

| Industrial structure rationalization | Westerlund | Variance ratio | 1.81 ** |

| Pedroni | Augmented Dickey–Fuller t | −9.29 *** | |

| Phillips–Perron t | −9.64 *** |

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| FE | FE | FE | GMM | GMM | GMM | |

| Lag of GDP | 0.674 *** | 0.681 *** | 0.765 *** | |||

| (0.039) | (0.053) | (0.048) | ||||

| INR | 0.042 * | 3.642 ** | ||||

| (0.023) | (1.702) | |||||

| ES | −0.050 *** | −7.471 *** | ||||

| (0.005) | (1.061) | |||||

| ER | −0.002 *** | −0.111 ** | ||||

| (0.000) | (0.053) | |||||

| URB | −0.397 *** | −0.376 *** | −0.355*** | 23.139 * | −3.815 | −2.35 |

| (0.040) | (0.030) | (0.033) | (13.552) | (16.382) | (16.908) | |

| FDI | 0.072 *** | 0.031 *** | 0.043*** | −4.737 ** | −2.073 | 5.644 * |

| (0.013) | (0.011) | (0.013) | (2.193) | (2.720) | (3.022) | |

| GOV | −0.033 | 0.101 ** | −0.037 | −1.221 | −1.051 | −6.186 ** |

| (0.046) | (0.042) | (0.044) | (5.29) | (3.016) | (2.875) | |

| PTB | −0.004 | 0.028 *** | −0.001 | 1.612 ** | 1.219 ** | 1.411 *** |

| (0.010) | (0.010) | (0.010) | (0.755) | (0.545) | (0.535) | |

| Hausman | −116.250 | 188.930 *** | −8655.080 | |||

| Sargan | 329.085 | 225.719 | 245.533 | |||

| AR (2) | 0.314 | 0.205 | −1.625 |

| (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|

| Total Effects | Mediation Effects of Structural Upgrading | Mediating Effects of Structural Rationalization | |||

| GDP | ES | GDP | ER | GDP | |

| INR | 2.346 ** (1.135) | −0.384 ** (0.177) | 1.829 * (1.118) | −4.016 * (2.118) | 2.427 ** (0.027) |

| ES | −1.344 *** (0.319) | ||||

| ER | 0.020 (1.414) | ||||

| URB | −6.111 *** (1.594) | 1.647 *** (0.249) | −3.897 ** (1.647) | 47.360 *** (2.975) | −7.074 *** (2.051) |

| PTB | −5.260 *** (1.212) | 1.283 *** (0.198) | −3.536 *** (1.311) | 9.000 *** (2.374) | −5.443 *** (1.296) |

| TIME EFFECTS | YES | YES | YES | YES | YES |

| INDIVIDUALS EFFECTS | YES | YES | YES | YES | YES |

| OBSERVATIONS | 392 | 392 | 392 | 392 | 392 |

| Eastern Region | |||||

| GDP | ES | GDP | ER | GDP | |

| INR | 9.116*** (2.163) | −0.286* (0.082) | 9.121*** (2.175) | 1.166 (5.067) | 9.344*** (2.191) |

| ES | −0.019 (0.303) | ||||

| ER | −0.027 (0.025) | ||||

| Central Region | |||||

| GDP | ES | GDP | ER | GDP | |

| INR | 7.439 * (4.262) | −1.030 *** (0.359) | 3.227 (4.246) | −5.900 ** (2.580) | 4.158 (4.213) |

| ES | −4.088 *** (0.894) | ||||

| ER | −0.556 *** (0.137) | ||||

| Western Region | |||||

| GDP | ES | GDP | ER | GDP | |

| INR | 6.795 ** (3.109) | −0.671 ** (0.279) | 2.867 (2.744) | 5.038 *** (1.251) | 8.462 ** (3.355) |

| ES | −5.849 *** (0.986) | ||||

| ER | −0.331 (0.256) | ||||

| Before the Financial Crisis in 2008 | |||||

| GDP | GDP | GDP | |||

| INR | 2.480 (2.841) | ||||

| ES | −1.513 * (0.831) | ||||

| ER | −0.166 ** (0.831) | ||||

| After the Financial Crisis in 2008 | |||||

| GDP | ES | GDP | ER | GDP | |

| INR | 2.150 * (1.136) | −0.584 *** (0.204) | 1.55 (1.134) | −6.510 *** (2.384) | 2.509 ** (1.145) |

| ES | −1.035 *** (0.329) | ||||

| ER | 0.055 * (0.029) | ||||

| Replacement of Economic Growth Indicator | |||||

| TFP | ES | TFP | ER | TFP | |

| INR | 1.177 *** | −0.478 ** | 1.112 *** | −7.504 *** | 1.163 *** |

| ES | −0.136 *** | ||||

| ER | 0.001 | ||||

| Replacement of AI Index Calculation Method | |||||

| GDP | ES | GDP | ER | GDP | |

| INR | 2.830 ** | −0.553 *** | −0.035 * | 5.24 | 2.849 ** |

| ES | −0.051 *** | ||||

| ER | 0.020 | ||||

| Replacement of Industrial Structure Upgrading Index | |||||

| GDP | E | GDP | |||

| INR | 2.830 *** | −0.101* | 3.137 ** | ||

| E | −11.091 *** | ||||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fan, D.; Liu, K. The Relationship between Artificial Intelligence and China’s Sustainable Economic Growth: Focused on the Mediating Effects of Industrial Structural Change. Sustainability 2021, 13, 11542. https://doi.org/10.3390/su132011542

Fan D, Liu K. The Relationship between Artificial Intelligence and China’s Sustainable Economic Growth: Focused on the Mediating Effects of Industrial Structural Change. Sustainability. 2021; 13(20):11542. https://doi.org/10.3390/su132011542

Chicago/Turabian StyleFan, Decheng, and Kairan Liu. 2021. "The Relationship between Artificial Intelligence and China’s Sustainable Economic Growth: Focused on the Mediating Effects of Industrial Structural Change" Sustainability 13, no. 20: 11542. https://doi.org/10.3390/su132011542

APA StyleFan, D., & Liu, K. (2021). The Relationship between Artificial Intelligence and China’s Sustainable Economic Growth: Focused on the Mediating Effects of Industrial Structural Change. Sustainability, 13(20), 11542. https://doi.org/10.3390/su132011542