Abstract

The sustainable development of a modern equity market heavily relies on an effective IPO system that can properly reflect the underlying risk, demand, and supply in the IPO market. Recently, China has implemented an unprecedented IPO reform that transforms the previous approval-based IPO system to a registration-based one. Despite its importance, the impacts of the reform still remain unexplored. Using firm-level data from the Chinese A-shares market, we show that the recent IPO reform significantly increases IPO cost and reduces the degree of IPO underpricing. We also investigated the impacts of the reform on the market structures in different IPO service markets. Overall, our findings are consistent with the hypothesis that the registration-based IPO reform makes the IPO system in China more market-oriented. To our best knowledge, this is the first empirical study that sheds light on the short-term impacts of the adoption of a registration-based IPO system.

1. Introduction

Initial public offering (IPO) is an important direct financing method for firms to raise capital from the equity market [1]. Compared with other financing tools, such as bank loans, IPO allows firms to better customize their long-term capital needs [2]. Meanwhile, the success of the equity market often heavily relies on an effective IPO system that can avoid the well-known adverse selection problem that often hinders the long-term stability of the market [3,4]. Therefore, it is important for policymakers to fully understand the potential impacts of the policy changes related to the IPO system.

Accompanied by China’s economic success in the past three decades, the Chinese equity market has experienced an unprecedented expansion. After 30 years of development, China’s equity market now has the world’s second largest market capitalization with more 4000 stocks traded in the A-shares market. (As of 25 September, there are 4491 stocks listed in China’s A-share market, including the main board, the Growth Enterprise Board, the Sci-tech Innovation Board, and the small and medium enterprise board. The data were acquired from the Wind Database.) Specifically, the market capitalization has grown from USD 1.6 billion in 1990 [5], when China first opened its equity market, to more than USD 13 trillion in August 2021, which is around 85% of China’s annual GDP (The recent market capitalization data were acquired from the Wind Database). However, despite of its fast growth, the Chinese equity market is often criticized for information nontransparency, corruption, and a lack of effective regulations [6,7,8].

Unlike most financially developed countries, China has insisted on an approval-based IPO system ever since the start of its equity market, that is decisions of whether firms are qualified for IPOs are made by the China Securities Regulatory Commission (CSRC) [9]. Under this arrangement, firms that are politically closer to the government are usually more likely to receive IPO approval [8,10]. Therefore, firms that successfully become listed may in fact perform unsatisfactorily in their actual business. This is also a vital mechanism that results in firms’ bad post-IPO performance in China’s equity market [11,12,13].

To deal with the problems in the IPO process, the central government in China has implemented several rounds of reforms of its IPO system. Among these reforms, the most important one is arguably the recent adoption of the registration-based IPO system. The official announcement of this reform can be dated back to as early as the “Decision of the CCCPC on Some Major Issues Concerning Comprehensively Deepening the Reform” publicized on 12 November 2013. However, the new IPO system was not put into use until 1 March 2019, when it was first introduced in the Sci-tech Innovation Board (SIB). One year later, on 12 June 2020, the registration-based IPO system was also implemented in the Growth Enterprise Board (GEB). As of 25 August 2021, there have been more than 400 firms that have successfully completed their IPO via this new system in these two trading boards.

The major difference between the registration-based and the approval-based IPO systems in China is that the former is much more market-oriented [14]. Under the new IPO system, the CSRC is only responsible for a formal review of the necessary IPO documents. Theoretically speaking, IPO cases will be automatically approved if such documents are eligible under the requirements of China’s securities law. Therefore, decisions about whether firms are qualified for IPOs are left to investment banks, along with the risk of being punished if the CSRC later finds out that there exists falsification within the IPO process. Without a doubt, the registration-based IPO reform inevitably curbs the government’s power and strengthens the role of the market. This reform, therefore, is likely to influence participants in the IPO market significantly. For example, under the new IPO system, investment banks face both higher risk and IPO demand, which may enhance firms’ IPO cost in the short run.

However, the potential impacts of this important reform still remains largely unexplored, making it difficult for policymakers to evaluate its effectiveness. Motivated by this observation, we investigated the short-term impacts of the registration-based IPO reform in the Chinese equity market using firm-level data acquired from the Wind Database. Specifically, we studied the impacts of the reform from three angles: (1) the IPO cost; (2) the IPO underpricing; (3) the market concentration in the IPO service markets. Using multivariate regression models, we found that the IPO cost, measured by the ratio of total IPO expense to capital raised, significantly increased after the reform, while the degree of IPO underpricing reduced significantly. In addition, the market concentration in the market of underwriting service increased slightly, while the same statistics for auditing and law services decreased. Overall, our results are consistent with the hypothesis that the recent registration-based IPO reform makes the IPO process more market-oriented, which eventually makes the equity market in China more sustainable.

It is noteworthy that the results identified in our study should be interpreted as “short-term impacts” due to the fact that the registration-based IPO system has only been adopted for less than two years up to this moment. It is likely that the long-term impacts of the reform can be different from the short-term ones as the IPO service markets gradually attain new equilibrium. We briefly discuss these aspects in our empirical study and point out several future research directions. To our best knowledge, this is the first paper that formally studies the impacts of the recent registration-based IPO reform in China, which we hope can deepen our understanding of China’s equity market and provide policymakers helpful insights for future reforms.

The paper is organized as follows. Section 2 briefly reviews the literature and develops research hypotheses. Section 3 provides the institutional background of the IPO system in China. Section 4 introduces the research design including both data and regression specifications. Section 5 presents and discusses the empirical results. Section 6 concludes.

2. Literature Review and Hypotheses Development

Our study mainly relates to two strands of the literature: (1) IPO cost; (2) IPO underpricing. Previous literature has studied different aspects about the IPO cost in various equity markets around the world. To save space, we only summarize those that are most relevant to our study. Chen and Ritter [15] investigated the cause of the high IPO cost in the U.S. during the 1990s. Specifically, they showed that the high underwriting cost was above the competitive level, which is consistent with the strategic pricing of the investment bankers. Beatty [16] studied factors that affect the auditing expense in the IPO market in the U.S., where the author found that the auditing cost is positively correlated with exposure to legal liability. Torstila [17] further looked into the distribution of fees within the IPO syndicate in the U.S. and found that IPO size is the main factor that influences fee division. Chaplinsky et al. [18] investigated the impacts of the JOBS Act using a sample of 312 emerging growth firms and found evidence of no reduction in IPO cost.

Regarding the Chinese equity market, Chen and Li [19] recognized several factors that significantly influence the IPO expense in the A-shares market. They found that the market concentration in the underwriting market is much higher in mainland China than that in Hong Kong. Wang [20] analyzed the determinants of IPO cost for private firms in China. Focusing on auditing expense, Sun et al. [21] showed that auditing firms with more expertise charge higher fees. Interestingly, Liu [9] compared the IPO cost of private firms and nonstate-owned enterprises in China and found that the IPO cost significantly increased after the introduction of the IPO bidding system. This finding is also consistent with the main finding in our paper, where we show that another market-oriented IPO reform—the adoption of the registration-based IPO system—also enhances the level of the IPO cost.

Our first research hypothesis on the IPO cost stems from two aspects. First, under the new IPO system, IPO service providers, including investment banks, auditing firms, and law firms, face larger exposure to legal liability. Therefore, following the similar logic in [16], we would expect the reform to increase the IPO cost, holding other factors constant. Second, as the IPO process becomes more market-oriented after the reform, it is likely that more firms will start their IPOs, resulting in a higher demand for IPO service. Since the supply of IPO service may not be able to be adjusted in a short period of time, the increasing demand will also enhance the level IPO cost. Based on these two observations, we developed our first hypothesis on IPO cost as follows:

Hypothesis 1 (H1).

The registration-based reform in the Chinese equity market enhances the level of IPO cost in the short run.

Another strand of the literature that is closely related to our study is about IPO underpricing, which refers to the practice of listing an initial public offering at a price below real values in the equity market. Such a phenomenon has already been confirmed in almost every equity market, such as the U.S., the U.K., and China [22,23,24,25]. There is a large literature on potential explanations of such phenomenon and its determinants. For example, Booth and Chua [26] showed that the issuer’s demand for ownership dispersion can be a leading cause of IPO underpricing, while Lowry and Shu [27] found that there exists a positive correlation between firms’ litigation risk and the degree of IPO underpricing. To save space here, we refer readers with further interest to Ljungqvist [28], who provided an excellent of review of the literature on factors that affect IPO underpricing.

In addition to its determinants, previous studies have also evaluated the effects of various exogenous shocks, such as reforms or policy changes, on the degree of IPO underpricing. Akyol et al. [29] examined the impact of the adoption of corporate governance codes by EU countries on IPO underpricing and found that the policy change significantly decreases the degree of IPO underpricing in these markets. Cheung et al. [30] studied how regulatory changes affected IPO underpricing in the Chinese equity market during the period 1992–2006. They found that reforms, including the abolishment of listing quotas and fixed issue price determination, lowered the degree of IPO underpricing significantly. Khurshed et al. [31] examined the impact of the split-share structure reform in 2005 and found that such reform significantly alleviated the degree of IPO underpricing in China. Other related studies of similar styles include Li et al. [32], who showed that IPOs were less underpriced after the 2008 financial crisis; Su and Brookfield [33], who found that the 2001 IPO system reform successfully reduced IPO underpricing through the channel of underwriter reputation, among many others.

In our context, we conjectured that the registration-based IPO reform would also reduce the degree of IPO underpricing. The logic is the same as that for IPO cost: under the new IPO system, firms and their underwriters have better controls over IPO prices. In the past, the CSRC had an implicit rule that newly listed firms’ PEs could not exceed 80% of the affiliated industry-level average [34]. The main purposes of such a practice were to attract more investors and protect retail investors from overspeculation. However, such a practice also enhanced the level of IPO underpricing as firms with good bargaining power on their IPO prices had to follow the rule. In contrast, the recent IPO reform enables firms with high bargaining power to set IPO prices more flexibly, which not only signals firms’ qualities, but also reduces the degree of IPO underpricing. Therefore, the second hypothesis in our study is as follows:

Hypothesis 2 (H2).

The registration-based reform in the Chinese equity market reduces the degree of IPO underpricing in the short run.

3. Institutional Background

3.1. A Brief History of China’s IPO System

China’s legal regime of IPOs has developed in stages since 1990, from purely administrative-oriented to market-oriented. In the 1990s, China’s capital market was designed in a “crossing the river by touching the stones” (mozhe shitouguo he) way with the purpose to raise capital for troubled state-owned enterprises (SOEs). From 1991 to 1998, the market was completely administrative-oriented [35]. The central government put a cap on the total number of funds raised in the equity market and allocated the quota to ministries and provincial governments. Therefore, only large SOEs would have the privilege to enter the capital market [36].

Being effective in July 1999, China’s first Securities Law formally recognized China Securities Regulatory Commission (“CSRC”) as the central regulator of Chinese securities market. Securities Law Article 10 also granted the CSRC the ultimate authority in determining whether a company can be permitted to issue securities publicly. During the first several years after the Securities Law was enacted, the IPO regime was still highly administrative-oriented. The CSRC authorized securities companies to select and recommend potential issuers and granted quotas directly to the recommenders. Since 2004, the sponsorship system in Hong Kong’s equity market has been introduced to mainland China. Under this new system, security companies act as sponsors and advisors for issuers. However, still, in any public offering, the CSRC retains the ultimate approval power.

The approval-based IPO system has received much criticism from both the industry and academia [37,38]. A key element of the approval-based regime is a hard threshold on profitability, which implicitly motivates firms to manipulate their cash flow. In addition, this system does not allow for a complex ownership structure. To avoid these requirements, most Internet companies in China choose to list in foreign equity markets. For example, Alibaba is listed on the New York Stock Exchange, while Tencent is listed on the Hong Kong Stock Exchange. Another concern arises from the nontransparent, slow, and unpredictable IPO review process. According to a public speech given by a senior official in the CSRC, it usually took three years to finish the IPO process before 2017. As a response to complaints of the approval-based IPO system, “Decision of the CCCPC on Some Major Issues Concerning Comprehensively Deepening the Reform”, passed by the Eighteenth Central Committee of the Communist Party of China in November 2013, first announced that the country should adopt a market-oriented registration-based IPO system, in which the CSRC only verifies the compliance of issuance application documents rather than making ultimate decisions.

However, it has taken a long time for China to formally adopt the new IPO system. In December 2015, the National People’s Congress authorized the State Council to adjust relevant provisions in the Securities Law to accommodate a registration-based IPO regime. The second reading of the Securities Law was conducted in April 2017, but with no achievements. In February 2018, the Standing Committee of the National People’s Congress decided to extend the aforesaid authorization period to 2020. One year later, the Central Committee for Comprehensive Deepening Reform deliberated and approved an “Overall Implementation Plan for Establishing a Science and Technology Innovation Board and Pilot Registration System on the Shanghai Stock Exchange”. In July 2019, the first batch of 25 companies on the Sci-tech Innovation Board (SIB) were listed for trading, showing a new registration-based regime had finally been launched. At this moment, the main boards in the Shanghai and Shenzhen Stock Exchanges are still subject to the old approval-based IPO system, while the SIB and the GEB are using the registration-based IPO system.

3.2. Registration Process under the New Regime

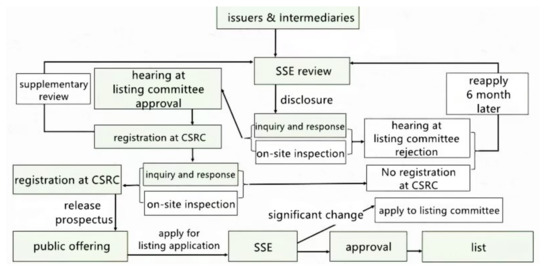

The registration process under the new regime is more transparent and efficient. Take the Sci-tech Innovation Board as an example: First, an issuer and sponsor shall submit application documents to the SSE through an online system. The documents shall include, but are not limited to, prospectus, audited report, and counsel’s opinion. The review center, an organ of the SSE, accepts and reviews the application documents. An independent advisory committee may provide advice to the review center, mainly on whether the applicant shall be regarded as a technological and innovative enterprise. The committee consists of professionals and experts in different areas, to help the review center better understand the nature and future of an applicant’s business. Furthermore, there will be rounds of inquiry and response during the review process, and the review center may conduct an on-site inspection if necessary. Second, the review center reports to the listing committee for deliberation and hearing, an independent committee consisting of officials from the CSRC, experts, and scholars. The committee will form the final opinion in a collegial manner on whether to approve the application. Third, the SSE will report the approval to the CSRC for securities registration. The CSRC has the power to reject or cancel registration, and it indeed has exercised its power, though not often. The following Figure 1 describes the registration process under the new IPO system in the Sci-tech Innovation Board.

Figure 1.

This figure describes the registration process under the new registration-based IPO system in the Sci-tech Innovation Board. Here, SSE stands for the Shanghai Stock Exchange and CSRC stands for the China Securities Regulatory Commission.

3.3. Key Differences between the Approval-Based Regime and Registration-Based Regime

The primary element of the registration-based IPO regime is openness and a high pace. Once an application is accepted by the review center, the application documents will be public to the market. The entire feedback process is open to examine, with all inquiries, responses, and updated information online. In contrast to queuing for several years under the approval-based framework, the new regime sets a three-month maximum to the review and registration process, which has qualitatively improved efficiency.

Secondly, the change of regime not only delegates authority from the central government to the market, but alters its nature. In the approval-based regime, the CSRC’s power over public issuance comes from its administrative power as the regulator of the entire securities market. The CSRC has substantial, if not unlimited, discretion. Even if an issuer meets all requirements, the CSRC can withhold its approval when the agency thinks it not in the best interest for the investors. The process remains highly nontransparent, and no remedies are provided to challenge a rejection decision. Under a registration-based regime, the public offering is a firm’s right; the stock exchanges have no authority to prevent it only because of concerns about the quality of the security.

This paternalistic approval-based regime holds the belief that the regulator is better informed and is more capable of making investment decisions. However, the truth is that unlimited discretion creates corruption and rent-seeking. The CSRC’s approval will also be regarded as an implicit quality guarantee of the issued security, which leads to a moral hazard.

Thirdly, the new regime is more disclosure-based and market-oriented. The new listing standard abandoned bottom-line requirements of sustained profitability (gross profits no less than thirty million continuously in the previous three years) and relaxed the “one share, one right” principle to facilitate the financing of innovative firms. Stock exchanges mainly review the completeness, consistency, and comprehensibility of the application documents instead of the substantive nature of an applicant’s profitability. Furthermore, the new issuance system becomes more flexible in timing and pricing. An issuer may choose to issue its securities anytime in a year after registration without any pressure regarding lowering the price. In the previous regime, all issuers followed an unofficial valuation cap of a 23× price-to-earnings ratio, taking its cue from the regulators’ need for more disclosures if issuers price new shares with a higher P/E ratio.

3.4. New Investor Protection Measures to Support the IPO Reform

There are concerns that a registration-based system may open the floodgates to public offerings by poorly managed issuers and even fraud. In its 2019 amendment, the Securities Law newly adopted and revised several measures to safeguard the interests of public investors.

First, the amendment tightens information disclosure obligations and significantly increases the cost of violations. Sponsors, auditors, and counsels are considered as gatekeepers and may be responsible for any false or misleading representation in issuance documents. The amendment raises the maximum penalties on intermediaries and professional service firms involved in fraudulent IPOs to ten-times the illegal gains or CYN 10 million, compared to CYN 600,000 in the past. Meanwhile, an amendment to the criminal law was enacted in 2021, which substantially increased the criminal punishment for securities crimes such as fraudulent issuance and information disclosure. Second, the amendment also adopts a new securities class-action provision and gives investor protection organizations an important role in such litigation. The litigation mechanism adds risk exposure to the issuers, insiders, and intermediaries in securities fraud. Third, the CSRC amended its delisting rule, stating that companies involved in fraudulent issuance and violations of major information disclosure will be suspended or terminated in trading.

4. Research Design

4.1. Data

Our sample included comprehensive information of firms completing IPOs in the Chinese A-shares stock market between January 2015 and July 2021. (The main findings in our study are not sensitive to alternative sample periods. The main reason that we selected January 2015–July 2021 was to roughly balance the numbers of firms completing their IPO before and after the registration-based IPO reform.) While there are four different trading boards in China, including the Main Board (MB), the Growth Enterprise Board (GEB), the Sci-tech Innovation Board (SIB), and the Small and Medium Enterprise Board (SMEB), we focused on firms listed in the Growth Enterprise Board and the Sci-tech Innovation Board in our empirical analysis because the registration-based IPO reform is most relevant for these two markets, as mentioned in Section 3. We followed the convention in the literature by discarding firms in the financial services sector as they usually raise much larger amounts of capital from IPOs than other firms. In total, our sample covered 585 firms listed in the GEB and 293 firms listed in the SIB that successfully completed their IPO during the sample period. All the data were acquired from the Wind Financial Database, one of the largest financial data providers in China. Table 1 shows the time distribution of IPOs in these two trading boards.

Table 1.

Time distribution of IPOs in the GEB and SIB.

The dataset we collected contains detailed information on firms’ characteristics, IPO expenses, as well as the underwriter, the law firm, and the accounting firm responsible for each IPO case. In addition to total IPO expenses, we also have specific amounts paid to underwriters, law firms, and accounting firms, which allows us to further investigate the effect of the IPO reform on these markets. As the Chinese stock market is featured by the predominant role of state-owned enterprises (SOEs), our dataset also includes a corresponding dummy variable to control the potential heterogeneity. The reason we paid special attention to SOEs lies in the fact that they are often criticized for lacking information transparency and poor corporate governance, which may affect their IPO cost, and such effects must be accounted for if the number of SOEs completing IPO process is unbalanced before and after the IPO reform. In Table 2, we describe the variables used in our empirical analysis.

Table 2.

Description of the variables.

Among the variables listed in Table 2, IPOER and IPOE measure the cost of the IPO, while IPOP, PE, PER, FIRC, POST, CAR, NVPS, and TAST are controlled variables that may affect the IPO costs. The rest are dummy variables, SOE, IT, MANU, and CONS, prepared for subgroup analysis, which enables us to scrutinize the impacts of the registration-based IPO reform on certain firms and industries. We deemed such subgroup analysis as a beneficial exercise for us to gain a deeper understanding of the recent IPO reform because previous literature has shown that there is significant heterogeneity in listed firms in China due to their ownership and industry classification [39,40]. In Table 3, we present the summary statistics for these variables with respect to the trading broads.

Table 3.

Summary statistics.

The results in Table 3 clearly indicate that firms completing IPOs in the SIB are on average larger than those in the GEB. The ratio of IPO expense to capital raised indicates that the IPO costs of these two groups of firms are roughly comparable, even though we have not considered any control variables up to this moment. Another interesting finding from Table 3 is that the ratio of the firm’s PE to its industry-level PE (PER) in the Sci-tech Innovation Board is significantly higher than that in the Growth Enterprise Board, which implies that the well-known IPO underpricing phenomenon in the Chinese stock market has been somehow alleviated. Based on this observation, we later adopt regression models to better evaluate the influence of the registration-based IPO reform on the degree of IPO underpricing. Lastly, we note that the proportion of state-owned enterprises is much lower in these two broads (SIB and GEB) than that in the Main Broad (5% vs. 30%) because firms in the two broads are usually more technology-based and owned by private shareholders. Such a difference therefore also validates our exclusive focus on the GEB and SIB when evaluating the impacts of the recent IPO reform next.

4.2. Research Methods

In this subsection, we briefly introduce the research methods used in our empirical analysis. We evaluate the impacts of the recent registration-based IPO reform from three aspects: (1) the IPO cost; (2) the degree of underpricing; (3) the competition in the markets of IPO services, including law, auditing, and underwriting. For the first two aspects, we adopted the general event study method by running linear regressions on the dummy variable of IPO reform (POST) and a set of other control variables. The coefficient of the event dummy would then measure the impact of the reform on the dependent variable if the timing of the reform itself is uncorrelated with the error term. More specifically, to investigate the impact of the IPO reform on the IPO cost, we adopted the following benchmark specification:

where i denotes the firms contained in the dataset, the subscript c stands for “cost”, and s are dummy variables that equal 1 if firm i completes the IPO in year t and 0 otherwise. These time dummies help us rule out an increasing time trend of the IPO cost. Regarding the set of control variables, we followed the literature on the IPO cost by including regressors such as , , , , and so on [16,32]. In addition, we included dummy variables and to control their influence on the IPO cost, respectively. Furthermore, we checked the impact the IPO reform on the cost of different IPO services: law, auditing, and underwriting, by replacing the total ratio of IPO expense with the ratio of specific services. To check the robustness of the results, we conducted subgroup analysis using subsamples of firms belonging to three sectors, including information technology, daily consumption, and manufacturing, which were derived from the dummy variables CONS, MANU, and IT.

To examine the impact of the registration-based IPO reform on IPO underpricing, we next considered the following specification:

where the subscript u stands for “underpricing”. Both linear regression models (1) and (2) were estimated using the ordinary least squares method with the White–Huber standard error that accounts for firm-level heteroskedasticity.

One potential concern with the above specifications is that the timing of the IPO reform, captured by the event dummy, , might be correlated with the error term, making the estimates inconsistent. However, we argue that this is unlike the case in the Chinese context, and even when there exists a certain degree of endogeneity, these estimates still provide some helpful insights for us to evaluate the impacts of the IPO reform. Firstly, the implementation of the registration-based IPO reform is directly determined by the central government, making it very difficult for firms to react to the policy change in advance. Furthermore, as firms listed in the Growth Enterprise Board and the Sci-tech Innovation Board are mainly private firms that are politically distant from regulatory institutions, it is even harder for them to know the exact date the reform will be implemented compared with state-owned enterprises. Therefore, the IPO reform could be treated as an exogenous shock at least in the GEB and SMEB. Secondly, if the IPO reform is indeed endogenous to some degree, i.e., the event indicator is correlated with the error term , we would expect firms to strategically choose to complete their IPOs before or after the reform. Such behavior, inevitably, would weaken the real impacts of the IPO reform. For example, if we expect the IPO reform can lower the IPO expense, then firms with higher IPO costs would strategically choose to complete their IPO after the reform, reducing the cost gap induced by the reform. Therefore, if the estimates from the above specifications are significant, we can confidently expect the real impacts to be close or even larger.

In addition to the IPO cost and the IPO underpricing, we were also interested in the impact of the recent IPO reform on the market structure, i.e., how the IPO reform shapes competition in different IPO service markets. To shed light on this, we utilized two popular indexes to measure market concentration that reflect the degree of market competitiveness. Due to the lack of more detailed data, the analysis we conducted in this part relies more on a heuristic comparison of these measures before and after the IPO reform, and we expect a more rigorous analysis if more order-level information is available in the future. The first measure we adopted is the famous Herfindahl–Hirschman Index (HHI). Given a specific market k, the HHI is defined as:

where is the market share (in percentage) of firm i in market k and is the total number of firms in this market. The other measure we used is the concentration ratio (CR), and the concentration ratio of order m is given by:

Without loss of generality, we considered concentration ratios of orders 3 and 6 in the empirical analysis.

In general, the Herfindahl–Hirschman Index depicts a comprehensive picture of the overall market concentration, while the concentration ratio focuses more on the market power of large firms. Therefore, both measures provide us useful angles to evaluate the impact of the recent IPO reform on the market structures of various IPO services. To end our discussion here, we document the relation among the HHI and CR and market competitiveness that has been widely applied in the literature [41,42,43] in Table 4.

Table 4.

Four classes of market structures.

5. Results and Discussions

In this section, we present and discuss our empirical findings based on the aforementioned Chinese IPO dataset. We investigate the impact of the registration-based IPO reform on the IPO cost in Section 5.1, the impact on IPO underpricing in Section 5.2, and the impact on market concentration in different IPO service markets in Section 5.3. In Section 5.4, we conduct robustness checks for our findings and further discuss them in Section 5.5.

5.1. IPO Cost

Table 5 reports the estimation results of specification (1) based on the joint sample of firms listed in both the GEM and SIB. To gain a broad understanding of the IPO reform impact on the IPO cost, we also restricted our analysis to the four main components of IPO expense, including underwriting, auditing, law, and information expense. Furthermore, as here we combined the data of both the GEM and SIB firms, we added an extra dummy variable SIB, which equals one if a firm is listed in the SIB, to control the inherent difference in IPO expense across these two boards. The coefficient of the event dummy, , was positive and significant at the 1% level in all five settings. For example, if we considered the impact of the recent IPO reform on the overall IPO cost, the coefficient estimate indicates that the ratio of the total IPO expense to capital raised increases by 1.427% after the reform if other control variables stay constant. In addition, the results show that such an effect is robust across different different components of IPO expense. The increase in the IPO cost therefore supports the hypothesis of a surging IPO demand and a higher risk premium charged by IPO service providers. However, a further distinction of these two mechanisms is beyond the scope of the current paper.

Table 5.

Baseline results for the IPO cost.

Regarding other control variables, we found that there is a positive and significant relation between firms’ total assets when starting the IPO process and the IPO cost with respect to the overall and underwriting expenses, while such a relation is small and insignificant for law and information expenses. We conjecture that such a pattern is due to the fact that law and information expenses are relatively fixed compared with underwriting and auditing expenses, which usually take up a certain proportion of the capital raised. The relation between the logarithm of the capital raised and IPO cost is negative and significant at 1%, which is not surprising because of the construction of the dependent variable.

Interestingly, we found that the PE ratio when starting the IPO process (PE) is positive and significant at 1% for the overall and underwriting cost and significant at the 10% level for the cost of information disclosure, and the relation between the ratio of a firm’s PE (PER) to its corresponding industry-level PE is negative and significant at the 1% level. Even though the signs of these two coefficients are opposite, such a pattern is consistent with the bargaining process between firms and their underwriters. Specifically, underwriters tend to charge firms with higher PEs a higher IPO expense, while on the other hand, firms that have stronger bargaining powers, measured by PER, can often enjoy a lower IPO cost. A good example for this point is the abortive IPO process of Ant Group. Ant Group’s IPO PE ratio was nearly 100 when the company was about to be listed in the SIB. However, the ratio of underwriting expense to capital raised was less than 2%. In addition, the results show that state-owned enterprises indeed enjoy a lower IPO cost than non-SOEs with respect to the overall, auditing, and law cost. Finally, the results also indicate that the overall IPO cost in the SIB is on average higher than that in the GEM by 0.547% at a significance level of 5%, which can be attributed to the increased underwriting cost. This observation, however, is consistent with the fact that firms that complete their IPOs in the SIB are usually more “risky” than those in the GEM, resulting in a higher risk premium from the underwriters.

5.2. IPO Underpricing

In Table 6, we report the estimation results of specification (2) that explore the impact of the registration-based IPO reform on the IPO underpricing phenomenon. It is probably not too surprising that the recent IPO reform indeed reduces the degree of IPO underpricing in these two boards. Specifically, we found that the ratio of the firm’s PE to its industry-level PE on average increases by 11.7% in the joint sample of the SIB and GEM and increases by 16.1% in the GEM. Both estimates are significant at 1%. Therefore, these results well validate one of the main targets of the registration-based IPO reform in China: providing firms a fairer pricing scheme.

Table 6.

Baseline results for IPO underpricing.

In addition, we also found that IPO underpricing is negatively correlated with the IPO offer price in the full sample. However, such a relation is insignificant if we restrict the regression to the sample of firms listed in the GEM. A possible explanation for this observation is that firms with high valuations tend to decrease their IPO offer prices to enhance the after-market liquidity and thus attract more stock buyers [26]. Not surprisingly, we found that PE is positively correlated with IPO underpricing, as implied by the construction of the dependent variable. Interestingly, the results show that firms located in the four first-tier cities in China suffer more severe IPO underpricing. We conjecture that this is caused by the large supply of homogeneous firms from first-tier cities in the stock market. To end our discussion in this subsection, we document that firms that complete their IPOs in the SIB are more likely to be underpriced as the corresponding coefficient estimate is negative and significant at 1%. On average, this implies that the IPO valuation is 18.1% lower in the SIB compared with the GEM. This observation, however, is consistent with the nature of the SIB: those technology-based firms have higher operation risk, and investors in the secondary market often require larger risk premiums.

5.3. Market Concentration

Our last focus in this paper was to evaluate the impact of the recent IPO reform on the market structures in different IPO service markets. In Table 7, we report the HHI, , and for different data samples following the instructions in Section 4. Here, we adopted HHI to describe the overall market concentration and used concentration ratios to scrutinize the impact on large service providers. Firstly, we note that all three IPO service markets (underwriting, auditing, and law) have a low degree of concentration based on the classification standards in Table 4. Comparing the HHI before and after the IPO reform, we observed a slight increase in overall market concentration with respect to the market of underwriting in the GEM after the IPO reform. On the hand other, the markets of auditing and law service experienced a moderate decrease in the overall market concentration after the IPO reform. Comparing the after-reform statistics of the GEM and the SIB, we found that the market concentrations in these two boards are very close to each other.

Table 7.

Market concentration before and after the IPO reform.

Regarding the market concentration for large firms, the results show that both and of the market of the underwriting service slightly increased in the GEM after the IPO reform, while the corresponding statistics for the markets of auditing and law decreased slightly. To summarize our findings in this subsection, we note that these results only reveal the temporary impact of the registration-based IPO reform on the market structures due to the lack of long-term data, and thus, they must be interpreted with caution. However, if more data become available in the future, we can easily adopt the statistical inference method to test if any change regarding market structures is significant.

5.4. Robustness Check

In the previous subsections, we showed that the recent registration-based IPO reform (1) increased the average IPO cost and (2) successfully alleviated IPO underpricing, using the joint sample of firms both in the GEM and SIB. Here, we conducted two basic robustness checks to ensure that these results are robust. Specifically, instead of combining firms from the GEM and SIC together, we re-estimated the specifications (1) and (2) only using the data of the GEM. In addition, we conducted subgroup analysis based on the firm’s category to check if our findings held for different categories of firms (We classified them into three broad categories: consumption-related (CONS), manufacturing (MANU), and information technology (IT)).

Table 8 reports the estimation results of the robustness check for the IPO cost. It is clear that both the scale and the significance of the coefficient that measures the impact of the IPO reform (POST) are similar to those in the benchmark regression shown in Table 5, which demonstrates the robustness of our findings. Interestingly, the results in Table 8 also imply that the impact of the IPO reform on the IPO cost is heterogeneous across different categories. For example, firms in the consumption-related category experience an increase of the IPO cost of 2.463%, which is almost four-times as large as the increase for firms in the IT category.

Table 8.

Robustness check for IPO cost.

In Table 9, we present the results of the robustness check for IPO underpricing. Similar to Table 6, we found that firms in all categories exhibit a lower degree of IPO underpricing after the registration-based IPO reform. For the reader’s convenience, we also include the estimation results for the full sample of the GEM to facilitate our comparison (The same results for the full sample of the GEM are also included in Table 6). Again, we found that the scale and significance of the estimates do not vary much under the new settings. However, there exists sizable heterogeneity with such an impact. Specifically, the ratio of firm-specific PE to industry-level PE increases by 7.4% in the consumption-related category, 12.2% in the manufacturing category, and 17.8% in the IT category. Interestingly, the results in Table 8 and Table 9 all imply that firms belonging to the IT category benefit the most from the recent IPO reform, as they not only enjoy higher evaluations, but also suffer a lower increase in the IPO cost than other firms.

Table 9.

Robustness check for IPO underpricing.

5.5. Discussions

Up to this point, we have shown that: (1) the IPO cost increased significantly after the recent registration-based IPO reform; (2) the IPO underpricing has been alleviated significantly after the reform; (3) the reform has not triggered a sensible change of the market structures in four IPO service markets. Based on these findings, we briefly discuss the potential limitations and future research directions for our current study.

One of the main limitations of the current study is that we were only able to evaluate the short-term impact of the registration-based IPO reform due to the lack of long-term data. As mentioned above, the registration-based IPO reform was an important event that fundamentally shapes the equity market in China, as it symbolizes a step further towards a modern financial market. Therefore, the reform is likely to induce many structural changes in the long-term, in addition to the short-term impacts. As more data become available in the future, we believe investigating the long-term impacts of the current IPO reform will be an intriguing research topic.

Another important research question related to the recent IPO reform is its potential influence on the after-IPO firm performance and the stock price performance. In the previous approval-based IPO system, only firms favored by the government could access the stock market. In this sense, there may exist severe information asymmetry among investors, firms, and the government. However, after the recent IPO reform, firms are now required to provide investors sufficient unbiased information that can help them make investment decisions, which can partly resolve the information asymmetry problem. Therefore, firms’ after-IPO performance may also differ because of the registration-based IPO reform. This topic, however, is beyond the scope of this paper, and we leave it for future research.

6. Conclusions

In this paper, we investigated the short-term impacts of the recent registration-based IPO reform in the Chinese equity market. Using firm-level data from the Chinese A-shares stock market during 2015 to 2021, we showed that the reform (1) significantly increased the IPO cost and (2) reduced the degree of IPO underpricing and that (3) the market structures in the IPO service markets changed slightly. We also conducted two robustness checks, which showed that our findings are plausible. Overall, these findings are consistent with the main hypothesis proposed in this paper that the recent IPO reform successfully makes the IPO market in China more market-oriented, and thus, both the level of the IPO cost and the IPO price can better reflect the underlying risk, demand, and supply in China’s IPO market.

Our study contributes to the existing literature in several aspects. First, to our best knowledge, this is the first study to evaluate the impacts of the registration-based IPO reform in China. Hence, this study can help policymakers better understand the effectiveness of the recent reform. Second, our study also provides valuable implications for China’s future IPO reforms, as well as IPO reforms in other emerging markets. Specifically, our study shows that adopting the registration-based IPO system makes the IPO process more market-oriented in the sense that the IPO cost and IPO pricing can better reflect the underlying risk, demand, and supply in the market. Given the fact that China has not adopted the registration-based IPO system in all trading boards, this study is particularly useful for subsequent policy decisions. Last but not least, this study contributes to the general literature on IPO cost and IPO underpricing by studying a unique policy change in one of the most important emerging markets in the world.

However, it is noteworthy that the findings in this study should be interpreted with caution because the impacts were identified based on relatively short-term data. We do acknowledge that the long-term impacts of the recent IPO reform could be different from the short-term impacts as participants in the IPO market gradually attain a new equilibrium in the long run. Since the registration-based IPO system has only been in use for less than two years, we leave the evaluation of such long-term impacts as a topic for future research when more data become available. Moreover, examining potential changes in firms’ post-IPO performance before and after the recent IPO reform may also be an interesting research question.

Author Contributions

Conceptualization, C.Z., W.Z. and J.L.; methodology, W.Z.; programming, J.L.; data, W.Z.; formal analysis, C.Z., W.Z. and J.L.; writing, C.Z., W.Z. and J.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research is supported by the Humanities and Social Sciences Research Projects of the Department of Education of Zhejiang Province (Project No. Y202146231, Grant No. 2021QN045), the Soft Science Research Projects by Zhejiang Province Association for Science and Technology (Grant No. 2021KXCX-KT023), the Fundamental Research Funds for the Central Universities (Grant No. 2021QN81022), and the Zhejiang University Global Partnership Fund.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data used in this study cannot be publicized due to copyright restrictions, but are available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ritter, J.R.; Welch, I. A review of IPO activity, pricing, and allocations. J. Financ. 2002, 57, 1795–1828. [Google Scholar] [CrossRef] [Green Version]

- Gompers, P.; Lerner, J. Equity financing. In Handbook of Entrepreneurship Research; Springer: Berlin, Germany, 2003; pp. 267–298. [Google Scholar]

- Amihud, Y.; Hauser, S.; Kirsh, A. Allocations, adverse selection, and cascades in IPOs: Evidence from the Tel Aviv Stock Exchange. J. Financ. Econ. 2003, 68, 137–158. [Google Scholar] [CrossRef]

- Leite, T. Adverse selection, public information, and underpricing in IPOs. J. Corp. Financ. 2007, 13, 813–828. [Google Scholar] [CrossRef]

- Wong, A.; Zhou, X. Development of financial market and economic growth: Review of Hong Kong, China, Japan, the United States and the United Kingdom. Int. J. Econ. Financ. 2011, 3, 111–115. [Google Scholar] [CrossRef]

- Chen, Y.; Xie, Y.; You, H.; Zhang, Y. Does crackdown on corruption reduce stock price crash risk? Evidence from China. J. Corp. Financ. 2018, 51, 125–141. [Google Scholar] [CrossRef]

- Chen, B.; Zhou, G. Anti-Corruptions and IPO Decision: Evidence from the Chinese Provincial Panel Data. Available online: https://ssrn.com/abstract=3632826 (accessed on 7 September 2021).

- Xiong, Y.; Zhao, Y. Guanxi, media coverage and IPO approvals: Evidence from China. Pac.-Basin Financ. J. 2021, 65, 101468. [Google Scholar] [CrossRef]

- Liu, Q.; Tang, J.; Tian, G.G. Does political capital create value in the IPO market? Evidence from China. J. Corp. Financ. 2013, 23, 395–413. [Google Scholar] [CrossRef] [Green Version]

- Chen, D.; Guan, Y.; Zhang, T.; Zhao, G. Political connection of financial intermediaries: Evidence from China’s IPO market. J. Bank. Financ. 2017, 76, 15–31. [Google Scholar] [CrossRef]

- Fan, J.P.; Wong, T.J.; Zhang, T. Politically connected CEOs, corporate governance, and Post-IPO performance of China’s newly partially privatized firms. J. Financ. Econ. 2007, 84, 330–357. [Google Scholar] [CrossRef]

- Li, D.; Moshirian, F.; Nguyen, P.; Tan, L.W. Managerial ownership and firm performance: Evidence from China’s privatizations. Res. Int. Bus. Financ. 2007, 21, 396–413. [Google Scholar] [CrossRef]

- Fan, J.P.; Wong, T.J.; Zhang, T. Politically connected CEOs, corporate governance, and the post-IPO performance of China’s partially privatized firms. J. Appl. Corp. Financ. 2014, 26, 85–95. [Google Scholar] [CrossRef] [Green Version]

- Lu, L. The Rising Star in the East: Unveiling China’s Star Market, the Registration-Based IPO Regime and Capital Markets Law Reform. Available online: https://ssrn.com/abstract=3782835 (accessed on 7 September 2021).

- Chen, H.C.; Ritter, J.R. The seven percent solution. J. Financ. 2000, 55, 1105–1131. [Google Scholar] [CrossRef]

- Beatty, R.P. The economic determinants of auditor compensation in the initial public offerings market. J. Account. Res. 1993, 31, 294–302. [Google Scholar] [CrossRef]

- Torstila, S. The distribution of fees within the IPO syndicate. Financ. Manag. 2001, 30, 25–43. [Google Scholar] [CrossRef]

- Chaplinsky, S.; Hanley, K.W.; Moon, S.K. The JOBS Act and the costs of going public. J. Account. Res. 2017, 55, 795–836. [Google Scholar] [CrossRef] [Green Version]

- Chen, S.L.; Li, R. The Main Factors of Effecting On Our Country’s IPO Costs. Mod. Prop. Manag. 2011, 10, 4–6. [Google Scholar]

- Wang, J.; Wang, P. Research on Issue Costs of Chinese Private Listed Companies. Econ. Probl. 2008, 2, 58–60. [Google Scholar]

- Peng, S.; Jixun, Z.; Yan, S. Industry Expertise, Character of Collected Capital and IPO Audit Fee Pricing. Secur. Mark. Her. 2008, 9, 23–29. [Google Scholar]

- Ting, Y.; Tse, Y.K. An empirical examination of IPO underpricing in the Chinese A-share market. China Econ. Rev. 2006, 17, 363–382. [Google Scholar]

- Su, D.; Fleisher, B.M. An empirical investigation of underpricing in Chinese IPOs. Pac.-Basin Financ. J. 1999, 7, 173–202. [Google Scholar] [CrossRef]

- Chambers, D.; Dimson, E. IPO underpricing over the very long run. J. Financ. 2009, 64, 1407–1443. [Google Scholar] [CrossRef]

- Boulton, T.J.; Smart, S.B.; Zutter, C.J. IPO underpricing and international corporate governance. J. Int. Bus. Stud. 2010, 41, 206–222. [Google Scholar] [CrossRef]

- Booth, J.R.; Chua, L. Ownership dispersion, costly information, and IPO underpricing. J. Financ. Econ. 1996, 41, 291–310. [Google Scholar] [CrossRef]

- Lowry, M.; Shu, S. Litigation risk and IPO underpricing. J. Financ. Econ. 2002, 65, 309–335. [Google Scholar] [CrossRef] [Green Version]

- Ljungqvist, A. IPO underpricing. In Handbook of Empirical Corporate Finance; Elsevier: Amsterdam, The Netherlands, 2007; pp. 375–422. [Google Scholar]

- Akyol, A.C.; Cooper, T.; Meoli, M.; Vismara, S. Do regulatory changes affect the underpricing of European IPOs? J. Bank. Financ. 2014, 45, 43–58. [Google Scholar] [CrossRef]

- Cheung, Y.l.; Ouyang, Z.; Weiqiang, T. How regulatory changes affect IPO underpricing in China. China Econ. Rev. 2009, 20, 692–702. [Google Scholar] [CrossRef]

- Khurshed, A.; Tong, Y.; Wang, M. Split-share structure reform and the underpricing of Chinese initial public offerings. Eur. J. Financ. 2018, 24, 1485–1505. [Google Scholar] [CrossRef]

- Li, R.; Liu, W.; Liu, Y.; Tsai, S.B. IPO underpricing after the 2008 financial crisis: A study of the Chinese stock markets. Sustainability 2018, 10, 2844. [Google Scholar] [CrossRef] [Green Version]

- Su, C.; Brookfield, D. An evaluation of the impact of stock market reforms on IPO under-pricing in China: The certification role of underwriters. Int. Rev. Financ. Anal. 2013, 28, 20–33. [Google Scholar] [CrossRef]

- Jiang, F.; Leger, L.A. The impact on performance of IPO allocation reform: An event study of Shanghai Stock Exchange A-shares. J. Financ. Econ. Policy 2010, 2, 251–272. [Google Scholar] [CrossRef]

- Brunnermeier, M.K.; Sockin, M.; Xiong, W. China’s gradualistic economic approach and financial markets. Am. Econ. Rev. 2017, 107, 608–613. [Google Scholar] [CrossRef] [Green Version]

- Pistor, K.; Xu, C. Governing stock markets in transition economies: Lessons from China. Am. Law Econ. Rev. 2005, 7, 184–210. [Google Scholar] [CrossRef] [Green Version]

- Huang, R.H. The regulation of securities offerings in China: Reconsidering the merit review element in light of the global financial crisis. Hong Kong LJ 2011, 41, 261. [Google Scholar]

- Fengqi, C. Promoting the Reformation of Stock Issuance Registration System. Nankai J. (Philos. Lit. Soc. Sci. Ed.) 2014, 2, 118–126. [Google Scholar]

- Kato, T.; Long, C. Executive compensation, firm performance, and corporate governance in China: Evidence from firms listed in the Shanghai and Shenzhen Stock Exchanges. Econ. Dev. Cult. Chang. 2006, 54, 945–983. [Google Scholar] [CrossRef] [Green Version]

- Aharony, J.; Lee, C.W.J.; Wong, T.J. Financial packaging of IPO firms in China. J. Account. Res. 2000, 38, 103–126. [Google Scholar] [CrossRef]

- Rhoades, S.A. Market share inequality, the HHI, and other measures of the firm-composition of a market. Rev. Ind. Organ. 1995, 10, 657–674. [Google Scholar] [CrossRef]

- Hannan, T.H. Market share inequality, the number of competitors, and the HHI: An examination of bank pricing. Rev. Ind. Organ. 1997, 12, 23–35. [Google Scholar] [CrossRef]

- Al-Muharrami, S.; Matthews, K.; Khabari, Y. Market structure and competitive conditions in the Arab GCC banking system. J. Bank. Financ. 2006, 30, 3487–3501. [Google Scholar] [CrossRef] [Green Version]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).