Fish Exports and the Growth of the Agricultural Sector: The Case of South and Southeast Asian Countries

Abstract

:1. Introduction

2. The Export-Led Growth Hypothesis and Its Empirical Support

3. ELG Hypothesis and Fish Exports

4. Data, Variables, and Empirical Methodology

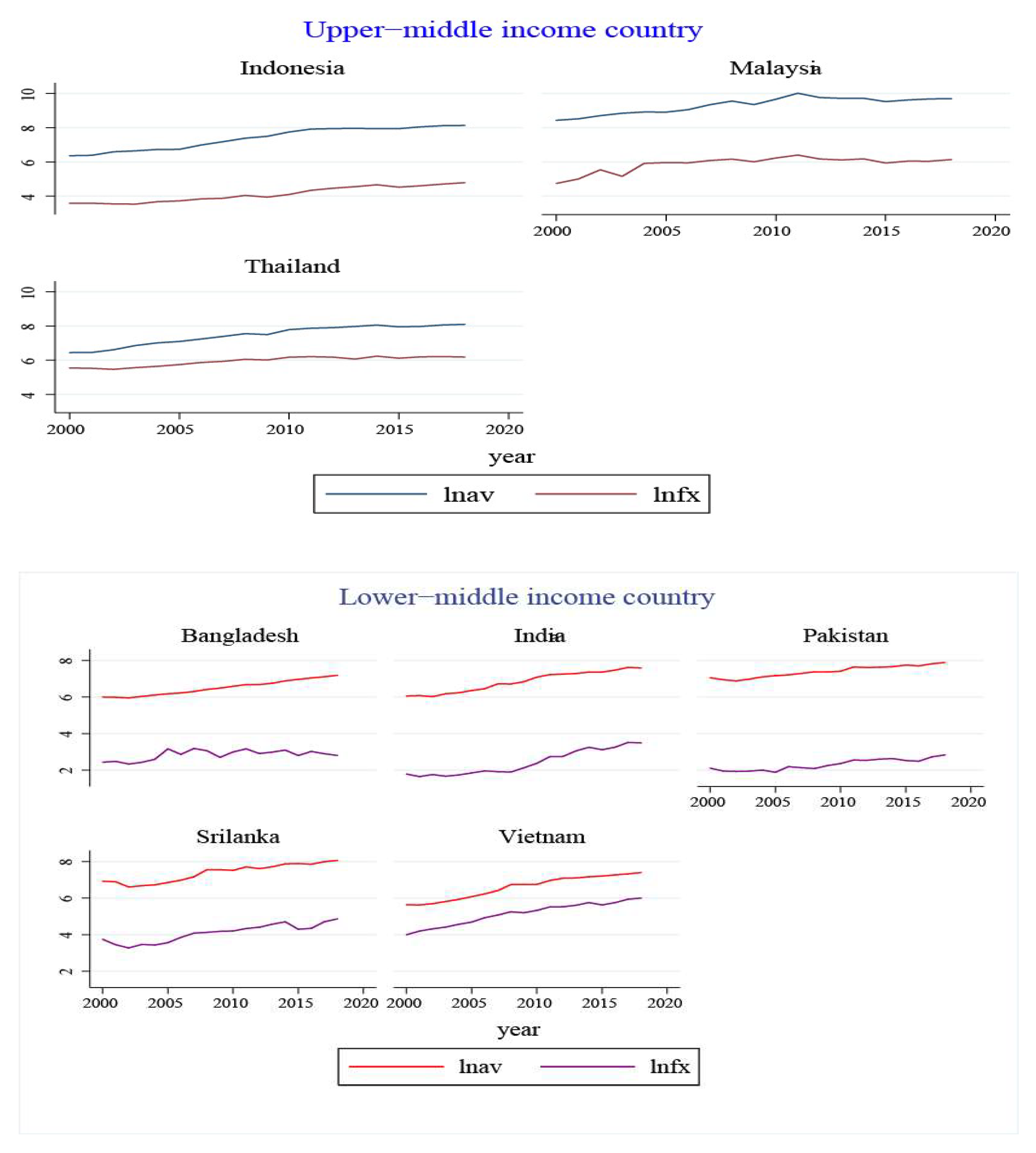

4.1. Data and Variables

4.2. Empirical Methodology

5. Results

5.1. Panel-Unit Root and Cointegration Tests

5.2. Estimation of the ECM

5.3. Country-Jackknife Analysis

5.4. Split by Income Level

5.5. Panel-Vector ECM-Type Granger-Causality Test

6. Summary and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- FAO. The State of World Fisheries and Aquaculture 2020. Sustainability in Action; FAO: Rome, Italy, 2020; Available online: http://www.fao.org/3/ca9229en/ca9229en.pdf (accessed on 4 April 2021).

- UNCTAD. Fishery Exports and the Economic Development of Least Developed Countries; UNCTAD: Geneva, Switzerland, 2017. [Google Scholar]

- Béné, C. Global Change in African Fish Trade: Engine of Development or Threat to Local Food Security? OECD Food, Agriculture and Fisheries Working Papers; OECD: Paris, France, 2008; Volume 10. [Google Scholar]

- Béné, C.; Macfadyen, G.; Allison, E.H. Increasing the Contribution of Small-Scale Fisheries to Poverty Alleviation and Food Security; FAO Fisheries Technical Paper; FAO: Rome, Italy, 2007. [Google Scholar]

- UNCTAD. Appraisal of the Implementation of the Brussels Programme of Action for LDCs for the Decade 2001–2010; United Nations Publication: New York, NY, USA; UNCTAD: Geneva, Switzerland, 2010. [Google Scholar]

- UNCTAD. Export Competitiveness and Development in LDCs; United Nations Publication: New York, NY, USA; UNCTAD: Geneva, Switzerland, 2008. [Google Scholar]

- World Bank/FAO/WorldFish 2012. Hidden Harvest: The Global Contribution of Capture Fisheries; World Bank Report, No. 66469-GLB; World Bank: Washington, DC, USA, 2012. [Google Scholar]

- Kumar, R.; Kumar, R.R.; Stauvermann, P.J. Effect of fisheries subsidies negotiations on fish production and interest rate. J. Risk Financ. Manag. 2020, 13, 297. [Google Scholar] [CrossRef]

- Béné, C.; Barange, M.; Subasinghe, R.; Pinstrup-Andersen, P.; Merino, G.; Hemre, G.-I.; Williams, M.J. Feeding 9 billion by 2050—Putting fish back on the menu. Food Secur. 2015, 7, 261–274. [Google Scholar] [CrossRef] [Green Version]

- Béné, C. Small-Scale Fisheries: Assessing Their Contribution to Rural Livelihoods in Developing Countries; FAO Fisheries Circular, Food and Agriculture Organization (FAO): Rome, Italy, 2006. [Google Scholar]

- FAO. The State of World Fisheries and Aquaculture (2020); Food and Agriculture Organization (FAO): Rome, Italy, 2020; Available online: http://www.fao.org/fishery/sofia/en (accessed on 5 May 2021).

- FAO. Responsible Fish Trade. In FAO. Technical Guidelines for Responsible Fisheries; Food and Agriculture Organization (FAO): Rome, Italy, 2009. [Google Scholar]

- Golub, S.; Varma, A. Fishing Exports and Economic Development of Least Developed Countries: Bangladesh, Cambodia, Comoros, Sierra Leone and Uganda; UNCTAD: Geneva, Switzerland, 2014. [Google Scholar]

- Mugwanya, M.; Dawood, M.A.O.; Kimera, F.; Sewilam, H. Biofloc systems for sustainable production of economically important aquatic species: A review. Sustainability 2021, 13, 7255. [Google Scholar] [CrossRef]

- SEAFDEC. Overview of the Fisheries Sector of Southeast Asia in 2018. Available online: http://www.seafdec.org/fishstat2018 (accessed on 10 May 2021).

- Siby, K.M.; Arunachalam, P. Growth, Instability and Demand Elasticity of Indian Fish Exports; Munich Personal RePEc Archive 107747: Munich, Germany, 2021. [Google Scholar]

- Ghose, B. Fisheries and aquaculture in Bangladesh: Challenges and opportunities. Ann. Aquac. Res. 2014, 1, 1–5. [Google Scholar]

- Balassa, B. Exports and economic growth. Further evidence. J. Dev. Econ. 1978, 5, 181–189. [Google Scholar] [CrossRef]

- World Bank. World Development Report 2008: Agriculture for Development; World Bank: Washington, DC, USA, 2008. [Google Scholar]

- Pesaran, H.; Shin, Y.; Smith, R. Pooled mean group estimation and dynamic heterogeneous panels. J. Am. Stat. Assoc. 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Dreger, C.; Herzer, D. A further examination of the export-led growth hypothesis. Empir. Econ. 2013, 45, 39–60. [Google Scholar] [CrossRef] [Green Version]

- Seok, J.H.; Moon, H. Agricultural exports and agricultural economic growth in developed countries: Evidence from OECD countries. J. Int. Trade Econ. Dev. 2021, 30, 1004–1019. [Google Scholar] [CrossRef]

- Bahmani-Oskooee, M.; Economidou, C. Export-led growth Vs. growth-led exports: LDCs experience. J. Dev. Areas 2009, 42, 179–212. [Google Scholar] [CrossRef]

- Ee, C.Y. Export-led growth hypothesis: Empirical evidence from selected Sub-saharan African countries. Procedia Econ. Finance 2016, 35, 232–240. [Google Scholar] [CrossRef] [Green Version]

- Ekanayake, E.M. Exports and economic growth in Asian developing countries: Cointegration and error-correction models. J. Econ. Dev. 1999, 24, 43–56. [Google Scholar]

- Mei-Chu, W. Tests of causality and exogeneity between exports and economic growth: The case of Asian NICs. J. Econ. Dev. 1987, 12, 149–159. [Google Scholar]

- Michaely, M. Exports and growth: An empirical investigation. J. Dev. Econ. 1977, 4, 49–53. [Google Scholar] [CrossRef]

- Murindahabi, T.; Li, Q.; Nisingizwe, E.; Ekanayake, E.M.B.P. Do coffee exports have impact on long-term economic growth of countries? Agric. Econ. 2019, 65, 385–393. [Google Scholar] [CrossRef]

- Vohra, R. Export and economic growth: Further time series evidence from less-developed countries. Int. Adv. Econ. Res. 2001, 7, 345–350. [Google Scholar] [CrossRef]

- Giles, J.A.; Williams, C.L. Export-led growth: A survey of the empirical literature and some non-causality results. Part 1. J. Int. Trade Econ. Dev. 2000, 9, 261–337. [Google Scholar] [CrossRef]

- Odhiambo, N.M. Is export-led growth hypothesis still valid for sub-Saharan African countries? New evidence from panel data analysis. Eur. J. Manag. Bus. Econ. 2021. forthcoming. [Google Scholar] [CrossRef]

- Shirazi, N.S.; Abdul Manap, T.A. Export-led growth hypothesis: Further econometric evidence from South Asia. Dev. Econ. 2005, 43, 472–488. [Google Scholar] [CrossRef]

- Hye, Q.M.A.; Wizarat, S.; Lau, W.Y. Trade-led growth hypothesis: An empirical analysis of South Asian countries. Econ. Model. 2013, 35, 654–660. [Google Scholar] [CrossRef]

- Kubo, A. Trade and economic growth: Is export-led growth passé? Econ. Bull. 2011, 31, 1623–1630. [Google Scholar]

- Lim, S.Y.; Ghazali, M.F.; Ho, C.M. Export and economic growth in Southeast Asia current newly industrialized countries: Evidence from nonparametric approach. Econ. Bull. 2011, 31, 2684–2693. [Google Scholar]

- Love, J.; Chandra, R. Testing export-led growth in India, Pakistan and Sri Lanka using a multivariate framework. Manch. Sch. 2004, 72, 483–496. [Google Scholar] [CrossRef]

- Shahbaz, M.; Ahmad, K.; Asad, M.A. Exports-led growth hypothesis in Pakistan: Further evidence. Asian Econ. Financ. Rev. 2011, 1, 182–197. [Google Scholar]

- Kurniasih, E.P. The long-run and short-run impacts of investment, export, money supply, and inflation on economic growth in Indonesia. J. Econ. Bus. Account. Ventur. 2019, 22, 21–28. [Google Scholar] [CrossRef] [Green Version]

- Liang, H.S.; Zuradi, J. Is The Export-Led Growth Hypothesis Valid for Malaysia? Working Paper; Universiti Sains Malaysia, Department of Statistics: Kuala Lumpur, Malaysia, 2012. [Google Scholar]

- Pham, H.M.; Nguyen, P.M. Empirical research on the impact of credit on economic growth in Vietnam. Manag. Sci. Lett. 2020, 10, 2897–2904. [Google Scholar] [CrossRef]

- Kim, D.-H.; Lin, S.-C. Trade and growth at different stages of economic development. J. Dev. Stud. 2009, 45, 1211–1224. [Google Scholar] [CrossRef]

- Lee, C.H.; Huang, B.N. The relationship between exports and economic growth in East Asian countries: A multivariate threshold autoregressive approach. J. Econ. Dev. 2002, 27, 45–68. [Google Scholar]

- Kalaitzi, A.S.; Chamberlain, T.W. Fuel-mining exports and growth in a developing state: The case of the UAE. Int. J. Energy Econ. Policy 2020, 10, 300–308. [Google Scholar] [CrossRef]

- Myint, H. The gains from international trade and the backward countries. Rev. Econ. Stud. 1954, 22, 129. [Google Scholar] [CrossRef]

- Kalaitzi, A.S.; Chamberlain, T.W. Merchandise exports and economic growth: Multivariate time series analysis for the United Arab Emirates. J. Appl. Econ. 2020, 23, 163–182. [Google Scholar] [CrossRef]

- Kim, D.-H.; Lin, S.-C.; Suen, Y.-B. Nonlinearity between trade openness and economic development. Rev. Dev. Econ. 2011, 15, 279–292. [Google Scholar] [CrossRef]

- Sannassee, R.; Seetanah, B.; Jugessur, J. Export-led growth hypothesis: A meta-analysis. J. Dev. Areas 2014, 48, 361–385. [Google Scholar] [CrossRef]

- Gries, T.; Redlin, M. Trade and economic development: Global causality and development- and openness-related heterogeneity. Int. Econ. Econ. Policy 2020, 17, 923–944. [Google Scholar] [CrossRef]

- Kurien, J. Responsible Fish Trade and Food Security. Toward Understanding the Relationship between International Fish Trade and Food Security (Report of the Study on the Impact of International Trade in Fishery Products on Food Security); Food and Agriculture Organization (FAO) and the Royal Norwegian Ministry of Foreign Affairs: Rome, Italy, 2005. [Google Scholar]

- Jawaid, S.T.; Siddiqui, M.H.; Atiq, Z.; Azhar, U. Fish exports and economic growth: The Pakistan’s experience. Glob. Bus. Rev. 2019, 20, 279–296. [Google Scholar] [CrossRef]

- Jaunky, V.C. Fish exports and economic growth: The case of SIDS. Coast. Manag. 2011, 39, 377–395. [Google Scholar] [CrossRef]

- FAO. Capital Stock in Agriculture, Forestry and Fishery; FAO: Rome, Italy, 2015; Available online: www.fao.org/fileadmin/templates/ess/documents/stocks/Ag_Capital_Stock_-_FAO_Statistical_Analysis_–_Key_findings_from__the_dataset.pdf (accessed on 27 August 2021).

- FAO. Food and Agriculture Data. 2021. Available online: http://www.fao.org/faostat/en/#data (accessed on 27 August 2021).

- World Bank. World Development Indicators. Open Access Data. Available online: http://databank.worldbank.org/data/views/variableSelection/selectvariables.aspx?source=world-development-indicators (accessed on 27 August 2021).

- Herzer, D.; Nowak-Lehmann, F.D.; Siliverstovs, B. Export-led growth in Chile: Assessing the role of export composition in productivity growth. Dev. Econ. 2006, 44, 306–328. [Google Scholar] [CrossRef] [Green Version]

- Emam, A.; Chen, T.; Leibrecht, M. Inward worker remittances and economic growth: The case of Bangladesh. Appl. Econ. J. 2021, 28, 43–62. [Google Scholar]

- Kim, D.-H.; Lin, S.-C. Dynamic relationship between inflation and financial development. Macroecon. Dyn. 2010, 14, 343–364. [Google Scholar] [CrossRef]

- Pesaran, M.; Smith, R. Estimating long-run relationships from dynamic heterogeneous panels. J. Econ. 1995, 68, 79–113. [Google Scholar] [CrossRef]

- Pedroni, P. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxf. Bull. Econ. Stat. 1999, 61, 653–670. [Google Scholar] [CrossRef]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. J. Econ. 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Singer, H.W.; Gray, P. Trade policy and growth of developing countries: Some new data. World Dev. 1988, 16, 395–403. [Google Scholar] [CrossRef]

- Serajuddin, U.; Hamadeh, N. New World Bank Country Classifications by Income Level: 2020–2021. Available online: https://blogs.worldbank.org/opendata/new-world-bank-country-classifications-income-level-2020-2021 (accessed on 27 August 2021).

- Hughes, A.C. Understanding the drivers of Southeast Asian biodiversity loss. Ecosphere 2017, 8, 1–33. [Google Scholar] [CrossRef]

- Liu, J.; Wang, M.; Yang, L.; Rahman, S.; Sriboonchitta, S. Agricultural productivity growth and its determinants in South and Southeast Asian countries. Sustainability 2020, 12, 49–81. [Google Scholar]

- Alltech. 8 Digital Technologies Disrupting Aquaculture. Available online: https://www.alltech.com/blog/8-digital-technologies-disrupting-aquaculture (accessed on 2 October 2021).

- UNCTAD. Inter-Regional Training and Capacity Building Workshop on Fisheries Trade, Management and Development in Selected Least Developed Countries; Albion Fishery Research Center: Mauritius, April 2017; Available online: https://unctad.org/system/files/official-document/aldc2017_mauritius_outcome.pdf (accessed on 2 October 2021).

- Sumaila, U.R. Trade and Sustainable Fisheries; ADBI Working Paper Series No. 676; ADBI: Tokyo, Japan, 2017. [Google Scholar]

- Tindall, A. How Do We Make Sure Fish Stocks Have a Sustainable Future? New Food. Available online: newfoodmagazine.com (accessed on 26 July 2021).

| av | k | fx | ox | |

|---|---|---|---|---|

| Mean | 2791.588 | 5486.277 | 144.646 | 2157.718 |

| Maximum | 22394.5 | 46693.530 | 601.414 | 24268.370 |

| Minimum | 276.230 | 159.017 | 5.198 | 3.178 |

| Std. Dev. | 4080.404 | 9782.634 | 168.410 | 4477.418 |

| Observations | 152 | 152 | 152 | 152 |

| Pedroni Panel Cointegration Tests: H0: No Cointegration | |||||

|---|---|---|---|---|---|

| Within Dimension | Between Dimension | ||||

| Panel | Statistics | Prob. | Group | Statistics | Prob. |

| v-statistics | 0.669 | 0.251 | rho-statistics | 1.078 | 0.869 |

| rho-statistics | 0.175 | 0.569 | PP-statistics | –5.759 | 0.000 |

| PP-statistics | –2.123 | 0.016 | ADF-statistics | –3.113 | 0.000 |

| ADF-statistics | –2.943 | 0.001 | |||

| Kao Cointegration Test: H0: No Cointegration | |||||

| t-Statistics | Prob. | ||||

| ADF | –5.879 | 0.000 | |||

| (1) PMG D.lnavit | (2) MG D.lnavit | (3) DFE D.lnavit | |

|---|---|---|---|

| Long Run | |||

| lnkit | 0.722 *** | 0.424 ** | 0.640 *** |

| (0.065) | (0.170) | (0.117) | |

| lnfxit | 0.453 *** | 0.343 *** | 0.244 ** |

| (0.071) | (0.106) | (0.107) | |

| lnoxit | 0.005 | 0.273 ** | 0.102 |

| (0.057) | (0.139) | (0.109) | |

| Short Run | |||

| SoA | –0.303 *** | 0.700 *** | –0.307 *** |

| (0.0929) | (0.0991) | (0.0548) | |

| D.lnkit | 0.492 ** | 0.270 | 0.469 *** |

| (0.203) | (0.213) | (0.101) | |

| D.lnfxit | –0.0417 | 0.124 *** | 0.0495 |

| (0.0395) | (0.0463) | (0.0304) | |

| D.lnoxit | 0.181 ** | 0.0672 | 0.115 *** |

| (0.0800) | (0.0762) | (0.0421) | |

| Cons | 0.0324 | 0.281 | 0.260 ** |

| (0.0970) | (0.299) | (0.122) | |

| N | 152 | 152 | 152 |

| Variable | Range | Coefficient | Country Excluded |

|---|---|---|---|

| lnk | Maximum | 0.938 *** | Pakistan |

| Minimum | 0.654 *** | Bangladesh | |

| lnfx | Maximum | 0.537 *** | Bangladesh |

| Minimum | 0.186 *** | Pakistan | |

| lnox | Maximum | 0.002 | Vietnam |

| Minimum | –0.087 *** | Pakistan |

| (1) LMI Group | (2) UMI Group | |

|---|---|---|

| D.lnavit | D.lnavit | |

| Long Run | ||

| lnkit | 0.956 *** | 0.454 *** |

| (0.053) | (0.080) | |

| lnfxit | 0.183 *** | 0.263 ** |

| (0.023) | (0.116) | |

| lnoxit | –0.095 *** | 0.437 *** |

| (0.032) | (0.091) | |

| Short Run | ||

| SoA | –0.504 ** | –0.457 *** |

| (0.208) | (0.064) | |

| D.lnkit | 0.161 | 0.683 ** |

| (0.257) | (0.317) | |

| D.lnfxit | 0.048 | –0.149 ** |

| (0.049) | (0.060) | |

| D.lnoxit | 0.145 *** | 0.124 |

| (0.054) | (0.204) | |

| Cons | –0.032 | –0.348 * |

| (0.065) | (0.178) | |

| N | 95 | 57 |

| (1) | 2 | (3) | (4) | (5) | (6) | (7) | (8) | |

|---|---|---|---|---|---|---|---|---|

| D.lnavit | D.lnkit | D.lnfxit | D.lnoxit | D.lnavit | D.lnkit | D.lnfxit | D.lnoxit | |

| Lower-middle-income countries | Upper-middle-income countries | |||||||

| D.lnavit−1 | –0.352 *** | –0.009 | –0.376 | –0.130 | 0.188 | 0.381 | 0.139 | 0.695 * |

| (0.131) | (0.104) | (0.251) | (0.293) | (0.288) | (0.200) | (0.400) | (0.380) | |

| D.lnkit−1 | 0.321 ** | 0.084 | 0.682 ** | 0.377 | 0.006 | 0.0784 | 0.294 | 0.266 |

| (0.162) | (0.129) | (0.311) | (0.362) | (0.295) | (0.200) | (0.410) | (0.389) | |

| D.lnfxit−1 | 0.080 | –0.008 | –0.178 * | –0.035 | –0.078 | –0.046 | –0.183 * | –0.012 |

| (0.049) | (0.039) | (0.095) | (0.111) | (0.069) | (0.047) | (0.096) | (0.091) | |

| D.lnoxit−1 | 0.014 | 0.078 * | 0.037 | 0.079 | –0.509 *** | –0.270 ** | 0.109 | –0.729 *** |

| (0.054) | (0.043) | (0.104) | (0.121) | (0.172) | (0.116) | (0.238) | (0.226) | |

| ECTit−1 | –0.233 *** | –0.018 | 0.082 | 0.067 | ||||

| (0.088) | (0.070) | (0.169) | (0.197) | |||||

| ECTit−1 | –0.492 ** | 0.042 | 0.309 | –0.104 | ||||

| (0.249) | (0.169) | (0.346) | (0.328) | |||||

| Cons | 0.024 | 0.110 | 0.067 | 0.059 | –0.425 | 0.114 | 0.344 | –0.025 |

| (0.021) | (0.030) *** | (0.072) | (0.046) | (0.263) | (0.178) | (0.365) | (0.346) | |

| N | 90 | 90 | 90 | 90 | 54 | 54 | 54 | 54 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Emam, M.A.; Leibrecht, M.; Chen, T. Fish Exports and the Growth of the Agricultural Sector: The Case of South and Southeast Asian Countries. Sustainability 2021, 13, 11177. https://doi.org/10.3390/su132011177

Emam MA, Leibrecht M, Chen T. Fish Exports and the Growth of the Agricultural Sector: The Case of South and Southeast Asian Countries. Sustainability. 2021; 13(20):11177. https://doi.org/10.3390/su132011177

Chicago/Turabian StyleEmam, Md Ali, Markus Leibrecht, and Tinggui Chen. 2021. "Fish Exports and the Growth of the Agricultural Sector: The Case of South and Southeast Asian Countries" Sustainability 13, no. 20: 11177. https://doi.org/10.3390/su132011177

APA StyleEmam, M. A., Leibrecht, M., & Chen, T. (2021). Fish Exports and the Growth of the Agricultural Sector: The Case of South and Southeast Asian Countries. Sustainability, 13(20), 11177. https://doi.org/10.3390/su132011177