Spatial and Statistical Analysis of Urban Poverty for Sustainable City Development

Abstract

1. Introduction

2. Literature Review

2.1. Traditional Determinants of the Prices of Flats

- Investors’ sentiment and the level of development of the national economy—there is a long-term relationship between the prices of flats and the gross domestic product per capita [29]; the prices of flats are indirectly (through an increase of demand) influenced by the wealth of the society [30] and the unemployment rate [31].

- Macroeconomic policy, especially in the conditions of the common market, which is the case of, for example, EU member states. The European Union influences, through a number of instruments (pricing and wage policy, interest and exchange rates, tax and customs policy), the fluctuations of the prices of flats in different countries. Research shows that the state’s interference with the market significantly determines the balance of housing prices, but it appears that there are differences in the response to various types of policy [32], as well as spatial differences in the implications of policies pursued in the residential property markets [25,33]. The positive influence of the inflation level on the increase of housing prices is also observed [4,34].

- The state’s housing policy—market limitations resulting from, among others, the housing policy or law regulations are difficult to observe, but they do have an impact on the housing market [35]; subsidies for the real estate market (government schemes) affect the dynamics of the prices of flats—residential property markets are not as volatile as other sectors of the economy, and the inertia of local real estate markets becomes particularly evident during violent changes. What affects the prices of residential properties in central and eastern European countries are factors that are specific to political transformation, connected with the demand for flats (financing the purchase through grants or aid schemes) [36]. Housing policy may promote the development of housing construction, but it may also contribute to an increase in the supply of flats and the ownership of wealthy citizens, deepening social and spatial inequalities [37].

- The banking system—the availability of diverse forms of providing loans for purchasing properties in the real estate market, including banks’ credit policies, as well as the availability and interest rate of loans, affect the level of housing prices and determine the volume of sales [4,36], while changes in the value of financed properties may contribute to the instability of banks [38].

- The business cycle, which affects cycles in the real estate market, but these changes do not have to be strongly correlated. Most studies of cycles in this market concern the reference variable of the price of flats. The specific sectors of the market are heterogeneous, which means that some markets are more cyclical than others; moreover, housing shocks are usually short-term [39]. Changes in the prices of flats particularly depend on the geographical location of the urbanization degree and individual features of a flat (e.g., age and material) [40].

- Local tax policy—the level of taxes and the system of reliefs and exemptions may influence the supply and prices of flats to a negligible degree in the long-term, but are quite noticeable in the short-term [44].

- Spatial policy, which affects the investment potential of a given area, promoting the increase of supply or reducing it. Land control and zoning create the opportunities to build new flats, thus influencing their prices [35].

- General location—location in a specific city, the distance from the central business district (CBD), and the property’s surroundings, including natural environment, green areas, and accessibility [43,48,49,50], which is more important in areas inhabited by a low-income population [51]. In the post-socialist cities of central and eastern Europe, zones that are characteristic for socio-economic phenomena have developed: (1) central parts of cities (old-town buildings), (2) large-block housing estates (with an increased crime rate), and (3) suburban areas (rural areas annexed to cities in the last few decades, inhabited by poor indigenous people with a mentality different from that of urban residents) [8,52,53,54].

- The individual features of properties—the floor area, number of rooms, architecture, design, the size and characteristics of the garden, technical condition, age, quality of materials used, frequency of repairs, quality of installations, possibility of extension, and renovation are all significant determinants of prices [55,56].

- Lessees—the value of a property with a lessee may differ from the value of a property without a tenant [57].

- Easiness of sale (time needed to perform a transaction) and the availability of information about a property—there is a big difference between asking prices and transaction prices; when combined with the sellers’ reluctance to reduce the price or delaying action in this regard, it prolongs the time in which the property is exposed in the market [58].

2.2. The Specific Determinants of the Prices of Flats

3. Materials and Methods

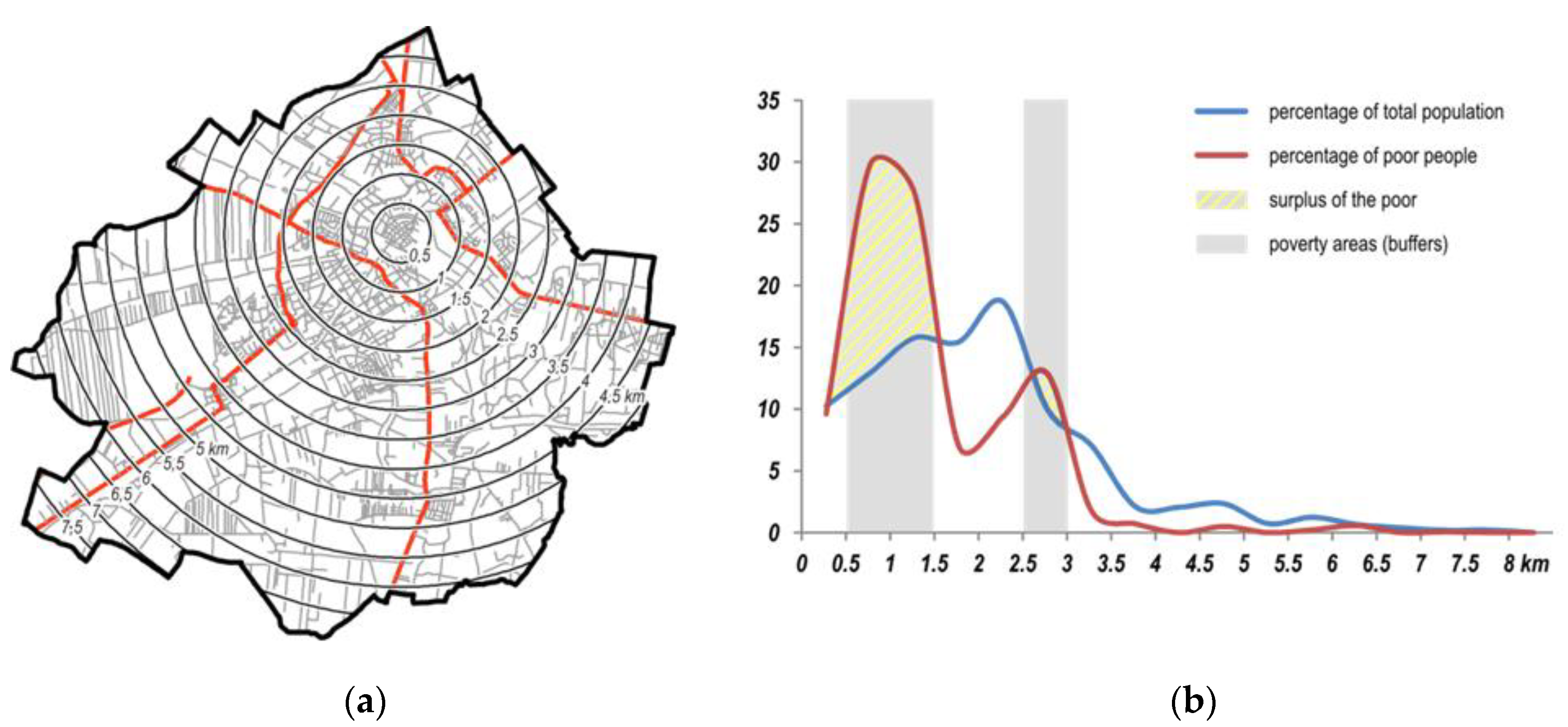

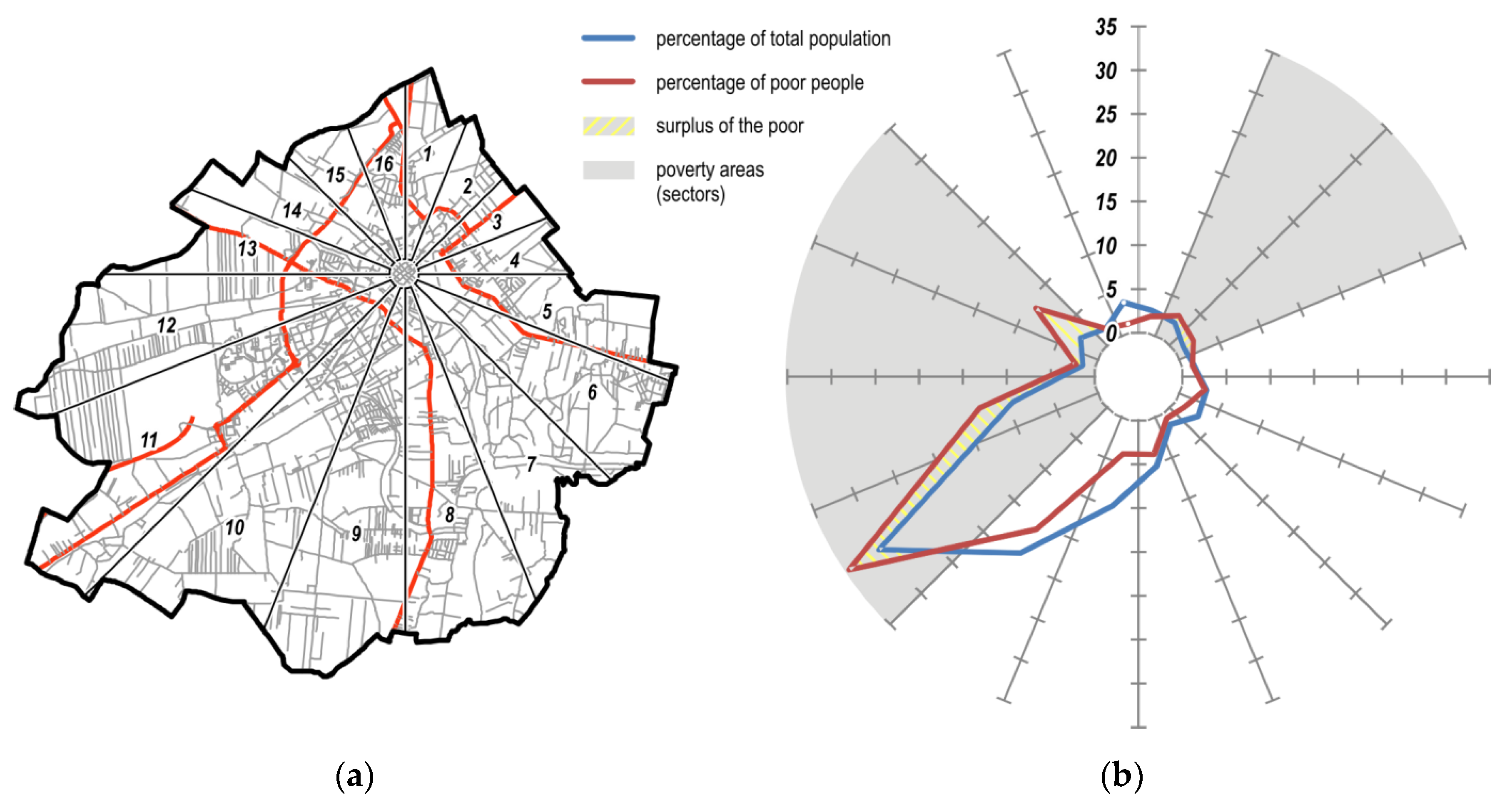

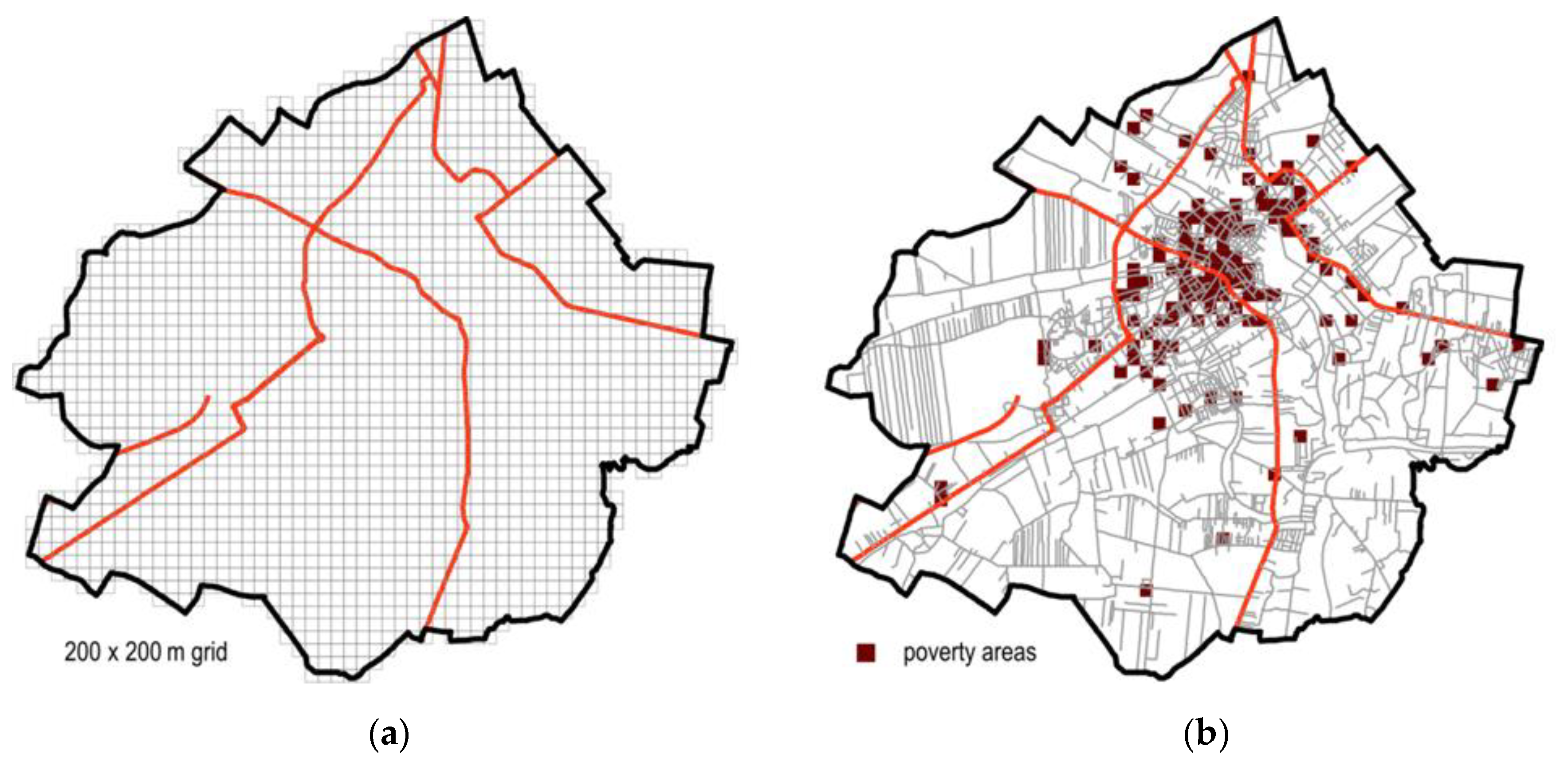

3.1. Stage I—Poverty Concentration Areas

3.2. Stage II—The Regression Analysis of the Prices of Flats

- Location in a concentric zone, in which there was a surplus of a poor population;

- Location in a radiating sector, in which there was a surplus of a poor population;

- Location in a basic field of the grid of squares, in which there was a surplus of a poor population.

4. Results

4.1. Poverty Concentration Areas

4.2. Regression Analysis

5. Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Take Action for the Sustainable Development Goals. Available online: https://www.un.org/sustainabledevelopment/sustainable-development-goals/ (accessed on 21 November 2020).

- Claeys, G.; Efstathiou, K.; Schoenmaker, D. Soaring House Prices in Major Cities: How to Spot and Moderate Them. In Hot Property. The Housing Market in Major Cities; Nijskens, R., Lohuis, M., Hilbers, P., Heeringa, W., Eds.; Springer: Cham, Switzerland, 2019; pp. 169–179. [Google Scholar] [CrossRef]

- van Doorn, L.; Arnold, A.; Rapoport, E. In the Age of Cities: The Impact of Urbanisation on House Prices and Affordability. In Hot Property. The Housing Market in Major Cities; Nijskens, R., Lohuis, M., Hilbers, P., Heeringa, W., Eds.; Springer: Cham, Switzerland, 2019; pp. 3–13. [Google Scholar] [CrossRef]

- Isaac, D. Property Valuation Principles; Palgrave: London, UK, 2002. [Google Scholar]

- Ramrattan, L.; Szenberg, M. The Sensitivity Analysis of the FHA Technique of Housing Market Analysis: The Effect of Ratios and variables, and Their Perturbations on Family and Elderly Demand Estimates. Am. Econ. 2004, 48, 61–88. [Google Scholar] [CrossRef]

- Ranci, C.; Brandsen, T.; Sabatinelli, S. (Eds.) Social Vulnerability in European Cities: The Role of Local Welfare in Times of Crisis; Palgrave Macmillan: London, UK, 2014. [Google Scholar]

- Ferlan, N.; Bastic, M.; Psunder, I. Influential Factors on the Market Value of Residential Properties. Inz. Ekon. -Eng. Econ. 2017, 28, 135–144. [Google Scholar] [CrossRef]

- Węcławowicz, G. Przestrzeń ubóstwa—nowy czy stary wymiar zróżnicowania społeczno-przestrzennego w miastach Polski (Areas of Poverty—New or Old Dimension of the Socio-spatial Differentiation in Polish Cities). Przegląd Geogr. 2001, 73, 451–475. [Google Scholar]

- Swiader, M.; Szewrański, S.; Kazak, J. Poverty risk index as a new methodology for social inequality distribution assessment. IOP Conf. Ser. Mater. Sci. Eng. 2017, 245. [Google Scholar] [CrossRef]

- Anderson, T.R. Social and Economic Factors Affecting the Location of Residential Neighborhoods. Pap. Proc. Reg. Sci. Assoc. 1962, 9, 161–170. [Google Scholar] [CrossRef]

- Goodhall, B. The Economics of Urban Areas; Pergamon: Oxford, NY, USA, 1972. [Google Scholar]

- Emerson, M.J.; Lamphear, F.C. Urban and Regional Economics; Allyn & Bacon: Boston, MA, USA, 1975. [Google Scholar]

- Malienė, V.; Atkinson, I.; Šubic Kovač, M.; Pȍdör, A.; Nyiri Mizseiné, J.; Dixon-Gough, R.; Hernik, J.; Pazdan, M.; Gaudėšius, R.; Gurskienė, V. Property Markets and Real Estate Valuation Practice in Central and Eastern Europe - Slovenia, Hungary, Poland and Lithuania. In Real Estate, Construction and Economic Development in Emerging Market Economies; Abdulai, R.A., Obeng-Odoom, F., Ochieng, E., Maliene, V., Eds.; Routledge: New York, NY, USA, 2016. [Google Scholar]

- Kiel, K.A.; Zabel, J.E. Location, location, location: The 3L Approach to house price determination. J. Hous. Econ. 2008, 17, 175–190. [Google Scholar] [CrossRef]

- Liang, X.; Liu, Y.; Qiu, T.; Jing, Y.; Fang, F. The effects of locational factors on the housing prices of residential communities: The case of Ningbo, China. Habitat Int. 2018, 81, 1–11. [Google Scholar] [CrossRef]

- Heyman, A.V.; Sommervoll, D.E. House prices and relative location. Cities 2019, 95. [Google Scholar] [CrossRef]

- Owusu-Manu, D.-G.; Edwards, D.J.; Donkor-Hyiaman, K.A.; Asiedu, R.O.; Hosseini, M.R.; Obiri-Yeboah, E. Housing attributes and relative house prices in Ghana. Int. J. Build. Pathol. Adapt. 2019, 37, 733–746. [Google Scholar] [CrossRef]

- Fanning, S.F. Market Analysis for Real Estate, 2nd ed.; Appraisal Institute: Chicago, IL, USA, 2014. [Google Scholar]

- Greer, G.E.; Kolbe, P.T. Investment Analysis for Real Estate Decisions; Dearborn Real Estate Education: Chicago, IL, USA, 2003. [Google Scholar]

- Kucharska-Stasiak, E. Ekonomiczny Wymiar Nieruchomości; Wydawnictwo Naukowe PWN: Warszawa, Poland, 2016. [Google Scholar]

- Rącka, I.; Palicki, S.; Kostov, I. State and Determinants of Real Estate Market Development in Central and Eastern European Countries on the Example of Poland and Bulgaria. Real Estate Manag. Valuat. 2015, 23, 74–87. [Google Scholar] [CrossRef]

- Burgess, E.W. The growth of the city: An introduction to a research project. In The City; Park, R.E., Burgess, E.W., Eds.; University of Chicago Press: Chicago, IL, USA, 1925; pp. 47–62. [Google Scholar]

- Hoyt, H. The Structure and Growth of Residential Neighborhoods in American Cities; Federal Housing Administration: Washington, DC, USA, 1939. [Google Scholar]

- Harris, C.D.; Ullman, E.L. The Nature of Cities. Ann. Am. Acad. Pol. Soc. Sci. 1945, 242, 7–17. [Google Scholar] [CrossRef]

- Galati, G.; Teppa, F.; Alessie, R. Macro and Micro Drivers of House Price Dynamics: An Application to Dutch Data. Ned. Bank Work. Pap. 2011, 288. Available online: https://www.dnb.nl/en/binaries/Working%20Paper%20288_tcm47-250127.pdf (accessed on 21 November 2020). [CrossRef]

- Mach, Ł.; Rącka, I. An analysis of the impact and influence of the global economic crisis on the housing market in European post-communist countries. In Proceedings of the 32nd International Business Information Management Association Conference (IBIMA), Vision 2020: Sustainable Economic Development and Application of Innovation Management from Regional expansion to Global Growth, Seville, Spain, 15–16 November 2018; pp. 2573–2584. [Google Scholar]

- Kisiała, W.; Suszyńska, K. The impact of the global economic crisis on the housing sector in Poland. In Globalization and Its Socio-Economic Consequences; Kliestik, T., Ed.; ZU—University of Zilina: Zilina, Slovakia, 2017; pp. 937–944. [Google Scholar]

- Mach, Ł. Measuring and assessing the impact of the global economic crisis on European real property market. J. Bus. Econ. Manag. 2019, 20, 1189–1209. [Google Scholar] [CrossRef]

- Rehman, M.U.; Ali, S.; Shahzad, S.J.H. Asymmetric Nonlinear Impact of Oil Prices and Inflation on Residential Property Prices: A Case of US, UK and Canada. J. Real Estate Finance Econ. 2020, 61, 39–54. [Google Scholar] [CrossRef]

- Olszewski, K.; Augustyniak, H.; Laszek, J.; Leszczynski, R.; Waszczuk, J. On the dynamics of the primary housing market and the forecasting of house prices. In Combining Micro and Macro Data for Financial Stability Analysis; Bank for International Settlements: Basel, Switzerland, 2016; Volume 41. [Google Scholar]

- Ma, Y.; Gopal, S. Geographically Weighted Regression Models in Estimating Median Home Prices in Towns of Massachusetts Based on an Urban Sustainability Framework. Sustainability 2018, 10, 1026. [Google Scholar] [CrossRef]

- Rosenberg, S. The effects of conventional and unconventional monetary policy on house prices in the Scandinavian countries. J. Hous. Econ. 2019, 46. [Google Scholar] [CrossRef]

- Duan, K.; Mishra, T.; Parhi, M.; Wolfe, S. How Effective are Policy Interventions in a Spatially-Embedded International Real Estate Market? J. Real Estate Finance Econ. 2019, 58, 596–637. [Google Scholar] [CrossRef]

- Frappa, S.; Mesonnier, J.S. The Housing Price Boom of the late 1990s: Did Inflation Targeting Matter. J. Financ. Stab. 2010, 6, 243–254. [Google Scholar] [CrossRef][Green Version]

- de La Paz, P.T. New housing supply and price reactions: Evidence from Spanish markets. J. Eur. Real Estate Res. 2014, 7, 4–28. [Google Scholar] [CrossRef]

- Hildebrandt, A.; Huynh-Olesen, D.T.; Steiner, K.; Wagner, K. Residential Property Prices in Central, Eastern and Southeastern European Countries. Focus Eur. Econ. Integr. 2013, 2, 52–76. [Google Scholar]

- Murie, A. Housing Policy and the Making of Inequality. In Inequalities in the UK; Fée, D., Kober-Smith, A., Eds.; Emerald Publishing Limited: Bingley, UK, 2017; pp. 185–204. [Google Scholar] [CrossRef]

- Koetter, M.; Poghosyan, T. Real estate prices and bank stability. J. Bank. Financ. 2010, 34, 1129–1138. [Google Scholar] [CrossRef]

- Klarl, T. The nexus between housing and GDP re-visited: A wavelet coherence view on housing and GDP for the U.S. Econ. Bull. 2016, 36, 704–720. [Google Scholar]

- Galati, G.; Teppa, F. Heterogeneity in House Price Dynamics; DNB Working Papers; Research Department, Netherlands Central Bank: Amsterdam, The Netherlands, 2017. [Google Scholar]

- Shiller, R. Long-Term Perspective on the Current Boom in Home Prices. Econ. Voice 2006, 3. [Google Scholar] [CrossRef]

- Wheaton, W.C.; Nechayev, G. The 1998–2005 Housing ‘Bubble’ and the Current ‘Correction’: What’s Different this Time? J. Real Estate Res. 2008, 30, 1–26. [Google Scholar] [CrossRef]

- Archer, W.R.; Gatzlaff, D.H.; Ling, D.C. Measuring the Importance of Location in House Price Appreciation. J. Urban Econ. 1996, 40, 334–353. [Google Scholar] [CrossRef]

- Lin, S.H.; Li, J.H.; Hsieh, J.C.; Huang, X.; Chen, J.T. Impact of Property Tax on Housing-Market Disequilibrium in Different Regions: Evidence from Taiwan for the period 1982–2016. Sustainability 2018, 10, 4318. [Google Scholar] [CrossRef]

- Saiz, A. The Geographic Determinants of Housing Supply. Q. J. Econ. 2010, 125, 1253–1296. [Google Scholar] [CrossRef]

- Dąbrowski, J.; Hvizdová, E.; Polačko, J. Demography as essential variable in real estate price prognosis. Geomat. Environ. Eng. 2019, 13, 19–29. [Google Scholar] [CrossRef]

- Monnet, E.; Wolf, C. Demographic cycles, migration and housing investment. J. Hous. Econ. 2017, 38, 38–49. [Google Scholar] [CrossRef]

- Timmermans, H.; van der Waerden, P.; Alves, M.; Polak, J.; Ellis, S.; Harvey, A.S.; Kurose, S.; Zandee, R. Spatial context and the complexity of daily travel patterns: An international comparison. J. Transp. Geogr. 2003, 11, 37–46. [Google Scholar] [CrossRef]

- Poudyal, N.C.; Hodges, D.G.; Merrett, C.D. A hedonic analysis of the demand for and benefits of urban recreation parks. Land Use Policy 2009, 26, 975–983. [Google Scholar] [CrossRef]

- Mulley, C.; Tsai, C.H.P. When and how much does new transport infrastructure add to property values? Evidence from the bus rapid transit system in Sydney, Australia. Transp. Policy 2016, 51, 15–23. [Google Scholar] [CrossRef]

- Fernandez-Duran, L.; Llorca, A.; Ruiz, N.; Valero, S. The impact of location on housing prices: Applying the Artificial Neural Network Model as an analytical tool. ERSA Conf. Pap. 2011, p. ersa11p1595. Available online: http://www-sre.wu.ac.at/ersa/ersaconfs/ersa11/e110830aFinal01595.pdf (accessed on 21 November 2020).

- Kozińska, D. Problemy mieszkaniowe osób w starszym wieku. Sprawy Mieszk. 1984, 1, 8–16. [Google Scholar]

- Węcławowicz, G. Elderly people in the socio-spatial structure of some Polish towns. Geogr. Pol. 1988, 54, 139–149. [Google Scholar]

- Węcławowicz, G. Some Aspects of Income and Spatial Disparities in Poland—Regional and Intra-Urban Scale. In Urban and Regional Development in Italy and in Poland; Besana, A., Ed.; Edizioni Colibri: Trident, Italy, 1997; pp. 315–334. [Google Scholar]

- Sirmans, S.; Macpherson, D.; Zietz, E. The Composition of Hedonic Pricing Models. J. Real Estate Lit. 2005, 13, 1–44. [Google Scholar] [CrossRef]

- Anthony, O.A. Examination of the determinants of housing values in urban Ghana and implications for policy makers. J. Afr. Real Estate Res. 2012, 2, 58–85. [Google Scholar]

- Carr, D.H.; Lawson, J.; Schultz, J. Mastering Real Estate Appraisal; Dearborn Real Estate Education: Chicago, IL, USA, 2003. [Google Scholar]

- Cirman, A.; Pahor, M.; Verbic, M. Determinants of Time on the Market in a Thin Real Estate Market. Inz. Ekon. -Eng. Econ. 2015, 26, 4–11. [Google Scholar] [CrossRef]

- Batóg, J.; Foryś, I.; Gaca, R.; Głuszak, M.; Konowalczuk, J. Investigating the Impact of Airport Noise and Land Use Restrictions on House Prices: Evidence from Selected Regional Airports in Poland. Sustainability 2019, 11, 412. [Google Scholar] [CrossRef]

- Szopińska, K.; Krajewska, M. Methods of assessing noise nuisance of real estate surroundings. Real Estate Manag. Valuat. 2016, 24, 19–30. [Google Scholar] [CrossRef]

- Diao, M.; Qin, Y.; Sing, T.F. Negative Externalities of Rail Noise and Housing Values: Evidence from the Cessation of Railway Operations in Singapore. Real Estate Econ. 2015, 44, 878–917. [Google Scholar] [CrossRef]

- Szewrański, S.; Świąder, M.; Kazak, J.K.; Tokarczyk-Dorociak, K.; van Hoof, J. Socio-Environmental Vulnerability Mapping for Environmental and Flood Resilience Assessment: The Case of Ageing and Poverty in the City of Wrocław, Poland. Integr. Environ. Assess. Manag. 2018, 14, 592–597. [Google Scholar] [CrossRef] [PubMed]

- Świąder, M.; Szewrański, S.; Kazak, J. Spatial-Temporal Diversification of Poverty in Wroclaw. Procedia Eng. 2016, 161, 1596–1600. [Google Scholar] [CrossRef]

- Ryan, B.D.; Weber, R. Valuing New Development in Distressed Urban Neighborhoods. J. Am. Plan. Assoc. 2007, 73, 100–111. [Google Scholar] [CrossRef]

- Judson, D. Where the Streets have no Neighborhoods: Marginality and Decline in St Louis, Missouri (USA). Adv. Educ. Diverse Communities Res. Policy Prax. 2012, 8, 201–267. [Google Scholar] [CrossRef]

- Tita, G.E.; Petras, T.L.; Greenbaum, R.T. Crime and Residential Choice: A Neighborhood Level Analysis of the Impact of Crime on Housing Prices. J. Quant. Criminol. 2006, 22, 299. [Google Scholar] [CrossRef]

- Act of 12 March 2004 on Social Assistance. Journal of Laws No. 64, item. 593, as Amended. Available online: https://isap.sejm.gov.pl/isap.nsf/DocDetails.xsp?id=WDU20040640593 (accessed on 21 November 2020).

- The Measurement of Extreme Poverty in the European Union. Available online: https://ec.europa.eu/social/BlobServlet?docId=6472&langId=en (accessed on 27 December 2020).

- Johnston, R.J. Urban geography: City structures. Progr. Hum. Geogr. 1977, 1, 118–129. [Google Scholar] [CrossRef]

- Swanson, K. Human Geography; Kaplan Publishing: Wokingham, UK, 2016. [Google Scholar]

- McCluskey, W.J.; McCord, M.; Davis, P.T.; Haran, M.; McIlhatton, D. Prediction accuracy in mass appraisal: A comparison of modern approaches. J. Prop. Res. 2013, 30, 239–265. [Google Scholar] [CrossRef]

- Doumpos, M.; Papastamos, D.; Andritsos, D.; Zopounidis, C. Developing automated valuation models for estimating property values: A comparison of global and locally weighted approaches. Ann. Oper. Res. 2020. [Google Scholar] [CrossRef]

- Morano, P.; Rosato, P.; Tajani, F.; Manganelli, B.; Di Liddo, F. Contextualized Property Market Models vs. Generalized Mass Appraisals: An Innovative Approach. Sustainability 2019, 11, 4896. [Google Scholar] [CrossRef]

- Słodczyk, J. Kierunki przemian funkcjonalno-przestrzennej struktury miast w Polsce po roku 1989. In Człowiek i Przestrzeń; Instytut Geografii i Gospodarki Przestrzennej UJ: Kraków, Poland, 2001; pp. 123–132. [Google Scholar]

- Prawelska-Skrzypek, G.; Porębski, W. Obszary deprywacji w Krakowie oraz zmiany w ich rozmieszczeniu w latach 1992–2001. Nierówności Społeczne a Wzrost Gospod. 2003, 2, 433–445. [Google Scholar]

- Weltrowska, J.; Kisiała, W. Obszary koncentracji ubóstwa w strukturze przestrzennej miasta (na przykładzie Poznania) (Areas of Concentration of Poverty in the City’s Spatial Structure—The Case Study of Poznań). Prace Naukowe Uniwersytetu Ekonomicznego we Wrocławiu Res. Pap. Wroc. Univ. Econ. 2014, 331, 235–245. [Google Scholar] [CrossRef]

- Wooldridge, J.M. Introductory Econometrics: A Modern Approach; Nelson Education: Toronto, Canada, 2016. [Google Scholar]

- Cox, D.R.; Wermuth, N. A comment on the coefficient of determination for binary responses. Am. Stat. 1992, 46, 1–4. [Google Scholar] [CrossRef]

- Murray, M.P. Econometrics. A Modern Introduction; Addison-Wesley Pearson: Boston, MA, USA, 2006. [Google Scholar]

- Bartnicki, S. Percepcja zagrożenia przestępczością—wstępna prezentacja wyników badań przeprowadzonych w 12 warszawskich osiedlach mieszkaniowych. Confer. Pap. IGiPZ PAN 1991, 14, 117–124. [Google Scholar]

- Grotowska-Leder, J. Zachowania aspołeczne w enklawach biedy. In Żyć i Pracować w Enklawach Biedy; Warzywoda-Kruszyńska, W., Ed.; Łódź: Angraf, Poland, 1998; pp. 99–121. [Google Scholar]

- Panek, T. Strefa niedostatku i jej determinanty w Polsce. Wiadomości Statystyczne 2001, 1, 21–32. [Google Scholar]

- Skupowa, J. Gdynia. Osiedla bogactwa i biedy. In Wybrane Problemy Badawcze Geografii Społecznej w Polsce; Sagan, I., Czepczyński, M., Eds.; Katedra Geografii Ekonomicznej, Uniwersytet Gdański: Gdansk, Poland, 2001; pp. 189–194. [Google Scholar]

- Trojanek, R.; Tanas, J.; Raslanas, S.; Banaitis, A. The impact of aircraft noise on housing prices in Poznan. Sustainability 2017, 9, 2088. [Google Scholar] [CrossRef]

- Trojanek, R.; Huderek-Glapska, S. Measuring the noise cost of aviation–The association between the Limited Use Area around Warsaw Chopin Airport and property values. J. Air Transp. Manag. 2018, 67, 103–114. [Google Scholar] [CrossRef]

- Guijarro, F. Assessing the Impact of Road Traffic Externalities on Residential Price Values: A Case Study in Madrid, Spain. Int. J. Environ. Res. Public Health 2019, 16, 5149. [Google Scholar] [CrossRef]

- He, Y.; Collins, A.R. Does environmental pollution affect metropolitan housing prices? Evidence from Guangzhou, China (1987–2014). Appl. Econ. Lett. 2020, 27, 213–220. [Google Scholar] [CrossRef]

- Yue, W.; Ni, C.; Tian, C.; Wen, H.; Fang, L. Impacts of an Urban Environmental Event on Housing Prices: Evidence from the Hangzhou Pesticide Plant Incident. J. Urban Plan. Dev. 2020, 146, 04020015. [Google Scholar] [CrossRef]

- Chiarazzo, V.; Coppola, P.; Dell’Olio, L.; Ibeas, A.; Ottomanelli, M. The Effects of Environmental Quality on Residential Choice Location. Procedia Soc. Behav. Sci. 2014, 162, 178–187. [Google Scholar] [CrossRef]

- Harrison, D.M.; Smersh, G.T.; Schwartz, A.L., Jr. Environmental Determinants of Housing Prices: The Impact of Flood Zone Status. J. Real Estate Res. 2001, 21, 3–20. [Google Scholar] [CrossRef]

- Gadziński, J.; Radzimski, A. The first rapid tram line in Poland: How has it affected travel behaviours, housing choices and satisfaction, and apartment prices? J. Transp. Geogr. 2016, 54, 451–463. [Google Scholar] [CrossRef]

- Trojanek, R.; Gluszak, M. Spatial and time effect of subway on property prices. J. Hous. Built Environ. 2018, 33, 359–384. [Google Scholar] [CrossRef]

- Trojanek, R. The impact of green areas on dwelling prices–the case of Poznań city. Entrep. Bus. Econ. Rev. 2016, 4, 27–35. [Google Scholar] [CrossRef]

- Palicki, S.; Rącka, I. Influence of Urban Renewal on the Assessment of Housing Market in the Context of Sustainable Socioeconomic City Development. In Smart City 360°; Springer: Cham, Switzerland, 2016. [Google Scholar] [CrossRef]

- Bełej, M.; Figurska, M. 3D Modeling of Discontinuity in the Spatial Distribution of Apartment Prices Using Voronoi Diagrams. Remote Sens. 2020, 12, 229. [Google Scholar] [CrossRef]

| Variable | Type of Variable | Characteristics and Variants of the Variable |

|---|---|---|

| Quarter | Quantitative | from 1 (1st quarter of 2006) to 52 (4th quarter of 2018) |

| District: I, II, III, IV, V, VI, VII, VII, VIII, IX, X; XI—base category | Qualitative (0/1) | 1—if a transaction was completed in a given district 0—otherwise |

| Floor area | Quantitative | Usable floor area of a flat in square meters |

| Associated floor area | Quantitative | Associated floor area in square meters |

| Cellar | Qualitative (0/1) | 1—if a transaction involved the sale of a cellar 0—otherwise |

| Garage | Qualitative (0/1) | 1—if a transaction involved the sale of a garage or a parking spot 0—otherwise |

| Number of rooms | Quantitative | Number of rooms in a flat |

| Number of floors | Quantitative | Number of floors in a building |

| Low block | Qualitative (0/1) | 1—if a transaction concerned a flat om a block of up to five floors 0—otherwise |

| Poverty area—zone | Qualitative (0/1) | 1—if a transaction was completed in a zone classified as a poverty area 0—otherwise |

| Poverty area—sector | Qualitative (0/1) | 1—if a transaction was completed in a sector classified as a poverty area 0—otherwise |

| Poverty area—grid | Qualitative (0/1) | 1–if a transaction was completed in a grid classified as a poverty area 0—otherwise |

| Buffer Model | Sector Model | Square Grid Model | ||||

|---|---|---|---|---|---|---|

| Coeff. | Growth Rate | Coeff. | Growth Rate | Coeff. | Growth Rate | |

| Constant term | 8.168 *** | – | 8.269 *** | – | 8.244 *** | – |

| No. of quarter | 0.005 *** | 0.5% | 0.002 *** | 0.2% | 0.004 *** | 0.4% |

| Floor area [m2] | −0.002 *** | −0.2% | −0.002 *** | −0.2% | −0.002 *** | −0.2% |

| Number of rooms | 0.052 *** | 5.3% | 0.047 *** | 4.8% | 0.053 *** | 5.4% |

| Associated area [m2] | 0.007 *** | 0.7% | 0.007 *** | 0.7% | 0.007 *** | 0.7% |

| Low block | −0.167 *** | −15.3% | −0.158 *** | −14.6% | −0.2 *** | −18.1% |

| District I | −0.199 *** | −18.1% | −0.163 *** | −15.0% | −0.266 *** | −23.4% |

| District II | −0.320 *** | −27.4% | −0.334 *** | −28.4% | −0.431 *** | −35.0% |

| District III | −0.218 *** | −19.6% | −0.153 *** | −14.2% | −0.208 *** | −18.8% |

| District IV | −0.076 *** | −7.4% | −0.135 *** | −12.7% | −0.143 *** | −13.4% |

| District V | −0.061 *** | −5.9% | −0.036 * | −3.5% | −0.191 *** | −17.4% |

| District VI | −0.252 *** | −22.3% | −0.177 *** | −16.2% | −0.21 *** | −18.9% |

| District VII | −0.151 *** | −14.0% | – | – | −0.092 ** | −8.8% |

| District VIII | – | – | −0.172 *** | −15.8% | −0.325 *** | −27.7% |

| District IX | −0.199 *** | −18.0% | −0.198 *** | −17.9% | −0.202 *** | −18.3% |

| District X | −0.291 *** | −25.3% | −0.165 *** | −15.2% | −0.389 *** | −32.2% |

| Poverty area | −0.020 *** | −2.0% | −0.016 *** | −1.6% | −0.104 ** | −9.9% |

| R2/Adjusted R2 | 0.378/0.368 | 0.345/0.334 | 0.331/0.319 | |||

| F (p-value) | 35.01 (<0.0001) | 30.29 (<0.0001) | 26.65 (<0.0001) | |||

| AIC | −991.50 | −952.57 | −941.30 | |||

| Standard Error | 0.1364 | 0.1395 | 0.1403 | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kisiała, W.; Rącka, I. Spatial and Statistical Analysis of Urban Poverty for Sustainable City Development. Sustainability 2021, 13, 858. https://doi.org/10.3390/su13020858

Kisiała W, Rącka I. Spatial and Statistical Analysis of Urban Poverty for Sustainable City Development. Sustainability. 2021; 13(2):858. https://doi.org/10.3390/su13020858

Chicago/Turabian StyleKisiała, Wojciech, and Izabela Rącka. 2021. "Spatial and Statistical Analysis of Urban Poverty for Sustainable City Development" Sustainability 13, no. 2: 858. https://doi.org/10.3390/su13020858

APA StyleKisiała, W., & Rącka, I. (2021). Spatial and Statistical Analysis of Urban Poverty for Sustainable City Development. Sustainability, 13(2), 858. https://doi.org/10.3390/su13020858