1. Introduction

Information and communications technology (ICT) plays an increasingly important role in the growth in many kinds of industrial fields [

1,

2,

3,

4]. Czernich et al. [

2], Han and Zhu [

3] conducted empirical study to measure the impact of broadband infrastructure on economic growth, while Guo and Luo [

4] studied the relationship between Internet and total factor productivity (TFP), and all of them came to the same conclusion that ICT is critical to the economic growth. Due to the widespread use of ICT, many industries have undergone tremendous changes, thus giving birth to the sharing economy [

5]. One of the typical applications of the sharing economy in the area of transportation is online car-hailing services [

6], which alleviate the pressure of taking a taxi, especially in rush hour. The two-sided platform mode [

7,

8] is the most common operating mode in the online car-hailing industry; hence, we also refer to online car-hailing platform as a general term composed of the stakeholders and the transaction relationships of online car-hailing services.

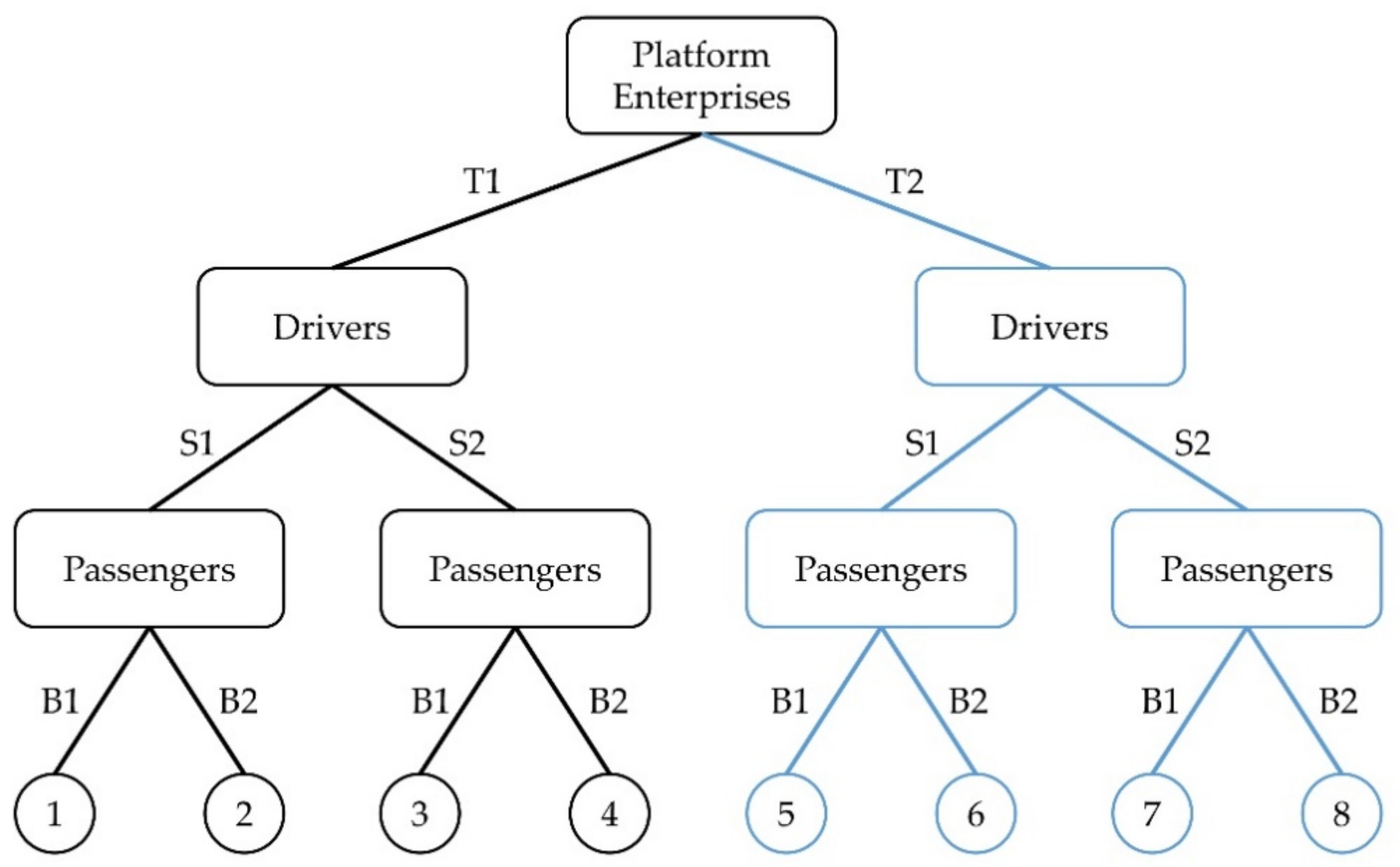

The stakeholders in online car-hailing platform include the online car-hailing service operating enterprises (hereinafter referred to as platform enterprises), drivers, and passengers. In the two-sided market theory, drivers and passengers are referred to as platform users, that is, the payoff of either group of users gained from the transaction depend on the number of other groups of users [

8]. Specifically, platform enterprises simultaneously bridge between drivers and passengers, and drivers are the platform users who provide point-to-point transportation services, while passengers are the platform users who need this service. On the one hand, drivers’ income depends on the number of passengers, as the more passengers, the greater the potential for drivers to provide their services, which increases their income. On the other hand, the utility of passengers depends on the number of drivers, as the more drivers, the shorter the waiting time for their services [

1]. Additionally, this characteristic of two-sided platform promotes the rapid development of the online car-hailing market. By June 2020, the users of online car-hailing services in China had reached 340 million, covering 36.2% of the Internet users in China [

9].

Due to their ability to reduce the uncertainty and anxiety of waiting for a traffic tool [

10,

11], online car-hailing services are becoming a key component of the public transportation system [

12]. Though the online car-hailing market has achieved vigorous development, there still exist some certain risks [

13], especially default risk. On the one hand, the operating mode of the online car-hailing services exacerbates the information asymmetry in the market. Due to the two-sided platform characteristic, the relationship between drivers and passengers is formed after the establishment of the agent relationship between the platform enterprises and the platform users [

14]. As a result, the information asymmetry problem exists not only between drivers and passengers, but also between the platform enterprises and platform users [

15]. On the other hand, the application of ICT largely reduces the default cost of platform users. Due to the openness of the transaction environment, the trust mechanism between drivers and passengers has changed, which not only leads to information distortion with high credit [

16], but also weakens the credit constraint on platform users’ default behavior. Specifically, the default risk of drivers is reflected in situations such as deviations from the prescribed route. In other words, the default behaviors of drivers refer to providing the abnormal service instead of the correct point-to-point transportation services. According to the information released by the WeChat platform of the Information Office of Shanghai Government, the complaints about online car-hailing services accepted by the Shanghai Transportation Commission focus on four aspects (see

Table 1). As can be seen from

Table 1, the total number of complaints for online car-hailing service of the first quarter and second quarter of 2020 are much less than those of 2019, for that the use of public transportation has dropped sharply in the early 2020 due to the outbreak of corona virus disease 2019 (COVID-19). However, as the number of complaints for “higher charge” and “bad service quality” are still relatively large, the default problem has not been alleviated. As for passengers, the typical manifestation of default risk is the refusal to pay their fare.

Although there have been plenty of studies on the online car-hailing market, most of them focus on the market prospect [

17,

18,

19], business mode [

20,

21], and influence [

11,

22,

23,

24]. Specifically, for the market prospect, Katzev [

17] investigated the motivation to participate in car sharing, while Shaheen and Martin [

18] assessed the market potential. Firnkorn and Müller [

19] described the free-floating carsharing-systems and reports the potential of private car reduction. As the market grows more mature, more scholars like Vanoutrive et al. [

20] and Yang and Tu [

21] focused on the internal operating mechanism such as transaction mechanism, value creation mechanism. As for the influence, Rogers [

11] described the social cost of the online car-hailing service in detail, and Chapman et al. [

22] paid attention to the relationship between car-sharing and car-use, while Jung and Koo [

23] studied the impact on greenhouse gas emission. Rayle et al. [

24] studied how online car-hailing service impacted the use of public transit and overall vehicle travel. In addition, some scholars like Anderson [

25] and Glöss et al. [

26] compared the pattern of online car-hailing services and traditional taxi services. However, research on default risk is scarcer, especially in terms of theoretical and empirical research. Fortunately, default risk is not a concept unique to the online car-hailing market, and the conclusions obtained from other market studies also have certain applicability. As for default risk management measures, there is an abundance of research results, which can be divided into two major categories, namely administrative management and market management. Administrative management includes improving laws and regulations [

27], establishing a service responsibility system [

28], and promoting the construction of a credit information system [

29], while market management includes the introduction of third parties [

30,

31,

32,

33] and applying new monitor technology [

34]. For example, Lizzeri [

30] and Albano and Lizzeri [

31] studied how third parties like certification intermediaries reduced the information asymmetry, so as the default risk. Stiglitz and Weiss [

32] and Bester [

33] focused on the credit markets, and investigated the role of third parties under imperfect information environment. As for the default risk supervision mode, the existing theoretical research mainly focuses on a single regulation subject or regulation object. For example, Gu et al. [

35] studied the supervision mode that regulators monitor the platform enterprises and analyzed its influence on the default risk of the Peer-to-Peer (P2P) lending market. Wang et al. [

36] compared three modes, including private supervision, public supervision, and coordinated supervision, from the perspective of dynamic game, focusing on the supervision on sellers. However, the supervision of the default risk pertaining to online car-hailing platform is a complex problem related to two regulation subjects and two regulation objects, and it is of great practical significance to discuss how to supervise and control this default risk.

This research intended to apply the evolutionary game theory to analyze the supervision of the default risk of online car-hailing platform, for the evolutionary game theory combines game theory with dynamic evolution process analysis [

37] and has been widely used to study the sharing economy [

38] and default risk control [

39]. This research focused on answering the following questions: (1) Can default risk be controlled under a no supervision environment? (2) From the perspective of pursuing own interests, can platform enterprises realize the control of default risk under its own interest constraint? (3) How should the regulators supervise platform enterprises in order to achieve the goal of controlling the default risk of platform users?

The remainder of this paper is organized as follows:

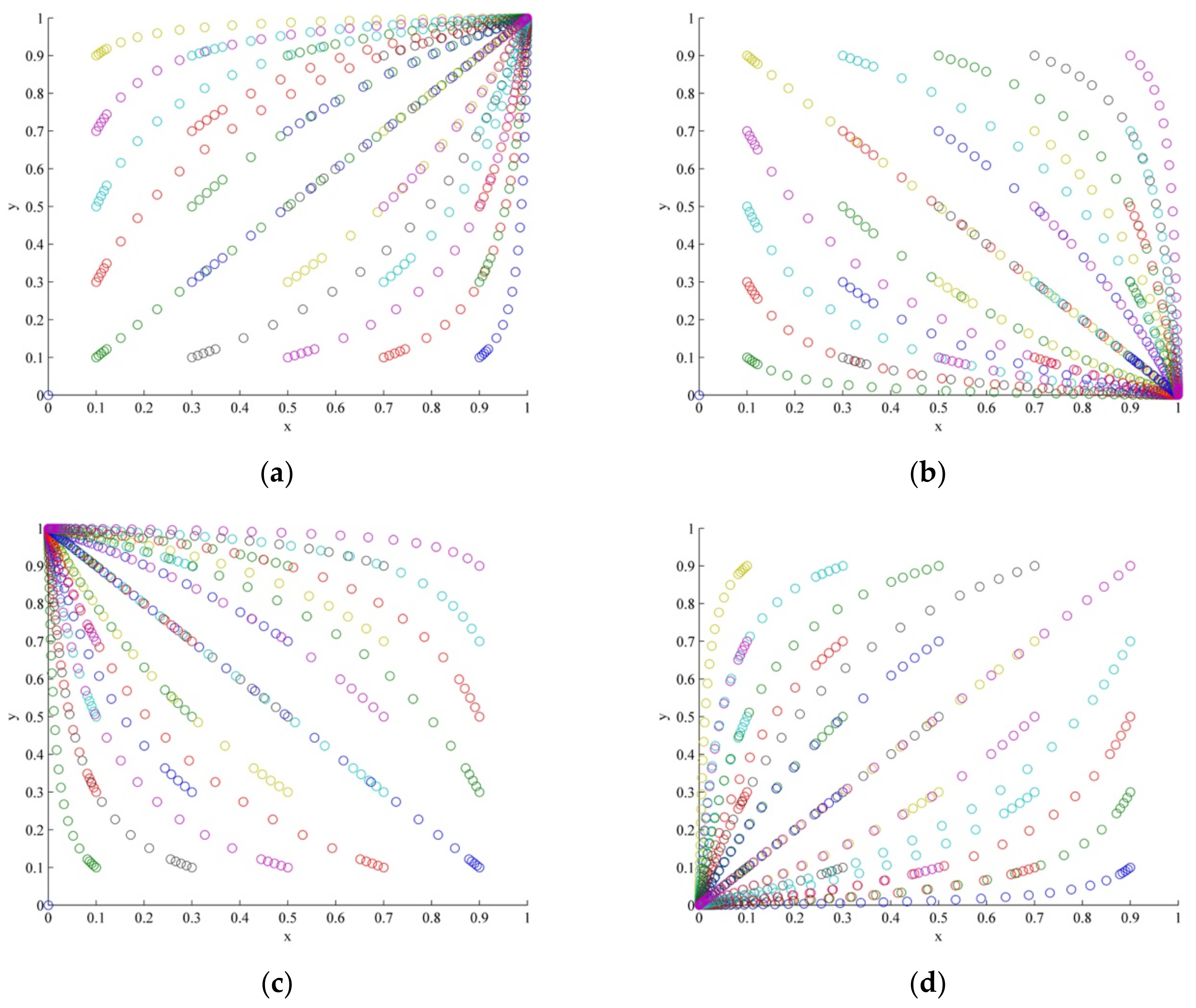

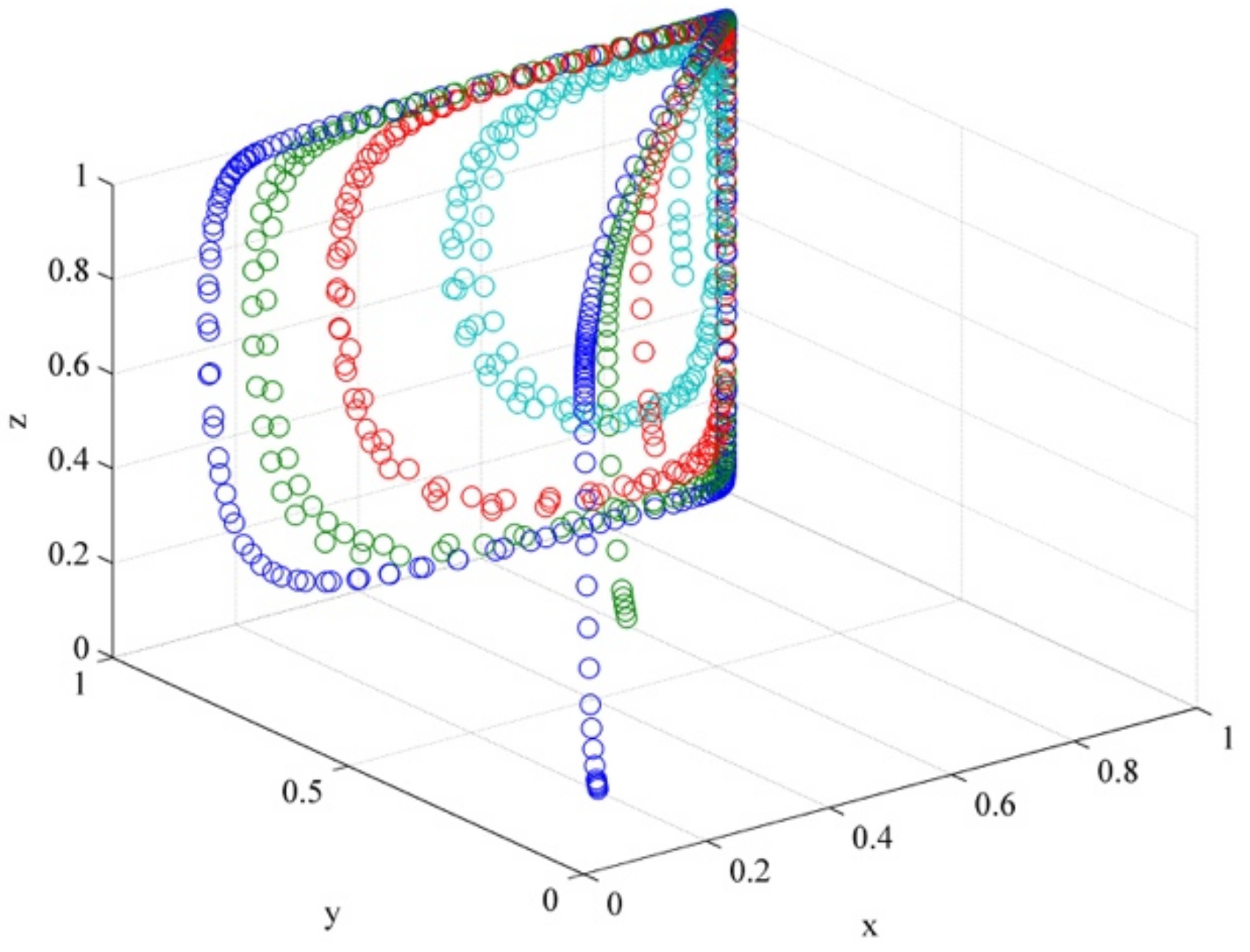

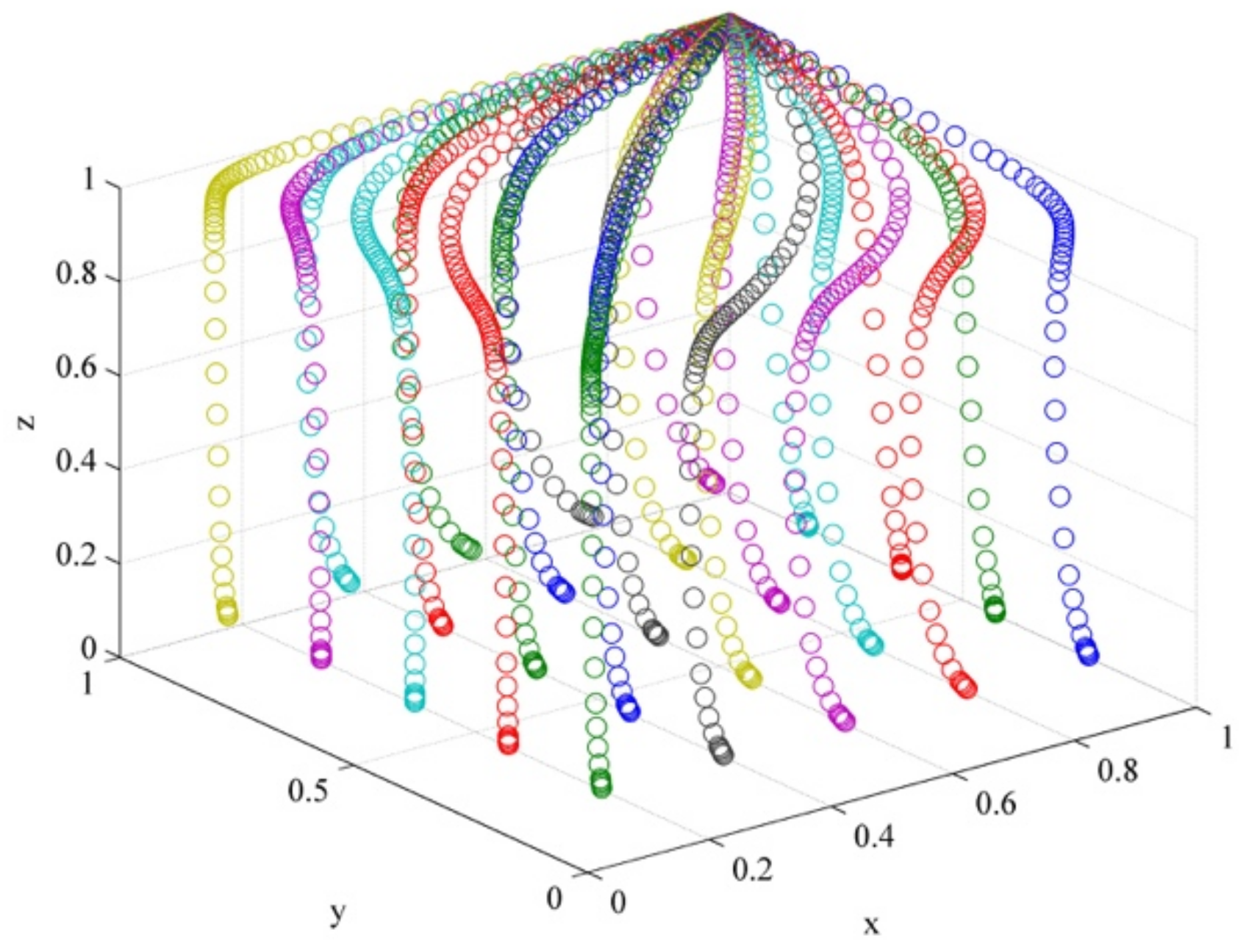

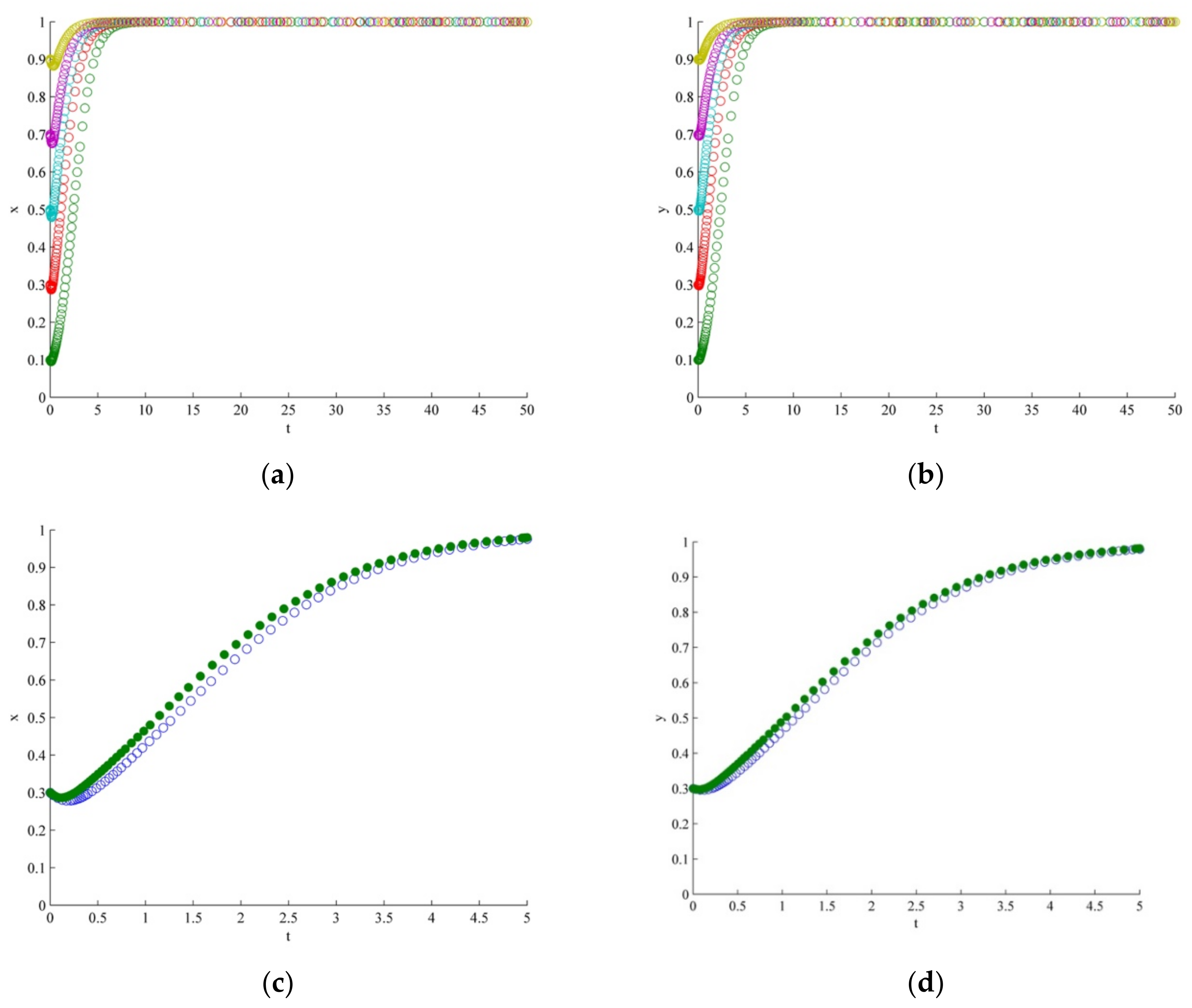

Section 2 constructs the evolutionary game model and analyzes the ESS of each scenario.

Section 3 shows the numerical stimulation and proposes the supervision mode and strategies. Finally, conclusions are drawn in

Section 4.

4. Conclusions

This research applied the method of evolutionary game theory, constructed an evolutionary game model containing drivers, passengers, and platform enterprises, and investigated different scenarios of supervision. The main conclusions of this research are as follows: (1) If the credit constraint of the online car-hailing platform is strong, effective control of default risk can be achieved without the introduction of supervision by platform enterprises or regulators. (2) In the case of insufficient credit constraints in the online car-hailing platform, the internal supervision by platform enterprises will fail to effectively control default risk in the long run due to the existence of supervision costs, that is, there is no ESS of the evolutionary game model in which the default risk is controlled. (3) If the supervision intensity of regulators and platform enterprises is strong enough, even if the credit constraint is not strong, default risk can be controlled, that is, there is an ESS of the evolutionary game model in which the default risk can be controlled. In addition, a combination of post-event and in-event supervision can enhance the effect of external supervision.

On this basis, this research put forward the coordinated governance mode and several suggested strategies for controlling default risk, namely promoting the construction of a credit system, strengthening the construction of laws and regulations, establishing a service process control mechanism, and introducing innovative regulatory means. The coordinated governance mode and strategies were put forward based on the transaction relationship and market organization form of online car-hailing platform. In this way, this research does help to advance the understanding of the platform enterprises’ operating process, and the conclusion would be able to extended to other platform economy and sharing economy fields to some extent.

There are several limitations to this study. In order to focus on the supervisory behavior of platform enterprises, this research did not consider neither the issue of competition between different platform enterprises nor the market variation, which worth conducting further study. In addition, this research only modeled the default risk problem of online car-hailing platform and stimulated the corresponding situation, but lacks an empirical examination, which can be taken as a future research direction.