Combining Value-Focused Thinking and PROMETHEE Techniques for Selecting a Portfolio of Distributed Energy Generation Projects in the Brazilian Electricity Sector

Abstract

1. Introduction

2. Literature Review

3. Material and Method

3.1. Value-Focused Thinking (VFT) Techniques

3.2. PROMETHEE II

3.3. PROMETHEE V

3.4. Decision Framework of Portfolio Selection of DGE Project Portfolio

4. Results and Discussion

4.1. Problem Characterization

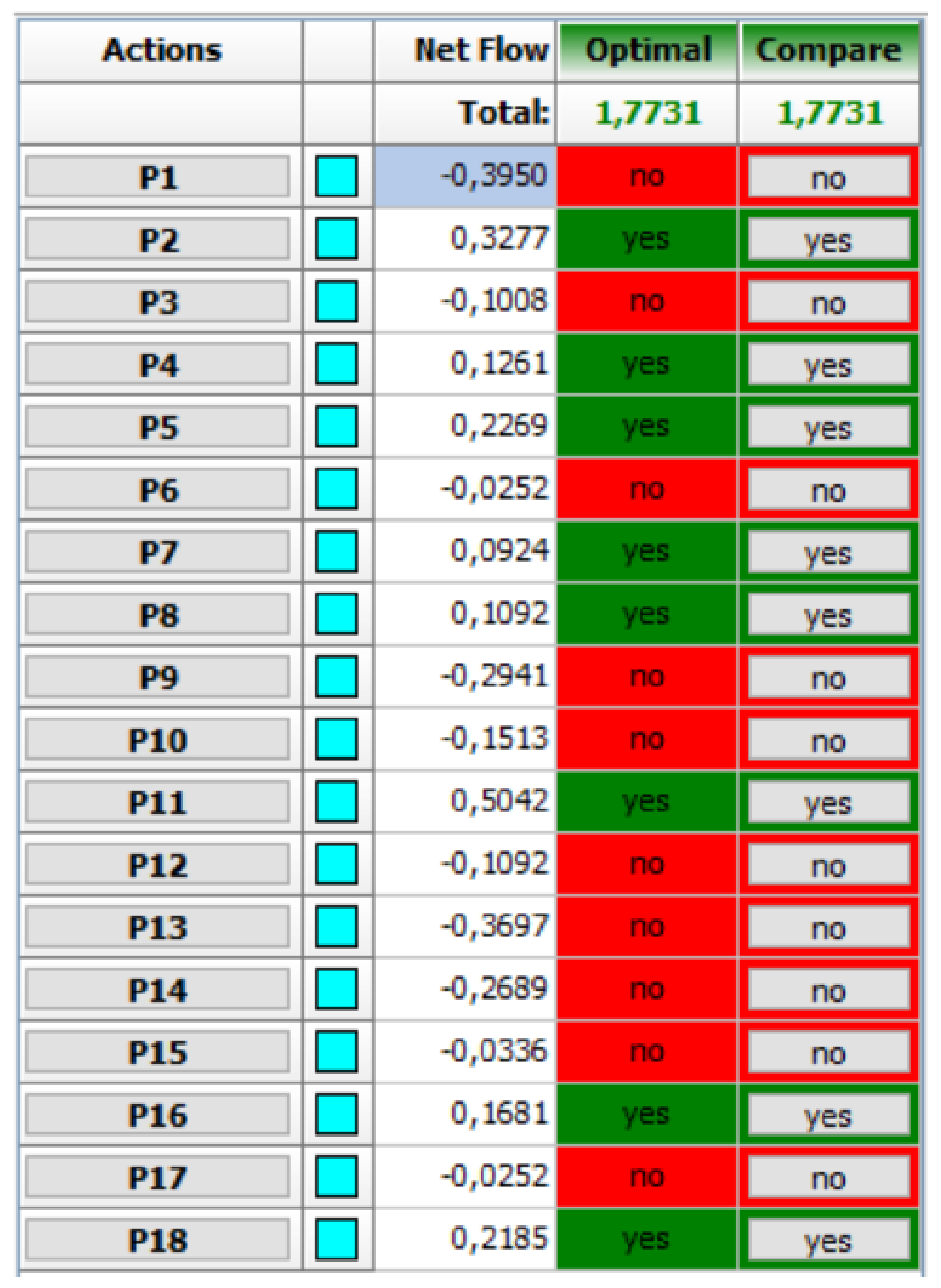

4.2. Portfolio Selection of Energy Distributed Generation Projects

5. Discussion and Managerial Implications

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Santika, W.G.; Urmee, T.; Simsek, Y.; Bahri, P.A. An Assessment of Energy Policy Impacts on Achieving Sustainable Development Goal 7 In Indonesia. Energy Sustain. Dev. 2020, 59, 33–48. [Google Scholar] [CrossRef]

- Wu, Y.; Xu, C.; Ke, Y.; Li, X.; Li, L. Portfolio Selection of Distributed Energy Generation Projects Considering Uncertainty and Project Interaction Under Different Enterprise Strategic Scenarios. Appl. Energy 2019, 236, 444–464. [Google Scholar] [CrossRef]

- Wu, Y.; Xu, C.; Ke, Y.; Chen, K.; Sun, X. An Intuitionistic Fuzzy Multi-Criteria Framework for Large-Scale Rooftop PV Project Portfolio Selection: Case Study in Zhejiang, China. Energy 2018, 143, 295–309. [Google Scholar] [CrossRef]

- Rodriguez, C.M.; Rodas, C.F.R.; Munoz, J.C.C.; Casas, A.F. A Multi-Criteria Approach for Comparison of Environmental Assessment Techniques in The Analysis of The Energy Efficiency in Agricultural Production Systems. J. Clean. Prod. 2019, 228, 1464–1471. [Google Scholar] [CrossRef]

- Rebelatto, B.G.; Salvia, A.L.; Reginatto, G.; Daneli, R.C.; Brandli, L.L. Energy Efficiency Actions at A Brazilian University and Their Contribution to Sustainable Development Goal 7. Int. J. Sustain. High. Educ. 2019, 20, 842–855. [Google Scholar] [CrossRef]

- Di Santo, K.G.; Kanashiro, E.; Di Santo, S.G.; Saidel, M.A. A Review on Smart Grids and Experiences in Brazil. Renew. Sustain. Energy Rev. 2015, 52, 1072–1082. [Google Scholar] [CrossRef]

- Mastorakis, K.; Siskos, E. Value Focused Pharmaceutical Strategy Determination with Multicriteria Decision Analysis Techniques. Omega-Int. J. Manag. Sci. 2016, 59, 84–96. [Google Scholar] [CrossRef]

- Keeney, R.L. Value-Focused Thinking: Identifying Decision Opportunities and Creating Alternatives. Eur. J. Oper. Res. 1996, 92, 537–549. [Google Scholar] [CrossRef]

- Abdel-Basset, M.; Gamal, A.; Chakrabortty, R.K.; Ryan, M. Development of A Hybrid Multi-Criteria Decision-Making Approach for Sustainability Evaluation of Bioenergy Production Technologies: A Case Study. J. Clean. Prod. 2021, 290, 125805. [Google Scholar] [CrossRef]

- Cruz, L.; Fernandez, E.; Gomez, C.; Rivera, G. Many-Objective Portfolio Optimization of Interdependent Projects With ‘A Priori’ Incorporation Of Decision-Maker Preferences. Appl. Math. Inf. Sci. 2014, 8, 1517–1531. [Google Scholar] [CrossRef]

- Farshchian, G.; Darestani, S.A.; Hamidi, N. Developing A Decision-Making Dashboard for Power Losses Attributes of Iran’s Electricity Distribution Network. Energy 2021, 216, 119248. [Google Scholar] [CrossRef]

- Debnath, A.; Roy, J.; Kar, S.; Zavadskas, E.K. A Hybrid MCDM Approach for Strategic Project Portfolio Selection of Agro By-Products. Sustainability 2017, 9, 1302. [Google Scholar] [CrossRef]

- De, M.; Mangaraj, B.K.; Das, K.B. A Fuzzy Goal Programming Model in Portfolio Selection Under Competitive-Cum-Compensatory Decision Strategies. Appl. Soft Comput. 2018, 73, 635–646. [Google Scholar] [CrossRef]

- Bernardo, H.; Gaspar, A.; Henggeler Antunes, C. A Combined Value Focused Thinking-Soft Systems Methodology Approach to Structure Decision Support for Energy Performance Assessment of School Buildings. Sustainability 2018, 10, 2295. [Google Scholar] [CrossRef]

- Mirakyan, A.; Guio, R.D. A Methodology in Innovative Support of The Integrated Energy Planning Preparation and Orientation Phase. Energy 2014, 78, 916–927. [Google Scholar] [CrossRef]

- Simon, J.; Regnier, E.; Whitney, L. A Value-Focused Approach to Energy Transformation in The United States Department of Defense. Decis. Anal. 2014, 11, 117–132. [Google Scholar] [CrossRef]

- Keeney, R.L.; Raiffa, H. Decisions with Multiple Objectives: Preferences and Value Trade-Offs; John Wiley & Sons: New York, NY, USA, 1976. [Google Scholar]

- Jajac, N.; Marović, I.; Mladineo, M. Planning support concept to implementation of sustainable parking development projects in ancient Mediterranean cities. Croat. Oper. Res. Rev. 2014, 5, 345–359. [Google Scholar] [CrossRef]

- Ávila, L.; Mine, M.R.M.; Kaviski, E.; Detzel, D.H.M. Evaluation of hydro-wind complementarity in the medium-term planning of electrical power systems by joint simulation of periodic streamflow and wind speed time series: A Brazilian case study. Renew. Energy 2021, 167, 685–699. [Google Scholar] [CrossRef]

- Corrêa Da Silva, R.; De Marchi Neto, I.; Silva Seifert, S. Electricity supply security and the future role of renewable energy sources in Brazil. Renew. Sustain. Energy Rev. 2016, 59, 328–341. [Google Scholar] [CrossRef]

- Bergier, I.; Assine, M.L.; Mcglue, M.M.; Alho, C.J.R.; Silva, A.; Guerreiro, R.L.; Carvalho, J.C. Amazon rainforest modulation of water security in the Pantanal wetland. Sci. Total Environ. 2018, 619–620, 1116–1125. [Google Scholar] [CrossRef] [PubMed]

- Leal Filho, W.; Azeiteiro, U.M.; Salvia, A.L.; Fritzen, B.; Libonati, R. Fire in Paradise: Why the Pantanal is burning. Environ. Sci. Policy 2021, 123, 31–34. [Google Scholar] [CrossRef]

- Shukla, S.; Mohanty, B.K.; Kumar, A. Strategizing sustainability in e-commerce channels for additive manufacturing using value-focused thinking and fuzzy cognitive maps. Ind. Manag. Data Syst. 2018, 118, 390–411. [Google Scholar] [CrossRef]

- Debbarma, B.; Chakraborti, P.; Bose, P.K.; Deb, M.; Banerjee, R. Exploration of PROMETHEE II and VIKOR methodology in a MCDM approach for ascertaining the optimal performance-emission trade-off vantage in a hydrogen-biohol dual fuel endeavour. Fuel 2017, 210, 922–935. [Google Scholar] [CrossRef]

- Mohagheghi, V.; Mousavi, S.M.; Mojtahedi, M. Project portfolio selection problems: Two decades review from 1999 to 2019. J. Intell. Fuzzy Syst. 2020, 1-15. [Google Scholar] [CrossRef]

- Hassanzadeh, F.; Nemati, H.; Sun, M. Robust optimization for interactive multiobjective programming with imprecise information applied to R&D project portfolio selection. Eur. J. Oper. Res. 2014, 238, 41–53. [Google Scholar] [CrossRef]

- Mild, P.; Liesiö, J.; Salo, A. Selecting infrastructure maintenance projects with Robust Portfolio Modeling. Decis. Support Syst. 2015, 77, 21–30. [Google Scholar] [CrossRef]

- Ewing, P.L.; Tarantino, W.; Parnell, G.S. Use of Decision Analysis in the Army Base Realignment and Closure (BRAC) 2005 Military Value Analysis. Decis. Anal. 2006, 3, 33–49. [Google Scholar] [CrossRef]

- Angelis, A.; Kanavos, P.; Montibeller, G. Resource Allocation and Priority Setting in Health Care: A Multi-criteria Decision Analysis Problem of Value? Glob. Policy 2016, 8, 76–83. [Google Scholar] [CrossRef]

- Dou, Y.; Zhou, Z.; Xu, X.; Lu, Y. System Portfolio Selection with Decision-making Preference Baseline Value for System of Systems Construction. Expert Syst. Appl. 2019, 123, 345–356. [Google Scholar] [CrossRef]

- Aragonés-Beltrán, P.; Chaparro-González, F.; Pastor-Ferrando, J.-P.; Pla-Rubio, A. An AHP (Analytic Hierarchy Process)/ANP (Analytic Network Process)-based multi-criteria decision approach for the selection of solar-thermal power plant investment projects. Energy 2014, 66, 222–238. [Google Scholar] [CrossRef]

- Lourenço, J.C.; Soares, J.O.; Bana e Costa, C.A. Portfolio robustness evaluation: A case study in the electricity sector. Technol. Econ. Dev. Econ. 2015, 23, 59–80. [Google Scholar] [CrossRef][Green Version]

- Jano-Ito, M.A.; Crawford-Brown, D. Investment decisions considering economic, environmental and social factors: An actors’ perspective for the electricity sector of Mexico. Energy 2017, 121, 92–106. [Google Scholar] [CrossRef]

- Büyükozkan, G.; Karabulut, Y. Energy projects performance evaluation with sustainability perspective. Energy 2017, 119, 549–560. [Google Scholar] [CrossRef]

- Martins, C.L.; López, H.M.L.; De Almeida, A.T.; Almeida, J.A.; de Oliveira Bortoluzzi, M.B. An MCDM project portfolio web-based DSS for sustainable strategic decision making in an electricity company. Ind. Manag. Data Syst. 2017, 117, 1362–1375. [Google Scholar] [CrossRef]

- De Almeida, A.T.; Cavalcante, C.A.V.; Alencar, M.H.; Ferreira, R.J.P.; Almeida-Filho, A.T.; Garcez, T.V. Multi-Criteria and Multiobjective Models for Risk, Reliability and Maintenance Decision Analysis; International Series in Operations Research & Management Science, v.231; Springer: New York, NY, USA, 2015; p. 395. [Google Scholar]

- Hernandez-Perdomo, E.A.; Mun, J.; Rocco, S.C. Active management in state-owned energy companies: Integrating a real options approach into multicriteria analysis to make companies sustainable. Appl. Energy 2017, 195, 487–502. [Google Scholar] [CrossRef]

- Guler, E.; Yerel Kandemir, S.; Acikkalp, E.; Ahmadi, M.H. Evaluation of sustainable energy performance for OECD countries. Energy Sources Part B Econ. Plan. Policy 2021, 16, 491–514. [Google Scholar] [CrossRef]

- Brans, J.P.; Vincke, P. A preference ranking organization technique. Manag. Sci. 1985, 31, 647–656. [Google Scholar] [CrossRef]

- Keeney, R.L. Value-Focused Thinking: A Path to Creative Decision Making; Harvard University Press: Cambridge, MA, USA, 1992; ISBN 0-674-93197-1. [Google Scholar]

- Bortoluzzi, M.; Correia De Souza, C.; Furlan, M. Bibliometric analysis of renewable energy types using key performance indicators and multicriteria decision models. Renew. Sustain. Energy Rev. 2021, 143, 110958. [Google Scholar] [CrossRef]

- Brans, J.P.; Mareschal, B. Promethee V: MCDM problems with segmentation constraints. INFOR 1992, 30, 85–96. [Google Scholar] [CrossRef]

- Aquila, G.; de Oliveira Pamplona, E.; Rodrigo de Queiroz, A.; Rotela Junior, P.; Fonseca, M.N. An overview of incentive policies for the expansion of renewable energy generation in electricity power systems and the Brazilian experience. Renew. Sustain. Energy Rev. 2017, 70, 1090–1098. [Google Scholar] [CrossRef]

- De Melo, C.A.; de Martino, J.G.; Bajay, S.V. Nonconventional renewable energy governance in Brazil: Lessons to learn from the German experience. Renew. Sustain. Energy Rev. 2016, 61, 222–234. [Google Scholar] [CrossRef]

- Fan, X.; Wang, W.; Shi, R.; Li, F. Analysis and countermeasures of wind power curtailment in China. Renew. Sustain. Energy Rev. 2015, 52, 1429–1436. [Google Scholar] [CrossRef]

- Agência Nacional de Energia Elétrica—ANEEL. Programa de Incentivo às Fontes Alternativas. Resolução Normativa No 482, de 17 de Abril de 2012. Available online: https://www.aneel.gov.br/informacoes-tecnicas (accessed on 3 April 2021).

- Agência Nacional de Energia Elétrica—ANEEL. Programa de Incentivo às Fontes Alternativas. Resolução Normativa No 687, de 24 de Novembro de 2015. Available online: https://www.aneel.gov.br/informacoes-tecnicas (accessed on 3 April 2021).

- Cuoghi, K.G.; Leoneti, A.B. A group MCDA method for aiding decision-making of complex problems in public sector: The case of Belo Monte Dam. Socio-Economic Plan. Sci. 2019, 68, 100625. [Google Scholar] [CrossRef]

- Instituto Brasileiro de Geografia e Estatística. Cidades e Estados—IBGE. 2021. Available online: https://www.ibge.gov.br/cidades-e-estados/ms.html (accessed on 13 September 2021).

- Secretaria de Estado de Meio Ambiente e Desenvolvimento Econômico, Produção e Agricultura Familiar—SEMAGRO. Perfil Estatístico de Mato Grosso do Sul. 2019. Available online: http://www.semagro.ms.gov.br/wp-content/uploads/2019/12/Perfil-Estat%C3%ADstico-de-MS-2019.pdf (accessed on 13 September 2021).

- Troldborg, M.; Heslop, S.; Hough, R.L. Assessing the sustainability of renewable energy technologies using multi-criteria analysis: Suitability of approach for national-scale assessments and associated uncertainties. Renew. Sustain. Energy Rev. 2014, 39, 1173–1184. [Google Scholar] [CrossRef]

- Gomes, C.F.S.; Costa, H.G.; De Barros, A.P. Sensibility analysis of MCDA using prospective in Brazilian energy sector. J. Model. Manag. 2017, 12, 475–497. [Google Scholar] [CrossRef]

- Karp, S.G.; Medina, J.D.C.; Letti, L.A.J.; Woiciechowski, A.L.; De Carvalho, J.C.; Schmitt, C.C.; De Oliveira Penha, R.; Kumlehn, G.S.; Soccol, C.R. Bioeconomy and biofuels: The case of sugarcane ethanol in Brazil. Biofuels Bioprod. Biorefining 2021, 15, 899–912. [Google Scholar] [CrossRef]

- Turkovska, O.; Castro, G.; Klingler, M.; Nitsch, F.; Regner, P.; Soterroni, A.C.; Schmidt, J. Land-use impacts of Brazilian wind power expansion. Environ. Res. Lett. 2021, 16, 024010. [Google Scholar] [CrossRef]

- Bastidas, D.; Mc Isaac, F. Reaching Brazil’s Nationally Determined Contributions: An assessment of the key transitions in final demand and employment. Energy Policy 2019, 135, 110983. [Google Scholar] [CrossRef]

- Simas, M.; Pacca, S. Energia eólica, geração de empregos e desenvolvimento sustentável. Estud. Avançados 2013, 27, 97–116. [Google Scholar] [CrossRef]

- Chiaravalloti, R.M.; Homewood, K.; Erikson, K. Sustainability and Land tenure: Who owns the floodplain in the Pantanal, Brazil? Land Use Policy 2017, 64, 511–524. [Google Scholar] [CrossRef]

- De Souza, N.R.D.; Fracarolli, J.A.; Junqueira, T.L.; Chagas, M.F.; Cardoso, T.F.; Watanabe, M.D.B.; Cavalett, O.; Venzke Filho, S.P.; Dale, B.E.; Bonomi, A.; et al. Sugarcane ethanol and beef cattle integration in Brazil. Biomass Bioenergy 2019, 120, 448–457. [Google Scholar] [CrossRef]

- Cantarella, H.; Nassar, A.M.; Cortez, L.A.B.; Baldassin, R. Potential feedstock for renewable aviation fuel in Brazil. Environ. Dev. 2015, 15, 52–63. [Google Scholar] [CrossRef]

- Alencar, M.H.; Priori, L., Jr.; Alencar, L.H. Structuring objectives based on value-focused thinking methodology: Creating alternatives for sustainability in the built environment. J. Clean. Prod. 2017, 156, 62–73. [Google Scholar] [CrossRef]

- Almaian, R.Y.; Needy, K.L.; Alves TDa, C.L.; Walsh, K.D. Analyzing Effective Supplier-Quality-Management Practices Using Simple Multiattribute Rating Technique and Value-Focused Thinking. J. Manag. Eng. 2016, 32, 04015035. [Google Scholar] [CrossRef]

| f1(.) | f2(.) | … | fj(.) | … | fq(.) | |

|---|---|---|---|---|---|---|

| a1 | f1(a1) | f2(a1) | … | fj(a1) | … | fq(a1) |

| a2 | f1(a2) | f2(a2) | … | fj(a2) | … | fq(a2) |

| … | … | … | … | … | … | … |

| ai | f1(ai) | f2(ai) | … | fj(ai) | … | fq(ai) |

| … | … | … | … | … | … | … |

| an | f1(an) | f2(an) | … | fj(an) | … | fq(an) |

|

| 1.1 Harnessing the potential of Mato Grosso do Sul |

| 1.2 Generating energy from clean and renewable sources |

| 1.3 Reducing energy waste |

| 1.4 Reducing greenhouse gas emission |

| 1.5 Lower the impacts of non-renewable source projects |

|

| 2.1 Generating employment and income |

| 2.2 Reducing energy losses |

| 2.3 Universalizing access to energy |

| 2.4 Reducing energy bills |

| 2.5 Strengthening energy and electric security |

|

| 3.1 Promoting attraction of international investment and renewable technology |

| 3.2 Encouraging the equipment industries with a focus on technology and sustainability |

| 3.3 Spread the use of clean and efficient technologies |

| 3.4 Reducing the institutional and market barriers for new technologies |

| Criterion | Denotation | Description | Unity | Type |

|---|---|---|---|---|

| Required Area | C1 | It corresponds to the amount of area necessary to implement the energy generation source | m2/kW | min |

| Greenhouse gases emission | C2 | It considers the amount of CO2 emitted from energy generation sources | gCO2eq/kW | min |

| Contribution to the economic and regional development | C3 | It corresponds to the social and economic effects associated with the initiatives, such as the creation of new jobs, new companies in the supply chain, emerging companies in the energy sector, etc. | Qualitative (1–5) | max |

| Operation and maintenance costs | C4 | It considers the relation between the investment cost of the energy generation system and thegenerated energy | R$/kW | min |

| Payback | C5 | It is the investment payback time | Year | min |

| Technology efficiency | C6 | It corresponds to the amount percentage of electricity generated from the primary source of energy generation | % | max |

| Employment | C7 | It refers to the employment amount to be generated with the implantation of the energy generation project | Employment/Year/kW | max |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bortoluzzi, M.; Furlan, M.; Colombo, S.G.; Amaral, T.M.; de Souza, C.C.; dos Reis Neto, J.F.; de França, J.F. Combining Value-Focused Thinking and PROMETHEE Techniques for Selecting a Portfolio of Distributed Energy Generation Projects in the Brazilian Electricity Sector. Sustainability 2021, 13, 11091. https://doi.org/10.3390/su131911091

Bortoluzzi M, Furlan M, Colombo SG, Amaral TM, de Souza CC, dos Reis Neto JF, de França JF. Combining Value-Focused Thinking and PROMETHEE Techniques for Selecting a Portfolio of Distributed Energy Generation Projects in the Brazilian Electricity Sector. Sustainability. 2021; 13(19):11091. https://doi.org/10.3390/su131911091

Chicago/Turabian StyleBortoluzzi, Mirian, Marcelo Furlan, Simone Geitenes Colombo, Tatiele Martins Amaral, Celso Correia de Souza, José Francisco dos Reis Neto, and Josimar Fernandes de França. 2021. "Combining Value-Focused Thinking and PROMETHEE Techniques for Selecting a Portfolio of Distributed Energy Generation Projects in the Brazilian Electricity Sector" Sustainability 13, no. 19: 11091. https://doi.org/10.3390/su131911091

APA StyleBortoluzzi, M., Furlan, M., Colombo, S. G., Amaral, T. M., de Souza, C. C., dos Reis Neto, J. F., & de França, J. F. (2021). Combining Value-Focused Thinking and PROMETHEE Techniques for Selecting a Portfolio of Distributed Energy Generation Projects in the Brazilian Electricity Sector. Sustainability, 13(19), 11091. https://doi.org/10.3390/su131911091