3.1. Forms of Urban Land Rent Recovery. Its Origin and Evolution in Time

The idea of the city as a “collective” good, created and defined by private and public investments and decisions, means that the economic value of its individual parts, is determined by collective action, rather than by individual one, produced by synergies and externalities intersecting with all locational, investment or management decisions [

14].

Several authors have highlighted the opportunity to recover the surplus value generated by urban planning decisions [

3,

14,

15]. It recalls, as an assumption, the thought of classical economists about the value of urban land that, in general, depends on the “overall development of society” in terms of distribution and production of wealth for individuals and for the community.

Urban land rent is, therefore, a logical way, rather than an economic way, to find new forms of financing. It can be at least partially taxed because its value depends sensibly on the investments and decisions that the PA and other private entities make in the urban context or in the surroundings of the evaluated property [

14].

The taxation purpose would not concern the land or property values stock, but rather the emerging rent or Extra Capital Gain (ECG), i.e., its variation generated by the processes of buildings redevelopment or transformation of land uses (and capitalized in the land value/price itself) [

3].

This concerns, in a broad sense, the financing of urbanization works, but implies, more generally, the accountability of PAs [

5].

Even the reports of international agencies or major study centres, referring to the so-called less advanced and developing countries, show an increasingly widespread orientation towards these regulation forms [

8] that can be traced back to the wide concept of land value recapture [

13,

16,

17,

18].

Recently (2021), in most of the so-called advanced countries, private actors are called on to contribute both to the city regeneration and development cost and to share with the public sector the surplus value generated by urban transformations. The legislative instruments and operational methods used in this sense are varied, generally combined with each other and with differentiated intensities [

6,

7].

In Europe, many countries pursue urban development by limiting the burdens on local governments as much as possible [

19] and, to compensate for the limited availability of public financial resources, the use of land value acquisition instruments is widespread [

20,

21].

In countries such as Germany, France and Spain, the share of local government tax levy reaches up to 30% on great urban transformation operations [

2].

A survey of the most followed European practices shows:

The obligation to build social housing totally or partially at the private expense, as provided for in Germany, the United Kingdom and the Scandinavian countries;

The contribution to build other infrastructures, not relevant to the intervention area, as foreseen in the English planning agreements and in the so-called perequative town planning in Italy, which implies negotiated agreements between public and private parties;

The partial recapture of capital gains from private urban transformation by the PA, typical of the Spanish and Italian case. This modality, in Spain, is even provided for in the 1978 Constitucion. The corresponding article n.47 obliges the local administration to recoup part of the surplus value created in the urban transformations through

cesiones de aprovechamiento urbanistico (cessions of some land against an estimate of the building right value) while the

Ley del Suelo of 2007 (national law on the land regime) introduced a range between 5% and 15% for

cesiones de aprovechamiento. Negotiated forms of value acquisition are thus indicated, obliging private operators to partially return their extraordinary gain (“plusvalìas”) to the community in exchange for certain benefits such as: containment of administrative time or additional building rights [

22].

In the United Kingdom, the right to build is practically nationalised and correlated to a detailed transformation plan (

planning permission). The so-called

betterments and windfalls, for example, include the planning of partially negotiable gains on the granting of a building permit in England [

4].

The Italian system evolution on the recapture of the surplus land value by the PAs partly resembles that of the English system, passing from taxation to planning obligations and then to

impact fees. Consequently, it may be interesting [

4] to consider in Italy the temporal evolution of the approaches adopted to acquire part of the land surplus value deriving from urban transformation interventions: starting from the law on expropriations of public utility (Art. 77–78, Law no. 2359/1865), declining with planning or fiscal policies and regulatory provisions: ranging from the so-called

contributi di miglioria (Art. no. 236, R.D. no. 1175/1931) to the tax imposition on increasing values of areas and buildings (Law no. 246/1963, Presidential Decree n. 643/1972), from the substantial nationalisation of building rights (Law no. 10/1977) to their transfer or negotiation [

4] up to the more recent application of

equalisation. These instruments have been strongly criticised by many operators as they would affect the real estate market by damaging the construction sector; this is why in practice, deductions on urbanisation and construction charges have often been introduced, precisely to “incentivise” the private developer to participate in the initiative.

Two aspects deserve particular attention: (i) the unsuccessful introduction of fiscal measures, implicitly set aside or abrogated only a few years after their introduction; (ii) the tendency to adopt a negotiation practice in order to return to the community part of the land surplus value created by the planning system [

4] and thus balance the gain (surplus) of developers in territorial operations.

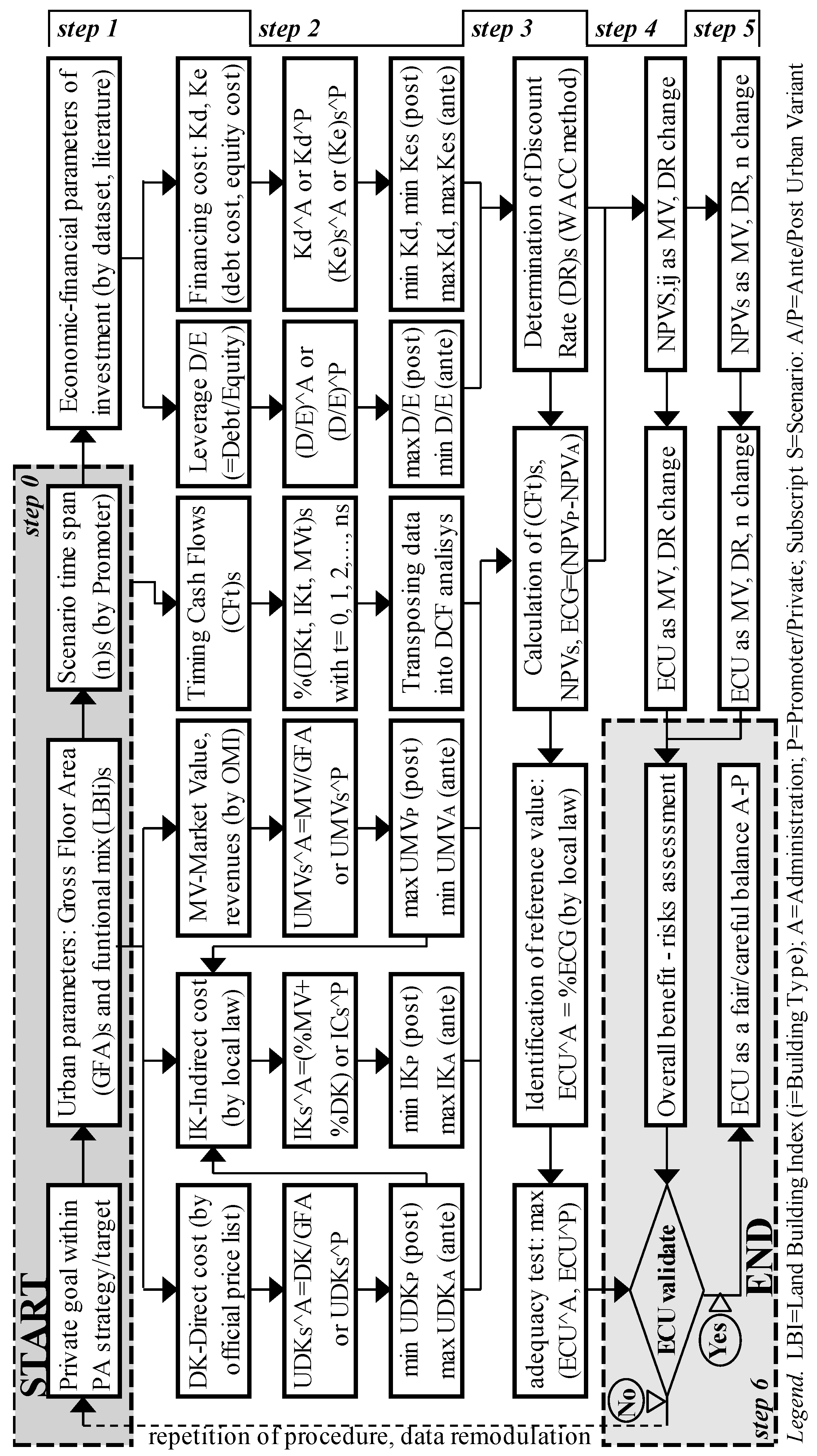

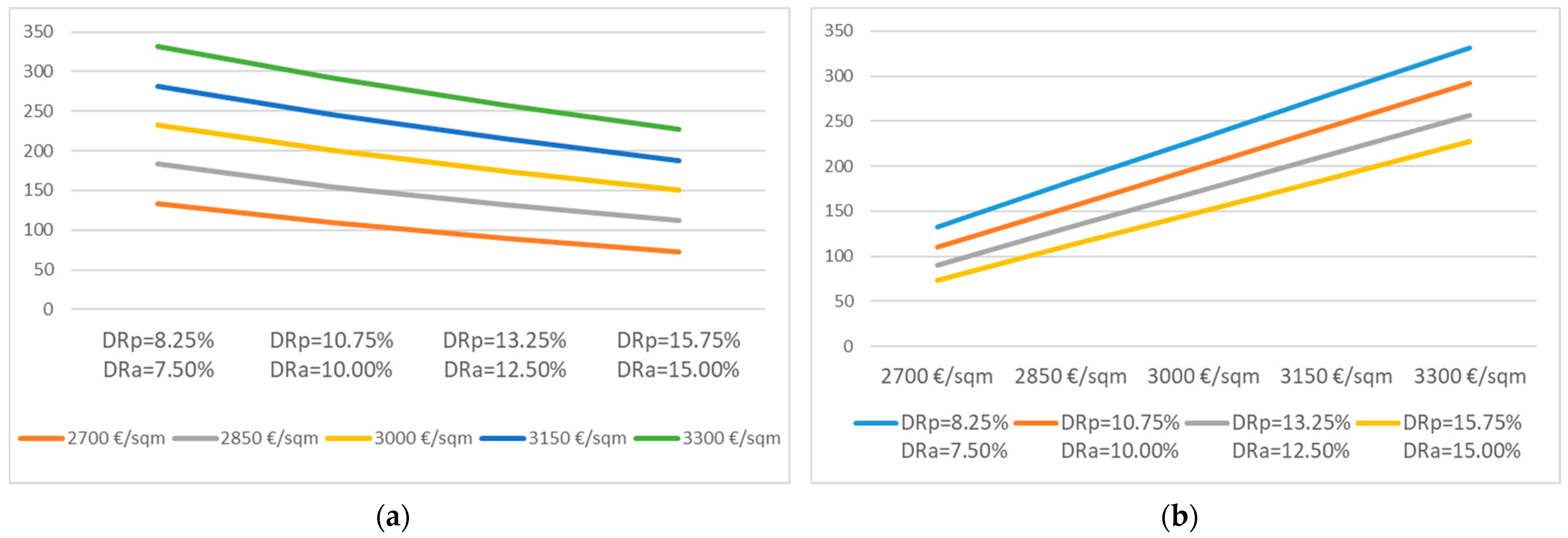

Currently (2021), the measures that somehow try to capture the surplus value and to acquire the contribution of developers to community infrastructures and services, are of three types: the implementation of urban planning standards, the payment of urbanisation and construction charges, the payment of an Extraordinary Charge of Urbanization (ECU). This extra-contribution is intended as an additional concessionary charge and is calculated by the municipal administration in proportion (not less than 50%) to the ECG produced by interventions in urban variance which, in turn, generally presupposes a negotiated agreement between the parties. In order to quantify the ECG, in literature as well as in the administrative and regulatory practice at a local level, the criterion of the transformation value (TV) is usually applied, according to a modality that determine the promoter profit of the initiative in a static way, without considering the realization time except for the financing cost (calculated according to its duration) [

23].

However, estimation practice now approaches the issue of investment in urban development in rather extensive and differentiated terms, depending on the intervention type and the instrument adopted [

23]. The most commonly used method to evaluate investment projects, both in literature and in estimation practice, is the discounted cash flow (DCF) analysis, which requires a discount rate (DR) to be estimated in a prudential way because it is decisive in assessing the project sustainability [

3] in relation to its duration.

3.3. Appeal to Public-Private Partnerships

Between the last decade of the 20th century and the first twenty years of the 21st, supranational law has given an increasingly decisive impulse towards overcoming the traditional “formalised” set-up of striking distance between PA and private operators. In Italy, this gap has stiffened the national frame of public contracting [

26].

The regulatory framework of the European Union (EU) member states, implementing the European Commission’s guidelines, already makes a wide range of tools available that are useful to compose public and private interests in urban projects and also as an alternative to traditional procurement procedures (in Italy, see Legislative Decree 50/2016 ff.) [

27].

The demand for urban quality and the need to minimise costs, in a capital-intensive sector, have led to a preference for the public–private partnership (PPP) as a solution to balance the double constraint of efficiency and scarcity of resources [

24]. Moreover, it is accepted that the quality of urban processes from the capacity for interaction between the public and private sectors, according to evolved cooperative forms [

28]. The success of an urban transformation intervention presupposes, in fact, the adequate balance of the actor’s conveniences involved, avoiding the “privatisation” of the positive externalities generated and the “socialisation” of the costs [

29].

The PPP concerns a bundle of legal institutions distinguishable in two main typologies (contractual and institutionalised), and characterised by four common elements: (i) long and delimited duration, (ii) private co-financing, (iii) risk transfer to the private sector, and (iv) PA’s control role [

30].

The choice of PPP can be ascribed mainly to three factors [

28]:

Acquisition of the intervention areas;

Finding the necessary resources to support the investment;

Urban planning revision due to the project inconsistency with the planning tools.

The activities in PPP can be related to [

31]:

A typical PPP project also has two characteristics [

25]: (i) different project phases (usually an initial construction or investment phase, with a substantial outlay of resources, and a management phase, with revenues distributed over time); (ii) final recovery value (value of the investment at the end of the project, if relevant).

In order to evaluate PPP interventions, from an economic and financial point of view, the ratio between resources absorbed and released is considered through the Net Present Value (NPV) and the Internal Rate of Return (IRR). The Debt Service Cover Ratio (DSCR) is instead used as an indicator to verify the compatibility of the cash flows generated with the resources available according to the financing dynamics [

25]. On this basis, both the amount of cash flows and time distribution are considered.

3.4. Regulations and Methodologies for Calculating the Extraordinary Charge of Urbanization (ECU) in Italy

The letter d-ter to co.4 of Art.16 of the Presidential Decree n.380/2001, introduced by Law n.164 of 2014 and recently amended by Law n.76 of 2020, configures the ECU in Italy as a consensual and negotiated concessionary charge—in addition to the primary and secondary urbanisation charges—related to the higher real estate value due to urban variants, derogations or changes of use. The private resources of the produced revenue are bound “to a specific cost centre for public works or services to be realised in the intervention context, transfer of areas or buildings destined to services of public utility, social housing or public works” (urban requalification, environmental protection, and social reform) [

19].

This provision is inspired by the most advanced international laws on the issue, but it is legislative and not regulatory [

32]. This because the competence in construction and urban planning matters, in Italy, is assigned to the regions (Presidential Decree no. 616/1977). More than seven years (2021) after the approval of the state law, only 5 out of 20 Regions have legislated on the matter (Emilia-Romagna, Liguria, Marche, Piemonte and Puglia), but only Piemonte and Puglia seem to have fully and specifically implemented its dictate [

1], while Liguria (Regional Law 16/2008, as amended by Regional Law 41/2014) has not specified any calculation method.

Other regions have set up forms and methods of taxes similar to the “extraordinary contribution”, or improperly defined as such (e.g., Lazio with R.L. no. 21/2009 and R.L. no. 7/2017, Umbria with Art. 35 of R.L. no. 1/2015, Abruzzo with R.L. no. 40/2017, Toscana with R.L. no. 65/2014): these provisions, in fact, concern the incidence of urbanisation charges or the urban standards monetisation.

The innovative spirit of the rule consists essentially in the obligation to share, in monetary terms, the real estate capital gain generated by the variation of urban planning tools (Vap-Vaa), or extra capital gain (ECG), between the public and private parties, instead of keeping the private prerogative only (Bpr): the public financial advantage (Bpu), starting from the previous Formula (1), should therefore include a monetary amount, or extra charge of urbanisation (ECU), not less than 50% of the ECG, according to the formula:

The few deliberations of the regions show many differences about the ECU calculation methodology to be adopted, its application modalities, the provision of incentives and disincentives [

1]. Operationally, two methods of estimating the ECU are identified, depending on whether or not the urban transformations are ascribed to the land component alone:

(a) The analytical one, applied by the regions: Piemonte (Decision of Regional Government (D.R.G.) no. 22-974/2016), Puglia (R.L. n.18/2019), Emilia-Romagna (D.R.G. no. 186/2018, amended by D.R.G. no. 1433/2019), Marche (D.R.G. no. 1156/2012) and in many municipalities, according to the formula that can be generalized as follows:

where TV = transformation value of the property (1 =

post/0 =

ante transformation) is equal to the difference between the market value of the goods produced by transformation (MV), inferred from the quotations published by the Italian Regency Agency’s Real Estate Market Observatory, and all transformation costs (K).

(b) The quick or synthetic one, foreseen by Marche, Puglia and Emilia-Romagna regions (for interventions located outside the urbanised territory and without design peculiarities), examines only the land component and calculates the ECG (Formula (5)) as the difference between the values of the area after (Vpost, expressing the additional buildability) and before (Vante, expressing the “intrinsic” buildability) the urban variant; these values are deduced from market analyses or from municipal tax values of building areas and, for Vante, also the average rural values of the Region (Emilia-Romagna).

This second method considers only the unit market values while transformation costs are not included in the surplus value calculation; in the case of Marche, it is determined and is fixed by tabular difference depending on the application parameters of the Municipal property tax, and quantified according to any: (i) change of use; (ii) increase in eligible volume:

On this basis, the Puglia region regulates further sub-cases which envisage: interventions without increase in volume/area or change of use (ECG = MV − K), the mere change of use of existing buildings (ECG = MV1 − MV0), the different use of services areas (ECG = TV1 − K1 − monetization value).

In both methods (relations 3-4-5), the discount factor does not appear and the literature has highlighted numerous inconsistencies [

33] even of the analytical one, although more defined than the synthetic method.

The literature has also highlighted how several regional and municipal measures actually decrease the potentialities contained in the regulation by reducing the estimated surplus values for interventions [

1] through deductible charges, overestimates of: the initial land cost, the value of works or land transfers, various interests and totally non-normal extra-profits [

8].

In the regions that have ignored or in some cases opposed the state law, such as Lombardia [

34] and Veneto, municipalities have either not implemented the rule or have decided on their own criteria, targets and methods for determining the ECU.

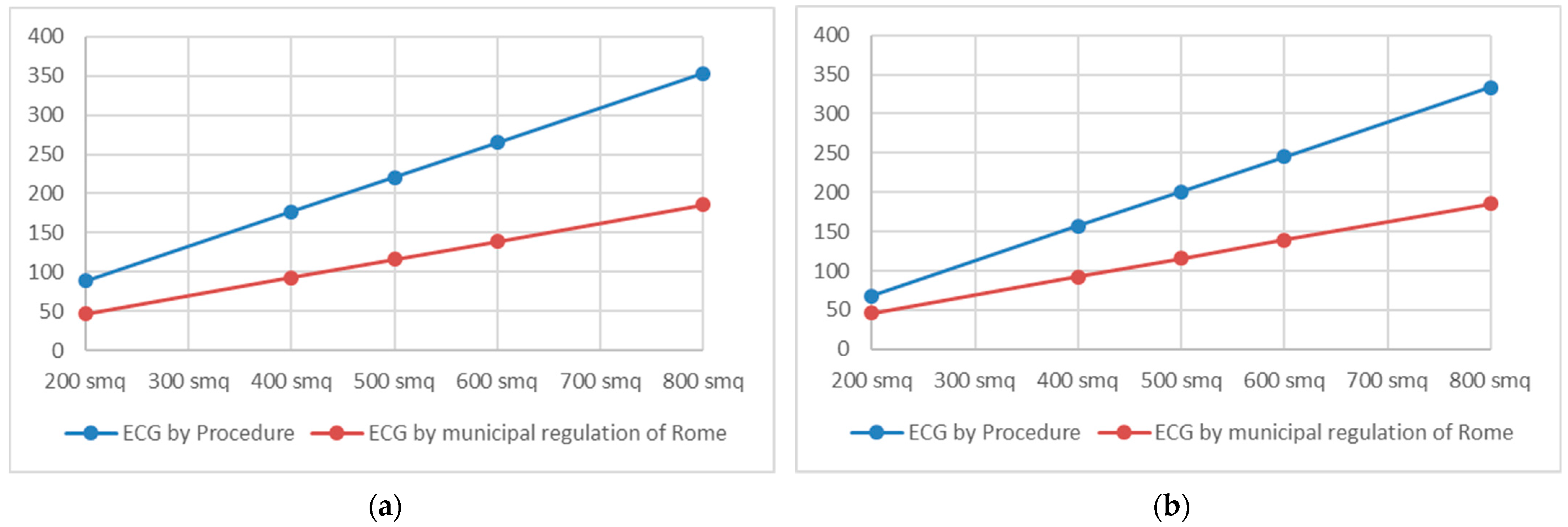

A web-based survey to identify municipal regulations on the ECU, as of 21 July 2021, revealed a sample of 100 municipal resolution that essentially adopt one of the two methods mentioned, but with some variations and applying different coefficients. In most of these cases, the percentage applied by the municipalities to the surplus value generated by the interventions (ECG) is 50% (the minimum required by national law); very few municipalities set a percentage higher than 50% of the ECG and among these the Municipality of Rome (66%) was one of the first to regulate the calculation of the EUC (Resolution of the Capitoline Assembly no. 128/2014).

Basically, the surplus value achievable with the urban variant is obtained through the difference between the TV post-variant and the TV pre-variant (in symbols: TV

post − TV

ante). According to the classical estimative doctrine and in line with the International Valuation Standards [

35], the TV is calculated as the difference between the market value of the building obtainable from the property transformation (MV) and the necessary transformation cost (K). Real estate quotations of the Italian Revenue Agency are often cited as a reference for determining MV, while a “conventional” calculation method for K is generally adopted, using regional price lists or municipal tabular data and fixed percentages for estimating indirect cost items (including the developer’s profit).

Many administrations have then introduced corrective coefficients (generally from 1.50 to 2.00) applicable to the ECU amount in order to direct the building activity towards a sustainable urban development or to incentivise the interventions aimed at: the settlement of tertiary and productive functions, the recovery of disused buildings in the historic centre, and the requalification of buildings and degraded urban areas, thus limiting the consumption of natural soil [

36,

37].

In other cases, however, the provision of reductive coefficients may lead to determining the ECU to an amount lower than the minimum legal threshold. The Puglia region, for example, provides multiplicative coefficients from 0.80 to 2.00 (depending on the territorial context concerned and the expected urban load) that municipalities may further reduce (through coefficients from 0.2 to 0.4) if intervention is a part of integrated urban regeneration programmes or is a result of architectural project competitions.

This heterogeneity and the evident limits of the calculation mechanism adopted by most of regions and municipalities hinders the effective reform law application [

1].

The few ECU assessment models found in the literature [

2,

38] refer to the TV determination scheme. They calculate the riskiness of the intervention within the promoter’s profit percentage (empirically established, one-off or as the sum of pre-established multi-criteria scores [

39]), and determine the discount factor [

3] over the entire duration of the transformation (sometimes preordained in 5 years) on the basis of a predetermined rate of interest expense (6%).

Similar models are re-proposed in guidelines adopted by PAs for the economic evaluation of public–private agreements that is aimed at including proposals or projects of relevant public interest in planning. For example, the Municipality of Vicenza [

40] refers to art.6 of the Veneto Regional Law no. 11/2004 and recalls in turn guidelines for the evaluation of instruments such as Integrated Intervention Plans used in the Municipalities of Milan, Verona (D.G. no. 659 of 1/06/2004), Rovigo (D.G. no. 20 of 10/02/2005).

The Municipality of Treviso, within the

Piano di Assetto del Territorio Territorial Management Plan [

41], adopted omnibus guidelines that present a comparative framework of methodological approaches, to evaluate and distribute the public–private benefit, and include also the financial version of the TV, besides the synthetic and non-discounted one.