Influence of Social Distancing Behavior and Cross-Cultural Motivation on Consumers’ Attitude to Using M-Payment Services

Abstract

1. Introduction

2. Literature Review

2.1. Mobile Payment in China

2.2. Culture and Social Distancing in the Aspect of M-Payment Adoption

2.3. Uncertainty Avoidance Index (UAI)

2.4. Construal Level and Mental Accounting Theory

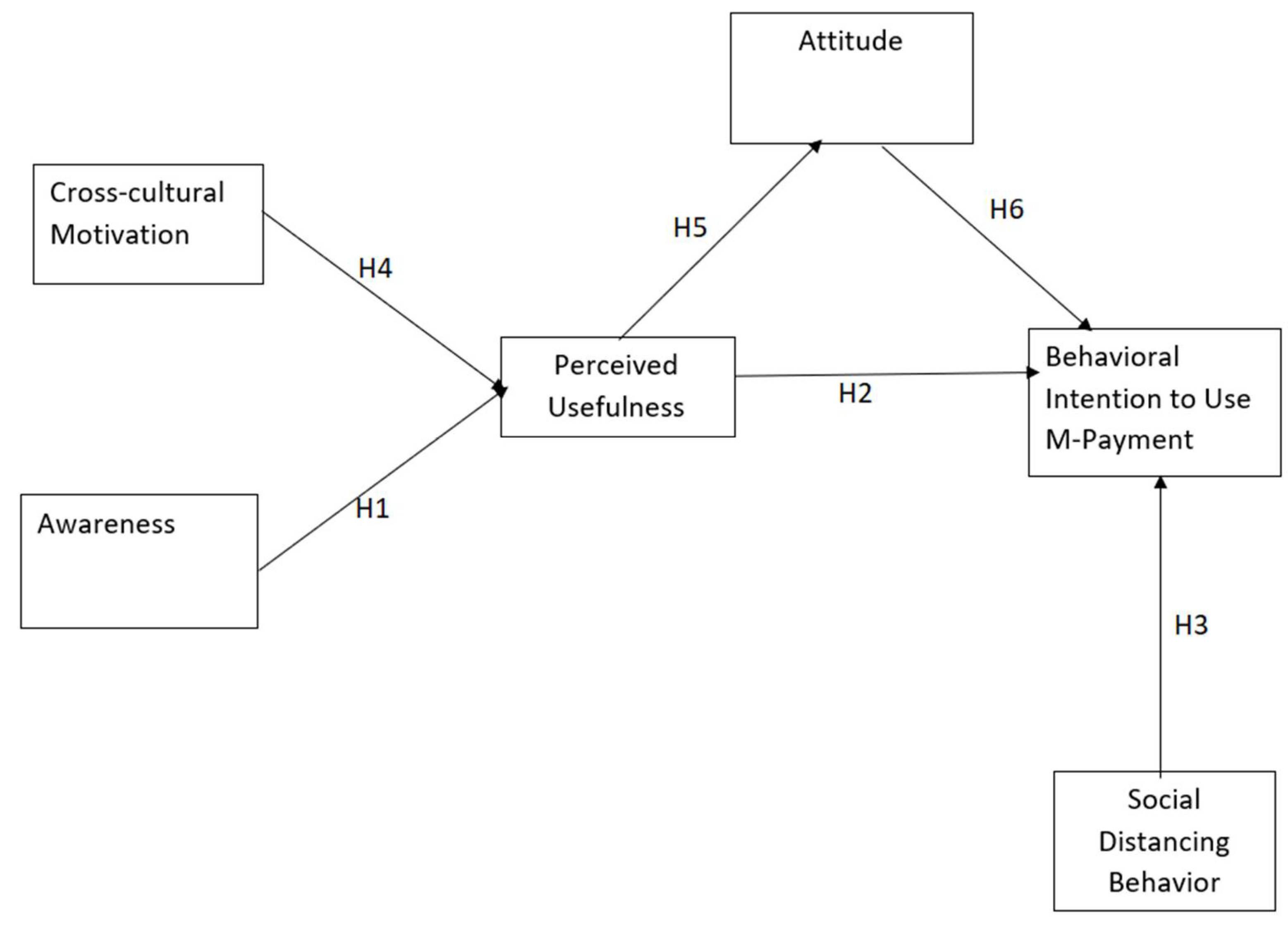

3. Theoretical Framework and Hypotheses Development

3.1. Awareness

3.2. Perceived Usefulness

3.3. Social Distancing Behavior

3.4. Cross-Cultural Motivation

3.5. Attitude

4. Research Methodology

5. Results

5.1. Descriptive Statistics

5.2. Common Method Bias

5.3. User Attitude as a Mediator

5.4. Measurement Model

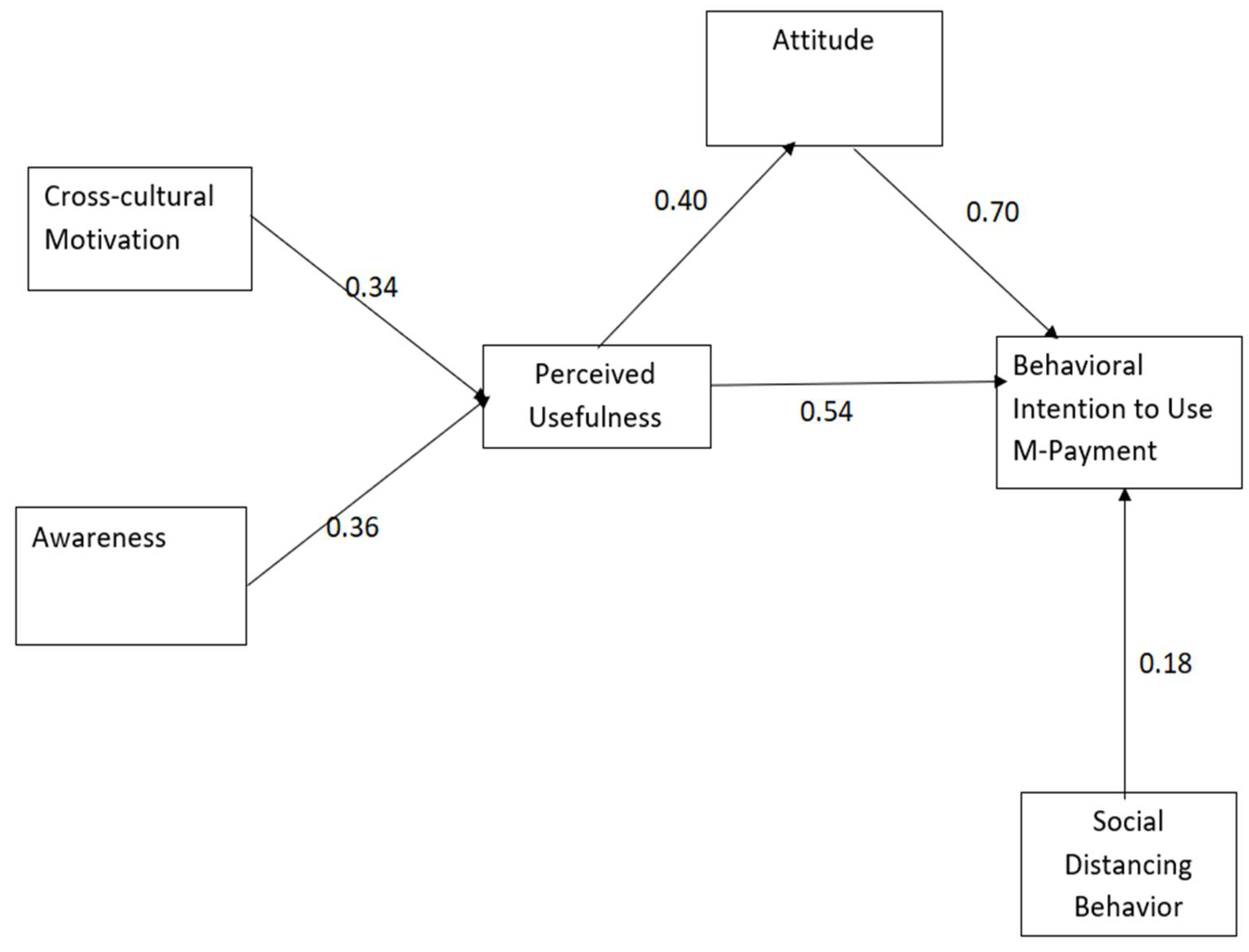

5.5. Structural Model

6. Discussion

6.1. Theoretical and Practical Implications

6.2. Limitations and Future Research Directions

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Questionnaire

| Constructs | Measurements Items | Sources |

|---|---|---|

| Cross Culture Motivation | I am confident that I can socialize with locals in a culture that is unfamiliar to me. I enjoy interacting with people from different cultures. I am sure I can deal with the stresses of adjusting to a culture that is new to me. I enjoy living in cultures that are unfamiliar to me. I am confident that I can get accustomed to shopping conditions in a different culture. | [17,41]. |

| Awareness | I received enough information about the benefit of the m-payment system. I received never received information about the m-payment system. M-payments awareness is high among the consumer. Consumers are aware of the use of the m-payment system effectively. Consumers are aware of the privacy aspects of the m-payment system. | [19,23]. |

| Perceived Usefulness | I believe that in my daily activities mobile payment would be a useful service. It saves time when I use mobile payment for paying. It makes my daily transaction more convenient. It could increase daily transection efficiency. It would increase my productivity. | [28]. |

| Social Distancing | Social distancing globally reduces the spread of COVID-19. Social distancing is a public good under the COVID-19. The positive impact of social distancing in reducing the risk of transmission of COVID-19. Social distancing increases hygiene procedures. Social distance can be voluntary at the individual level. Social distance can be voluntary at the community level. | [74,95]. |

| Attitude | Using m-payment systems is a wise idea. Using m-payment systems is pleasant. I like the idea of using m-payment systems. Using m-payment systems is beneficial. Using m-payment systems is interesting. | [82]. |

| Behavioral Intention to use | I will always try to use mobile payment systems in my daily life. I plan to use mobile payment systems frequently. I will recommend others to use mobile payment systems. I predict that I would use mobile payments. | [94] |

References

- Dwivedi, Y.K.; Hughes, D.L.; Coombs, C.; Constantiou, I.; Duan, Y.; Edwards, J.S.; Gupta, B.; Lal, B.; Misra, S.; Prashant, P.; et al. Impact of COVID-19 pandemic on information management research and practice: Transforming education, work and life. Int. J. Inf. Manag. 2020, 102211. [Google Scholar] [CrossRef]

- Sheth, J. Impact of COVID-19 on consumer behavior: Will the old habits return or die? J. Bus. Res. 2020, 117, 280–283. [Google Scholar] [CrossRef] [PubMed]

- Anderson, R.M.; Heesterbeek, H.; Klinkenberg, D.; Hollingsworth, T.D. How will country-based mitigation measures influence the course of the COVID-19 epidemic? Lancet 2020, 395, 931–934. [Google Scholar] [CrossRef]

- Carroll, N.; Conboy, K. Normalising the “new normal”: Changing tech-driven work practices under pandemic time pressure. Int. J. Inf. Manag. 2020, 102186. [Google Scholar] [CrossRef]

- Kaba, B. Modeling information and communication technology use continuance behavior: Are there differences between users on basis of their status? Int. J. Inf. Manag. 2018, 38, 77–85. [Google Scholar] [CrossRef]

- Park, J.K.; Ahn, J.; Thavisay, T.; Ren, T. Examining the role of anxiety and social influence in multi-benefits of mobile payment service. J. Retail. Consum. Serv. 2019, 47, 140–149. [Google Scholar] [CrossRef]

- Kaba, B.; Osei-Bryson, K.M. Examining influence of national culture on individuals’ attitude and use of information and communication technology: Assessment of moderating effect of culture through cross countries study. Int. J. Inf. Manag. 2013, 33, 441–452. [Google Scholar] [CrossRef]

- Edwards, J.R.; Lambert, L.S. Methods for integrating moderation and mediation: A general analytical framework using moderated path analysis. Psychol Methods 2007, 12, 1–22. [Google Scholar] [CrossRef] [PubMed]

- Smith, R.A.; Khawaja, N.G. A review of the acculturation experiences of international students. Int. J. Intercult. Relat. 2011, 35, 699–713. [Google Scholar] [CrossRef]

- Bierwiaczonek, K.; Waldzus, S. Socio-Cultural Factors as Antecedents of Cross-Cultural Adaptation in Expatriates, International Students, and Migrants: A Review. J. Cross-Cult. Psychol. 2016, 47, 767–817. [Google Scholar] [CrossRef]

- Liu, X.; Shaffer, M.A. An investigation of expatriate adjustment and performance: A social capital perspective. Int. J. Cross Cult. Manag. 2005, 5, 235–254. [Google Scholar] [CrossRef]

- Chen, G.; Klimosk, R.J. The impact of expectations on newcomer performance in teams as mediated by work characteristics, social exchanges, and empowerment. Acad. Manag. J. 2003, 46, 591–607. [Google Scholar]

- Peterson, R.S. Cultural intelligence. Lond. Bus. Sch. Rev. 2019, 30, 74–75. [Google Scholar] [CrossRef]

- Cheung, W.; Chang, M.K.; Lai, V.S. Prediction of Internet and World Wide Web usage at work: A test of an extended Triandis model. Decis. Support Syst. 2000, 30, 83–100. [Google Scholar] [CrossRef]

- Wang, Y.S. The adoption of electronic tax filing systems: An empirical study. Gov. Inf. Q. 2003, 20, 333–352. [Google Scholar] [CrossRef]

- McCoy, S.; Galletta, D.F.; King, W.R. Applying TAM across cultures: The need for caution. Eur. J. Inf. Syst. 2007, 16, 81–90. [Google Scholar] [CrossRef]

- Chen, G.; Kirkman, B.; Kim, K.; Farh, C.; Tangirala, S. When does cross-cultural motivation enhance expatriate effectiveness? A multilevel investigation of the moderating roles of subsidiary support and cultural distance. Acad. Manag. J. 2010, 53, 1110–1130. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Sánchez-Fernández, J.; Muñoz-Leiva, F. Antecedents of the adoption of the new mobile payment systems: The moderating effect of age. Comput. Human Behav. 2014, 35, 464–478. [Google Scholar] [CrossRef]

- Al-Okaily, M.; Lutfi, A.; Alsaad, A.; Taamneh, A.; Alsyouf, A. The Determinants of Digital Payment Systems’ Acceptance under Cultural Orientation Differences: The Case of Uncertainty Avoidance. Technol. Soc. 2020, 63, 101367. [Google Scholar] [CrossRef]

- S Freiwald - Harv. JL & Tech., 2000Of ASE, For I, of A, The NOF. in C Yberspace: T He C Ase of I Ntermediary; Spring: Berlin/Heidelberg, Germany, 2001; Volume 14, pp. 1–14.

- Huynh, T.L.D. Does culture matter social distancing under the COVID-19 pandemic? Saf. Sci. 2020, 130, 104872. [Google Scholar] [CrossRef]

- Ren, T.; Tang, Y. Accelerate the promotion of mobile payments during the COVID-19 epidemic. Innovation 2020, 1, 2. [Google Scholar] [CrossRef] [PubMed]

- Singh, N.; Sinha, N. How perceived trust mediates merchant’s Intention to use a mobile wallet technology. J. Retail. Consum. Serv. 2020, 52, 101894. [Google Scholar] [CrossRef]

- Ajzen, I. The theory of planned behavior. Handb. Theor. Soc. Psychol. 2012, 211, 438–459. [Google Scholar]

- Li, F.; Japutra, A. Assessment of mobile technology use in the emerging market: Analyzing Intention to use m-payment services in India. Telecommun. Policy 2020, 44, 102009. [Google Scholar]

- Chopdar, P.K.; Sivakumar, V.J. Understanding continuance usage of mobile shopping applications in India: The role of espoused cultural values and perceived risk. Behav. Inf. Technol. 2019, 38, 42–64. [Google Scholar] [CrossRef]

- Guo, J.; Bouwman, H. An ecosystem view on third party mobile payment providers: A case study of Alipay wallet. Info 2016, 18, 56–78. [Google Scholar] [CrossRef]

- Wu, J.; Liu, L.; Huang, L. Consumer acceptance of mobile payment across time Antecedents and moderating role of diffusion stages. Ind. Manag. Data Syst. 2017, 117, 1761–1776. [Google Scholar] [CrossRef]

- Van Der Heijden, H. Hedonic Information Systems In researce User Acceptance of Hedonic information systems. MIS Q. 2004, 28, 695–704. [Google Scholar] [CrossRef]

- King, W.R.; He, J. A meta-analysis of the technology acceptance model. Inf. Manag. 2006, 43, 740–755. [Google Scholar] [CrossRef]

- Davis, F.D.; Bagozzi, R.P.; Warshaw, P.R. User Acceptance of Computer Technology: A Comparison of Two Theoretical Models. Manag. Sci. 1989, 35, 982–1003. [Google Scholar] [CrossRef]

- Briz-Ponce, L.; García-Peñalvo, F.J. An Empirical Assessment of a Technology Acceptance Model for Apps in Medical Education. J. Med. Syst. 2015, 39, 1–5. [Google Scholar] [CrossRef] [PubMed]

- Silver, D.; Schrittwieser, J.; Simonyan, K.; Antonoglou, I.; Huang, A.; Guez, A.; Hubert, T.; Baker, L.; Lai, M.; Bolton, A.; et al. Mastering the game of Go without human knowledge. Nature 2017, 550, 354–359. [Google Scholar] [CrossRef] [PubMed]

- Wang, Y.; Wang, S.; Wang, J.; Wei, J.; Wang, C. An empirical study of consumers’Intention to use ride-sharing services: Using an extended technology acceptance model. Transportation 2020, 47, 397–415. [Google Scholar] [CrossRef]

- Girod, B.; Mayer, S.; Nägele, F. Economic versus belief-based models: Shedding light on the adoption of novel green technologies. Energy Policy 2017, 101, 415–426. [Google Scholar] [CrossRef]

- Alam, M.Z.; Hoque, M.R.; Hu, W.; Barua, Z. Factors influencing the adoption of mHealth services in a developing country: A patient-centric study. Int. J. Inf. Manag. 2020, 50, 128–143. [Google Scholar] [CrossRef]

- Irani, Z.; Kamal, M. Transforming Government: People, Process and Policy. Gov. People Process. Policy 2016, 10, 190–195. [Google Scholar] [CrossRef]

- Shaw, N. The mediating influence of trust in the adoption of the mobile wallet. J. Retail. Consum. Serv. 2014, 21, 449–459. [Google Scholar] [CrossRef]

- Yang, Y.; Liu, Y.; Li, H.; Yu, B. Understanding perceived risks in mobile payment acceptance. Ind. Manag. Data Syst. 2015, 115, 253–269. [Google Scholar] [CrossRef]

- Wang, X.; Lin, X.; Spencer, M.K. Exploring the effects of extrinsic motivation on consumer behaviors in social commerce: Revealing consumers’ perceptions of social commerce benefits. Int. J. Inf. Manag. 2019, 45, 163–175. [Google Scholar] [CrossRef]

- Tinsley, C. Models of conflict resolution in Japanese, German, and American cultures. J. Appl. Psychol. 1998, 83, 316–323. [Google Scholar] [CrossRef]

- Ghezzi, A.; Renga, F.; Balocco, R.; Pescetto, P. Mobile payment applications: Offer state of the art in the Italian market. Info 2010, 12, 3–22. [Google Scholar] [CrossRef]

- Lu, Y.; Yang, S.; Chau, P.Y.K.; Cao, Y. Dynamics between the trust transfer process and Intention to use mobile payment services: A cross-environment perspective. Inf. Manag. 2011, 48, 393–403. [Google Scholar] [CrossRef]

- Montinari, N.; Rancan, M. A friend is a treasure: On the interplay of social distance and monetary incentives when risk is taken on behalf of others. J. Behav. Exp. Econ. 2020, 86, 101544. [Google Scholar] [CrossRef]

- Eckhardt, G. Culture’s Consequences: Comparing Values, Behaviors, Institutions and Organisations across Nations. Aust. J. Manag. 2002, 27, 89–94. [Google Scholar] [CrossRef]

- Muriithi, N.; Crawford, L. Approaches to project management in Africa: Implications for international development projects. Int. J. Proj. Manag. 2003, 21, 309–319. [Google Scholar] [CrossRef]

- Cesario, J.; Grant, H.; Higgins, E.T. Regulatory Fit and Persuasion: Transfer from “Feeling Right”. J. Pers. Soc. Psychol. 2004, 86, 388–404. [Google Scholar] [CrossRef]

- Liberman, N.; Trope, Y.; Wakslak, C. Construal level theory and consumer behavior. J. Consum. Psychol. 2007, 17, 113–117. [Google Scholar] [CrossRef]

- Fujita, K.; Henderson, M.D.; Eng, J.; Trope, Y.; Liberman, N. Spatial distance and mental construal of social events. Psychol. Sci. 2006, 17, 278–282. [Google Scholar] [CrossRef] [PubMed]

- Zhang, E.M. Understanding the Acceptance of Mobile SMS Advertising among Young Chinese Consumers. Psychol. Mark. 2010, 30, 461–469. [Google Scholar] [CrossRef]

- Thaler, R.H. Mental accounting and consumer choice. Mark. Sci. 2008, 27, 15–25. [Google Scholar] [CrossRef]

- Koukova, N.; Kannan, P.; Ratchford, B. Product form bundling: Implications for marketing digital products. J. Retail. 2008, 84, 181–194. [Google Scholar] [CrossRef]

- Hayashi, F.; Do, U.S. Consumers Really Benefit from Payment Card Rewards? Econ. Rev. 2009, 94, 37–63. [Google Scholar]

- Mohammadi, H. A study of mobile banking loyalty in Iran. Comput. Human Behav. 2015, 44, 35–47. [Google Scholar] [CrossRef]

- Chen, C.S. Perceived risk, usage frequency of mobile banking services. Manag. Serv. Qual. 2013, 23, 410–436. [Google Scholar] [CrossRef]

- Hanafizadeh, P.; Khedmatgozar, H.R. The mediating role of the dimensions of the perceived risk in the effect of customers’ awareness on the adoption of Internet banking in Iran. Electron. Commer. Res. 2012, 12, 151–175. [Google Scholar] [CrossRef]

- Huang, D.L.; Patrick Rau, P.L.; Salvendy, G.; Gao, F.; Zhou, J. Factors affecting perception of information security and their impacts on IT adoption and security practices. Int. J. Hum. Comput. Stud. 2011, 69, 870–883. [Google Scholar] [CrossRef]

- Laukkanen, T.; Kiviniemi, V. The role of information in mobile banking resistance. Int. J. Bank Mark. 2010, 28, 372–388. [Google Scholar] [CrossRef]

- Al-Somali, S.A.; Gholami, R.; Clegg, B. An investigation into the acceptance of online banking in Saudi Arabia. Technovation 2009, 29, 130–141. [Google Scholar] [CrossRef]

- Stepcic, C.; Salah, K. The Institutionalisation of Mobile Payment Technologies in Kenya: Retailers’ Pespective. In Proceedings of the 24th European Conference Information Systems Ecis 2016, Istanbul, Turkey, 12–15 June 2016; Available online: https://aisel.aisnet.org/ecis2016_rp/12/ (accessed on 2 November 2020).

- Dai, H.; Palvia, P.C. Mobile Commerce Adoption in China and the United States: A Cross-Cultural Study. Data Base Adv. Inf. Syst. 2009, 40, 43–61. [Google Scholar] [CrossRef]

- Adoption, S.; Services, I. IoT A study on the successful acceptance of services: Focusing on iBeacon and Nearby. J. Inf. Technol. Serv. 2015, 14, 217–236. [Google Scholar] [CrossRef][Green Version]

- Natarajan, T.; Balasubramanian, S.A.; Kasilingam, D.L. Understanding the Intention to use mobile shopping applications and its influence on price sensitivity. J. Retail. Consum. Serv. 2017, 37, 8–22. [Google Scholar] [CrossRef]

- Phong, N.D.; Khoi, N.H.; Nhat-Hanh Le, A. Factors affecting mobile shopping: A Vietnamese perspective. J. Asian Bus. Econ. Stud. 2018, 25, 186–205. [Google Scholar] [CrossRef]

- Vijayasarathy, L.R. Predicting consumer intentions to use online shopping: The case for an augmented technology acceptance model. Inf. Manag. 2004, 41, 747–762. [Google Scholar] [CrossRef]

- Kesharwani, A.; Bisht, S.S. The impact of trust and perceived risk on internet banking adoption in India: An extension of technology acceptance model. Int. J. Bank Mark. 2012, 30, 303–322. [Google Scholar] [CrossRef]

- Lara-Rubio, J.; Villarejo-Ramos, A.F.; Liébana-Cabanillas, F. Explanatory and predictive model of the adoption of P2P payment systems. Behav. Inf. Technol. 2020, 40, 528–541. [Google Scholar] [CrossRef]

- Liébana-Cabanillas, F.; Marinković, V.; Kalinić, Z. A SEM-neural network approach for predicting antecedents of m-commerce acceptance. Int. J. Inf. Manag. 2017, 37, 14–24. [Google Scholar] [CrossRef]

- Mun, Y.P.; Khalid, H.; Nadarajah, D. Millennials’ Perception on Mobile Payment Services in Malaysia. Procedia Comput. Sci. 2017, 124, 397–404. [Google Scholar] [CrossRef]

- Ooi, K.B.; Tan, G.W.H. Mobile technology acceptance model: An investigation using mobile users to explore smartphone credit card. Expert Syst. Appl. 2016, 59, 33–46. [Google Scholar] [CrossRef]

- Fan, A.; Mattila, A.S.; Zhao, X. How does social distance impact customers’ complaint intentions? A cross-cultural examination. Int. J. Hosp. Manag. 2015, 47, 35–42. [Google Scholar] [CrossRef]

- Ntounis, N.; Mumford, C.; Loroño-Leturiondo, M.; Parker, C.; Still, K. How safe is it to shop? Estimating the amount of space needed to safely social distance in various retail environments. Saf. Sci. 2020, 132, 104985. [Google Scholar] [CrossRef] [PubMed]

- Pannu, J. Nonpharmaceutical measures for pandemic influenza in nonhealthcare settings-international travel-related measures. Emerg. Infect. Dis. 2020, 26, 2298–2299. [Google Scholar] [CrossRef] [PubMed]

- Mahtani, K.R.; Heneghan, C.; Aronson, J.K. What is the evidence for social distancing during global pandemics? A rapid summary of current knowledge. Oxford COVID-19 Evid. Serv. 2020, 15, 1–9. [Google Scholar]

- Nan, X. Social distance, framing, and judgment: A construal level perspective. Human Commun. Res. 2007, 33, 489–514. [Google Scholar] [CrossRef]

- Orlikowski, W.J.; Baroudi, J.J. Studying information technology in organizations: Research approaches and assumptions. Inf. Syst. Res. 1991, 2, 1–28. [Google Scholar] [CrossRef]

- Ang, S.; Van Dyne, L.; Koh, C.; Ng, K.Y.; Templer, K.J.; Tay, C.; Chandrasekar, N.A. Cultural intelligence: Its measurement and effects on cultural judgment and decision making, cultural adaptation and task performance. Manag. Organ. Rev. 2007, 3, 335–371. [Google Scholar] [CrossRef]

- Harrison, D.A.; Shaffer, M.A. Mapping the criterion space for expatriate success: Task- and relationship-based performance, effort and adaptation. Int. J. Hum. Resour. Manag. 2005, 16, 1454–1474. [Google Scholar] [CrossRef]

- Cato, S.; Iida, T.; Ishida, K.; Ito, A.; McElwain, K.M.; Shoji, M. Social distancing as a public good under the COVID-19 pandemic. Public Health 2020, 188, 51–53. [Google Scholar] [CrossRef] [PubMed]

- Bentler, P.M.; Chou, C. Practical Issues of Grinding; Sage Publication: Los Angeles, LA, USA, 1987. [Google Scholar]

- Kaba, B.; N’Da, K.; Meso, P.; Mbarika, V.W.A. Micro factors influencing the attitudes toward and the use of a mobile technology: A model of cell-phone use in Guinea. IEEE Trans. Prof. Commun. 2009, 52, 272–290. [Google Scholar] [CrossRef]

- Bhaskar-Shrinivas, P.; Harrison, D.A.; Shaffer, M.A.; Luk, D.M. Input-based and time-based models of international adjustment: Meta-analytic evidence and theoretical extensions. Acad. Manag. J. 2005, 48, 257–281. [Google Scholar] [CrossRef]

- Shin, D.H. Towards an understanding of the consumer acceptance of mobile wallet. Comput. Human Behav. 2009, 25, 1343–1354. [Google Scholar] [CrossRef]

- Oosterhoff, B.; Palmer, C.A.; Wilson, J.; Shook, N. Adolescents’ Motivations to Engage in Social Distancing During the COVID-19 Pandemic: Associations with Mental and Social Health. J. Adolesc. Health 2020, 67, 179–185. [Google Scholar] [CrossRef] [PubMed]

- Lin, S.Y.; Juan, P.J.; Lin, S.W. A tam framework to evaluate the effect of smartphone application on tourism information search behavior of foreign independent travelers. Sustainability 2020, 12, 9366. [Google Scholar] [CrossRef]

- Naveed, Q.N.; Alam, M.M.; Tairan, N. Structural equation modeling for mobile learning acceptance by university students: An empirical study. Sustainability 2020, 12, 8618. [Google Scholar] [CrossRef]

- Baron, R.M.; Kenny, D.A. The Moderator-Mediator Variable Distinction in Social Psychological Research. Conceptual, Strategic, and Statistical Considerations. J. Pers. Soc. Psychol. 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Alalwan, A.A.; Dwivedi, Y.K.; Rana, N.P. Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. Int. J. Inf. Manag. 2017, 37, 99–110. [Google Scholar] [CrossRef]

- Xu, F.; Du, J.T. Factors influencing users’ satisfaction and loyalty to digital libraries in Chinese universities. Comput. Human Behav. 2018, 83, 64–72. [Google Scholar] [CrossRef]

- Remuzzi, A.; Remuzzi, G. COVID-19 and Italy: What next? Lancet 2020, 395, 1225–1228. [Google Scholar] [CrossRef]

- Maier, C.; Laumer, S.; Eckhardt, A. Theory-Guided Modeling and Empiricism in Information Systems Research; Springer: Heidelberg, Germany, 2011; pp. 901–911. [Google Scholar]

- Sreelakshmi, C.C.; Prathap, S.K. Continuance adoption of mobile-based payments in COVID-19 context: An integrated framework of health belief model and expectation confirmation model. Int. J. Pervasive Comput. Commun. 2020, 16, 351–369. [Google Scholar]

- Schierz, P.G.; Schilke, O.; Wirtz, B.W. Understanding consumer acceptance of mobile payment services: An empirical analysis. Electron. Commer Res. Appl. 2010, 9, 209–216. [Google Scholar] [CrossRef]

- Patil, P.; Tamilmani, K.; Rana, N.P.; Raghavan, V. Understanding consumer adoption of mobile payment in India: Extending Meta-UTAUT model with personal innovativeness, anxiety, trust, and grievance redressal. Int. J. Inf. Manag. 2020, 54, 102144. [Google Scholar] [CrossRef]

- Wang, M.; Takeuchi, R. The Role of Goal Orientation during Expatriation: A Cross-Sectional and Longitudinal Investigation. J. Appl. Psychol. 2007, 92, 1437–1445. [Google Scholar] [CrossRef] [PubMed]

| Demographics | Frequency | Percentage | |

|---|---|---|---|

| Edu | Bachelor | 114 | 27.9 |

| Master | 185 | 45.2 | |

| PhD | 87 | 21.3 | |

| Others | 23 | 5.6 | |

| Gender | Male | 309 | 75.6 |

| Female | 100 | 24.4 | |

| Age | Under 20 | 34 | 8.3 |

| 21–30 | 253 | 61.9 | |

| 31–40 | 119 | 29.1 | |

| Above 40 | 3 | 0.7 | |

| Region | Asia | 335 | 81.9 |

| Africa | 43 | 10.5 | |

| European Union | 5 | 1.2 | |

| Eastern Europe | 10 | 2.4 | |

| North America | 0 | 0 | |

| South America | 3 | 0.7 | |

| Middle East | 12 | 2.9 | |

| Oceania | 0 | 0 | |

| Others | 1 | 0.2 | |

| Religion | Islam | 204 | 49.9 |

| Christianity | 38 | 9.3 | |

| Buddhism | 147 | 35.9 | |

| Hinduism | 7 | 1.7 | |

| Others | 0 | 0 | |

| Nothing | 13 | 3.2 | |

| For how many years haveyou used internet payment before entering China | Less than 3 years | 269 | 65.8 |

| 3–5 years | 73 | 17.8 | |

| 5–8 years | 33 | 8.1 | |

| Above 8 years | 34 | 8.3 | |

| For how many years haveyou used mobile payment before entering China | Less than 3 years | 291 | 71.1 |

| 3–5 years | 65 | 15.9 | |

| 5–8 years | 32 | 7.8 | |

| Above 8 years | 21 | 5.1 | |

| In which city are you living in China | Wuhan | 307 | 75.1 |

| Zhengzhou | 7 | 1.7 | |

| Nanchang | 4 | 1 | |

| Guangzhou | 78 | 19.1 | |

| Nanjing | 0 | 0 | |

| Kunming | 0 | 0 | |

| Beijing | 6 | 1.5 | |

| Others | 7 | 1.7 | |

| Have you ever participated in a mobile payment experience in your country | Yes | 244 | 59.7 |

| No | 165 | 41.3 |

| Component | ||||||

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | |

| SDB5.4 | 0.823 | 0.004 | −0.023 | −0.012 | −0.074 | 0.160 |

| SDB5.5 | 0.810 | 0.021 | −0.095 | 0.179 | 0.199 | 0.100 |

| SDB5.1 | 0.800 | 0.011 | 0.040 | 0.086 | 0.098 | 0.095 |

| SDB5.3 | 0.774 | −0.047 | −0.050 | −0.030 | 0.088 | 0.206 |

| SDB5.2 | 0.762 | 0.027 | −0.004 | −0.021 | 0.007 | 0.442 |

| CCM2.5 | 0.017 | 0.878 | 0.152 | −0.047 | −0.009 | −0.006 |

| CCM2.4 | 0.042 | 0.868 | 0.153 | 0.005 | 0.026 | 0.051 |

| CCM2.3 | −0.041 | 0.854 | 0.083 | −0.003 | 0.146 | 0.006 |

| CCM2.2 | 0.082 | 0.848 | 0.160 | 0.036 | −0.001 | −0.052 |

| CCM2.1 | −0.067 | 0.695 | 0.026 | 0.013 | 0.117 | 0.034 |

| PU3.1 | −0.017 | 0.124 | 0.883 | 0.106 | 0.068 | −0.011 |

| PU3.2 | −0.010 | 0.153 | 0.851 | 0.163 | 0.224 | 0.101 |

| PU3.4 | 0.006 | 0.134 | 0.842 | 0.181 | 0.162 | −0.135 |

| PU3.3 | −0.152 | 0.208 | 0.771 | 0.211 | 0.260 | 0.006 |

| AT9.1 | 0.097 | −0.048 | 0.119 | 0.866 | 0.062 | −0.021 |

| AT9.4 | 0.048 | 0.068 | 0.206 | 0.848 | 0.230 | 0.019 |

| AT9.5 | −0.001 | −0.019 | 0.244 | 0.840 | 0.009 | −0.037 |

| IU6.1 | 0.282 | 0.055 | 0.060 | 0.223 | 0.774 | 0.059 |

| IU6.6 | −0.117 | 0.157 | 0.460 | 0.172 | 0.702 | 0.106 |

| IU6.4 | 0.251 | 0.120 | 0.349 | −0.174 | 0.655 | −0.070 |

| IU6.2 | −0.038 | 0.082 | 0.479 | 0.226 | 0.613 | −0.124 |

| AW4.1 | 0.325 | 0.028 | 0.080 | 0.085 | −0.140 | 0.839 |

| AW4.2 | 0.475 | −0.002 | −0.064 | −0.069 | 0.152 | 0.702 |

| AW4.3 | 0.516 | 0.021 | −0.122 | −0.117 | 0.050 | 0.695 |

| (a) | ||||

| Social Distancing Behavior | Perceived Usefulness | Awareness | Attitude | |

| Attitude | 0.000 | 0.330 | 0.362 | 0.000 |

| Social distancing Behavior | 0.027 | 0.000 | 0.082 | 0.413 |

| (b) | ||||

| Social Distancing Behavior | Perceived Usefulness | Awareness | Attitude | |

| Attitude | 0.000 | 0.000 | 0.000 | 0.000 |

| Social distancing Behavior | 0.000 | 0.136 | 0.150 | 0.000 |

| (c) | ||||

| Social Distancing Behavior | Perceived Usefulness | Awareness | Attitude | |

| Attitude | 0.000 | 0.330 | 0.362 | 0.000 |

| Social distancing Behavior | 0.027 | 0.136 | 0.232 | 0.413 |

| (d) | ||||

| Social Distancing Behavior | Perceived Usefulness | Awareness | Attitude | |

| Attitude | ... | 0.010 | 0.010 | ... |

| Social distancing Behavior | 0.010 | 0.010 | 0.010 | 0.010 |

| Construct | Cronbach’s Alpha | AVE | CR | FL Range | MSV | MaxR(H) |

|---|---|---|---|---|---|---|

| Cross-Cultural Motivation | 0.909 | 0.643 | 0.899 ** | 0.82–0.86 | 0.121 | 0.915 |

| Perceived Usefulness | 0.904 | 0.712 | 0.881 ** | 0.82–0.86 | 0.587 | 0.883 |

| Social DistancingBehavior | 0.886 | 0.613 | 0.826 *** | 0.74–0.82 | 0.593 | 0.83 |

| Awareness | 0.861 | 0.632 | 0.837 *** | 0.76–0.82 | 0.593 | 0.84 |

| Attitude | 0.879 | 0.678 | 0.863 ** | 0.79–0.86 | 0.21 | 0.867 |

| Intention to Use | 0.852 | 0.625 | 0.833 *** | 0.72–0.84 | 0.587 | 0.842 |

| CCM | PU | SD | AW | AT | IU | |

|---|---|---|---|---|---|---|

| CCM | 0.802 | |||||

| PU | 0.348 *** | 0.844 | ||||

| SDB | 0.013 | −0.079 | 0.783 | |||

| AW | 0.026 | −0.147 * | 0.770 *** | 0.795 | ||

| AT | 0.054 | 0.458 *** | 0.166 ** | −0.05 | 0.823 | |

| IU | 0.301 *** | 0.766 *** | 0.105 † | 0.026 | 0.451 *** | 0.79 |

| Hypotheses | Relationships | Path | T-Value | p-Value | Result |

|---|---|---|---|---|---|

| H1 | AW < PU | 0.36 | 8.679 | 0.01 | Supported |

| H2 | PU < BINT | 0.54 | 14.332 | 0.00 | Supported |

| H3 | SDB < BINT | 0.18 | 5.643 | 0.00 | Supported |

| H4 | CCM < PU | 0.34 | 6.635 | 0.00 | Supported |

| H5 | PU < AT | 0.40 | 8.468 | 0.00 | Supported |

| H6 | AT < BINT | 0.70 | 4.709 | 0.05 | Supported |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alam, M.Z.; Moudud-Ul-Huq, S.; Sadekin, M.N.; Hassan, M.G.; Rahman, M.M. Influence of Social Distancing Behavior and Cross-Cultural Motivation on Consumers’ Attitude to Using M-Payment Services. Sustainability 2021, 13, 10676. https://doi.org/10.3390/su131910676

Alam MZ, Moudud-Ul-Huq S, Sadekin MN, Hassan MG, Rahman MM. Influence of Social Distancing Behavior and Cross-Cultural Motivation on Consumers’ Attitude to Using M-Payment Services. Sustainability. 2021; 13(19):10676. https://doi.org/10.3390/su131910676

Chicago/Turabian StyleAlam, Md. Zahid, Syed Moudud-Ul-Huq, Md. Nazmus Sadekin, Mohamad Ghozali Hassan, and Mohammad Morshedur Rahman. 2021. "Influence of Social Distancing Behavior and Cross-Cultural Motivation on Consumers’ Attitude to Using M-Payment Services" Sustainability 13, no. 19: 10676. https://doi.org/10.3390/su131910676

APA StyleAlam, M. Z., Moudud-Ul-Huq, S., Sadekin, M. N., Hassan, M. G., & Rahman, M. M. (2021). Influence of Social Distancing Behavior and Cross-Cultural Motivation on Consumers’ Attitude to Using M-Payment Services. Sustainability, 13(19), 10676. https://doi.org/10.3390/su131910676