The Approach of Value Innovation towards Superior Performance, Competitive Advantage, and Sustainable Growth: A Systematic Literature Review

Abstract

1. Introduction

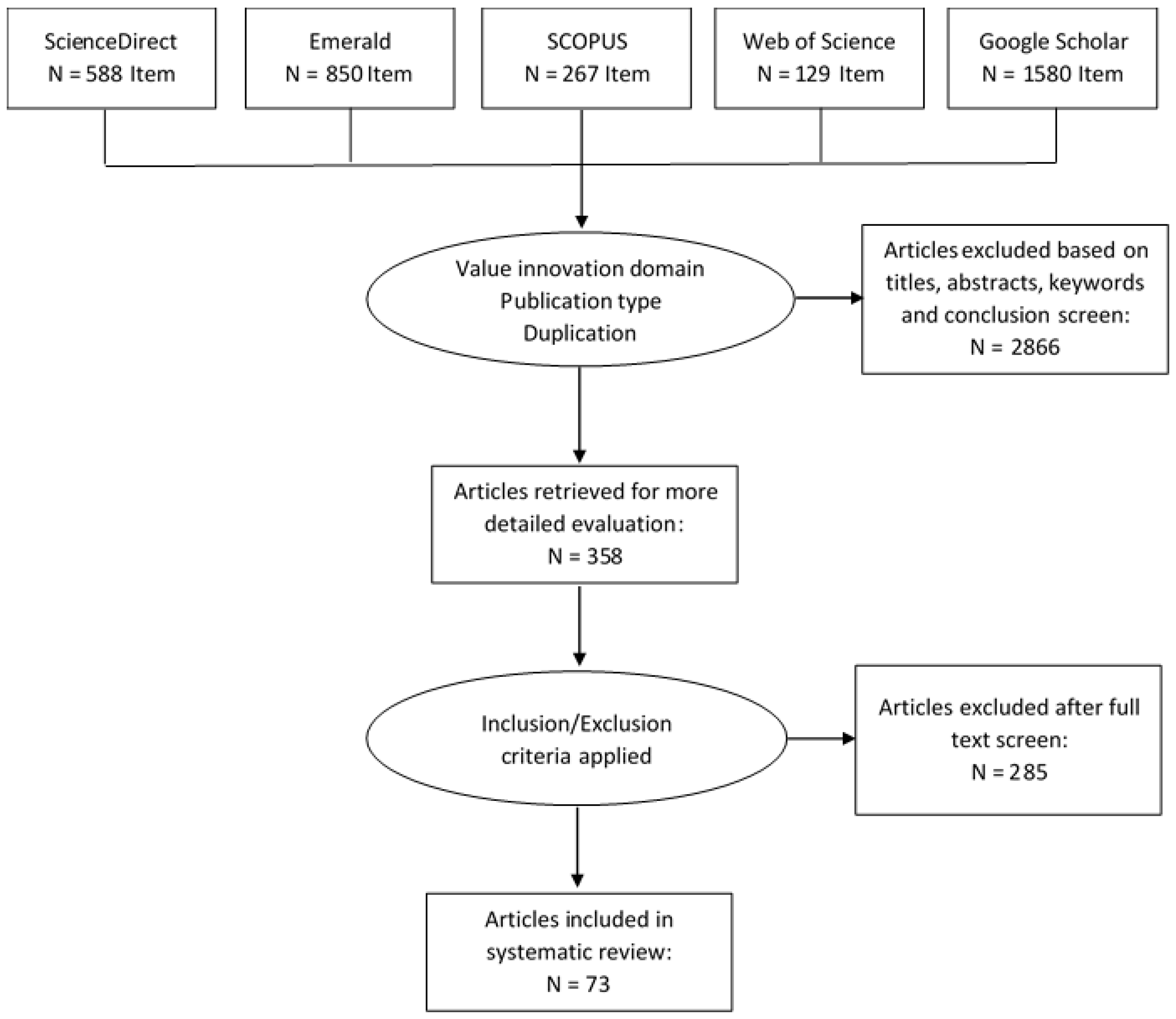

2. Definition and Domains

3. Methodology

4. Results and Discussion

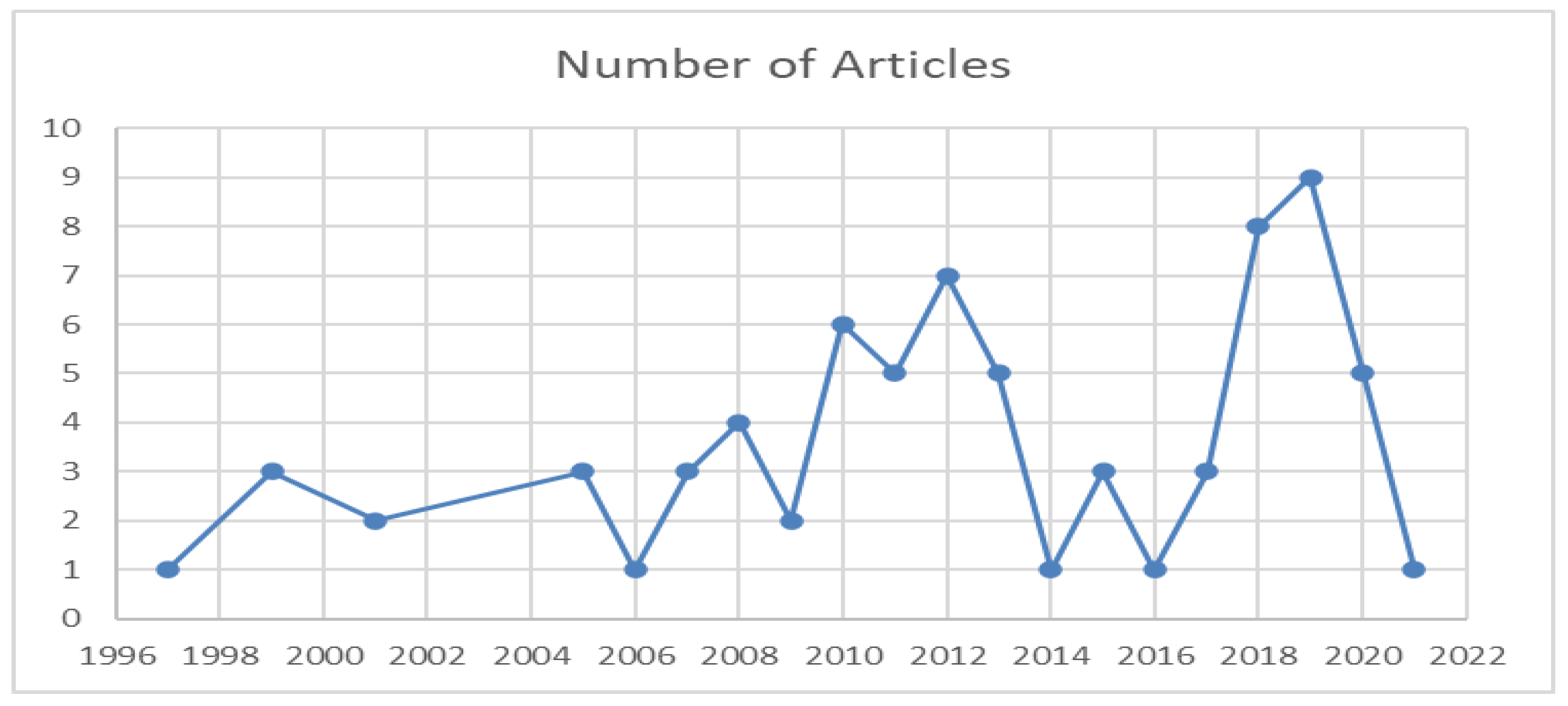

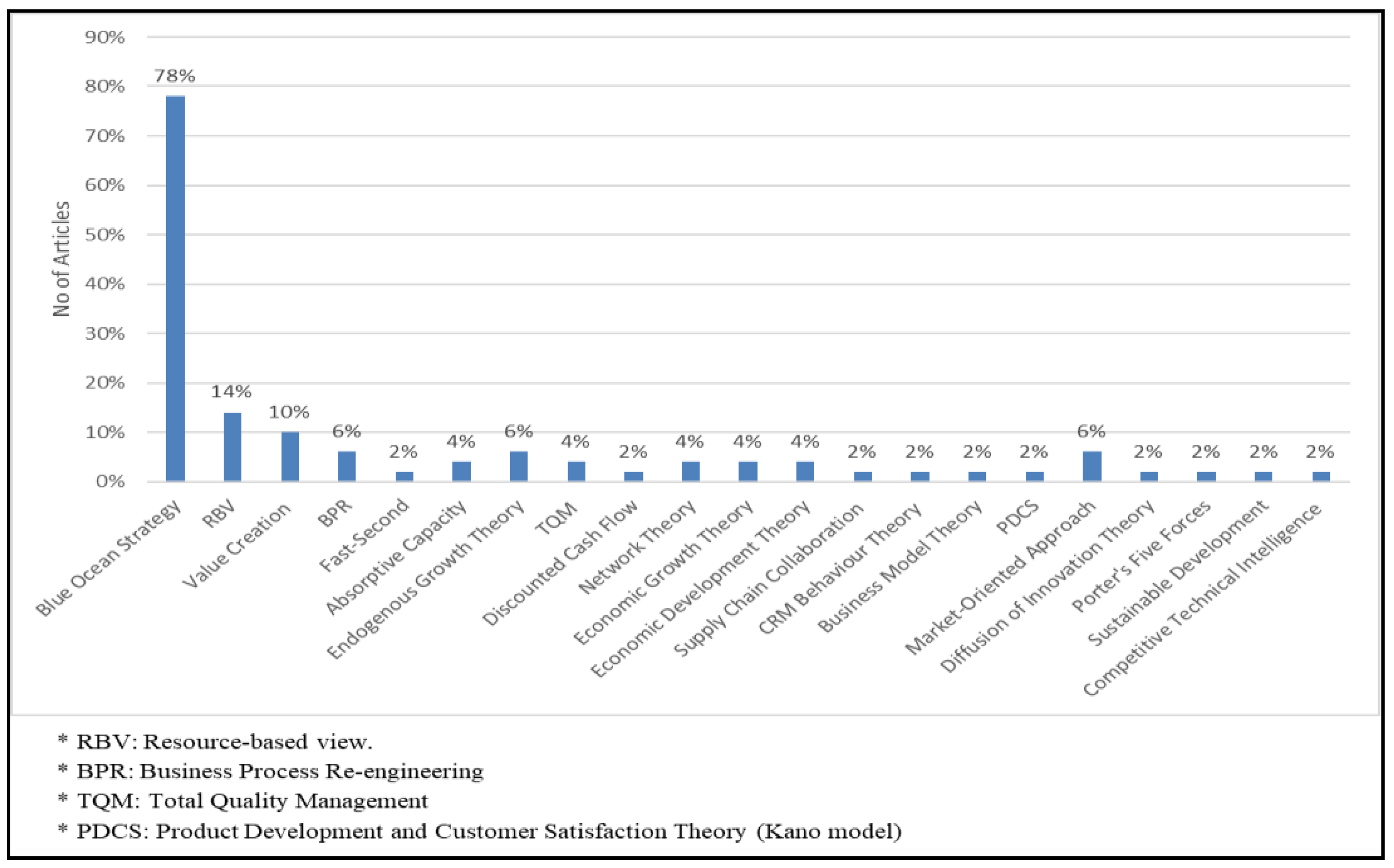

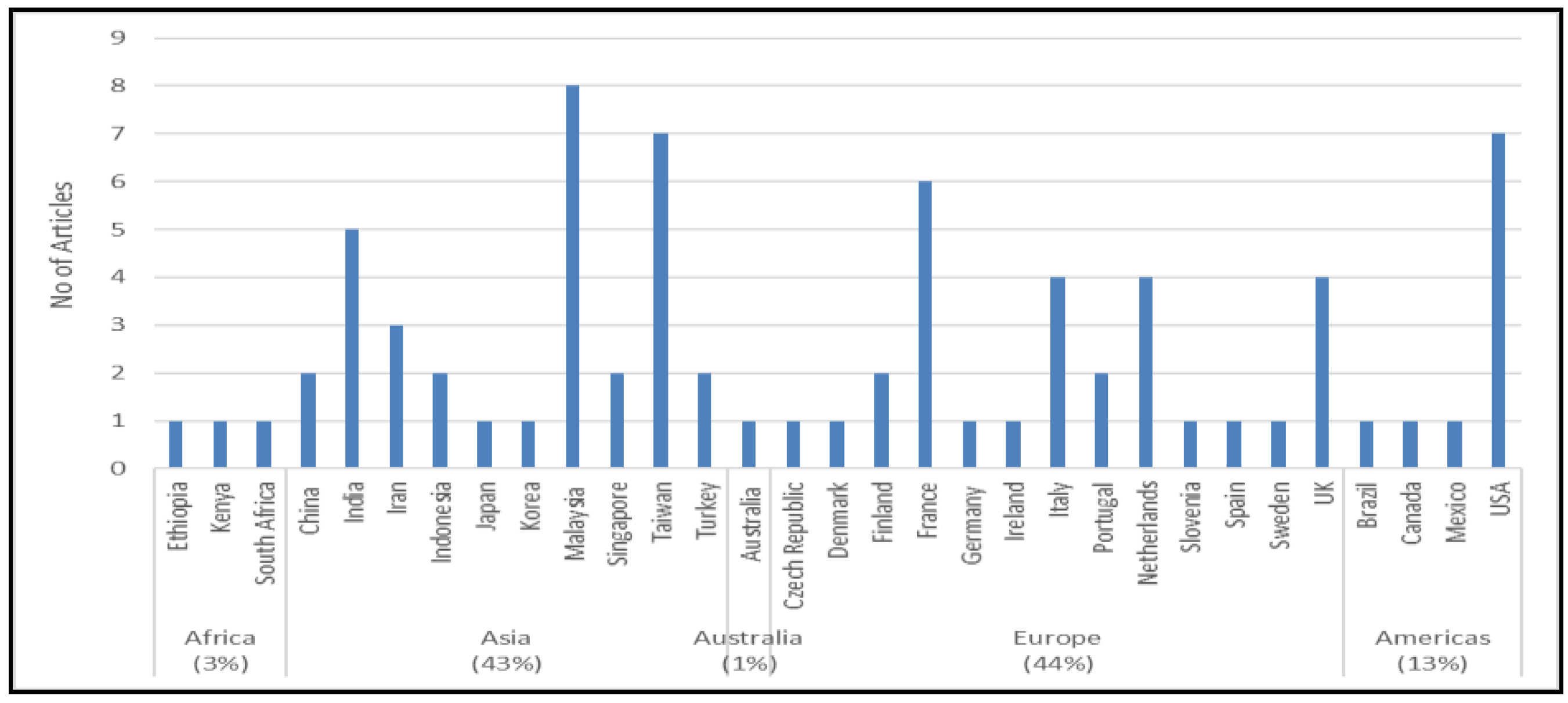

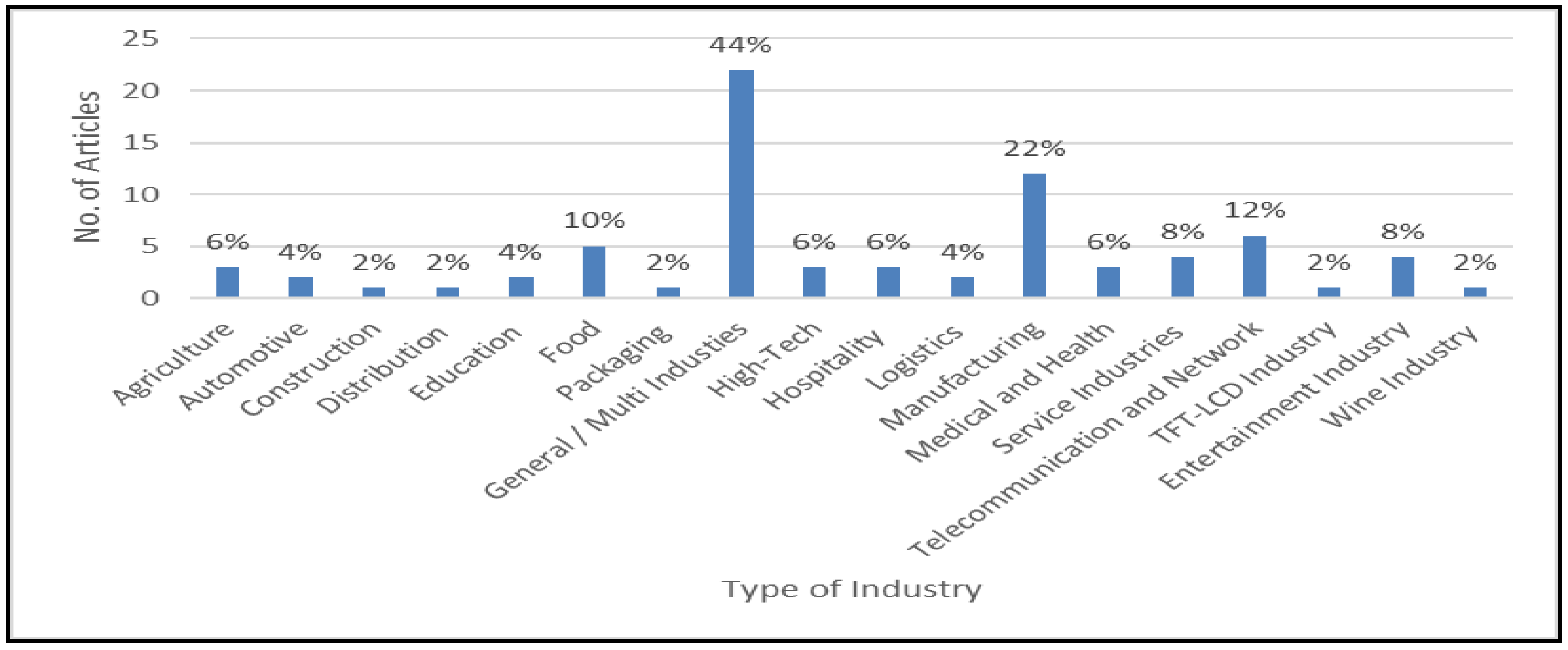

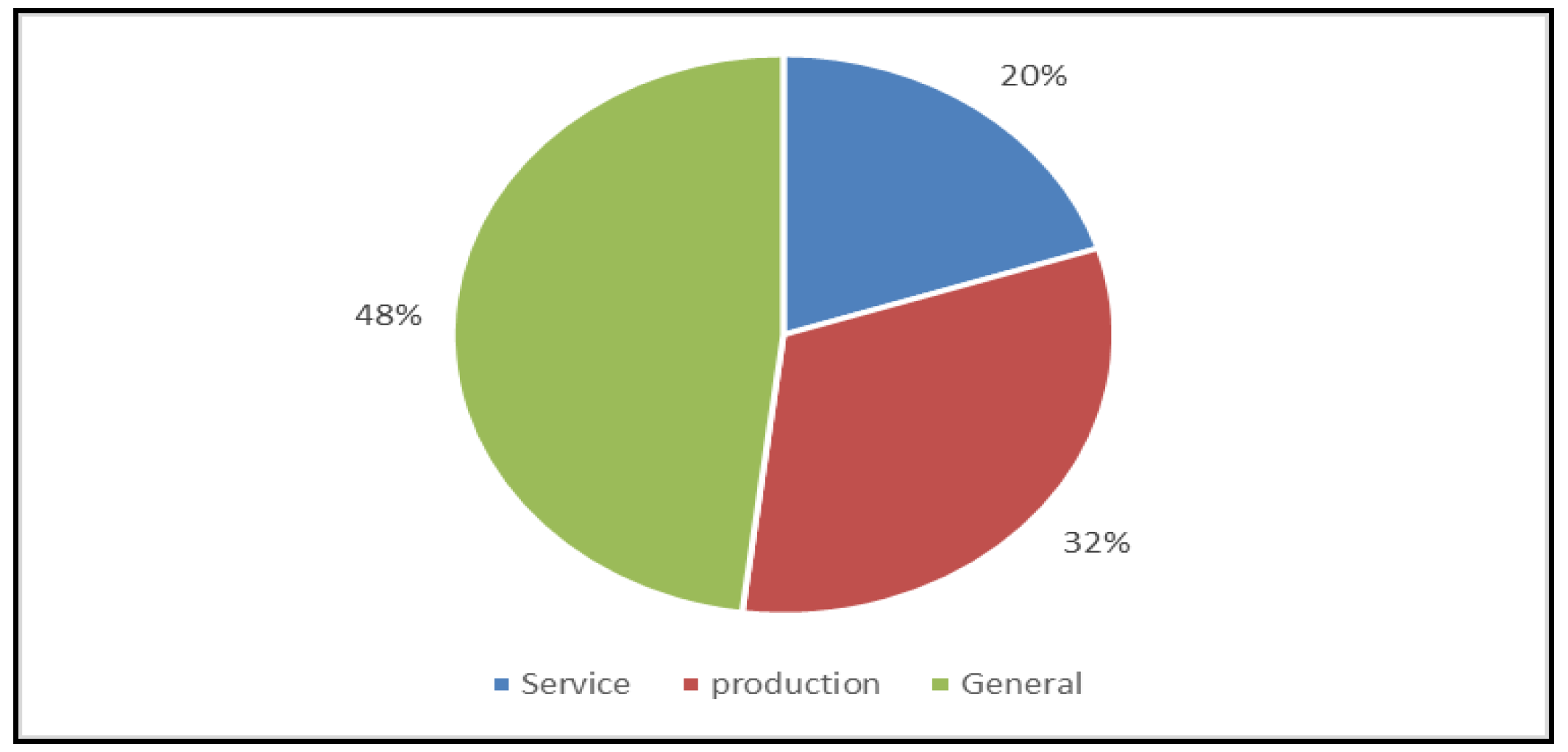

4.1. General Characteristics of Included Studies

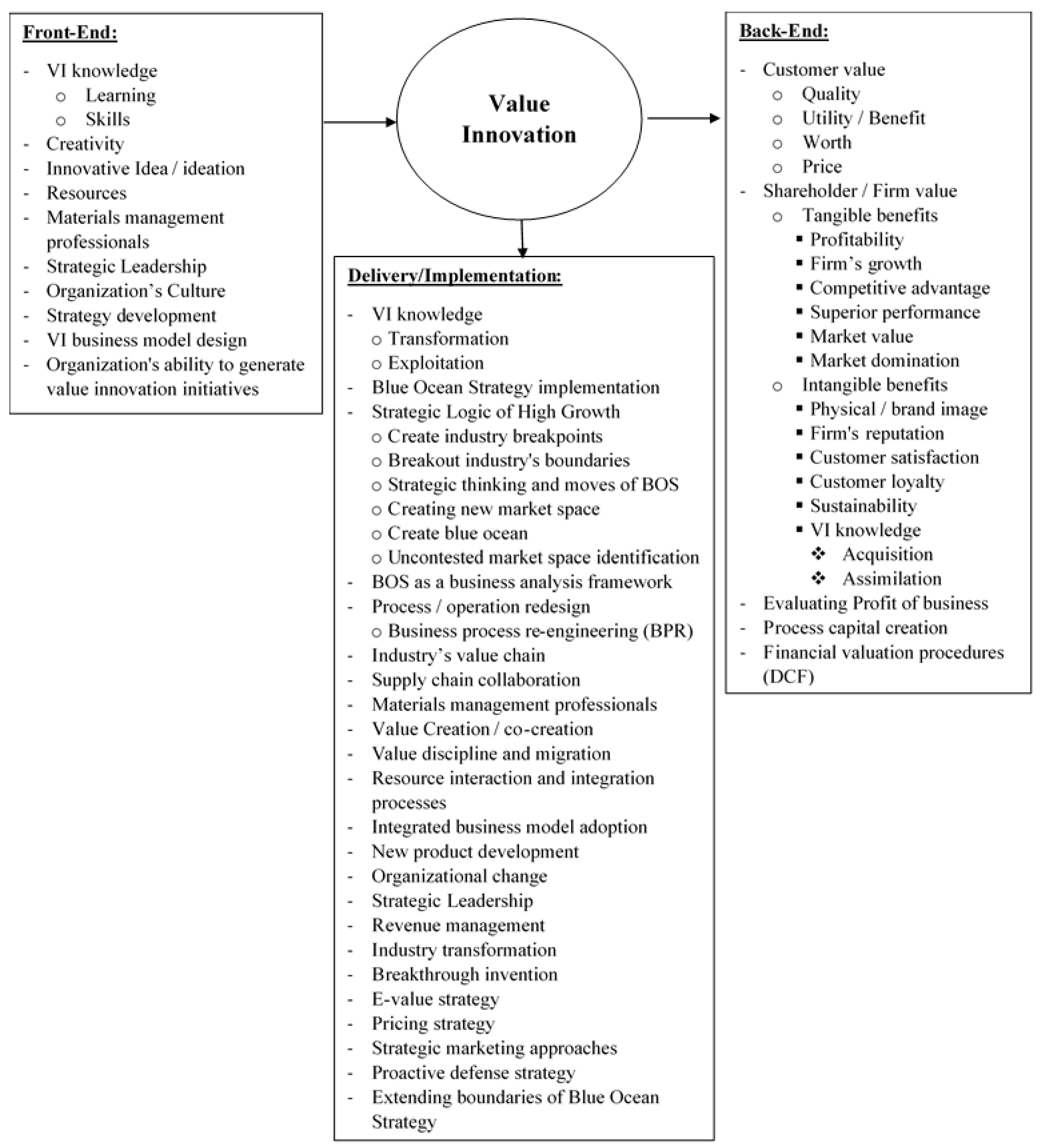

4.2. Value Innovation

- Front-End: the pre-implementation process stage, in which organizations take decision to be value innovative and review their knowledge and resources.

- Delivery/Implementation: the during-implementation process stage, in which value innovation ideas are being installed and developed.

- Back-End: the post-implementation process stage, in which value innovation outcomes are appraised or reported.

4.2.1. Value Innovation Front-End

4.2.2. Value Innovation Implementation

4.2.3. Value Innovation Back-End

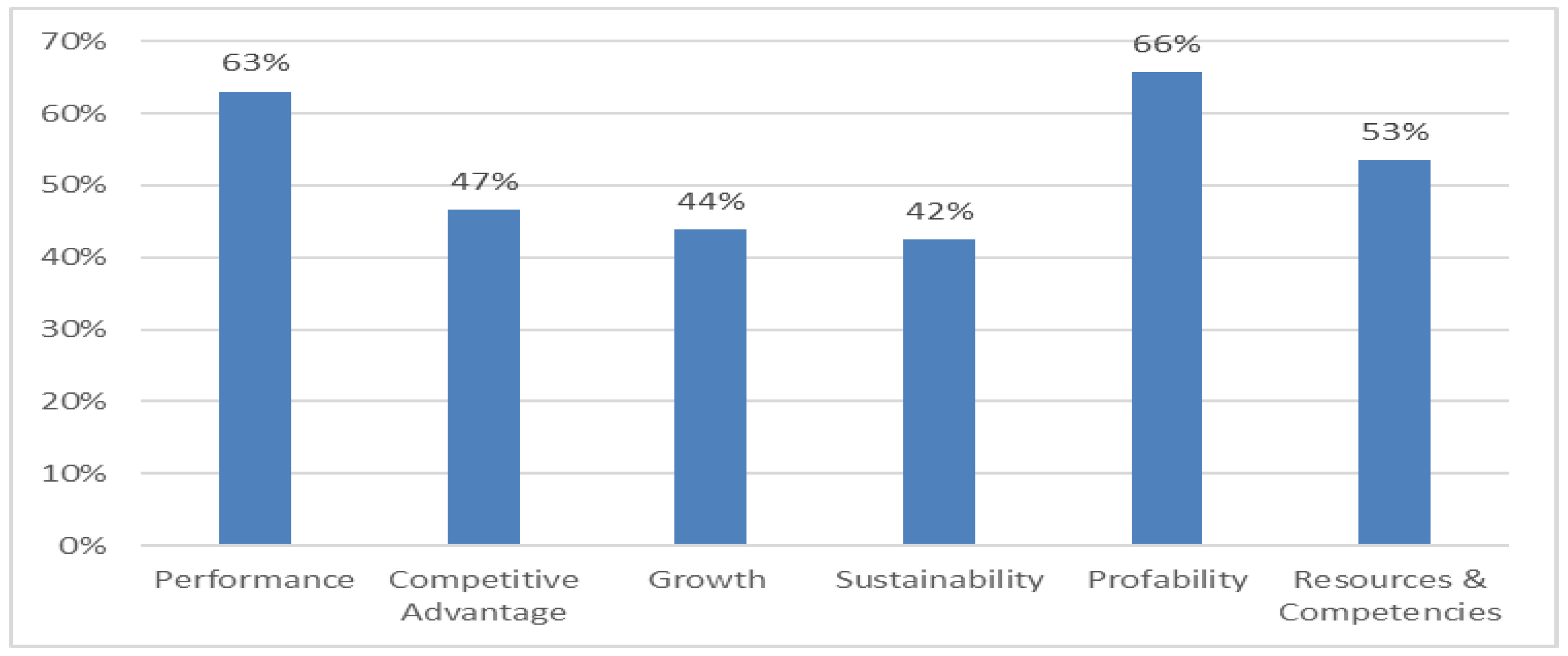

4.3. Overview of Value Innovation Approach on Companies’ Outcomes

4.4. Potential Gaps in Value Innovation

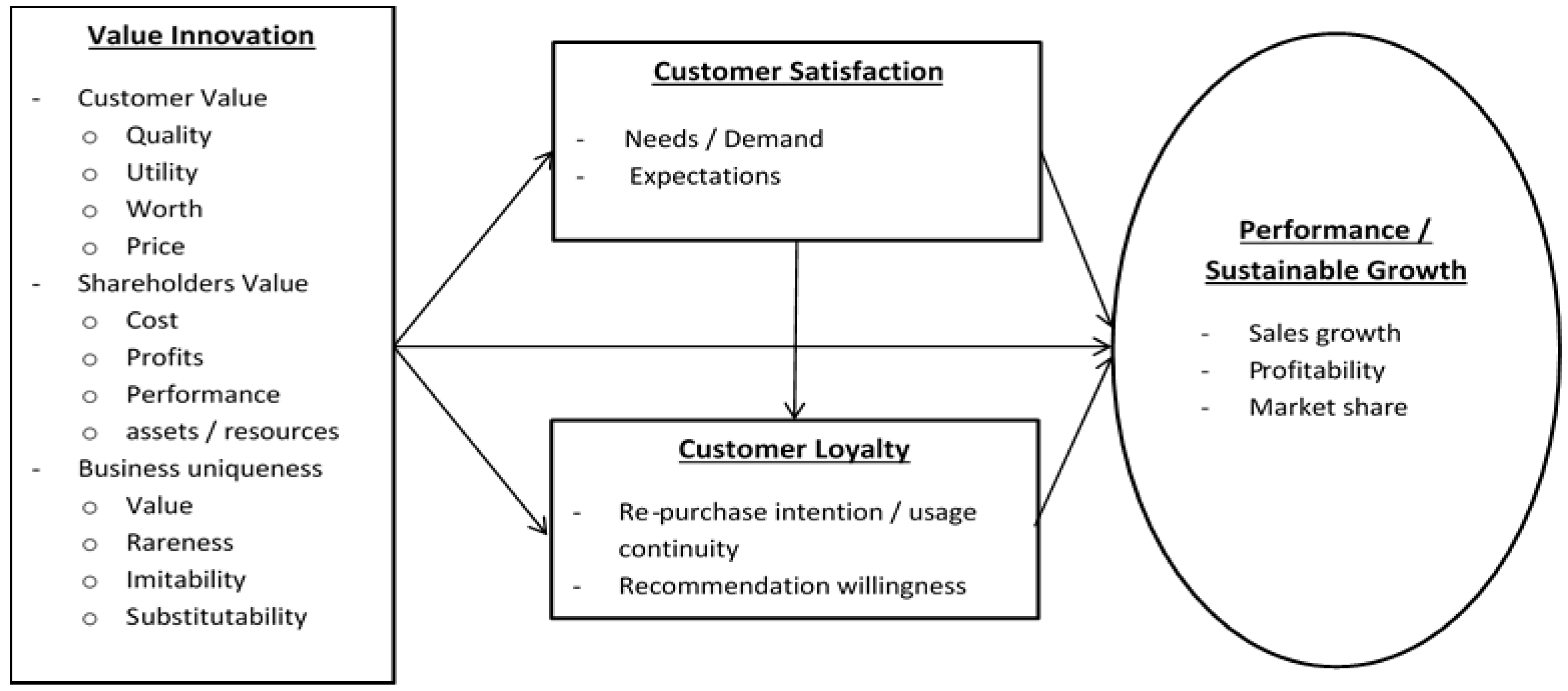

4.5. Value Innovation-Integrated Model Proposal

5. Conclusions and Implications

5.1. Recommendations

5.2. Limitations

Funding

Conflicts of Interest

Appendix A

| Database | Words of Search | Boolean | Field of Search | Publication Period | Results |

|---|---|---|---|---|---|

| ScienceDirect | “value innovation” OR “blue ocean strategy” | OR | All field | 1997–Present | 588 |

| Emerald | All field | 1997–2021 | 850 | ||

| SCOPUS | Abstract, title, keywords | 1997–Present | 267 | ||

| Web of Science | Topic | 1997–2021 | 129 | ||

| Google Scholar | Title | 1997–2021 | 1580 |

Appendix B

| NO. | Author | Year | Title |

|---|---|---|---|

| 1 | Aboujafari, M.R., Farhadnejad, M.M., Fakher, H.R., Bagherzadeh, M. | 2013 | Study of Blue Ocean Strategy Effect on the Market Value of Listed Companies in Tehran Stock Exchange Market |

| 2 | Agnihotri, A. | 2016 | Extending Boundaries of Blue Ocean Strategy |

| 3 | Berghman, L., Matthyssens, P., Vandenbempt, K. | 2012 | Value Innovation, Deliberate Learning Mechanisms and Information From Supply Chain Partners |

| 4 | Buisson, B., Silberzahn, P. | 2010 | Blue Ocean or Fast-Second Innovation? A Four-Breakthrough Model to Explain Successful Market Domination |

| 5 | Carli, R., Del Moro, A., Righi, C. | 2008 | Properties and Control of Fluxes for Ingot Casting and Continuous Casting |

| 6 | Carter, T., Diro Ejara, D. | 2008 | Value Innovation Management and Discounted Cash Flow |

| 7 | Christodoulou, I., Langley, P.A. | 2019 | A Gaming Simulation Approach to Understanding Blue Ocean Strategy Development as a Transition From Traditional Competitive Strategy |

| 8 | Cooke, H., Appel-Meulenbroek, R., Arentze, T. | 2019 | Adjustment of Corporate Real Estate During a Period of Significant Business Change |

| 9 | Coughlan, P., Fergus, M.A. | 2009 | Defining The Path to Value Innovation |

| 10 | Wollmann, D., Tortato, U. | 2019 | Proposal for A Model to Hierarchize Strategic Decisions According to Criteria Of Value Innovation, Sustainability And Budgetary Constraint |

| 11 | Dikmen, I., Birgonul, M.T., Artuk, S.U. | 2005 | Integrated Framework to Investigate Value Innovations |

| 12 | Dillon, T.A., Lee, R.K., Matheson, D. | 2005 | Value Innovation: Passport to Wealth Creation |

| 13 | Dvorak, J., Razova, I. | 2018 | Empirical Validation of Blue Ocean Strategy Sustainability in an International Environment |

| 14 | El Sawy, O.A., Malhotra, A., Gosain, S., Young, K.M. | 1999 | It-Intensive Value Innovation in The Electronic Economy: Insights from Marshall Industries |

| 15 | Elsa Vieira, João J. Ferreira, Ricardo São João | 2019 | Creation of Value for Business from the Importance-Performance Analysis: The Case of Health Clubs |

| 16 | Ernst, H., Kahle, H.N., Dubiel, A., Prabhu, J., Subramaniam, M. | 2015 | The Antecedents and Consequences of Affordable Value Innovations for Emerging Markets |

| 17 | González-Cruz, T.F., Roig-Tierno, N., Botella-Carrubí, D. | 2018 | Quality Management as a Driver of Innovation in the Service Industry |

| 18 | Ho, Y.C., Tsai, C.T. | 2011 | Comparing ANFIS and SEM in Linear and Nonlinear Forecasting of New Product Development Performance |

| 19 | Hollensen, S. | 2013 | The Blue Ocean that Disappeared—The Case of Nintendo Wii |

| 20 | Jacobs, H., Zulu, C. | 2012 | Reaping the Benefits of Value Innovation: Lessons for Small Agribusinesses in Africa |

| 21 | Kachouie, R., Mavondo, F., Sands, S. | 2018 | Dynamic Marketing Capabilities View on Creating Market Change |

| 22 | Kim, C., Yang, K.H., Kim, J. | 2008 | A Strategy for Third-Party Logistics Systems: A Case Analysis Using the Blue Ocean Strategy |

| 23 | Kim, R.B. | 2010 | Value Innovation in Export Marketing Strategy: The Case of a Canadian Firm in Japan |

| 24 | Kim, W.C., Mauborgne, R. | 1997 | Value Innovation: The Strategic Logic of High Growth |

| 25 | Kim, W.C., Mauborgne, R. | 1999 | Creating New Market Space |

| 26 | Kim, W.C., Mauborgne, R. | 2005 | Value Innovation: A Leap into the Blue Ocean |

| 27 | Koh, J., Wang, B. | 2012 | Breakthrough Markets, Innovation and Internet Firms |

| 28 | Kulkarni, B., Sivaraman, V. | 2019 | Making a Blue Ocean Shift: Tata Ace Captures a New Market |

| 29 | Kuznetsov, A., Kuznetsova, O. | 2011 | Looking for Ways to Increase Student Motivation: Internationalisation and Value Innovation |

| 30 | Lai, Y.F., Khoong, C.M., Aw, T.C. | 1999 | Value Innovation Through Business Process Re-Engineering: A&E Services at a Public Hospital |

| 31 | Liao, S.H., Kuo, F.I. | 2014 | The Study of Relationships Between the Collaboration for Supply Chain, Supply Chain Capabilities and Firm Performance: A Case of the Taiwan’s TFT-LCD Industry |

| 32 | Liao, S.H., Hu, D.C., Ding, L.W. | 2017 | Assessing The Influence of Supply Chain Collaboration Value Innovation, Supply Chain Capability and Competitive Advantage in Taiwan’s Networking Communication Industry |

| 33 | Lindič, J., Bavdaž, M., Kovačič, H. | 2012 | Higher Growth Through the Blue Ocean Strategy: Implications for Economic Policy |

| 34 | Liu, D.-Y., Liu, C.-C. | 2007 | Success with Venture Capital: A Case Study on Business Strategy |

| 35 | Matthyssens, P., Vandenbempt, K., Berghman, L | 2006 | Value Innovation in Business Markets: Breaking the Industry Recipe |

| 36 | Matthyssens, P., Vandenbempt, K., Berghman, L. | 2008 | Value Innovation in the Functional Foods Industry: Deviations from the Industry Recipe |

| 37 | Mele, C | 2009 | Value Innovation in B2B: Learning, Creativity, and the Provision of Solutions Within Service-Dominant Logic |

| 38 | Mele, C., Russo Spena, T., Colurcio, M. | 2010 | Co-Creating Value Innovation Through Resource Integration |

| 39 | Mina, F.T., Mohseni, R. | 2015 | Blue Ocean Strategy (Evaluating Profit of Businesses in the Industrial Town of Bu Ali in Hamadan) |

| 40 | Mohanty R.P., Deshmukh, S.G. | 2001 | Reengineering of Materials Management System: A Case Study |

| 41 | Mohanty, R.P., Deshmukh, S.G. | 2001 | Business Process Reengineering: Value Innovation in Industrial Engineering Practices |

| 42 | Nancy Bocken Samuel Short Padmakshi Rana Steve Evans | 2013 | A Value Mapping Tool for Sustainable Business Modelling |

| 43 | Ochieng, C.M.O. | 2007 | Revitalising African Agriculture through Innovative Business Models and Organisational Arrangements: Promising Developments in the Traditional Crops Sector |

| 44 | Pateman, J. | 2019 | Blue Ocean Strategy: Making a Blue Ocean Shift at Thunder Bay Public Library |

| 45 | Petri Parvinen Jaakko Aspara Joel Hietanen Sami Kajalo, | 2011 | Awareness, Action and Context-Specificity of Blue Ocean Practices in Sales Management |

| 46 | Rabino, S., Gabay, G., Moskowitz, D., Moskowitz, H.R. | 2010 | Assessing Pricing For a New Product Concept: PDA + Electronic Health Records + Real-Time Monitoring. |

| 47 | Radzi, S.M., Yasin, M.F.M., Zahari, M.S.M., Ahmat, N.H.C., Ong, M.H.A. | 2017 | Moderating Effects of Environmental Variables on The Relationship Between BOS and Performance of Four and Five Star Hotels in Kuala Lumpur, Selangor, and Putrajaya, Malaysia |

| 48 | Salvador, M.R., Reyes, M.A.B. | 2011 | Methodology of Integration for Competitive Technical Intelligence with Blue Ocean Strategy: Application to an Exotic Fruit |

| 49 | Santini, C., Cavicchi, A., Rocchi, B. | 2007 | Italian Wineries and Strategic Options: The Role of Premium Bag in Box |

| 50 | Setijono, D. | 2010 | Model and Principles of Stakeholders-Oriented Quality Management Based on Radical (Discontinuous) Improvement—A Modern Re-Interpretation of TQM and CWQC? |

| 51 | Shafiq, M., Tasmin, R., Qureshi, M.I., Takala, J. | 2019 | A New Framework of Blue Ocean Strategy for Innovation Performance in Manufacturing Sector |

| 52 | Shafiq, M., Tasmin, R., Takala, J., Qureshi, M. I., Rashid, M. | 2018 | Mediating Role of Open Innovation Between the Relationship of Blue Ocean Strategy and Innovation Performance, A Study of Malaysian Industry |

| 53 | Shih-Chi Chang | 2010 | Bandit Cellphones: A Blue Ocean Strategy |

| 54 | Sitinjak, M.F., Pramawijaya, K., Gunawan, A | 2018 | Icanstudiolive Use of Blue Ocean Marketing Strategy for Value Differentiation |

| 55 | Tang, S.F., Tong, P.Y. | 2013 | E-Value Strategies in Internet Retailing: The Case of a Malaysian Leading E-Coupon Retailer |

| 56 | Tarantino, D.P., Smith, D.B. | 2005 | Bariatric Surgery: Assessing Opportunities for Value Innovation |

| 57 | Tseng, M.L., Lim, M.K., Wu, K.J. | 2019 | Improving the Benefits and Costs on Sustainable Supply Chain Finance Under Uncertainty |

| 58 | Vieira, E.R.M., erreira, J.J. | 2018 | Strategic Framework of Fitness Clubs Based on Quality Dimensions: The Blue Ocean Strategy Approach |

| 59 | Vimm, I., Salmela, E. | 2018 | Unsuccessful Fan-Centred Innovation of Thick Value for a Music Festival: What Went Wrong? |

| 60 | Wee, C.H. | 2017 | Think Tank—Beyond The Five Forces Model and Blue Ocean Strategy: An Integrative Perspective from Sun Zi Bingfa |

| 61 | Wubben, E.F., Düsseldorf, S., Batterink, M.H. | 2012 | Finding Uncontested Markets for European Fruit and Vegetables through Applying The Blue Ocean Strategy |

| 62 | Xavier, J.A., Siddiquee, N.A., Mohamed, M.Z. | 2019 | Public Management Reform in The Post-NPM Era: Lessons from Malaysia’s National Blue Ocean Strategy (NBOS) |

| 63 | Yang Liu, Jiang Wei, | 2013 | Business Modeling for Entrepreneurial Firms: Four Cases in China |

| 64 | Yang, C.C., Yang, K.J. | 2011 | An Integrated Model of Value Creation Based on The Refined Kano’s Model and The Blue Ocean Strategy |

| 65 | Yang, J.T. | 2012 | Effects of Ownership Change on Organizational Settings and Strategies in a Taiwanese Hotel Chain |

| 66 | Yang, J.T. | 2012 | Identifying The Attributes of Blue Ocean Strategies in Hospitality |

| 67 | Yap, J.B.H., Chua, K.L. | 2018 | Application of E-Booking System in Enhancing Malaysian Property Developers’ Competitive Advantage: A Blue Ocean Strategy? |

| 68 | Faghat, E.R.B., Khani, N., Alemtabriz, A. | 2020 | A paradigmatic model for shared value innovation management in the supply chain A grounded theory research |

| 69 | Mohammed A. Hajar, Daing Nasir Ibrahim, Mohd Ridzuan Darun, Mohammed A. Al-Sharafi | 2020 | Value innovation activities in the wireless telecommunications service sector: A case study of the Malaysian market |

| 70 | Acar, A. Zafer. | 2020 | The mediating role of value innovation between market orientation and business performance: evidence from the logistics industry |

| 71 | Wanjugu, Gachora Susan, Kinyua Jesse Maina, and Kirema Nkanata Mburugu | 2020 | The Influence of Value Innovation Strategy on the Financial Performance of Manufacturing Firms in Kenya |

| 72 | Christa, U.R., Wardana, I., Dwiatmadja, C., Kristinae, V. | 2020 | The Role of Value Innovation Capabilities in the Influence of Market Orientation and Social Capital to Improving the Performance of Central Kalimantan Bank in Indonesia |

| 73 | Siddiquee, N.A., Xavier, J.A. | 2021 | Collaborative approach to public service improvement: the Malaysian experience and lessons |

Appendix C

| Journal | No. of Articles | Categories of Journals | |||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Business, Management and Accounting | Strategy and Management | Management of Technology and Innovation | Business and International Management | Organizational Behavior and Human Resource Management | Management Science and Operations Research | Economics, Econometrics and Finance | Food Science | Computer Science Applications | Information Systems and Management | Education | Marketing | Tourism, Leisure and Hospitality Management | Materials Science | Social Sciences | Engineering | Biochemistry, Genetics and Molecular Biology | Surgery | Industrial and Manufacturing Engineering | Environmental Science | ||

| Corporate Governance | 1 | 1 | 1 | 1 | |||||||||||||||||

| African Journal of Business Management | 1 | 1 | 1 | ||||||||||||||||||

| Asian Social Science | 1 | 1 | 1 | ||||||||||||||||||

| British Food Journal | 2 | 1 | |||||||||||||||||||

| Chinese Management Studies | 1 | 1 | |||||||||||||||||||

| Expert Systems with Applications | 1 | 1 | 1 | ||||||||||||||||||

| Global Business and Organizational Excellence | 1 | 1 | 1 | ||||||||||||||||||

| Harvard Business Review | 2 | 1 | 1 | 1 | 1 | ||||||||||||||||

| Higher Education Quarterly | 1 | 1 | |||||||||||||||||||

| Industrial Marketing Management | 2 | 1 | |||||||||||||||||||

| International Journal of Applied Business and Economic Research (JABER) | 1 | 1 | 1 | ||||||||||||||||||

| International Journal of Business Innovation and Research | 1 | 1 | 1 | ||||||||||||||||||

| International Journal of Computer Applications in Technology | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||

| International Journal of Contemporary Hospitality Management | 1 | 1 | |||||||||||||||||||

| International Journal of Hospitality Management | 1 | 1 | 1 | ||||||||||||||||||

| International Journal of Information Systems and Change Management | 1 | 1 | |||||||||||||||||||

| International Journal of Innovation Management, | 1 | 1 | 1 | 1 | |||||||||||||||||

| International Journal of Manufacturing Technology and Management | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||

| International Journal of Production Economics | 4 | 1 | 1 | 1 | 1 | 1 | 1 | ||||||||||||||

| International Journal of Quality and Service Sciences | 1 | 1 | |||||||||||||||||||

| International Journal of Wine Business Research | 1 | 1 | |||||||||||||||||||

| Journal Of Business Strategy | 3 | 1 | 1 | ||||||||||||||||||

| Journal of Customer Behaviour | 1 | 1 | |||||||||||||||||||

| Journal of Direct, Data and Digital Marketing Practice | 1 | 1 | 1 | ||||||||||||||||||

| Journal of Food Products Marketing | 1 | 1 | 1 | ||||||||||||||||||

| Journal of Intelligence Studies in Business | 1 | 1 | 1 | ||||||||||||||||||

| Journal of Management in Engineering | 1 | 1 | 1 | 1 | |||||||||||||||||

| Journal of Product Innovation Management | 1 | 1 | 1 | 1 | |||||||||||||||||

| Journal of Strategic Marketing | 2 | 1 | 1 | ||||||||||||||||||

| Knowledge and Process Management | 1 | 1 | 1 | ||||||||||||||||||

| La Metallurgia Italiana | 1 | 1 | |||||||||||||||||||

| Life Science Journal | 1 | 1 | |||||||||||||||||||

| Management Decision | 2 | 1 | 1 | ||||||||||||||||||

| MIS quarterly | 1 | 1 | 1 | 1 | |||||||||||||||||

| International Journal of Quality and Innovation | 1 | 1 | 1 | 1 | |||||||||||||||||

| Omega | 1 | 1 | 1 | 1 | |||||||||||||||||

| Research policy | 1 | 1 | 1 | ||||||||||||||||||

| Research-Technology Management | 1 | 1 | 1 | 1 | |||||||||||||||||

| Surgical innovation | 1 | 1 | |||||||||||||||||||

| Technology in society | 1 | 1 | 1 | 1 | |||||||||||||||||

| The Journal of Modern African Studies | 1 | 1 | |||||||||||||||||||

| Total Quality Management & Business Excellence | 2 | 1 | |||||||||||||||||||

| European Journal of Marketing | 1 | 1 | 1 | ||||||||||||||||||

| Measuring Business Excellence | 1 | 1 | 1 | ||||||||||||||||||

| Journal of Cleaner Production | 1 | 1 | 1 | 1 | 1 | 1 | |||||||||||||||

| SOCIAL SCIENCES & HUMANITIES | 1 | 1 | 1 | ||||||||||||||||||

| Public Library Quarterly | 1 | 1 | |||||||||||||||||||

| Property Management | 1 | 1 | 1 | ||||||||||||||||||

| International Journal of Strategic Property Management | 1 | 1 | 1 | ||||||||||||||||||

| International Journal of Engineering and Advanced Technology (IJEAT) | 1 | 1 | 1 | 1 | |||||||||||||||||

| Foundations of Management | 1 | 1 | |||||||||||||||||||

| Advanced Science Letters | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||

| International Journal of Engineering & Technology | 1 | 1 | |||||||||||||||||||

| Service Business | 1 | 1 | 1 | 1 | |||||||||||||||||

| Public Money & Management | 1 | 1 | 1 | ||||||||||||||||||

| International Journal of Innovation and Learning | 1 | 1 | 1 | 1 | 1 | ||||||||||||||||

| International Journal of Innovation Science | 1 | 1 | 1 | ||||||||||||||||||

| Journal of Global Business Insights | 1 | 1 | 1 | 1 | |||||||||||||||||

| The Journal of Social Sciences Research | 1 | 1 | 1 | 1 | |||||||||||||||||

| Journal of Open Innovation: Technology, Market, and Complexity | 1 | 1 | 1 | 1 | |||||||||||||||||

| International Journal of Public Sector Management | 1 | 1 | 1 | ||||||||||||||||||

| Total No of Articles | 73 | 19 | 21 | 14 | 12 | 3 | 6 | 6 | 2 | 6 | 5 | 4 | 3 | 3 | 1 | 11 | 11 | 1 | 1 | 4 | 4 |

| Percentage % | 100% | 26% | 29% | 19% | 16% | 4% | 8% | 8% | 3% | 8% | 7% | 5% | 4% | 4% | 1% | 15% | 15% | 1% | 1% | 5% | 5% |

References

- Kim, W.C.; Mauborgne, R. Blue Ocean Strategy; Harvard Business Review Paperback Series; Harvard Business School Press: Brighton, UK, 2004; pp. 1–10. [Google Scholar]

- Buisson, B.; Silberzahn, P. Blue ocean or fast-second innovation? A Four-breakthrough model to explain successful market domination. Int. J. Innov. Manag. 2010, 14, 359–378. [Google Scholar] [CrossRef]

- Koh, J.; Wang, B. Breakthrough markets, innovation and internet firms. Int. J. Bus. Innov. Res. 2012, 6, 322–335. [Google Scholar] [CrossRef]

- El Sawy, O.A.; Malhotra, A.; Gosain, S.; Young, K.M. IT-intensive value innovation in the electronic economy: Insights from Marshall Industries. MIS Q. 1999, 23, 305–335. [Google Scholar] [CrossRef]

- Carli, R.; Del Moro, A.; Righi, C. Properties and Control of Fluxes for Ingot Casting and Continuous Casting. Metall. Ital. 2008, 5, 13–18. [Google Scholar]

- Liu, D.-Y.; Liu, C.-C. Success with venture capital: A case study on business strategy. Int. J. Inf. Syst. Chang. Manag. 2007, 2, 372–391. [Google Scholar] [CrossRef]

- Ochieng, C.M.O. Revitalising African agriculture through innovative business models and organisational arrangements: Promising developments in the traditional crops sector. J. Mod. Afr. Stud. 2007, 45, 143–169. [Google Scholar] [CrossRef][Green Version]

- Matthyssens, P.; Vandenbempt, K.; Berghman, L. Value innovation in business markets: Breaking the industry recipe. Ind. Mark. Manag. 2006, 35, 751–761. [Google Scholar] [CrossRef]

- Yang, C.-C.; Yang, K.-J. An integrated model of value creation based on the refined Kano’s model and the blue ocean strategy. Total Qual. Manag. Bus. Excell. 2011, 22, 925–940. [Google Scholar] [CrossRef]

- Yang, J.-t. Effects of ownership change on organizational settings and strategies in a Taiwanese hotel chain. Int. J. Hosp. Manag. 2012, 31, 428–441. [Google Scholar] [CrossRef]

- Setijono, D. Model and principles of stakeholders-oriented quality management based on radical (discontinuous) improvement–a modern re-interpretation of TQM and CWQC? Int. J. Qual. Innov. 2010, 1, 167–183. [Google Scholar] [CrossRef]

- Kachouie, R.; Mavondo, F.; Sands, S. Dynamic marketing capabilities view on creating market change. Eur. J. Mark. 2018, 52, 1007–1036. [Google Scholar] [CrossRef]

- Wollmann, D.; Tortato, U. Proposal for a model to hierarchize strategic decisions according to criteria of value innovation, sustainability and budgetary constraint. J. Clean. Prod. 2019, 231, 278–289. [Google Scholar] [CrossRef]

- Vieira, E.R.M.; Ferreira, J.J. Strategic framework of fitness clubs based on quality dimensions: The blue ocean strategy approach. Total Qual. Manag. Bus. Excell. 2018, 29, 1648–1667. [Google Scholar] [CrossRef]

- Yang, S.J.; Jang, S. How Does Corporate Sustainability Increase Financial Performance for Small-and Medium-Sized Fashion Companies: Roles of Organizational Values and Business Model Innovation. Sustainability 2020, 12, 10322. [Google Scholar] [CrossRef]

- Kneipp, J.M.; Gomes, C.M.; Bichueti, R.S.; Frizzo, K.; Perlin, A.P. Sustainable innovation practices and their relationship with the performance of industrial companies. Rev. Gestão 2019, 26, 94–111. [Google Scholar] [CrossRef]

- Liberati, A.; Altman, D.G.; Tetzlaff, J.; Mulrow, C.; Gøtzsche, P.C.; Ioannidis, J.P.; Clarke, M.; Devereaux, P.J.; Kleijnen, J.; Moher, D. The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: Explanation and elaboration. J. Clin. Epidemiol. 2009, 62, e1–e34. [Google Scholar] [CrossRef] [PubMed]

- de Jesus Pacheco, D.A.; Carla, S.; Jung, C.F.; Ribeiro, J.L.D.; Navas, H.V.G.; Cruz-Machado, V.A. Eco-innovation determinants in manufacturing SMEs: Systematic review and research directions. J. Clean. Prod. 2017, 142, 2277–2287. [Google Scholar] [CrossRef]

- Christa, U.R.; Wardana, I.; Dwiatmadja, C.; Kristinae, V. The Role of Value Innovation Capabilities in the Influence of Market Orientation and Social Capital to Improving the Performance of Central Kalimantan Bank in Indonesia. J. Open Innov. Technol. Mark. Complex. 2020, 6, 140. [Google Scholar] [CrossRef]

- Wanjugu, G.S.; Maina, K.J.; Mburugu, K.N. The Influence of Value Innovation Strategy on the Financial Performance of Manufacturing Firms in Kenya. J. Soc. Sci. Res. 2020, 6, 995–1000. [Google Scholar]

- Kim, C.; Mauborgne, R. Value innovation: The strategic logic of high growth. Harv. Bus. Rev. 1997, 82, 172–180. [Google Scholar]

- Kim, C.; Mauborgne, R. Strategy, value innovation, and the knowledge economy. MIT Sloan Manag. Rev. 1999, 40, 41. [Google Scholar]

- Lindič, J.; Bavdaž, M.; Kovačič, H. Higher growth through the Blue Ocean Strategy: Implications for economic policy. Res. Policy 2012, 41, 928–938. [Google Scholar] [CrossRef]

- Mohanty, R. Value innovation perspective in Indian organizations. Particip. Empower. Int. J. 1999, 7, 88–103. [Google Scholar] [CrossRef]

- Mele, C. Value innovation in B2B: Learning, creativity, and the provision of solutions within Service-Dominant Logic. J. Cust. Behav. 2009, 8, 199–220. [Google Scholar] [CrossRef]

- Mele, C.; Russo Spena, T.; Colurcio, M. Co-creating value innovation through resource integration. Int. J. Qual. Serv. Sci. 2010, 2, 60–78. [Google Scholar] [CrossRef]

- Agnihotri, A. Extending boundaries of Blue Ocean Strategy. J. Strateg. Mark. 2016, 24, 519–528. [Google Scholar] [CrossRef]

- Rabino, S.; Gabay, G.; Moskowitz, D.; Moskowitz, H.R. Assessing pricing for a new product concept: PDA+ electronic health records+ real-time monitoring. J. Direct Data Digit. Mark. Pract. 2010, 12, 27–51. [Google Scholar] [CrossRef][Green Version]

- Chang, S.-C. Bandit cellphones: A blue ocean strategy. Technol. Soc. 2010, 32, 219–223. [Google Scholar] [CrossRef]

- Lindgreen, A.; Hingley, M.; Matthyssens, P.; Vandenbempt, K.; Berghman, L. Value innovation in the functional foods industry: Deviations from the industry recipe. Br. Food J. 2008, 110, 144–155. [Google Scholar]

- Berghman, L.; Matthyssens, P.; Vandenbempt, K. Value innovation, deliberate learning mechanisms and information from supply chain partners. Ind. Mark. Manag. 2012, 41, 27–39. [Google Scholar] [CrossRef]

- Chrisidu-Budnik, A.; Sus, A. Contemporary Strategic Innovations in the Indian Medical Industry–a Descriptive Approach to Problem. Wroc. Rev. Law Adm. Econ. 2015, 4, 26–40. [Google Scholar] [CrossRef][Green Version]

- Hsiao, H.-C.; Chang, J.-C.; Yeh, Y.-M.; Chen, S.-C.; Chou, C.-M.; Shen, C.-H. Creation of customer value innovation with refined service: Taking ABC life logistics company in Taiwan as an example. In Proceedings of the Logistics Systems and Intelligent Management, Harbin, China, 9–10 January 2010; pp. 803–808. [Google Scholar]

- Kataria, S. Strategic Innovation: A Review and a Theoretical Framework; University of Twente: Enschede, The Netherlands, 2013. [Google Scholar]

- Kim, C.; Mauborgne, R. Creating new market space. Harv. Bus. Rev. 1999, 77, 83–93. [Google Scholar]

- Wang, C.L.; Ahmed, P.K. Learning through quality and innovation. Manag. Audit. J. 2002, 17, 417–423. [Google Scholar] [CrossRef]

- Leavy, B. A system for innovating business models for breakaway growth. Strategy Leadersh. 2010, 38, 5–15. [Google Scholar] [CrossRef]

- Jacobs, H.; Zulu, C. Reaping the benefits of value innovation: Lessons for small agribusinesses in Africa. Afr. J. Bus. Manag. 2012, 6, 9510–9523. [Google Scholar] [CrossRef][Green Version]

- González-Cruz, T.F.; Roig-Tierno, N.; Botella-Carrubí, D. Quality management as a driver of innovation in the service industry. Serv. Bus. 2018, 12, 505–524. [Google Scholar] [CrossRef]

- Yang, J.-t. Identifying the attributes of blue ocean strategies in hospitality. Int. J. Contemp. Hosp. Manag. 2012, 24, 701–720. [Google Scholar] [CrossRef]

- Peiris, I.K.; Akoorie, M.E.; Sinha, P. International entrepreneurship: A critical analysis of studies in the past two decades and future directions for research. J. Int. Entrep. 2012, 10, 279–324. [Google Scholar] [CrossRef]

- Kim, S.; In, H.P.; Baik, J.; Kazman, R.; Han, K. VIRE: Sailing a blue ocean with value-innovative requirements. IEEE Softw. 2008, 25, 80–87. [Google Scholar] [CrossRef]

- Fan, C.; Jun, B.H.; Wolfstetter, E.G. Licensing a common value innovation when signaling strength may backfire. Int. J. Game Theory 2014, 43, 215–244. [Google Scholar] [CrossRef][Green Version]

- Berghman, L.; Matthyssens, P.; Vandenbempt, K. Building competences for new customer value creation: An exploratory study. Ind. Mark. Manag. 2006, 35, 961–973. [Google Scholar] [CrossRef]

- Elenurm, T. Entrepreneurial orientations of business students and entrepreneurs. Balt. J. Manag. 2012, 7, 217–231. [Google Scholar] [CrossRef]

- Dhanoa, D. “Boots on the Ground” Radiology: Practical Strategy and Value Innovation for Local Radiology Practices. Can. Assoc. Radiol. J. 2013, 64, 180–181. [Google Scholar] [CrossRef] [PubMed]

- Becheikh, N.; Landry, R.; Amara, N. Lessons from innovation empirical studies in the manufacturing sector: A systematic review of the literature from 1993–2003. Technovation 2006, 26, 644–664. [Google Scholar] [CrossRef]

- Tranfield, D.; Denyer, D.; Smart, P. Towards a methodology for developing evidence-informed management knowledge by means of systematic review. Br. J. Manag. 2003, 14, 207–222. [Google Scholar] [CrossRef]

- Kim, C.; Mauborgne, R. Value innovation: A leap into the blue ocean. J. Bus. Strategy 2005, 26, 22–28. [Google Scholar]

- Lai, Y.; Khoong, C.; Aw, T. Value innovation through business process re-engineering: A&E services at a public hospital. Knowl. Process Manag. 1999, 6, 139. [Google Scholar]

- Mohanty, R.; Deshmukh, S. Reengineering of materials management system: A case study. Int. J. Prod. Econ. 2001, 70, 267–278. [Google Scholar] [CrossRef]

- Mohanty, R.; Deshmukh, S. Business process reengineering: Value innovation in industrial engineering practices. Int. J. Comput. Appl. Technol. 2001, 14, 119–135. [Google Scholar] [CrossRef]

- Dikmen, I.; Birgonul, M.T.; Artuk, S.U. Integrated framework to investigate value innovations. J. Manag. Eng. 2005, 21, 81–90. [Google Scholar] [CrossRef]

- Ho, Y.-C.; Tsai, C.-T. Comparing ANFIS and SEM in linear and nonlinear forecasting of new product development performance. Expert Syst. Appl. 2011, 38, 6498–6507. [Google Scholar] [CrossRef]

- Liao, S.-H.; Hu, D.-C.; Ding, L.-W. Assessing the influence of supply chain collaboration value innovation, supply chain capability and competitive advantage in Taiwan’s networking communication industry. Int. J. Prod. Econ. 2017, 191, 143–153. [Google Scholar] [CrossRef]

- Hajar, M.A.; Ibrahim, D.N.; Darun, M.R.; Al-Sharafi, M.A. Value Innovation Activities in Wireless Telecommunications Service Sector: A Case Study on Malaysian Market Service Sector: A Case Study on Malaysian Market. J. Glob. Bus. Insights 2020, 5, 57–72. [Google Scholar] [CrossRef]

- Xavier, J.A.; Siddiquee, N.A.; Mohamed, M.Z. Public management reform in the post-NPM era: Lessons from Malaysia’s National Blue Ocean Strategy (NBOS). Public Money Manag. 2019, 41, 152–160. [Google Scholar] [CrossRef]

- Dillon, T.A.; Lee, R.K.; Matheson, D. Value innovation: Passport to wealth creation. Res.-Technol. Manag. 2005, 48, 22–36. [Google Scholar] [CrossRef][Green Version]

- Kim, C.; Yang, K.H.; Kim, J. A strategy for third-party logistics systems: A case analysis using the blue ocean strategy. Omega 2008, 36, 522–534. [Google Scholar] [CrossRef]

- Pateman, J. Blue Ocean Strategy: Making a Blue Ocean Shift at Thunder Bay Public Library. Public Libr. Q. 2019, 38, 353–368. [Google Scholar] [CrossRef]

- Christodoulou, I.; Langley, P.A. A gaming simulation approach to understanding blue ocean strategy development as a transition from traditional competitive strategy. J. Strateg. Mark. 2019, 28, 727–752. [Google Scholar] [CrossRef]

- Tang, S.F.; Tong, P.Y. E-Value Strategies in Internet Retailing: The Case of a Malaysian Leading E-Coupon Retailer. Asian Soc. Sci. 2013, 9, 252. [Google Scholar]

- Aboujafari, M.R.; Farhadnejad, M.M.; Fakher, H.R.; Bagherzadeh, M. Study of Blue Ocean Strategy Effect on the Market Value of Listed Companies in Tehran Stock Exchange Market. Life Sci. J. 2013, 10, 61–69. [Google Scholar]

- Kulkarni, B.; Sivaraman, V. Making a Blue Ocean Shift: Tata Ace captures a new market. J. Bus. Strategy 2019, 41, 11–20. [Google Scholar] [CrossRef]

- Liao, S.-H.; Kuo, F.-I. The study of relationships between the collaboration for supply chain, supply chain capabilities and firm performance: A case of the Taiwan’s TFT-LCD industry. Int. J. Prod. Econ. 2014, 156, 295–304. [Google Scholar] [CrossRef]

- Xi, Y.; Zhang, X.; Liu, Y.; Wei, J. Business modeling for entrepreneurial firms: Four cases in China. Chin. Manag. Stud. 2013, 7, 344–359. [Google Scholar]

- Hajar, M.A.; Ibrahim, D.N.; Darun, M.R.; Al-Sharafi, M.A. The Role of Emerging Technologies in Shaping the Value Innovation Aptitude Towards Competitive Advantage and Sustainability. In Proceedings of the Information and Communication Technologies in Organizations and Society, Paris, France, 5–6 November 2020. [Google Scholar]

- Kim, C.; Mauborgne, R. Blue Ocean Strategy: How to Create Uncontested Market Space and Make Competition Irrelevant; Harvard Business School Press: Brighton, UK, 2005. [Google Scholar]

- Parvinen, P.; Aspara, J.; Hietanen, J.; Kajalo, S. Awareness, action and context-specificity of blue ocean practices in sales management. Manag. Decis. 2011, 49, 1218–1234. [Google Scholar] [CrossRef]

- Mina, F.T.; Mohseni, R. Blue ocean strategy (evaluating profit of businesses in the industrial town of bu ali in hamadan). Int. J. Appl. Bus. Econ. Res. 2015, 13, 1941–1952. [Google Scholar]

- Hollensen, S. The Blue Ocean that disappeared–the case of Nintendo Wii. J. Bus. Strategy 2013, 34, 25–35. [Google Scholar] [CrossRef]

- Wubben, E.F.; Düsseldorf, S.; Batterink, M.H. Finding uncontested markets for European fruit and vegetables through applying the Blue Ocean Strategy. Br. Food J. 2012, 114, 248–271. [Google Scholar] [CrossRef]

- Tarantino, D.P.; Smith, D.B. Bariatric surgery: Assessing opportunities for value innovation. Surg. Innov. 2005, 12, 91–99. [Google Scholar] [CrossRef] [PubMed]

- Vieira, E.; Ferreira, J.J.; São João, R. Creation of value for business from the importance-performance analysis: The case of health clubs. Meas. Bus. Excell. 2019, 23, 199–215. [Google Scholar] [CrossRef]

- Coughlan, P.; Fergus, M.A. Defining the path to value innovation. Int. J. Manuf. Technol. Manag. 2009, 16, 234–249. [Google Scholar] [CrossRef]

- Wee, C.H. Think tank—Beyond the five forces model and blue ocean strategy: An integrative perspective from Sun Zi Bingfa. Glob. Bus. Organ. Excell. 2017, 36, 34–45. [Google Scholar] [CrossRef]

- Kim, R.B. Value innovation in export marketing strategy: The case of a Canadian firm in Japan. J. Food Prod. Mark. 2010, 16, 361–372. [Google Scholar] [CrossRef]

- Sitinjak, M.F.; Pramawijaya, K.; Gunawan, A. ICanStudioLive use of Blue Ocean Marketing Strategy for Value Differentiation. Pertanika J. Soc. Sci. Humanit. 2018, 26, 203–214. [Google Scholar]

- Ernst, H.; Kahle, H.N.; Dubiel, A.; Prabhu, J.; Subramaniam, M. The antecedents and consequences of affordable value innovations for emerging markets. J. Prod. Innov. Manag. 2015, 32, 65–79. [Google Scholar] [CrossRef]

- Loosemore, M.; Richard, J. Valuing innovation in construction and infrastructure: Getting clients past a lowest price mentality. Eng. Constr. Archit. Manag. 2015, 22, 38–53. [Google Scholar] [CrossRef]

- Donada, C. Electric mobility calls for new strategic tools and paradigm for automakers. Int. J. Automot. Technol. Manag. 2013, 13, 167–182. [Google Scholar] [CrossRef]

- Tseng, M.-L.; Lim, M.K.; Wu, K.-J. Improving the benefits and costs on sustainable supply chain finance under uncertainty. Int. J. Prod. Econ. 2019, 218, 308–321. [Google Scholar] [CrossRef]

- Hajar, M.A.; Ibrahim, D.N.; Darun, M.R. Value Innovation: The New Source Of Sustainability. In Proceedings of the Advances in Global Business Research, New Delhi, India, 2–4 July 2019; pp. 1029–1037. [Google Scholar]

- Carter, T.; Diro Ejara, D. Value innovation management and discounted cash flow. Manag. Decis. 2008, 46, 58–76. [Google Scholar] [CrossRef]

- Shafiq, M.; Tasmin, R.; Takala, J.; Qureshi, M.I.; Rashid, M. Mediating role of open innovation between the relationship of Blue ocean strategy and innovation performance, a study of Malaysian industry. Int. J. Eng. Technol. 2018, 7, 1076–1081. [Google Scholar] [CrossRef]

- Yap, J.B.H.; Chua, K.L. Application of e-booking system in enhancing Malaysian property developers’ competitive advantage: A blue ocean strategy? Prop. Manag. 2018, 36, 86–102. [Google Scholar] [CrossRef]

- Shafiq, M.; Tasmin, R.; Qureshi, M.I.; Takala, J. A new framework of blue ocean strategy for innovation performance in manufacturing sector. Int. J. Eng. Adv. Technol. 2019, 8, 1382–1389. [Google Scholar] [CrossRef]

- Santini, C.; Cavicchi, A.; Rocchi, B. Italian wineries and strategic options: The role of premium bag in box. Int. J. Wine Bus. Res. 2007, 19, 216–230. [Google Scholar] [CrossRef]

- Faghat, E.R.B.; Khani, N.; Alemtabriz, A. A paradigmatic model for shared value innovation management in the supply chain. Int. J. Innov. Sci. 2020, 12, 142–166. [Google Scholar] [CrossRef]

- Acar, A.Z. The mediating role of value innovation between market orientation and business performance: Evidence from the logistics industry. Int. J. Bus. Innov. Res. 2020, 21, 540–563. [Google Scholar] [CrossRef]

- Radzi, S.M.; Yasin, M.F.M.; Zahari, M.S.M.; Ahmat, N.H.C.; Ong, M.H.A. Moderating Effects of Environmental Variables on the Relationship Between BOS and Performance of Four and Five Star Hotels in Kuala Lumpur, Selangor, and Putrajaya, Malaysia. Adv. Sci. Lett. 2017, 23, 10830–10833. [Google Scholar] [CrossRef]

- Siddiquee, N.A.; Xavier, J.A. Collaborative approach to public service improvement: The Malaysian experience and lessons. Int. J. Public Sect. Manag. 2020, 34, 17–32. [Google Scholar] [CrossRef]

- Kuznetsov, A.; Kuznetsova, O. Looking for ways to increase student motivation: Internationalisation and value innovation. High. Educ. Q. 2011, 65, 353–367. [Google Scholar] [CrossRef]

- Bocken, N.; Short, S.; Rana, P.; Evans, S. A value mapping tool for sustainable business modelling. Corp. Gov. 2013, 13, 482–497. [Google Scholar] [CrossRef]

- Dvorak, J.; Razova, I. Empirical Validation of Blue Ocean Strategy Sustainability in an International Environment. Found. Manag. 2018, 10, 143–162. [Google Scholar] [CrossRef]

- Cooke, H.; Appel-Meulenbroek, R.; Arentze, T. Adjustment of corporate real estate during a period of significant business change. Int. J. Strateg. Prop. Manag. 2019, 23, 171–186. [Google Scholar] [CrossRef]

- Abraham, S. Blue oceans, temporary monopolies, and lessons from practice. Strategy Leadersh. 2006, 34, 52–57. [Google Scholar] [CrossRef]

- Kim, W.C.; Mauborgne, R. Tipping point leadership. In If You Read Nothing Else on Change, Read These Best-Selling Articles; Harvard Business School Press: Brighton, UK, 2003; p. 37. [Google Scholar]

- Barney, J. Firm resources and sustained competitive advantage. J. Manag. 1991, 17, 99–120. [Google Scholar] [CrossRef]

- Clulow, V.; Barry, C.; Gerstman, J. The resource-based view and value: The customer-based view of the firm. J. Eur. Ind. Train. 2007, 31, 19–35. [Google Scholar] [CrossRef]

- Wang, Y.; Lo, H.-P. Customer-focused performance and its key resource-based determinants: An integrated framework. Compet. Rev. Int. Bus. J. 2004, 14, 34–59. [Google Scholar] [CrossRef]

| Criteria | Inclusion | Exclusion |

|---|---|---|

| Topic | Value Innovation | Other irrelevant topics |

| Research question | Value innovation/BOS | Value innovation is not the main topic |

| Company performance | Papers that have used BOS as an analysis tool for other topics | |

| Competitive advantage | ||

| Sustainable growth | ||

| Research design | Experimental, empirical, qualitative, quantitative, and case studies; content analysis; research papers are supported with data and justification. | Review and conceptual papers |

| Date | 1997–Present (January 2021) | Before 1997 |

| Publication type | Empirical | Conference and conceptual papers, lecture notes, symposiums, trade magazines, workshops, book reviews, reports, and letters |

| No. of Articles | Percentage (%) | |

|---|---|---|

| Qualitative | (44) | (60%) |

| Interview | 26 | 36% |

| Case study | 22 | 30% |

| Secondary data | 19 | 26% |

| Observation | 3 | 4% |

| Quantitative | (22) | (30%) |

| Survey | 20 | 27% |

| Secondary data | 2 | 3% |

| Case Study | 2 | 3% |

| Mixed method | (7) | (10%) |

| Interview | 7 | 10% |

| Survey | 7 | 10% |

| Case study | 2 | 3% |

| TOTAL | 73 | 100% |

| Category | Studies |

|---|---|

| Profitability | [4,12,19,20,22,23,28,29,53,56,59,60,64,65,69,70,71,72,74,75,77,79,82,84,85,88,89,90] |

| Performance | [4,5,9,10,12,14,19,20,22,23,26,29,39,50,51,54,56,57,60,61,63,65,69,74,77,79,82,85,86,87,89,90,91,92] |

| Firms’ Growth | [4,20,21,22,23,29,56,59,60,61,64,69,75,77,79,84,88,89] |

| Competitive Advantage | [8,10,26,29,40,53,55,56,59,60,62,64,65,66,71,72,79,82,86,89,90,93] |

| Sustainability | [10,13,40,56,61,62,65,76,77,82,89,94,95] |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hajar, M.A.; Alkahtani, A.A.; Ibrahim, D.N.; Darun, M.R.; Al-Sharafi, M.A.; Tiong, S.K. The Approach of Value Innovation towards Superior Performance, Competitive Advantage, and Sustainable Growth: A Systematic Literature Review. Sustainability 2021, 13, 10131. https://doi.org/10.3390/su131810131

Hajar MA, Alkahtani AA, Ibrahim DN, Darun MR, Al-Sharafi MA, Tiong SK. The Approach of Value Innovation towards Superior Performance, Competitive Advantage, and Sustainable Growth: A Systematic Literature Review. Sustainability. 2021; 13(18):10131. https://doi.org/10.3390/su131810131

Chicago/Turabian StyleHajar, Mohammed A., Ammar Ahmed Alkahtani, Daing Nasir Ibrahim, Mohd Ridzuan Darun, Mohammed A. Al-Sharafi, and Sieh Kiong Tiong. 2021. "The Approach of Value Innovation towards Superior Performance, Competitive Advantage, and Sustainable Growth: A Systematic Literature Review" Sustainability 13, no. 18: 10131. https://doi.org/10.3390/su131810131

APA StyleHajar, M. A., Alkahtani, A. A., Ibrahim, D. N., Darun, M. R., Al-Sharafi, M. A., & Tiong, S. K. (2021). The Approach of Value Innovation towards Superior Performance, Competitive Advantage, and Sustainable Growth: A Systematic Literature Review. Sustainability, 13(18), 10131. https://doi.org/10.3390/su131810131