Abstract

Hungarian Information and Communication Technology (ICT) companies have an essential role to play in a disruptive era. ICT firms should collaborate and innovate to obtain profit. The elusive correlation between trust in business partners and financial performance inspired this study, which proposed innovation as a mediating variable. The research had two objectives: to investigate the effect of inter-organizational trust on financial performance and innovation and to observe the role of innovation in improving financial performance within different categories of ICT companies. The population included active Hungarian ICT firms. The analysis used 100 samples, comprising micro-, small-, and medium-sized ICT corporations. Those samples were selected by random cluster sampling. This research used Partial Least Square Structural Equation Modelling. This study supported the idea that inter-organizational trust improved innovation, and that innovation enhanced financial performance. As an expected finding, innovation could mediate a positive direction between inter-organizational trust and financial performance.

1. Introduction

The Hungarian Information and Communication Technology (ICT) sector plays an essential role in the economy and support Industry 4.0. The ICT sector contributed five percent of the total Gross Domestic Product (GDP) in the last three years. The sector also supports other sectors, such as the manufacturing sector, which had the highest GDP contribution, with a value of 22% [1]. Furthermore, the innovative applications of the ICT industry ease the tasks of other industries, such as wholesale trade, government services, commercial property, and logistics, when undertaking e-commerce.

About 1800 ICT firms [2] provide communication technologies that enable users to access, store, retrieve, and manipulate information in digital forms [3,4]. They recruited about 60,000 staff in 2018, and this increased by about 30% in 2020 [5]. They obtained revenues of about 7 million Euros in 2018, and this amount grew by approximately 45% in 2019. In general, the profits of ICT companies have tended to increase over the last three years. The increasing returns continue climbing, followed by the challenges of achieving and retaining significant revenues. The promising profit has attracted ICT firms to compete with others in a competitive market [6]. As a result, approximately 10% of ICT firms have shut down two years ago [5].

ICT firms clash with their competitors, and encounter challenges in a disruptive era, which is illustrated by the fact that start-up firms disrupt the existing firms from the market because the newcomer corporates offer innovative products [7,8]. ICT firms should collaborate with their business partners to improve innovation toward the exchange of the inflows and outflows of communicated information between them [9]. To enable the smooth inflows and outflows of shared information, ICT businesses require trust in their business partners. Innovation also increases potential market, which is connected to improve business performance [10].

The correlation between trust and business performance continues to be a controversial area of investigation. Evidence from several cohort studies indicated a strong relationship between inter-organizational trust and business performance [11,12,13,14,15]. Their results contrast with the findings of Oláh et al. [16].

Therefore, this study proposed innovation as a moderating variable, improving the correlation between inter-organizational trust and financial performance. The relationship between trust in business partners and innovation is not clearly stated in the context of social capital [17,18]. In addition, some scholars obtained different findings. One group of researchers supported the idea that inter-organizational trust positively influenced innovation [19,20,21,22]. Another group claimed that there was no direct influence operating between trust in business partners and innovation [23,24].

Prior studies supported the idea that trust in business partners improved the combination and exchange of resources between collaborating parties, which influenced innovation [25,26]. Other studies proved that inter-organizational trust improved innovative processes, economies of scale, and sales [27]. Innovation also developed product performance positively influencing financial performance [28,29]. Additionally, the company maintained an ideal level of trust that supported innovation [30].

The study argues that the extent of trust in business partners improves financial performance [11,12,13,14,15]. The research also claims that innovation strengthens the relationship between inter-organizational trust and financial performance [19,20,21,22]. Thus, the study raised three research questions:

- RQ1: How does inter-organizational trust improve financial performance?

- RQ2: How does inter-organizational trust enhance innovation?

- RQ3: How does innovation improve financial performance?

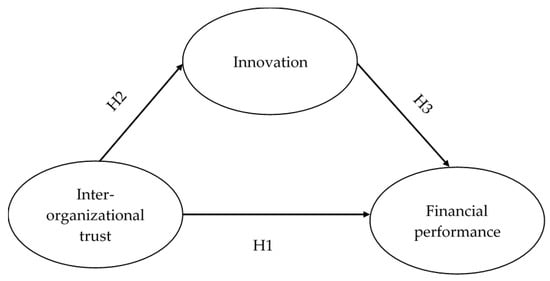

Subsequently, the research proposed three hypotheses: firstly, inter-organizational trust has a positive effect on financial performance. Secondly, a higher level of inter-organizational trust positively affects innovation, and thirdly, innovation positively affects financial performance within different firm categories. The study had two objectives. The initial goal is to investigate the level of inter-organizational trust on financial performance and innovation. Later, the study observes the role of innovation in improving financial performance. The study also looked at a summary of the perspectives of social capital, trust, innovation, and financial performance to develop three hypotheses. It then described how the research was carried out, discussed the results, extended the findings, and elaborated the conclusions.

2. Literature Review

2.1. Social Capital and Inter-Organizational Trust

Putnam [31] describes social capital as the qualities of a collaborative social network, including trust, mutuality standards, and networks between firms and their partners. This study argues that networking and collaboration require trust in business partners, which stimulates commitment which makes coordinated achievement possible, and in consequence, makes cooperation more efficient [32,33].

Some scholars approach social capital from three perspectives: resource, networking, and purpose. From the resource perspective, social capital refers to a resource embedded in social networks among companies and their partners. Networking can support a bonded system enabling activities among companies and their affiliates to generate added value from collaboration. Finally, trust in business partners can facilitate companies and their affiliates through social organization to coordinate and cooperate in order to achieve collective advantage [34]. Social capital gives the company advantages to access prominent assets and mobilize them to conduct purposeful activities [35]. The amount of social cohesiveness, horizontal linkages, and the kind of interactions are all shaped by social capital [36,37]. As a consequence, a firm in a network or linkage builds synergy with its business partners and increases manufacturing capacity to accomplish cooperative performance [17,18]. Social capital improves the competitive advantage of firms and improves their performance [34,38]. This effect can be achieved due to the links between organizational trust and knowledge sharing [39].

This study indicated that the trust between organizations is a sign of trust between a corporation and its business partners, customers and contractors and the network. The firm expects that they will honor their aptitudes [15,40,41,42], and act or behave in a manner that is reliable and workable solutions [43,44,45]. The term “inter-organizational trust” relates to the synergy approach that stimulates complementarity and embeddedness between the bounded network and institutions. Complementarity regards mutually supportive connections between companies and their partners enshrined in legal frameworks that safeguard their responsibilities and privileges. Cohesion shows the kind and extent of the obligations connected to enterprises and their affiliations, supported by public bureaucrats [46]. This study argues that the shared links and connections amongst businesses and business associates make mutual actions easier to plan and achieve common goals.

This study supports the idea that two ways generate outstanding financial performance through inter-organizational trust. Firstly, inter-organizational trust acts as a safeguard against probable opportunistic and risky moral hazards from business partners. Such an assurance significantly minimizes high costs and the need for formal safeguarding activities, namely complex contracts and tight monitoring [47,48,49]. Secondly, in a trusted network, bounded partners can engage in intense communication and focus information gathering through informal sources, enabling valuable innovation through focal collaboration [12].

This study supports the idea that inter-organizational trust boosts business performance, measured as profitability. Profitability represents one significant achievement in business performance, reflecting the company’s efficiency in improving sales while reducing costs of production [50]. The profitability also reflects how firms control and use their resources well. This study argues that inter-organizational trust improves profitability through increasing production and sales. The first hypothesis proposed is the following.

Hypothesis 1 (H1).

Inter-organizational trust has a positive direction to financial performance.

2.2. Inter-Organizational Trust

Inter-organizational trust encourages reliable information to be shared, initiates contracts that can be accomplished, simplifies the way firms disclose tacit information, and engages business partners in a similar organized framework. A company acquires improved benefits when it expands its networks and strengthens the prerequisites for coordination between and among corporations [51]. Social capital is characterized by different features, predominantly trust, norms, and networks. It is obvious that a high level of confidence between an enterprise and its partners induces innovation possibilities. Business networks develop as actors cultivate reliable and effective communication channels across organizational boundaries [23]. Trust in partners has a beneficial impact on the combination and exchange of resources and expertise among cooperating parties, which in turn has an impact on the value creation of innovative products [26]. Especially in R+D t requires cooperation between the companies as it allows them to gain a competitive advantage [52]. A firm should create novel products to be sustained in a competitive market [19]. This study supports Jean et al. [25] that confidence in business associates improves inventiveness.

However, there is debate on the result of the effect of trustworthiness on innovation. One set of scholars agreed that confidence between the company and its partners had a beneficial impact on innovation [19,21,53]. Trust ignites innovative processes, increases economies of scale, and develops sales [27]. Besides, trust positively affects and relates to the level of innovative performance [22].

Another group of researchers finds no direct influence between trust and innovation [23]. The firm requires an optimal climate in which trust improves the level of innovation. An excessive level of trust, exceeding optimal conditions, diminishes innovation. This study argues that confidence is commendable, but excessive confidence is not good [30]. This study proposes the second hypothesis below, which supports the positive effect of trust on innovation.

Hypothesis 2 (H2).

A higher level of inter-organizational trust has a positive effect on innovation.

2.3. Innovation

The concept of innovation starts with knowledge developed as a solitary experience within an internal company, before moving to a collaborative process through interactions and exchanges of knowledge with other interdependent companies and their partners [9]. Innovation opportunities describe the prospects of enhancing products or production processes [20,23,54,55,56].

This study adopts the technological network theory, which describes how companies develop innovation that correlates with that of various partners within networks of cooperation. Collaboration transfers critical information among those within the network [10]. This concept highlights the value of information from external company stakeholders such as clients, suppliers, consultants, government agencies, government laboratories, university research, and others. A company should sustain and interact intensively with external sources of critical information to support manufacturing. The exchange of information is also intensively discussed in forms of cooperation, networking, and partnerships which highlight the importance of technological networks [23,57,58].

A company requires knowledge-based innovation from various types of knowledge owned by different categories of business partners. Networks and communities characterize focal knowledge, and social capital is a vital aspect in recognizing innovation. This research defines innovation as a company’s capabilities in developing distinctive products sustained through market demand [23]. A company enhances its innovation prospects by implements advanced production systems and innovative working methods [53,59,60,61].

Social network theory argues that a company has innovation opportunities by emphasizing networks and the strategic importance of knowledge. The pressure to transform information into knowledge is the critical development from the technological network concept to the social network insight [62]. In this context, the information relates to the development or improvement of products or production processes [23]. Innovation develops product performance, which positively influences financial performance [29]. The research proposes the third hypothesis, as following.

Hypothesis 3 (H3).

Innovation positively affects financial performance.

2.4. Financial Performance

Researchers have investigated measures of business performance used in the field of strategic management. A seminal study by Venkatraman and Ramanujam [63], cited by Stam et al. [64] and Lyu and Ji [34], argues that the schematic domain of business performance consists of three fields: financial performance, financial-operational performance, and organizational effectiveness. The financial performance approach is the result of using the goals achieved by a firm, as measured by financial indicators. Financial performance refers solely to indicators, such as sales growth, profitability, earning per share, and others [65]. Some authors investigate business successes of firms through the growth of assets [66] and return on assets [67] along with the system of above-mentioned indicators. Subsequent fields of business performance include comprehensive indicators of financial and operational performance. In this framework, the measurement of operational performance includes such indicators as market-share, new product introduction, product quality, marketing effectiveness, manufacturing value-added, and other technological efficiency indicators. Ultimately, business performance in a broader concept, which is framed within the multiple and conflicting nature of organizational goals and the influence of various stakeholders and indicates organizational effectiveness [63].

This study uses the initial approach of business performance measured in term of financial performance. An important question emerges whether is a firm generating profits based on the assets and capital employed? Thus, profitability indicates the effectiveness of a company in creating profits based on the assets and capital used. Some indicators are commonly applied in profitability measurement in terms of the profit assets ratio such as Return on Sales, Return on Assets, Operating Profit Margin, and Return on Capital including Return on Equity and Return on Capital Employed [68].

This study illustrates the model according to three hypotheses in Figure 1, as follows:

Figure 1.

Simultaneous paths of inter-organizational trust, innovation, and financial performance.

3. Material and Methods

3.1. Population and Samples

Only active Hungarian ICT businesses with at least a reciprocal partnership with industry ties were considered in this study. This study analyzed around 90% of the remaining 1800 businesses. Almost all of the study’s sample of Hungarian ICT businesses, 71 percent, were based in Budapest. The leftover businesses were situated in various locations, including Debrecen, Budaörs, Székesfehérvár, Szeged, Győr, Nyíregyháza, and others, accounting for 29 percent of the total [69].

The location of Hungarian ICT businesses was the basic criteria used in a random cluster sampling. The online survey was submitted to the ICT companies operating in Budapest and other towns and cities in Hungary through January-March 2019. The online survey was circulated to business owners and/or managers, as well as to notable critical sources and spokespeople. A total of 149 replies were received from 250 surveys. The research included 100 samples made up of micro, small to medium enterprises.

Three latent variables were used in this study: inter-organizational trust, innovation, and financial performance. The indications for each latent construct were drawn from prior research by various experts. Table 1 shows the descriptions of the latent constructs and how they are measured.

Table 1.

Latent variables and the indicators.

This study assessed inter-organizational trust and innovation measures, with survey’s results, expressed on a five-point scale ranging from strongly disagree to strongly agree. A profitability ratio derived from the financial statement was used to evaluate financial performance. This study established inter-organizational trust and innovation, which were reflected in their measures. Financial performance, on the other hand, had formative dimensions. As a result, each construct’s evaluation necessitated a distinct technique.

3.2. Research Approach

Firstly, we used Principal Component Analysis to assess the interdependence of significant indicators underlying the latent variables. The small error of variance is assumed to be represented by the high inter-correlated indicators of the latent variables. The high inter-interconnected dimensions can be used in the analysis of Partial Least Squares Structural Equation Model SEM (PLS-SEM). We only included significant indicators having a minimal factor loading of 0.55 [73]. We presented the indicators which used in the examination in Table 2.

Table 2.

Loading factor of Principal Component Analysis.

We reduced the indicators of three latent variables, then used two dimensions of each. To meet the number of samples used, we considered summarizing the indicators. In addition, we purposed to obtain the value of Average Variance Extracted (AVE) greater than 0.5 as the threshold point.

Secondly, this study used PLS-SEM to examine the relationship between inter-organizational trust, innovation, and financial performance. PLS-SEM underlies the causative analytical method of SEM that emphasizes assessing statistical models, whose structures are aimed at offering fundamental predictions of key constructs. This research applied PLS-SEM because PLS-SEM is a powerful method to assess the representation of the constructs by weighting composites of the measured indicators. The weighting of aggregated constructs signifies representations of measurement error. PLS-SEM also creates a single accurate outcome of each composite of each assessment [74,75,76]. PLS-SEM simplifies the measurement of the complicated models comprising various latent variables, observed variables, and structural paths. PLS-SEM underlies the causative analytical method of SEM that emphasizes assessing statistical models, whose structures are aimed to offer fundamental clarifications [74,75]

4. Results

4.1. Company Profiles

This section outlines the characteristics of ICT companies that have been surveyed in this study. The debate starts with the analysis of the categories and staff of the ICT firms.

There are three categories of firms observed-micro, small and medium-categorized enterprises as shown in Table 3. In terms of the categories of the enterprises observed, the largest percentage of small businesses was 44%. The ratio of micro-enterprises then differed slightly to around four percent of small companies. Medium-size firms were the smallest share.

Table 3.

Companies classification and their employees’ amount.

A total of 2615 employees were employed by the companies observed. In fact, with over 1400 people, the mid-size firms employed the most. Next, there were nearly half of all employees in the small companies of 1000. Finally, micro-entities employed about 200 workers, almost one-tenth of the total, with no workforces and with one and nine workers. This study referred to the International Standard for All Economic Activities for Industry Classification (ISIC). The companies studied were in division 62, and ICT enterprises are classified into four corporate services. In category 62.01, ICT enterprises are capable of delivering IT technology know-how involving creation, modification, test and supporting software. Division 62.02 includes companies that are experts in formulating, designing and developing computer systems that integrate computer hardware, software and communication technologies. Finally, ICT businesses that provide a variety of computer services, both applied and specialized, are classified as category 62.09 [4].

Table 4 displays the number of businesses assessed with a cross-tabulation of their expertise and firm type. The highest number of surveyed ICT companies-44-supplied competence in computer programming, with half of them being small businesses. Following that, 30 of the examined ICT enterprises provided information and technology consultation, a market dominated by micro-sized and small-categorized businesses. Other information technology activities were provided by 20 observed corporations, as well as a similar number of small and micro-businesses-nine each. Finally, the businesses that supply computer operating services had the fewest number.

Table 4.

Business activities of the observed company.

4.2. Assessment of Constructs

This part looked at how well the constructions and structural models were measured. First, the research examined how constructs were measured in terms of different sorts of formative and reflective indicators. The evaluation of reflective constructs reveals the indicators’ reliability, validity, variances, and collinearity. Meanwhile, reliability, convergent validity, collinearity, and substantial weight are identified in the examination of formative conceptions [74,76]. The structural model is examined in terms of goodness of fit, path coefficient of regression, coefficient of determination, and mediation path analysis once the constructs have been evaluated [74,78].

The study constructed financial performance to be composed of formative indicators. Consequently, the construct of latent variables should accomplish requirements of reliability, convergent validity, collinearity, and significant weight. Meanwhile, the study investigated inter-organizational trust and innovation, which reflected their indicators. The assessment of reflective constructs should achieve reliability, validity, collinearity, and good variances.

The first assessments investigated the reflective indicators of inter-organizational trust and innovation. Table 5 shows the figures of observed variables, including the values of Cronbach’s Alpha (CA), Dillon-Goldstein (D.G.) rho, Average Variance Extracted (AVE), and Variance Inflation Factor (VIF). The values mentioned above are used to support the examination of the constructs. The CA and D.G. rho values indicate reliable and consistent constructs. Meanwhile, the VIF value reveals the collinearity level of the indicators.

Table 5.

Observed variables, Cronbach’s Alpha (CA), Dillon-Goldstein (D.G.) rho and Variance Inflation Factor (VIF) and Average Variance Extracted (AVE) summary.

At this point, this study examined the internal reliability ratio with CA. Table 5 demonstrates that the CA coefficient of inter-organizational trust was about 0.7, meanwhile the CA number of innovation was about 0.8. Therefore, we concluded that those two latent variables met the internal consistency assumption. This study also indicated that the values of D.G. rho for inter-organizational trust and innovation were above 0.7 as the rule thumb. Definitively, this study indicated that internal consistency and uni-dimensionality were attained through inter-organizational trust and innovation indicators. The internal reliability indicated the constructs of those two latent variables were sufficiently consistent, constructing the two unobserved variables. The uni-dimensionality described the observed variables of inter-organizational trust and innovation reflected their indicators. Besides, the uni-dimensionality illustrated that indicators of inter-organizational trust had a strong association and signified as a single concept. Similarly, the constructs of innovation could be interpreted.

The constructs of inter-organizational trust and innovation had VIF values below three, as shown in Table 5. Consequently, those two latent variables’ indicators met the non-collinearity assumption, which indicates the indicators had not correlated with each other.

The subsequent evaluation of the reflective indicators concentrated on examining the convergent validity of the constructs. This study indicated that the AVE values of inter-organizational trust and financial performance were above 0.7, which indicate the good variance due to the measurement error. Therefore, this study concluded that inter-organizational trust and innovation met the convergent validity, which clarified their constructs, explaining at least 50% of the variance of the constructs. Innovation had an AVE value of 0.826, which indicate a good variance of indicators. The final evaluation was the measurement of discriminant validity. The requirement is that the AVE value of a construct should be greater than the highest correlation of any other construct. Table 6 shows the comparison between the AVE values and the correlation of their constructs.

Table 6.

Squared correlations of the latent variables.

As seen in Table 6, the AVE values were greater than any other construct relationships. Thus, this study clarified that inter-organizational trust and innovation reflected discriminant validity. It also indicated that the constructs’ degree of inter-organizational trust and innovation were empirically distinguished from other constructs in the structural model. To conclude, inter-organizational trust and innovation indicators passed the requirements such as reliability, validity, collinearity, and variances of the indicators to perform as reflective indicators.

This study also examined financial performance as a formative construct. The evaluation of formative indicators comprises reliability, convergent validity, collinearity, and significant weight [74,76]. The first evaluation was to identify the internal reliability of the constructs. The D.G. rho value’s financial performance constructs were higher than 0.7 as the minimal value, as shown in Table 5. Therefore, this study assumed that the indicators of financial performance were internally reliable and consistent. The internal reliability clarified that the constructs of financial performance significantly and consistently explained the degree of their variance.

This study then examined the convergent validity of the constructs of financial performance regarding the value of the outer loading factor.

Table 7 illustrates the loading factors of financial performance, all of which were higher than 0.7 as the standard point. As a result, this research revealed that two observed variables of financial performance met the convergent validity requirement. This implies that two formative indicators of financial performance are related to construct a formative variable. Two indicators of financial performance had a Variance Inflation Factor (VIF) value below three, as shown in Table 5. According to the findings of this study, two observable indicators of financial performance did not correlate with one another. This meant that the two observed variables satisfied a non-collinearity condition.

Table 7.

Loading factors of financial performance.

Finally, this research examined the significance of the weight dimension of financial performance. Table 8 depicts the summary of the weight dimension, which is the primary standard to evaluate each indicator’s relative significance in formative measurement models. The significant weight dimension refers to the critical value which is positioned between the lower and upper bound. The result of the research showed that Return on Equity (ROE) and Return on Capital Employed (ROCE) were significant. A significant indicator weight indicates that the constructs have good measurement quality as formative indicators [74,76].

Table 8.

Weights dimension of the indicators.

To sum up, the constructs of financial performance accomplished the criteria in terms of reliability, convergent validity, collinearity, and significant weight. As a result, two constructs of financial performance could provide formative measures.

4.3. Evaluation of The Model

We then examined the structural model in terms of the inner model and outer model. The examination implemented the Goodness of Fit (GoF) to reveal the good model. Table 9 illustrates the results of the GoF test.

Table 9.

The Goodness of Fit (GoF) test.

This study examines the fit of models according to the goodness of fit (GoF) values, which indicates a good measurement of a PLS-SEM analysis model [75,79]. The inner model illustrates good associations between the latent variables and the indicators. Meanwhile, the outer model represents the directions of inter-organizational trust improving financial performance through innovation. The suggested cut-off point of the two models is 0.60 [76,80]. We found that the model had good outer and inner models due to the values of GoF above the cut-off point.

We performed a bootstrap test to evaluate the mediating variable. The approach is effortlessly suitable for the PLS-SEM analysis [75]. We analyzed the direct and indirect effect of the model which proposed innovation as a mediator in improving the relationship between inter-organizational trust and financial performance. Table 10 shows how innovation was examined as a mediating variable.

Table 10.

Direct and indirect effect of the model.

Innovation had a role as a complementary mediating variable. It implied that innovation had a complementing effect with inter-organizational trust. Therefore, innovation had significantly mediated the direction between inter-organizational trust and financial performance.

4.4. Examination of Hypotheses

This section examines and investigates the three following hypotheses.

- Interorganizational trust has a positive effect on financial performance (H1);

- A higher level of inter-organizational trust has a positive effect on innovation (H2);

- Innovation has a positive effect on financial performance (H3).

Table 11 shows the examination of three hypotheses and coefficient of determination. The results appear to tally with this study’s expectancies.

Table 11.

Hypotheses testing and coefficient determination (R2).

Statistical analyses were performed, applying a significance level of 10 percent. This study disclosed interesting findings regarding the examination of hypotheses.

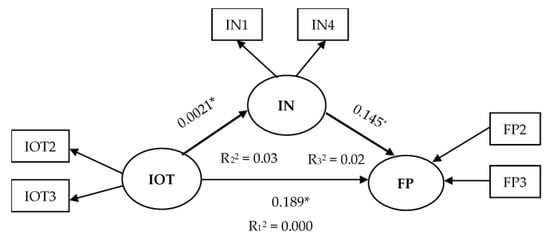

The first hypothesis was accepted. It was unsurprising to find a significant relationship between trust in business partners and financial performance. This result also supported the previous results of various researchers, namely, Fang et al. [81], Moeller [82], Gaur et al. [12], Wei et al. [70], Bien et al. [11], and Shahmehr et al. [13]. In the framework of transaction costs, trust in business partners involves managing transaction costs, namely searching costs, negotiating fees, and controlling costs. Meanwhile, the company can optimize its assets to support production. As a consequence, production is optimized while reducing total costs offers the prospect of enhancing profits. Consequently, this result went against that of Palmatier et al. [83], who showed that trust in business partners had a disturbing if the incoherent effect on business performance. Furthermore, this study also conflicted with previous studies by Moeller [82] and Al-Hakim and Lu [84], who revealed that confidence in business associates did not modify business performance. This research disclosed that inter-organizational trust contributed to about four percent of the variance in financial performance.

Furthermore, this study proved the positive relationship between trust in business partners and innovation. This result supported previous studies by Corsten and Felde [19] and Y.-H. Tsai et al. [35], who showed that trust in business partners had a positive relationship with innovation. This study also revealed that inter-organizational trust was related to innovation opportunities within ICT companies. Inter-organizational trust encourages the companies and their business partners to focus their endeavors on improving innovation prospects by enriching their chances of achieving innovation [32]. Extending the result, trust in business partners encourages the effective exchange of knowledge, which improves innovation [11]. The previous argument is consistent with Fawcett et al. [85], who claim that sharing knowledge encourage entities to boost cooperation, innovation, and competitive performance. In conclusion, inter-organizational trust had a positive connection with innovation [22]. This study also observed that inter-organizational trust determined below one percent of the variance in innovation.

Finally, the direction between innovation and financial performance was accepted. This result supported Zaheer et al. [15] and Vaccaro et al. [29]. Social capital theory supports the idea that an ICT company can achieve innovation opportunities through networks and knowledge transfers between business networks. In turn, an ICT company and its partners can transform information into knowledge and critical innovation. In this context, ICT companies successfully develop innovation to improve financial performance [23]. This study supported the idea that innovation positively influenced financial performance [29], and also showed that innovation contributed about two percent of the variance in financial performance.

5. Discussion

This study illustrates the model of the hypotheses in Figure 2.

Figure 2.

Path regression of inter-organizational trust, innovation, and financial performance within ICT firms. (*) significant at α = 10%. R: Coefficient determination. IOT: Inter-organizational trust; IOT2: Trust in customers-clients; IOT3: Trust in other providers; IN: Innovation; IN1: Innovation of products/services; IN4: Innovative procedure. FP: Financial performance; FP2: ROE; FP3: ROCE.

This study contributed to literature to a certain extent. First, this study discovered a strong, positive association between inter-organizational trust and financial performance. Thus, it supported the idea of a positive relationship between trust in business partners and business performance. Furthermore, the study emphasized that a higher level of trust in business partners [86] positively impacted business performance [50,87,88,89]. As a significant contribution, the financial performance of the company was used as a proxy for business performance in this study. The study supported work by other researchers, namely, Fang et al. [81], Moeller [82], Gaur et al. [12], Wei et al. [70], Bien et al. [11], and Shahmehr et al. [13], who argued that inter-organizational trust enhanced financial performance.

Companies can expand production through the use of internal resources or outsourcing. When a company predicts that the beneficial impact of outsourcing will exceed that of internal improvement, it will decide to borrow assets from its partners. Therefore, a corporation needs to control transaction expenses such as the cost of finding, negotiating fees and monitoring costs to accomplish business collaboration. Trust in business partners works as hierarchical governance in support of co-operation in order to encourage business associates to reach an agreement to support manufacturing or outsourcing within the firm [26,86,90]. It, thus, enhances production, sales and profit-related financial performance, while reducing expenses.

On the other hand, this study contradicted scholars who claimed that trust in business partners had an inconsistent effect on company performance [83], or that trust in a business partner did not have a direct effect on business performance [84]. This study reached the opposite conclusion to Moeller [82], and Oláh et al. [24], who revealed that trust in business partners did not affect financial performance.

Also supported was the idea that inter-organizational trust positively affected innovation. Therefore, this research corroborated previous results of various scholars, namely Corsten and Felde [19] and Y.-H. Tsai et al. [35]. The study emphasizes that inter-organizational trust prompts an exchange of resources and knowledge between companies and their business partners. Shared resources and knowledge cultivate innovation capabilities. According to the study, inter-organizational trust only contributed below one percent of the variance in innovation. Extending the discussion, this study recommended that various variables impact both innovations directly and business partner confidence. Scholars have previously claimed that the R&D budget [91], inter-functional coordination and practice in human resources [17], rapid response of market information and technology [92] improve innovative levels. This research also suggested that the intermediary variables which contribute to innovations, such as mutually cooperative work, the use of technology to transmit information, the adoption of current knowledge and technology and the flexibility and opportunism [93].

This study indicated that innovation was closely related to financial performance. Vaccaro et al. [29] and Zaheer et al. [15] have been backed by this result. According to the idea of social capital, there is an important role of trust in supporting the combination and exchange of resources. The combination and resources exchange then produce value for the company by having a substantial and beneficial impact on products innovations [26]. In addition to innovation, this study also specifies that successful relevancy and network involvement have a substantial financial impact [82]. Indeed, both quality and cost improvements are significant and associated with financial performance [94]. According to the findings of this study, innovation mediated the relationship between intra-organizational trust and financial success. As anticipated, innovation had the potential to mediate the direction of inter-organizational trust in financial performance. This study found that inter-organizational trust and innovation explained approximately six percent of the variability in financial performance. In a nation like Hungary, this finding was noteworthy, and it was similar to facts in European nations such as Denmark, Ireland, and Wales [95].

ICT firms can sustain themselves in a disruptive era through strategic approaches, as follows: they should set up their resources, processes, and values to confront newcomers emerging with new types of innovations. They should innovate to develop products or services to obtain potential profits, and then sustain them in a competitive market [7,8]. This study argued that Hungarian ICT corporates were a good model in which inter-organizational trust improved innovation. ICT firms had a high level of innovative methods, new procedures, and systems. Consequently, Hungarian ICT firms could sustain in a disruptive era by offering innovative products or services to their best customers to gain good potential profit margins.

Besides, ICT companies should offer competitive prices, improve the performance of products or services, and create market demand [96]. Those strategies could support ICT firms in meeting the challenges of disruptive technologies in a disruptive era. According to the study’s findings, a firm should create shared connection ties, confidence in partners, and mutuality, which are strongly related to the intention to share information to accomplish innovation [97] to compete under commercial pressure in a disruptive era. Innovation also improves financial performance. ICT companies should achieve innovation to compete in a disruptive era because innovation can improve business growth and anticipate volatile markets. A firm should innovate continuously, developing unique processes or systems, further developing innovative products and services, and applying an up-to-date approach to innovation. As a result, potential innovation improves profitability related to ROE, and ROCE, as shown in this study.

We noticed that the manuscript contained two flaws. First, three coefficient determinations (R2) were below six percent. The lowest R2 was the relationship between inter-organizational trust and innovation. Therefore, we suggested that future studies would examine the mediating variables in improving the relationship of aforesaid two variables, namely working in partnership with international customers, using technology to disseminate knowledge, responding to knowledge about technology, and being flexible and opportunistic [93]. We suggested that future studies include will assess financial performance using measures other than profitability, such as liquidity, leverage, and efficiency. As a result of the correct measurement, the future outcomes will have good variances. Second, we admitted that the number of samples was a minimum sample size. As a result, this research recommended increasing the number of proportionate samples representing micro, small, medium, and large ICT firms in the event of a pandemic in both developing and industrialized countries.

The findings, research questions, results of hypotheses, and further agenda are summarized in Table 12.

Table 12.

Summary of research findings.

6. Conclusions

This study supported a positive direction between trust in business partners and business performance. It emphasized that trust in business partners positively impacted financial performance as a proxy for company performance. It also extended the debate by proposing innovation as a mediating variable, improving a positive correlation between inter-organizational trust and financial performance. This study underlined the simultaneous effect of trust in business partners, innovation, and financial performance. It concluded that ICT companies were a good model explaining that cultivated inter-organizational trust, positively improved innovation, which was then related to an improvement in financial performance. However, this study had some limitations then recommended the future research agenda. First, it obtained coefficient determinations were below six percent. Therefore, it is recommended that the mediating variables in improving positive relationship trust in business partners and innovation. Second, this research did not include large companies. A further study could include and observe large firms to obtain comparable results. Finally, the result of this study only investigated companies in one sector. This result could not be generalized to an examination of other categories of firms. Hence, an exciting pathway would be an investigation of similar variables and additional indicators within different categories of companies located in developing and developed countries.

Author Contributions

J.O. designed the formal analysis, investigation, and resources; Y.A.H. performed the research method and wrote the paper; M.H. formatted the tables and the figures; Z.D.-P. performed formal analysis and funding acquisition, and J.P. conducted conceptualization, and supervision. All authors have read and agreed to the published version of the manuscript.

Funding

The project was funded under the program of the Minister of Science and Higher Education titled “Regional Initiative of Excellence” in 2019–2022, project number 018/RID/2018/19, the amount of funding PLN 10 788 423,16.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data underlying the study are available on Kaggle.com (DOI: 10.34740/KAGGLE/DSV/2583363).

Conflicts of Interest

The authors declare no conflict of interest. The founding sponsors had no role in the design of the study; in the collection, analyses, or interpretation of data; in the writing of the manuscript, and in the decision to publish the results.

References

- KSH. Value and Distribution of Gross Value Added by Industry in 2018. 2020. Available online: http://www.ksh.hu/docs/eng/xstadat/xstadat_annual/i_qpt002d.html (accessed on 13 May 2020).

- EMIS. EMIS Benchmark Key Indicators: Information (51). 2020. Available online: https://www.emis.com/php/benchmark/sector/indicators?gid=1&pc=HU&prod%5B0%5D=HU&indu=51&change_selected_countries=1&c=EUR (accessed on 21 April 2020).

- OECD. Information and Technology Companies. 2011. Available online: https://www.oecd-ilibrary.org/science-and-technology/information-and-communication-technology-ict/indicator-group/english_04df17c2-en (accessed on 2 March 2021). [CrossRef]

- United-Nations. International Standard Industrial Classification of All Economic Activities (ISIC); United Nations Publications: New York, NY, USA, 2008; Available online: https://unstats.un.org/unsd/publication/seriesm/seriesm_4rev4e.pdf (accessed on 28 February 2021).

- EMIS. EMIS Benchmark Income Statement: Information (51). 2020. Available online: https://www.emis.com/php/benchmark/sector/indicators?gid=3&pc=HU&prod%5B0%5D=HU&indu=51&change_selected_countries=1&c=EUR (accessed on 2 March 2020).

- Oláh, J.; Popp, J.; Máté, D.; Hidayat, Y.A. Market structure and concentration ratio: Evidence of Information Technology companies in Hungary. Forum Sci. Oeconomia 2019, 7, 7–18. [Google Scholar] [CrossRef]

- Christensen, C.M. The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail; Harvard Business Review Press: Cambridge, MA, USA, 1997. [Google Scholar]

- Christensen, C.M. The ongoing process of building a theory of disruption. J. Prod. Innov. Manag. 2006, 23, 39–55. [Google Scholar] [CrossRef]

- Szczepańska-Woszczyna, K. Management Theory, Innovation, and Organisation: A Model of Managerial Competencies; Routledge: London, UK, 2020. [Google Scholar]

- Szczepańska-Woszczyna, K. Strategy, corporate culture, structure and operational processes as the context for the innovativeness of an organization. Found. Manag. 2018, 10, 33–44. [Google Scholar] [CrossRef]

- Bien, H.-J.; Ben, T.-M.; Wang, K.-F. Trust relationships within R&D networks: A case study from the biotechnological industry. Innovation 2014, 16, 354–373. [Google Scholar] [CrossRef]

- Gaur, A.S.; Mukherjee, D.; Gaur, S.S.; Schmid, F. Environmental and firm level influences on inter-organizational trust and SME performance. J. Manag. Stud. 2011, 48, 1752–1781. [Google Scholar] [CrossRef]

- Shahmehr, F.S.; Khaksar, S.M.; Zaefarian, R.; Talebi, K. How relational embeddedness affects business performance through trust: Empirical research on emerging SMEs. Int. J. Entrep. Small Bus. 2015, 26, 61–77. [Google Scholar] [CrossRef]

- Vasa, L.; Baranyai, Z.; Kovacs, Z.; Szabo, G.G. Drivers of trust: Some experiences from Hungarian agricultural cooperatives. J. Int. Food Agric. Mark. 2014, 26, 286–297. [Google Scholar] [CrossRef]

- Zaheer, A.; McEvily, B.; Perrone, V. Does trust matter? Exploring the effects of interorganizational and interpersonal trust on performance. Organ. Sci. 1998, 9, 141–159. [Google Scholar] [CrossRef]

- Oláh, J.; Yusmar, A.H.; Máté, D.; Novotny, Á.; Popp, J.; Lakner, Z.; Kovács, S. A trust approach to the financial performance of information and communications technology enterprises. Pol. J. Manag. Stud. 2019, 20, 332–343. [Google Scholar] [CrossRef]

- Suseno, Y.; Ratten, V. A theoretical framework of alliance performance: The role of trust, social capital and knowledge development. J. Manag. Organ. 2007, 13, 4–23. [Google Scholar] [CrossRef]

- Gonda, G.; Gorgenyi-Hegyes, E.; Nathan, R.J.; Fekete-Farkas, M. Competitive Factors of Fashion Retail Sector with Special Focus on SMEs. Economies 2020, 8, 95. [Google Scholar] [CrossRef]

- Corsten, D.; Felde, J. Exploring the performance effects of key-supplier collaboration. Int. J. Phys. Distrib. Logist. Manag. 2005, 35, 445–461. [Google Scholar] [CrossRef]

- Lee, Y.; Cho, I.; Park, H. The effect of collaboration quality on collaboration performance: Empirical evidence from manufacturing SMEs in the Republic of Korea. TQM Bus. Excell. 2015, 26, 986–1001. [Google Scholar] [CrossRef]

- Murphy, J.T. Networks, trust, and innovation in Tanzania’s manufacturing sector. World Dev. 2002, 30, 591–619. [Google Scholar] [CrossRef]

- Wang, L.; Yeung, J.H.Y.; Zhang, M. The impact of trust and contract on innovation performance: The moderating role of environmental uncertainty. Int. J. Prod. Econ. 2011, 134, 114–122. [Google Scholar] [CrossRef]

- Landry, R.; Amara, N.; Lamari, M. Does social capital determine innovation? To what extent? Technol. Forecast. Soc. Chang. 2002, 69, 681–701. [Google Scholar] [CrossRef]

- Oláh, J.; Hidayat, Y.A.; Popp, J.; Lakner, Z.; Kovács, S. Integrative Trust and Innovation on Financial Performance in Disruptive Era. Econ. Sociol. 2021, 14, 111–136. [Google Scholar]

- Jean, R.J.B.; Sinkovics, R.R.; Hiebaum, T.P. The effects of supplier involvement and knowledge protection on product innovation in customer–supplier relationships: A study of global automotive suppliers in China. J. Prod. Innov. Manag. 2014, 31, 98–113. [Google Scholar] [CrossRef]

- Tsai, W.; Ghoshal, S. Social capital and value creation: The role of intrafirm networks. Acad. Manag. J. 1998, 41, 464–476. [Google Scholar] [CrossRef]

- Chao, Y.-C. Decision-making biases in the alliance life cycle: Implications for alliance failure. Manag. Decis. 2011, 49, 350–364. [Google Scholar] [CrossRef]

- Kliestikova, J.; Kovacova, M. Motion to innovation: Brand value sources have (not) changed over time. In Proceedings of the Innovative Economic Symposium 2017 (IES2017): Strategic Partnership in International Trade, Ceske Budejovice, Czech Republic, 19 October 2017; EDP Sciences: Ulis, France, 2017; Volume 39. [Google Scholar] [CrossRef][Green Version]

- Vaccaro, A.; Parente, R.; Veloso, F.M. Knowledge management tools, inter-organizational relationships, innovation and firm performance. Technol. Forecast. Soc. Chang. 2010, 77, 1076–1089. [Google Scholar] [CrossRef]

- Molina-Morales, F.X.; Martínez-Fernández, M.T.; Torlo, V.J. The dark side of trust: The benefits, costs and optimal levels of trust for innovation performance. Long Range Plan. 2011, 44, 118–133. [Google Scholar] [CrossRef]

- Putnam, R.D. Tuning in, tuning out: The strange disappearance of social capital in America. PS Political Sci. Politics 1995, 28, 664–683. [Google Scholar] [CrossRef]

- Fulkerson, G.M.; Thompson, G.H. The evolution of a contested concept: A meta-analysis of social capital definitions and trends (1988–2006). Sociol. Inq. 2008, 78, 536–557. [Google Scholar] [CrossRef]

- Lazányi, K.; Bilan, Y. Generetion Z on the labour market: Do they trust others within their workplace? Pol. J. Manag. Stud. 2017, 16, 78–93. [Google Scholar] [CrossRef]

- Lyu, T.; Ji, X. A meta-analysis on the impact of social capital on firm performance in China’s transition economy. Sustainability 2020, 12, 2642. [Google Scholar] [CrossRef]

- Tsai, Y.H.; Joe, S.W.; Ding, C.G.; Lin, C.P. Modeling technological innovation performance and its determinants: An aspect of buyer–seller social capital. Technol. Forecast. Soc. Chang. 2013, 80, 1211–1221. [Google Scholar] [CrossRef]

- Pratono, A.H. From social network to firm performance. Manag. Res. Rev. 2018, 41, 680–700. [Google Scholar] [CrossRef]

- Kaasa, A. Determinants of individual-level social capital: Culture and personal values. J. Int. Stud. 2019, 12, 9–32. [Google Scholar] [CrossRef]

- Cepel, M. Social and cultural factors and their impact on the quality of business environment in the SME segment. Int. J. Entrep. Knowl. 2019, 7, 65–73. [Google Scholar] [CrossRef]

- Bencsik, A.; Juhasz, T. Impacts of informal knowledge sharing (workplace gossip) on organisational trust. Econ. Sociol. 2020, 13, 249–270. [Google Scholar] [CrossRef]

- Brower, H.H.; Lester, S.W.; Korsgaard, M.A.; Dineen, B.R. A closer look at trust between managers and subordinates: Understanding the effects of both trusting and being trusted on subordinate outcomes. J. Manag. 2009, 35, 327–347. [Google Scholar] [CrossRef]

- Sako, M. Price, Quality and Trust: Inter-Firm Relations in Britain and Japan; Cambridge University Press: Cambridge, UK, 1992. [Google Scholar]

- Sako, M.; Helper, S. Determinants of trust in supplier relations: Evidence from the automotive industry in Japan and the United States. J. Econ. Behav. Organ. 1998, 34, 387–417. [Google Scholar] [CrossRef]

- Castaldo, S.; Premazzi, K.; Zerbini, F. The meaning(s) of trust. A content analysis on the diverse conceptualizations of trust in scholarly research on business relationships. J. Bus. Ethics 2010, 96, 657–668. [Google Scholar] [CrossRef]

- La Porta, R.; Lopez-de-Silanes, F.; Shleifer, A.; Vishny, R.W. Trust in Large Organizations; National Bureau of Economic Research: Cambridge, MA, USA, 1996. [Google Scholar]

- Huynh, Q.L. Reputation to the vicious circle of earnings quality and financial performance. Econ. Sociol. 2019, 12, 361–375. [Google Scholar] [CrossRef]

- Woolcock, M.; Narayan, D. Social capital: Implications for development theory, research, and policy. World Bank Res. Obs. 2000, 15, 225–249. [Google Scholar] [CrossRef]

- Williamson, O.E. Calculativeness, trust, and economic organization. J. Law Econ. 1993, 36, 453–486. [Google Scholar] [CrossRef]

- Dyer, J.H.; Singh, H. The relational view: Cooperative strategy and sources of interorganizational competitive advantage. Acad. Manag. Rev. 1998, 23, 660–679. [Google Scholar] [CrossRef]

- Baranyai, Z.; Gyuricza, C.; Vasa, L. Moral Hazard Problem and Cooperation Willingness: Some Experiences from Hungary. Actual Prob. Econ. 2012, 138, 301–310. [Google Scholar]

- Davis, J.H.; Schoorman, F.D.; Mayer, R.C.; Tan, H.H. The trusted general manager and business unit performance: Empirical evidence of a competitive advantage. Strateg. Manag. J. 2000, 21, 563–576. [Google Scholar] [CrossRef]

- Majerova, J. Monistic concept of branding has been broken: How to guarantee consistency in brand value management? Pol. J. Manag. Stud. 2020, 22, 232–246. [Google Scholar] [CrossRef]

- Cygler, J.; Wyka, S. Internal barriers to international R&D cooperation: The case of Polish high tech firms. Forum Sci. Oeconomia 2019, 7, 25–45. [Google Scholar] [CrossRef]

- Laan, A.; Noorderhaven, N.; Voordijk, H.; Dewulf, G. Building trust in construction partnering projects: An exploratory case-study. J. Purch. Supply Manag. 2012, 17, 98–108. [Google Scholar] [CrossRef]

- Afonasova, M.A.; Panfilova, E.E.; Galichkina, M.A.; Ślusarczyk, B. Digitalization in economy and innovation: The effect on social and economic processes. Pol. J. Manag. Stud. 2019, 19, 22–32. [Google Scholar] [CrossRef]

- Lendel, V.; Hittmar, S.; Sroka, W.; Siantova, E. Identification of The Main Aspects of Innovation Management and the Problems Arising from Their Misunderstanding. Commun.-Sci. Lett. Univ. Zilina 2016, 18, 42–48. [Google Scholar]

- Török, Á.; Tóth, J.; Balogh, J.M. Push or Pull? The nature of innovation process in the Hungarian food SMEs. J. Innov. Knowl. 2019, 4, 234–239. [Google Scholar] [CrossRef]

- Muriqi, S.; Fekete-Farkas, M.; Baranyai, Z. Drivers of Cooperation Activity in Kosovo’s Agriculture. Agriculture 2019, 9, 96. [Google Scholar] [CrossRef]

- Sroka, W.; Cygler, J.; Gajdzik, B. The transfer of knowledge in intra-organizational networks: A case study analysis. Organizacija 2014, 47, 24–34. [Google Scholar] [CrossRef]

- Maurer, I. How to build trust in inter-organizational projects: The impact of project staffing and project rewards on the formation of trust, knowledge acquisition and product innovation. Int. J. Proj. Manag. 2010, 28, 629–637. [Google Scholar] [CrossRef]

- Sankowska, A. Relationships between organizational trust, knowledge transfer, knowledge creation, and firm’s innovativeness. Learn. Organ. 2013, 20, 85–100. [Google Scholar] [CrossRef]

- Tóth, J.; Rizzo, G. Search strategies in innovation networks: The case of the Hungarian food industry. Sustainability 2020, 12, 1752. [Google Scholar] [CrossRef]

- Žufan, J.; Civelek, M.; Hamarneh, I.; Kmeco, Ľ. The impacts of firm characteristics on social media usage of SMEs: Evidence from the Czech Republic. Int. J. Entrep. Knowl. 2020, 8, 102–113. [Google Scholar] [CrossRef]

- Venkatraman, N.; Ramanujam, V. Measurement of business performance in strategy research: A comparison of approaches. Acad. Manag. Rev. 1986, 11, 801–814. [Google Scholar] [CrossRef]

- Stam, W.; Arzlanian, S.; Elfring, T. Social capital of entrepreneurs and small firm performance: A meta-analysis of contextual and methodological moderators. J. Bus. Vent. 2014, 29, 152–173. [Google Scholar] [CrossRef]

- Khan, K.A.; Çera, G.; Nétek, V. Perception of the selected business environment aspects by service firms. J. Tour. Serv. 2019, 10, 111–127. [Google Scholar] [CrossRef]

- Bilan, Y.; Mishchuk, H.; Roshchyk, I.; Joshi, O. Hiring and retaining skilled employees in SMEs: Problems in human resource practices and links with organizational success. Bus. Theory Pract. 2020, 21, 780–791. [Google Scholar] [CrossRef]

- Shkodra, J. Financial performance of microfinance institutions in Kosovo. J. Int. Stud. 2019, 12, 31–37. [Google Scholar] [CrossRef][Green Version]

- Martin, J.D.; Keown, A.J.; Petty, J.W. Foundations of Finance; Pearson Education Inc.: Upper Saddle River, NJ, USA, 2016; pp. 106–128. ISBN 978-0-13-299487-3. [Google Scholar]

- EMIS. Hungary ICT Sector2017/2018: An EMIS Insights Industry Report. 2018. Available online: https://www.emis.com/php/store/reports/HU/Hungary_ICT_Sector_Report_20172018_en_599331364.html (accessed on 23 November 2018).

- Wei, H.-L.; Wong, C.W.; Lai, K.-H. Linking inter-organizational trust with logistics information integration and partner cooperation under environmental uncertainty. Int. J. Prod. Econ. 2012, 139, 642–653. [Google Scholar] [CrossRef]

- Balboni, B.; Marchi, G.; Vignola, M. The moderating effect of trust on formal control mechanisms in international alliances. Eur. Manag. Rev. 2018, 15, 541–558. [Google Scholar] [CrossRef]

- Brigham, E.F.; Houston, J.F. Fundamentals of Financial Management, 15th ed.; Cengage Learning Inc.: Boston, MA, USA, 2019; pp. 116–121. ISBN 978-1-337-39525-0. [Google Scholar]

- Hair, J.F., Jr.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate Data Analysis; Cengage Learning: Andover, UK, 2019; p. 152. ISBN 978-1-4737-5654-0. [Google Scholar]

- Hair, J.F.; Risher, J.J.; Sarstedt, M.; Ringle, C.M. When to use and how to report the results of PLS-SEM. Eur. Bus. Rev. 2018, 31, 2–24. [Google Scholar] [CrossRef]

- Hair, J.F., Jr.; Hult, G.T.M.; Ringle, C.M.; Sarstedt, M. A Primer on Partial Least Squares Structural Equation Modeling (PLS-SEM); Sage Publications Inc.: Los Angeles, CA, USA, 2017; p. 235. ISBN 9781483377445. [Google Scholar]

- Ravand, H.; Baghaei, P. Partial least squares structural equation modeling with R. Pract. Assess. Res. Eval. 2016, 21, 11. [Google Scholar] [CrossRef]

- KSH. Annual Structural Indicators by SME Size Class. 2021. Available online: https://www.ksh.hu/stadat_files/gsz/en/gsz0018.html (accessed on 20 May 2021).

- Tenenhaus, M.; Vinzi, V.E.; Chatelin, Y.M.; Lauro, C. PLS path modeling. Comp. Stat. Data Anal. 2005, 48, 159–205. [Google Scholar] [CrossRef]

- Henseler, J.; Sarstedt, M. Goodness-of-fit indices for partial least squares path modeling. Comp. Stat. 2013, 28, 565–580. [Google Scholar] [CrossRef]

- Sanchez, G.; Trinchera, L.; Russolillo, G. PLS-PM: Tools for Partial Least Squares Path Modeling (PLS-PM); R Package Version 0.4; SAGE Publishing: Thousand Oaks, CA, USA, 2013. [Google Scholar]

- Fang, E.; Palmatier, R.W.; Scheer, L.K.; Li, N. Trust at different organizational levels. J. Market. 2008, 72, 80–98. [Google Scholar] [CrossRef]

- Moeller, K. Intangible and financial performance: Causes and effects. J. Int. Cap. 2009, 10, 224–245. [Google Scholar] [CrossRef]

- Palmatier, R.W.; Dant, R.P.; Grewal, D.; Evans, K.R. Factors influencing the effectiveness of relationship marketing: A meta-analysis. J. Mark. 2006, 70, 136–153. [Google Scholar] [CrossRef]

- Al-Hakim, L.; Lu, W. The role of collaboration and technology diffusion on business performance. Int. J. Prod. Perform. Manag. 2017, 66, 22–50. [Google Scholar] [CrossRef]

- Fawcett, S.E.; Jones, S.L.; Fawcett, A.M. Supply chain trust: The catalyst for collaborative innovation. Bus. Horiz. 2012, 55, 163–178. [Google Scholar] [CrossRef]

- Galford, R.; Drapeau, A.S. The enemies of trust. Harv. Bus. Rev. 2003, 81, 88–95. [Google Scholar]

- Allen, M.R.; George, B.A.; Davis, J.H. A model for the role of trust in firm level performance: The case of family businesses. J. Bus. Res. 2018, 84, 34–45. [Google Scholar] [CrossRef]

- Dyer, J.H.; Chu, W. The role of trustworthiness in reducing transaction costs and improving performance: Empirical evidence from the United States, Japan, and Korea. Organ. Sci. 2003, 14, 57–68. [Google Scholar] [CrossRef]

- Iancu, I.A.; Nedelea, A.-M. Consumer confidence from Cluj-Napoca metropolitan area, in the food labeling system. Amfiteatru Econ. 2018, 20, 116–133. [Google Scholar] [CrossRef]

- Inkpen, A.C.; Tsang, E.W. Social capital, networks, and knowledge transfer. Acad. Manag. Rev. 2005, 30, 146–165. [Google Scholar] [CrossRef]

- Capon, N.; Farley, J.U.; Lehmann, D.R.; Hulbert, J.M. Profiles of product innovators among large US manufacturers. Manag. Sci. 1992, 38, 157–169. [Google Scholar] [CrossRef]

- Darroch, J.; McNaughton, R. Examining the link between knowledge management practices and types of innovation. J. Int. Cap. 2002, 3, 210–222. [Google Scholar] [CrossRef]

- Kitchell, S. Corporate culture, environmental adaptation, and innovation adoption: A qualitative/quantitative approach. J. Acad. Mark. Sci. 1995, 23, 195–205. [Google Scholar] [CrossRef]

- Maiga, A.S.; Jacobs, F.A. Activity-based cost management and manufacturing, operational and financial performance: A structural equation modeling approach. Adv. Manag. Account. 2007, 16, 217–260. [Google Scholar] [CrossRef]

- Cooke, P.; Wills, D. Small firms, social capital and the enhancement of business performance through innovation programmes. Small Bus. Econ. 1999, 13, 219–234. [Google Scholar] [CrossRef]

- Adner, R. When are technologies disruptive? A demand-based view of the emergence of competition. Strateg. Manag. J. 2002, 23, 667–688. [Google Scholar] [CrossRef]

- Akhavan, P.; Mahdi Hosseini, S. Social capital, knowledge sharing, and innovation capability: An empirical study of R&D teams in Iran. Technol. Anal. Strateg. Manag. 2016, 28, 96–113. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).