Abstract

Competition is a relevant element in any open economy. Public policies are necessary to induce economic efficiency and to create conditions to preserve or stimulate a competitive environment. This paper aims to assess the competitiveness of hydrous ethanol price in a period of political, social and economic crises, in 15 Brazilian state capitals between the years 2012 and 2019. We compared the ethanol–gasoline price ratio behavior in two different periods, before and after the import parity price policy implemented by Petrobras in 2016. Mann–Whitney and Levene’s tests, two non-parametric statistical methods, were applied to verify significant changes between these periods. The implementation of changes in Petrobras’ pricing policy from 2016 onwards caused a statistically significant increase in the ratio coefficient of variation in two-thirds of the distribution market and more than the half of analyzed retail markets. Second, overall, the cities that showed statistically significant changes in the median and coefficient of variation in the distribution market price ratio were followed by the retail market. Our findings suggest that government interventions in the fuel and byproduct final selling prices to distributors negatively impact competition between companies that are part of the fuel distribution and retail chain, also affecting the sale of biofuels in Brazil and discouraging the initiatives to use renewable fuels to reduce the emission of pollutants.

1. Introduction

Brazilians lived through a period of political and economic stop-and-go from 2010 to 2019. Four covers’ headings from the respected British magazine The Economist summarizes how the Brazilian economic crisis turned into an institutional crisis. In November 2009 the heading was “Brazil takes off” [1]; Brazil’s economy was growing at an annualized rate of 5%. It should have picked up more speed over the following few years as big new deep-sea oil fields came online, and commodity sales grew. As a prelude to the upcoming crisis, fiscal stimulus policies, spending and tax cuts, and a monetary policy that was more lenient with inflation, continued to stimulate the market through 2014. In September 2013 the heading was “Has Brazil Blown it?” [2]; the economy grew by 0.9% relative to the previous year and hundreds of thousands of people took to the streets in mid-year for the biggest protests of this generation, protesting the rise of living costs, poor public services, and the greed and corruption of politicians. Then, between 2014 and 2016, one of the worst recessions in Brazil’s history was followed by the impeachment of president Dilma Rousseff, accused of a crime of responsibility [3].

In 2016 the heading was “The great betrayal” [4]; the economic stagnation in 2014, fiscal adjustment, and more restrictive monetary and credit policies limited the Brazilian GDP. A series of corruption allegations started in 2014, which culminated in the federal police operation named “Lava Jato”, a new anti-corruption initiative mainly focused on the state-owned oil company, Petrobras. This led to the shutdown of Petrobras’ investment capacity and a truckers’ strike in 2018. Then, in 2019 the heading was “Deathwatch for the Amazon” [5]; the government of Jair Bolsonaro tacitly approved the process of devastating the forest in the name of what the government called “development”, creating an environment of world isolationism for the country. All of these issues have contributed to persistent political, economic, and environmental crises in recent years in Brazil.

Despite being a period of severe recession, Brazil presented an atypical scenario with double-digit inflation in 2015 [6], reaching almost 11% inflation in that year [7]. The recession was driven by government austerity, for instance the withdrawal of subsidies to intermediate inputs, which led to an increase in fossil fuel and electricity prices. Brazilian inflation rose by 4.26% in 2015 compared to 2014, and variations in electricity, diesel, and gasoline prices contributed to 2.35% of this inflation rise [6].

1.1. Brazilian Fossil Fuel Policy Framework

Regarding fossil and renewable fuel products, Brazil has a price-free regime for all segments without any prior government authorization for price adjustments since 2002. Until the mid-1990s, the Brazilian federal government controlled prices, sales margins, and freight for all automotive chain fuels. Thereafter, a process of price liberalization began in the entire production chain of oil, natural gas, and biofuels, more effectively based on the Brazilian Petroleum Law (BPL), Law No. 9478/1997, which started to be fully applied on 31 December 2001. As of that date, the readjustments in fuel prices started to fall exclusively to each economic agent, including upstream fuel markets (distribution and retail). Thus, they were allowed to establish their sales prices and commercialization margins in a scenario of free competition [8,9].

Petrobras was officially the only company allowed to operate in the oil and derivatives industry in Brazil until the mid-1990s. The BPL broke this monopoly, allowing other competitors to operate in Brazil. Literature addresses the importance of free competition in fuel prices and how it affects the final consumer. The fuel price difference between unbranded and branded gas stations was analyzed in Austria, which showed that the quality of the gasoline influenced the demand, the price elasticity of demand was negative, and unbranded stations had a small influence on the prices charged by branded stations [10]. The gasoline price dispersion in San Diego, US, was measured and showed a sensitivity to the composition of station types in the local market [11]. Prices, brands, and locations at the gas station level were analyzed in Spain, with the empirical results suggesting that dominant firms tend to set prices above the average and that “low-cost” stations produce relative downward effects on the prices of local competitors [12].

On the other hand, the competition of the fuel markets can be neutralized due government fuel-subsidies [13,14,15,16]. In general, the fuel prices hold an essential role in economic policy due its lack of elasticity and the direct impact in mobility costs wherein any positive variation may cause negative reactions on many different socioeconomic levels [17]. Aucott and Hall [18] analyzed the impact of fossil and nuclear fuels on the US Gross Domestic Product (GDP). The empirical results suggest that the availability and cost of energy significantly impact the country’s economic performance, where the rise of the energy cost reflects upon the reduction of GDP.

The Brazilian government has artificially frozen gasoline C (anhydrous ethanol blended into gasoline) and diesel prices to the end consumer since 2008 with the intention of controlling inflation [19]. This seems to be a contradiction, because the BPL was created for stimulating the competition in the whole oil distribution and retail chain and its byproducts as well. The fuel price control was possible because of two reasons: Petrobras is practically the only fuel supplier for Brazilians with more than 80% of the market share for Gasoline A delivered to the distributor chain [20], and the Brazilian federal government holds the majority of the ordinary shares of Petrobras (PETR3) [21]. There was also a lack of definition regarding who was mainly responsible for the Petrobras’ pricing policy. In summary, the variation in international prices was applied with a delay to fuel prices in the country.

The period between 2012 and 2015 saw successive changes in Petrobras’ Chief Executive Officer (CEO), suggesting the attempt of the Brazilian government to intervene in fuel prices. Due to the company net losses from 2014 to 2016, with a huge loss of BRL 34.8 billion in 2015 [22], in a period where the Brent crude oil price reached values above 100 USD [23], Petrobras decided to adjust (raise) the fossil fuel prices. These years coincided with the highest Brazilian inflation rate of the decade, reaching 10.67% in 2015 (Figure 1). In 2016, Pedro Parente became the new company CEO, appointed by the president Michel Temer. He promoted a new diesel and gasoline company pricing policy based on two factors: Import parity price (IPP) plus a price margin to remunerate risks inherent to the operation [24]. The IPP increased the importance of markets in setting prices [25]. Even this change in pricing policy was not able to prevent freezing the diesel prices to face the Brazilian truckers’ strike in 2018 [26,27], likely the worst political and economic crisis of that year in Brazil.

Figure 1.

Timeline of Brazilian political and economic crises, Petrobras’ CEO turnover, and the IPP policy released in 2016. The Brazilian Inflation percentile between 2012 and 2020 is also included, provided by [7].

The Brazilian political and economic scenario in this period of recession and crisis and the main events in Petrobras including the company’s CEO turnover are summarized in Figure 1.

1.2. Ethanol and the Transition from Oil-Based Economy to the Use of Renewable Energy Resources

Bio-economy is creating a new era of economic development due to the transition from a fossil fuel-based economy to the use of renewable resources [28], and hydrous ethanol plays an important role in Brazilian’s bio-economy. Brazil is the second-largest ethanol producer worldwide, contributing 30% of the world’s ethanol production [29]. As a result of government policies, research, and technological development, sugarcane ethanol has become the most representative biofuel in the Brazilian energy matrix [30]. One way to positively impact the country GPD might be by replacing fossil fuel-powered systems with inexpensive renewable energy sources [18], such as Brazilian hydrous ethanol.

Despite Petrobras’ fossil fuel pricing policy being influenced by the Brazilian government, the price of hydrous ethanol continued to be free from governmental controls [19]. The ethanol price has a seasonal pattern and its volatility is associated with some factors—for instance, the quantity of production of sugarcane and the production mix, among other factors [31]. Dutta [32] showed that oil and sugar prices influence the Brazilian ethanol prices in the long run and suggested that an increase in the oil prices will raise the ethanol prices, but sugar prices are not affected by the fluctuations in Brent oil or ethanol prices. Kristoufek, Janda, and Zilberman [33] showed a positive long-run relationship between prices of ethanol and sugar in Brazil.

As part of a government policy to promote hydrous ethanol consumption, consumers are informed that this biofuel is economically viable to fuel vehicles when the ethanol–gasoline price ratio is below 0.70 [19,34], and the government encourages the reduction of pollutants with the renewable energy source from sugarcane [35] by the Brazilian National Biofuel Policy (Renovabio). It is a program that provides incentives for the development of biofuel chains by giving carbon credits for all biofuels in Brazil. The RenovaBio program may be compared with the United States Renewable Fuel Standard (RFS), the California Low Carbon Fuel Standard (LCFS), and the Renewable Energy Directive (RED) of the European Union. Renovabio has the ambition to expand biofuel consumption and impact the final price in the retail market, introducing a direct path between ethanol plants and service stations [9].

Consequently, over the last decade, studies have changed their focus from the effect of asymmetry in gasoline retail and crude oil prices as well as gasoline retail and distribution price movements [36,37,38] to the comparison between renewable fuels and gasoline price. Rodrigues, Losekann, and Silveira Filho [39] evaluated the asymmetric price response of gasoline and hydrous ethanol and concluded that there is both a rise of a flex-fuel vehicle fleet made consumers more sensitive to price changes, increasing the competition between hydrous ethanol and gasoline, and a high substitutability between both fuels in Brazil. Laurini [40] evaluated the spatio-temporal dynamics of ethanol–gasoline price ratios in Brazil between 2009 and 2014 and found that the hydrous ethanol price was more competitive than gasoline C only in 2009, becoming uncompetitive after that. El Montasser et al. [19] analyzed the ethanol–gasoline price ratio and showed that freezing gasoline prices weakened Petrobras’ investment capacity, depressed investments in both new sugarcane crops and distillation plants, and made hydrous ethanol prices noncompetitive for the end consumer. Khanna, Nuñez, and Zilberman [41] provided insights on the fuel policy in Brazil and analyzed the tradeoffs that the choices of this policy caused in the fuel and sugar markets.

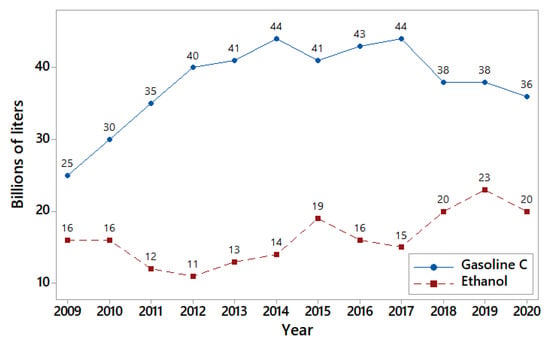

Overall, the Renovabio program, the favorable Brazilian economic scenario (mainly the inflation rate decrease), and the rise of Brent crude oil price in the period between 2016 and 2020 might have positively impacted hydrous ethanol competitiveness in the Brazilian fuel market, as gasoline C demand in the country decreased while hydrous ethanol demand increased after 2017 [42] (Figure 2).

Figure 2.

Brazilian annual demand for hydrous ethanol and gasoline C from 2009 to 2020. The gasoline C demand in Brazil decreased while hydrous ethanol demand increased after 2017.

This raises many questions regarding the impact of the Brazilian political and economic scenario, which led to Petrobras’ IPP policy, for the Brazilian fuel consumer, as well as its impact on hydrous ethanol price behavior. This paper aims to assess the ethanol–gasoline price ratio in two distinct Brazilian periods, before and after Petrobras’ IPP policy in 2016, and the competitiveness of hydrous ethanol in Brazil during the economic and political crises through 2012–2019. For this purpose, we compared the behavior of 15 Brazilian state capitals.

2. Materials and Methods

2.1. Data

We investigated the dynamics of fuel markets from 2012 to 2019 using the spatio-temporal dynamics of ethanol–gasoline price ratios in the distribution and retail markets. The ratio is an important metric for the analysis of the market dynamic because hydrous ethanol is considered economically viable for flex-fuel vehicles when the ethanol–gasoline price ratio is below 0.7 [19,34,40] and this information is highly publicized by the Brazilian media. The original data used in ethanol–gasoline price ratios were collected from a weekly survey of gasoline prices, available at the National Petroleum, Natural Gas and Biofuel Agency (ANP) [43].

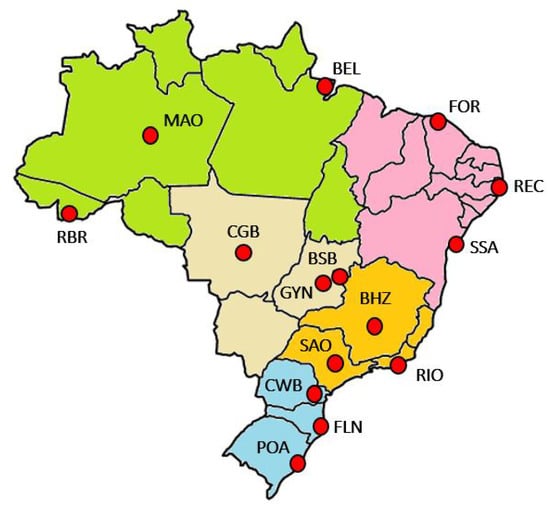

The criteria used to choose these cities was as follows: three capitals from each of the five Brazilian regions where the population is over 500,000 people (Figure 3). The same cities were used in previous studies about gasoline and ethanol prices ([8,9] with the objective of analyzing fuel markets with different behaviors and costs across the country. The time series of ethanol–gasoline price ratios were divided into two parts, before, from January 2012 to May 2016, the occasion when the Brazilian government informally imposed a policy on Petrobras that prevented the adjustment of fuel prices based on the international oil price fluctuations [44], and after, the period between June 2016 and June 2019, the occasion on which the new Petrobras CEO, Pedro Parente, implemented a new fuel price mechanism based on parity with the international market policy, the IPP. This price policy promotes the price adjustment for gasoline and diesel in refineries based on IPP plus costs such as ship freight, internal transport costs, port fees, and a markup to remunerate risks inherent to the operation, such as exchange rate volatility and prices on stays in ports and profit, in addition to taxes [24]. A similar approach regarding the sample periods was applied by Hallack, Kaufmann, and Szklo [25] to investigate Granger causality of the Brazilian fuel market.

Figure 3.

Brazilian map with the location all 15 evaluated capitals—Belém (BEL), Belo Horizonte (BHZ), Brasília (BSB), Cuiabá (CGB), Curitiba (CWB), Florianópolis (FLN), Fortaleza (FOR), Goiânia (GYN), Manaus (MAO), Porto Alegre (POA), Recife (REC), Rio Branco (RBR), Rio de Janeiro (RIO), Salvador (SSA), and São Paulo (SAO).

The dynamics of the hydrous ethanol price, the gasoline C price and the ethanol–gasoline price ratio for distribution and retail of the 15 markets per Brazilian region between 2012 and 2019 are available in the Supplementary Materials (Figures S1–S5).

2.2. Statistical Method

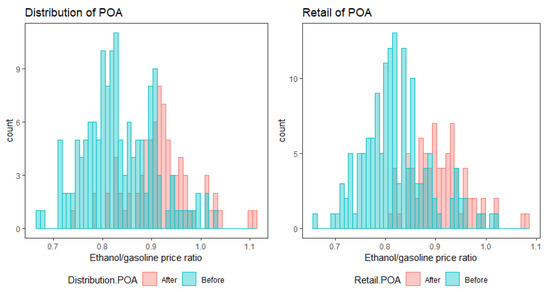

We evaluated the data used to define the statistical methods to be used in order to compare the ethanol–gasoline price ratio behavior before and after the IPP. Part of the data does not follow a normal distribution (i.e., Figure 4); we thus decided to use two non-parametric tests to determine whether the population medians and variance of these two groups differ.

Figure 4.

Sample of distribution and retail ethanol–gasoline price ratio.

First, the Mann–Whitney test [45] was applied to compare the medians between these groups, for distribution and retail markets, where means the two populations, called before and after, are equal, versus , which means the two populations are not equal with a significance level of 5% (p–value).

Second, Levene’s test based on the proposed modification of Brown and Forsythe [46] was applied to compare the variance between the same groups, where means the two populations are equal and means the two populations are not equal with a significance level of 5%.

3. Results and Discussion

The results of the non-parametric Mann–Whitney test applied to the ethanol–gasoline price ratio of the 15 cities are shown in Table 1. A third of the cities showed significant change in the distribution median, followed by a significant change on the retail median. In total, 50% of the cities showed a significant change from the median in retail. POA showed the greatest change from the median, with a rise of more than 11% after 2016 for both distribution and retail. On the other hand, the median of ethanol–gasoline price ratio for CGB was more than 8% in the retail market, which was not preceded by the distributor chain.

Table 1.

Comparative analysis of the median before and after the IPP using the statistical Mann–Whitney test. All statistically significant changes, with p-values less than 0.05, are highlighted in gray. A third of the cities showed a significant change in the distribution median. These same cities showed significant changes in the retail median (POA, FOR, RIO, REC, and BHZ). Three other cities also had significant changes in the retail median (FLN, CWB, and CGB), totaling significant changes in more than half of the cities.

FLN, CWB, and CGB demonstrated an asymmetry between distributors and retailers, as if policy changes affect only their retail markets or that there is an independence between distribution and retail in these cities. For instance, Figure 5 shows the histogram and boxplot of ethanol–gasoline price ratios before and after the IPP for CWB.

Figure 5.

CWB ethanol–gasoline price ratio of distribution and retail markets from January 2012 to May 2016 (Before) and from June 2016 to June 2019 (After)—(a) histogram of distribution, (b) boxplot of distribution, (c) histogram of retail and (d) boxplot of retail.

Table 2 shows the Interquartile Range (IQR), Coefficient of Variation (CoefVar) and Levene’s test results for the studied cities. With a few exceptions, our results show that significant changes in the distributors’ ethanol–gasoline price ratio variance were followed by changes of similar magnitude to the retailers’ (p-values less than 0.05 are highlighted in gray). The cities whose variance value rose only for the distributor chain were GYN and FOR. Two-thirds of all cities presented some kind of significant change in variance and all of these changes resulted in an increase of the CoefVar and IRQ.

Table 2.

The IQR, CoefVar, and Levene’s test results for the 15 studied cities. All statistically significant changes, with p-value sless than 0.05, are highlighted in gray. Two-thirds of all cities presented some kind of significant change in variance and all of these changes resulted in an increase of the CoefVar and IRQ.

Overall, the political and economic conditions found in Brazil after 2016 (mainly the reduction of inflation and the fiscal austerity policy implemented in the government of former president Michel Temer), Petrobras’ IPP policy implemented after the company net losses from 2014 to 2016, and the price of Brent crude oil price after 2016 impacted more than a half of the ethanol–gasoline price ratio medians.

However, the ethanol–gasoline price ratio median remained the same or significantly decreased in 66% of the analyzed cities, although the nominal oil prices were generally low after 2016 (57 USD per oil barrel on average), when compared to the pre-IPP period where the average was 75 USD and the maximum nominal price was 142 USD per barrel [25]. At first glance, this seems to be a contradiction, but it may be explained by the government interventions in the fuel and byproduct final selling prices before 2016, artificially reducing the gasoline C price at oil refineries while Brent oil prices were high in the international market [19] before the IPP and the correlation between Brent oil price and ethanol price [32].

The capitals SAO, BHZ, CWB, GYN, and CGB, which are located in the states that were the largest consumers of hydrous ethanol over the evaluated period [47], maintained a favorable price ratio for hydrous ethanol to the final consumer of approximately 0.7 or less. BHZ and CGB also showed a reduction in the ethanol–gasoline price ratio median of 4.87% and 8.87% after 2016, respectively. This scenario may have contributed to the increase in the Brazilian demand for ethanol in the same period (Figure 2). Furthermore, the increase of the ethanol–gasoline price ratio CoefVar in most cities may have been caused by the increase in the amount of readjustments in gasoline prices as a result of the IPP. The rise of gasoline price fluctuations after 2016 is shown in Figures S1–S5 of the Supplementary Materials.

The most striking observation to emerge from the data comparison was an apparent dependence of the Brazilian fuel market on the ethanol–gasoline price ratio practiced by the distributor chain. Overall, statistically significant changes of the ethanol–gasoline price ratio median or variance in the fuel distributors after 2016 were followed by changes of similar magnitude and direction of the ratio practiced by service stations in the retail market.

An increasing number of studies suggest that crises might offer room for creativity and innovation. Mens et al. [48] found that the Netherlands’ shift from conventional urban planning practices to organic planning practices, called bottom–up urban development, coincided with the financial crisis that occurred from 2008 to 2016 and can be attributed to an absence of investment. Pallagst, Vargas-Hernández, and Hammer [49] presented new strategies for shrinking cities, many of them undergoing structural changes because of economic crises. Scheidgen et al. [50] showed that crises such as COVID–19 might result in new entrepreneurial opportunities and social innovation. Petrobras’ CEO Pedro Parente released the IPP in 2016, modifying the company policy for gasoline pricing after some economic and political issues. This policy virtually extinguished the Brazilian government’s influence on artificially frozen gasoline prices to the final consumer and significantly increased the ethanol–gasoline price ratio variance, generating a new market behavior.

4. Conclusions

In this paper we verified the competitiveness of the Brazilian hydrous ethanol market after the implementation of Petrobras’ IPP policy during a period of political, social and economic turbulence in the country, from 2012 to 2019. The ethanol–gasoline price ratios were used to compare the behavior of the fuel market throughout this period. Brazil is the second-largest ethanol producer worldwide [29], contributing to the transition from a fossil energy economy to a bio-economy based on renewable sources of energy.

We have demonstrated that the political and economic scenario after Petrobras’ IPP policy modified the behavior of the ethanol–gasoline price ratio, by both changes in the cities’ median and an overall increase of the ratio variance. Hallack, Kaufmann, and Szklo [25] also identified a change in the behavior of the Brazilian fuel market after the IPP, where ethanol became a dead–end price, which fostered competition between hydrous ethanol and gasoline C. This behavior change may be related to the rise in hydrous ethanol demand after 2016 [42]. However, the likely impact of the IPP on Brazilian biofuel demand and hydrous ethanol price should be interpreted with caution. We acknowledge that sugar plays a key role in the ethanol price [32,33], and further work needs to be done to establish IPP’s contribution to increasing the consumption of hydrous ethanol from the perspective of the flex-fuel vehicle fleet in Brazil after 2016. Additionally, the impact of IPP on other biofuels, such as biodiesel, should be analyzed.

Our findings highlight the market’s dependence on the ethanol–gasoline price ratio practiced by the fuel distributors, because statistically significant changes in the fuel price ratio median or variance that occurred among the distributors were followed by changes of similar magnitude and direction in the price ratio of the retail market after the IPP, as stated in the discussion. On 12 August 2021, the government published the Provisional Measure 1063/21 that authorizes producers and importers of hydrated ethanol to sell the product directly to service stations and may reduce the dependence on fuel distributors. Murari et al. [9] also mentioned that the government may promote biofuel-only service stations through Renovabio carbon credit incentives to minimize the retail market dependence on the fuel distributors’ price and make hydrous ethanol a perfect substitute for gasoline C.

Although the price of ethanol is free from governmental controls, the ethanol–gasoline price ratio can be artificially modified if the Brazilian government eventually decides to freeze prices or give subsidies to fossil fuels with the objective of reducing pressure politics or controlling inflation. Once consumers are widely informed that hydrous ethanol is economically viable to fuel vehicles when this price ratio is below 0.7, further changes in Petrobras’ current fuel pricing policy might modify the renewable fuel market dynamics. This work has revealed the need to implement new government policies to reduce the impact of fossil fuel pricing on the final price of hydrous ethanol in the service stations, stimulating the competition between fossil and renewable fuel and taking full advantage of the benefits of the flex-fuel vehicle fleet in Brazil.

Supplementary Materials

The following are available online at https://www.mdpi.com/article/10.3390/su13179899/s1, Figure S1: The Distribution and Retail time series of the hydrous ethanol price, gasoline price and ethanol–gasoline price ratio between 2012 and 2019 of cities of the North region of Brazil. Figure S2: The Distribution and Retail time series of the hydrous ethanol price, gasoline price and ethanol–gasoline price ratio between 2012 and 2019 of cities of the Midwest region of Brazil. Figure S3: The Distribution and Retail time series of the hydrous ethanol price, gasoline price and ethanol–gasoline price ratio between 2012 and 2019 of cities of the Northeast region of Brazil. Figure S4: The Distribution and Retail time series of the hydrous ethanol price, gasoline price and ethanol–gasoline price ratio between 2012 and 2019 of cities of the Southeast region of Brazil. Figure S5: The Distribution and Retail time series of the hydrous ethanol price, gasoline price and ethanol–gasoline price ratio between 2012 and 2019 of cities of the South region of Brazil.

Author Contributions

A.S.N.F.: Supervision, Conceptualization, Methodology, Validation, Formal analysis, Investigation, Data Curation, Writing—Original Draft, Writing—Review and Editing, Funding acquisition. T.B.M.: Supervision, Conceptualization, Methodology, Validation, Formal analysis, Investigation, Data Curation, Writing—Original Draft, Writing—Review and Editing. R.G.O.d.S.: Methodology, Software, Validation, Formal analysis. J.G.A.C.: Methodology, Software, Validation, Formal analysis. H.S.: Conceptualization, Resources, Project administration, Writing—Review and Editing. M.L.V.A., Resources, Project administration, Writing—Review and Editing. E.M.F.J., Resources, Project administration, Writing—Review and Editing. All authors have read and agreed to the published version of the manuscript.

Funding

This work received financial support from the National Council for Scientific and Technological Development—CNPq, grant numbers 431990/2018-2, 313423/2019-9 and 431651/2018-3, and Bahia State Research Support Foundation—Fapesb, grant number 3022/2020.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Publicly available datasets were analyzed in this study. This data can be found here: http://www.anp.gov.br/precos-e-defesa-da-concorrencia/precos/levantamento-de-precos/serie-historica-levantamento-precos.

Conflicts of Interest

The authors declare no conflict of interest.

References

- The Economist. Brazil Takes off. 2009. Available online: https://www.economist.com/leaders/2009/11/12/brazil-takes-off (accessed on 20 June 2021).

- The Economist. Has Brazil Blown It? 2013. Available online: https://www.economist.com/leaders/2013/09/27/has-brazil-blown-it (accessed on 20 June 2021).

- Vartanian, P.R.; de Souza Garbe, H. The Brazilian economic crisis during the period 2014–2016: Is there precedence of internal or external factors? J. Int. Glob. Econ. Stud. 2019, 12, 66–86. [Google Scholar]

- The Economist. The Great Betrayal. 2016. Available online: https://www.economist.com/leaders/2016/04/23/the-great-betrayal (accessed on 20 June 2021).

- The Economist. Deathwatch for the Amazon. 2019. Available online: https://www.economist.com/leaders/2019/08/01/deathwatch-for-the-amazon (accessed on 23 June 2021).

- Sicsú, J.; de Melo Modenesi, A.; Pimentel, D. Severe recession with inflation: The case of Brazil. J. Post Keynes. Econ. 2021, 44, 89–111. [Google Scholar]

- IBGE. Instituto Brasileiro de Geografia e Estatística—(IBGE). Available online: www.ibge.gov.br (accessed on 10 May 2021).

- Nascimento Filho, A.; Pereira, E.; Ferreira, P.; Murari, T.; Moret, M. Cross-correlation analysis on Brazilian gasoline retail market. Phys. Stat. Mech. Appl. 2018, 508, 550–557. [Google Scholar] [CrossRef]

- Murari, T.B.; Nascimento Filho, A.S.; Pereira, E.J.; Ferreira, P.; Pitombo, S.; Pereira, H.B.; Santos, A.A.; Moret, M.A. Comparative analysis between hydrous ethanol and gasoline c pricing in brazilian retail market. Sustainability 2019, 11, 4719. [Google Scholar]

- Pennerstorfer, D. Spatial price competition in retail gasoline markets: Evidence from Austria. Ann. Reg. Sci. 2009, 43, 133–158. [Google Scholar] [CrossRef]

- Lewis, M. Price dispersion and competition with differentiated sellers. J. Ind. Econ. 2008, 56, 654–678. [Google Scholar]

- Balaguer, J.; Ripollés, J. Do classes of gas stations contribute differently to fuel prices? Evidence to foster effective competition in Spain. Energy Policy 2020, 139, 111315. [Google Scholar] [CrossRef]

- Davis, L.W. The economic cost of global fuel subsidies. Am. Econ. Rev. 2014, 104, 581–585. [Google Scholar] [CrossRef] [Green Version]

- Victor, D.G. The Politics of Fossil-Fuel Subsidies; International Institute for Sustainable Development: Geneva, Switzerland, 2009; pp. 26–28. [Google Scholar]

- Del Granado, F.J.A.; Coady, D.; Gillingham, R. The unequal benefits of fuel subsidies: A review of evidence for developing countries. World Dev. 2012, 40, 2234–2248. [Google Scholar]

- Parry, I. Fossil-Fuel Subsidies Assessed. Nature 2018, 554, 175–176. [Google Scholar] [CrossRef] [Green Version]

- Arzaghi, M.; Squalli, J. How price inelastic is demand for gasoline in fuel-subsidizing economies? Energy Econ. 2015, 50, 117–124. [Google Scholar] [CrossRef]

- Aucott, M.; Hall, C. Does a change in price of fuel affect GDP growth? An examination of the US data from 1950–2013. Energies 2014, 7, 6558–6570. [Google Scholar] [CrossRef] [Green Version]

- El Montasser, G.; Gupta, R.; Martins, A.L.; Wanke, P. Are there multiple bubbles in the ethanol–gasoline price ratio of Brazil? Renew. Sustain. Energy Rev. 2015, 52, 19–23. [Google Scholar] [CrossRef] [Green Version]

- Agência Nacional do Petróleo, Gás Natural e Biocombustíveis. Boletim Abastecimento em Números—63. 2019. Available online: https://www.gov.br/anp/pt-br/centrais-de-conteudo/publicacoes/boletins-anp/ban/boletim-n63.pdf (accessed on 25 July 2021).

- Petrobras. Composição Acionária. 2021. Available online: https://www.investidorpetrobras.com.br/visao-geral/composicao-acionaria/ (accessed on 25 July 2021).

- Petrobras. Divulgação de Resultados do Exercício de 2015. 2016. Available online: https://petrobras.com.br/fatos-e-dados/divulgacao-de-resultados-do-exercicio-de-2015.htm (accessed on 26 July 2021).

- Khan, K.; Su, C.W.; Umar, M.; Yue, X.G. Do crude oil price bubbles occur? Resour. Policy 2021, 71, 101936. [Google Scholar] [CrossRef]

- Petrobras. Adotamos Nova Política de Preços de Diesel e Gasolina. 2016. Available online: https://petrobras.com.br/fatos-e-dados/adotamos-nova-politica-de-precos-de-diesel-e-gasolina.htm (accessed on 27 July 2021).

- Hallack, L.N.; Kaufmann, R.; Szklo, A.S. Price discovery in Brazil: Causal relations among prices for crude oil, ethanol, and gasoline. Energy Sources Part Econ. Plan. Policy 2020, 15, 230–251. [Google Scholar]

- Moura, H.N.; Neto, J.B.L.; da Silva Santos, V.É.; Tavares, F.B.R. Resultantes da greve dos caminhoneiros (2018): Um hibridismo de estatística bilionária e o óleo diesel em face à macroeconomia. Res. Soc. Dev. 2019, 8, e50871164. [Google Scholar] [CrossRef]

- Leirião, L.F.L.; Debone, D.; Pauliquevis, T.; do Rosário, N.M.É.; Miraglia, S.G.E.K. Environmental and public health effects of vehicle emissions in a large metropolis: Case study of a truck driver strike in Sao Paulo, Brazil. Atmos. Pollut. Res. 2020, 11, 24–31. [Google Scholar]

- Vargas-Hernández, J.G.; Pallagst, K.; Hammer, P. Bio economy’s institutional and policy framework for the sustainable development of nature’s ecosystems. Econ. Coyunt. 2017, 2, 51–104. [Google Scholar]

- Renewable Fuels Association. Annual Fuel Ethanol Production. 2021. Available online: https://ethanolrfa.org/statistics/annual-ethanol-production/ (accessed on 29 July 2021).

- Karp, S.G.; Medina, J.D.; Letti, L.A.; Woiciechowski, A.L.; de Carvalho, J.C.; Schmitt, C.C.; de Oliveira Penha, R.; Kumlehn, G.S.; Soccol, C.R. Bioeconomy and biofuels: The case of sugarcane ethanol in Brazil. Biofuels Bioprod. Biorefining 2021, 15, 899–912. [Google Scholar] [CrossRef]

- David, S.A.; Quintino, D.D.; Inacio, C., Jr.; Machado, J.T. Fractional dynamic behavior in ethanol prices series. J. Comput. Appl. Math. 2018, 339, 85–93. [Google Scholar]

- Dutta, A. Cointegration and nonlinear causality among ethanol-related prices: Evidence from Brazil. GCB Bioenergy 2018, 10, 335–342. [Google Scholar] [CrossRef] [Green Version]

- Kristoufek, L.; Janda, K.; Zilberman, D. Comovements of ethanol-related prices: Evidence from Brazil and the USA. GCB Bioenergy 2016, 8, 346–356. [Google Scholar] [CrossRef] [Green Version]

- Cardoso, L.C.; Bittencourt, M.V.; Litt, W.H.; Irwin, E.G. Biofuels policies and fuel demand elasticities in Brazil. Energy Policy 2019, 128, 296–305. [Google Scholar] [CrossRef]

- Da Silva Lima, N.D.; de Alencar Nääs, I.; Reis, J.G.M.d.; Silva, R.B.T.R.d. Classifying the Level of Energy-Environmental Efficiency Rating of Brazilian Ethanol. Energies 2020, 13, 2067. [Google Scholar] [CrossRef] [Green Version]

- Borenstein, S.; Cameron, A.C.; Gilbert, R. Do gasoline prices respond asymmetrically to crude oil price changes? Q. J. Econ. 1997, 112, 305–339. [Google Scholar] [CrossRef]

- Peltzman, S. Prices rise faster than they fall. J. Political Econ. 2000, 108, 466–502. [Google Scholar] [CrossRef]

- Ray, S.; Chen, H.; Bergen, M.E.; Levy, D. Asymmetric wholesale pricing: Theory and evidence. Mark. Sci. 2006, 25, 131–154. [Google Scholar] [CrossRef]

- Rodrigues, N.; Losekann, L.; Silveira Filho, G. Demand of automotive fuels in Brazil: Underlying energy demand trend and asymmetric price response. Energy Econ. 2018, 74, 644–655. [Google Scholar]

- Laurini, M.P. The spatio-temporal dynamics of ethanol/gasoline price ratio in Brazil. Renew. Sustain. Energy Rev. 2017, 70, 1–12. [Google Scholar] [CrossRef]

- Khanna, M.; Nuñez, H.M.; Zilberman, D. Who pays and who gains from fuel policies in Brazil? Energy Econ. 2016, 54, 133–143. [Google Scholar]

- Empresa de Pesquisa Energética—EPE. Análise de Conjuntura dos Biocombustíveis—Ano 2020. Available online: https://www.epe.gov.br/sites-pt/publicacoes-dados-abertos/publicacoes/PublicacoesArquivos/publicacao-615/NT-EPE-DPG-SDB-2021-03_Analise_de_Conjuntura_dos_Biocombustiveis_ano_2020.pdf (accessed on 22 June 2021).

- Agência Nacional do Petróleo, Gás Natural e Biocombustíveis. Série Histórica do Levantamento de preçOs. 2020. Available online: http://www.anp.gov.br/precos-e-defesa-da-concorrencia/precos/levantamento-de-precos/serie-historica-levantamento-precos (accessed on 13 May 2021).

- Ferreira, P.C.G. Post-cartel behavior: Assessing the effects of antitrust policy on brazilian fuel market. REM Work. Pap. Ser. 2020, 152. [Google Scholar]

- Bauer, D.F. Constructing confidence sets using rank statistics. J. Am. Stat. Assoc. 1972, 67, 687–690. [Google Scholar] [CrossRef]

- Brown, M.B.; Forsythe, A.B. Robust tests for the equality of variances. J. Am. Stat. Assoc. 1974, 69, 364–367. [Google Scholar] [CrossRef]

- Observatório da Cana. Consumo de combustíveis. 2020. Available online: https://observatoriodacana.com.br/ (accessed on 22 August 2021).

- Mens, J.; van Bueren, E.; Vrijhoef, R.; Heurkens, E. A typology of social entrepreneurs in bottom-up urban development. Cities 2021, 110, 103066. [Google Scholar] [CrossRef]

- Pallagst, K.; Vargas-Hernández, J.; Hammer, P. Green Innovation Areas—En Route to Sustainability for Shrinking Cities? Sustainability 2019, 11, 6674. [Google Scholar] [CrossRef] [Green Version]

- Scheidgen, K.; Gümüsay, A.A.; Günzel-Jensen, F.; Krlev, G.; Wolf, M. Crises and entrepreneurial opportunities: Digital social innovation in response to physical distancing. J. Bus. Ventur. Insights 2021, 15, e00222. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).