5.1. The Influence of Economic Fluctuation and Local Bond Risk on CCB Risk-Taking

Data analysis and theoretical research show that there is a close relationship between CCB risk-taking, local debt risk and local economic fluctuation. Therefore, the following empirical model was constructed to test the impact of the local debt risk and economic fluctuations on the CCB risk-taking:

In Formula (1), the dependent variable RISK is the risk-taking of CCBs. Based on literature, the most widely used variables of bank risk-taking are NPL, RWAI and Z-score. Since the research in this paper focuses on the risk-taking of CCBs and their industrial loan flows, while Z-score focuses on measuring the bankruptcy risk, therefore, NPL and RWAI are more appropriate for this study.

Use spread between CIB and treasury as the proxy variable for local government debt risk. CIB spread is used to represent local debt risks in much classical literature [

53,

54]. Although local governments can issue bonds by themselves after 2015, local government bonds are priced irrationally sometimes [

55], and their liquidity is poor. Meanwhile, the time series since 2015 is short. In order to ensure the coherence and consistency of data, the spread of CIB is chosen as the proxy variable for local debt risk. For economic fluctuations, the provincial GDP growth rate is adopted [

56,

57].

The control variables include the growth rate of the provincial budget expenditure, which is a measure for local fiscal expenditure, the inflation rate, the growth rate of fixed asset investment and residential investment, which are measures for local economic conditions. For monetary policy, the seasonally adjusted M1 growth rate is used. In respect of the characteristic of the CCBs, the logarithm of total assets is used to represent the scale of the CCBs, the deposit/total assets is used to represent the discipline constraint [

58], the deposit/liability is used to represent the debt structure [

59], the shareholder’s equity/total assets is used to represent the leverage ratio [

60], the ROA is used to represent the profitability [

17,

61], the loan-deposit ratio and provision coverage ratio are used to represent the risk control ability [

62,

63].

The yield of CIBs and the treasury, as well as the macroeconomic data were obtained from the Wind database. The data of CCBs were obtained from Bankscope and CSMAR database. The variables definition are shown in

Table 1. The descriptive statistics is shown in

Table 2.

A Hausman test was carried out to determine whether the fixed effect or random effect model should be adopted. The results rejected the null hypothesis of random effect at the 1% level and the fixed effect model should be adopted. The model estimation results are shown in

Table 3.

The regression results show that the spread of CIBs and local economic fluctuations have a significant impact on the risk-taking of CCBs, whether using NPL or RWAI. An increase in the spread per unit of CIBs will significantly increase the NPL of CCBs by 0.1 and the RWAI by 0.02 on average. This proves that local debt risk is positively correlated with the risk-taking of CCBs, which is consistent with the research results of Zheng et al. [

64]. The negative relationship with GDP growth rate shows that every 1 percentage increase in the local economic growth rate will reduce the NPL of CCBs by 1.31 percentage and the RWAI by 0.28 percentage. This indicates that the increase of local GDP growth rate is helpful to reduce the risk-taking of the CCBs. Thus Hypothesis 1 is verified.

5.2. The Interaction among Economic Fluctuation, Local Bond Risk and CCB Risk-Taking

In order to further study the interactive relationship between local economic growth, CIB risk and CCB risk-taking, following Love & Zicchino [

65], the panel vector autoregressive (PVAR) model was constructed to describe the interaction among the three from multiple dimensions.

In Equation (2), and are fixed and time effect variables, respectively, is random disturbance, is the coefficient matrix of the variable in lag j. Subscriber i denotes the 102 CCBs, t denotes the year. is 5 * 1 vector based on the panel data. In this study, the growth rate of local fiscal expenditure and the local inflation rate are added into the endogenous variables, because these two factors are closely related to the local economic growth, local debt and CCB. Thus, the explanatory power of the model can be improved.

In order to avoid pseudo regression, the unit root test is performed first. Since the data of CCB is an unbalanced panel, only the Fisher method is applicable, while LLC and Fisher-ADF are respectively used for macro data. The unit root test results show that all the data pass the significance test at 1% level, they are stationary series.

The BIC Information criterion is calculated to select the optimal lag. The results show that 1 lag is optimal for NPL and RWAI.

5.2.1. The Interaction between Economic Fluctuation, Local Bond Risk and CCB Risk-Taking

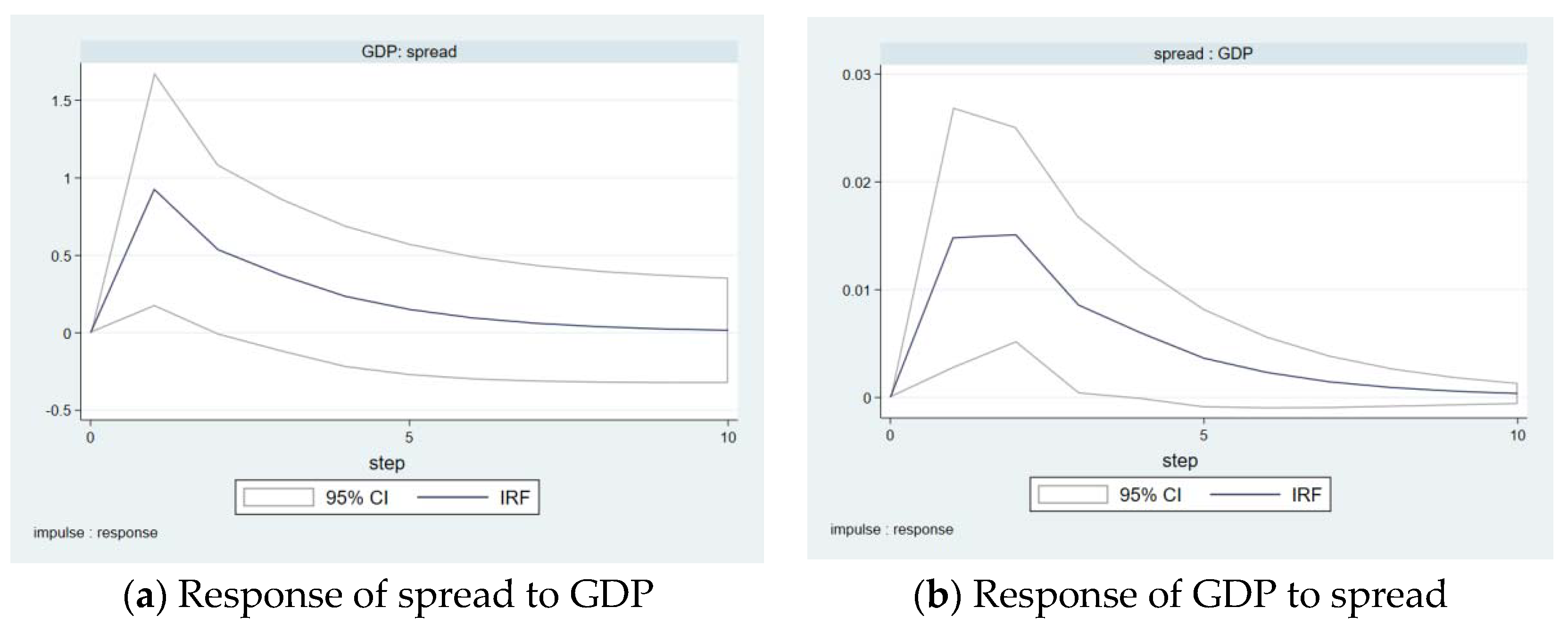

The impulse−response functions (IRF), which consider contemporaneous as well as lagged responses are presented in

Figure 2 to capture dynamic interactions among the endogenous variables. The shocks’ responses are significant when the plotted 95% confidence intervals, using 200 Monte Carlo replications, do not contain 0.

As can be seen from

Figure 2, for the impulse of the CIB spread with a standard deviation, the NPL has a negative response in the short run, then rises after reaching the lowest point in the second period, and remains positive after becoming positive in the sixth period. It suggests that although the rise of local government bond risk has a short-term tendency to reduce the risk of CCBs, it may be because the short-term increase of local debt risk prompts CCBs to adjust their risk-taking to reduce the risk, but in the long run, it still increases the risk of the CCBs. The results for RWAI are roughly the same: for the impulse of the CIB spread with a standard deviation, the RWAI has a negative response in the first three periods, then rises after reaching the lowest point in the second period, and remains positive after becoming positive in the third period. In general, the increase in the CIB risk tends to increase the risk-taking of the CCBs, which is roughly consistent with the conclusion of OLS. On the other hand, for the impulse of the NPL with a standard deviation, the CIB spread has a negative response in the short and long run, that is, CCBs increase their risk-taking behavior of credit assets, so that the CIB risk has a negative response. The results for RWAI are broadly consistent. The above results prove that in the long run, the increase in the risk of local bonds tends to increase the CCBs risk-taking, while the increase in the risk-taking of CCBs is conducive to reducing the risk of local bonds.

On the other hand, for the impulse of GDP with a standard deviation, the NPL has a positive response in the short run, then keeps declining after reaching the peak in the first period. This indicates that the CCBs increase the risk-taking when they feel the economic upturn, increase the high yield and high-risk credit supply, which confirms the procyclical behavior of CCBs. However, the sustained high economic growth offsets the risk of high-yield credit, making the NPL of CCBs quickly reduce. The IRF of RWAI is slightly different, but points to similar implications. For the impulse of GDP with a standard deviation, the RWAI has a negative response. This may be due to the different nature of the assets they reflect. The RWAI covers the financial assets such as bonds, which are more sensitive to the response of economic fluctuations and can reflect the economic trend more quickly, thus accelerating to offset the procyclical consequence of the risk-taking behavior of the CCBs. Therefore, in the IRF, it is only reflected as a negative response to economic growth. This implies that different types of CCB assets have different sensitivities to economic fluctuations. In a period of economic upswing, the risk of credit assets can only be reflected by the decline of risk until the improvement of corporate profits [

20], while the volatility of bond assets is often ahead of the economic volatility, so the risk decline can be reflected faster. This, in fact, confirms the explanation of Hypothesis 1 from another perspective: during the economic boom, CCBs tend to increase the risk-taking, but the performance of enterprises and solvency improve so as to offset the risk of CCBs partially. Therefore, the conclusions of the IRF further support Hypothesis 1.

5.2.2. The Interaction between Economic Fluctuation and Local Debt Risk

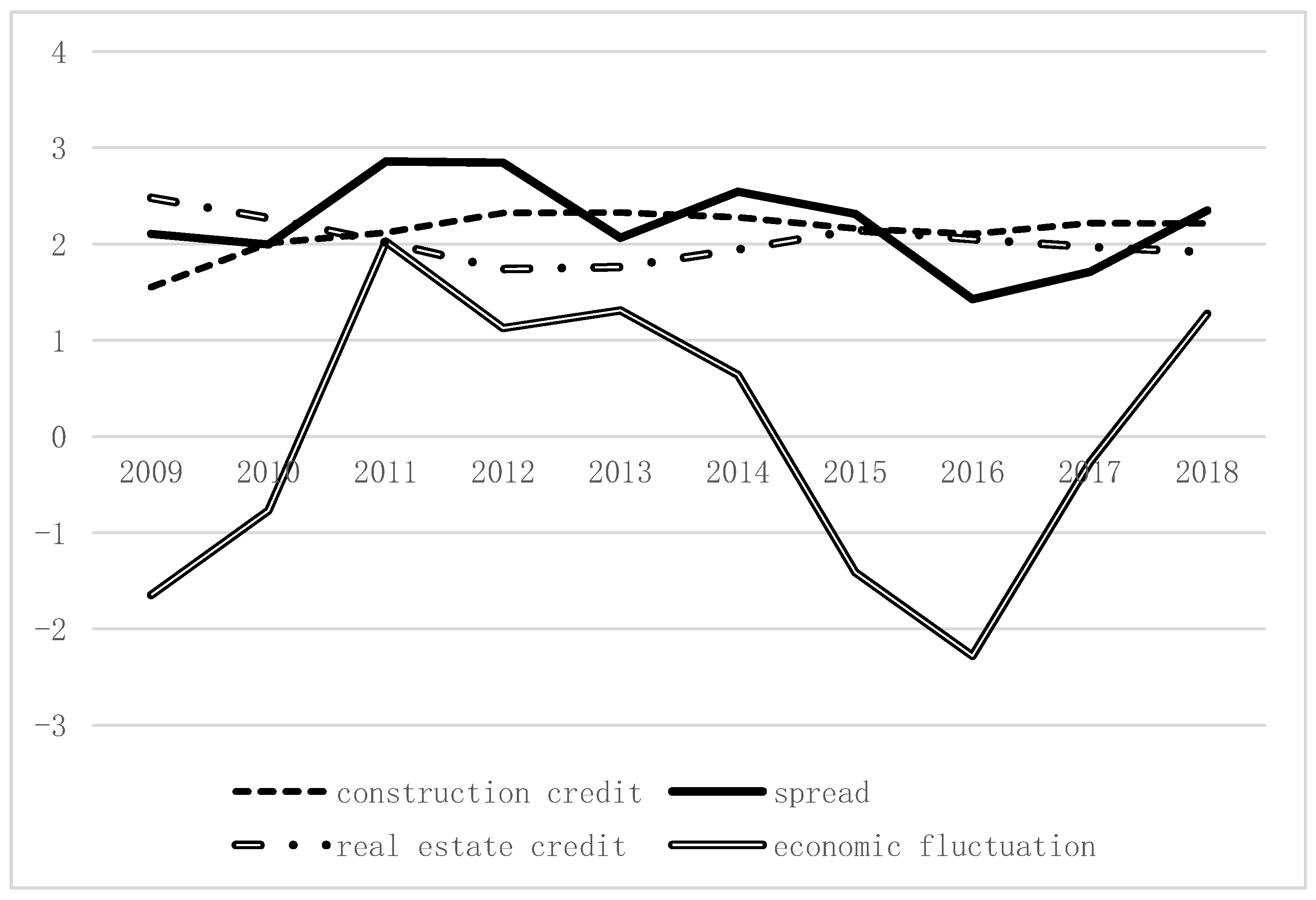

As mentioned above, the CIB risks and economic fluctuations are obviously countercyclical, that is, the CIB risks are low in a period of economic recession and vice versa. Based on the PVAR conclusion, the authors expect further studies to verify this relationship.

As can be seen from

Figure 3, for the impulse of GDP with a standard deviation, the CIB spread had a positive response rapidly, then declined after reaching the peak in the first period, remained positive and converged to 0. In other words, economic growth tends to increase the risk of CIBs, which further verifies the role played by CICs in the local economy as a countercyclical regulator: in the boom period, local governments significantly reduce fiscal investment, such as infrastructure construction, the CICs are “left out in the cold”. The capital of the CCBs that flows to CICs is greatly reduced. In addition, the debt ratio of most CICs is high. Therefore, the risk of CIBs greatly increases. However, in an economic depression, local governments greatly increase fiscal investment, such as infrastructure, to boost economic growth, so a large amount of capital from CCBs flows to CICs, which greatly increases the business volume of CICs. All these, on the one hand, greatly reduce the CIC risk. On the other hand, for the impulse of CIB risk with a standard deviation, the GDP has a positive response in the short run, which then declines after reaching the peak in the third period and converges to 0. This shows that the rising risk of CIBs is accompanied by economic recovery, the fiscal investment of CICs does a good job in stimulating economic growth. The conclusions of the IRF support Hypothesis 3. Hypothesis 3 will receive more support in our subsequent studies.

Variance decomposition can further explain the relationship among the three. The variance decomposition results are shown in

Table 4.

As shown in

Table 4, the most important explanatory factor for CIB spread is the local GDP growth rate, which reaches 2.18% after 10 periods. This further verifies the important impact of local economic growth on the CIB spread. At the same time, local fiscal investment (buex) is also an important factor, which reaches 1.85% after 10 periods. The most important factor to explain the variance of local GDP growth is also the local fiscal investment and CIB spread. Local fiscal investment explains 29% of the fluctuation of local GDP growth after 10 periods, and CIB spread also explains 7.01% of the fluctuation, which fully demonstrates the close relationship between local public finance, local economic growth and CICs. At the same time, the NPL also explains 4.61% of the fluctuation of the local GDP growth, which is also an important factor affecting the local economy. Therefore, the conclusion of variance decomposition illustrates the close relationship between local economic fluctuations and CIB spreads, which provides further support for Hypothesis 3.

On the other hand, from the perspective of the explanatory factor for NPL, the most important explanatory factor is the local GDP growth and fiscal expenditure (buex), which reach 5.5% and 9.66%, respectively, after the 10th period. CIB spread also has a certain explanatory power on the NPL of CCBs.

5.3. A Further Study on the Loan Flow Directions of CCBs

It has been proved above that the CCB risk-taking is significantly affected by the local economic fluctuations of CIB risk. Different from the existing literature, this research tries to further study what kinds of CCB assets are most affected by local economic fluctuations and CIB risk. Since credit assets account for the largest proportion in the total assets of CCBs, following the paradigm of most existing literature, this study focuses on whether the industrial flow of CCB loans is affected by the local economic fluctuations and CIB risk. Qian et al. [

66] found that CCBs will increase loan flow into the construction industry in districts where promotion pressure is high. The promotion pressure is mainly due to the pressure of local GDP growth, and the CIC’s business is mainly focused on infrastructure. Therefore, the construction industry loans from CCB are chosen to carry out further research.

As shown in

Table 5, the average proportion of the loan flow into the construction industry from CCBs to the total loans (consloan) is 6.46%, and its volume is close to the proportion of the real estate loans.

The unit root test was performed firstly. Because the data of CCB are an unbalanced panel, Fisher-ADF was selected for testing. The test results showed that the variable consloan is stable. Both AIC and BIC information criteria indicated that one lag should be selected.

The estimated PVAR parameters do not provide much information, according to Galariotis et al. [

67]. The IRF and the variance decomposition should be focused. Therefore, these IRF and variance decomposition provide valuable information in achieving the focal point of this study, which examines how CCB risk-taking responds to a surprise shock for economic fluctuation and CIB risk. Following some previous research [

67,

68] that did not discuss the estimated PVAR parameters, we thus only report the IRF and variance decomposition. However, the full results of the PVAR coefficient are available upon request.

The results of IRF are shown in

Figure 4.

Firstly, from the perspective of the consloan’s interaction with GDP and spread. For the impulse of the CIB spread with a standard deviation, the consloan had a positive response in the short run, then declined after reaching the peak in the first period, but remained positive and converged to zero. This shows that the rise of the CIB risk makes the CCBs rapidly increase the construction industry loans. As people know, one of the most important businesses of the CIC is the construction of urban infrastructure, and CCBs are the most important source of credit funds for the CICs, while the study found that when the CIB risk rose, CCBs tended to increase construction loans. Related to the above OLS regression conclusions, all this information points to the CCBs increasing the credit supply to the CICs when their risk rises, thus increasing the CCB risk-taking. This risk transmission chain from CIB to CCB has been relatively clear. Meanwhile,

Figure 4c shows that for the impulse of GDP with a standard deviation, the consloan had a sharp negative response in the short run, then rose rapidly after reaching the lowest point in the first period, became positive in the third period and converged to zero. This shows that, with the improvement of the local economy, the CCBs have rapidly reduced the construction credit supply, but in the medium and long term, they still increase the construction credit supply. This may be due to the economic growth promoted by the countercyclical fiscal regulation, which makes the construction loans fall in the short term. However, the infrastructure investment itself has a long construction cycle, so the infrastructure investment in the economic downturn period may be maintained until the economic recovery period, which also brings the local government fiscal policy partial procyclicality. This echoes the research conclusion of Jia et al. [

33].

Figure 4b shows that for the impulse of consloan with a standard deviation, the CIB spread had a negative response in the short run, then rose after reaching the lowest point in the first period and converged to zero. This indicates that the construction loans of CCBs is helpful to reduce the CIB risk, further verifies the risk transmission process of the two, linked through construction credit.

Figure 4d shows that for the impulse of consloan with a standard deviation, the GDP had a positive response in the short run, then declined after reaching the peak in the first period, remained positive and converged to zero. It shows that the construction loans increased by the CCBs due to the fiscal countercyclical regulation does play a role in stimulating economic growth.

Secondly, from the perspective of interaction between the local GDP growth and CIB spread,

Figure 4e shows that for the impulse of GDP with a standard deviation, the spread had a sharp positive response in the short run, then declined after reaching the peak in the first period, but remained positive and converged to zero. It shows that local GDP growth tends to increase the risk of CIBs.

Figure 4f shows that for the impulse of spread with a standard deviation, the GDP had a positive response in the short run, then maintained positive after reaching the peak in the second period and converged to zero. This conclusion is completely consistent with the GMM regression results of NPL mentioned above, which once again verifies that the CIB risk increases in economic prosperity, but decreases in economic recession.

The conclusions of the IRFs confirm that the impact of local economic growth tends to reduce the construction loan proportion of CCBs, while the positive impact of the CIB risk tends to make the CCBs increase the construction loan proportion. Thus, Hypothesis 2 is verified.

A series of conclusions of the model and fact analysis demonstrate that the construction industry, as the most important means of fiscal countercyclical regulation in recent years, has a significant impact on the loan flows of CCBs and CICs. During the economic recession, the countercyclical fiscal regulation mainly invests the funds into the construction industry, and the CICs undertake most of the local infrastructure. Meanwhile, the CCBs are the most important source of funds for the CICs, thus forming some strange interactions in the local economy: the economic recession forces local governments to increase infrastructure investment, so the risks of CICs, which are suppliers of local governments and undertake major infrastructure construction, are reduced, while the CCBs, as an important source of funds, significantly increase the construction loans, then the increase of construction loans indeed boosts local economic growth. As the economy recovers and business improves, CCBs are taking fewer risks. This virtuous cycle can continue if there is no significant risk to economic activity. However, empirical evidence suggests that risk does pass in this cycle. Overcommitment at any one link, which upsets the balance of the system, could create a greater risk of a vicious spiral spiraling from a virtuous one.

Finally, variance decomposition can further verify our conclusions.

From the perspective of the historical explanatory power of the capital flow of CCBs, in addition to itself, the primary explanatory factor of the consloan is the CIB spread, which reaches 1.74% after the 10th period. The impact of GDP, buex and inf is small, at 0.08%, 0.41% and 0.02%, after the 10th period. In contrast, the primary explanation factor for the spread of CIBs is also consloan, which reaches 7.56% after 10 periods, followed by GDP, 3.13% and buex, 1.78%. The construction loans ratio of CCBs and the spread of CIBs are the most important factors for each other, respectively, which once again confirms the close relationship between the construction industry, local debt and local finance. By comparing the variance decomposition of NPL in

Table 6, obvious differences can be found. The primary explanatory factors of the variance of NPL and spread are both GDP and buex. Therefore, the CIB risk affects the construction loans of CCBs, and then affects the CCB risk-taking. The variance decomposition verified the unusually close relationship between construction loans and CIB spreads, which provided further support for Hypothesis 2.

From the perspective of the explanatory power to local economic growth, the variance decomposition results in

Table 4 and

Table 6 both show the huge effect of local fiscal expenditure on local economic growth, the explanatory power after 10 periods reaches up to about 30%. At the same time, the explanatory power of CIB spread also reached 4.55% and 7.01 respectively. These two are the biggest contributors to local GDP growth. In contrast, local GDP growth and CIB spreads are also important explanatory factors for local fiscal expenditure. This implies that the local fiscal expenditure and CIC risk are closely related to local economic growth and are the most important explanatory factors for local economic growth.

5.4. Robustness

In order to further examine the robustness of the results, the following aspects were tested:

(1) According to the principle of PVAR model, the sequence of endogenous variables may affect the conclusion of the model. We re-examined the results of the GMM estimation, IRF and variance decomposition by changing the sequence of the Cholesky decomposition of endogenous variables, the main results were basically consistent with the previous analysis.

(2) In the OLS regression, the explanatory variable was changed to the z-value for the bankruptcy risk for CCBs, the results were basically consistent with the regression results of NPL and RWAI. The regression result of Z-score is shown in

Table 7.

The IRF of PVAR with Z-score is shown in

Figure 5.

Figure 5a shows that for the impulse of spread with a standard deviation, the z-score had a positive response in the short run, a negative response in the long run. That is, in the long run, the CIB spread increases the risk of bankruptcy of CCBs, which is most similar to the conclusion of NPL and basically consistent with the conclusion of RWAI.

Figure 5b shows that for the impulse of z-score with a standard deviation, the spread had a positive response. That is, the decline of the bankruptcy risk of CCBs tends to increase the CIB risk, which is completely consistent with the conclusions drawn by the aforementioned NPL, RWAI and consloan indicators.

Figure 5c shows that for the impulse of GDP with a standard deviation, the Z-score had a negative response in the short run, then rose after reaching the lowest point in the first period, remained negative and converged to zero. It shows that the economic boom makes the CCBs increase their risk-taking in a procyclical manner, but the economic growth partially offsets the risks of the CCBs. This is consistent with the result of NPL, and the RWAI results are almost the same. Slightly different, the impulsive results of RWAI did not reflect the upward trend of short-term risk, possibly because noncredit assets such as bonds were more sensitive to economic fluctuations and the economic growth accelerated to offset the procyclical behavior of CCBs, so the IRF did not show an upward trend of short-term risk, but a sustained decline of risk. The interactive relationship between GDP and CIB spread reflected in

Figure 5e,f is completely consistent with the above conclusion. To sum up, the conclusion that the risk-taking indicator of CCBs is replaced by Z-score can generally support the above analysis results of NPL and RWAI, the conclusion is robust.

(3) In order to verify the interactive relationship between the spread of CIBs and local GDP growth, these two variables were chosen to make PVAR estimates, the conclusions significantly supported the above conclusions.

As shown in

Table 8, the GMM estimation results were all significantly positive at the 1% level, and the impulse−response graphs shown in

Figure 6 are completely consistent with the above conclusions.

(4) We remove variables buex and inf in PVAR model, use , where denotes NPL, RWAI and consloan, for PVAR and IRF respectively, the conclusions are basically the same.