Impacts of Environmental Certificate and Pollution Abatement Equipment on SMEs’ Performance: An Empirical Case in Vietnam

Abstract

:1. Introduction

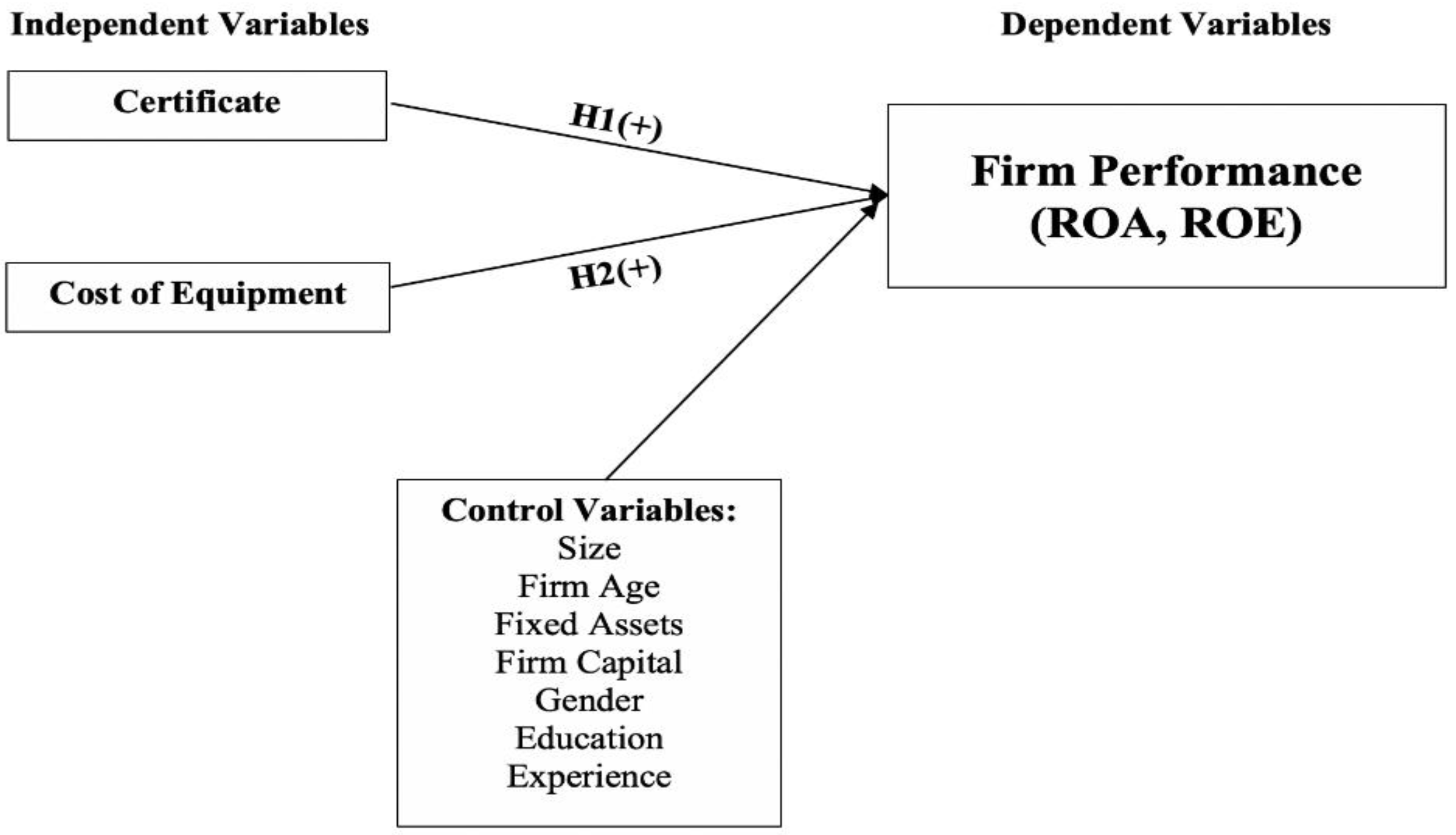

2. Literature Review and Hypothesis Development

3. Methodology and Data

3.1. Empirical Methodology

| Firm Performancei = | β0 + β1 Certificateit + β2 Cost of Equipmentit + β3 Sizeit |

| + β4 FirmAgeit + β5 Fixed Assetsit + β6 Firm Capitalit | |

| + β7 Genderit +β8 Educationit + β9 Expericenceit +Fixed Effects + μit |

3.1.1. Dependent Variable

3.1.2. Independent Variables

3.1.3. Control Variables

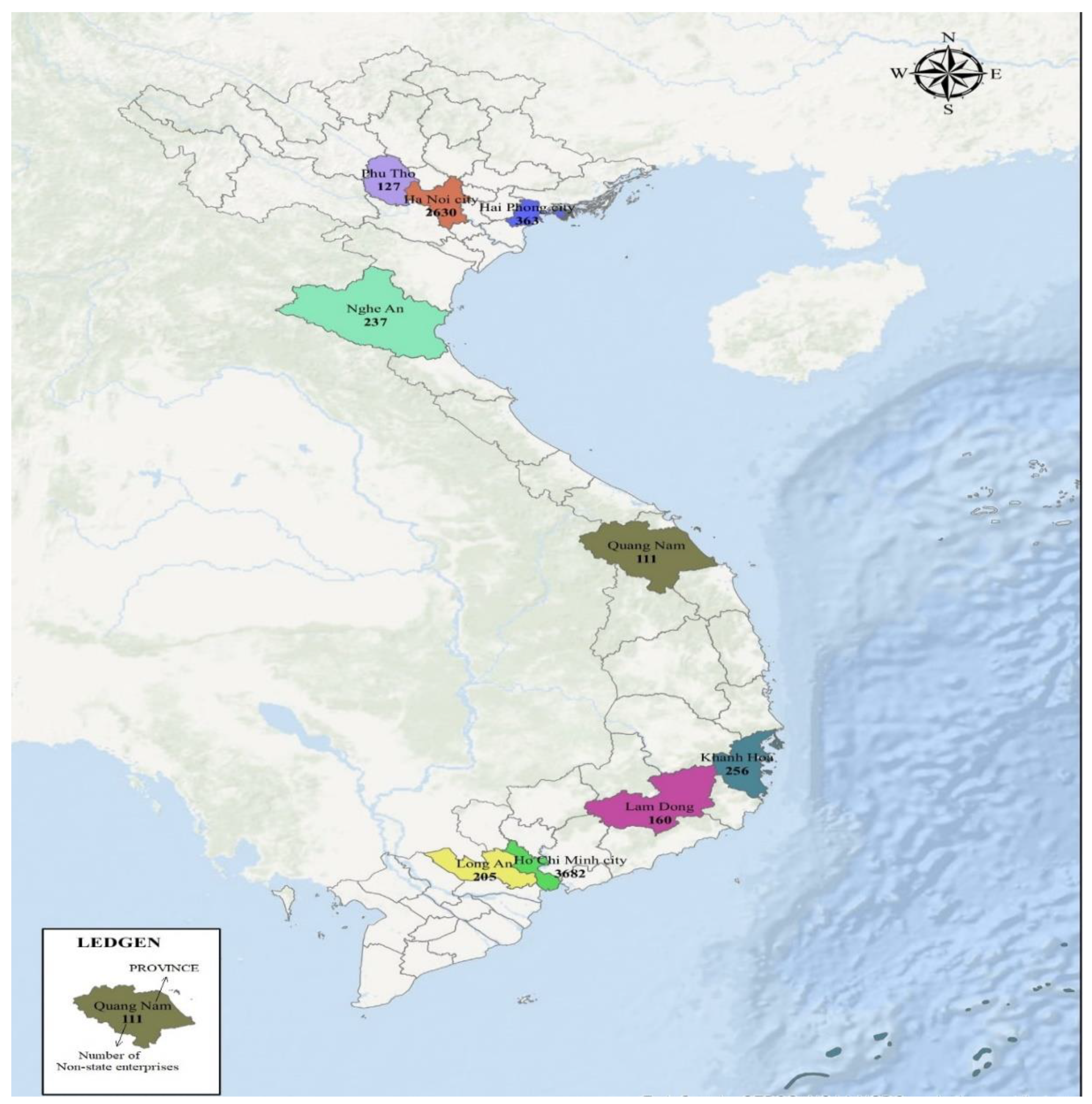

3.2. Data Description

4. Empirical Results

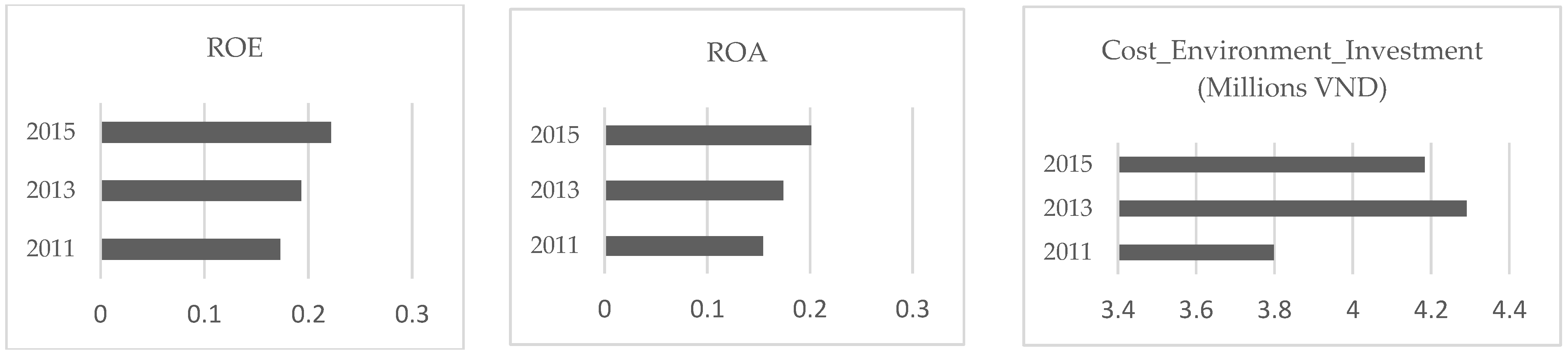

4.1. Descriptive Statistic

4.2. Correlation Analysis

4.3. Regression Analysis

4.4. Inverted U-Shaped Relationship between Investment Scales and Firm Performance

5. Conclusions

6. Implications and Limitations

- SMEs should improve their ability to make their products certified and possess more environment-related technology to accommodate greater performance and government policy.

- More importantly, getting a firm certified will broaden the benefit for owners in the long term, helping firms avoid business problems.

- In addition, enlarging the size of the firm or fixed assets will be considered a secondary plan for developing firms when they decide to accommodate a “green” project; this, thereby ensuring the effectiveness of the “green” policy on firm performance.

- The scope of this research is only conducted on SMEs in Vietnam and may not apply to other countries or market situations; therefore, the variance in the results may be significant and require retesting.

- The results of this study are based on the aggregate of certificates and funds for environment-related investments and may not accurately reflect the effect of specific conditions, such as new certificates or a different investment strategy.

- Additionally, the empirical analysis results are based on 3504 SMEs in Vietnam; hence, with a larger firm size or other significant small and medium businesses, pollution abatement equipment and certificates will have a different effect on a firm’s performance.

- Finally, we are unable to evaluate resource savings before and after the SMEs adopt and gain certificates. Another idea for future research is to study the application of environmental performance indicators in SMEs with an EMS.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Decree No. 39/2018/ND-CP Dated March 11, 2018 on Guidelines for Law on Support for Small and Medium-Sized Enterprises. 2018. Available online: https://hethongphapluat.com/decree-no-39-2018-nd-cp-dated-march-11-2018-on-guidelines-for-law-on-support-for-small-and-medium-sized-enterprises.html (accessed on 15 July 2021).

- Jenkins, H. A critique of conventional CSR theory: An SME perspective. J. Gen. Manag. 2004, 29, 37–57. [Google Scholar] [CrossRef]

- Spence, L.J.; Jeurissen, R.; Rutherfoord, R. Small business and the environment in the UK and the Netherlands: Toward stakeholder cooperation. Bus. Ethics Q. 2000, 10, 945–965. [Google Scholar] [CrossRef]

- Rand, J.; Tarp, F. Micro, Small, and Medium Enterprises in Vietnam; Oxford University Press: Oxford, UK, 2020; pp. 30–51. [Google Scholar]

- Shehu, A.M.; Mahmood, R. Influence of Entrepreneurial Orientation and Business Environment on Small and Medium Firm Performance: A PLS Approach. Adv. Manag. Appl. Econ. 2014, 4, 101–114. [Google Scholar]

- Hart, S.L.; Ahuja, G.; Arbor, A. Does it pay to be green? An empirical examination of the relationship between emission reduction and firm performance. Bus. Strategy Environ. 1996, 5, 30–37. [Google Scholar] [CrossRef]

- Taghizadeh-hesary, F.; Yoshino, N. The way to induce private participation in green finance and investment. Financ. Res. Lett. 2019, 31, 98–103. [Google Scholar] [CrossRef]

- Henriques, I.; Sadorsky, P. The relationship between environmental commitment and managerial perceptions of stakeholder importance. Acad. Manag. J. 1999, 42, 87–99. [Google Scholar]

- De Burgos-Jiménez, J.; Vázquez-Brust, D.; Plaza-Úbeda, J.A.; Dijkshoorn, J. Environmental protection and financial performance: An empirical analysis in Wales. Int. J. Oper. Prod. Manag. 2013, 33, 981–1018. [Google Scholar] [CrossRef]

- D’Amato, D.; Droste, N.; Allen, B.; Kettunen, M.; Lähtinen, K.; Korhonen, J.; Leskinen, P.; Matthies, B.D.; Toppinen, A. Green, circular, bio economy: A comparative analysis of sustainability avenues. J. Clean. Prod. 2017, 168, 716–734. [Google Scholar] [CrossRef]

- Cordeiro, J.J.; Sarkis, J. Proactivism and firm performance: Evidence from security analyst earnings forecasts. Bus. Strategy Environ. 1997, 6, 104–114. [Google Scholar] [CrossRef]

- Thornton, D.; Kagan, R.A.; Gunningham, N. Sources of Corporate Environmental Performance. Calif. Manag. Rev. 2003, 46, 127–141. [Google Scholar] [CrossRef] [Green Version]

- Rose, A. Modeling the macroeconomic impact of air pollution abatement. J. Reg. Sci. 1983, 23, 441–459. [Google Scholar] [CrossRef]

- Joshi, S.; Lave, L.; Shih, J.S.; McMichael, F. Impact of Environmental Regulations on the US Steel Industry; Carnegie Mellow University: Pittsburgh, PA, USA, 1997. [Google Scholar]

- Nelson, R.A.; Tietenberg, T.; Donihue, M.R. Differential environmental regulation: Effects on electric utility capital turnover and emissions. Rev. Econ. Stat. 1993, 75, 368–373. [Google Scholar] [CrossRef]

- Nguyen, P.H.; Nguyen, P.H.; Tsai, J.F.; Nguyen, T.T.; Ho, V.N.; Dao, T.K. Determinants of Share Prices of Listed Companies Operating in the Steel Industry: An Empirical Case from Vietnam. J. Asian Financ. Econ. Bus. 2020, 7, 131–138. [Google Scholar] [CrossRef]

- Meseguer-Sánchez, V.; Gálvez-Sánchez, F.J.; López-Martínez, G.; Molina-Moreno, V. Corporate social responsibility and sustainability. A bibliometric analysis of their interrelations. Sustainability 2021, 13, 1636. [Google Scholar] [CrossRef]

- Svensson, G.; Ferro, C.; Høgevold, N.; Padin, C.; Varela, J.C.S.; Sarstedt, M. Framing the triple bottom line approach: Direct and mediation effects between economic, social and environmental elements. J. Clean. Prod. 2018, 197, 972–991. [Google Scholar] [CrossRef]

- Ikram, M.; Zhou, P.; Shah, S.A.A.; Liu, G.Q. Do environmental management systems help improve corporate sustainable development? Evidence from manufacturing companies in Pakistan. J. Clean. Prod. 2019, 226, 628–641. [Google Scholar] [CrossRef]

- Nguyen, H.T.; Hoang, T.G.; Luu, H. Corporate social responsibility in Vietnam: Opportunities and innovation experienced by multinational corporation subsidiaries. Soc. Responsib. J. 2020, 6, 771–792. [Google Scholar] [CrossRef]

- Del Brío, J.Á.; Junquera, B. Influence of the perception of the external environmental pressures on obtaining the ISO 14001 standard in Spanish industrial companies. Int. J. Prod. Res. 2003, 41, 337–348. [Google Scholar] [CrossRef]

- Tung, N.C.; Tung, N.C. determinants of a firm’s iso 14001 certification: An empirical study of taiwan. Pac. Econ. Rev. 2007, 12, 467–487. [Google Scholar] [CrossRef]

- Pargal, S.; Wheeler, D.; Bank, T.W.; Dc, W. Determinants of Pollution Abatement in Developing Countries: Evidence from South and Southeast Asia. World Dev. 1996, 24, 1891–1904. [Google Scholar]

- Schaltegger, S.; Synnestvedt, T. The link between ‘green’ and economic success: Environmental management as the crucial trigger between environmental and economic performance. J. Environ. Manag. 2002, 65, 339–346. [Google Scholar] [CrossRef]

- Link, S.; Naveh, E. Standardization and discretion: Does the environmental standard ISO 14001 lead to performance benefits? IEEE Trans. Eng. Manag. 2006, 53, 508–519. [Google Scholar] [CrossRef]

- Barla, P. ISO 14001 certification and environmental performance in Quebec’s pulp and paper industry. J. Environ. Econ. Manag. 2007, 53, 291–306. [Google Scholar] [CrossRef]

- Nguyen, Q.A.; Hens, L. Environmental performance of the cement industry in Vietnam: The influence of ISO 14001 certification. J. Clean. Prod. 2015, 96, 362–378. [Google Scholar] [CrossRef]

- General Statistics Office. Results of the 2017 Economic Census; Statistical Publishing House: Hanoi, Vietnam, 2018. Available online: https://www.gso.gov.vn/en/data-and-statistics/2019/03/results-of-the-2017-economic-census/ (accessed on 15 July 2021).

- Mohammed, M. The ISO 14001 EMS Implementation Process and Its Implications: A Case Study of Central Japan. Environ. Manag. 2000, 25, 177–188. [Google Scholar] [CrossRef]

- Price, T.J. ISO 14001: Transition to champion? Environ. Qual. Manag. 2007, 16, 11–23. [Google Scholar] [CrossRef]

- Le Van, Q.; Viet Nguyen, T.; Nguyen, M.H. Sustainable development and environmental policy: The engagement of stakeholders in green products in Vietnam. Bus. Strateg. Environ. 2019, 28, 675–687. [Google Scholar] [CrossRef]

- Tsvetkova, D.; Bengtsson, E.; Durst, S. Maintaining sustainable practices in SMEs: Insights from Sweden. Sustainability 2020, 12, 242. [Google Scholar] [CrossRef]

- Evangelista, P.; Durst, S. Knowledge management in environmental sustainability practices of third-party logistics service providers. VINE 2015, 45, 509–529. [Google Scholar] [CrossRef]

- Länsiluoto, A.; Järvenpää, M. Environmental and performance management forces. Qual. Res. Account. Manag. 2008, 5, 184–206. [Google Scholar] [CrossRef]

- Carroll, A.B. The pyramid of corporate social responsibility: Toward the moral management of organizational stakeholders. Bus. Horiz. 1991, 34, 39–48. [Google Scholar] [CrossRef]

- Freeman, R.E. The politics of stakeholder theory: Some future directions. Bus. Ethics Q. 1994, 4, 409–421. [Google Scholar] [CrossRef]

- Friedman, M. The social responsibility of business is to increase its profits. In Corporate Ethics and Corporate Governance; Springer: Berlin/Heidelberg, Germany, 2007; pp. 173–178. [Google Scholar]

- Davidson III, W.N.; Worrell, D.L. Regulatory pressure and environmental management infrastructure and practices. Bus. Soc. 2001, 40, 315–342. [Google Scholar] [CrossRef]

- Enquist, B.; Johnson, M.; Skålén, P. Adoption of corporate social responsibility—Incorporating a stakeholder perspective. Qual. Res. Account. Manag. 2006, 3, 188–207. [Google Scholar] [CrossRef]

- Bansal, P.; Roth, K. Why companies go green: A model of ecological responsiveness. Acad. Manag. J. 2000, 43, 717–736. [Google Scholar]

- Pan, J. A comparative study on motivation for and experience with ISO 9000 and ISO 14000 certification among Far Eastern countries. Ind. Manag. Data Syst. 2003, 103, 564–578. [Google Scholar] [CrossRef] [Green Version]

- Hart, S.L. A natural-resource-based view of the firm. Acad. Manag. Rev. 1995, 20, 986–1014. [Google Scholar] [CrossRef] [Green Version]

- Porter, M.; Van der Linde, C. Green and competitive: Ending the stalemate. Harv. Bus. Rev. 1995, 73, 120–133. [Google Scholar]

- Shrivastava, P. Environmental technologies and competitive advantage. Strateg. Manag. J. 1995, 16 (Suppl. 1), 183–200. [Google Scholar] [CrossRef]

- Oxborrow, L.; Brindley, C. Adoption of “eco-advantage” by SMEs: Emerging opportunities and constraints. Eur. J. Innov. Manag. 2013, 16, 355–375. [Google Scholar] [CrossRef]

- Van Hemel, C.; Cramer, J. Barriers and stimuli for ecodesign in SMEs. J. Clean. Prod. 2002, 10, 439–453. [Google Scholar] [CrossRef]

- Rand, J.; Tarp, F. Characteristics of the Vietnamese Business Environment: Evidence from a SME Survey in 2015; Central Institute for Economic Management: Hanoi, Vietnam, 2007. [Google Scholar]

- Anh Van, N.T.; Hieu, N.K. Factors Affecting the Achievement of Environmental Standard Certificates (ESC) at Small and Medium Vietnamese Enterprises. In Proceedings of the 2018 4th International Conference on Green Technology and Sustainable Development (GTSD), Ho Chi Minh City, Vietnam, 23–24 November 2018; pp. 460–465. [Google Scholar] [CrossRef]

- Rezaee, Z.; Elam, R. Emerging ISO 14000 environmental standards: A step-by-step implementation guide. Manag. Audit. J. 2000, 15, 60–67. [Google Scholar] [CrossRef]

- Hoang-Anh, H. Business Compliance with Environmental Regulations: Evidence from Vietnam; Gothenburg: Ho Chi Minh City, Vietnam, 2015. [Google Scholar]

- Cohen, M.A.; Fenn, S.; Naimon, J.S. Environmental and Financial Performance: Are They Related? Investor Responsibility Research Center, Environmental Information Service: Washington, DC, USA, 1995. [Google Scholar]

- Cassells, S.; Lewis, K. SMEs and environmental responsibility: Do actions reflect attitudes? Corp. Soc. Responsib. Environ. Manag. 2011, 18, 186–199. [Google Scholar] [CrossRef]

- Al-Najjar, B.; Anfimiadou, A. Environmental policies and firm value. Bus. Strateg. Environ. 2012, 21, 49–59. [Google Scholar] [CrossRef]

- Freedman, M.; Jaggi, B. Pollution disclosures, pollution performance and economic performance. Omega 1982, 10, 167–176. [Google Scholar] [CrossRef]

- Ingram, R.W.; Frazier, K.B. Environmental performance and corporate disclosure. J. Account. Res. 1980, 18, 614–622. [Google Scholar] [CrossRef]

- Burke, S.; Gaughran, W.F. Developing a framework for sustainability management in engineering SMEs. Robot. Comput. Integr. Manuf. 2007, 23, 696–703. [Google Scholar] [CrossRef]

- Vernon, J.; Essex, S.; Pinder, D.; Curry, K. The ‘greening’of tourism micro-businesses: Outcomes of focus group investigations in South East Cornwall. Bus. Strateg. Environ. 2003, 12, 49–69. [Google Scholar] [CrossRef]

- Yacob, P.; Wong, L.S.; Khor, S.C. An empirical investigation of green initiatives and environmental sustainability for manufacturing SMEs. J. Manuf. Technol. Manag. 2019, 30, 2–25. [Google Scholar] [CrossRef]

- Fadly, D. Greening industry in Vietnam: Environmental management standards and resource efficiency in SMEs. Sustainability 2020, 12, 7455. [Google Scholar] [CrossRef]

- Cascio, J. The ISO 14000 Handbook; ASQ: Milwaukee, WI, USA, 1996; ISBN 0873894405. [Google Scholar]

- Marcus, P.A.; Willig, J.T. Moving Ahead with ISO 14000: Improving Environmental Management and Advancing Sustainable Development; John Wiley & Sons: San Francisco, CA, USA, 1997; Volume 4, ISBN 0471168777. [Google Scholar]

- Woodside, G.; Aurrichio, P. ISO 14001 Auditing Manual; McGraw Hill Professional: New York, NY, USA, 2000; ISBN 0071349073. [Google Scholar]

- Cheremisinoff, N.P.; Bendavid-Val, A. Green Profits: The Manager’s Handbook for ISO 14001 and Pollution Prevention; Elsevier: Amsterdam, The Netherlands, 2001; ISBN 0080507603. [Google Scholar]

- Morris, A.S. ISO 14000 Environmental Management Standards: Engineering and Financial Aspects; John Wiley & Sons: San Francisco, CA, USA, 2004; ISBN 0470090774. [Google Scholar]

- Sheldon, C. ISO 14001 and Beyond: Environmental Management Systems in the Real World; Routledge: London, UK, 2017; ISBN 1351283367. [Google Scholar]

- Heras-Saizarbitoria, I.; Molina-Azorín, J.F.; Dick, G.P.M. ISO 14001 certification and financial performance: Selection-effect versus treatment-effect. J. Clean. Prod. 2011, 19, 1–12. [Google Scholar] [CrossRef] [Green Version]

- Del Brìo, J.A.; Junquera, B. A review of the literature on environmental innovation management in SMEs: Implications for public policies. Technovation 2003, 23, 939–948. [Google Scholar] [CrossRef]

- Le, D.V.; Le, H.T.T.; Pham, T.; Van Vo, L. Access to Finance and Innovation in Small and Medium Enterprises—Evidence in Vietnam. SSRN Electron. J. 2019. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3450916 (accessed on 15 July 2021).

- Luu, H.N.; Nguyen, L.Q.T.; Vu, Q.H.; Tuan, L.Q. Income diversification and financial performance of commercial banks in Vietnam: Do experience and ownership structure matter? Rev. Behav. Financ. 2019, 12, 185–199. [Google Scholar] [CrossRef]

- Đạt, T.T.; Trường, Đ.Đ. Green Growth Towards Sustainable Development in Vietnam. VNU J. Soc. Sci. Humanit. 2013, 29, 1–14. [Google Scholar]

- Hillary, R. ISO 14001: Case Studies and Practical Experiences; Routledge: London, UK, 2017; ISBN 1351282751. [Google Scholar]

- Rehfeld, K.-M.; Rennings, K.; Ziegler, A. Integrated product policy and environmental product innovations: An empirical analysis. Ecol. Econ. 2007, 61, 91–100. [Google Scholar] [CrossRef] [Green Version]

- Coughlan, A.T.; Schmidt, R.M. Executive compensation, management turnover, and firm performance. An empirical investigation. J. Account. Econ. 1985, 7, 43–66. [Google Scholar] [CrossRef]

- Lausten, M. CEO turnover, firm performance and corporate governance: Empirical evidence on Danish firms. Int. J. Ind. Organ. 2002, 20, 391–414. [Google Scholar] [CrossRef]

- Wu, M.-W.; Shen, C.-H. Corporate social responsibility in the banking industry: Motives and financial performance. J. Bank. Financ. 2013, 37, 3529–3547. [Google Scholar] [CrossRef]

- Kamasak, R. The contribution of tangible and intangible resources, and capabilities to a firm’s profitability and market performance. Eur. J. Manag. Bus. Econ. 2017, 26, 252–275. [Google Scholar] [CrossRef] [Green Version]

- Margaritis, D.; Psillaki, M. Capital structure, equity ownership and firm performance. J. Bank. Financ. 2010, 34, 621–632. [Google Scholar] [CrossRef]

- Jadiyappa, N.; Jyothi, P.; Sireesha, B.; Hickman, L.E. CEO gender, firm performance and agency costs: Evidence from India. J. Econ. Stud. 2019, 46, 482–495. [Google Scholar] [CrossRef]

- Vu, T.-H.; Nguyen, V.-D.; Ho, M.-T.; Vuong, Q.-H. Determinants of Vietnamese Listed Firm Performance: Competition, Wage, CEO, Firm Size, Age, and International Trade. J. Risk Financ. Manag. 2019, 12, 62. [Google Scholar] [CrossRef] [Green Version]

- Becker, G.S. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education, 3rd ed.; The University of Chicago Press: Chicago, IL, USA, 2002. [Google Scholar]

- Peni, E. CEO and Chairperson characteristics and firm performance. J. Manag. Gov. 2014, 18, 185–205. [Google Scholar] [CrossRef]

- General Statistics Office of Vietnam (GSO). Business Establishments. In Results of Establishment Census of Vietnam 2002; Statistical Publishing House: Hanoi, Vietnam, 2004. [Google Scholar]

- General Statistics Office of Vietnam (GSO). The Real Situation of Enterprises through the Results of Surveys Conducted in 2005, 2006, 2007; Statistical Publishing House: Hanoi, Vietnam, 2008. Available online: https://www.gso.gov.vn/en/data-and-statistics/2019/03/2232/ (accessed on 15 July 2021).

- White Paper: Small and Medium Enterprises in Vietnam; Agency for Enterprise Development: HaNoi, Vietnam, 2014; Available online: https://www.economica.vn/Portals/0/Documents/VN%20SME%20White%20Book%202014Available%20online (accessed on 15 July 2021).

- Bostian, M.; Färe, R.; Grosskopf, S.; Lundgren, T. Environmental investment and firm performance: A network approach. Energy Econ. 2016, 57, 243–255. [Google Scholar] [CrossRef] [Green Version]

- Aron, D.J. Ability, Moral Hazard, Firm Size, and Diversification. RAND J. Econ. 1988, 19, 72. [Google Scholar] [CrossRef]

- Porter, M. America’s green strategy. Bus. Environ. A Read. 1996, 33, 1072. [Google Scholar]

- Akhtar, I.; Nazir, N. Effect of waterlogging and drought stress in plants. Int. J. Water Resour. Environ. Sci. 2013, 2, 34–40. [Google Scholar] [CrossRef]

- Quesada, C.A.; Miranda, A.C.; Hodnett, M.G.; Santos, A.J.B.; Miranda, H.S.; Breyer, L.M. Seasonal and depth variation of soil moisture in a burned open savanna (campo sujo) in central Brazil. Ecol. Appl. 2004, 14 (Suppl. 4), 33–41. [Google Scholar] [CrossRef]

- Masakure, O.; Cranfield, J.; Henson, S. Factors affecting the incidence and intensity of standards certification evidence from exporting firms in Pakistan. Appl. Econ. 2011, 43, 901–915. [Google Scholar] [CrossRef]

- Campos, L.M.S. Environmental management systems (EMS) for small companies: A study in Southern Brazil. J. Clean. Prod. 2012, 32, 141–148. [Google Scholar] [CrossRef]

- Nakamura, M.; Takahashi, T.; Vertinsky, I. Why Japanese firms choose to certify: A study of managerial responses to environmental issues. J. Environ. Econ. Manag. 2001, 42, 23–52. [Google Scholar] [CrossRef] [Green Version]

- Jawahar, I.M.; McLaughlin, G.L. Toward a descriptive stakeholder theory: An organizational life cycle approach. Acad. Manag. Rev. 2001, 26, 397–414. [Google Scholar] [CrossRef]

- Blomgren, A. Does corporate social responsibility influence profit margins? A case study of executive perceptions. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 263–274. [Google Scholar] [CrossRef]

| Micro-Enterprises | Small Enterprises | Medium Enterprises | ||||

|---|---|---|---|---|---|---|

| Number of employees (Person) | Total capital and total revenue (VND billion) | Number of employees (Person) | Total capital and total revenue (VND billion) | Number of employees (Person) | Total capital and total revenue (VND billion) | |

| Agriculture, Forestry, Fisheries, Industry and Construction | No more than 10 | No more than 3 in annual total revenue or no more than 3 in total capital | From more than 10 to 100 | No more than 50 in annual total revenue or no more than 20 in total capital | From more than 10 to 200 | No more than 200 in annual total revenue or no more than 100 in total capital |

| Trade and service | No more than 10 | No more than 10 in annual total revenue or no more than 3 in total capital | From more than 10 to 50 | No more than 100 in annual total revenue or no more than 50 in total capital | From more than 10 to 100 | No more than 300 in annual total revenue or no more than 100 in total capital |

| Variables | Definition | Source |

|---|---|---|

| Performance | Return on Equity (ROE), Return on Assets (ROA) | SMEs Surveys |

| Certificate | Dummy variables, one if the firm has the ESC, zero otherwise | SMEs Surveys |

| Cost of Equipment | Total expenses the firm spends to buy equipment for tackling the environment-related problems | SMEs Surveys |

| Size | Ln (Total Assets) | SMEs Surveys |

| Firm Age | Ln (Years of operation since the firm’s establishment +1) | SMEs Surveys |

| Fixed Assets | Firm’s fixed assets divided by total assets | SMEs Surveys |

| Firm Capital | Firm’s equity divided by total assets | SMEs Surveys |

| Gender | Dummy variables, one if the owner is male, zero otherwise | SMEs Surveys |

| Education | Dummy variables, one if the owner finished upper secondary school, zero otherwise | SMEs Surveys |

| Experience | Ln (Number of years the owner taking over the company) | SMEs Surveys |

| Firm Size | 2011 | 2013 | 2015 |

|---|---|---|---|

| Micro | 535 | 596 | 680 |

| Small | 604 | 607 | 596 |

| Medium | 1248 | 1192 | 1177 |

| Total | 2387 | 2395 | 2453 |

| Mean | SD | p25 | p50 | p75 | |

|---|---|---|---|---|---|

| ROE | 0.197 | 0.201 | 0.049 | 0.121 | 0.280 |

| ROA | 0.177 | 0.177 | 0.047 | 0.113 | 0.250 |

| Certificate (dummy) | 0.154 | 0.361 | 0 | 0 | 0 |

| Cost of Equipment (Millions VND) | 4.093 | 4.441 | 0 | 0 | 8.305 |

| Size (ln) | 14.239 | 1.430 | 13.164 | 14.300 | 15.315 |

| Firm Age (year) | 2.581 | 0.549 | 2.197 | 2.639 | 2.996 |

| Fixed Assets (ln) | 0.783 | 0.187 | 0.681 | 0.845 | 0.932 |

| Firm Capital | 0.944 | 0.103 | 0.938 | 1 | 1 |

| Gender (dummy) | 0.606 | 0.488 | 0 | 1 | 1 |

| Education (dummy) | 0.687 | 0.464 | 0 | 1 | 1 |

| Experience (ln) | 13.008 | 6.980 | 8 | 12 | 18 |

| Observations | 7701 | 7701 | 7701 | 7701 | 7701 |

| Variables | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

|---|---|---|---|---|---|---|---|---|---|

| ROE | 1.000 | ||||||||

| ROA | 0.305 *** | 1.000 | |||||||

| Certificate | 0.309 *** | 0.435 *** | 1.000 | ||||||

| Cost of Equipment | −0.043 *** | −0.151 *** | −0.161 *** | 1.000 | |||||

| Size | −0.094 *** | −0.098 *** | 0.052 *** | 0.127 *** | 1.000 | ||||

| Firm Age | −0.098 *** | −0.067 *** | −0.061 *** | 0.076 *** | 0.298 *** | 1.000 | |||

| Fixed Assets | −0.101 *** | −0.106 *** | −0.078 *** | 0.043 *** | 0.029 ** | 0.015 | 1.000 | ||

| Firm Capital | 0.156 *** | 0.259 *** | 0.259 *** | −0.155 *** | −0.172 *** | −0.109 *** | −0.012 | 1.000 | |

| Gender | −0.079 *** | −0.158 *** | −0.198 *** | 0.862 *** | 0.141 *** | 0.089 *** | 0.069 *** | −0.155 *** | 1.000 |

| (1) | (2) | |

|---|---|---|

| Variables | ROE | ROA |

| Certificate | 0.024 *** | 0.022 *** |

| (0.007) | (0.006) | |

| Cost of Equipment | 3.201 *** | 2.725 *** |

| (0.667) | (0.606) | |

| Size | −0.071 *** | −0.065 *** |

| (0.002) | (0.002) | |

| Firm Age | −0.010 | −0.006 |

| (0.008) | (0.007) | |

| Fixed Assets | −0.256 *** | −0.237 *** |

| (0.016) | (0.014) | |

| Firm Capital | −0.187 *** | 0.006 |

| (0.029) | (0.024) | |

| Gender | −0.003 | −0.002 |

| (0.005) | (0.004) | |

| Education | 0.002 | 0.003 |

| (0.005) | (0.005) | |

| Experience | −0.000 | −0.000 |

| (0.001) | (0.001) | |

| Constant | 1.564 *** | 1.238 *** |

| (0.096) | (0.084) | |

| Year FEs | Yes | Yes |

| Industry FEs | Yes | Yes |

| R-square | 0.37 | 0.36 |

| Observations | 5558 | 5527 |

| Number of Firms | 2906 | 2898 |

| (1) | (2) | |

|---|---|---|

| Variables | ROE | ROA |

| Certificate | 0.024 *** | 0.022 *** |

| (0.007) | (0.006) | |

| Cost of Equipment | 3.518 ** | 3.529 ** |

| (1.580) | (1.448) | |

| Size | −0.072 *** | −0.065 *** |

| (0.002) | (0.002) | |

| Firm Age | −0.010 | −0.006 |

| (0.008) | (0.007) | |

| Fixed Assets | −0.256 *** | −0.237 *** |

| (0.016) | (0.014) | |

| Firm Capital | −0.187 *** | 0.007 |

| (0.029) | (0.024) | |

| Gender | −0.003 | −0.001 |

| (0.005) | (0.004) | |

| Education | 0.002 | 0.002 |

| (0.005) | (0.005) | |

| Experience | −0.000 | −0.000 |

| (0.001) | (0.001) | |

| Constant | 1.563 *** | 1.237 *** |

| (0.096) | (0.085) | |

| Year FEs | Yes | Yes |

| Industry FEs | Yes | Yes |

| R-square | 0.37 | 0.36 |

| Observations | 5558 | 5527 |

| Number of Firms | 2906 | 2898 |

| ROE | ROA | |||

|---|---|---|---|---|

| (1) | (2) | (3) | (4) | |

| Variables | Small Investment | Large Investment | Small Investment | Large Investment |

| Certificate | 0.015 * | 0.043 *** | 0.012 * | 0.040 *** |

| (0.008) | (0.014) | (0.007) | (0.013) | |

| Cost of Equipment | 8.863 * | 3.685 *** | 8.525 * | 2.749 *** |

| (4.933) | (1.044) | (4.456) | (0.976) | |

| Size | −0.070 *** | −0.076 *** | −0.064 *** | −0.068 *** |

| (0.002) | (0.005) | (0.002) | (0.004) | |

| Firm Age | −0.010 | −0.009 | −0.008 | −0.002 |

| (0.008) | (0.020) | (0.007) | (0.019) | |

| Fixed Assets | −0.271 *** | −0.249 *** | −0.246 *** | −0.243 *** |

| (0.019) | (0.030) | (0.017) | (0.028) | |

| Firm Capital | −0.187 *** | −0.192 *** | −0.013 | 0.043 |

| (0.032) | (0.056) | (0.027) | (0.047) | |

| Gender | 0.001 | −0.013 | 0.001 | −0.007 |

| (0.005) | (0.011) | (0.005) | (0.010) | |

| Education | 0.001 | 0.015 | 0.001 | 0.015 |

| (0.005) | (0.013) | (0.005) | (0.012) | |

| Experience | −0.000 | −0.000 | 0.000 | −0.001 |

| (0.001) | (0.002) | (0.001) | (0.001) | |

| Constant | 1.649 *** | 1.502 *** | 1.324 *** | 1.138 *** |

| (0.044) | (0.177) | (0.041) | (0.161) | |

| Year FEs | Yes | Yes | Yes | Yes |

| Industry FEs | Yes | Yes | Yes | Yes |

| R-square | 0.38 | 0.33 | 0.38 | 0.32 |

| Observations | 4399 | 1159 | 4371 | 1156 |

| Number of Firms | 2551 | 962 | 2538 | 963 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tsai, J.-F.; Nguyen, P.-H.; Lin, M.-H.; Nguyen, D.-V.; Lin, H.-H.; Ngo, A.-T. Impacts of Environmental Certificate and Pollution Abatement Equipment on SMEs’ Performance: An Empirical Case in Vietnam. Sustainability 2021, 13, 9705. https://doi.org/10.3390/su13179705

Tsai J-F, Nguyen P-H, Lin M-H, Nguyen D-V, Lin H-H, Ngo A-T. Impacts of Environmental Certificate and Pollution Abatement Equipment on SMEs’ Performance: An Empirical Case in Vietnam. Sustainability. 2021; 13(17):9705. https://doi.org/10.3390/su13179705

Chicago/Turabian StyleTsai, Jung-Fa, Phi-Hung Nguyen, Ming-Hua Lin, Duy-Van Nguyen, Hsu-Hao Lin, and Anh-Tuan Ngo. 2021. "Impacts of Environmental Certificate and Pollution Abatement Equipment on SMEs’ Performance: An Empirical Case in Vietnam" Sustainability 13, no. 17: 9705. https://doi.org/10.3390/su13179705

APA StyleTsai, J.-F., Nguyen, P.-H., Lin, M.-H., Nguyen, D.-V., Lin, H.-H., & Ngo, A.-T. (2021). Impacts of Environmental Certificate and Pollution Abatement Equipment on SMEs’ Performance: An Empirical Case in Vietnam. Sustainability, 13(17), 9705. https://doi.org/10.3390/su13179705