Application of Fuzzy Logic to Evaluate the Economic Impact of COVID-19: Case Study of a Project-Oriented Travel Agency

Abstract

:1. Introduction

2. Materials and Methods

2.1. Basic Concepts of Fuzzy Logic

- -

- Intersection of two fuzzy subsets A and B: μA∩μB = minimum {μA(x), μB(x)}

- -

- Merge of two fuzzy subsets A and B: μA∪μB = maximum {μA(x), μB(x)}

- -

- The complement of A: μA’(x) = 1 − μA(x)

2.2. Steps of Modeling

3. Results

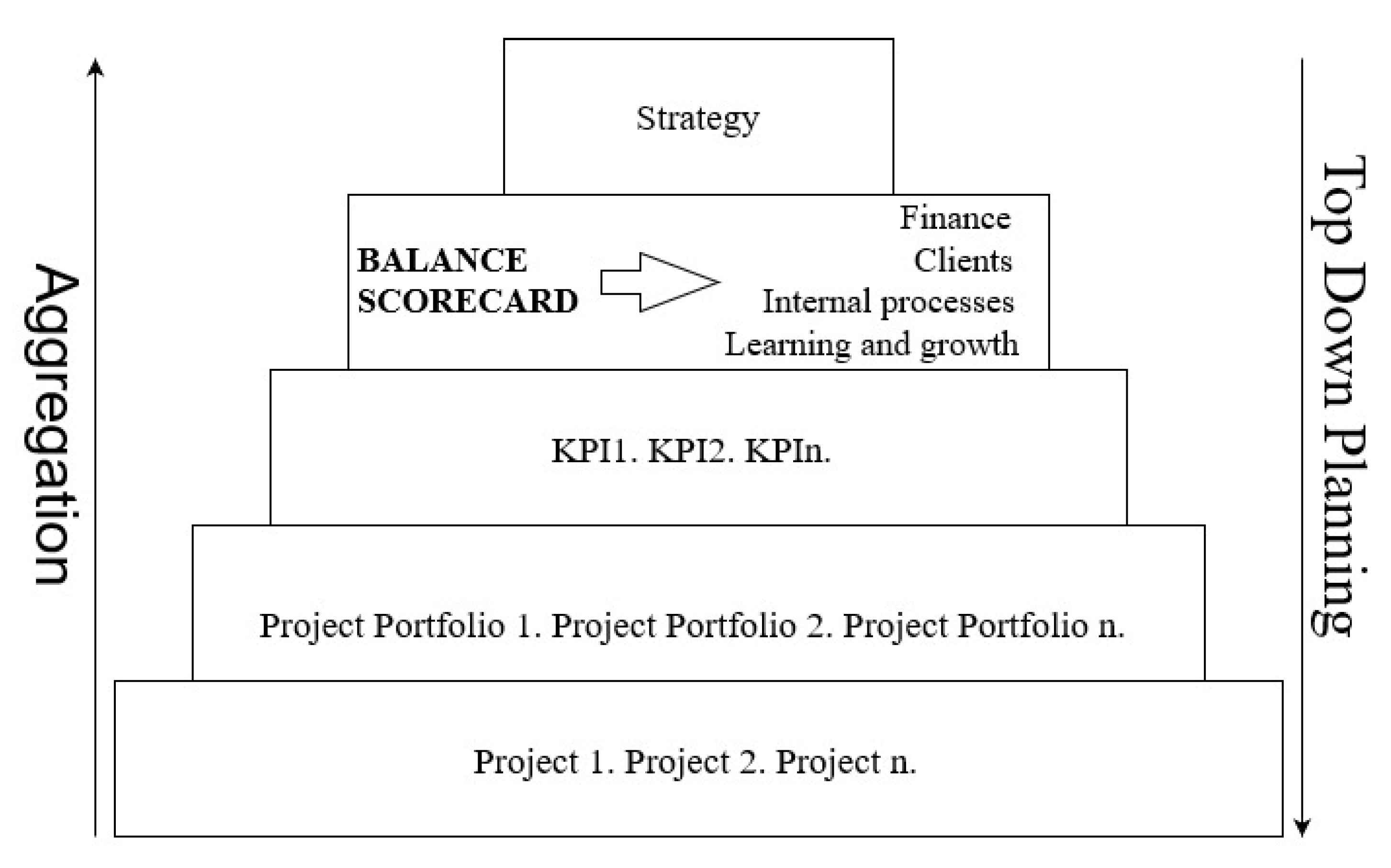

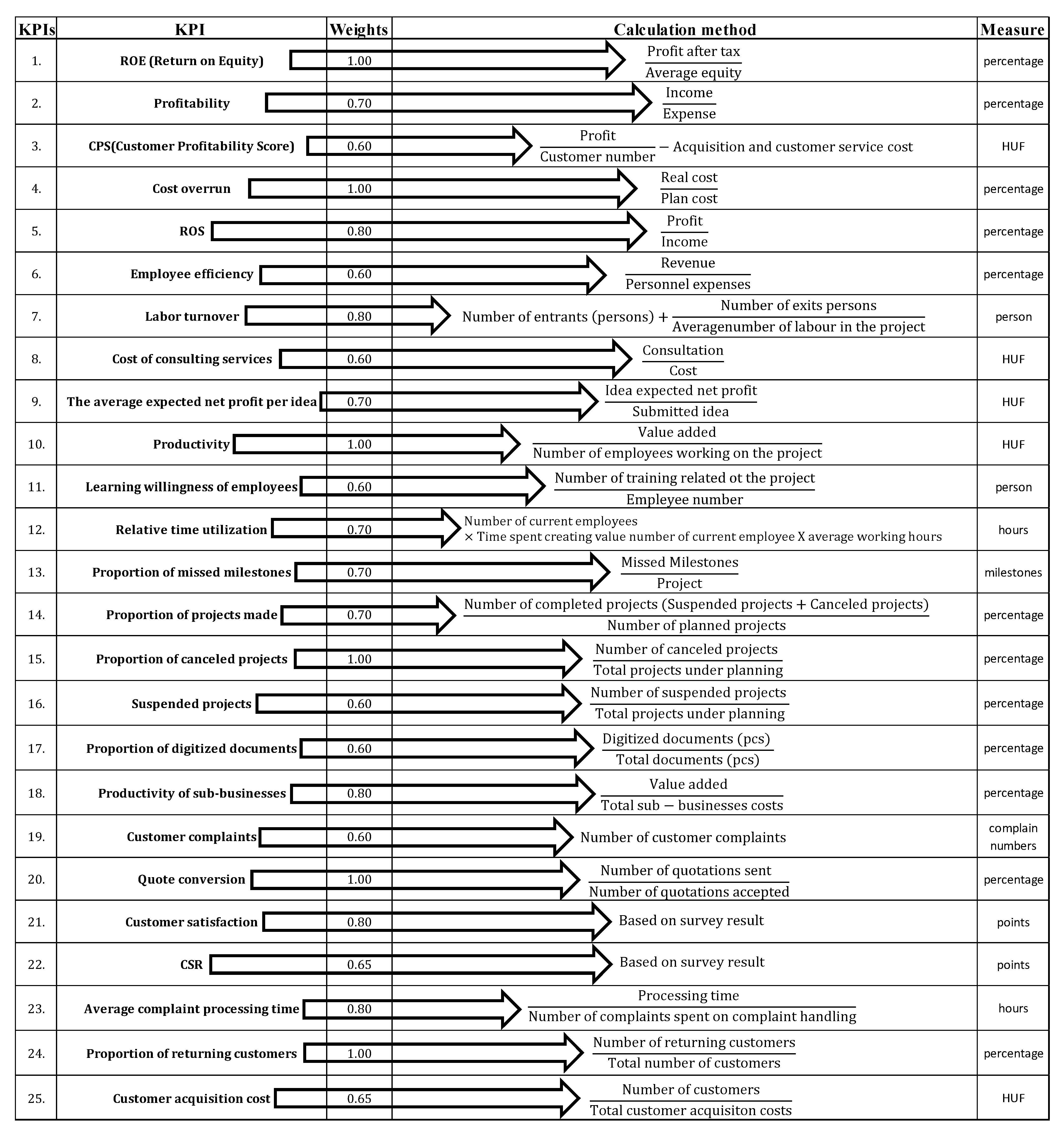

3.1. Step 1. Selection of the KPIs that Affect Strategic Effectiveness and Determining Plan–Fact Analysis Ratios for the KPIs

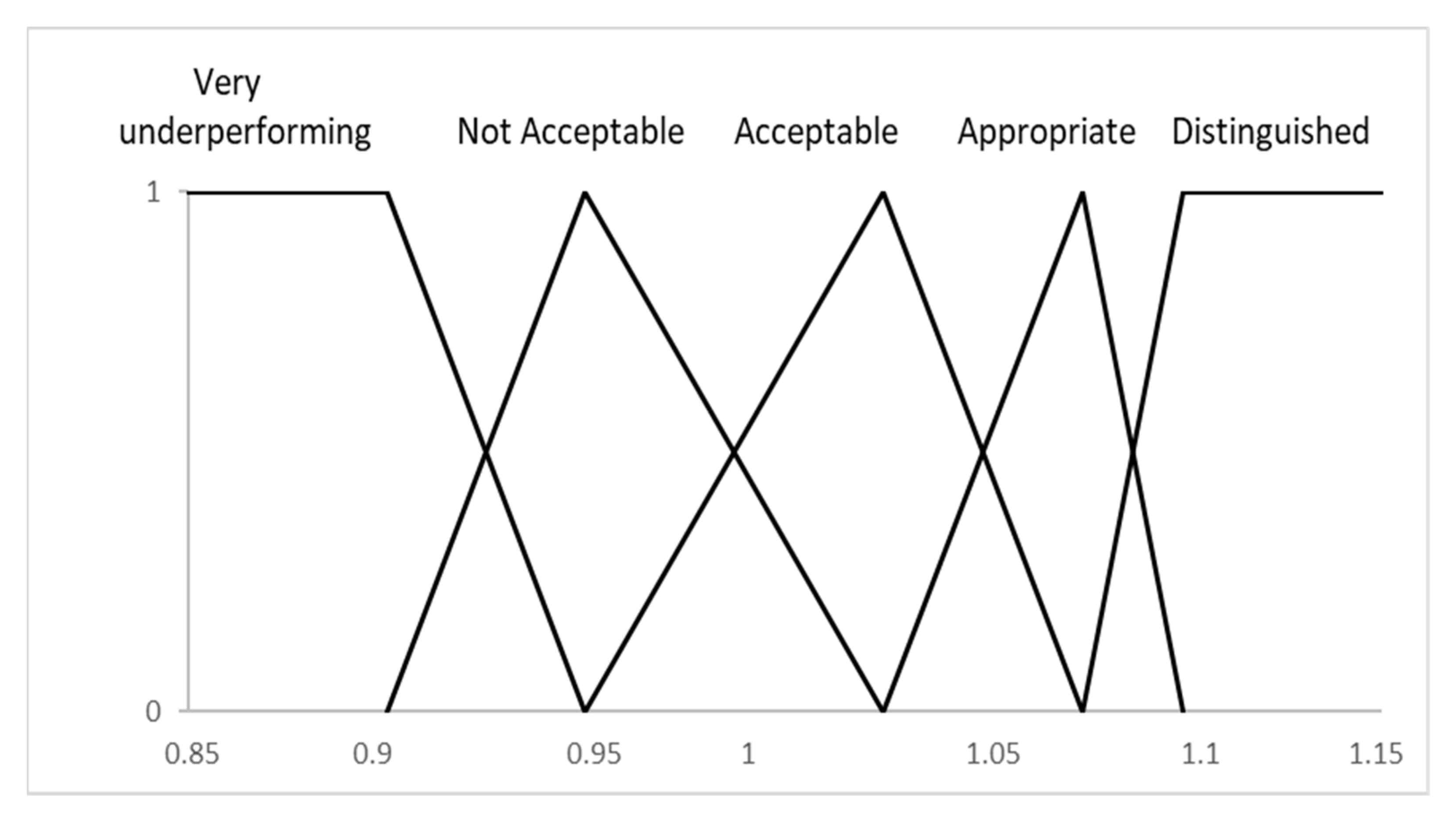

3.2. Step 2: Weighting of Aggregates Created Based on Subjective Expert Opinion. Choice of Different Standardization Norms to Evaluate Ratios from Plan–Fact Analysis for the KPIs

3.3. Step 3: Evaluate Aggregates, Created Based on Subjective Expert Opinion, Based on Selected Standardized Norms

3.4. Step 4: Evaluate the Aggregated Results of the Selected KPIs Based on the Selected Standardized Norms

3.5. Step 5: Define and Evaluate Aggregates for Balanced-Scorecard Perspectives Based on Different Standardization Norms

3.6. Step 6: Define and Evaluate a Strategic Performance Index Based on Different Standardization Norms

4. Discussion

5. Conclusions

6. Implications of the Study

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Lew, A.A. Why travel?–travel, tourism and global consciousness. Tour. Geogr. 2018, 20, 742–749. [Google Scholar] [CrossRef] [Green Version]

- Gössling, S.; Scott, D.; Hall, C.M. Pandemics, tourism and global change: A rapid assessment. J. Sustain. Tour. 2020, 29, 1–20. [Google Scholar] [CrossRef]

- Gursoy, D.; Chi, C.G. Effects of COVID-19 pandemic on hospitality industry: Review of the current situations and a research agenda. J. Hosp. Mark. Manag. 2020, 29, 527–529. [Google Scholar] [CrossRef]

- Song, H.J.; Yeon, J.; Lee, S. Impact of the COVID-19 pandemic: Evidence from the U.S. restaurant industry. Int. J. Hosp. Manag. 2021, 92, 102702. [Google Scholar] [CrossRef]

- Yeon, J.; Song, H.J.; Yu, H.C.; Vaughan, Y.; Lee, S. Are socially responsible firms in the U.S. tourism and hospitality industry better off during COVID-19? Tour. Manag. 2021, 85, 104321. [Google Scholar] [CrossRef]

- Aliperti, G.; Sandholz, S.; Hagenlocher, M.; Rizzi, F.; Frey, M.; Garschagen, M. Tourism, crisis, disaster: An interdisciplinary approach. Ann. Tour. Res. 2019, 79, 102808. [Google Scholar] [CrossRef]

- Vaishar, A.; Štastná, M. Impact of the COVID-19 pandemic on rural tourism in Czechia preliminary considerations. Curr. Issues Tour. 2020, 1–5. [Google Scholar] [CrossRef]

- Ramelli, S.; Wagner, A.F. Feverish stock price reactions to COVID-19. Rev. Corp. Financ. Stud. 2020, 9, 622–655. [Google Scholar] [CrossRef]

- Hall, C.M.; Scott, D.; Gössling, S. Pandemics, transformations and tourism: Be careful what you wish for. Tour. Geogr. 2020, 22, 577–598. [Google Scholar] [CrossRef]

- Rastegar, R.; Higgins-Desbiolles, F.; Ruhanen, L. COVID-19 and a justice framework to guide tourism recovery. Ann. Tour. Res. 2021, 103161. [Google Scholar] [CrossRef] [PubMed]

- Lew, A.A.; Cheer, J.M.; Haywood, M.; Brouder, P.; Salazar, N.B. Visions of travel and tourism after the global COVID-19 transformation of 2020. Tour. Geogr. 2020, 22, 455–466. [Google Scholar] [CrossRef]

- Nepal, S.K. Adventure travel and tourism after COVID-19–business as usual or opportunity to reset? Tour. Geogr. 2020, 22, 646–650. [Google Scholar] [CrossRef]

- Horváth, P. Der koordinationsorientierte Ansatz. In Controlling als Akademische Disziplin. Schriften des Center for Controlling & Management (CCM), 11th ed.; Weber, J., Hirsch, B., Eds.; Deutscher Universitätsverlag: Wiesbaden, Germany, 2002; Volume 7. [Google Scholar]

- Cohen, E. The changing faces of contemporary tourism. Society 2008, 45, 330–333. [Google Scholar] [CrossRef]

- Bowen, J.; Whalen, E. Trends that are changing travel and tourism. Worldw. Hosp. Tour. Themes 2017, 9, 592–602. [Google Scholar] [CrossRef]

- Hall, C.M. Changing paradigms and global change: From sustainable to steady-state tourism. Tour. Recreat. Res. 2010, 35, 131–143. [Google Scholar] [CrossRef]

- Capriello, A.; Riboldazzi, S. How can a travel agency network survive in the wake of digitalization? Evidence from the robintur case study. Curr. Issues Tour. 2019, 1–4. [Google Scholar] [CrossRef]

- Palos-Sanchez, P.R.; Correia, M.B. The collaborative economy based analysis of demand: Study of airbnb case in Spain and Portugal. J. Theor. Appl. Electron. Commer. Res. 2018, 13, 85–98. [Google Scholar] [CrossRef] [Green Version]

- Xiang, Z.; Wang, D.; O’Leary, J.T.; Fesenmaier, D.R. Adapting to the internet. J. Travel Res. 2014, 54, 511–527. [Google Scholar] [CrossRef]

- Kim, H.; Xiang, Z.; Fesenmaier, D.R. Use of the internet for trip planning: A generational analysis. J. Travel Tour. Mark. 2015, 32, 276–289. [Google Scholar] [CrossRef]

- Chiappa, G.D. Internet versus travel agencies. J. Vacat. Mark. 2013, 19, 55–66. [Google Scholar] [CrossRef]

- Chang, Y. Identifiying positions and roles of travel agencies based on relationship redundancy in a package tour network. Heliyon 2020, 6. [Google Scholar] [CrossRef] [Green Version]

- Müller, R.; Turner, R.J. The influence of project managers on project success criteria and project success by type of project. Eur. Manag. J. 2007, 25, 298–309. [Google Scholar] [CrossRef]

- Miterev, M.; Mancini, M.; Turner, R. Towards a design for the project-based organization. Int. J. Proj. Manag. 2016, 35, 479–491. [Google Scholar] [CrossRef]

- Bayou, M.E.; Korvin, A. Measuring the leanness of manufacturing systems-a case study of ford motor company and general motors. J. Eng. Technol. Manag. 2008, 25, 287–304. [Google Scholar] [CrossRef]

- Yang, C.C.; Chen, B.S. Key quality performance evaluation using fuzzy AHP. J. Chin. Inst. Ind. Eng. 2004, 21, 543–550. [Google Scholar] [CrossRef]

- Gareis, R. Management by projects: The new management strategy of the project-oriented company. Int. J. Proj. Manag. 1991, 9, 71–76. [Google Scholar] [CrossRef]

- Günther, E. Ökologieorientiertes Management, 1st ed.; Lucius&Lucius: Stuttgart, Germany, 2008; pp. 40–42. [Google Scholar]

- Gemünden, H.G.; Lehner, P.; Kock, A. The project-oriented organization and its contribution to innovation. Int. J. Proj. Manag. 2018, 36, 147–160. [Google Scholar] [CrossRef]

- Hazen, B.T.; Boone, C.A.; Ezel, J.D.; Jones-Farmer, L.A. Data quality for data science, predictive analytics and big data in supply chain management: An introduction to the problem and suggestions for research and applications. Int. J. Prod. Econ. 2014, 154, 72–80. [Google Scholar] [CrossRef]

- Otley, D. Performance management: A framework for management control systems research. Manag. Account. Res. 1999, 10, 363–382. [Google Scholar] [CrossRef] [Green Version]

- Anthony, R.; Govindarajan, V. Management Control Systems, 12th ed.; McGraw-Hill Education: New York, NY, USA, 2006; pp. 135–144. [Google Scholar]

- Babbie, E. The Practice of Social Research, 13th ed.; Wadsworth Publishing: Belmont, MA, USA, 2013; pp. 27–30. [Google Scholar]

- Giangiacomo, G. Vagueness and formal fuzzy logic: Some criticisms. Log. Log. Philos. 2017, 26, 431–460. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control 1965, 8, 338–353. [Google Scholar] [CrossRef] [Green Version]

- Zadeh, L.A. PRUF—A meaning representation language for natural languages. Int. J. Man-Mach. Stud. 1978, 10, 395–460. [Google Scholar] [CrossRef]

- Havasi, I.; Benő, D. Comparison of traditional and fuzzy unsupervised classification on the basis of vegetation index. J. Landsc. Ecol. 2012, 10, 115–123. [Google Scholar]

- Asadabadi, M.R.; Chang, E.; Zwikael, O.; Saberi, M.; Sharpe, K. Hidden fuzzy information: Requirement specification and measurement of project provider performance using the best worst method. Fuzzy Sets Syst. 2020, 383, 127–145. [Google Scholar] [CrossRef]

- Ammar, M.A.; Abd-ElKhalek, S.I. Criticality measurement in fuzzy project scheduling. Int. J. Constr. Manag. 2019, 1–10. [Google Scholar] [CrossRef]

- Nieto-Morote, A.; Ruz-Vila, F. A fuzzy approach to construction project risk assessment. Int. J. Proj. Manag. 2009, 29, 220–231. [Google Scholar] [CrossRef] [Green Version]

- Maghsoodi, A.I.; Khalilzadeh, M. Identification and evaluation of construction projects’ critical success factors employing fuzzy-topsis approach. KSCE J. Civ. Eng. 2018, 22, 1593–1605. [Google Scholar] [CrossRef]

- Khan, A.A.; Shameem, M.; Kumar, R.R.; Hussain, S.; Yan, X. Fuzzy AHP based prioritization and taxonomy of software process improvement success factors in global software development. Appl. Soft Comput. 2019, 83, 105648. [Google Scholar] [CrossRef]

- Baccarini, D. The logical framework method for defining project success. Proj. Manag. J. 1999, 30, 25–32. [Google Scholar] [CrossRef]

- Piller, I.; Kovács, S. Fuzzy behavior description language: A declarative language for interpolative behavior modeling. Acta Polytech. Hung. 2019, 16, 47–72. [Google Scholar]

- Zadeh, L.A. Is there a need for fuzzy logic? Inf. Sci. 2008, 178, 2751–2779. [Google Scholar] [CrossRef]

- Turner, J.R.; Müller, R. On the nature of the project as a temporary organization. Int. J. Proj. Manag. 2003, 21, 1–8. [Google Scholar] [CrossRef]

- Lindkvist, L. Project organization: Exploring its adaptation properties. Int. J. Proj. Manag. 2008, 26, 13–20. [Google Scholar] [CrossRef]

- Sainaghi, R.; Phillips, P.; Zavarrone, E. Performance measurement in tourism firms: A content analytical meta-approach. Tour. Manag. 2017, 59, 36–56. [Google Scholar] [CrossRef]

- Quintana, T.A.; Gil, S.M.; Peral, P.P. How could traditional travel agencies improve their competitiveness and survive? A qualitative study in Spain. Tour. Manag. Perspect. 2016, 20, 98–108. [Google Scholar] [CrossRef]

- Bell, R.A.; Morrey, R.C. Increasing the efficiency of corporate travel management through macro benchmarking. J. Travel Res. 1995, 33, 11–20. [Google Scholar] [CrossRef]

- Köksal, C.D.; Aksu, A.A. Efficiency evaluation of a-group travel agencies with data envelopment analysis (DEA). A case study in the Antalya region, Turkey. Tour. Manag. 2007, 28, 830–834. [Google Scholar] [CrossRef]

- González-Rodriguez, M.R.; Sámper, R.M. An analysis of the efficiency of Spanish travel agencies. Electron. J. Appl. Stat. Anal. 2012, 5, 60–73. [Google Scholar]

- Barros, C.P.; Matias, A. Assessing the efficiency of travel agencies with a stochastic cost frontier: A Portuguese case study. Int. J. Tour. Res. 2006, 8, 367–379. [Google Scholar] [CrossRef]

- Sainaghi, R.; Phillips, P.; Corti, V. Measuring hotel performance: Using a balanced scorecard perspectives’ approach. Int. J. Hosp. Manag. 2013, 34, 150–159. [Google Scholar] [CrossRef]

- Dutescu, A.; Popa, A.F.; Ponorîca, A.G. Sustainability of the tourism industry, based on financial key performance indicators. Amfiteatru Econ. J. 2014, 16, 1048–1062. [Google Scholar]

- Phillips, P.A.; Louvieris, P. Performance measurement in the SME UK hospitality, tourism and leisure industry: A balanced scorecard perspective. J. Travel Res. 2005, 44, 201–211. [Google Scholar] [CrossRef]

- Kaplan, R.S.; Norton, D.P. The balanced scorecard: Measures that drive performance. Harv. Bus. Rev. 1992, 33, 72–79. [Google Scholar]

- Atkinson, H.; Brown, J.B. Rethinking performance measures: Assessing progress in UK hotels. Int. J. Contemp. Hosp. Manag. 2001, 13, 128–136. [Google Scholar] [CrossRef]

- Assaf, A.G.; Josiassen, A. Identifying and ranking determinants of tourism performance. A global investigation. J. Travel Res. 2012, 51, 388–399. [Google Scholar] [CrossRef]

- Zeydan, M.; Çolpan, C. A new decision support system for performance measurement using combined fuzzy TOPSIS/DEA approach. Int. J. Prod. Res. 2009, 47, 4327–4349. [Google Scholar] [CrossRef]

- Sofiyabadi, J.; Kolahi, B.; Valmohammadi, C. Key performance indicators measurement in service business: A fuzzy VIKOR approach. Total Qual. Manag. Bus. Excell. 2015, 27, 1028–1042. [Google Scholar] [CrossRef]

- Grigoroudis, E.; Orfanoudaki, E.; Zopounidis, C. Strategic performance measurement in a healthcare organisation: A multiple criteria approach based on balanced scorecard. Omega 2012, 40, 104–119. [Google Scholar] [CrossRef]

- Lin, C.T.; Lee, C.; Chen, W.Y. Using fuzzy analytic hierarchy process to evaluate service performance of a travel intermediary. Serv. Ind. J. 2009, 29, 281–296. [Google Scholar] [CrossRef]

- Dweiri, F.T.; Kablan, M.M. Using fuzzy decision making for the evaluation of the project management internal efficiency. Decis. Support Syst. 2006, 42, 712–726. [Google Scholar] [CrossRef]

- Carlsson, C.; Fullér, R.; Heikkilä, M.; Majlender, P. A fuzzy approach to R&D project portfolio selection. Int. J. Approx. Reason. 2007, 44, 93–105. [Google Scholar] [CrossRef] [Green Version]

- Pérez, F.; Gómez, T.; Caballero, R.; Liern, V. Project portfolio selection and planning with fuzzy constraints. Technol. Forecast. Soc. Chang. 2018, 131, 117–129. [Google Scholar] [CrossRef]

- Yao, Y.; Cao, Y. A neural network enhanced hidden Markov model for tourism demand forecasting. Appl. Soft Comput. 2020, 94, 106465. [Google Scholar] [CrossRef]

- Anasari, R. Expectation of tourism demand in iraq by using artificial neural network. Int. J. Soc. Sci. Res. Rev. 2019, 2, 1–7. [Google Scholar] [CrossRef]

- Kulshrestha, A.; Krishnaswamy, V.; Sharma, M. Bayesian BILSTM approach for tourism demand forecasting. Ann. Tour. Res. 2020, 83, 102925. [Google Scholar] [CrossRef]

- Phillips, P.; Zigan, K.; Silva, M.M.S.; Schegg, R. The interactive effects of online reviews on the determinants of Swiss hotel performance: A neural network analysis. Tour. Manag. 2015, 50, 130–141. [Google Scholar] [CrossRef]

- Assaf, A.; Tsionas, M.G.; Gillen, D. Measuring firm performance: Differentiating between uncontrollable and controllable bad outputs. Tour. Manag. 2020, 80, 104107. [Google Scholar] [CrossRef]

| Project Portfolio 1. | Project Portfolio 2. | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| KPIs | ST1.A | ST1.B | ST2. | ST3.A | ST3.B | ST3.C | ST1.A | ST1.B | ST2. | ST3.A | ST3.B | ST3.C |

| 1. | 4.62 | 9.77 | 1.30 | 4.62 | 9.77 | 0.75 | 4.13 | 9.51 | 1.34 | 4.13 | 9.51 | 1.01 |

| 2. | 5.03 | 17.31 | 2.04 | 3.52 | 12.12 | 0.67 | 4.73 | 17.25 | 2.09 | 3.31 | 12.08 | 1.47 |

| 3. | −1.87 | 6.16 | −2.21 | −1.12 | 3.70 | −0.67 | −1.51 | 5.59 | −1.38 | −0.91 | 3.35 | −1.05 |

| 4. | −2.67 | −3.39 | −2.92 | −2.67 | −3.39 | −1.15 | −5.73 | −2.41 | −2.64 | −5.73 | −2.41 | −1.34 |

| 5. | 1.92 | 11.79 | 0.92 | 1.54 | 9.43 | 0.05 | 3.61 | 12.22 | 0.45 | 2.89 | 9.78 | 0.46 |

| 6. | 8.36 | 11.65 | 1.08 | 5.02 | 6.99 | 0.30 | 6.49 | 11.41 | 2.27 | 3.89 | 6.85 | 0.24 |

| 7. | 12.26 | 8.08 | 0.20 | 9.81 | 6.46 | 0.13 | 8.93 | 9.07 | 0.75 | 7.14 | 7.26 | 0.23 |

| 8. | 4.85 | 5.13 | −5.00 | 2.91 | 3.08 | −2.49 | 8.03 | 5.19 | −2.36 | 4.82 | 3.11 | −3.69 |

| 9. | −3.58 | 4.38 | 0.45 | −2.51 | 3.07 | 0.24 | −1.56 | 4.80 | 0.66 | −1.09 | 3.36 | 0.45 |

| 10. | −1.77 | −0.95 | 0.61 | −1.77 | −0.95 | 1.37 | −0.78 | −0.96 | 0.48 | −0.78 | −0.96 | 1.45 |

| 11. | 6.67 | 8.50 | 1.02 | 4.00 | 5.10 | 4.19 | 5.02 | 8.41 | 1.32 | 3.01 | 5.05 | 6.13 |

| 12. | 1.56 | 5.52 | −1.00 | 1.09 | 3.86 | −0.12 | 2.61 | 5.97 | −0.22 | 1.83 | 4.18 | −0.24 |

| 13. | −0.70 | −3.68 | −10.30 | −0.49 | −2.58 | 0.32 | −0.26 | −4.11 | −9.21 | −0.18 | −2.88 | 0.33 |

| 14. | −0.48 | 25.07 | 4.10 | 4.10 | 17.55 | 0.26 | −3.76 | 18.77 | 6.14 | −2.63 | 13.14 | 0.89 |

| 15. | 0.34 | 20.49 | 3.49 | 0.34 | 20.49 | −2.45 | −0.57 | 19.72 | 8.20 | −0.57 | 19.72 | −1.64 |

| 16. | −5.78 | 22.73 | 8.84 | −3.47 | 13.64 | 3.00 | −3.42 | 21.88 | 10.24 | −2.05 | 13.13 | 4.03 |

| 17. | 2.64 | 10.09 | −3.59 | 1.58 | 6.05 | −0.79 | 3.26 | 10.52 | −3.47 | 1.96 | 6.31 | −1.18 |

| 18. | −1.76 | 4.91 | −3.95 | −1.41 | 3.93 | −0.82 | −0.13 | 5.42 | −1.42 | −0.10 | 4.34 | −1.28 |

| 19. | −4.74 | −1.94 | −3.57 | −2.84 | −1.16 | −0.72 | −3.31 | −1.22 | −1.78 | −1.99 | −0.73 | −1.04 |

| 20. | 4.93 | 29.28 | 2.07 | 4.93 | 29.28 | 2.41 | 5.66 | 29.10 | 1.90 | 5.66 | 29.10 | 3.40 |

| 21. | −4.90 | −4.21 | −1.66 | −3.92 | −3.37 | −0.29 | −2.10 | −4.05 | −3.42 | −1.68 | −3.24 | −0.28 |

| 22. | 5.47 | 4.91 | 0.14 | 3.56 | 3.19 | 0.75 | 3.37 | 5.71 | 0.17 | 2.19 | 3.71 | 1.10 |

| 23. | 0.19 | 6.15 | −2.74 | 0.15 | 4.92 | −0.63 | 2.42 | 5.74 | −2.51 | 1.94 | 4.59 | −1.18 |

| 24. | 13.24 | 7.00 | 5.98 | 13.24 | 7.00 | 4.20 | 14.72 | 12.09 | 6.31 | 14.72 | 12.09 | 5.19 |

| 25. | 0.00 | 14.70 | 1.21 | 0.00 | 9.56 | 0.83 | −1.09 | 14.63 | 1.21 | −0.71 | 9.51 | 1.14 |

| Project Portfolio 3. | ||||||||||||

| KPIs | ST1.A | ST1.B | ST2. | ST3.A | ST3.B | ST3.C | ||||||

| 1. | 5.84 | 9.91 | 1.08 | 5.84 | 9.91 | 0.98 | ||||||

| 2. | 6.33 | 18.25 | 1.10 | 4.43 | 12.78 | 1.04 | ||||||

| 3. | 1.41 | 5.59 | −5.61 | 0.85 | 3.35 | −0.88 | ||||||

| 4. | −4.65 | −3.26 | −1.22 | −4.65 | −3.26 | −1.04 | ||||||

| 5. | 3.66 | 11.77 | 1.42 | 2.93 | 9.42 | 0.31 | ||||||

| 6. | 7.62 | 12.00 | 2.06 | 4.57 | 7.20 | 0.10 | ||||||

| 7. | 10.75 | 9.72 | 1.08 | 8.60 | 7.78 | 0.22 | Very underperforming: | |||||

| 8. | 3.64 | 5.75 | −6.53 | 2.18 | 3.45 | −2.43 | Not acceptable: | |||||

| 9. | −0.50 | 5.12 | 2.36 | −0.35 | 3.58 | 0.28 | Acceptable: | |||||

| 10. | −0.06 | −0.98 | 0.75 | −0.06 | −0.98 | 0.96 | Appropriate: | |||||

| 11. | 5.85 | 9.17 | 7.84 | 3.51 | 5.50 | 4.19 | Distinguished: | |||||

| 12. | 2.24 | 6.08 | −1.00 | 1.57 | 4.26 | −0.28 | ||||||

| 13. | −2.51 | −3.48 | −7.59 | −1.76 | −2.44 | 0.12 | ||||||

| 14. | −1.06 | 23.72 | 2.63 | −0.74 | 16.60 | −0.12 | ||||||

| 15. | −3.26 | 20.31 | 5.63 | −3.26 | 20.31 | −2.79 | ||||||

| 16. | −4.17 | 14.47 | 9.75 | −2.50 | 8.68 | 4.58 | ||||||

| 17. | 1.95 | 10.45 | −5.32 | 1.17 | 6.27 | −0.62 | ||||||

| 18. | −1.54 | 5.16 | −4.75 | −1.23 | 4.13 | −0.69 | ST1.A = ST1. 2019 (%) | |||||

| 19. | −2.93 | −1.45 | −3.57 | −1.76 | −0.87 | −0.71 | ST1.B = ST1. 2020 (%) | |||||

| 20. | 4.57 | 28.82 | 4.31 | 4.57 | 28.82 | 2.32 | ST2. = ST2. 2019–2020 (%) | |||||

| 21. | −5.87 | −4.58 | −4.69 | −4.70 | −3.66 | −0.53 | ST3.A = ST3. 2019 (%) | |||||

| 22. | 6.05 | 5.76 | 0.41 | 3.93 | 3.74 | 0.88 | ST3.B = ST3. 2020 (%) | |||||

| 23. | 1.52 | 6.01 | −6.68 | 1.22 | 4.81 | −0.69 | ST3.C = ST3. 2019–2020 (%) | |||||

| 24. | 12.25 | 11.73 | 1.96 | 12.25 | 11.73 | 4.65 | ||||||

| 25. | −1.69 | 15.59 | 1.36 | −1.10 | 10.13 | 0.73 | ||||||

| Aggregated Key Performance Indicators | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| KPIs | ST1.A | ST1.B | ST2. | ST3.A | ST3.B | ST3.C | |||||

| 1. | 3.97 | 8.09 | 1.07 | 3.97 | 8.09 | 1.07 | |||||

| 2. | 4.40 | 14.64 | 1.52 | 3.08 | 10.25 | 1.07 | |||||

| 3. | −0.65 | 4.80 | −2.59 | −0.39 | 2.88 | −1.56 | |||||

| 4. | −3.78 | −2.46 | −1.86 | −3.78 | −2.46 | −1.86 | |||||

| 5. | 2.62 | 9.97 | 0.83 | 2.09 | 7.98 | 0.66 | |||||

| 6. | 6.13 | 9.72 | 1.47 | 3.68 | 5.83 | 0.88 | Very underperforming: | ||||

| 7. | 8.69 | 7.48 | 0.58 | 6.95 | 5.98 | 0.47 | Not acceptable: | ||||

| 8. | 4.88 | 4.45 | −3.85 | 2.93 | 2.67 | −2.31 | Acceptable: | ||||

| 9. | −1.53 | 3.98 | 0.97 | −1.07 | 2.78 | 0.68 | Appropriate: | ||||

| 10. | −0.72 | −0.80 | 0.44 | −0.72 | −0.80 | 0.44 | Distinguished: | ||||

| 11. | 4.79 | 7.21 | 2.84 | 2.87 | 4.33 | 1.70 | |||||

| 12. | 1.84 | 4.90 | −0.65 | 1.29 | 3.43 | −0.45 | |||||

| 13. | −0.86 | −3.17 | −7.57 | −0.60 | −2.22 | −5.30 | |||||

| 14. | −1.53 | 19.08 | 3.57 | −1.07 | 13.35 | 2.50 | |||||

| 15. | −1.17 | 17.14 | 5.01 | −1.17 | 17.14 | 5.01 | |||||

| 16. | −3.71 | 16.33 | 8.21 | −2.23 | 9.80 | 4.93 | |||||

| 17. | 2.26 | 8.65 | −3.42 | 1.35 | 5.19 | −2.05 | ST1.A = ST1. 2019 (%) | ||||

| 18. | −0.84 | 4.33 | −2.79 | −0.67 | 3.46 | −2.24 | ST1.B = ST1. 2020 (%) | ||||

| 19. | −3.02 | −1.25 | −2.48 | −1.81 | −0.75 | −1.49 | ST2. = ST2. 2019–2020 (%) | ||||

| 20. | 4.28 | 24.24 | 2.29 | 4.28 | 24.24 | 2.29 | ST3.A = ST3. 2019 (%) | ||||

| 21. | −3.33 | −3.55 | −2.76 | −2.66 | −2.84 | −2.21 | ST3.B = ST3. 2020 (%) | ||||

| 22. | 3.96 | 4.58 | 0.22 | 2.57 | 2.98 | 0.14 | ST3.C = ST3. 2019–2020 (%) | ||||

| 23. | 1.26 | 4.95 | −3.33 | 1.01 | 3.96 | −2.67 | |||||

| 24. | 11.34 | 8.97 | 3.84 | 11.34 | 8.97 | 3.84 | |||||

| 25. | −0.79 | 12.45 | 1.03 | −0.51 | 8.09 | 0.67 | |||||

| Balanced Scorecard Perspectives | |||||||

|---|---|---|---|---|---|---|---|

| Weights (points) | ST1.A | ST1.B | ST2. | ST3.A | ST3.B | ST3.C | |

| Financial | 1.00 | 1.44 | 5.43 | 0.26 | 1.44 | 5.43 | 0.26 |

| Learning and growth | 0.80 | 2.04 | 3.06 | 0.52 | 1.63 | 2.45 | 0.42 |

| Internal business | 0.90 | −0.73 | 7.79 | 2.86 | −0.66 | 7.01 | 2.58 |

| Customer | 0.85 | 2.03 | 6.38 | 0.59 | 1.73 | 5.42 | 0.50 |

| Very underperforming: | |||||||

| Not acceptable: | |||||||

| Acceptable: | |||||||

| Appropriate: | |||||||

| Distinguished: | |||||||

| ST1.A = ST1. 2019 (%) | |||||||

| ST1.B = ST1. 2020 (%) | |||||||

| ST2. = ST2. 2019–2020 (%) | |||||||

| ST3.A = ST3. 2019 (%) | |||||||

| ST3.B = ST3. 2020 (%) | |||||||

| ST3.C = ST3. 2019–2020 (%) | |||||||

| Strategy | |||

|---|---|---|---|

| ST1A. | ST1.B | ST2. | |

| Strategy index | 1.04 | 5.08 | 0.94 |

| Very underperforming: | |||

| Not acceptable: | |||

| Acceptable: | |||

| Appropriate: | |||

| Distinguished: | |||

| ST1.A = ST1. 2019 (%) | |||

| ST1.B = ST1. 2020 (%) | |||

| ST2. = ST2. 2019–2020 (%) | |||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Thalmeiner, G.; Gáspár, S.; Barta, Á.; Zéman, Z. Application of Fuzzy Logic to Evaluate the Economic Impact of COVID-19: Case Study of a Project-Oriented Travel Agency. Sustainability 2021, 13, 9602. https://doi.org/10.3390/su13179602

Thalmeiner G, Gáspár S, Barta Á, Zéman Z. Application of Fuzzy Logic to Evaluate the Economic Impact of COVID-19: Case Study of a Project-Oriented Travel Agency. Sustainability. 2021; 13(17):9602. https://doi.org/10.3390/su13179602

Chicago/Turabian StyleThalmeiner, Gergő, Sándor Gáspár, Ákos Barta, and Zoltán Zéman. 2021. "Application of Fuzzy Logic to Evaluate the Economic Impact of COVID-19: Case Study of a Project-Oriented Travel Agency" Sustainability 13, no. 17: 9602. https://doi.org/10.3390/su13179602

APA StyleThalmeiner, G., Gáspár, S., Barta, Á., & Zéman, Z. (2021). Application of Fuzzy Logic to Evaluate the Economic Impact of COVID-19: Case Study of a Project-Oriented Travel Agency. Sustainability, 13(17), 9602. https://doi.org/10.3390/su13179602