Abstract

Slack is a resource held by a firm but exceeds its needs. It is crucial for a firm to raise more attention on slack when facing environmental shocks, which are one of the causes of unsustainability. Based on agency theory and behavioral theory, this paper analyzes the buffer effect of slack on market performance under different periods and degrees of environmental shocks. Taking two major earthquakes that occurred in China as the natural experimental background and the listed firms in hit areas as the sample, we find that environmental shock is exposed to acts as a positive contingency for the impact of unabsorbed slack on market performance, and as a negative contingency for absorbed slack’s effect. The severity of environmental shock promotes the unabsorbed slack to act as a buffer in the immediate post-shock period and absorbed slack in the during-shock period. These findings contribute to answering the question of how to configure slack to protect firms and even achieve sustainable development when facing environmental shock.

1. Introduction

Environmental shock events, including natural disasters (e.g., earthquakes, typhoons, and floods), man-made threats (e.g., the September 11 attacks), and public health emergencies (e.g., COVID-19 epidemic), have encouraged firms to focus on resource allocation, environment buffering, and sustainable development [1,2]. According to Sharfman and his colleagues, “the faster that changes come, and the larger those changes are, the more high discretion slack the firm will need” (1988, p. 606) [3]. This argument contains three widely cited implications on slack’s buffer effects [2,4]. First, the realization of slack’s buffer effects depends on the situation, and it is essential to take a contingency perspective for related research. Although slack is costly to organizations and seems to be incompatible with sustainable development, the positive effects of slack cannot be underestimated when environmental shocks occur [5]. Second, environmental shocks are multidimensional concepts, which differ in speed (fast or slow), direction (threat or opportunity), degree (weak or strong), period (before, during, and after the events) [3,6,7], etc. Most studies only focus on whether change occurs or not, but few focus on these related multiple dimensions. Third, slack can be classified into unabsorbed and absorbed slack, each with different functions [8,9,10,11]. Especially, the two forms of slack can be interconverted if time or other conditions permit, and this may be the critical reason why different slacks act similarly, or have even had exactly the same effects in previous studies. Hence, it is necessary to select and design the context to avoid them transforming, and further, revealing their true effects.

Extant studies have put forward various arguments and evidence to explain slack’s effects on managers’ behaviors and firms’ performances, especially on financial performance [5,12,13,14] and innovation performance [4,15,16,17], but seldom on market performance. Although agency theory briefly points out that slack is one of the products and the source of conflicts between stockholders and managers [2,18], the reaction of stockholders to slack and its influences on stock price have not been further discussed. As organization behavior theorists stated [8,19,20], managers reserve slack resources to prevent or decrease impacts of environmental shocks, primarily for its buffer effect to avoid resource unsustainability and protect firms’ cores. Managers, whose responses to environmental change are vital to sustainability [21], often hold different or even opposite views on slack with stockholders, who are closely tied to the firm but cannot directly affect specific affairs of firms’ operations and development. Therefore, stockholders cannot understand and estimate the real impacts of environmental shocks and slack’s buffer effect on internal affairs. Consequently, external information will exert major effects on their responses, which differ from managers’ or other internal stakeholders’ significantly and have their own special characteristics. Moreover, attitudes and reactions to environmental change are often more visible and rapid in market performance than in financial performance stated periodically [22]. Therefore, it is necessary to specifically investigate slack’s buffer effect from the perspective of market performance, which is not considered in existing work.

To solve these research questions, our study attempts to explore the effects of unabsorbed and absorbed slack on market performance in the during-shock and immediate post-shock period based on the Wenchuan (12 May 2008) and Ya’an (20 April 2013) earthquakes, which occurred suddenly in China. Taking these two major earthquakes as the empirical study background, we believe that they provide natural and unique scenarios to test slack’s effects. First, environmental changes, such as epidemics, industrial deregulation, and economic crisis, are slow, ongoing, or even foreseeable. Firms will accumulate resources and change the quantity or the forms of slack proactively in this situation, all of which may further mask and confuse the effects of slack. However, earthquakes occur suddenly, and it is impossible to transform the slack in advance or during the shocking period. Second, earthquakes have a clear occurrence time and last just a few seconds. Periods and time windows can be confirmed indisputably. Meanwhile, the extent of devastating earthquakes can be anywhere from minor to significant, and they may provide opportunities as well. Thus, earthquakes provide us with the ideal background to study slack’s effects on environmental shock from multiple perspectives and dimensions. Third, transforming slack requires time, cost, and an external environment with abundant and diverse resources, all of which may be scarce in emergencies. The interconversion between different categories of slack will be prevented or slowed down, and hence their true effects will become more apparent and easier to detect. Finally, environmental change usually induces corresponding strategic adaption. For example, industrial deregulations alter firms’ survival and competitive environment, and then slack may act as the facilitator of strategic adaption and a buffering cushion simultaneously, both of which have been mentioned in Bourgeois’s (1981) work as the key roles of slack. It is hard to demonstrate and distinguish their effects clearly, which impedes empirical study. In sum, as a kind of environmental shock, an earthquake helps one to describe environmental change in detail and testify buffer effects of slack precisely.

Our study aims to clarify attitudes and actions of capital markets toward the buffer effect of slack and focuses on how slack’s effects change with environmental context. Its implications and theoretical contributions are as follows: (1) some scholars have pointed out that slack may work as a buffer on a psychological level [20,23], but few have studied this in detail or in depth, while most related study focuses on the interpretation of buffer effects on an operational level. One generally accepted and cited viewpoint is that slack often acts as the cushion to protects firms’ technical “core” [9]. This study broadens the scope of slack research to a psychological level and contributes to finding out more application scenarios and action mechanisms of slack. (2) As mentioned above, slack’s effect, certainly including the buffer effect, varies with environmental change. Exploring slack’s change law therein will increase the effectiveness and efficiency of resource allocation. Especially, the impacts of environmental shock range from slight to severe, while a shock itself can be divided into several stages, such as pre-shock, during-shock, and post-shock period [7]. Our results about moderating effects of environmental shock severity and periods detail the nature and the change law of slack’s effects, which provides ideas for sustainable development of firms even when an outside shock occurs. (3) Our research takes the sudden, unpredictable, and completely exogenous environmental shocks that occurred in Wenchuan, and Ya’an, China, as the background, which provides a reliable context for studying the role of unabsorbed slack and absorbed slack, respectively. Earthquakes and other natural disasters can lead to the unsustainable development of firms, and our study supports slack’s buffer effect. That is to say, by utilizing different categories of slack, which are held by a firm but exceed its needs, to buffer the negative effect of environment shock in the during-shock or immediate post-shock period, firms can stabilize their stock price and even achieve sustainable development.

The remainder of this study is contained as follows. We start with the current literature review on slack resources and environmental shocks, and research hypotheses related to the effect of environmental shock and its severity on the relationship between slack and market performance (Section 2). Section 3 presents the research methods used to test our hypothesis, including the sample, measures, and statistical method. The detailed analysis of the results of hypothesis testing are shown in Section 4. Section 5 discusses our findings, and Section 6 concludes this paper.

2. Literature Review and Research Hypotheses

2.1. Slack Resources

Cyert and March (1963) conceptualized slack as “the excess resources available to a firm in a particular period” or “unutilized resources” [8]. Based on this, Bourgeois (1981) and Sharfman et al., (1988) claimed, the role of slack varies with context, and each role corresponds to certain activities and theories, respectively, especially for its buffer role, which has drawn the most attention of related studies [3,19]. Thompson (1967) and other pioneer works, more in-depth studies, have explored mechanisms of slack’s buffer effect. Although various studies have described and discussed the buffer effect they have seldom defined its role precisely [24,25]. Buffers only appear with firms’ internal or external changes, but these changes may be simultaneously appropriate for adaption, which is always treated as another key role of slack. The adaption role of slack is related to changes in strategy, behavior, or technical core and is frequently used to explain strategic formulation, adjustment [8], etc. Changes may be long-term and can be permanent, and firms cannot return to the past. By contrast, buffers, as cushions, aim to maintain operations continuously and support firms in reverting to their original state [10,24,26]. It is important to note that adaption should be distinguished with the buffer effect, although both of them occur only in the context of environmental change. Thompson (1967) and other scholars proposed and repeatedly cited the concept of “core” to explain why slack’s buffer effect benefits firms [27]. The main conclusion is that buffers contribute to the core to remain stable regardless of environmental changes or not, while passive changes in the core are unfavorable to firm performance. As Haveman et al. (2001) stated, the process of core change will be detrimental for its costly activities of reorganizing divisions, redeploying resources, rebuilding or resuming production, and redirecting strategy, while the content of related change may bring high risk of unfitness to the external environment [28].

Moreover, the effects of slack have always been controversial from different perspectives [3,9,24]. According to resource-based view and behavioral theory, slack can improve firms’ performance by reducing resource constraints and serving as a buffer for strengthening the adaptability to environments [8,14,29]. On the contrary, based on agency theory [18], slack provides material resources for agents to meet their personal goals and easily stimulate agency problems that further impact performance negatively [11,30,31]. To integrate this controversy, the following two aspects of the research have been explored in recent years [9,13,23,24]. One way to analyze the divergence is that slack may be classified into two categories, namely, absorbed slack and unabsorbed slack, according to managerial discretion in redeployment and consumption [11,16,32,33]. Absorbed slack often exists in the form of specialized assets with low discretion and less redeploy ability. They have already been absorbed as costs into operations (e.g., idle skilled labor, additional dedicated machine capacity, and excess overhead expenses) and increase the conversion cost of firms, reduce operational efficiency, and eventually have negative impacts on firms’ performance [3,4]. Unabsorbed slack (e.g., cash or liquidities) has high liquidity without being earmarked for a specific use and can be made freely available to firms to protect their core and even develop new capabilities, especially in environment shock context [32,34]. Another approach is to examine the impact of context in the relationship between slack and firm performance [35,36]. For example, researchers consider the effect of slack in different contexts and factors that refer to environmental threat [4], environmental complexity [24], and industry factors [11,13] and argue that environmental contexts create the need for which slack can be applied.

In brief, the results of slack’s effect on firm performance have been explained from different perspectives, and the buffer effect of slack has been approved. As the above mentioned, slack resources are the result of managers and shareholders holding different or even opposing views of firm operation. However, few studies have involved the relationship between slack and market performance. It is particularly urgent and meaningful to analyze the effects of different types of slack on market performance response to environmental shock.

2.2. Environmental Shock

Slack is important to protect firms confronting environmental changes [5,14,20]. Environmental changes to existing research concern economic transition [32], economic crisis [7], and industry complexity [11,37] but rarely environmental shocks such as earthquakes and tsunamis. Environmental shock differs from environmental uncertainty. Supply chain glitch, price fluctuation, and other environmental uncertainties are common and frequently occur in the long term, and resources allocated to smooth or eliminate these fluctuations should be regarded as a necessity for survival and competition, not as slack, although they seem unused or idle normally [3]. However, environmental shocks, such as natural disasters and military coup, are unforeseen and small probability events that cannot be prevented or prepared for. Buffer effects mentioned in slack literature should refer to these unexpected sudden changes but not environmental uncertainty or fluctuations with high probability. Therefore, our study analyzes how buffer effects benefit the sustainable development of firms in the context of environmental shocks.

Buffer and some other effects are only recognized when shocks occur, especially for stockholders. In other words, slack always sits idle and stays the same, and stockholders seldom notice and respond to slack in normalcy. However, environmental shocks lead stockholders to pay attention to recommended solutions that require large amounts of resources in emergency and recovery periods, causing slack to gain more attention from stockholders. This demonstrates that periods should be regarded as critical contextual variables for slack’s effects. Just as Meyer (1982) and Wan and Yiu (2009) posited, environmental changes are usually divided into pre-shock, during-shock, and post-shock periods for unexpected changes, and anticipatory, responsive, readjustment phases for expected ones [7,38]. In their studies, slack seems more beneficial for firms in the during-shock period or responsive phase than in the other two time periods from perspectives of managers, while post-shock period and readjustment-phase are also interpreted differently from pre-shock and anticipatory ones, because environment and firms’ core may change forever with environmental changes. Moreover, environmental shocks, discussed in this study, deserve special attention as firms need not adapt or alter their core but only require a buffer effect from slack. Therefore, it is necessary to distinguish between pre-/anticipatory periods and post-/readjustment ones.

2.3. Environmental Shock and Effects of Slack

As mentioned above, unlike supply-chain glitch, price fluctuation, and other common uncertain affairs, environmental shock lacks targeted precautions, and, absorbed slack, typically as capacity slack, inventory slack, and supply chain slack [14,24], will be useless in these contexts. These types of slack seem beneficial to the business continuity of firms confronting common uncertain affairs and sustainability, instead of natural disasters or other unexpected shocks. Moreover, according to Barberis et al., (2003) and some other literature on behavioral theory, slack usually means decentralization and relaxation of control, especially for absorbed slack [12,16]. Decentralization provides freedom and flexibility of action for junior staff and may benefit performance by inducing adaptable reactions in uncertain environments, unlike during environmental shocks, which they seldom have enough experience or capacity to deal with. Obviously, if these junior staff make decisions according to limited information gathered during a panic, they will be ineffective, and lacking unified command may further cause more chaos and confusion. Another point to be noted is that, if managers retain absorbed slack for self-interesting, rent-seeking, or other ignoble reasons, then decentralization caused by these slack may further worsen the situation [23]. Just as agency theory posits, slack reflects power, strength, and the arbitrary power of managers in relation to dispersed stockholders [18,22], and this slack should be the absorbed one that is difficult to supervise or control from outside. Furthermore, ignoring, betraying, or even damaging stockholders’ interests, often accompanied by incorrect or irrational judgments and decisions, will certainly produce worse consequences for stockholders in an emergency context.

Moreover, a large amount of absorbed slack may alert stockholders to the activities of managers, and environmental shocks will trigger massive sell-off in stocks because low-discretion resources become more unbearable when resource gaps increase too much after shocks occur. Even if environmental shocks provide opportunity for firms, according to value creation and appropriation (VCA) theory [39] or house money effect [40], the extra value created in this context will facilitate risk-seeking behaviors not accepted normally since the potential loss seems less painful immediately after gaining the windfall. Besides, shocks confront firms with asymmetric and poor information, which further causes the interests of stockholders to be vulnerable because it is easier to appropriate extra value for managers in tımes of chaos and opacity [37]. Thus, stockholders are unable to easily determine how much they can really gain, and their worries about appropriation will increase with firms’ opportunities. Although transferring loss to insurance companies may reduce environmental shocks’ direct effects [41], stockholders will be uncertain how much spare equipment, factory buildings, or other absorbed slack will get destroyed by the shocks and paid by the insurance, causing them to worry. All in all, it is hard for absorbed slack to play a buffer role in the context of environmental shock.

In contrast, unabsorbed slack, typically as cash, can “act as safety net…, and provide flexibility in the face of unknown environments [42].” Cash and other unabsorbed slack are uncommitted resources that are available freely as required, and their high discretion signifies high availability of resources with the broadest capacity necessary for developing new capabilities [13,32,34,35]. Especially, environmental shocks often raise resource prices, and a large amount of cash or other unabsorbed reserves can also ease cost pressure. Therefore, this kind of slack seems more valuable to fill resource gaps and to meet demand after environmental shocks. Besides, emergency decisions often rely on partial, incomplete, or even false information, and wrong or unwise decisions doubtless have serious consequences and worsen situations [43]. Spare cash and other unabsorbed slack provide necessary and flexible resources, and more importantly, confidence to help firms protect the status quo for a period of time instead of making hasty decisions in response to a shock. From this perspective, unabsorbed slack is extremely valuable for delaying emergency decisions until firms gain more or even adequate information to improve decision quality significantly [23,34,37].

It is hard to determine if holding slack is beneficial or harmful to firms, and this topic has aroused controversy for decades. The relationship between slack and firm performance depends on two aspects: utility and cost of slack. If utility exceeds cost, the slack-performance relationship is positive, so slack seems beneficial, and vice versa. We do not know exactly whether the utility can cover the cost but can conclude that slack’s utility changes when environmental shocks occur. Meanwhile, slack will be consumed in emergencies and accumulated in normal periods, and its cost remains constant. There is no doubt that natural disasters and other similar shocks may destroy facilities and cause shortage of reconstruction resources overnight, while slack can satisfy resource needs of reconstruction and other costly activities, including in opportunity context. Our theoretical arguments suggest that the overall effects of slack on stock prices will change in post-shock periods. External stockholders cannot get detailed information about how slack works in emergency contexts, and just make judgments based on slack’s characters and its potential effects, all of which will influence stock prices further. Considering firms’ and stockholders’ reaction lag and information delay, we hypothesize:

Hypotheses 1 (H1).

Environmental shock positively moderates the effect of unabsorbed slack on market performance in the during-shock and the immediate post-shock period.

Hypotheses 2 (H2).

Environmental shock negatively moderates the effect of absorbed slack on market performance in the during-shock and the immediate post-shock period.

2.4. The Severity of Environmental Shock and Effects of Slack

Effects of slack depend on situational and environmental factors [13,23,32]. Even when faced with the same environmental shock, the impact on firms varies and buffer effects of slack vary in form and extent. For example, firms’ cores may experience various levels of impacts, and unchanged status of core, which slack buffer effect aims to achieve, takes two forms, namely, without any change and change to some extent but recovery to the same status as before. As Thompson (1967) argued, the buffer effect includes keeping the core unchanged and helping restore the changed core to its previous status. Although the buffer effect has been widely used to explain the benefits of slack [10,20,25,32], few studies have testified to the existence of this effect or analyzed why and how this effect varies with environmental changes. Degree and severity are two of the basic and common dimensions to measure environmental changes and their effects, which further trigger slack’s buffer. Related degree or severity should be studied more regarding slack.

The consequences of environmental shocks on firms, including direct and indirect economic impacts, cannot be assessed or learned accurately and detailed by stockholders [44]. External stockholders tend to estimate the contribution of slack according to their judgments and attitudes in emergencies because of information lagging or lacking. Unabsorbed slack provides high-discretion resources to firms for reallocation [37], and it is no exaggeration to say that this kind of slack can solve most of the resource problems brought by the environmental shock from the point of view of stockholders because they cannot detect and realize actual or potential problems that unabsorbed slack cannot solve; they only see its effectiveness and advantages. Slight effects of environmental shock can be quickly and easily mitigated or eliminated with cash at hand. However, severe shock may cause acute shortages in critical resources, or even worse, change firms’ cores, and firms are in urgent need of specific resources to recover. More importantly, exogenous shocks may influence a larger range and larger number of firms, and some commonly required resources become so scarce that they cannot be traded, even to firms willing to pay higher prices. Evidently, unabsorbed slack seems less valuable in severe contexts.

Absorbed slack has so many forms that it is hard and meaningless to point out the effect of specific absorbed slack. Their quantity often reflects firms’ operating and managing philosophy, which is used to speculate on managers’ behavior modes and firms’ performances by external stakeholders. Allocating more resources to specific sub-organizations, positions, or activities often involves decentralization of authority and vice versa. If environmental shocks impose significant impacts on firms, then managers will face more challenges and have to make judgment calls in emergencies and under great pressure. More often, various types of information and decision-making are required to push managers far beyond their capabilities in the short period after exogenous shocks occur; after, advantages of central control will dwindle and become less remarkable. Instead, decentralization brought about by absorbed slack allows for more openness to new information and vigilance in the processing of that information while acting as a substitute for coordination among primary units or junior employees, which becomes more crucial in urgent contexts [9]. Moreover, some specific resources, such as risk reserves, will not begin to take effect until the severity of environmental shock exceeds the threshold level. Moreover, firms’ cores may be altered in serious contexts, and slack absorbed into the operational process may contribute to protecting core, although it is hard to flexibly apply it to deal with environmental shock directly. From the above analysis, we put forward that:

Hypotheses 3 (H3).

The severity of environmental shock positively moderates the effect of unabsorbed slack on market performance in the during-shock and the immediate post-shock periods.

Hypotheses 4 (H4).

The severity of environmental shock positively moderates the effect of absorbed slack on market performance in the during-shock and the immediate post-shock periods.

3. Method

3.1. Sample

Exogenous and unanticipated shocks weaken the aggressiveness and preparedness of a firm and provide suitable natural experiments to test the hypotheses on slack’s effects, especially the buffer effect [7]. We select the earthquake, a kind of typical exogenous shock, as the background of our empirical study for four reasons. First, slack can be interconverted if time permits, and therefore it is hard to distinguish the effects of one specific category of slack from another when firms reconstruct their resource portfolio to respond to environmental slow changes. These two kinds of slack are difficult or even impossible to convert when an earthquake occurs. Second, it is important for stockholders to realize seismic intensities and listed firms’ announcements [44], both of which can contribute to distinguishing severe shocks from slight ones, and in turn, cause various reactions of the stock market to the earthquake. Third, earthquakes occur in a split second, and it is easy to clearly define their during-shock or emergency periods. These time features further help to testify to changes in slack’s effects across different periods. Fourth, environmental changes stimulate or induce not only buffer but also adaption or strategic changes of firms, and it is difficult to identify the distinction between them. In short, earthquakes provide important and natural contexts with which to solve this problem.

More importantly, some kinds of changes are slow (e.g., economic crisis) or can be forecasted (e.g., industrial deregulation). Firms have enough time to respond initiatively and proactively, while the buffer role of slack is not necessary for them in these contexts; however, it will lead to confusion in understanding slack’s multiple roles and functions definitely and exactly. For example, epidemics (e.g., COVID-19 in 2020) impact nearly all enterprises involved, but it is hard to accurately determine when they will break out. Moreover, epidemics often persist for several months or even years, and slack resources can be easily converted between various categories in demand, all of which further hamper the identification of the different impacts between them. Hence, epidemic and other similar slow environmental changes are not suitable contexts for studying slack’s buffer effect.

Wenchuan earthquake (12 May 2008) and Ya’an earthquake (20 April 2013) are two major natural disasters that occurred in the past two decades in China [45,46]. We take the listed firms in the quake-hit provinces and municipalities as samples and then obtain two sets of data, namely, “balanced-firm” and “all firm”. Similar to Wan and Yiu (2009) [7], the former set consisted of 211 listed firms with strongly balanced panel data in pre-shock, during-shock, and immediate post-shock periods. Even if other firms do not have full sets of data in these three periods, they still can contribute to testing hypotheses, and we add them to the “all firm” set, which contains both balanced-firm data and unbalanced-firm data. Both of these two earthquakes occurred in the second quarter, and all of the affected firms had announced the resumption of operations or production before the end of June. Moreover, listed firms have to release their financial data once a quarter, and thus, pre-, during- and immediate post-shock periods for them refer to first, second, and third quarter in 2008 or 2013, respectively. Wind Info financial database is the primary source for collecting the sample data in this study.

3.2. Measures

Market performance: we use the quarterly abnormal return to measure firms’ market performance, which is calculated as rates of firms’ stock price change minus corresponding industry-average rates during the whole quarter. In our study, industrial-average rates are calculated by averaging all the listed firms with the same industry codes (first letter and two digits), which are issued by CSRC (China Securities Regulatory Commission).

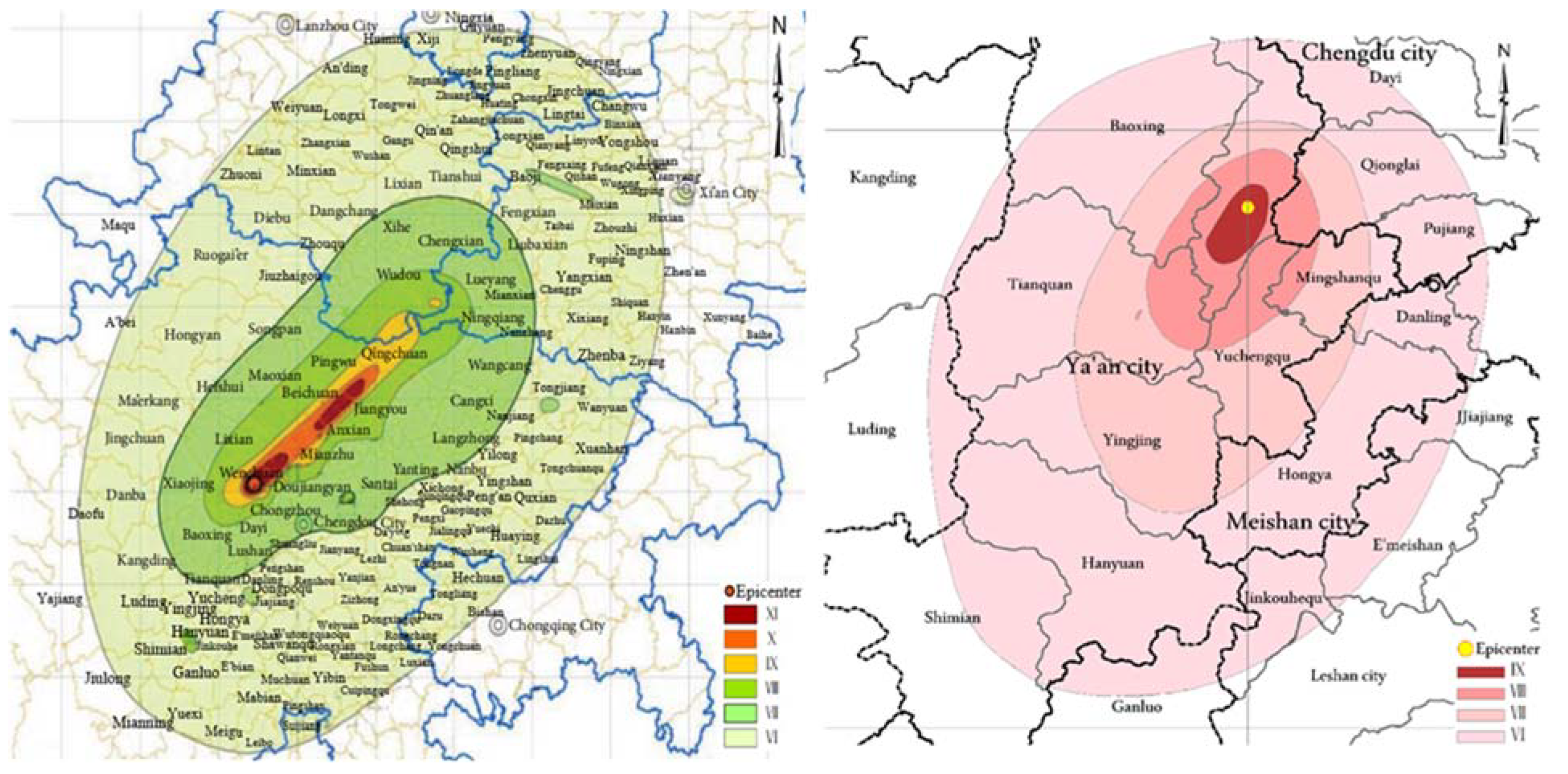

Environmental shock and its severity. With two dummy variables (during-shock period and post-shock period), during-shock and immediate post-shock period are distinguished from pre-shock period. It is hard to assess the impacts of the earthquake on firms, especially the full economic impacts [44,47]. Seismic intensity, just like Modified Mercalli intensity and Rossi-Forel intensity, measures the level of seismic ground motion and building shaking [48] and is often more suitable as the proxy for earthquake impacts than earthquake magnitude. China Seismic Bureau announces seismic intensity maps as soon as earthquakes occur. Seismic areas are classified into 12 intensity zones according to Chinese Earthquake Code GB50011-2001. The higher the intensity, the more severe the impacts on firms. We sorted out the intensity of the Wenchuan earthquake and Ya’an earthquake in Figure 1, according to the data and figures published by the China Earthquake Administration. As shown in the figure, the Wenchuan earthquake struck five provinces or municipalities while the Ya’an earthquake struck one. We judge the seismic intensity of each listed firm’s site according to firms’ registration address, Google Map, and seismic intensity map. Seismic intensities of firms located in areas with intensity below VI-level are assigned to the same category, namely, V-level, because these areas are not marked in the seismic intensity map, and persons and buildings there are not affected by the earthquake. Moreover, some firms’ stock exchanges are suspended to avoid over-fluctuation of the stock price immediately after earthquakes occur, especially for firms hit heavily or near epicenters, and we induce another indicator variable (1-suspended, 0-non-suspended) to increase the validity of measurement on the severity of environmental shocks. Therefore, suspended or non-suspended and seismic intensity are standardized and summed together to form a composite index that indicates the severity of environmental shock.

Figure 1.

Intensity map of Wenchuan earthquake (left, published by China Earthquake Administration on 1 September 2008) and Ya’an earthquake (right, published by China Earthquake Administration on 25 April 2013).

Unabsorbed and absorbed slack: researchers have proposed various methods to measure organizational slack resources by accounting indicators [11,20,23,24,25,33]. Cash holding can represent idle and unabsorbed resources of firms confronting external changes [34], and following George (2005) [11], we select the result of “firm’s cash minus industrial-average cash” (unit = billion RMB) as the proxy for unabsorbed slack. According to Kovach et al., (2015) [14], the ratio of fixed assets in the quarter (including gross property, plant, and equipment) to quarterly sales, the ratio of inventory in the quarter to quarterly cost of sales, the ratio of accounts receivable in the quarter to quarterly sales, and the ratio of accounts payables in the quarter to quarterly cost of sales are in correspondence to, respectively, the indicators of capacity slack, inventory slack, and supply chain slack, all of which belong to and stand for absorbed slack. As in other similar studies [26], these four indicators are adjusted by industry means and then standardized and summed together to form the absorbed slack indicator.

Control variables: we control the firm size by total assets (unit = billion RMB) and age by years from the date of establishment to the beginning of the quarter. Numbers of main product categories are used to stand for product diversification. Many Chinese listed firms are state-controlled, which is often expected to enhance anti-risk ability [18,49,50], and we also control ownership type (1-state-owned, 0-others). Although external available resources may become scarce in an environmental shock context [47], they are still controlled and measured by the assets-liability ratio in our study. Normally, the stock valuation will either be less or be more favorable when confronted by environmental shock, and that depends on whether the shock is a threat or opportunity to the firm [7,42]. Some industrial firms (e.g., medical firms, cement firms) are expected to gain from an earthquake, and leading business and financial news publishers have made lists of them. We take a dummy variable to stand for opportunity or threat (1-threat, 0-opportunity), and the judgment is based on analysts’ comments, which were issued by China’s mainstream media (e.g., finance.sina.com, finance.qq.com). The industry dummy is controlled to eliminate the influence of industry characteristics. Another dummy variable is included to distinguish between the Wenchuan earthquake and the Ya’an earthquake.

3.3. Statistical Method

Similar to the work of Wan and Yiu (2009) [7], the random-effects model is more appropriate for this study, and the results of the Hausman test also confirm that. Most sample firms in this study have strongly balanced data, while some ones miss data in one period but have data in the other two periods. For robust checking, we analyze data of two sample groups and then get similar results, both of which are reported in this paper. Our hypothesis predicts effects of slack will change during and immediately after environmental shock compared with normally, and therefore, we use two dummy variables to distinguish pre- from during- and immediately post-shock periods. In addition, to prevent the possible interaction between unabsorbed and absorbed, we respectively analyze the effect of two categories slack when environmental shocks occurred.

4. Results

As mentioned above, some samples miss data in one period while others have strongly balanced data across all three periods. Thus, our sample is composed of the “all firm” group and the “balanced-firm” group. Table 1 provides the descriptive statistics report of variables with the data of all-firms sample group but not including dummy variables. The summary statistics of this group data reveal that neither unabsorbed slack nor absorbed slack has a significant correlation with the stock price. We also employ strongly balanced group data and obtain similar results (not reported), as Table 1 reports. Table 2 reports the regression results that used data of all-firm group (model 1–7) and strongly balanced group (model 8–14).

Table 1.

Means, standard deviations, and correlations of variables.

Table 2.

Regression results.

Hypothesis l and Hypothesis 2 argue that environmental shock positively moderates the effect of unabsorbed slack but negatively moderates the effect of absorbed slack on market performance, respectively. Both of them are strongly supported. The coefficients for during-shock period dummy × unabsorbed slack are positive significantly (p < 0.01 for Models 3; p < 0.01 for Model 10), while the coefficients for during-shock period dummy × absorbed slack are negative significantly (p < 0.1 for Models 6; p < 0.01 for Model 13). For the post-shock period, both of the coefficients for immediately post-shock period dummy × unabsorbed slack are positive and significantly (p < 0.5 for Model 3, and Model 10) while for immediately post-shock period dummy × absorbed slack are also negative and significant (p < 0.01 for Model 6, and Model 13).

Hypothesis 3 predicts that the severity of environmental shock positively moderates the effect of unabsorbed slack on market performance, but it is only supported by post-shock period data. The coefficients for post-shock period dummy × unabsorbed slack × severity are positively significant in Model 4 (p < 0.001) and in Model 11 (p < 0.01), but variables of during-shock period dummy × unabsorbed slack × severity are not significant in Model 4 and Model 11. Hypothesis 3 is partly supported. Similarly, Hypothesis 4, which argues that the severity of environmental shock positively moderates the effect of absorbed slack on market performance, also receives partial support. The coefficients for during-shock period dummy × absorbed slack × severity are positive significantly in Model 7 (p <0.001) and in Model 14 (p < 0.001), but variables of post-shock period dummy × absorbed slack × severity are not significant in Model 7 and Model 14. In brief, Hypothesis 3 only receives support from post-shock period data, and Hypothesis 4, in contrast, receives support from during-shock period data only.

5. Discussion

Slack performance has aroused widespread concern and generated some conflicting viewpoints and findings, especially in the domain of its buffer effect. Taking the Wenchuan earthquake and Ya’an earthquake as the natural experimental investigation, our findings confirm that the buffer effects of two types of slack are different for market performance after environmental shock.

5.1. Buffer Effect

The effects of slack on firms’ performance remain debated, largely because slack often plays multiple roles, one of which is widely discussed is the buffer effect. Even as buffer effect alone, various theories have been used to demonstrate and explain action mechanism therein. For controlling other effects, it is necessary to analyze and testify buffer role in specific context. Environmental changes stimulate and induce buffer, but we should not ignore that external changes also produce adaption or other internal changes to firms. Adaption, which frequently appears in Cyert and March (1963) and other literature on slack’s effects, is important for firms, but it is related to changes in firms’ strategies, behaviors, or even their cores. The changes therein may be permanent; in other words, latter state of firms may differ from the ones before changes. In contrast, buffer results in an invariant state or maintenance of the status quo. Adaption should be integrated into the explanation of strategic formulation, adjustment, etc., but not buffer process. Combined with the assumption of “technology core” promoted by Thompson (1967), we believe that buffer contributes to protecting the core even when environmental shocks occur [27].

As noted, buffer effects cannot be testified on effectively without a fast-changing context. Moreover, resources, prepared for supply chain glitches or other frequent events, cannot be classified as slack but as a necessity for absorbing normal environmental fluctuations. As Miller and Leiblein (1996) stated, “…these findings contradict the contention that slack acts as a buffer reducing organizational performance and risk-taking…(p. 115)” [51], it is unwise to equate risk-taking and uncertainty with responding to the buffer directly. That is, operational slack and other absorbed slack are oriented for expected incidents in whose context this type of slack cannot play the buffer role, unlike for earthquakes or other unexpected environmental shocks. Furthermore, we have posited and confirmed that effects of absorbed slack will be more negative after environmental shocks occur because decentralization induces them.

Unabsorbed slack, by contrast, has been proven to buffer effectively in our empirical study, both in during-shock period and in immediate post-shock period. Sirmon et al. (2007) stated that slack resource was used to alter current capabilities or to create new ones in response to environmental changes (either opportunities or threats) [52], and Bourgeois (1981) posited that slack allowed firms to “adjust to gross shifts in the external environment with minimal trauma” (p. 31) [19]. Our study develops these propositions and confirms that they are applicable only for unabsorbed slack. We believe that differences between these two kinds of slack stem from their different capacities to meet flexible application. This finding has great significance for environmental shock preparedness, especially for earthquakes and other natural disasters from the perspectives of stockholders, because the amount of resources is limited and firms have to make decisions on resource allocation. It is beneficial for them to clarify which resource should remain or be eliminated. According to the results of this study, firms should maintain a “cash pool” or similar unabsorbed resource pool instead of the absorbed one for disaster preparedness and response. Taking cost and flexibility of unabsorbed slack into consideration, this kind of slack, further, can be collected and shared among several unionized firms. By contrast, the amount of external available resources, such as financing and lending capacity, may alter greatly with environmental changes, and their effects will be weakened or strengthened sharply. Therefore, this kind of slack will result in more uncertainty when environment shocks occur, although it can be transformed into unabsorbed slack on some given occasions. Accordingly, the redefinition and refinement of slack’s buffer role in emergencies constitute our most important theoretical contributions.

5.2. Environmental Shocks

There is rich research about slack’s effects on financial performance but seldom on market performance. Although agency theory states slack is one of the outcomes of agency relationship between stockholders and managers [18], attitudes of stockholders to slack deserve further study, rather than directly eliminating all of slack as some scholars advocate. Stockholders, typically external stakeholders, are deeply concerned with firms’ operations, including the effects of environmental shocks, but seldom can follow them in detail. Therefore, unlike managers and other internal stakeholders, most stockholders’ judgments and actions mainly depend on seismic intensity and firms’ announcements on disaster situations, and some of them probably cannot reflect the real situation of firms. Therefore, relationships between slack and market performance have their unique characteristics and require special study. Our empirical study has testified that only unabsorbed slack can have a buffer effect as posited by previous studies [14,23,25], and this effect will be strengthened by the severity of environmental shocks from the perspective of stockholders in immediate post-shock period. Namely, relationship between stock price and unabsorbed slack will be more positive after earthquakes occur, especially for the firms hit heavily, because resource gap and resource scarcity will increase too much in serious context, and this kind of slack can satisfy resource demands for high flexibility and fluidity.

It may take a long time to distribute and consume a large amount of cash or other unabsorbed slack, and financial gains will be presented in periodic financial reports, which are the main, or even only, information source for stockholders to learn about firms’ operation statuses. This is why moderating effects of environmental shock’s severity delay were felt in the immediate post-shock period but not in during-shock period. For example, cash may not enable the resumption of production or adjustments to strategy until it has been transferred into the materials needed. Especially, cash reserves cannot change anything confronting exogenous shocks, because nearly all categories of goods may become unavailable in the short-term after exogenous shocks occur [44]. This conclusion also contributes to revealing that resilience and recovery of firms’ cores cannot be achieved immediately by cash or other unabsorbed slack. In contrast, our study confirms that the severity of environmental shock exerts positive moderating influences on absorbed slack’s effects during shock, but not in the post-shock period. The main reason probably lies in the fact that absorbed slack is normally distributed at the site for instant use, and then effects of decentralization and behaviors supported by this slack perform instantly. Thus, stockholders react more rapidly to influence of shocks’ severity on absorbed slack.

These results also imply that directions, velocities, and mechanisms of buffer effects are various and even opposite for different types of slack. Some previous works confuse buffer effect with adaption or another effect, and their empirical studies are set in a slow-changing context in which absorbed slack and unabsorbed slack have enough time to interconvert. Our results underline that more attention should be paid to the definition and the empirical context of slack’s buffer effect, and it is unwise to make a general conclusion about this effect. Natural disasters, such as earthquakes, occur suddenly and last just for a few seconds. Few firms conduct specific emergency preparation for these rare events, nor do they readjust strategy afterward. Therefore, this kind of environmental change provides rigorous context for testing buffer effect, and our study tries to testify buffer effect through these natural experimental investigations and thus provide a pioneering attempt and advancement for other related research.

In summary, the buffer effect depends on the nature of slack and environmental contingent factors [10,24]. Slack is just a tag for resources, and there is no substantial difference between necessary part and slack part of organization resources. As for slack, absorbed and unabsorbed slack not only have common features but also have special features. It is necessary to treat each category of slack separately and to use corresponding theories to analyze their effects, and it is no surprise to get various or even opposite views from the point of different types of slack. Moreover, contingency is not equal to arbitrariness or randomness. Various and multiple theories have explained the effects and the roles of slack, but real effects and action mechanisms therein need to be testified further. Especially in some contexts, slack may play several roles simultaneously, and it is so hard to distinguish buffer from them that an elaborate and well-designed study context becomes necessary. Our study is expected to draw attention to stockholders’ attitudes and reactions to slack’s effect, especially the buffer effect in environmental shocking context. More importantly, it distinguishes buffer from adaption and other effects and confirms not all slack can play a buffer role, alter current capabilities, or create new ones in response to external changes. By selecting a natural experimental background and taking listed firms in hit areas as the samples, our study confirms the different effects between absorbed slack and unabsorbed slack from the perspectives of stockholders. Buffer effect, which is advocated by behavioral theory [8], is often embodied in absorbed slack but not in unabsorbed slack. This study concludes that stockholders prefer to maintain unabsorbed slack instead of absorbed slack to respond to unexpected shocks. Kevin et al. (2020) examined how stock prices reacted to the 2011 Great East Japan Earthquake and pointed out that the reaction had its characters and some important implications [53]. Our study also contributes to advancing this and reveals how stock prices fluctuate when confronted by environmental shocks and which theory is suitable for explaining slack’s effects therein. Furthermore, shocks’ severity influences absorbed slack’s effect more rapidly than unabsorbed slack’s. This finding suggests that discretionary and flexibility also influence speed and efficiency, not only effectiveness of slack’s buffer, which needs novel theoretical explanation in the future study.

6. Conclusions

This study provides an examination of slack’s buffer effect on market performance during and after environmental shock. Using the data of listed firms in the quake-hit provinces and municipalities, we find that environment shock introduces buffer effects and changes stockholders’ attitudes about slack resources. That is to say, environmental shock has been proven to positively moderate the impact of unabsorbed slack on market performance but to negatively moderate the buffer effect of absorbed slack, whether in the during-shock period or the immediate post-shock period. Moreover, the severity of environmental shock positively moderates the effect of absorbed slack and unabsorbed slack on market performance; the effect of the former is only supported by post-shock period data, while the latter is only verified in the immediate post-shock period. Overall, these results increase our understanding of how firms reserve and leverage slack, as a buffer or core’s “cushion”, to generate value and achieve sustainability, and also provide a reference for future studies to clearly distinguish slack’s effect from others.

This study also has three limitations that should be addressed in the future. First, the main limitation stems from the measurements of slack resources. Although frequently present in the literature, financial indicators cannot accurately reflect the amount of slack. For example, even if two firms hold the same amount of cash, it is doubtful that they will have the same quantity and quality of unabsorbed slack. Therefore, it is necessary to explore more accurate measurements of slack resources in the future. Second, this study has confirmed slack’s effects change with time window and severity of shock in the context of the Wenchuan earthquake and Ya’an earthquake, and these results need to be further studied in other emergency contexts, especially in unnatural disaster contexts. Finally, even including three quarters (pre-, during-, and immediate post-shock periods), the time window in this study is still limited. Future studies can adjust the length of the time window according to study context and then explore slack’s effects more accurately and in greater detail.

Author Contributions

Conceptualization, X.L.; data collection and analysis, S.Z.; writing—original draft preparation, X.L. and S.Z.; writing—review and editing, X.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation of China (Grant No. 71972001), the key program of philosophy and Social Sciences in Anhui Province (Grant No.AHSKZ2019D002), and the Major Cultivation Project and Excellent Talents Program of Anhui University (Grant No.S030314003/009).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Salvato, C.; Sargiacomo, M.; Amore, M.D.; Minichilli, A. Natural disasters as a source of entrepreneurial opportunity: Family business resilience after an earthquake. Strateg. Entrep. J. 2020, 14, 594–615. [Google Scholar] [CrossRef]

- You, X.; Jia, S.; Dou, J.; Su, E. Is organizational slack honey or poison? Experimental research based on external investors’ perception. Emerg. Mark. Rev. 2020, 44, 100698. [Google Scholar] [CrossRef]

- Sharfman, M.P.; Wolf, G.; Chase, R.B.; Tansik, D.A. Antecedents of organizational slack. Acad. Manag. Rev. 1988, 13, 601–614. [Google Scholar] [CrossRef]

- Voss, G.B.; Sirdeshmukh, D.; Voss, Z.G. The effects of slack resources and environmental threat on product exploration and exploitation. Acad. Manag. J. 2008, 51, 147–164. [Google Scholar] [CrossRef] [Green Version]

- Bradley, S.W.; Shepherd, D.A.; Wiklund, J. The importance of slack for new organizations facing ‘tough’environments. J. Manag. Stud. 2011, 48, 1071–1097. [Google Scholar] [CrossRef]

- Osiyevskyy, O.; Shirokova, G.; Ritala, P. Exploration and exploitation in crisis environment: Implications for level and variability of firm performance. J. Bus. Res. 2020, 114, 227–239. [Google Scholar] [CrossRef]

- Wan, W.P.; Yiu, D.W. From crisis to opportunity: Environmental jolt, corporate acquisitions, and firm performance. Strateg. Manag. J. 2009, 30, 791–801. [Google Scholar] [CrossRef]

- Cyert, R.M.; March, J.G. A Behavioral Theory of the Firm; Prentice Hall: Englewood Cliffs, NJ, USA, 1963. [Google Scholar]

- Duan, Y.; Wang, W.; Zhou, W. The multiple mediation effect of absorptive capacity on the organizational slack and innovation performance of high-tech manufacturing firms: Evidence from Chinese firms. Int. J. Prod. Econ. 2020, 229, 107754. [Google Scholar] [CrossRef]

- Paeleman, I.; Vanacker, T. Less is more, or not? On the interplay between bundles of slack resources, firm performance and firm survival. J. Manag. Stud. 2015, 52, 819–848. [Google Scholar] [CrossRef]

- George, G. Slack resources and the performance of privately held firms. Acad. Manag. J. 2005, 48, 661–676. [Google Scholar] [CrossRef]

- Carnes, C.; Xu, K.; Sirmon, D.; Karadag, R. How competitive action mediates the resource slack-performance relationship: A meta-analytic approach. J. Manag. Stud. 2018, 56, 57–90. [Google Scholar] [CrossRef] [Green Version]

- Guo, F.; Zou, B.; Zhang, X.; Bo, Q.; Li, K. Financial slack and firm performance of SMMEs in China: Moderating effects of government subsidies and market-supporting institutions. Int. J. Prod. Econ. 2019, 223, 107530. [Google Scholar] [CrossRef]

- Kovach, J.J.; Hora, M.; Manikas, A.; Patel, P.C. Firm performance in dynamic environments: The role of operational slack and operational scope. J. Oper. Manag. 2015, 37, 1–12. [Google Scholar] [CrossRef]

- Lungeanu, R.; Stern, I.; Zajac, E.J. When do firms change technology-sourcing vehicles? The role of poor innovative performance and financial slack. Strateg. Manag. J. 2016, 37, 855–869. [Google Scholar] [CrossRef]

- Tabesh, P.; Vera, D.; Keller, R. Unabsorbed slack resource deployment and exploratory and exploitative innovation: How much does CEO expertise matter? J. Bus. Res. 2019, 94, 65–80. [Google Scholar] [CrossRef]

- Soetanto, D.; Jack, S. Slack resources, exploratory and exploitative innovation and the performance of small technology-based firms at incubators. J. Technol. Transf. 2018, 43, 1–19. [Google Scholar] [CrossRef]

- Jensen, M.; Meckling, W. Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 1976, 3, 305–360. [Google Scholar] [CrossRef]

- Bourgeois, L.J., III. On the measurement of organizational slack. Acad. Manag. Rev. 1981, 6, 29–39. [Google Scholar] [CrossRef]

- Cheng, J.L.; Kesner, I.F. Organizational slack and response to environmental shifts: The impact of resource allocation patterns. J. Manag. 1997, 23, 1–18. [Google Scholar] [CrossRef]

- Sun, Y.; Du, S.; Ding, Y. The Relationship between Slack Resources, Resource Bricolage, and Entrepreneurial Opportunity Identification—Based on Resource Opportunity Perspective. Sustainability 2020, 12, 1199. [Google Scholar] [CrossRef] [Green Version]

- Martin, G.P.; Wiseman, R.M.; Gomez-Mejia, L.R. Going short-term or long-term? CEO stock options and temporal orientation in the presence of slack. Strateg. Manag. J. 2016, 37, 2463–2480. [Google Scholar] [CrossRef]

- Vanacker, T.; Collewaert, V.; Zahra, S. Slack resources, firm performance and the institutional context: Evidence from privately held European firms. Strateg. Manag. J. 2017, 38, 1305–1326. [Google Scholar] [CrossRef]

- Godoy-Bejarano, J.; Ruiz-Pava, G.; Téllez, D. Environmental complexity, slack, and firm performance. J. Econ. Bus. 2020, 112, 105933. [Google Scholar] [CrossRef]

- Symeou, P.; Zyglidopoulos, S.; Gardberg, N. Corporate environmental performance: Revisiting the role of organizational slack. J. Bus. Res. 2018, 96, 169–182. [Google Scholar] [CrossRef]

- Steensma, H.K.; Corley, K.G. Organizational context as a moderator of theories on firm boundaries for technology sourcing. Acad. Manag. J. 2001, 44, 271–291. [Google Scholar] [CrossRef]

- Thompson, J.D. Organizations in Action; McGraw-Hill: New York, NY, USA, 1967. [Google Scholar]

- Haveman, H.; Russo, M.; Meyer, A. Organizational environments in flux: The impact of regulatory punctuations on organizational domains, CEO succession, and performance. Organ. Sci. 2001, 12, 253–273. [Google Scholar] [CrossRef] [Green Version]

- Hendricks, K.; Singhal, V.; Zhang, R. The effect of operational slack, diversification, and vertical relatedness on the stock market reaction to supply chain disruptions. J. Oper. Manag. 2009, 27, 233–246. [Google Scholar] [CrossRef]

- de la Hiz, D.I.L.; Ferron-Vilchez, V.; Aragon-Correa, J.A. Do firms’ slack resources influence the relationship between focused environmental innovations and financial performance? More is not always better. J. Bus. Ethics 2019, 159, 1215–1227. [Google Scholar] [CrossRef]

- Teirlinck, P. Engaging in new and more research-oriented R&D projects: Interplay between level of new slack, business strategy and slack absorption. J. Bus. Res. 2020, 120, 181–194. [Google Scholar] [CrossRef]

- Tan, J.; Peng, M.W. Organizational slack and firm performance during economic transitions: Two studies from an emerging economy. Strateg. Manag. J. 2003, 24, 1249–1263. [Google Scholar] [CrossRef]

- Singh, J.V. Performance, slack, and risk taking in organizational decision making. Acad. Manag. J. 1986, 29, 562–585. [Google Scholar] [CrossRef]

- Kim, C.; Bettis, R.A. Cash is surprisingly valuable as a strategic asset. Strateg. Manag. J. 2014, 35, 2053–2063. [Google Scholar] [CrossRef]

- Bentley, F.; Kehoe, R. Give them some slack—They’re trying to change! The benefits of excess cash, excess employees, and increased human capital in the strategic change context. Acad. Manag. J. 2018, 63, 181–204. [Google Scholar] [CrossRef]

- Troilo, G.; De Luca, L.; Atuahene-Gima, K. More Innovation with Less? A strategic contingency view of slack resources, information search, and radical innovation. J. Prod. Innov. Manag. 2014, 31, 259–277. [Google Scholar] [CrossRef]

- Deb, P.; David, P.; O’Brien, J. When is cash good or bad for firm performance? Strateg. Manag. J. 2017, 38, 436–454. [Google Scholar] [CrossRef]

- Meyer, A.D. Adapting to environmental jolts. Adm. Sci. Q. 1982, 27, 515–537. [Google Scholar] [CrossRef] [PubMed]

- Coff, R.W. When competitive advantage doesn’t lead to performance: The resource-based view and stakeholder bargaining power. Organ. Sci. 1999, 10, 119–133. [Google Scholar] [CrossRef]

- Barberis, N.; Thaler, R. A survey of behavioral finance. In Handbook of the Economics of Finance; Constantinides, G.M., Harris, M., Stulz, R.M., Eds.; Elsevier: Amsterdam, The Netherlands, 2003; Volume 1, pp. 1053–1128. [Google Scholar]

- Linnerooth-Bayer, J.; Surminski, S.; Bouwer, L.M.; Noy, I.; Mechler, R. Insurance as a response to loss and damage? In Loss and Damage from Climate Change: Concepts, Methods and Policy Options; Mechler, R., Bouwer, L.M., Schinko, T., Surminski, S., Linnerooth-Bayer, J., Eds.; Springer: Cham, Switzerland, 2019; pp. 483–512. [Google Scholar] [CrossRef] [Green Version]

- Nason, R.S.; Patel, P.C. Is cash king? Market performance and cash during a recession. J. Bus. Res. 2016, 69, 4242–4248. [Google Scholar] [CrossRef]

- Yu, L.; Lai, K.K. A distance-based group decision-making methodology for multi-person multi-criteria emergency decision support. Decis. Support Syst. 2011, 51, 307–315. [Google Scholar] [CrossRef]

- Cavallo, A.; Cavallo, E.; Rigobon, R. Prices and supply disruptions during natural disasters. Rev. Income Wealth 2014, 60, 449–471. [Google Scholar] [CrossRef]

- Park, A.; Wang, S. Benefiting from disaster? Public and private responses to the Wenchuan earthquake. World Dev. 2017, 94, 38–50. [Google Scholar] [CrossRef]

- Liu, J.; Wang, S. Analysis of the differentiation in human vulnerability to earthquake hazard between rural and urban areas: Case studies in 5.12 Wenchuan Earthquake (2008) and 4.20 Ya’an Earthquake (2013), China. J. Hous. Built Environ. 2015, 30, 87–107. [Google Scholar] [CrossRef]

- Hosono, K.; Miyakawa, D.; Uchino, T.; Hazama, M.; Ono, A.; Uchida, H.; Uesugi, I. Natural disasters, damage to banks, and firm investment. Int. Econ. Rev. 2016, 57, 1335–1370. [Google Scholar] [CrossRef] [Green Version]

- Zhang, Q.; Zhang, Y.; Yang, X.; Su, B. Automatic recognition of seismic intensity based on RS and GIS: A case study in Wenchuan Ms8. 0 earthquake of China. Sci. World J. 2014, 2014, 878149. [Google Scholar] [CrossRef]

- Lin, Y.-H.; Chen, C.-J.; Lin, B.-W. The dual-edged role of returnee board members in new venture performance. J. Bus. Res. 2018, 90, 347–358. [Google Scholar] [CrossRef]

- Vanacker, T.; Collewaert, V.; Paeleman, I. The relationship between slack resources and the performance of entrepreneurial firms: The role of venture capital and angel investors. J. Manag. Stud. 2013, 50, 1070–1096. [Google Scholar] [CrossRef]

- Miller, K.D.; Leiblein, M.J. Corporate risk-return relations: Returns variability versus downside risk. Acad. Manag. J. 1996, 39, 91–122. [Google Scholar] [CrossRef]

- Sirmon, D.G.; Hitt, M.A.; Ireland, R.D. Managing firm resources in dynamic environments to create value: Looking inside the black box. Acad. Manag. Rev. 2007, 32, 273–292. [Google Scholar] [CrossRef] [Green Version]

- Hendricks, K.B.; Jacobs, B.W.; Singhal, V.R. Stock market reaction to supply chain disruptions from the 2011 Great East Japan Earthquake. Manuf. Serv. Oper. Manag. 2020, 22, 683–699. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).