Climate Change Policies and the Carbon Tax Effect on Meat and Dairy Industries in Brazil

Abstract

:1. Introduction

2. Background

2.1. Agriculture and GHG Metrics

2.2. Brazilian Environmental Policy

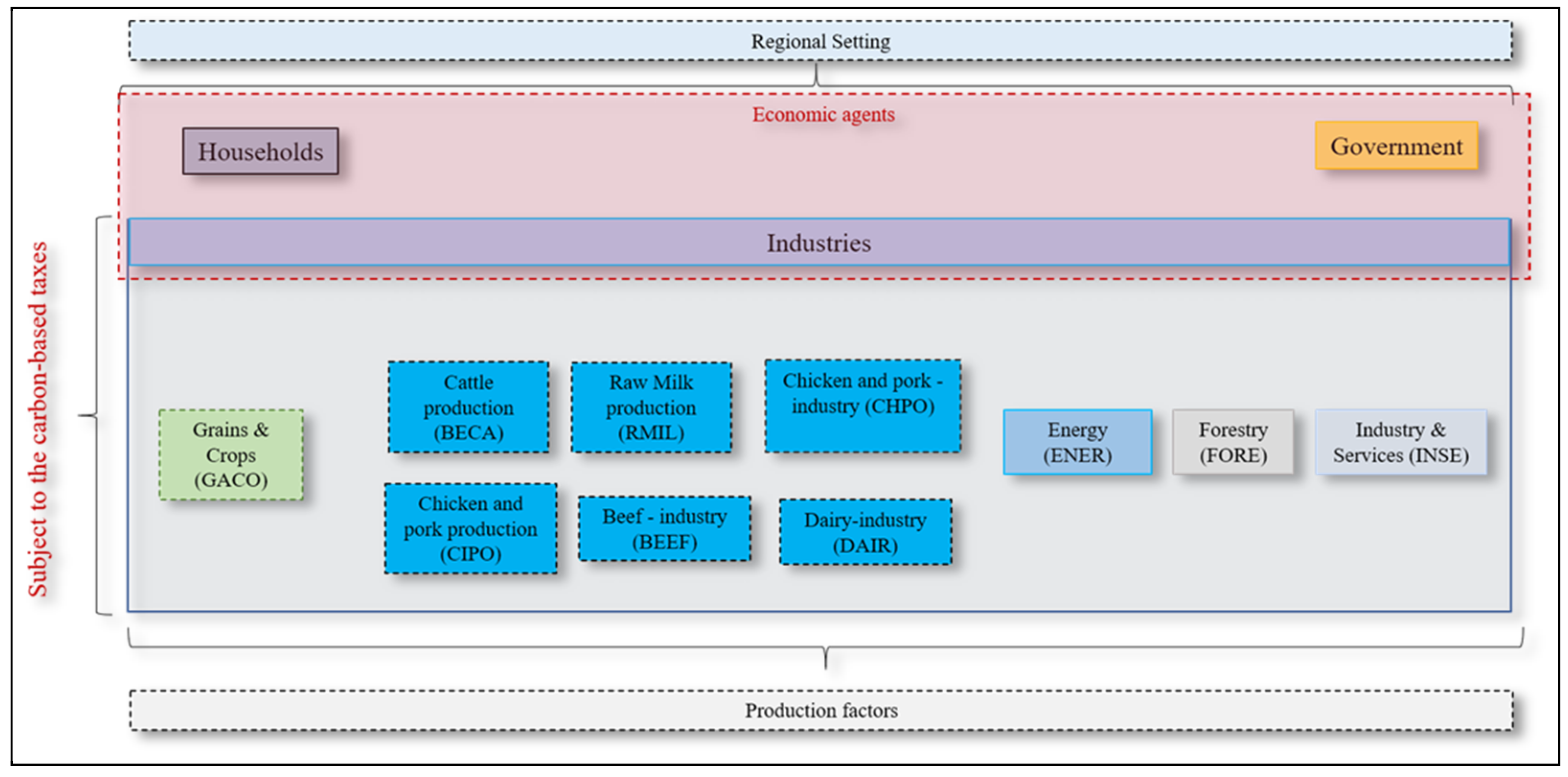

3. Materials and Methods

- (a)

- Scenario 1 reflects the application of carbon taxes to the Meat & Dairy industry and zero-carbon taxes to the other sectors in Brazil.

- (b)

- Scenario 2 includes only carbon taxes on the Energy industry.

- (c)

- Scenario 3 simulates equal carbon taxes on all industries ($20, $40, and $60 per t. of CO2), though no carbon taxes apply to the forestry sector.

- (d)

- Scenario 4 considers the application of carbon taxes to the Meat & Dairy and Grains & Crops sectors lower than those applied to the Energy and Industry & Services sectors.

3.1. Carbon Taxes

3.2. Closure and Channel Effects

- (a)

- Pigou’s well-being: there is an efficiency gain associated with the decrease in the consumption of the polluting good concerning the marginal external cost of pollution and the change in the price of the polluting good;

- (b)

- Tax interaction: environmental policies increase the price of polluting products related to household leisure and create market distortions;

- (c)

- Revenue feedback: when environmental tax revenue is recycled through cuts in (other) marginal tax rates, this reduces the distortion caused by pre-existing taxes, improving the level of well-being.

4. Results

4.1. GHG Emissions

4.2. Economic Output and Trade Impacts

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Brasil. Política Agrícola. Política Agrícola no Brasil. 2020. Available online: https://www.gov.br/agricultura/pt-br/assuntos/politica-agricola (accessed on 27 February 2021). (In Portuguese)

- Lynch, J. Availability of disaggregated greenhouse gas emissions from beef cattle production: A systematic review. In Environmental Impact Assessment Review; Elsevier Inc.: Amsterdam, The Netherlands, 2019; Volume 76, pp. 69–78. [Google Scholar] [CrossRef]

- SEEG. Sistema de Emissões de Gases de Efeito Estufa. 2020. Available online: https://www.seeg.eco (accessed on 27 February 2021). (In Portuguese).

- Margulis, S. Causes of Deforestation of the Brazilian Amazon; World Bank Publications: Washington, DC, USA, 2004. [Google Scholar] [CrossRef] [Green Version]

- Filho, H.S.R.; Ferreira, M.E.P. A taxa de câmbio e os ajustes no saldo da balança comercial brasileira: Uma análise setorial da Curva J. Nova Econ. 2016, 26, 887–907. [Google Scholar] [CrossRef] [Green Version]

- Carvalho, T.S.; Domingues, E.P.; Horridge, J.M. Controlling deforestation in the Brazilian Amazon: Regional economic impacts and land-use change. Land Use Policy 2017, 64, 327–341. [Google Scholar] [CrossRef] [Green Version]

- Johansson, D.J.A. Economics- and physical-based metrics for comparing greenhouse gases. Clim. Chang. 2011, 110, 123–141. [Google Scholar] [CrossRef]

- Persson, U.M.; Johansson, D.J.A.; Cederberg, C.; Hedenus, F.; Bryngelsson, D. Climate metrics and the carbon footprint of livestock products: Where’s the beef? Environ. Res. Lett. 2015, 10, 034005. [Google Scholar] [CrossRef]

- Lynch, J.; Cain, M.; Pierrehumbert, R.; Allen, M. Demonstrating GWP: A means of reporting warming-equivalent emissions that captures the contrasting impacts of short- and long-lived climate pollutants. Environ. Res. Lett. 2020, 15, 044023. [Google Scholar] [CrossRef]

- Bobokhonov, A.; Pokrivcak, J.; Rajcaniova, M. The impact of agricultural and trade policies on price transmission: The case of Tajikistan and Uzbekistan. J. Int. Trade Econ. Dev. 2017, 26, 677–692. [Google Scholar] [CrossRef]

- Desjardins, P.; Polèse, M.; Shearmur, R. The Evolu on of Canada’s Regional Economies: Structural Pa erns, Emerging Trends and Future Challenges Legal Deposit: Bibliothèque et Archives nationales du Québec, 2013 Bibliothèque et Archives Canada. Available online: www.ucs.inrs.ca/ucs/publications/collections/rapports-et-notes-de-recherche (accessed on 27 February 2021).

- Henderson, B.; Golub, A.; Pambudi, D.; Hertel, T.; Godde, C.; Herrero, M.; Cacho, O.; Gerber, P. The power and pain of market-based carbon policies: A global application to greenhouse gases from ruminant livestock production. Mitig. Adapt. Strateg. Glob. Chang. 2017, 23, 349–369. [Google Scholar] [CrossRef]

- Van Veelen, B. Cash cows? Assembling low-carbon agriculture through green finance. Geoforum 2021, 118, 130–139. [Google Scholar] [CrossRef]

- Myhre, G.; Shindell, D.; Pongratz, J. Anthropogenic and Natural Radiative Forcing. In Climate Change 2013: The Physical Science Basis. Contribution of Working Group I; Cambridge University Press: Cambridge, UK, 2013. [Google Scholar]

- Maraqa, M.A.; Albuquerque, F.D.B.; Alzard, M.H.; Chowdhury, R.; Kamareddine, L.A.; el Zarif, J. GHG Emission Reduction Opportunities for Road Projects in the Emirate of Abu Dhabi: A Scenario Approach. Sustainability 2021, 13, 7367. [Google Scholar] [CrossRef]

- D’Aurea, A.P.; Cardoso, A.d.; Guimarães, Y.S.R.; Fernandes, L.B.; Ferreira, L.E.; Reis, R.A. Mitigating Greenhouse Gas Emissions from Beef Cattle Production in Brazil through Animal Management. Sustainability 2021, 13, 7207. [Google Scholar] [CrossRef]

- Sajid, M.J.; Qiao, W.; Cao, Q.; Kang, W. Prospects of industrial consumption embedded final emissions: A revision on Chinese household embodied industrial emissions. Sci. Rep. 2020, 10, 287–309. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Vasel-Be-Hagh, A.; Ting, D.S.K. (Eds.) Environmental Management of Air, Water, Agriculture, and Energy; CRC Press: Boca Raton, FL, USA, 2020. [Google Scholar] [CrossRef]

- Pan, C.; Shrestha, A.K.; Wang, G.; Innes, J.L.; Wang, K.X.; Li, N.; Li, J.; He, Y.; Sheng, C.; Niles, J. A Linkage Framework for the China National Emission Trading System (CETS): Insight from Key Global Carbon Markets. Sustainability 2021, 13, 7459. [Google Scholar] [CrossRef]

- Miceikienė, A.; Gesevičienė, K.; Rimkuvienė, D. Assessment of the Dependence of GHG Emissions on the Support and Taxes in the EU Countries. Sustainability 2021, 13, 7650. [Google Scholar] [CrossRef]

- Zabrodskyi, A.; Šarauskis, E.; Kukharets, S.; Juostas, A.; Vasiliauskas, G.; Andriušis, A. Analysis of the Impact of Soil Compaction on the Environment and Agricultural Economic Losses in Lithuania and Ukraine. Sustainability 2021, 13, 7762. [Google Scholar] [CrossRef]

- Mohebbi, G.; Bahadori-Jahromi, A.; Ferri, M.; Mylona, A. The Role of Embodied Carbon Databases in the Accuracy of Life Cycle Assessment (LCA) Calculations for the Embodied Carbon of Buildings. Sustainability 2021, 13, 7988. [Google Scholar] [CrossRef]

- Kroeger, M.E.; Meredith, L.K.; Meyer, K.M.; Webster, K.D.; de Camargo, P.B.; de Souza, L.F.; Tsai, S.M.; van Haren, J.; Saleska, S.; Bohannan, B.J.M.; et al. Rainforest-to-pasture conversion stimulates soil methanogenesis across the Brazilian Amazon. ISME J. 2021, 15, 658–672. [Google Scholar] [CrossRef]

- Gurgel, A.C.; Paltsev, S.; Breviglieri, G.V. The impacts of the Brazilian NDC and their contribution to the Paris agreement on climate change. Environ. Dev. Econ. 2019, 24, 395–412. [Google Scholar] [CrossRef]

- Brasil and C. I. S. M. do Clima. Plano Nacional Sobre Mudança do Clima—PNMC. Brasilia—Distrito Federal, Brazil. 2008. Available online: http://www.mma.gov.br/estruturas/smcq_climaticas/_arquivos/plano_nacional_mudanca_clima.pdf (accessed on 27 February 2021).

- Lucena, A.F.P.; Clarke, L.; Schaeffer, R.; Szklo, A.; Rochedo, P.R.R.; Nogueira, L.P.P.; Daenzer, K.; Gurgel, A.; Kitous, A.; Kober, T. Climate policy scenarios in Brazil: A multi-model comparison for energy. Energy Econ. 2016, 56, 564–574. [Google Scholar] [CrossRef]

- Pereda, P.C.; Lucchesi, A.; Garcia, C.P.; Palialol, B.T. Neutral carbon tax and environmental targets in Brazil. Econ. Syst. Res. 2018, 31, 70–91. [Google Scholar] [CrossRef]

- Gurgel, A.C.; Paltsev, S. Costs of reducing GHG emissions in Brazil. Clim. Policy 2013, 14, 209–223. [Google Scholar] [CrossRef]

- Santos, L.; Garaffa, R.; Lucena, A.F.P.; Szklo, A. Impacts of Carbon Pricing on Brazilian Industry: Domestic Vulnerability and International Trade Exposure. Sustainability 2018, 10, 2390. [Google Scholar] [CrossRef] [Green Version]

- Nasirov, S.; O’Ryan, R.; Osorio, H. Decarbonization Trade-offs: A Dynamic General Equilibrium Modeling Analysis for the Chilean Power Sector. Sustainability 2020, 12, 8248. [Google Scholar] [CrossRef]

- Cain, M.; Lynch, J.; Allen, M.R.; Fuglestvedt, J.S.; Frame, D.J.; Macey, A.H. Improved calculation of warming-equivalent emissions for short-lived climate pollutants. NPJ Clim. Atmos. Sci. 2019, 2, 1–7. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Chen, Z.; Chen, D.; Kwan, M.; Chen, B.; Gao, B.; Zhuang, Y.; Li, R.; Xu, B. The control of anthropogenic emissions contributed to 80% of the decrease in PM2.5 concentrations in Beijing from 2013 to 2017. Atmos. Chem. Phys. 2019, 19, 13519–13533. [Google Scholar] [CrossRef] [Green Version]

- Walmsley, T.; Narayanan, B.; Aguiar, A.; McDougall, R. Building a global database: Consequences for the national I–O data. Econ. Syst. Res. 2018, 30, 478–496. [Google Scholar] [CrossRef]

- Antimiani, A.; Fusacchia, I.; Salvatici, L. GTAP-VA: An Integrated Tool for Global Value Chain Analysis. J. Glob. Econ. Anal. 2018, 3, 69–105. [Google Scholar] [CrossRef]

- Fraser, I.; Waschik, R. The Double Dividend hypothesis in a CGE model: Specific factors and the carbon base. Energy Econ. 2013, 39, 283–295. [Google Scholar] [CrossRef]

- De Azevedo, T.R.; Junior, C.C.; Junior, A.B.; Cremer, M.d.S.; Piatto, M.; Tsai, D.S.; Barreto, P.; Martins, H.; Sales, M.; Galuchi, T.; et al. SEEG initiative estimates of Brazilian greenhouse gas emissions from 1970 to 2015. Sci. Data 2018, 5, 1–43. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Van Meijl, H.; van Rheenen, T.; Tabeau, A.; Eickhout, B. The impact of different policy environments on agricultural land use in Europe. Agric. Ecosyst. Environ. 2006, 114, 21–38. [Google Scholar] [CrossRef]

- Rutherford, T.F. Climate-Linked Tariffs: Practical Issues 1 Thinking Ahead on International Trade (TAIT) Climate-Linked Tariffs: Practical Issues. 2010. Available online: www.graduateinstitute.ch/ctei (accessed on 18 July 2021).

- Frey, M. Assessing the impact of a carbon tax in Ukraine. Clim. Policy 2016, 17, 378–396. [Google Scholar] [CrossRef]

- Allen, D.T.; Sullivan, D.W.; Zavala-Araiza, D.; Pacsi, A.P.; Harrison, M.; Keen, K.; Fraser, M.P.; Hill, A.D.; Lamb, B.K.; Sawyer, R.F.; et al. Methane emissions fro(m process equipment at natural gas production sites in the United States: Liquid unloadings. Environ. Sci. Technol. 2015, 49, 641–648. [Google Scholar] [CrossRef]

- Allen, D.T. Emissions from oil and gas operations in the United States and their air quality implications. J. Air Waste Manag. Assoc. 2016, 66, 549–575. [Google Scholar] [CrossRef] [Green Version]

- Boucher, O.; Reddy, M.S. Climate trade-off between black carbon and carbon dioxide emissions. Energy Policy 2008, 36, 193–200. [Google Scholar] [CrossRef]

- Brewer, T.L. Black carbon emissions and regulatory policies in transportation. Energy Policy 2019, 129, 1047–1055. [Google Scholar] [CrossRef]

- SEEG. Emissões Totais|SEEG—Sistema de Estimativa de Emissão de Gases. Emissões Totais de Gases de Efeito Estufa; 2020. Available online: http://plataforma.seeg.eco.br/total_emission# (accessed on 20 July 2021).

- Schmitt, D.J. Ministro Edson Duarte Secretário-Executivo Substituto Secretário Departamento de Florestas e Combate ao Desmatamento Presidente Michel Temer Ministério do Meio Ambiente República Federativa do Brasil Secretaria Executiva Romeu Mendes do Carmo Secretaria de Mudança do Clima E Florestas. 2018. Available online: http://www.mma.gov.br/publicacoes-mma (accessed on 18 July 2021).

- G. F. do B. Ministério do Meio Ambiente. Plano de Ação para Prevenção e Controle do Desmatamento na Amazônia Legal (PPCDAm). Brasília, DF. 2004. Available online: http://redd.mma.gov.br/images/central-de-midia/pdf/artigos/enredd-ppcdam.pdf (accessed on 20 July 2021).

- G. F. do B. Ministério do Meio Ambiente. Planos de Ação para Prevenção e Controle do Desmatamento na Amazônia Legal e no Cerrado-PPCDAm e PPCerrado Comissão Executiva para Controle do Desmatamento Ilegal e Recuperação da Vegetação. Brasília, DF. 2019. Available online: http://combateaodesmatamento.mma.gov.br/images/Doc_ComissaoExecutiva/Balano-PPCDAm-e-PPCerrado_2019_aprovado.pdf (accessed on 20 July 2021).

- Civil, C.; Mapa, M.D. Plano Setorial de Mitigação e de Adaptação às Mudanças Climáticas para a Consolidação de uma Economia de Baixa Emissão de Carbono na Agricultura-Plano de Agricultura de Baixa Emissão de Carbono (Plano ABC)-Versão Preliminar 20 Maio; Ministerio da Agricultura: Brasilia, Brazil, 2011.

- Bergquist, D.A.; Cavalett, O.; Rydberg, T. Participatory emergy synthesis of integrated food and biofuel production: A case study from Brazil. Environ. Dev. Sustain. 2011, 14, 167–182. [Google Scholar] [CrossRef]

- Aguiar, A.; Narayanan, B.; McDougall, R. An Overview of the GTAP 9 Data Base. J. Glob. Econ. Anal. 2016, 1, 181–208. [Google Scholar] [CrossRef]

- Hertel, T.W. Global Trade Analysis: Modeling and Applications; Press Syndicate of the University of Cambridge: Cambridge, UK, 1997. [Google Scholar]

- Narayanan, B. Chapter 3: What’s New in GTAP 9. May 2015. Available online: https://www.gtap.agecon.purdue.edu/resources/res_display.asp?RecordID=4820 (accessed on 18 July 2021).

- Feijó, F.T.; Júnior, S.P. O Protocolo De Quioto E O Bem-Estar Econômico No Brasil—Uma Análise Utilizando Equilíbrio Geral Computável. Anál. Econ. 2009, 27, 127–154. [Google Scholar] [CrossRef] [Green Version]

- Röös, E.; Sundberg, C.; Tidåker, P.; Strid, I.; Hansson, P.A. Can carbon footprint serve as an indicator of the environmental impact of meat production? Ecol. Indic. 2013, 24, 573–581. [Google Scholar] [CrossRef]

- Tourinho, O.A.F.; da Motta, R.S.; Alves, Y.L.B. Uma Aplicação Ambiental de um Modelo de Equilíbrio Geral. 2003. Available online: http://repositorio.ipea.gov.br/handle/11058/2921 (accessed on 18 July 2021).

- Tol, R.S.J. A social cost of carbon for (almost) every country. Energy Econ. 2019, 83, 555–566. [Google Scholar] [CrossRef]

- Pigou, A.C. Some Problems of Foreign Exchange. Econ. J. 1920, 30, 460–472. Available online: https://www.jstor.org/stable/2222870 (accessed on 20 July 2021). [CrossRef]

- Nong, D. Development of the electricity-environmental policy CGE model (GTAP-E-PowerS): A case of the carbon tax in South Africa. Energy Policy 2020, 140, 111375. [Google Scholar] [CrossRef]

- Hubbard, C.; Alvim, A.M.; Garrod, G. Brazilian Agriculture as a Global Player. EuroChoices 2017, 16, 3–4. [Google Scholar] [CrossRef]

- Filho, J.B.d.F.; Ribera, L.; Horridge, M. Deforestation Control and Agricultural Supply in Brazil. Am. J. Agric. Econ. 2015, 97, 589–601. [Google Scholar] [CrossRef]

- Säll, S. Environmental food taxes and inequalities: Simulation of a meat tax in Sweden. Food Policy 2018, 74, 147–153. [Google Scholar] [CrossRef]

| SEEG Sectors | 2005 | 2018 | % (2005–2018) | |||

|---|---|---|---|---|---|---|

| GWP (t.) | GTP (t.) | GWP (t.) | GTP (t.) | GWP | GTP | |

| Meat & Dairy | 400,022,781 | 114,435,703 | 408,675,212 | 117,924,190 | 2 | 3 |

| Deforestation 1 | 2,068,426,095 | 1,989,495,796 | 827,043,560 | 794,106,885 | −60 | −60 |

| Grains & Crops | 94,537,522 | 48,417,779 | 146,699,271 | 83,439,144 | 55 | 72 |

| Industry & Services 2 | 115,122,063 | 78,806,916 | 148,787,577 | 93,671,081 | 29 | 19 |

| Energy | 331,843,307 | 315,180,572 | 424,803,865 | 407,694,211 | 28 | 29 |

| Carbon Sequestration | −446,394,750 | −446,394,750 | −529,451,505 | −529,451,505 | 19 | 19 |

| Total | 2,563,557,019 | 2,099,942,016 | 1,426,557,980 | 967,384,005 | −44 | −54 |

| Regions | Industries | Primary Factors |

|---|---|---|

| Africa (AFR) Argentina (ARG) Brazil (BRA) China (CHN) East Asia (EAS) EU-25 (EUR) Canada and Mexico (NAM) Oceania (OCE) Russia (RUS) South Asia (SAS) Southeast Asia (STA) United States (USA) Rest of the World (ROW) | Cattle production (BECA) Chicken and pork production (CIPO) Raw Milk production (RMIL) Other Agriculture (OTAG) Forestry (FORE) Beef—industry (BEEF) Chicken and pork—industry (CHPO) Dairy-industry (DAIR) Industry & Services (INSE) Energy (ENER) | Capital Land Natural Resources Skilled Labor Unskilled Labor |

| Scenarios | Description | Deforestation | Mitigation in the Agricultural Sector in Brazil | Mitigation in Other Sectors in Brazil |

|---|---|---|---|---|

| Carbon taxes apply to the Brazilian Meat & Dairy industry. (EI) | The same level of carbon sequestration as the base scenario. (flexible command and control instruments). | YES (20, 40, 60 $/t) | NO |

| Carbon taxes are applied to the Brazilian Energy industry. (EI). | The same level of carbon sequestration as the base scenario. (flexible command and control instruments). | NO | YES (20, 40, 60 $/t) |

| Carbon taxes are applied to all sectors in Brazil. | The same level of carbon sequestration as the base scenario. (flexible command and control instruments). | YES (20, 40, 60 $/t) | YES (20, 40, 60 $/t) |

| Carbon taxes: lower taxes on the Meat & Dairy industry. | The same level of carbon sequestration as the base scenario. (flexible command and control instruments). | YES (20, 40 $/t) | YES (40, 60 $/t) |

| Equivalent Shock (%) | |||

|---|---|---|---|

| Sector | 10 $/GHG (t.) | 20 $/GHG (t.) | 40 $/GHG (t.) |

| BECA | 10.76 | 21.53 | 43.05 |

| CIPO | 0.91 | 1.83 | 3.66 |

| RMIL | 4.20 | 8.40 | 16.80 |

| BEEF | 0.03 | 0.05 | 0.10 |

| CHPO | 0.03 | 0.06 | 0.12 |

| DAIR | 0.08 | 0.17 | 0.34 |

| OTAG | 0.84 | 1.68 | 3.36 |

| INSE | 0.04 | 0.07 | 0.15 |

| ENERG | 3.50 | 6.90 | 13.9 |

| Equivalent Shock (%) | |||

|---|---|---|---|

| Sectors | 10 $/GHG (t.) | 20 $/GHG (t.) | 40 $/GHG (t.) |

| BECA | 2.87 | 5.74 | 11.47 |

| CIPO | 0.47 | 0.95 | 1.89 |

| RMIL | 1.48 | 2.96 | 5.91 |

| BEEF | 0.00 | 0.01 | 0.01 |

| CHPO | 0.00 | 0.01 | 0.02 |

| DAIR | 0.01 | 0.02 | 0.05 |

| OTAG | 0.45 | 0.90 | 1.79 |

| INSE | 0.03 | 0.05 | 0.10 |

| ENERG | 3.30 | 6.70 | 13.40 |

| Scenario and Carbon-Tax Amount | Beef | Pork & Chicken | Dairy | Grains & Crops | ||||

|---|---|---|---|---|---|---|---|---|

| GWP | GTP | GWP | GTP | GWP | GTP | GWP | GTP | |

| 1–20 | −11.9 | −2.7 | 1.7 | 1.6 | −1.4 | −0.3 | 0.7 | 0.2 |

| 1–40 | −24.5 | −6.0 | 1.0 | 0.9 | −3.0 | −0.9 | 1.6 | 0.4 |

| 1–60 | −37.1 | −9.3 | 0.3 | 0.1 | −4.6 | −1.4 | 2.4 | 0.6 |

| 2–20 | 0.5 | 0.5 | 2.3 | 2.2 | 0.0 | 0.0 | 0.8 | 0.8 |

| 2–40 | 1.1 | 1.1 | 4.8 | 4.6 | 0.1 | 0.1 | 1.8 | 1.7 |

| 2–60 | 1.7 | 1.7 | 7.3 | 7.0 | 0.1 | 0.1 | 2.7 | 2.6 |

| 3–20 | −12.0 | −3.0 | 0.9 | 0.3 | −1.5 | −0.4 | −1.1 | −1.1 |

| 3–40 | −23.7 | −5.5 | 4.1 | 2.7 | −3.0 | −0.9 | −0.5 | −0.6 |

| 3–60 | −35.3 | −8.1 | 7.1 | 5.2 | −4.5 | −1.4 | 0.1 | 0.0 |

| 4–20/40 | −11.2 | −2.4 | 3.9 | 2.7 | −9.2 | −0.4 | 0.2 | −0.2 |

| 4–20/60 | −10.6 | −1.9 | 6.9 | 4.9 | −1.3 | −0.4 | 1.1 | 1.7 |

| 4–40/60 | −23.0 | −4.9 | 7.0 | 5.1 | −2.9 | −0.9 | 0.6 | 0.3 |

| Scenario and Carbon-Tax Amount | Energy | Forestry | Ind. & Serv. | Total | ||||

|---|---|---|---|---|---|---|---|---|

| GWP | GTP | GWP | GTP | GWP | GTP | GWP | GTP | |

| 1–20 | 0.6 | 0.1 | −0.1 | 0.0 | 0.1 | 0.0 | −2.4 | −0.2 |

| 1–40 | 1.3 | 0.3 | −0.2 | −0.1 | 0.2 | 0.1 | −5.0 | −0.4 |

| 1–60 | 2.0 | 0.5 | −0.3 | −0.1 | 0.3 | 0.1 | −7.6 | −0.6 |

| 2–20 | −6.8 | −6.6 | 0.1 | 0.1 | 0.2 | 0.2 | −1.7 | −2.5 |

| 2–40 | −14.5 | −14.0 | 0.2 | 0.2 | 0.4 | 0.4 | −3.7 | −5.2 |

| 2–60 | −22.1 | −21.3 | 0.2 | 0.2 | 0.6 | 0.1 | −5.6 | −8.0 |

| 3–20 | −7.7 | −8.1 | 0.3 | 0.3 | 0.5 | 0.4 | −4.6 | −3.2 |

| 3–40 | −14.2 | −15.0 | 0.2 | 0.4 | 0.8 | 0.6 | −9.1 | −6.1 |

| 3–60 | −20.6 | −21.9 | 0.2 | 0.4 | 1.1 | 0.8 | −13.5 | −9.0 |

| 4–20/40 | −15.1 | −15.5 | 0.3 | 0.4 | 0.7 | 0.6 | −6.7 | −6.0 |

| 4–20/60 | −22.5 | −22.9 | 0.4 | 0.4 | 0.8 | 0.7 | −8.4 | −8.7 |

| 4–40/60 | −21.6 | −22.4 | 0.3 | 0.4 | 1.0 | 0.8 | −10.9 | −8.8 |

| Exports | GDP | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Scenarios Carbon-Tax | Beef | Pork & Chicken | Dairy | Total | ||||||

| GWP | GTP | GWP | GTP | GWP | GTP | GWP | GTP | GWP | GTP | |

| 1–20 | −73.9 | −16.5 | 3.9 | 3.7 | −16.8 | −3.6 | 1.5 | 0.4 | −0.3 | −0.1 |

| 1–40 | −152.1 | −37.1 | 2.6 | 2.0 | −37.3 | −10.9 | 3.0 | 0.8 | −0.5 | −0.1 |

| 1–60 | −230.2 | −57.9 | 1.3 | 0.5 | −57.8 | −18.1 | 4.4 | 1.2 | −0.8 | −0.2 |

| 2–20 | 5.1 | 4.9 | 5.5 | 5.4 | 5.5 | 5.3 | 2.4 | 2.3 | −0.9 | −0.8 |

| 2–40 | 10.4 | 10.4 | 11.3 | 11.3 | 11.1 | 11.1 | 4.9 | 4.9 | −1.8 | −1.8 |

| 2–60 | 16.5 | 16.7 | 17.9 | 18.2 | 17.6 | 17.9 | 7.7 | 7.8 | −2.8 | −2.8 |

| 3–20 | −74.9 | −15.9 | 2.3 | 0.6 | −18.2 | −5.3 | −1.0 | −2.4 | −0.3 | 0.0 |

| 3–40 | −144.2 | −32.2 | 10.3 | 6.7 | −29.6 | −6.0 | 4.1 | 1.1 | −1.8 | −1.2 |

| 3–60 | −213.8 | −45.8 | 18.1 | 12.9 | −41.2 | −5.7 | 9.1 | 4.6 | −3.3 | −2.3 |

| 4–20/40 | −68.5 | −13.3 | 9.7 | 6.6 | −10.9 | −0.4 | 2.4 | 0.2 | −1.4 | −0.9 |

| 4–20/60 | −61.5 | −8.5 | 16.9 | 12.1 | −3.9 | 5.0 | 5.6 | 3.0 | −2.5 | −1.9 |

| 4–40/60 | −137.6 | −26.75 | 17.4 | 12.7 | −22.5 | −0.11 | 7.3 | 3.7 | −2.9 | −2.1 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alvim, A.M.; Sanguinet, E.R. Climate Change Policies and the Carbon Tax Effect on Meat and Dairy Industries in Brazil. Sustainability 2021, 13, 9026. https://doi.org/10.3390/su13169026

Alvim AM, Sanguinet ER. Climate Change Policies and the Carbon Tax Effect on Meat and Dairy Industries in Brazil. Sustainability. 2021; 13(16):9026. https://doi.org/10.3390/su13169026

Chicago/Turabian StyleAlvim, Augusto Mussi, and Eduardo Rodrigues Sanguinet. 2021. "Climate Change Policies and the Carbon Tax Effect on Meat and Dairy Industries in Brazil" Sustainability 13, no. 16: 9026. https://doi.org/10.3390/su13169026

APA StyleAlvim, A. M., & Sanguinet, E. R. (2021). Climate Change Policies and the Carbon Tax Effect on Meat and Dairy Industries in Brazil. Sustainability, 13(16), 9026. https://doi.org/10.3390/su13169026