The Individual Dimension of Digital Innovation: The Altered Roles of Innovation Agents and Market Actors

Abstract

:1. Introduction

2. Literature Review

3. Theoretical Background

4. Methodology

5. Data Analysis

6. Results

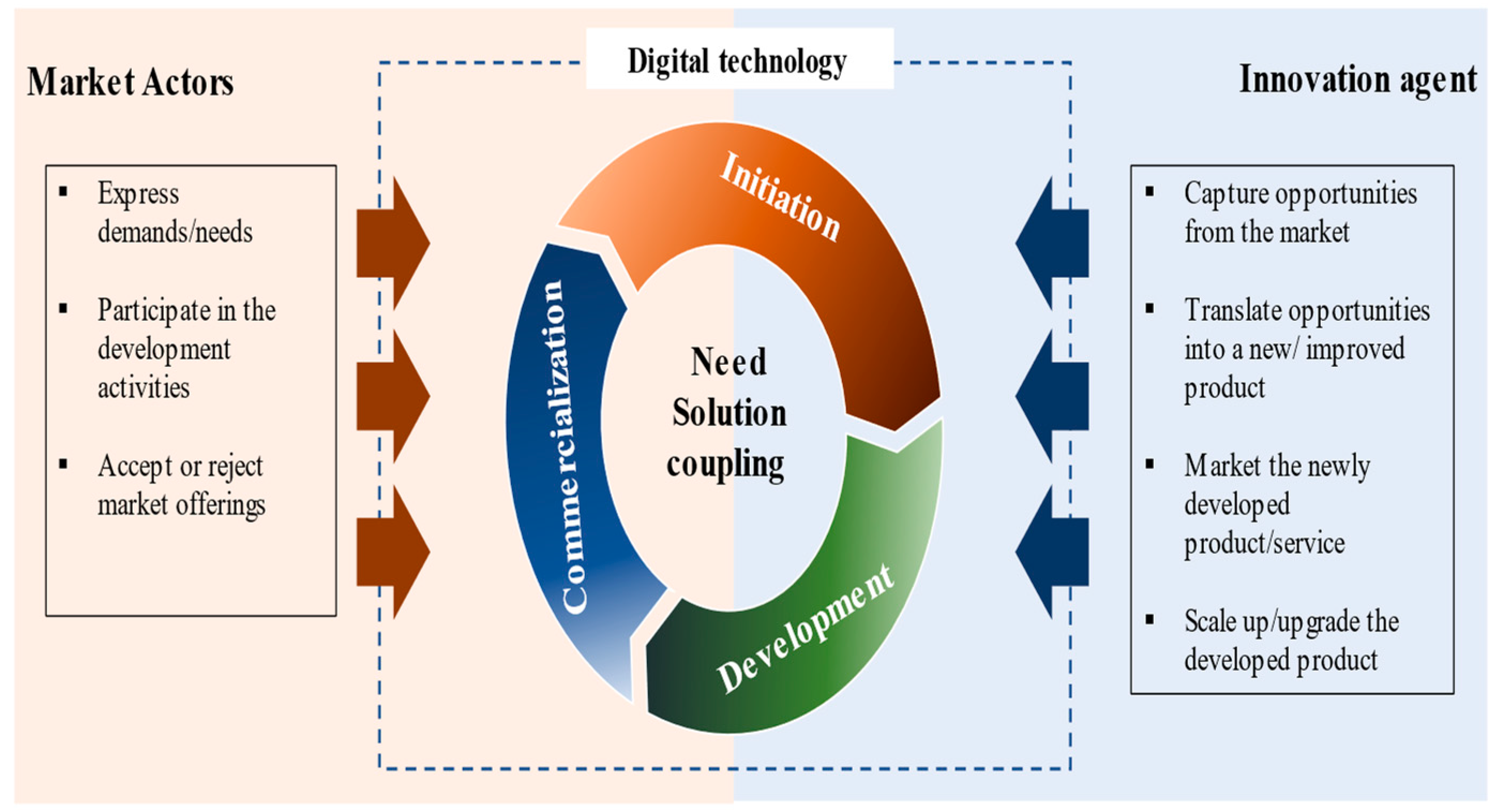

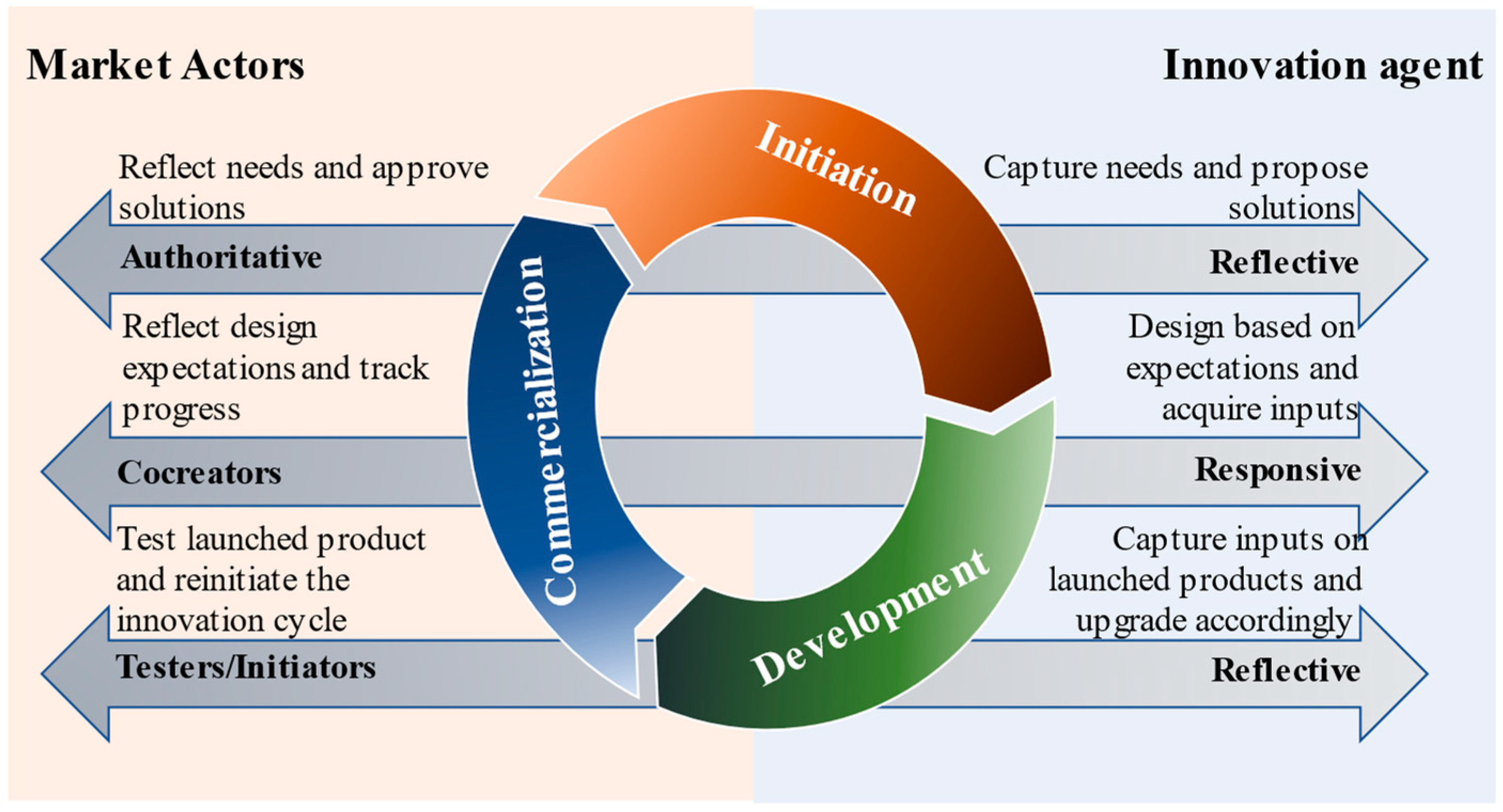

Based on the need–solution coupling notion of von Hippel & von Krogh [9], the individual dimension was analyzed at three main stages of the digital innovation process: Initiation, development, and commercialization. Appendix F provides exemplary quotations.

6.1. Initiation Stage: Shift in Roles of Innovation Agents and Market Actors

- The participants indicated that giving control to market actors, as drivers of innovation, is important to increase the potentiality of market acceptance upon product launch. Several participants emphasized that innovative ideas that are not initiated by market actors inherently have high uncertainty and risk. Company B shared that they had developed a digital product which was based on their own generated ideas, and did not project the idea against the needs of market actors, or evaluate it based on market acceptance. As a result, the product failed in the market. Company K also shared a similar experience of failure. Subsequently, companies H, K, B, and J explained that, based on their experience, avoid the internal generation of innovation ideas and relies on market to initiate innovation.

6.2. Development Stage: Innovation Co-Creation

6.3. Commercialization Stage: Market Actor Testing and Initiating Roles

- Enabling cost reduction and speed operations, through the automation of different operational activities.

- Allowing a heterogenous pool of actors to be actively engaged in the innovation process, which enables innovation agents to tap into a larger pool of knowledge and, thus, improves the efficiency and effectiveness of their innovative activities.

- Increasing the efficiency of communication and distribution channels, allowing for a large amount of data to be quickly circulated between various actors.

- Improving the dynamism and transparency of the innovation processes, by eliminating intermediaries and directly linking innovation agents with market actors. This transparency builds trust, which is required to increase the satisfaction and purchasing desire of market actors.

- Gathering a huge mass of data, as business intelligence, can be used to predict market trends, plan and make decisions, modify existing products, improve user experiences, and to serve market actors and attract new ones.

7. Discussion

8. Contributions, Implications and Limitations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Size | Micro | Small | Medium | |||

|---|---|---|---|---|---|---|

| Sales Turnover | Employees | Sales Turnover | Employees | Sales Turnover | Employees | |

| manufacturing | <RM 300,000 | <5 employees | RM 300,000 to <15 million | 5 to <75 employees | RM 15 million to ≤50 million | 75 to ≤200 employees |

| service & other sectors | RM 300,000 to <3 million | 5 to <30 employees | RM 3 million to ≤20 million | 30 to ≤75 employees | ||

Appendix B

| firm size | Only SMEs will be selected. Large companies will be excluded from the study, as they do not represent the population of Malaysian companies. |

| ict sector | Companies will be selected from the ICT sector, as the research phenomenon is in the digital context. |

| sme’s location | SMEs located in Klang Valley region are selected. These companies are located in Kuala Lumpur and its neighboring suburbs, towns, and cities in the Selangor state. This area is recognized for its more than 23% GDP of economic growth rate, which is being built by Kuala Lumpur and Selangor, corresponding to the Department of Statistics Malaysia (DoSM) (2017). Furthermore, a substantial proportion of SMEs involved in the services sector (which ICT is a part of) are present in Klang Valley area, contributing to a competitive business market. |

| innovative companies | Innovative companies that introduce at least one identifiable commercialized innovation project, which can create value for the company and its stakeholders. |

| locally owned | Foreign-owned companies will be excluded from this study. |

| accessible to researcher | Interview research needs good transparency and collaboration (Yin, 2014). Thus, it is significant to choose companies that express a high level of interest in engaging in the research and were available at the time of conducting the study. |

| information content | The participant needs to give enough details about the phenomenon considered in the research to allow the researcher to properly examine the research question. |

Appendix C

| Company Name | Company Age | Company Services and Products | Participant’s Position |

|---|---|---|---|

| Middle-size companies | |||

| Company A | 23 years | Big Data Analytics, Cloud Computing, and Software Engineering | COO |

| Company C | 14 years | Information technology, internet of things, project management services, security solutions and management, desktop solutions and management, and networking | director |

| Company K | 20 years | Artificial intelligence and internet of things | CEO |

| Company M | 14 years | Digital Project Management, Project Management Training and Education, Business Process Improvements, Big Data, and Business Intelligence | vice president |

| Company F | 10 years | IoT, business consultancy, e-marketing, and solution development | owner and CEO |

| Company Q | 9 years | Efficient and Convenient Odoo ERP and CRM solutions for enterprises, co-creation software product development partnership, Mobile Applications, and Data Visualization | owner and CEO |

| Small-size companies | |||

| Company D | 5 years | Consulting, Technological and Digital HR Solutions, Programme and Project Management | CIO |

| Company B | 10 years | Artificial intelligence, app development, and internet of things | owner and MD |

| Company G | 15 years | IoT, mobile apps and website development, hosting services, UI and UX design, digital marketing, and solution providers | owner and CEO |

| Company J | 4 years | Online Tools, NEM Merchandise Shop, Blockchain Crypto Consultancy, Blockchain App Design, NEM Supernode Service, Network, and Bitcoin Lightning | CIO |

| Company I | 6 years | IT Services, IT Solutions Provider, and Supply Chain Services | owner and CEO |

| Company E | 11 years | Consultancy, websites, and mobile app development | CEO |

| Company L | 3 years | Blockchain development service, training, and consultancy | co-owner and CTO |

| Company O | 19 years | Data Centre and Enterprise Networking, and Surveillance Solutions | owner and CEO |

| Company P | 11 years | App development | owner and CEO |

| Company H | 3 years | Analytics consultancy and training, Applied Analytics, Analytics Talent Upskilling (ATU), and Sentiment Analysis | owner and CEO |

| Company N | 5 years | Management consultancy and training, Product Discovery, Web and Mobile Development, and Digital Transformation | owner and CEO |

| Company R | 5 years | IoT, Cloud computing, and Artificial Intelligence | owner and CEO |

| Company S | 5 years | Specialized in connected fitness, wellness, and healthcare technology solutions | founder & CEO |

| Company T | 5 years | Contact center management, IT management, App and Web development | CEO |

| Company U | 4 years | Business end-to-end management and networking | founder & CEO |

Appendix D

| familiarization with data | The aim of this step is to gather all potential occurrences that emerged from the text record of the interviewees. The researcher becomes familiar with the data by repetitively reading the text and reporting any initial analytical observations. |

| initial coding | Coding is not a method of data reduction; instead, it is an analytic process. Codes should include a conceptual and semantic reading of the data. The researcher begins coding by interpreting the meaning of what had been said. The researcher starts coding with research questions and theory in mind. This involves highlighting significant features of the data that are related to the research questions guiding the analysis. The researcher codes every data item and ends this phase by comparing all codes and relevant data extracted. |

| generating themes | A theme is a meaningful and coherent pattern of data that is linked to the research question. Searching for themes is similar to coding your codes to identify similarity in the data. The researcher constructs themes, and text that could not be categorized with the initial coding scheme is given a new code. The coded data is confirmed to be related to each theme to end this phase. |

| reviewing themes | This stage implies checking that the themes ‘work’, in relevance to both the full data set and coded extracts. The researcher reflects on whether the themes tell a compelling and convincing story, regarding the data, and starts to determine the nature of each theme, as well as the relationships between the themes. Certain themes are split into two or more themes, others are collapsed together, while some themes are discarded. |

| defining and naming themes | This phase demands that the researcher writes and produces a detailed analysis of each individual theme. The researcher determines the ‘essence’ of each theme and provides an informative name and a brief description for each theme. |

| writing up | The writing stage is an integral part of the analytical process. The researcher describes the findings of the data analysis, by answering the research questions according to both existing and new codes |

Appendix E

| Categories of Construct | Emergent Themes | Companies | ||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| A | B | C | D | E | F | G | H | I | J | K | L | M | N | O | P | Q | R | S | T | U | ||

| Innovation agent roles | ||||||||||||||||||||||

| all stages | reflective/responsive agents | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X | |||||

| Market actor roles | ||||||||||||||||||||||

| initiation stage | authoritative role | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X | ||||||

| development stage | co-creator role | X | X | X | X | X | X | X | X | X | X | X | ||||||||||

| commercialization stage | tester role | X | X | X | X | X | X | X | X | X | ||||||||||||

| initiator role | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X | X | |||||

Appendix F

| Main Emergent Themes | Exemplary Quotations from Respondents |

|---|---|

| innovation agents as reflective agents | “we listen, understand and respond with innovative and creative solutions that adds value to the clients” [company C]; “we always say that we are a tailor house: we have you to tailor whatever you feel like is nice to wear for you. This is our role … we can only tell you based on your requirements, we will try the best to do for you and the best will it be. That’s our limit” [company G]. |

| customer’s authoritative role | “Usually, clients ask us to do that thing because they want it” [company G]; “So, from [listening to client] we understand what the client needs” [company M]; “So I got to put my salespeople, and they will go out to smell those opportunities” [company A]; “we found that emerging need in the market” [company H]. “You cannot have blockchain and then you look up for problems. So, if the problem exist, whether blockchain serves that is very important … Whether AI resolve that is very important” [company Q]; “you need to be clear with what the problem is … it depends on your problem whether the technology is the solution” [company D]. “do really customers need this? What is the pain point? Do you really see the pain? Do they really need it?” [company A]; “assess each of the solutions” [company C]; “if I want to implement a solution so we actually try to see whether it fit the needs” [company M]. someone comes with an idea; we need to evaluate whether it is doable or not” [company T]; “make sure that the market fit to the solution is very important... That comes to validations” [company Q]; “in doing all these evaluations, you can get to a point where you realize that: yes, we are capable of taking this opportunity and do well” [Company T]. “validation is needed. I shared this idea, and I received the feedbacks to improve the idea before lunching it” [company H]; “the best way to do anything is to validate. Validation is an important process, which means before you design something you actually talk to the customers not directly about the product but about what is their experiences. Let’s say for an example, when we are designing this medical product, we don’t know whether it will be successful of not, there is a 50-50 chance. But we involve the real stakeholders, we involve the shares of the company, we involved the doctors. If the real stakeholders will talk about the product so this is will work” [company C]. “So, essentially the product and the customer should be able to have some “product-market fit” which is very important” [company Q]; “from there we understand what the client needs, and we try to cater that to what we want to deliver to them” [company M]. “you want to share the idea with small market for you to get the right feedback and go deep in the discussion. So, you check, you have some metrics to validate; did I validate this this and this; if not, I have to iterate; I have to come back, change the business model, change the pricing, change everything until I validate” [company U]. |

| customer’s co-creational role | “when you build the product, build a prototyping model” [company Q]; “we conducted a lot of pilot studies” [company S]; “most of the time the issue will be that customers don’t like the design … because when they put in the requirement, they cannot see the system yet … now we do [prototyping]” [Company M]; “charge them 50% of the real cost to build the first pilot of users. That’s what I do; until now they are with me!” [company N]. “we exchange ideas and exchange feedback with customers … during this [development] process” [company C]; “If more than 85% of the people here like your product, what you have done, the way user experience and everything, then you say okay we have done a nice job” [company Q]. “next will be design. Design based on whatever requirements. After the signoff if customers agree, we go to the development” [company G]; “we have tools that can be shared together with customers. So, they know the list of milestones. So, each one of those milestones follow those schedules. Each one of the schedules… customers will gain insight” [company A]; “we always do follow projects …there will be a weekly project status update” [company A]; “I just engage the client on monthly bases or weekly bases” [company M]. |

| customer tester role | “we completed the product, and then the user needs to accept it, they need to test every function” [company B]; “we will give it for user-acceptance test, and then if the customer want something fixed, then we can do it” [company J]; “and after that there will be training” [company G]; “we also do tutorial” [company S]; “normally we will do all the after-sale service” [company F]; “we will take up the feedback in a way which is helpful and aligned to [our] service” [company Q]; “they will usually report of the project to see what works, what doesn’t work” [company L]; “we already have like few clients with more control, more feedback” [company N]. |

| customer initiator and inspirational role | “we progress stage by stage based on the needs, remember it always go back there” [company N]; “we get feedbacks, constant feedbacks from users and then we go and improve on our solutions” [company S]; “we got all the data from there we have other features that we plan to develop” [company B]; “if you see my first version and until now it is different … this is after a lot of people giving feedback” [company N]; “you want to continually push things into that customer … because someone else will come and do it to your customer if you don’t do it to them” [company D]. “So, find a problem, challenge your assumptions based on your findings and take feedback from the people and it may require from you to go back … It may require going back and try again. So, the iteration you have to make when you find out that whatever you thought that was a solution for the problem actually it is not true” [company U]. |

| the advantages of engaging market actors | “it is important to understand customers’ requirements because you cannot afford misunderstanding or miscommunication in any project implementation,” [company K]. “we seek advice from customers and at the same time we do our self-brainstorming to basically complement each other in term of operation understanding. So, we exchanged ideas and exchanged feedback. During the process I would say we made the product more mature, and richer in terms of the features, in terms of the feedback, in terms of the user-friendliness” [company C]. “seeking customers feedback can open up your mind, widen the horizon and more business opportunities for you” [company C]. “we get initial feedback, we give them wire frame or an idea of what the app can look like and then they can give feedback, then we will go back and fix it” [company J]. “and why we are successful? … Because I like to take input from users all the time” [company N]. “You got to get that feedback all the time. Otherwise, if you are working in a perfect innovation in the corner, you going to tell people about it later! It doesn’t work; the world moved on, or you missed it” [company D]. |

| digital technology- initiation stage | “one of the tools that I always use is called “talk to CEO”. Clients can talk to me directly to give feedback. they come in here and they talk about whatever they need. They currently asked for a better postage calculation, so then I tell them within two weeks we going to do it” [company N]; “Big Data, we collect a lot of information … then you catch it, analyze roughly, this will be the trend of next year” [company G]; “the database help create all the ideas” [company F]. |

| digitally technology- development stage | “For example, if I open my phone, I have my app that can look at all the status by a dashboard. So, I can see all the information of my projects in the phone … you do not need to come in the office. You do not need to call people and disturb them. You can just go in a dashboard or a system and see where the project is … I don’t need to go and be present” [company M]; “we talk through skype and we talk through WhatsApp … through emails if they need me and we are updated through these means” [company F]. |

| digital technology- commercialization stage | “after collecting the data from social media we already develop some motion learning algorithms to automatically find that for these pieces of the text; what is the sentiment of it? Is it positive or negative?” [company H]; “we market through Facebook, YouTube or any other media channel” [company F]. |

| digital technology benefits | The cost reduction comes from the fact that we can automate a lot of things. So, a lot of it comes from removing inefficiency in the current [system] also” [company L]; “The product is actually the same cost all the time, just that digital things eliminate middlemen. With all these feasibilities, I mean it is very transparent and now … once the confident is there you can see the volume is just exponential growth” [company O]; “If you have thousands of data, it is very difficult … everything has to be digitalized … thus, easy to transport between partners and partners” [company P]; “based on big data you can predict customer behavior the next month and based on those predictions … you can tell what the next step will be to take to … satisfy the customers in a better way, to create more revenue” [company H]; “most common thing is using data to make your decision” [company J]; “all these data … at the end of the day you can use it for planning … all these data can be analyzed. It can be analyzed then it can become business intelligent” [company C]; “data helps them make better decisions towards increasing the revenue and decreasing the cost of the company and creating more satisfaction for the customer and keep that customer” [company H] |

References

- Yoo, Y.; Henfridsson, O.; Lyytinen, K. Research commentary—The new organizing logic of digital innovation: An agenda for information systems research. Inf. Syst. Res. 2010, 21, 724–735. [Google Scholar] [CrossRef]

- Lyytinen, K.; Yoo, Y.; Boland, R.J., Jr. Digital product innovation within four classes of innovation networks. Inf. Syst. J. 2016, 26, 47–75. [Google Scholar] [CrossRef]

- Yoo, Y.; Boland, R.J., Jr.; Lyytinen, K.; Majchrzak, A. Organizing for innovation in the digitized world. Organ. Sci. 2012, 23, 1398–1408. [Google Scholar] [CrossRef]

- Goncalves, D.; Bergquist, M.; Bunk, R.; Alänge, S. The Impact of Digitization on Contemporary Innovation Management. In Proceedings of the 25th Americas Conference on Information Systems (AMCIS), Cancun, Mexico, 15–17 August 2019. [Google Scholar]

- Nambisan, S.; Wright, M.; Feldman, M. The digital transformation of innovation and entrepreneurship: Progress, challenges and key themes. Res. Policy 2019, 48, 103773. [Google Scholar] [CrossRef]

- Barrett, M.; Davidson, E.; Prabhu, J.; Vargo, S.L. Service innovation in the digital age. MIS Q. 2015, 39, 135–154. [Google Scholar] [CrossRef]

- Ebermann, C.; Piccinini, E.; Busse, S.; Leonhardt, D.; Kolbe, L.M. What Determines the Adoption of Digital Innovations by Digital Natives?—The Role of Motivational Affordances. In Proceedings of the 2016 International Conference on Information Systems (ICIS 2016), Dublin, Ireland, 11–14 December 2016. [Google Scholar]

- Makkonen, H.; Komulainen, H. Explicating the market dimension in the study of digital innovation: A management framework for digital innovation. Technol. Anal. Strateg. Manag. 2018, 30, 1015–1028. [Google Scholar] [CrossRef]

- Von Hippel, E.; Von Krogh, G. Crossroads—Identifying viable “need–solution pairs”: Problem solving without problem formulation. Organ. Sci. 2016, 27, 207–221. [Google Scholar] [CrossRef] [Green Version]

- Svahn, F.; Mathiassen, L.; Lindgren, R. Embracing Digital Innovation in Incumbent Firms: How Volvo Cars Managed Competing Concerns. MIS Q. 2017, 41, 239–253. [Google Scholar] [CrossRef]

- Ahmad, T.; Van Looy, A. Business process management and digital innovations: A systematic literature review. Sustainability 2020, 12, 6827. [Google Scholar] [CrossRef]

- Nambisan, S.; Lyytinen, K.; Majchrzak, A.; Song, M. Digital Innovation Management: Reinventing innovation management research in a digital world. MIS Q. 2017, 41. [Google Scholar] [CrossRef]

- Leonhardt, D.; Haffke, I.; Kranz, J.; Benlian, A. Reinventing the IT function: The Role of IT Agility and IT Ambidexterity in Supporting Digital Business Transformation. In Proceedings of the 25th European Conference on Information Systems (ECIS), Guimarães, Portugal, 8–10 June 2017. [Google Scholar]

- Urbinati, A.; Bogers, M.; Chiesa, V.; Frattini, F. Creating and capturing value from Big Data: A multiple-case study analysis of provider companies. Technovation 2019, 84, 21–36. [Google Scholar] [CrossRef]

- Ciriello, R.F.; Richter, A.; Schwabe, G. From Process to Practice: Towards a Practice-based Model of Digital Innovation. In Proceedings of the38th International Conference on Information Systems (ICIS 2017), Seoul, Korea, 10–13 December 2017. [Google Scholar]

- Lubik, S.; Garnsey, E. Entrepreneurial innovation in science-based firms: The need for an ecosystem perspective. In Handbook of Research on Small Business and Entrepreneurship; Edward Elgar Publishing: Cheltenham, UK, 2014. [Google Scholar]

- Pellinen, A.; Ritala, P.; Järvi, K.; Sainio, L.M. Taking initiative in market creation–a business ecosystem actor perspective. Int. J. Bus. Environ. 2012, 5, 140–158. [Google Scholar] [CrossRef]

- Moro-Visconti, R. Networking Digital Platforms and Healthcare Project Finance Bankability. Sustainability 2021, 13, 5061. [Google Scholar] [CrossRef]

- Guo, Y.; Zhu, Y.; Chen, J. Business Model Innovation of IT-Enabled Customer Participating in Value Co-Creation Based on the Affordance Theory: A Case Study. Sustainability 2021, 13, 5753. [Google Scholar] [CrossRef]

- Polykarpou, S.; Barrett, M. Why Place Still Matters in Digital Innovation: Organizing 3D Printing in a UK Hospital. In Proceedings of the 38th International Conference on Information Systems (ICIS), Seoul, Korea, 10–13 December 2017. [Google Scholar]

- Huang, J.W.; Li, Y.H. Green innovation and performance: The view of organizational capability and social reciprocity. J. Bus. Ethics 2017, 145, 309–324. [Google Scholar] [CrossRef]

- Ciriello, R.F.; Richter, A. Idea hubs as nexus of collective creativity in digital innovation. In Proceedings of the 36th International Conference on Information Systems (ICIS 2015), Fort Worth, TX, USA, 13–16 December 2015. [Google Scholar]

- Liu, W.; Moultrie, J.; Ye, S. The customer-dominated innovation process: Involving customers as designers and decision-makers in developing new product. Des. J. 2019, 22, 299–324. [Google Scholar] [CrossRef]

- Galvagno, M.; Dalli, D. Theory of value co-creation: A systematic literature review. Manag. Serv. Qual. 2014, 24, 643–683. [Google Scholar] [CrossRef]

- Tao, F.; Sui, F.; Liu, A.; Qi, Q.; Zhang, M.; Song, B.; Lu, S.C.-Y.; Nee, A.Y.C. Digital twin-driven product design framework. Int. J. Prod. Res. 2019, 57, 3935–3953. [Google Scholar] [CrossRef] [Green Version]

- Brannen, J. Mixing Methods: Qualitative and Quantitative Research; Routledge: London, UK, 2017. [Google Scholar]

- Omery, A. Phenomenology: A method for nursing research. Adv. Nurs. Sci. 1983, 5, 49–64. [Google Scholar] [CrossRef]

- Merleau-Ponty, M. Phenomenology of Perception; Routledge Kegan Paul: London, UK, 1962; p. 182. [Google Scholar]

- Patton, M.Q. Qualitative Evaluation and Research Methods; SAGE Publications, Inc.: Los Angeles, CA, USA, 1990. [Google Scholar]

- Clark, A.M. The qualitative-quantitative debate: Moving from positivism and confrontation to post-positivism and reconciliation. J. Adv. Nurs. 1998, 27, 1242–1249. [Google Scholar] [CrossRef]

- Malaysian SMEs Corps. SME Annual Report: Survey on SMEs in 2017/18. Available online: https://www.smecorp.gov.my/index.php/en/laporan-tahunan/3342-laporan-tahunan-pks-2017-18 (accessed on 5 August 2021).

- OECD. Small, Medium, Strong. Trends in SME Performance and Business Conditions; OECD Publishing: Paris, France, 2017. [Google Scholar]

- Nor, N.M.; Bahari, N.A.S.; Adnan, N.A.; Kamal, S.M.Q.A.S.; Ali, I.M. The effects of environmental disclosure on financial performance in Malaysia. Procedia Econ. Financ. 2016, 35, 117–126. [Google Scholar] [CrossRef] [Green Version]

- Khin, S.; Ho, T.C. Digital technology, digital capability and organizational performance. Int. J. Innov. Sci. 2019, 11, 177–195. [Google Scholar] [CrossRef]

- Ghezzi, A.; Balocco, R. Disclosing the role of IT Suppliers as Digital Innovation enablers for SMEs: A strategy analysis of the European IT Sales Channel. In Proceedings of the 49th Hawaii International Conference on System Sciences (HICSS), Koloa, HI, USA, 5–8 January 2016. [Google Scholar]

- Hungler, B.P.; Beck, C.; Polit, D. Essentials of Nursing Research: Methods, Appraisal, and Utilization; Lippincott-Raven: New York, NY, USA, 1997. [Google Scholar]

- Ames, H.; Glenton, C.; Lewin, S. Purposive sampling in a qualitative evidence synthesis: A worked example from a synthesis on parental perceptions of vaccination communication. BMC Med. Res. Methodol. 2019, 19, 26. [Google Scholar] [CrossRef]

- Law, C.C.; Ngai, E.W. An empirical study of the effects of knowledge sharing and learning behaviors on firm performance. Expert Syst. Appl. 2008, 34, 2342–2349. [Google Scholar] [CrossRef]

- Ngo, L.V.; O’Cass, A. In search of innovation and customer-related performance superiority: The role of market orientation, marketing capability, and innovation capability interactions. J. Prod. Innov. Manag. 2012, 29, 861–877. [Google Scholar] [CrossRef]

- Miles, M.B.; Huberman, A.M. Qualitative Data Analysis: An Expanded Sourcebook; Sage: New York, NY, USA, 1994. [Google Scholar]

- Cooper, H.E.; Camic, P.M.; Long, D.L.; Panter, A.T.; Rindskopf, D.E.; Sher, K.J. (Eds.) APA Handbook of Research Methods in Psychology, Vol 2: Research Designs: Quantitative, Qualitative, Neuropsychological, and Biological; American Psychological Association: Washington, DC, USA, 2012; pp. 57–71. [Google Scholar]

- Ricœur, P. Heretical Essays in the Philosophy of History; Open Court Publishing: Chicago, IL, USA, 1996. [Google Scholar]

- Willig, C. Interpretation in qualitative research. In The SAGE Handbook of Qualitative Research in Psychology; SAGE: Los Angeles, CA, USA, 2017; pp. 274–288. [Google Scholar]

- Eisenhardt, K.M. Building theories from case study research. Acad. Manag. Rev. 1989, 14, 532–550. [Google Scholar] [CrossRef]

- Vega, A.; Chiasson, M. A comprehensive framework to research digital innovation: The joint use of the systems of innovation and critical realism. J. Strateg. Inf. Syst. 2019, 28, 242–256. [Google Scholar] [CrossRef]

- Barthel, P.; Hess, T. Are Digital Transformation Projects Special? In Proceedings of the 23rd Pacific Asia Conference on Information Systems (PACIS 2019), Xi’an, China, 8–12 July 2019. [Google Scholar]

- Bhatnagar, N.; Gopalaswamy, A.K. The role of a firm’s innovation competence on customer adoption of service innovation. Manag. Res. Rev. 2017, 40, 378–409. [Google Scholar] [CrossRef]

- López-Cabarcos, M.Á.; Srinivasan, S.; Vázquez-Rodríguez, P. The role of product innovation and customer centricity in transforming tacit and explicit knowledge into profitability. J. Knowl. Manag. 2020, 24, 1037–1057. [Google Scholar] [CrossRef]

- Psomas, E.; Kafetzopoulos, D.; Gotzamani, K. Determinants of company innovation and market performance. TQM J. 2018, 30, 54–73. [Google Scholar] [CrossRef]

- Danarahmanto, P.A.; Primiana, I.; Azis, Y.; Kaltum, U. The sustainable performance of the digital start-up company based on customer participation, innovation, and business model. Bus. Theory Pract. 2020, 21, 115–124. [Google Scholar] [CrossRef]

- Chang, W.; Taylor, S.A. The effectiveness of customer participation in new product development: A meta-analysis. J. Mark. 2016, 80, 47–64. [Google Scholar] [CrossRef]

- Goyal, S.; Ahuja, M.; Kankanhalli, A. Does the source of external knowledge matter? Examining the role of customer co-creation and partner sourcing in knowledge creation and innovation. Inf. Manag. 2020, 57, 103325. [Google Scholar] [CrossRef]

- Heim, G.R.; Mallick, D.N.; Peng, X. Antecedents and consequences of new product development practices and software tools: An exploratory study. IEEE Trans. Eng. Manag. 2011, 59, 428–442. [Google Scholar] [CrossRef] [Green Version]

- Kawakami, T.; Durmuşoğlu, S.S.; Barczak, G. Factors influencing information technology usage for new product development: The case of japanese companies. J. Prod. Innov. Manag. 2011, 28, 833–847. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Allataifeh, H.; Moghavvemi, S. The Individual Dimension of Digital Innovation: The Altered Roles of Innovation Agents and Market Actors. Sustainability 2021, 13, 8971. https://doi.org/10.3390/su13168971

Allataifeh H, Moghavvemi S. The Individual Dimension of Digital Innovation: The Altered Roles of Innovation Agents and Market Actors. Sustainability. 2021; 13(16):8971. https://doi.org/10.3390/su13168971

Chicago/Turabian StyleAllataifeh, Haneen, and Sedigheh Moghavvemi. 2021. "The Individual Dimension of Digital Innovation: The Altered Roles of Innovation Agents and Market Actors" Sustainability 13, no. 16: 8971. https://doi.org/10.3390/su13168971

APA StyleAllataifeh, H., & Moghavvemi, S. (2021). The Individual Dimension of Digital Innovation: The Altered Roles of Innovation Agents and Market Actors. Sustainability, 13(16), 8971. https://doi.org/10.3390/su13168971